Would you like to save this?

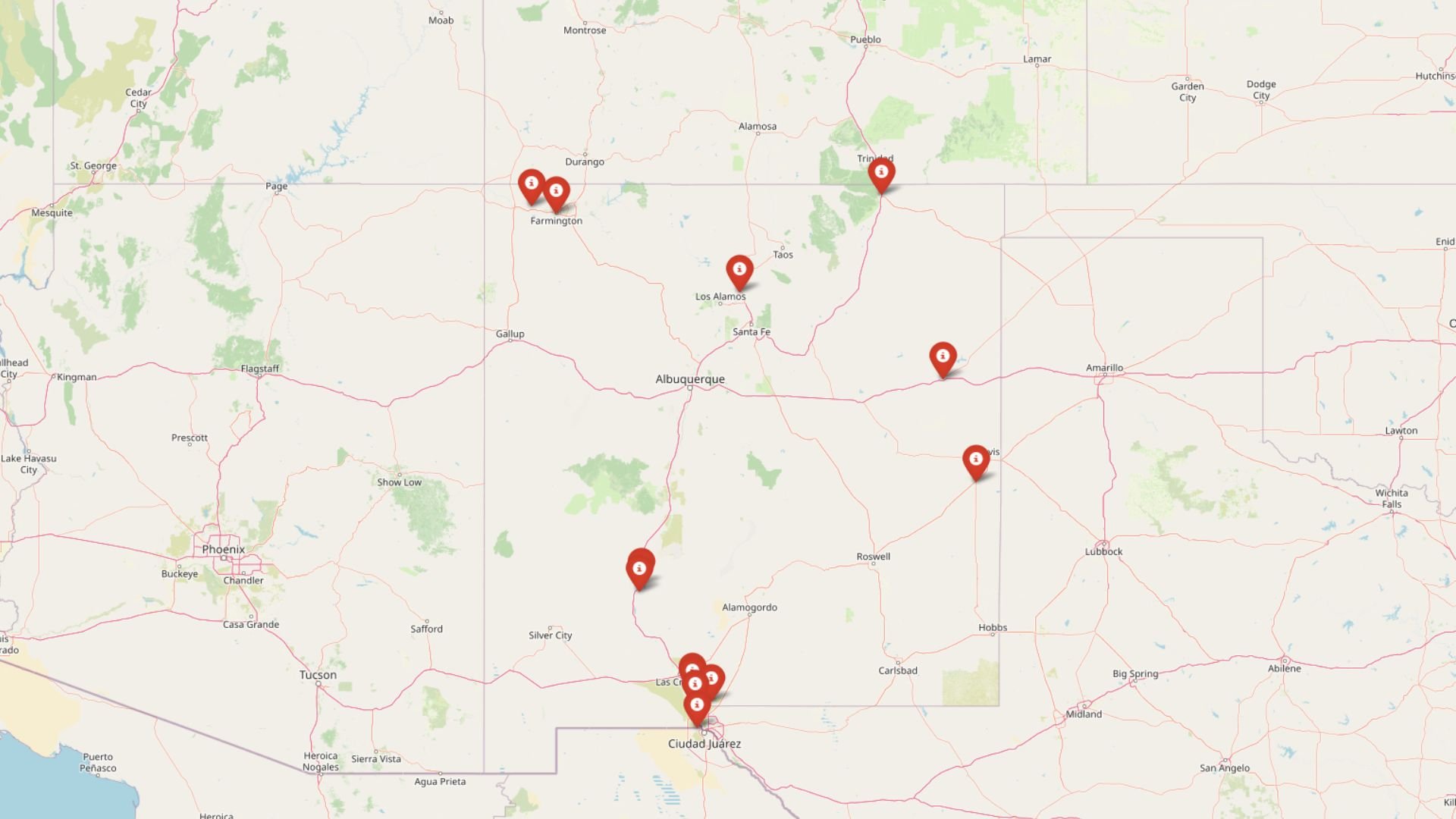

According to the Zillow Home Value Index, housing prices in parts of New Mexico are rising at unsustainable rates—and it’s not local demand pushing them higher. In these 13 towns, home values have spiked far beyond historical trends, fueled by speculative investors and second-home buyers. Some markets now show investor frenzy scores topping 150%, a clear sign that traditional buyers are being priced out. The result? Once-affordable communities are transforming fast, leaving longtime residents struggling to compete with all-cash offers and skyrocketing price tags.

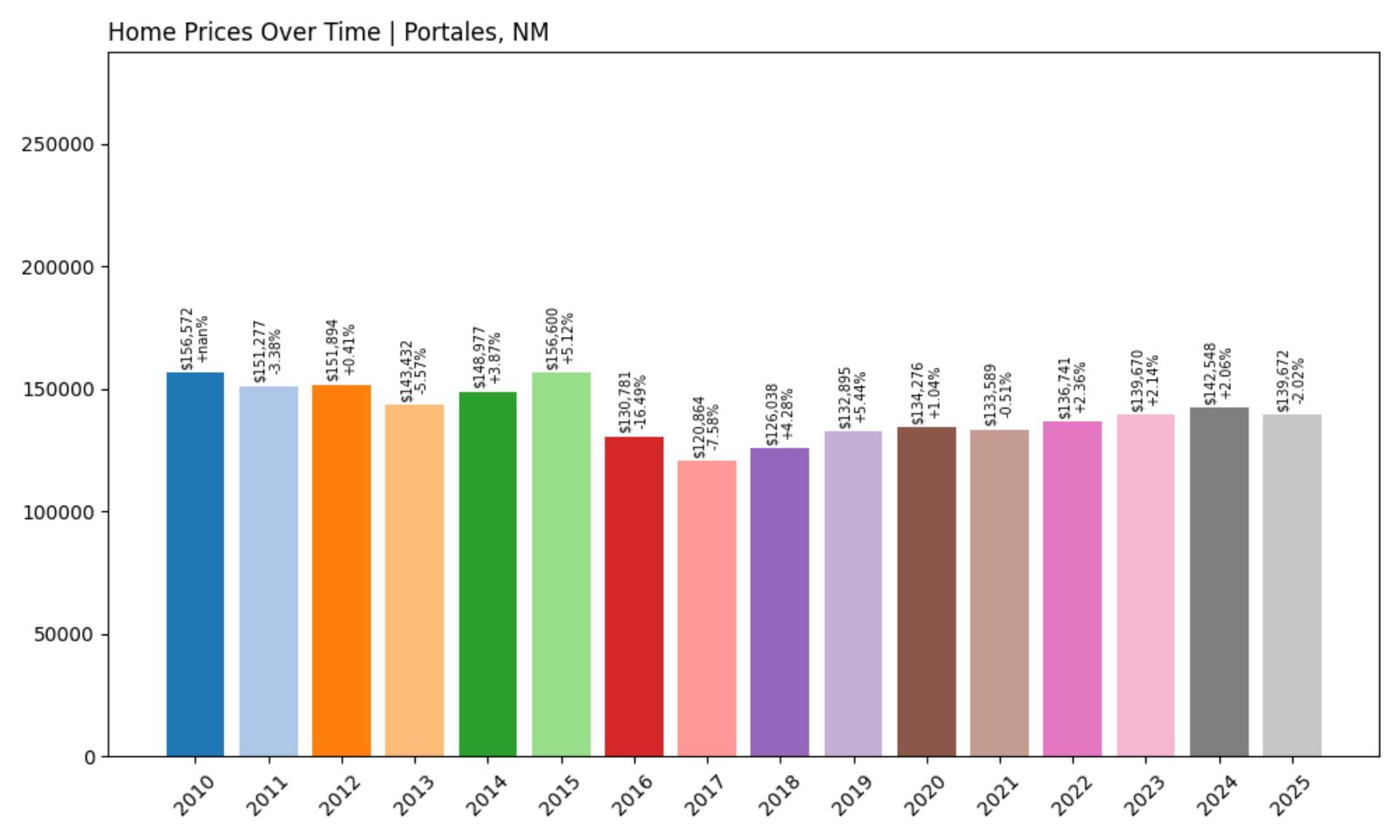

13. Portales – Investor Feeding Frenzy Factor -167.87% (July 2025)

- Historical annual growth rate (2012–2022): -1.05%

- Recent annual growth rate (2022–2025): 0.71%

- Investor Feeding Frenzy Factor: -167.87%

- Current 2025 price: $139,672.30

Portales presents a unique situation where recent price recovery has actually improved market conditions compared to historical decline. The city experienced negative growth of -1.05% annually over the past decade but has seen a modest recovery to 0.71% growth in recent years, resulting in a negative feeding frenzy factor of -168%. With median home prices at approximately $139,700, Portales offers some of the most affordable housing in New Mexico, though the market recovery reflects broader economic challenges in this agricultural region.

Portales – Agricultural Economy and Market Recovery

Located in eastern New Mexico’s Roosevelt County, Portales is a city of approximately 12,000 residents that serves as an agricultural and educational center for the region. Home to Eastern New Mexico University, the city’s economy has traditionally relied on agriculture, particularly dairy farming and peanut production, along with education and related services. The area’s housing market experienced significant challenges during the agricultural downturn of the 2010s, when declining commodity prices and drought conditions led to economic stress and falling property values.

The recent modest price recovery in Portales reflects stabilization in the regional agricultural economy and renewed confidence in the area’s long-term prospects. Eastern New Mexico University’s continued presence provides economic stability and housing demand from faculty, staff, and students, while improvements in agricultural technology and water management have helped local farming operations become more resilient. The city’s affordable housing costs have also attracted some remote workers and retirees seeking low-cost living options in a small-town environment.

