Would you like to save this?

Investor-driven housing shifts aren’t just hitting the coasts—New Hampshire is feeling the squeeze too. The Zillow Home Value Index shows that while the statewide median hit $502,500 in early 2025, some towns are breaking away from normal growth patterns in unsettling ways. In places like Claremont and Charlestown, home price acceleration is running far ahead of historic trends—clear signs of speculative pressure. These aren’t just hot markets—they’re investor feeding zones where rising prices are pushing working families out and reshaping who gets to live in these communities.

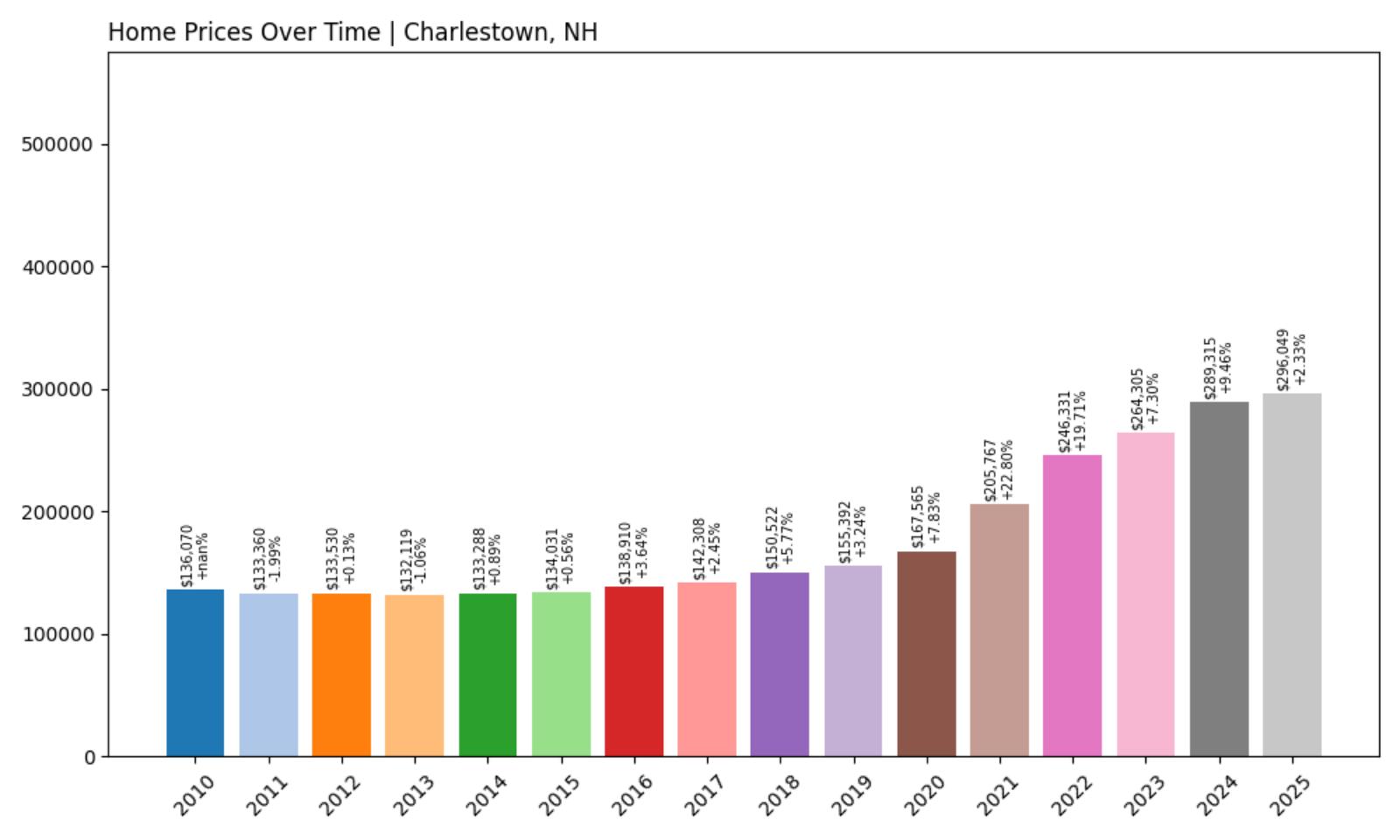

12. Charlestown – Investor Feeding Frenzy Factor 0.08% (July 2025)

- Historical annual growth rate (2012–2022): 6.31%

- Recent annual growth rate (2022–2025): 6.32%

- Investor Feeding Frenzy Factor: 0.08%

- Current 2025 price: $296,048.73

Charlestown demonstrates the most stable market conditions with only 0.08% acceleration beyond historical norms, showing recent growth of 6.32% that nearly perfectly matches its 6.31% historical pattern. The current median price of $296,048 makes Charlestown one of New Hampshire’s most affordable communities while maintaining steady, sustainable appreciation driven by organic demand rather than speculative investment.

Charlestown – Connecticut River Valley Stability

Situated in Sullivan County along the Connecticut River, Charlestown is a historic town of approximately 4,800 residents that has maintained its small-town character while providing affordable housing options for western New Hampshire. The community’s economy traditionally centered on manufacturing and agriculture, creating modest but stable economic growth that supported consistent housing demand. Charlestown’s location along major transportation routes provides access to employment centers while maintaining affordability.

The minimal 0.08% feeding frenzy factor makes Charlestown a rare example of market stability in New Hampshire’s heated housing environment. This stability reflects the town’s working-class character and distance from major tourist attractions, making it less attractive to speculative investors while serving the housing needs of local families. The current median price of $296,048 represents excellent value in New Hampshire’s expensive market, offering one of the few remaining opportunities for working families to achieve homeownership without competing against investor speculation.

