Would you like to save this?

Ohio’s housing market is seeing a sharp shift as home prices surge well beyond their usual pace. According to the Zillow Home Value Index, a wave of investor activity is transforming once-stable towns across the Buckeye State. Rapid buying, flipping, and speculative demand have fueled price spikes that often double historical growth rates, leaving local buyers struggling to compete.

These shifts carry real consequences. Affordable neighborhoods are tightening, first-time homebuyers are being squeezed out, and communities are changing faster than many residents ever expected. The following 30 towns show the clearest signs of this investor-driven surge as of July 2025.

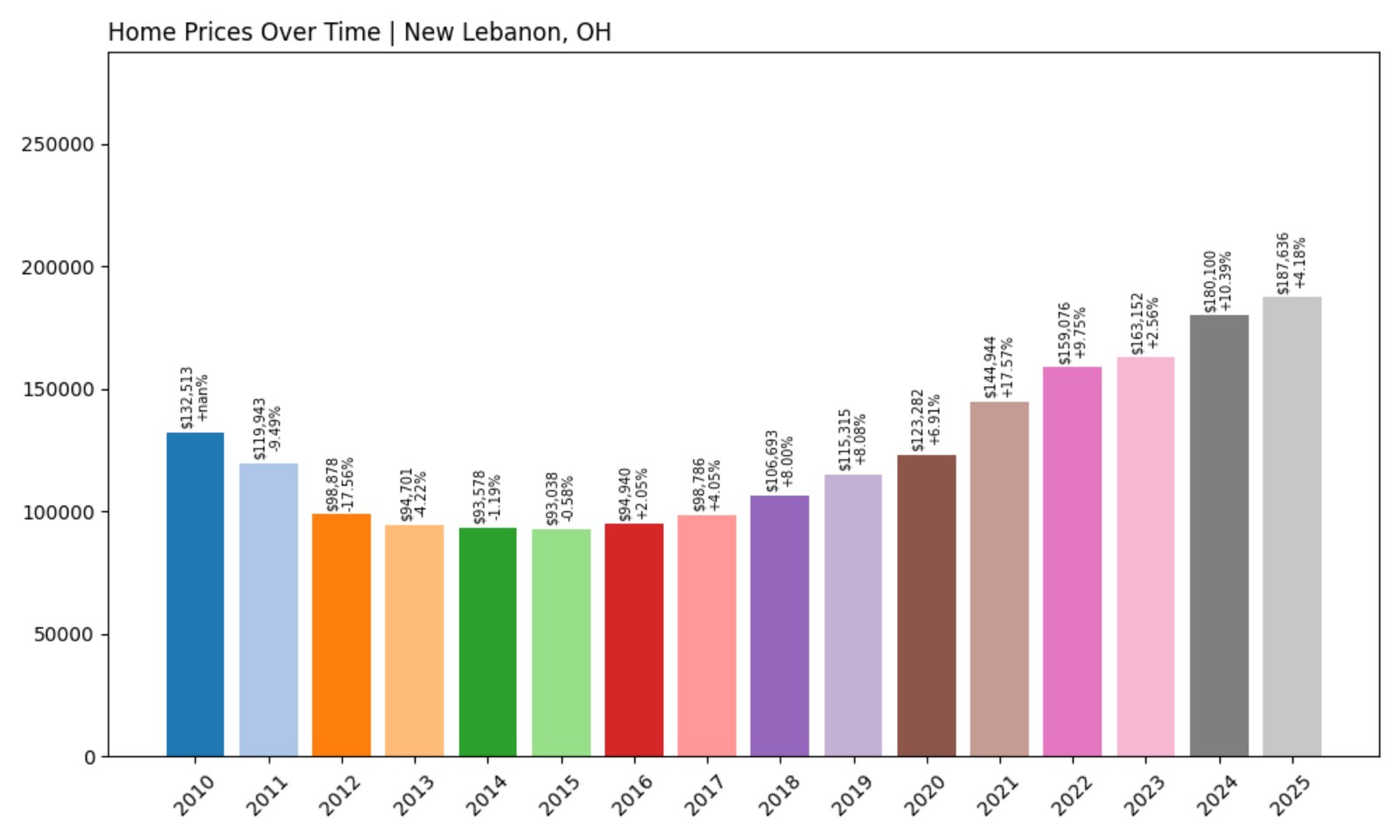

30. New Lebanon – Investor Feeding Frenzy Factor 16.19% (July 2025)

- Historical annual growth rate (2012–2022): 4.87%

- Recent annual growth rate (2022–2025): 5.66%

- Investor Feeding Frenzy Factor: 16.19%

- Current 2025 price: $187,636.33

New Lebanon’s recent growth of 5.66% annually outpaces its decade-long average of 4.87%, pushing its Feeding Frenzy Factor to over 16%. That may not sound like much at first glance, but in a community where growth has historically been modest, even a small surge can signal early investor interest. This kind of acceleration can quietly reshape affordability trends for local buyers.

New Lebanon – Modest Prices, Rising Pressure

Tucked just west of Dayton in Montgomery County, New Lebanon has long been considered a budget-friendly suburb with a close-knit feel. The 2025 average home price of $187,636 still ranks well below the Ohio state average, but recent pricing momentum hints at growing investor appetite. Schools in the area are served by the New Lebanon Local School District, and the town’s easy access to US Route 35 adds appeal for commuters.

With a historically slow-but-steady market, even a 16% spike in price growth above baseline could mean trouble for first-time homebuyers. If investor activity continues to heat up, this once-sleepy market may not stay quiet for long.

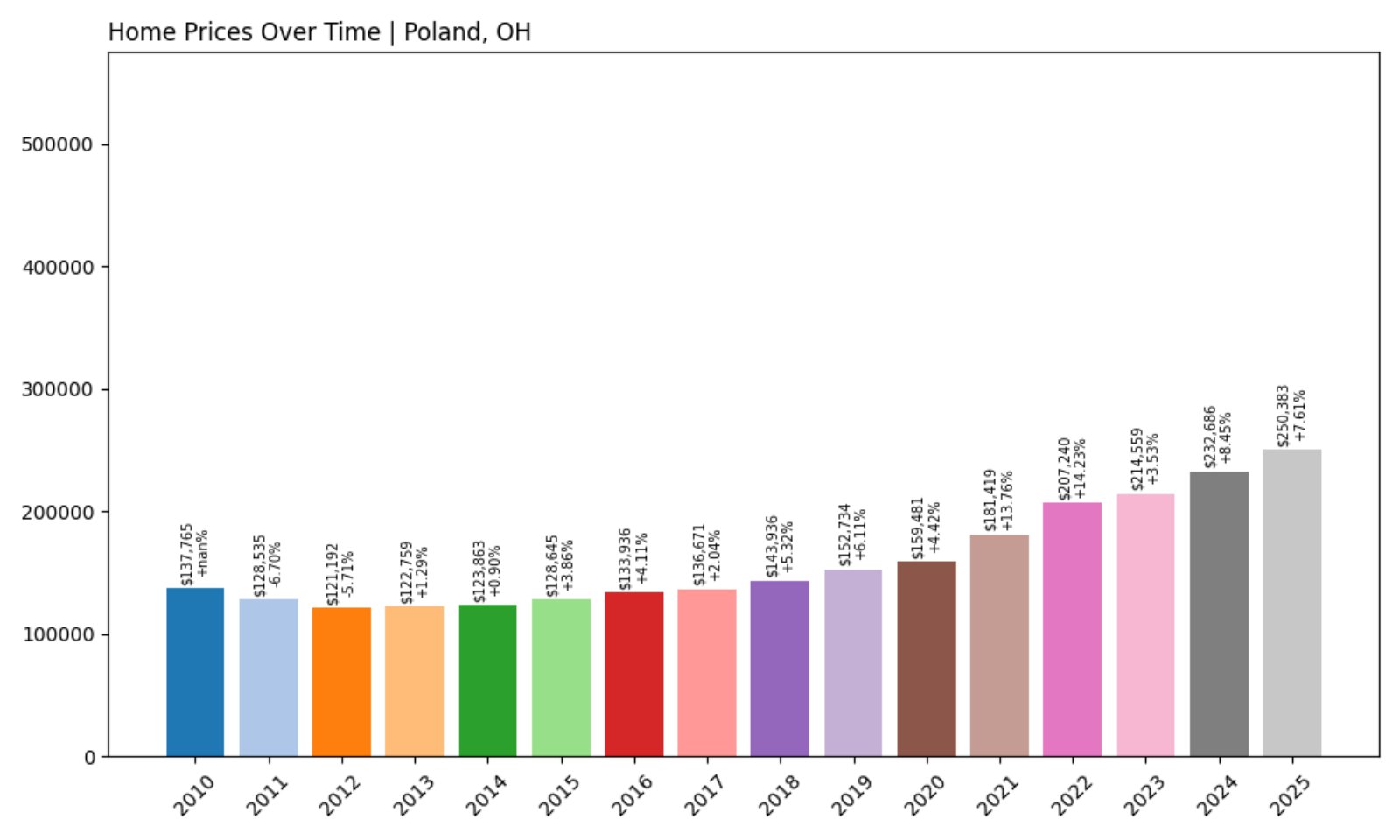

29. Poland – Investor Feeding Frenzy Factor 18.05% (July 2025)

- Historical annual growth rate (2012–2022): 5.51%

- Recent annual growth rate (2022–2025): 6.51%

- Investor Feeding Frenzy Factor: 18.05%

- Current 2025 price: $250,382.66

Poland’s Investor Feeding Frenzy Factor just cleared 18%, signaling a measurable uptick in housing demand. While the recent 6.51% annual growth doesn’t seem extreme in isolation, it’s notably higher than the previous decade’s rate of 5.51%. That kind of shift can put pressure on an already competitive market.

Poland – A Classic Suburb Feeling the Heat

Kitchen Style?

Located in Mahoning County near the Pennsylvania border, Poland is known for its highly rated schools and picturesque residential neighborhoods. Home prices in 2025 hover around $250,000, reflecting the area’s enduring appeal. Investors may be betting on continued demand from families looking for stability and quality of life without the cost of urban living.

As competition stiffens and prices creep upward, some local buyers may find themselves edged out. With limited housing stock and strong fundamentals, even subtle price movements here can snowball quickly.

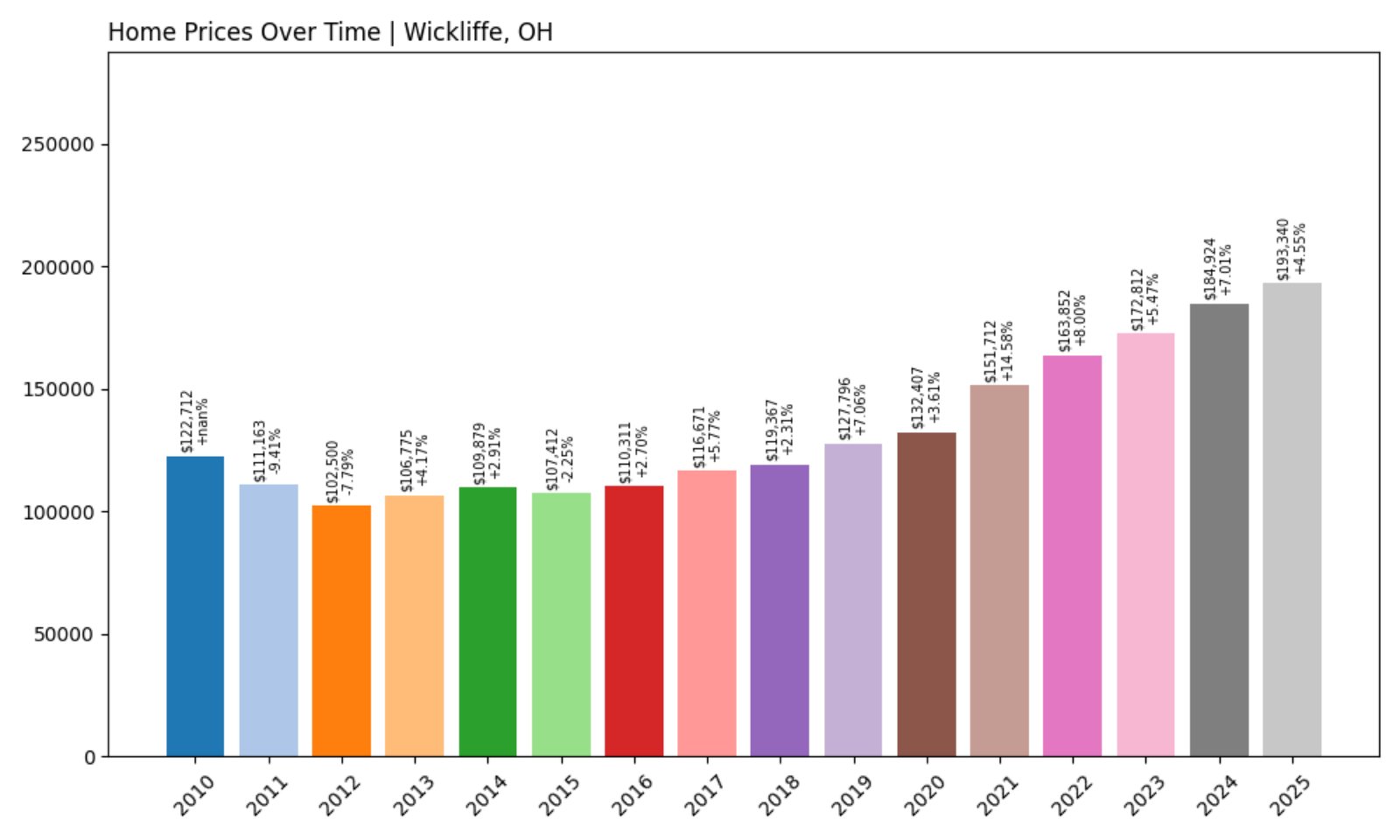

28. Wickliffe – Investor Feeding Frenzy Factor 18.08% (July 2025)

- Historical annual growth rate (2012–2022): 4.80%

- Recent annual growth rate (2022–2025): 5.67%

- Investor Feeding Frenzy Factor: 18.08%

- Current 2025 price: $193,339.69

Wickliffe’s Feeding Frenzy Factor crosses the 18% mark, driven by a recent annual growth rate of 5.67%—well above its long-term average. That kind of shift may not make headlines, but it quietly reveals how investors could be targeting markets on the upswing before prices explode.

Wickliffe – Affordable Appeal Near Lake Erie

Set in Lake County northeast of Cleveland, Wickliffe offers a convenient suburban lifestyle close to both the lakefront and major highways. Its 2025 average home value sits below $200,000, making it a natural candidate for investor interest. Good public schools and a range of mid-century homes add to its long-term growth potential.

The town’s relative affordability and location make it ripe for speculative interest. If price momentum continues to build, Wickliffe could soon become one of the region’s next hot spots—leaving local buyers struggling to keep pace.

