Would you like to save this?

Home values in these Kansas towns are still hovering near the bottom of the charts, based the Zillow Home Value Index. While prices in bigger cities keep climbing, these 15 spots have stayed surprisingly affordable—some even seeing gentle upticks that hint at future growth. Whether it’s the quiet streets, low-key charm, or just the chance to own a home without maxing out your budget, these towns prove Kansas still has real estate deals worth chasing.

15. Ashland – 77% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $38,821

- 2017: $37,900 (-$920, -2.37% from previous year)

- 2018: $35,592 (-$2,308, -6.09% from previous year)

- 2019: $41,823 (+$6,231, +17.51% from previous year)

- 2020: N/A

- 2021: $54,944

- 2022: $61,716 (+$6,772, +12.32% from previous year)

- 2023: $63,991 (+$2,275, +3.69% from previous year)

- 2024: $66,124 (+$2,133, +3.33% from previous year)

- 2025: $68,671 (+$2,548, +3.85% from previous year)

Ashland’s home prices have climbed 77% since 2016, with steady gains each year since 2021. There was a notable jump in 2019 followed by consistent, moderate growth. Even with some early fluctuations, housing here has appreciated at a healthy pace, making it one of the more affordable towns where values are trending upward. The lack of 2020 data doesn’t obscure the longer-term pattern of recovery and price strengthening.

Ashland – Remote Living With Steady Growth

Ashland is tucked into the far southwest corner of Kansas, just north of the Oklahoma border. Known for its open prairie views and small-town character, it’s the seat of Clark County and home to around 800 residents. The town has seen moderate but consistent home price increases since 2021, with 2025 values nearing $69,000. With a history rooted in cattle ranching and the nearby Cimarron National Grassland offering outdoor appeal, Ashland has drawn modest attention from those seeking space and quiet at a lower price point.

While it lacks big-city conveniences, Ashland’s affordability makes it attractive to retirees and remote workers alike. The small public school system and close-knit community vibe help maintain its rural identity. Given its position on this list, it remains a viable option for budget-conscious buyers who want to stretch their housing dollars in a quieter, more relaxed setting.

14. Kiowa – 87% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $36,298

- 2017: $36,645 (+$347, +0.96% from previous year)

- 2018: $35,291 (-$1,354, -3.70% from previous year)

- 2019: $35,325 (+$34, +0.10% from previous year)

- 2020: N/A

- 2021: $50,439

- 2022: $50,672 (+$232, +0.46% from previous year)

- 2023: $55,487 (+$4,815, +9.50% from previous year)

- 2024: $59,330 (+$3,843, +6.93% from previous year)

- 2025: $67,716 (+$8,385, +14.13% from previous year)

Since 2016, Kiowa’s home values have jumped by nearly 87%, with the biggest gains arriving in the last three years. Prices spiked between 2023 and 2025, rising more than $12,000 in just two years. While 2020 data is unavailable, the overall trend shows this town’s property market heating up. It’s one of the most affordable places in Kansas that’s also seen accelerating growth.

Kiowa – Rising Prices in a Quiet Border Town

Located just a few miles north of Oklahoma in Barber County, Kiowa is a small community of around 900 residents. It sits in a scenic stretch of south-central Kansas known for wheat fields and wide skies. Home values have surged since 2021, reaching nearly $68,000 in 2025, with a particularly sharp climb between 2023 and 2025 that reflects renewed interest in smaller rural towns.

Kiowa offers basic amenities like local schools, parks, and a public library. Its affordability combined with modest growth could appeal to buyers seeking long-term investment potential without the price tags found in urban or suburban markets. Though job options are limited locally, the town’s charm and price point continue to draw interest from families and remote workers willing to trade convenience for calm.

13. Howard – 51% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $43,131

- 2017: $41,508 (-$1,623, -3.76% from previous year)

- 2018: $42,380 (+$872, +2.10% from previous year)

- 2019: $42,784 (+$404, +0.95% from previous year)

- 2020: N/A

- 2021: $49,125

- 2022: $52,347 (+$3,222, +6.56% from previous year)

- 2023: $56,155 (+$3,807, +7.27% from previous year)

- 2024: $61,243 (+$5,088, +9.06% from previous year)

- 2025: $65,270 (+$4,027, +6.58% from previous year)

Howard has seen home values increase by more than 51% since 2016. Growth was gradual at first, with small year-to-year gains, but accelerated after 2021. The town’s housing prices have risen consistently in recent years, with no major dips and a strong upward trend heading into 2025. This makes it a solid option for buyers looking for long-term value in a smaller market.

Howard – Small Town with Steady Momentum

Howard is located in Elk County in southeastern Kansas and has a population of roughly 600 residents. Known for its rolling hills and quiet surroundings, Howard offers peaceful rural living. While it might fly under the radar, its home values have quietly risen, reaching over $65,000 in 2025. The market picked up noticeably post-2021, with consistent yearly increases.

The town features a few local businesses, a school district, and basic services, with bigger shopping centers available in neighboring counties. Affordable prices and consistent growth have positioned Howard as a town with quiet momentum. For buyers seeking affordability with a slow and reliable increase in home value, Howard continues to be a contender.

