Would you like to save this?

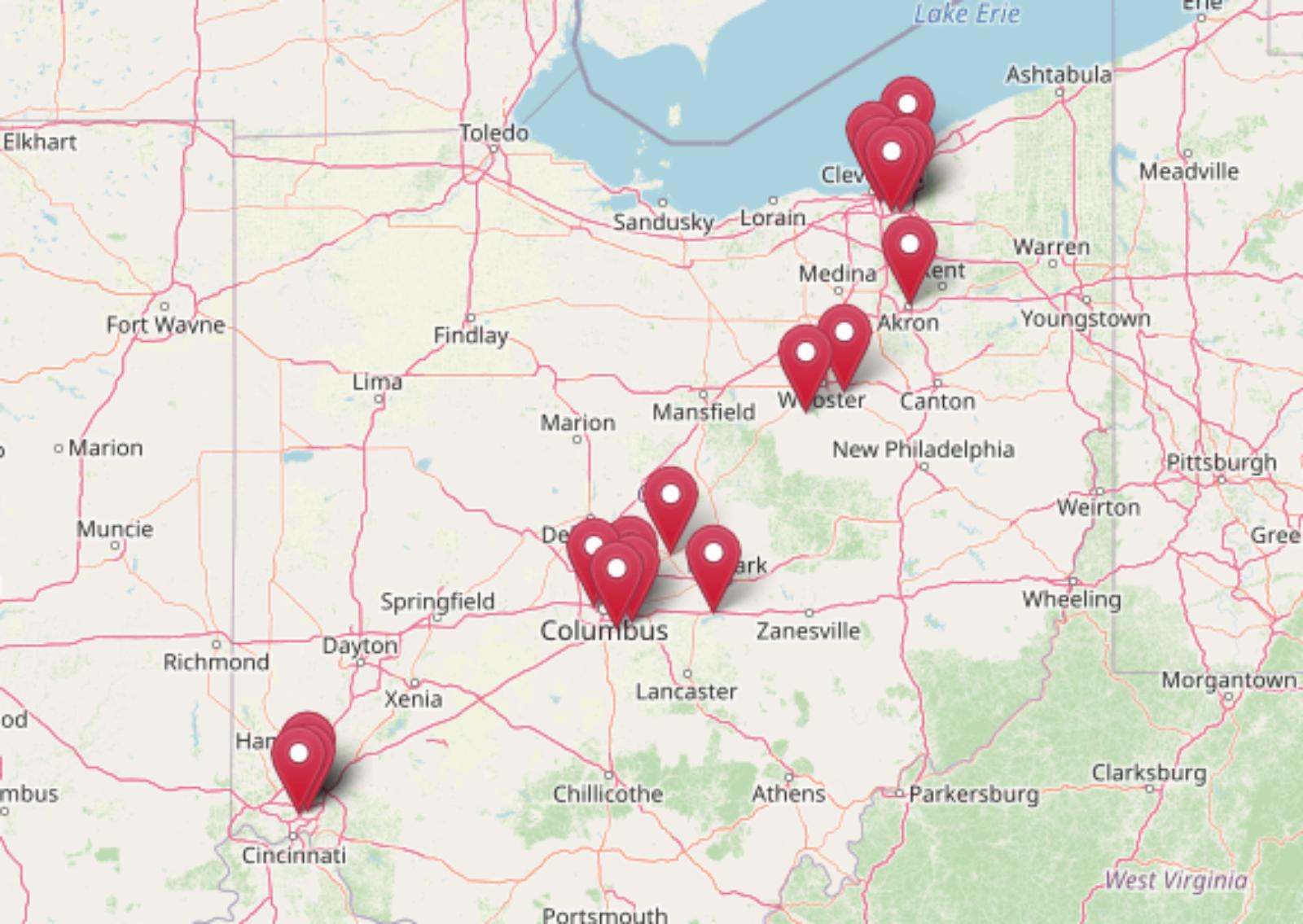

Ohio’s housing market is showing signs of strain in more places than you might expect. According to the Zillow Home Value Index, 19 communities across the state are flashing red on key risk indicators. From sudden slowdowns to sharp overvaluation, these towns are displaying the same danger signs that often show up just before a price correction hits. With boom-bust history, unsustainable appreciation, and shifting momentum, many of these markets could be the first to stumble if the tide turns.

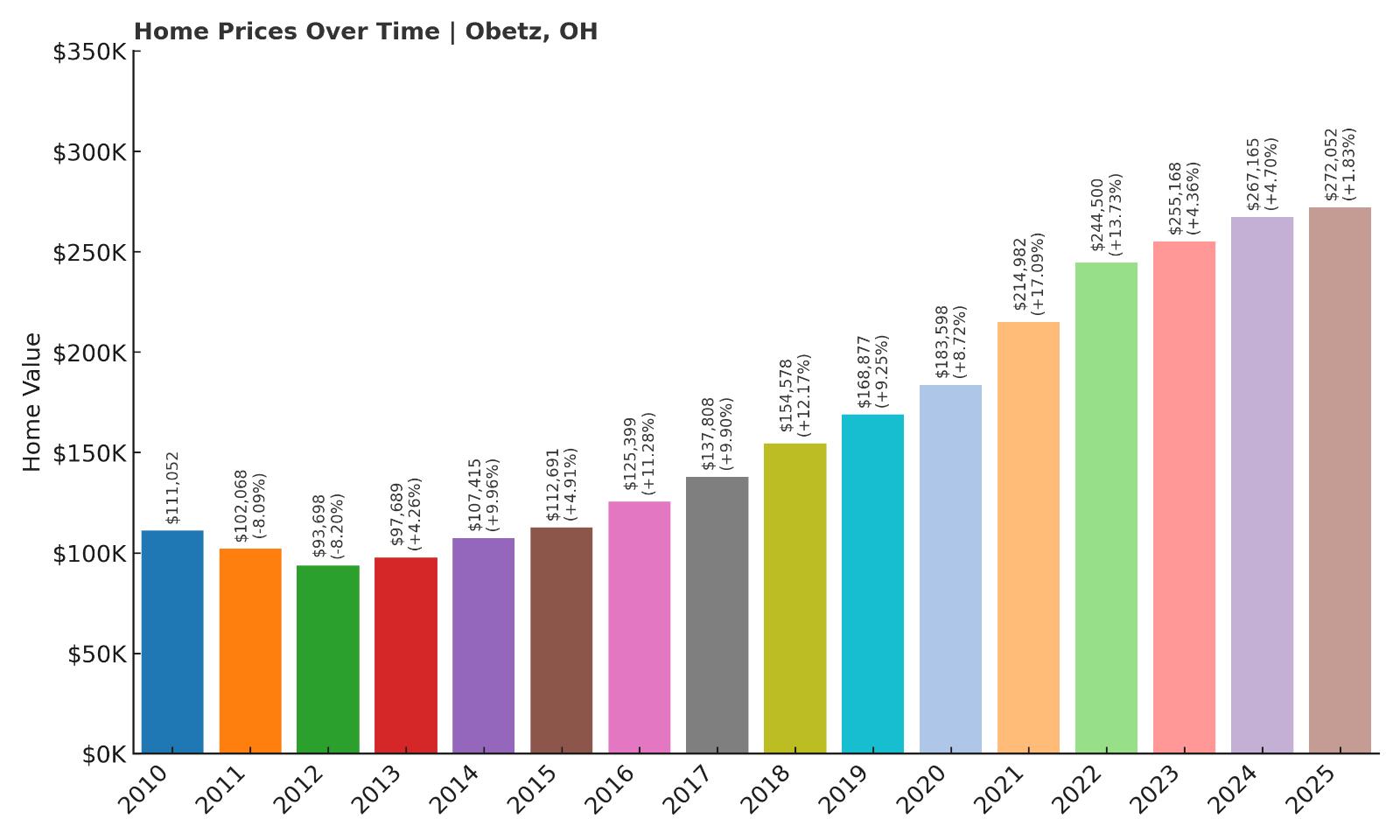

19. Obetz – Crash Risk Percentage: 70.25%

- Crash Risk Percentage: 70.25%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 8.2% (2012)

- Total price increase since 2010: 145.0%

- Overextended above long-term average: 64.3%

- Price volatility (annual swings): 6.9%

- Current 2025 price: $272,052

Obetz shows concerning signs despite having the lowest crash risk among these 19 communities. The town has experienced two significant downturns since 2010, including back-to-back crashes in 2011 and 2012 that wiped out nearly $17,000 in home values. While prices have more than doubled since the 2010 baseline, the current $272,052 median sits 64% above the community’s long-term sustainable average.

Obetz – Explosive Growth Raising Red Flags

This Franklin County suburb south of Columbus has seen remarkable appreciation, with home values climbing 145% since 2010. The community experienced particularly aggressive growth between 2016 and 2022, when prices jumped from $125,399 to $244,500. Located just 10 miles from downtown Columbus, Obetz benefits from proximity to major employers and Ohio State University, but this same desirability may have pushed prices beyond sustainable levels.

The town’s modest size and limited housing inventory create conditions ripe for volatile price swings. Recent growth has slowed dramatically, with 2025 showing just 1.83% appreciation compared to double-digit gains in previous years. This momentum loss, combined with the community’s history of significant corrections and current overextension, suggests Obetz could face another substantial price adjustment if economic conditions shift.

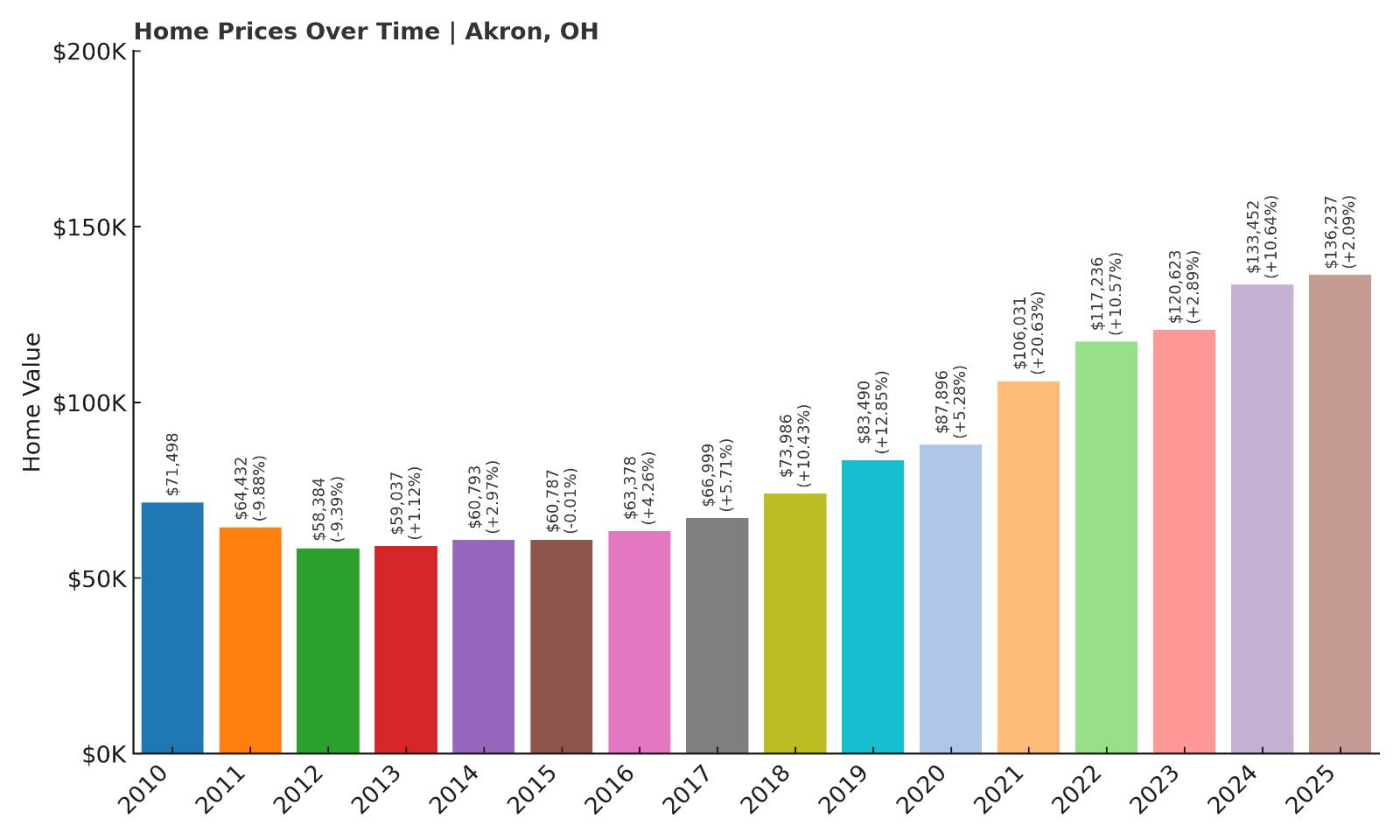

18. Akron – Crash Risk Percentage: 73.15%

- Crash Risk Percentage: 73.15%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 9.9% (2011)

- Total price increase since 2010: 90.5%

- Overextended above long-term average: 59.8%

- Price volatility (annual swings): 7.7%

- Current 2025 price: $136,237

Akron presents a classic case of a former industrial powerhouse struggling with housing market instability. The city endured brutal crashes in 2011 and 2012, losing nearly 19% of home values during the post-recession period. Despite recovering to current levels around $136,237, the market remains 60% above its long-term sustainable trend, creating vulnerability for another correction.

