Would you like to save this?

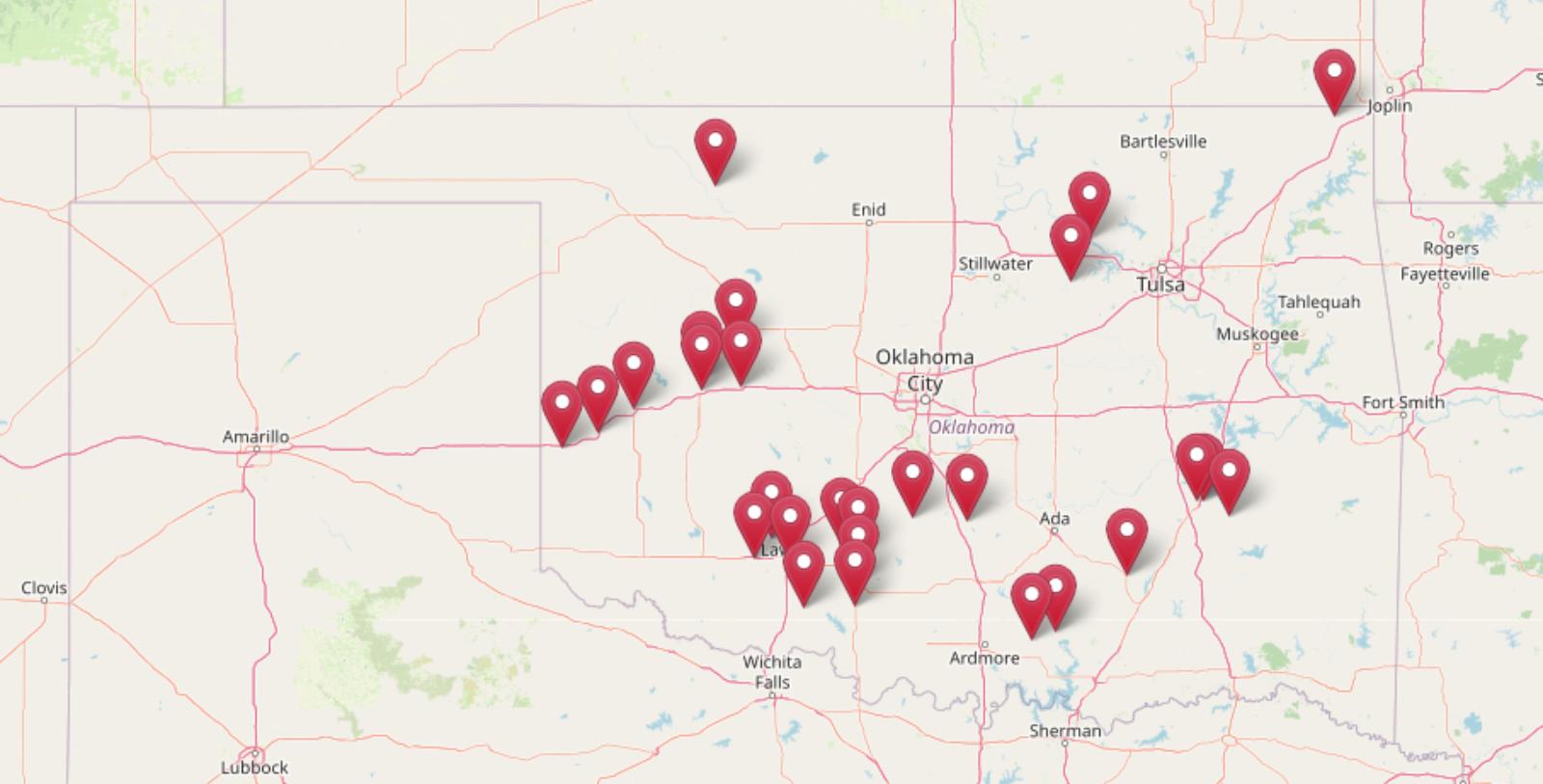

In dozens of Oklahoma towns, home prices are no longer creeping up—they’re exploding. According to the Zillow Home Value Index, some markets have seen price jumps in the last three years that outpace the entire previous decade. That kind of acceleration often means one thing: investors are moving in fast. From flippers to institutional buyers, speculative demand is flooding small-town markets, driving up prices and crowding out longtime residents. These are the places where locals are getting squeezed—and where the shift feels personal.

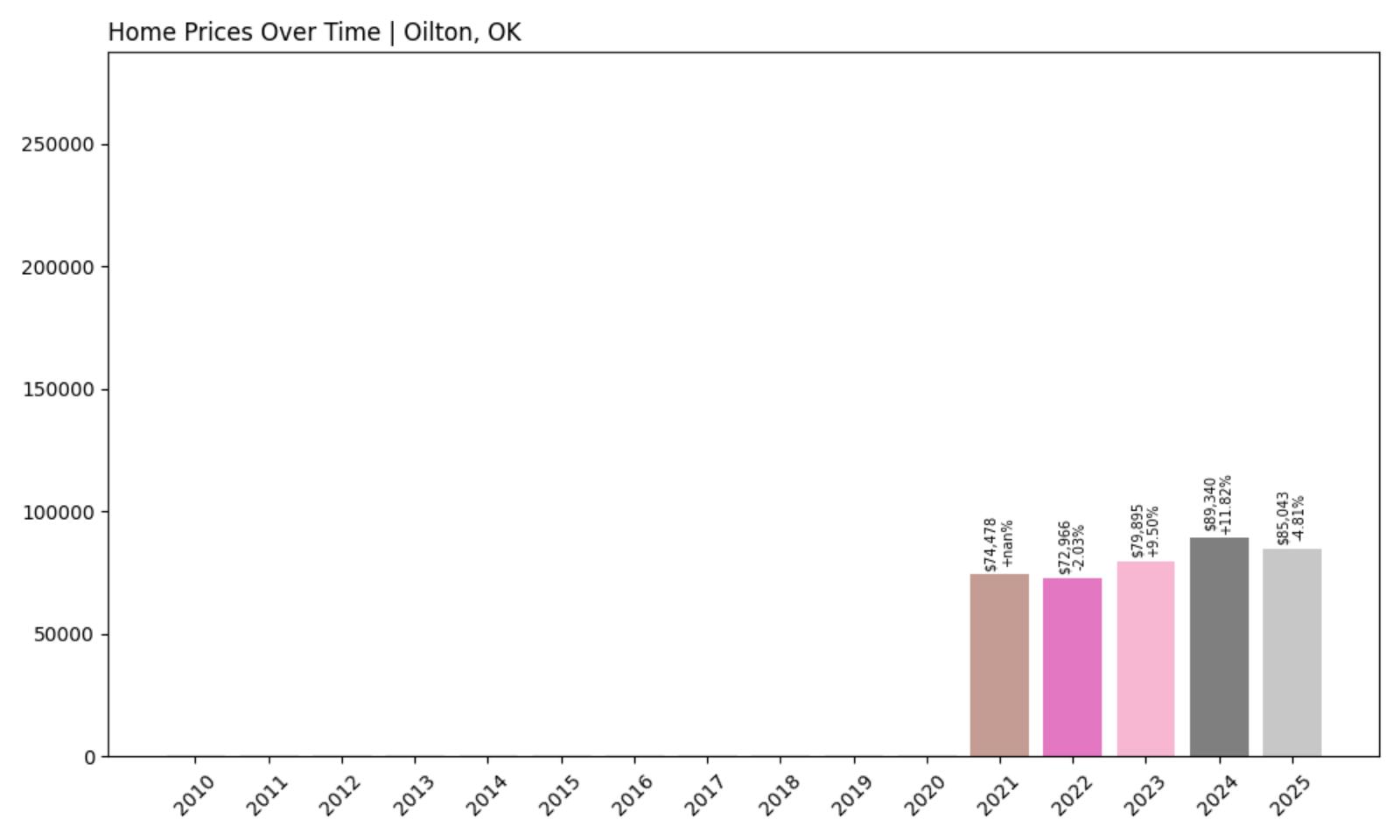

27. Oilton – Investor Feeding Frenzy Factor -358.13% (July 2025)

- Historical annual growth rate (2012–2022): -2.03%

- Recent annual growth rate (2022–2025): 5.24%

- Investor Feeding Frenzy Factor: -358.13%

- Current 2025 price: $85,042.57

Oilton’s home prices have reversed a decade-long decline, with a recent growth rate of 5.24% per year since 2022—far stronger than its negative historical average. This dramatic turnaround results in an Investor Feeding Frenzy Factor of -358.13%, one of the most extreme on the list. The sudden price movement signals sharp investor interest in a market that was previously stagnant.

Oilton – From Slump to Sudden Surge

Located in northeastern Oklahoma, Oilton has long been a quiet town that flew under the radar. The town’s earlier sluggish price growth may have deterred typical buyers, but recent upticks have likely been fueled by speculative investors spotting undervalued opportunities. The sharp change in trend has led to home prices jumping to $85,042.57 as of May 2025, well above expectations for a town of its size and profile.

While Oilton still offers relatively low home prices, the pace of appreciation is now raising eyebrows. Investors may be banking on broader regional growth, but the rapid change could price out local families if the trend continues unchecked. The question remains: is this the start of sustainable growth, or the peak of speculative demand?

26. Erick – Investor Feeding Frenzy Factor -304.25% (July 2025)

- Historical annual growth rate (2012–2022): -2.37%

- Recent annual growth rate (2022–2025): 4.84%

- Investor Feeding Frenzy Factor: -304.25%

- Current 2025 price: $82,398.55

Erick’s sharp pivot from negative to positive price growth has raised its Investor Feeding Frenzy Factor to an extreme -304.25%. Historically declining by over 2% annually, the town now sees nearly 5% annual growth—a sign that investor speculation may be intensifying in a once-overlooked market.

Erick – A Market Reversal in Motion

Nestled near the Texas border along historic Route 66, Erick is experiencing a transformation that few predicted. After a decade of declining home values, the tide has turned dramatically, likely attracting flippers and outside buyers who view the town as an undervalued gem. With a 2025 average home price just above $82,000, the affordability alone may be drawing outside interest.

The sudden upswing in values could strain affordability for locals who’ve weathered years of stagnation. Whether it’s improved infrastructure or spillover from nearby areas, Erick’s housing market is shifting fast—and locals may need to adapt quickly to stay ahead of the curve.

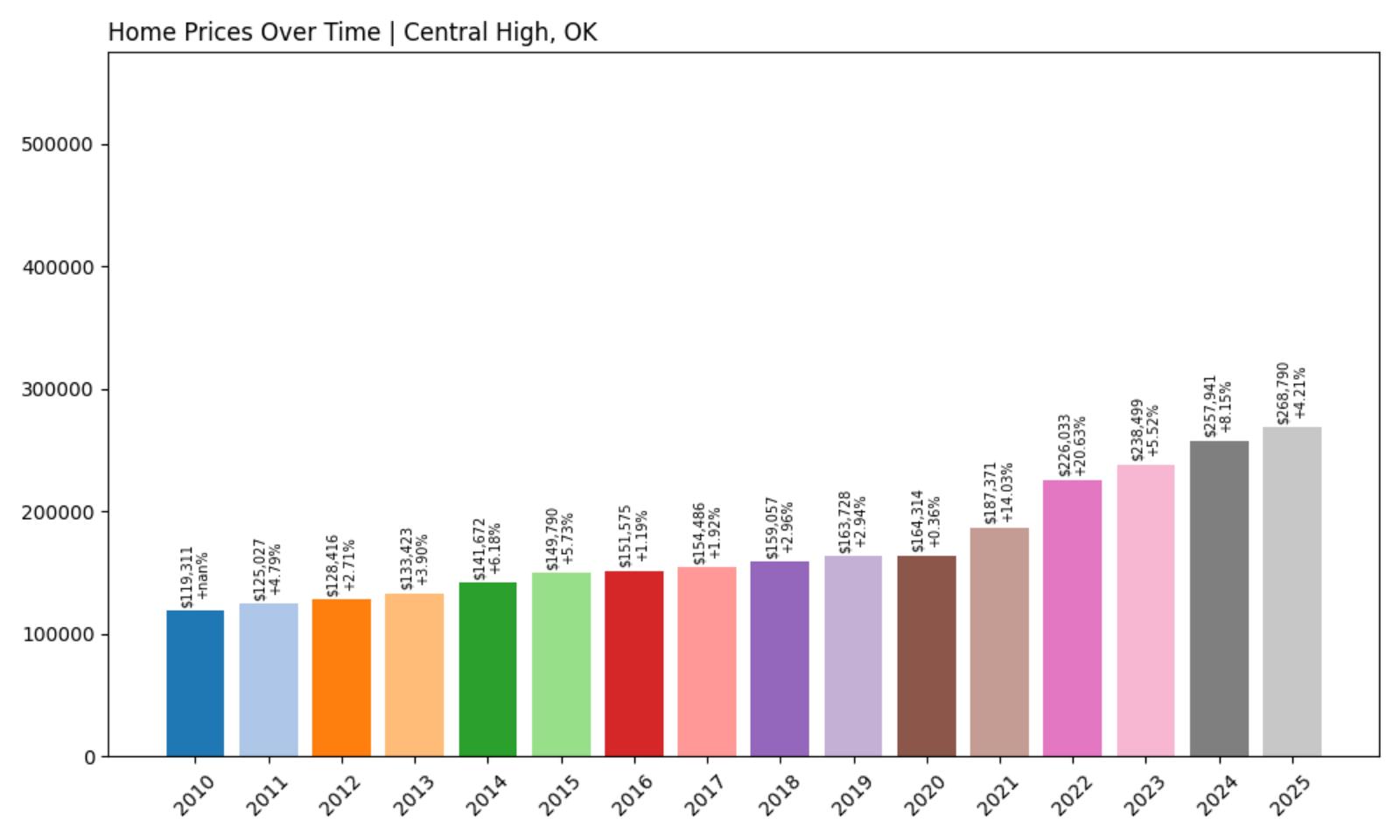

25. Central High – Investor Feeding Frenzy Factor 2.20% (July 2025)

- Historical annual growth rate (2012–2022): 5.82%

- Recent annual growth rate (2022–2025): 5.95%

- Investor Feeding Frenzy Factor: 2.20%

- Current 2025 price: $268,790.43

Central High’s housing market has remained remarkably stable, with a near-identical growth rate over the past decade and in recent years. Its Investor Feeding Frenzy Factor of 2.20% indicates consistency rather than a speculative spike, suggesting organic, steady demand rather than investor-fueled volatility.

Central High – Steady Growth, Strong Value

Would you like to save this?

Located in Stephens County, Central High sits in a rural area that offers peace and space without being too far from urban amenities. The town’s home values have steadily appreciated year after year, with a current median price near $269,000. This price point suggests a relatively affluent rural market, possibly supported by commuters or retirees seeking quiet living.

While Central High doesn’t show signs of runaway investor activity, its dependable growth and solid property values may be precisely what makes it appealing to long-term buyers. It’s a town where stability reigns, and that predictability is starting to stand out in an otherwise volatile market landscape.