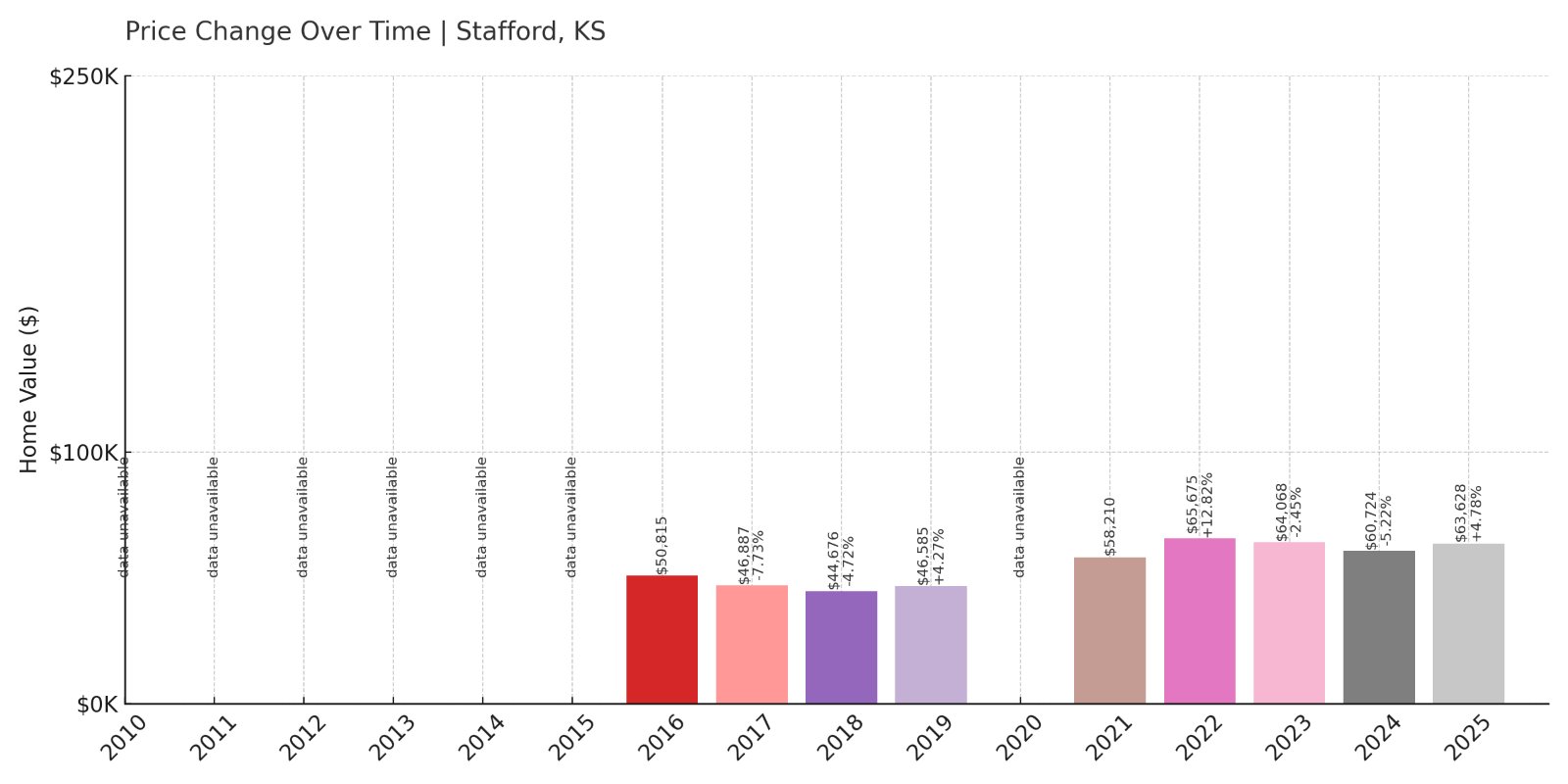

12. Stafford – 25% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $50,815

- 2017: $46,887 (-$3,929, -7.73% from previous year)

- 2018: $44,676 (-$2,211, -4.71% from previous year)

- 2019: $46,585 (+$1,909, +4.27% from previous year)

- 2020: N/A

- 2021: $58,210

- 2022: $65,675 (+$7,466, +12.83% from previous year)

- 2023: $64,068 (-$1,607, -2.45% from previous year)

- 2024: $60,724 (-$3,345, -5.22% from previous year)

- 2025: $63,628 (+$2,905, +4.78% from previous year)

Stafford’s home values have risen by 25% since 2016, with a peak in 2022 followed by a slight decline and then partial recovery. Though prices dipped in 2023 and 2024, the longer-term trend remains positive. Overall, housing in Stafford remains accessible, and the recent rebound suggests renewed buyer confidence.

Stafford – A Rebounding Rural Market

Stafford, in central Kansas, is a town of about 900 residents known for its open spaces and quiet pace of life. Housing prices have experienced ups and downs over the last decade but are trending upward again, reaching over $63,000 in 2025. A surge in 2021–2022 gave way to brief setbacks, but signs point to renewed market health.

Local amenities include schools, a library, and community parks. The town’s affordability and central location may be drawing modest interest, especially from families and retirees seeking a quiet place with manageable living costs. While it’s not experiencing explosive growth, Stafford offers signs of resilience that may appeal to long-term buyers.

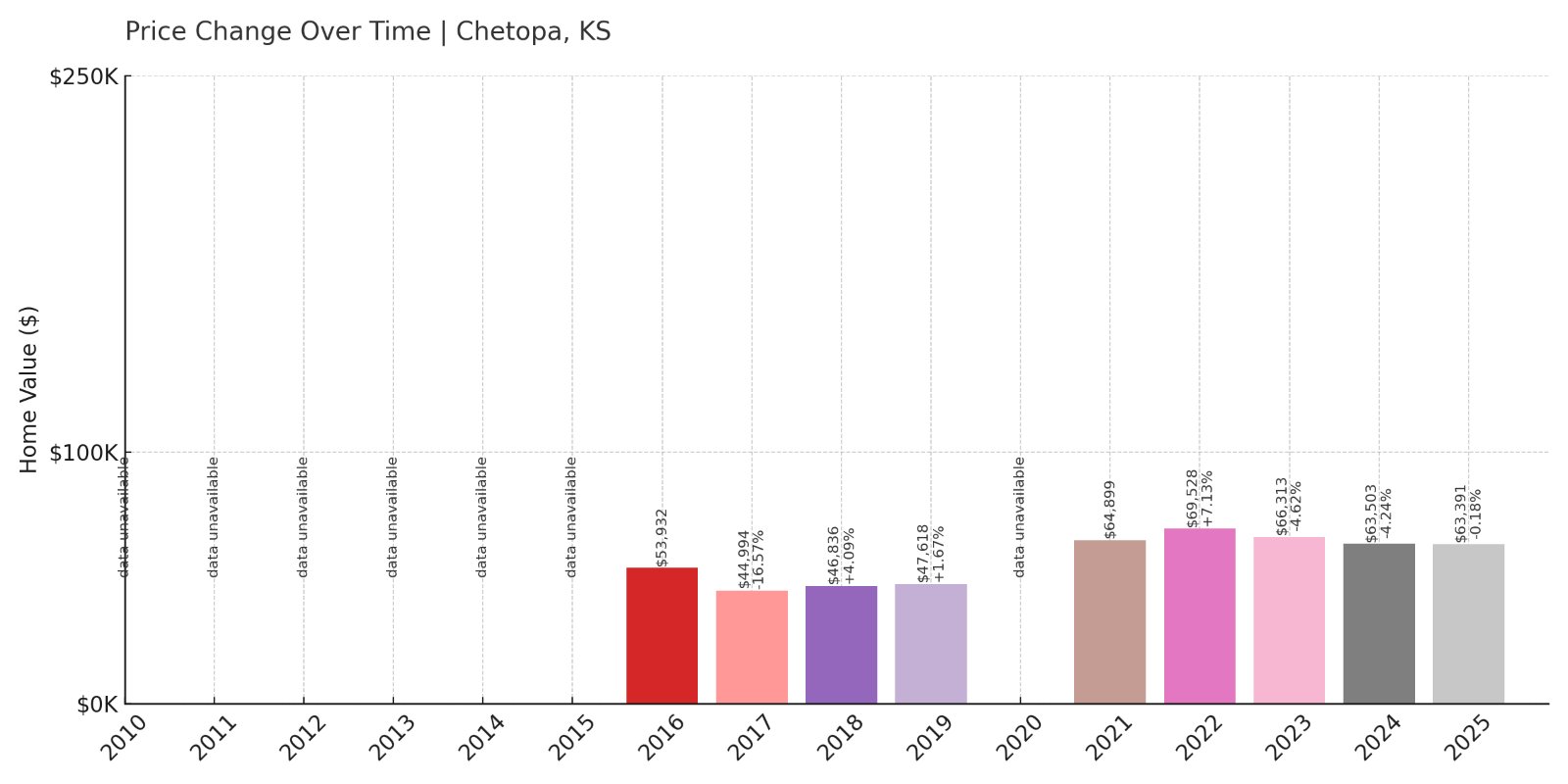

11. Chetopa – 17% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $53,932

- 2017: $44,994 (-$8,938, -16.57% from previous year)