Akron – Rust Belt Recovery Faces New Threats

Ohio’s fifth-largest city has worked to reinvent itself since the decline of its rubber industry, but housing market volatility remains a persistent challenge. Summit County’s seat experienced devastating losses following the 2008 financial crisis, with median home values plummeting from $71,498 to just $58,384. The city’s economy now relies heavily on healthcare, education, and polymer research, with institutions like the University of Akron and Akron Children’s Hospital providing stability.

Recent price movements show concerning patterns, with 2024 delivering a significant 10.63% jump that appears unsustainable given local economic fundamentals. Akron’s housing market has historically been sensitive to broader economic downturns, and current prices trading nearly 60% above long-term averages suggest the market may be due for another substantial correction. The city’s ongoing population decline and industrial legacy continue to create headwinds for sustained housing appreciation.

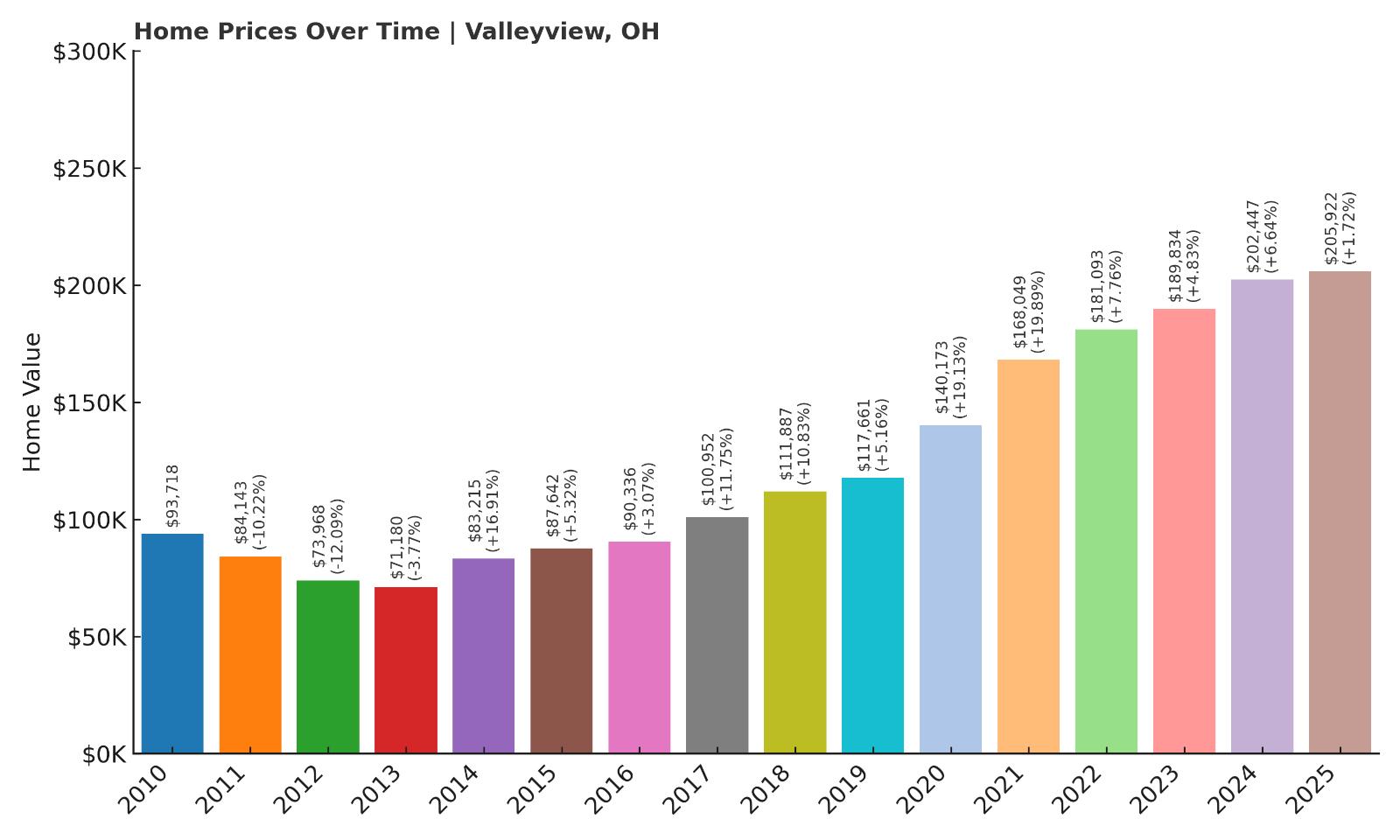

17. Valleyview – Crash Risk Percentage: 73.95%

- Crash Risk Percentage: 73.95%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 12.1% (2012)

- Total price increase since 2010: 119.7%

- Overextended above long-term average: 64.6%

- Price volatility (annual swings): 9.2%

- Current 2025 price: $205,922

Valleyview demonstrates the dangers of extreme market volatility in small communities. This Franklin County village suffered devastating losses in the early 2010s, including a catastrophic 12.1% crash in 2012 that represents the worst single-year decline among these 19 towns. The community has since recovered dramatically, with prices more than doubling, but now trades at concerning levels 65% above sustainable trends.

Valleyview – Small Town, Big Price Swings

Would you like to save this?

This tiny Franklin County community of fewer than 1,000 residents sits northwest of Columbus and exemplifies how limited housing inventory can create extreme price volatility. Valleyview’s proximity to major transportation corridors and the Columbus metropolitan area has driven significant appreciation, but the same factors that enable rapid growth also facilitate swift corrections. The village’s small size means individual sales can dramatically impact median prices.

The community’s 9.2% annual price volatility ranks among the highest in this analysis, reflecting the inherent instability of micro-markets. After experiencing back-to-back crashes totaling over 20% in 2011-2012, Valleyview has seen prices surge 119.7% since 2010. However, growth momentum has slowed to just 1.72% in 2025, and with current prices sitting nearly 65% above long-term averages, the village appears positioned for another significant correction.

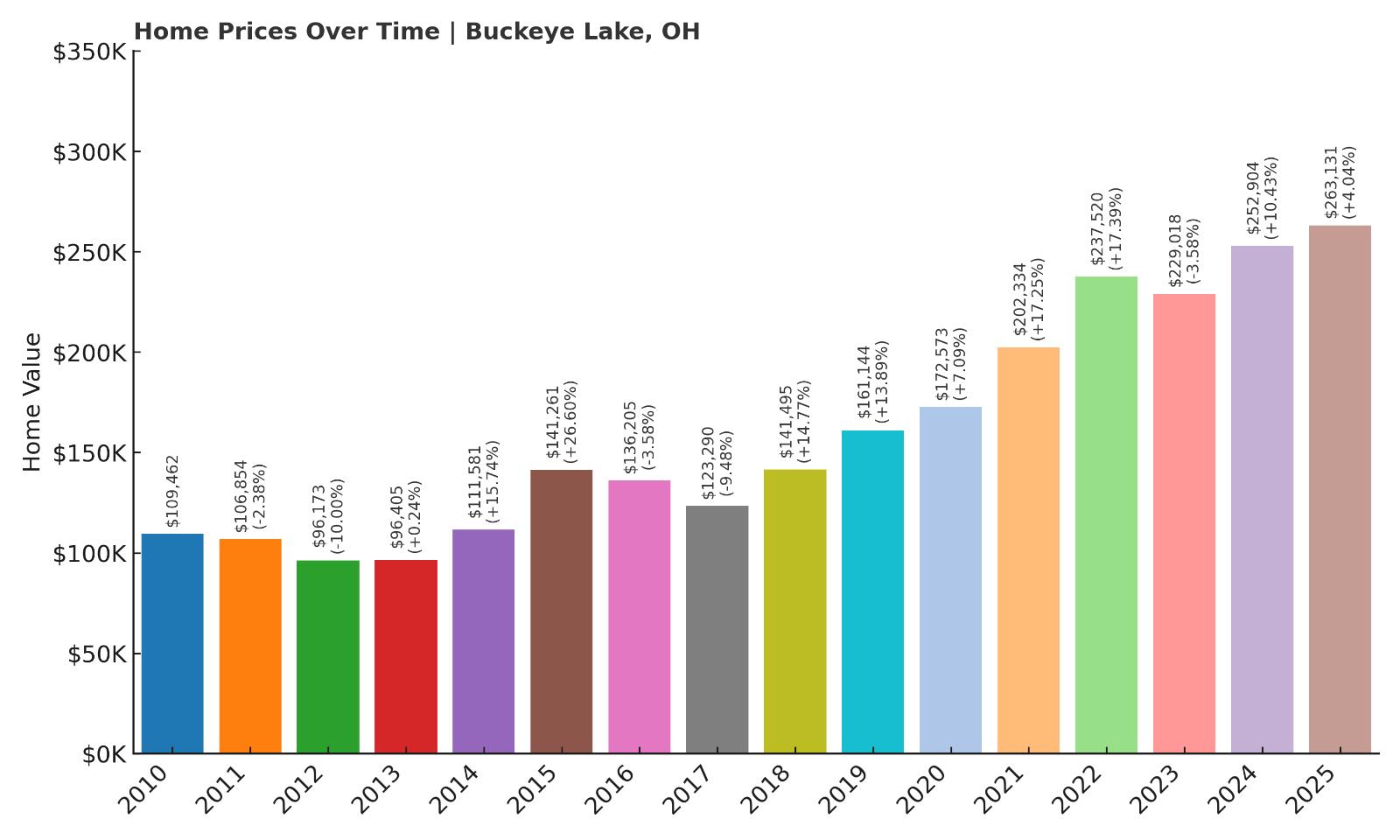

16. Buckeye Lake – Crash Risk Percentage: 74.25%

- Crash Risk Percentage: 74.25%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 10.0% (2012)

- Total price increase since 2010: 140.4%

- Overextended above long-term average: 63.1%

- Price volatility (annual swings): 10.7%

- Current 2025 price: $263,131

Buckeye Lake showcases the risks facing recreational property markets in Ohio. This Licking County community has experienced wild price swings, including major crashes in 2012 and 2017, followed by periods of explosive growth. The lakefront location drives demand but also creates seasonal volatility that contributes to the 10.7% annual price swings. Current values sit 63% above sustainable levels at $263,131.

Buckeye Lake – Lakefront Premium Becomes Liability

Situated around Ohio’s largest inland lake, this Licking County community serves as both a year-round residential area and recreational destination. The village’s unique position creates both opportunity and risk, as lakefront properties command premium prices but also face greater volatility. Buckeye Lake’s housing market reflects the broader challenges facing recreational property markets, where seasonal demand and limited inventory create conditions for dramatic price swings.

The community has experienced remarkable growth spurts, including a 26.6% surge in 2015, followed by corrections that erased those gains. Recent years have brought renewed appreciation, with prices climbing 140.4% since 2010, but this growth has pushed values well beyond sustainable levels. The area’s dependence on recreational tourism and weekend residents creates additional vulnerability during economic downturns, when discretionary real estate purchases typically decline first.