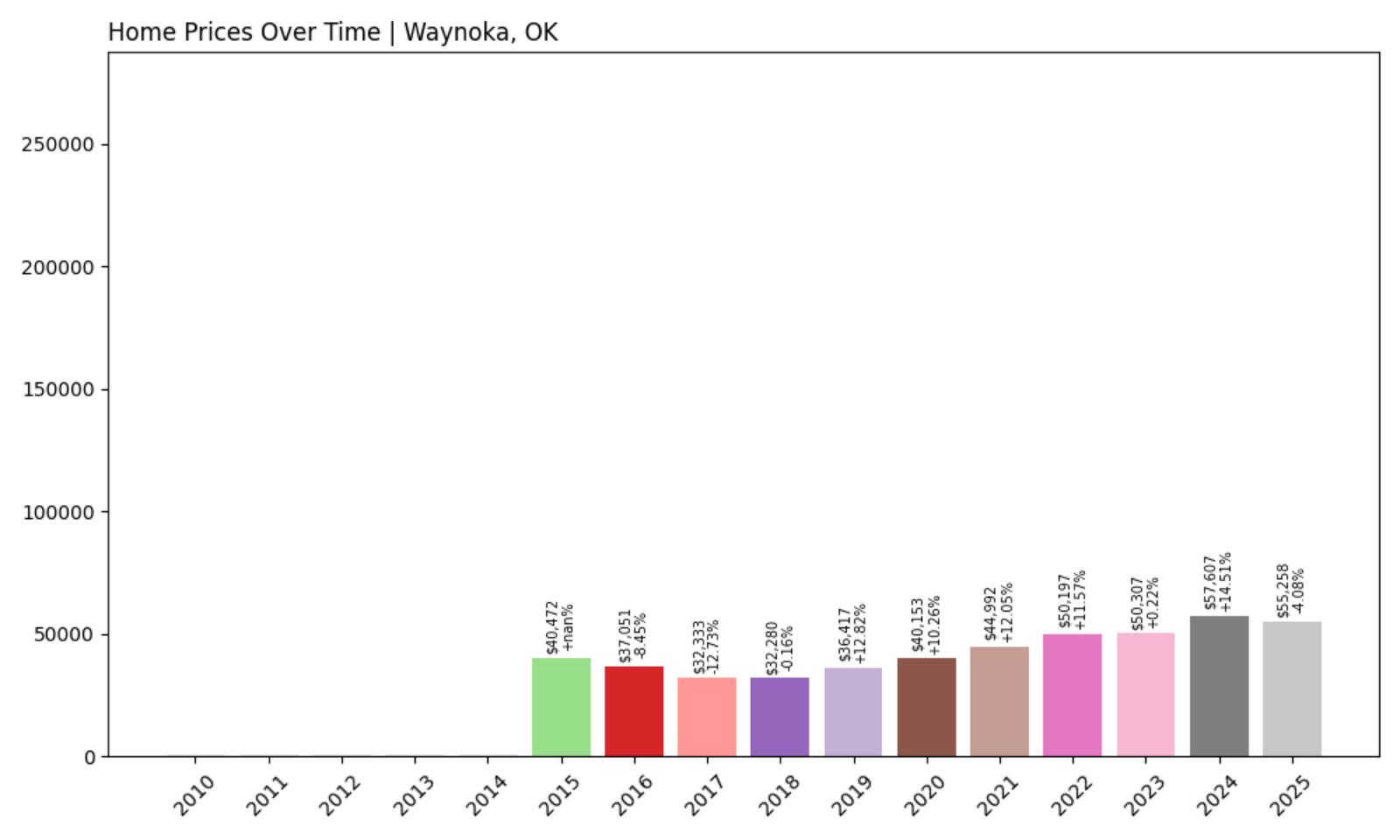

24. Waynoka – Investor Feeding Frenzy Factor 4.16% (July 2025)

- Historical annual growth rate (2012–2022): 3.12%

- Recent annual growth rate (2022–2025): 3.25%

- Investor Feeding Frenzy Factor: 4.16%

- Current 2025 price: $55,258.08

Waynoka’s home values have ticked up slightly in recent years, mirroring its already-modest historical trend. The Investor Feeding Frenzy Factor of 4.16% points to mild acceleration, but nothing yet resembling speculative mania. Prices remain low, but stable growth is drawing quiet attention.

Waynoka – Quiet, Affordable, and Rising Slowly

In northwest Oklahoma, Waynoka is best known as the gateway to Little Sahara State Park—a destination that brings tourists and seasonal traffic. Despite its small size and rural setting, the town’s real estate is inching upward, with a 2025 price just over $55,000. That figure reflects ongoing affordability but also suggests demand is starting to climb.

The gentle uptick in values may reflect outside interest from recreational land buyers or budget-conscious retirees. While investors haven’t descended en masse, the conditions for a low-level feeding frenzy could be forming if growth continues. For now, Waynoka remains accessible, but the tide may be starting to shift.

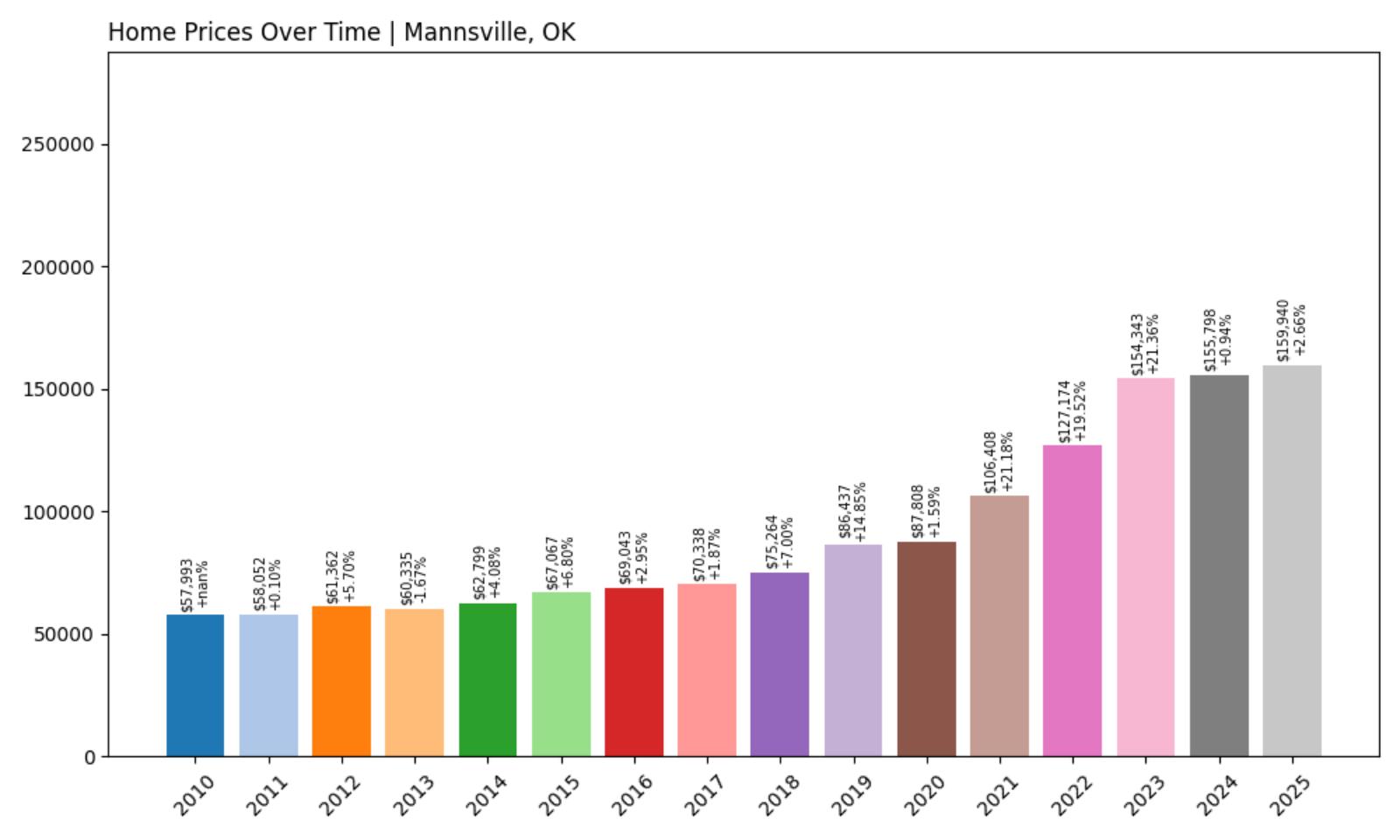

23. Mannsville – Investor Feeding Frenzy Factor 5.04% (July 2025)

- Historical annual growth rate (2012–2022): 7.56%

- Recent annual growth rate (2022–2025): 7.94%

- Investor Feeding Frenzy Factor: 5.04%

- Current 2025 price: $159,940.26

Mannsville has maintained an already-strong pace of appreciation, with a modest boost in recent years pushing its Feeding Frenzy Factor to 5.04%. At nearly $160,000 in 2025, prices remain relatively reasonable for a town experiencing sustained high growth rates.

Mannsville – Steady Performer With Growing Appeal

Located in Johnston County in southern Oklahoma, Mannsville is a small community that’s been on a steady climb. Its double-digit annual growth rates since 2012 highlight a long-term upward trajectory. That stability, coupled with recent acceleration, points to a healthy market that could become a magnet for long-term investors.

Though not yet a hotbed of speculative buying, Mannsville’s consistent appreciation and relatively affordable price point make it one to watch. The slow but reliable value increase may attract buyers looking for less volatility without sacrificing long-term upside.

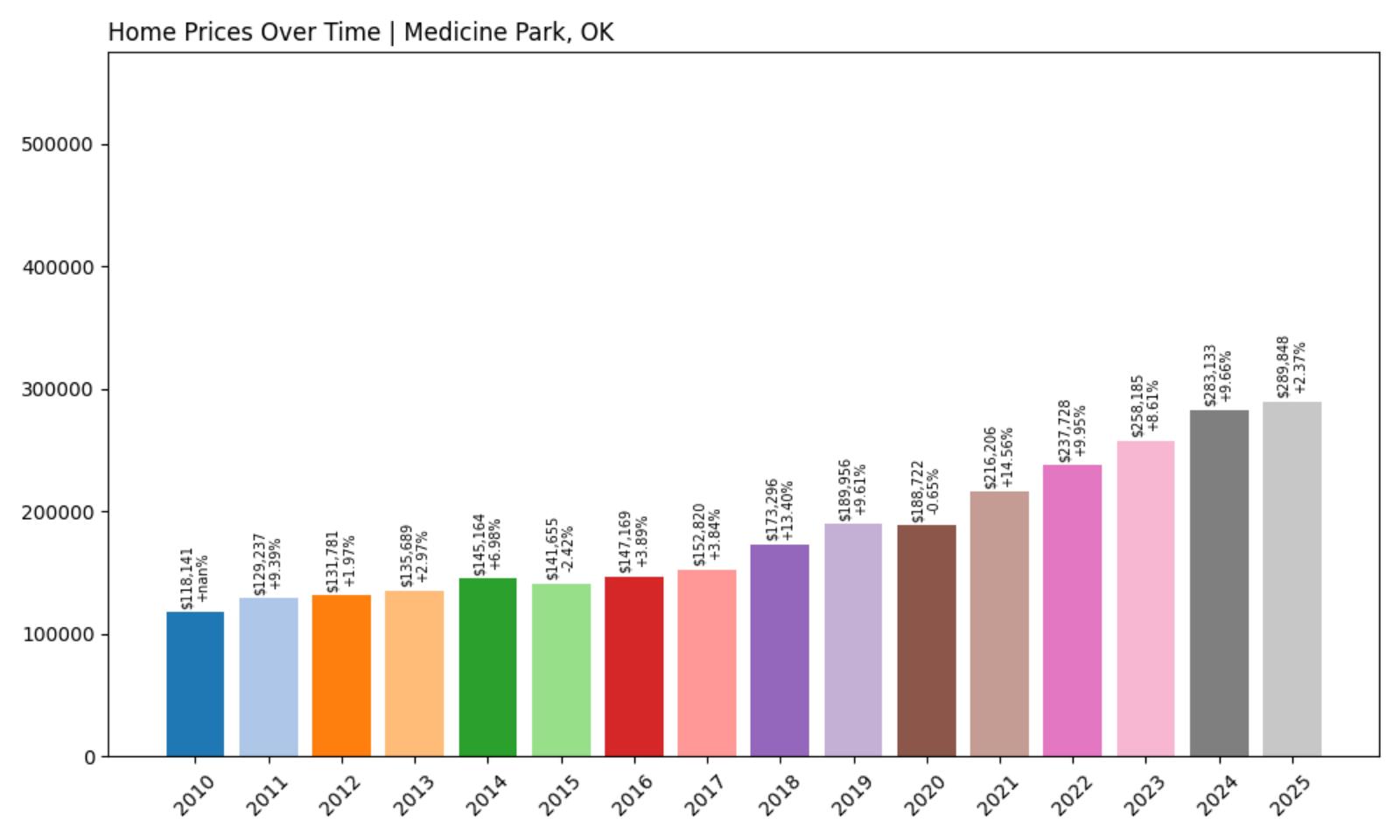

22. Medicine Park – Investor Feeding Frenzy Factor 12.40% (July 2025)

- Historical annual growth rate (2012–2022): 6.08%

- Recent annual growth rate (2022–2025): 6.83%

- Investor Feeding Frenzy Factor: 12.40%

- Current 2025 price: $289,848.01

Medicine Park has seen its already-healthy growth rate accelerate slightly in recent years, lifting its Investor Feeding Frenzy Factor to 12.40%. With 2025 home prices nearing $290,000, the town is now one of the more expensive entries on this list. This recent bump hints at heightened investor interest in a market that’s long been desirable.

Medicine Park – Scenic Demand Drives Price Gains

Situated near the Wichita Mountains and just northwest of Lawton, Medicine Park blends historic charm with natural beauty. Known for its cobblestone architecture and resort-town feel, the area has long been a regional getaway. That appeal seems to be translating into property value growth, especially as outdoor-oriented lifestyles have gained traction post-pandemic.

Its unique setting and architectural flair make Medicine Park stand out in rural Oklahoma. As demand grows, so do prices, with investor activity possibly adding pressure to a limited housing stock. The consistent upward price trend signals long-term confidence—but may also make it harder for locals to compete with outside buyers seeking vacation homes or rentals.

