Would you like to save this?

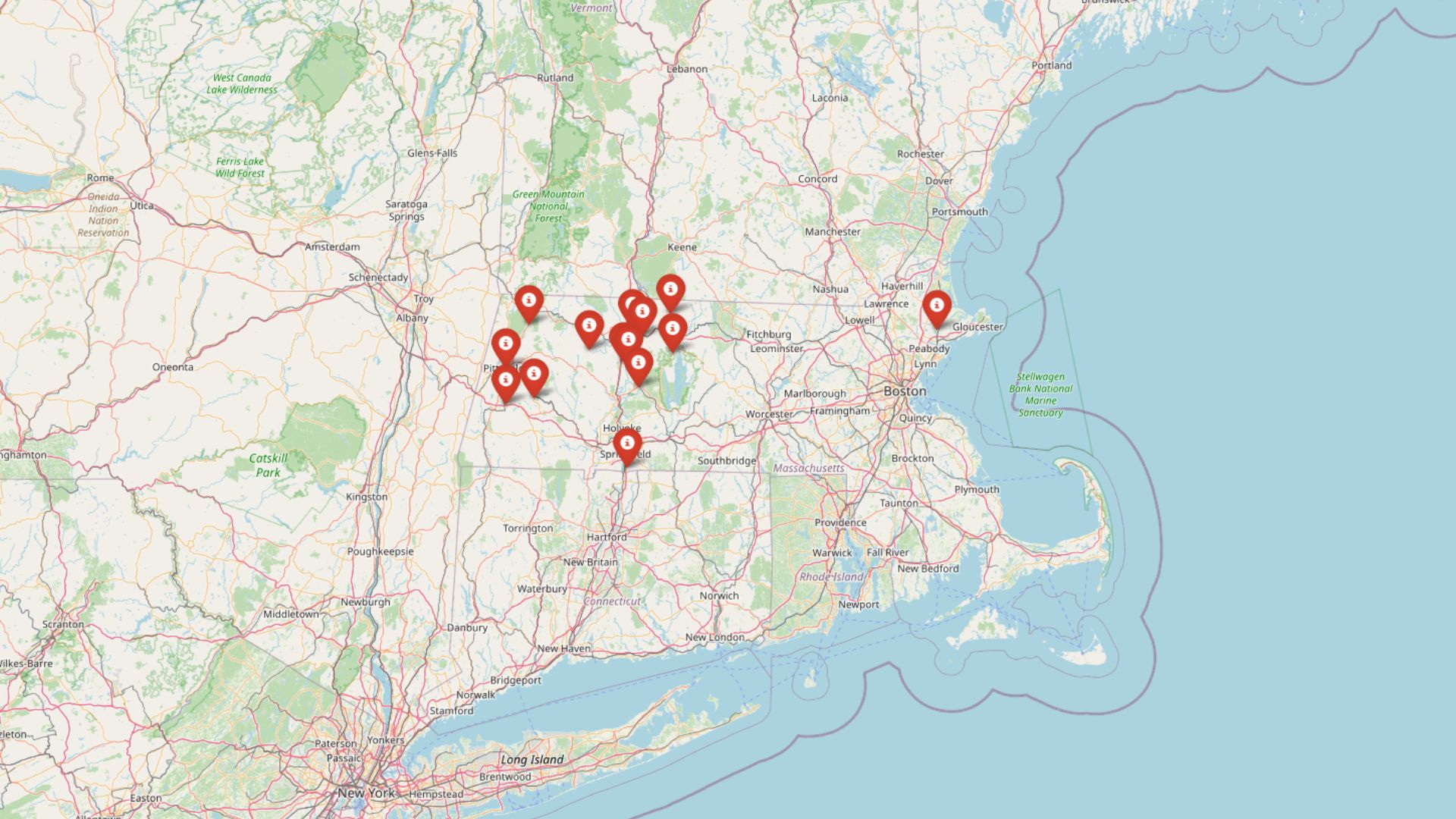

Massachusetts isn’t just expensive—it’s becoming increasingly investor-driven. According to the Zillow Home Value Index, 14 towns across the state are showing signs of what economists call an investor feeding frenzy. That’s when recent home price acceleration leaps far beyond historical norms, often fueled by speculation instead of sustainable demand. From sleepy rural towns to polished suburbs, these communities are facing an affordability crisis powered not by growth—but by profit-seeking pressure that’s squeezing out local families.

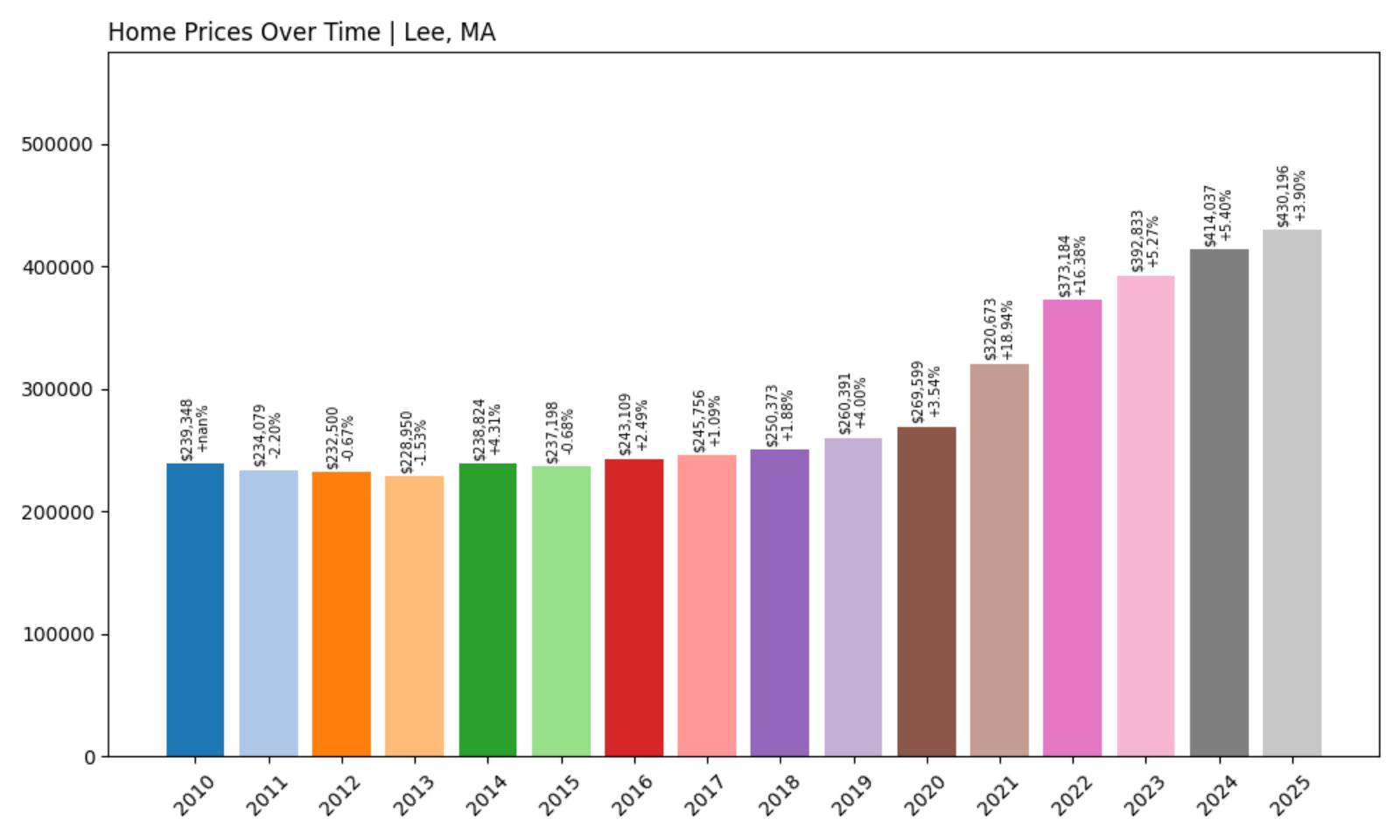

14. Lee – Investor Feeding Frenzy Factor 0.16% (July 2025)

- Historical annual growth rate (2012–2022): 4.85%

- Recent annual growth rate (2022–2025): 4.85%

- Investor Feeding Frenzy Factor: 0.16%

- Current 2025 price: $430,196.25

Lee shows minimal signs of speculative investor activity, with recent price growth barely exceeding historical patterns by just 0.16%. The town’s median home price of $430,196 reflects steady appreciation rather than the dramatic acceleration seen elsewhere. This stability suggests the local market remains primarily driven by genuine housing demand rather than investment speculation.

