🔥 Would you like to save this?

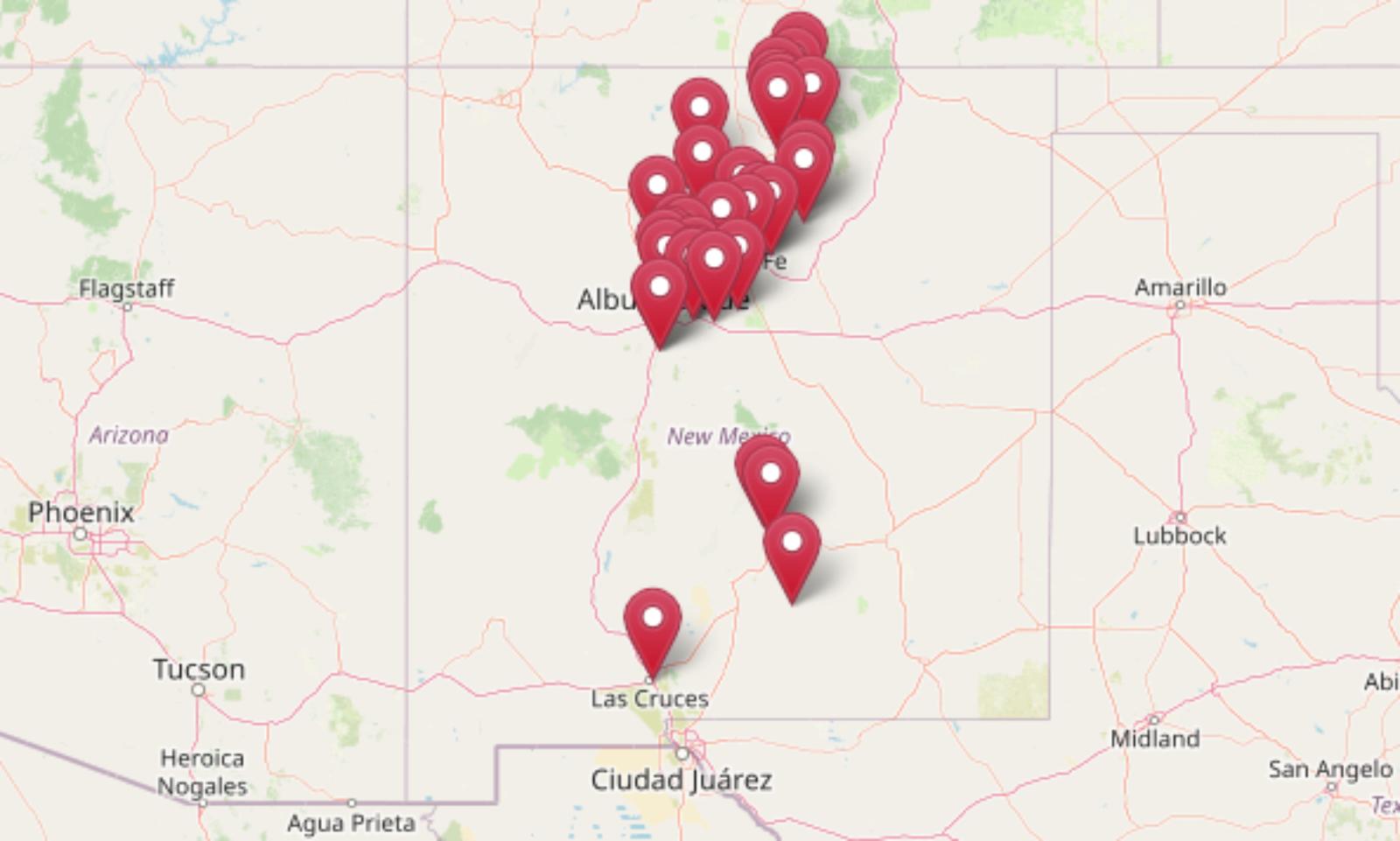

Think New Mexico still means wide-open spaces and budget-friendly real estate? Not in these 33 towns. The Zillow Home Value Index shows that some of the state’s top markets have climbed fast—so fast, in fact, that a few now rival prices in big coastal cities. From artsy enclaves to mountain retreats and high-income hubs, these communities are commanding big dollars thanks to a mix of lifestyle perks, limited housing, and out-of-state buyers willing to pay for the view. Some towns have held steady, others exploded post-2020—but either way, affordable they are not.

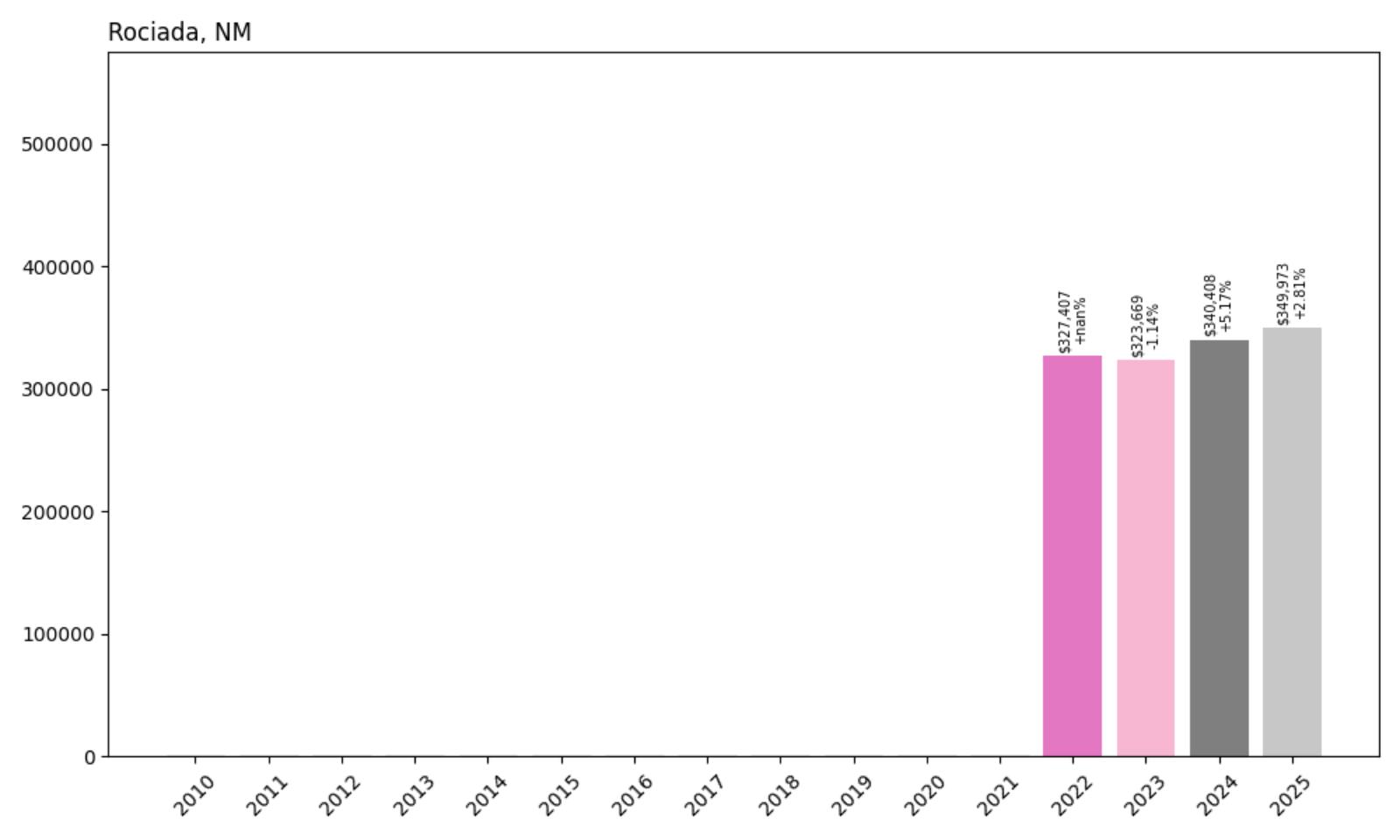

33. Rociada – 6.9% Home Price Increase Since 2022

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $NA

- 2020: $NA

- 2021: $NA

- 2022: $327,407

- 2023: $323,669 (−$3,738, −1.14% from previous year)

- 2024: $340,408 (+$16,739, +5.17% from previous year)

- 2025: $349,973 (+$9,565, +2.81% from previous year)

Rociada’s home values have risen modestly since Zillow first recorded prices in 2022. The town posted a 6.9% increase over three years, with prices reaching $349,973 in June 2025. The trend includes a small dip in 2023, followed by steady gains in 2024 and 2025. While the market hasn’t experienced explosive growth like other parts of New Mexico, it has maintained a consistent upward trajectory. That suggests a stable demand for property in the area, even as broader market conditions fluctuate.

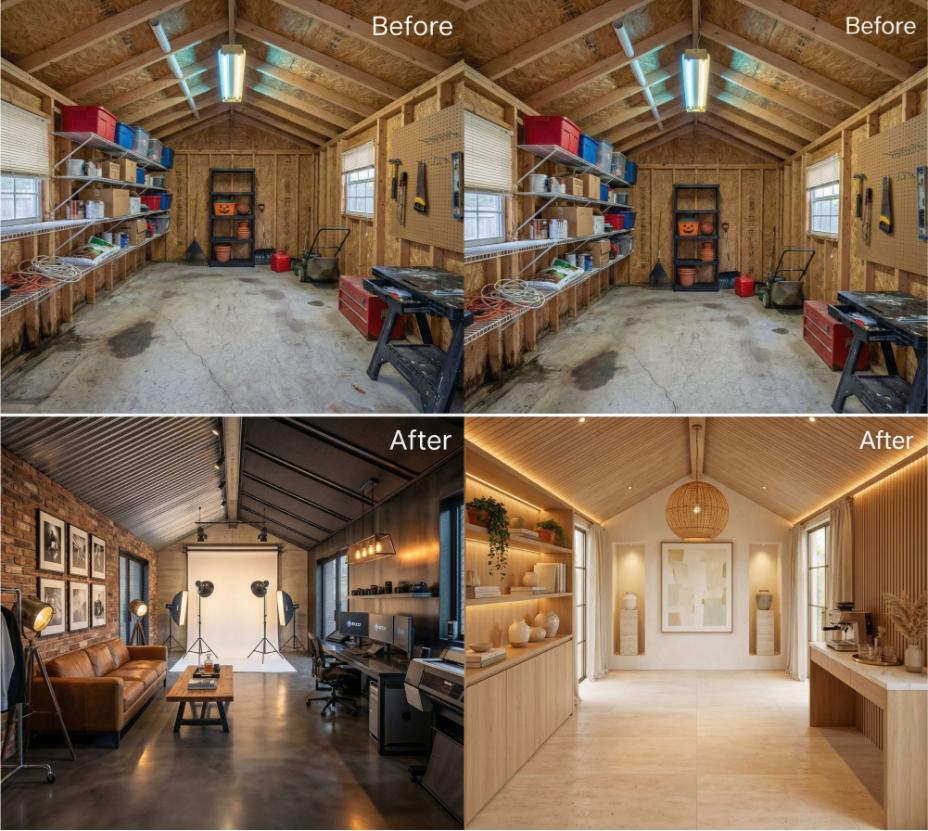

In order to come up with the very specific design ideas, we create most designs with the assistance of state-of-the-art AI interior design software.

Rociada – Remote Living With Scenic Value

Rociada is a rural community located in the Sangre de Cristo Mountains, northwest of Las Vegas, New Mexico. It’s known for its alpine setting, tall pine forests, and cool summers—making it a quiet retreat for second-home buyers and retirees. The town’s isolation can be both a benefit and a drawback: access to services is limited, but those seeking privacy and natural beauty find Rociada appealing. The modest price appreciation over the past few years reflects that niche demand rather than widespread investor interest.

Unlike some of New Mexico’s more tourist-driven markets, Rociada remains relatively unknown outside of local circles. There’s no major resort or commercial district, but the area does boast small ranch properties, cabins, and scenic drives like State Road 105. The real estate inventory is limited, which helps maintain home values even during softer market periods. Rociada’s growth appears to be fueled by steady interest in mountain living rather than any sharp economic or population shifts.

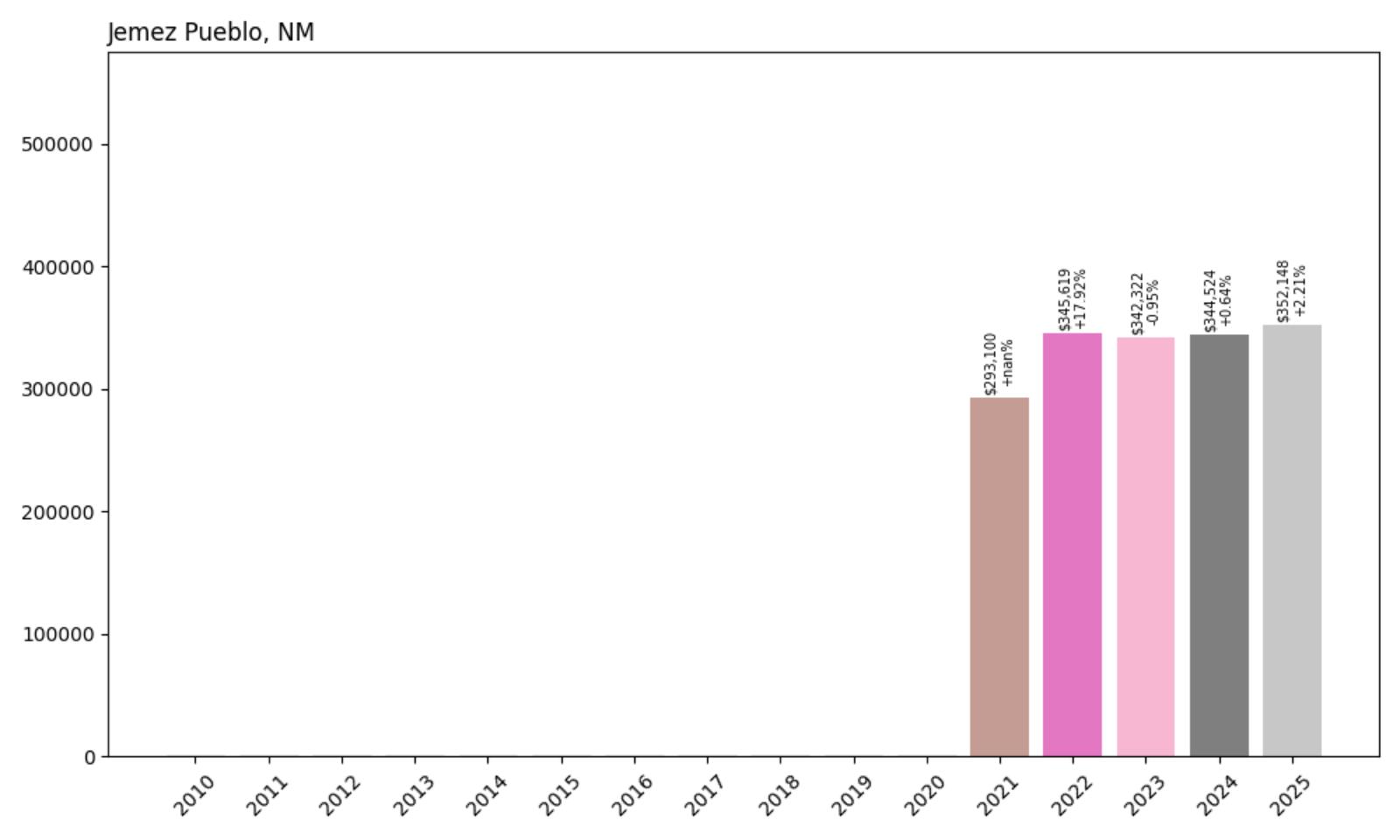

32. Jemez Pueblo – 20.1% Home Price Increase Since 2021

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $NA

- 2020: $NA

- 2021: $293,100

- 2022: $345,619 (+$52,519, +17.92% from previous year)

- 2023: $342,322 (−$3,297, −0.95% from previous year)

- 2024: $344,524 (+$2,202, +0.64% from previous year)

- 2025: $352,148 (+$7,624, +2.21% from previous year)

Jemez Pueblo has recorded a 20.1% gain in home prices since 2021, reaching $352,148 in 2025. The largest jump came early, with a nearly 18% increase between 2021 and 2022. The years since have brought a mix of small gains and corrections, suggesting the market has leveled out. Nonetheless, the overall trend points upward and reflects a growing interest in the area. This is consistent with rising values across other rural but culturally significant areas of New Mexico.

Jemez Pueblo – Cultural Significance and Quiet Demand

Jemez Pueblo is a Native American tribal community located northwest of Albuquerque in Sandoval County. Known for its red rock landscapes and cultural heritage, the area draws visitors and residents who value tradition and scenery over commercial development. The housing stock is limited, and much of the land is held by tribal members, which naturally restricts the supply of available properties. That scarcity has likely contributed to the town’s early price surge in 2022.

The market here is not driven by speculative investment but by local and regional interest. Buyers often include former residents returning to the area or those with family ties. Proximity to Jemez Springs and natural sites like the Valles Caldera also adds appeal. While growth has slowed in the past two years, the town’s strong early gains continue to support its relatively high home value. Jemez Pueblo remains a low-volume, steady-growth market with strong ties to culture and land.

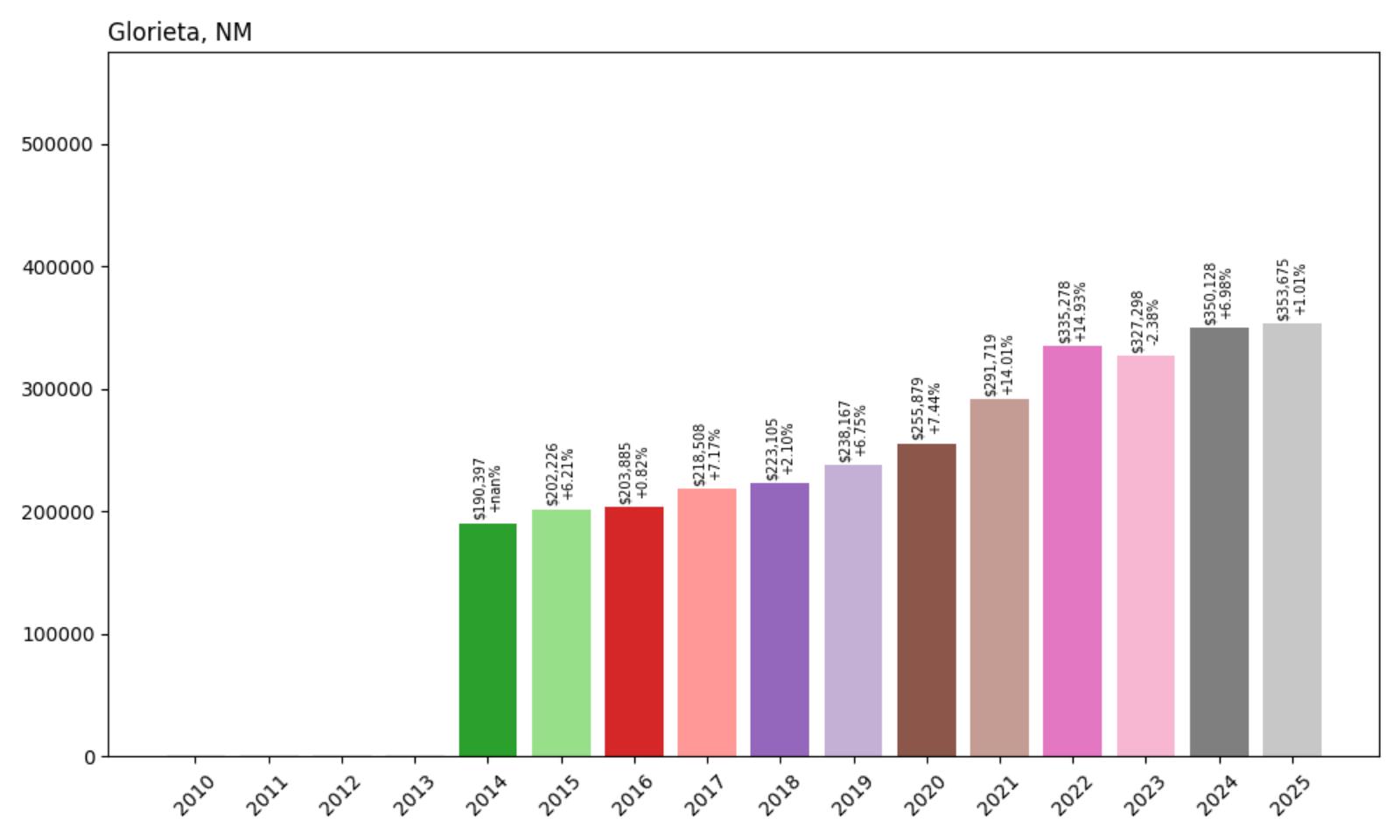

31. Glorieta – 85.7% Home Price Increase Since 2014

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $190,397

- 2015: $202,226 (+$11,828, +6.21% from previous year)

- 2016: $203,885 (+$1,659, +0.82% from previous year)

- 2017: $218,508 (+$14,623, +7.17% from previous year)

- 2018: $223,105 (+$4,597, +2.10% from previous year)

- 2019: $238,167 (+$15,062, +6.75% from previous year)

- 2020: $255,879 (+$17,712, +7.44% from previous year)

- 2021: $291,719 (+$35,841, +14.01% from previous year)

- 2022: $335,278 (+$43,559, +14.93% from previous year)

- 2023: $327,298 (−$7,980, −2.38% from previous year)

- 2024: $350,128 (+$22,831, +6.98% from previous year)

- 2025: $353,675 (+$3,546, +1.01% from previous year)

Glorieta home values have climbed 85.7% since 2014, with the average home price reaching $353,675 in 2025. The market’s biggest spikes occurred between 2020 and 2022, when values jumped by more than $79,000 in just two years. Recent years have brought slower gains and even a small drop in 2023, but overall, the long-term trend remains strongly positive. This growth reflects Glorieta’s increasing popularity among buyers seeking homes near Santa Fe but outside city limits.

Glorieta – High Desert Retreat With Access to Santa Fe

Located just 25 minutes east of Santa Fe, Glorieta combines scenic surroundings with relative proximity to major amenities. It’s a quiet, semi-rural community known for forested hills, nearby hiking trails, and the historic Glorieta Pass. Unlike larger towns, Glorieta offers limited services and a very small residential base, which helps keep inventory tight. That scarcity, combined with steady interest from retirees and remote workers, has lifted prices substantially since the mid-2010s.

The town’s appeal lies in its seclusion and elevation, offering cooler summers than lower desert areas. Buyers often include commuters from Santa Fe or those purchasing second homes. While there was a slight price dip in 2023, it was quickly followed by gains in 2024 and 2025, indicating strong underlying demand. Glorieta’s growth story is one of gradual appreciation fueled by low turnover and consistent interest in quiet, forested living environments near cultural centers.

