Would you like to save this?

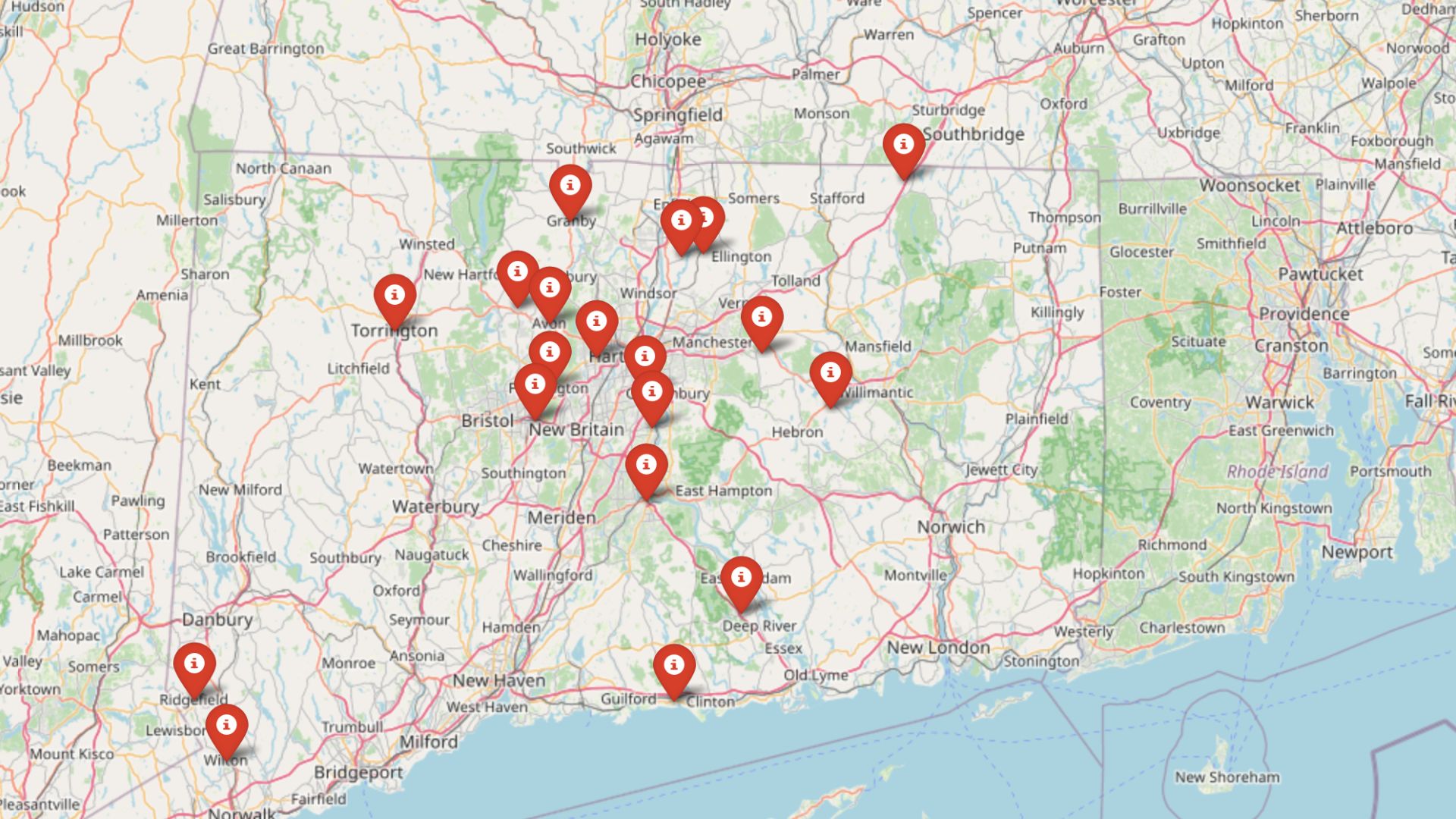

Out-of-town investors are snapping up homes across Connecticut—and local families are paying the price. The Zillow Home Value Index shows just how extreme things have become in 19 towns where prices are no longer just rising—they’re surging, fueled by speculative buying. These aren’t your typical luxury markets. They’re ordinary towns where steady growth has suddenly turned into a feeding frenzy, pricing out long-time residents and first-time buyers alike. If it feels like locals can’t compete anymore, it’s because in many places, they can’t.