Lee – Berkshire County Stability in Volatile Times

Located in the scenic Berkshires of western Massachusetts, Lee maintains a relatively stable housing market despite pressures affecting neighboring communities. This town of approximately 5,900 residents sits along the Housatonic River and serves as a gateway to popular attractions like Tanglewood and the Norman Rockwell Museum.

The current median price of $430,196 represents consistent growth that aligns with the area’s genuine appeal to families and retirees seeking small-town New England living. Lee’s economy benefits from its proximity to cultural attractions and outdoor recreation, supporting local businesses and seasonal employment opportunities. The town’s historic downtown includes antique shops, restaurants, and services that cater to both residents and tourists, creating a more balanced economic foundation than purely speculative markets typically support.

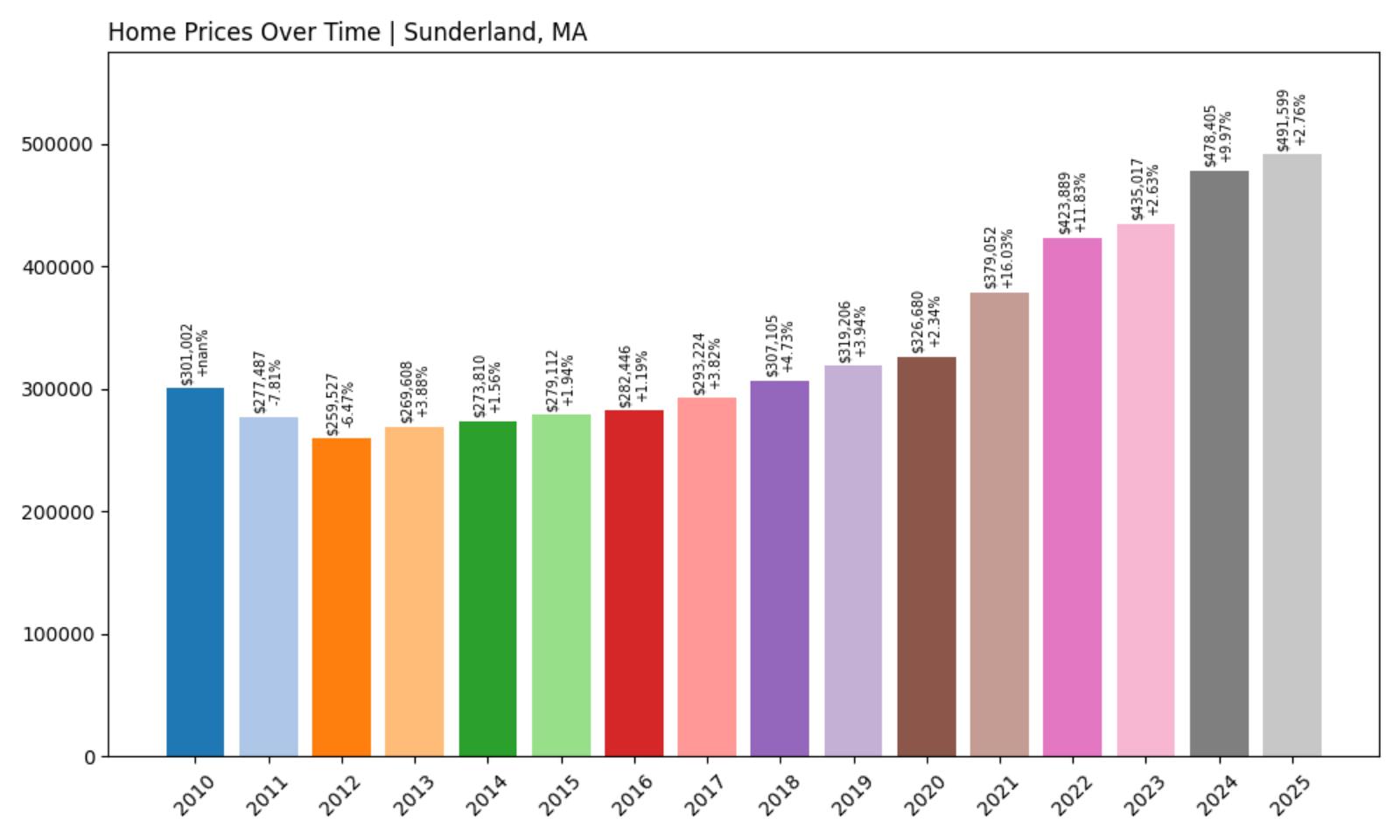

13. Sunderland – Investor Feeding Frenzy Factor 0.70% (July 2025)

- Historical annual growth rate (2012–2022): 5.03%

- Recent annual growth rate (2022–2025): 5.06%

- Investor Feeding Frenzy Factor: 0.70%

- Current 2025 price: $491,599.07

Sunderland exhibits very modest investor pressure, with recent growth rates increasing just 0.70% beyond historical trends. At $491,599, homes here command premium prices, but the gradual appreciation pattern suggests organic market forces rather than speculative buying. This Connecticut River Valley community maintains relatively stable pricing despite its desirable location.

Sunderland – Connecticut River Valley Appeal Without the Frenzy

Were You Meant

to Live In?

This small town of roughly 3,700 residents occupies prime real estate in the Connecticut River Valley, surrounded by fertile farmland and scenic mountain views. Sunderland’s location between Amherst and Greenfield provides access to employment opportunities while maintaining rural character.

The median home price of $491,599 reflects the area’s natural beauty and proximity to the Five College region, but growth remains measured rather than explosive. The community’s agricultural heritage continues today with working farms and conservation land that preserve open space and rural atmosphere. Local amenities include elementary schools, recreational facilities, and easy access to the Connecticut River for outdoor activities, creating genuine lifestyle value that supports steady rather than speculative price appreciation.