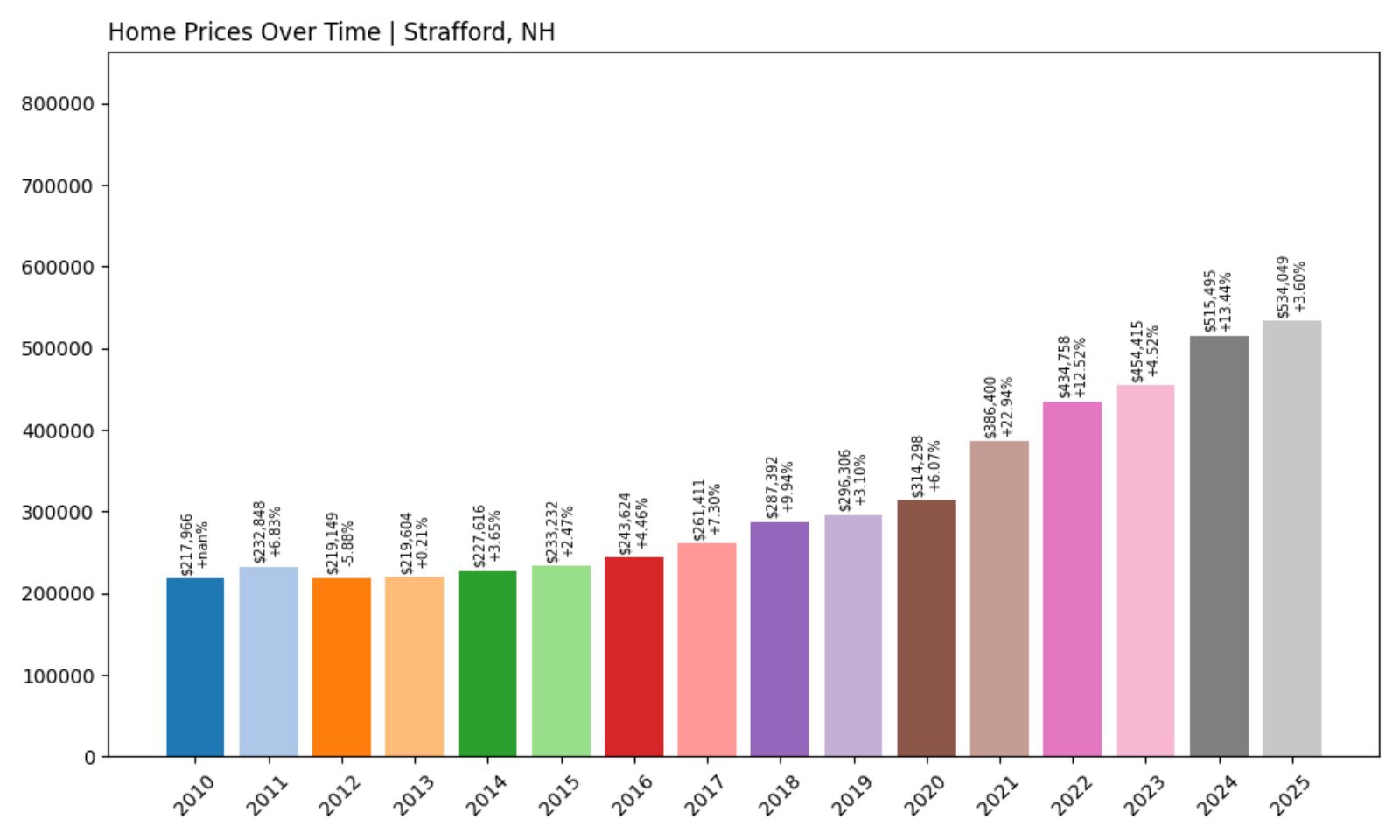

11. Strafford – Investor Feeding Frenzy Factor 0.09% (July 2025)

- Historical annual growth rate (2012–2022): 7.09%

- Recent annual growth rate (2022–2025): 7.10%

- Investor Feeding Frenzy Factor: 0.09%

- Current 2025 price: $534,048.96

Strafford shows virtually no deviation from historical patterns with only 0.09% acceleration, indicating that recent growth of 7.10% essentially matches its historical 7.09% rate. The current median price of $534,048 reflects steady appreciation driven by the town’s rural appeal and proximity to the Seacoast region, but without the speculative pressure affecting many other New Hampshire communities.

Strafford – Rural Stability in Strafford County

Kitchen Style?

Located in Strafford County, this rural community of approximately 4,200 residents offers a blend of agricultural heritage and modern convenience within commuting distance of Portsmouth and Dover. Strafford’s economy combines traditional farming with residential development, creating steady housing demand that has supported consistent 7% annual appreciation. The town’s location between major employment centers and recreational areas makes it attractive to families seeking rural living with urban access.

The minimal 0.09% feeding frenzy factor indicates that Strafford has maintained market stability despite broader regional pressures. This stability likely reflects the town’s rural character and distance from major tourist destinations, making it less attractive to speculative investors while remaining appealing to families seeking permanent residences. The current median price of $534,048 represents significant value for a community with good access to employment and amenities, though even stable appreciation at 7% annually challenges affordability for many working families.

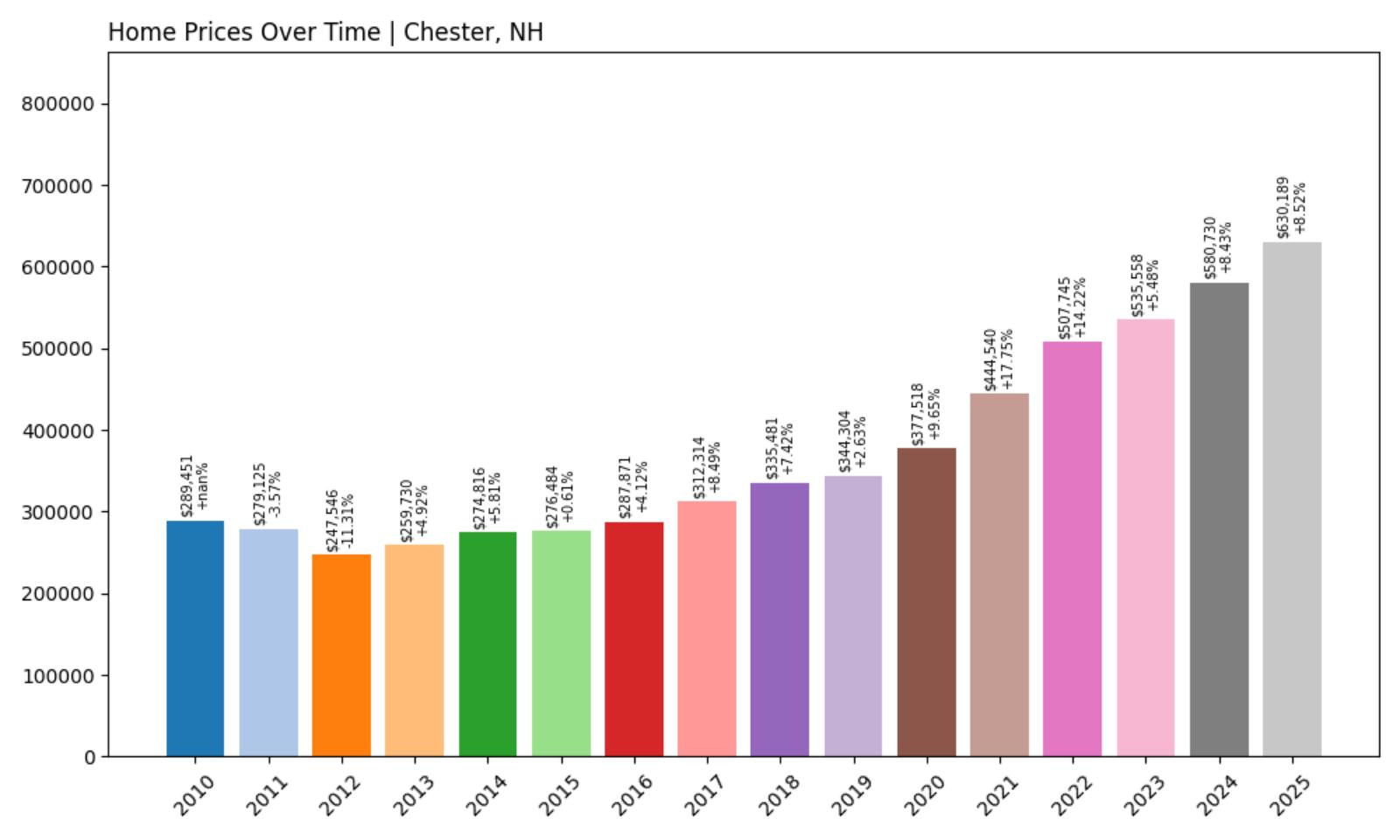

10. Chester – Investor Feeding Frenzy Factor 0.25% (July 2025)

- Historical annual growth rate (2012–2022): 7.45%

- Recent annual growth rate (2022–2025): 7.47%

- Investor Feeding Frenzy Factor: 0.25%

- Current 2025 price: $630,188.51

Chester exhibits virtually no feeding frenzy activity with just 0.25% acceleration, indicating that recent growth of 7.47% closely mirrors its robust historical 7.45% appreciation pattern. Despite the high current median price of $630,188, the stable growth pattern suggests this expensive market is driven by fundamental demand rather than speculative investment, though affordability remains a significant challenge for most families.