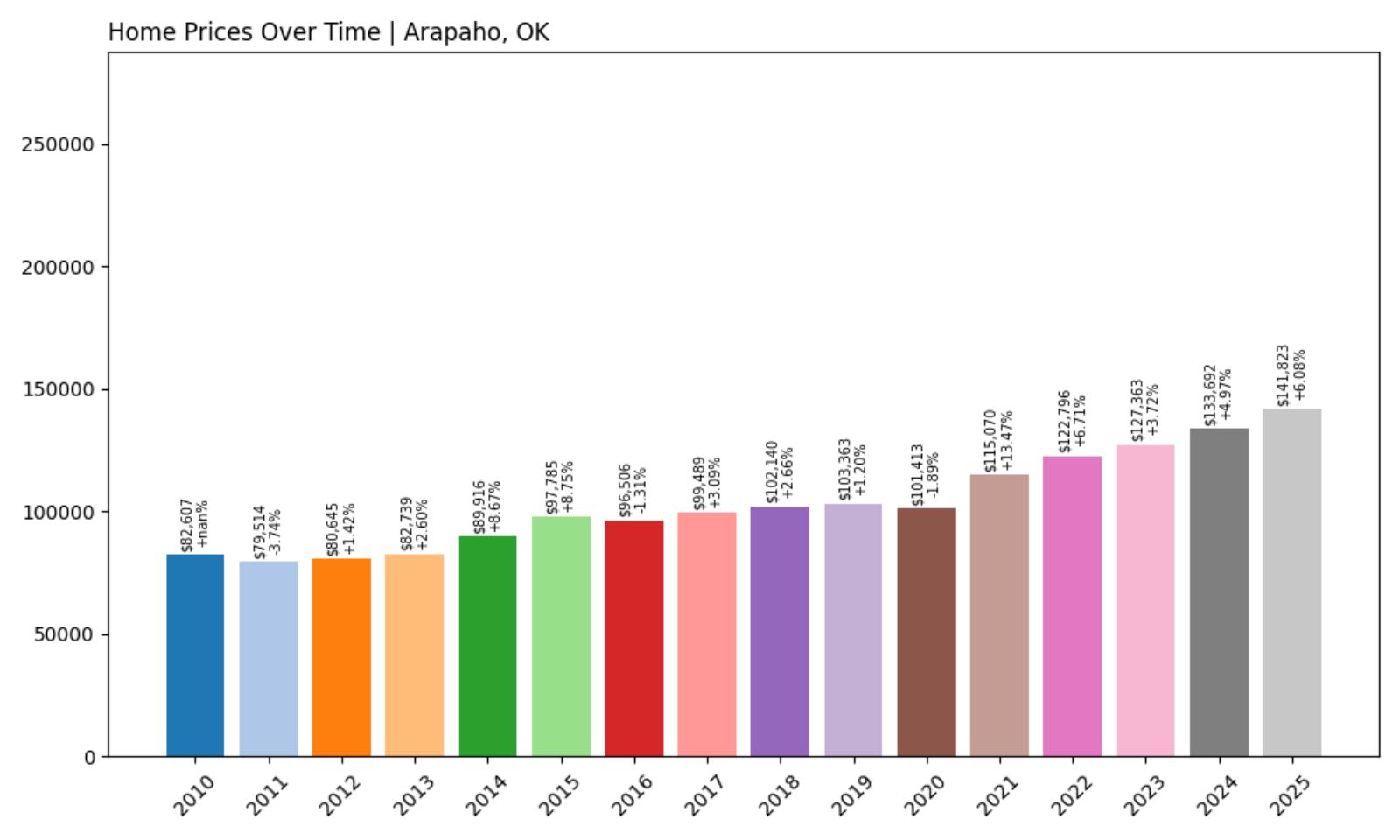

21. Arapaho – Investor Feeding Frenzy Factor 14.54% (July 2025)

- Historical annual growth rate (2012–2022): 4.29%

- Recent annual growth rate (2022–2025): 4.92%

- Investor Feeding Frenzy Factor: 14.54%

- Current 2025 price: $141,822.68

Arapaho’s growth rate has ticked up modestly in the last three years, enough to produce a Feeding Frenzy Factor of 14.54%. Home values have climbed to just over $141,000, indicating both steady appreciation and possible signals of investor involvement.

Arapaho – Modest Town, Measured Momentum

As the county seat of Custer County in western Oklahoma, Arapaho benefits from regional administrative importance despite its small size. The town has avoided the dramatic price swings seen elsewhere, but the recent uptick in growth suggests that external interest may be creeping in. The relatively affordable pricing paired with new attention may be setting the stage for stronger momentum.

With no major industrial drivers, Arapaho’s housing shift is likely driven by broader affordability trends and overflow from nearby areas like Clinton. Investors seeking entry-level markets could view Arapaho as a stable alternative with future upside potential.

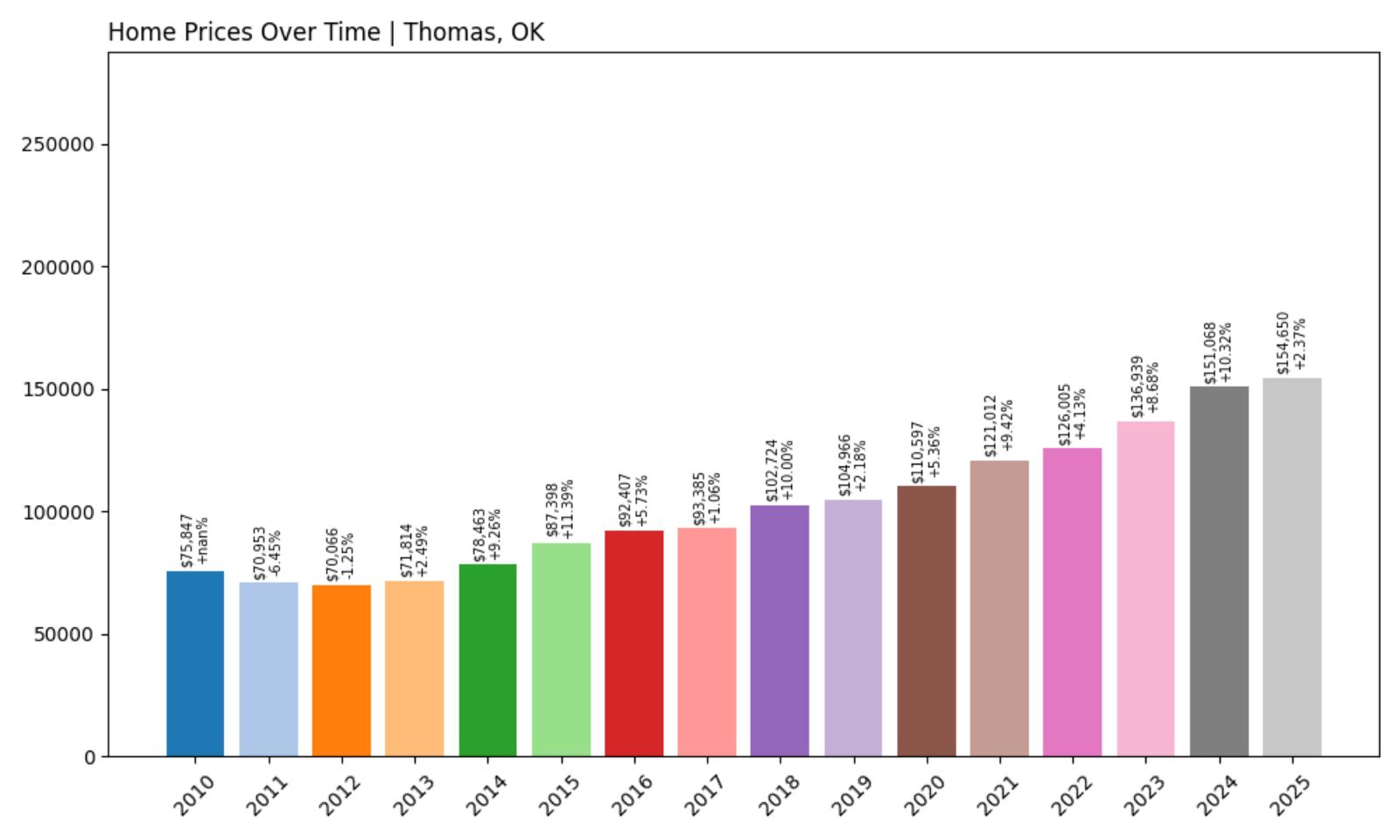

20. Thomas – Investor Feeding Frenzy Factor 16.91% (July 2025)

- Historical annual growth rate (2012–2022): 6.04%

- Recent annual growth rate (2022–2025): 7.07%

- Investor Feeding Frenzy Factor: 16.91%

- Current 2025 price: $154,649.98

Thomas has experienced an uptick in price momentum, with growth jumping from an already-strong 6.04% annually to 7.07% in recent years. The Feeding Frenzy Factor of 16.91% is a sign that investor interest is playing a growing role in shaping the market.

Thomas – Quiet Town, Rising Interest

Located in Custer County, Thomas has flown under the radar for years but is now attracting more attention due to its consistent growth. Its median home value sits just above $154,000—an approachable price that makes it a potential target for both local buyers and speculative investors. With relatively low inventory, even small demand spikes can shift the market noticeably.

The data shows that this is not a flash-in-the-pan trend; Thomas has been appreciating steadily over the past decade. The recent boost may reflect changing demographics or investor confidence in rural Oklahoma as a whole. Whether this pace holds remains to be seen, but the town is clearly on more radars now than before.

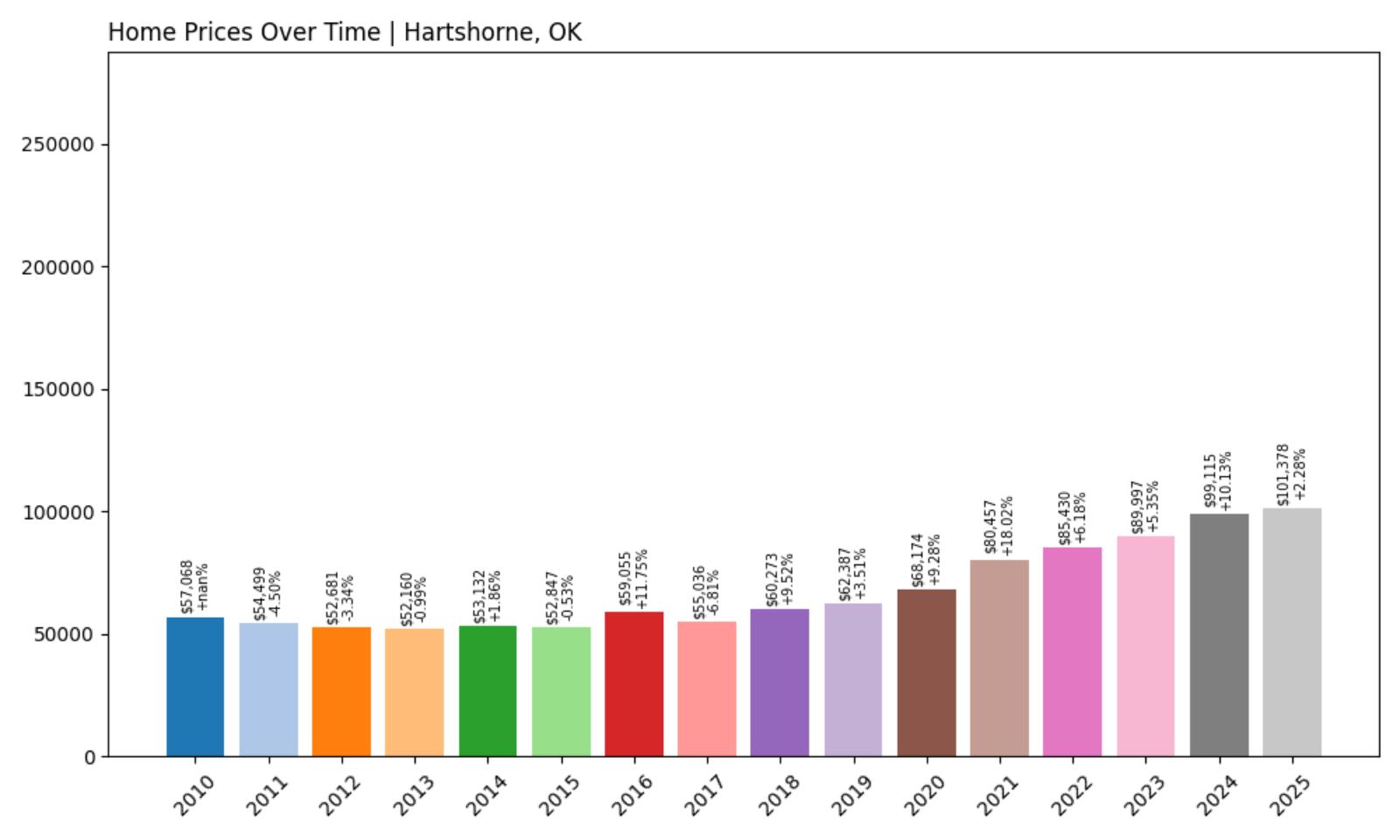

19. Hartshorne – Investor Feeding Frenzy Factor 18.53% (July 2025)

- Historical annual growth rate (2012–2022): 4.95%

- Recent annual growth rate (2022–2025): 5.87%

- Investor Feeding Frenzy Factor: 18.53%

- Current 2025 price: $101,377.64

Hartshorne has posted a strong recent performance with growth rates rising to nearly 6% per year, up from a historical average of under 5%. That increase results in a Feeding Frenzy Factor of 18.53%, suggesting a moderate but noticeable investor footprint in the area.

Hartshorne – Modest Prices, Growing Pressure

Located in Pittsburg County in southeastern Oklahoma, Hartshorne sits near the edge of the Ouachita Mountains and has long offered budget-friendly housing. At just over $101,000, the median price remains low, but the recent acceleration in growth suggests more competition entering the market. With few new builds, rising prices may quickly translate to reduced affordability for locals.

The town’s economic base is small, which makes it more sensitive to shifts in housing demand. As regional affordability dwindles in bigger towns, Hartshorne may become a target for investors looking to scoop up low-cost properties while prices still seem low. That behavior may already be starting to show in the data.

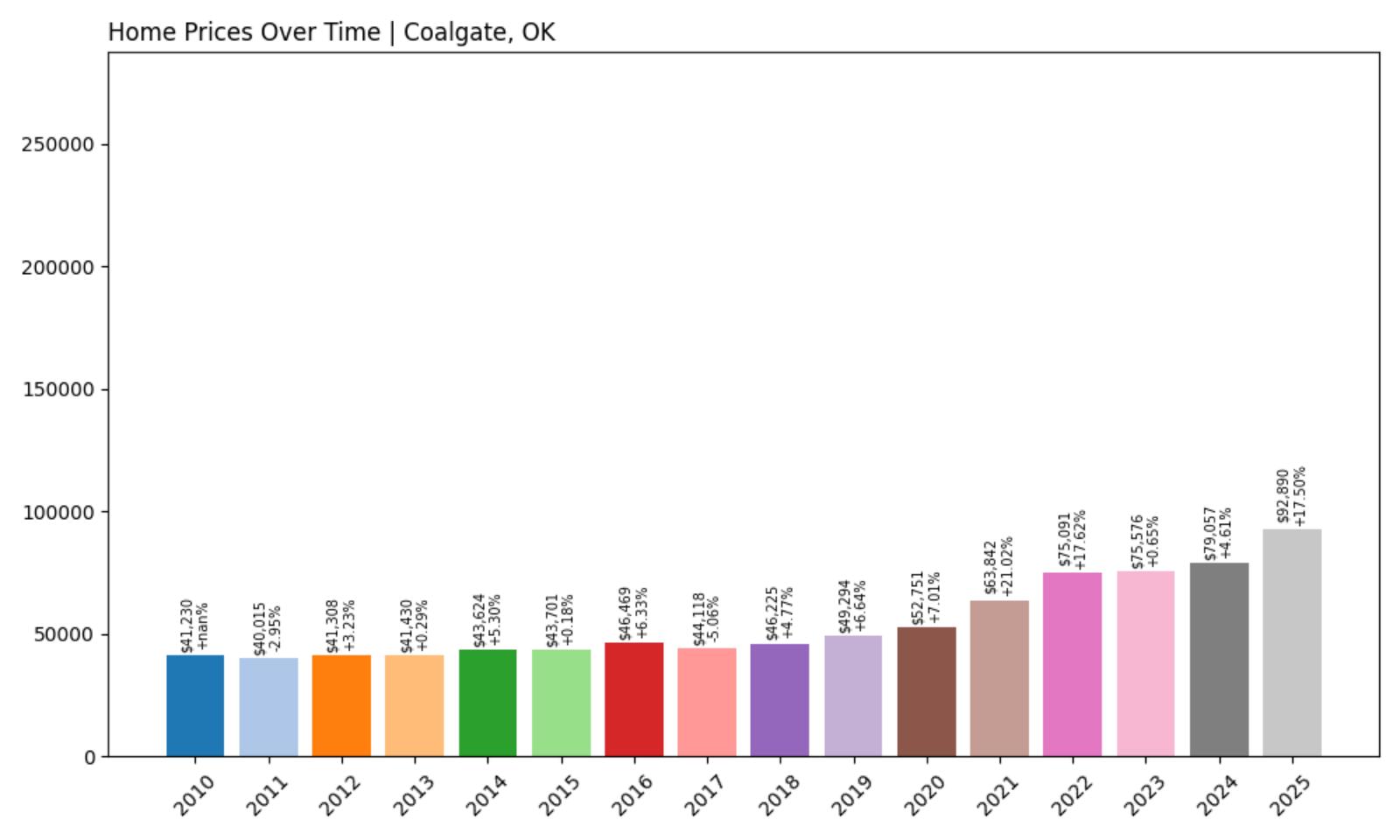

18. Coalgate – Investor Feeding Frenzy Factor 19.32% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 6.16%

- Recent annual growth rate (2022–2025): 7.35%

- Investor Feeding Frenzy Factor: 19.32%

- Current 2025 price: $92,890.27

Coalgate’s already-strong growth trend has picked up in recent years, bringing its Feeding Frenzy Factor to 19.32%. At under $93,000, the town remains affordable, but the upward momentum may indicate increasing pressure from investors and out-of-town buyers.