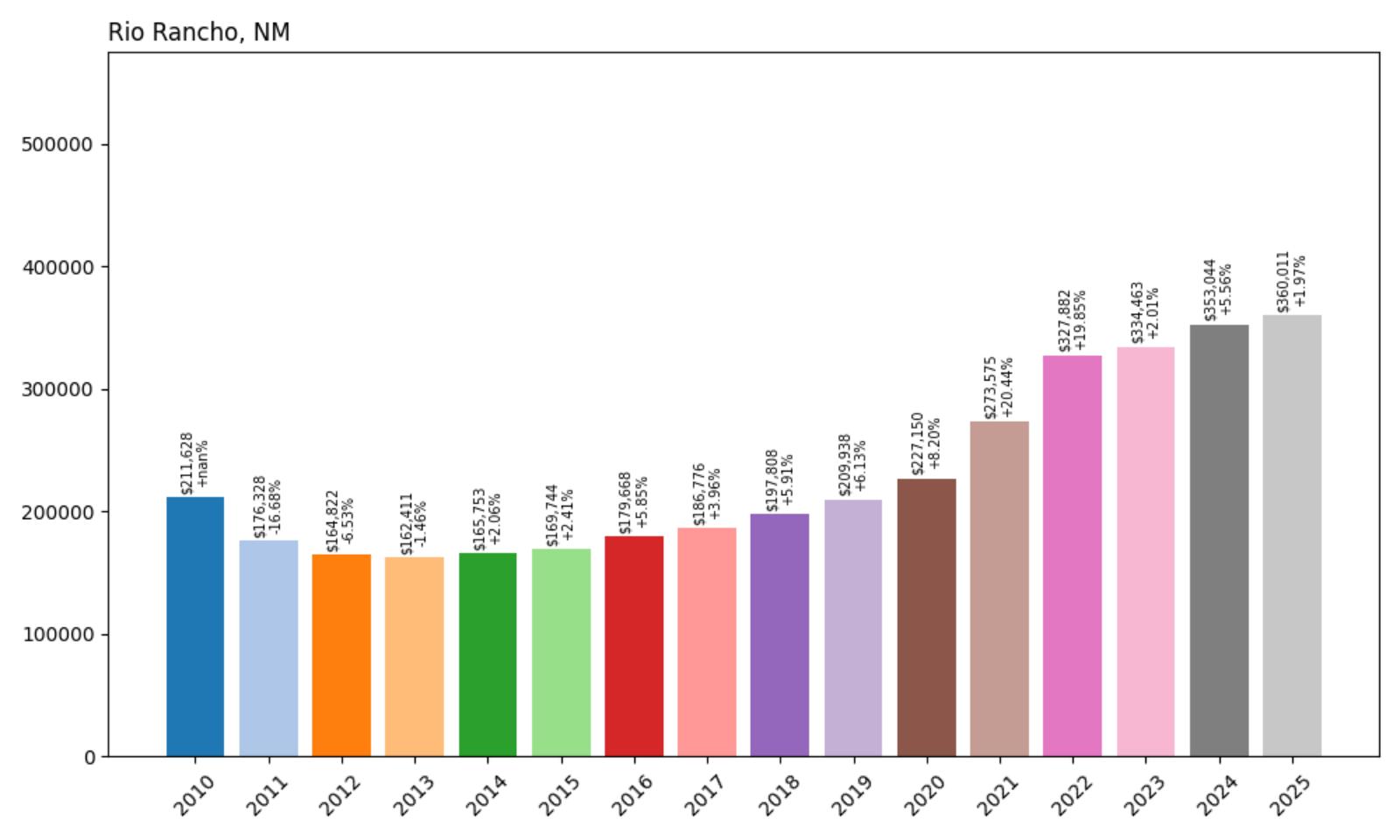

30. Rio Rancho – 70.1% Home Price Increase Since 2010

- 2010: $211,628

- 2011: $176,328 (−$35,300, −16.68% from previous year)

- 2012: $164,822 (−$11,506, −6.53% from previous year)

- 2013: $162,411 (−$2,411, −1.46% from previous year)

- 2014: $165,753 (+$3,342, +2.06% from previous year)

- 2015: $169,744 (+$3,991, +2.41% from previous year)

- 2016: $179,668 (+$9,924, +5.85% from previous year)

- 2017: $186,776 (+$7,108, +3.96% from previous year)

- 2018: $197,808 (+$11,031, +5.91% from previous year)

- 2019: $209,938 (+$12,131, +6.13% from previous year)

- 2020: $227,150 (+$17,212, +8.20% from previous year)

- 2021: $273,575 (+$46,425, +20.44% from previous year)

- 2022: $327,882 (+$54,307, +19.85% from previous year)

- 2023: $334,463 (+$6,581, +2.01% from previous year)

- 2024: $353,044 (+$18,581, +5.56% from previous year)

- 2025: $360,011 (+$6,967, +1.97% from previous year)

Rio Rancho’s housing market has grown steadily over the past 15 years, with home values rising 70.1% since 2010. The city experienced a rough start to the decade with sharp declines through 2012, but recovered by 2015 and gained momentum through the 2020s. Price surges in 2021 and 2022 pushed values up dramatically, and while recent years have seen smaller gains, the overall trend remains strongly upward. As of June 2025, the average home price is $360,011—making Rio Rancho one of the pricier markets in central New Mexico.

Rio Rancho – Suburban Growth Hub Outside Albuquerque

Rio Rancho is one of the fastest-growing cities in New Mexico and a major suburb of Albuquerque. Over the last decade, it has evolved into a high-demand residential zone, driven by affordable land, new construction, and major employers like Intel. As families and professionals seek more space than Albuquerque’s core offers, Rio Rancho continues to absorb that demand. The city’s robust infrastructure, good school ratings, and expanding amenities have helped keep its housing market resilient through economic cycles.

Its proximity to Albuquerque—roughly a 30-minute drive—makes it a practical choice for commuters who want suburban living without sacrificing city access. New subdivisions, parks, and retail centers have helped transform Rio Rancho from a sleepy suburb into a standalone community. While early 2010s price drops were tied to the broader housing crash, the subsequent rebound reflects genuine population growth and investment. Today, Rio Rancho remains a leading example of sustained suburban appreciation in the state.

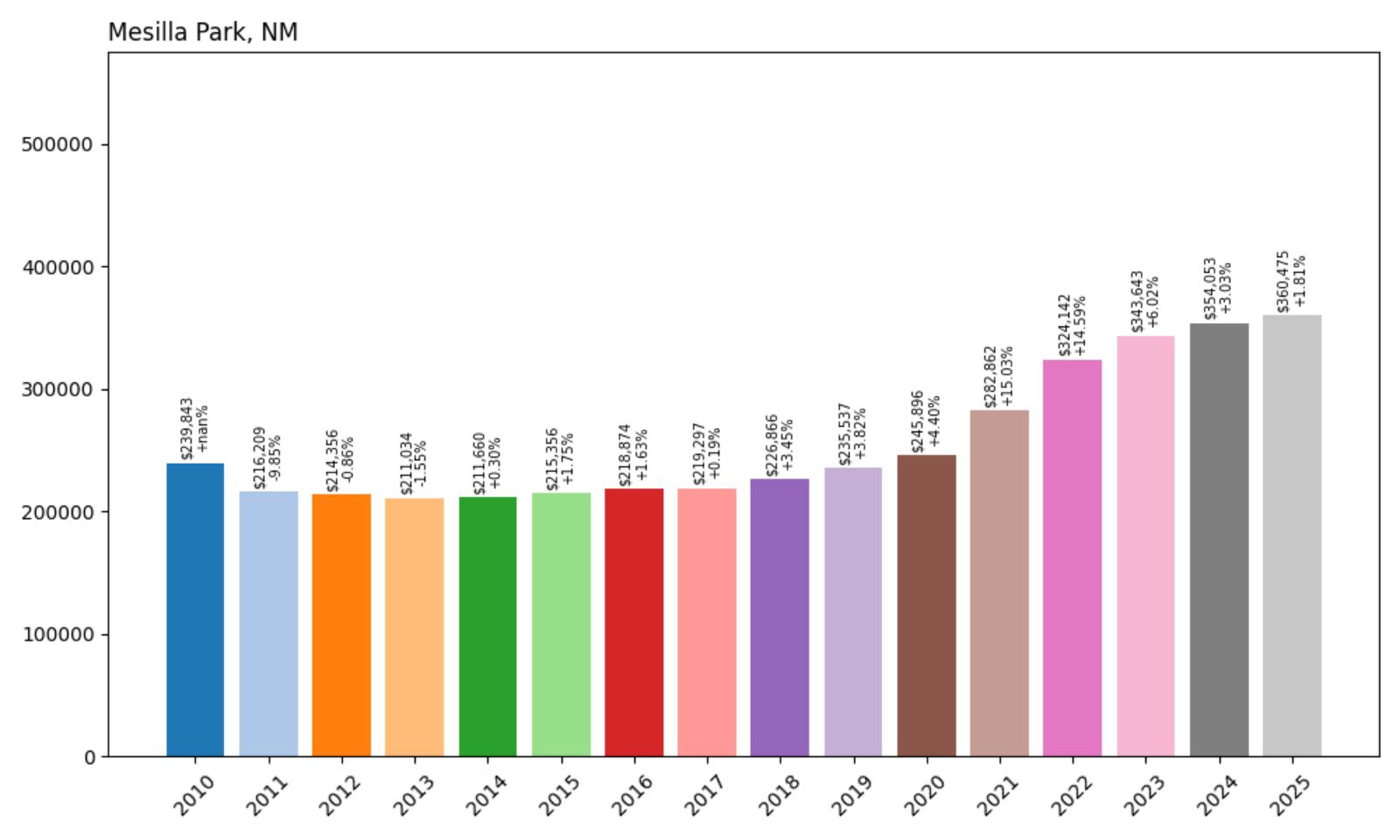

29. Mesilla Park – 50.3% Home Price Increase Since 2010

- 2010: $239,843

- 2011: $216,209 (−$23,634, −9.85% from previous year)

- 2012: $214,356 (−$1,853, −0.86% from previous year)

- 2013: $211,034 (−$3,322, −1.55% from previous year)

- 2014: $211,660 (+$626, +0.30% from previous year)

- 2015: $215,356 (+$3,696, +1.75% from previous year)

- 2016: $218,874 (+$3,518, +1.63% from previous year)

- 2017: $219,297 (+$423, +0.19% from previous year)

- 2018: $226,866 (+$7,569, +3.45% from previous year)

- 2019: $235,537 (+$8,671, +3.82% from previous year)

- 2020: $245,896 (+$10,358, +4.40% from previous year)

- 2021: $282,862 (+$36,966, +15.03% from previous year)

- 2022: $324,142 (+$41,280, +14.59% from previous year)

- 2023: $343,643 (+$19,501, +6.02% from previous year)

- 2024: $354,053 (+$10,410, +3.03% from previous year)

- 2025: $360,475 (+$6,422, +1.81% from previous year)

Home prices in Mesilla Park have increased 50.3% since 2010, with most of the gains occurring over the last five years. After a slow recovery from the early 2010s dip, the market picked up significantly starting in 2021, when values jumped by over 15% in a single year. Since then, prices have continued to rise, albeit more gradually. The average home now costs $360,475—a substantial increase that places Mesilla Park firmly among New Mexico’s more expensive housing markets.

Mesilla Park – Historic Charm in the Las Cruces Area

Mesilla Park is a small neighborhood just south of Las Cruces, known for its quiet streets, adobe-style homes, and close-knit atmosphere. Originally established in the late 1800s, the area has retained much of its historic character while benefiting from Las Cruces’s regional growth. Buyers here are often drawn to the balance of old-world charm and access to modern amenities. The town is near New Mexico State University and offers easy access to employment, retail, and healthcare hubs in Las Cruces.

The housing market has become more competitive in recent years as Las Cruces has grown in popularity. Mesilla Park’s appeal comes from its location within a larger metro area combined with its small-town feel. The architecture, mature trees, and slower pace of life create a distinct identity that’s attractive to both retirees and younger families. Although it saw sluggish price growth for much of the 2010s, Mesilla Park’s recent acceleration highlights a renewed demand for established, centrally located neighborhoods.

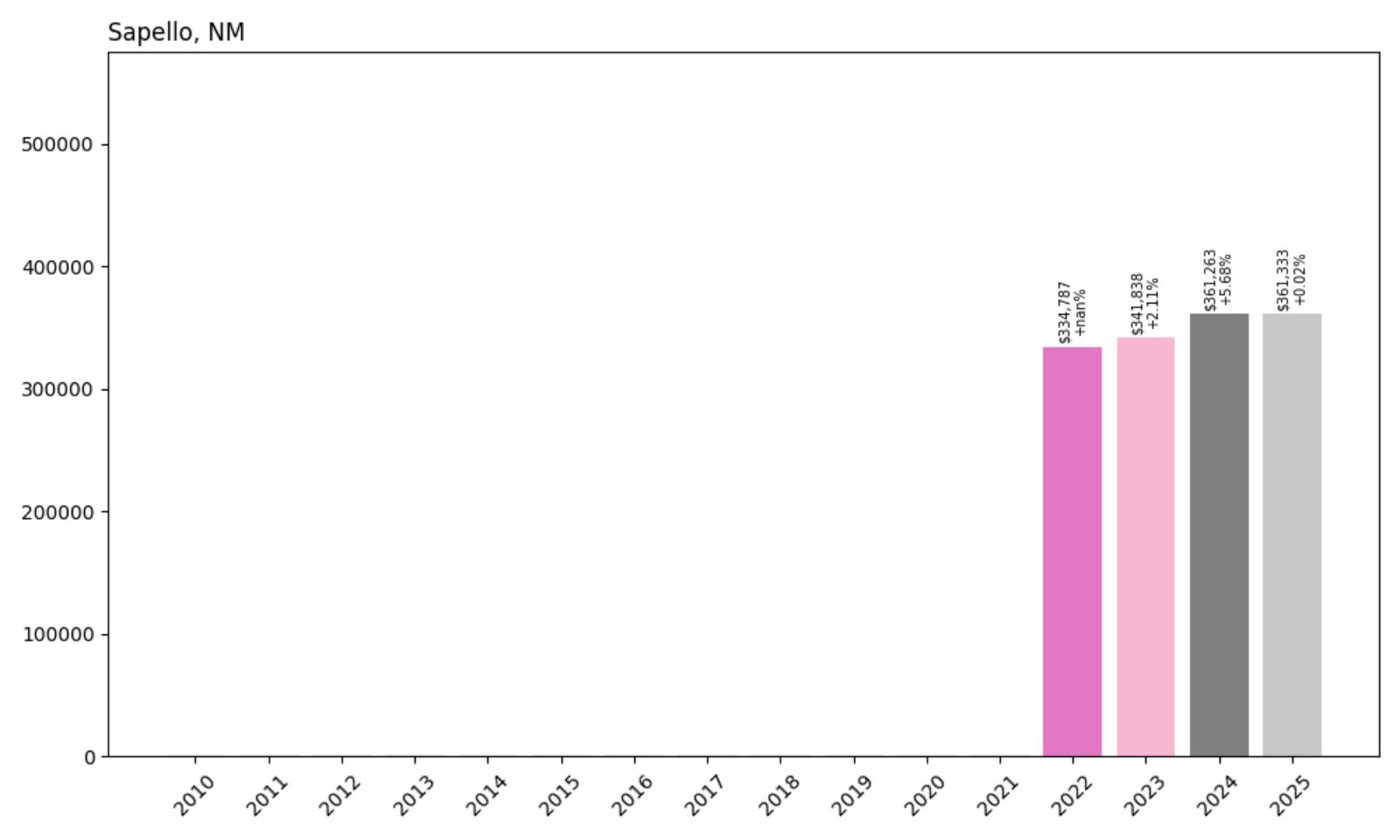

28. Sapello – 7.9% Home Price Increase Since 2022

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $NA

- 2020: $NA

- 2021: $NA

- 2022: $334,787

- 2023: $341,838 (+$7,052, +2.11% from previous year)

- 2024: $361,263 (+$19,424, +5.68% from previous year)

- 2025: $361,333 (+$70, +0.02% from previous year)

Sapello’s home values have increased by 7.9% since 2022, with most of the growth occurring between 2022 and 2024. The market leveled out significantly in 2025, posting virtually no change from the previous year. This plateau may signal a market adjusting to limited demand or constrained inventory. Nevertheless, the price trend reflects a modest appreciation in a very quiet corner of New Mexico’s real estate landscape.

Sapello – Forested Privacy in Northern New Mexico

Sapello is a remote, rural area northeast of Las Vegas, NM, situated in the foothills of the Sangre de Cristo Mountains. Known for its wooded properties, high elevation, and peaceful surroundings, it appeals to those looking for solitude and space. There are no major towns nearby, and commercial services are minimal, but that’s exactly what draws a certain type of buyer. The region offers large parcels and rustic cabins that serve as permanent homes or off-grid retreats.

While home price appreciation here has been mild compared to more competitive areas, it reflects steady demand for secluded mountain living. Sapello is largely unknown outside of local circles, and the housing stock is extremely limited. When properties do come up for sale, they often move quietly. This is not a place seeing a flood of short-term speculation—rather, it’s a stable market driven by lifestyle preferences and long-term ownership. The absence of volatility in 2025 could indicate that prices have reached a natural ceiling for now.

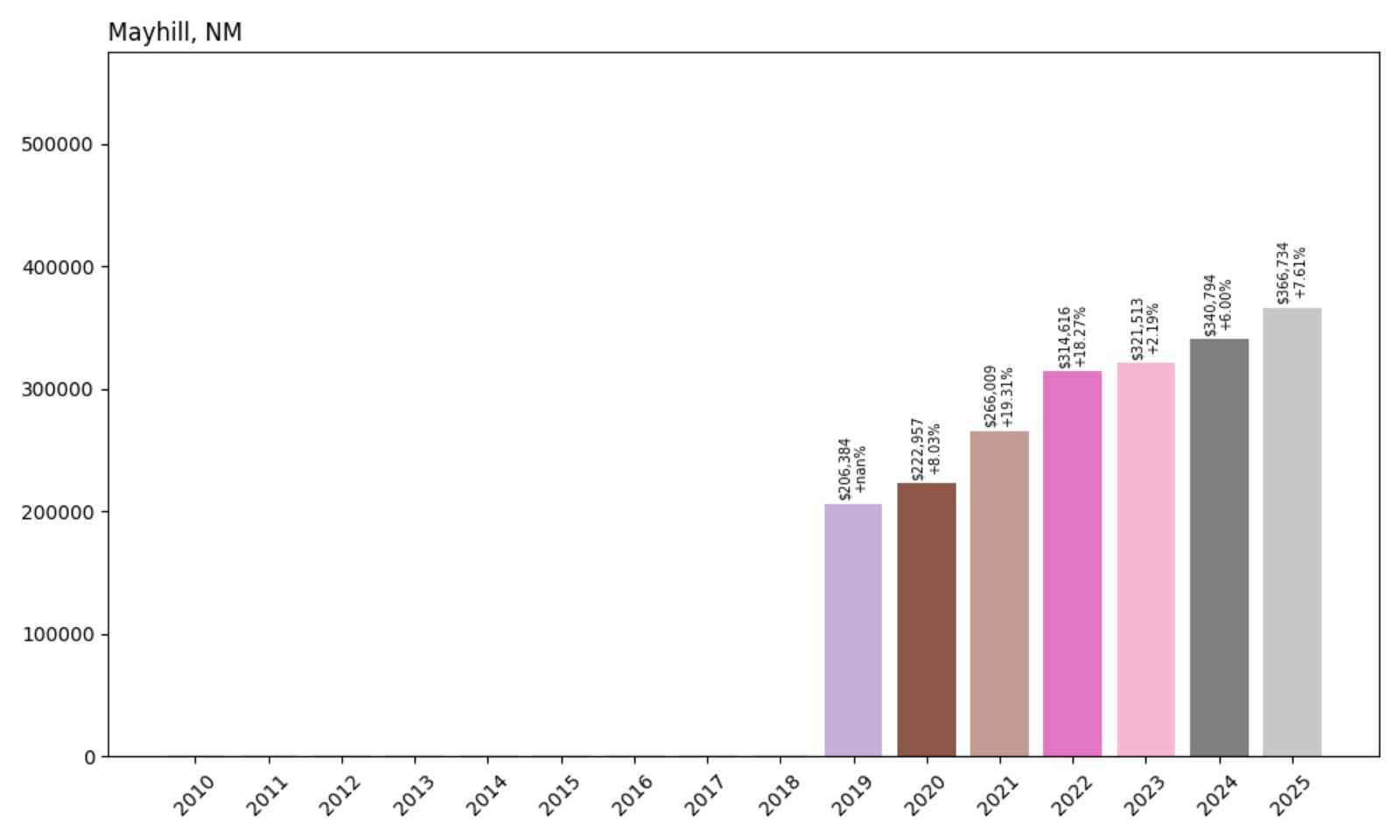

27. Mayhill – 77.7% Home Price Increase Since 2019

🔥 Would you like to save this?

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $206,384

- 2020: $222,957 (+$16,573, +8.03% from previous year)

- 2021: $266,009 (+$43,052, +19.31% from previous year)

- 2022: $314,616 (+$48,608, +18.27% from previous year)

- 2023: $321,513 (+$6,897, +2.19% from previous year)

- 2024: $340,794 (+$19,281, +6.00% from previous year)

- 2025: $366,734 (+$25,940, +7.61% from previous year)

Home prices in Mayhill have surged by 77.7% since 2019, with steady gains nearly every year. After an explosive rise from 2020 to 2022, the market cooled briefly in 2023 but regained momentum in the two years since. By mid-2025, the average home price hit $366,734. The town’s appeal lies in its scenic setting and distance from high-traffic areas, which has attracted a niche set of buyers looking for quiet, elevated living.

Mayhill – High-Elevation Living Near Cloudcroft

Mayhill is a small, forested town located in the Sacramento Mountains of southern New Mexico. Tucked between Cloudcroft and Artesia, it sits at an elevation of over 6,700 feet, offering cool summers, crisp air, and scenic beauty. It has long been a destination for second homes, summer cabins, and retirees wanting to escape the heat of the lowlands. There’s not much in terms of infrastructure—just a few shops and local services—but the mountain lifestyle is a powerful draw.

Recent price gains reflect a growing interest in the area’s lifestyle appeal. As more buyers search for remote homes with natural surroundings, places like Mayhill benefit. Its proximity to Cloudcroft adds to the appeal, giving residents access to small-town amenities without sacrificing the quietude they’re after. The town’s consistent value increases since 2019 suggest it’s not a boom-and-bust market, but one that continues to attract steady interest from well-matched buyers.

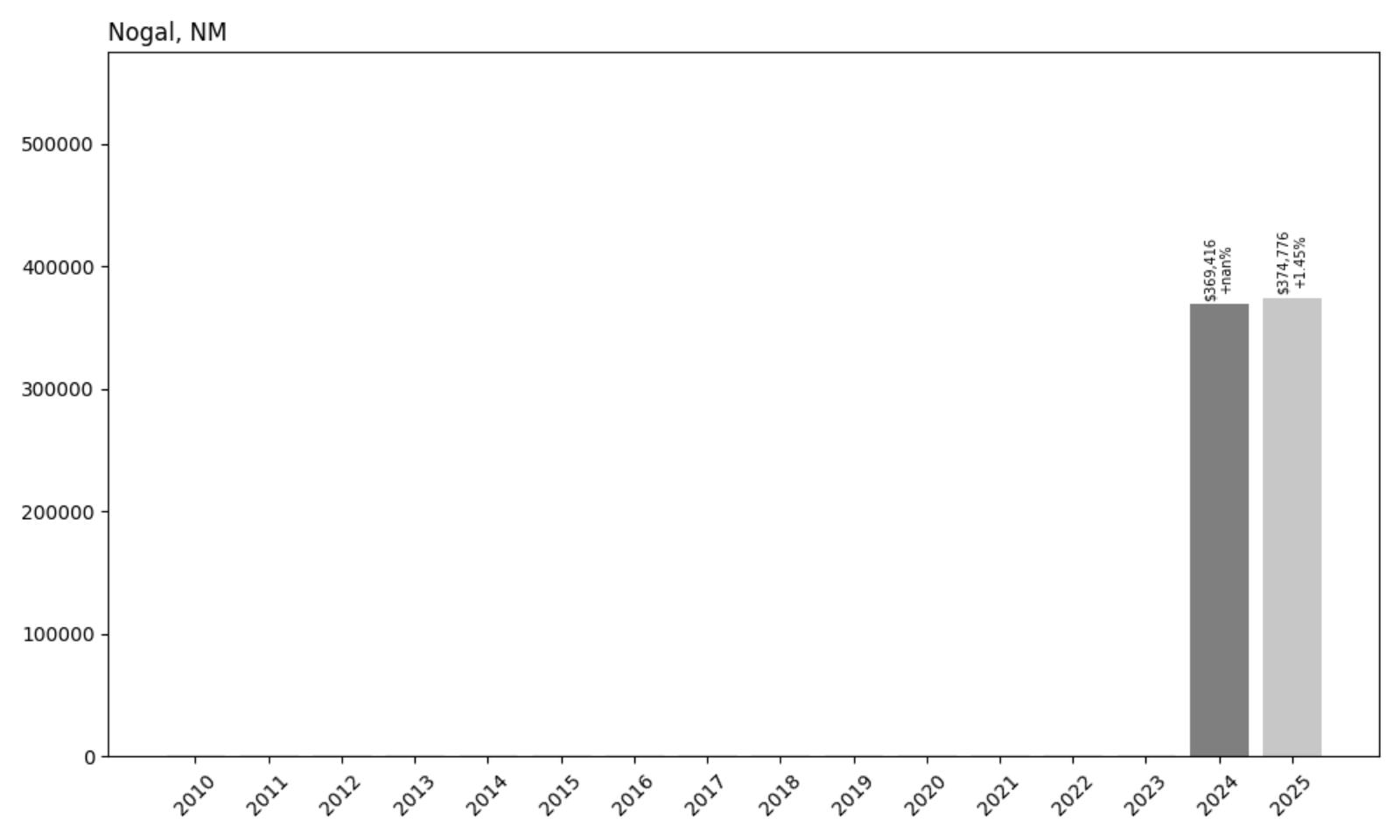

26. Nogal – 1.45% Home Price Increase Since 2024

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $NA

- 2020: $NA

- 2021: $NA

- 2022: $NA

- 2023: $NA

- 2024: $369,416

- 2025: $374,776 (+$5,360, +1.45% from previous year)

Nogal entered Zillow’s dataset in 2024 with an average home price of $369,416. In the year since, prices rose slightly to $374,776, marking a 1.45% increase. While this doesn’t represent major growth, it does suggest a stable, if limited, market. The small gain may be a result of limited sales volume and tight inventory, which are common in remote mountain areas like this one.