Chester – Premium Rockingham County Community

This Rockingham County town of approximately 5,000 residents represents one of New Hampshire’s premier residential communities, offering excellent schools, scenic beauty, and convenient access to both Manchester and the Massachusetts border. Chester’s historical growth rate of 7.45% reflected strong fundamental demand from affluent families attracted to its rural character and top-rated school system. The current median price of $630,188 places Chester among New Hampshire’s more expensive communities.

The minimal 0.25% feeding frenzy factor suggests that Chester’s high prices are supported by genuine demand rather than speculative investment pressure. The town’s strict zoning laws and large lot requirements naturally limit development, maintaining exclusivity while supporting steady appreciation. However, even without investor-driven acceleration, Chester’s prices have grown beyond the reach of middle-class families, demonstrating how even stable markets can become unaffordable when underlying demand consistently exceeds supply.

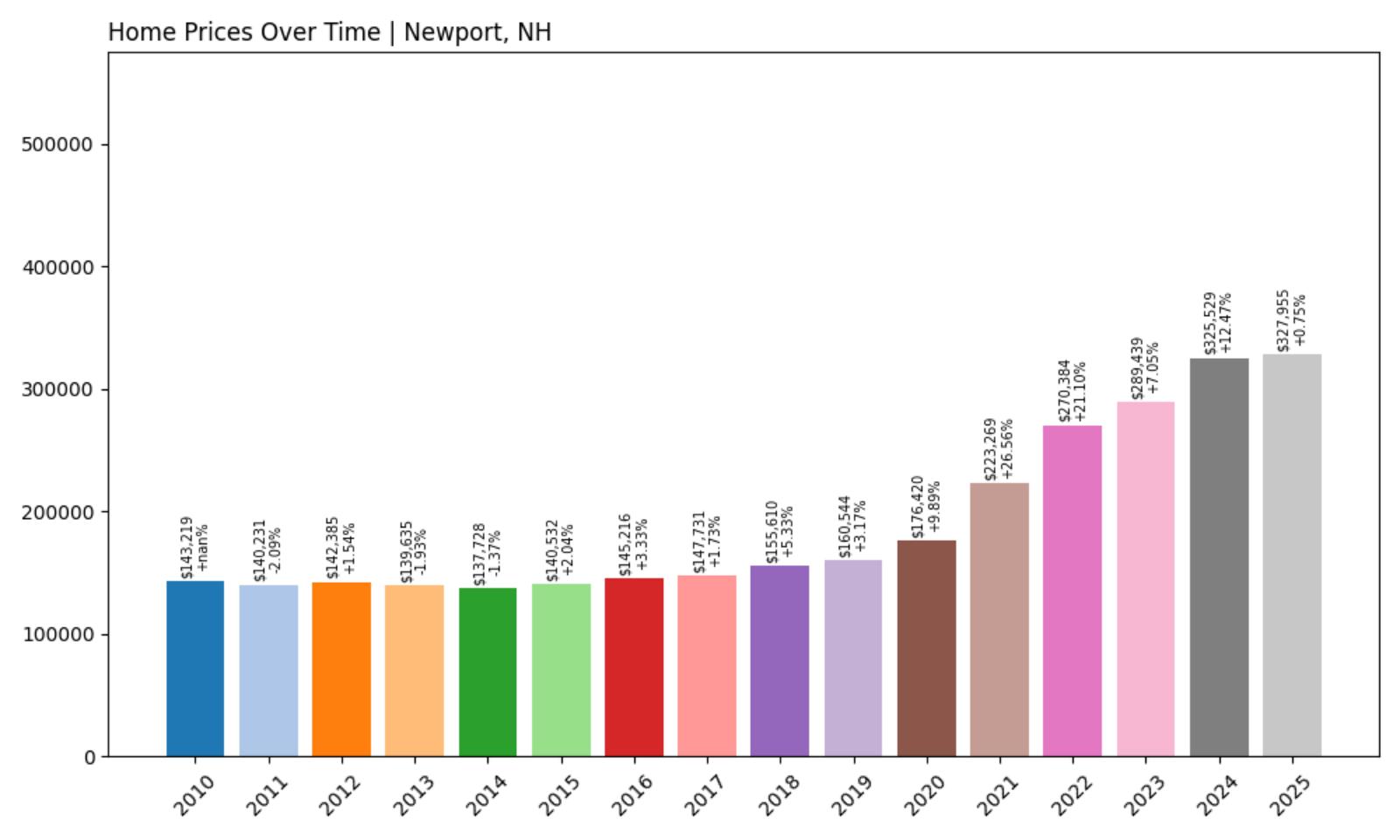

9. Newport – Investor Feeding Frenzy Factor 0.34% (July 2025)

- Historical annual growth rate (2012–2022): 6.62%

- Recent annual growth rate (2022–2025): 6.65%

- Investor Feeding Frenzy Factor: 0.34%

- Current 2025 price: $327,954.82

Newport shows minimal feeding frenzy activity with only 0.34% acceleration beyond its historical 6.62% growth rate, suggesting a more stable market where recent growth of 6.65% closely matches long-term patterns. The current median price of $327,954 makes Newport one of the more affordable communities on this list, with price growth that appears driven by organic demand rather than speculative investment pressure.

Newport – Stable Market in Sullivan County

Located in Sullivan County, Newport serves as a regional center for approximately 6,200 residents, offering essential services and employment opportunities for the surrounding rural area. The town’s economy traditionally relied on manufacturing and agriculture, creating steady but modest economic growth that supported consistent housing demand. Newport’s current median price of $327,954 reflects its role as an affordable option for working families in western New Hampshire.

The minimal 0.34% feeding frenzy factor indicates that Newport has largely avoided the speculative pressure affecting other New Hampshire communities. This stability likely reflects the town’s distance from major employment centers and tourist destinations, making it less attractive to investors seeking quick appreciation or rental income. For local families, this represents a rare opportunity to purchase homes without competing against speculative investment, though even Newport’s modest prices continue rising at a pace that challenges local wage growth.