Coalgate – A High-Growth Market Under the Radar

As the seat of Coal County, Coalgate is a small town with strong historical roots and access to key regional roads. Its price growth of over 7% annually since 2022 is impressive, particularly given its small base. The consistent upward trend likely reflects limited housing supply coupled with growing investor interest in overlooked rural areas.

Buyers seeking value may have zeroed in on Coalgate as a rare mix of low entry price and solid appreciation. Whether it’s early retirees, landlords, or cash investors, their presence may be accelerating the town’s transformation. Continued price growth could soon put pressure on locals who have long relied on Coalgate’s affordability.

17. Cleveland – Investor Feeding Frenzy Factor 19.74% (July 2025)

- Historical annual growth rate (2012–2022): 5.93%

- Recent annual growth rate (2022–2025): 7.10%

- Investor Feeding Frenzy Factor: 19.74%

- Current 2025 price: $134,128.08

Cleveland’s growth rate has accelerated from just under 6% historically to over 7% in the last three years, resulting in a Feeding Frenzy Factor of 19.74%. With current home prices around $134,000, the town remains relatively accessible—but that could change if investor activity keeps pushing prices upward.

Cleveland – Rising Demand in a Riverfront Town

Located along the Arkansas River northwest of Tulsa, Cleveland is part of the Tulsa metro commuter zone, offering a mix of small-town living with access to city amenities. Its location, combined with scenic views and proximity to Keystone Lake, gives it appeal for both families and remote workers looking for affordability and quality of life.

The recent growth trend suggests Cleveland is becoming more attractive to outside buyers. Investors looking for properties in emerging suburban markets may be zeroing in, and the data shows the impact. While prices are still moderate, continued acceleration could limit options for locals, especially first-time homebuyers trying to enter the market.

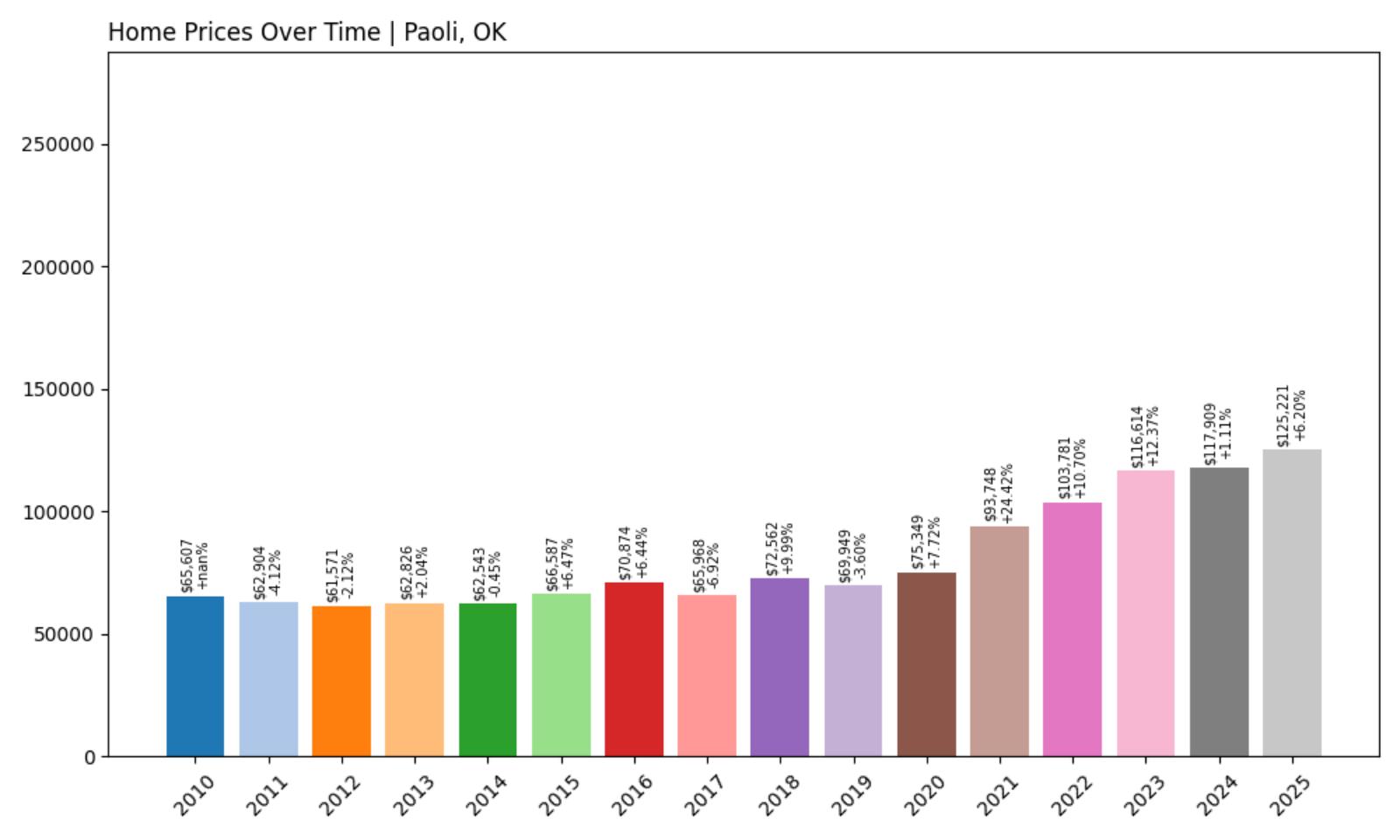

16. Paoli – Investor Feeding Frenzy Factor 20.53% (July 2025)

- Historical annual growth rate (2012–2022): 5.36%

- Recent annual growth rate (2022–2025): 6.46%

- Investor Feeding Frenzy Factor: 20.53%

- Current 2025 price: $125,220.73

Paoli has moved from steady growth to a slightly faster pace, bumping its Feeding Frenzy Factor to 20.53%. The 2025 home price sits at just over $125,000, marking it as an affordable rural option that’s starting to catch attention.

Paoli – Affordable and Heating Up

Paoli is a small town in Garvin County with fewer than 1,000 residents, known for its agricultural roots and quiet charm. That quiet may not last forever, as investors appear to be taking a second look at places like this. Growth in recent years has surpassed historical norms, suggesting something is stirring beneath the surface.

The town’s location along major routes like I-35 makes it more connected than its size implies. As larger nearby markets become expensive, Paoli could see more inflow from cost-conscious buyers—and investors trying to get in ahead of broader regional appreciation. With limited inventory, even modest demand shifts can move the needle quickly here.

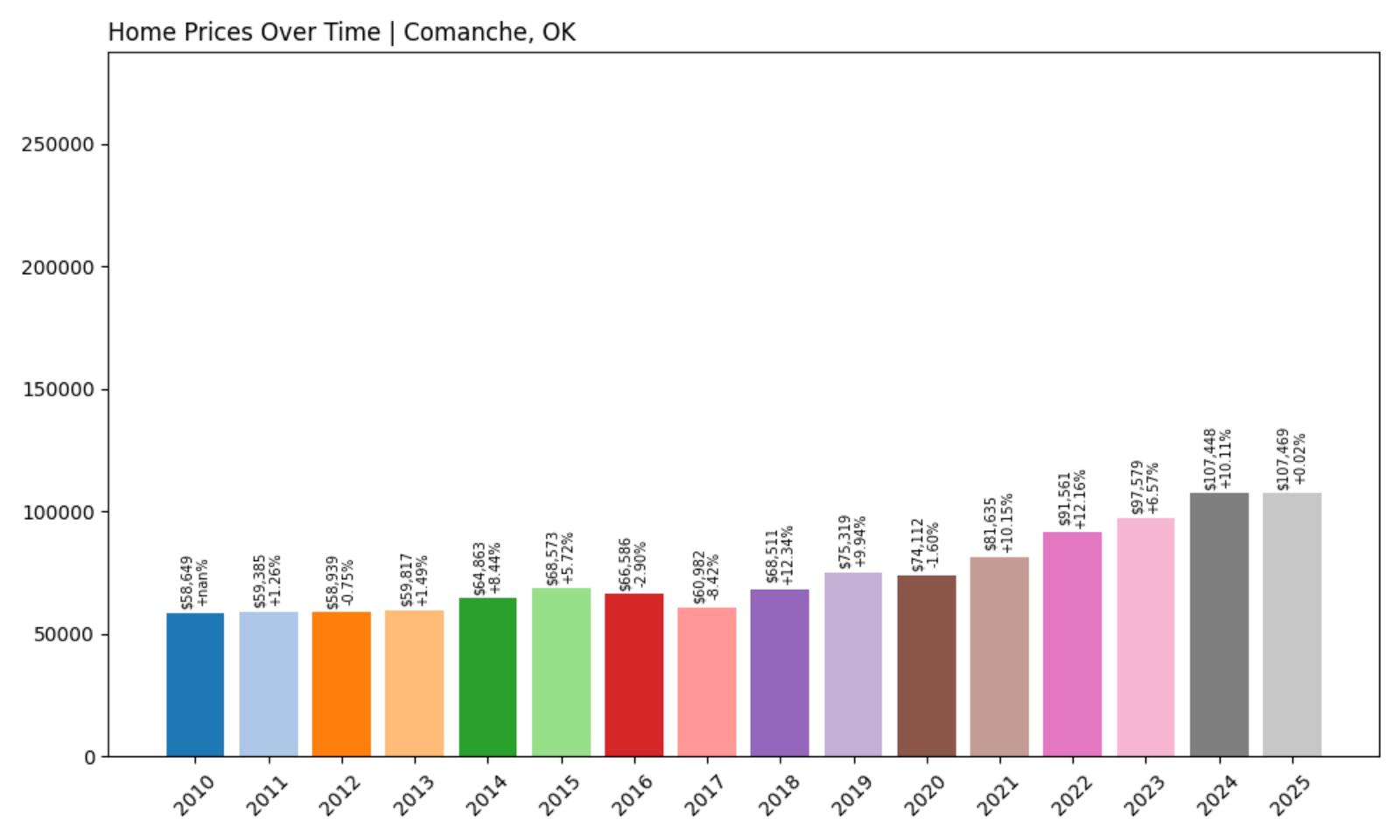

15. Comanche – Investor Feeding Frenzy Factor 21.80% (July 2025)

- Historical annual growth rate (2012–2022): 4.50%

- Recent annual growth rate (2022–2025): 5.49%

- Investor Feeding Frenzy Factor: 21.80%

- Current 2025 price: $107,468.54

Comanche’s growth has picked up noticeably in recent years, with its annual rate increasing from 4.50% to 5.49%. This jump drives a Feeding Frenzy Factor of 21.80%, showing that housing momentum here is accelerating faster than the long-term norm.

Comanche – Price Gains in a Ranching Hub

Located in Stephens County, Comanche has a rich history tied to ranching and oil. It’s a place where home prices have historically stayed reasonable, but that’s beginning to shift. The recent increase in growth rate and a 2025 home value around $107,000 suggest outside demand is influencing the market more than before.

Buyers may be drawn by the small-town lifestyle or lower costs compared to urban centers. Investors, too, might be seeing the steady pace as a reliable return with room to grow. With its historical stability now giving way to faster appreciation, Comanche could be on a path to greater attention—and steeper prices.

14. Weatherford – Investor Feeding Frenzy Factor 24.57% (July 2025)

- Historical annual growth rate (2012–2022): 4.74%

- Recent annual growth rate (2022–2025): 5.91%

- Investor Feeding Frenzy Factor: 24.57%

- Current 2025 price: $225,927.48

Weatherford’s home price growth has stepped up in recent years, moving nearly 1.2 points above its historical average. With home values now sitting near $226,000, the town is no longer the low-cost alternative it once was. The Feeding Frenzy Factor of 24.57% confirms a noticeable price acceleration.

Weatherford – A College Town on the Rise

Home to Southwestern Oklahoma State University, Weatherford has always had a built-in source of rental demand and a stable economy. That base may now be attracting broader investor interest, particularly as Oklahoma’s regional cities continue expanding. The combination of academic presence and interstate access makes this a strategic market.

The town’s fast-growing prices suggest that buyers—both investors and residents—are seeing long-term potential. With amenities like retail, healthcare, and jobs concentrated locally, Weatherford is evolving into more than a college town. As prices climb, it may also be transitioning from affordable to competitive.