Nogal – Hidden Hillside Living Near Ruidoso

Nogal is a rural community in Lincoln County, located north of Ruidoso and surrounded by national forest. It’s sparsely populated and known for its open land, cattle ranches, and pine-covered hills. There are no commercial centers here—just scattered homes, winding mountain roads, and big views. That seclusion makes it appealing to off-grid enthusiasts, retirees, and remote workers seeking a slower pace of life.

With limited listings and few recent sales, the market in Nogal doesn’t move rapidly. Home prices may fluctuate based on a handful of transactions, rather than broader market forces. Still, the slight uptick in 2025 suggests that property in the area continues to hold its value. Buyers here tend to be deliberate and long-term, and the area’s natural beauty ensures ongoing interest from those looking to step away from city life entirely.

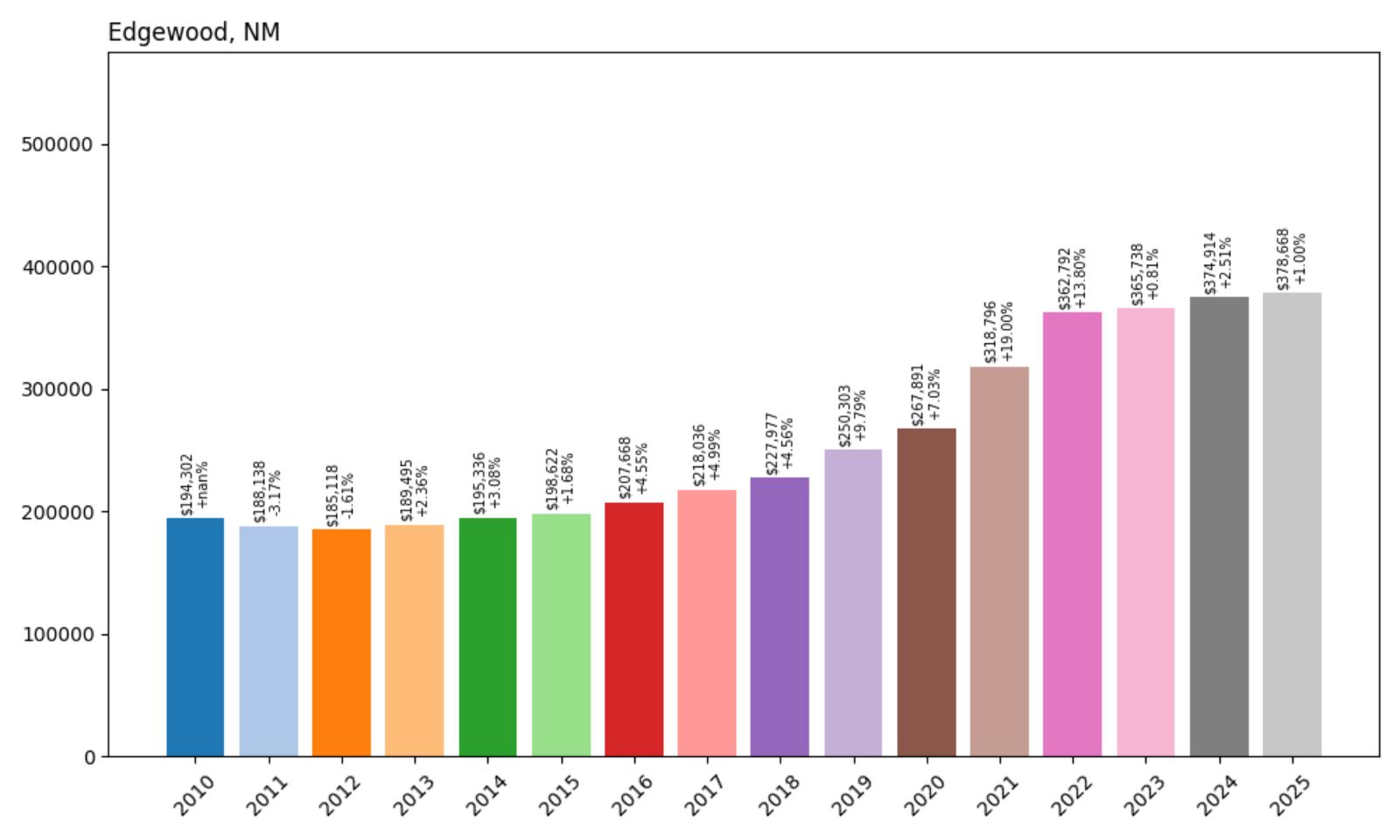

25. Edgewood – 94.9% Home Price Increase Since 2010

- 2010: $194,302

- 2011: $188,138 (−$6,163, −3.17% from previous year)

- 2012: $185,118 (−$3,021, −1.61% from previous year)

- 2013: $189,495 (+$4,377, +2.36% from previous year)

- 2014: $195,336 (+$5,842, +3.08% from previous year)

- 2015: $198,622 (+$3,286, +1.68% from previous year)

- 2016: $207,668 (+$9,046, +4.55% from previous year)

- 2017: $218,036 (+$10,368, +4.99% from previous year)

- 2018: $227,977 (+$9,941, +4.56% from previous year)

- 2019: $250,303 (+$22,326, +9.79% from previous year)

- 2020: $267,891 (+$17,588, +7.03% from previous year)

- 2021: $318,796 (+$50,904, +19.00% from previous year)

- 2022: $362,792 (+$43,996, +13.80% from previous year)

- 2023: $365,738 (+$2,946, +0.81% from previous year)

- 2024: $374,914 (+$9,176, +2.51% from previous year)

- 2025: $378,668 (+$3,755, +1.00% from previous year)

Edgewood has experienced a 94.9% increase in home prices since 2010, nearly doubling over the past 15 years. The most dramatic jump came during the 2020–2022 period, when values surged by more than $94,000. Growth has cooled since then, but prices have held steady, with only small increases in 2024 and 2025. The town’s long-term upward trend is among the strongest in the Albuquerque region.

Edgewood – Suburban Growth East of Albuquerque

Edgewood sits along I-40 in the East Mountains area, offering a blend of rural charm and highway access that appeals to commuters and families alike. It’s technically part of the Albuquerque metro, but its spacious lots, horse properties, and pine-dotted hills give it a distinctly different feel. As housing costs in the city climbed, Edgewood became an attractive alternative for buyers looking for more space without giving up connectivity.

The town has invested in local services, schools, and retail in recent years, all of which support housing demand. The market has cooled slightly since its peak in 2022, but the pace of new listings and ongoing development suggests that interest remains strong. Edgewood’s pricing stability over the past three years points to a market that has matured—no longer in a boom phase, but still rising on solid fundamentals.

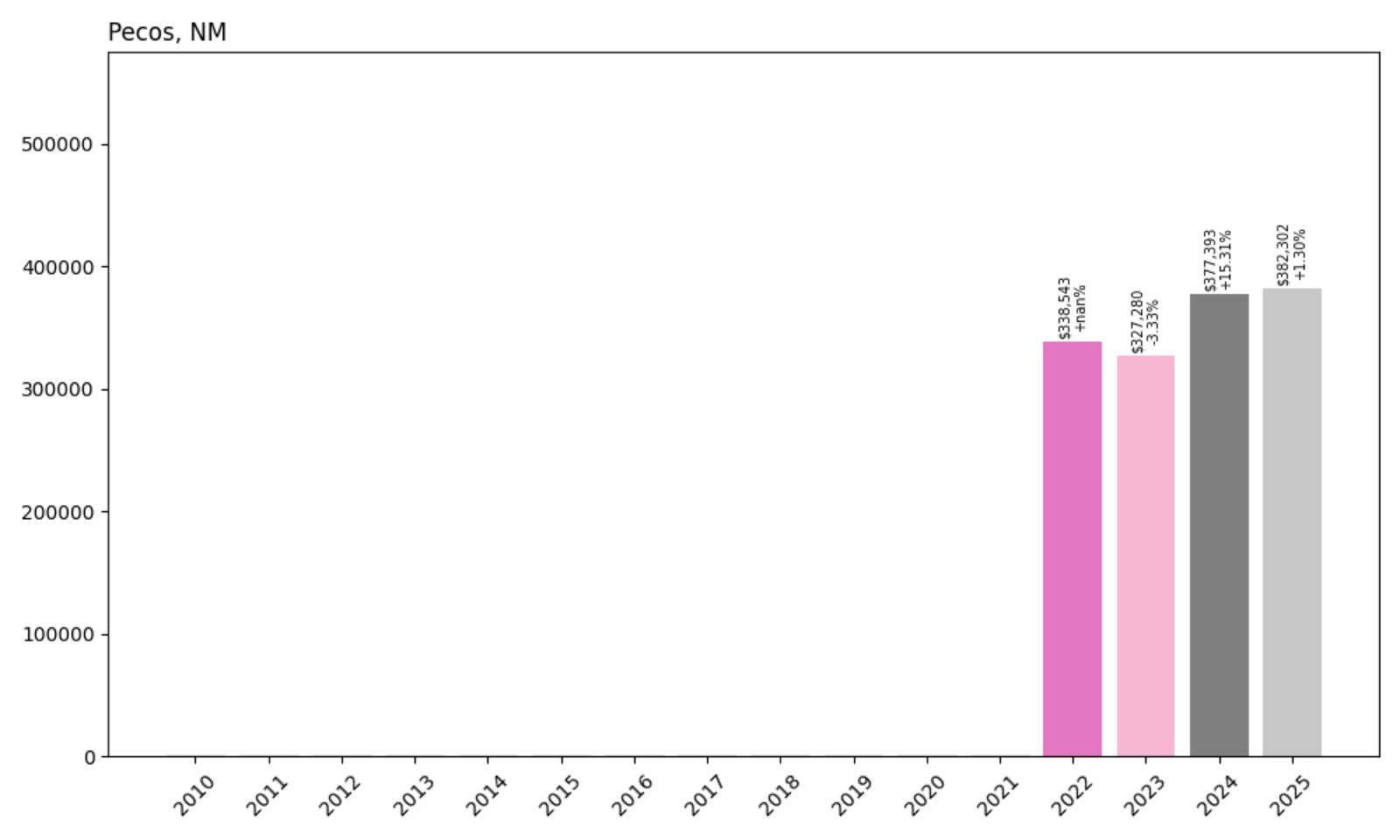

24. Pecos – 12.9% Home Price Increase Since 2022

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $NA

- 2020: $NA

- 2021: $NA

- 2022: $338,543

- 2023: $327,280 (−$11,263, −3.33% from previous year)

- 2024: $377,393 (+$50,113, +15.31% from previous year)

- 2025: $382,302 (+$4,909, +1.30% from previous year)

Home values in Pecos have increased 12.9% since 2022, despite a temporary drop in 2023. That dip was followed by a dramatic rebound in 2024—prices jumped over $50,000 in a single year. As of June 2025, the average home value in Pecos stands at $382,302. The price trend shows signs of volatility, but the long-term trajectory remains positive, especially for a remote, small-market location.

Pecos – Gateway to the Wilderness, Minutes From Santa Fe

Pecos is located in San Miguel County, just 30 minutes east of Santa Fe, nestled along the Pecos River and bordering the Pecos Wilderness. Its setting—high in the pine-covered mountains—makes it a popular spot for fishing, hiking, and cabin-style living. Despite its close proximity to a major urban center, Pecos retains a small-town character, with just a few cafes, local businesses, and a school. This blend of nature and accessibility gives it broad appeal for second-home owners and outdoor enthusiasts alike.

The dramatic swing in home prices from 2023 to 2024 may reflect a limited inventory market where even a few sales can move averages significantly. But it also speaks to renewed demand following a momentary pullback. Pecos continues to attract buyers seeking year-round homes and seasonal retreats. Its location on the edge of vast public lands and forest service access trails makes it a rare mix of convenience and isolation—fueling steady, if occasionally lumpy, price appreciation.

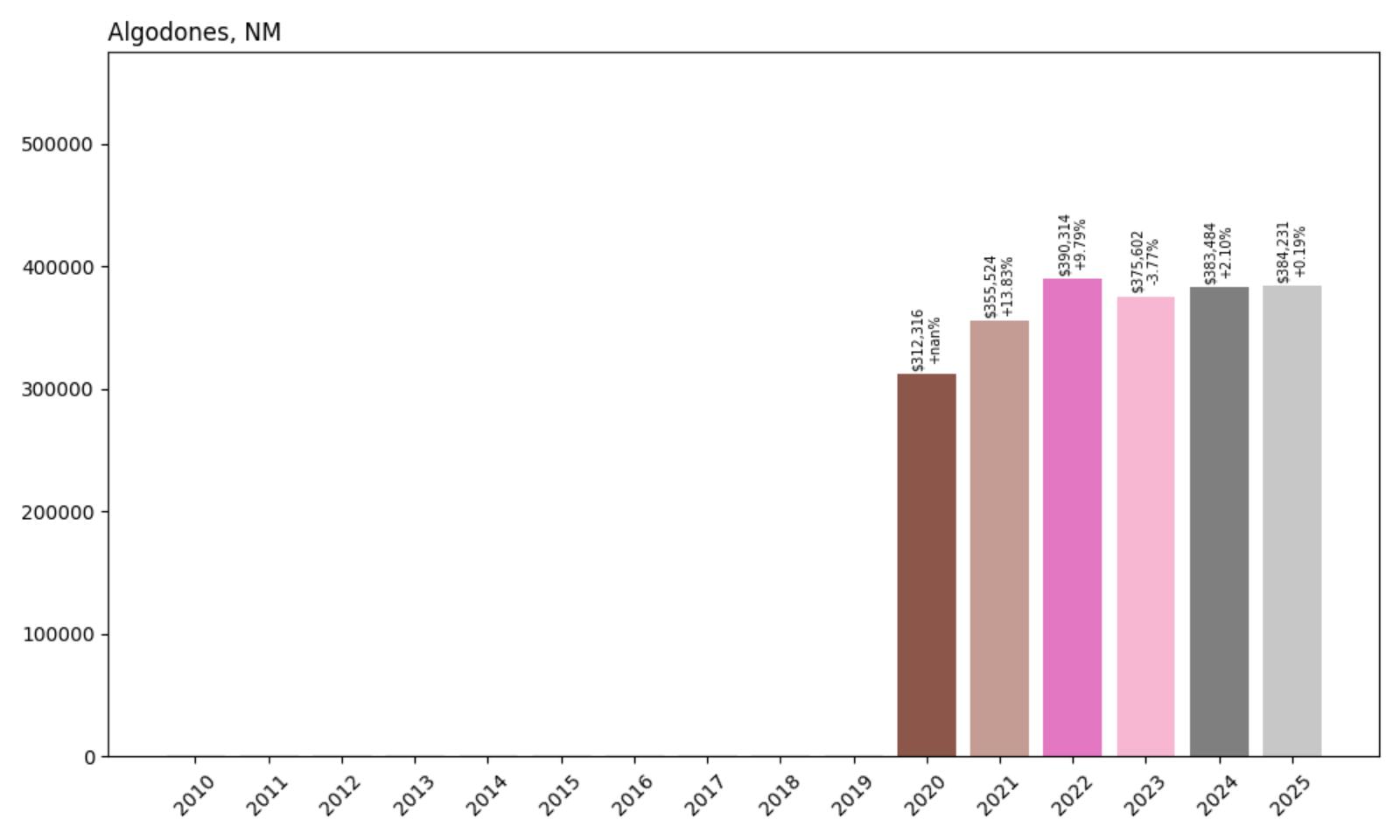

23. Algodones – 23.0% Home Price Increase Since 2020

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $NA

- 2020: $312,316

- 2021: $355,524 (+$43,208, +13.83% from previous year)

- 2022: $390,314 (+$34,789, +9.79% from previous year)

- 2023: $375,602 (−$14,712, −3.77% from previous year)

- 2024: $383,484 (+$7,882, +2.10% from previous year)

- 2025: $384,231 (+$747, +0.19% from previous year)

Home values in Algodones have risen 23.0% since 2020, with most of that growth occurring between 2020 and 2022. After a brief pullback in 2023, prices began to stabilize again, with mild gains continuing into 2025. The average home price now sits at $384,231. The pattern here reflects a modest market correction followed by a plateau—indicative of a maturing local housing market following a period of elevated demand.

Algodones – Quiet Locale With Regional Appeal

Located between Albuquerque and Santa Fe along I-25, Algodones is a small community that offers convenient access to both cities while maintaining a very low-density, semi-rural atmosphere. Its geography, nestled between the Sandia and Jemez Mountains, gives it broad visual appeal, while the limited development helps maintain a calm and private setting. This blend of location and seclusion has made Algodones appealing to retirees, commuters, and remote workers seeking space without isolation.

The housing market in Algodones remains relatively thin, which means price shifts can be driven by a small number of transactions. That said, its 2021–2022 boom aligns with broader trends seen in edge communities across New Mexico. The slight correction in 2023 suggests a short-term cooling, likely in response to interest rate pressures and affordability concerns. However, the quick rebound and stabilization in 2024–2025 reflect underlying strength and continued buyer interest in this uniquely situated town.

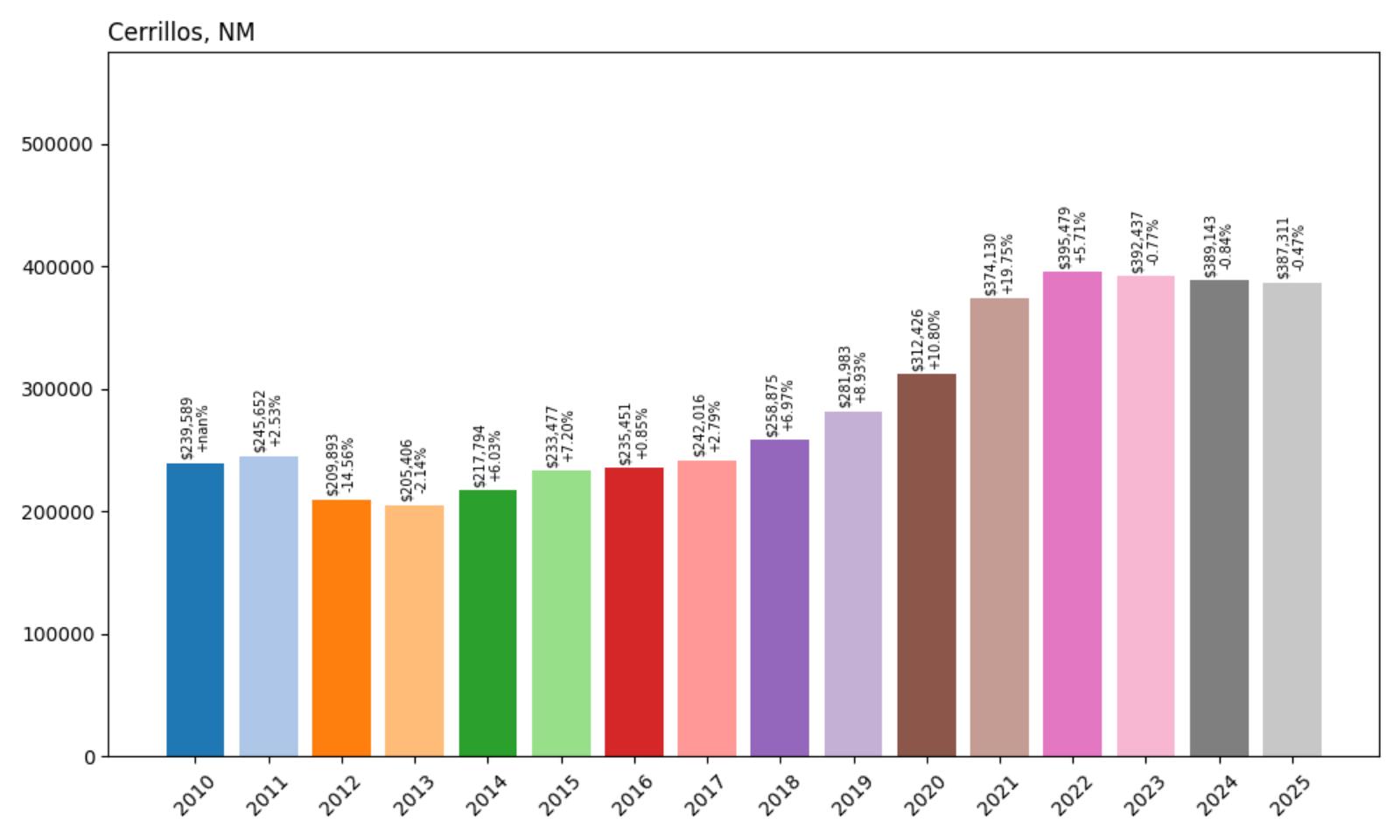

22. Cerrillos – 61.6% Home Price Increase Since 2010

- 2010: $239,589

- 2011: $245,652 (+$6,063, +2.53% from previous year)

- 2012: $209,893 (−$35,759, −14.56% from previous year)

- 2013: $205,406 (−$4,487, −2.14% from previous year)

- 2014: $217,794 (+$12,387, +6.03% from previous year)

- 2015: $233,477 (+$15,684, +7.20% from previous year)

- 2016: $235,451 (+$1,973, +0.85% from previous year)

- 2017: $242,016 (+$6,565, +2.79% from previous year)

- 2018: $258,875 (+$16,859, +6.97% from previous year)

- 2019: $281,983 (+$23,108, +8.93% from previous year)

- 2020: $312,426 (+$30,443, +10.80% from previous year)

- 2021: $374,130 (+$61,704, +19.75% from previous year)

- 2022: $395,479 (+$21,349, +5.71% from previous year)

- 2023: $392,437 (−$3,042, −0.77% from previous year)

- 2024: $389,143 (−$3,294, −0.84% from previous year)

- 2025: $387,311 (−$1,832, −0.47% from previous year)

Cerrillos home prices have increased 61.6% since 2010, though the past three years have brought mild declines. Prices peaked in 2022 at just under $396,000 before gradually pulling back. As of 2025, the average home price is $387,311. The earlier part of the decade saw strong gains, especially during the post-pandemic boom years. More recently, the market appears to be finding a new equilibrium.

Cerrillos – Historic Mining Town With Rustic Appeal

Located off Highway 14 along the scenic Turquoise Trail, Cerrillos is a former mining town turned artist haven. The community still retains many of its original 19th-century buildings, giving it a distinct Old West aesthetic. Tourists often pass through on their way to Madrid or Santa Fe, but some choose to stay, charmed by the landscape, slower pace, and the town’s strong sense of place. With few new homes built, demand can easily outpace supply, especially during periods of heightened interest in rural properties.

The housing market in Cerrillos is small and quirky—like the town itself. Homes here are often adobe-style or off-grid, and buyers are drawn by the character more than modern conveniences. The 2020–2022 boom pushed prices sharply higher, but recent pullbacks suggest that the pandemic-era demand has cooled. Still, the long-term trend is clear: over the past 15 years, Cerrillos has transformed from a niche backwater into one of Santa Fe County’s most interesting and valuable housing markets.

