Would you like to save this?

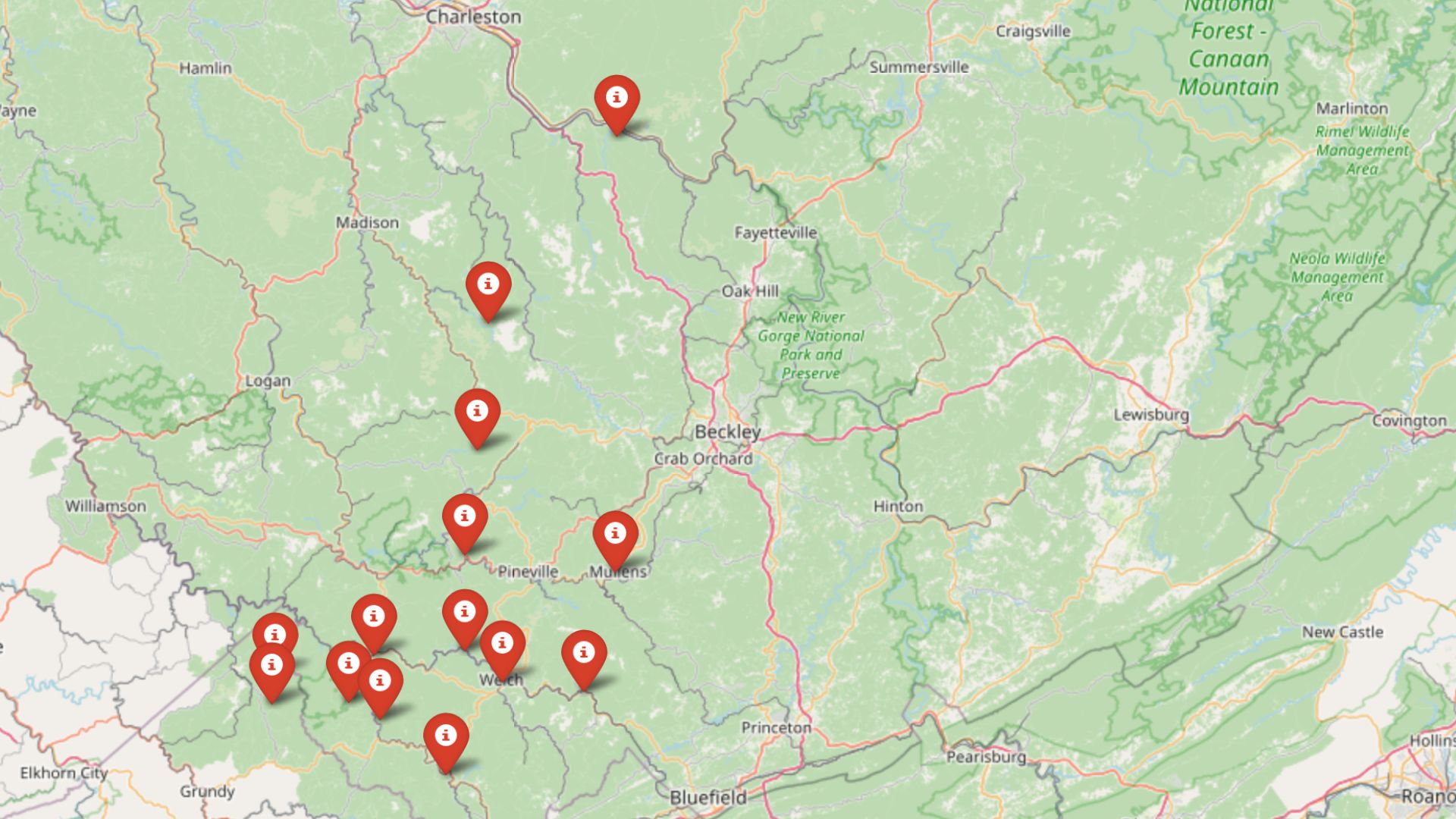

According to the latest Zillow Home Value Index, West Virginia still has towns where homes come at a steal—and these 15 rank among the most affordable in 2025. Some saw price bumps during the pandemic, only to settle back down. Others never left the bargain bin.