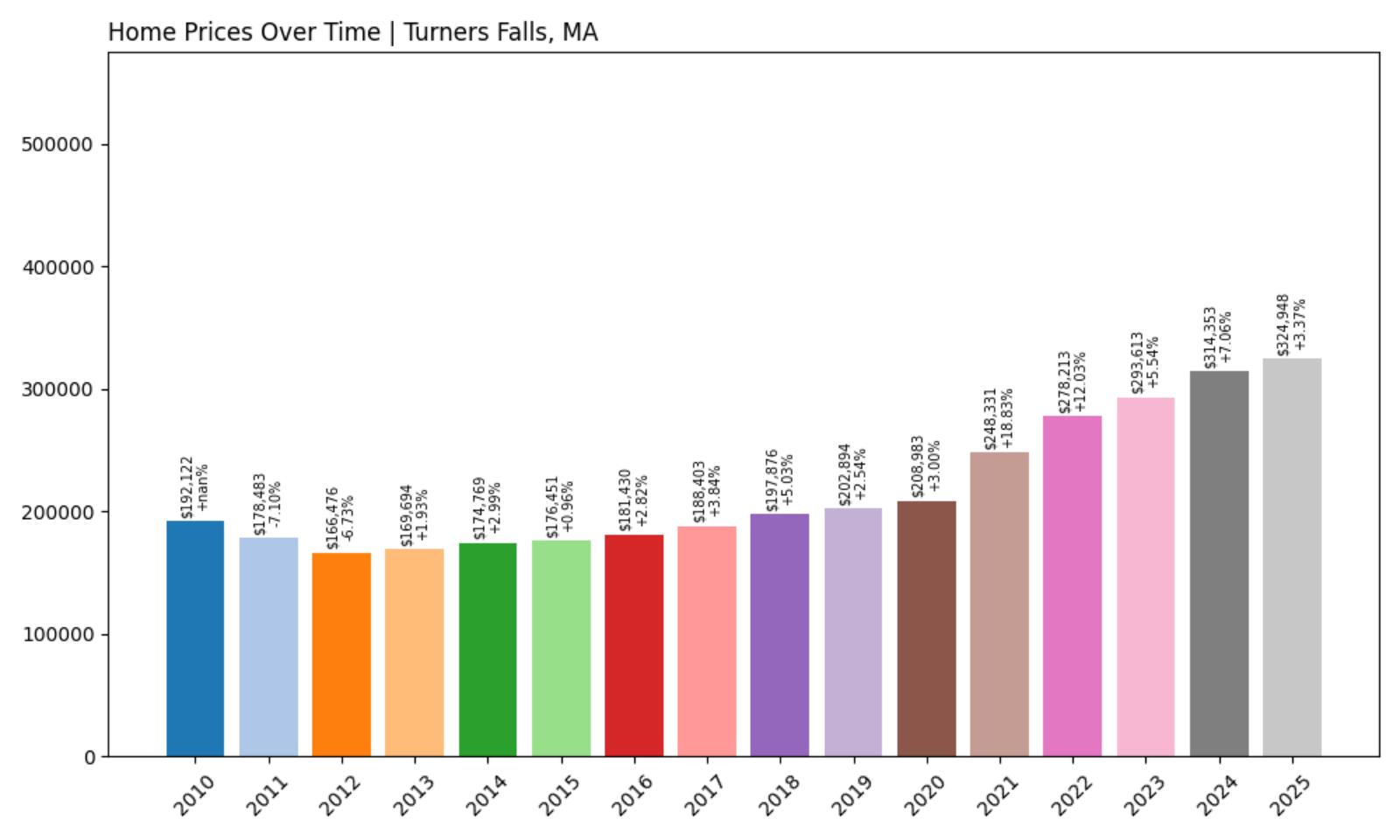

12. Turners Falls – Investor Feeding Frenzy Factor 0.81% (July 2025)

- Historical annual growth rate (2012–2022): 5.27%

- Recent annual growth rate (2022–2025): 5.31%

- Investor Feeding Frenzy Factor: 0.81%

- Current 2025 price: $324,947.68

Turners Falls shows minimal speculative pressure with growth acceleration of just 0.81% above historical norms. The median price of $324,947 represents one of the more affordable options in the region while maintaining steady appreciation. This former industrial community along the Connecticut River demonstrates stable market conditions despite ongoing revitalization efforts.

Turners Falls – Historic Mill Town Finding New Purpose

Part of the larger town of Montague, Turners Falls sits at a dramatic bend in the Connecticut River where historic dams once powered textile mills and paper factories. Today, this community of several thousand residents is experiencing gradual renewal as artists, young families, and telecommuters discover its affordable housing and scenic riverfront location.

The current median price of $324,947 makes it accessible compared to many Massachusetts communities while still offering small-town charm and natural beauty. The area’s industrial heritage remains visible in converted mill buildings and historic architecture, while new businesses and cultural venues slowly replace abandoned factories. Recent infrastructure improvements and community development initiatives suggest genuine revitalization rather than speculative investment, supporting sustainable rather than explosive price growth.

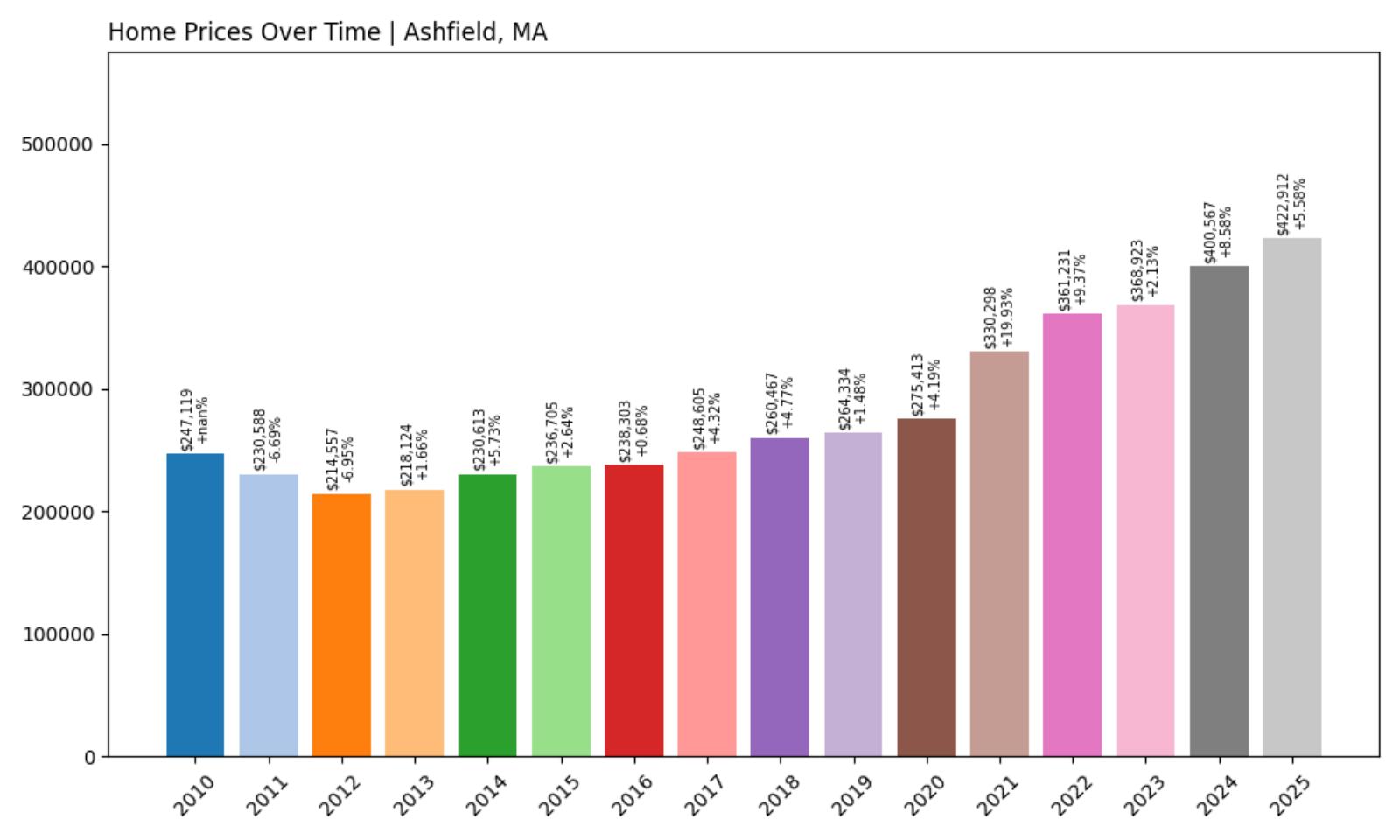

11. Ashfield – Investor Feeding Frenzy Factor 0.90% (July 2025)

- Historical annual growth rate (2012–2022): 5.35%

- Recent annual growth rate (2022–2025): 5.40%

- Investor Feeding Frenzy Factor: 0.90%

- Current 2025 price: $422,911.87

Ashfield demonstrates very low speculative activity, with recent price growth exceeding historical patterns by less than 1%. The median home price of $422,911 reflects steady appreciation in this rural Franklin County community. The minimal feeding frenzy factor suggests the local market remains driven by residents and families rather than outside investors.

Ashfield – Hilltop Community Maintaining Authenticity

Perched on a plateau in the hills of western Massachusetts, Ashfield encompasses about 1,800 residents spread across a landscape of working farms, forests, and historic homesteads. This Franklin County town maintains strong agricultural traditions while attracting residents seeking rural tranquility within commuting distance of larger employment centers.

The current median price of $422,911 reflects the area’s natural beauty and small-town character without the speculative pressures affecting many New England communities. Ashfield’s economy centers on agriculture, small businesses, and residents who commute to nearby towns for work. The community hosts the annual Ashfield Fall Festival, maintains active volunteer organizations, and preserves significant amounts of conservation land, creating genuine value for families seeking authentic rural living rather than investment opportunities.