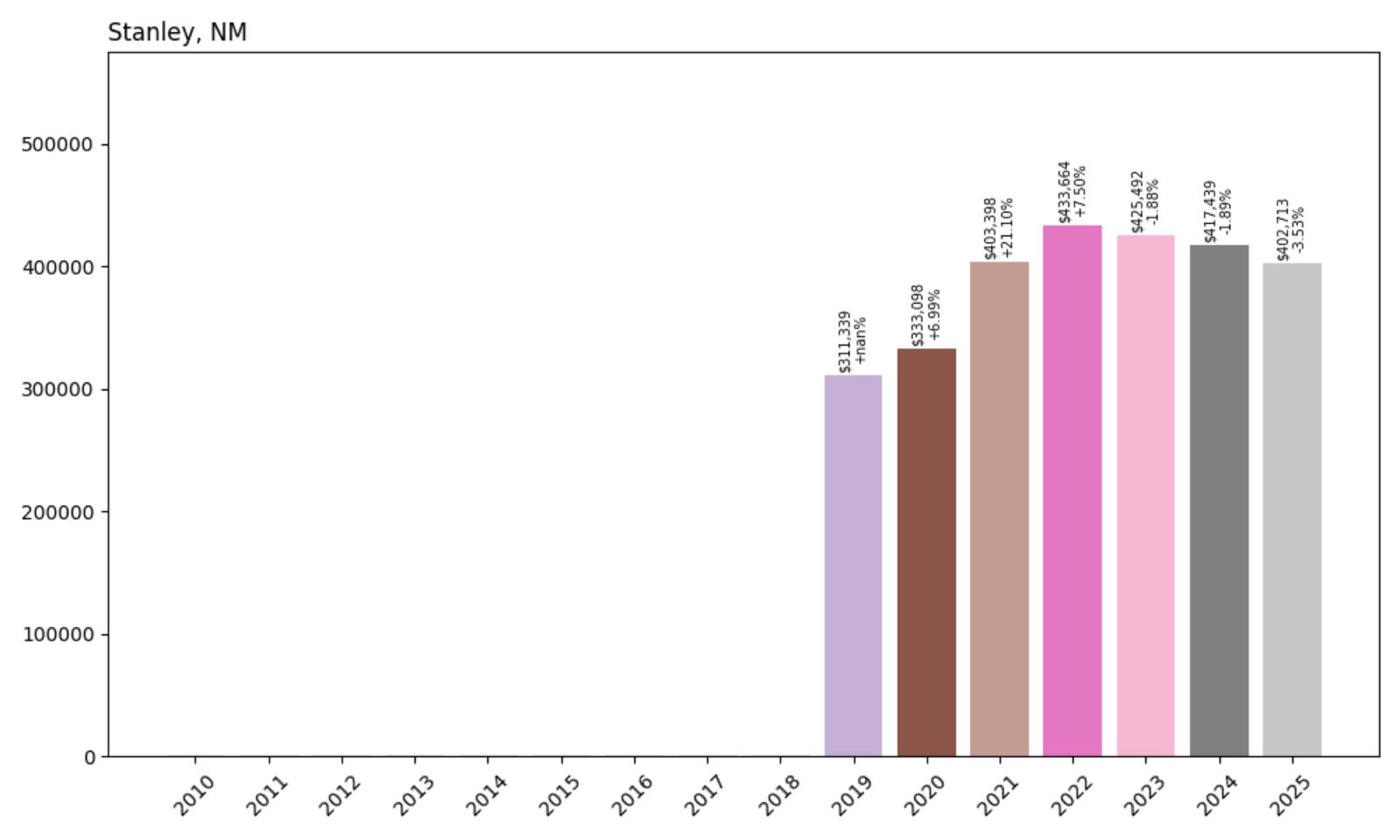

21. Stanley – 29.3% Home Price Increase Since 2019

🔥 Would you like to save this?

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $311,339

- 2020: $333,098 (+$21,760, +6.99% from previous year)

- 2021: $403,398 (+$70,300, +21.10% from previous year)

- 2022: $433,664 (+$30,265, +7.50% from previous year)

- 2023: $425,492 (−$8,172, −1.88% from previous year)

- 2024: $417,439 (−$8,053, −1.89% from previous year)

- 2025: $402,713 (−$14,727, −3.53% from previous year)

Stanley’s home prices are up 29.3% since 2019, with the peak occurring in 2022. Prices have dropped each year since then, settling at $402,713 in 2025. The steep climb in 2021 and 2022 was followed by a gradual correction, but values remain well above pre-pandemic levels. The town’s market reflects broader trends seen in rural, high-desirability areas across the state.

Stanley – Wide-Open Land and Equestrian Living

Stanley is an unincorporated community in Santa Fe County, about an hour east of Albuquerque. Known for its open plains, ranch properties, and agricultural zoning, it has long attracted buyers looking for space—especially those in the equestrian and homesteading communities. It’s not a traditional town in the sense of having a central business district, but rather a dispersed settlement of custom homes and large-acreage parcels.

During the 2021 real estate surge, Stanley became a target for buyers priced out of closer-in suburbs. The ability to own several acres and build freely proved appealing during the remote work shift. The recent decline in home prices mirrors the retreat of speculative pressure and a return to local-only demand. While prices are off their highs, the long-term value of Stanley real estate has continued to trend upward, supported by low density and land value scarcity.

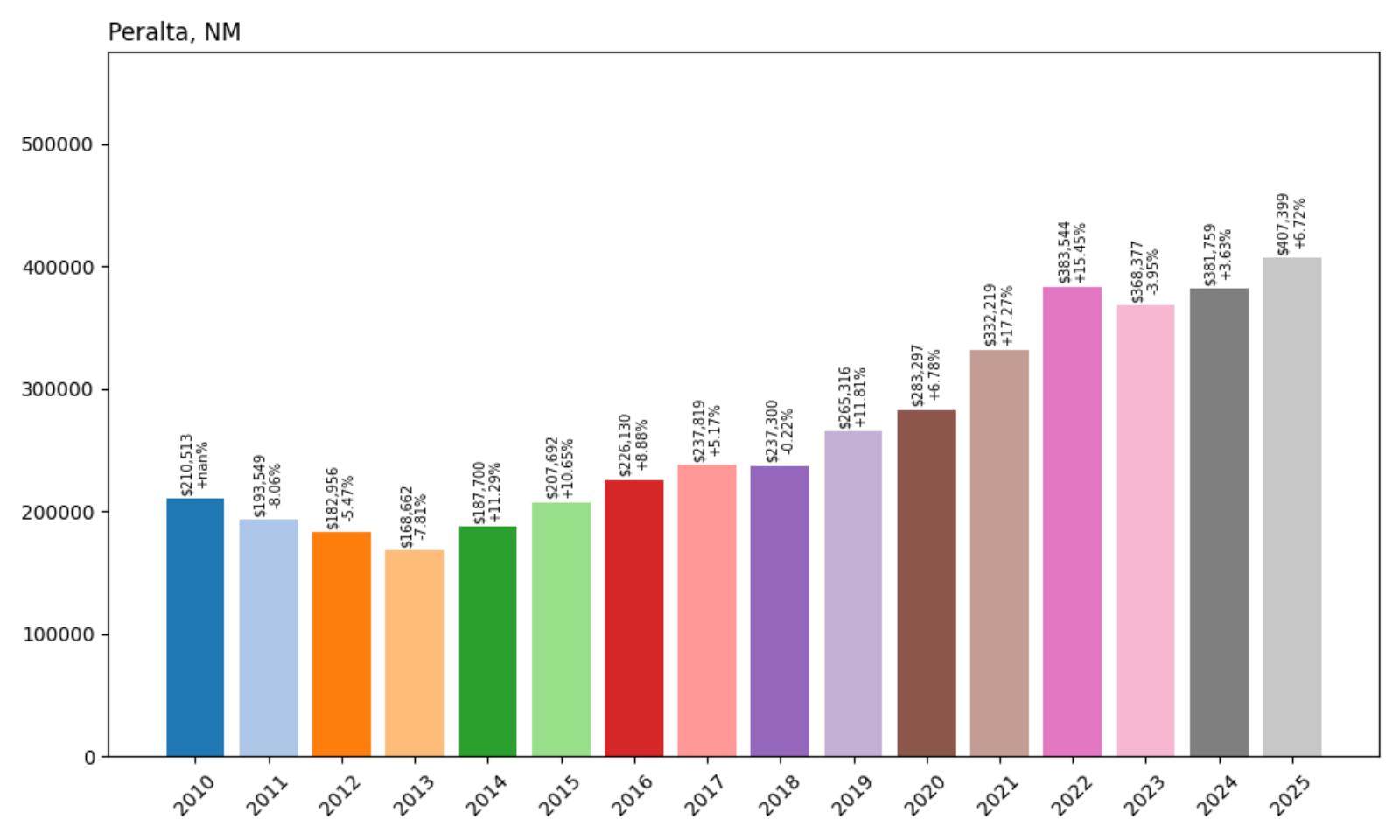

20. Peralta – 93.6% Home Price Increase Since 2010

- 2010: $210,513

- 2011: $193,549 (−$16,964, −8.06% from previous year)

- 2012: $182,956 (−$10,593, −5.47% from previous year)

- 2013: $168,662 (−$14,294, −7.81% from previous year)

- 2014: $187,700 (+$19,038, +11.29% from previous year)

- 2015: $207,692 (+$19,993, +10.65% from previous year)

- 2016: $226,130 (+$18,438, +8.88% from previous year)

- 2017: $237,819 (+$11,689, +5.17% from previous year)

- 2018: $237,300 (−$519, −0.22% from previous year)

- 2019: $265,316 (+$28,016, +11.81% from previous year)

- 2020: $283,297 (+$17,981, +6.78% from previous year)

- 2021: $332,219 (+$48,922, +17.27% from previous year)

- 2022: $383,544 (+$51,325, +15.45% from previous year)

- 2023: $368,377 (−$15,167, −3.95% from previous year)

- 2024: $381,759 (+$13,381, +3.63% from previous year)

- 2025: $407,399 (+$25,640, +6.72% from previous year)

Peralta home values have surged 93.6% since 2010, nearly doubling over the past 15 years. The most aggressive growth occurred between 2019 and 2022, when values shot up by nearly $120,000. Although prices dipped slightly in 2023, they quickly rebounded. As of 2025, the average home price is $407,399. This long-term rise reflects Peralta’s transition from a rural bedroom community into a stable housing market of its own.

Peralta – Affordable Access Near Albuquerque

Located in Valencia County just south of Los Lunas, Peralta offers proximity to Albuquerque with a more rural lifestyle. It has historically served as an agricultural town, with many properties featuring large lots, irrigation ditches, and space for farming or livestock. Over time, however, new development and rising regional demand have increased the area’s profile among suburban buyers.

Housing prices in Peralta remained stagnant for much of the early 2010s but began rising rapidly in the years following the pandemic. Buyers looking for space without sacrificing access to job centers have turned to places like Peralta as home values in Albuquerque and Los Lunas climb. The modest retreat in 2023 appears to have been short-lived, and current trends suggest Peralta remains a solid option for families and investors alike.

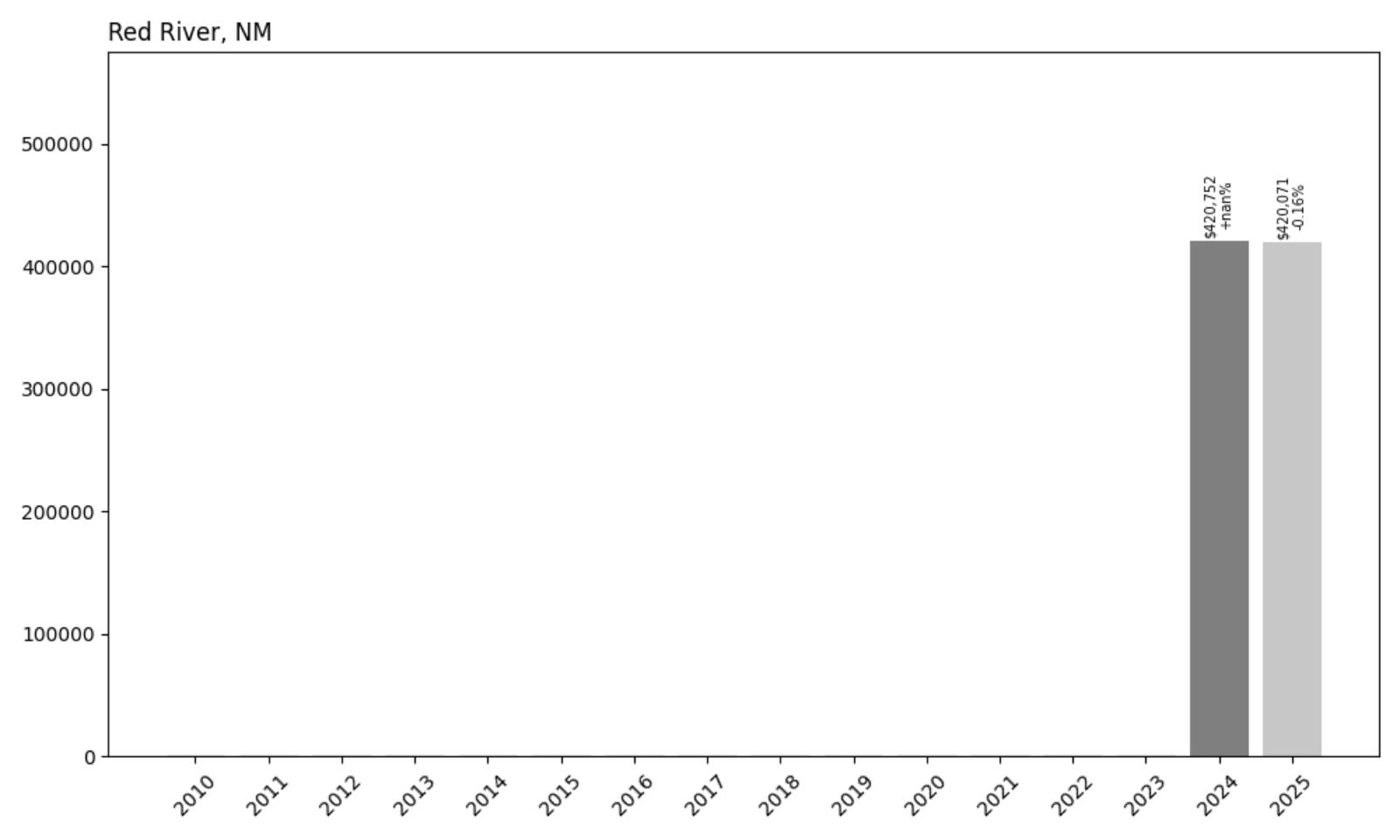

19. Red River – 0.16% Home Price Decrease Since 2024

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $NA

- 2019: $NA

- 2020: $NA

- 2021: $NA

- 2022: $NA

- 2023: $NA

- 2024: $420,752

- 2025: $420,071 (−$681, −0.16% from previous year)

Red River recorded a slight dip in home values from 2024 to 2025, falling by just 0.16%. This marginal decrease leaves the town’s average home price at $420,071—still one of the highest among northern New Mexico’s resort communities. Because no prior Zillow data is available before 2024, it’s difficult to assess the full historical trajectory, but current prices place Red River squarely in the premium tier of New Mexico housing markets.

Red River – Ski Resort Living in the Sangre de Cristo Mountains

Red River is a picturesque mountain town and ski destination located in Taos County, deep in the Sangre de Cristo range. It’s known for its family-friendly ski slopes, alpine charm, and year-round appeal. Tourists flock here for hiking, off-roading, fishing, and winter sports, and many end up buying property as vacation homes or seasonal rentals. Because of the tourism economy, homes tend to retain high value, and the limited number of properties in town keeps inventory tight.

The tiny dip in price from 2024 to 2025 likely reflects short-term fluctuations in buyer behavior rather than any weakening of the town’s desirability. In a market with few listings, even one or two low-priced sales can shift the average. Red River’s economy is built on tourism, and demand for vacation homes or investment rentals remains strong. With its scenic backdrop and easy access to the Enchanted Circle, Red River remains one of the most sought-after alpine markets in the state.

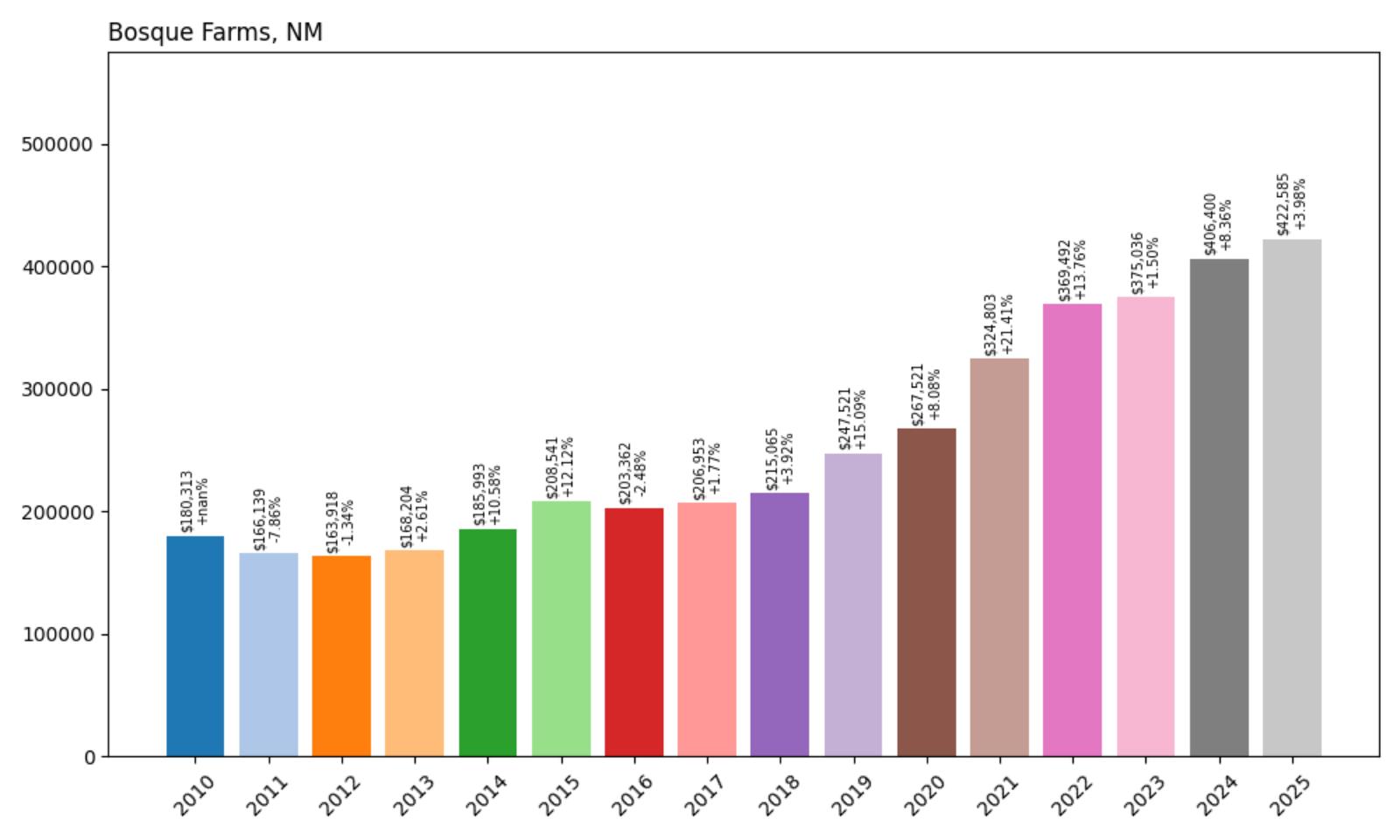

18. Bosque Farms – 134.3% Home Price Increase Since 2010

- 2010: $180,313

- 2011: $166,139 (−$14,173, −7.86% from previous year)

- 2012: $163,918 (−$2,222, −1.34% from previous year)

- 2013: $168,204 (+$4,286, +2.61% from previous year)

- 2014: $185,993 (+$17,789, +10.58% from previous year)

- 2015: $208,541 (+$22,548, +12.12% from previous year)

- 2016: $203,362 (−$5,178, −2.48% from previous year)

- 2017: $206,953 (+$3,591, +1.77% from previous year)

- 2018: $215,065 (+$8,111, +3.92% from previous year)

- 2019: $247,521 (+$32,456, +15.09% from previous year)

- 2020: $267,521 (+$20,000, +8.08% from previous year)

- 2021: $324,803 (+$57,282, +21.41% from previous year)

- 2022: $369,492 (+$44,689, +13.76% from previous year)

- 2023: $375,036 (+$5,544, +1.50% from previous year)

- 2024: $406,400 (+$31,363, +8.36% from previous year)

- 2025: $422,585 (+$16,185, +3.98% from previous year)

Bosque Farms has seen home values soar 134.3% since 2010, rising from $180,313 to $422,585 over 15 years. Growth was especially rapid between 2019 and 2022, with a consistent upward trend in the years since. While the pace of increases has slowed slightly, the market remains solid, and recent gains show no signs of a pullback.

Bosque Farms – Small-Town Growth Just South of Albuquerque

Bosque Farms is a semi-rural community in Valencia County, about 20 minutes south of Albuquerque. Known for its wide lots, horse-friendly zoning, and quiet pace of life, it has long been attractive to families and retirees seeking room to breathe. While it’s not considered a major suburb, its proximity to the city allows for easy commuting without the congestion of urban life.

The market here has benefited from Albuquerque’s growing housing pressures, drawing interest from buyers priced out of the metro. Bosque Farms offers a unique blend of rural charm and accessibility, and its steady infrastructure improvements—including fiber internet access—have made it more viable for remote workers. The home value growth over the past decade reflects this evolving identity: no longer just an agricultural town, Bosque Farms has become one of the Albuquerque area’s most consistent performers in real estate.

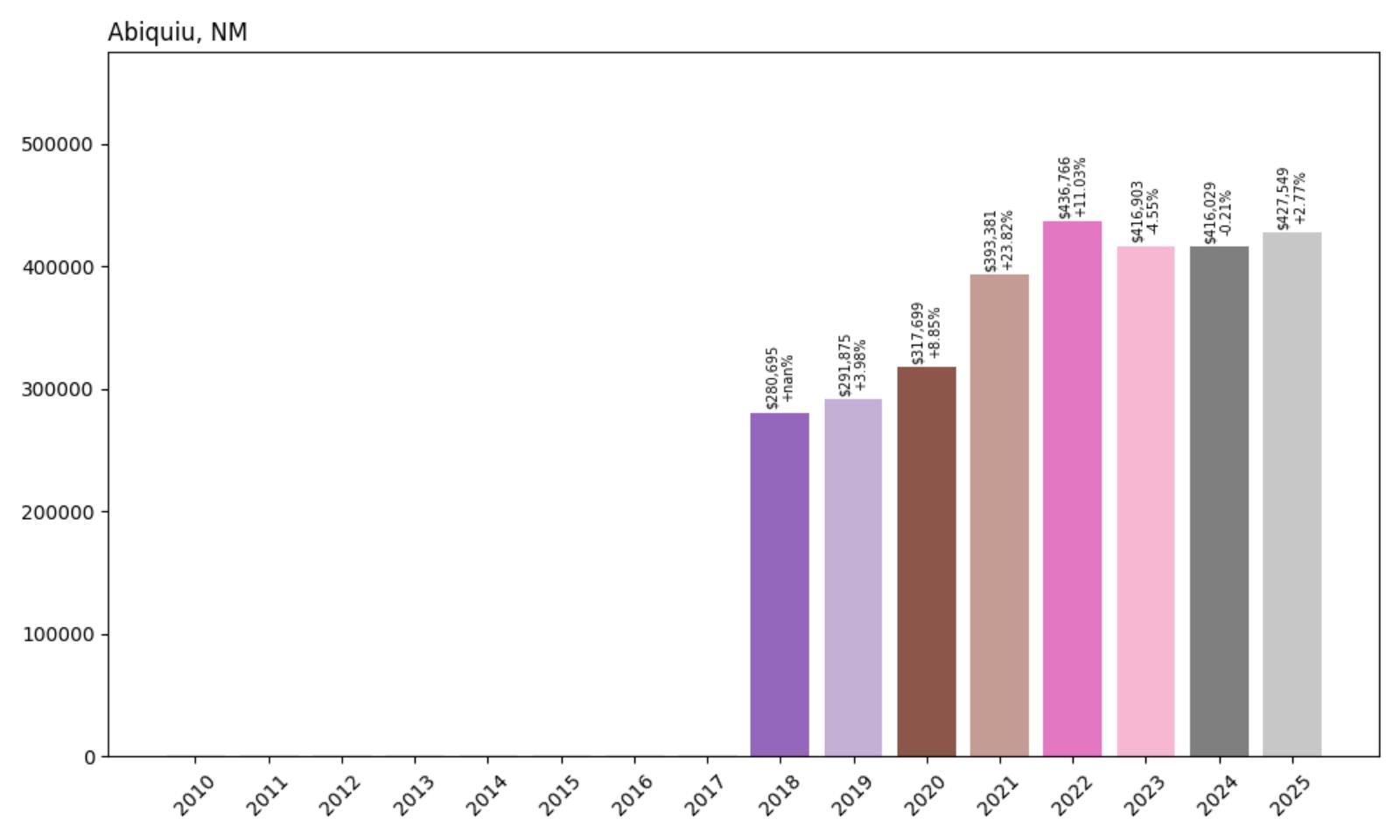

17. Abiquiu – 52.3% Home Price Increase Since 2018

- 2010: $NA

- 2011: $NA

- 2012: $NA

- 2013: $NA

- 2014: $NA

- 2015: $NA

- 2016: $NA

- 2017: $NA

- 2018: $280,695

- 2019: $291,875 (+$11,180, +3.98% from previous year)

- 2020: $317,699 (+$25,824, +8.85% from previous year)

- 2021: $393,381 (+$75,682, +23.82% from previous year)

- 2022: $436,766 (+$43,384, +11.03% from previous year)

- 2023: $416,903 (−$19,863, −4.55% from previous year)

- 2024: $416,029 (−$874, −0.21% from previous year)

- 2025: $427,549 (+$11,520, +2.77% from previous year)

Since 2018, Abiquiu’s home values have increased by 52.3%, rising from $280,695 to $427,549. The strongest growth came between 2020 and 2022, when prices soared by over $155,000 in just two years. While there was a dip in 2023 and flatlining in 2024, the market began to recover in 2025, suggesting stable interest in this artistic and scenic community.