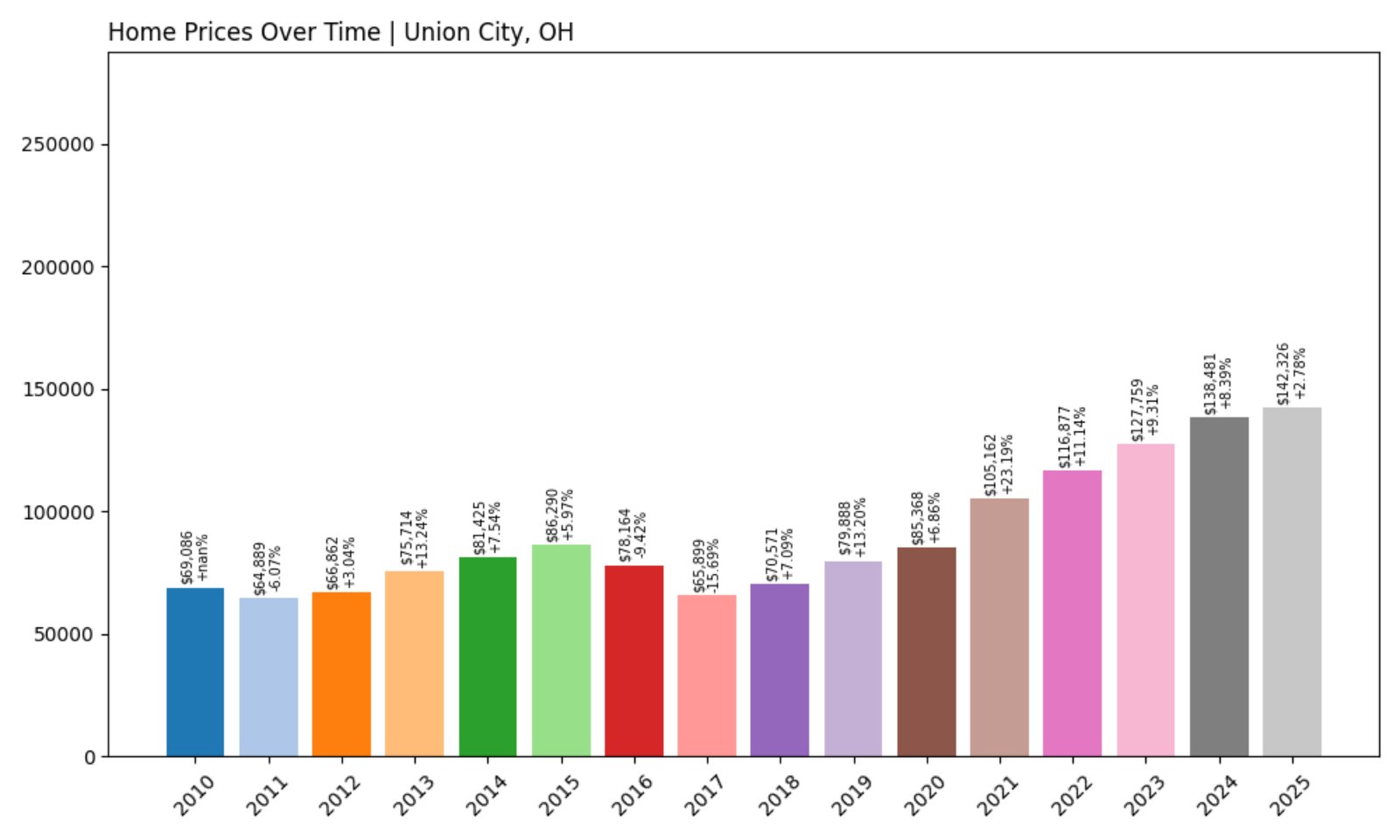

27. Union City – Investor Feeding Frenzy Factor 18.16% (July 2025)

- Historical annual growth rate (2012–2022): 5.74%

- Recent annual growth rate (2022–2025): 6.79%

- Investor Feeding Frenzy Factor: 18.16%

- Current 2025 price: $142,325.63

Union City’s price acceleration—rising from a steady 5.74% to 6.79% annually—has bumped its Feeding Frenzy Factor to just over 18%. It’s a classic sign of increased investor activity in a market that’s still relatively affordable.

Union City – Bargain Market with Sudden Momentum

Sitting along the Indiana border in Darke County, Union City is a small, historically industrial community with a tight-knit population. With a current median home price of just $142,325, it’s among the most affordable towns on this list. But affordability can be a magnet for outside buyers looking to flip or hold for long-term gains.

If the growth trend continues, residents here may find themselves facing higher property taxes and stiffer competition for starter homes. The pattern is familiar: quiet market, small spike, sudden frenzy.

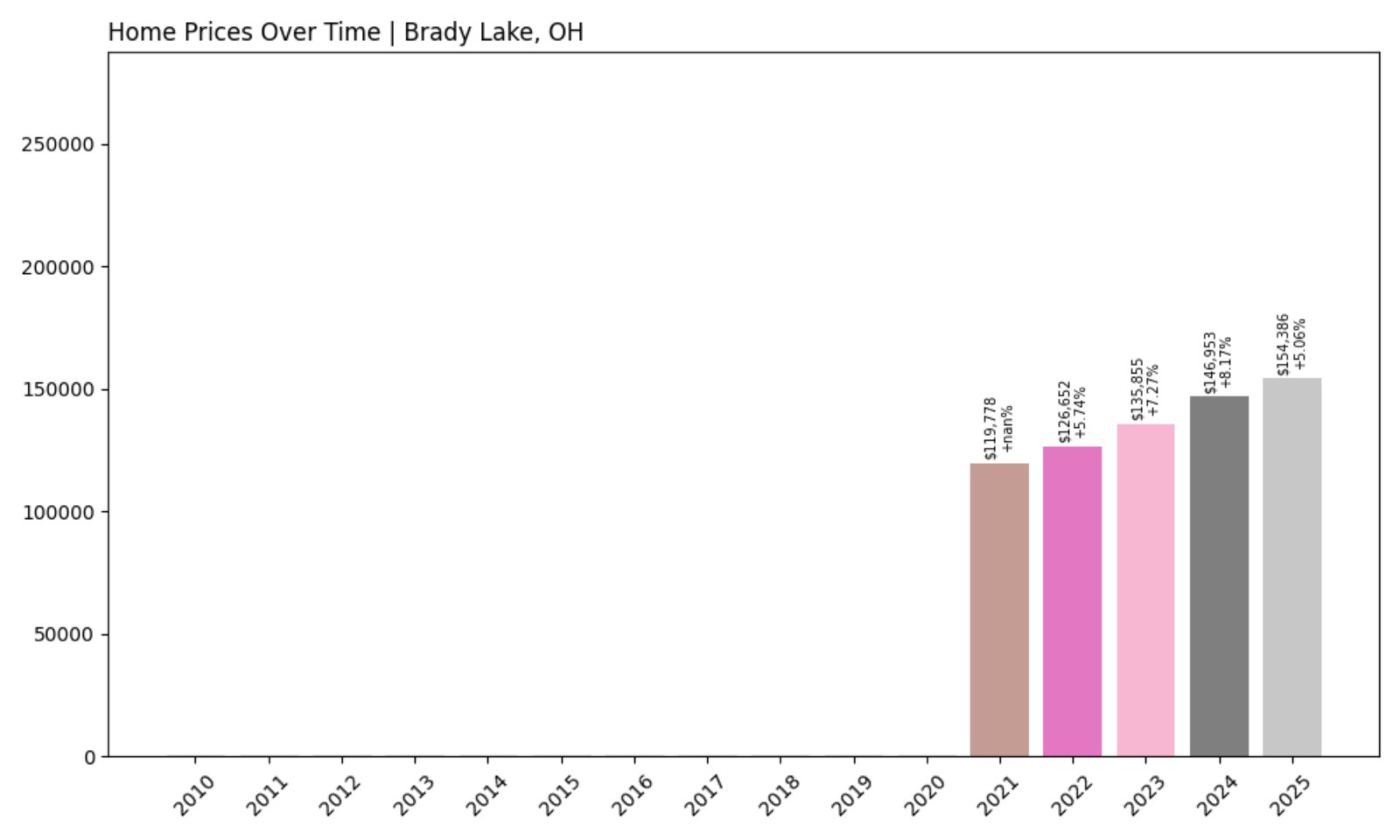

26. Brady Lake – Investor Feeding Frenzy Factor 18.90% (July 2025)

- Historical annual growth rate (2012–2022): 5.74%

- Recent annual growth rate (2022–2025): 6.82%

- Investor Feeding Frenzy Factor: 18.90%

- Current 2025 price: $154,385.63

Brady Lake has jumped to a Feeding Frenzy Factor of 18.9%, as its growth climbed from 5.74% to 6.82% annually. The uptick is a key indicator of a market catching investor attention—subtle but undeniable.

Brady Lake – Lake Views and Quiet Acceleration

Tucked into Portage County near Kent, Brady Lake offers scenic charm and a relatively low cost of entry. With homes averaging just over $154,000 in 2025, it’s an accessible option for buyers seeking nature and affordability. But those same qualities have drawn the eyes of outside investors looking to capitalize on undervalued markets.

While the increase in prices is modest for now, the town’s location and small size make it especially sensitive to speculative surges. As more homes are purchased for short-term gain rather than long-term residence, local families could be left with fewer options.

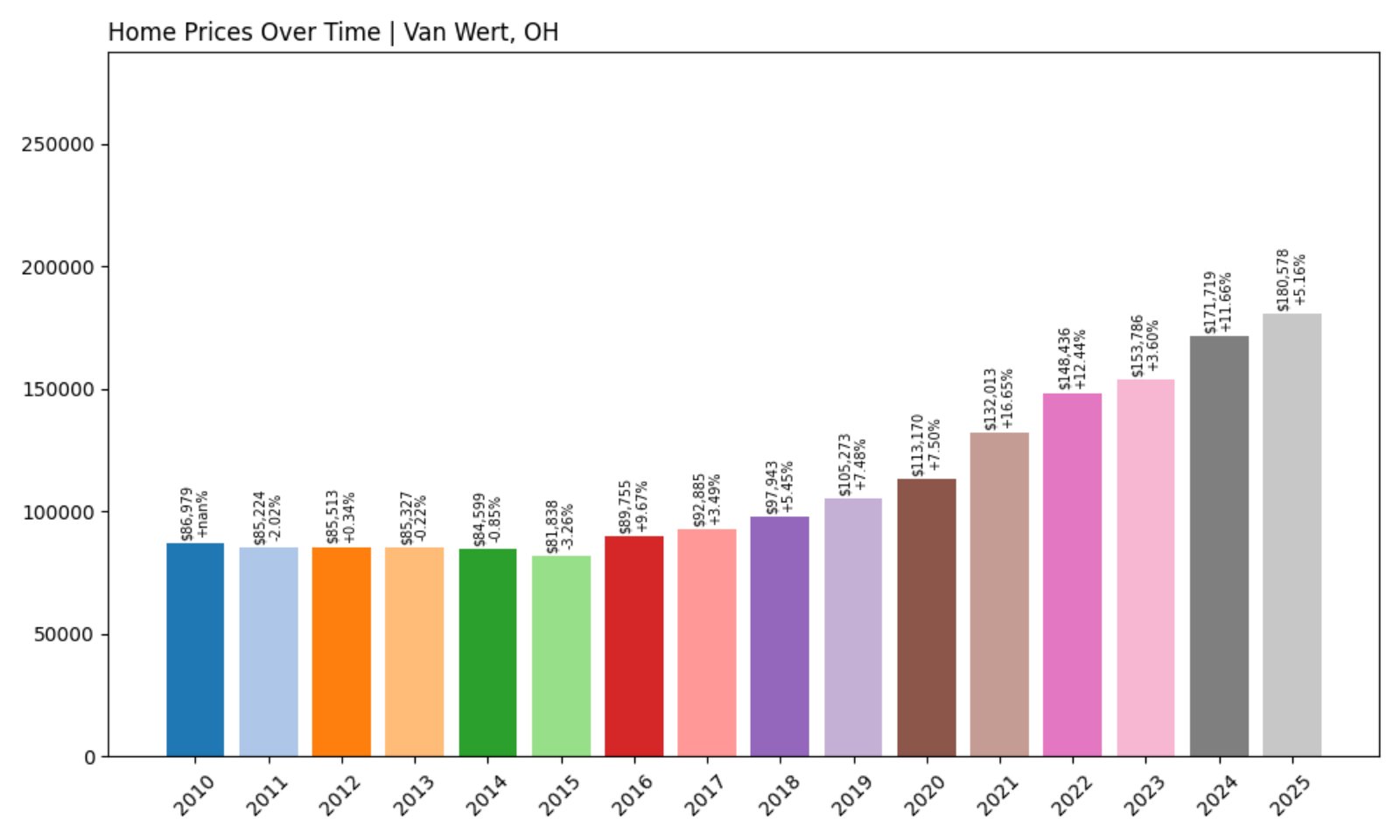

25. Van Wert – Investor Feeding Frenzy Factor 19.08% (July 2025)

- Historical annual growth rate (2012–2022): 5.67%

- Recent annual growth rate (2022–2025): 6.75%

- Investor Feeding Frenzy Factor: 19.08%

- Current 2025 price: $180,578.23

Van Wert’s home value growth has ticked upward in recent years, with the annual growth rate rising from 5.67% to 6.75%. That shift represents a 19.08% increase over its historical baseline—an early warning signal that investor activity may be increasing in this west-central Ohio community.

Van Wert – Steady Town with Sudden Acceleration

Located near the Indiana border, Van Wert has long been a quiet, rural city known for its agricultural roots and historic downtown. Its current average home price of $180,578 remains attractive for families and investors alike. With a low cost of living and solid infrastructure, it’s not surprising that growth is heating up.

This jump in price growth may indicate an early-stage frenzy. If outside buyers continue to enter the market, Van Wert could quickly transition from a stable local market to a competitive investment zone.

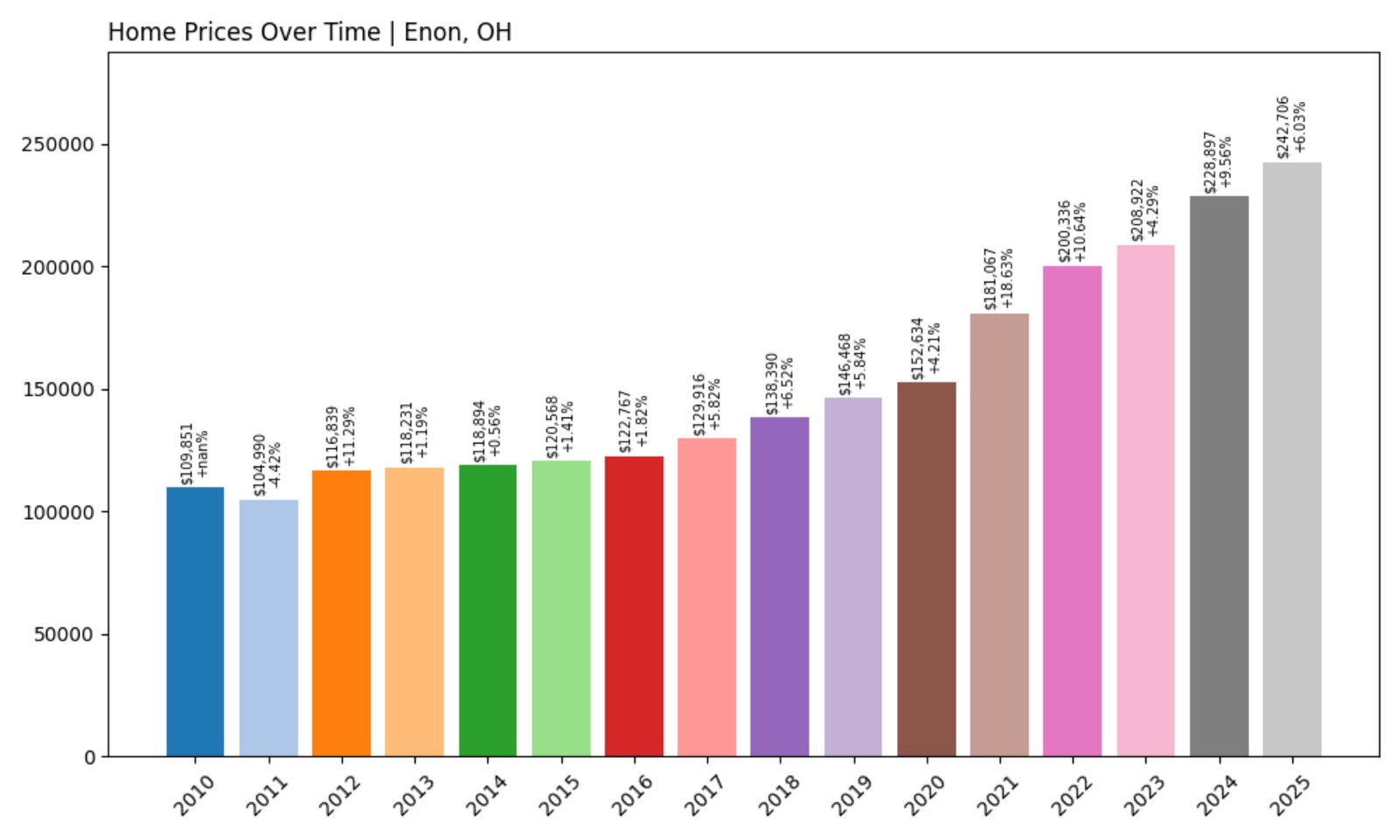

24. Enon – Investor Feeding Frenzy Factor 19.21% (July 2025)

- Historical annual growth rate (2012–2022): 5.54%

- Recent annual growth rate (2022–2025): 6.60%

- Investor Feeding Frenzy Factor: 19.21%

- Current 2025 price: $242,706.14

Enon’s recent home price acceleration of over 19% relative to its historical norm suggests a shift is underway. While 6.60% annual growth doesn’t break records, it’s well above its prior decade average of 5.54%, signaling a potential rise in speculative activity.