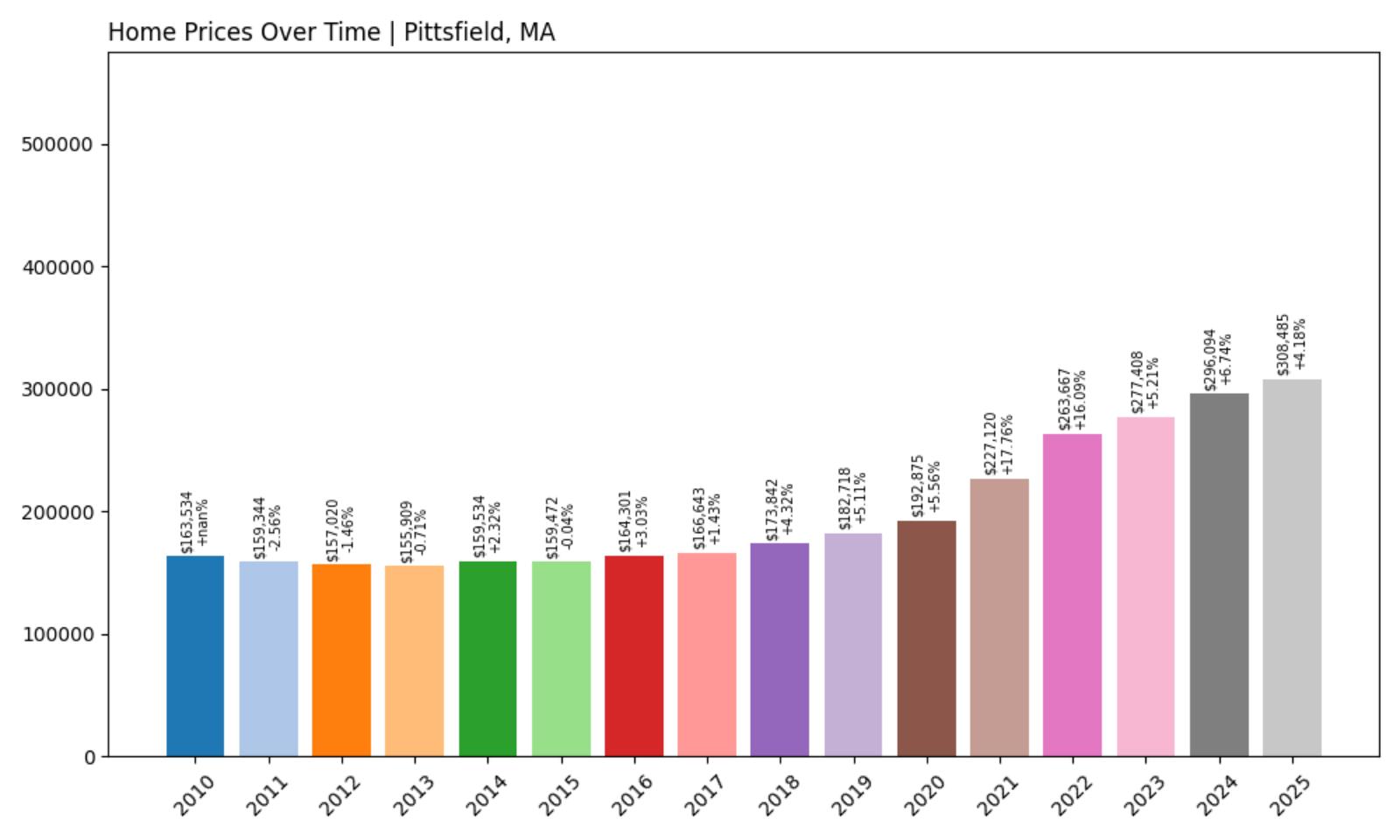

10. Pittsfield – Investor Feeding Frenzy Factor 0.98% (July 2025)

- Historical annual growth rate (2012–2022): 5.32%

- Recent annual growth rate (2022–2025): 5.37%

- Investor Feeding Frenzy Factor: 0.98%

- Current 2025 price: $308,484.81

Pittsfield shows minimal investor feeding frenzy activity with growth acceleration under 1% beyond historical trends. At $308,484, the median home price remains relatively affordable for a city of its size and amenities. The modest feeding frenzy factor indicates the market continues to serve local residents rather than speculative investors.

Pittsfield – Berkshire County’s Largest City Stays Grounded

As the largest city in Berkshire County with roughly 43,000 residents, Pittsfield serves as the region’s economic and cultural hub while maintaining affordable housing compared to coastal Massachusetts markets. The current median price of $308,484 reflects the city’s role as a working-class community with diverse employment opportunities in healthcare, education, manufacturing, and services. Recent price growth remains modest despite the city’s ongoing downtown revitalization and cultural attractions.

Pittsfield’s economy benefits from major employers like Berkshire Medical Center and General Electric’s legacy operations, while cultural venues like the Colonial Theatre and Berkshire Museum add quality of life value. The city’s location provides access to outdoor recreation throughout the Berkshires while offering urban amenities like restaurants, shopping, and professional services that support steady rather than speculative housing demand.

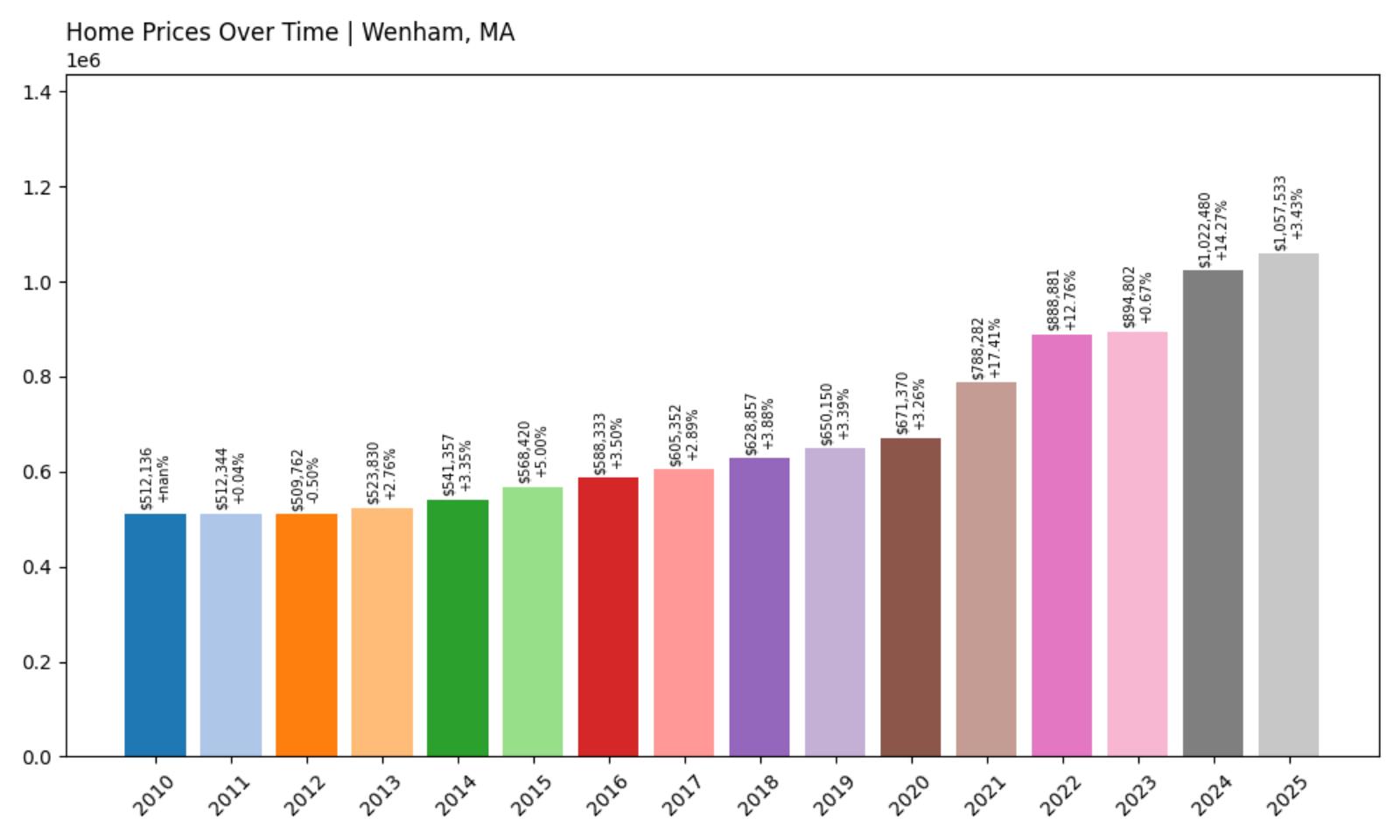

9. Wenham – Investor Feeding Frenzy Factor 4.27% (July 2025)

- Historical annual growth rate (2012–2022): 5.72%

- Recent annual growth rate (2022–2025): 5.96%

- Investor Feeding Frenzy Factor: 4.27%

- Current 2025 price: $1,057,533.04

Wenham exhibits low but noticeable speculative pressure, with recent growth rates accelerating 4.27% beyond historical patterns. The exceptionally high median price of $1,057,533 reflects this affluent North Shore community’s premium status, while the modest feeding frenzy factor suggests continued demand from wealthy families rather than pure speculation.