- 2018: $46,836 (+$1,842, +4.09% from previous year)

- 2019: $47,618 (+$782, +1.67% from previous year)

- 2020: N/A

- 2021: $64,899

- 2022: $69,528 (+$4,630, +7.13% from previous year)

- 2023: $66,313 (-$3,215, -4.62% from previous year)

- 2024: $63,503 (-$2,810, -4.24% from previous year)

- 2025: $63,391 (-$112, -0.18% from previous year)

Chetopa’s home prices have increased about 17% since 2016, but that growth has been uneven. A dramatic drop in 2017 was followed by modest gains, then a surge after 2021. However, prices have cooled again since 2023. While values are currently up from 2016 levels, this town’s housing market has shown more volatility than others on the list.

Chetopa – Historic Community With Modest Growth

Situated in Labette County in southeastern Kansas, Chetopa is a historic town on the banks of the Neosho River. Once an important regional hub, its current population hovers near 1,000. The town’s home values peaked around 2022 but have slipped slightly since, stabilizing at around $63,000 in 2025. That’s still a modest increase from 2016, but recent movement suggests the market is in a cooling phase.

Chetopa is known for its scenic setting, small school district, and quiet charm. Its housing market may appeal to those looking for historical character and affordability, though prospective buyers should keep an eye on recent trends before making decisions.

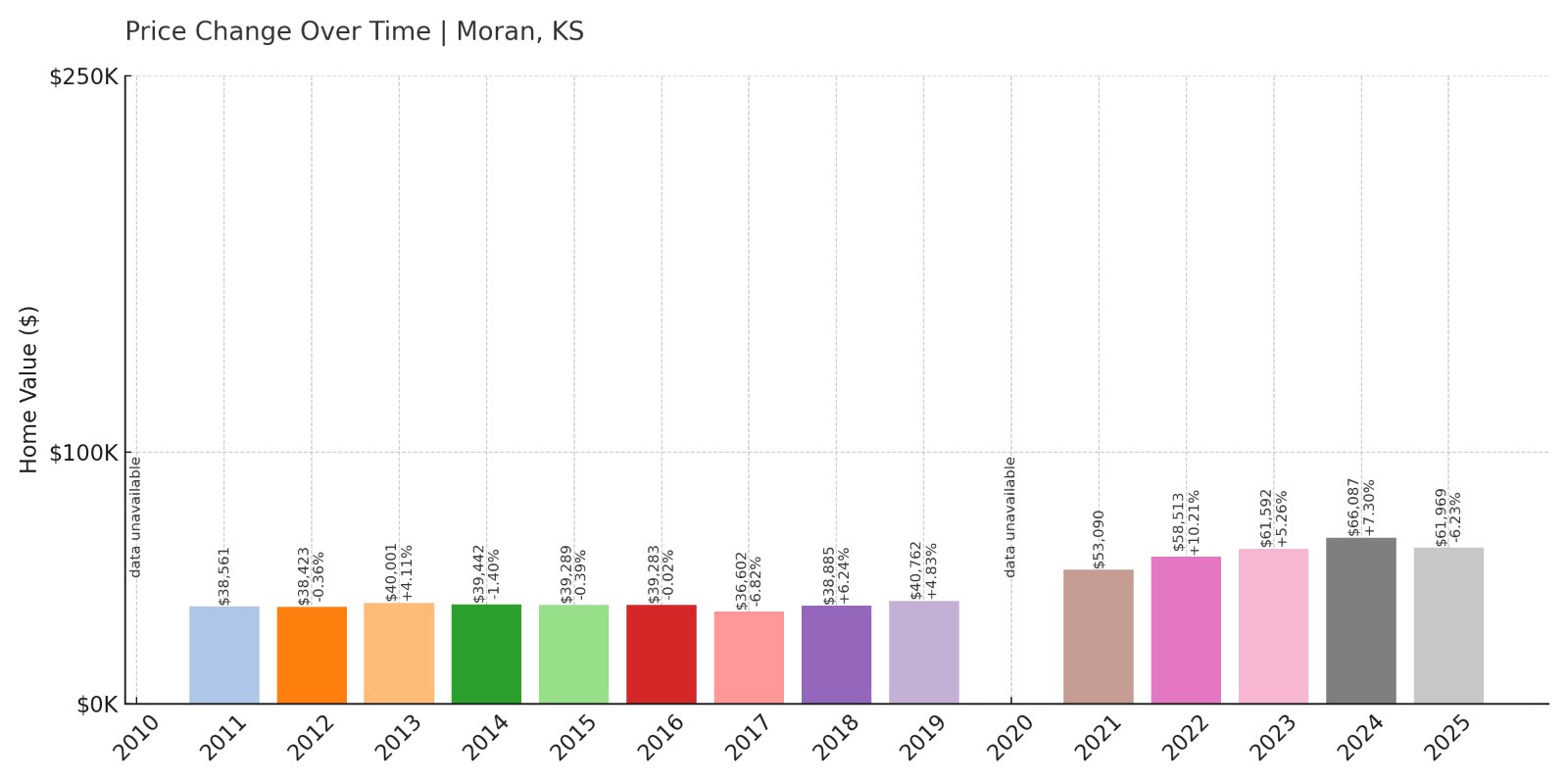

10. Moran – 61% Home Price Increase Since 2011

- 2010: N/A

- 2011: $38,561

- 2012: $38,423 (-$138, -0.36% from previous year)

- 2013: $40,001 (+$1,578, +4.11% from previous year)

- 2014: $39,442 (-$559, -1.40% from previous year)

- 2015: $39,289 (-$153, -0.39% from previous year)

- 2016: $39,283 (-$6, -0.02% from previous year)

- 2017: $36,602 (-$2,681, -6.83% from previous year)

- 2018: $38,885 (+$2,283, +6.24% from previous year)

- 2019: $40,762 (+$1,877, +4.83% from previous year)

- 2020: N/A

- 2021: $53,090

- 2022: $58,513 (+$5,423, +10.21% from previous year)

- 2023: $61,592 (+$3,079, +5.26% from previous year)

- 2024: $66,087 (+$4,496, +7.30% from previous year)

- 2025: $61,969 (-$4,119, -6.23% from previous year)

Moran’s home prices have gone up by about 61% since 2011, rising steadily through 2024 before dropping slightly in 2025. Prices nearly doubled between 2017 and 2024, showing strong market momentum. While the latest year brought a small decline, overall growth over the past decade remains solid.