While Portales hasn’t experienced the investor feeding frenzy affecting other New Mexico communities, the transition from declining to modest positive growth represents an important market recovery for local residents. The median home price of under $140,000 makes Portales one of the most affordable housing markets in the state, though this affordability reflects the ongoing economic challenges in rural eastern New Mexico rather than speculative undervaluation. For families committed to agricultural livelihoods or university employment, Portales offers genuine affordability that has become increasingly rare in New Mexico’s housing market.

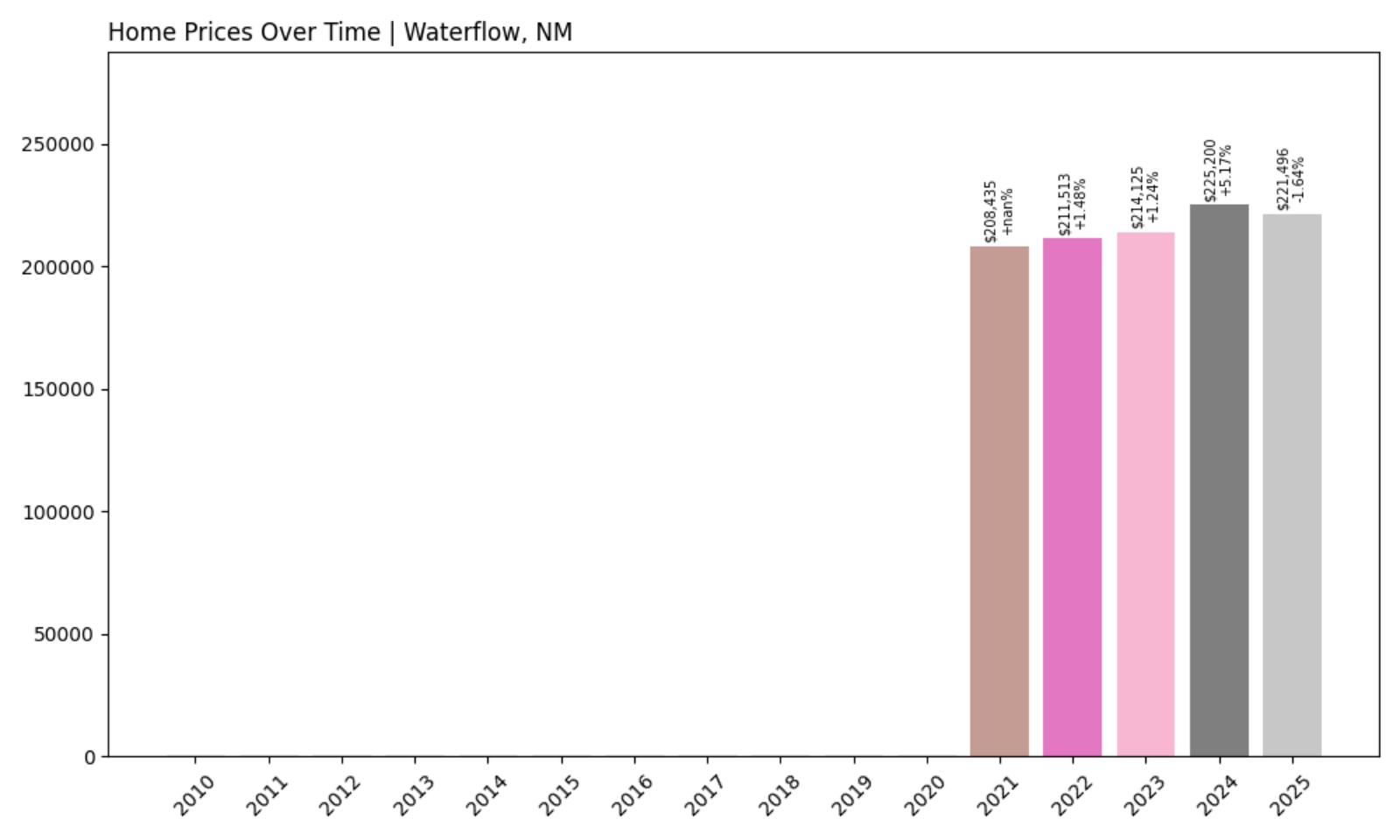

12. Waterflow – Investor Feeding Frenzy Factor 4.92% (July 2025)

- Historical annual growth rate (2012–2022): 1.48%

- Recent annual growth rate (2022–2025): 1.55%

- Investor Feeding Frenzy Factor: 4.92%

- Current 2025 price: $221,496.29

Waterflow exhibits minimal speculative activity, with price growth showing only slight acceleration from historical patterns. The community’s appreciation has increased modestly from 1.48% annually over the past decade to 1.55% in recent years, creating a very low feeding frenzy factor of less than 5%. With median home prices at approximately $221,500, Waterflow represents a relatively stable market in northwestern New Mexico that has avoided the dramatic speculation affecting other parts of the state.

Waterflow – Rural Stability in Energy Region

Located in San Juan County near Farmington, Waterflow is a small unincorporated community that has maintained relative housing market stability despite being situated in New Mexico’s active energy production region. The area’s rural character and agricultural heritage have helped insulate it from the investor speculation that has affected other communities in the Four Corners region. With a population of fewer than 1,500 residents, Waterflow offers a quiet alternative to larger energy boom towns while still providing access to employment opportunities in the natural gas and agricultural sectors.

The community’s housing market stability reflects its established rural character and the preference of longtime residents for owner-occupied properties rather than investment or rental housing. Many properties in Waterflow feature larger lots with agricultural zoning, making them less attractive to typical residential investors but appealing to families seeking rural lifestyles. The area’s location along major irrigation systems and its history of farming and ranching have created a strong local culture of property ownership and community stability.

While Waterflow has avoided significant investor speculation, the median home price of over $221,000 still represents a substantial investment for local residents working in agriculture or energy-related industries. The community’s stable price growth, while beneficial for existing homeowners, reflects limited housing turnover and strong local demand rather than outside investment pressure. This stability has helped preserve Waterflow’s rural character and community cohesion, though it also means fewer opportunities for new residents to enter the market.

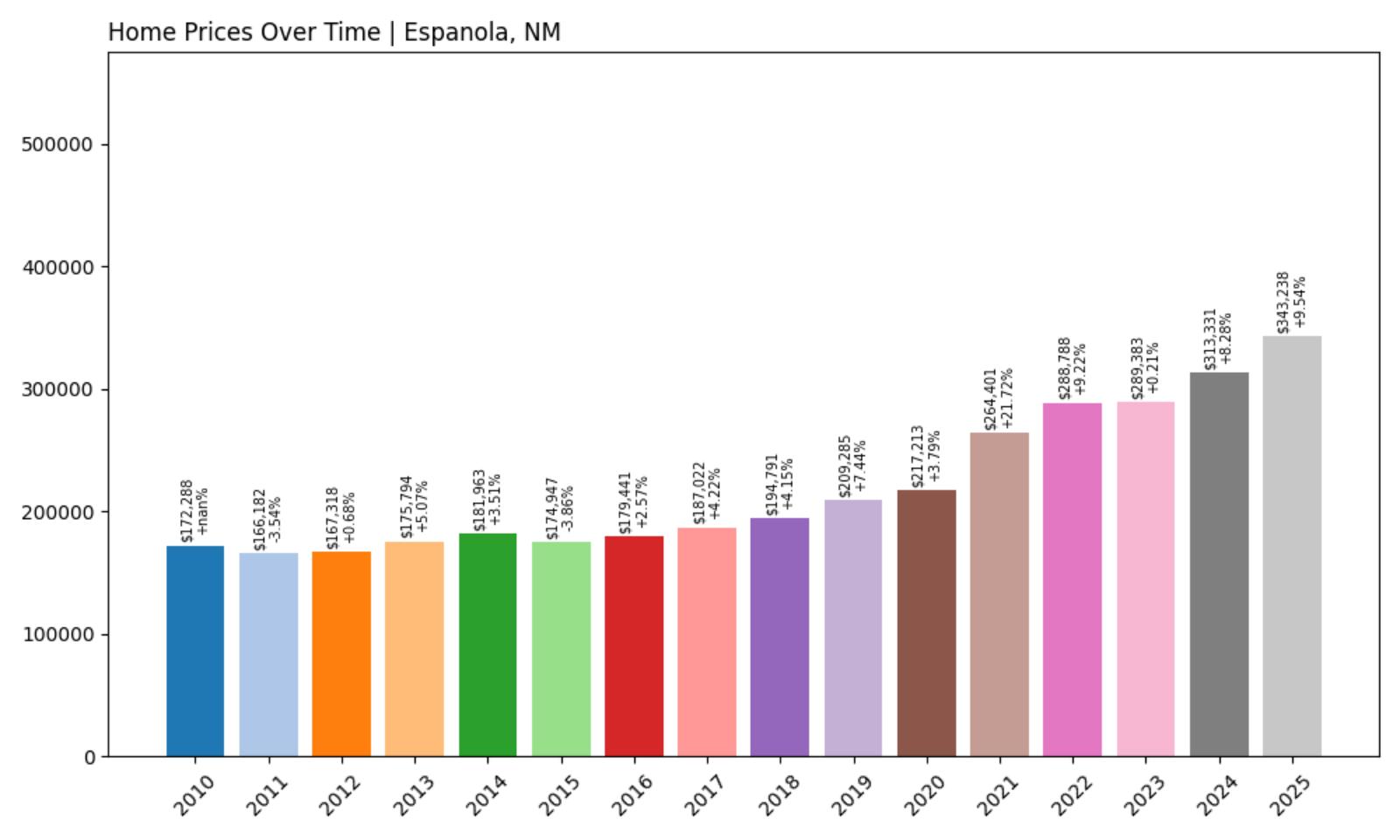

11. Espanola – Investor Feeding Frenzy Factor 5.65% (July 2025)

- Historical annual growth rate (2012–2022): 5.61%

- Recent annual growth rate (2022–2025): 5.93%

- Investor Feeding Frenzy Factor: 5.65%

- Current 2025 price: $343,238.21

Espanola shows minimal signs of speculative activity, with price growth remaining relatively stable compared to historical patterns. The city’s appreciation has increased only slightly from 5.61% annually over the past decade to 5.93% in recent years, resulting in a modest feeding frenzy factor of less than 6%. However, with median home prices now exceeding $343,000, Espanola represents one of the more expensive markets in northern New Mexico, reflecting its desirable location and cultural significance.