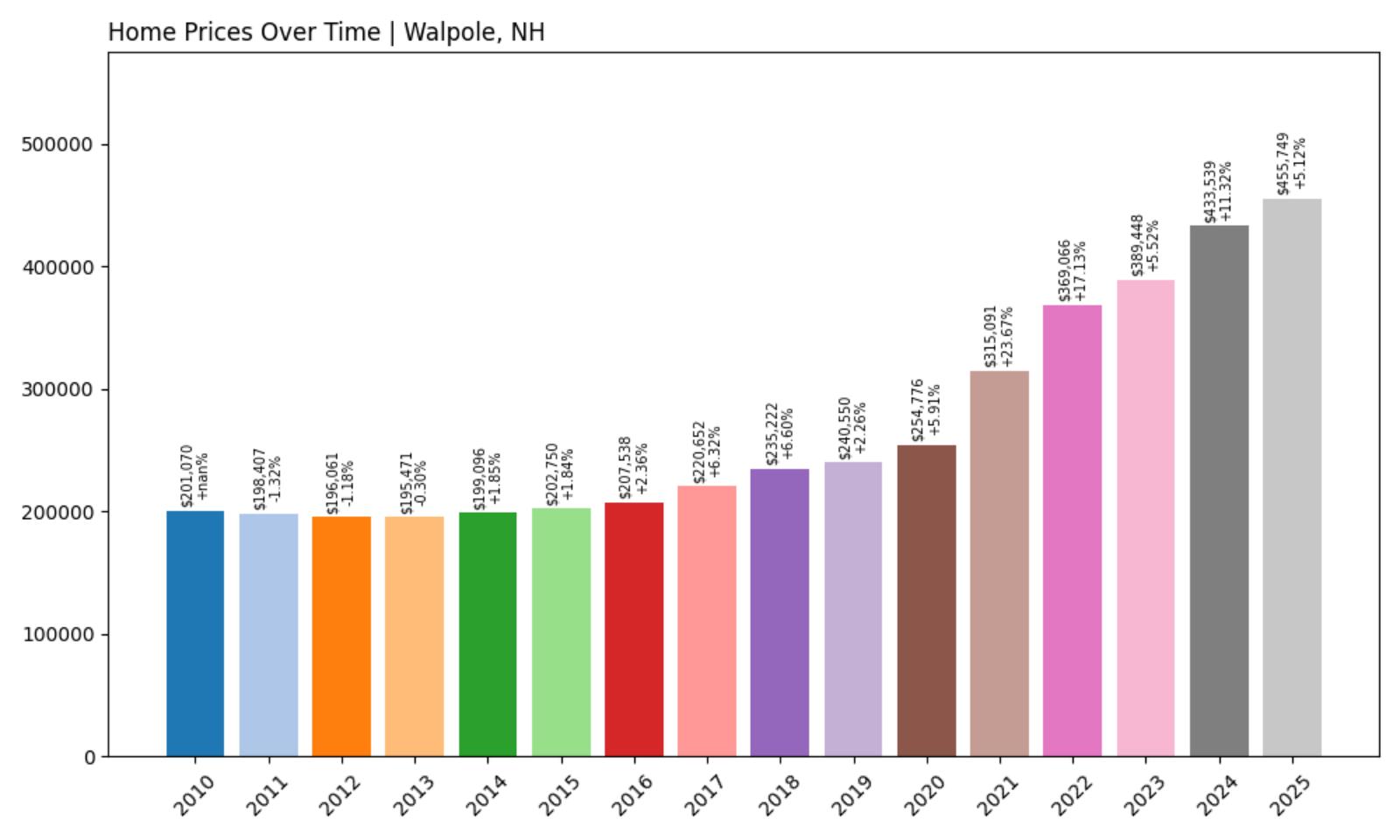

8. Walpole – Investor Feeding Frenzy Factor 11.57% (July 2025)

- Historical annual growth rate (2012–2022): 6.53%

- Recent annual growth rate (2022–2025): 7.29%

- Investor Feeding Frenzy Factor: 11.57%

- Current 2025 price: $455,748.59

Walpole demonstrates how even modest acceleration can signal feeding frenzy conditions, with recent growth exceeding historical patterns by 11.57%. The increase from 6.53% to 7.29% annual growth might appear gradual, but it represents significant additional pressure in a market where the current median price of $455,748 already challenges local affordability. This level of acceleration often marks the early stages of more intense investor activity.

Walpole – Connecticut River Valley Appeal

Situated in Sullivan County along the Connecticut River, Walpole is a picturesque town of roughly 3,600 residents known for its historic downtown and cultural attractions. The community’s location between Keene and the Upper Valley provides access to employment and amenities while maintaining small-town character. Walpole’s historical growth rate of 6.53% reflected steady demand from families attracted to its schools, cultural amenities, and river valley setting.

The 11.57% feeding frenzy factor suggests early-stage investor interest that could accelerate if left unchecked. Walpole’s combination of historic charm, cultural attractions, and scenic beauty makes it appealing to vacation home buyers and investors seeking properties with rental potential. The current median price of $455,748 remains within reach for many families, but the accelerating growth pattern indicates increasing competition from investors who can afford to pay above asking prices, gradually pushing out local buyers.

