Would you like to save this?

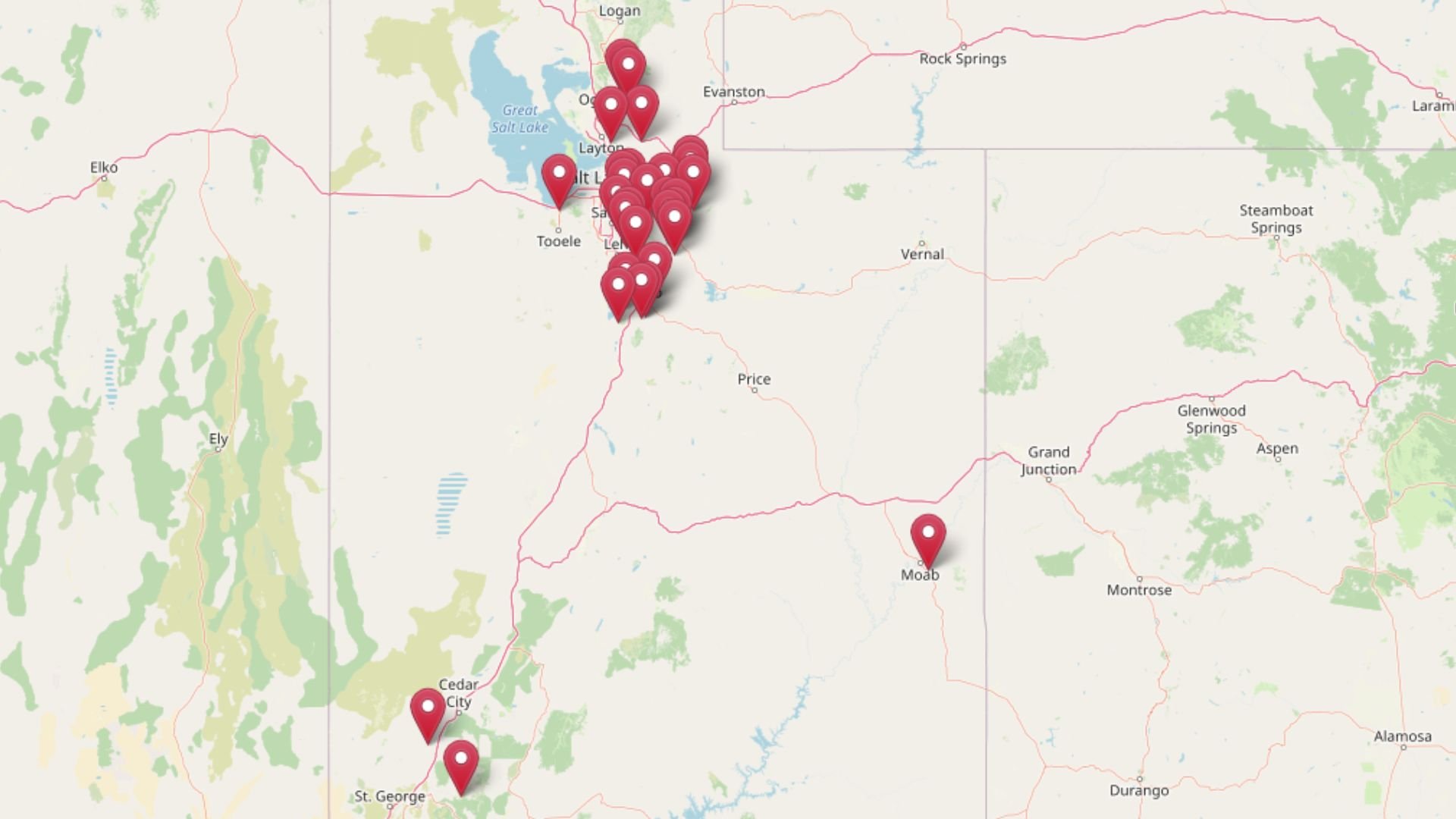

Utah’s housing market hasn’t just held steady—it’s soared in some of the state’s most sought-after towns. According to the Zillow Home Value Index, prices in these 15 communities have climbed sharply over the past decade, pushed higher by tight supply, strong demand, and a serious lifestyle appeal. From ski towns with global name recognition to quiet enclaves with mountain views and private trails, these places are commanding big prices—and often, even bigger attention.

But this isn’t just a list of the usual suspects. It’s a deeper look at what’s driving the market in each town, from long-term trends to recent cooling in a few overheated areas. Whether you’re eyeing a second home or just tracking the top of the market, these are the towns setting the pace for high-end real estate in Utah.

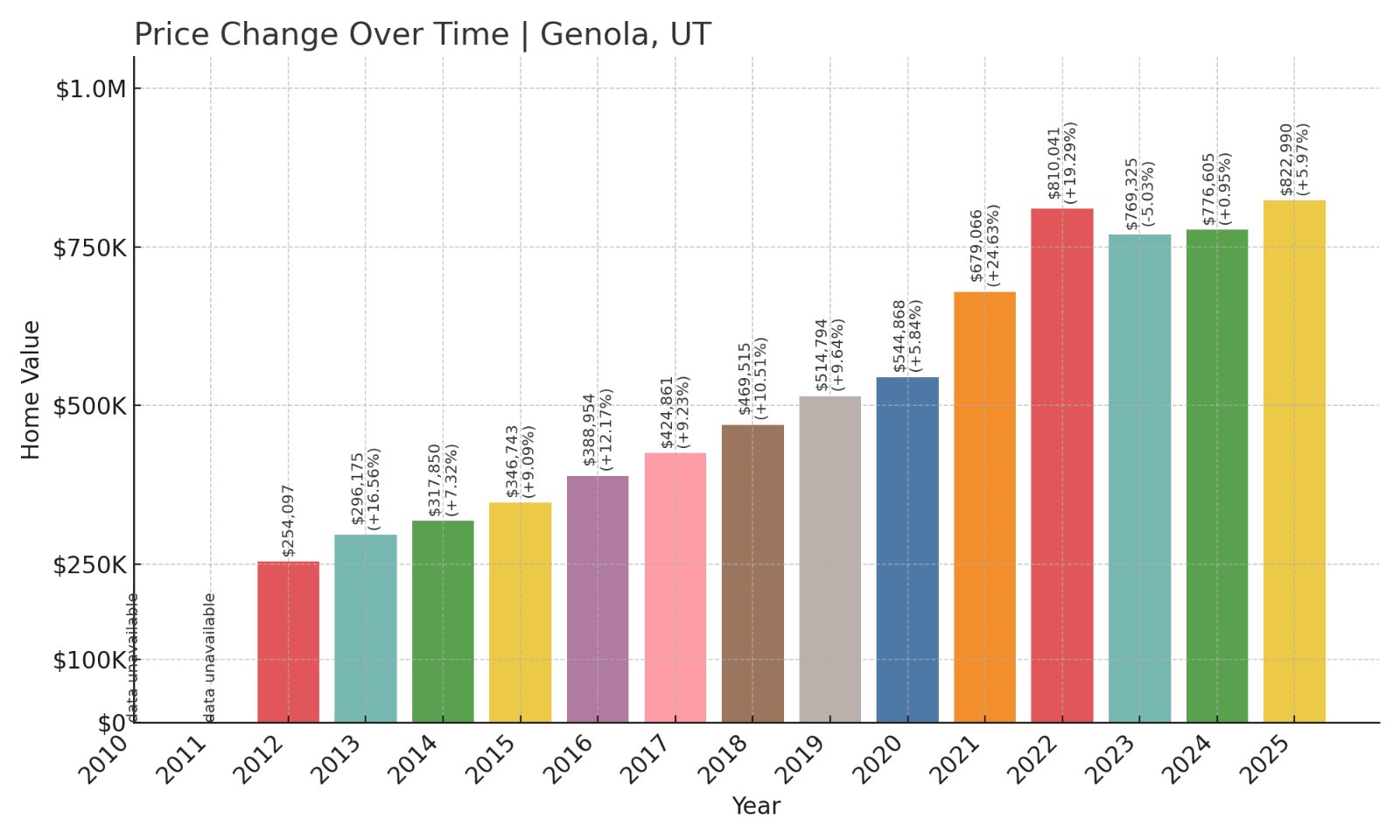

15. Genola – 224% Home Price Increase Since 2012

- 2012: $254,097

- 2013: $296,175 (+$42,078, +16.56% from previous year)

- 2014: $317,850 (+$21,675, +7.32% from previous year)

- 2015: $346,743 (+$28,893, +9.09% from previous year)

- 2016: $388,954 (+$42,211, +12.17% from previous year)

- 2017: $424,861 (+$35,907, +9.23% from previous year)

- 2018: $469,515 (+$44,654, +10.51% from previous year)

- 2019: $514,794 (+$45,279, +9.64% from previous year)

- 2020: $544,868 (+$30,074, +5.84% from previous year)

- 2021: $679,066 (+$134,199, +24.63% from previous year)

- 2022: $810,041 (+$130,974, +19.29% from previous year)

- 2023: $769,325 ($-40,716, -5.03% from previous year)

- 2024: $776,605 (+$7,280, +0.95% from previous year)

- 2025: $822,990 (+$46,386, +5.97% from previous year)

Home values in Genola have surged since 2012, increasing by more than 224%. The town experienced double-digit gains in several years, with the most dramatic leap in 2021, when values jumped nearly 25%. While there was a slight correction in 2023, Genola’s prices rebounded again in 2024 and 2025, indicating continued interest in this small but growing community.

Genola – Steady Growth in a Quiet Farming Community

Genola is a peaceful farming town nestled in Utah County, surrounded by open land and views of the Wasatch Range. It offers a rural lifestyle just 30 minutes from the Provo-Orem metro area. The sharp rise in home values likely reflects increased demand from buyers seeking larger lots and affordability within commuting distance of the city. With a 2025 median price of $822,990, Genola remains expensive compared to its past but more approachable than Utah’s resort markets.

The town’s agricultural zoning and spacious properties appeal to families and those seeking to escape suburban sprawl. Recent home value stabilization suggests the market may be reaching a plateau, but continued growth in nearby tech and education sectors could keep upward pressure on prices over the long term.