Enon – Suburban Appeal with Fast-Moving Prices

Located in Clark County between Springfield and Dayton, Enon offers a suburban setting with excellent access to job centers and nature. The median home price of $242,706 in 2025 places it solidly in the middle of the market, but with recent gains, affordability may be slipping.

Its location and livability make it a clear target for investors seeking reliable returns. As prices continue to grow faster than expected, long-time residents could find themselves caught in a tightening squeeze.

23. West Alexandria – Investor Feeding Frenzy Factor 19.51% (July 2025)

- Historical annual growth rate (2012–2022): 3.79%

- Recent annual growth rate (2022–2025): 4.53%

- Investor Feeding Frenzy Factor: 19.51%

- Current 2025 price: $232,750.70

West Alexandria’s home price growth has risen nearly 20% above its long-term trend, indicating a marked shift in market behavior. This is a key metric for early-stage investor involvement—often the first sign that affordability could be in danger.

West Alexandria – Small Town, Big Moves

This Preble County village lies west of Dayton and maintains a rural character with easy access to metropolitan areas. The 2025 average home price of $232,750 is manageable by Ohio standards but shows signs of creeping upward. Investors may be seeing long-term upside in this market’s location and livability.

A small population and limited housing stock make West Alexandria vulnerable to price shocks if investor interest continues to grow. Families seeking value may need to act fast—or look elsewhere.

22. South Point – Investor Feeding Frenzy Factor 22.17% (July 2025)

- Historical annual growth rate (2012–2022): 3.72%

- Recent annual growth rate (2022–2025): 4.55%

- Investor Feeding Frenzy Factor: 22.17%

- Current 2025 price: $157,185.14

South Point’s Feeding Frenzy Factor of 22.17% reflects a noticeable acceleration in home price growth. While both its historical and recent rates are modest, the jump suggests more than just natural appreciation—it may be a sign of outside interest picking up.

South Point – Riverfront Town on the Radar

Situated along the Ohio River in Lawrence County, South Point blends small-town charm with strong access to regional employment hubs like Huntington, West Virginia. With average home prices at just over $157,000, it’s an affordable area that now shows signs of catching investor attention.

The town’s strategic location and affordability make it attractive for both rental property buyers and value investors. But with growth climbing over 22% above baseline, local residents could face affordability challenges if current trends continue.

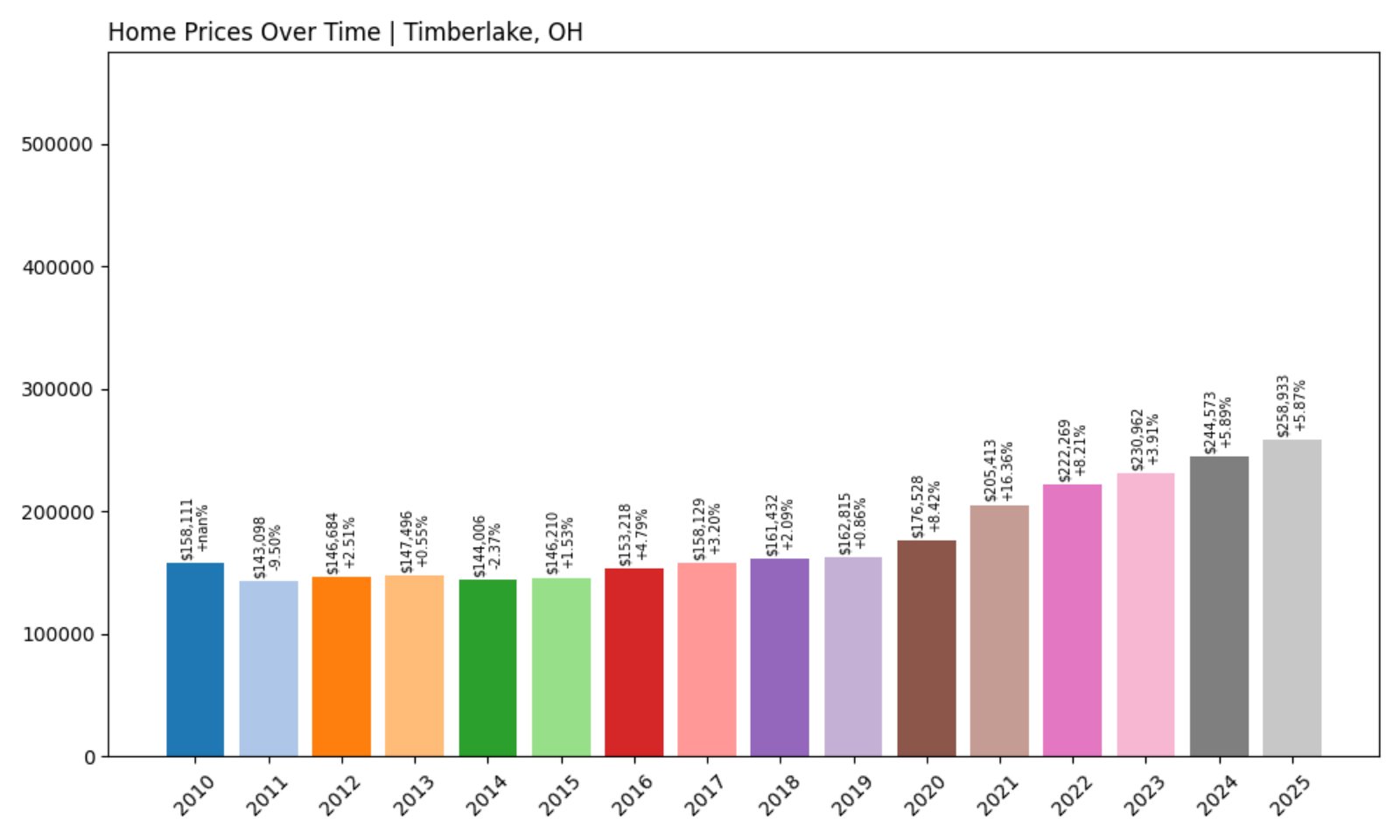

21. Timberlake – Investor Feeding Frenzy Factor 23.03% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 4.24%

- Recent annual growth rate (2022–2025): 5.22%

- Investor Feeding Frenzy Factor: 23.03%

- Current 2025 price: $258,932.80

Timberlake has seen its home price growth rise from 4.24% to 5.22% annually—an increase of over 23% relative to its decade-long average. That kind of uptick may not seem explosive, but in housing terms, it’s a significant move and a potential red flag for speculative activity.

Timberlake – Lake County’s Quiet Surge

A compact village nestled along Lake Erie in Lake County, Timberlake offers lake views, privacy, and peaceful streets. The average home value in 2025 is just under $260,000, a price that balances lifestyle appeal and accessibility. Investors may be looking at this coastal location as a hidden value opportunity.

While growth here has been steady in the past, the recent surge in value could change the local market’s dynamics. As prices move faster than usual, longtime residents may begin to feel the strain.

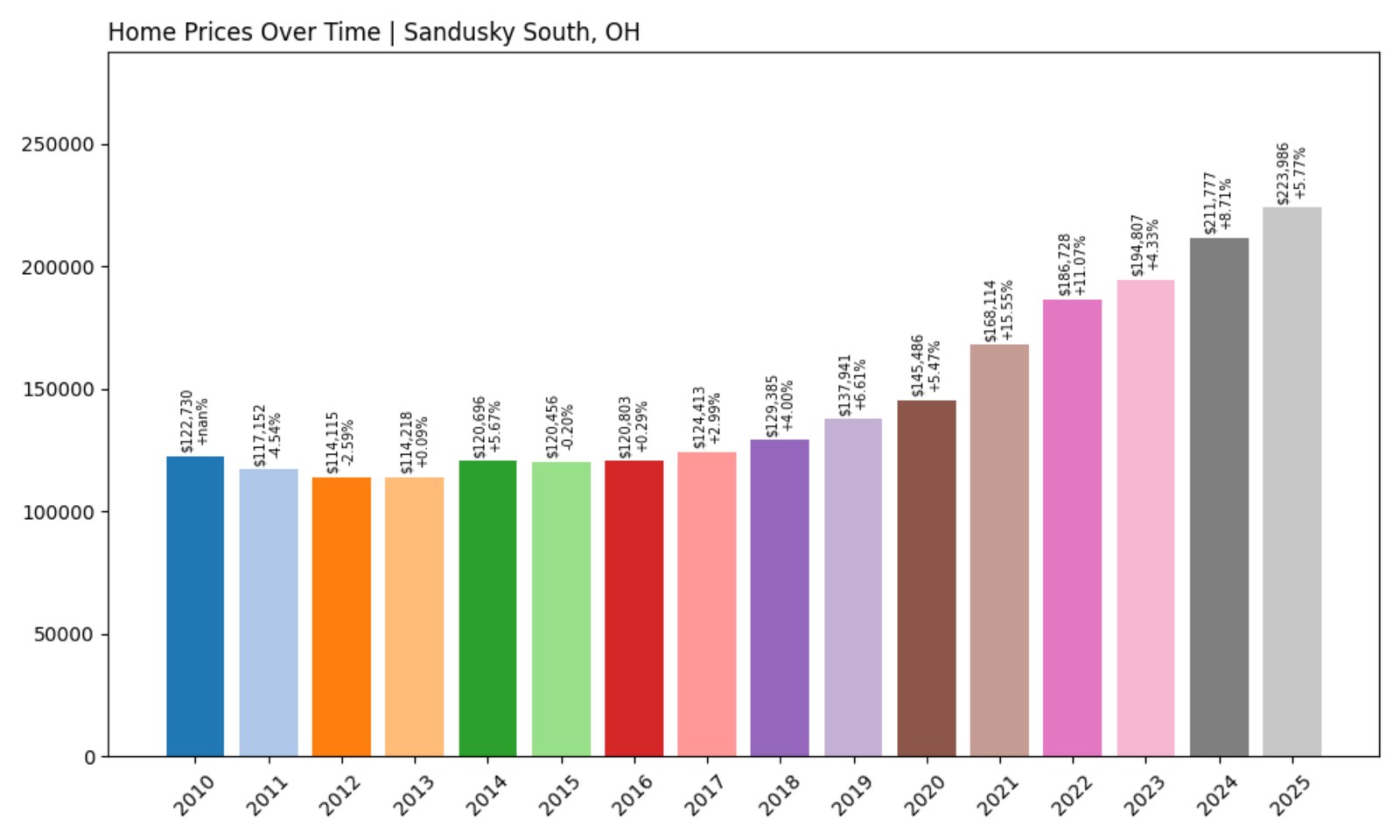

20. Sandusky South – Investor Feeding Frenzy Factor 23.86% (July 2025)

- Historical annual growth rate (2012–2022): 5.05%

- Recent annual growth rate (2022–2025): 6.25%

- Investor Feeding Frenzy Factor: 23.86%

- Current 2025 price: $223,985.98

In Sandusky South, home value growth has climbed from a steady 5.05% to 6.25% annually, pushing its Feeding Frenzy Factor to nearly 24%. That’s a clear sign of market behavior accelerating beyond historical norms, often triggered by investor activity targeting value-rich regions.

Sandusky South – Shifting Quickly Near the Shoreline

Located in Erie County, Sandusky South lies just south of its namesake city on the Lake Erie shoreline. It offers access to jobs, recreation, and attractions like Cedar Point, while maintaining a quieter suburban environment. Homes here average just under $224,000 in 2025—still relatively affordable but moving steadily upward.

With waterfront proximity and decent infrastructure, Sandusky South may be attracting investors who sense untapped potential. If demand keeps increasing, locals might face stiffer competition for homes in an already modestly sized market.

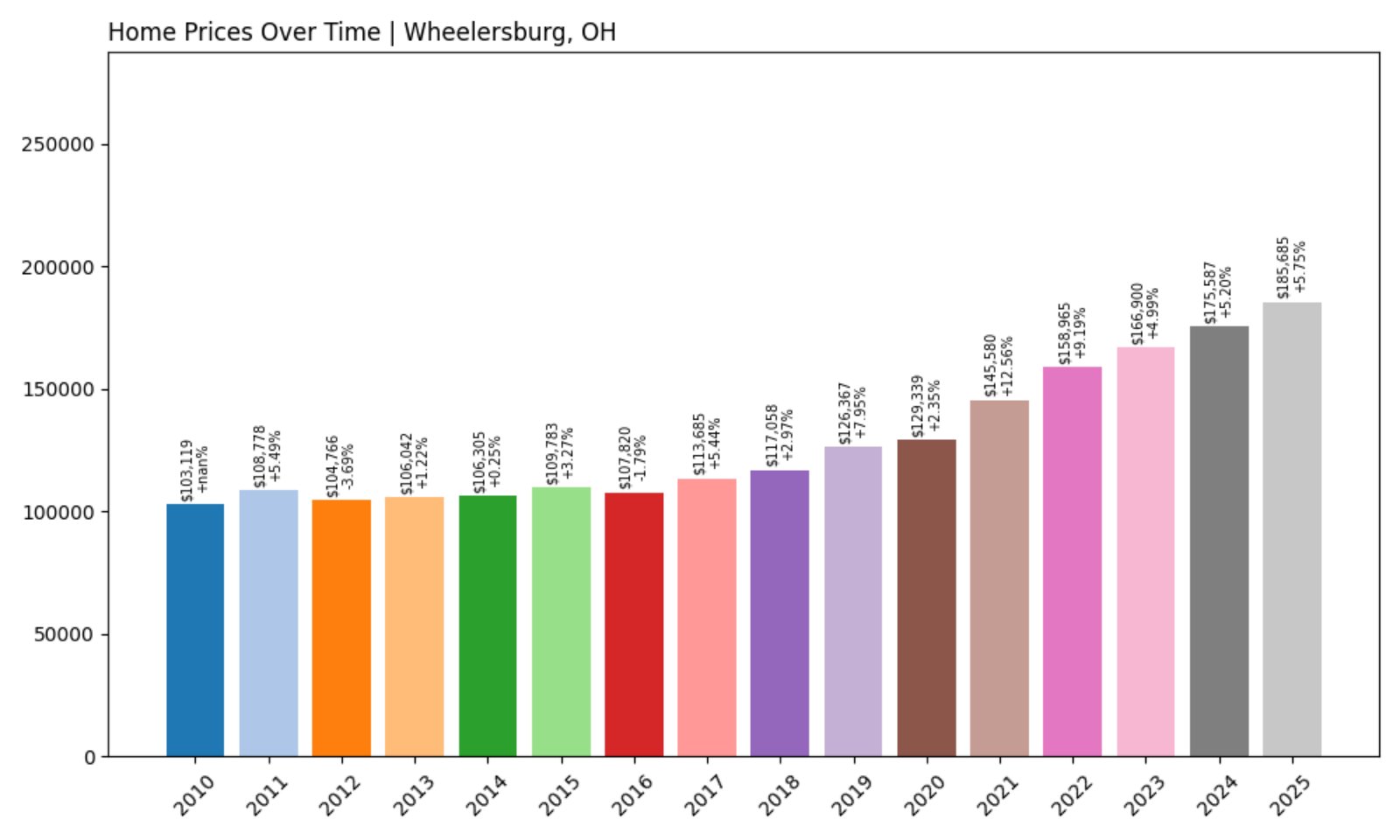

19. Wheelersburg – Investor Feeding Frenzy Factor 24.84% (July 2025)

- Historical annual growth rate (2012–2022): 4.26%

- Recent annual growth rate (2022–2025): 5.32%

- Investor Feeding Frenzy Factor: 24.84%

- Current 2025 price: $185,685.13

Wheelersburg’s jump from a 4.26% to 5.32% growth rate translates to a Feeding Frenzy Factor just shy of 25%. This steady, rural town is now seeing an unusual amount of heat in its housing market—enough to suggest that investor influence is starting to play a role.