Abiquiu – Desert Light and Artistic Legacy

🔥 Would you like to save this?

Abiquiu is best known as the former home of artist Georgia O’Keeffe, and the landscape here has inspired generations of painters, writers, and travelers. Located along the Chama River northwest of Española, Abiquiu offers wide open desert views, red rock cliffs, and star-filled skies. It remains sparsely populated, with much of the surrounding land preserved or protected, adding to its mystique and limiting available housing stock.

The town’s home prices surged during the early 2020s as remote work and retreat lifestyles became more desirable. Abiquiu’s mystique continues to attract buyers seeking a mix of natural beauty and cultural history. While its recent market correction brought a pause, the rebound in 2025 shows that demand hasn’t disappeared—just recalibrated. For those drawn to New Mexico’s spiritual and artistic heartland, Abiquiu remains one of the most coveted places to buy property.

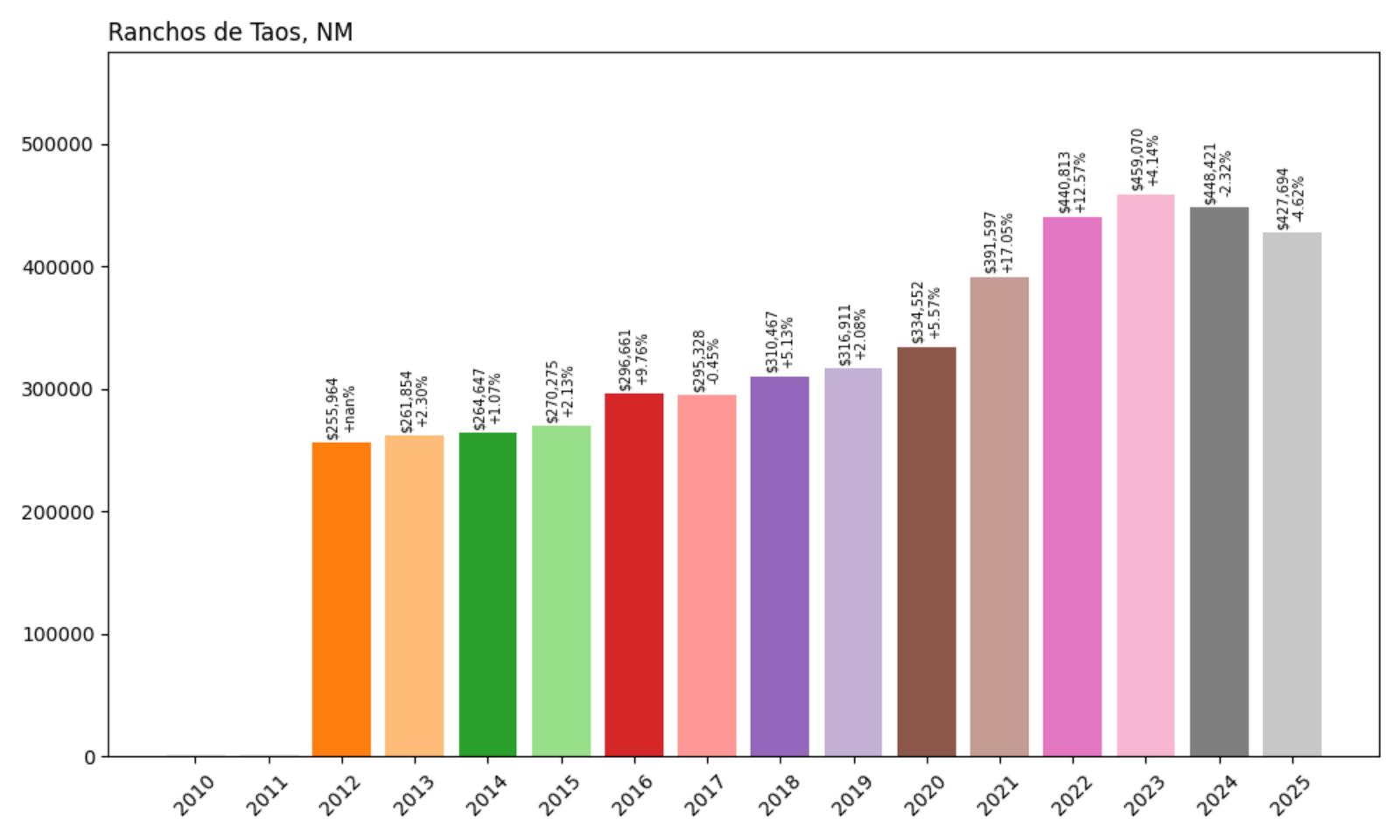

16. Ranchos de Taos – 67.0% Home Price Increase Since 2012

- 2010: $NA

- 2011: $NA

- 2012: $255,964

- 2013: $261,854 (+$5,890, +2.30% from previous year)

- 2014: $264,647 (+$2,793, +1.07% from previous year)

- 2015: $270,275 (+$5,628, +2.13% from previous year)

- 2016: $296,661 (+$26,386, +9.76% from previous year)

- 2017: $295,328 (−$1,333, −0.45% from previous year)

- 2018: $310,467 (+$15,139, +5.13% from previous year)

- 2019: $316,911 (+$6,445, +2.08% from previous year)

- 2020: $334,552 (+$17,640, +5.57% from previous year)

- 2021: $391,597 (+$57,046, +17.05% from previous year)

- 2022: $440,813 (+$49,216, +12.57% from previous year)

- 2023: $459,070 (+$18,256, +4.14% from previous year)

- 2024: $448,421 (−$10,648, −2.32% from previous year)

- 2025: $427,694 (−$20,727, −4.62% from previous year)

Home values in Ranchos de Taos have risen 67.0% since 2012, climbing from $255,964 to $427,694 in 2025. Prices peaked in 2023 before slipping in both 2024 and 2025, likely reflecting broader affordability concerns in northern New Mexico. Despite this pullback, the long-term growth trend remains strong, and the town continues to hold one of the higher average home values in Taos County.

Ranchos de Taos – Culture, Views, and Steady Demand

Ranchos de Taos is just south of Taos proper, and home to the iconic San Francisco de Asís Mission Church. The area offers a quieter alternative to central Taos while still benefiting from the town’s artistic reputation, ski tourism, and scenic value. The mix of adobe homes, local shops, and historic neighborhoods draws buyers who want culture and quiet in equal measure.

The strong appreciation seen during the 2020–2022 period pushed local values well above their historic averages. While the past two years brought mild declines, the market remains far above where it was just a decade ago. Demand for homes in Ranchos de Taos is still solid—especially for those priced out of central Taos. Its balance of access, history, and mountain views keeps buyers interested, even during market slowdowns.

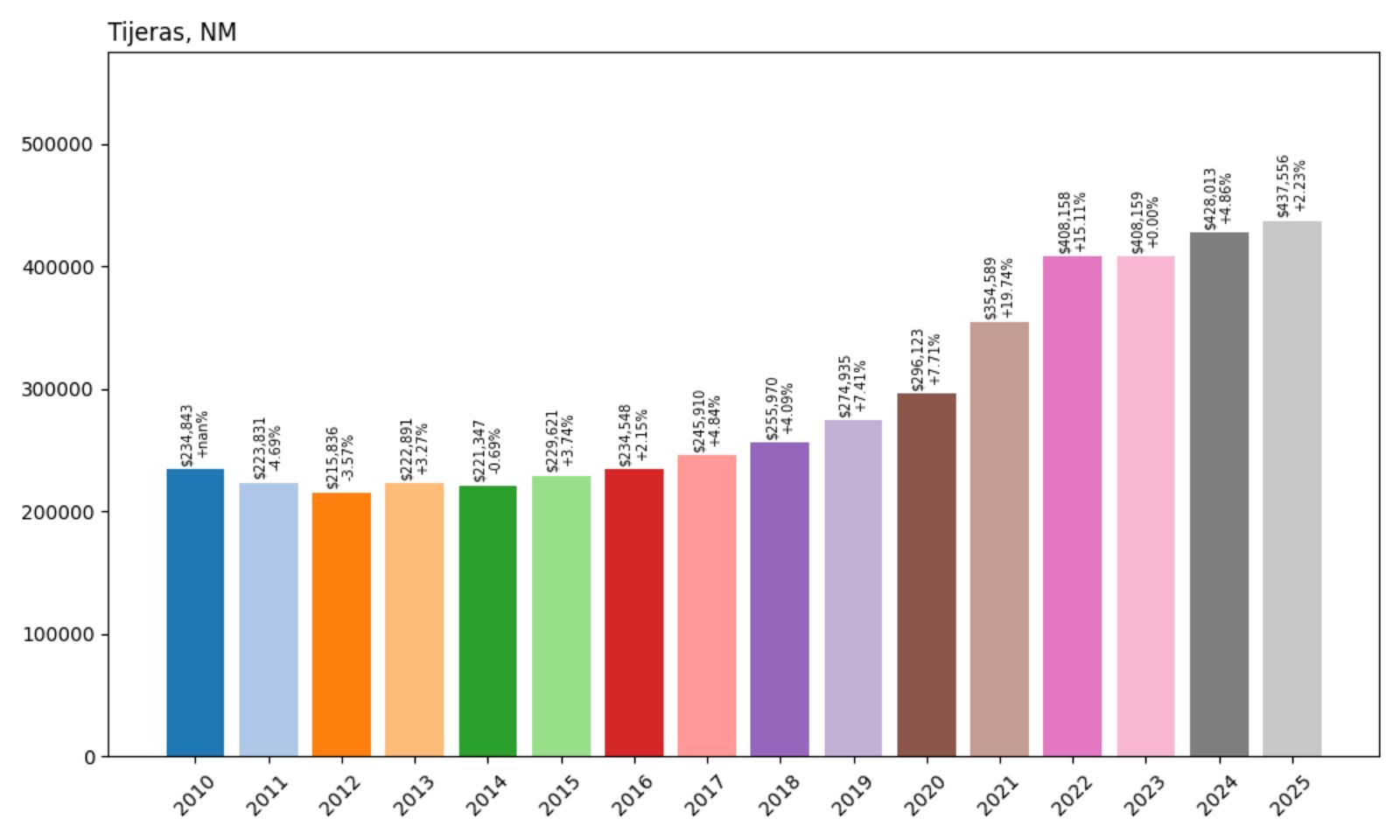

15. Tijeras – 86.3% Home Price Increase Since 2010

- 2010: $234,843

- 2011: $223,831 (−$11,011, −4.69% from previous year)

- 2012: $215,836 (−$7,995, −3.57% from previous year)

- 2013: $222,891 (+$7,055, +3.27% from previous year)

- 2014: $221,347 (−$1,544, −0.69% from previous year)

- 2015: $229,621 (+$8,274, +3.74% from previous year)

- 2016: $234,548 (+$4,926, +2.15% from previous year)

- 2017: $245,910 (+$11,362, +4.84% from previous year)

- 2018: $255,970 (+$10,060, +4.09% from previous year)

- 2019: $274,935 (+$18,964, +7.41% from previous year)

- 2020: $296,123 (+$21,188, +7.71% from previous year)

- 2021: $354,589 (+$58,467, +19.74% from previous year)

- 2022: $408,158 (+$53,568, +15.11% from previous year)

- 2023: $408,159 (+$1, +0.00% from previous year)

- 2024: $428,013 (+$19,854, +4.86% from previous year)

- 2025: $437,556 (+$9,543, +2.23% from previous year)

Since 2010, home values in Tijeras have jumped 86.3%, climbing from $234,843 to $437,556 in 2025. Much of that growth occurred between 2020 and 2022, when the market experienced a steep surge. While prices have stabilized in more recent years, they’ve continued to post modest gains, pointing to ongoing demand for this high-desirability location east of Albuquerque.

Tijeras – Forested Homes in the East Mountains

Tijeras is a gateway to the East Mountains along I-40, offering a wooded setting within commuting distance of Albuquerque. The area attracts buyers who want space, cooler summer temperatures, and proximity to hiking, biking, and open land. While it’s close to the metro area, Tijeras retains a distinctly rural, outdoorsy feel—ideal for those looking to escape city noise without sacrificing access to work or services.

The pandemic-era boom pushed prices rapidly upward as remote workers and outdoor enthusiasts looked for housing with better access to nature. Since then, the market has cooled, but not reversed—home prices have continued to inch up year over year. With its mix of rustic and upscale homes, plus good access via Highway 337 and I-40, Tijeras remains one of the most desirable East Mountain towns. Inventory is typically low, which supports ongoing price stability even as regional trends shift.

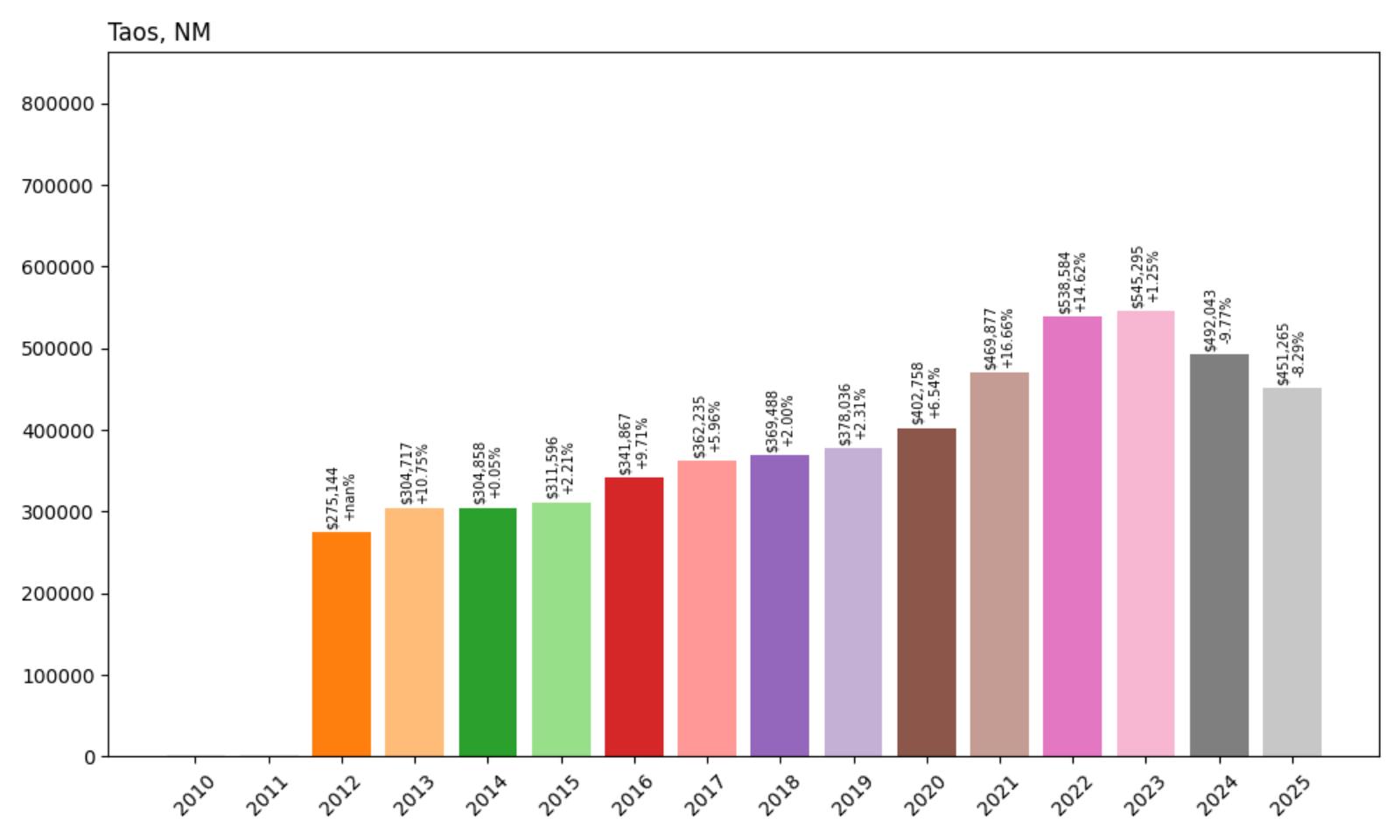

14. Taos – 64.0% Home Price Increase Since 2012

- 2010: $NA

- 2011: $NA

- 2012: $275,144

- 2013: $304,717 (+$29,573, +10.75% from previous year)

- 2014: $304,858 (+$141, +0.05% from previous year)

- 2015: $311,596 (+$6,738, +2.21% from previous year)

- 2016: $341,867 (+$30,271, +9.71% from previous year)

- 2017: $362,235 (+$20,368, +5.96% from previous year)

- 2018: $369,488 (+$7,253, +2.00% from previous year)

- 2019: $378,036 (+$8,548, +2.31% from previous year)

- 2020: $402,758 (+$24,722, +6.54% from previous year)

- 2021: $469,877 (+$67,119, +16.66% from previous year)

- 2022: $538,584 (+$68,707, +14.62% from previous year)

- 2023: $545,295 (+$6,710, +1.25% from previous year)

- 2024: $492,043 (−$53,252, −9.77% from previous year)

- 2025: $451,265 (−$40,778, −8.29% from previous year)

Home values in Taos have increased 64.0% since 2012, though the last two years have seen a notable decline. After peaking in 2022 at over $538,000, prices dropped to $451,265 by 2025. Despite the recent dip, Taos remains one of the most expensive and culturally significant markets in northern New Mexico.

Taos – Art, Skiing, and a Unique Market Identity

Taos is known internationally for its mix of Pueblo heritage, arts scene, and natural beauty. Home to Taos Ski Valley and a major hub for creatives, the town has a long-standing reputation as one of New Mexico’s most iconic destinations. Its real estate market has historically drawn second-home buyers, retirees, and investors, which has kept demand high and inventory tight, particularly near the town center and in neighborhoods with historic charm.

Recent price drops may reflect affordability pressures and cooling demand after several years of intense appreciation. However, the fundamentals—location, tourism, and culture—continue to support long-term demand. The broader Taos region still offers a lifestyle that few towns can match, and the current decline in pricing may present new entry opportunities for buyers waiting on the sidelines. Either way, Taos remains a cornerstone of New Mexico’s premium real estate tier.

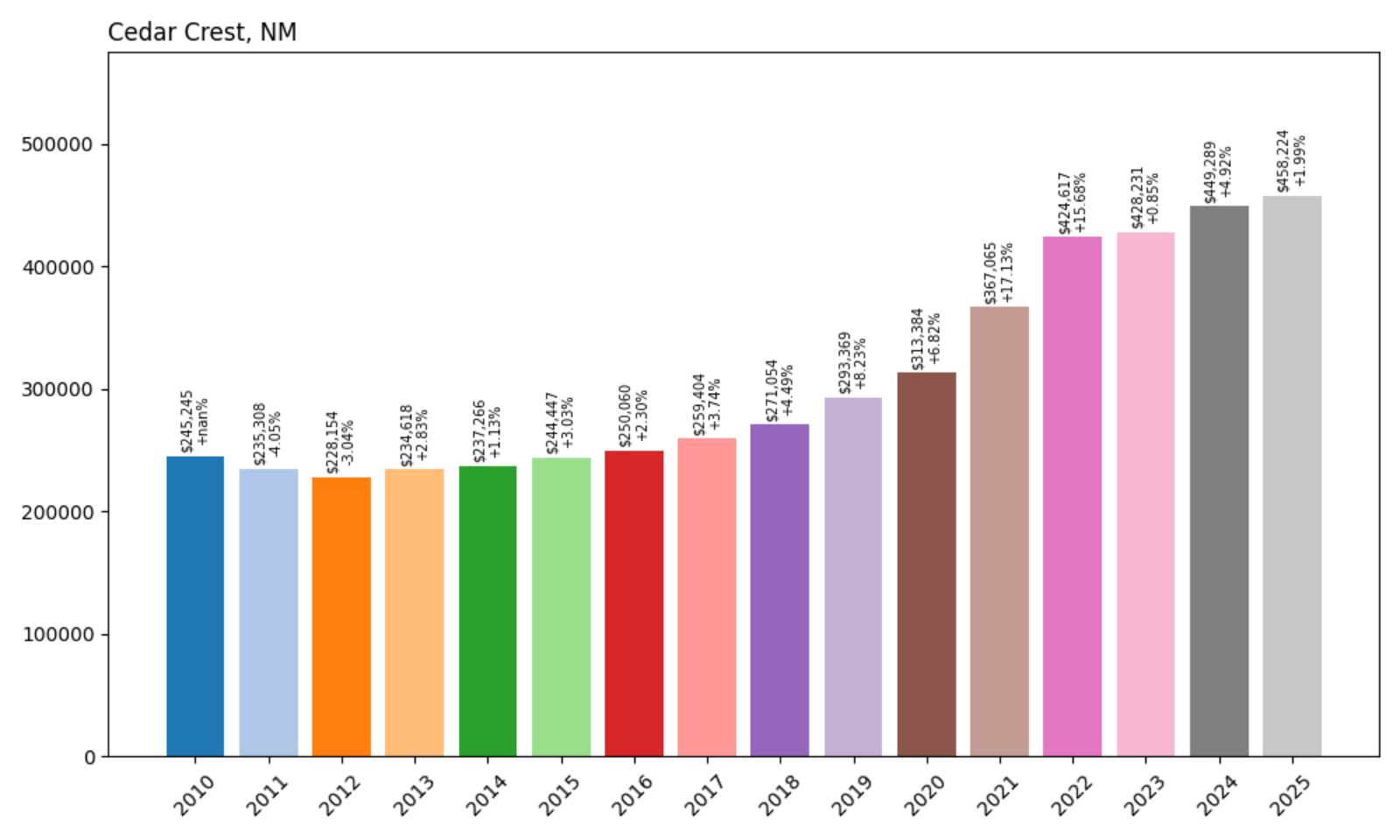

13. Cedar Crest – 86.9% Home Price Increase Since 2010

- 2010: $245,245

- 2011: $235,308 (−$9,937, −4.05% from previous year)

- 2012: $228,154 (−$7,153, −3.04% from previous year)

- 2013: $234,618 (+$6,464, +2.83% from previous year)

- 2014: $237,266 (+$2,648, +1.13% from previous year)

- 2015: $244,447 (+$7,181, +3.03% from previous year)

- 2016: $250,060 (+$5,614, +2.30% from previous year)

- 2017: $259,404 (+$9,343, +3.74% from previous year)

- 2018: $271,054 (+$11,650, +4.49% from previous year)

- 2019: $293,369 (+$22,315, +8.23% from previous year)

- 2020: $313,384 (+$20,016, +6.82% from previous year)

- 2021: $367,065 (+$53,681, +17.13% from previous year)

- 2022: $424,617 (+$57,552, +15.68% from previous year)

- 2023: $428,231 (+$3,613, +0.85% from previous year)

- 2024: $449,289 (+$21,058, +4.92% from previous year)

- 2025: $458,224 (+$8,936, +1.99% from previous year)

Cedar Crest has seen home values climb 86.9% since 2010, with consistent growth throughout the decade and a major surge between 2020 and 2022. The market has continued rising since then, albeit at a slower pace, reaching $458,224 in 2025. The town remains one of the most desirable parts of the East Mountains region for commuters and retirees alike.