Espanola – Cultural Heritage and Santa Fe Proximity

Located about 25 miles north of Santa Fe in the heart of the Española Valley, this city of approximately 10,000 residents serves as a cultural and economic center for northern New Mexico’s Hispanic and Native American communities. Espanola’s high median home price of over $343,000 reflects its proximity to Santa Fe’s expensive real estate market and its position in one of New Mexico’s most historically and culturally significant regions. The area’s rich heritage, including numerous art galleries, traditional crafts, and cultural festivals, has maintained steady demand for housing without the dramatic speculation seen elsewhere in the state.

The city’s economy benefits from its role as a regional hub for government services, healthcare, and education, with many residents commuting to jobs in Santa Fe or Los Alamos. Espanola’s location in the Rio Grande Valley, surrounded by dramatic mesas and ancient Native American sites, has long attracted artists, writers, and other professionals seeking an authentic Southwestern lifestyle. The area’s established character and higher baseline prices have helped insulate it from the type of rapid speculation affecting other New Mexico communities.

While Espanola hasn’t experienced a significant investor feeding frenzy, its high median home prices still present affordability challenges for local residents, particularly those working in service industries or traditional arts and crafts. The stable but elevated price growth reflects the area’s enduring appeal and limited housing supply rather than speculative investment activity. This market stability, while beneficial for long-term residents, still makes homeownership difficult for young families and those seeking to enter the market for the first time.

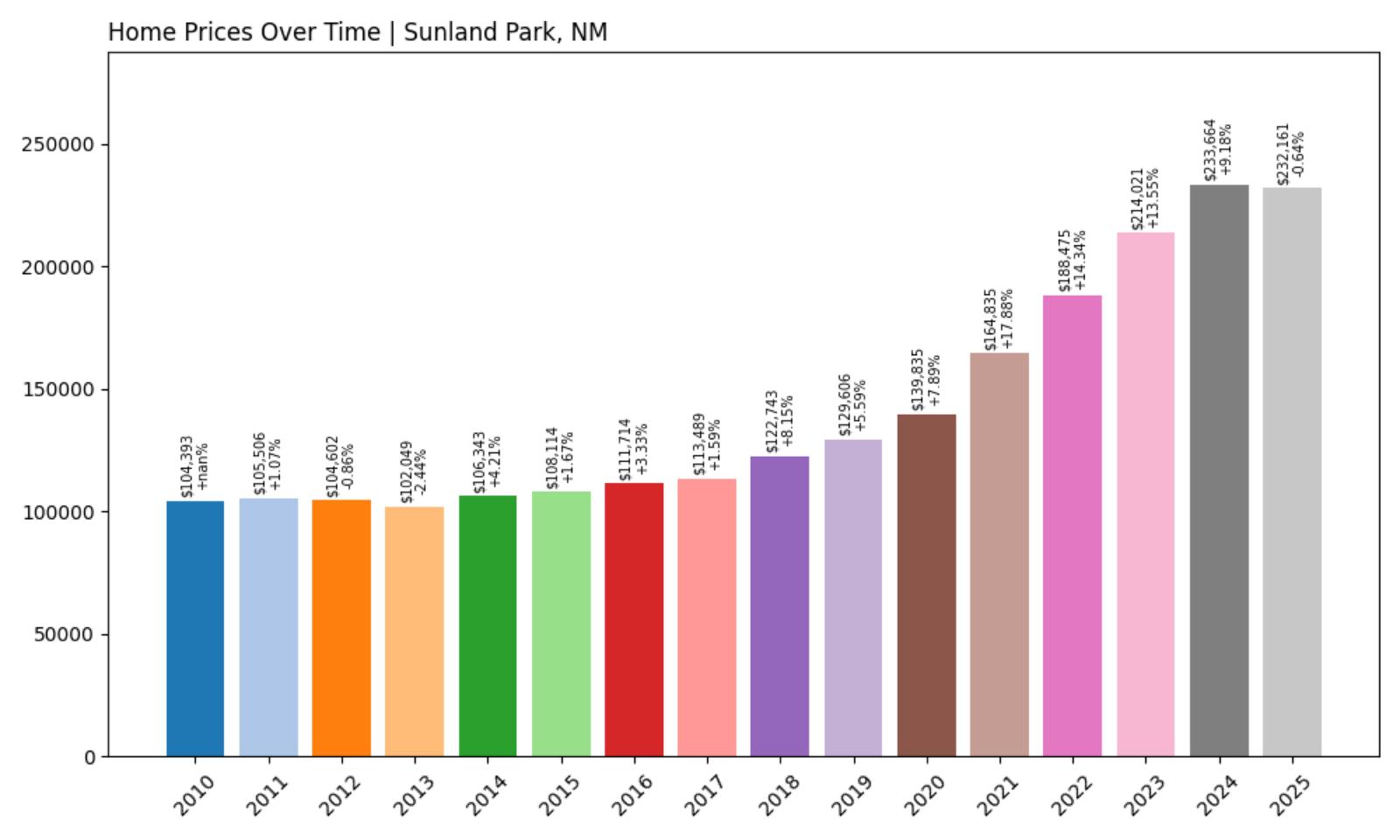

10. Sunland Park – Investor Feeding Frenzy Factor 18.65% (July 2025)

- Historical annual growth rate (2012–2022): 6.06%

- Recent annual growth rate (2022–2025): 7.20%

- Investor Feeding Frenzy Factor: 18.65%

- Current 2025 price: $232,161.11

Sunland Park demonstrates how communities with already strong price growth can still experience speculative pressure. The city’s price appreciation has accelerated from a robust 6.06% annually over the past decade to over 7% in recent years, creating a feeding frenzy factor of nearly 19%. With median home prices exceeding $232,000, this border city continues to attract investor interest despite having one of the higher baseline growth rates among New Mexico communities experiencing speculation.

Sunland Park – Border Commerce and Recreation Drive Investment

Situated at the intersection of New Mexico, Texas, and Mexico, Sunland Park occupies a unique position that has made it increasingly attractive to investors interested in border commerce and cross-cultural real estate opportunities. The city of approximately 17,000 residents benefits from its proximity to El Paso, Texas, and Ciudad Juárez, Mexico, creating a trilateral metropolitan area with significant economic activity. This strategic location has attracted investors seeking rental properties for cross-border workers, as well as those interested in the area’s potential for continued international trade growth.

Sunland Park’s economy is closely tied to its border location, with many residents working in international trade, logistics, and services that support cross-border commerce. The city also benefits from its position near major recreational areas, including the Franklin Mountains and various desert recreation sites that attract tourists and outdoor enthusiasts. Recent infrastructure improvements, including upgrades to border crossing facilities and transportation networks, have enhanced the area’s investment appeal and contributed to the sustained price growth.

The investor interest in Sunland Park has been particularly focused on newer residential developments and properties with good access to major transportation corridors. While the feeding frenzy factor remains relatively modest, the consistent strong price growth has made homeownership increasingly challenging for local service workers and those in entry-level positions in the international trade sector. The speculation has been most noticeable in subdivisions that offer modern amenities and easy access to both El Paso employment centers and border crossing facilities.