Wenham – North Shore Affluence With Growing Investment Interest

This exclusive Essex County town of approximately 5,000 residents occupies prime North Shore real estate between Salem and Ipswich, combining rural estates with easy access to Boston employment centers. Wenham’s median home price of over $1 million reflects its status as one of Massachusetts’ most affluent communities, featuring large properties, excellent schools, and preserved open space. The recent acceleration in price growth suggests growing interest from investors recognizing the area’s long-term value.

The town’s character centers on equestrian activities, conservation land, and historic properties dating to the colonial era, creating an exclusive atmosphere that appeals to wealthy families and potentially speculative buyers. Wenham’s proximity to commuter rail service and major highways provides convenient access to Boston while maintaining a rural feel that commands premium prices in the competitive North Shore market.

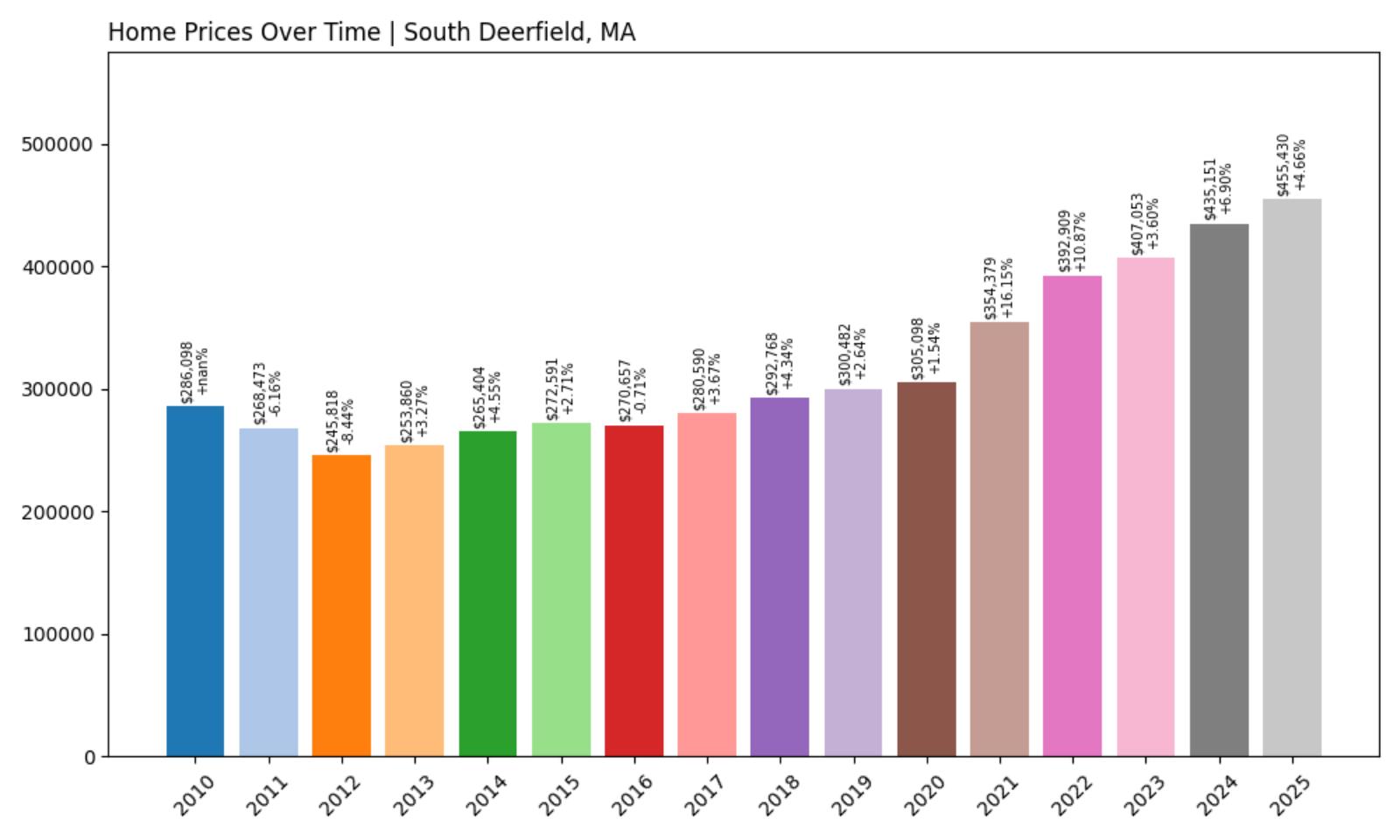

8. South Deerfield – Investor Feeding Frenzy Factor 5.08% (July 2025)

- Historical annual growth rate (2012–2022): 4.80%

- Recent annual growth rate (2022–2025): 5.05%

- Investor Feeding Frenzy Factor: 5.08%

- Current 2025 price: $455,429.86

South Deerfield shows modest investor feeding frenzy activity with growth acceleration of 5.08% above historical norms. The median price of $455,429 represents a significant increase for this Franklin County community along the Connecticut River. The feeding frenzy factor suggests early-stage speculative interest in this scenic Pioneer Valley location.

South Deerfield – Pioneer Valley Village Drawing Outside Attention

Part of the larger town of Deerfield, South Deerfield sits in the fertile Connecticut River Valley surrounded by productive farmland and scenic mountain views. This community of several thousand residents maintains a village atmosphere while providing access to employment centers in Springfield, Northampton, and Amherst.

The current median price of $455,429 reflects growing recognition of the area’s appeal, with recent acceleration suggesting investors are discovering this previously overlooked market. The area’s agricultural heritage continues with working farms and farmers’ markets, while proximity to Interstate 91 provides convenient transportation access. Historic sites including Old Deerfield and natural attractions along the Connecticut River add to the community’s appeal, creating genuine value that may be attracting both residents and speculative buyers seeking undervalued New England properties.