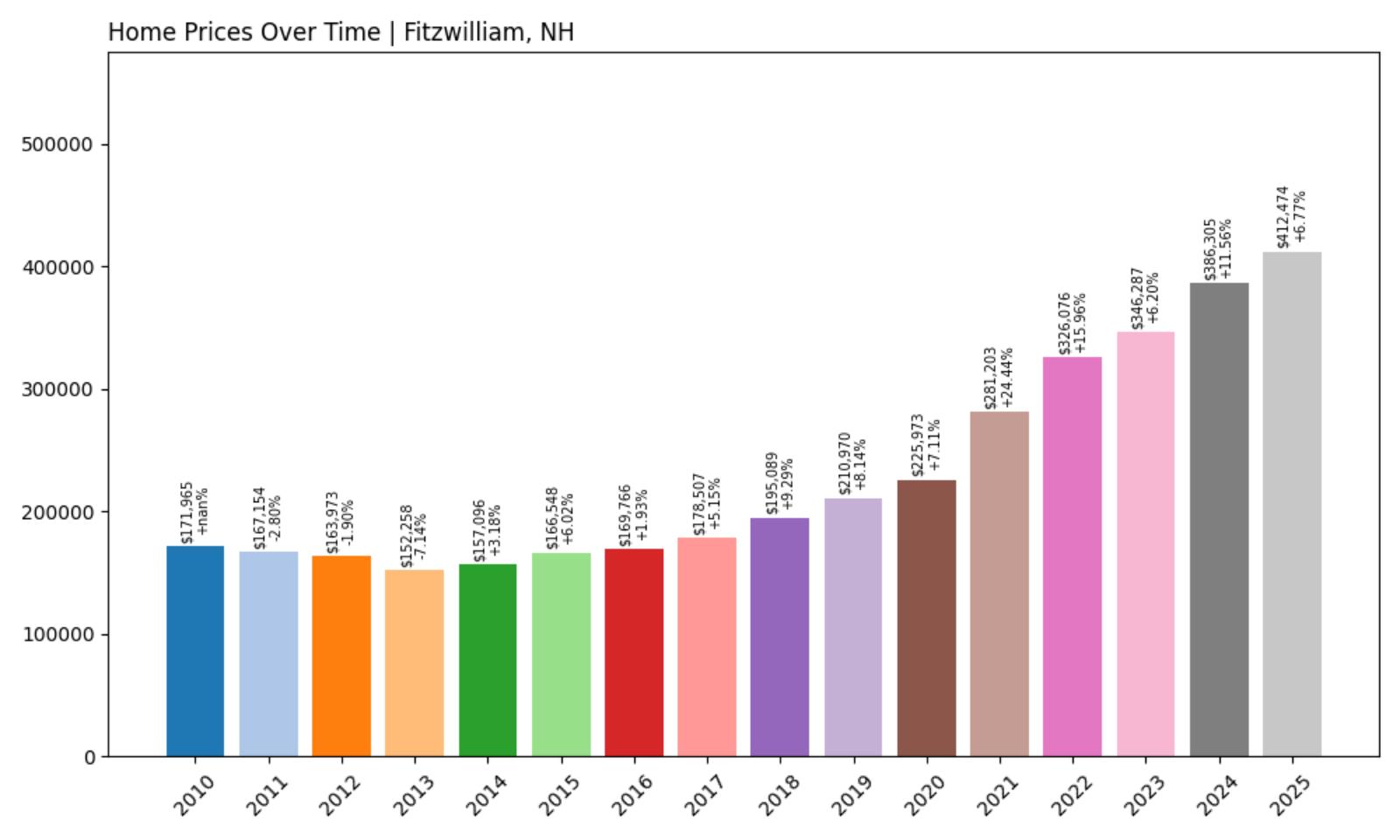

7. Fitzwilliam – Investor Feeding Frenzy Factor 14.53% (July 2025)

- Historical annual growth rate (2012–2022): 7.12%

- Recent annual growth rate (2022–2025): 8.15%

- Investor Feeding Frenzy Factor: 14.53%

- Current 2025 price: $412,473.84

Fitzwilliam exemplifies how communities with solid historical appreciation can still experience concerning acceleration, with recent growth pushing 14.53% beyond its healthy 7.12% historical pattern. The current price of $412,473 positions the town in the middle tier of New Hampshire markets, but the acceleration to 8.15% annual growth indicates growing investor interest in previously stable communities.

Fitzwilliam – Monadnock Region Under Pressure

This Cheshire County town of approximately 2,400 residents sits in the scenic Monadnock Region, offering rural character with reasonable access to employment centers in Massachusetts and southern New Hampshire. Fitzwilliam’s location near the Massachusetts border and Mount Monadnock makes it attractive to both year-round residents and recreational property buyers. The town’s historical growth rate of 7.12% reflected steady appreciation driven by its natural beauty and convenient location.

The 14.53% feeding frenzy factor signals that investor activity is beginning to distort this traditionally stable market. Fitzwilliam’s appeal as a rural retreat within commuting distance of urban employment has attracted increased attention from investors seeking properties for vacation rentals and second homes. The current median price of $412,473 remains accessible to middle-class families, but the accelerating growth rate suggests this affordability window may be narrowing as speculative pressure intensifies.

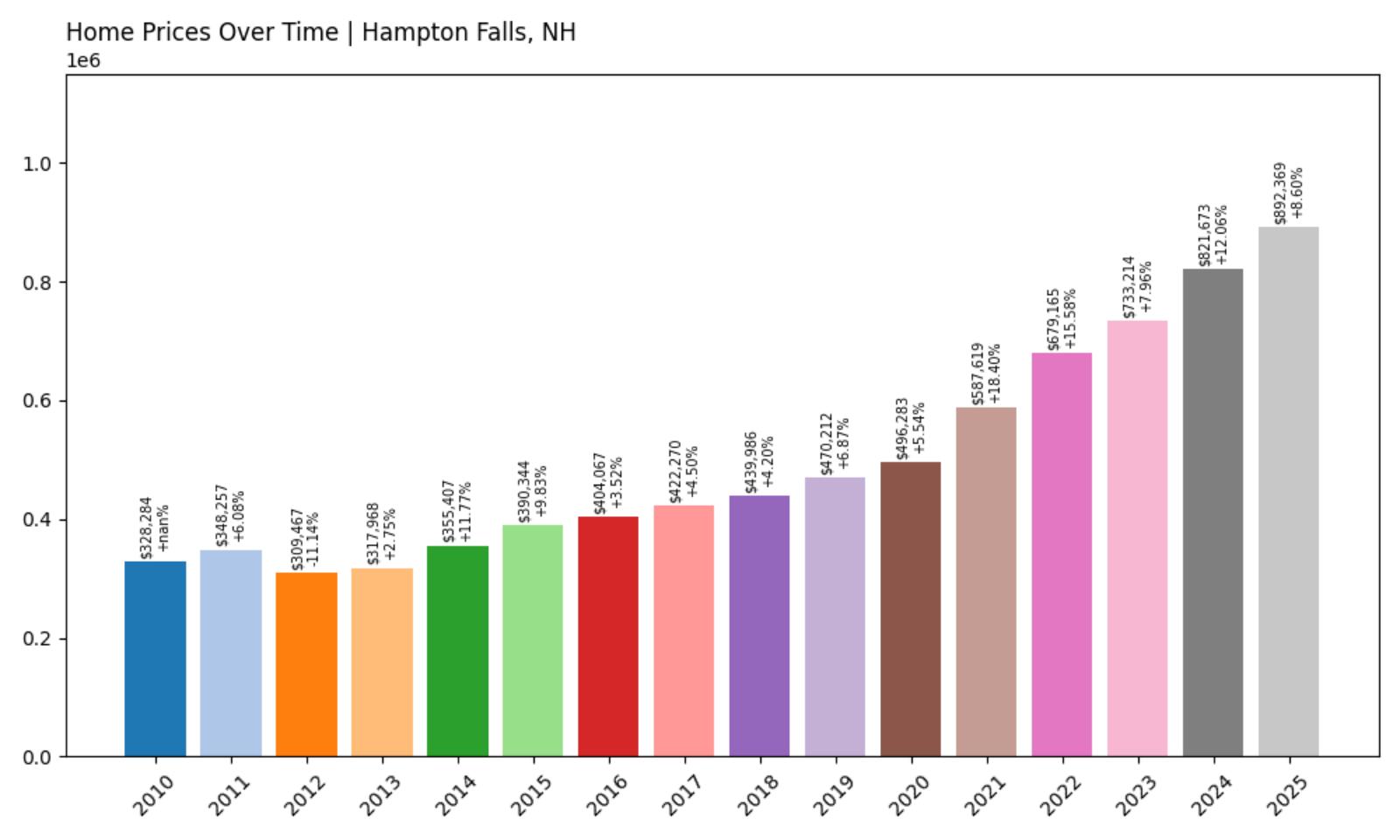

6. Hampton Falls – Investor Feeding Frenzy Factor 16.51% (July 2025)

- Historical annual growth rate (2012–2022): 8.18%

- Recent annual growth rate (2022–2025): 9.53%

- Investor Feeding Frenzy Factor: 16.51%

- Current 2025 price: $892,369.30

Hampton Falls shows how even luxury markets can experience feeding frenzies, with prices accelerating 16.51% beyond an already impressive 8.18% historical growth rate. The current median price of $892,369 makes this one of New Hampshire’s most expensive communities, yet investor activity continues to push prices higher at an unsustainable 9.53% annual rate that far exceeds income growth in the region.

Hampton Falls – Exclusive Seacoast Community

Located in Rockingham County near the Massachusetts border, Hampton Falls is an affluent seacoast community of approximately 2,300 residents known for its excellent schools and proximity to both Boston and New Hampshire’s beaches. The town’s historical growth rate of 8.18% already reflected its premium status and limited housing supply. At nearly $900,000, the current median price represents some of New Hampshire’s most expensive real estate, traditionally accessible only to high-income families and second-home buyers.

Despite its already elevated prices, the 16.51% feeding frenzy factor indicates that investor speculation is pushing this luxury market even further out of reach. The acceleration to 9.53% annual growth suggests intense competition among investors, vacation home buyers, and wealthy families relocating from Massachusetts. Hampton Falls’ combination of top-rated schools, seacoast location, and commuter access to Boston creates multiple investment incentives that continue driving prices beyond what even upper-middle-class families can afford.