Moran – Growth Plateau in a Rural Market

Located in Allen County, Moran is a small farming town in southeastern Kansas with a population of roughly 500. Its home prices climbed significantly through the early 2020s, reaching a peak of over $66,000 in 2024 before slipping slightly to $61,969 in 2025. Despite the recent dip, it remains a relatively affordable town with good long-term value trends.

Moran’s appeal lies in its simple rural character, quiet streets, and low cost of living. Local schools and parks serve the community, and regional access to Iola and Fort Scott adds convenience. While recent prices have softened, the broader trend still supports affordability and moderate appreciation potential for homebuyers.

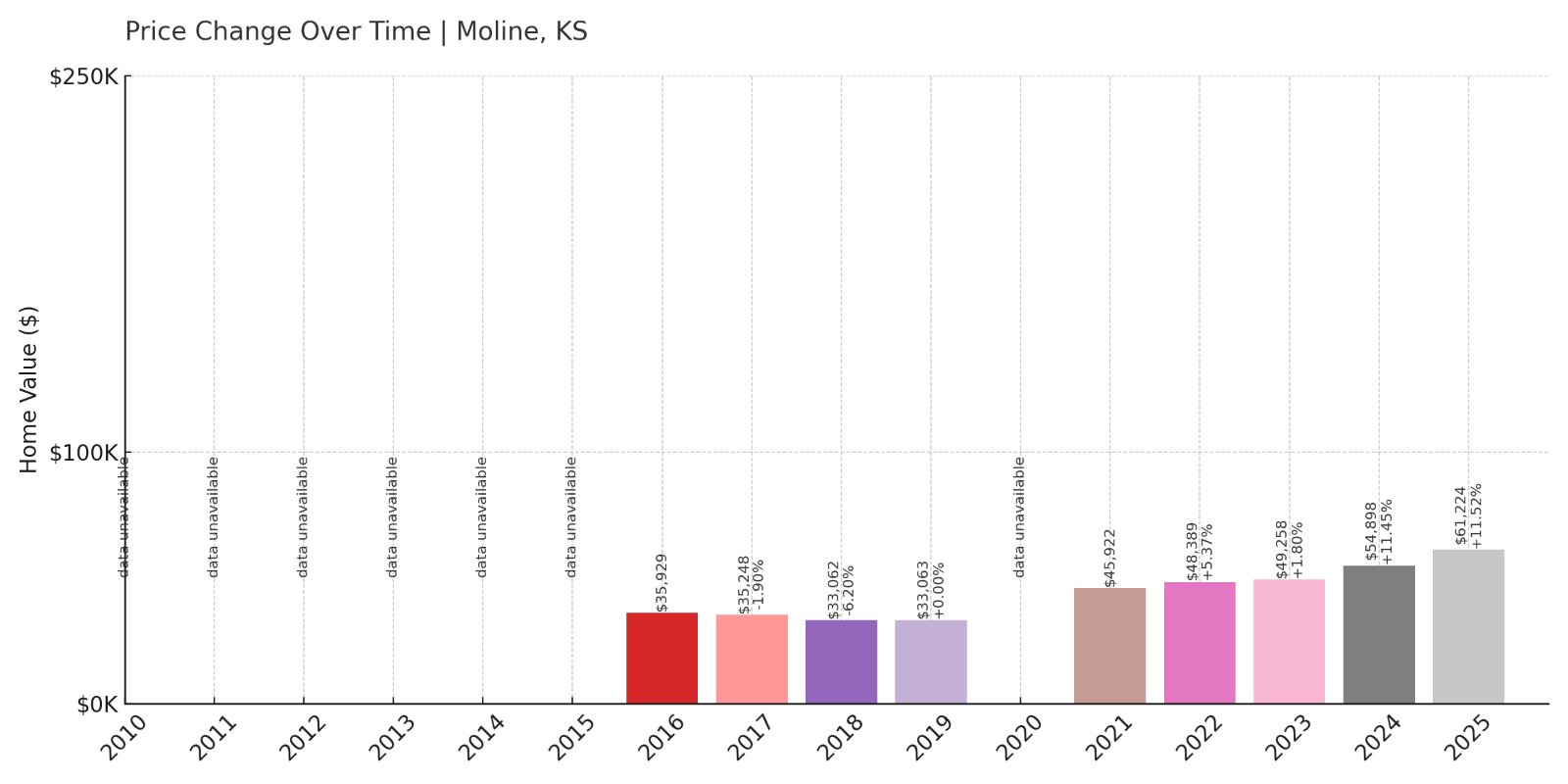

9. Moline – 70% Home Price Increase Since 2016

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $35,929

- 2017: $35,248 (-$681, -1.90% from previous year)

- 2018: $33,062 (-$2,186, -6.20% from previous year)

- 2019: $33,063 (+$1, +0.00% from previous year)

- 2020: N/A

- 2021: $45,922

- 2022: $48,389 (+$2,466, +5.37% from previous year)

- 2023: $49,258 (+$869, +1.80% from previous year)

- 2024: $54,898 (+$5,640, +11.45% from previous year)

- 2025: $61,224 (+$6,326, +11.52% from previous year)

Home prices in Moline have risen by 70% since 2016. While the town saw stagnant values in the late 2010s, the surge began in 2021 and has remained strong through 2025. Two consecutive years of double-digit growth pushed values over $61,000, showing robust momentum in this quiet community.

Moline – Rapid Gains in a Quiet Setting

Moline, a small town in Elk County with under 400 residents, is experiencing significant home value growth after years of little movement. After stagnating through the late 2010s, prices have taken off since 2021, reflecting renewed demand for low-cost rural living. By 2025, homes in Moline are valued over $61,000 — a major increase from previous years.

The town is known for its rural charm, antique stores, and the nearby Moline Waterfall — one of the few natural waterfalls in the state. Its secluded nature hasn’t stopped prices from rising, and affordability remains one of its strong suits. With fewer than 200 households, the market is small but clearly heating up.