Cedar Crest – Woodland Setting With Quick Access to Albuquerque

Cedar Crest sits just east of Albuquerque in Bernalillo County, along the scenic Turquoise Trail. It offers the feel of a forested mountain town but lies only 20–25 minutes from the city via I-40. With its tall pines, cooler weather, and strong sense of community, Cedar Crest attracts a mix of full-time residents, second-home owners, and outdoor enthusiasts. The nearby Sandia Mountains and national forest land provide endless recreation opportunities.

What sets Cedar Crest apart is its balance: it’s close enough for daily commuting, yet far enough to feel like an escape. The strong appreciation seen in recent years reflects both that convenience and the natural limitations on development in the region. As more people seek this blend of privacy and accessibility, the Cedar Crest market is likely to remain competitive. Even as growth slows slightly, the fundamentals remain solid.

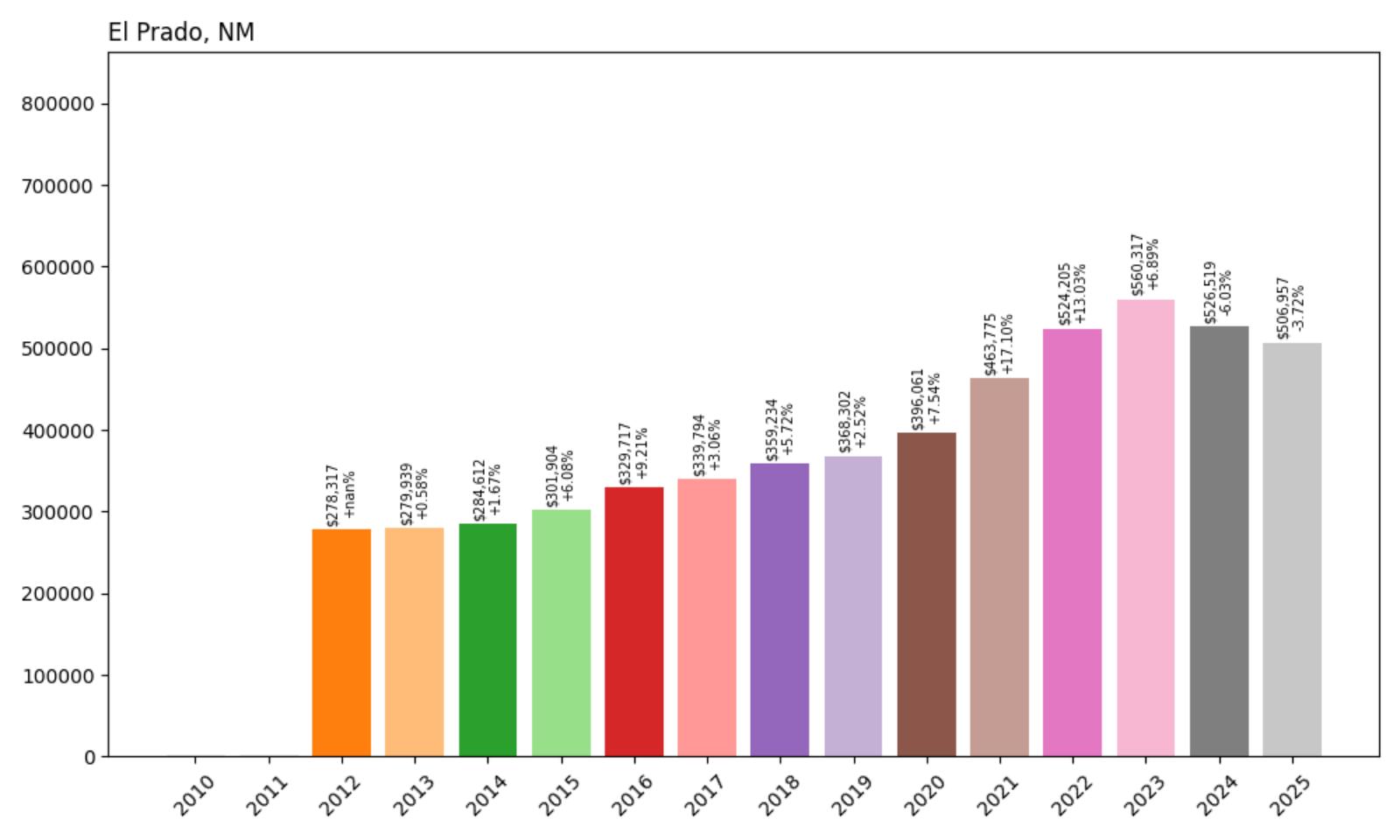

12. El Prado – 82.2% Home Price Increase Since 2012

- 2010: $NA

- 2011: $NA

- 2012: $278,317

- 2013: $279,939 (+$1,622, +0.58% from previous year)

- 2014: $284,612 (+$4,673, +1.67% from previous year)

- 2015: $301,904 (+$17,292, +6.08% from previous year)

- 2016: $329,717 (+$27,813, +9.21% from previous year)

- 2017: $339,794 (+$10,077, +3.06% from previous year)

- 2018: $359,234 (+$19,440, +5.72% from previous year)

- 2019: $368,302 (+$9,067, +2.52% from previous year)

- 2020: $396,061 (+$27,759, +7.54% from previous year)

- 2021: $463,775 (+$67,714, +17.10% from previous year)

- 2022: $524,205 (+$60,430, +13.03% from previous year)

- 2023: $560,317 (+$36,112, +6.89% from previous year)

- 2024: $526,519 (−$33,798, −6.03% from previous year)

- 2025: $506,957 (−$19,563, −3.72% from previous year)

El Prado home prices have increased 82.2% since 2012, even after accounting for recent declines. The town peaked in 2023 and has since seen moderate pullbacks, but still holds one of the highest average home values in Taos County at $506,957. The area’s blend of scenic setting and limited inventory continues to support strong long-term value.

El Prado – Open Vistas and High-Altitude Housing

Just north of Taos, El Prado offers expansive views of the Taos Plateau and Sangre de Cristo Mountains. The community is known for its open spaces, alternative architecture, and relaxed vibe. It has long attracted artists, retirees, and those looking for peace and open sky. While there’s no defined town center, the area has a number of small businesses and easy access to Taos proper.

The growth in home values reflects the increasing appeal of this quiet yet well-located enclave. Prices dipped in 2024 and 2025, but the long-term appreciation remains strong. Buyers who prioritize landscape, light, and a bit of space from town often choose El Prado over more densely developed parts of Taos. As high-desert living continues to attract newcomers, El Prado’s popularity—and pricing power—is likely to remain intact.

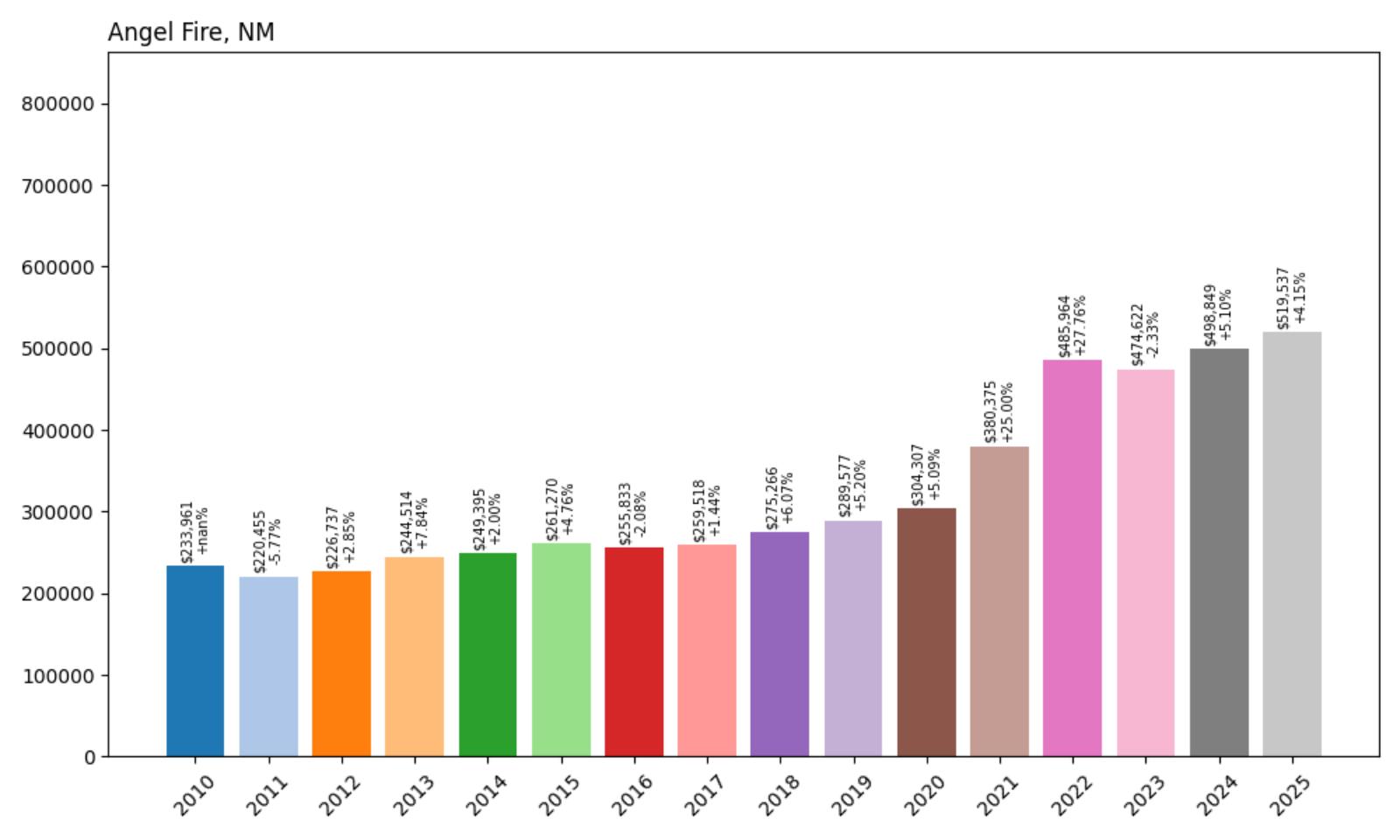

11. Angel Fire – 121.9% Home Price Increase Since 2010

- 2010: $233,961

- 2011: $220,455 (−$13,506, −5.77% from previous year)

- 2012: $226,737 (+$6,282, +2.85% from previous year)

- 2013: $244,514 (+$17,776, +7.84% from previous year)

- 2014: $249,395 (+$4,881, +2.00% from previous year)

- 2015: $261,270 (+$11,874, +4.76% from previous year)

- 2016: $255,833 (−$5,436, −2.08% from previous year)

- 2017: $259,518 (+$3,684, +1.44% from previous year)

- 2018: $275,266 (+$15,749, +6.07% from previous year)

- 2019: $289,577 (+$14,310, +5.20% from previous year)

- 2020: $304,307 (+$14,731, +5.09% from previous year)

- 2021: $380,375 (+$76,067, +25.00% from previous year)

- 2022: $485,964 (+$105,589, +27.76% from previous year)

- 2023: $474,622 (−$11,342, −2.33% from previous year)

- 2024: $498,849 (+$24,228, +5.10% from previous year)

- 2025: $519,537 (+$20,688, +4.15% from previous year)

Since 2010, Angel Fire’s home values have risen by an impressive 121.9%, more than doubling in just 15 years. The average home value in 2025 is $519,537, up from $233,961 in 2010. After modest growth in the early 2010s, the pace picked up sharply in 2020 and especially in 2021 and 2022, when prices saw double-digit annual jumps. Even after a slight correction in 2023, values rebounded quickly, signaling continued demand and resilience in this high-altitude resort community. The steepest annual increase came in 2022, with prices surging more than $100,000 in a single year.

Angel Fire – Northern New Mexico’s Mountain Retreat

Angel Fire is a resort town located in the Sangre de Cristo Mountains, part of the scenic Moreno Valley. It’s a favorite destination for outdoor enthusiasts year-round, with a ski resort in winter, and hiking, biking, and golfing in the warmer months. The town’s altitude—over 8,000 feet—provides cooler temperatures and stunning alpine views that draw buyers from Texas, Oklahoma, and other parts of New Mexico. Much of the housing stock consists of cabins, vacation homes, and investment properties catering to seasonal visitors. This market dynamic helps explain the volatility in year-to-year prices, especially during and after the pandemic boom in remote and recreational living.

The dramatic jump in prices during 2021 and 2022 coincides with nationwide trends of people relocating to less urban, more nature-oriented locations, especially with the rise of remote work. Angel Fire benefited from this shift, with buyers snapping up properties near the ski slopes and golf course. The 2023 dip may reflect both national interest rate pressures and a temporary lull after the surge, but the following rebound shows sustained interest. Limited inventory and rising costs of new construction also contribute to the long-term pricing power. Angel Fire continues to command premium values among mountain towns in New Mexico, and its recreational amenities help it hold that position.

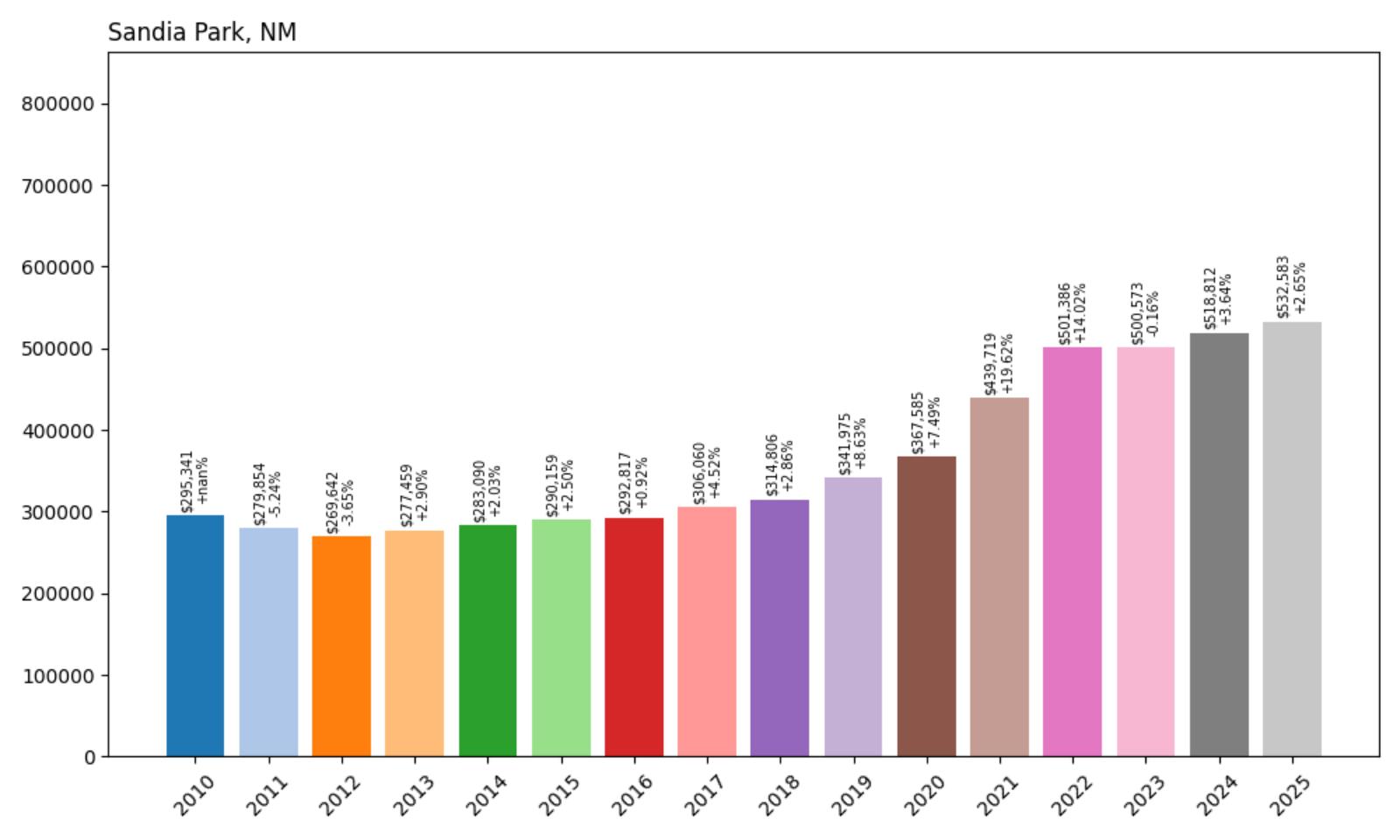

10. Sandia Park – 80.3% Home Price Increase Since 2010

- 2010: $295,341

- 2011: $279,854 (−$15,487, −5.24% from previous year)

- 2012: $269,642 (−$10,212, −3.65% from previous year)

- 2013: $277,459 (+$7,817, +2.90% from previous year)

- 2014: $283,090 (+$5,631, +2.03% from previous year)

- 2015: $290,159 (+$7,069, +2.50% from previous year)

- 2016: $292,817 (+$2,658, +0.92% from previous year)

- 2017: $306,060 (+$13,243, +4.52% from previous year)

- 2018: $314,806 (+$8,747, +2.86% from previous year)

- 2019: $341,975 (+$27,169, +8.63% from previous year)

- 2020: $367,585 (+$25,610, +7.49% from previous year)

- 2021: $439,719 (+$72,134, +19.62% from previous year)

- 2022: $501,386 (+$61,666, +14.02% from previous year)

- 2023: $500,573 (−$812, −0.16% from previous year)

- 2024: $518,812 (+$18,239, +3.64% from previous year)

- 2025: $532,583 (+$13,771, +2.65% from previous year)

Home values in Sandia Park have appreciated by 80.3% since 2010, with the average price now sitting at $532,583. The early years were marked by softening values, but things began to turn in 2013. From that point forward, price growth was steady, culminating in large gains between 2019 and 2022. Even after a slight dip in 2023, the market remained strong and quickly recovered. The long-term growth reflects steady demand in this East Mountains enclave, which offers both privacy and proximity to Albuquerque.

Sandia Park – Peaceful Mountain Living Near Albuquerque

Sandia Park sits in the Sandia Mountains just east of Albuquerque and is part of the scenic Turquoise Trail National Scenic Byway. It’s a peaceful, pine-covered community known for larger lots, mountain views, and an escape from city congestion—all while remaining within commuting distance to Albuquerque and Sandia Labs. The area is especially appealing to retirees, second-home buyers, and telecommuters looking for fresh air, quiet roads, and more space without leaving civilization behind. With the Sandia Peak Tramway and hiking trails nearby, outdoor access is unmatched, and this proximity to both nature and metro services continues to drive long-term interest in the area.

Between 2019 and 2022, Sandia Park experienced its strongest price acceleration, jumping over $160,000 in just three years. These years reflect heightened buyer urgency across rural and semi-rural parts of the Southwest. Unlike vacation-focused towns, Sandia Park appeals to full-time residents seeking a long-term home. Homes here often sit on 1–5 acres, and zoning limits density, which helps keep inventory low and values competitive. As interest rates shifted in 2023, prices held up better than in many other regions—pointing to sustained, demand-driven value rather than speculative pressure. Sandia Park remains a prime location for those seeking New Mexico’s mountain beauty without sacrificing access to jobs or amenities.

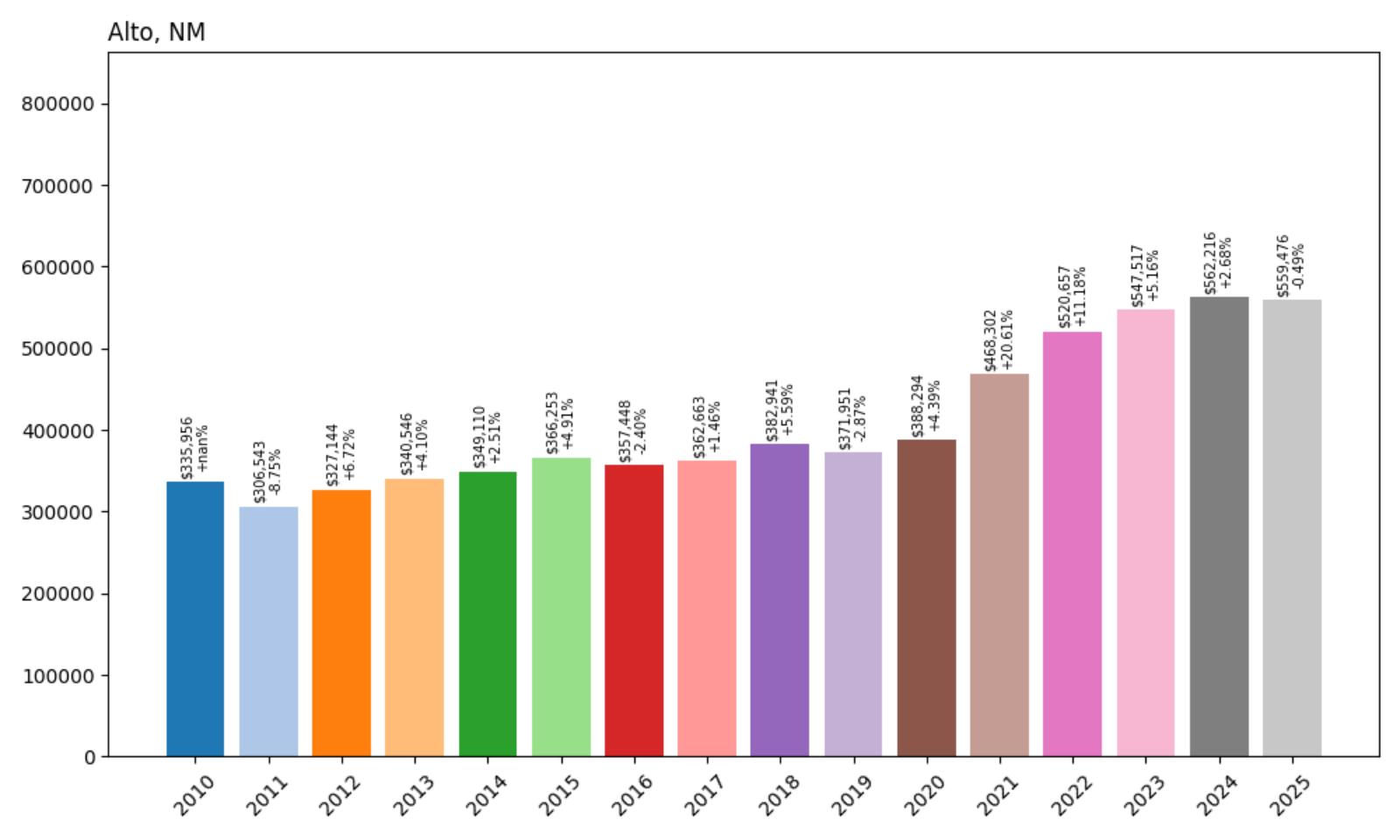

9. Alto – 66.5% Home Price Increase Since 2010

- 2010: $335,956

- 2011: $306,543 (−$29,413, −8.75% from previous year)

- 2012: $327,144 (+$20,601, +6.72% from previous year)

- 2013: $340,546 (+$13,402, +4.10% from previous year)

- 2014: $349,110 (+$8,564, +2.51% from previous year)

- 2015: $366,253 (+$17,143, +4.91% from previous year)

- 2016: $357,448 (−$8,805, −2.40% from previous year)

- 2017: $362,663 (+$5,215, +1.46% from previous year)

- 2018: $382,941 (+$20,279, +5.59% from previous year)

- 2019: $371,951 (−$10,991, −2.87% from previous year)

- 2020: $388,294 (+$16,343, +4.39% from previous year)

- 2021: $468,302 (+$80,009, +20.61% from previous year)

- 2022: $520,657 (+$52,355, +11.18% from previous year)

- 2023: $547,517 (+$26,859, +5.16% from previous year)

- 2024: $562,216 (+$14,700, +2.68% from previous year)

- 2025: $559,476 (−$2,740, −0.49% from previous year)

Alto’s home prices have climbed 66.5% since 2010, from $335,956 to $559,476 in 2025. Despite some mild declines in years like 2011, 2016, and 2019, the overall growth trend remains strong—especially since 2020. The largest single-year leap came in 2021 when prices surged over $80,000, marking a turning point in the local housing market. Even with a small dip in 2025, prices remain well above their pre-pandemic levels. Buyers here seem to be prioritizing the area’s combination of space, scenery, and semi-remote lifestyle.