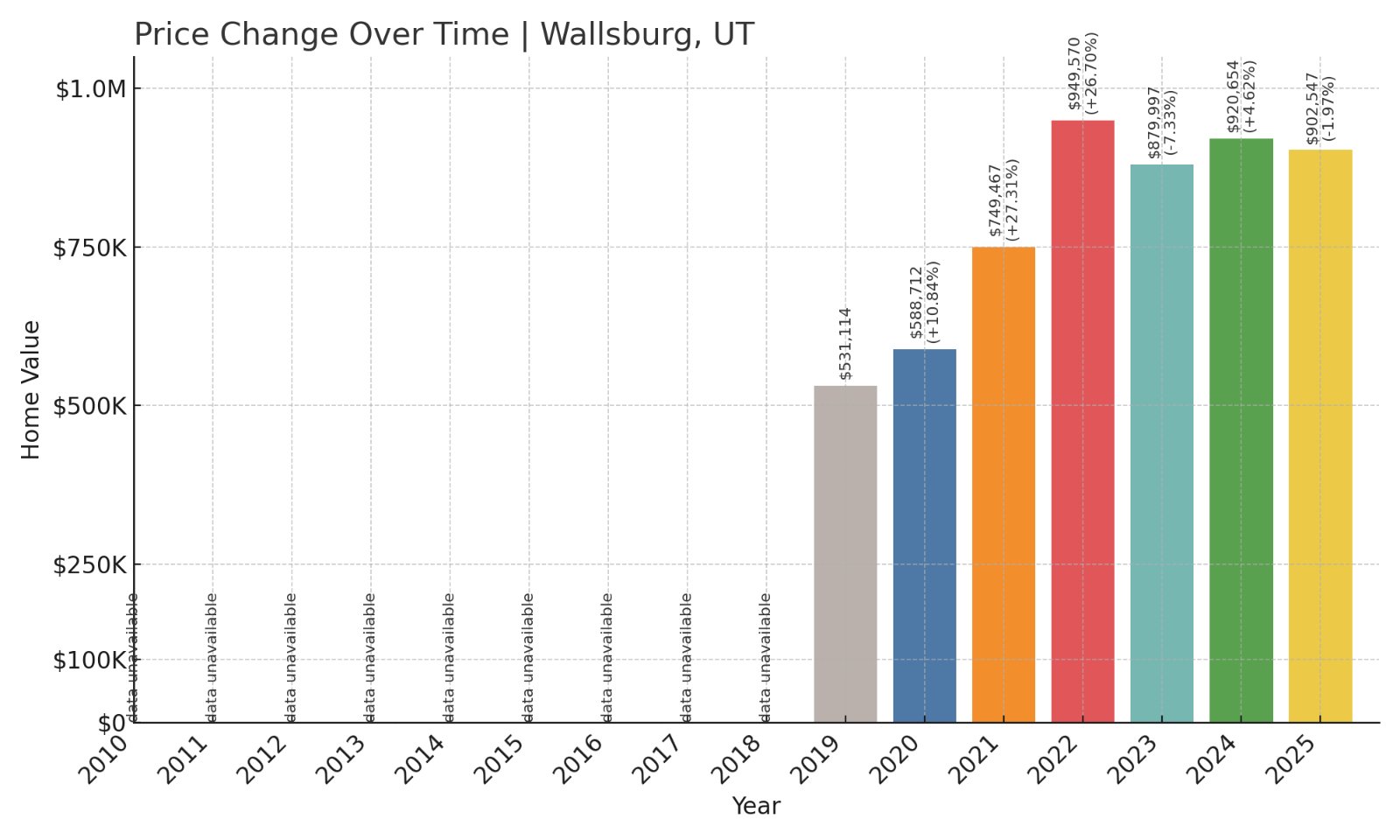

14. Wallsburg – 70% Home Price Increase Since 2019

- 2019: $531,114

- 2020: $588,712 (+$57,597, +10.84% from previous year)

- 2021: $749,467 (+$160,755, +27.31% from previous year)

- 2022: $949,570 (+$200,103, +26.70% from previous year)

- 2023: $879,997 ($-69,572, -7.33% from previous year)

- 2024: $920,654 (+$40,656, +4.62% from previous year)

- 2025: $902,547 ($-18,107, -1.97% from previous year)

Wallsburg’s home prices have grown 70% since 2019, with massive jumps in 2021 and 2022. Although the market cooled in 2023 and 2025 showed a slight drop, values remain well above pre-pandemic levels. The town’s remote charm and proximity to nature have likely contributed to its appeal during the recent housing boom.

Wallsburg – Secluded Living in Utah’s Wasatch Back

Were You Meant

to Live In?

Wallsburg is a hidden mountain enclave in Wasatch County, surrounded by national forest and near Deer Creek Reservoir. Known for its rugged beauty and limited development, the town offers a rare combination of seclusion and access to outdoor recreation. With few listings and little turnover, prices are highly sensitive to demand shifts.

The steep climbs in 2021 and 2022 reflect the COVID-era trend of buyers favoring remote, scenic areas. Although the slight declines in 2023 and 2025 may indicate market adjustment, Wallsburg’s lack of inventory could keep prices high for the foreseeable future. Its 2025 median value of $902,547 speaks to how desirable this small town has become among Utah’s elite rural markets.

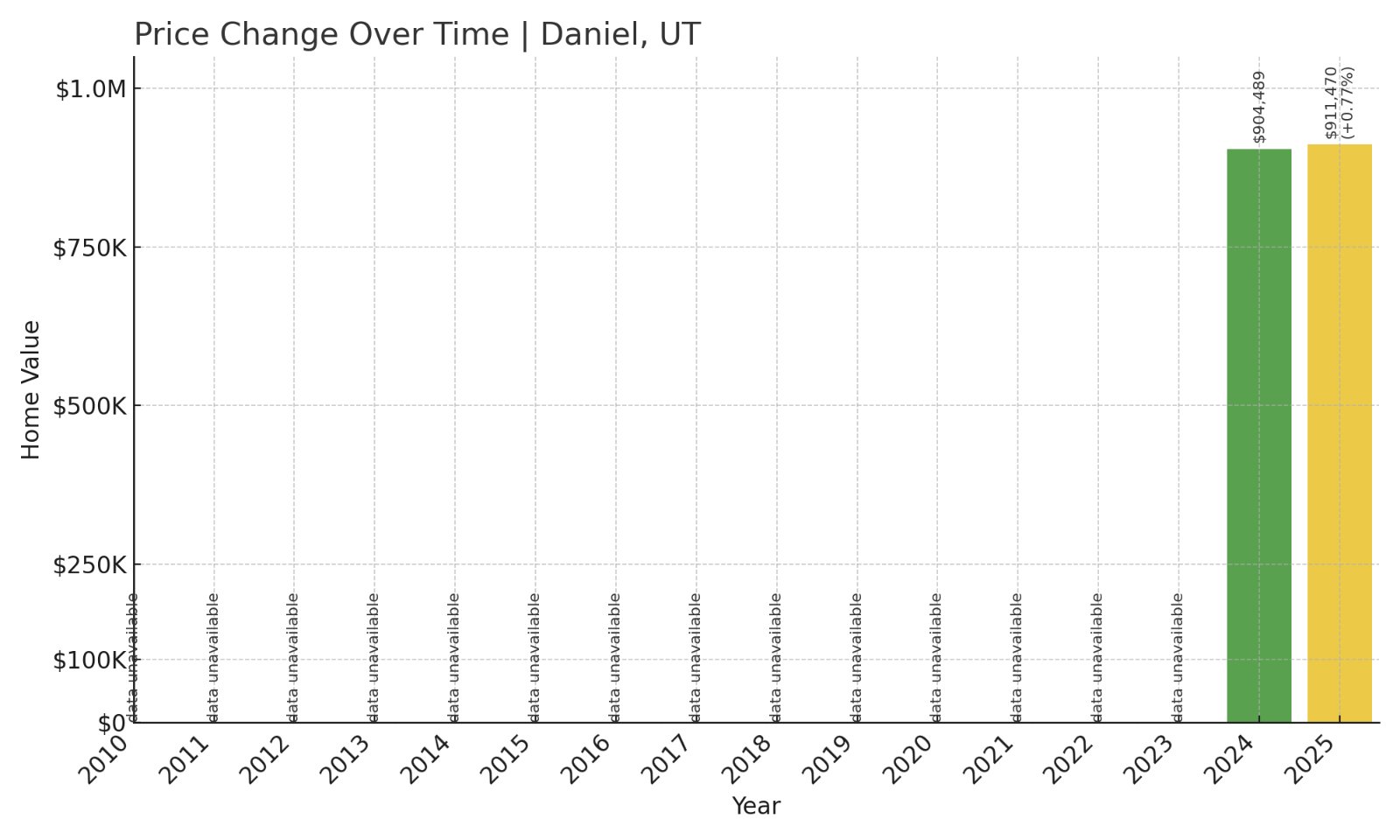

13. Daniel – 0.77% Home Price Increase Since 2024

- 2024: $904,489

- 2025: $911,470 (+$6,981, +0.77% from previous year)

Daniel’s housing data is limited, but from 2024 to 2025, prices increased by less than 1%. While the gain is modest, it suggests relative stability in the local market. With home values already topping $900K, this small Wasatch County town remains among Utah’s most expensive places to live.

Daniel – Small Town, High Value

Daniel is located just southeast of Heber City and benefits from its proximity to Utah’s thriving Wasatch Back. Though small in population, the town’s real estate is prized for its scenic views, access to outdoor activities, and relatively large lots. These characteristics contribute to its high property values, even in a market with limited data points.

With a median home price of $911,470 in 2025, Daniel remains a prime choice for buyers looking for a quieter lifestyle without sacrificing convenience. The steady rise from 2024 to 2025 signals that demand is still present, even if dramatic jumps are no longer occurring post-pandemic.