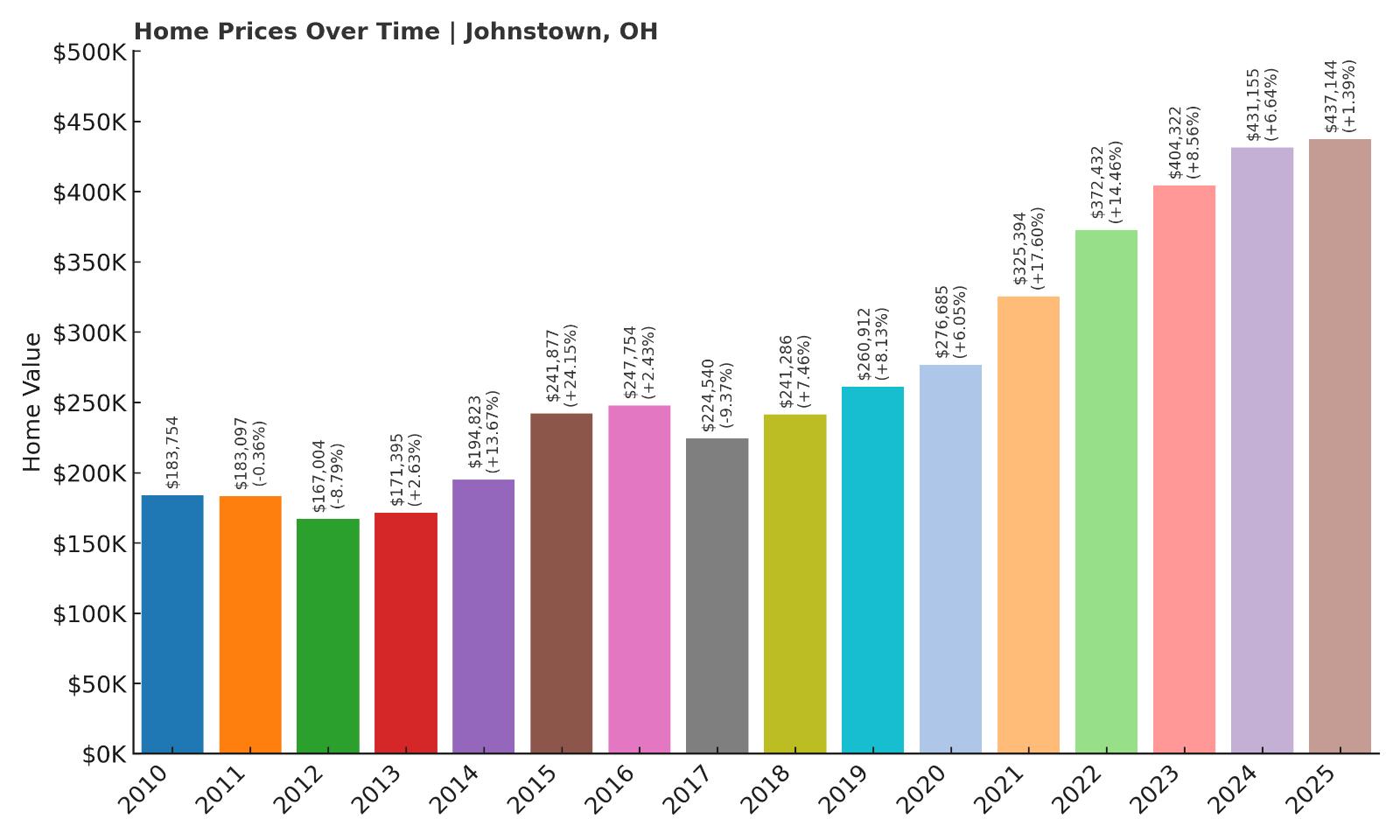

15. Johnstown – Crash Risk Percentage: 74.45%

- Crash Risk Percentage: 74.45%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 9.4% (2017)

- Total price increase since 2010: 137.9%

- Overextended above long-term average: 60.3%

- Price volatility (annual swings): 8.7%

- Current 2025 price: $437,144

Johnstown represents the highest-priced market among these vulnerable communities, with median homes now approaching $440,000. This Licking County town has seen extraordinary appreciation of 137.9% since 2010, but the rapid growth has pushed prices 60% above long-term sustainable levels. The community’s proximity to Columbus and New Albany has driven demand, but current valuations appear divorced from local economic fundamentals.

Johnstown – Suburban Premium Reaches Breaking Point

Located in northeastern Licking County, Johnstown has transformed from a rural community into a sought-after suburban destination. The town’s position between Columbus and Newark, combined with highly-rated schools and newer housing developments, has attracted affluent families willing to pay premium prices. This demand has driven median home values from $183,754 in 2010 to $437,144 today, representing the steepest appreciation among these 19 communities.

However, Johnstown’s rapid ascent shows troubling signs of unsustainability. The market experienced a significant 9.4% correction in 2017, demonstrating sensitivity to economic shifts. Recent growth momentum has slowed dramatically, with 2025 showing just 1.39% appreciation compared to double-digit gains in previous years. With current prices trading 60% above long-term averages and affordability becoming a major constraint, Johnstown appears increasingly vulnerable to a substantial price correction.

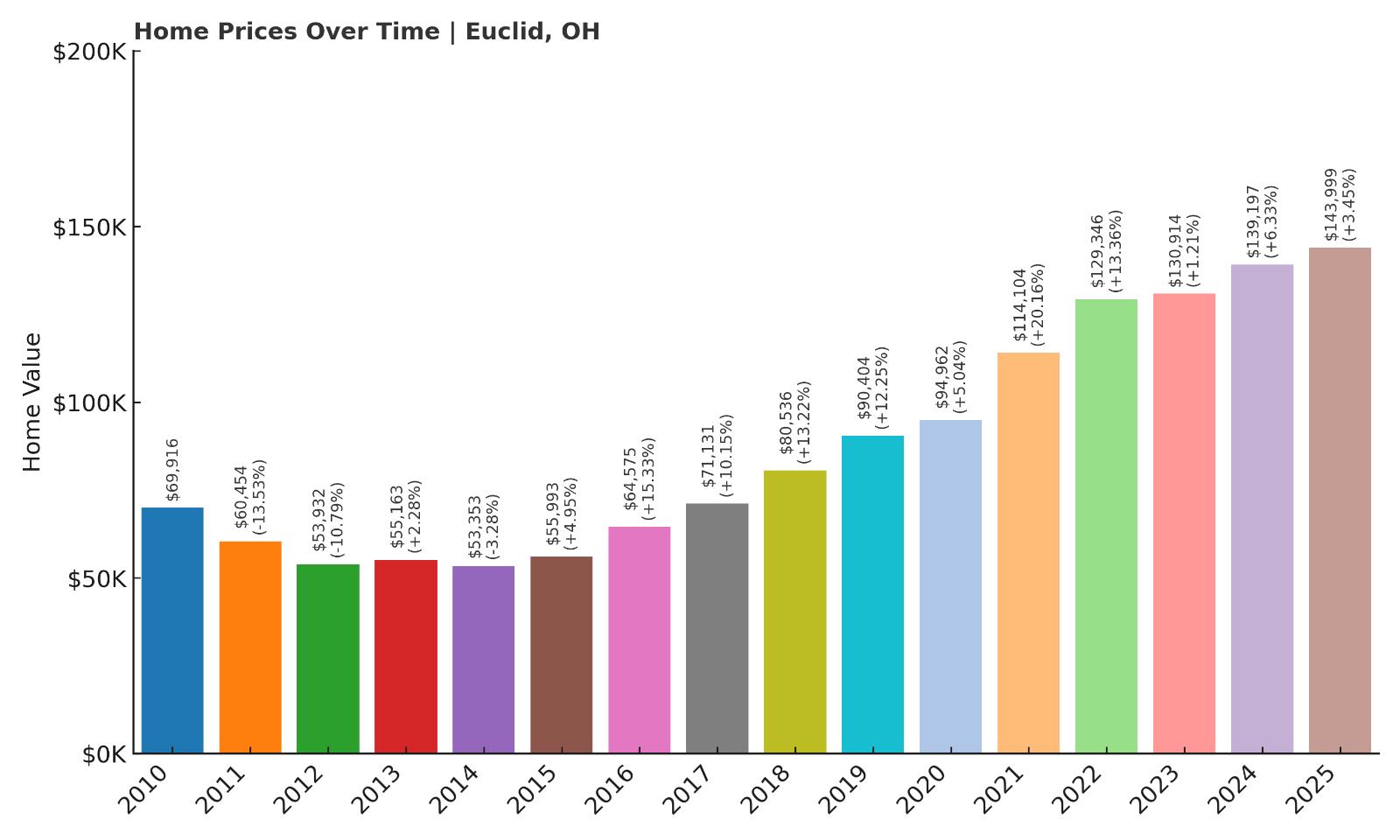

14. Euclid – Crash Risk Percentage: 74.55%

- Crash Risk Percentage: 74.55%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 13.5% (2011)

- Total price increase since 2010: 106.0%

- Overextended above long-term average: 63.6%

- Price volatility (annual swings): 9.1%

- Current 2025 price: $143,999

Euclid faces significant crash risk despite more modest appreciation compared to other communities on this list. This Cuyahoga County city endured a devastating 13.5% crash in 2011, followed by another significant drop in 2012, demonstrating vulnerability to economic downturns. While prices have recovered to $143,999, the market remains 64% above its long-term sustainable average, creating conditions for another correction.

Euclid – Cleveland Suburb Struggles With Stability

This lakefront city east of Cleveland has battled economic challenges while working to maintain housing market stability. Euclid’s location along Lake Erie provides natural amenities, but the community has struggled with population decline and aging infrastructure typical of older Cleveland suburbs. The city’s housing market reflects these broader challenges, with significant volatility and two major crashes since 2010.

Recent price movements show concerning patterns, with 2024 delivering a 6.33% jump followed by 3.45% growth in 2025. While these gains appear modest, they’ve pushed median values 106% above 2010 levels and 64% beyond sustainable trends. Euclid’s history of dramatic corrections, combined with ongoing demographic pressures and current overextension, positions the market for potential significant losses if economic conditions deteriorate.

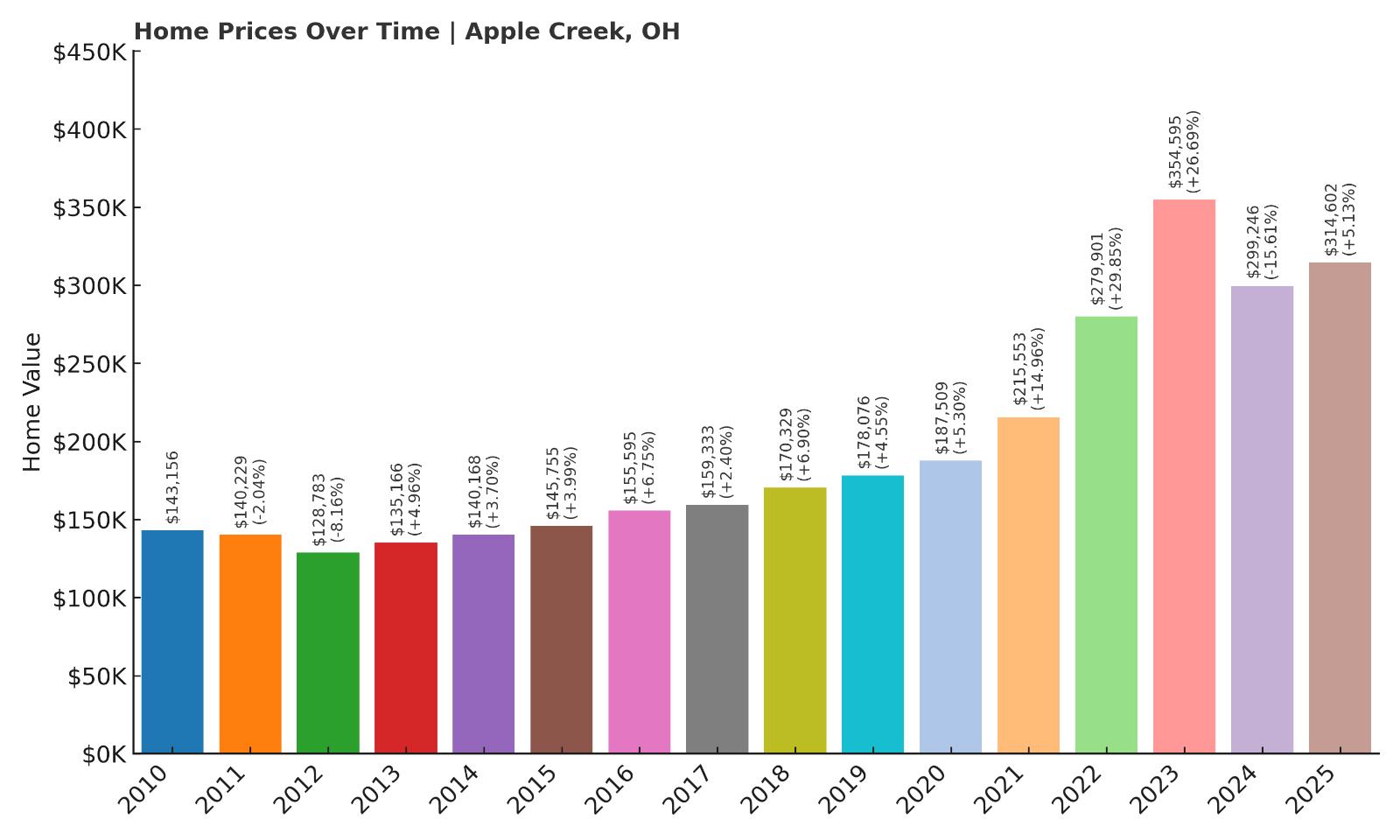

13. Apple Creek – Crash Risk Percentage: 75.00%

- Crash Risk Percentage: 75.00%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 15.6% (2024)

- Total price increase since 2010: 119.8%

- Overextended above long-term average: 59.9%

- Price volatility (annual swings): 11.1%

- Current 2025 price: $314,602

Apple Creek presents a particularly troubling case, having suffered a massive 15.6% crash in 2024 yet still maintaining elevated crash risk. This Wayne County village experienced extreme volatility, including spectacular gains of nearly 30% in 2022 and over 26% in 2023, followed by the devastating 2024 correction. Despite recent losses, current prices remain 60% above sustainable levels, suggesting further declines may be necessary.