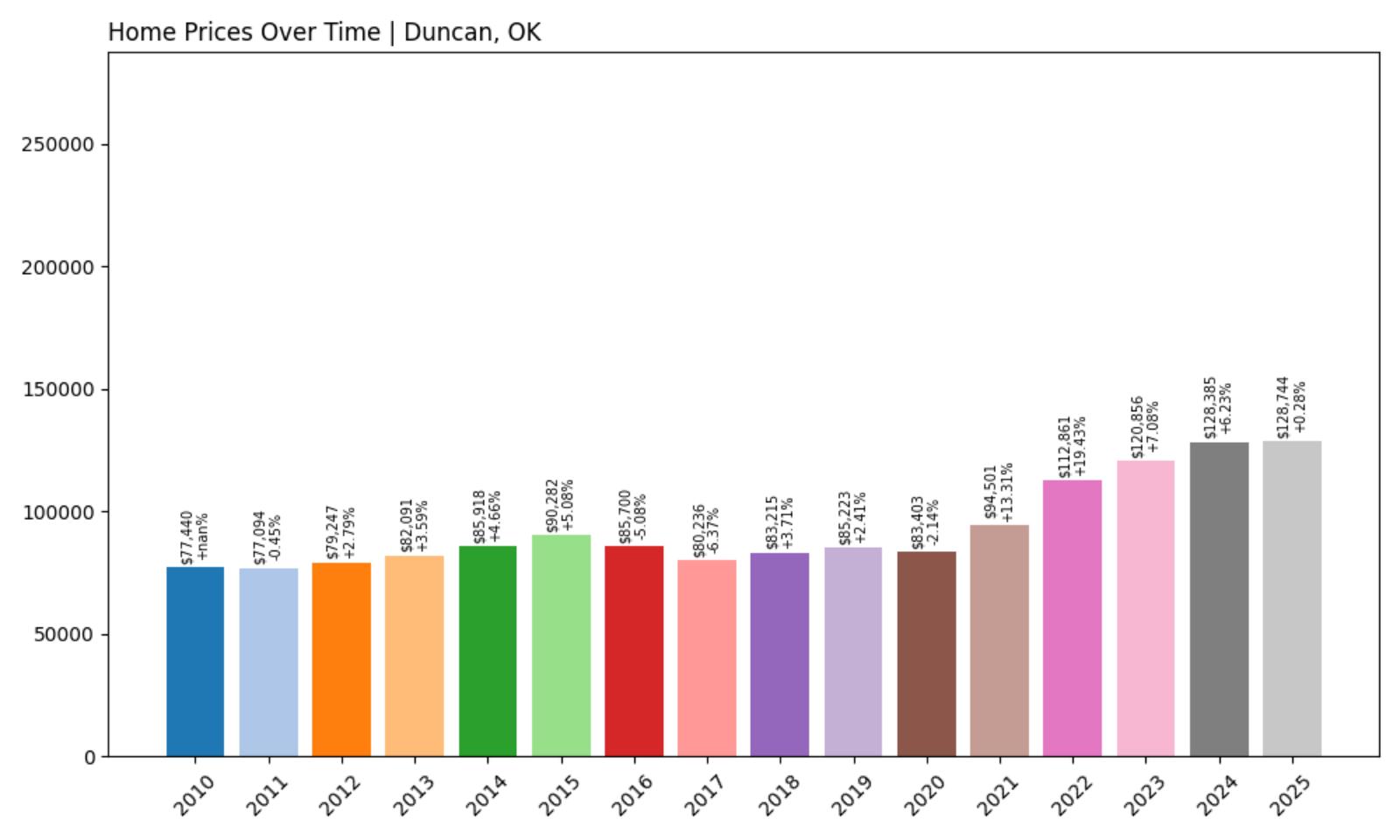

13. Duncan – Investor Feeding Frenzy Factor 24.66% (July 2025)

- Historical annual growth rate (2012–2022): 3.60%

- Recent annual growth rate (2022–2025): 4.49%

- Investor Feeding Frenzy Factor: 24.66%

- Current 2025 price: $128,744.27

Duncan’s price trajectory has tilted upward, lifting its annual growth to nearly 4.5%—up from a historical rate of 3.6%. That’s enough to push its Feeding Frenzy Factor to 24.66%, signaling increased momentum in a market that was previously more measured.

Duncan – Industry, Stability, and a Price Shift

Duncan is a mid-sized city in southern Oklahoma and serves as the headquarters of Halliburton Energy Services, which helps explain its historically stable economy. But while the town has long seen gradual home value increases, recent data suggests a new wave of interest is emerging. Its central location and industrial jobs make it a draw for working families—and perhaps now for investors, too.

At just under $129,000, the median price is still within reach for many, but growth has quickened. Duncan may be seeing spillover effects from affordability crunches in nearby regions or simply attracting attention for its mix of job access and reasonable home prices. Either way, the pace is picking up—and the numbers show it.

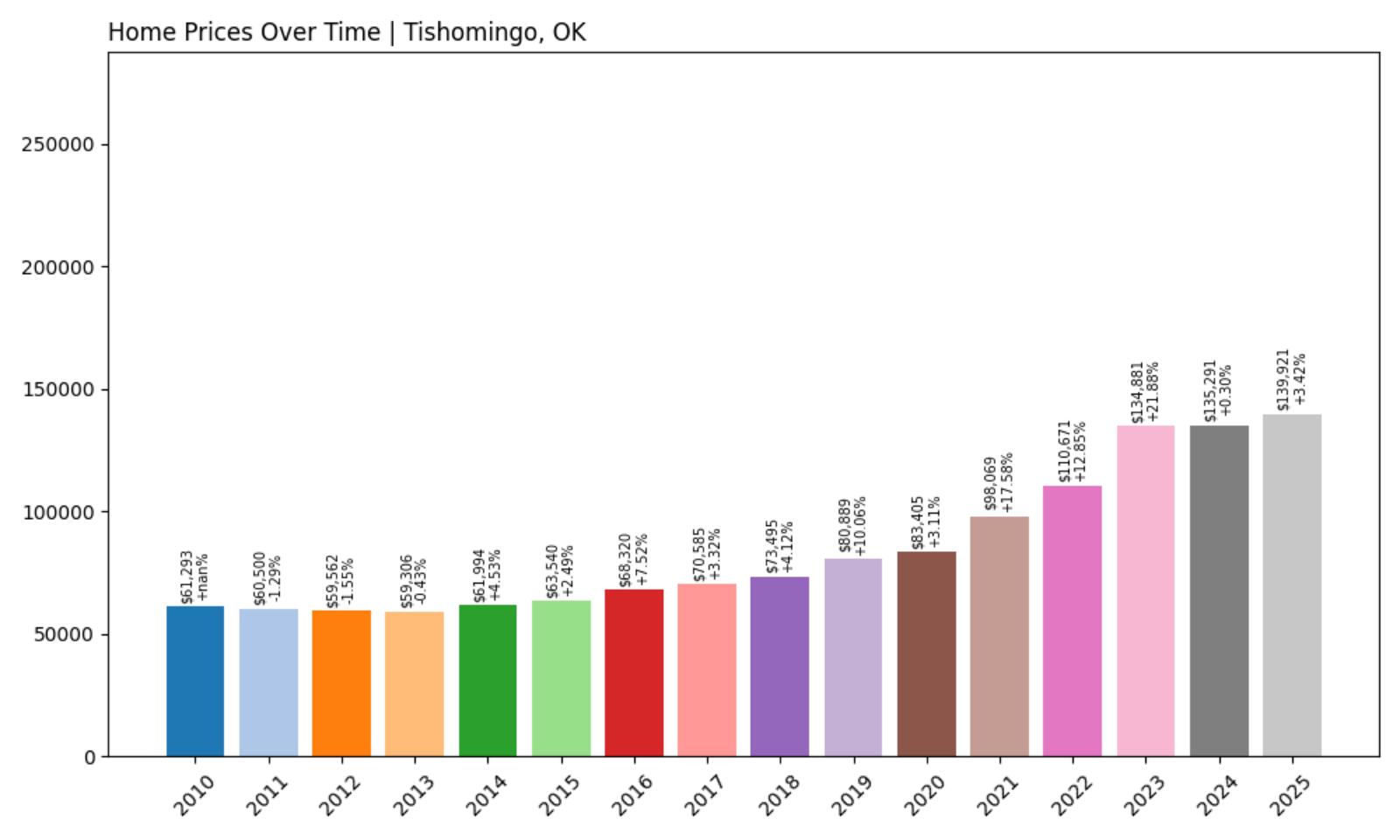

12. Tishomingo – Investor Feeding Frenzy Factor 27.21% (July 2025)

- Historical annual growth rate (2012–2022): 6.39%

- Recent annual growth rate (2022–2025): 8.13%

- Investor Feeding Frenzy Factor: 27.21%

- Current 2025 price: $139,920.60

Tishomingo’s home price growth jumped from an already strong 6.39% to over 8% in recent years, lifting its Feeding Frenzy Factor to 27.21%. With a current home value just under $140,000, the town is now seeing significant investor-driven price momentum.

Tishomingo – Popularity Rises Alongside Prices

As the county seat of Johnston County and the home of Murray State College, Tishomingo has long enjoyed a mix of education, small business, and historical charm. The town has received growing attention in recent years, thanks in part to increased tourism and rising local investment. These trends appear to be contributing to the acceleration in housing demand and prices.

Tishomingo’s strong growth in recent years may also reflect its increasing visibility in the media and regional development. While the town still offers sub-$150K housing, the sharp increase in growth rate shows investor confidence is surging—and locals may begin to feel the squeeze if this pace continues.

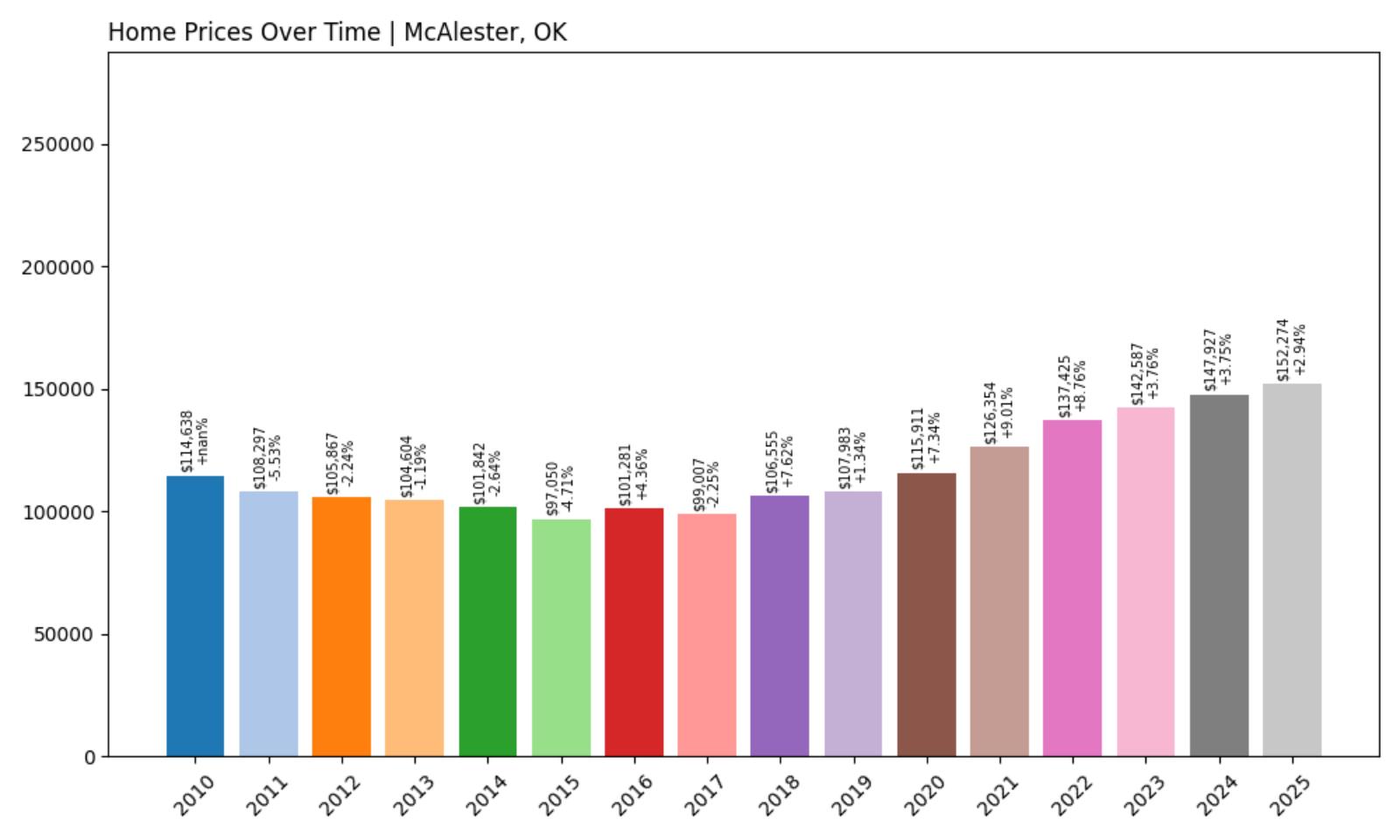

11. McAlester – Investor Feeding Frenzy Factor 31.63% (July 2025)

- Historical annual growth rate (2012–2022): 2.64%

- Recent annual growth rate (2022–2025): 3.48%

- Investor Feeding Frenzy Factor: 31.63%

- Current 2025 price: $152,273.90

McAlester’s price growth has seen a sizable uptick, with recent trends showing 3.48% annual growth compared to just 2.64% historically. Its Feeding Frenzy Factor of 31.63% suggests the market has shifted into faster territory, with investors potentially playing a growing role in the local market.

McAlester – Regional Hub Seeing Renewed Interest

Located in southeastern Oklahoma, McAlester is one of the larger towns on this list, offering a more developed economy and infrastructure. The town is known for its correctional facilities, defense industry ties, and retail presence, making it a regional anchor. That established foundation is now paired with rising housing demand.

At over $152,000, McAlester’s 2025 home values suggest it’s no longer a budget option, especially with growth speeding up. Investors may be drawn by the city’s economic base and relatively stable rental market, fueling faster appreciation and tighter conditions for local buyers.

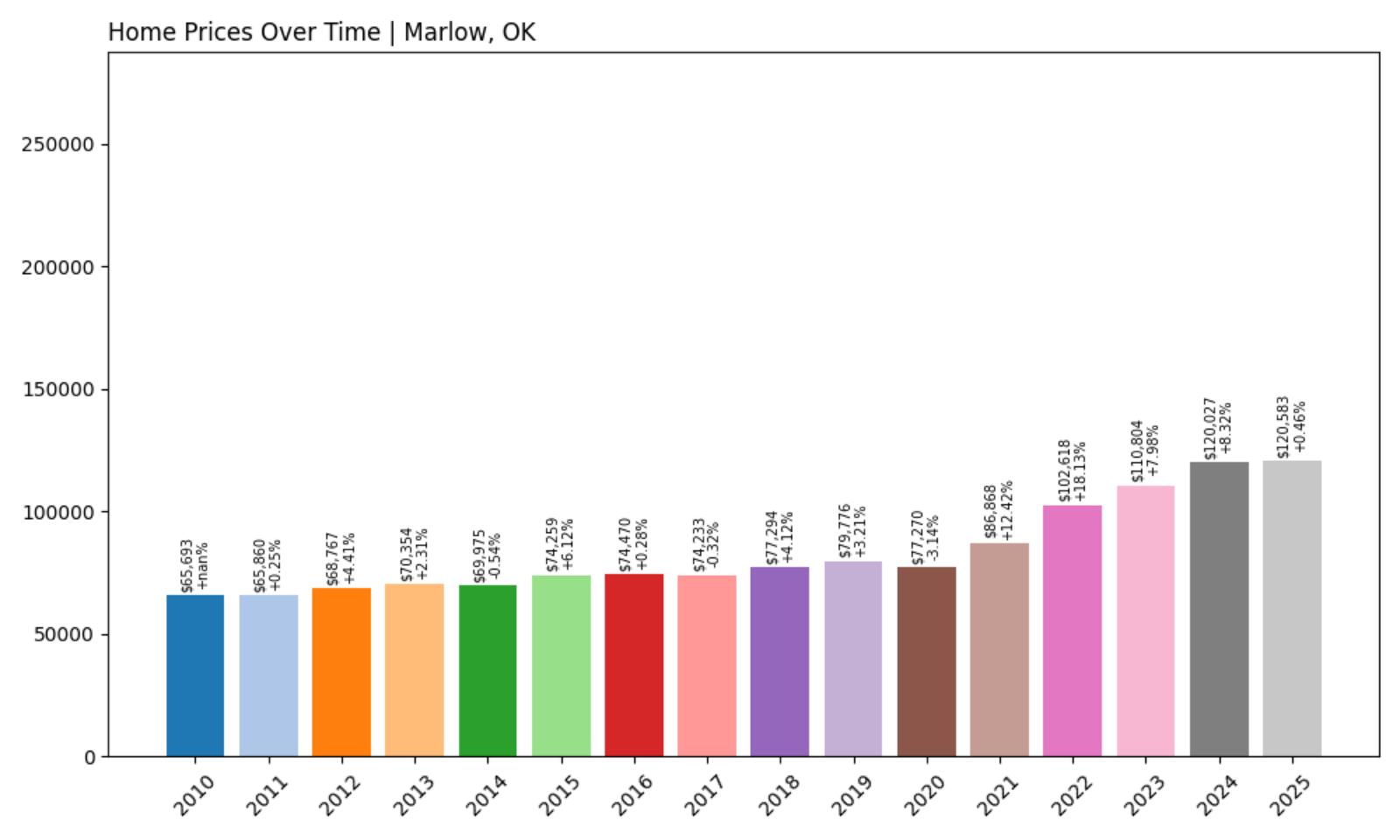

10. Marlow – Investor Feeding Frenzy Factor 35.27% (July 2025)

- Historical annual growth rate (2012–2022): 4.08%

- Recent annual growth rate (2022–2025): 5.52%

- Investor Feeding Frenzy Factor: 35.27%

- Current 2025 price: $120,583.24

Marlow has posted a strong jump in recent housing appreciation, with annual growth rising by nearly 1.5 percentage points. The town’s Feeding Frenzy Factor of 35.27% reflects a growing divergence between past trends and recent acceleration, suggesting outside forces may be pushing the market.