8. Bison – 81% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $33,615

- 2017: $32,253 (-$1,362, -4.05% from previous year)

- 2018: $33,456 (+$1,203, +3.73% from previous year)

- 2019: $34,729 (+$1,273, +3.81% from previous year)

- 2020: N/A

- 2021: $51,249

- 2022: $57,858 (+$6,609, +12.90% from previous year)

- 2023: $57,227 (-$631, -1.09% from previous year)

- 2024: $58,139 (+$912, +1.59% from previous year)

- 2025: $60,867 (+$2,728, +4.69% from previous year)

Bison has experienced a remarkable 81% increase in home values since 2016. While the early years showed slow changes, prices surged starting in 2021. Despite a small dip in 2023, the growth remains strong, making Bison one of the more rapidly appreciating affordable towns on this list.

Bison – Quiet but Climbing

Located in Rush County in western Kansas, Bison is a very small town — home to fewer than 300 people. It’s part of the Great Plains region and provides a peaceful environment surrounded by farmland. Housing prices have climbed rapidly in the last four years, nearing $61,000 in 2025.

The town offers a post office, grain elevators, and a handful of local services. Its sharp increase in values since 2021 could be due to low supply or increased rural interest during the remote work boom. For budget-conscious buyers open to wide-open spaces, Bison is showing signs of value appreciation.

7. Coffeyville – 10% Home Price Decrease Since 2010

- 2010: $66,100

- 2011: $65,824 (-$276, -0.42% from previous year)

- 2012: $63,749 (-$2,075, -3.15% from previous year)

- 2013: $52,828 (-$10,921, -17.13% from previous year)

- 2014: $50,099 (-$2,729, -5.17% from previous year)

- 2015: $46,671 (-$3,428, -6.84% from previous year)

- 2016: $41,638 (-$5,033, -10.78% from previous year)

- 2017: $40,170 (-$1,469, -3.53% from previous year)

- 2018: $40,211 (+$42, +0.10% from previous year)

- 2019: $40,299 (+$88, +0.22% from previous year)

- 2020: N/A

- 2021: $47,687

- 2022: $58,855 (+$11,168, +23.42% from previous year)

- 2023: $57,625 (-$1,230, -2.09% from previous year)

- 2024: $53,913 (-$3,712, -6.44% from previous year)

- 2025: $59,250 (+$5,337, +9.90% from previous year)

Coffeyville’s home prices are actually 10% lower than they were in 2010, making it one of the only towns on this list to show long-term depreciation. That said, there has been a recovery since 2021, with values climbing over 24% between 2021 and 2025. The market is still volatile, but showing signs of rebuilding.

Coffeyville – Recovery in Progress

Coffeyville is a larger town by this list’s standards, with a population of around 8,000. Located in Montgomery County near the Oklahoma border, it has a more industrial past and has seen economic ups and downs. After bottoming out in the 2010s, home prices are rebounding, passing $59,000 in 2025.

The town has public schools, a community college, and cultural attractions like the Dalton Defenders Museum. Coffeyville’s price swings reflect deeper economic shifts, but its recent momentum points to a slow but steady recovery. It’s now one of Kansas’ most affordable towns — and possibly one with value upside if trends continue.

6. Natoma – 29% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $45,804

- 2017: $44,567 (-$1,237, -2.70% from previous year)

- 2018: $45,142 (+$575, +1.29% from previous year)

- 2019: $46,771 (+$1,630, +3.61% from previous year)

- 2020: N/A

- 2021: $48,548

- 2022: $56,181 (+$7,634, +15.72% from previous year)

- 2023: $50,574 (-$5,608, -9.98% from previous year)

- 2024: $52,216 (+$1,642, +3.25% from previous year)

- 2025: $59,085 (+$6,869, +13.16% from previous year)

Since 2016, Natoma’s home prices have risen 29%, with major spikes in 2022 and 2025 helping boost its overall performance. Though it experienced a large dip in 2023, the quick recovery suggests resilient buyer interest. Long-term, the upward trend remains intact.

Natoma – Rebounding in Rural Kansas

Natoma is located in Osborne County in north-central Kansas, with a population of about 250 people. It’s a rural community with deep agricultural roots. Housing prices have shown a strong rebound after a decline in 2023, reaching $59,085 in 2025 — their highest point on record.

Like many small towns in the state, Natoma offers affordability, quiet living, and a tight-knit atmosphere. The sharp increase in home prices in 2022 and again in 2025 hints at increased demand or limited inventory. It’s a compelling option for those seeking low prices with signs of healthy recovery.