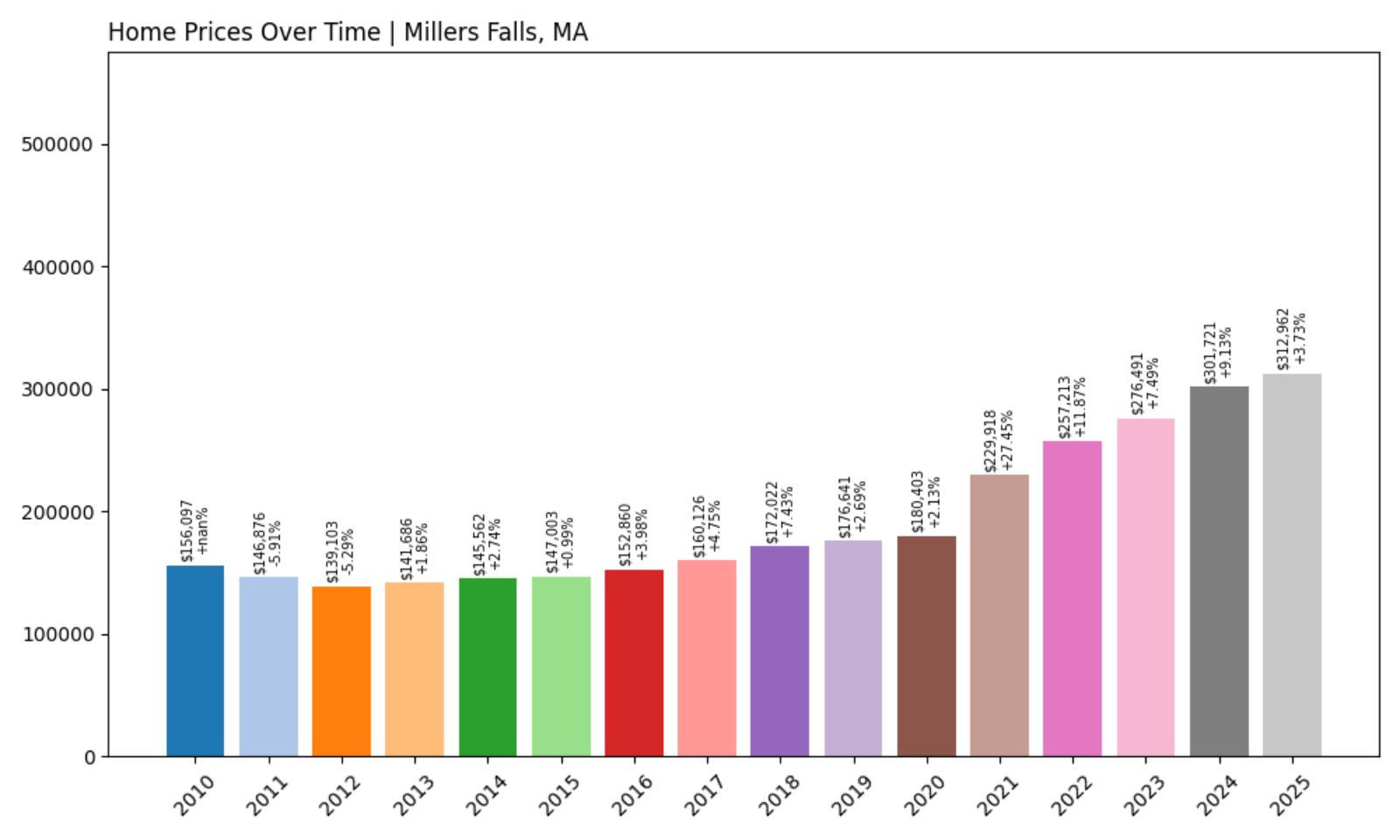

7. Millers Falls – Investor Feeding Frenzy Factor 6.59% (July 2025)

- Historical annual growth rate (2012–2022): 6.34%

- Recent annual growth rate (2022–2025): 6.76%

- Investor Feeding Frenzy Factor: 6.59%

- Current 2025 price: $312,961.94

Millers Falls demonstrates growing speculative pressure with price acceleration 6.59% beyond historical trends. Despite the median price of $312,961 remaining relatively affordable, the acceleration suggests investors are recognizing potential in this Connecticut River community. The feeding frenzy factor indicates early-stage speculation that could intensify if not monitored.

Millers Falls – Riverside Community Catching Investor Eyes

This small village within the town of Montague occupies a scenic position along the Connecticut River, featuring historic mill buildings and a compact downtown area. With a population of roughly 1,200 residents, Millers Falls maintains small-town character while offering relatively affordable housing compared to many Massachusetts communities.

The current median price of $312,961 represents good value for buyers, but recent acceleration suggests investors may be positioning for future appreciation. The community’s location provides easy access to outdoor recreation along the Connecticut River while maintaining connections to larger employment centers through nearby highways. Historic mill buildings and riverside location create development potential that may be attracting speculative interest, though the area still functions primarily as a residential community for working families and retirees seeking affordable New England living.

6. Becket – Investor Feeding Frenzy Factor 7.73% (July 2025)

- Historical annual growth rate (2012–2022): 5.68%

- Recent annual growth rate (2022–2025): 6.12%

- Investor Feeding Frenzy Factor: 7.73%

- Current 2025 price: $399,073.95

Becket shows noticeable speculative activity with growth rates accelerating 7.73% beyond historical patterns. The median price of $399,073 reflects increasing demand for this Berkshire County community known for outdoor recreation and seasonal attractions. The feeding frenzy factor suggests investors are targeting the area for vacation rental potential and appreciation opportunities.

Becket – Berkshire Recreation Hub Attracting Speculation

Located in the heart of the Berkshire Mountains, Becket encompasses roughly 1,800 year-round residents across a landscape dominated by forests, lakes, and recreational facilities. The town hosts popular attractions including Jacob’s Pillow Dance Festival and numerous outdoor recreation opportunities that draw seasonal visitors throughout the year. The current median price of $399,073 reflects growing recognition of the area’s tourism potential, with recent acceleration suggesting investors are capitalizing on vacation rental opportunities. Becket’s economy relies heavily on seasonal tourism, outdoor recreation, and second-home ownership, creating conditions that naturally attract speculative investment.

The combination of scenic beauty, recreational amenities, and proximity to cultural attractions makes the area appealing to investors seeking properties that can generate rental income while appreciating in value, potentially pricing out local families who work in the service industries that support the tourism economy.

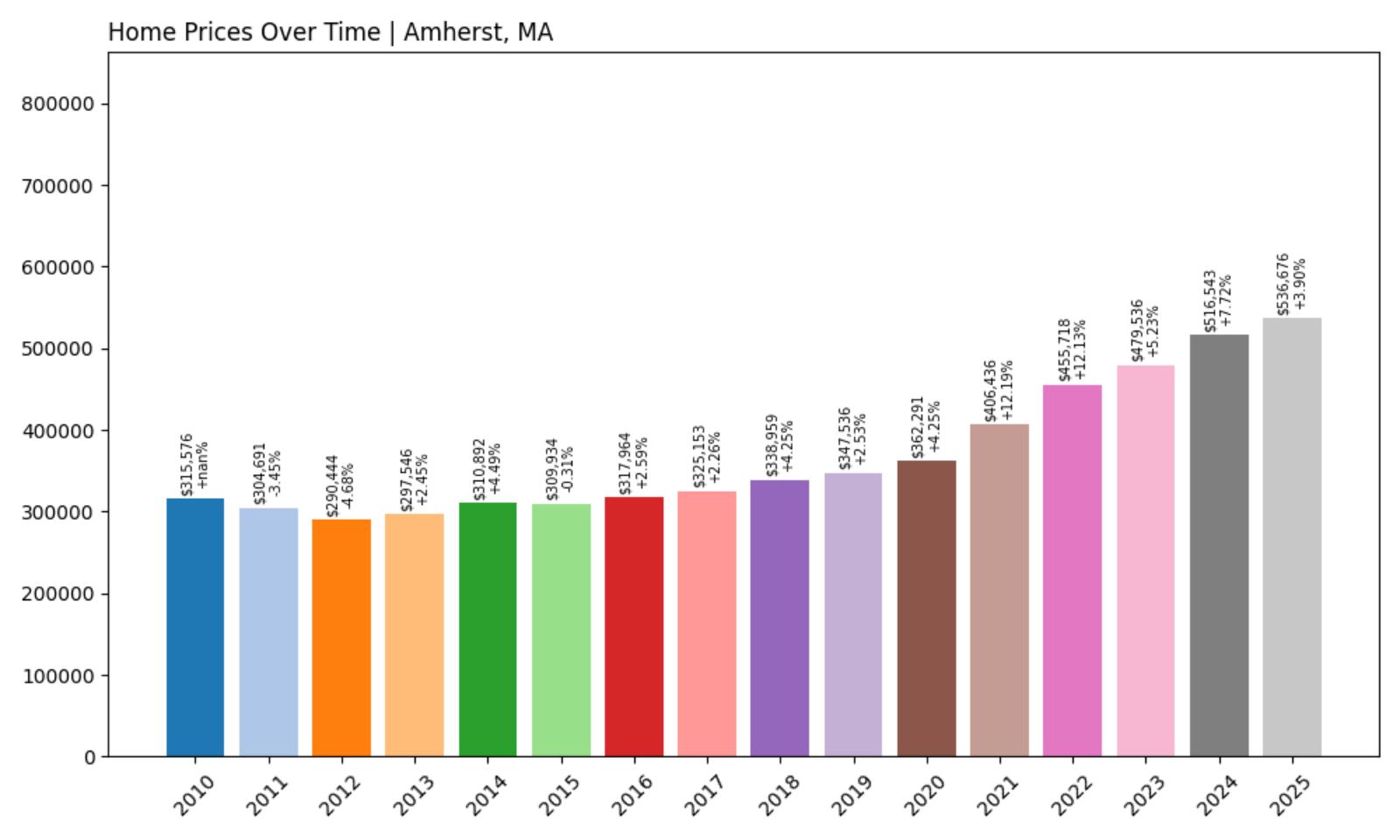

5. Amherst – Investor Feeding Frenzy Factor 21.58% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 4.61%

- Recent annual growth rate (2022–2025): 5.60%

- Investor Feeding Frenzy Factor: 21.58%

- Current 2025 price: $536,675.83

Amherst demonstrates significant speculative pressure with price acceleration running 21.58% above historical norms. The median price of $536,675 represents a substantial burden for many residents in this college town, where university employees and local families compete with investors for limited housing stock. The high feeding frenzy factor indicates strong speculative interest disrupting traditional market patterns.

Amherst – College Town Housing Crisis Intensifies

AlexiusHoratius, CC BY-SA 3.0, via Wikimedia Commons

Home to the University of Massachusetts flagship campus and Amherst College, this Pioneer Valley community of roughly 40,000 residents faces intense housing pressures from multiple sources. The current median price of $536,675 creates affordability challenges for university staff, local service workers, and families trying to remain in the community.

Recent price acceleration well beyond historical trends suggests investors are exploiting the tight housing market created by steady student and faculty demand. The town’s economy revolves around higher education, creating stable demand for housing that makes it attractive to investors seeking reliable rental income and appreciation potential. However, speculative buying compounds existing affordability problems for local residents who can’t compete with cash investors, potentially threatening the community’s ability to house the workers and families that support its educational and service economy.