What they have in common: low typical home values, steady price trends, and real estate that stays within reach. Whether you’re a first-time buyer, downsizer, or deal-hunter, these towns prove that affordable housing is still alive in the Mountain State.

15. Mohawk – 8.6% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $50,273

- 2020: N/A

- 2021: $73,642

- 2022: $76,591 (+$2,949, +4.00% from previous year)

- 2023: $68,237 (-$8,354, -10.91% from previous year)

- 2024: $58,498 (-$9,739, -14.27% from previous year)

- 2025: $54,600 (-$3,898, -6.66% from previous year)

Mohawk’s home values peaked in 2022 at over $76,000 before beginning a steady decline. As of 2025, the median value is $54,600—still nearly 9% higher than in 2019. The town experienced rapid growth followed by consistent depreciation, a trend likely tied to market shifts post-pandemic.

Mohawk – Recent Declines After an Early Surge

Mohawk, located in McDowell County, is a quiet Appalachian community shaped by the rise and fall of coal. Its home prices saw a major spike between 2019 and 2022, rising by over 50% during that period. Since then, values have steadily declined, likely reflecting the broader pullback in rural demand that followed the peak pandemic housing frenzy. With a 2025 median of $54,600, Mohawk still sits well above its 2019 value but well below its recent high.

The lack of consistent price data before 2019 suggests limited transactions and a small housing stock. As a result, even modest changes in supply or demand can drive sharp value swings. While the recent price declines may discourage short-term investors, long-term affordability and the area’s quiet rural setting may still appeal to budget-minded buyers looking for a retreat or low-cost living option.

14. Handley – 23% Home Price Increase Since 2021

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: $43,941

- 2022: $50,011 (+$6,070, +13.81% from previous year)

- 2023: $51,691 (+$1,680, +3.36% from previous year)

- 2024: $54,313 (+$2,622, +5.07% from previous year)

- 2025: $54,096 (-$217, -0.40% from previous year)

Handley has enjoyed slow but consistent growth since 2021. The median price rose more than 23% by 2025. Though values dipped slightly this year, the overall trend remains positive, with the current typical home price at just over $54,000.

Handley – Steady Gains in a Quiet Town

Handley sits in Kanawha County, within reach of Charleston but far enough removed to feel rural. Its home prices have increased in a measured and steady fashion since 2021, with only a very minor dip in 2025. The town’s affordability and proximity to job centers likely help support ongoing demand, even amid broader market shifts across the state.

With a median home value of just over $54,000, Handley continues to rank among West Virginia’s least expensive places to live. It may appeal to first-time buyers or retirees seeking affordable options in a peaceful, small-town environment. The steady pricing trend suggests a degree of insulation from the volatility seen in more remote areas.

13. Brenton – 40% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $34,077

- 2020: N/A

- 2021: $46,582

- 2022: $52,827 (+$6,246, +13.41% from previous year)

- 2023: $51,886 (-$941, -1.78% from previous year)

- 2024: $47,666 (-$4,220, -8.13% from previous year)

- 2025: $47,904 (+$238, +0.50% from previous year)

Brenton’s home prices surged between 2019 and 2022, followed by modest corrections. Despite the declines, 2025 prices are still about 40% higher than six years ago. The recent stabilization suggests a possible bottoming-out of the market.

Brenton – Holding Gains Despite Volatility

Would you like to save this?

Brenton is a small, quiet town nestled in Wyoming County, shaped by its position along the Guyandotte River. After a sharp surge in home values through 2022, prices fell slightly and have since begun to stabilize. The 2025 uptick in median value suggests a more balanced market, following the dramatic swings of the previous years.

Long-term trends in Brenton remain strong, with current home values about 40% higher than in 2019. That kind of growth is unusual for such an isolated market. While volatility remains a factor, the town’s pricing makes it an attractive option for those looking for a foothold in southern West Virginia’s real estate market.

12. Mullens – 41% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $33,723

- 2020: N/A

- 2021: $44,765

- 2022: $49,512 (+$4,748, +10.61% from previous year)

- 2023: $47,978 (-$1,535, -3.10% from previous year)

- 2024: $46,059 (-$1,919, -4.00% from previous year)

- 2025: $47,649 (+$1,590, +3.45% from previous year)

Home prices in Mullens rose sharply from 2019 through 2022 and dipped slightly before rebounding in 2025. The current median sits at $47,649—up more than 41% since 2019.