Marlow – A Small Town Moving Quickly

Marlow sits in Stephens County, south of Chickasha and east of Duncan, and has traditionally been a stable, working-class town. But things are moving faster now. The local housing market has turned a corner, with price increases outpacing historical expectations and the current value just over $120,000.

The modest price point combined with fast growth may be attracting investors looking for reliable returns in smaller towns. With little new housing supply and rising demand, Marlow could be feeling early-stage effects of speculative buying. The pace of change is picking up—and may not slow anytime soon.

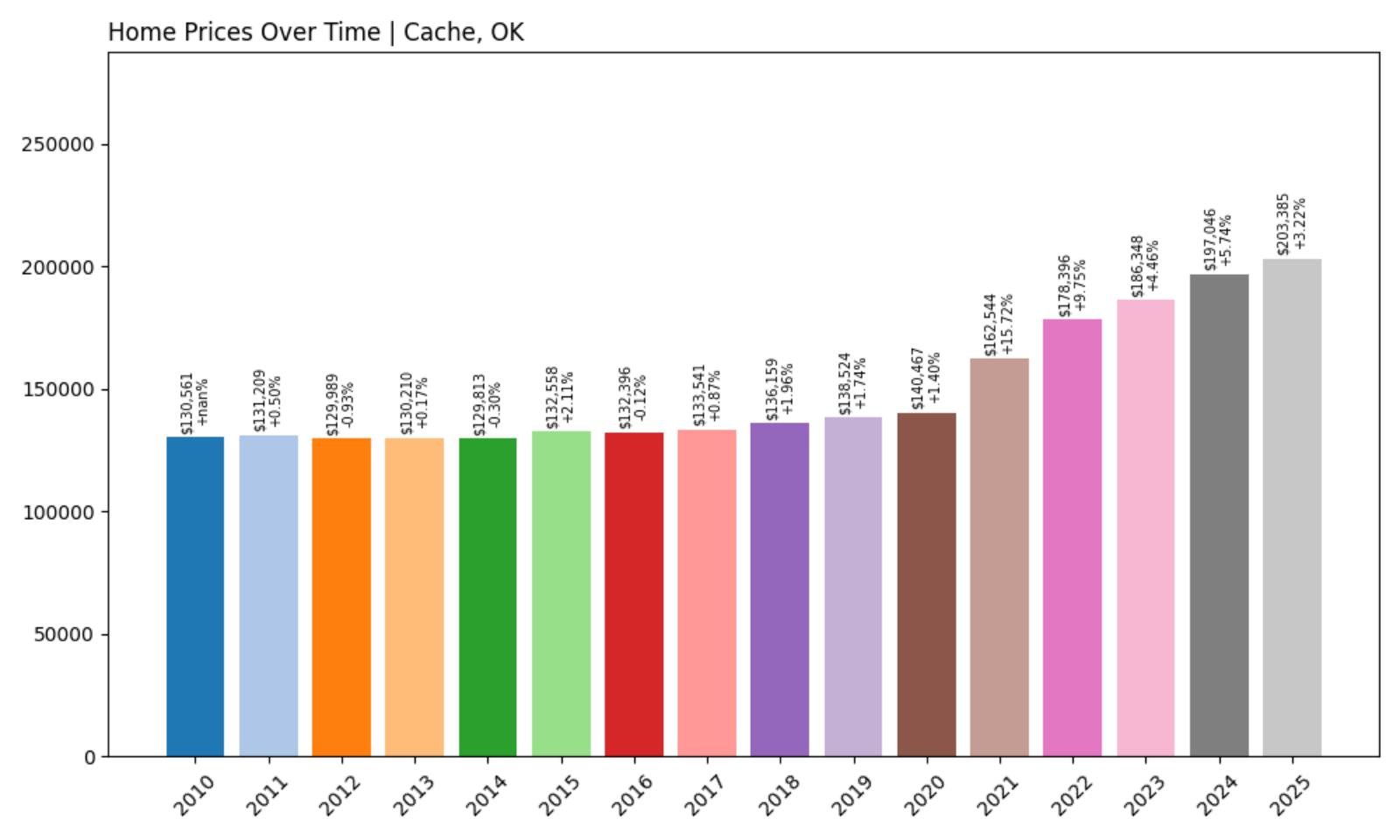

9. Cache – Investor Feeding Frenzy Factor 38.88% (July 2025)

- Historical annual growth rate (2012–2022): 3.22%

- Recent annual growth rate (2022–2025): 4.47%

- Investor Feeding Frenzy Factor: 38.88%

- Current 2025 price: $203,384.76

Cache has experienced one of the largest relative increases in growth, with recent rates far outpacing its historical average. A Feeding Frenzy Factor of 38.88% signals that investor-driven demand may be exerting serious pressure, especially as the median home price pushes past $200,000.

Cache – Fast Appreciation Near Lawton

Cache lies just west of Lawton and benefits from proximity to Fort Sill, a major military base. That connection has always given the town some economic insulation, but what’s new is the rate at which prices are climbing. Cache now stands as one of the priciest towns in southwestern Oklahoma, a major change from just a few years ago.

Families, service members, and investors alike are showing interest—possibly driving the recent price acceleration. With land values rising and housing inventory limited, Cache is becoming less of a budget option and more of a strategic bet for investors seeking growth near stable employment centers.

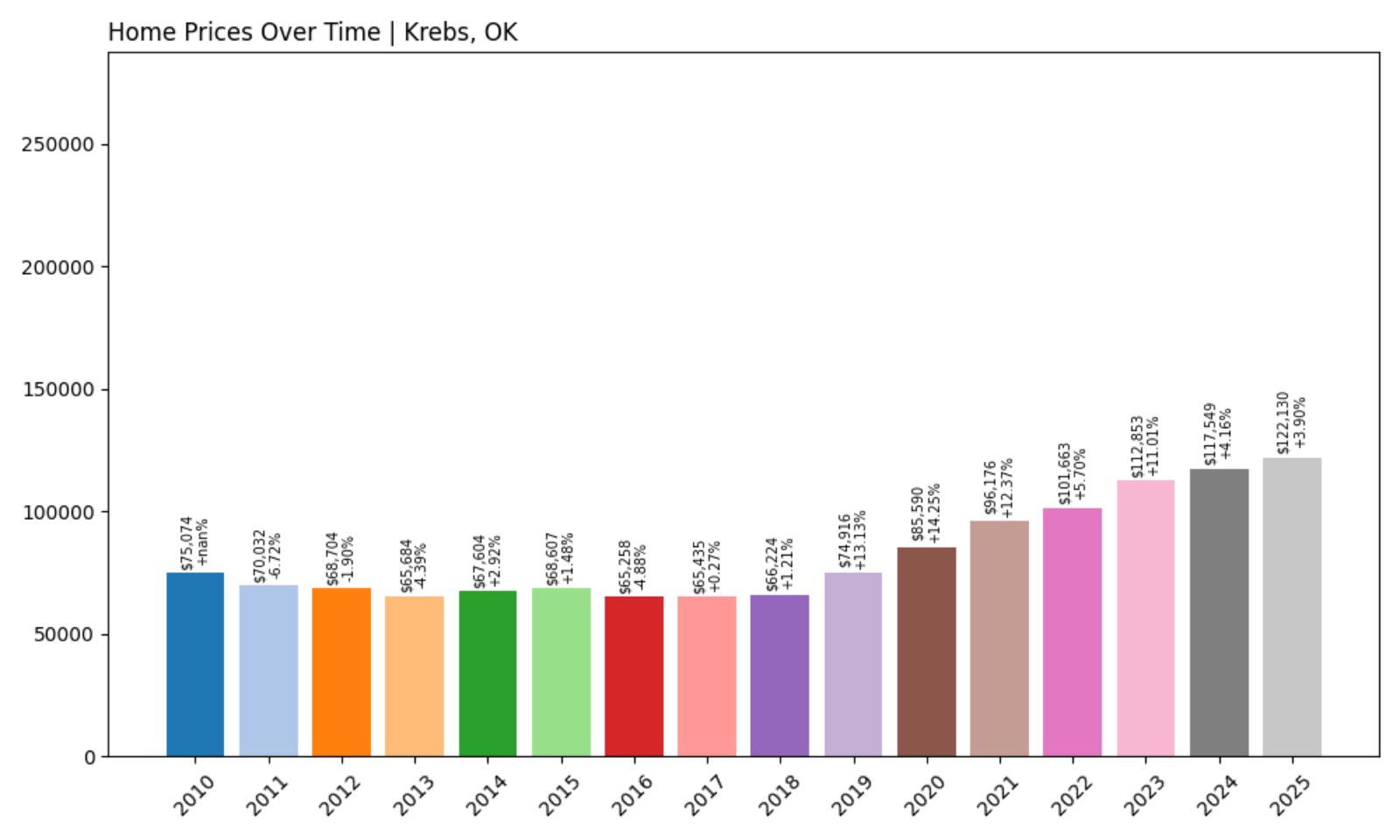

8. Krebs – Investor Feeding Frenzy Factor 57.77% (July 2025)

- Historical annual growth rate (2012–2022): 4.00%

- Recent annual growth rate (2022–2025): 6.31%

- Investor Feeding Frenzy Factor: 57.77%

- Current 2025 price: $122,130.11

Krebs has seen a dramatic price acceleration, with recent growth rising to 6.31% per year—well above its 4.00% historical average. The Feeding Frenzy Factor of 57.77% ranks among the highest in the state, pointing to strong investor interest or outside pressure on a small-town market.

Krebs – Big Gains in a Historic Community

Known for its Italian heritage and family-owned restaurants, Krebs is a cultural standout in southeastern Oklahoma. Located near McAlester, the town combines charm with access to employment and services. That mix is now translating into hot housing numbers as more people look for alternatives to bigger, costlier towns.

The surge in growth is notable given the town’s small size. With a median home price now above $122,000, Krebs is climbing faster than expected. Whether it’s buyers relocating from urban areas or short-term investors trying to capitalize, the pressure is real—and the numbers prove it.

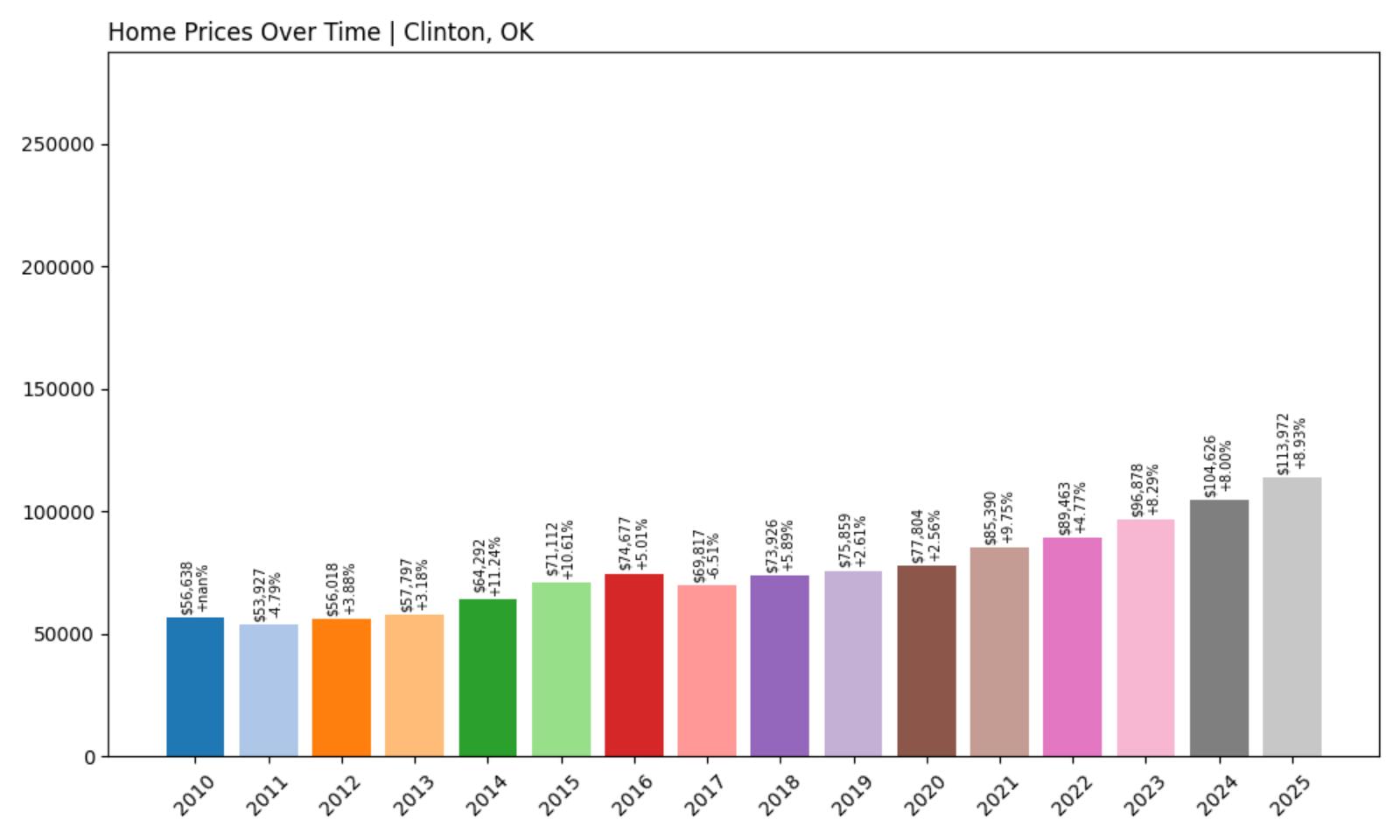

7. Clinton – Investor Feeding Frenzy Factor 75.37% (July 2025)

- Historical annual growth rate (2012–2022): 4.79%

- Recent annual growth rate (2022–2025): 8.41%

- Investor Feeding Frenzy Factor: 75.37%

- Current 2025 price: $113,972.33

Clinton’s home prices have taken a sharp upward turn, with the growth rate leaping from a stable 4.79% to a striking 8.41% annually since 2022. That rapid acceleration drives a Feeding Frenzy Factor of 75.37%, suggesting a significant increase in investor activity or speculative purchases. At just under $114,000, home prices are still reasonable by statewide standards—but the rate of increase could signal that affordability won’t last long.

Clinton – Investor Pressure Hits a Tipping Point

Clinton sits in western Oklahoma along Interstate 40 and holds a rich connection to historic Route 66. It has traditionally attracted families and travelers with its small-town charm, local museums, and community-oriented lifestyle. However, the real estate market here is shifting quickly. The combination of highway access, regional job stability, and relatively low home prices has made Clinton a prime target for investors seeking both appreciation and rental income. The price jump over the last three years suggests that institutional buyers or flippers may be entering the market more aggressively than ever before. Properties that once lingered on the market are now being scooped up much faster, and new listings are seeing multiple offers—especially in well-kept neighborhoods near schools or retail corridors.