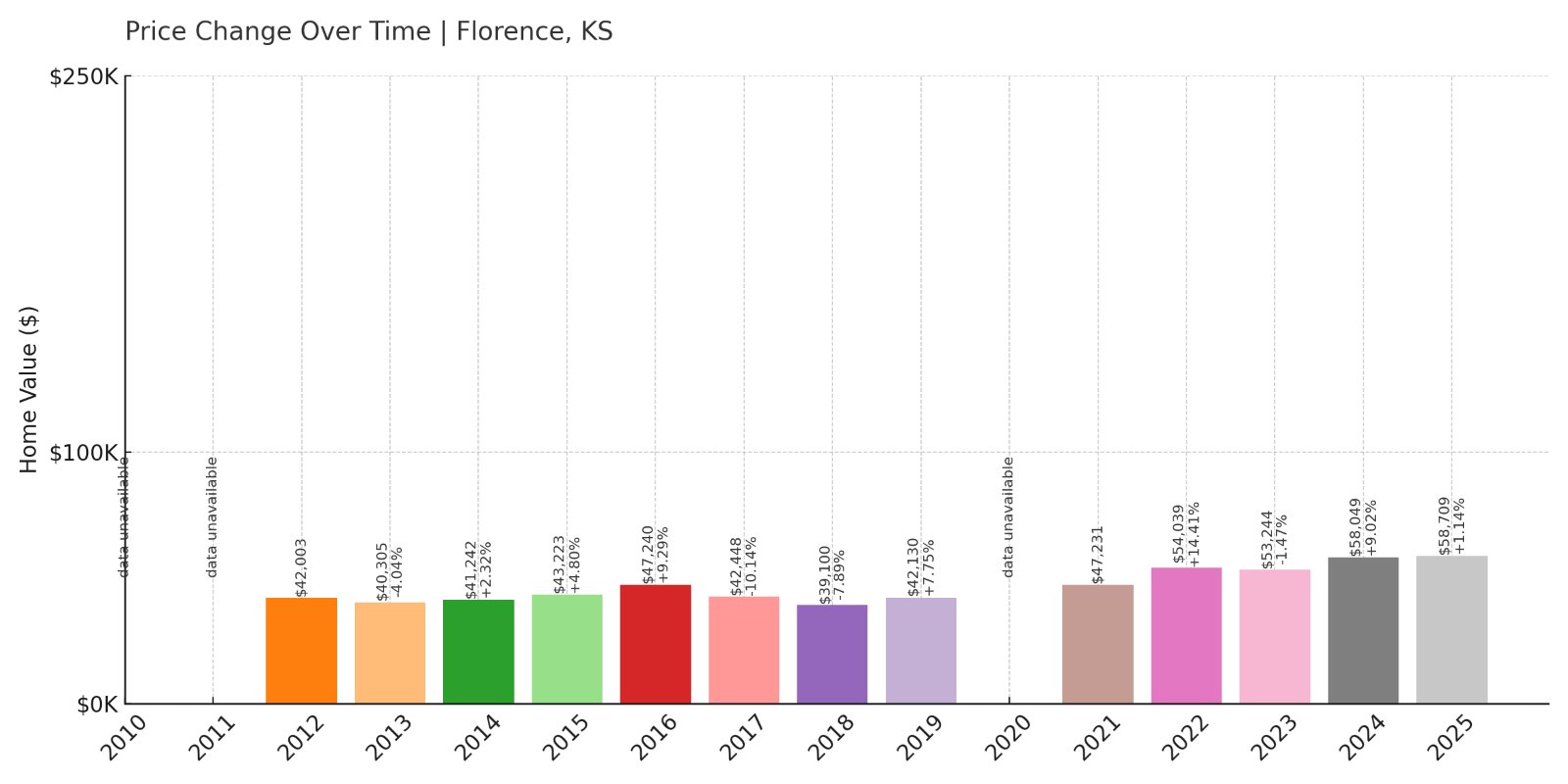

5. Florence – 40% Home Price Increase Since 2012

- 2010: N/A

- 2011: N/A

- 2012: $42,003

- 2013: $40,305 (-$1,698, -4.04% from previous year)

- 2014: $41,242 (+$936, +2.32% from previous year)

- 2015: $43,223 (+$1,981, +4.80% from previous year)

- 2016: $47,240 (+$4,018, +9.30% from previous year)

- 2017: $42,448 (-$4,792, -10.14% from previous year)

- 2018: $39,100 (-$3,348, -7.89% from previous year)

- 2019: $42,130 (+$3,031, +7.75% from previous year)

- 2020: N/A

- 2021: $47,231

- 2022: $54,039 (+$6,807, +14.41% from previous year)

- 2023: $53,244 (-$795, -1.47% from previous year)

- 2024: $58,049 (+$4,805, +9.02% from previous year)

- 2025: $58,709 (+$661, +1.14% from previous year)

Florence has seen home prices rise by 40% since 2012. While the town experienced significant volatility over the years, especially between 2017 and 2019, it has recovered steadily. The price of a home now hovers just under $59,000.

Florence – Bouncing Back from the Bottom

Florence is located in Marion County, nestled in the Flint Hills of central Kansas. This small town of roughly 400 residents has experienced ups and downs in housing prices but appears to be stabilizing with solid growth in recent years. The jump from 2021 to 2025 suggests renewed interest or local investment.

The town’s economy was historically tied to railroads, and it still maintains some historical architecture and attractions. Affordable prices combined with recent upward price momentum could attract value-minded buyers who don’t mind a quiet, slower-paced environment.

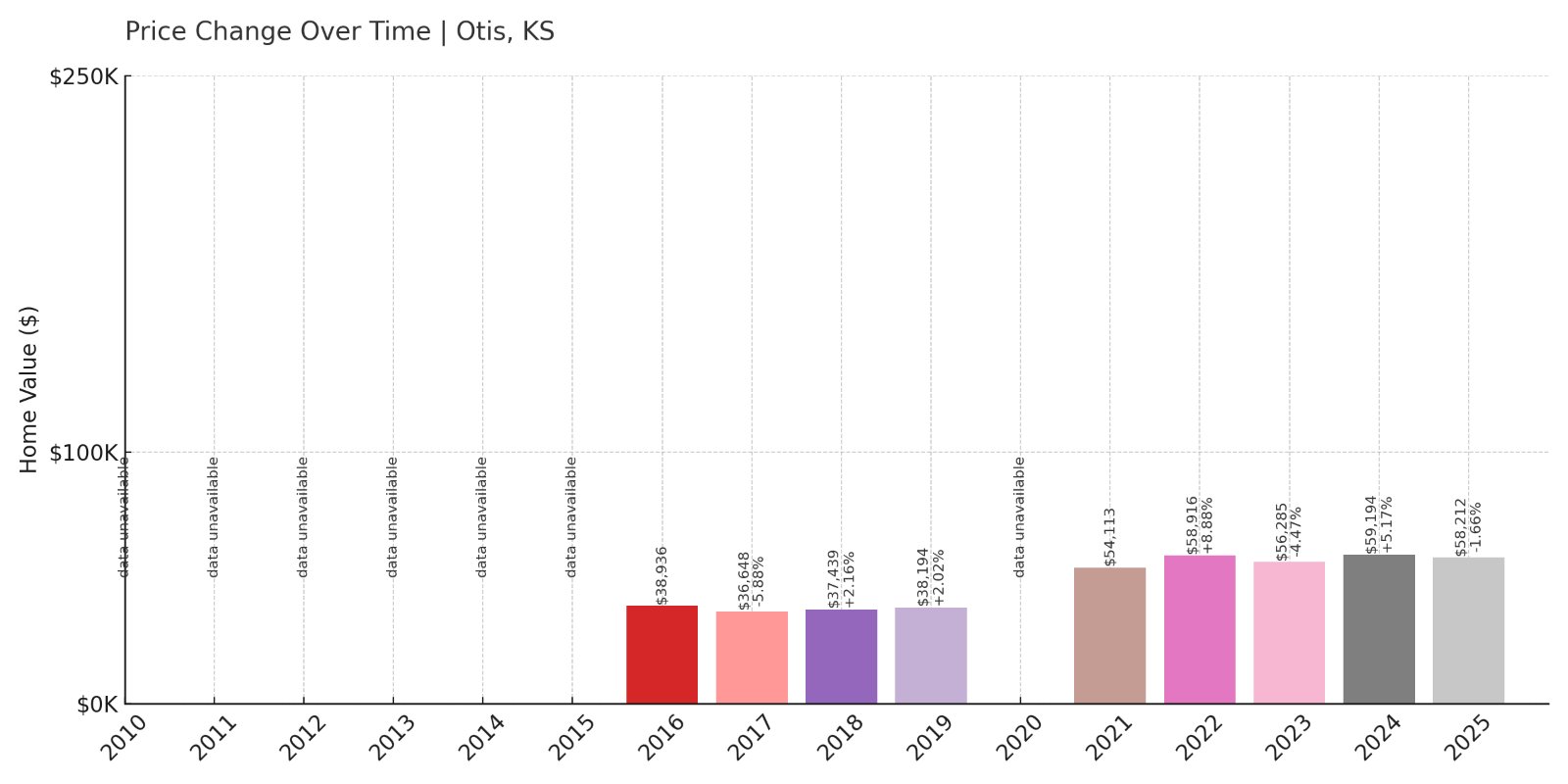

4. Otis – 49% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $38,936

- 2017: $36,648 (-$2,288, -5.88% from previous year)

- 2018: $37,439 (+$791, +2.16% from previous year)

- 2019: $38,194 (+$755, +2.02% from previous year)

- 2020: N/A

- 2021: $54,113

- 2022: $58,916 (+$4,802, +8.87% from previous year)

- 2023: $56,285 (-$2,631, -4.47% from previous year)

- 2024: $59,194 (+$2,909, +5.17% from previous year)

- 2025: $58,212 (-$982, -1.66% from previous year)

Otis has seen nearly a 49% increase in home values since 2016. Despite a few dips in recent years, prices remain significantly higher than a decade ago. Values appear to be stabilizing just under $59,000 in 2025.