Alto – Scenic Privacy with Resort Appeal

Alto sits just north of Ruidoso in Lincoln County and offers a more serene, elevated living experience. It’s best known for the Alto Lakes Golf & Country Club, which has drawn retirees and second-home owners from across Texas and New Mexico for decades. With alpine forests, wildlife, and lake views all around, it offers a cooler and greener retreat compared to much of the state. Many homes are custom-built and sit on large lots, giving the area a secluded, upscale vibe. In recent years, as buyers fled high-density areas, Alto became an attractive option for those seeking vacation properties or long-term escapes within driving distance of El Paso, Albuquerque, and Lubbock.

Much of Alto’s growth after 2020 was fueled by broader trends in remote work and vacation home investing. The town’s limited land for new development and low housing turnover has helped maintain upward pressure on prices. Its relative isolation—both a challenge and an asset—means that buyers here are often more committed and less speculative. The slight softening in 2025 may reflect short-term adjustments in the broader market, but Alto’s long-term trajectory remains solid. As climate patterns continue to favor higher-elevation regions and demand for outdoor living persists, Alto is likely to remain a valuable slice of New Mexico’s housing market.

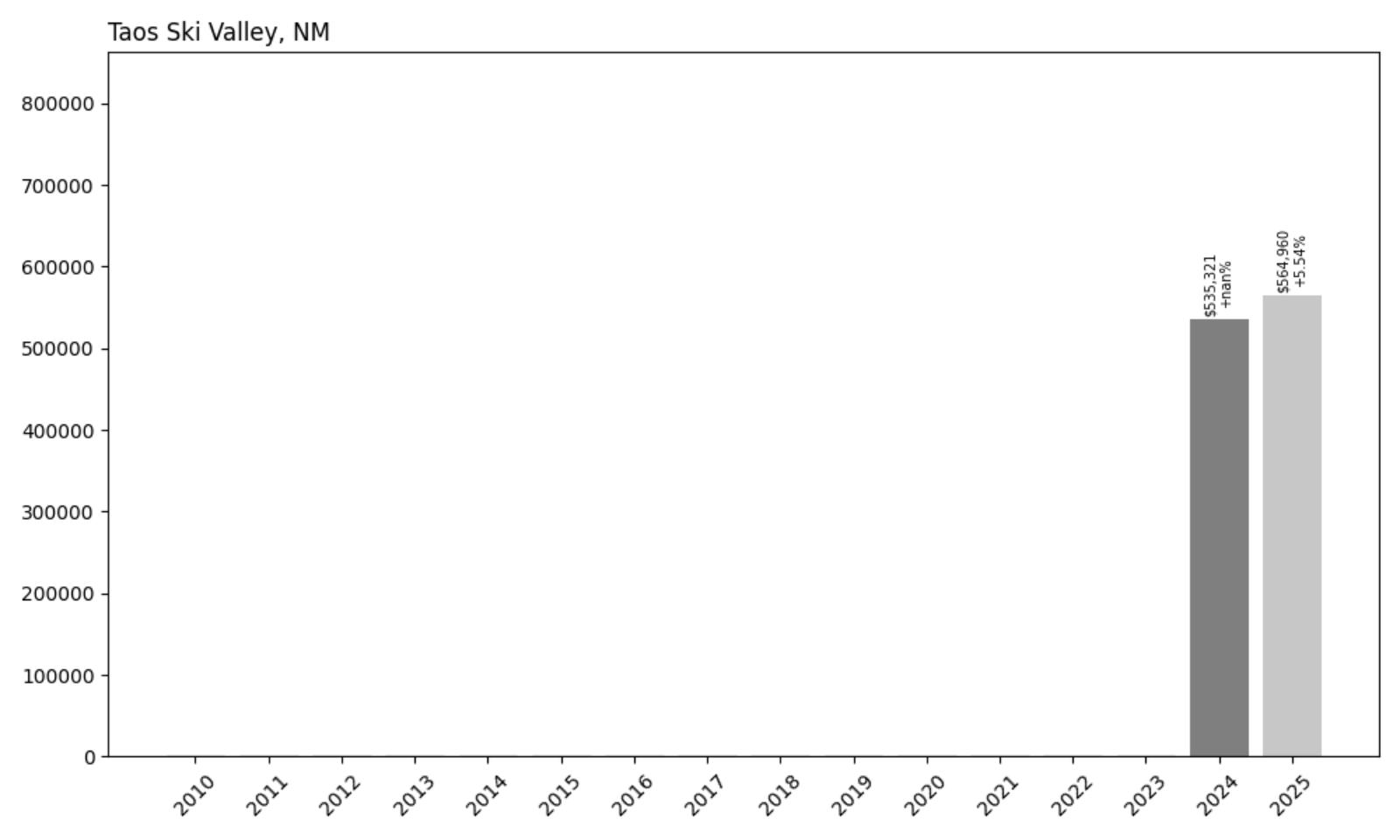

8. Taos Ski Valley – 5.5% Home Price Increase Since 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $535,321

- 2025: $564,960 (+$29,639, +5.54% from previous year)

Because Zillow data only begins in 2024 for Taos Ski Valley, the measured growth is limited to a single year—a 5.5% gain from $535,321 to $564,960. While that may not seem like a massive spike in the grand scheme of long-term appreciation, it’s a substantial jump for just one year, particularly in a niche luxury market like this one. Taos Ski Valley’s real estate market operates very differently from most towns in the state, catering to a narrow but affluent buyer segment with deep pockets and highly specific demands.

Taos Ski Valley – New Mexico’s Exclusive Alpine Resort Market

Taos Ski Valley is a world apart from most New Mexico towns. Located at over 9,000 feet in elevation and nestled deep within the Sangre de Cristo Mountains, it’s the highest incorporated municipality in the state. The area is best known for its namesake ski resort, which has seen major upgrades and private investment since billionaire conservationist Louis Bacon acquired it in 2013. Real estate here is characterized by luxury chalets, modern lodges, and a market that caters to second-home owners, vacation renters, and ski enthusiasts. With limited inventory and nearly no new builds outside resort planning, pricing is extremely supply-constrained.

The 2025 price increase underscores ongoing demand from affluent out-of-state buyers seeking mountain real estate with strong rental potential and year-round appeal. The village benefits from proximity to Taos proper while remaining isolated enough to maintain an elite, secluded feel. Unlike broader markets that rise and fall with economic conditions, Taos Ski Valley is relatively insulated—its buyers are less price-sensitive, and its offerings are unique in the region. Even modest annual growth here represents high dollar-value changes. With sustainability improvements, new lifts, and boutique hospitality upgrades in recent years, the area is positioned to continue attracting attention well beyond the ski season.

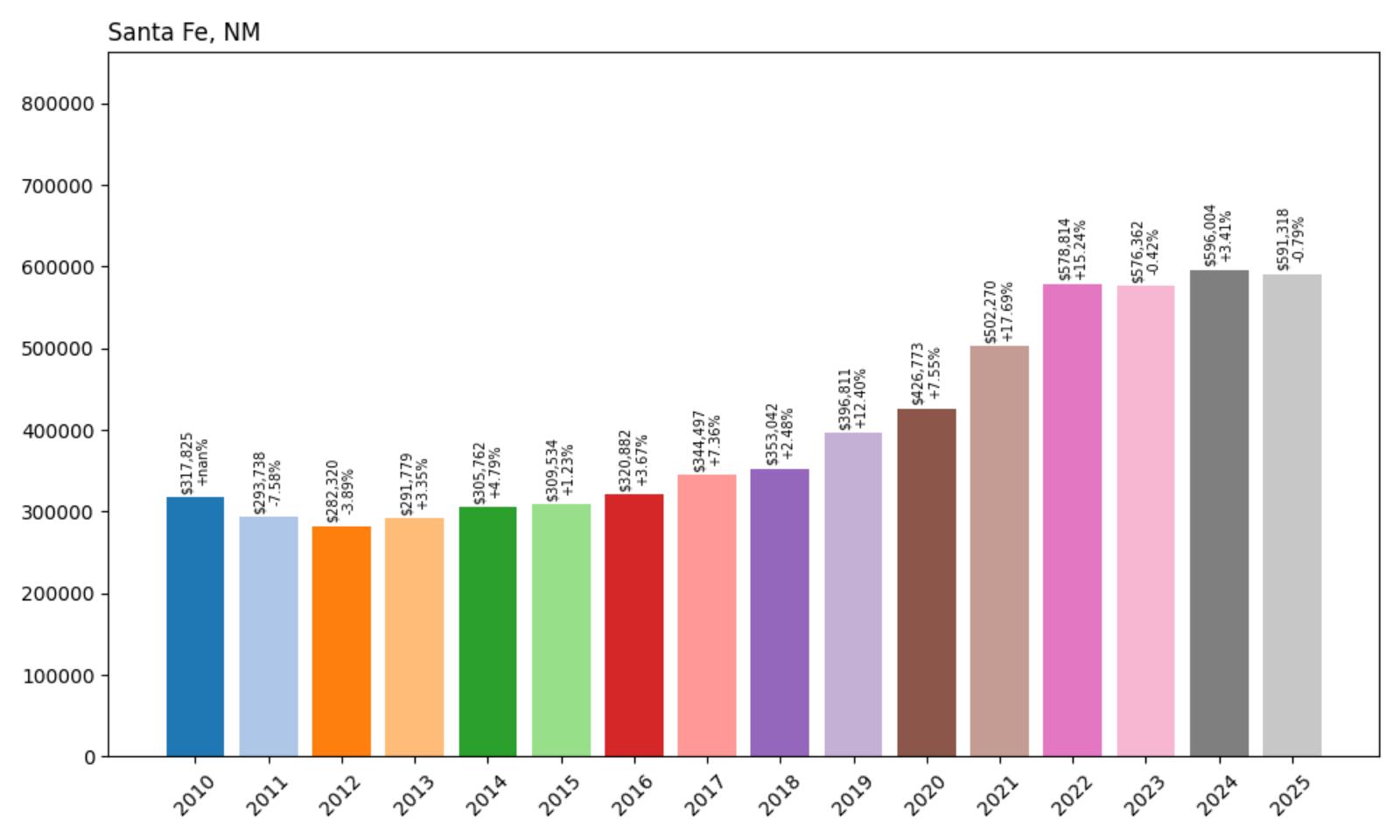

7. Santa Fe – 86% Home Price Increase Since 2010

- 2010: $317,825

- 2011: $293,738 (−$24,087, −7.58% from previous year)

- 2012: $282,320 (−$11,418, −3.89% from previous year)

- 2013: $291,779 (+$9,459, +3.35% from previous year)

- 2014: $305,762 (+$13,982, +4.79% from previous year)

- 2015: $309,534 (+$3,772, +1.23% from previous year)

- 2016: $320,882 (+$11,348, +3.67% from previous year)

- 2017: $344,497 (+$23,615, +7.36% from previous year)

- 2018: $353,042 (+$8,545, +2.48% from previous year)

- 2019: $396,811 (+$43,769, +12.40% from previous year)

- 2020: $426,773 (+$29,962, +7.55% from previous year)

- 2021: $502,270 (+$75,497, +17.69% from previous year)

- 2022: $578,814 (+$76,544, +15.24% from previous year)

- 2023: $576,362 (−$2,452, −0.42% from previous year)

- 2024: $596,004 (+$19,643, +3.41% from previous year)

- 2025: $591,318 (−$4,687, −0.79% from previous year)

Santa Fe’s home prices have grown 86% over the past 15 years, from $317,825 in 2010 to $591,318 in 2025. While the early 2010s saw modest dips, a strong and consistent upward trend began in 2013 and exploded during the pandemic years. The largest single-year gain occurred in 2021 with a massive $75,000+ jump, followed by another sharp increase in 2022. Although prices dipped slightly in 2023 and again in 2025, the broader trend remains upward, reflecting Santa Fe’s growing appeal as both a cultural center and luxury housing market.

Santa Fe – Timeless Appeal Meets Soaring Demand

Santa Fe is the oldest capital city in the U.S. and one of New Mexico’s most iconic destinations. Known for its unique blend of Pueblo Revival architecture, world-class art galleries, and rich cultural heritage, it continues to attract a wide range of buyers—from retirees and remote workers to investors seeking high-end rentals. The city’s elevation, natural beauty, and four-season climate make it one of the most livable cities in the Southwest. Additionally, the limited availability of land for development within the historic core has added significant upward pressure on prices, especially for homes near Canyon Road, the Plaza, or along the foothills of the Sangre de Cristo Mountains.

Post-2020, Santa Fe became one of the most sought-after relocation cities in the country, thanks to its reputation for clean air, scenic views, and slower pace of life. High-income professionals from places like California and Texas have added fuel to the fire, competing for a shrinking supply of homes in desirable neighborhoods. The local government’s strict zoning and architectural preservation standards, while maintaining the city’s charm, also limit new construction. This supply constraint, paired with increasing demand, has helped sustain high price levels even during broader economic cooldowns. Santa Fe may no longer be the bargain it once was, but its long-term value remains supported by strong fundamentals and unmatched cultural cachet.

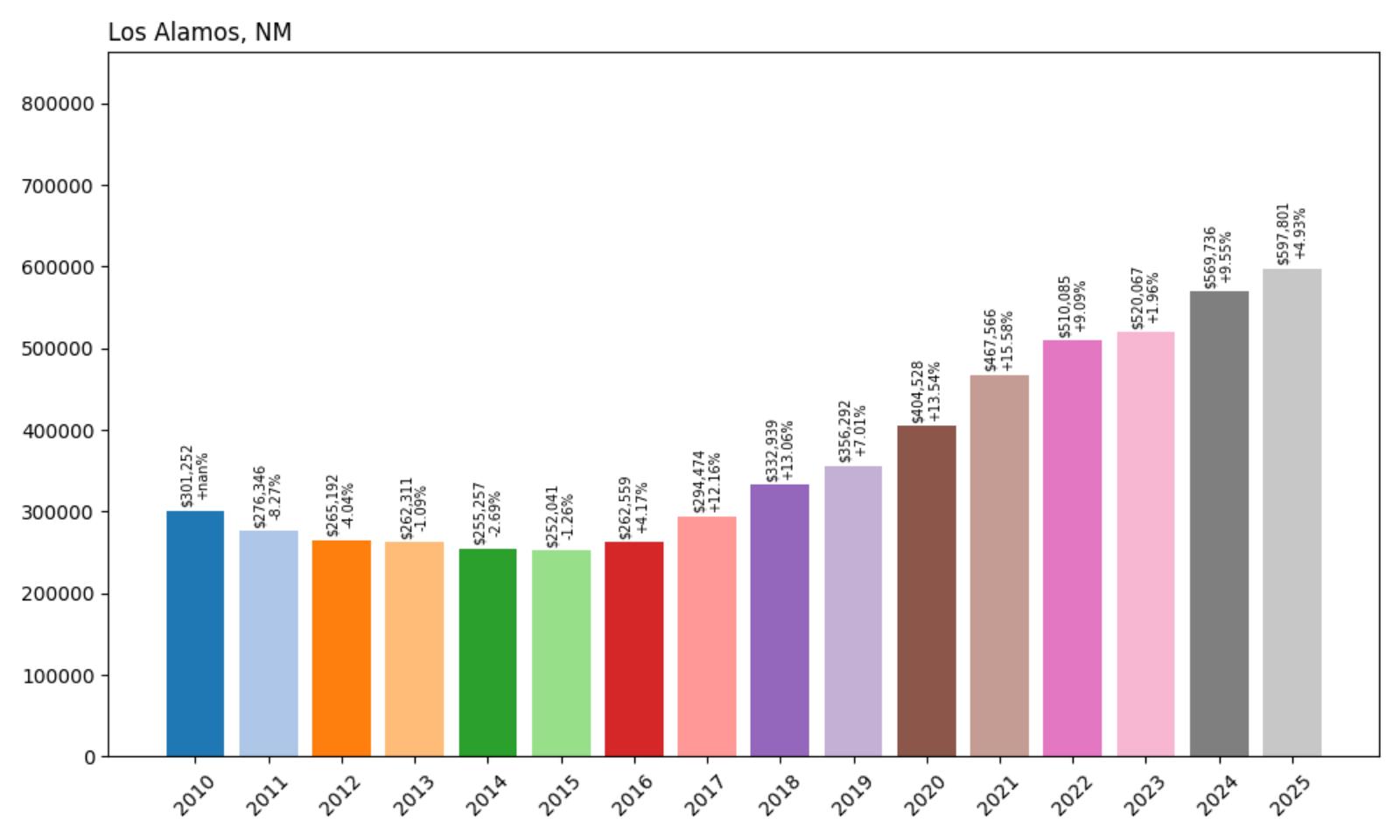

6. Los Alamos – 98% Home Price Increase Since 2010

- 2010: $301,252

- 2011: $276,346 (−$24,906, −8.27% from previous year)

- 2012: $265,192 (−$11,153, −4.04% from previous year)

- 2013: $262,311 (−$2,882, −1.09% from previous year)

- 2014: $255,257 (−$7,054, −2.69% from previous year)

- 2015: $252,041 (−$3,216, −1.26% from previous year)

- 2016: $262,559 (+$10,518, +4.17% from previous year)

- 2017: $294,474 (+$31,915, +12.16% from previous year)

- 2018: $332,939 (+$38,465, +13.06% from previous year)

- 2019: $356,292 (+$23,353, +7.01% from previous year)

- 2020: $404,528 (+$48,236, +13.54% from previous year)

- 2021: $467,566 (+$63,038, +15.58% from previous year)

- 2022: $510,085 (+$42,520, +9.09% from previous year)

- 2023: $520,067 (+$9,981, +1.96% from previous year)

- 2024: $569,736 (+$49,670, +9.55% from previous year)

- 2025: $597,801 (+$28,065, +4.93% from previous year)

Home prices in Los Alamos have nearly doubled since 2010, rising from $301,252 to $597,801 in 2025—a 98% increase over 15 years. After several years of gradual declines early in the decade, the town saw a major turnaround beginning in 2016. The most dramatic price jumps came between 2017 and 2021, fueled by robust demand and limited housing supply. Recent years have seen continued momentum, with 2024 marking one of the highest year-over-year jumps in the town’s recent history.

Los Alamos – A High-Tech Hub with a Housing Crunch

Los Alamos stands out in New Mexico as a scientific and research epicenter. Home to the world-renowned Los Alamos National Laboratory, the town has long attracted a highly educated workforce with stable, well-paying jobs. This has created consistent housing demand even when other markets cool. The town is perched on the Pajarito Plateau in northern New Mexico, surrounded by mountains and mesas, with limited space for new residential development. This geographic constraint has played a significant role in pushing prices upward, especially in recent years as demand surged during the work-from-home boom and federal investment in energy research grew.

Quality of life in Los Alamos is another major draw. The town boasts excellent public schools, low crime rates, and access to extensive hiking and mountain biking trails in the nearby Santa Fe National Forest. While the housing stock is relatively small, it’s diverse—ranging from mid-century homes to newly constructed properties aimed at incoming lab employees. With few options for significant expansion and ongoing growth in federal science initiatives, the local market remains tight. For buyers, this means steep competition and persistent upward pressure on prices, especially for move-in-ready homes. Los Alamos isn’t just a high-demand market—it’s one where the fundamentals of supply and demand are more extreme than nearly anywhere else in the state.

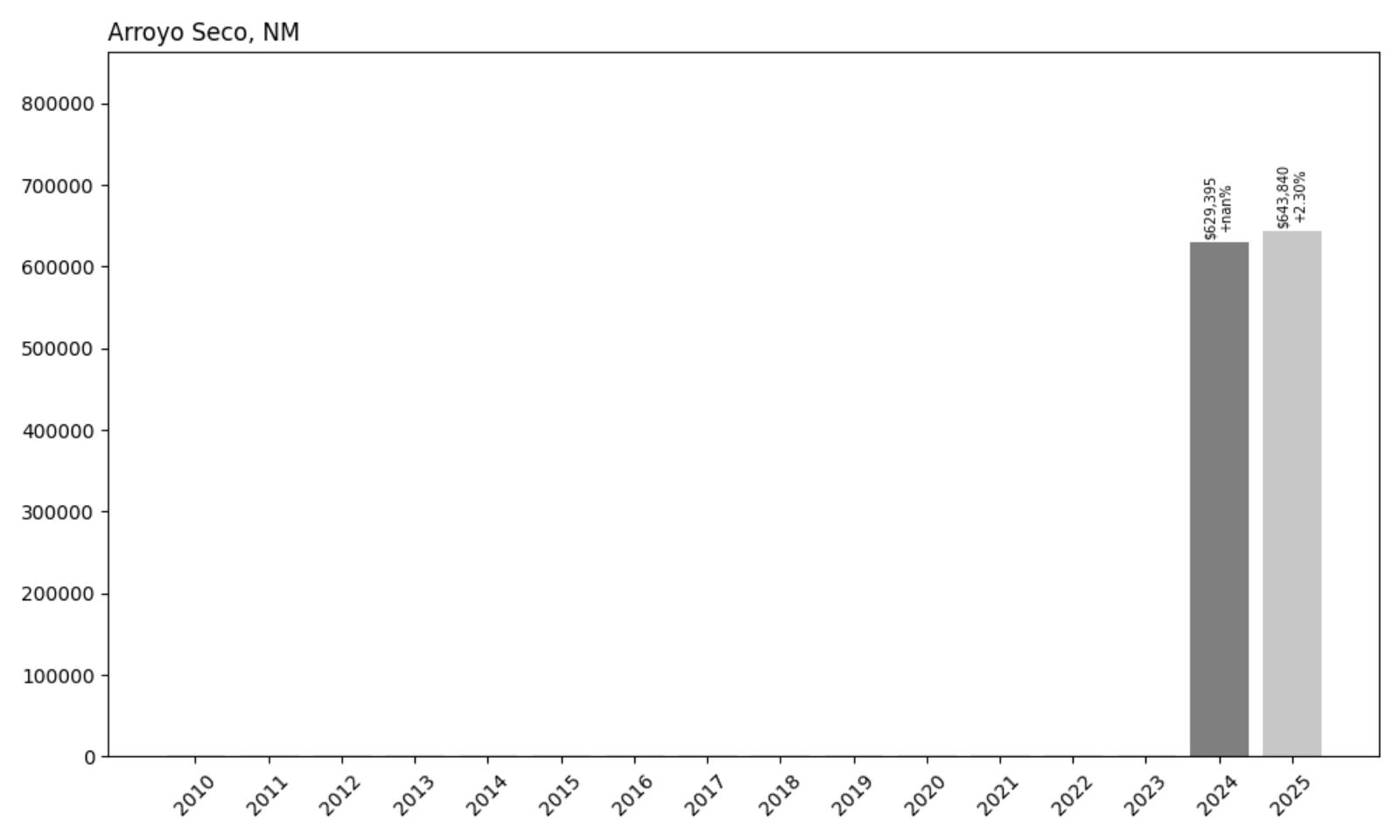

5. Arroyo Seco – 2.30% Home Price Increase Since 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $629,395

- 2025: $643,840 (+$14,446, +2.30% from previous year)

Arroyo Seco saw a modest home price gain of 2.30% between 2024 and 2025, based on the limited available data. While historical figures are unavailable for earlier years, the recent year-over-year growth suggests a relatively stable, high-value market. With prices already well above $600,000, any increase reflects ongoing demand and limited housing inventory in this scenic enclave just north of Taos.

Arroyo Seco – Artistic Charm and Mountain Proximity

Arroyo Seco is a small, unincorporated community nestled between the artsy town of Taos and the slopes of Taos Ski Valley. Despite its size, the area has become increasingly attractive to both seasonal visitors and full-time residents seeking mountain views and a slower pace of life. The town’s proximity to world-class skiing and hiking, along with its rustic charm and strong artistic culture, has kept demand steady, particularly for luxury second homes. The narrow inventory and tight zoning rules mean that available properties are rare and often come at a premium.