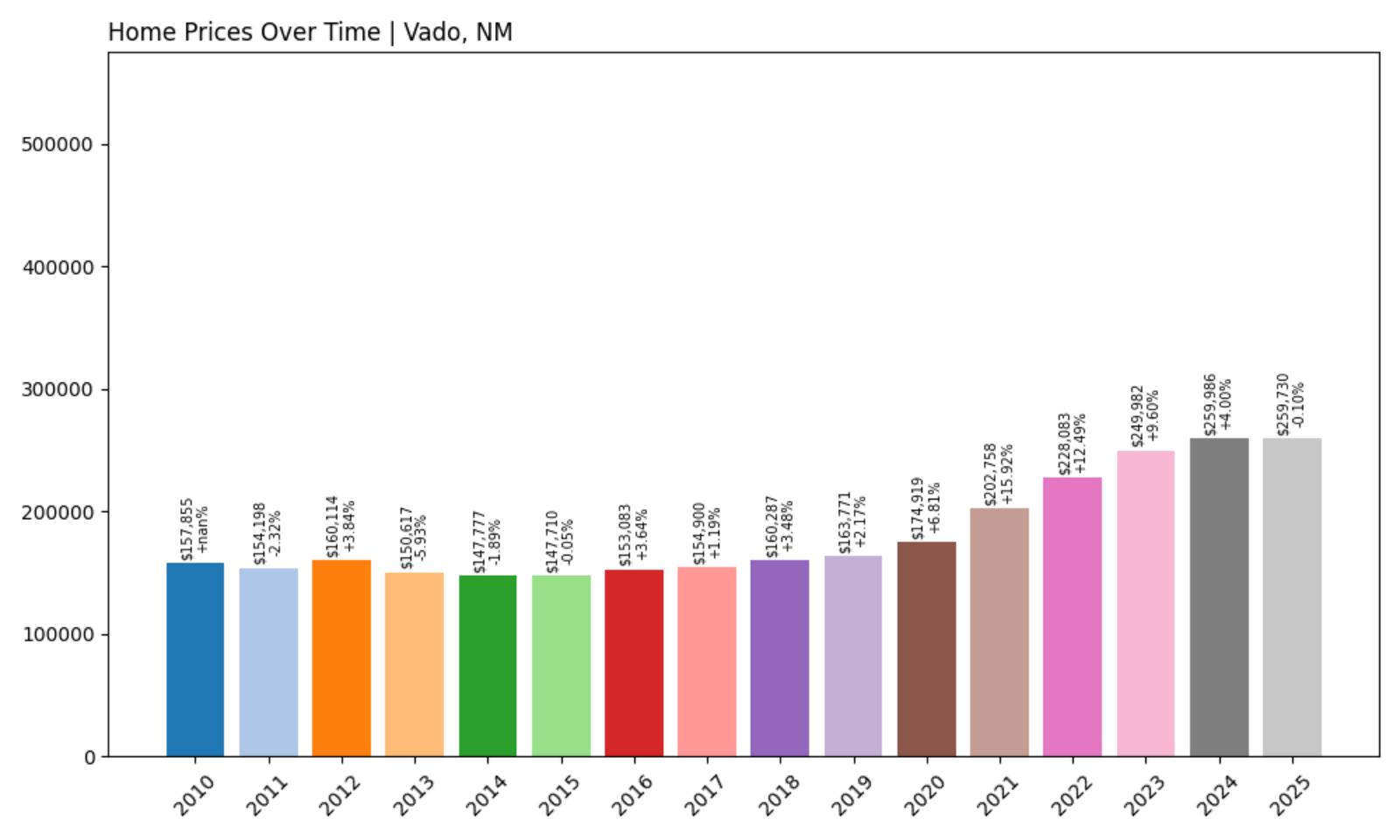

9. Vado – Investor Feeding Frenzy Factor 22.90% (July 2025)

- Historical annual growth rate (2012–2022): 3.60%

- Recent annual growth rate (2022–2025): 4.43%

- Investor Feeding Frenzy Factor: 22.90%

- Current 2025 price: $259,730.49

Vado’s housing market reflects moderate investor interest in this small agricultural community near the Mexican border. The town’s price growth has accelerated from 3.6% annually over the past decade to over 4.4% in recent years, creating a feeding frenzy factor of nearly 23%. With median home prices now exceeding $259,000, this rural community has experienced significant appreciation that challenges traditional affordability for local agricultural workers and their families.

Vado – Agricultural Heritage Meets Investment Interest

Located in the fertile Mesilla Valley of southern New Mexico, Vado is a small unincorporated community of approximately 3,200 residents with deep roots in agriculture and Mexican-American culture. The area has traditionally been known for its chile farming, cotton production, and pecans, with many families having worked the same land for multiple generations. However, Vado’s proximity to Las Cruces (about 20 miles north) and its position in the rapidly developing southern New Mexico corridor has attracted investor attention from those seeking rural properties with investment potential.

The community’s appeal to investors stems partly from its authentic rural character and the availability of properties with significant acreage, which are increasingly rare in developing areas of New Mexico. Many of Vado’s homes sit on lots of an acre or more, offering privacy and space for horses, gardens, and other rural amenities that appeal to urban transplants. The area’s location along major irrigation canals and its agricultural zoning also make it attractive to investors interested in agritourism or hobby farming operations.

The moderate investor feeding frenzy in Vado has been most pronounced in larger properties with established homes and outbuildings, which offer the rural lifestyle experience that many out-of-area buyers seek. However, this speculation has created challenges for local farmworker families, who often struggle to compete with cash offers from investors. The price increases have been particularly difficult for young adults from agricultural families who wish to continue farming traditions but find themselves priced out of the land their families have worked for generations.

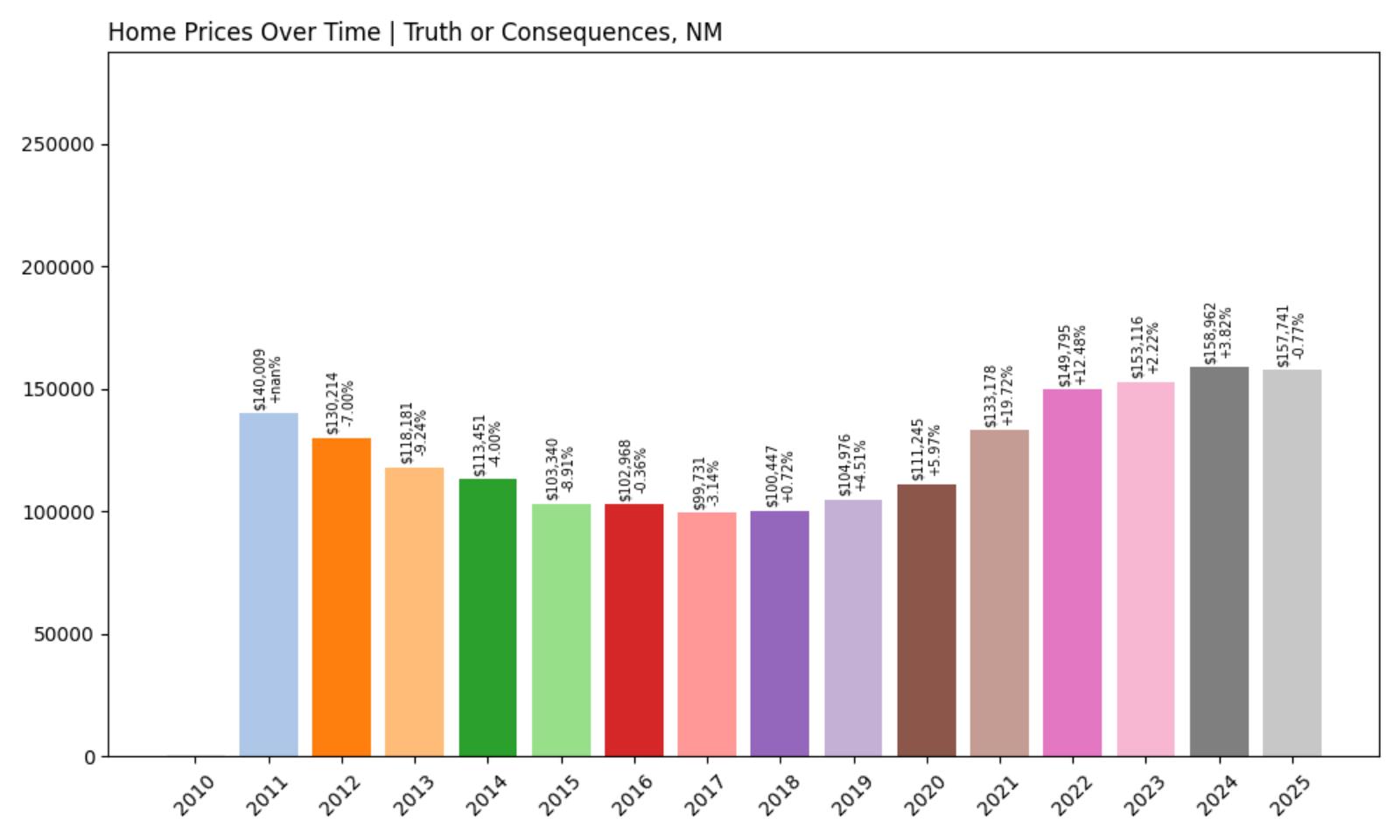

8. Truth or Consequences – Investor Feeding Frenzy Factor 23.20% (July 2025)

- Historical annual growth rate (2012–2022): 1.41%

- Recent annual growth rate (2022–2025): 1.74%

- Investor Feeding Frenzy Factor: 23.20%

- Current 2025 price: $157,741.37

Truth or Consequences exhibits a modest but noticeable acceleration in housing prices that reflects growing investor interest in this unique desert community. The town’s growth rate has increased from 1.41% annually over the past decade to 1.74% in recent years, creating a feeding frenzy factor of over 23%. Despite the relatively affordable median home price of approximately $157,700, this acceleration represents a significant shift for a community that has traditionally maintained stable, slow-growth housing values.

Truth or Consequences – Hot Springs Tourism Drives Interest

Famous for its natural hot springs and quirky name (adopted in 1950 after a radio show contest), Truth or Consequences has emerged as an unexpected investment target in south-central New Mexico. The city of roughly 6,000 residents sits along the Rio Grande and has long attracted visitors seeking the therapeutic benefits of its mineral-rich hot springs. Recent years have seen increased interest from investors looking to capitalize on wellness tourism trends and the area’s potential for vacation rental properties, particularly those offering access to the historic downtown hot springs district.

The community’s economy has traditionally relied on tourism, retirees, and government services, with many residents working in hospitality, healthcare, and retail sectors. Truth or Consequences’ proximity to Elephant Butte Lake, just five miles south, has enhanced its appeal as a recreational destination, while its location along Interstate 25 makes it accessible to visitors from Albuquerque and El Paso. The town’s eclectic mix of adobe architecture, vintage motels, and artist studios has created a distinctive character that appeals to investors interested in unique properties with tourism potential.

The investor feeding frenzy in Truth or Consequences has been most evident in properties near the hot springs district and homes with distinctive architectural features or artistic elements. While price increases remain modest compared to other speculative markets, they have nonetheless impacted affordability for local residents, particularly those working in seasonal tourism jobs or on fixed incomes. The trend has raised concerns among longtime residents about maintaining the community’s authentic character and ensuring that local families can continue to afford living in this historically affordable desert town.