Mullens – Resilience After a Correction

Mullens, a former boomtown in Wyoming County, continues to show signs of resilience. Prices rose quickly in the early 2020s, followed by two consecutive years of decline. However, a rebound in 2025 helped bring values back up, suggesting the correction may have bottomed out.

At $47,649, Mullens remains highly affordable while still showing solid long-term growth—about 41% above its 2019 level. With infrastructure investments and community renewal efforts underway, Mullens may be positioned for more steady growth in the future, especially for buyers seeking affordable alternatives to higher-cost cities.

11. Junior – 32% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $33,948

- 2020: N/A

- 2021: $45,191

- 2022: $46,497 (+$1,307, +2.89% from previous year)

- 2023: $42,516 (-$3,982, -8.56% from previous year)

- 2024: $51,112 (+$8,596, +20.22% from previous year)

- 2025: $44,749 (-$6,363, -12.45% from previous year)

Junior’s housing market has been a rollercoaster over the past few years. Prices soared in 2024, only to fall back in 2025. But compared to 2019, values are still up 32%, with the typical home now worth $44,749.

Junior – Big Swings in a Small Market

Junior, located in Barbour County, has experienced one of the more dramatic housing price arcs in recent years. Home values surged in 2024 only to fall sharply in 2025, highlighting the volatility that small rural markets can face. Still, the long-term trend remains upward, and 2025 values remain well above those from 2019.

Junior’s proximity to larger towns in central West Virginia might play a role in its fluctuating demand. While it remains affordable—just under $45,000—it also presents a cautionary tale about how limited inventory and a small number of transactions can influence price data. For buyers willing to ride out potential ups and downs, it remains a strong low-cost contender.

10. Wharton – 35.2% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $32,643

- 2020: N/A

- 2021: $39,113

- 2022: $41,178 (+$2,065, +5.28% from previous year)

- 2023: $37,487 (-$3,691, -8.96% from previous year)

- 2024: $42,568 (+$5,081, +13.55% from previous year)

- 2025: $44,166 (+$1,597, +3.75% from previous year)

Wharton has posted a fairly steady rise in home values since 2019, despite a drop in 2023. With a current median of $44,166, prices are up more than 35% over six years. Recent growth appears to have recovered the short-term losses.

Wharton – Quiet Climb With Recent Growth

Wharton, a small community in Boone County, has experienced a mostly upward housing trend since 2019. A minor setback in 2023 was quickly erased by two years of steady growth, with prices climbing to over $44,000 in 2025. The town’s remote setting hasn’t prevented it from maintaining a positive trajectory.

This kind of resilience is notable, especially for a place with limited amenities and population growth. With affordable real estate and modest increases year over year, Wharton offers a potential long-term opportunity for budget-conscious homebuyers seeking stability over volatility.

9. Jolo – 14.9% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $38,360

- 2020: N/A

- 2021: $58,776

- 2022: $60,913 (+$2,137, +3.64% from previous year)

- 2023: $52,146 (-$8,768, -14.39% from previous year)

- 2024: $48,080 (-$4,065, -7.80% from previous year)

- 2025: $44,072 (-$4,008, -8.34% from previous year)

Jolo saw a significant spike in home values in 2021 and 2022, but that momentum didn’t last. Since then, values have dropped every year. Even so, the 2025 median of $44,072 is still nearly 15% higher than in 2019.

Jolo – From Peak to Pullback

Jolo, located in rural McDowell County, experienced a brief but pronounced housing boom, with prices hitting over $60,000 in 2022. Since then, the market has steadily declined, with values falling each year through 2025. At $44,072, prices are now much closer to pre-pandemic levels, though still higher than in 2019.

The steep post-peak decline suggests a possible overcorrection after demand surged earlier in the decade. Jolo’s remote location and limited development may contribute to this volatility. Still, with its quiet mountain setting and relatively low prices, it may remain attractive to buyers looking for affordability in southern West Virginia.