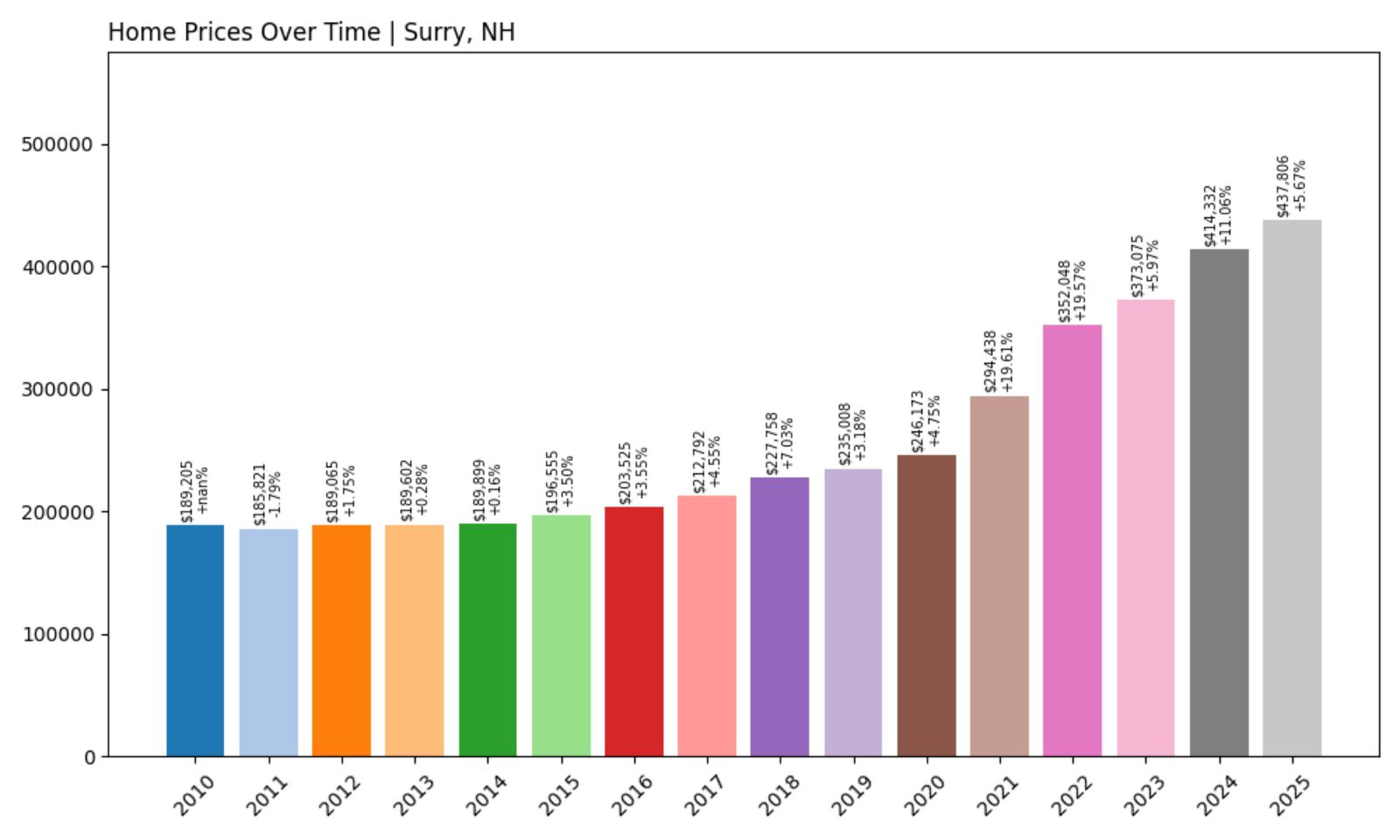

5. Surry – Investor Feeding Frenzy Factor 17.52% (July 2025)

- Historical annual growth rate (2012–2022): 6.41%

- Recent annual growth rate (2022–2025): 7.54%

- Investor Feeding Frenzy Factor: 17.52%

- Current 2025 price: $437,806.19

Surry demonstrates how rural communities with strong historical appreciation can still experience feeding frenzy conditions, with recent growth accelerating 17.52% beyond its solid 6.41% historical rate. The current price of $437,806 reflects the town’s desirability and proximity to more expensive markets, but the acceleration to 7.54% annual growth indicates investor pressure is intensifying even in established high-value communities.

Surry – Rural Retreat Under Investment Pressure

This small Cheshire County town of roughly 800 residents epitomizes rural New Hampshire living, with its scenic countryside and proximity to Keene providing an attractive combination of tranquility and convenience. Surry’s historically strong growth rate of 6.41% already reflected its desirability among families seeking rural properties within commuting distance of employment centers. The current median price of $437,806 places it in the upper tier of New Hampshire communities, yet still attracts investment interest.

The 17.52% feeding frenzy factor suggests that even expensive rural markets aren’t immune to speculative pressure. Surry’s appeal to vacation home buyers and investors seeking properties for short-term rental conversion has intensified competition beyond what local residents can afford. The town’s limited housing stock and restrictive zoning make new construction challenging, concentrating investor pressure on existing homes and further accelerating price growth beyond sustainable levels for working families.