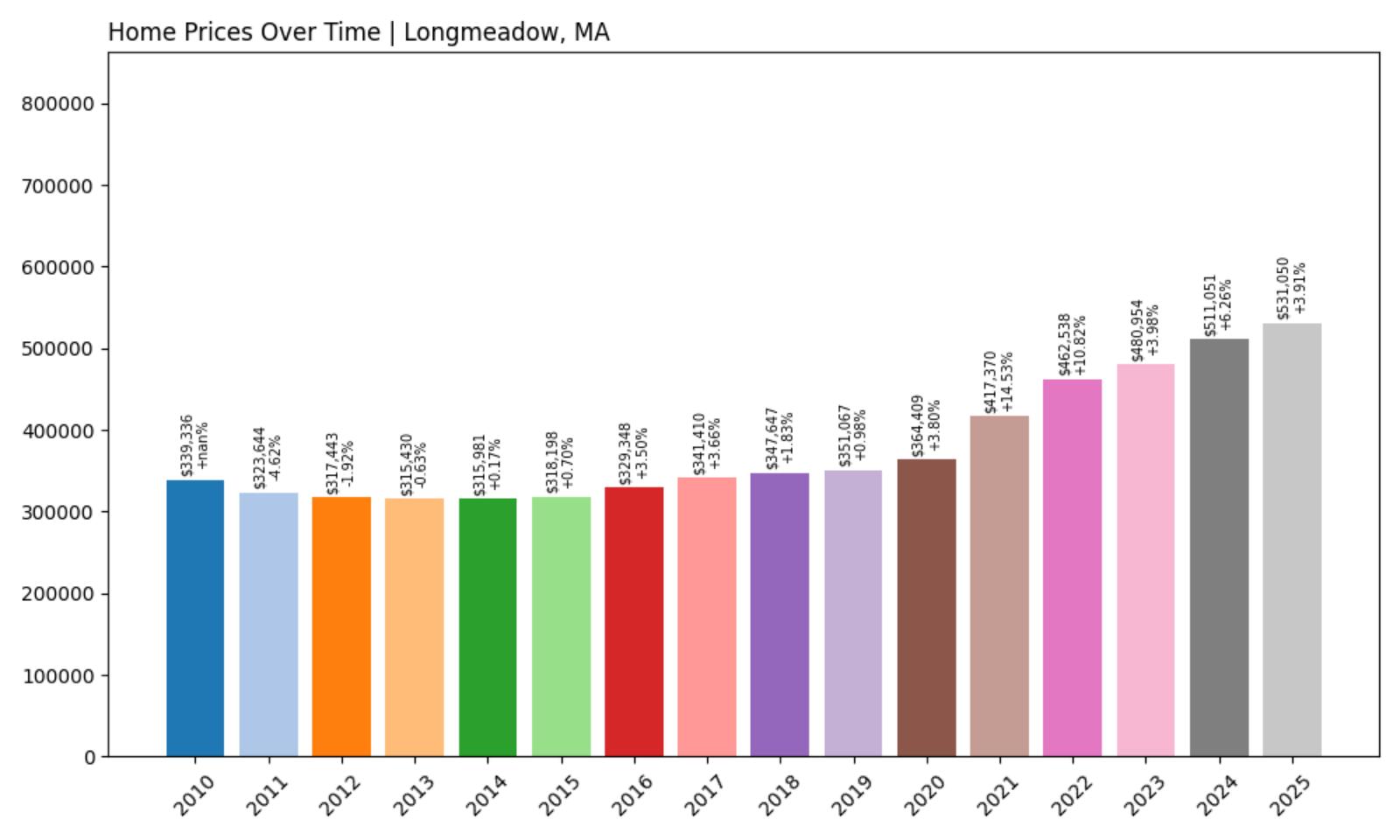

4. Longmeadow – Investor Feeding Frenzy Factor 22.83% (July 2025)

- Historical annual growth rate (2012–2022): 3.84%

- Recent annual growth rate (2022–2025): 4.71%

- Investor Feeding Frenzy Factor: 22.83%

- Current 2025 price: $531,050.23

Longmeadow shows substantial speculative activity with growth acceleration of 22.83% beyond historical patterns. The median price of $531,050 reflects strong investor interest in this affluent Springfield suburb known for excellent schools and upscale neighborhoods. The significant feeding frenzy factor indicates speculative forces are driving prices well beyond traditional appreciation rates.

Longmeadow – Suburban Excellence Draws Heavy Speculation

This prestigious Hampden County town of approximately 15,000 residents consistently ranks among Massachusetts’ most desirable suburban communities, featuring excellent public schools, well-maintained neighborhoods, and convenient access to Springfield and Hartford employment centers. The current median price of $531,050 reflects the area’s reputation for quality family living, but recent acceleration suggests investors are capitalizing on the community’s established appeal and limited housing inventory.

Longmeadow’s combination of top-rated schools, safe neighborhoods, and proximity to major highways creates conditions that naturally attract both families and speculative buyers. The substantial price acceleration beyond historical norms indicates investor activity may be pricing out working families who have traditionally formed the community’s backbone, potentially altering the demographic balance that made the town desirable in the first place.

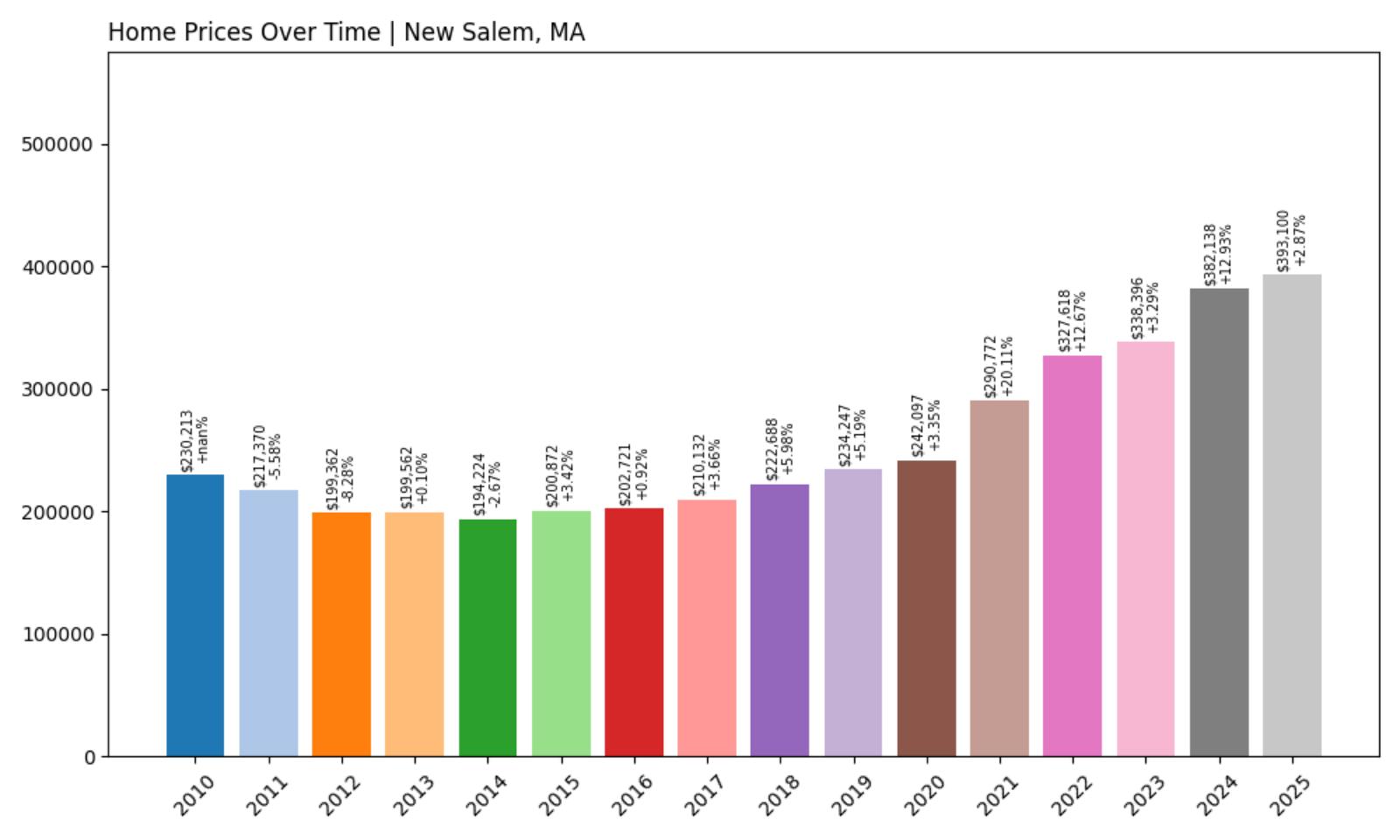

3. New Salem – Investor Feeding Frenzy Factor 22.96% (July 2025)

- Historical annual growth rate (2012–2022): 5.09%

- Recent annual growth rate (2022–2025): 6.26%

- Investor Feeding Frenzy Factor: 22.96%

- Current 2025 price: $393,099.95

New Salem exhibits intense speculative pressure with price acceleration running 22.96% above historical trends. At $393,099, the median price represents a dramatic shift for this small Franklin County community that historically offered affordable rural living. The high feeding frenzy factor suggests investors are targeting the area for its development potential and scenic appeal.