Many homes in Arroyo Seco are adobe-style with stunning views of the Sangre de Cristo Mountains, and buyers are often drawn by the town’s authenticity and small-village feel. It serves as a quieter alternative to nearby Taos, offering privacy without sacrificing access to amenities. As the broader Taos County area sees interest from out-of-state buyers, Arroyo Seco benefits from spillover demand—especially among those prioritizing charm and seclusion. While its prices haven’t jumped dramatically, the steady climb in value underscores its desirability and potential for long-term appreciation.

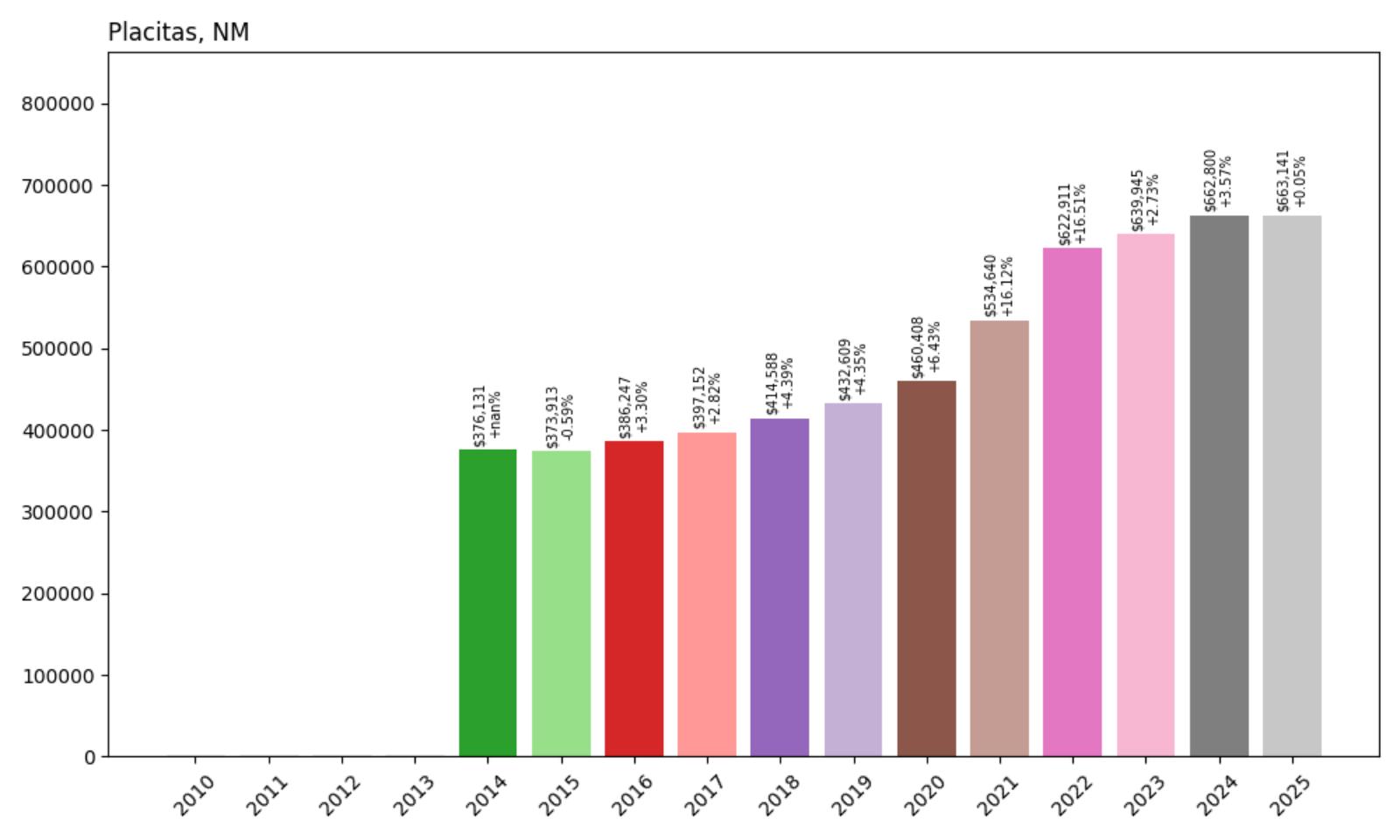

4. Placitas – 76% Home Price Increase Since 2014

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: $376,131

- 2015: $373,913 (−$2,218, −0.59% from previous year)

- 2016: $386,247 (+$12,334, +3.30% from previous year)

- 2017: $397,152 (+$10,905, +2.82% from previous year)

- 2018: $414,588 (+$17,436, +4.39% from previous year)

- 2019: $432,609 (+$18,022, +4.35% from previous year)

- 2020: $460,408 (+$27,798, +6.43% from previous year)

- 2021: $534,640 (+$74,232, +16.12% from previous year)

- 2022: $622,911 (+$88,271, +16.51% from previous year)

- 2023: $639,945 (+$17,035, +2.73% from previous year)

- 2024: $662,800 (+$22,855, +3.57% from previous year)

- 2025: $663,141 (+$340, +0.05% from previous year)

Placitas experienced a 76% increase in home prices between 2014 and 2025, moving from $376,131 to $663,141. Prices climbed most sharply between 2020 and 2022, when the town saw double-digit percentage gains year-over-year. Although appreciation slowed in recent years, the current home values remain among the highest in Sandoval County, reflecting its desirability and limited development.

Placitas – High Desert Living with Luxury Appeal

Placitas is a high-desert community located just east of Albuquerque. Known for its wide open landscapes, expansive custom homes, and panoramic views of the Sandia Mountains, it appeals to those seeking peace and natural beauty without venturing far from urban convenience. The community’s popularity grew substantially during the pandemic, especially among buyers seeking remote-work-friendly homes on large lots. Strict zoning policies and natural geography limit sprawl, helping maintain high home values despite broader regional fluctuations.

In addition to its visual appeal, Placitas boasts a tight-knit, artistic community, with numerous local galleries and seasonal studio tours. The area also has access to excellent outdoor recreation, including hiking trails and wildlife viewing. The surge in luxury home construction over the past decade has further elevated prices, with new builds often commanding well over half a million dollars. Placitas has become a go-to for affluent buyers relocating from other states who value privacy, space, and scenic living in the Southwest.

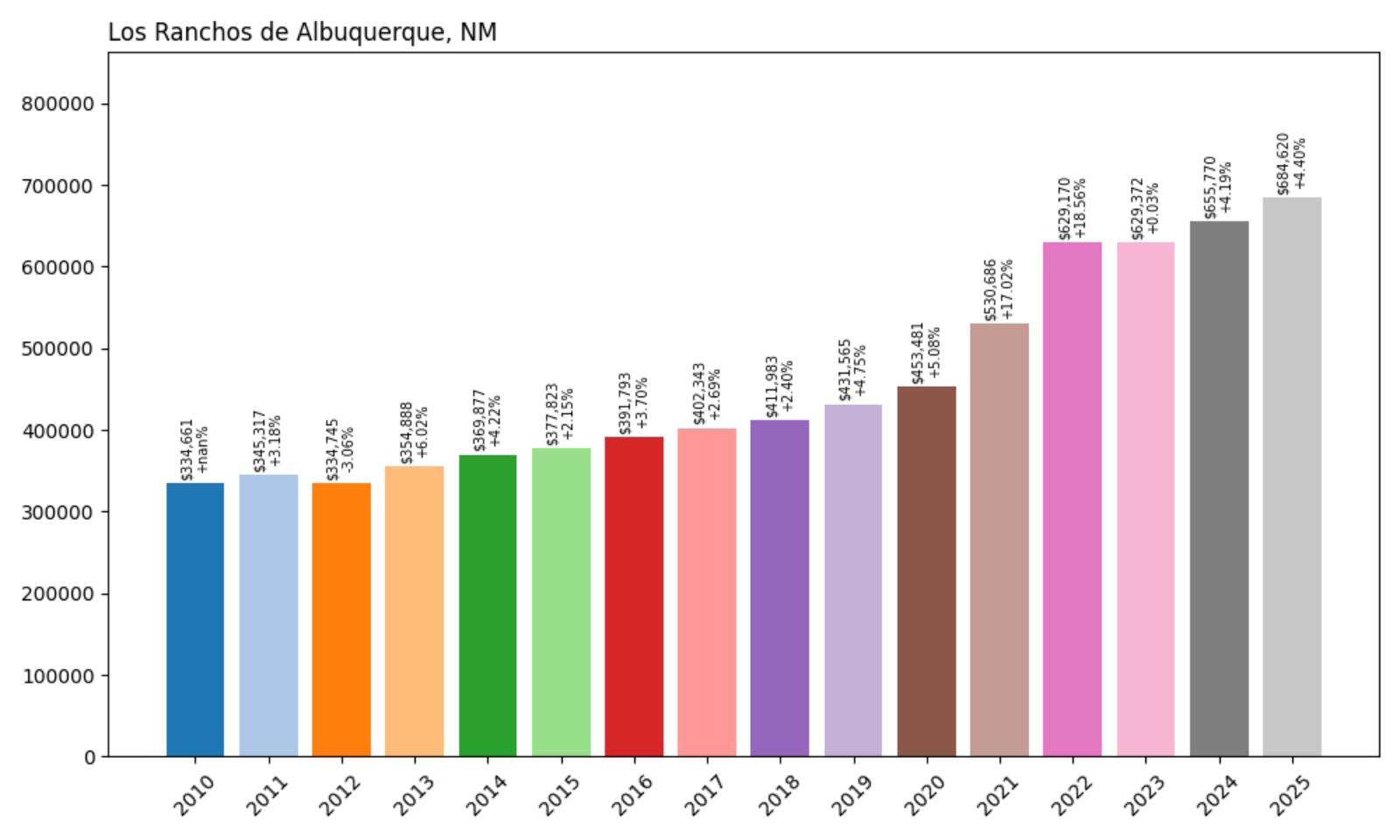

3. Los Ranchos de Albuquerque – 104.5% Home Price Increase Since 2010

- 2010: $334,661

- 2011: $345,317 (+$10,656, +3.18% from previous year)

- 2012: $334,745 (−$10,572, −3.06% from previous year)

- 2013: $354,888 (+$20,143, +6.02% from previous year)

- 2014: $369,877 (+$14,989, +4.22% from previous year)

- 2015: $377,823 (+$7,945, +2.15% from previous year)

- 2016: $391,793 (+$13,970, +3.70% from previous year)

- 2017: $402,343 (+$10,551, +2.69% from previous year)

- 2018: $411,983 (+$9,640, +2.40% from previous year)

- 2019: $431,565 (+$19,582, +4.75% from previous year)

- 2020: $453,481 (+$21,916, +5.08% from previous year)

- 2021: $530,686 (+$77,205, +17.02% from previous year)

- 2022: $629,170 (+$98,484, +18.56% from previous year)

- 2023: $629,372 (+$202, +0.03% from previous year)

- 2024: $655,770 (+$26,398, +4.19% from previous year)

- 2025: $684,620 (+$28,849, +4.40% from previous year)

Home values in Los Ranchos de Albuquerque have risen substantially over the past 15 years, growing from $334,661 in 2010 to $684,620 in 2025. That’s a staggering 104.5% increase, driven by both steady annual appreciation and a few notable jumps during the pandemic-era housing surge. The years 2021 and 2022 were especially transformative, with back-to-back double-digit gains totaling over $175,000 in just two years. While the pace slowed slightly in 2023, growth resumed in 2024 and 2025, reflecting sustained buyer demand in this picturesque Albuquerque suburb.

Los Ranchos de Albuquerque – Rural Charm, Elevated Prices

Los Ranchos de Albuquerque stands apart for its rare blend of rural character and proximity to the urban amenities of New Mexico’s largest city. Buyers are drawn to the village’s large lots, mature cottonwood groves, and equestrian-friendly zoning—features that are increasingly rare in the Southwest’s fast-developing corridors. The appeal has only intensified as remote work and quality-of-life priorities drive migration to places with more space and serenity. The median home price here has surged well above state and national averages, reflecting its exclusivity and constrained supply.

What’s particularly notable is how Los Ranchos maintained price stability even during years when nearby areas experienced dips. This resilience points to a buyer base with long-term commitment and the financial means to ride out market turbulence. The neighborhood’s unique zoning restrictions, limited inventory, and enduring local charm have effectively insulated it from the volatility seen elsewhere. As such, investors and homeowners alike regard it as a prime piece of New Mexico real estate—one that’s likely to retain value regardless of broader market shifts.

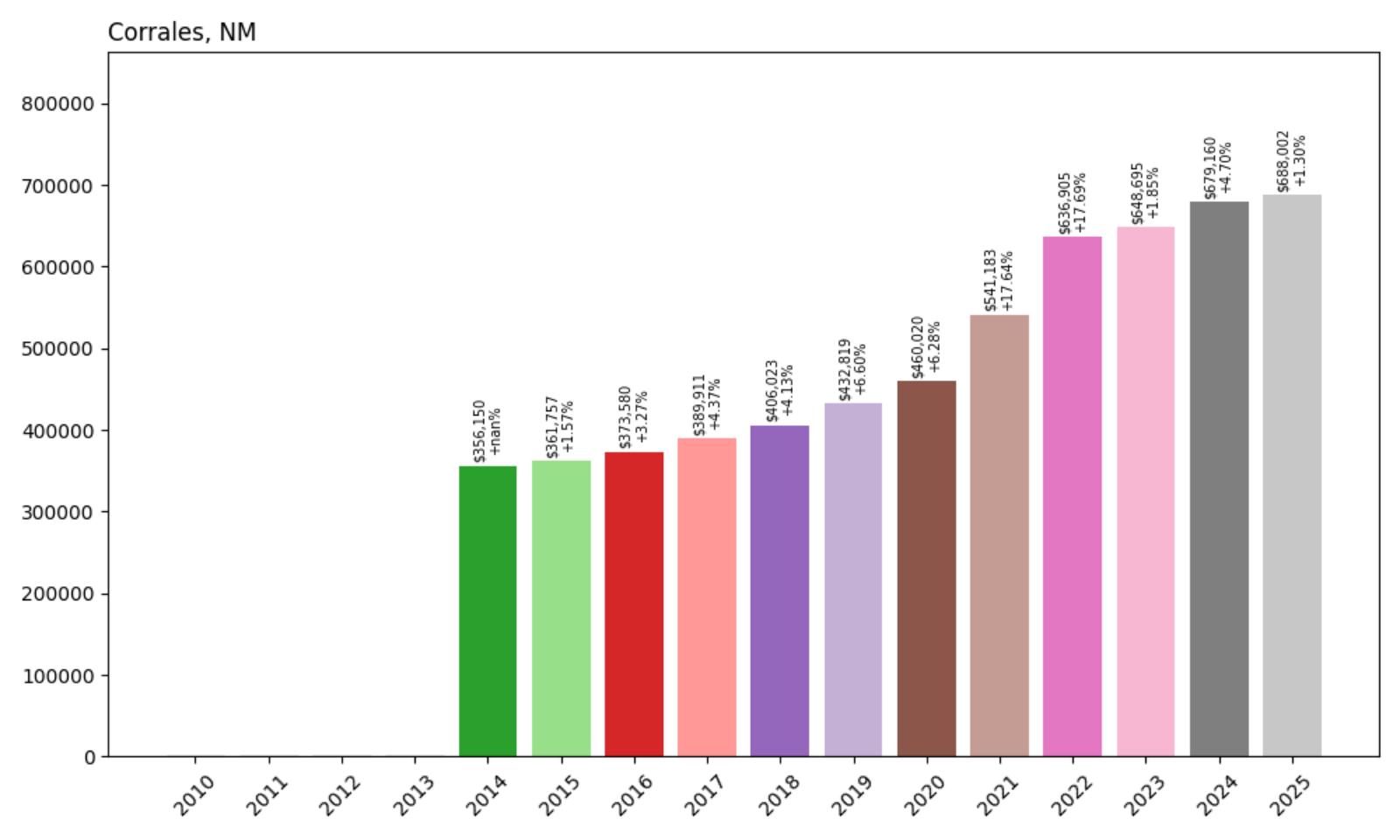

2. Corrales – 93.2% Home Price Increase Since 2014

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: $356,150

- 2015: $361,757 (+$5,607, +1.57% from previous year)

- 2016: $373,580 (+$11,824, +3.27% from previous year)

- 2017: $389,911 (+$16,331, +4.37% from previous year)

- 2018: $406,023 (+$16,112, +4.13% from previous year)

- 2019: $432,819 (+$26,796, +6.60% from previous year)

- 2020: $460,020 (+$27,201, +6.28% from previous year)

- 2021: $541,183 (+$81,163, +17.64% from previous year)

- 2022: $636,905 (+$95,722, +17.69% from previous year)

- 2023: $648,695 (+$11,790, +1.85% from previous year)

- 2024: $679,160 (+$30,465, +4.70% from previous year)

- 2025: $688,002 (+$8,842, +1.30% from previous year)

Since 2014, Corrales home prices have nearly doubled, rising from $356,150 to $688,002 by 2025. The largest increases came in 2021 and 2022 when home values jumped over 35% in just two years—fueled by pandemic-driven migration, ultra-low interest rates, and growing interest in New Mexico’s lifestyle appeal. Unlike towns with boom-and-bust tendencies, Corrales followed that spike with moderate yet consistent gains, maintaining its status as one of the most desirable semi-rural locales in the state.

Corrales – High-Desert Luxury in a Village Setting

Corrales blends upscale living with the character of a traditional farming village, offering sprawling adobe homes, horse properties, and panoramic Sandia Mountain views. Residents enjoy access to vineyards, artists’ studios, and some of the region’s most scenic open spaces, all just minutes from Albuquerque. That rare mix of privacy, nature, and accessibility has turned Corrales into a magnet for buyers seeking a slower pace of life without sacrificing modern comforts. The village’s identity is fiercely preserved by zoning that discourages overdevelopment, which helps keep supply tight and values high.

Home values in Corrales also reflect its reputation as a cultural hub, with a community that celebrates heritage through local events, art festivals, and a thriving farmers market. Over the past decade, the area has seen increasing interest from professionals and retirees looking to escape metro sprawl. The combination of low turnover, high demand, and limited new construction continues to apply upward pressure on prices. With infrastructure and policy supporting a quality-over-quantity mindset, Corrales remains a safe bet for buyers prioritizing character and investment stability.

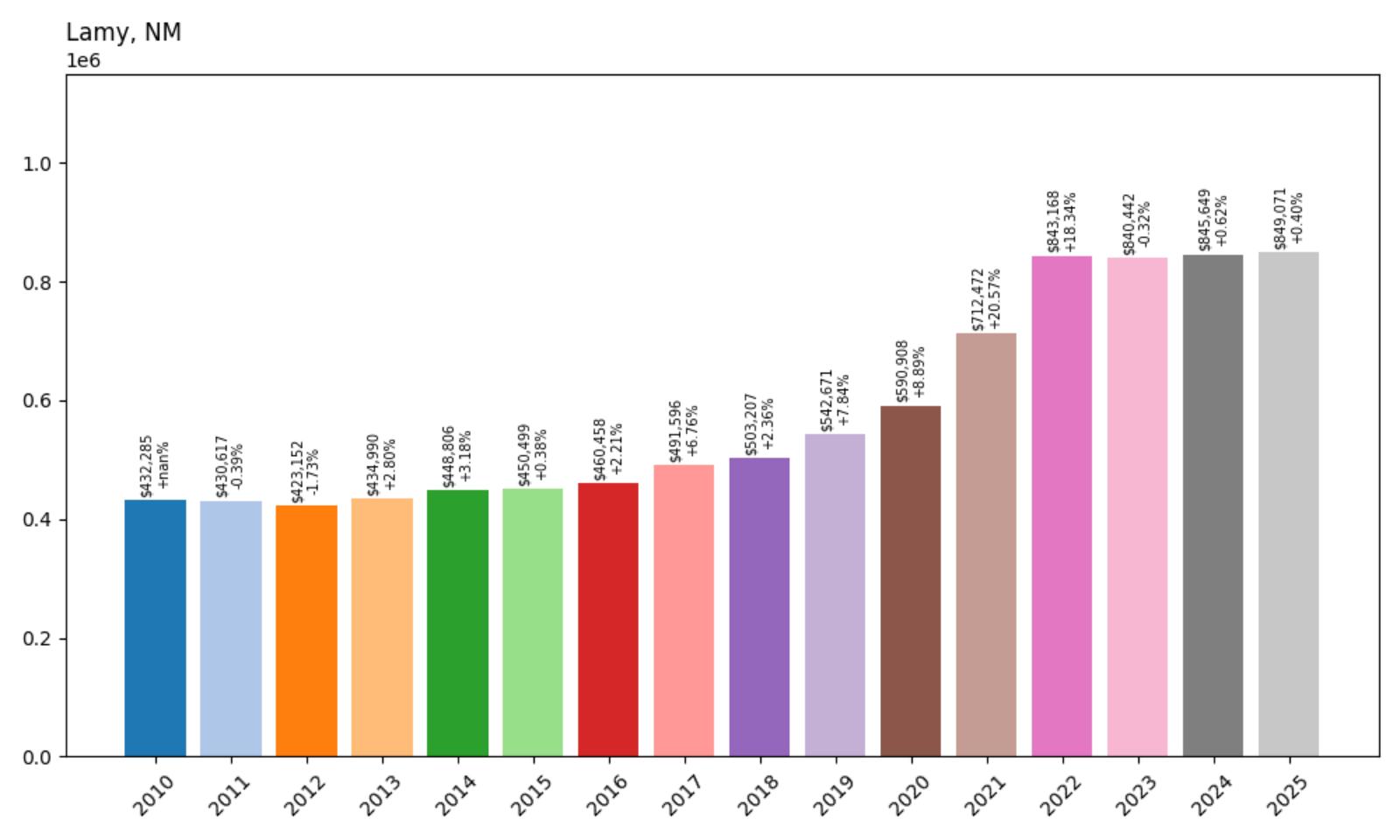

1. Lamy – 96.3% Home Price Increase Since 2010

- 2010: $432,285

- 2011: $430,617 (−$1,668, −0.39% from previous year)

- 2012: $423,152 (−$7,465, −1.73% from previous year)

- 2013: $434,990 (+$11,837, +2.80% from previous year)

- 2014: $448,806 (+$13,817, +3.18% from previous year)

- 2015: $450,499 (+$1,692, +0.38% from previous year)

- 2016: $460,458 (+$9,960, +2.21% from previous year)

- 2017: $491,596 (+$31,138, +6.76% from previous year)

- 2018: $503,207 (+$11,611, +2.36% from previous year)

- 2019: $542,671 (+$39,464, +7.84% from previous year)

- 2020: $590,908 (+$48,237, +8.89% from previous year)

- 2021: $712,472 (+$121,565, +20.57% from previous year)

- 2022: $843,168 (+$130,695, +18.34% from previous year)

- 2023: $840,442 (−$2,725, −0.32% from previous year)

- 2024: $845,649 (+$5,207, +0.62% from previous year)

- 2025: $849,071 (+$3,421, +0.40% from previous year)

Lamy’s housing market has grown by 96.3% since 2010, with prices climbing from $432,285 to $849,071 in 2025. The most striking surge happened between 2020 and 2022, when home values soared by more than $250,000, transforming Lamy from a niche market into one of New Mexico’s priciest destinations. Though growth has slowed to single digits in recent years, values have held steady, suggesting a new plateau supported by lasting demand and buyer confidence.

Lamy – From Historic Rail Stop to High-End Refuge

Lamy’s appeal lies in its quiet setting, rich history, and proximity to Santa Fe without the bustle. Once a key railroad junction, the town has reinvented itself as a haven for artists, remote workers, and nature enthusiasts looking for authenticity and solitude. The community’s distinct architecture and preserved landscapes offer a tranquil escape from urban life, yet it’s close enough to tap into Santa Fe’s cultural and culinary offerings. This balance has made Lamy increasingly attractive to out-of-state buyers seeking Southwestern charm with long-term upside.

What sets Lamy apart is its limited housing inventory and architectural character—adobe-style homes and historic ranches dominate the landscape, with few new developments to dilute the aesthetic. That scarcity has driven prices upward even during market cooldowns. The town also benefits from a loyal resident base and preservation-minded policies that protect its small-town identity. As home values stabilize at elevated levels, Lamy continues to hold its place as New Mexico’s most exclusive housing market, commanding a premium for its serenity, story, and scenery.