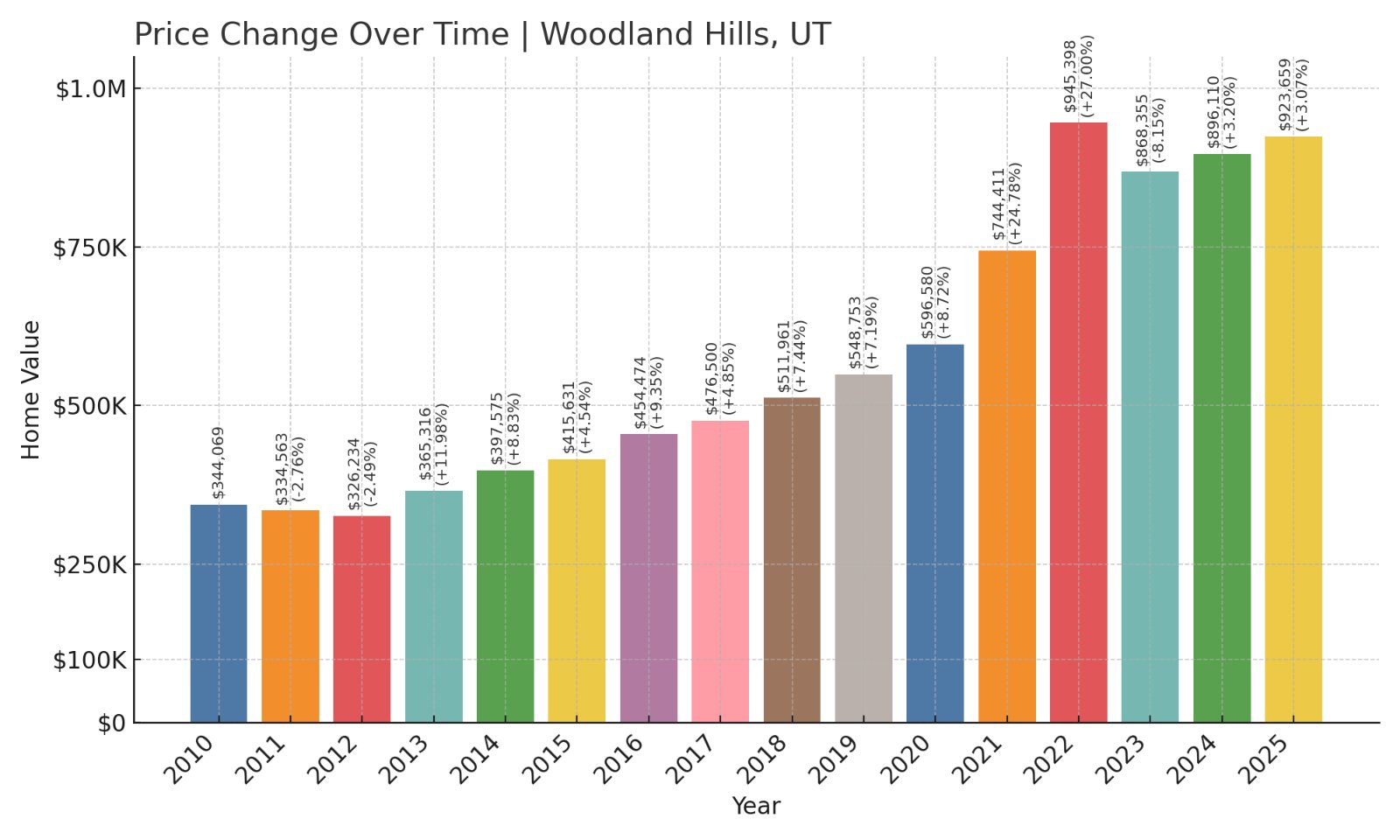

12. Woodland Hills – 168% Home Price Increase Since 2010

Home Stratosphere Guide

Your Personality Already Knows

How Your Home Should Feel

113 pages of room-by-room design guidance built around your actual brain, your actual habits, and the way you actually live.

You might be an ISFJ or INFP designer…

You design through feeling — your spaces are personal, comforting, and full of meaning. The guide covers your exact color palettes, room layouts, and the one mistake your type always makes.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ISTJ or INTJ designer…

You crave order, function, and visual calm. The guide shows you how to create spaces that feel both serene and intentional — without ending up sterile.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENFP or ESTP designer…

You design by instinct and energy. Your home should feel alive. The guide shows you how to channel that into rooms that feel curated, not chaotic.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

You might be an ENTJ or ESTJ designer…

You value quality, structure, and things done right. The guide gives you the framework to build rooms that feel polished without overthinking every detail.

The full guide maps all 16 types to specific rooms, palettes & furniture picks ↓

- 2010: $344,069

- 2011: $334,563 ($-9,506, -2.76% from previous year)

- 2012: $326,234 ($-8,329, -2.49% from previous year)

- 2013: $365,316 (+$39,082, +11.98% from previous year)

- 2014: $397,575 (+$32,258, +8.83% from previous year)

- 2015: $415,631 (+$18,056, +4.54% from previous year)

- 2016: $454,474 (+$38,843, +9.35% from previous year)

- 2017: $476,500 (+$22,026, +4.85% from previous year)

- 2018: $511,961 (+$35,461, +7.44% from previous year)

- 2019: $548,753 (+$36,791, +7.19% from previous year)

- 2020: $596,580 (+$47,828, +8.72% from previous year)

- 2021: $744,411 (+$147,831, +24.78% from previous year)

- 2022: $945,398 (+$200,987, +27.00% from previous year)

- 2023: $868,355 ($-77,044, -8.15% from previous year)

- 2024: $896,110 (+$27,755, +3.20% from previous year)

- 2025: $923,659 (+$27,549, +3.07% from previous year)

Since 2010, Woodland Hills has seen a 168% increase in home values. Although the market dipped slightly in 2023, it has since recovered with steady growth in 2024 and 2025. The pandemic years marked some of the most dramatic jumps, highlighting the town’s appeal to affluent buyers.

Woodland Hills – Hillside Homes and Mountain Views

Woodland Hills, in southern Utah County, is known for its dramatic elevation and forested setting. This town of custom-built homes offers panoramic views of the valley and Mount Loafer. The area is especially attractive to buyers seeking privacy and a luxury mountain-home lifestyle within driving distance of Provo and Silicon Slopes.

With a 2025 median price of $923,659, Woodland Hills commands top-dollar in large part due to its limited development and large, scenic lots. Recent slower growth indicates the market may be normalizing after the pandemic boom, but interest remains strong in this high-end hill town.

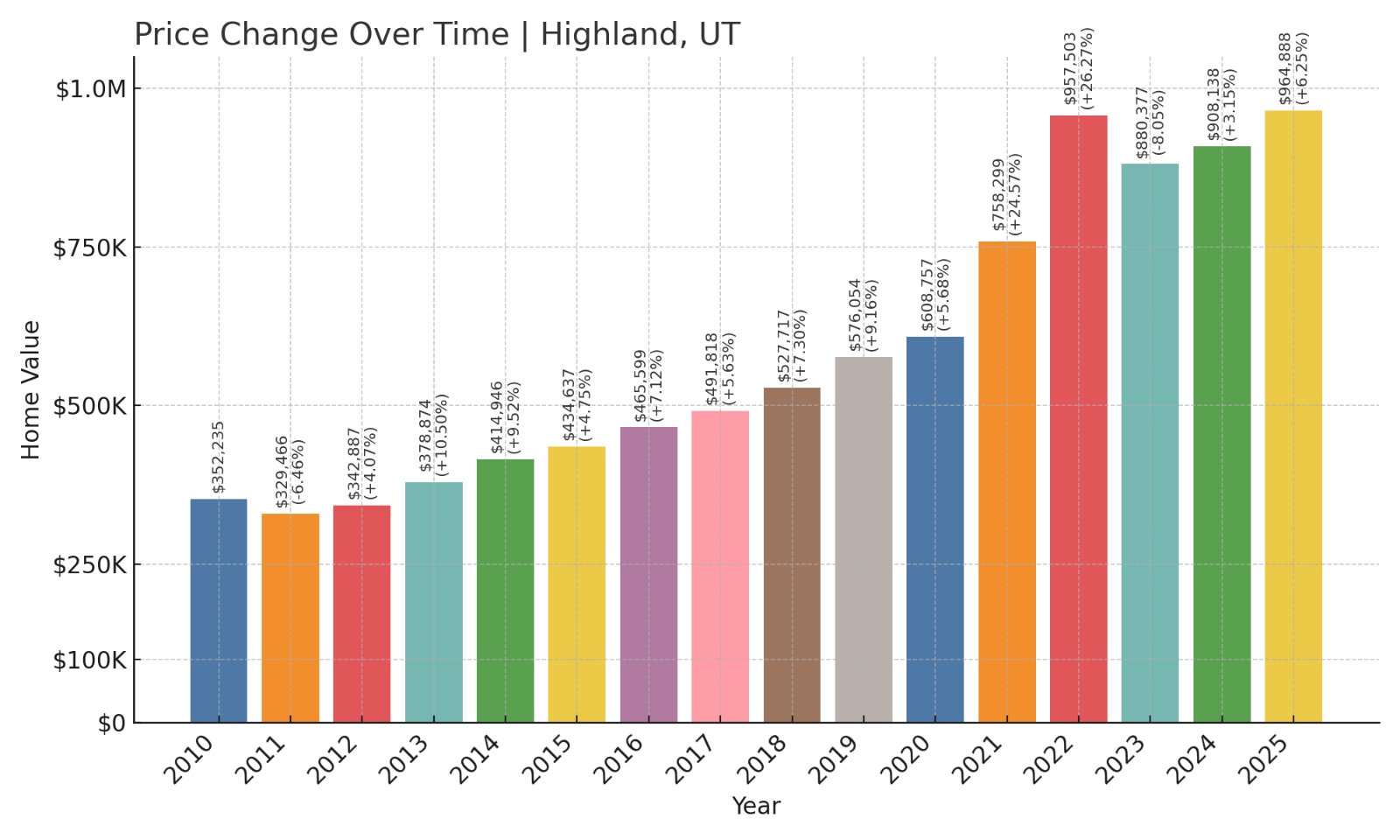

11. Highland – 174% Home Price Increase Since 2010

- 2010: $352,235

- 2011: $329,466 ($-22,770, -6.46% from previous year)

- 2012: $342,887 (+$13,421, +4.07% from previous year)

- 2013: $378,874 (+$35,987, +10.50% from previous year)

- 2014: $414,946 (+$36,072, +9.52% from previous year)

- 2015: $434,637 (+$19,691, +4.75% from previous year)

- 2016: $465,599 (+$30,962, +7.12% from previous year)

- 2017: $491,818 (+$26,219, +5.63% from previous year)

- 2018: $527,717 (+$35,899, +7.30% from previous year)

- 2019: $576,054 (+$48,337, +9.16% from previous year)

- 2020: $608,757 (+$32,703, +5.68% from previous year)

- 2021: $758,299 (+$149,541, +24.57% from previous year)

- 2022: $957,503 (+$199,204, +26.27% from previous year)

- 2023: $880,377 ($-77,126, -8.05% from previous year)

- 2024: $908,138 (+$27,761, +3.15% from previous year)

- 2025: $964,888 (+$56,750, +6.25% from previous year)

Highland has seen home prices rise by 174% since 2010. Gains were particularly strong in 2021 and 2022. Despite a brief drop in 2023, the market has rebounded, ending 2025 with a solid $964,888 average home value.

Highland – Premium Living on the Alpine Bench

Located north of American Fork, Highland combines scenic foothills living with proximity to major employers in Utah County. Known for its highly rated schools, large custom homes, and family-friendly feel, the town has long attracted high-income buyers. Parks, trails, and mountain views add to the appeal.