New Salem – Rural Character Under Speculative Pressure

This small town of roughly 1,000 residents occupies rolling hills in north-central Massachusetts, featuring working farms, forests, and historic properties spread across a largely rural landscape. New Salem’s traditional appeal lay in offering affordable country living within commuting distance of employment centers, but the current median price of $393,099 represents a significant departure from historical affordability. Recent price acceleration well beyond normal patterns suggests speculative buyers are discovering this previously overlooked market.

The community’s rural character and potential for development may be attracting investors seeking undervalued properties with appreciation potential, but rapid price increases threaten to displace longtime residents and alter the agricultural character that made the area attractive. The substantial feeding frenzy factor indicates speculative forces rather than organic demand are driving market conditions, potentially creating an unsustainable bubble in a community with limited economic fundamentals to support current pricing.

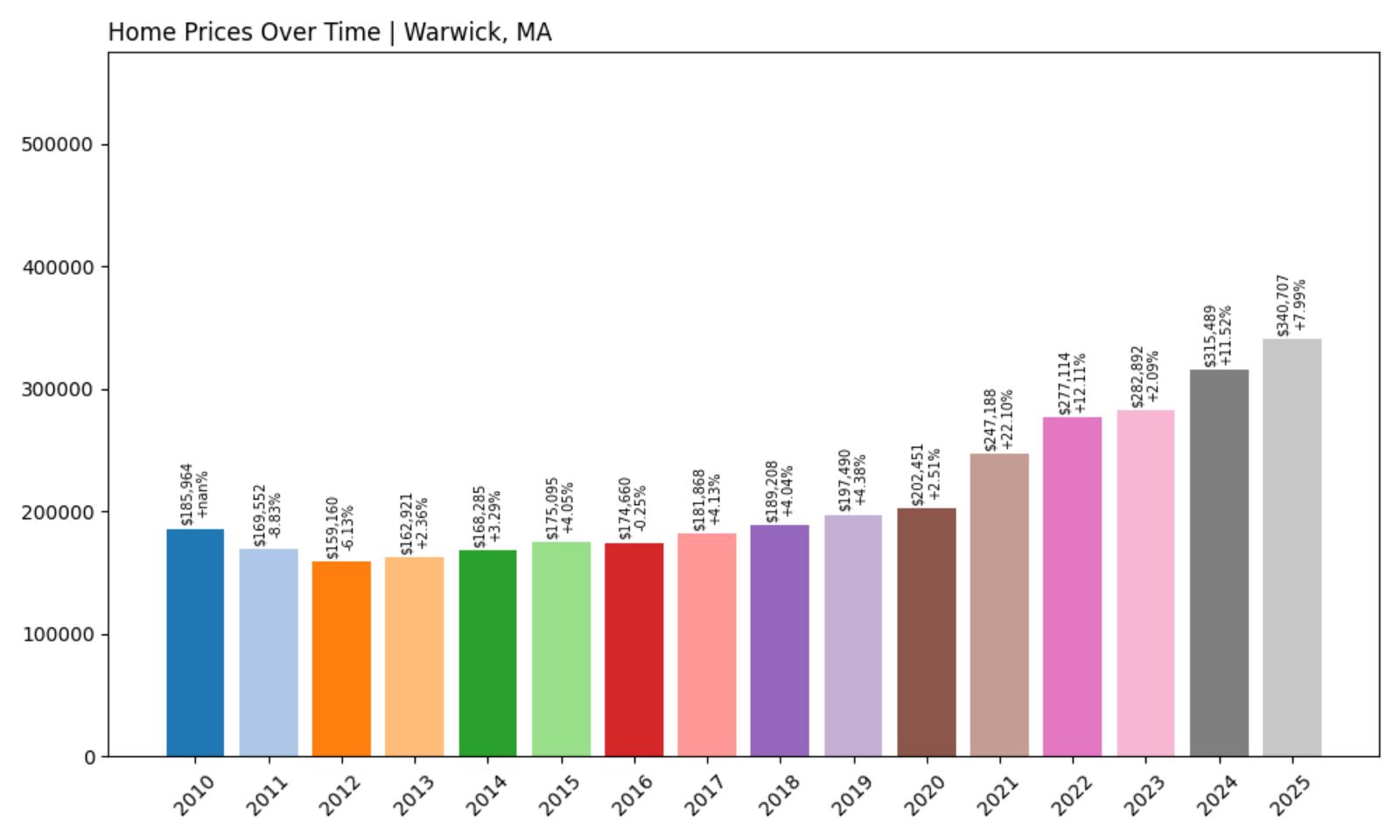

2. Warwick – Investor Feeding Frenzy Factor 25.03% (July 2025)

- Historical annual growth rate (2012–2022): 5.70%

- Recent annual growth rate (2022–2025): 7.13%

- Investor Feeding Frenzy Factor: 25.03%

- Current 2025 price: $340,706.81

Warwick demonstrates severe speculative pressure with price acceleration running 25.03% above historical norms. At $340,706, homes here cost significantly more than what local employment opportunities typically support. The dramatic shift from the town’s steady 5.70% historical growth to current levels indicates strong investor influence disrupting traditional market patterns.

Warwick – Rural Charm Attracting Dangerous Speculation

This small hilltop community in Franklin County encompasses just over 800 residents spread across a largely rural landscape of farms, forests, and scenic vistas. Warwick’s location in north-central Massachusetts provides a pastoral setting that appears increasingly attractive to investors seeking properties in quaint New England towns. The current median price of $340,706 represents a substantial increase for an area where many residents work in agriculture, local services, or commute to larger employment centers.

The town’s appeal lies in its quintessential New England character, complete with a traditional town common, historic buildings dating to the 1700s, and preserved agricultural land that creates postcard-perfect scenery. However, the dramatic price acceleration suggests investors are prioritizing the area’s aesthetic appeal and potential returns over community sustainability, creating conditions where longtime residents may be priced out of their own hometown.

1. Adams – Investor Feeding Frenzy Factor 31.40% (July 2025)

- Historical annual growth rate (2012–2022): 5.30%

- Recent annual growth rate (2022–2025): 6.97%

- Investor Feeding Frenzy Factor: 31.40%

- Current 2025 price: $265,344.00

Adams shows the most dramatic investor feeding frenzy activity in the state, with recent price growth acceleration running 31.40% beyond its historical pattern. The town’s median home price has climbed to $265,344, representing a significant burden for local families in this former industrial community. This acceleration suggests speculative buying pressure that completely disconnects pricing from local economic fundamentals.

Adams – Former Mill Town Consumed by Speculation

Located in the heart of the Berkshires in northwestern Massachusetts, Adams has transformed from a struggling post-industrial community into the state’s most extreme example of investor-driven housing speculation. The town of roughly 8,000 residents sits along the Hoosic River and was historically known for its textile mills and paper manufacturing, industries that provided working-class employment but have largely disappeared. Today’s $265,344 median home price represents a shocking disconnect for a community where many residents work in service industries or commute to nearby Pittsfield for employment. The extreme 31.40% feeding frenzy factor reveals speculative forces completely overwhelming organic housing demand from local residents and families.

Investors appear to be targeting Adams as an undervalued market with potential for quick returns, possibly attracted by the town’s proximity to outdoor recreation opportunities including nearby Mount Greylock State Reservation. However, this level of speculation creates devastating affordability challenges for working families and threatens to hollow out the community by pricing out the very people who make it function, turning a working-class town into an investment commodity rather than a place where people can afford to live and raise families.

Haven't Seen Yet

Curated from our most popular plans. Click any to explore.