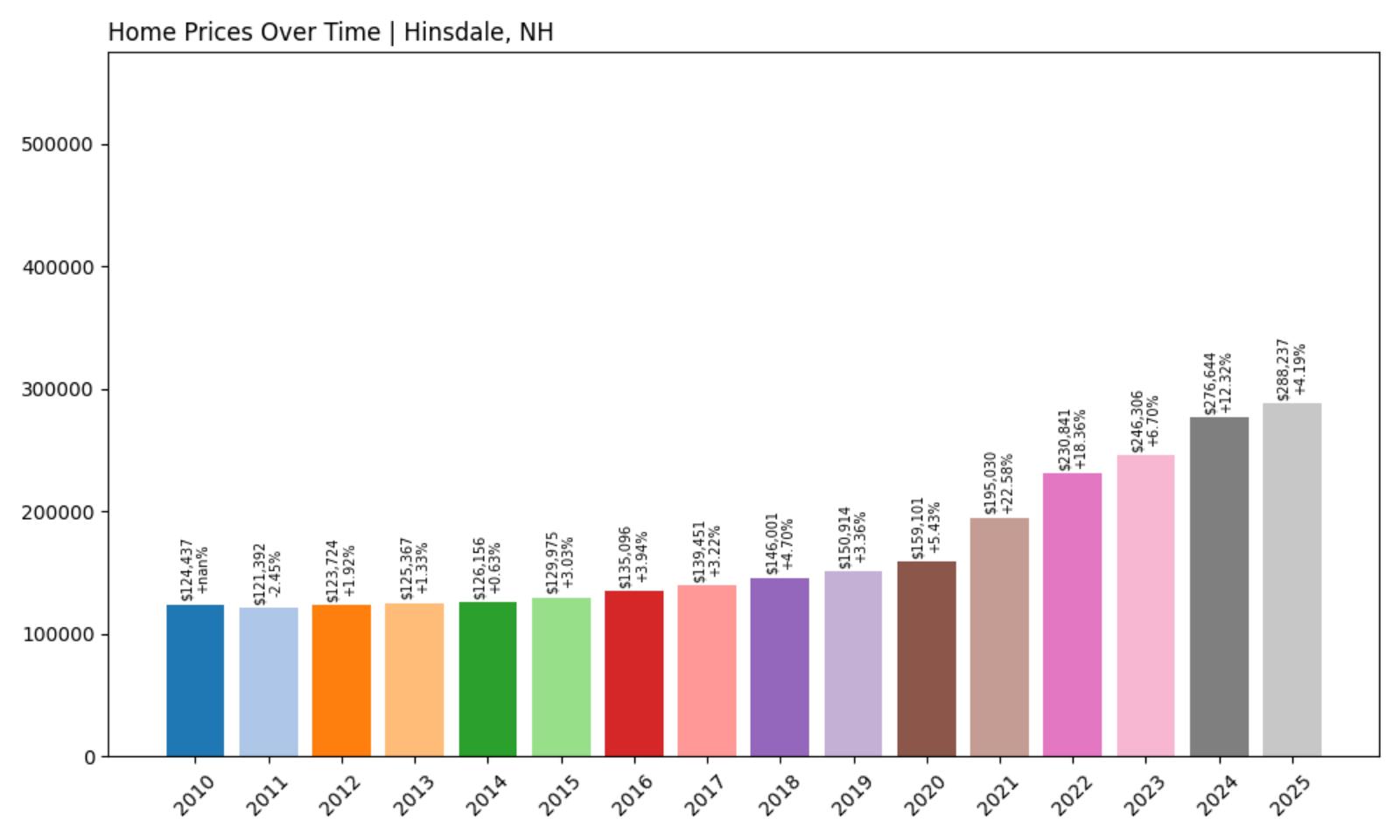

4. Hinsdale – Investor Feeding Frenzy Factor 19.38% (July 2025)

- Historical annual growth rate (2012–2022): 6.44%

- Recent annual growth rate (2022–2025): 7.68%

- Investor Feeding Frenzy Factor: 19.38%

- Current 2025 price: $288,236.58

Hinsdale shows how even towns with stronger historical growth rates can experience investor feeding frenzies, with recent acceleration pushing growth 19.38% beyond its already robust 6.44% historical pattern. The current median price of $288,236 makes Hinsdale one of the most affordable communities on this list, but the rapid acceleration from 6.44% to 7.68% annual growth signals intensifying investment pressure even in smaller markets.

Hinsdale – Border Town Attracting Investment Attention

Located in Cheshire County along the Connecticut River border with Vermont, Hinsdale is a small town of approximately 4,000 residents that has historically offered some of New Hampshire’s most affordable housing. The community’s proximity to Brattleboro, Vermont, and its position along major transportation routes has always provided appeal to commuters and families seeking value. However, the 19.38% feeding frenzy factor suggests that investors are now targeting even small border communities for their portfolios.

Hinsdale’s economy has traditionally been anchored by manufacturing and small businesses, creating a stable but modest economic base. The current median price of $288,236 represents excellent value in New Hampshire’s expensive housing market, but the accelerating growth rate indicates that this affordability window may be closing rapidly. Local residents report increased competition from cash buyers and investors, making it increasingly difficult for local families to purchase homes in their own community.

3. Plymouth – Investor Feeding Frenzy Factor 23.10% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 5.20%

- Recent annual growth rate (2022–2025): 6.40%

- Investor Feeding Frenzy Factor: 23.10%

- Current 2025 price: $376,935.04

Plymouth demonstrates how college towns aren’t immune to investor feeding frenzies, with prices accelerating 23.10% beyond historical trends. The increase from 5.20% to 6.40% annual growth might seem modest, but it represents significant additional pressure on families in a community where housing demand is already constrained by the presence of Plymouth State University. The current median price of $376,935 reflects both the town’s desirability and increasing speculative pressure.

Plymouth – College Town Faces Housing Crunch

Home to Plymouth State University and approximately 6,200 residents, this Grafton County town serves as both an educational center and gateway to the White Mountains region. Plymouth’s economy revolves around the university, tourism, and outdoor recreation, creating natural housing demand that’s now being amplified by investor speculation. The town’s location at the confluence of the Pemigewasset and Baker rivers, combined with easy access to skiing and hiking destinations, makes it attractive to both permanent residents and vacation home investors.

The 23.10% feeding frenzy factor indicates that investor activity is adding significant pressure to an already constrained housing market. University enrollment creates consistent rental demand, making Plymouth attractive to investors converting homes to student housing. This dynamic forces working families and non-student residents to compete not only with typical market forces but also with investors capitalizing on the college town premium, driving prices well beyond what local wages can support.