Wheelersburg – Quiet but Catching Fire

Located in Scioto County along the southern edge of Ohio, Wheelersburg is a community known for its schools and strong civic spirit. The average home now costs $185,685, which is still affordable for many Ohioans—but upward movement in price could change that quickly.

Its small-town stability and scenic southern location may be drawing new types of buyers into the fold. As prices drift upward, residents may start to see fewer local buyers and more investors looking for rentals or long-term appreciation.

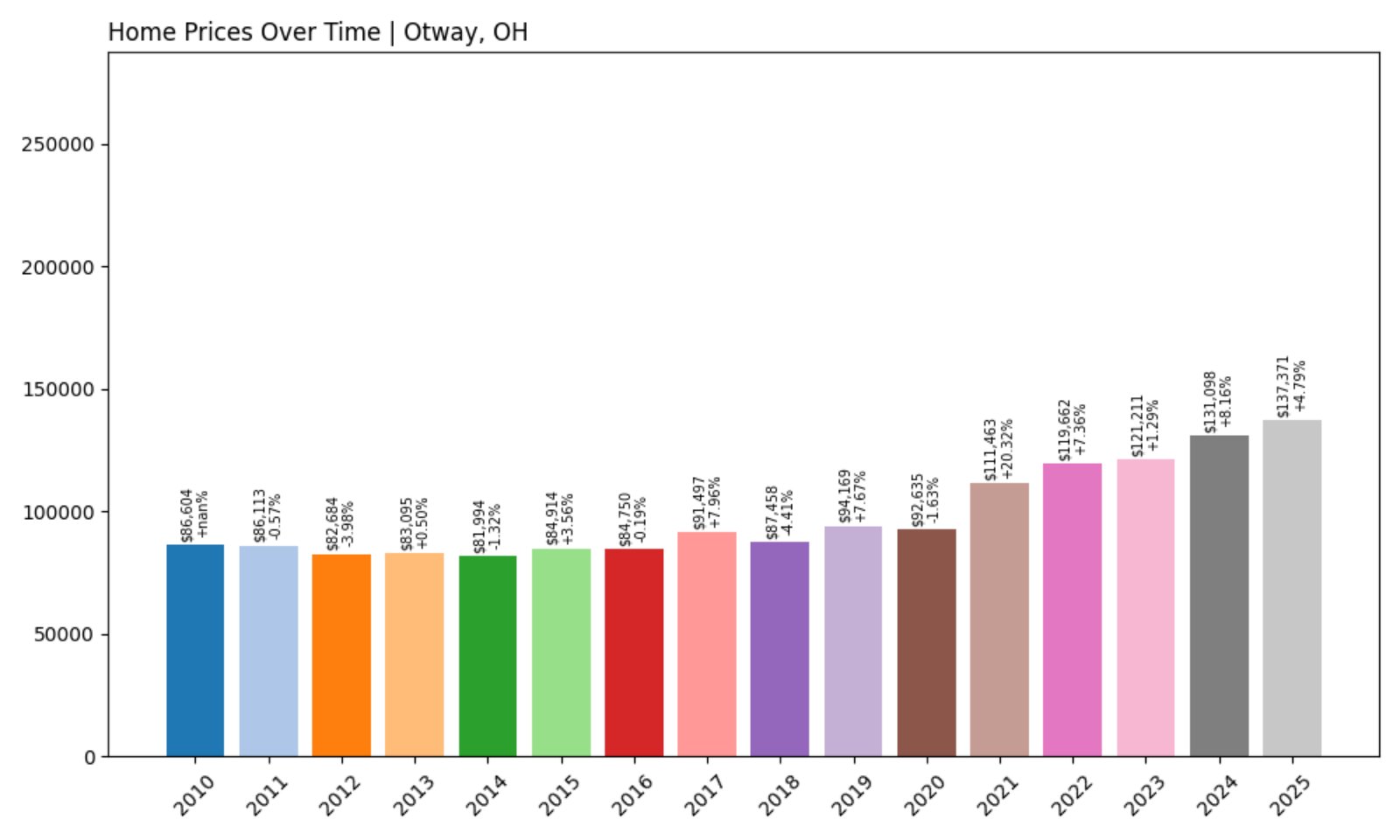

18. Otway – Investor Feeding Frenzy Factor 25.02% (July 2025)

- Historical annual growth rate (2012–2022): 3.77%

- Recent annual growth rate (2022–2025): 4.71%

- Investor Feeding Frenzy Factor: 25.02%

- Current 2025 price: $137,371.44

Otway’s Feeding Frenzy Factor crosses 25%, thanks to a jump from a 3.77% to 4.71% annual growth rate. This kind of price surge—though moderate in absolute terms—is notable for a market that’s long been stable and overlooked.

Otway – Rural and Rising

Tucked into Scioto County near the Appalachian foothills, Otway is a tiny, rural village with just a few hundred residents. Homes here average around $137,000 in 2025, offering extreme affordability in today’s overheated real estate landscape.

That very affordability is likely attracting investors, especially those seeking rental returns or long-term holds. While prices are still low, the increased growth rate suggests local dynamics are shifting, and those changes often hit smaller towns the hardest.

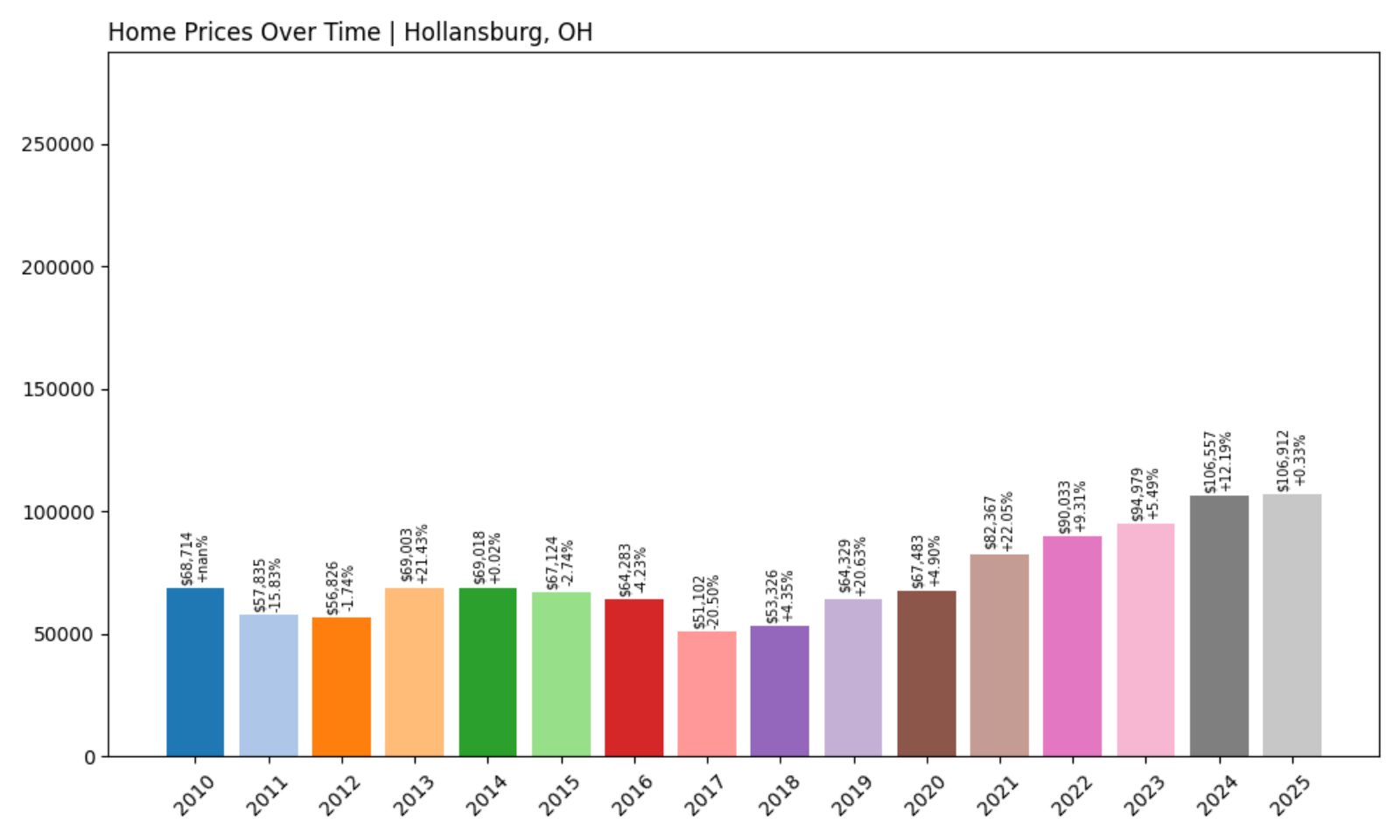

17. Hollansburg – Investor Feeding Frenzy Factor 25.18% (July 2025)

- Historical annual growth rate (2012–2022): 4.71%

- Recent annual growth rate (2022–2025): 5.90%

- Investor Feeding Frenzy Factor: 25.18%

- Current 2025 price: $106,912.20

Hollansburg’s home price appreciation has climbed by over 25% compared to historical levels, marking it as a potential investor target. A market moving from 4.71% to 5.90% annual growth in just a few years is not just growing—it’s changing.

Hollansburg – One of Ohio’s Most Affordable Markets

Hollansburg, in Darke County near the Indiana border, is among the most affordable places on this list, with home prices averaging just under $107,000 in 2025. That low barrier to entry could make it a magnet for speculative buyers seeking strong returns on smaller investments.

While the town retains a rural, residential feel, price movements like this could have an outsized impact. With limited inventory, even a few investor purchases can tilt the market sharply—pushing out local buyers in the process.

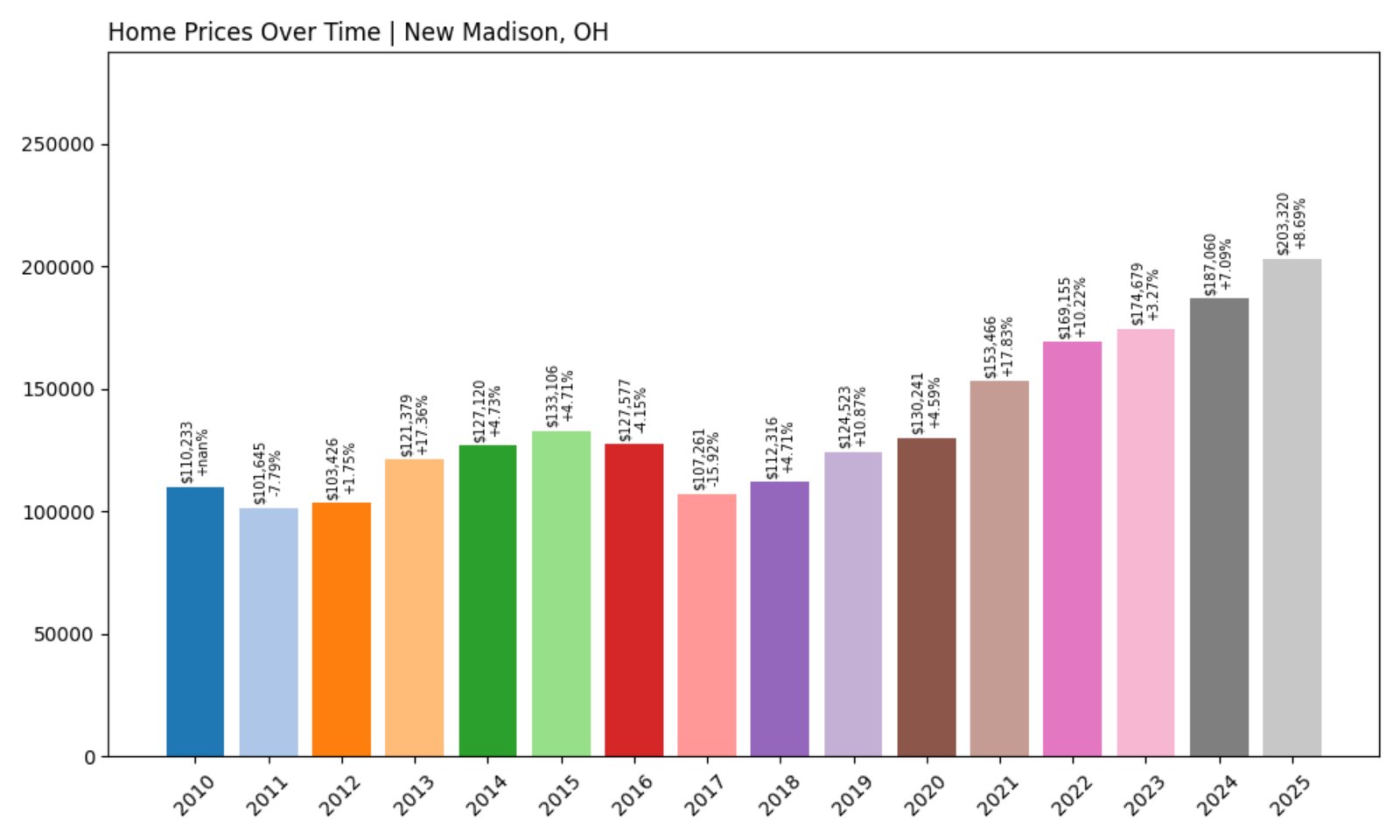

16. New Madison – Investor Feeding Frenzy Factor 25.41% (July 2025)

- Historical annual growth rate (2012–2022): 5.04%

- Recent annual growth rate (2022–2025): 6.32%

- Investor Feeding Frenzy Factor: 25.41%

- Current 2025 price: $203,320.10

New Madison’s Feeding Frenzy Factor of 25.41% is driven by a meaningful shift in annual growth—from 5.04% historically to 6.32% in the last three years. That kind of acceleration typically signals external pressure, most often in the form of investor competition.