Apple Creek – Rural Boom Turns Bust

This small Wayne County community in Ohio’s Amish Country experienced one of the most dramatic housing market cycles among these vulnerable towns. Apple Creek’s rural setting and proximity to tourist destinations initially drove explosive growth, with prices skyrocketing from $215,553 in 2021 to $354,595 by 2023. This represented a staggering 64% increase in just two years, far exceeding any reasonable measure of sustainable appreciation.

The inevitable correction arrived in 2024, wiping out $55,349 in median home values in a single year. Despite this 15.6% crash and partial recovery in 2025, the community remains dangerously overextended at 60% above long-term averages. Apple Creek’s 11.1% annual volatility reflects the inherent instability of small rural markets, where limited inventory and seasonal demand create conditions for extreme price swings. The recent boom-bust cycle suggests the market may not have found its bottom yet.

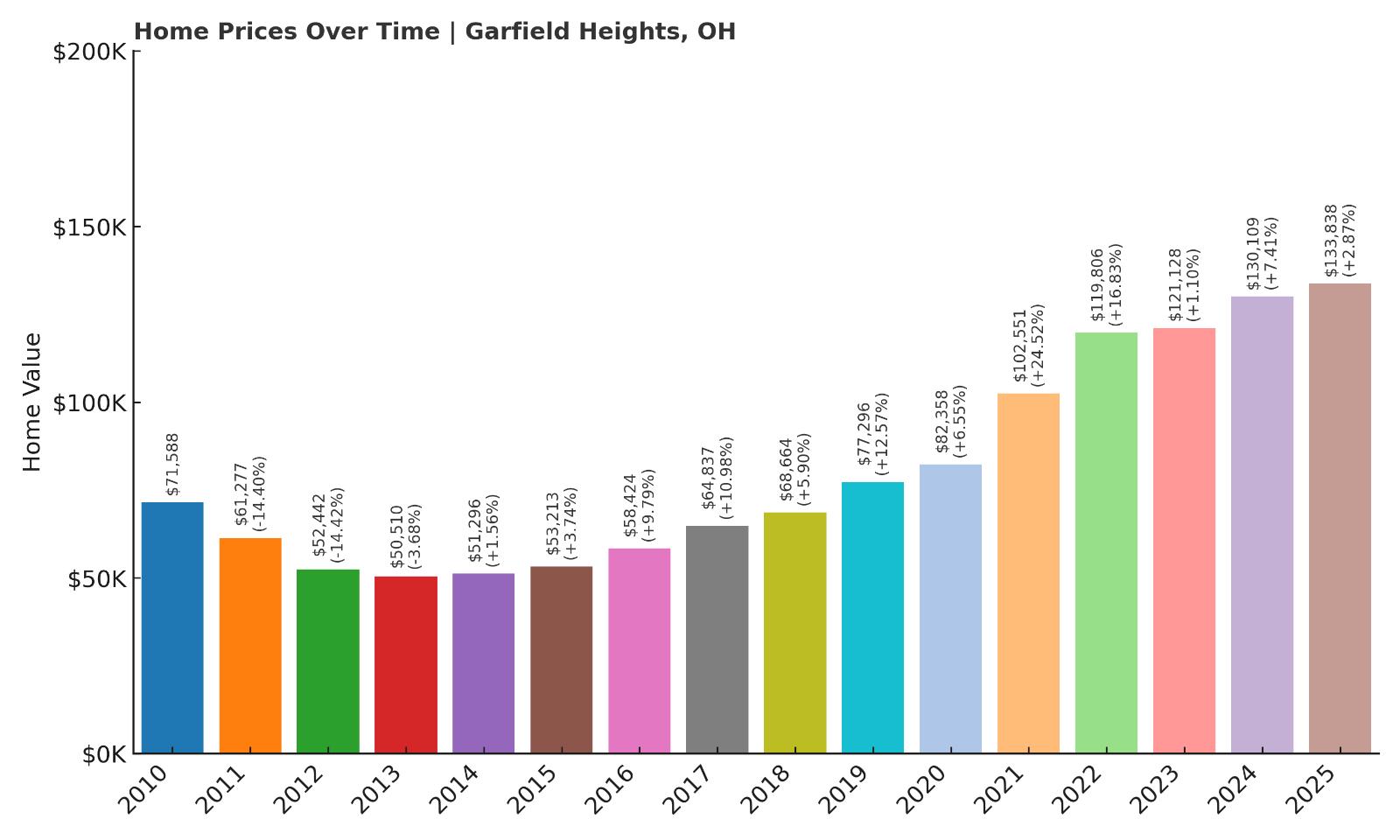

12. Garfield Heights – Crash Risk Percentage: 75.35%

- Crash Risk Percentage: 75.35%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 14.4% (2012)

- Total price increase since 2010: 87.0%

- Overextended above long-term average: 64.8%

- Price volatility (annual swings): 10.0%

- Current 2025 price: $133,838

Garfield Heights shows the persistent vulnerability of Cleveland-area suburbs to housing market instability. This Cuyahoga County city suffered back-to-back crashes in 2011 and 2012, losing over 28% of median home values during that devastating period. While prices have recovered significantly, the current $133,838 median sits 65% above long-term sustainable levels, creating conditions for another potential correction.

Garfield Heights – Cleveland Suburb’s Fragile Recovery

Located just south of Cleveland, Garfield Heights exemplifies the challenges facing inner-ring suburbs in Ohio’s former industrial centers. The city has worked to stabilize its housing market following the devastating crashes of the early 2010s, when median values plummeted from $71,588 to just $50,510. Recent years have brought renewed appreciation, but the 87% total gain since 2010 has pushed prices well beyond what local economic fundamentals can support.

The community’s 10% annual price volatility reflects ongoing market instability, with values swinging dramatically based on external economic conditions. Garfield Heights’ dependence on the broader Cleveland metropolitan economy creates additional vulnerability, as regional economic downturns typically hit inner-ring suburbs particularly hard. With current prices trading nearly 65% above sustainable averages and momentum slowing to just 2.87% in 2025, the city appears positioned for another significant correction.

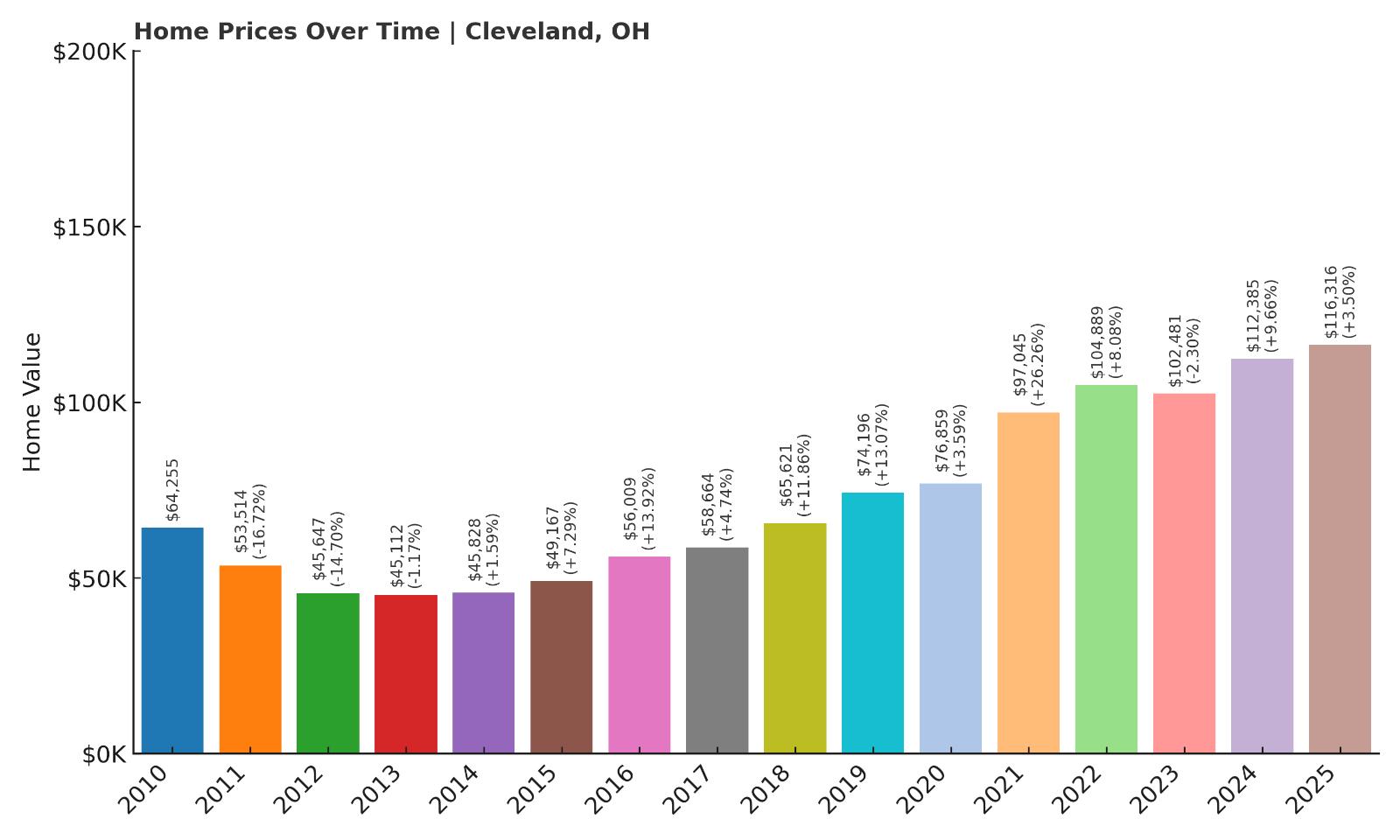

11. Cleveland – Crash Risk Percentage: 76.05%

- Crash Risk Percentage: 76.05%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 16.7% (2011)

- Total price increase since 2010: 81.0%

- Overextended above long-term average: 59.3%

- Price volatility (annual swings): 10.5%

- Current 2025 price: $116,316

Cleveland’s inclusion on this list reflects the ongoing fragility of Ohio’s largest city’s housing market. The city endured devastating crashes in 2011 and 2012, with the worst single-year decline reaching 16.7%. Despite efforts to revitalize downtown and key neighborhoods, median home values remain volatile, with 10.5% annual swings that indicate fundamental market instability. Current prices at $116,316 sit 59% above sustainable long-term levels.

Cleveland – Urban Revival Faces Reality Check

Ohio’s second-largest city has worked aggressively to overcome decades of population decline and economic challenges, with significant investment in downtown development and neighborhood revitalization. Cleveland’s housing market reflects these mixed signals, showing substantial appreciation since the devastating post-recession crashes while maintaining concerning volatility. The city’s median home values crashed from $64,255 in 2010 to just $45,112 by 2013, representing a 30% total decline.

Recent years have brought renewed optimism, with prices climbing 81% since 2010, but this recovery has pushed values well beyond sustainable levels. Cleveland’s economy remains heavily dependent on healthcare, education, and manufacturing, sectors that provide stability but limited growth potential. The city’s 10.5% annual price volatility and history of dramatic corrections suggest the housing market remains vulnerable to external economic shocks, particularly given current overextension above long-term averages.