The surge in values during the early 2020s was driven by pandemic-era demand and the area’s low inventory. Though prices dipped in 2023, steady growth has returned. At nearly $1 million, Highland remains one of Utah’s most expensive family-oriented suburbs.

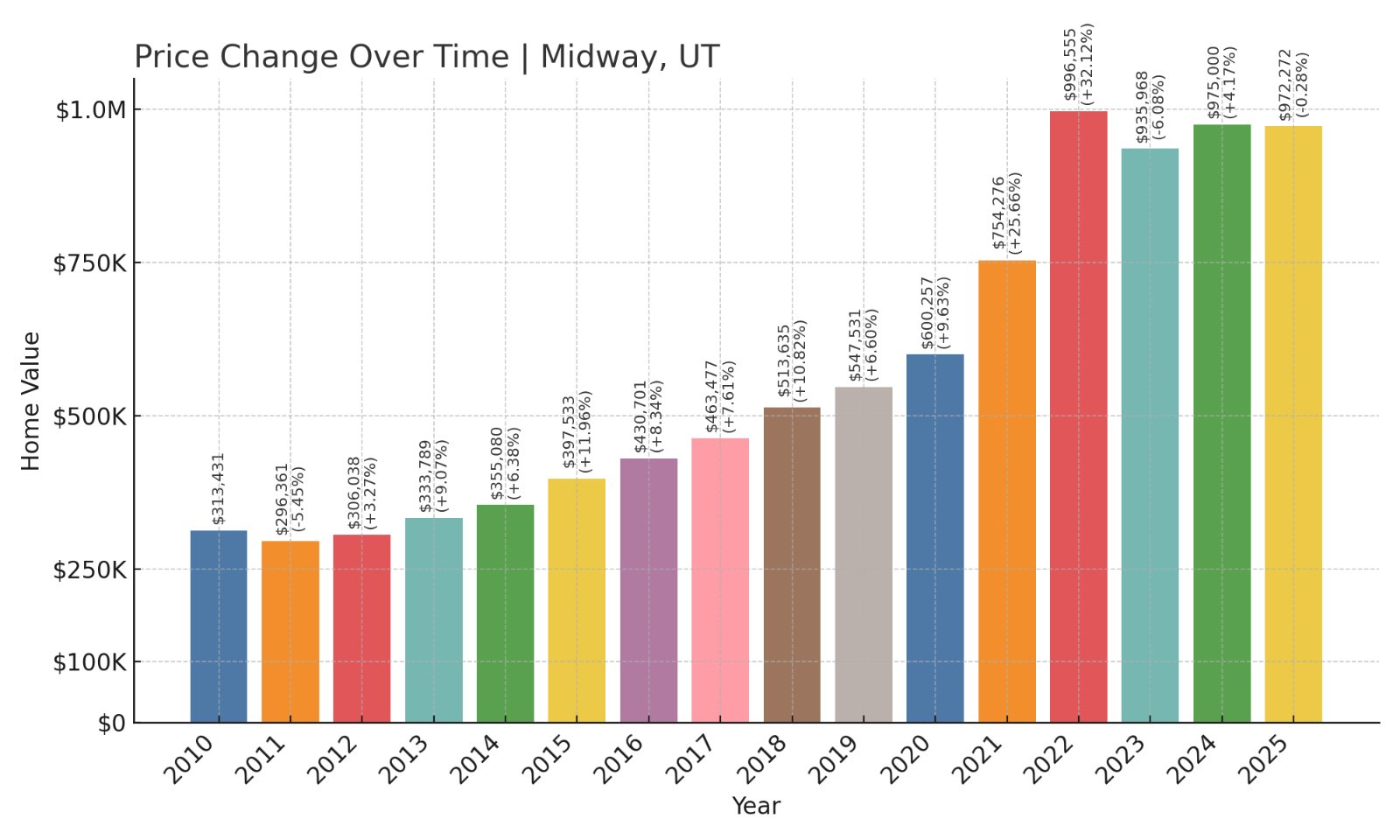

10. Midway – 210% Home Price Increase Since 2010

- 2010: $313,431

- 2011: $296,361 ($-17,070, -5.45% from previous year)

- 2012: $306,038 (+$9,677, +3.27% from previous year)

- 2013: $333,789 (+$27,750, +9.07% from previous year)

- 2014: $355,080 (+$21,291, +6.38% from previous year)

- 2015: $397,533 (+$42,453, +11.96% from previous year)

- 2016: $430,701 (+$33,168, +8.34% from previous year)

- 2017: $463,477 (+$32,776, +7.61% from previous year)

- 2018: $513,635 (+$50,158, +10.82% from previous year)

- 2019: $547,531 (+$33,896, +6.60% from previous year)

- 2020: $600,257 (+$52,727, +9.63% from previous year)

- 2021: $754,276 (+$154,019, +25.66% from previous year)

- 2022: $996,555 (+$242,279, +32.12% from previous year)

- 2023: $935,968 ($-60,587, -6.08% from previous year)

- 2024: $975,000 (+$39,033, +4.17% from previous year)

- 2025: $972,272 ($-2,729, -0.28% from previous year)

Midway’s housing market has surged more than 210% since 2010, with major gains between 2020 and 2022. Although the market dipped slightly in 2023 and experienced a marginal drop in 2025, home values remain nearly triple what they were 15 years ago. The town continues to rank among Utah’s most sought-after destinations.

Midway – Alpine Charm with Resort-Style Appeal

Midway is a picturesque mountain town in the Heber Valley, known for its Swiss-themed architecture and year-round recreation. With easy access to Deer Valley, Park City, and Wasatch Mountain State Park, it’s a favorite for both full-time residents and second-home buyers. The area’s beauty and recreational options helped fuel massive price increases during the pandemic-driven housing boom.

Home prices approached $1 million in 2022 and have hovered just under that mark since, with the 2025 average sitting at $972,272. Midway’s popularity among affluent buyers looking for an alpine getaway helps support its high price point, even amid broader market corrections elsewhere.

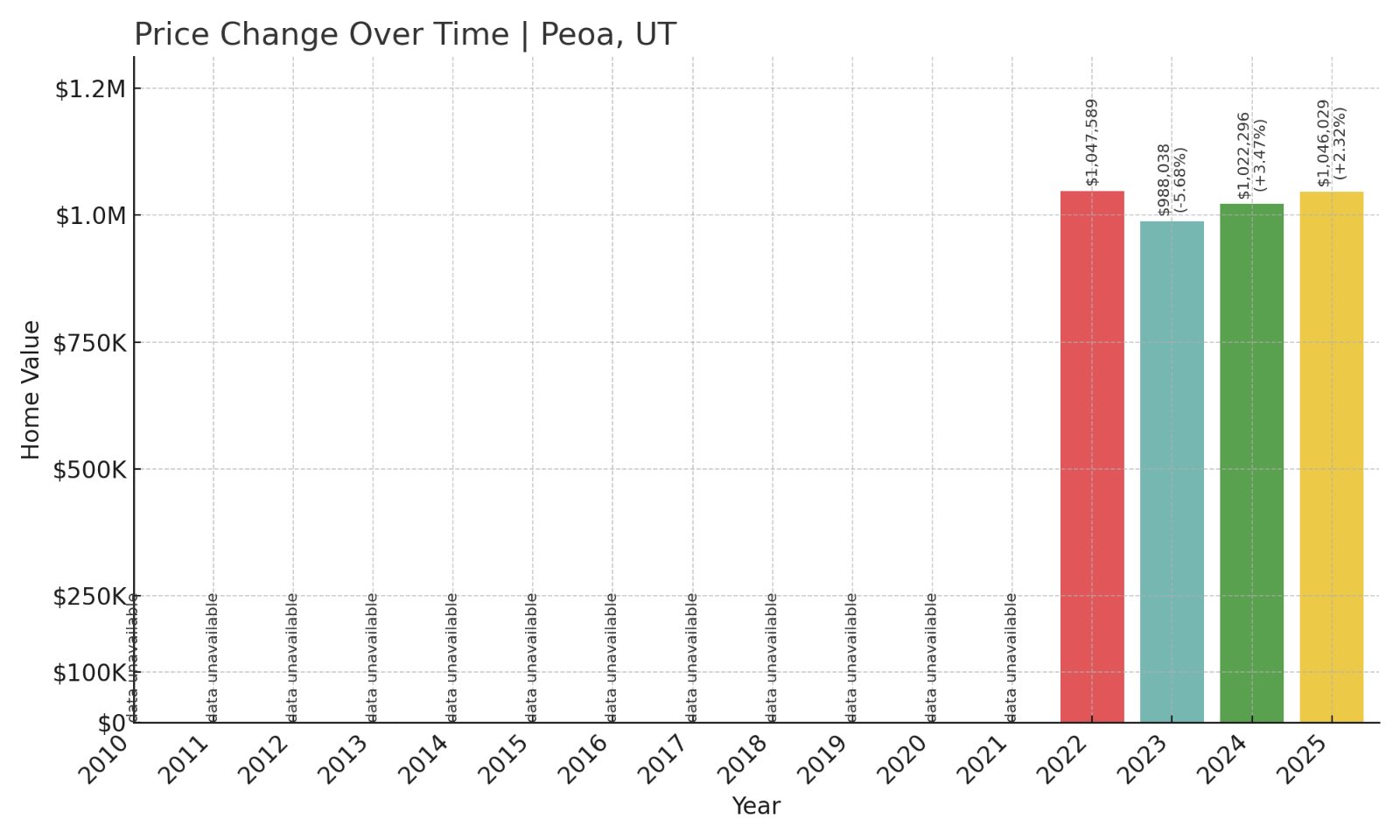

9. Peoa – 0.82% Home Price Increase Since 2022

- 2022: $1,047,589

- 2023: $988,038 ($-59,552, -5.68% from previous year)

- 2024: $1,022,296 (+$34,258, +3.47% from previous year)

- 2025: $1,046,029 (+$23,733, +2.32% from previous year)

Peoa’s home values have grown only slightly since 2022, with a net increase of 0.82%. After a decline in 2023, prices recovered in the following two years, landing just shy of their previous high. Despite the modest growth, the town remains one of the priciest in Utah, with homes averaging over $1 million.

Peoa – Luxury in a Quiet Corner of Summit County

Peoa is a rural community located in Summit County, just outside Oakley and within driving distance of Park City. It offers a peaceful setting with large plots, horse property, and breathtaking views of the Uinta Mountains. The quiet atmosphere and access to premier ski resorts and trails make it attractive to buyers seeking solitude and proximity to outdoor adventure.