New Madison – From Stable to Surging

This town in Darke County has seen modest but consistent growth over the years, and its 2025 home price average of $203,320 keeps it solidly within reach for middle-income families. However, the jump in recent growth indicates something new may be at play—namely, investment-driven demand.

Local residents may find themselves caught between historical norms and a fast-changing market dynamic. If price growth continues at this new pace, affordability could become a thing of the past in what was once a reliably steady town.

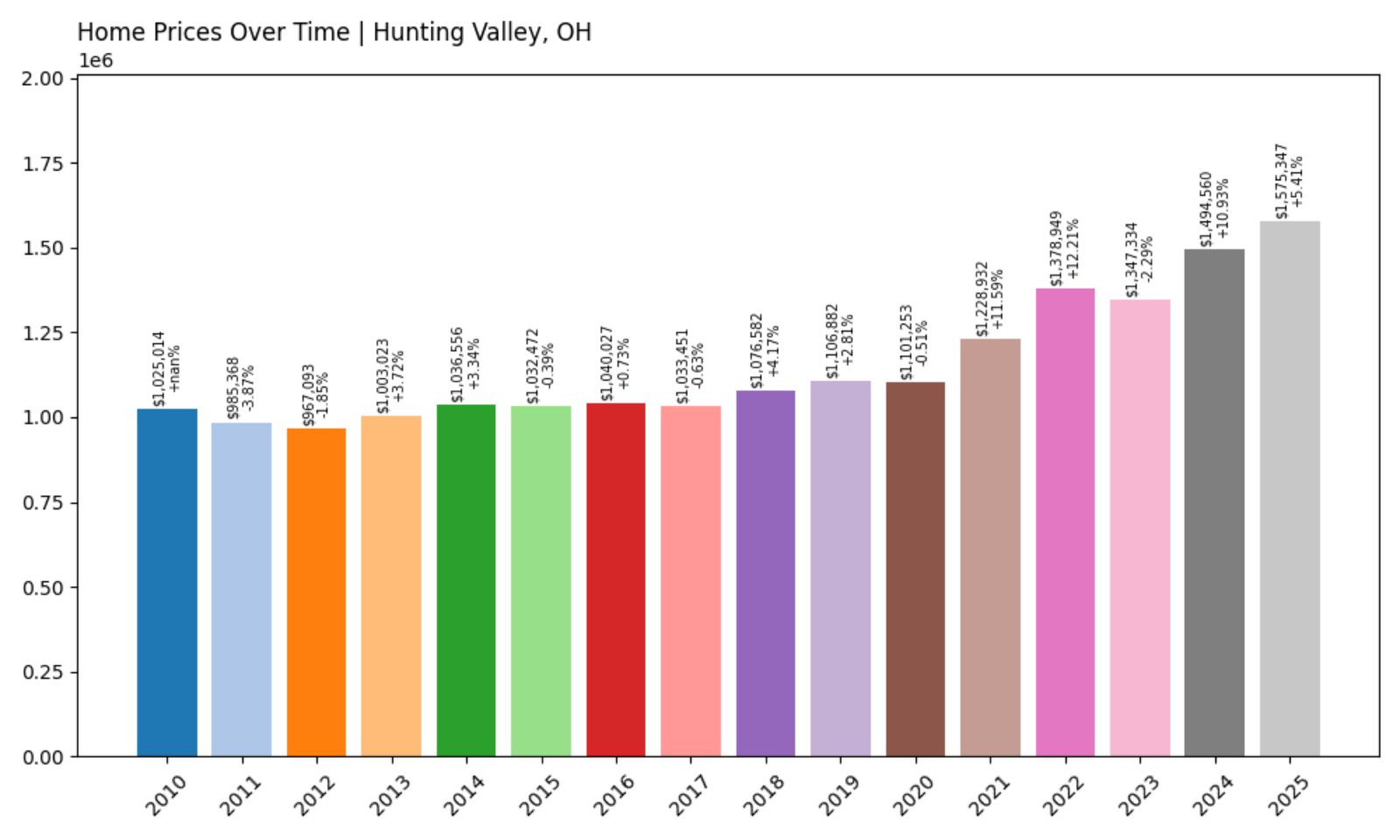

15. Hunting Valley – Investor Feeding Frenzy Factor 25.67% (July 2025)

- Historical annual growth rate (2012–2022): 3.61%

- Recent annual growth rate (2022–2025): 4.54%

- Investor Feeding Frenzy Factor: 25.67%

- Current 2025 price: $1,575,347.50

Even in Ohio’s most expensive enclaves, investor interest can accelerate prices. In Hunting Valley, where the average home price has surpassed $1.57 million, the annual growth rate has jumped from 3.61% to 4.54%, raising the Feeding Frenzy Factor above 25%.

Hunting Valley – Luxury Market With Investor Tailwinds

Located just east of Cleveland, Hunting Valley is one of Ohio’s wealthiest zip codes, known for sprawling estates, private schools, and country club living. With limited housing stock and immense exclusivity, the town’s luxury market has seen quiet but sharp value increases.

Though often driven by high-net-worth individuals rather than institutional investors, Hunting Valley’s price trajectory shows that speculative demand isn’t just a working-class issue—it affects all segments of the market. Continued gains may further entrench economic barriers in this already elite community.

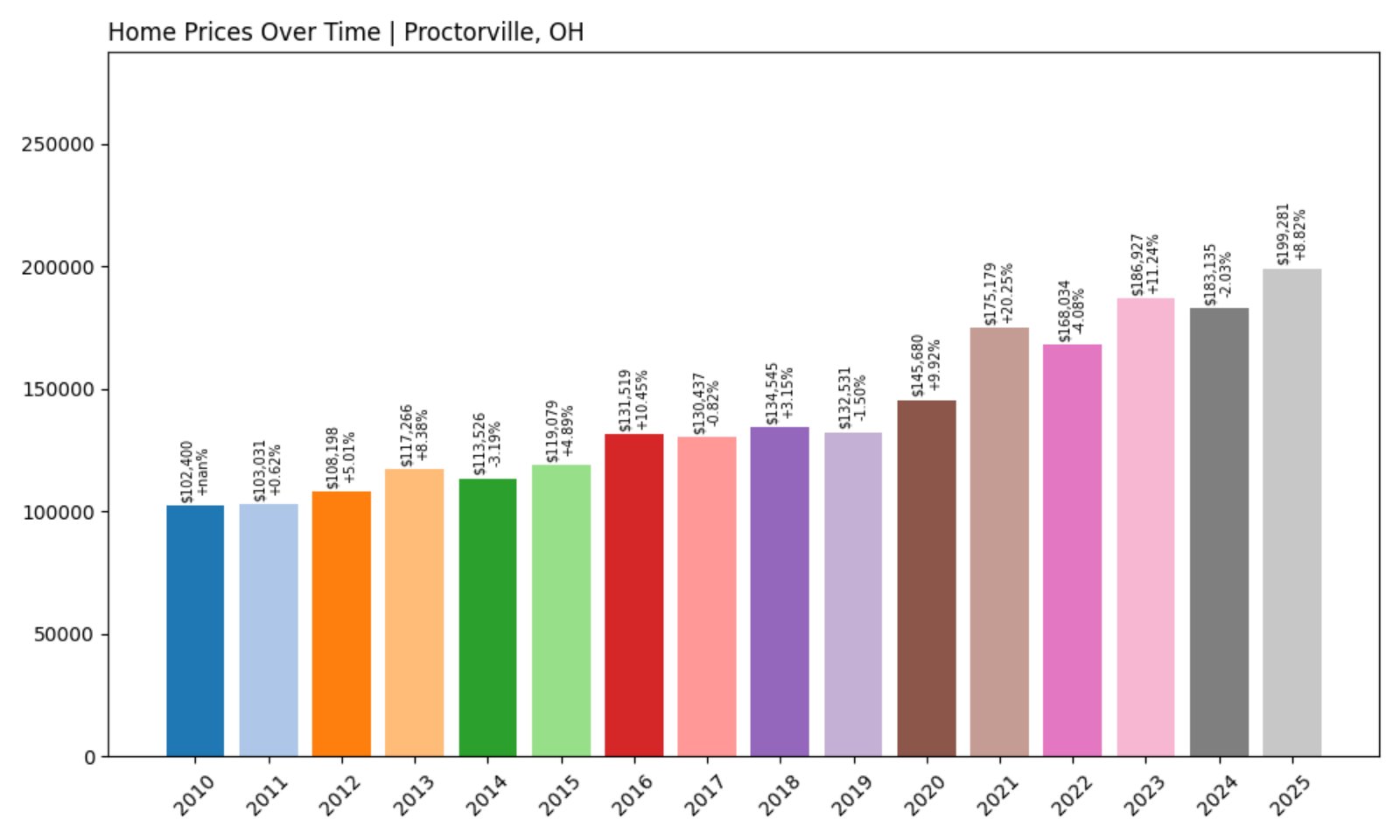

14. Proctorville – Investor Feeding Frenzy Factor 29.98% (July 2025)

- Historical annual growth rate (2012–2022): 4.50%

- Recent annual growth rate (2022–2025): 5.85%

- Investor Feeding Frenzy Factor: 29.98%

- Current 2025 price: $199,280.78

Proctorville’s growth has moved from a steady 4.5% to 5.85% annually in recent years, pushing its Feeding Frenzy Factor just under 30%. That marks a serious pivot in a market that has otherwise followed a modest, predictable path.

Proctorville – A Riverside Market Seeing Steady Heat

Situated in Lawrence County along the Ohio River, Proctorville enjoys proximity to Huntington, WV, and offers a quiet residential feel. With home prices hovering around $199,000 in 2025, the area is still attainable for many—but rising demand may not leave it that way for long.

The town’s location and affordability are key ingredients for attracting investor activity. If this pattern continues, Proctorville’s calm real estate waters may soon be choppier than locals are used to.

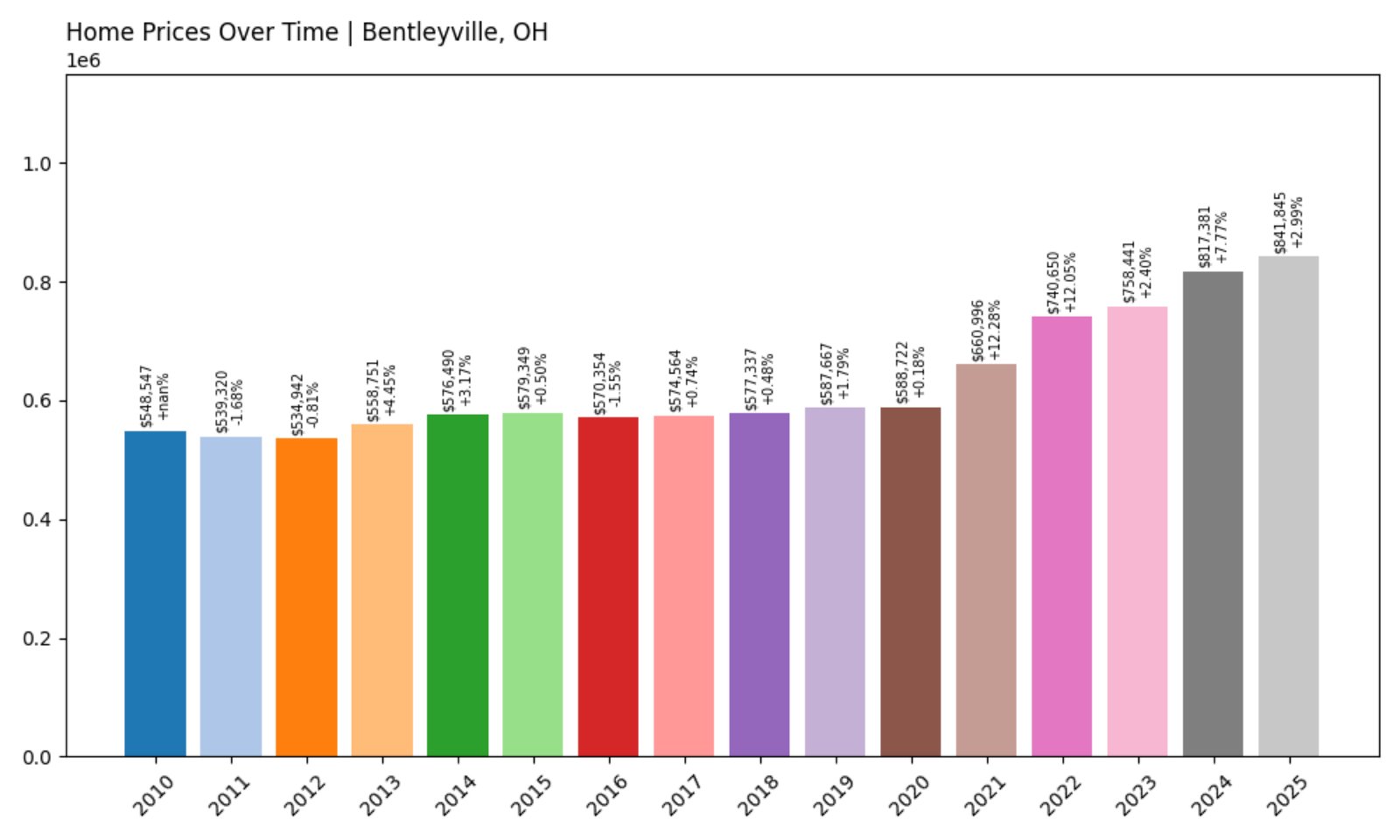

13. Bentleyville – Investor Feeding Frenzy Factor 31.87% (July 2025)

- Historical annual growth rate (2012–2022): 3.31%

- Recent annual growth rate (2022–2025): 4.36%

- Investor Feeding Frenzy Factor: 31.87%

- Current 2025 price: $841,844.95

Bentleyville’s annual home value growth has increased significantly, from 3.31% to 4.36%, giving it a Feeding Frenzy Factor of nearly 32%. In high-cost areas like this, such a spike reflects rising investor confidence—or pressure.

Bentleyville – Affluent Yet Accelerating

A suburban community in Cuyahoga County, Bentleyville is known for large properties, low density, and top-tier schools. With an average home price of over $840,000 in 2025, it’s far from Ohio’s typical housing market. Yet the accelerated price growth shows even luxury towns aren’t immune to speculative pressures.

High-end real estate often serves as a hedge for wealthier buyers, and Bentleyville may be experiencing that effect. For existing residents, it could mean a rapid climb in property taxes and an influx of non-local ownership.