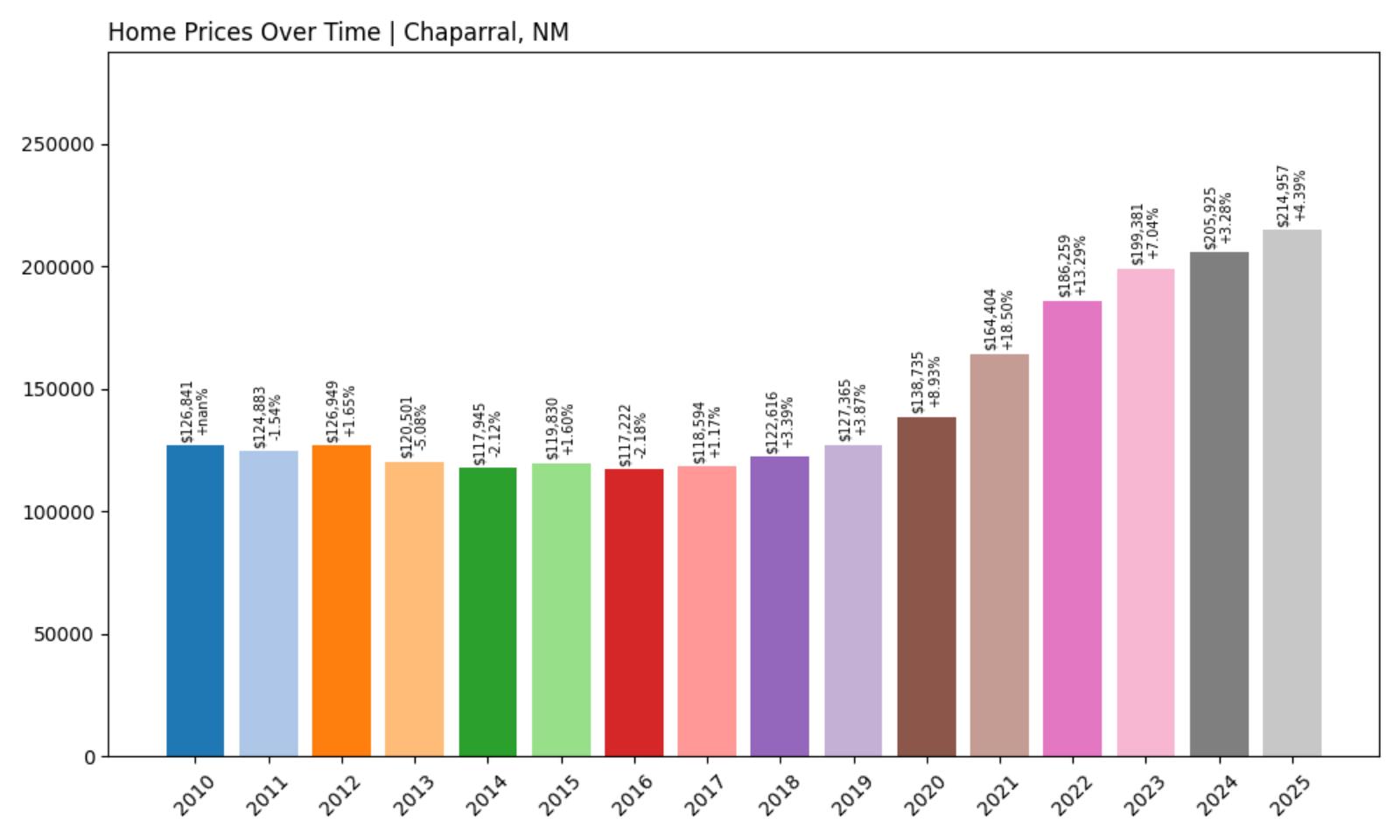

7. Chaparral – Investor Feeding Frenzy Factor 25.19% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 3.91%

- Recent annual growth rate (2022–2025): 4.89%

- Investor Feeding Frenzy Factor: 25.19%

- Current 2025 price: $214,957.03

Chaparral’s housing market demonstrates how suburban-style development can attract moderate investor interest in border regions. The community’s price growth has increased from 3.91% annually over the past decade to nearly 5% in recent years, resulting in a feeding frenzy factor of about 25%. With median home prices now exceeding $214,000, this unincorporated community has experienced steady appreciation that reflects growing investor confidence in southern New Mexico’s real estate potential.

Chaparral – Suburban Character Appeals to Investors

Located in south-central New Mexico near the Texas border, Chaparral is an unincorporated community of approximately 14,000 residents that has developed a distinctly suburban character despite its rural setting. The area features newer subdivisions with larger lots and modern amenities, making it attractive to families seeking more space and privacy than available in traditional urban settings. This suburban appeal has drawn investor interest from those looking to capitalize on the area’s growth potential and its position between Las Cruces and El Paso metropolitan areas.

Chaparral’s economy benefits from its proximity to major employment centers while offering more affordable housing and a slower pace of life. Many residents commute to jobs in Las Cruces, El Paso, or the surrounding military installations, including White Sands Missile Range and Fort Bliss. The community’s location along Highway 213 provides easy access to Interstate 25, making it convenient for workers and attractive to investors who see potential in the area’s continued residential development.

The investor activity in Chaparral has focused primarily on newer construction and properties in planned subdivisions, which offer the suburban amenities that appeal to families relocating from urban areas. While the feeding frenzy factor remains moderate compared to other New Mexico communities, the steady price acceleration has made homeownership more challenging for local service workers and those in entry-level positions. The speculation has been particularly noticeable in move-in ready homes with modern features and larger lots, which often receive multiple offers from investors and out-of-area buyers.

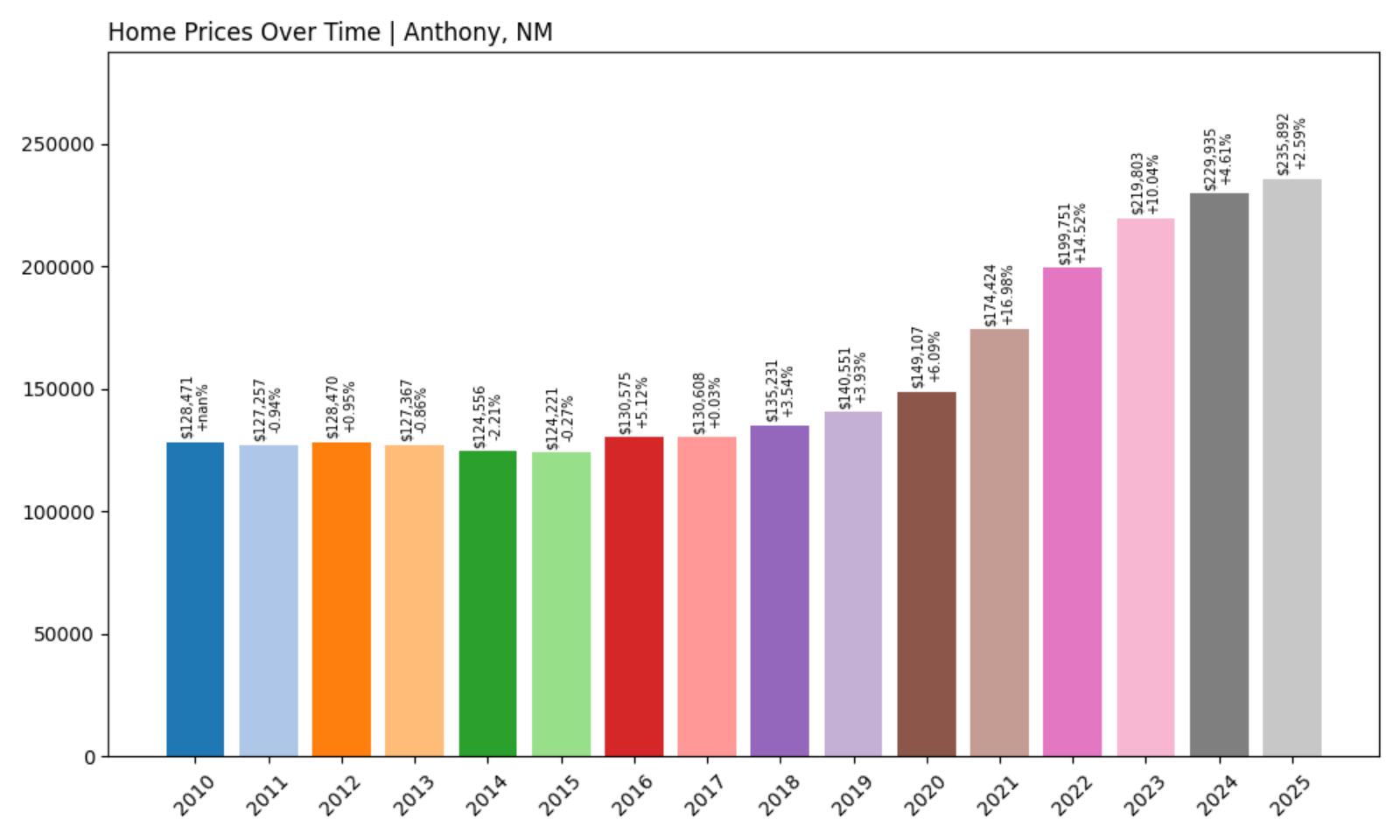

6. Anthony – Investor Feeding Frenzy Factor 26.31% (July 2025)

- Historical annual growth rate (2012–2022): 4.51%

- Recent annual growth rate (2022–2025): 5.70%

- Investor Feeding Frenzy Factor: 26.31%

- Current 2025 price: $235,891.77

Anthony’s housing market shows how border communities can experience moderate speculation driven by cross-state investment interest. The town’s price growth has accelerated from 4.51% annually over the past decade to 5.7% in recent years, creating a feeding frenzy factor of over 26%. With median home prices approaching $236,000, this small border community has seen significant appreciation that challenges affordability for local residents working in agriculture and cross-border commerce.