With limited development and a small population, Peoa’s real estate market is shaped by just a few high-value listings. While prices briefly dipped in 2023, a strong rebound in 2024 and 2025 has brought values back near their all-time high. Its $1.046 million average reflects its niche appeal to high-end rural buyers.

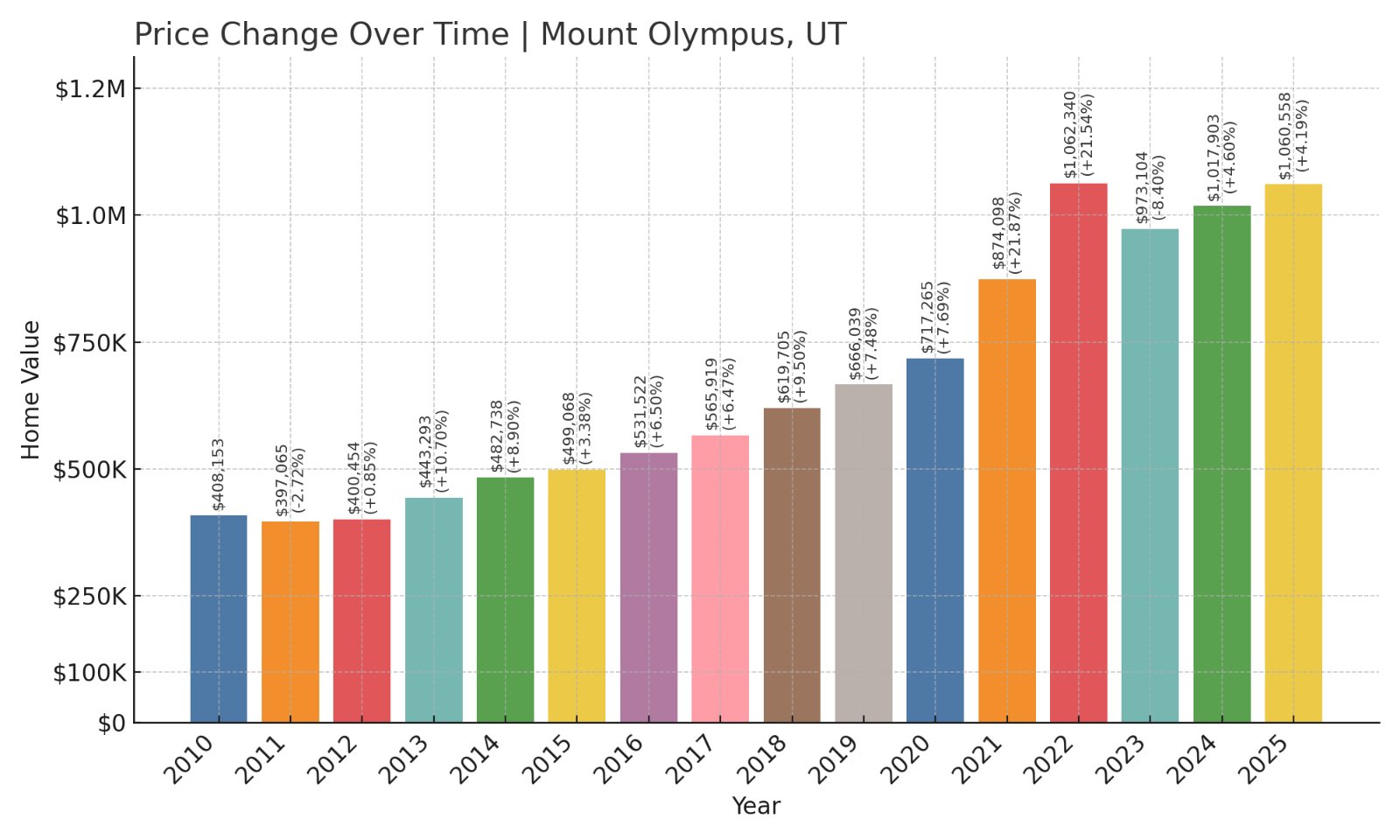

8. Mount Olympus – 160% Home Price Increase Since 2010

- 2010: $408,153

- 2011: $397,065 ($-11,088, -2.72% from previous year)

- 2012: $400,454 (+$3,388, +0.85% from previous year)

- 2013: $443,293 (+$42,839, +10.70% from previous year)

- 2014: $482,738 (+$39,445, +8.90% from previous year)

- 2015: $499,068 (+$16,331, +3.38% from previous year)

- 2016: $531,522 (+$32,454, +6.50% from previous year)

- 2017: $565,919 (+$34,397, +6.47% from previous year)

- 2018: $619,705 (+$53,786, +9.50% from previous year)

- 2019: $666,039 (+$46,334, +7.48% from previous year)

- 2020: $717,265 (+$51,227, +7.69% from previous year)

- 2021: $874,098 (+$156,833, +21.87% from previous year)

- 2022: $1,062,340 (+$188,242, +21.54% from previous year)

- 2023: $973,104 ($-89,236, -8.40% from previous year)

- 2024: $1,017,903 (+$44,799, +4.60% from previous year)

- 2025: $1,060,558 (+$42,655, +4.19% from previous year)

Home values in Mount Olympus have risen by over 160% since 2010, driven by steady gains and standout growth during the pandemic years. While prices dipped in 2023, the market bounced back in 2024 and 2025, bringing home values back above $1 million.

Mount Olympus – Prime Foothills Real Estate in Salt Lake County

Mount Olympus is a prestigious neighborhood in Millcreek, perched along the base of the Wasatch Mountains. It’s a favorite for professionals and retirees who want quiet streets, large lots, and quick access to both downtown Salt Lake City and recreation areas like Millcreek and Neff’s Canyons. The area offers a combination of convenience and natural beauty that commands a premium.

Home values surged during the pandemic, and while there was a temporary decline in 2023, values have since stabilized and continue to grow. In 2025, the median home value stands at $1,060,558, reflecting Mount Olympus’s long-standing reputation as one of Salt Lake County’s most exclusive neighborhoods.

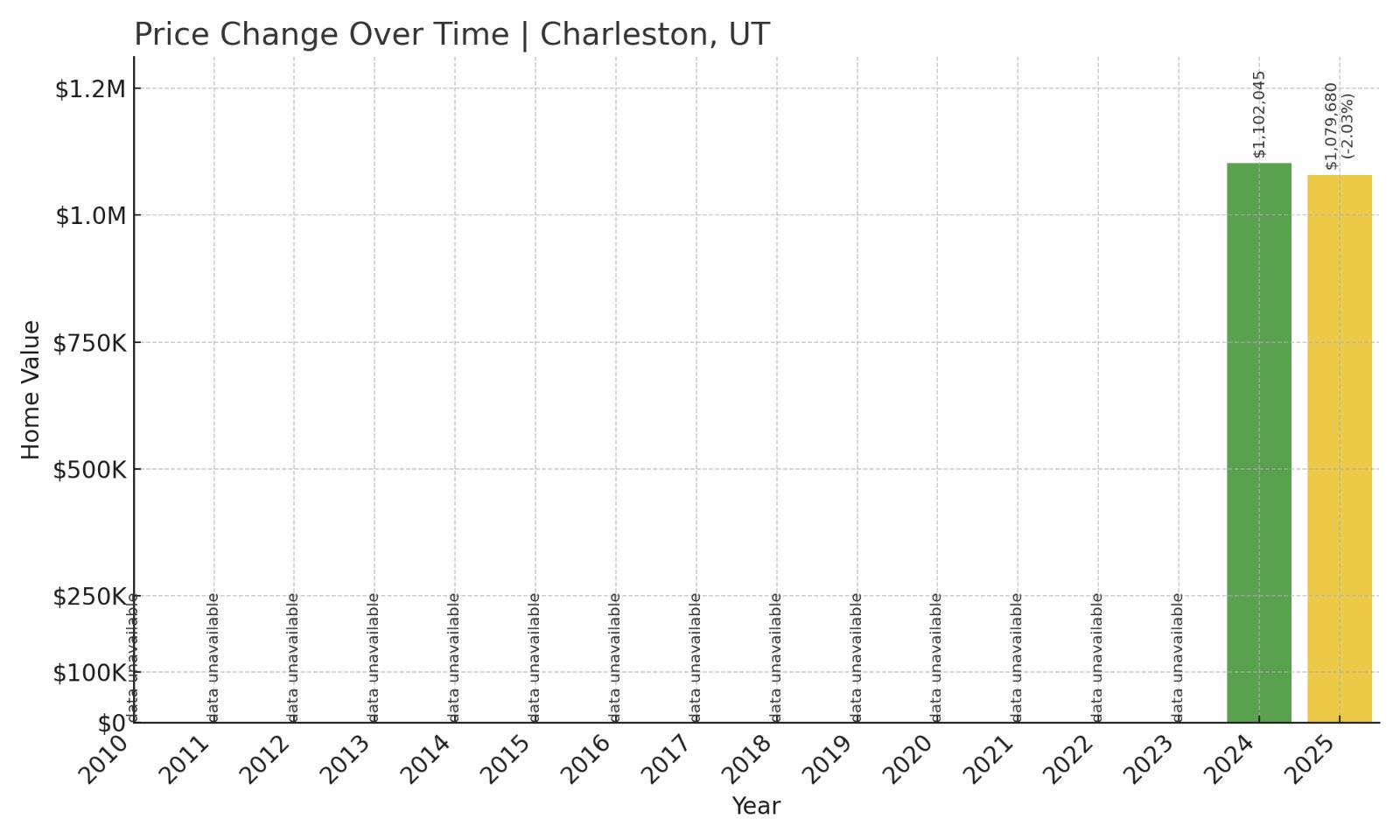

7. Charleston – 2.03% Home Price Decrease Since 2024

- 2024: $1,102,045

- 2025: $1,079,680 ($-22,364, -2.03% from previous year)

Charleston saw a minor decline in home prices between 2024 and 2025. Though it’s a short drop, it follows a high starting point, with homes still valued over $1 million. With limited data, it’s unclear whether this is the start of a trend or a brief adjustment.

Charleston – Scenic Shores and Estate Properties

Charleston sits on the west side of Deer Creek Reservoir in Wasatch County. It’s known for its large estate homes, lake views, and limited commercial development. The combination of water access and open land makes it one of Utah’s most scenic and private luxury markets.

The dip in home values may reflect normalization after steep gains during the pandemic years, or limited sales data in a low-volume market. Even so, with a 2025 median value of $1,079,680, Charleston remains one of Utah’s most elite communities — where land is scarce and demand stays high.