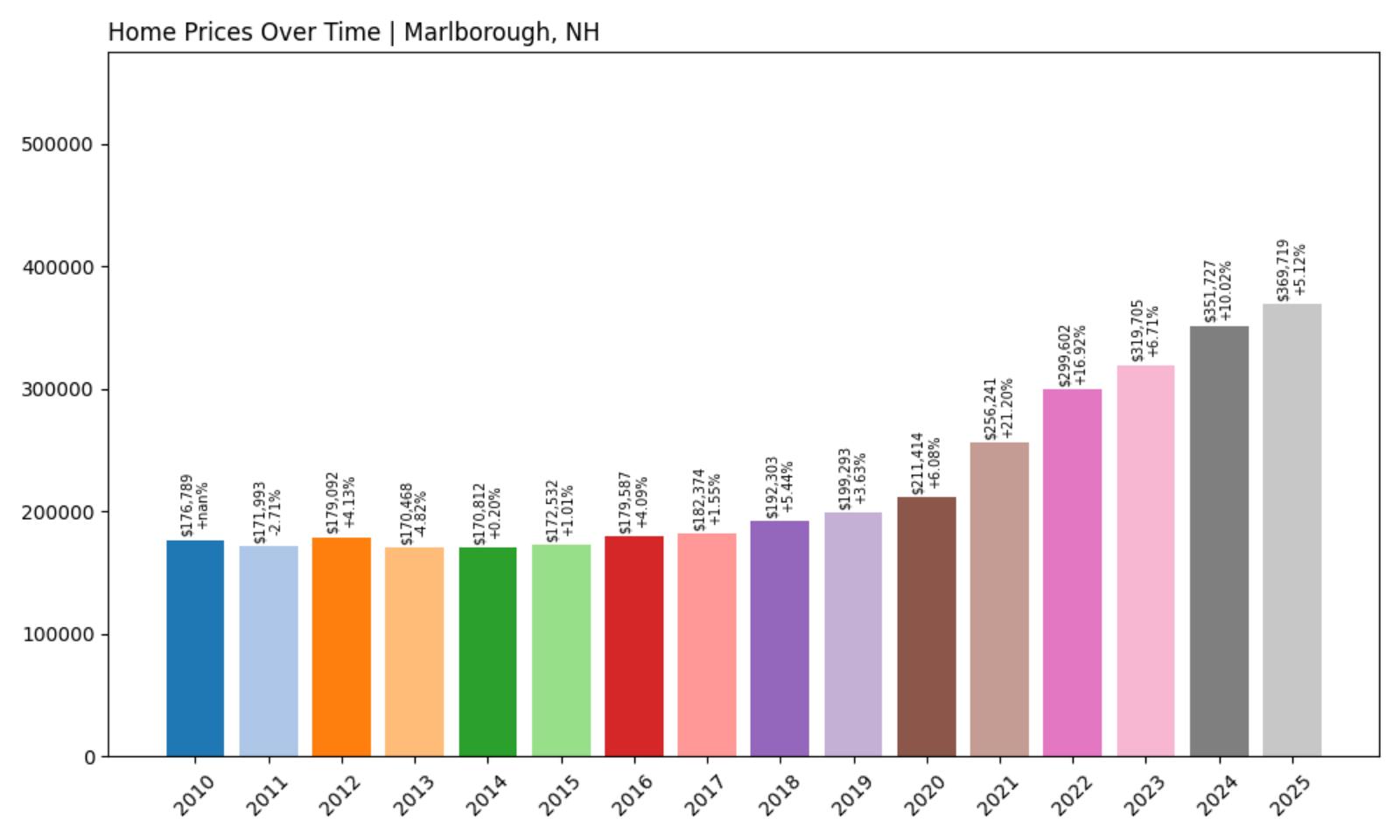

2. Marlborough – Investor Feeding Frenzy Factor 37.51% (July 2025)

- Historical annual growth rate (2012–2022): 5.28%

- Recent annual growth rate (2022–2025): 7.26%

- Investor Feeding Frenzy Factor: 37.51%

- Current 2025 price: $369,718.57

Marlborough ranks second with a feeding frenzy factor just slightly below Claremont’s, showing how investor activity is accelerating prices 37.51% beyond historical norms. The town’s recent growth rate of 7.26% represents a substantial increase from its traditional 5.28% annual appreciation. At $369,718, Marlborough homes are priced significantly higher than Claremont but still below the state median, creating a sweet spot for investors.

Marlborough – Small Town Charm Under Pressure

This quiet Cheshire County town of roughly 2,100 residents sits in the Monadnock Region, known for its scenic beauty and small-town atmosphere. Marlborough’s location along Route 101 provides convenient access to Keene and the broader region, while maintaining the rural character that attracts both residents and investors. The town’s relatively modest current price of $369,718 masks the intense pressure families face as investor activity drives prices up nearly 40% faster than historical patterns.

The community has traditionally attracted young families and retirees seeking affordable rural living within commuting distance of larger employment centers. However, the 37.51% feeding frenzy factor suggests external investment pressure is fundamentally altering the local housing market. Real estate professionals report increased activity from out-of-state investors targeting properties for short-term rentals and rental conversions, putting additional strain on an already limited housing stock.

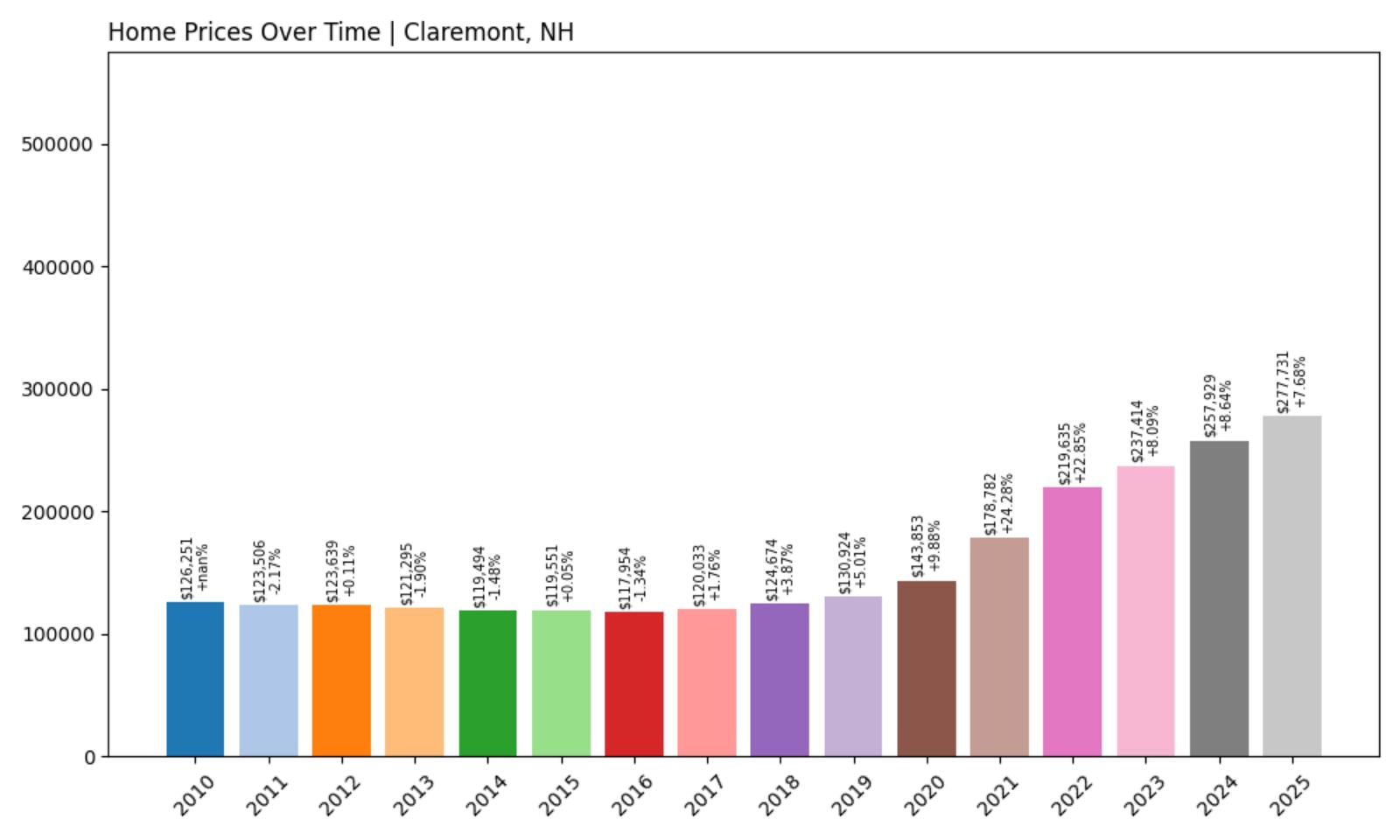

1. Claremont – Investor Feeding Frenzy Factor 37.58% (July 2025)

- Historical annual growth rate (2012–2022): 5.91%

- Recent annual growth rate (2022–2025): 8.14%

- Investor Feeding Frenzy Factor: 37.58%

- Current 2025 price: $277,731.22

Claremont shows the most severe investor feeding frenzy in New Hampshire, with recent price growth accelerating 37.58% beyond its historical pattern. The jump from 5.91% annual growth to 8.14% represents a significant departure from the city’s traditional market dynamics. Despite the acceleration, homes in Claremont remain relatively affordable at $277,731, making it an attractive target for investors seeking entry-level properties in a state where the median home price exceeds $500,000.

Claremont – Gateway City Experiencing Rapid Transformation

Located in Sullivan County along the Connecticut River, Claremont serves as a regional hub for western New Hampshire with a population of approximately 12,800. The city’s affordability relative to other New Hampshire markets has made it a magnet for investors, particularly those converting single-family homes to rental properties. Claremont’s proximity to Vermont and its position along major transportation corridors has historically made it attractive to commuters, but the recent price acceleration suggests speculative investment is outpacing organic demand.

The city’s economy traditionally relied on manufacturing, but recent economic diversification efforts have attracted new businesses and residents. However, the 37.58% feeding frenzy factor indicates that price growth is being driven more by investor speculation than fundamental economic improvements. Local officials have expressed concern about long-term residents being priced out of a community where many families have lived for generations.

Haven't Seen Yet

Curated from our most popular plans. Click any to explore.