Anthony – Border Position Creates Investment Opportunities

Straddling the New Mexico-Texas border with a combined population of approximately 9,000 residents, Anthony represents a unique binational community where housing markets on both sides of the state line influence each other. The New Mexico portion of Anthony has attracted investor interest due to its proximity to El Paso, Texas, and Las Cruces, New Mexico, both major metropolitan areas with higher housing costs. This strategic location has made Anthony attractive to investors seeking rental properties for commuters and cross-border workers, as well as those looking for more affordable alternatives to urban markets.

The community’s economy is deeply tied to agriculture, particularly cotton, chili, and pecan farming in the fertile Rio Grande Valley. Anthony also benefits from its position along major transportation corridors, including Interstate 10 and several rail lines, which has attracted distribution and logistics businesses to the area. The town’s Mexican-American cultural heritage and authentic Southwestern character have also made it appealing to investors interested in vacation rental properties that offer visitors an authentic border experience.

The moderate investor feeding frenzy in Anthony has been most pronounced in properties with larger lots and rural characteristics, which appeal to buyers seeking more space and privacy than available in urban areas. However, even this relatively modest speculation has impacted local families, particularly those working in seasonal agricultural jobs where income can vary significantly throughout the year. The price increases have been especially challenging for young adults who grew up in Anthony and wish to purchase their first homes in the community where their families have lived for generations.

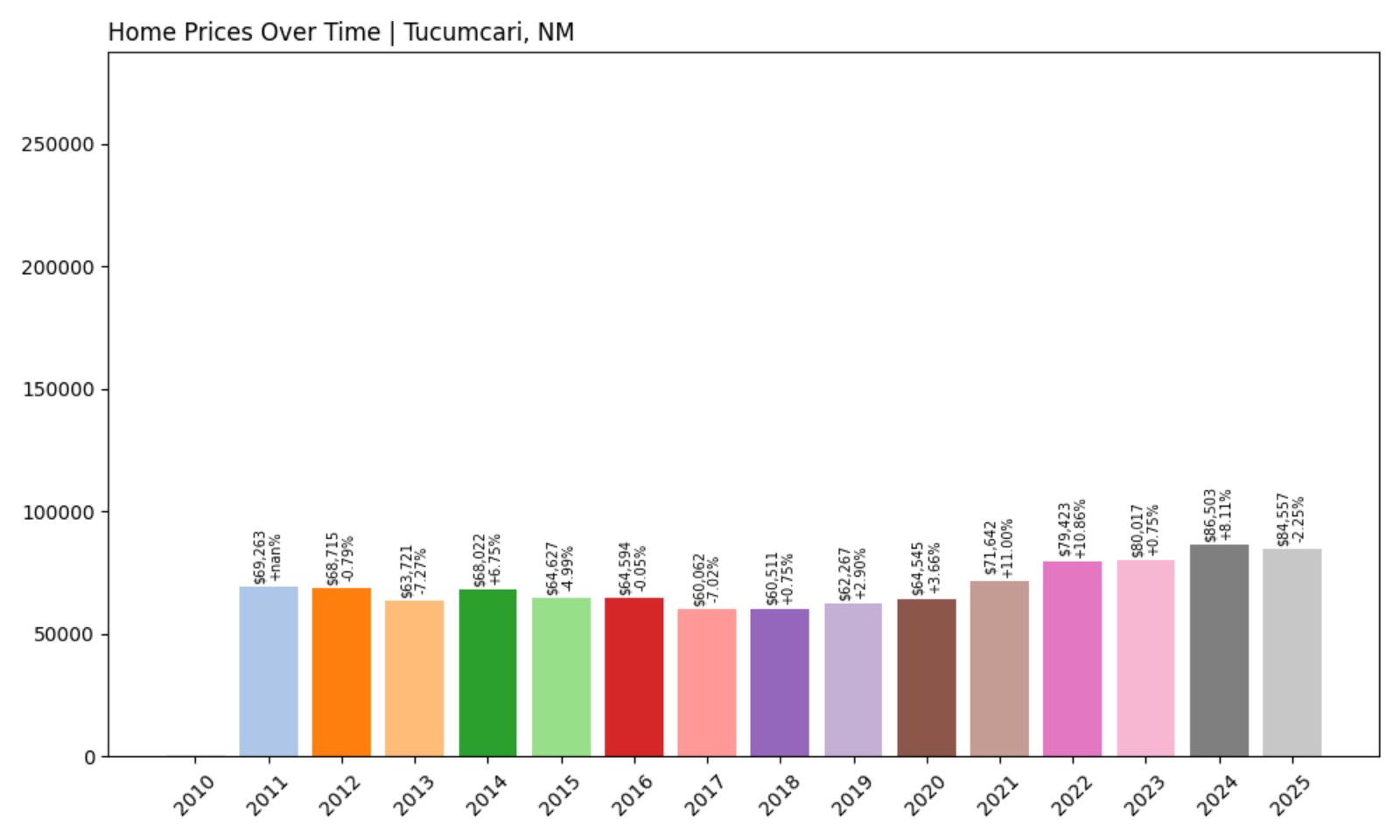

5. Tucumcari – Investor Feeding Frenzy Factor 44.65% (July 2025)

- Historical annual growth rate (2012–2022): 1.46%

- Recent annual growth rate (2022–2025): 2.11%

- Investor Feeding Frenzy Factor: 44.65%

- Current 2025 price: $84,556.85

Tucumcari’s housing market illustrates how even modest price acceleration can create significant speculation in smaller communities. The town’s growth rate has increased from 1.46% annually over the past decade to over 2% in recent years, resulting in a feeding frenzy factor of nearly 45%. Despite the relatively low median home price of approximately $84,500, this acceleration has made homeownership more challenging for local residents in this historic Route 66 community.

Tucumcari – Route 66 Heritage Attracts Tourism Investment

Located along the legendary Route 66 in eastern New Mexico, Tucumcari has long been known as a stopping point for travelers crossing the American Southwest. This small city of roughly 5,000 residents sits at the intersection of Interstate 40 and several major highways, making it a natural hub for transportation and tourism-related businesses. The town’s collection of vintage motels, neon signs, and mid-century architecture has made it increasingly popular with Route 66 enthusiasts and nostalgia tourism, attracting investors interested in vacation rental properties and boutique hospitality ventures.

Tucumcari’s economy has traditionally relied on agriculture, transportation, and tourism, with many residents working in ranching, trucking, and service industries. The town’s location in the high plains region provides access to excellent hunting and outdoor recreation, while its position along major transportation corridors has made it attractive to logistics and distribution companies. Recent investments in renewable energy projects, including wind farms in the surrounding area, have also brought new economic opportunities and attracted outside interest in local real estate.

The investor feeding frenzy in Tucumcari has been concentrated primarily in the town’s historic downtown district and properties with unique architectural features. While median home prices remain relatively affordable compared to other parts of New Mexico, the acceleration in price growth has outpaced local wage increases, making it more difficult for young families and service workers to achieve homeownership. The speculation has been particularly challenging for local residents who work in seasonal tourism businesses, as their incomes often fluctuate while housing costs continue to rise.