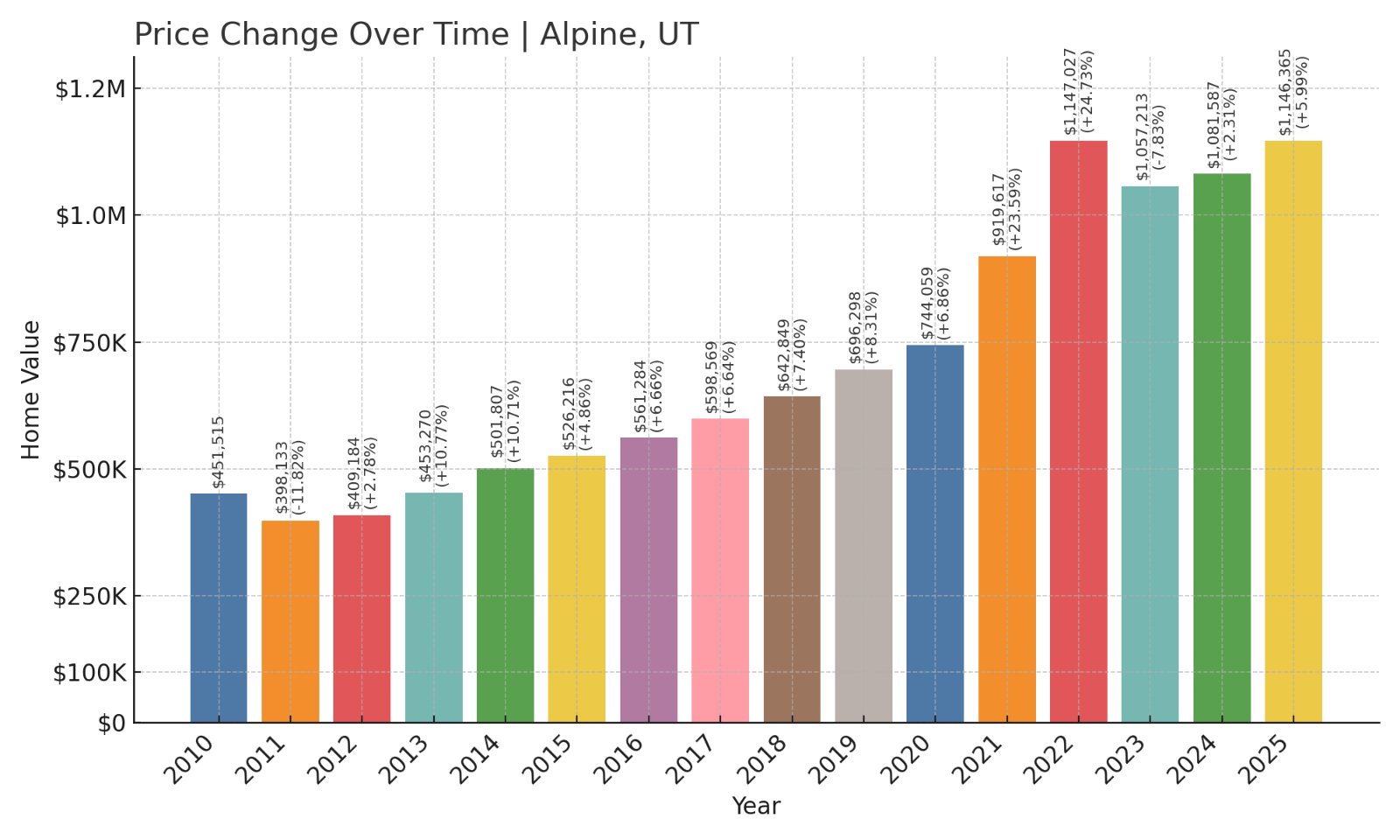

6. Alpine – 154% Home Price Increase Since 2010

Would you like to save this?

- 2010: $451,515

- 2011: $398,133 ($-53,382, -11.82% from previous year)

- 2012: $409,184 (+$11,052, +2.78% from previous year)

- 2013: $453,270 (+$44,085, +10.77% from previous year)

- 2014: $501,807 (+$48,537, +10.71% from previous year)

- 2015: $526,216 (+$24,409, +4.86% from previous year)

- 2016: $561,284 (+$35,067, +6.66% from previous year)

- 2017: $598,569 (+$37,285, +6.64% from previous year)

- 2018: $642,849 (+$44,280, +7.40% from previous year)

- 2019: $696,298 (+$53,449, +8.31% from previous year)

- 2020: $744,059 (+$47,761, +6.86% from previous year)

- 2021: $919,617 (+$175,559, +23.59% from previous year)

- 2022: $1,147,027 (+$227,410, +24.73% from previous year)

- 2023: $1,057,213 ($-89,814, -7.83% from previous year)

- 2024: $1,081,587 (+$24,374, +2.31% from previous year)

- 2025: $1,146,365 (+$64,778, +5.99% from previous year)

Home values in Alpine have risen 154% since 2010, with significant spikes in 2021 and 2022. While prices dipped in 2023, they rebounded in the following years, reaching a median value of $1,146,365 in 2025. The growth shows sustained interest in this high-end suburb.

Alpine – Exclusive Living in Northern Utah County

Alpine sits against the towering peaks of the Wasatch Mountains, offering panoramic views and some of Utah County’s most prestigious addresses. The town has built a reputation for its luxury homes, gated communities, and high-performing schools, drawing executives and professionals from across the state.

Alpine’s real estate boom during the pandemic years pushed prices to new heights, with a jump of over 24% in both 2021 and 2022. Despite a correction in 2023, demand remains high. The 2025 home value of $1.14 million places Alpine among the top-tier real estate markets in Utah, sustained by its blend of scenic beauty and proximity to major employment hubs.

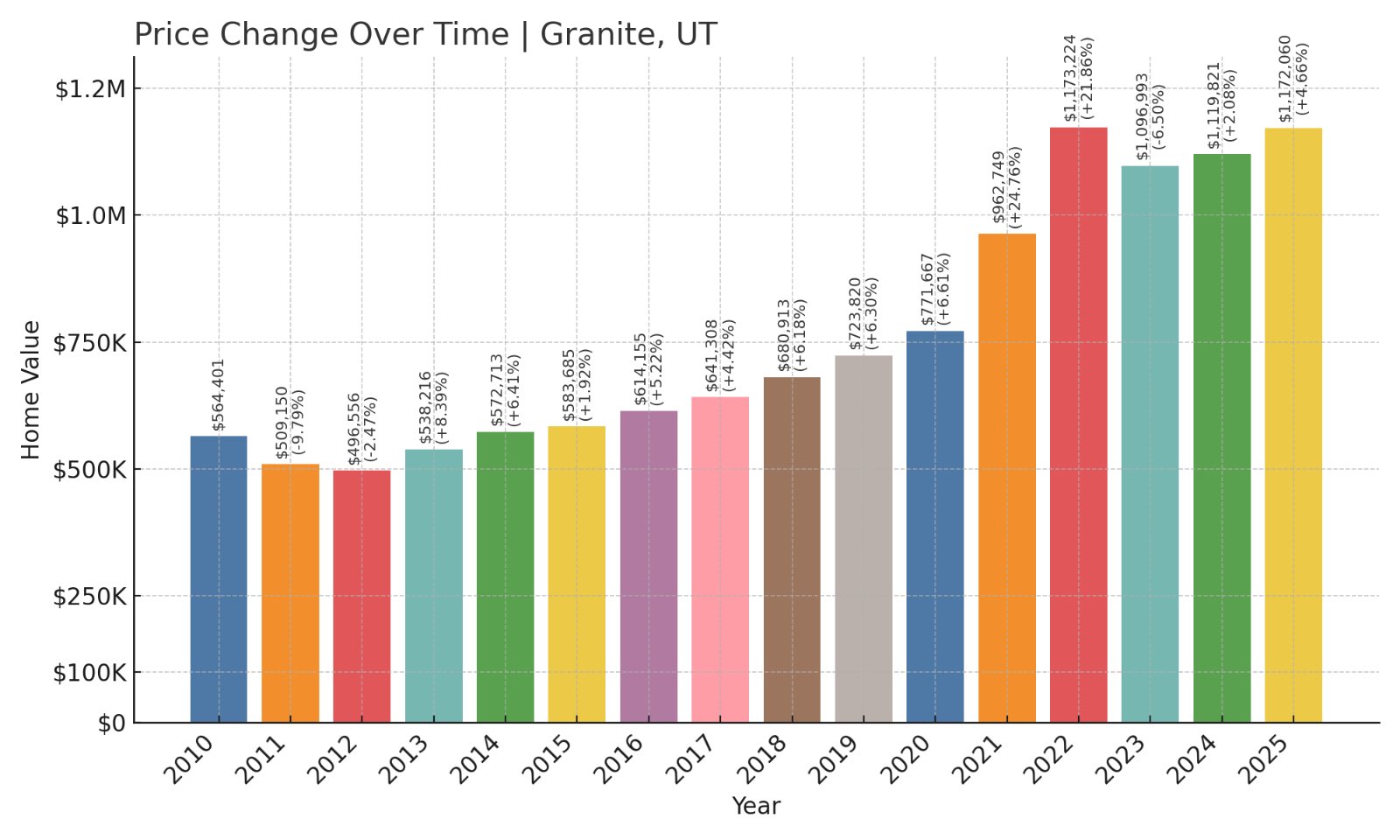

5. Granite – 108% Home Price Increase Since 2010

- 2010: $564,401

- 2011: $509,150 ($-55,252, -9.79% from previous year)

- 2012: $496,556 ($-12,594, -2.47% from previous year)

- 2013: $538,216 (+$41,660, +8.39% from previous year)

- 2014: $572,713 (+$34,497, +6.41% from previous year)

- 2015: $583,685 (+$10,972, +1.92% from previous year)

- 2016: $614,155 (+$30,470, +5.22% from previous year)

- 2017: $641,308 (+$27,152, +4.42% from previous year)

- 2018: $680,913 (+$39,605, +6.18% from previous year)

- 2019: $723,820 (+$42,907, +6.30% from previous year)

- 2020: $771,667 (+$47,848, +6.61% from previous year)

- 2021: $962,749 (+$191,082, +24.76% from previous year)

- 2022: $1,173,224 (+$210,475, +21.86% from previous year)

- 2023: $1,096,993 ($-76,231, -6.50% from previous year)

- 2024: $1,119,821 (+$22,828, +2.08% from previous year)

- 2025: $1,172,060 (+$52,238, +4.66% from previous year)

Granite’s home values have grown by 108% since 2010, with two major leaps in 2021 and 2022. Although 2023 saw a dip, the market bounced back quickly and remains strong in 2025. With home prices now averaging over $1.17 million, Granite has solidified its place in Utah’s high-end housing market.