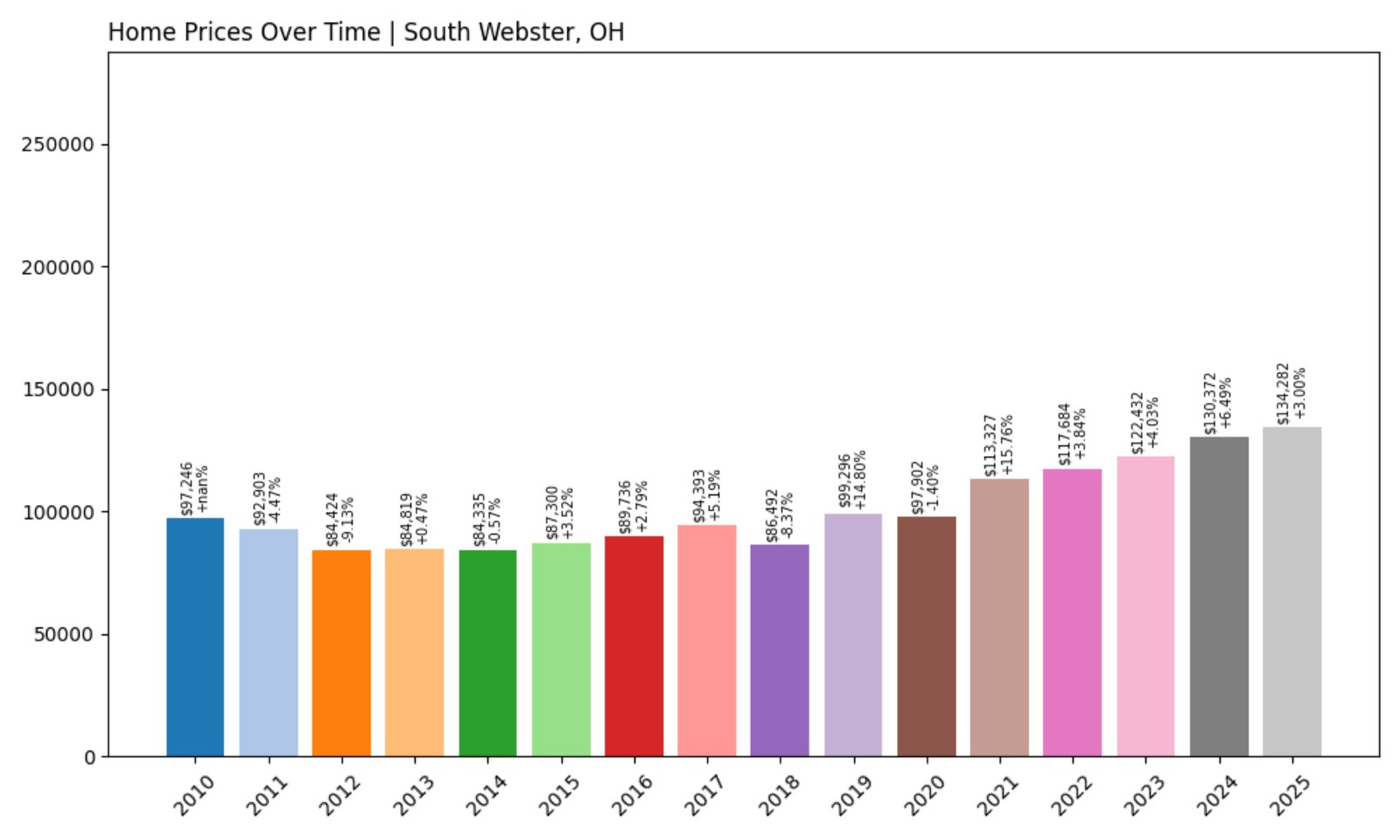

12. South Webster – Investor Feeding Frenzy Factor 33.12% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 3.38%

- Recent annual growth rate (2022–2025): 4.50%

- Investor Feeding Frenzy Factor: 33.12%

- Current 2025 price: $134,281.94

South Webster’s housing market has gained notable momentum, moving from 3.38% to 4.50% annual growth. That 33% surge in growth rate relative to historical norms is a flashing light for potential investor-driven activity.

South Webster – Affordable Prices, Sharp Growth

Found in Scioto County, South Webster is a small village with deep local roots and strong community pride. The average home now costs just over $134,000, making it one of the more accessible towns in southern Ohio. But affordability may not last if this trend keeps pace.

The growing Feeding Frenzy Factor suggests that investors might be getting ahead of the curve here, buying in while prices remain low. Local buyers could soon find themselves priced out in what has long been a working-class community.

11. Fremont – Investor Feeding Frenzy Factor 35.59% (July 2025)

- Historical annual growth rate (2012–2022): 4.31%

- Recent annual growth rate (2022–2025): 5.84%

- Investor Feeding Frenzy Factor: 35.59%

- Current 2025 price: $175,341.62

Fremont has seen its growth rate rise sharply from 4.31% to 5.84%, pushing its Feeding Frenzy Factor above 35%. That suggests a notable shift in market behavior, especially for a town with traditionally moderate appreciation.

Fremont – Historic and Heating Up

Located in Sandusky County, Fremont sits along the Sandusky River and offers historical architecture and a vibrant local history. With home prices averaging around $175,000 in 2025, it remains affordable—at least for now.

The recent uptick may reflect interest from buyers seeking out under-the-radar value markets. If investor demand keeps driving price increases, Fremont’s historic charm could come at a rising premium for future homeowners.

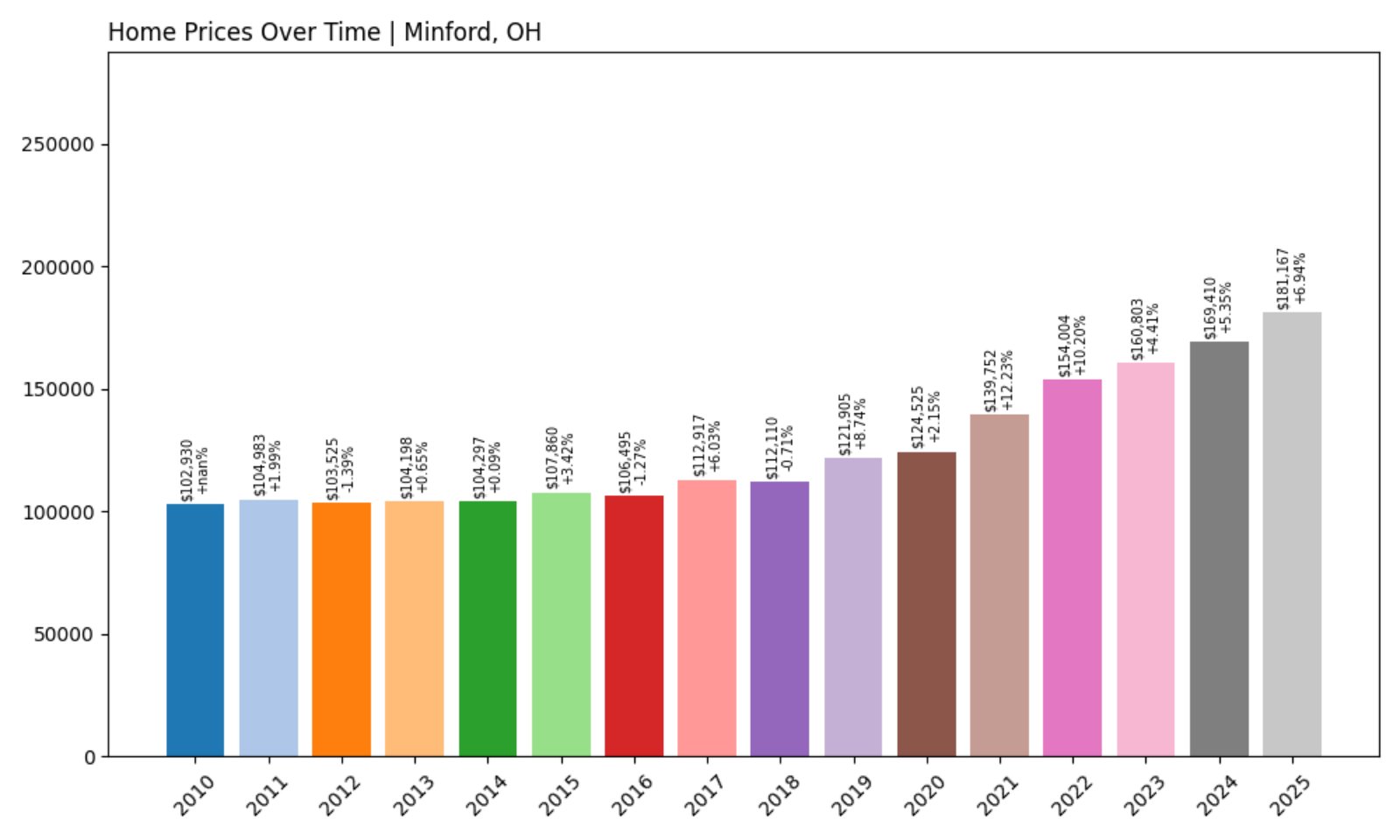

10. Minford – Investor Feeding Frenzy Factor 37.33% (July 2025)

- Historical annual growth rate (2012–2022): 4.05%

- Recent annual growth rate (2022–2025): 5.56%

- Investor Feeding Frenzy Factor: 37.33%

- Current 2025 price: $181,166.58

Minford’s jump from a historical growth rate of 4.05% to a recent rate of 5.56% has raised its Feeding Frenzy Factor to over 37%. The uptick suggests that this small southern Ohio town may be drawing fresh attention from outside buyers.

Minford – Modest Growth with Big Implications

Minford is a rural community in Scioto County, part of the Appalachian region of Ohio. The town has traditionally offered affordability and a quiet lifestyle, with the average 2025 home value sitting around $181,000.

A nearly 40% surge in growth rate above historical norms is significant in such a small market. Even a handful of investors targeting Minford can put pressure on supply and affordability for local families.

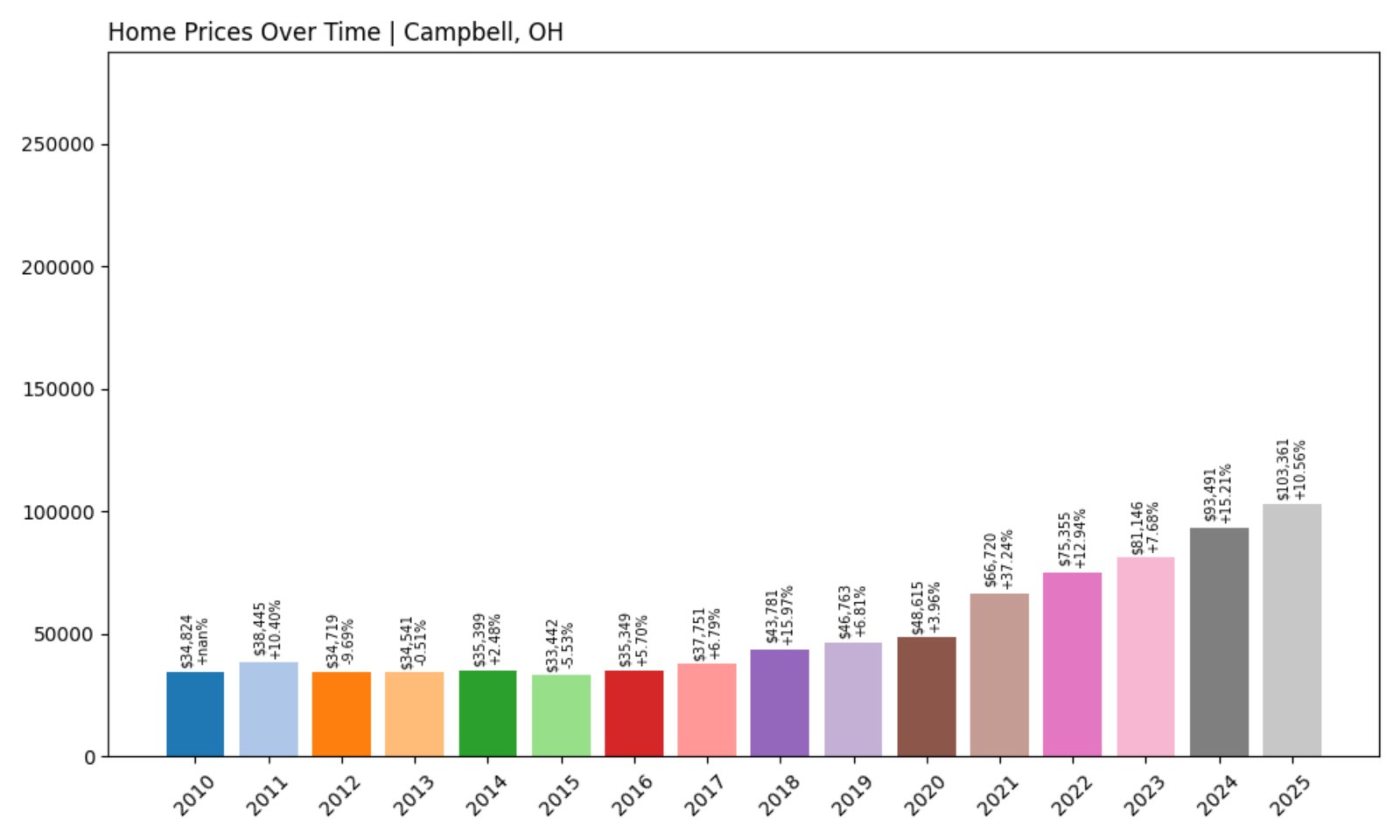

9. Campbell – Investor Feeding Frenzy Factor 37.87% (July 2025)

- Historical annual growth rate (2012–2022): 8.06%

- Recent annual growth rate (2022–2025): 11.11%

- Investor Feeding Frenzy Factor: 37.87%

- Current 2025 price: $103,360.87

Campbell’s Feeding Frenzy Factor has reached nearly 38% due to an aggressive jump in recent price growth—up from 8.06% to 11.11%. That’s a remarkable climb for any market, especially one where homes still average just over $100,000.

Campbell – Skyrocketing Growth in a Low-Cost Market

Located in Mahoning County near Youngstown, Campbell has long been one of the most affordable towns in Ohio. With a 2025 home value averaging just above $103,000, it’s no wonder investors have taken notice of its high potential for gains.

When a town with historically high appreciation sees that growth jump even further, it’s a sign of a hot market turning red hot. If these trends continue, Campbell could soon move out of reach for many of the buyers it once served.