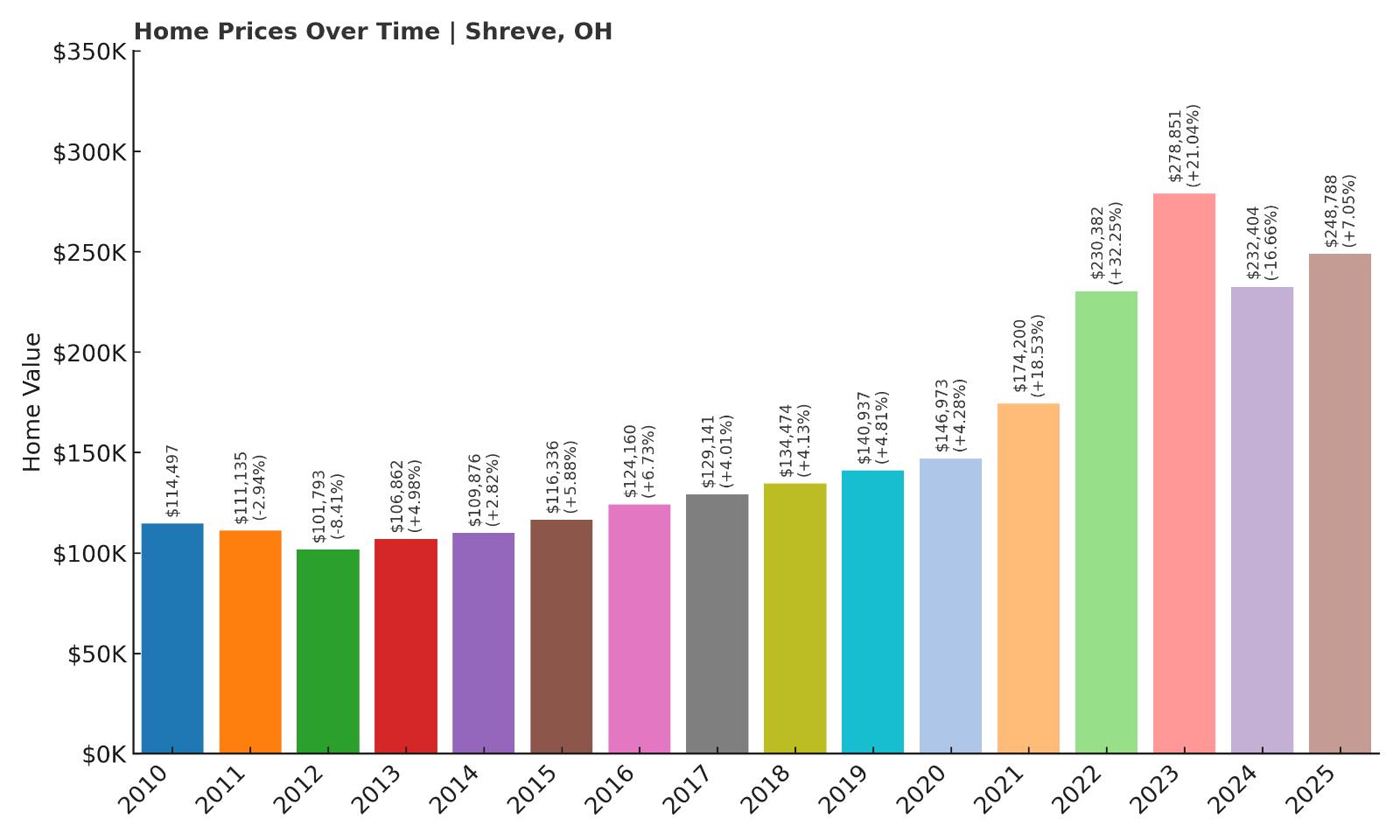

10. Shreve – Crash Risk Percentage: 76.95%

Would you like to save this?

- Crash Risk Percentage: 76.95%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 16.7% (2024)

- Total price increase since 2010: 117.3%

- Overextended above long-term average: 59.2%

- Price volatility (annual swings): 11.2%

- Current 2025 price: $248,788

Shreve experienced one of the most recent and severe crashes among these communities, losing 16.7% of median home values in 2024. This Wayne County village had seen explosive growth, with prices nearly doubling between 2021 and 2023, before reality set in. Despite the recent correction and partial recovery in 2025, current values remain 59% above long-term sustainable levels, suggesting additional declines may be necessary to restore market balance.

Shreve – Recent Crash Signals More Pain Ahead

This small Wayne County community in north-central Ohio experienced a textbook housing bubble and crash cycle in recent years. Shreve’s proximity to Wayne County’s agricultural and manufacturing centers initially drove steady appreciation, but the market entered speculative territory between 2021 and 2023. During this period, median home values exploded from $174,200 to $278,851, representing a 60% increase that far exceeded any reasonable economic justification.

The inevitable correction arrived in 2024, erasing $46,447 in median values through a devastating 16.7% single-year crash. While 2025 has brought partial recovery with 7.05% appreciation, current prices at $248,788 remain dangerously elevated at 59% above long-term trends. Shreve’s 11.2% annual volatility ranks among the highest in this analysis, reflecting the inherent instability of small rural markets where limited housing inventory amplifies price swings in both directions.

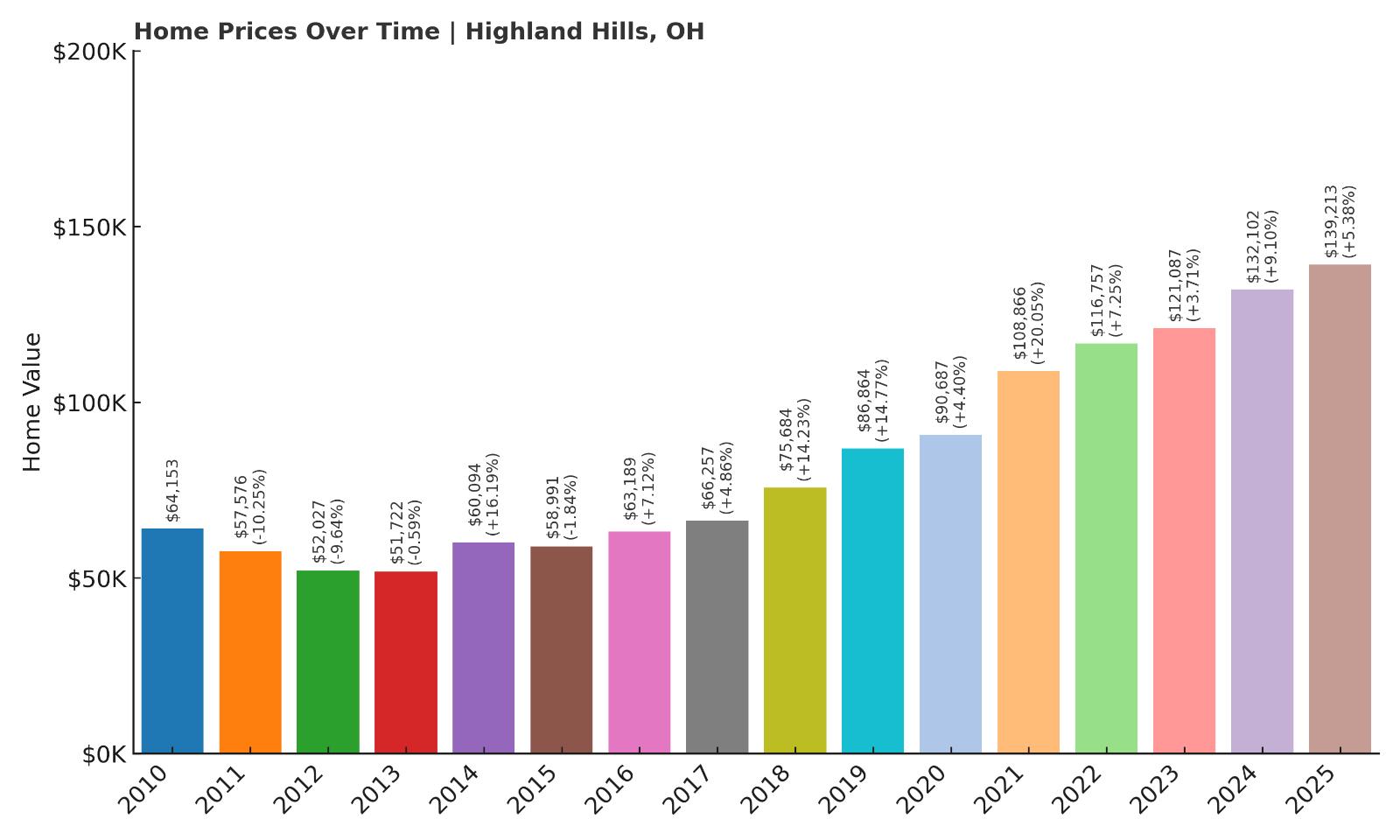

9. Highland Hills – Crash Risk Percentage: 77.05%

- Crash Risk Percentage: 77.05%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 10.3% (2011)

- Total price increase since 2010: 117.0%

- Overextended above long-term average: 65.6%

- Price volatility (annual swings): 8.5%

- Current 2025 price: $139,213

Highland Hills demonstrates how even modest-sized communities can face significant crash risk when markets become overextended. This Cuyahoga County village has seen prices more than double since 2010, climbing 117% to reach $139,213. The community experienced crashes in both 2011 and 2012, showing vulnerability to broader economic downturns. Current values trading 66% above sustainable averages create conditions for another substantial correction.

Highland Hills – Small Village, Big Vulnerabilities

Located in southeastern Cuyahoga County, Highland Hills serves as a small residential community within the greater Cleveland metropolitan area. The village’s compact size of roughly 1,000 residents creates conditions where individual property sales can significantly impact median values, contributing to market volatility. Highland Hills weathered the post-recession period with typical challenges, experiencing back-to-back crashes that reduced median values by nearly 20% between 2011 and 2013.

The subsequent recovery has been dramatic but potentially unsustainable, with prices climbing 117% since 2010. Recent appreciation has been particularly aggressive, with 2024 delivering a 9.1% jump followed by continued gains in 2025. This growth trajectory has pushed current values 66% above long-term sustainable levels, creating mathematical conditions for a significant correction. Highland Hills’ history of market volatility and current overextension suggest residents should prepare for potential substantial value declines.

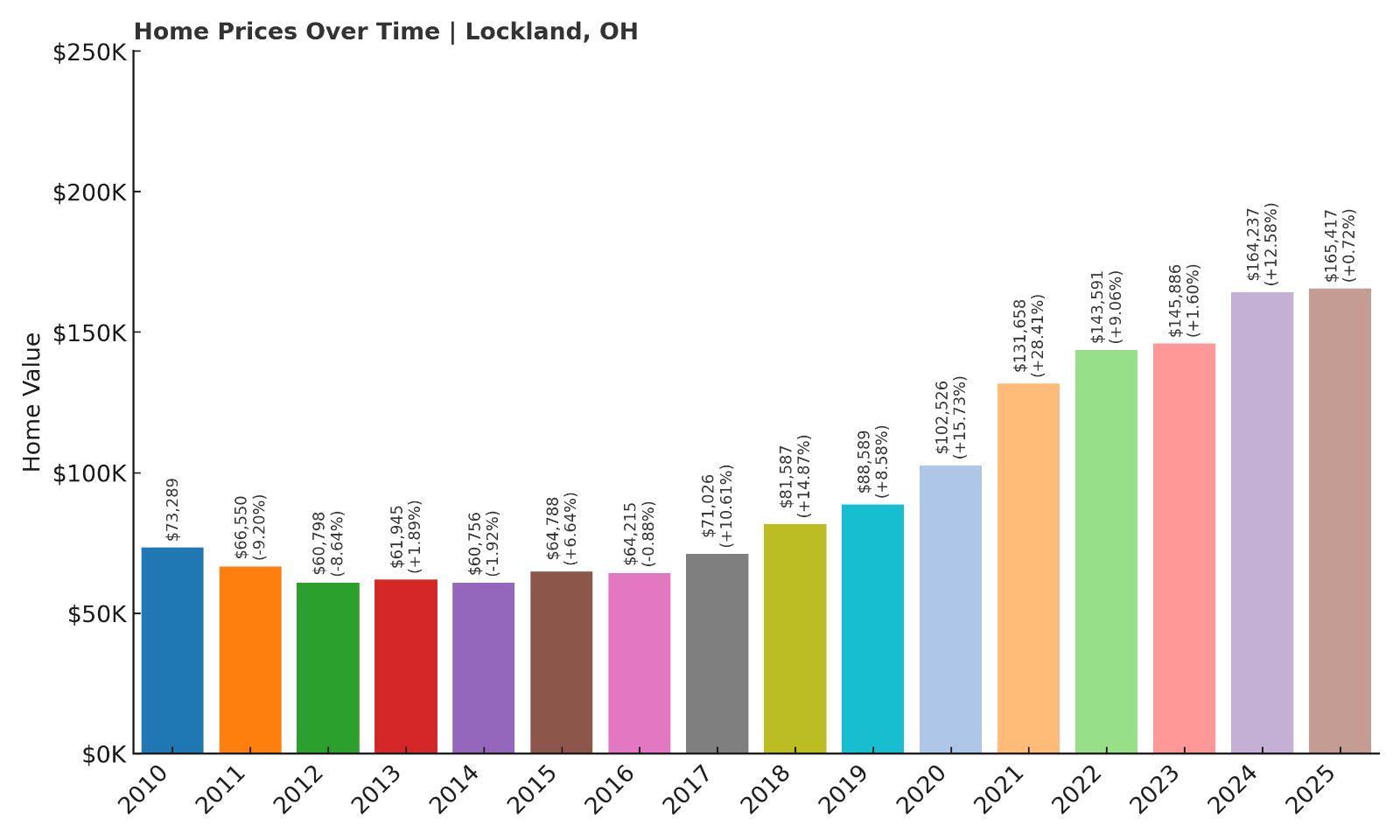

8. Lockland – Crash Risk Percentage: 77.85%

- Crash Risk Percentage: 77.85%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 9.2% (2011)

- Total price increase since 2010: 125.7%

- Overextended above long-term average: 71.1%

- Price volatility (annual swings): 9.6%

- Current 2025 price: $165,417

Lockland faces serious crash risk with the highest overextension ratio among communities in this range, trading 71% above long-term sustainable levels. This Hamilton County village has experienced remarkable appreciation of 125.7% since 2010, but much of this growth appears divorced from local economic fundamentals. The community’s proximity to Cincinnati provides some support, but current valuations appear unsustainable given historical patterns and recent momentum loss.