Otis – Affordable Living with Upside

Otis is a quiet town in Rush County, located in west-central Kansas. Home to around 250 residents, it is known for being the site of a major helium plant and for its wide, open farmland. The housing market here gained serious momentum after 2020, with values hitting their peak in 2022 before settling slightly.

The community is small but affordable, with strong long-term value growth that could appeal to buyers who want to hold real estate for the long haul. While recent prices dipped slightly, the market overall appears stable and remains highly affordable.

3. Chase – 21% Home Price Increase Since 2016

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $44,120

- 2017: $43,195 (-$925, -2.10% from previous year)

- 2018: $43,374 (+$179, +0.41% from previous year)

- 2019: $47,294 (+$3,920, +9.04% from previous year)

- 2020: N/A

- 2021: $62,668

- 2022: $67,675 (+$5,008, +7.99% from previous year)

- 2023: $58,664 (-$9,011, -13.32% from previous year)

- 2024: $64,413 (+$5,749, +9.80% from previous year)

- 2025: $53,430 (-$10,983, -17.05% from previous year)

Chase’s home values have risen about 21% since 2016. While the increase is notable, the town has experienced sharp volatility in the last two years. A big drop in 2025 reversed much of the recent momentum, bringing values back closer to 2019 levels.

Chase – A Volatile Market With Room to Grow

Chase, located in Rice County, is a very small town with fewer than 500 residents. It has experienced sharp fluctuations in home prices in recent years, peaking above $67,000 in 2022 before falling back to around $53,000 in 2025. This reflects a volatile market that may have been influenced by shifting demand or investor behavior.

Despite the recent drop, Chase remains an affordable town with long-term potential. Its small size and limited inventory could lead to price swings, but for budget-focused buyers willing to ride out the bumps, it may offer long-term value.

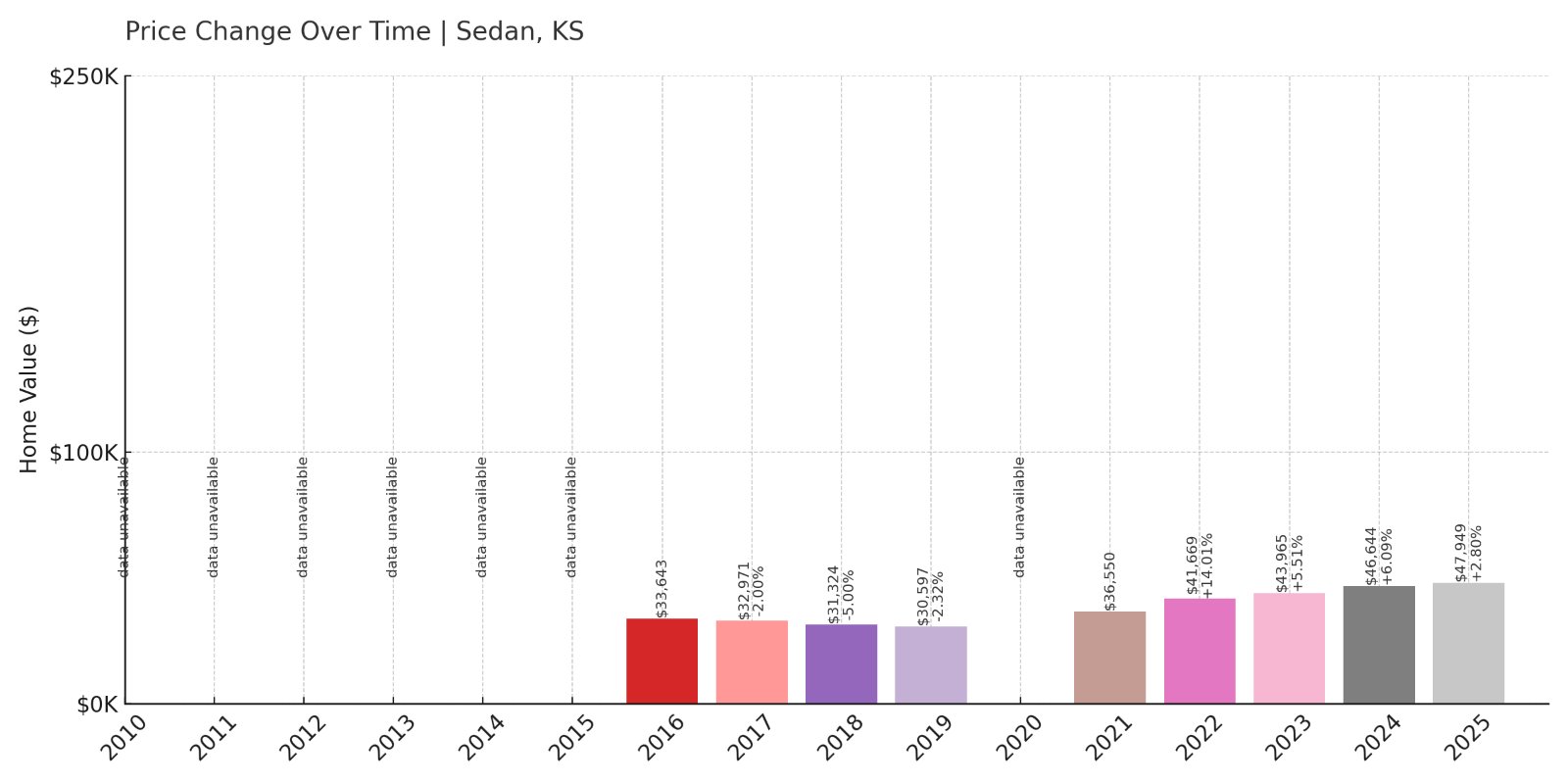

2. Sedan – 42% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $33,643

- 2017: $32,971 (-$672, -2.00% from previous year)

- 2018: $31,324 (-$1,647, -5.00% from previous year)

- 2019: $30,597 (-$727, -2.32% from previous year)

- 2020: N/A

- 2021: $36,550

- 2022: $41,669 (+$5,119, +14.01% from previous year)

- 2023: $43,965 (+$2,296, +5.51% from previous year)

- 2024: $46,644 (+$2,678, +6.09% from previous year)

- 2025: $47,949 (+$1,305, +2.80% from previous year)

Sedan’s home prices have risen 42% since 2016, with steady gains since 2021. Early declines gave way to solid and reliable growth, especially over the past four years. With 2025 values approaching $48,000, Sedan continues to be one of Kansas’ most affordable towns showing consistent appreciation.