8. Iaeger – -0.8% Home Price Decrease Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $44,147

- 2020: N/A

- 2021: $66,893

- 2022: $65,200 (-$1,693, -2.53% from previous year)

- 2023: $53,749 (-$11,451, -17.56% from previous year)

- 2024: $48,178 (-$5,571, -10.37% from previous year)

- 2025: $43,774 (-$4,403, -9.14% from previous year)

Iaeger’s housing market surged through 2021 but has declined sharply since. Home values have now dipped slightly below their 2019 levels, falling to $43,774 in 2025. That’s a near-total reversal of earlier pandemic-era gains.

Iaeger – Boom and Bust in a Remote Market

Iaeger, another McDowell County town, saw its home prices climb as high as $66,893 in 2021—one of the steepest rises in the region. But those gains were short-lived, and by 2025, home values had fallen below their 2019 baseline. That reversal reflects the fragility of housing demand in deeply rural areas.

Even so, Iaeger may appeal to buyers willing to trade modern amenities for exceptionally low real estate prices. With a 2025 median home value of $43,774, it’s still among the cheapest towns in the state. Any future growth would likely depend on regional economic improvements or renewed interest in rural relocation.

7. Kopperston – 30.7% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $33,016

- 2020: N/A

- 2021: $46,032

- 2022: $48,488 (+$2,456, +5.34% from previous year)

- 2023: $47,037 (-$1,451, -2.99% from previous year)

- 2024: $45,657 (-$1,380, -2.93% from previous year)

- 2025: $43,180 (-$2,478, -5.43% from previous year)

Despite recent price declines, Kopperston has gained over 30% in home value since 2019. After peaking in 2022, the market has softened, with the median price settling at $43,180 in 2025. The town has held on to most of its gains.

Kopperston – Sustained Growth with a Recent Slide

Kopperston, located in Wyoming County, managed to retain much of its early-2020s housing gains despite several recent years of decline. At $43,180 in 2025, prices are still more than 30% higher than in 2019. The trend shows that while growth has slowed, the market has not entirely reversed.

This suggests relative resilience for a town with few economic anchors. Its remote setting may limit future demand, but for those seeking extremely affordable homes, Kopperston offers access to property far below state and national averages. Continued affordability could help support future stability.

6. Avondale – 17.8% Home Price Decrease Since 2023

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: $51,386

- 2024: $45,951 (-$5,434, -10.58% from previous year)

- 2025: $42,226 (-$3,725, -8.11% from previous year)

Avondale’s home prices have declined for two years in a row. After peaking at $51,386 in 2023, the median price fell to $42,226 in 2025. That’s a 17.8% drop in just two years, placing it firmly among the lowest-priced towns in the state.

Avondale – Fast Fall from a Pandemic-Era High

Avondale experienced a rapid decline in home values after peaking in 2023. With prices falling more than 17% in just two years, the town reflects the volatility that many small Appalachian housing markets face post-pandemic. The sharp downturn likely corresponds with waning interest from out-of-state buyers and limited local demand.

Still, at $42,226, Avondale remains among the most affordable towns in West Virginia. Its tiny size and limited real estate activity make for volatile pricing, but those very factors also mean buyers with flexibility can find bargain opportunities—especially if values begin to recover.

5. Bradshaw – 16.7% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $34,559

- 2020: N/A

- 2021: $52,553

- 2022: $53,631 (+$1,078, +2.05% from previous year)

- 2023: $44,961 (-$8,670, -16.17% from previous year)

- 2024: $44,306 (-$654, -1.46% from previous year)

- 2025: $40,333 (-$3,973, -8.97% from previous year)

Bradshaw’s housing market has seen significant ups and downs since 2019. After hitting a high in 2022, prices have fallen steadily for three years. Despite those losses, the 2025 median of $40,333 still marks a 16.7% increase over the 2019 value.

Bradshaw – Peaks and Dips in Coal Country

Bradshaw, also in McDowell County, followed a now-familiar pattern: early decade price increases followed by a steady decline. Since peaking in 2022, prices have dropped each year, yet the 2025 median of $40,333 still marks a substantial improvement over 2019 levels.

The town’s location and history as a coal community continue to shape its real estate market. As with many towns in the area, small shifts in demand can result in large swings in value. Bradshaw remains one of the most affordable towns in the state, especially for buyers prioritizing low upfront costs.