Granite – Gateway to the Canyons

Granite, located at the mouth of Little Cottonwood Canyon in Salt Lake County, offers immediate access to some of Utah’s best hiking, climbing, and skiing. It’s a favored location for outdoor enthusiasts and retirees who want a serene neighborhood close to both nature and the city.

The dramatic price jumps in the early 2020s were partly driven by out-of-state buyers and locals alike seeking access to world-class trails and slopes. Granite’s quiet atmosphere and spacious homes remain in demand, with the 2025 average home value approaching its previous peak. Expect this niche neighborhood to continue attracting buyers who value recreation and exclusivity.

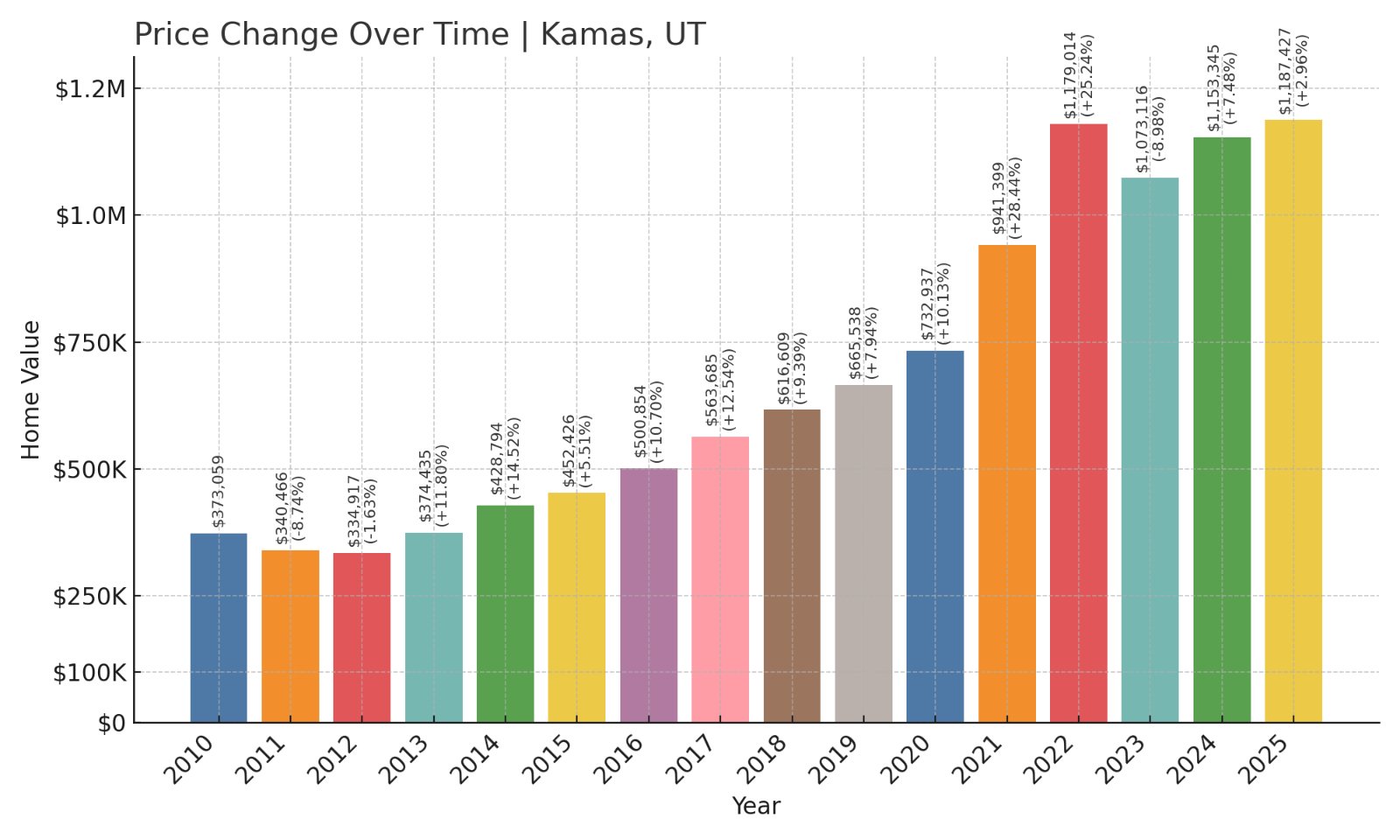

4. Kamas – 218% Home Price Increase Since 2010

- 2010: $373,059

- 2011: $340,466 ($-32,593, -8.74% from previous year)

- 2012: $334,917 ($-5,550, -1.63% from previous year)

- 2013: $374,435 (+$39,519, +11.80% from previous year)

- 2014: $428,794 (+$54,359, +14.52% from previous year)

- 2015: $452,426 (+$23,632, +5.51% from previous year)

- 2016: $500,854 (+$48,429, +10.70% from previous year)

- 2017: $563,685 (+$62,831, +12.54% from previous year)

- 2018: $616,609 (+$52,924, +9.39% from previous year)

- 2019: $665,538 (+$48,929, +7.94% from previous year)

- 2020: $732,937 (+$67,399, +10.13% from previous year)

- 2021: $941,399 (+$208,462, +28.44% from previous year)

- 2022: $1,179,014 (+$237,615, +25.24% from previous year)

- 2023: $1,073,116 ($-105,898, -8.98% from previous year)

- 2024: $1,153,345 (+$80,228, +7.48% from previous year)

- 2025: $1,187,427 (+$34,082, +2.96% from previous year)

Home values in Kamas have soared 218% since 2010, driven by sustained demand and major gains during the pandemic years. While the market dipped in 2023, it has since rebounded, finishing 2025 at $1.19 million.

Kamas – Rustic Roots, Luxury Prices

Kamas, located east of Park City, has transformed from a quiet ranching community to a hot spot for luxury mountain living. Its scenic pastures, proximity to the Uinta Mountains, and lower density than Park City make it a popular choice for buyers wanting high-end homes without resort crowds.

Gains in 2021 and 2022 were driven by a surge in demand for space, privacy, and natural surroundings. As a result, property values surged over 60% in just two years. Though prices dipped in 2023, the upward trend has resumed, and 2025 figures suggest continued strength in this growing market.

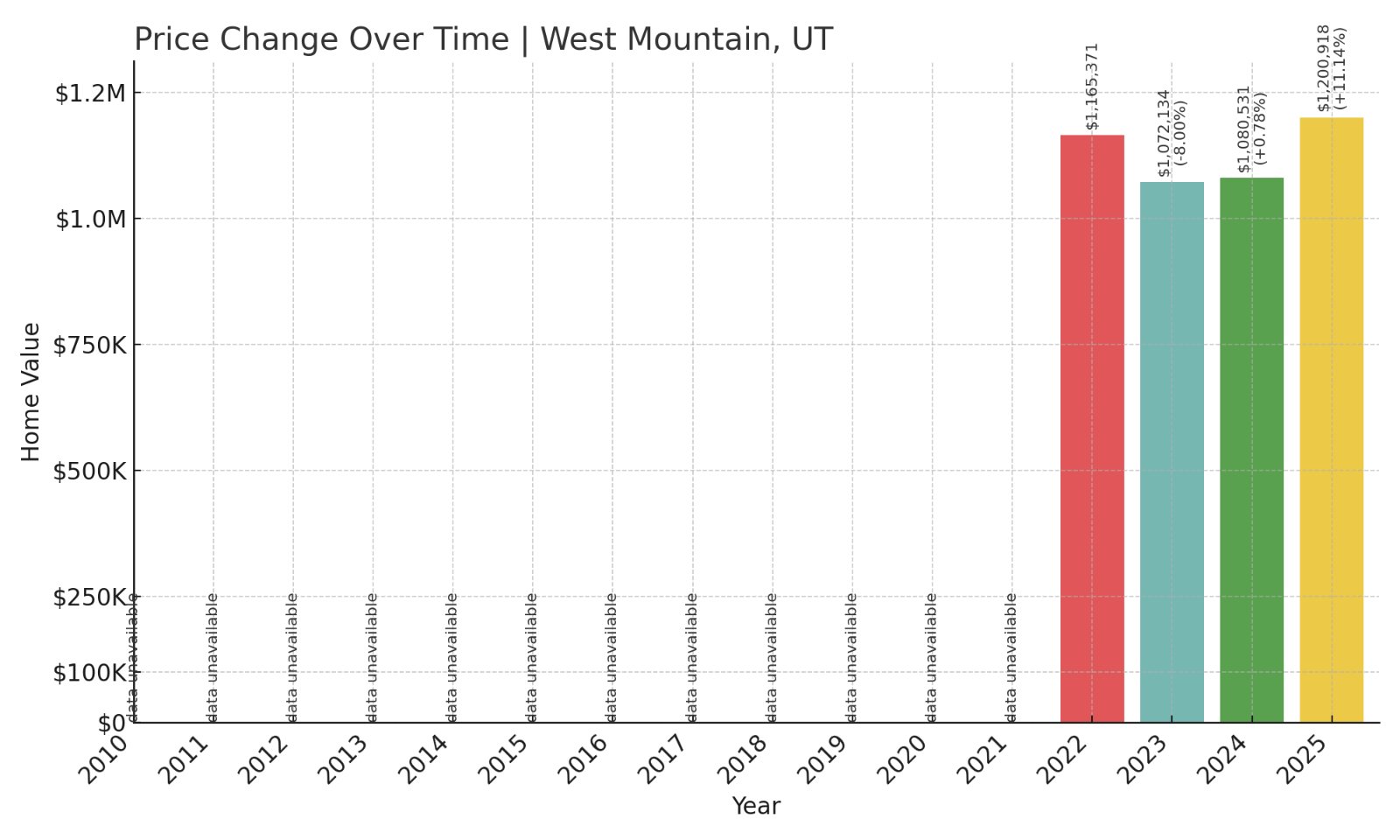

3. West Mountain – 3.05% Home Price Increase Since 2022

- 2022: $1,165,371

- 2023: $1,072,134 ($-93,237, -8.00% from previous year)

- 2024: $1,080,531 (+$8,397, +0.78% from previous year)

- 2025: $1,200,918 (+$120,387, +11.14% from previous year)

West Mountain’s home values have grown just over 3% since 2022, despite a sharp drop in 2023. However, a strong rebound in 2025 pushed values to a new high of $1.2 million. The market appears to be regaining momentum in this scenic corner of Utah County.

West Mountain – High Elevation and New Development

West Mountain, located southwest of Payson, is a lesser-known rural area that’s seen increasing interest from buyers seeking open space and elevated views. As larger Utah Valley towns become more expensive, new development in the foothills of West Mountain has pushed prices up significantly.