Lockland – Cincinnati Suburb Reaches Dangerous Heights

This small Hamilton County community north of Cincinnati has benefited from proximity to the region’s economic center while maintaining a distinct village character. Lockland’s housing market reflects broader suburban trends, with appreciation driven by families seeking affordable alternatives to Cincinnati proper. The village experienced typical post-recession challenges, with median values declining from $73,289 in 2010 to $60,756 by 2014.

However, the subsequent recovery has been extraordinary, with prices more than doubling to reach $165,417 by 2025. This 125.7% total appreciation has pushed the market to dangerous levels, with current values trading 71% above sustainable long-term averages. Recent growth momentum has slowed dramatically, with 2025 showing just 0.72% appreciation compared to double-digit gains in previous years. Lockland’s combination of extreme overextension, slowing momentum, and historical volatility creates conditions for a potentially severe correction.

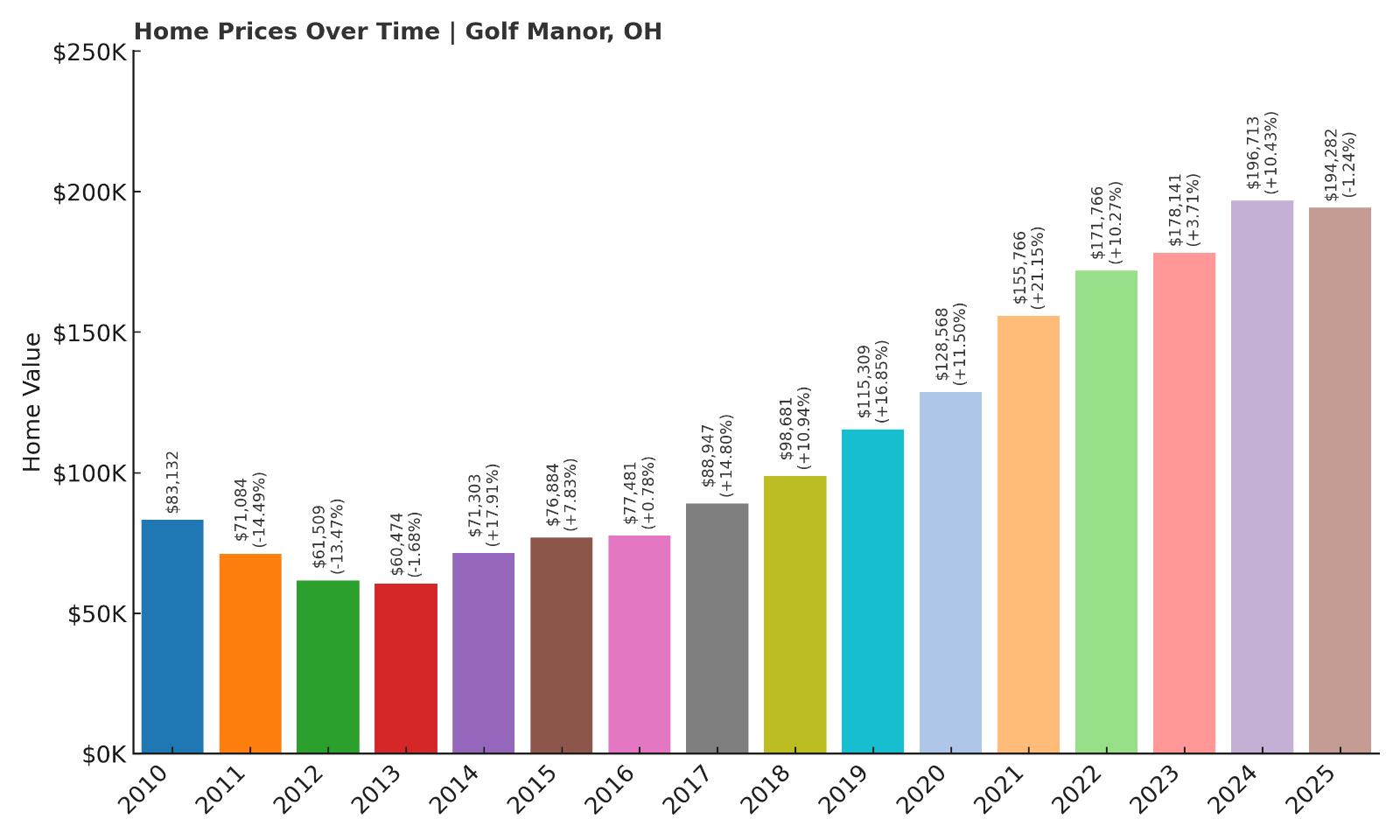

7. Golf Manor – Crash Risk Percentage: 78.45%

- Crash Risk Percentage: 78.45%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 14.5% (2011)

- Total price increase since 2010: 133.7%

- Overextended above long-term average: 69.9%

- Price volatility (annual swings): 10.3%

- Current 2025 price: $194,282

Golf Manor enters the high-risk category with concerning signals across multiple indicators. This Hamilton County village suffered a devastating 14.5% crash in 2011, demonstrating vulnerability to economic downturns. Despite recovery to $194,282, current prices remain 70% above sustainable levels while showing recent signs of momentum loss. The community’s 10.3% annual volatility indicates ongoing market instability that could amplify any future correction.

Golf Manor – Cincinnati Enclave Shows Warning Signs

This small Hamilton County community, completely surrounded by Cincinnati, occupies a unique position as an independent village within the larger metropolitan area. Golf Manor’s compact size of roughly 3,500 residents creates both intimacy and vulnerability, as limited housing inventory can amplify price movements in either direction. The village experienced brutal losses during the post-recession period, with median values crashing from $83,132 to $60,474 between 2010 and 2013.

The recovery has been remarkable but potentially excessive, with prices climbing 133.7% since 2010 to reach current levels of $194,282. This appreciation has pushed values 70% above long-term sustainable trends, creating mathematical conditions for a significant correction. Recent momentum shows troubling signs, with 2025 actually posting a 1.24% decline despite continued regional growth. Golf Manor’s history of volatile corrections, current overextension, and emerging weakness position the community for potentially substantial losses.

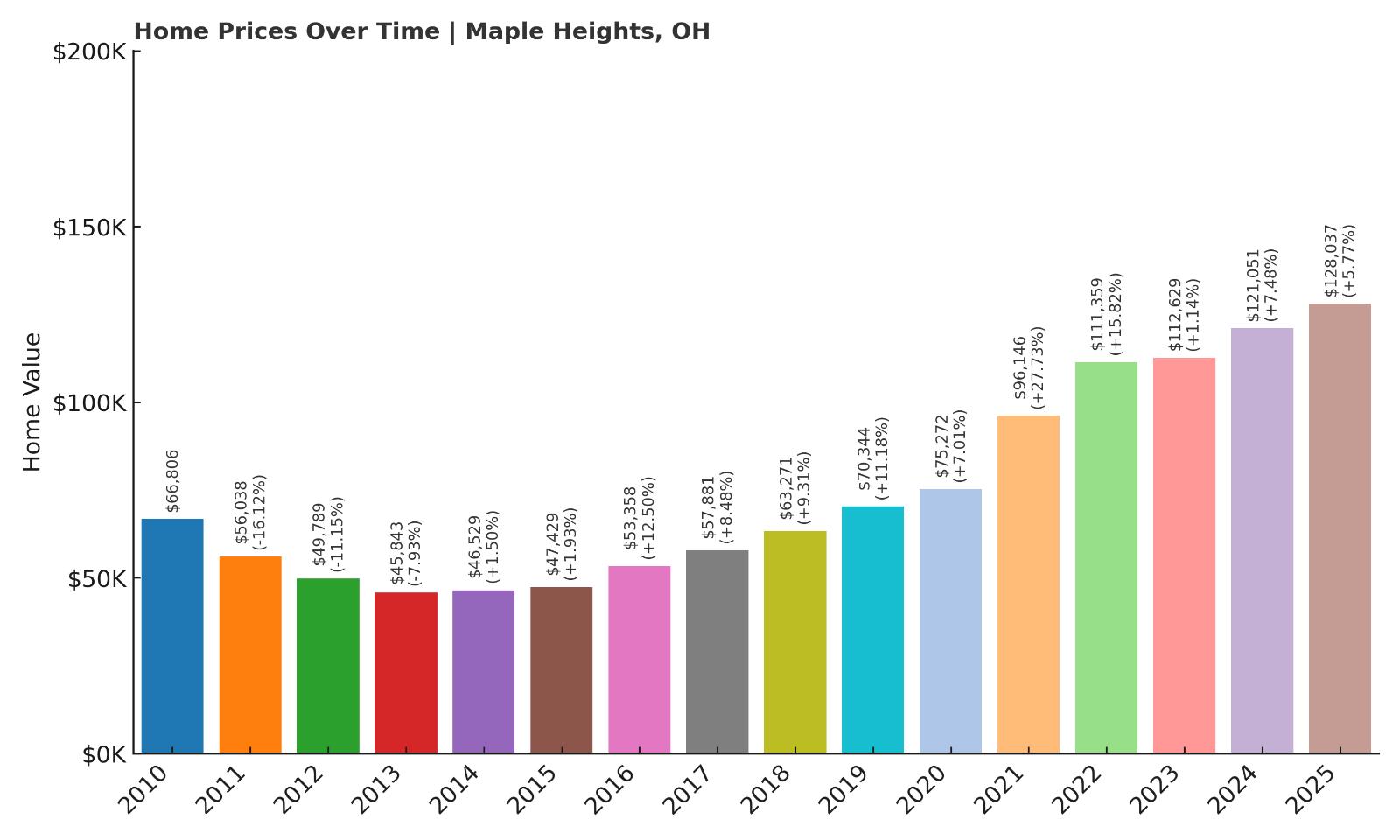

6. Maple Heights – Crash Risk Percentage: 78.65%

- Crash Risk Percentage: 78.65%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 16.1% (2011)

- Total price increase since 2010: 91.7%

- Overextended above long-term average: 70.5%

- Price volatility (annual swings): 10.6%

- Current 2025 price: $128,037

Maple Heights faces elevated crash risk despite more moderate appreciation compared to other high-risk communities. This Cuyahoga County city endured a catastrophic 16.1% crash in 2011, followed by continued declines that reduced median values by over 30% through 2013. While recovery has brought prices to $128,037, current levels remain 71% above sustainable averages, creating conditions for another significant correction in this historically volatile market.

Maple Heights – Cleveland Suburb’s Precarious Position

Located in southeastern Cuyahoga County, Maple Heights serves as a diverse suburban community within the greater Cleveland metropolitan area. The city of approximately 22,000 residents has struggled with the typical challenges facing older Cleveland suburbs, including aging infrastructure and demographic shifts. Maple Heights experienced devastating housing market losses following the 2008 financial crisis, with median values plummeting from $66,806 in 2010 to just $45,843 by 2013.

The subsequent recovery has been substantial, with prices climbing 91.7% since 2010, but this growth has pushed values well beyond sustainable levels. Current median values of $128,037 trade 71% above long-term averages, creating dangerous overextension despite the city’s working-class character. Maple Heights’ 10.6% annual volatility reflects ongoing market instability, while recent momentum shows concerning signs with growth slowing from double digits to more modest levels. The city’s history of severe corrections combined with current overextension suggests another substantial price decline may be necessary.