4. Davy – 26.3% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $30,279

- 2020: N/A

- 2021: $46,613

- 2022: $50,266 (+$3,654, +7.84% from previous year)

- 2023: $40,013 (-$10,253, -20.40% from previous year)

- 2024: $39,832 (-$181, -0.45% from previous year)

- 2025: $38,246 (-$1,585, -3.98% from previous year)

Home prices in Davy rose sharply during the early 2020s, with values peaking in 2022 before sliding for three consecutive years. Still, the 2025 median of $38,246 is more than 26% above the town’s 2019 figure.

Davy – Early Gains Give Way to Cooling Prices

Davy’s housing market saw strong growth in the early 2020s, rising to over $50,000 before dropping in the years that followed. By 2025, prices had fallen back to $38,246, though still well above their 2019 value. The recent downturn suggests the local market is cooling off after earlier surges.

Its quiet setting and small-town character remain intact, and affordability continues to define the housing landscape here. Davy may appeal to those seeking long-term value at a low entry price, though future growth will likely depend on broader economic factors in McDowell County and beyond.

3. Welch – 8.8% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $34,536

- 2020: N/A

- 2021: $49,231

- 2022: $49,301 (+$69, +0.14% from previous year)

- 2023: $42,105 (-$7,196, -14.60% from previous year)

- 2024: $39,898 (-$2,207, -5.24% from previous year)

- 2025: $37,576 (-$2,322, -5.82% from previous year)

Welch saw home values peak in 2022 and then fall for three straight years. Despite that trend, the 2025 price of $37,576 still represents an 8.8% increase over 2019 levels—proof of the town’s modest, long-term growth.

Welch – Long-Term Modest Gains Amid Downturn

Welch, the McDowell County seat, has maintained its role as a regional hub despite population losses. Housing prices rose modestly in the early part of the decade before falling for three consecutive years. Still, 2025 values remain almost 9% higher than in 2019.

As one of the only towns in the county with civic infrastructure and local services, Welch may remain more stable than its smaller neighbors. It represents a value-driven option for buyers who want access to basic amenities without paying high housing costs.

2. Northfork – 7.4% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $32,287

- 2020: N/A

- 2021: $50,270

- 2022: $56,198 (+$5,927, +11.79% from previous year)

- 2023: $37,102 (-$19,096, -33.98% from previous year)

- 2024: $35,214 (-$1,887, -5.09% from previous year)

- 2025: $34,667 (-$547, -1.55% from previous year)

After soaring to over $56,000 in 2022, Northfork’s home prices dropped steeply. But even with those losses, 2025 values remain 7.4% higher than in 2019. At $34,667, it’s one of the lowest-priced towns in the state.

Northfork – Pandemic-Era Highs Have Faded

Northfork’s housing market peaked in 2022, like many towns in West Virginia, before crashing dramatically the following year. Home values dropped nearly 34% in 2023 alone. Despite further minor declines, prices in 2025 remain 7% higher than they were in 2019.

Northfork’s affordability—under $35,000 for a typical home—makes it one of the most accessible markets in the state. While volatility remains a concern, long-term buyers may find opportunities here, especially if broader economic trends stabilize the market.

1. War – 37.2% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $23,223

- 2020: N/A

- 2021: $33,831

- 2022: $38,280 (+$4,450, +13.15% from previous year)

- 2023: $29,443 (-$8,837, -23.09% from previous year)

- 2024: $31,146 (+$1,703, +5.78% from previous year)

- 2025: $31,885 (+$739, +2.37% from previous year)

War has the lowest home prices on this list, with a 2025 median of just $31,885. That’s a 37.2% increase over 2019 values, despite a sharp drop in 2023. The market appears to be rebounding slowly.

War – West Virginia’s Most Affordable Housing Market

War holds the distinction of being the least expensive housing market in West Virginia. Despite dramatic swings—like a 23% drop in 2023—home prices remain up more than 37% since 2019. The current median of $31,885 makes it the cheapest town in the state by a significant margin.

Located at the southern edge of McDowell County, War’s extreme affordability reflects both economic hardship and limited demand. Yet it also offers potential upside for long-term investors or homeowners looking for the absolute lowest entry point into West Virginia real estate.