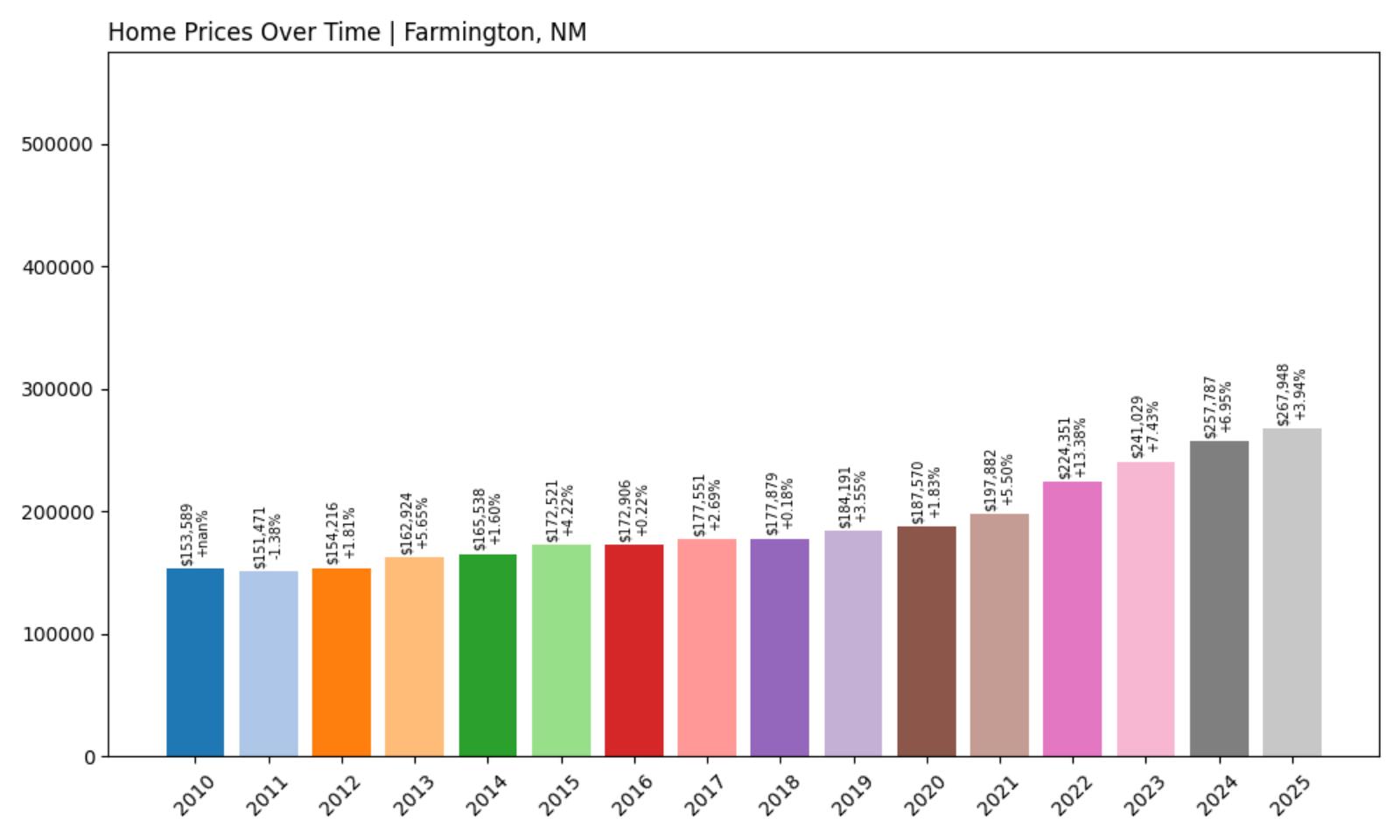

4. Farmington – Investor Feeding Frenzy Factor 59.65% (July 2025)

- Historical annual growth rate (2012–2022): 3.82%

- Recent annual growth rate (2022–2025): 6.10%

- Investor Feeding Frenzy Factor: 59.65%

- Current 2025 price: $267,948.13

Farmington’s emergence as an investment hotspot reflects the broader speculation affecting New Mexico’s energy-producing regions. The city’s price growth has accelerated from a steady 3.82% annually over the past decade to over 6% in recent years, creating a feeding frenzy factor approaching 60%. With median home prices now exceeding $267,000, this San Juan County hub has become increasingly expensive for local workers in the energy and agricultural sectors that drive the regional economy.

Farmington – Energy Sector Growth Fuels Speculation

As the largest city in northwestern New Mexico with a population of approximately 45,000, Farmington serves as the economic and cultural center for the Four Corners region. The city sits atop the San Juan Basin, one of the most productive natural gas fields in the United States, and has experienced significant economic growth due to increased energy production and related industrial development. This economic expansion has attracted investors from across the region who see opportunity in the area’s growing job market and relatively affordable housing costs compared to other energy boom towns.

Farmington’s housing market has been further influenced by its role as a regional healthcare and education center, home to San Juan Regional Medical Center and a branch of New Mexico State University. The city’s diverse economy, which includes energy, healthcare, education, and tourism related to nearby Mesa Verde National Park and Chaco Culture National Historical Park, has made it attractive to investors seeking stable rental markets. The recent development of new subdivisions and commercial districts has also drawn speculative interest from developers and investment groups.

However, the rapid price appreciation has created significant challenges for local residents, particularly those working in traditional industries like agriculture and small-scale energy services. Many longtime Farmington families find themselves competing with cash offers from investors, making it difficult to purchase homes in neighborhoods where they’ve lived for generations. The speculation has been particularly pronounced in the city’s more established neighborhoods, where well-maintained homes with mature landscaping command premium prices from out-of-area buyers.

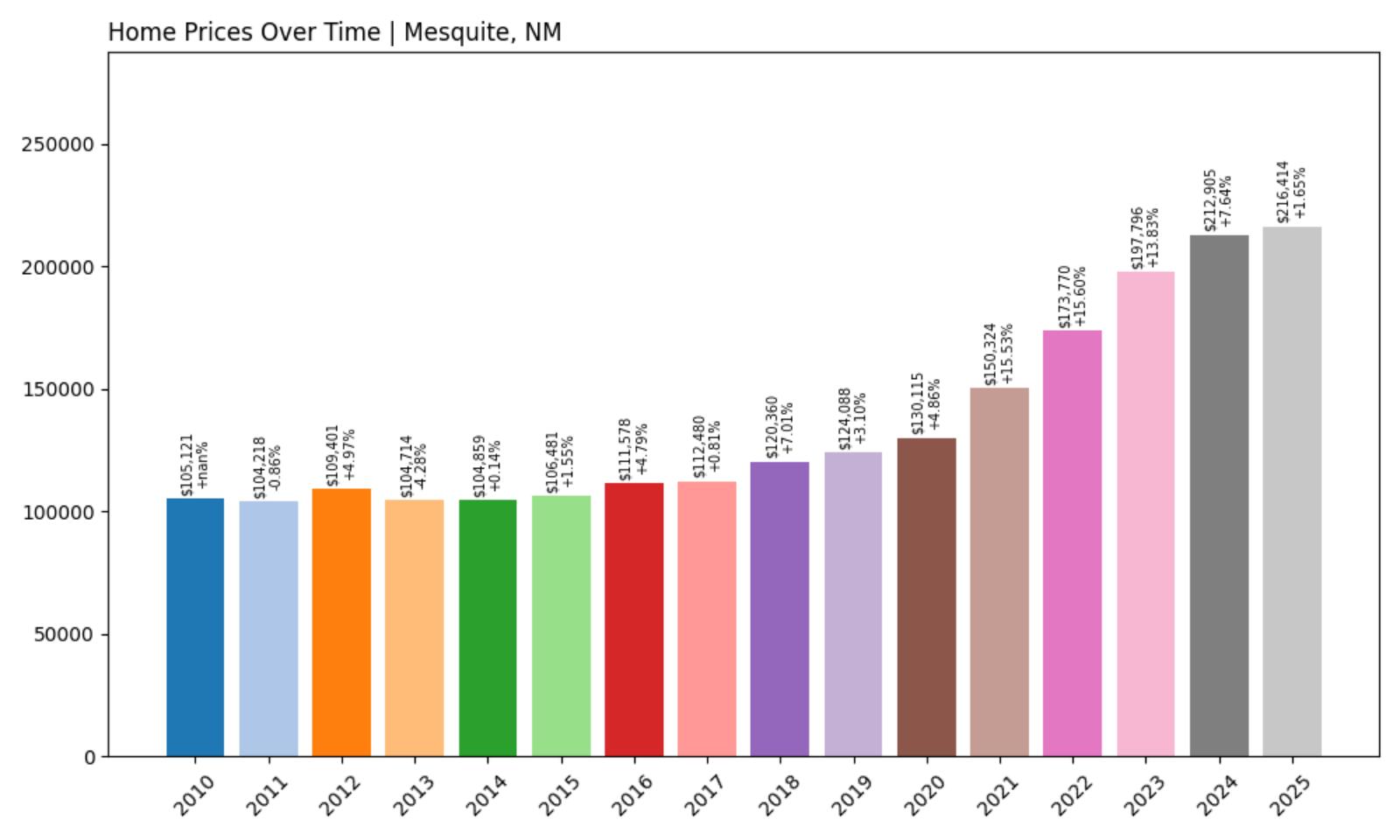

3. Mesquite – Investor Feeding Frenzy Factor 60.26% (July 2025)

- Historical annual growth rate (2012–2022): 4.74%

- Recent annual growth rate (2022–2025): 7.59%

- Investor Feeding Frenzy Factor: 60.26%

- Current 2025 price: $216,414.04

Mesquite’s housing market demonstrates how even communities with historically strong price growth can experience speculative bubbles. While the town maintained a healthy 4.74% annual appreciation rate over the past decade, recent years have seen this accelerate to over 7.5% annually, creating a 60% feeding frenzy factor. The median home price of approximately $216,000 reflects this rapid acceleration, putting homeownership out of reach for many local families in this small border community.

Mesquite – Border Location Attracts Cross-State Investment

Located in New Mexico’s far southern region near the Texas border, Mesquite occupies a unique position that has attracted significant investor attention in recent years. This small community of fewer than 2,000 residents sits in the fertile Mesilla Valley, where agriculture has traditionally been the primary economic driver. The area’s proximity to Las Cruces, just 45 miles to the northwest, and El Paso, Texas, approximately 50 miles to the southeast, has made it increasingly attractive to investors and commuters seeking more affordable housing options.

The town’s rural character and agricultural heritage have been key selling points for out-of-state buyers looking for authentic Southwestern living experiences. Many properties in the area feature small acreage, allowing for horse ownership, gardens, and other rural amenities that appeal to urban transplants. The recent completion of broadband infrastructure improvements has also made the area more viable for remote workers, further increasing investor interest in vacation rentals and second homes.

Unfortunately, the investor feeding frenzy has had significant impacts on the local agricultural community. Many farmworker families who have lived in the area for generations now find themselves unable to purchase homes, as properties that once sold for under $150,000 are now commanding prices above $200,000. This displacement has created challenges for local farms and ranches that depend on stable, long-term workers who live in the community year-round.