Local residents are beginning to notice that homes are selling for well above what would’ve been expected just a few years ago. That dynamic is reshaping expectations in the town, especially for younger buyers who may have planned to buy locally. With rents also climbing in tandem, Clinton’s longtime balance between affordability and accessibility is now in flux. The recent data implies that prices are not just rising because of organic population growth or wage increases, but because speculative money is entering the picture. If current growth continues unchecked, Clinton may soon cross the line from affordable to unaffordable for many of its long-term residents—especially those without competitive income growth or access to cash-rich financing options.

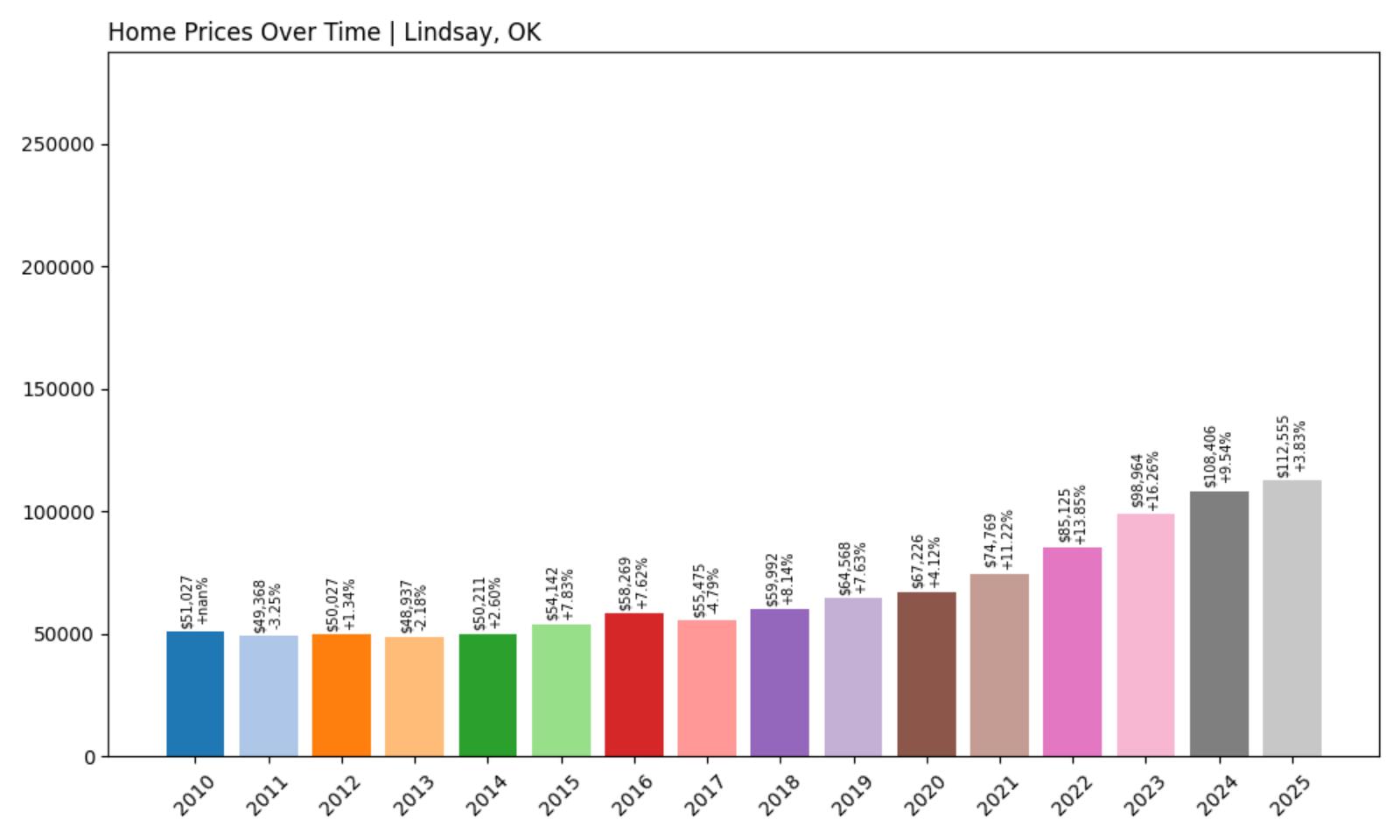

6. Lindsay – Investor Feeding Frenzy Factor 78.74% (July 2025)

- Historical annual growth rate (2012–2022): 5.46%

- Recent annual growth rate (2022–2025): 9.76%

- Investor Feeding Frenzy Factor: 78.74%

- Current 2025 price: $112,554.57

Lindsay’s housing market has nearly doubled its pace of growth in just three years, jumping from 5.46% to a dramatic 9.76%. That places it among the most rapidly accelerating towns in Oklahoma, with a Feeding Frenzy Factor of 78.74% reflecting the stark shift. At a 2025 price of just over $112,000, homes are still relatively affordable—but the sharp uptick suggests that local conditions may be changing faster than residents expected.

Lindsay – A Sharp Shift in a Modest Market

Lindsay, located in Garvin County, has historically been a quiet, blue-collar town supported by agriculture, energy, and small manufacturing businesses. Until recently, home values in the area followed a slow and predictable upward trend, often staying well below the state average. That pattern has now been disrupted. Buyers—particularly out-of-town investors—are entering the market with speed and volume, likely responding to the town’s affordability and potential rental margins. The town’s location along Highway 19 and its proximity to larger hubs like Norman and Oklahoma City have also boosted its appeal, making it viable for commuters or remote workers seeking lower-cost living. As more investors arrive, homes that might have stayed on the market for months are now disappearing in weeks.

Locals report bidding wars on entry-level homes and a visible uptick in “We Buy Houses” signs and out-of-state license plates at open houses. With limited new construction and relatively static inventory, this new demand is placing pressure on an aging housing stock. At current trends, the affordability that once defined Lindsay may not last. Renters are already feeling squeezed, and first-time buyers are beginning to struggle to match investor-backed cash offers. If this dynamic continues, Lindsay could be in for a rapid transformation, with increasing socioeconomic tension between new arrivals and longtime residents. While the economic benefits of rising home values are clear for property owners, the long-term consequences for housing stability in the community remain uncertain.

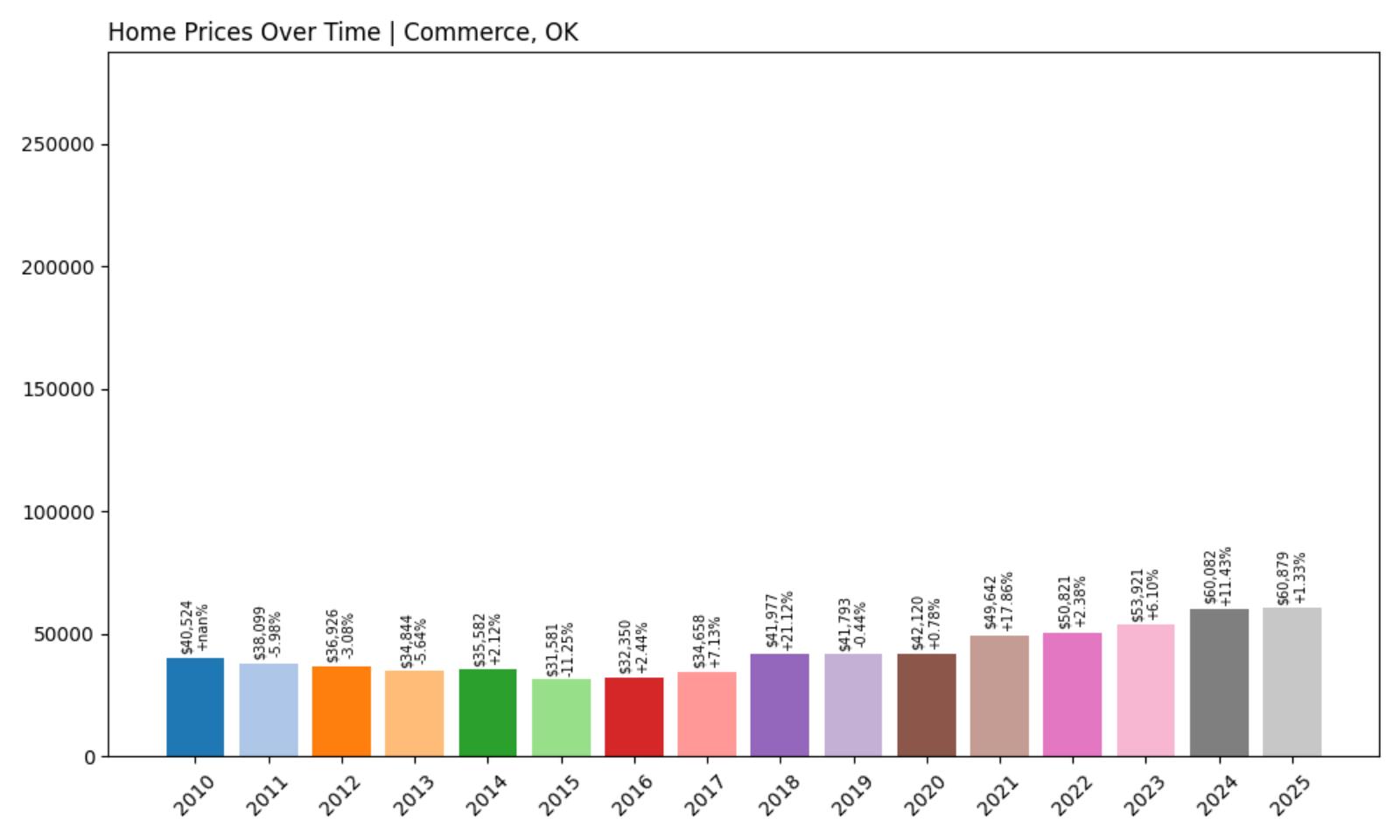

5. Commerce – Investor Feeding Frenzy Factor 91.14% (July 2025)

- Historical annual growth rate (2012–2022): 3.25%

- Recent annual growth rate (2022–2025): 6.20%

- Investor Feeding Frenzy Factor: 91.14%

- Current 2025 price: $60,879.18

Commerce’s growth rate has almost doubled in just three years, jumping from a modest 3.25% to 6.20% annually. That change delivers a Feeding Frenzy Factor of 91.14%, pointing to a substantial shift in the way this small northeastern Oklahoma town is being viewed by buyers and investors. While the 2025 price remains low at just under $61,000, it’s the pace of change—rather than the price level—that’s turning heads. This sudden acceleration marks a departure from the town’s long-standing market trends. Traditionally considered a sleepy and affordable option, Commerce now appears to be undergoing a rapid transformation. The sharp jump in values is likely being driven not just by local demand but by external forces targeting low-cost housing opportunities.

Commerce – Explosive Growth from a Low Base

Commerce has long flown under the radar. Situated near the Kansas and Missouri borders, the town is best known as the birthplace of baseball legend Mickey Mantle and has a history steeped in mining and railroads. Until recently, home values here had barely moved—often making it one of the most affordable places to buy property in the entire region. But that narrative is changing quickly. The rise in price growth and attention from out-of-area investors has created new tension between affordability and demand. It’s likely that some buyers are looking to flip low-cost properties or hold them as rentals, capitalizing on the town’s low barrier to entry. As a result, the housing inventory is tightening, and residents are reporting faster sales and more competition for listings. This new wave of activity is altering the real estate landscape in real time.

What makes this especially impactful is how small changes in investor activity can cause outsized effects in towns like Commerce, where the housing market is small and supply is limited. A handful of buyers looking for returns can quickly drive prices beyond what local wages can support. With little new construction and minimal zoning flexibility, the town may be ill-equipped to handle sustained investor demand. While rising values are good news for longtime homeowners, renters and first-time buyers may now find themselves struggling to keep up. Whether this trend represents long-term revitalization or short-term speculation remains to be seen—but the current data signals one of the fastest-developing market shifts in rural Oklahoma.

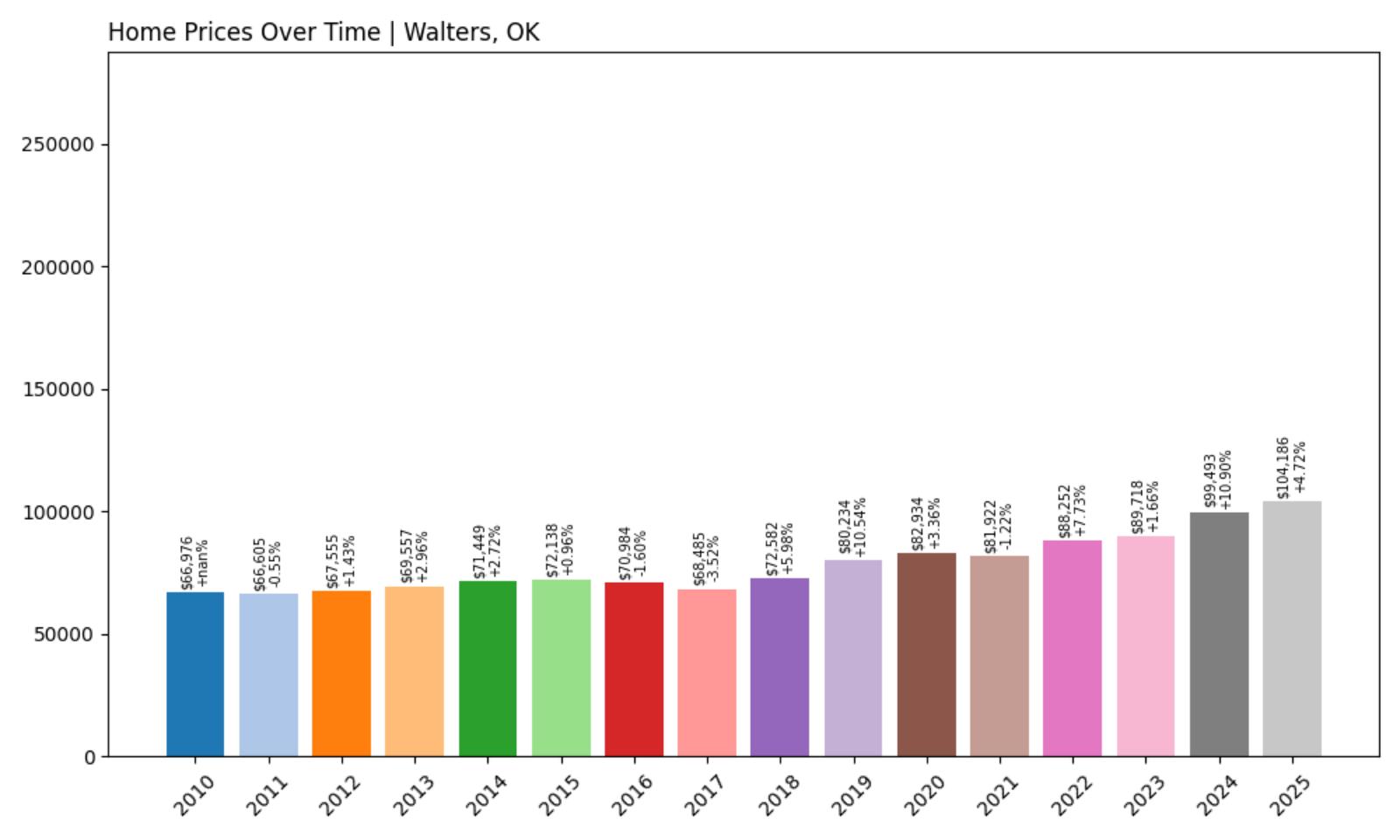

4. Walters – Investor Feeding Frenzy Factor 110.04% (July 2025)

- Historical annual growth rate (2012–2022): 2.71%

- Recent annual growth rate (2022–2025): 5.69%

- Investor Feeding Frenzy Factor: 110.04%

- Current 2025 price: $104,186.21

Walters has more than doubled its historical growth rate in just three years, with annual home price increases climbing from 2.71% to 5.69%. The result is a Feeding Frenzy Factor of 110.04%, indicating an aggressive shift in price momentum. This kind of acceleration rarely happens organically in small, rural towns, which suggests external demand—likely from investors—is playing a major role. The current home price sits at just over $104,000, still affordable, but no longer the deeply discounted market it once was. The concern now is whether this trend continues and how it might reshape the character of the community. A rapid price climb can bring temporary prosperity but often comes at the cost of housing stability for longtime residents.