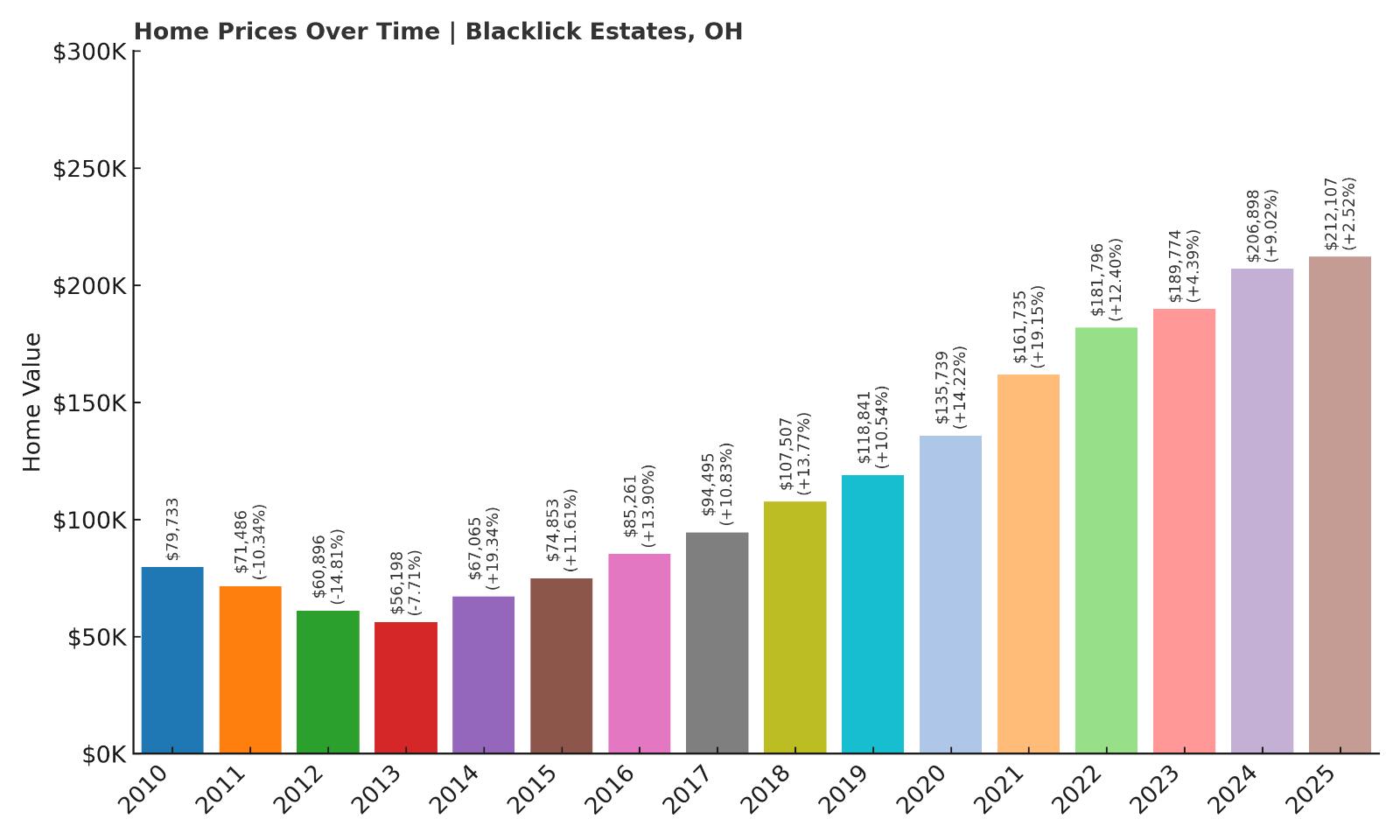

5. Blacklick Estates – Crash Risk Percentage: 84.30%

- Crash Risk Percentage: 84.30%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 14.8% (2012)

- Total price increase since 2010: 166.0%

- Overextended above long-term average: 78.2%

- Price volatility (annual swings): 10.2%

- Current 2025 price: $212,107

Blacklick Estates enters the extreme risk category with multiple concerning indicators. This Franklin County community has experienced explosive 166% appreciation since 2010, far exceeding any reasonable measure of sustainable growth. Current prices at $212,107 trade 78% above long-term sustainable levels, representing the most severe overextension among communities in this risk range. The area suffered devastating crashes in 2012 and 2013, losing over 25% of median values during that period.

Blacklick Estates – Columbus Suburb Reaches Breaking Point

This unincorporated Franklin County community east of Columbus has transformed from an affordable suburban option into a significantly overpriced market. Blacklick Estates benefits from proximity to major employment centers and quality schools, but recent appreciation has pushed prices well beyond what local fundamentals can support. The area experienced brutal losses during the post-recession period, with median values crashing from $79,733 in 2010 to just $56,198 by 2013.

The recovery has been extraordinary but unsustainable, with prices more than tripling to reach $212,107 by 2025. This 166% appreciation represents one of the most extreme examples of market overheating in central Ohio. Recent momentum has slowed dramatically, with 2025 showing just 2.52% growth compared to double-digit gains in previous years. Blacklick Estates’ combination of extreme overextension at 78% above sustainable levels, slowing momentum, and historical volatility creates conditions for a potentially devastating correction.

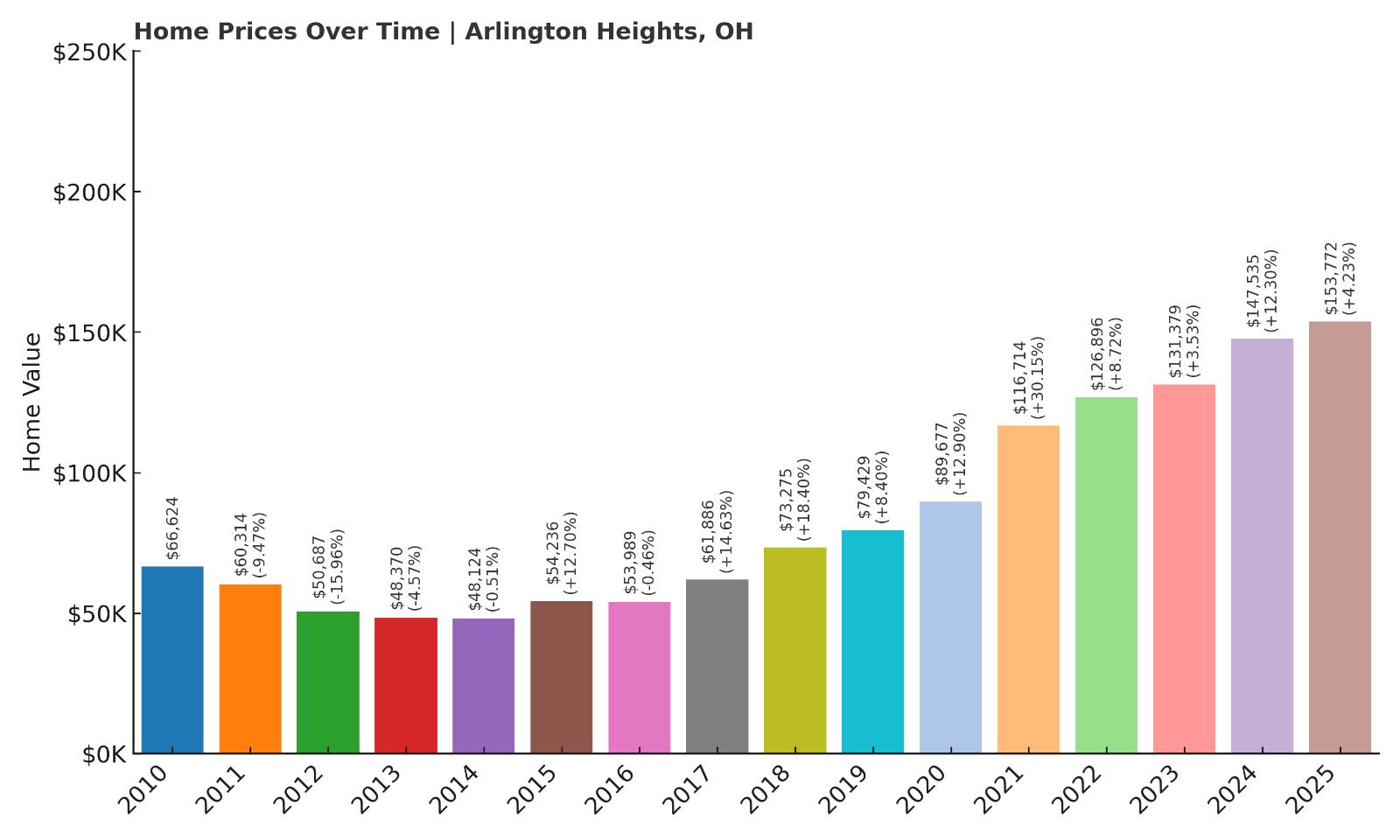

4. Arlington Heights – Crash Risk Percentage: 86.95%

- Crash Risk Percentage: 86.95%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 16.0% (2012)

- Total price increase since 2010: 130.8%

- Overextended above long-term average: 80.5%

- Price volatility (annual swings): 11.2%

- Current 2025 price: $153,772

Arlington Heights faces severe crash risk with dangerous overextension reaching 80% above sustainable levels. This Hamilton County community has seen prices more than double since 2010, climbing 130.8% to reach $153,772. The area experienced devastating back-to-back crashes in 2011 and 2012, losing over 27% of median values during that brutal period. High volatility at 11.2% annually indicates ongoing market instability that could amplify any future correction.

Arlington Heights – Cincinnati Suburb on Dangerous Ground

This small Hamilton County community northwest of Cincinnati exemplifies the risks facing suburban markets that have experienced excessive appreciation. Arlington Heights weathered devastating losses during the post-recession period, with median values plummeting from $66,624 in 2010 to just $48,124 by 2014. The community’s recovery has been dramatic, with prices more than tripling from their low point, but this growth has created dangerous market conditions.

Current median values of $153,772 represent a 130.8% increase since 2010, pushing the market 80% above sustainable long-term trends. This extreme overextension, combined with 11.2% annual volatility, creates mathematical conditions for a severe correction. Recent momentum shows concerning patterns, with growth becoming increasingly erratic and unsustainable. Arlington Heights’ history of dramatic crashes and current extreme overvaluation suggest the community faces significant downside risk.

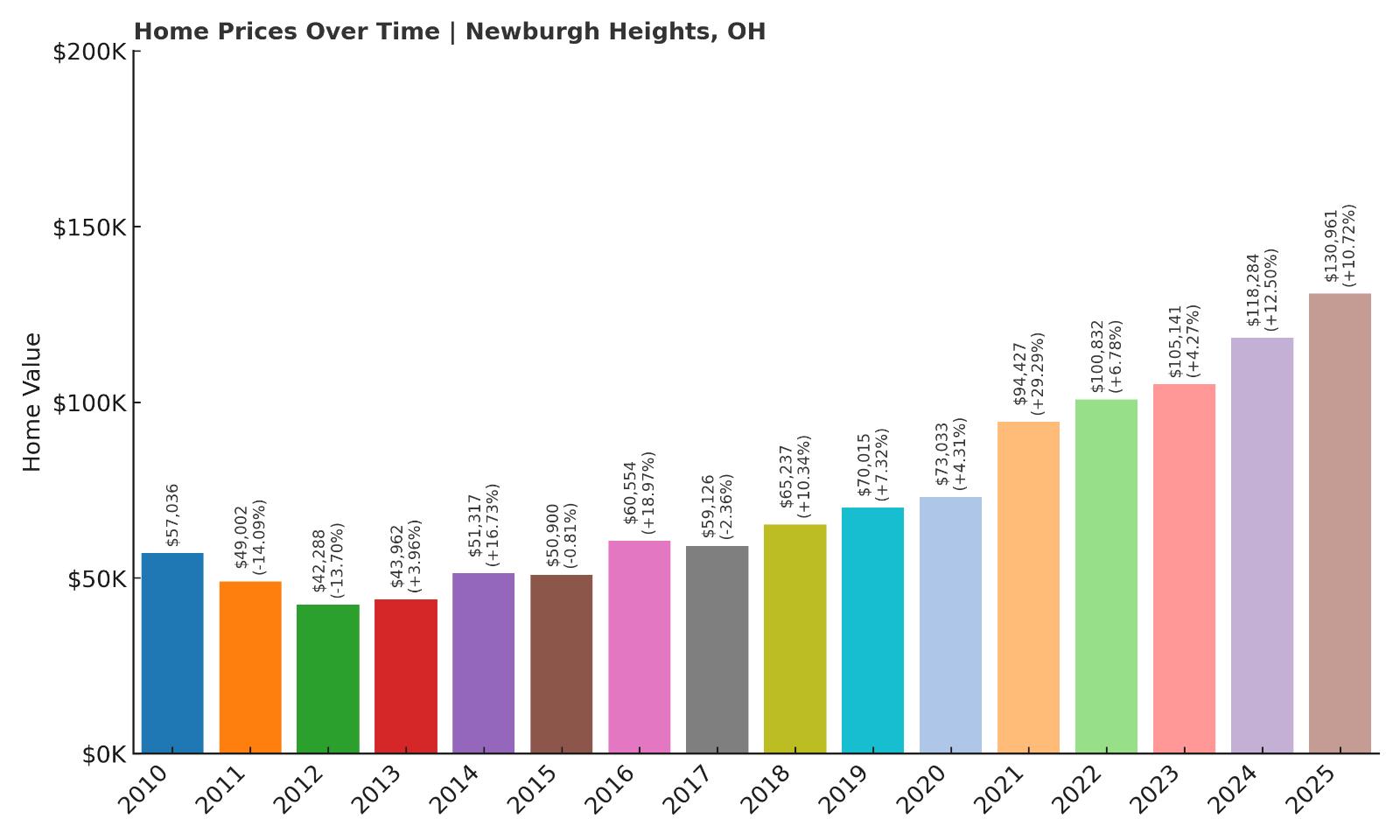

3. Newburgh Heights – Crash Risk Percentage: 88.75%

- Crash Risk Percentage: 88.75%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 14.1% (2011)

- Total price increase since 2010: 129.6%

- Overextended above long-term average: 78.8%

- Price volatility (annual swings): 11.0%

- Current 2025 price: $130,961

Newburgh Heights approaches extreme crash risk territory with concerning indicators across all metrics. This Cuyahoga County village has experienced remarkable 129.6% appreciation since 2010, but recent acceleration appears unsustainable. The community suffered significant crashes in 2011 and 2012, demonstrating vulnerability to economic downturns. Current prices at $130,961 trade nearly 79% above sustainable levels, while 11% annual volatility indicates ongoing market instability.