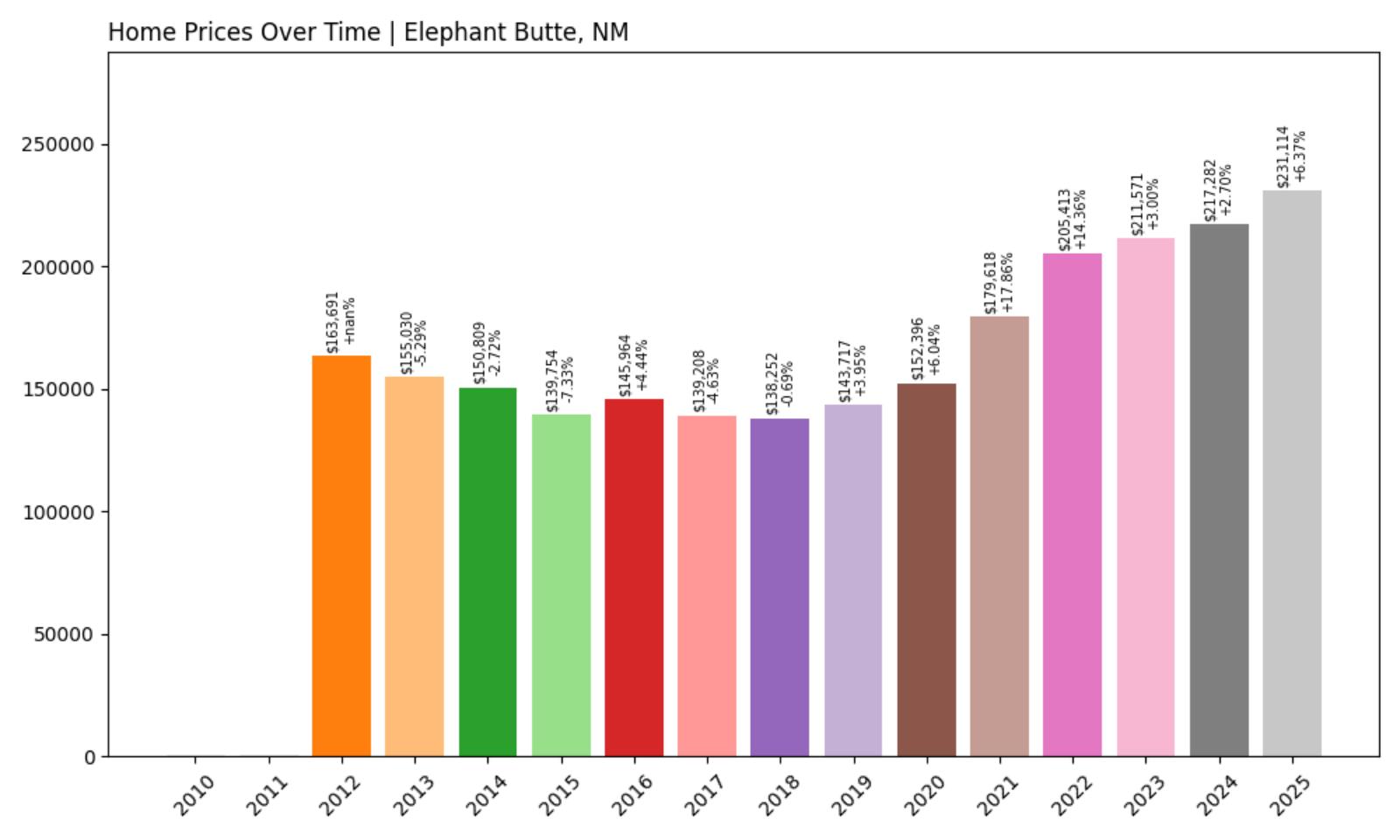

2. Elephant Butte – Investor Feeding Frenzy Factor 74.53% (July 2025)

- Historical annual growth rate (2012–2022): 2.30%

- Recent annual growth rate (2022–2025): 4.01%

- Investor Feeding Frenzy Factor: 74.53%

- Current 2025 price: $231,114.07

Elephant Butte’s transformation from a quiet lakeside community to a hot investment target reflects the broader trend of recreational areas becoming speculative markets. The town’s recent growth rate of just over 4% annually represents a significant acceleration from its historical 2.3% pace, resulting in a feeding frenzy factor of nearly 75%. With median home prices now exceeding $231,000, the community that once offered affordable lakefront living has become increasingly expensive for local residents.

Elephant Butte – Lake Recreation Drives Investment Interest

Situated along the shores of New Mexico’s largest lake, Elephant Butte has long been a popular destination for boating, fishing, and water sports enthusiasts from across the Southwest. The community of roughly 1,200 permanent residents swells dramatically during summer months as seasonal visitors flock to the area’s marinas, RV parks, and vacation rentals. This seasonal tourism pattern has made the area particularly attractive to investors seeking short-term rental properties, contributing significantly to the recent price acceleration.

The town’s housing market has been further influenced by its proximity to Truth or Consequences, just five miles to the north, and its position along Interstate 25. Many of the area’s homes offer direct lake access or spectacular views of the surrounding desert landscape, features that command premium prices in today’s market. The recent completion of infrastructure improvements, including upgraded utilities and road improvements, has made the area more appealing to out-of-state buyers looking for second homes or investment properties.

However, the rapid price increases have created challenges for local workers in the hospitality and recreation industries that drive the area’s economy. Many seasonal employees who once could afford to live year-round in Elephant Butte now find themselves priced out, creating labor shortages during peak tourism seasons and forcing longtime residents to relocate to less expensive areas further from the lake.

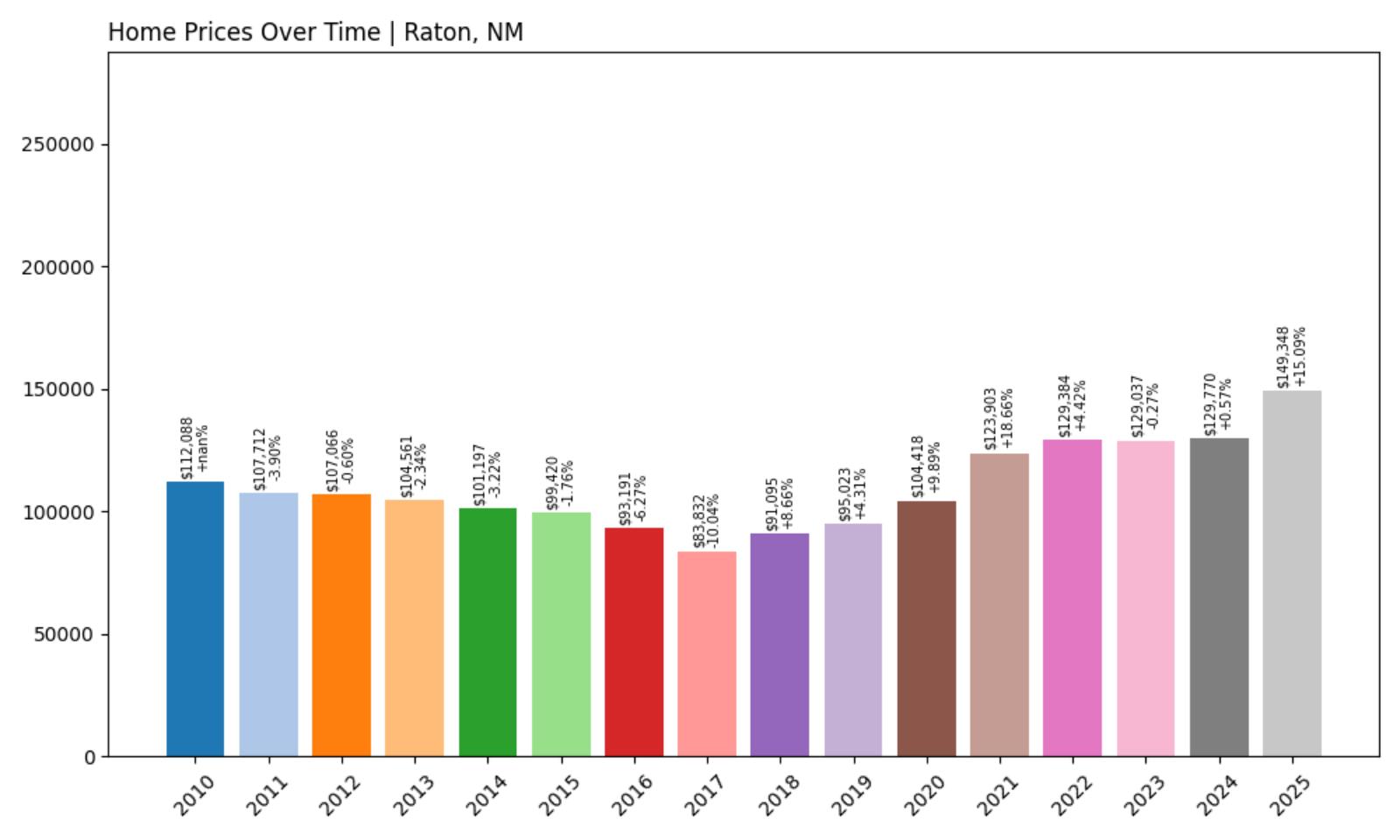

1. Raton – Investor Feeding Frenzy Factor 156.32% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 1.91%

- Recent annual growth rate (2022–2025): 4.90%

- Investor Feeding Frenzy Factor: 156.32%

- Current 2025 price: $149,348.36

Raton’s housing market exemplifies the extreme speculation that can occur when investor interest suddenly focuses on a previously stable community. The town’s price growth has accelerated from a modest 1.91% annually over the past decade to nearly 5% in just the last three years, creating an investor feeding frenzy factor of over 156%. This dramatic shift has pushed the median home price to nearly $150,000, making homeownership increasingly difficult for local families earning typical wages in this rural area.

Raton – Gateway Location Fueling Speculation

Located just eight miles south of the Colorado border along Interstate 25, Raton sits strategically positioned as New Mexico’s northern gateway. This small city of approximately 6,000 residents has historically served as a railroad hub and coal mining center, with the dramatic Raton Pass providing a scenic backdrop that now attracts out-of-state buyers. The town’s proximity to Colorado’s expensive housing markets has made it an attractive target for investors seeking affordable properties within driving distance of major metropolitan areas.

Raton’s historic downtown district features well-preserved early 20th-century architecture, including the beautifully restored Shuler Theater and numerous buildings listed on the National Register of Historic Places. The area’s outdoor recreation opportunities, including hunting, fishing, and hiking in the nearby Sangre de Cristo Mountains, have increased its appeal to buyers from urban areas. However, the rapid price acceleration has created significant challenges for local residents, many of whom work in agriculture, transportation, or tourism-related industries that haven’t seen corresponding wage increases.

The investor feeding frenzy has been particularly pronounced in Raton’s older neighborhoods, where charming bungalows and Victorian-era homes that once sold for under $100,000 are now commanding prices that put them out of reach for many local buyers. This speculation has created a concerning dynamic where longtime residents find themselves unable to afford homes in the community where they’ve lived and worked for years.