Its 2025 rebound suggests that demand for rural luxury homes remains strong. With wide-open views, recent construction, and relative affordability compared to Park City-area prices, West Mountain is carving out a spot among Utah’s priciest towns.

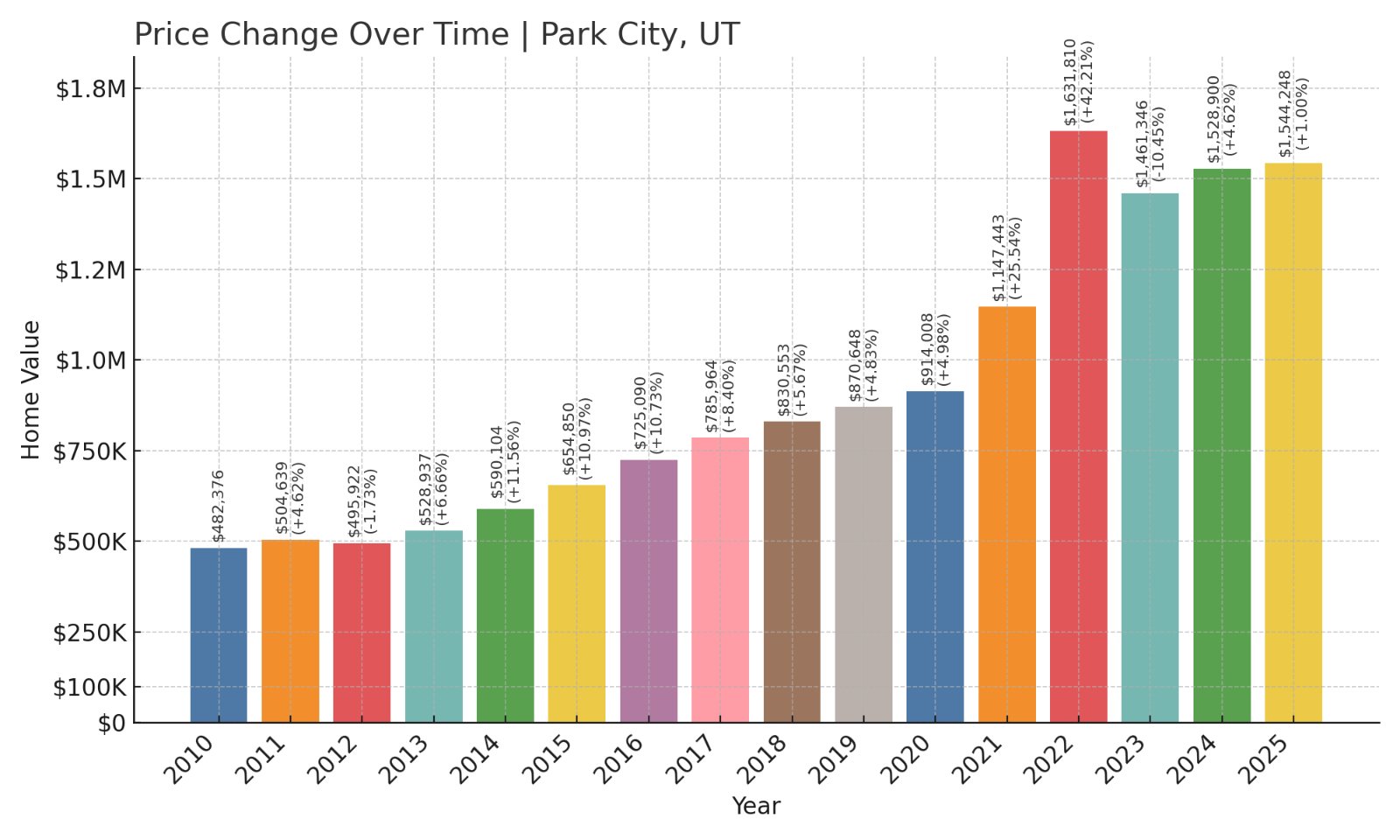

2. Park City – 220% Home Price Increase Since 2010

- 2010: $482,376

- 2011: $504,639 (+$22,263, +4.62% from previous year)

- 2012: $495,922 ($-8,717, -1.73% from previous year)

- 2013: $528,937 (+$33,015, +6.66% from previous year)

- 2014: $590,104 (+$61,167, +11.56% from previous year)

- 2015: $654,850 (+$64,746, +10.97% from previous year)

- 2016: $725,090 (+$70,240, +10.73% from previous year)

- 2017: $785,964 (+$60,873, +8.40% from previous year)

- 2018: $830,553 (+$44,590, +5.67% from previous year)

- 2019: $870,648 (+$40,094, +4.83% from previous year)

- 2020: $914,008 (+$43,360, +4.98% from previous year)

- 2021: $1,147,443 (+$233,435, +25.54% from previous year)

- 2022: $1,631,810 (+$484,367, +42.21% from previous year)

- 2023: $1,461,346 ($-170,464, -10.45% from previous year)

- 2024: $1,528,900 (+$67,554, +4.62% from previous year)

- 2025: $1,544,248 (+$15,348, +1.00% from previous year)

Park City has seen home values rise by 220% since 2010, with the biggest increases occurring in 2021 and 2022. Although values dipped in 2023, the market stabilized and inched up again through 2025, with the average home price exceeding $1.54 million.

Park City – Utah’s Luxury Real Estate Capital

Park City is world-famous for its ski resorts, film festival, and high-end real estate. Located in Summit County, it draws celebrities, tech entrepreneurs, and luxury buyers from around the world. With top-tier amenities, boutique shopping, and proximity to Salt Lake City International Airport, it offers unmatched convenience and prestige.

Home prices exploded in the early 2020s, fueled by remote work trends and record-low inventory. The post-boom dip in 2023 was followed by renewed interest and slower, steadier growth in the years since. At $1.54 million in 2025, Park City remains Utah’s most recognizable — and reliably expensive — housing market.

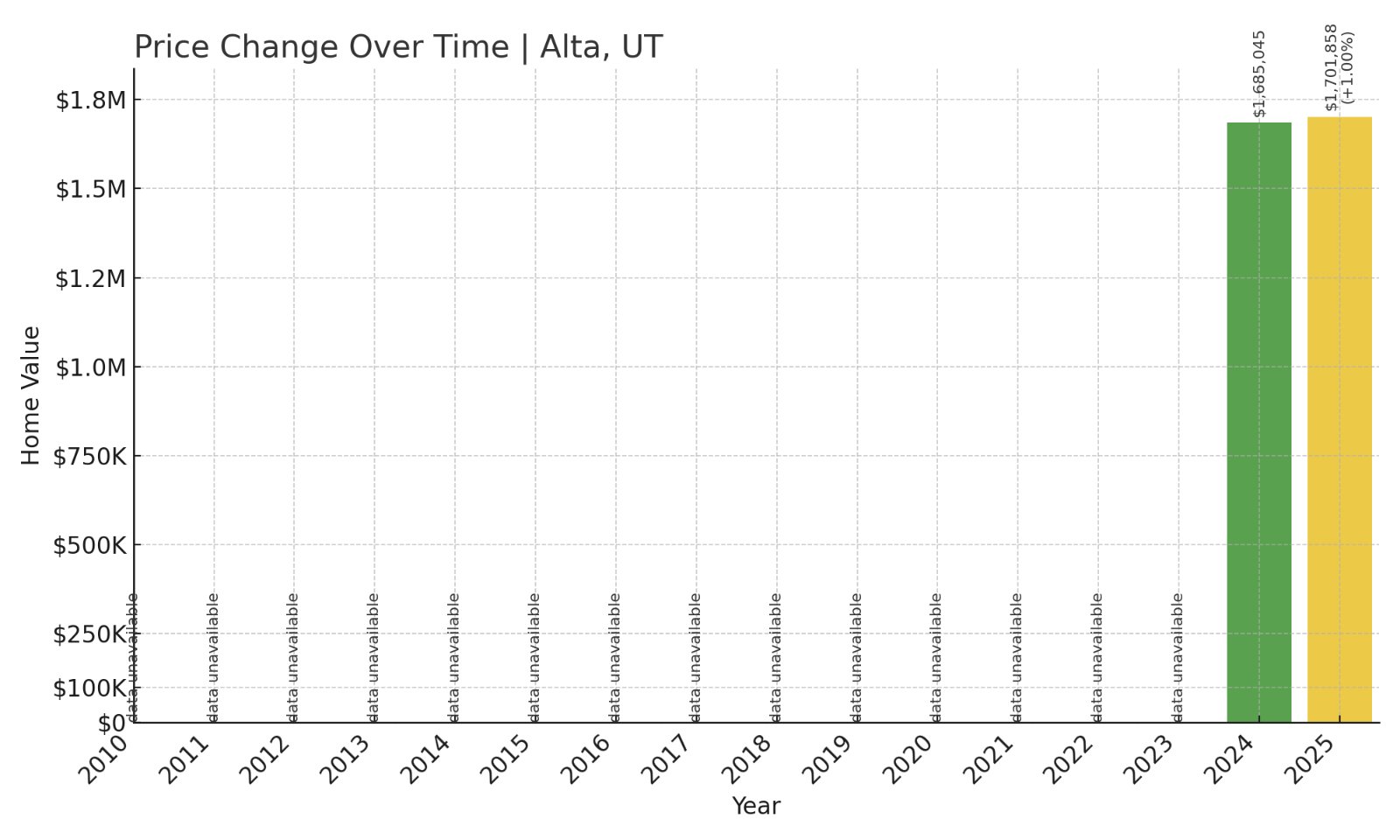

1. Alta – 1.00% Home Price Increase Since 2024

- 2024: $1,685,045

- 2025: $1,701,858 (+$16,813, +1.00% from previous year)

Alta tops the list with a 2025 home value of over $1.7 million. While we only have data from 2024 onward, even that short timeframe shows modest growth. Its extremely limited housing stock and unmatched skiing access help support sky-high values.

Alta – Elevation, Powder, and Exclusivity

Alta is a tiny mountain town located at the top of Little Cottonwood Canyon, home to one of the most celebrated ski resorts in North America. With only a handful of residential properties and nearly all land managed by the U.S. Forest Service or ski area operators, housing here is extremely scarce — and incredibly expensive.

The town’s remote location, deep snowpack, and high elevation make it a dream for powder hounds and backcountry skiers. Its real estate market is unlike any other in Utah: minimal listings, long-term ownership, and a luxury niche appeal. With homes averaging $1.7 million, Alta is a true outlier — and the state’s most expensive place to own property in 2025.