Newburgh Heights – Industrial Village Faces Housing Reality

This small Cuyahoga County community sits in the heart of Cleveland’s industrial valley, serving as both a residential area and industrial center. Newburgh Heights’ unique character as a village with significant manufacturing presence creates both opportunity and risk for the housing market. The community experienced typical post-recession challenges, with median values declining from $57,036 in 2010 to $42,288 by 2012, representing a 26% total decline.

The recovery has been extraordinary, with prices more than tripling from their low point to reach $130,961 by 2025. Recent momentum has been particularly aggressive, with 2024 and 2025 delivering combined appreciation of over 23%. This acceleration has pushed values 79% above sustainable trends, creating dangerous market conditions. Newburgh Heights’ combination of extreme overextension, accelerating momentum that appears unsustainable, and historical volatility positions the village for a potentially severe correction.

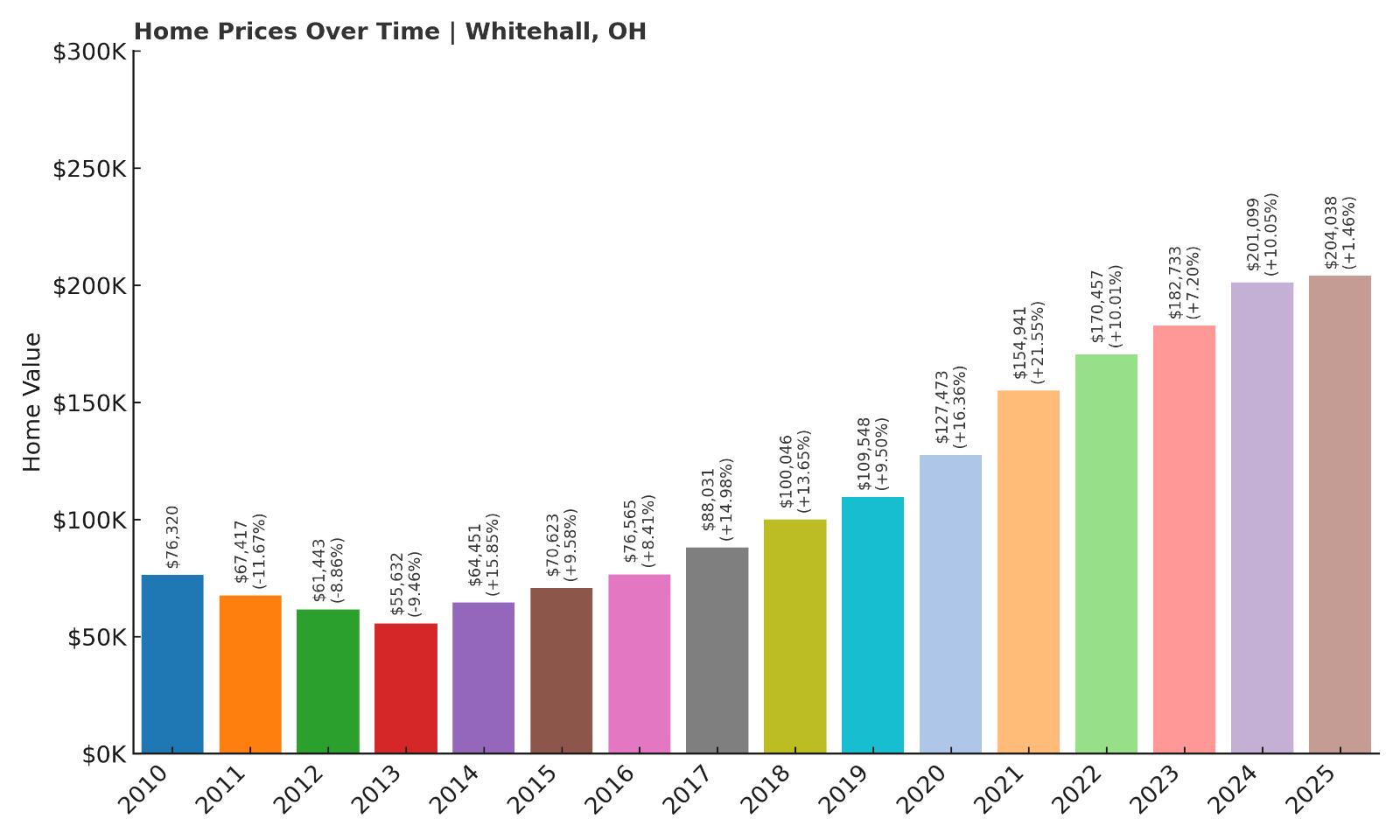

2. Whitehall – Crash Risk Percentage: 90.30%

- Crash Risk Percentage: 90.30%

- Historical crashes (8%+ drops): 3

- Worst historical crash: 11.7% (2011)

- Total price increase since 2010: 167.3%

- Overextended above long-term average: 80.3%

- Price volatility (annual swings): 9.7%

- Current 2025 price: $204,038

Whitehall faces extreme crash risk as the only community with three historical crashes among these 19 towns. This Franklin County city has experienced explosive 167.3% appreciation since 2010, representing unsustainable growth that has pushed current prices 80% above long-term sustainable levels. The community’s history of repeated corrections, combined with current extreme overextension, creates conditions for potentially devastating losses when market conditions shift.

Whitehall – Columbus Suburb’s Dangerous Trajectory

This Franklin County city east of Columbus has transformed from an affordable suburban option into a significantly overpriced market showing extreme crash risk. Whitehall’s central location and access to major transportation corridors have driven substantial demand, but recent appreciation far exceeds any reasonable economic justification. The city experienced a series of crashes between 2011 and 2013, with median values declining from $76,320 to $55,632, representing a 27% total decline.

The subsequent recovery has been extraordinary but clearly unsustainable, with prices climbing 167.3% since 2010 to reach $204,038. This growth has pushed values 80% above long-term sustainable trends, creating mathematical conditions for a severe correction. Whitehall’s unique position as the only community with three historical crashes demonstrates particular vulnerability to economic downturns. Recent momentum has slowed dramatically, with 2025 showing just 1.46% appreciation, suggesting the market may be losing steam as it reaches unsustainable heights.

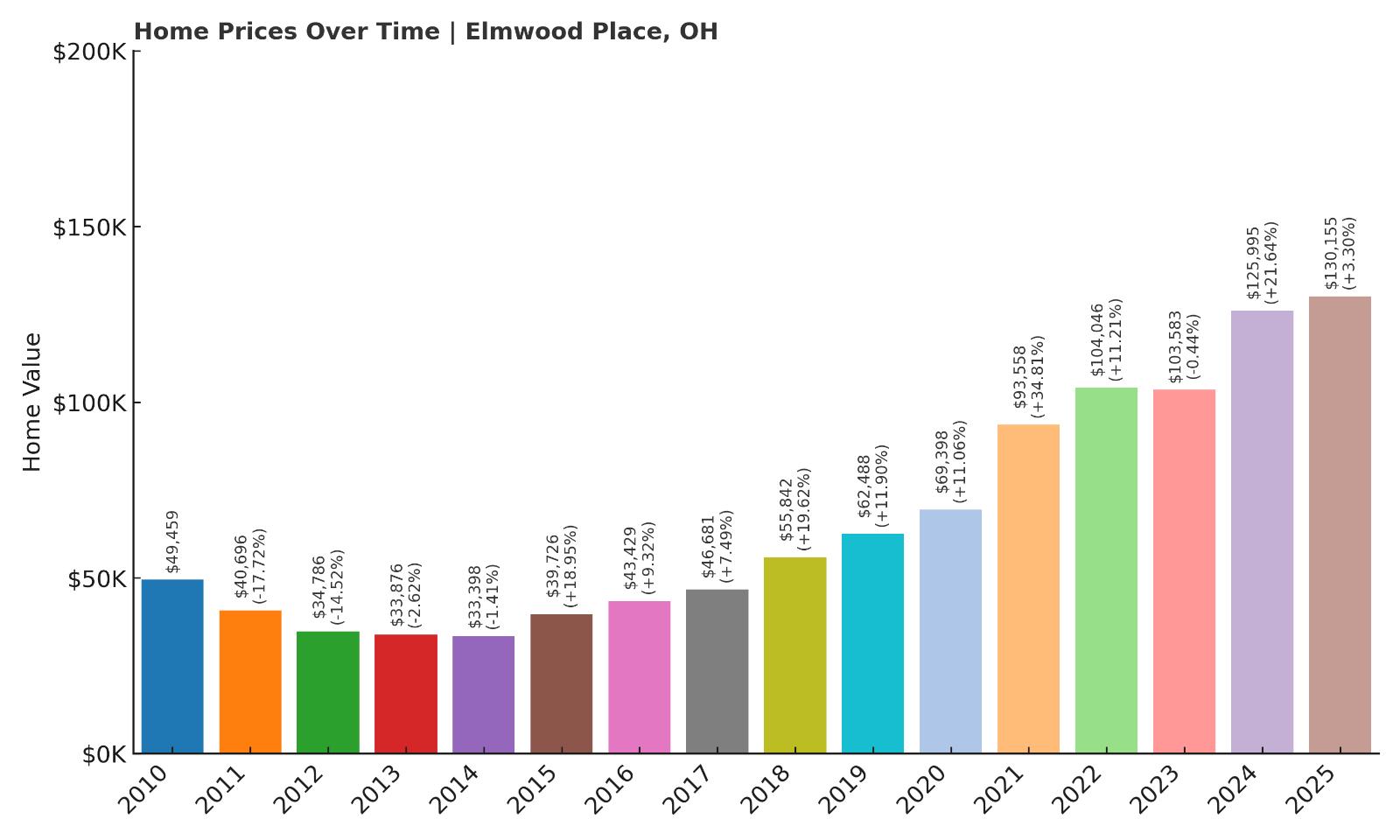

1. Elmwood Place – Crash Risk Percentage: 95.00%

- Crash Risk Percentage: 95.00%

- Historical crashes (8%+ drops): 2

- Worst historical crash: 17.7% (2011)

- Total price increase since 2010: 163.2%

- Overextended above long-term average: 95.2%

- Price volatility (annual swings): 13.3%

- Current 2025 price: $130,155

Elmwood Place tops this analysis with extreme 95% crash risk, driven by the most severe overextension in Ohio at 95% above sustainable levels. This Hamilton County village has experienced explosive 163.2% appreciation since 2010, but current prices appear completely divorced from economic reality. The community suffered the worst single crash among these towns at 17.7% in 2011, demonstrating extreme vulnerability to economic downturns. Record 13.3% annual volatility indicates a fundamentally unstable market.

Elmwood Place – Ohio’s Most Dangerous Housing Market

This tiny Hamilton County village of roughly 2,500 residents represents the most extreme example of housing market overextension in Ohio. Completely surrounded by Cincinnati, Elmwood Place occupies less than one square mile but has experienced price movements that defy economic logic. The village suffered catastrophic losses during the post-recession period, with median values crashing from $49,459 in 2010 to just $33,398 by 2014, representing a devastating 32% decline.

The recovery has been extraordinary but clearly unsustainable, with prices nearly quadrupling from their low point to reach $130,155 by 2025. This 163.2% appreciation since 2010 has pushed values 95% above sustainable long-term trends, creating the most dangerous market conditions in the state. Elmwood Place’s 13.3% annual volatility represents extreme instability, while recent momentum shows troubling patterns with massive swings between years. The village’s combination of record overextension, extreme volatility, and history of devastating crashes creates conditions for potentially catastrophic losses when market reality inevitably returns.