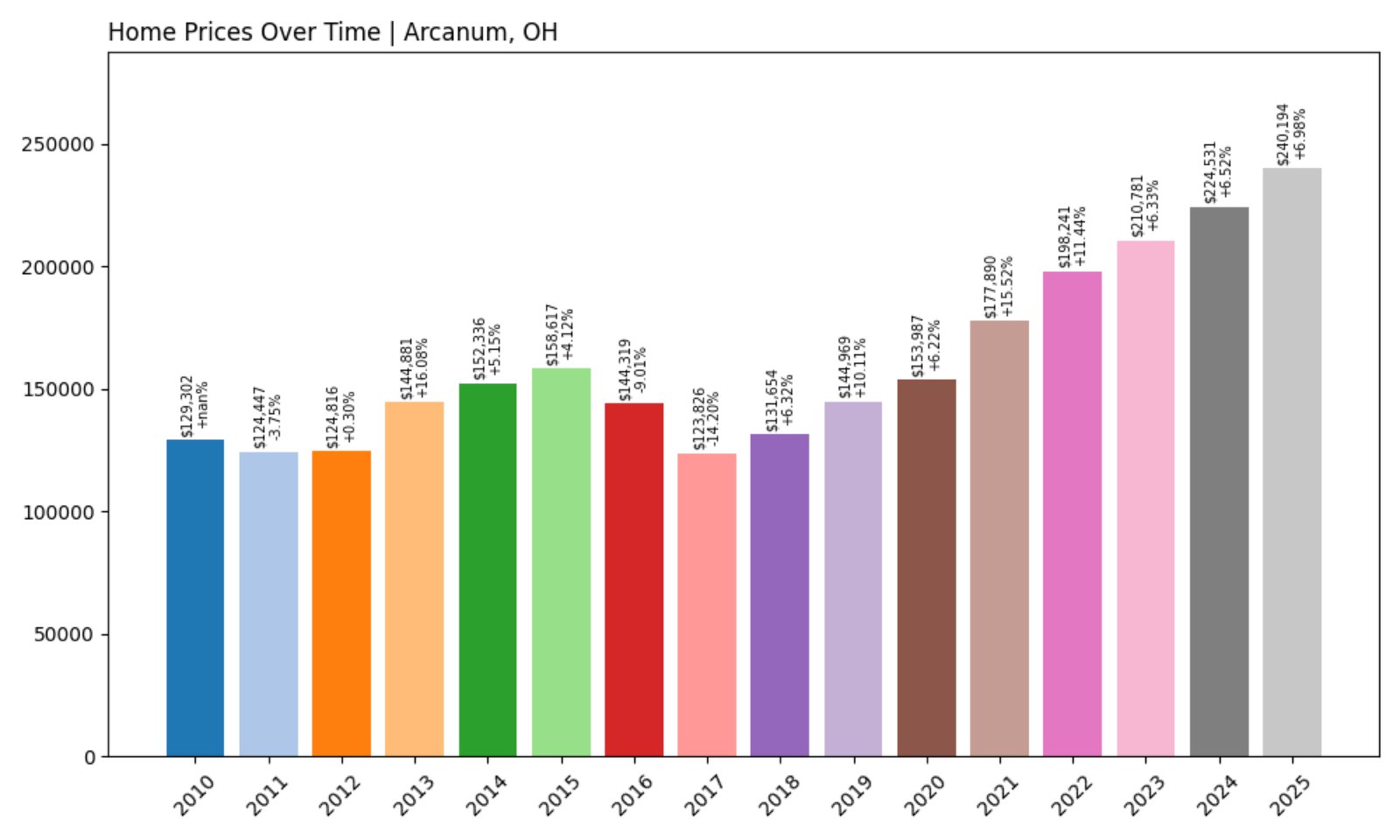

8. Arcanum – Investor Feeding Frenzy Factor 39.55% (July 2025)

- Historical annual growth rate (2012–2022): 4.74%

- Recent annual growth rate (2022–2025): 6.61%

- Investor Feeding Frenzy Factor: 39.55%

- Current 2025 price: $240,194.37

With home prices rising from a long-term trend of 4.74% to 6.61% annually, Arcanum’s Feeding Frenzy Factor now exceeds 39%. That kind of movement often signals the early stages of significant investor influence.

Arcanum – A Quiet Town Attracting Fresh Interest

This Darke County community in western Ohio is home to just a few thousand residents and has traditionally seen stable, predictable price appreciation. In 2025, average home values are nearing $240,000, up considerably from a few years ago.

With limited supply and strong appeal for families and retirees alike, Arcanum may be attracting outside buyers looking to capitalize before prices rise even further. That can tighten inventory quickly and leave local buyers on the sidelines.

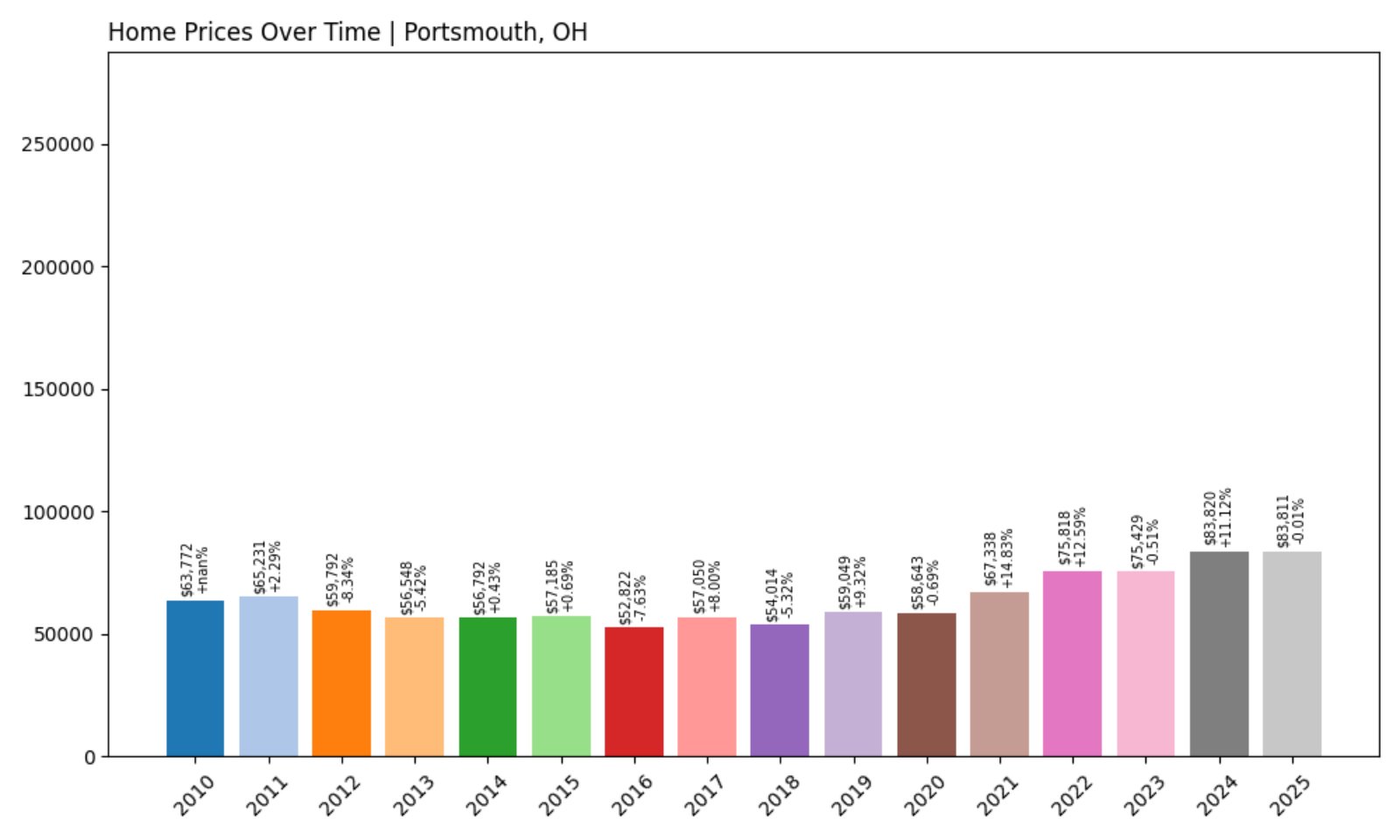

7. Portsmouth – Investor Feeding Frenzy Factor 41.37% (July 2025)

- Historical annual growth rate (2012–2022): 2.40%

- Recent annual growth rate (2022–2025): 3.40%

- Investor Feeding Frenzy Factor: 41.37%

- Current 2025 price: $83,810.71

Portsmouth’s recent growth rate of 3.40% may seem modest, but compared to its historical average of just 2.40%, it’s a dramatic 41% jump—marking the town as a potential hotspot for speculative buyers.

Portsmouth – Ohio’s Cheapest Market Sees a Shift

Situated in southern Scioto County along the Ohio River, Portsmouth is one of the most affordable housing markets in the state, with 2025 home prices averaging just under $84,000. That affordability is precisely what makes it a likely target for investors looking to buy low.

A feeding frenzy in a market this small and inexpensive can have outsized consequences. If investor activity continues, prices could rise quickly—pricing out residents in one of the state’s last truly affordable towns.

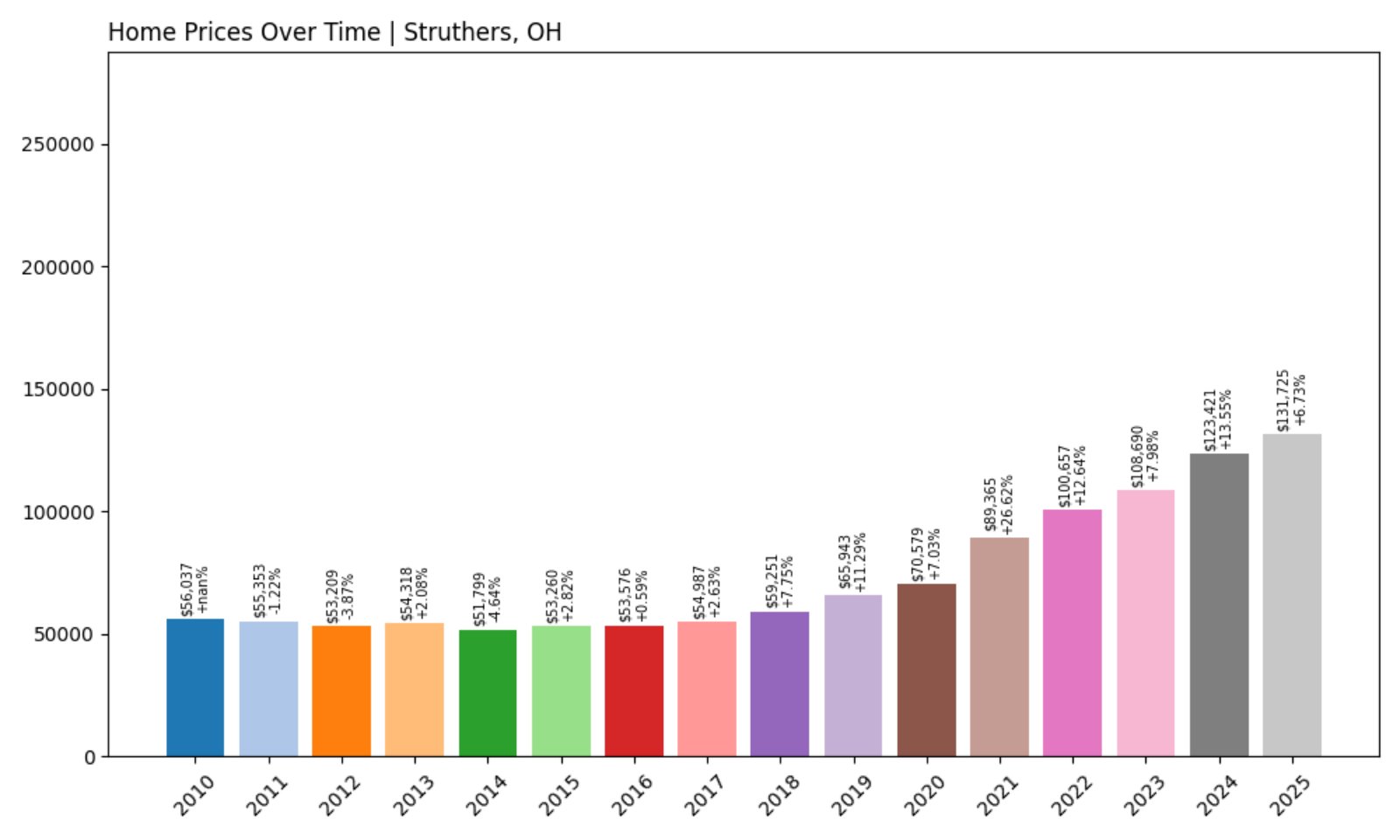

6. Struthers – Investor Feeding Frenzy Factor 42.51% (July 2025)

- Historical annual growth rate (2012–2022): 6.58%

- Recent annual growth rate (2022–2025): 9.38%

- Investor Feeding Frenzy Factor: 42.51%

- Current 2025 price: $131,725.02

Struthers has seen a sharp price acceleration from 6.58% to 9.38% annual growth, elevating its Feeding Frenzy Factor to 42.51%. That’s a substantial shift in a market already known for moderate but consistent value gains.

Struthers – A Mahoning County Market Heating Up Fast

Just southeast of Youngstown, Struthers has long been a modest, working-class town. The average 2025 home value of $131,725 remains well below the state average, making it a potential magnet for investors looking for low-cost opportunities with high upside.

This recent surge suggests speculation may be accelerating, which could push prices up faster than incomes. That’s especially problematic in communities like Struthers, where affordability has always been central to its appeal.

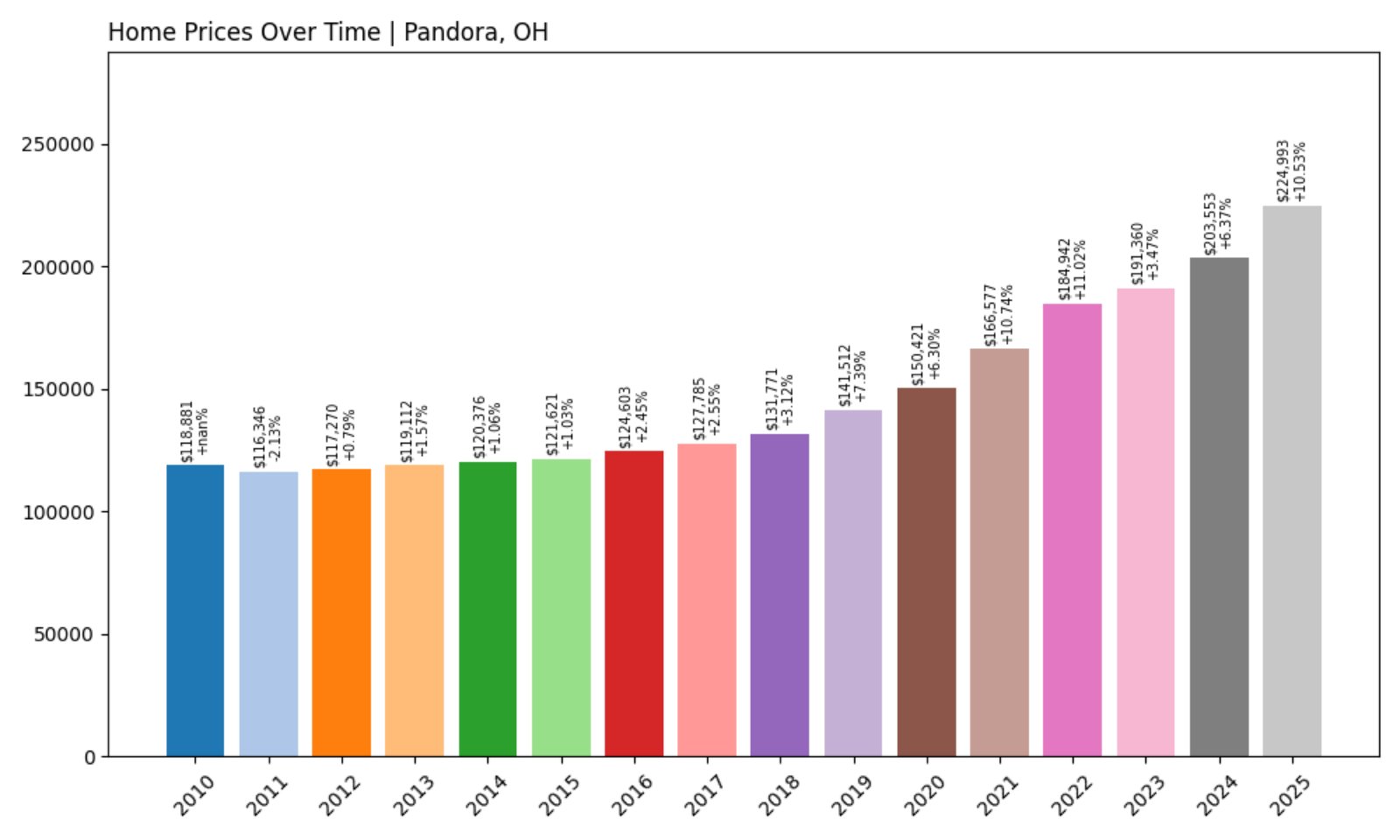

5. Pandora – Investor Feeding Frenzy Factor 44.87% (July 2025)

- Historical annual growth rate (2012–2022): 4.66%

- Recent annual growth rate (2022–2025): 6.75%

- Investor Feeding Frenzy Factor: 44.87%

- Current 2025 price: $224,992.83

Pandora’s growth rate has jumped nearly 45% above its historical trend, climbing from 4.66% to 6.75% in recent years. That places it firmly in the top five Ohio towns most affected by investor-driven acceleration in home values.