Walters – From Sleepy to Surging

As the county seat of Cotton County in southern Oklahoma, Walters has historically seen minimal price fluctuations. The town’s modest population and agricultural base kept it somewhat insulated from the rapid housing booms seen elsewhere. But the latest data suggests a dramatic change is underway. Walters’ proximity to Lawton and Fort Sill may be drawing in more commuter households, remote workers, or military-connected buyers. At the same time, investors seem to have taken note of the town’s affordable entry point and are capitalizing on the opportunity to acquire properties at scale. Locals have reported homes being snapped up quickly, sometimes before they even hit the market, and cash offers becoming more common.

The pace of change is unsettling to many in the community, especially as younger buyers and lower-income renters find fewer available options. Unlike larger cities, Walters lacks the infrastructure or development pipeline to respond quickly to rising demand. That puts pressure on existing housing stock and raises the stakes for those trying to enter the market. While increased property values can help local budgets and stimulate reinvestment, they can also shift the town’s demographics in ways that challenge its rural identity. If investor interest continues to grow, Walters may become a textbook example of what happens when a formerly overlooked town becomes the center of a speculative feeding frenzy.

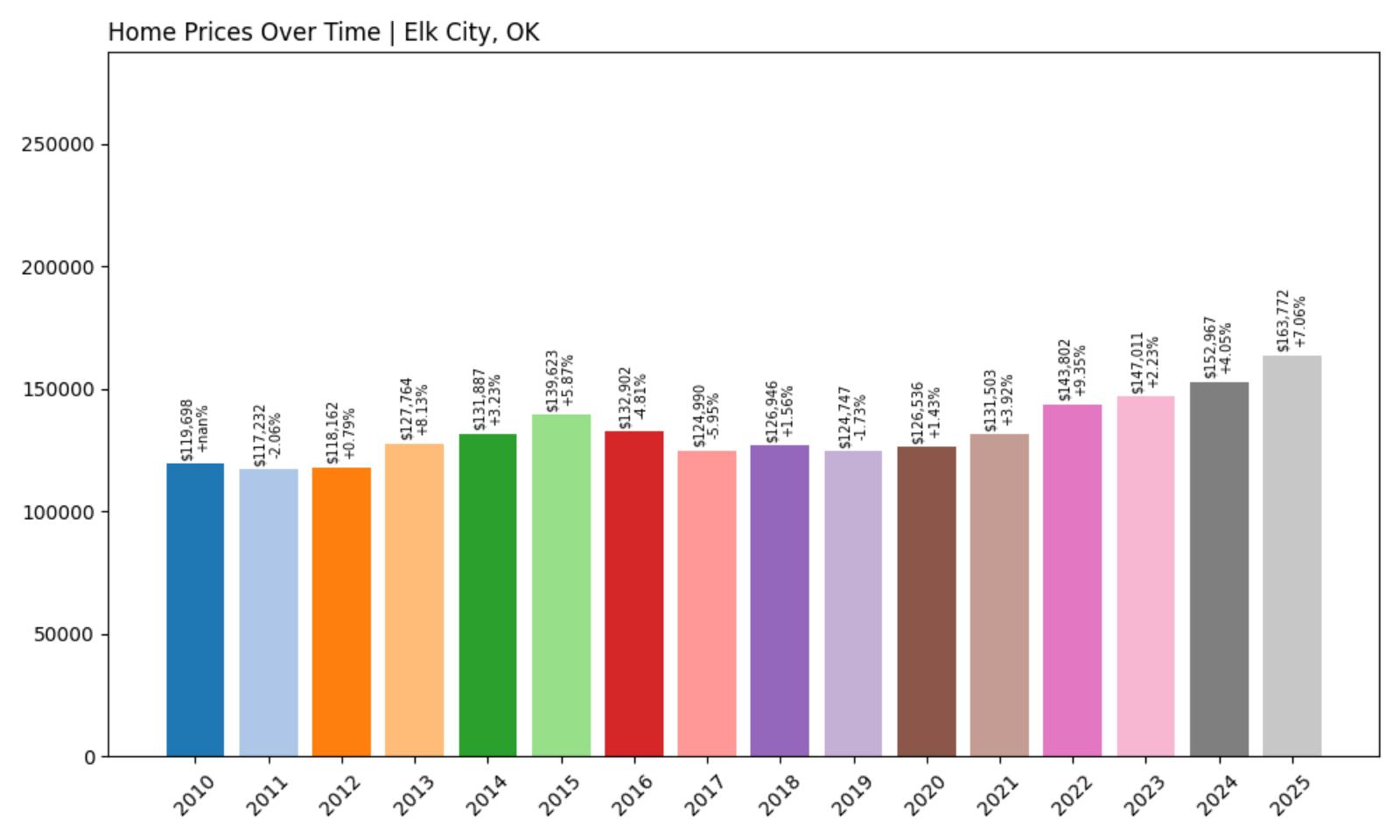

3. Elk City – Investor Feeding Frenzy Factor 123.36% (July 2025)

- Historical annual growth rate (2012–2022): 1.98%

- Recent annual growth rate (2022–2025): 4.43%

- Investor Feeding Frenzy Factor: 123.36%

- Current 2025 price: $163,771.98

Elk City’s housing market has shifted into a new gear. After a decade of slow appreciation—just 1.98% per year from 2012 to 2022—the town has seen its home values soar at 4.43% annually in the last three years. That pace is more than double its historical trend, and the result is a Feeding Frenzy Factor of 123.36%, one of the highest in the entire state. With prices now hovering around $163,772, this once-stable market is suddenly under serious pressure. The town’s growing appeal is no accident. It sits along Interstate 40, offering easy access to regional hubs, and continues to benefit from a stable economy rooted in the energy sector. But while the job base hasn’t changed drastically, demand for housing has. Listings are moving faster, inventory is shrinking, and longtime residents are facing stiffer competition from cash-backed buyers, many of whom are investors looking for long-term rental income or short-term flips.

Elk City – Energy Hub Now Facing Real Estate Heat

For years, Elk City was a classic example of slow-but-steady growth in rural Oklahoma—low prices, stable employment, and predictable property trends. But that stability may have made it an ideal target for investors seeking undervalued markets with untapped potential. As larger cities become saturated and unaffordable, smaller towns like Elk City offer the chance to buy at relatively low cost while enjoying solid rent yields or resale margins. The local housing supply, however, hasn’t caught up. There’s little new construction, and older homes are being snapped up quickly by out-of-area buyers. The result is mounting pressure on prices and rising frustration among residents who suddenly find themselves priced out of the neighborhoods they grew up in. It’s not just the price tag that’s changing—it’s the velocity of transactions, the type of buyers showing up at open houses, and the speculative mindset that’s taken root.

What’s happening in Elk City reflects a broader pattern seen across Oklahoma: towns with infrastructure, stable employment, and cheap housing are no longer immune to outside demand. As word spreads about where the “next big opportunity” is, communities like Elk City become investment targets, not just places to live. This could mean more money flowing into the local economy—but it also means housing decisions are no longer being made solely by locals. With home values climbing more than expected and rents trending upward, the risk is that Elk City becomes unaffordable to the very families who have kept it running for generations. Whether this surge ends in balance or bust will depend on how much speculative buying the town can absorb—and whether housing supply can keep up before the market overheats.

2. Lawton – Investor Feeding Frenzy Factor 137.95% (July 2025)

- Historical annual growth rate (2012–2022): 1.18%

- Recent annual growth rate (2022–2025): 2.82%

- Investor Feeding Frenzy Factor: 137.95%

- Current 2025 price: $133,781.29

Lawton has seen its growth rate more than double, moving from a historical 1.18% to 2.82% in just three years. That sharp uptick earns it a Feeding Frenzy Factor of 137.95%, signaling a significant deviation from past trends. With a current price nearing $134,000, Lawton remains mid-range by Oklahoma standards, but the velocity of its recent growth raises important questions about what’s driving this surge.

Lawton – Surge in Investor Activity Around a Military Hub

As the home of Fort Sill, Lawton has long been a critical military and training center, supporting a stable population of service members, federal employees, and associated industries. While the town’s housing market used to move slowly and predictably, recent years have brought noticeable shifts. Investors are increasingly eyeing Lawton’s rental potential—driven by the consistent flow of military personnel and demand for off-base housing. This has translated into upward pressure on prices, even in areas that were historically overlooked. The city’s infrastructure, healthcare access, and retail presence give it more staying power than smaller rural markets, but also make it vulnerable to accelerated demand once investors step in.

Beyond the military economy, Lawton is now attracting more remote workers and regional migrants looking for affordability with amenities. As Oklahoma’s housing affordability declines in major metros, Lawton stands out as a full-service city with prices that still seem accessible—though that window may be closing. The sharp increase in growth, well above historic norms, could strain affordability for longtime residents, especially renters. With home values jumping and inventory tight, Lawton may be facing a tipping point where investor influence begins to shift not just prices, but the character of its neighborhoods. The next few years will show whether this trend levels out—or continues to reshape the market entirely.

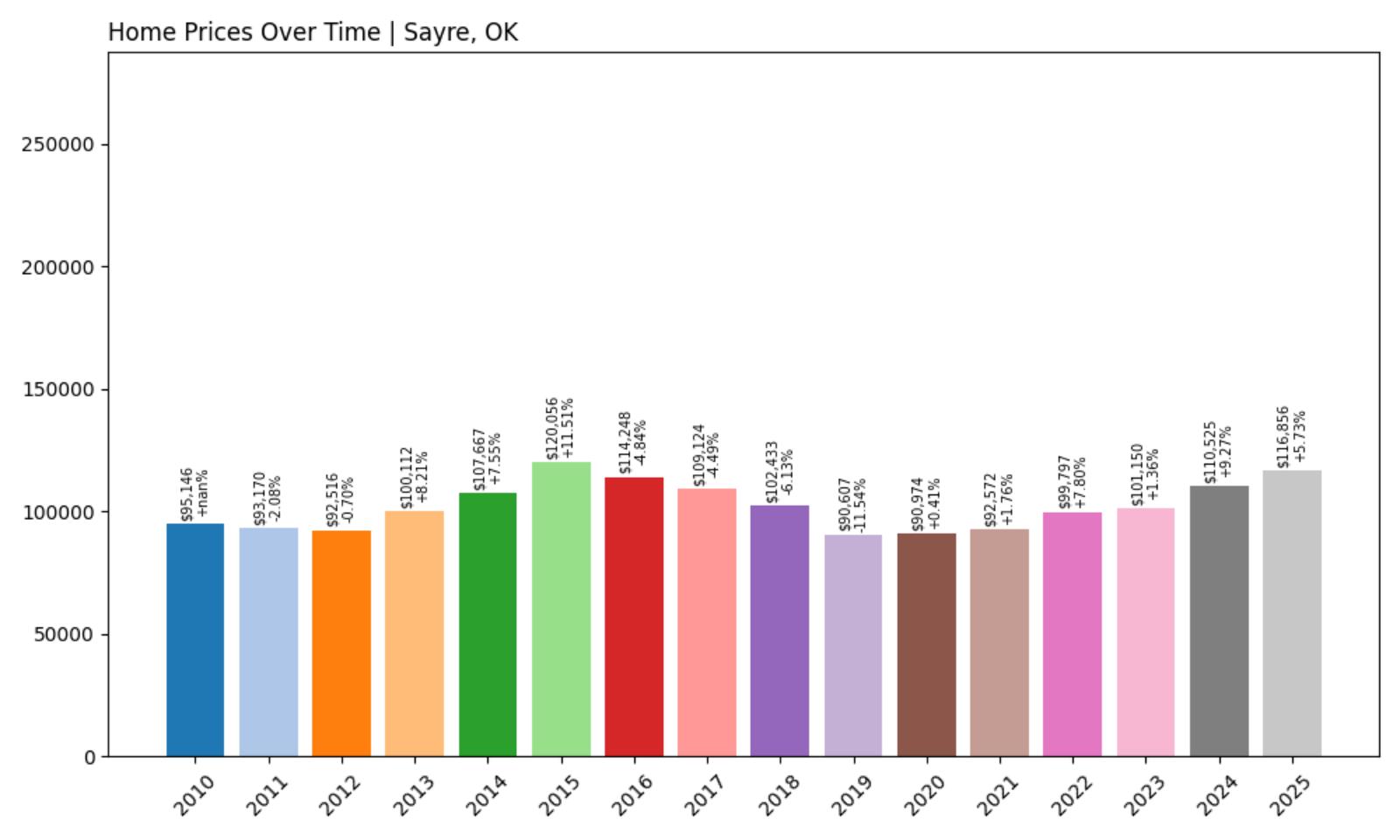

1. Sayre – Investor Feeding Frenzy Factor 610.24% (July 2025)

- Historical annual growth rate (2012–2022): 0.76%

- Recent annual growth rate (2022–2025): 5.40%

- Investor Feeding Frenzy Factor: 610.24%

- Current 2025 price: $116,855.95

Sayre tops the list with an astounding Feeding Frenzy Factor of 610.24%—by far the largest deviation from historical norms in the entire state. The town’s long-term growth rate hovered under 1% for a decade, but recent years have seen prices jump by over 5% annually. This level of acceleration is extremely rare, and strongly suggests a wave of speculative buying or rapid market saturation. At just under $117,000, home prices remain within reach, but the pace of change is the real story here.

Sayre – Oklahoma’s Most Extreme Price Acceleration

Located in Beckham County near the Texas border, Sayre is a small community that has historically seen minimal housing volatility. Known for its Route 66 charm and agricultural economy, the town had long been insulated from the boom-bust cycles of larger cities. That’s no longer the case. The data shows a dramatic change in the past three years—something rarely seen in rural housing markets. With such a low baseline of historical growth, even modest demand would’ve made an impact, but a 5.40% annual increase points to something much bigger. Investors likely see Sayre as a cheap entry point with potential for outsized returns, especially as nearby towns experience similar growth. This speculation could be the primary force behind Sayre’s meteoric rise in home values.

There’s a good chance Sayre is experiencing the early stages of a transformation, whether it’s being driven by short-term flippers, landlords entering the rental market, or simply buyers fleeing more expensive markets. Whatever the cause, the pace is intense—and locals may not have seen this coming. Infrastructure improvements or planned developments could add fuel to the fire, but even in their absence, the current price trajectory suggests supply-demand imbalances are already taking root. If affordability was once Sayre’s key advantage, that edge may now be under serious threat. The town sits at the crossroads of opportunity and risk, and whether this feeding frenzy ends in sustainable growth or overreach will depend on what comes next.