Sedan – Quiet Climb in a Scenic County Seat

Sedan is the county seat of Chautauqua County in southeast Kansas, nestled in the picturesque Flint Hills. With a population of about 1,000, it combines affordability with a historic small-town feel. Its housing market has seen gradual but consistent growth, particularly since 2021, when values rebounded strongly from earlier lows.

Known for its charming downtown and artistic touches—like the Yellow Brick Road mural—Sedan draws visitors and residents who appreciate its peaceful lifestyle and natural beauty. With values just under $48,000, it’s a budget-friendly option with room to grow for buyers who value scenery and affordability.

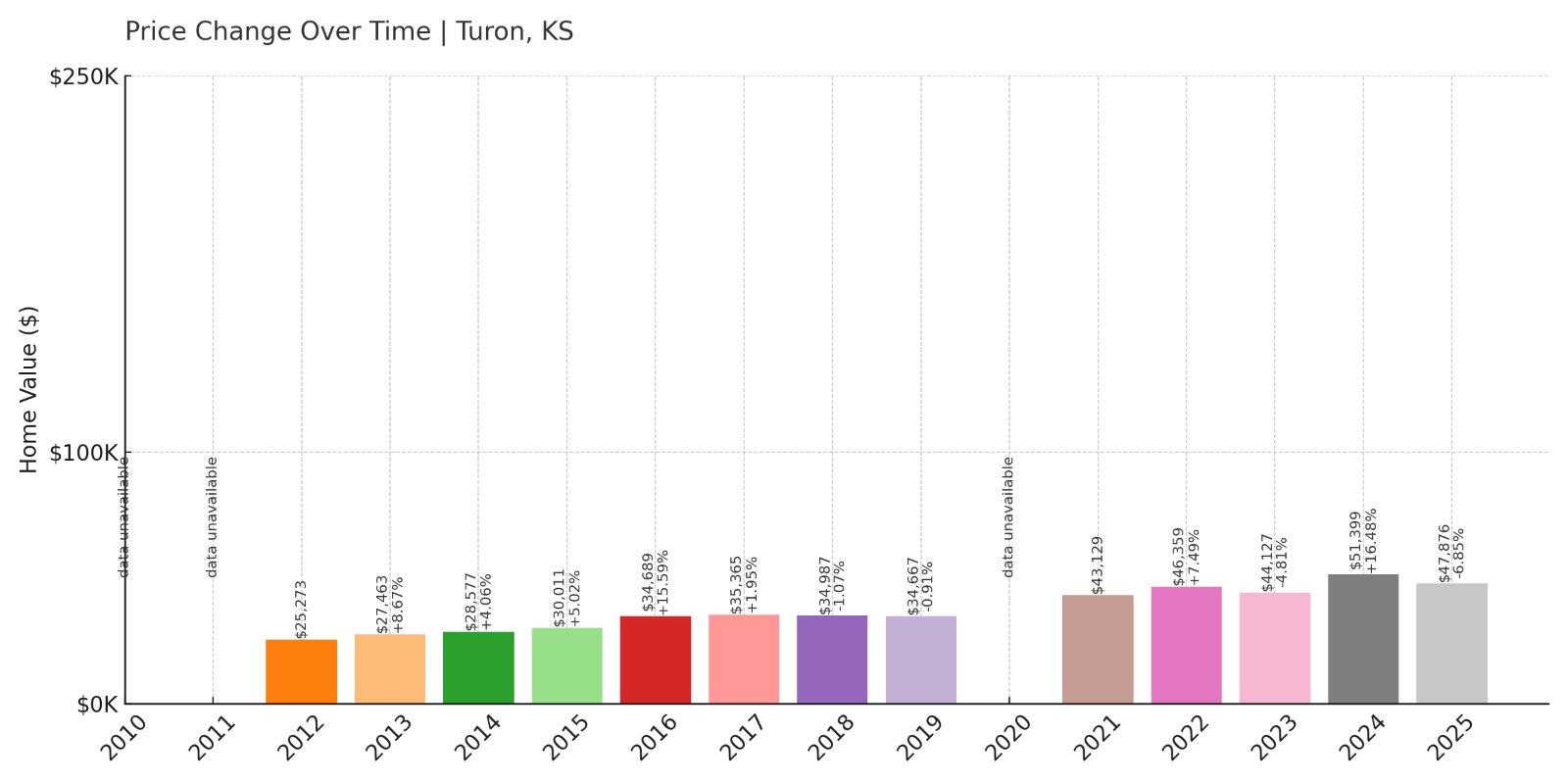

1. Turon – 90% Home Price Increase Since 2012

- 2010: N/A

- 2011: N/A

- 2012: $25,273

- 2013: $27,463 (+$2,190, +8.66% from previous year)

- 2014: $28,577 (+$1,114, +4.06% from previous year)

- 2015: $30,011 (+$1,434, +5.02% from previous year)

- 2016: $34,689 (+$4,677, +15.59% from previous year)

- 2017: $35,365 (+$676, +1.95% from previous year)

- 2018: $34,987 (-$377, -1.07% from previous year)

- 2019: $34,667 (-$321, -0.92% from previous year)

- 2020: N/A

- 2021: $43,129

- 2022: $46,359 (+$3,230, +7.49% from previous year)

- 2023: $44,127 (-$2,232, -4.81% from previous year)

- 2024: $51,399 (+$7,272, +16.48% from previous year)

- 2025: $47,876 (-$3,523, -6.85% from previous year)

Turon has experienced a 90% rise in home prices since 2012, the largest increase on this list. While there have been fluctuations, particularly in the last two years, overall growth remains strong. With home values near $48,000 in 2025, it tops the list as both highly affordable and fast-growing over the long term.

Turon – Leading the Pack in Long-Term Growth

Turon is a tiny town in Reno County, western Kansas, with a population of fewer than 400 people. Though it may be small in size, it tops this list thanks to a nearly 90% increase in home prices since 2012. Values jumped significantly in 2016 and again in 2024, pushing average prices well above their previous decade levels.

Turon’s affordability and modest growth have made it appealing to buyers looking for rural solitude with investment potential. While the price drop in 2025 is worth noting, the overall upward trend is hard to ignore. For buyers focused on low entry prices and long-term value, Turon stands out in Kansas’ housing market.