Pandora – Rising Quickly in Putnam County

Pandora is a small town in northwestern Ohio, known for its rural charm and strong local institutions. With home prices now averaging nearly $225,000, it’s become a target for both first-time buyers and investors sensing hidden value.

This level of price growth suggests a market tipping toward competition and limited supply. Without significant new construction, residents could soon face a much steeper climb into homeownership.

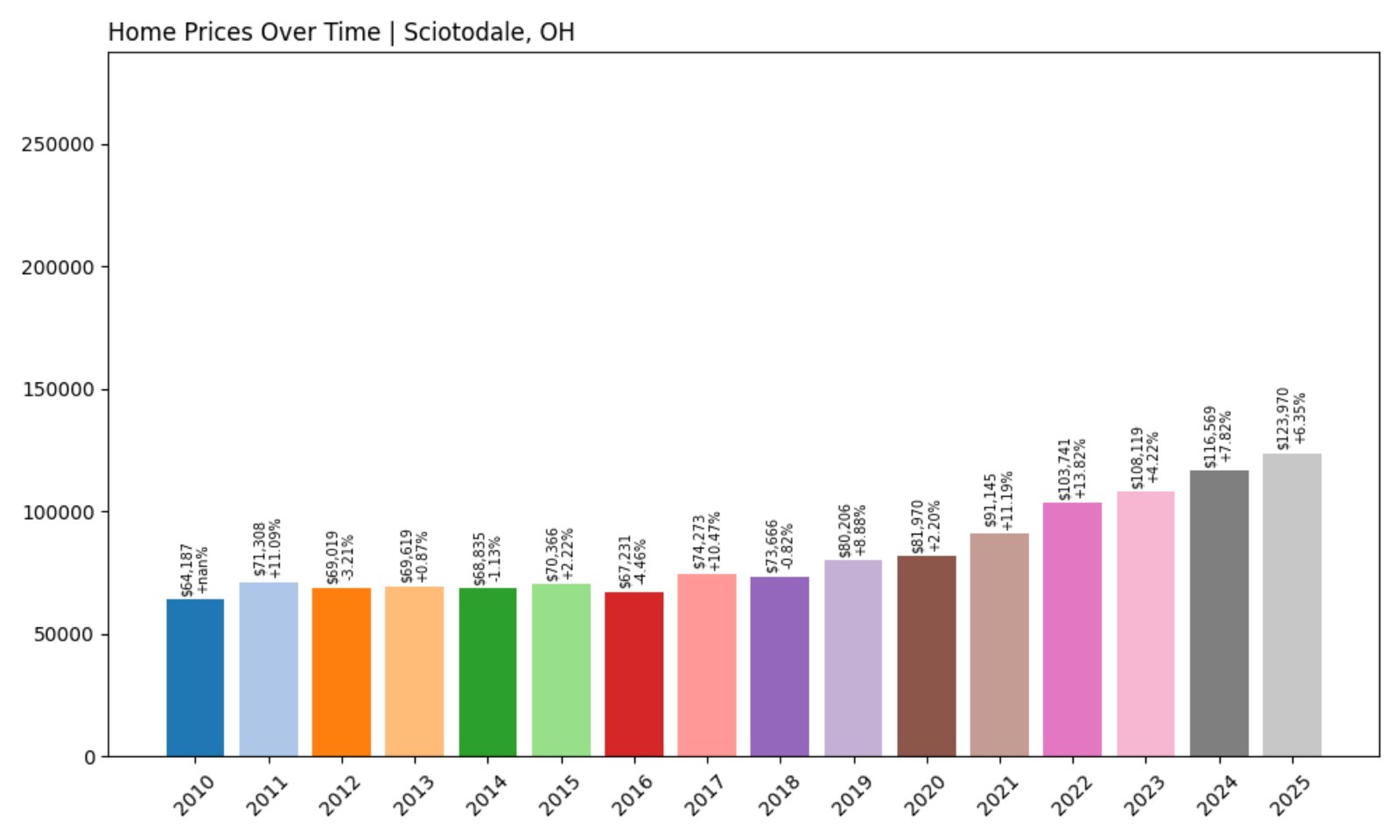

4. Sciotodale – Investor Feeding Frenzy Factor 47.09% (July 2025)

- Historical annual growth rate (2012–2022): 4.16%

- Recent annual growth rate (2022–2025): 6.12%

- Investor Feeding Frenzy Factor: 47.09%

- Current 2025 price: $123,969.83

Sciotodale’s home price growth has surged 47% past its historical average, now increasing at over 6% annually. That’s a significant shift for a community that has long hovered in the low-growth range.

Sciotodale – Big Gains in a Small Community

Part of Scioto County, Sciotodale is a small, unincorporated area near Portsmouth. It has remained under the radar for years, but at just under $124,000 in 2025, its homes are still extremely affordable—making it prime territory for investors.

The data suggests an early-stage boom. If speculative interest continues to grow, the resulting pressure could rapidly shift this quiet pocket into a less accessible one for longtime residents.

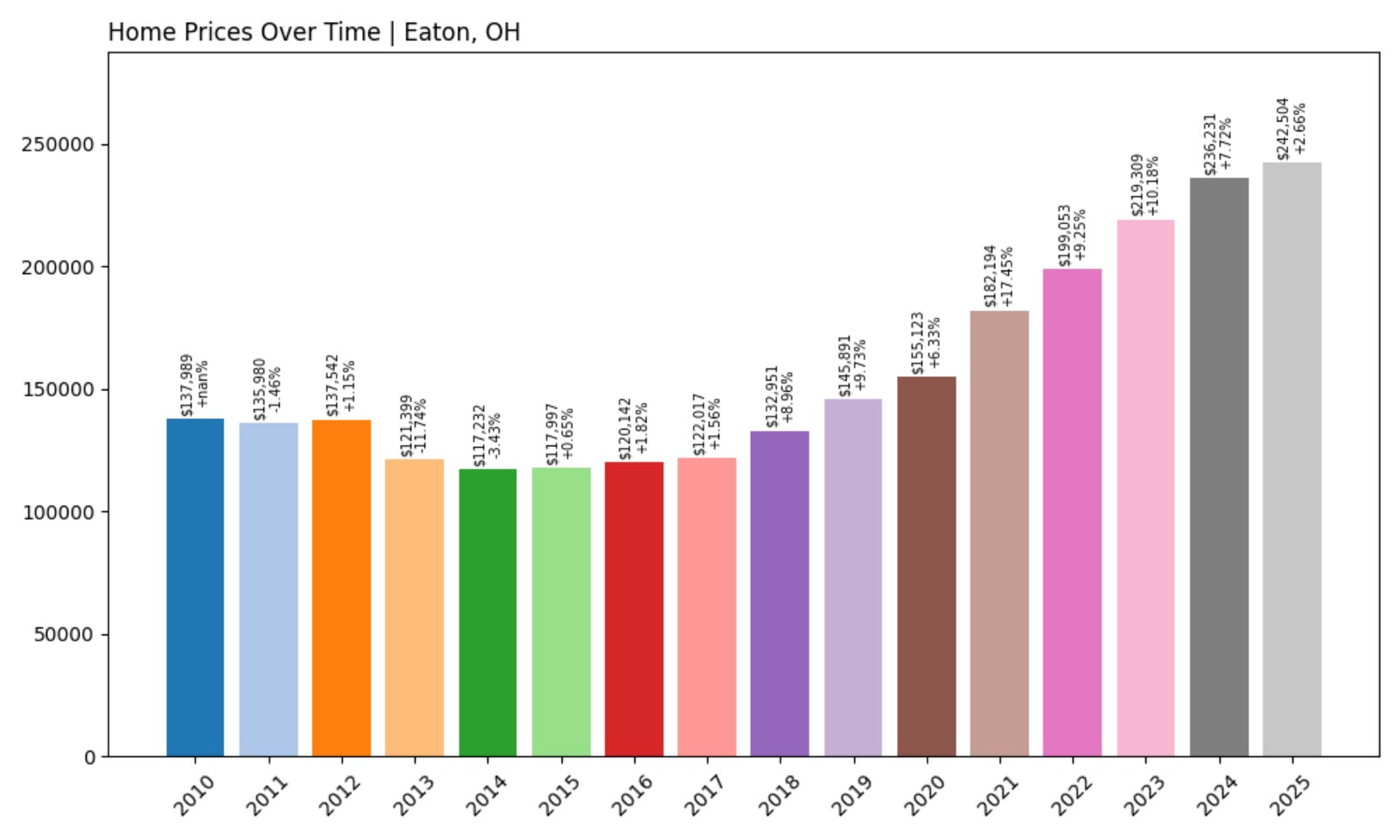

3. Eaton – Investor Feeding Frenzy Factor 80.66% (July 2025)

- Historical annual growth rate (2012–2022): 3.77%

- Recent annual growth rate (2022–2025): 6.80%

- Investor Feeding Frenzy Factor: 80.66%

- Current 2025 price: $242,504.41

Eaton’s growth rate has jumped from 3.77% to 6.80% annually—an astonishing 80.66% surge. That level of acceleration suggests strong investor pressure in a town that’s rapidly transitioning into a high-demand housing market.

Eaton – A County Seat on the Upswing

Eaton is the seat of Preble County in western Ohio. Known for its community events and access to nature, it’s become increasingly popular with buyers seeking small-town living without the isolation. With homes now averaging $242,500, the market is heating up fast.

This level of frenzy shows how quickly prices can escalate once investor demand sets in. Families looking to settle down may find it harder to compete as Eaton becomes a magnet for outside buyers.

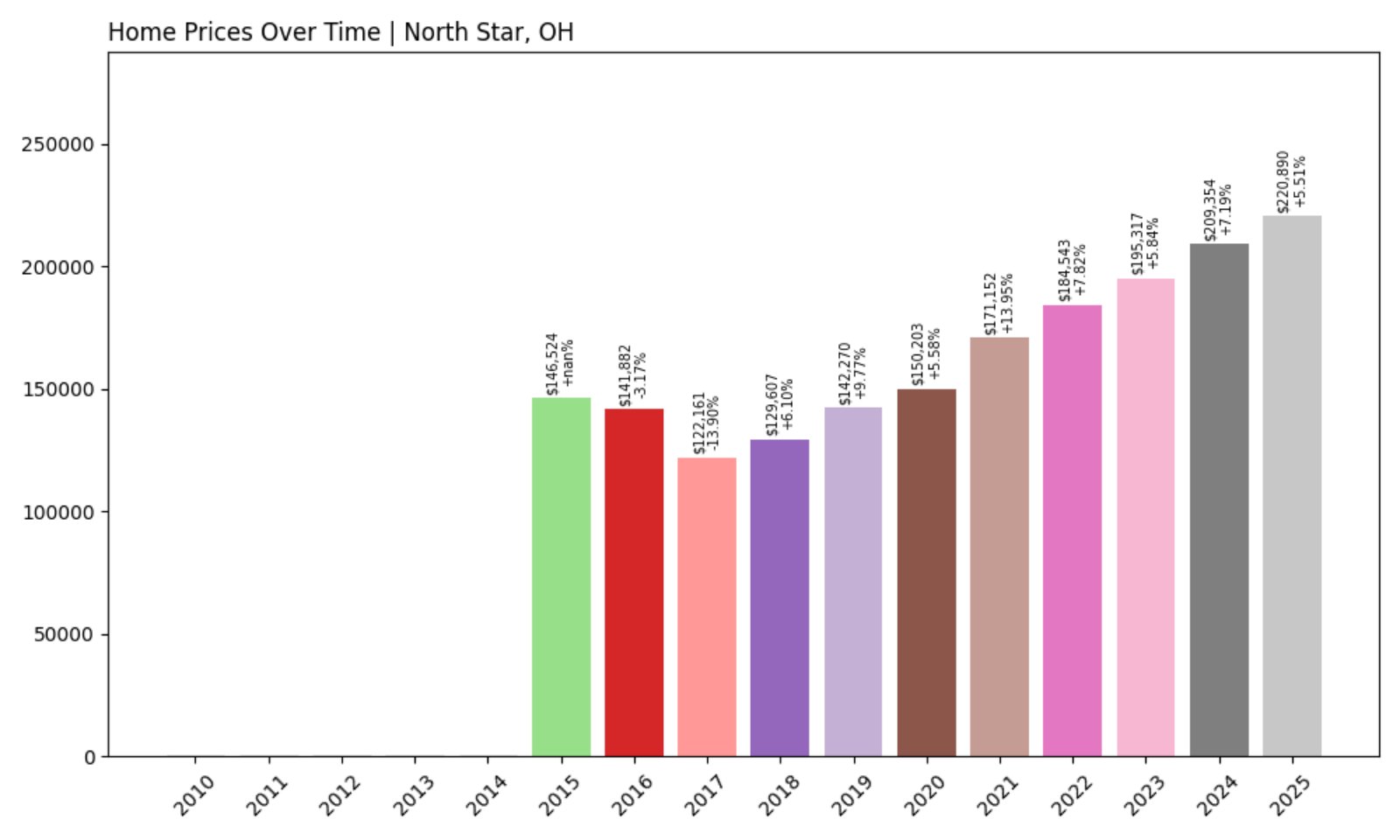

2. North Star – Investor Feeding Frenzy Factor 84.33% (July 2025)

- Historical annual growth rate (2012–2022): 3.35%

- Recent annual growth rate (2022–2025): 6.18%

- Investor Feeding Frenzy Factor: 84.33%

- Current 2025 price: $220,890.48

North Star’s Feeding Frenzy Factor has soared to 84.33%—an enormous increase stemming from a jump in price growth from 3.35% to 6.18% annually. It’s the second most dramatic spike in the state and a clear sign of investor activity.

North Star – From Sleepy to Surging

Located in Darke County, North Star is a tiny rural town with a population under 300. The 2025 average home price of $220,890 may seem modest, but for a place of this size, it represents a major climb—and one that could reshape its housing profile entirely.

With such a small supply of homes, even modest investor activity can cause sharp price shifts. That’s exactly what the data suggests is happening in North Star right now.

1. Glouster – Investor Feeding Frenzy Factor 85.53% (July 2025)

- Historical annual growth rate (2012–2022): 5.70%

- Recent annual growth rate (2022–2025): 10.58%

- Investor Feeding Frenzy Factor: 85.53%

- Current 2025 price: $81,825.28

Glouster ranks first in Ohio with a staggering Feeding Frenzy Factor of 85.53%, fueled by a growth rate that has nearly doubled from 5.70% to 10.58% annually. That kind of acceleration is textbook frenzy—and comes with serious affordability consequences.

Glouster – The Epicenter of Ohio’s Housing Surge

Nestled in Athens County in the Appalachian region, Glouster is a small town with deep historic roots and a traditionally affordable housing stock. In 2025, homes average just $81,825—still cheap on paper, but up dramatically from recent years.

Such a rapid rise in home values is a double-edged sword: investors see opportunity, while local families may struggle to keep up. If the trend continues, Glouster could serve as a case study for how quickly a low-cost community can become out of reach.

Haven't Seen Yet

Curated from our most popular plans. Click any to explore.