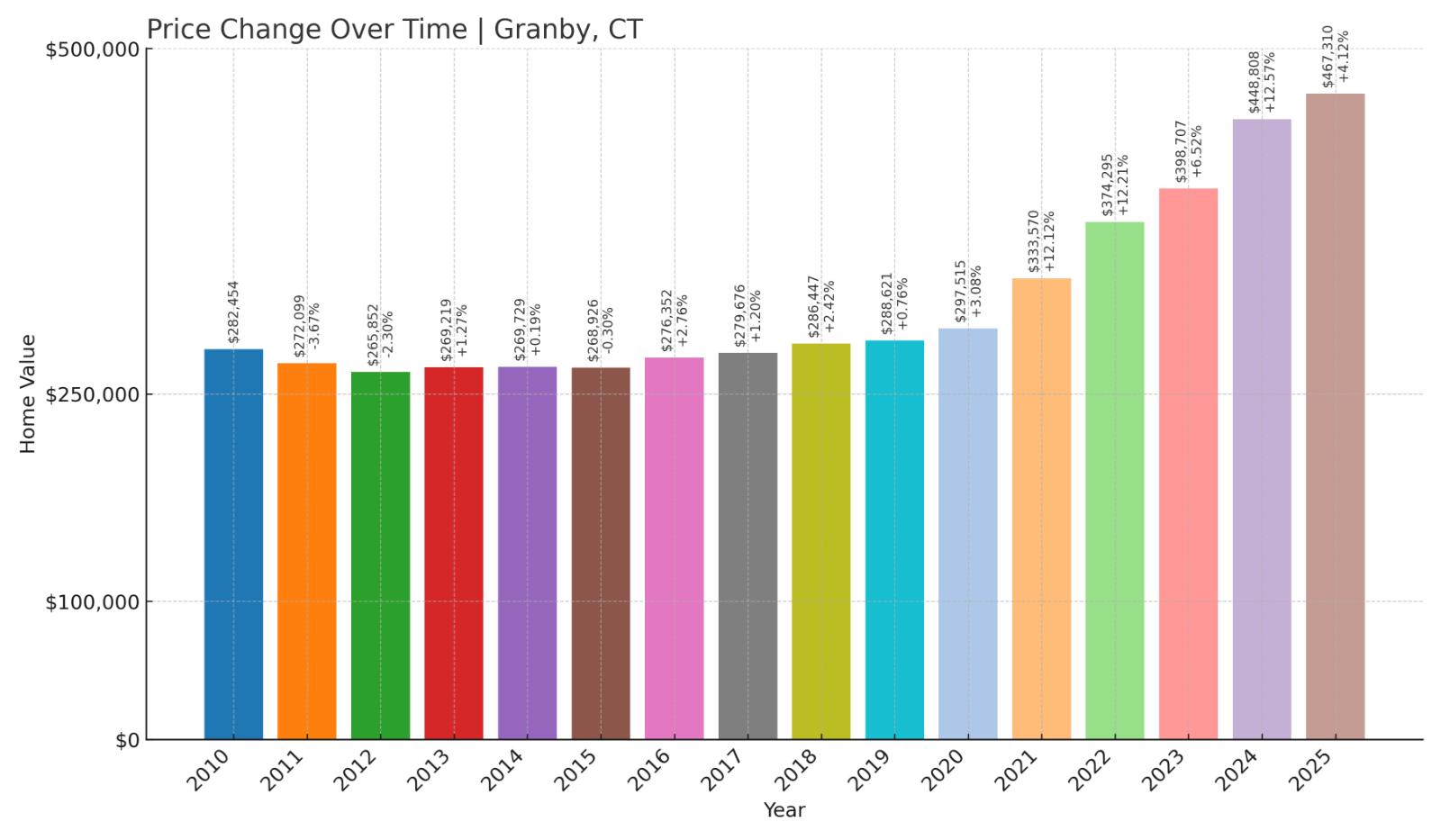

19. Granby – Investor Feeding Frenzy Factor 120.64% (June 2025)

- Historical annual growth rate (2012–2022): 3.48%

- Recent annual growth rate (2022–2025): 7.68%

- Investor Feeding Frenzy Factor: 120.64%

- Current 2025 price: $467,310.02

Granby’s home prices have more than doubled their historical pace in the last three years. From a long-term average of 3.48% annually, growth has surged to 7.68% since 2022—creating a feeding frenzy factor of 120.64%. That’s a dramatic acceleration that has pushed the average home value to $467,310 in June 2025, according to Zillow.

Granby – A Quiet Town Facing Sudden Price Pressure

Located in Hartford County near the Massachusetts border, Granby is known for its rural charm, highly rated schools, and access to open space like McLean Game Refuge and Enders State Forest. Traditionally, it has seen moderate and steady price appreciation. But lately, the pace has quickened—possibly driven by investor interest in suburban markets that offer relative affordability compared to Greater Hartford.

Despite its small-town feel, Granby’s rising values may be testing the limits for first-time homebuyers and long-time renters. As more investors seek properties in towns that offer strong school districts and good commuter access, Granby appears to be getting caught up in the wave—changing the pricing dynamics for locals hoping to stay.

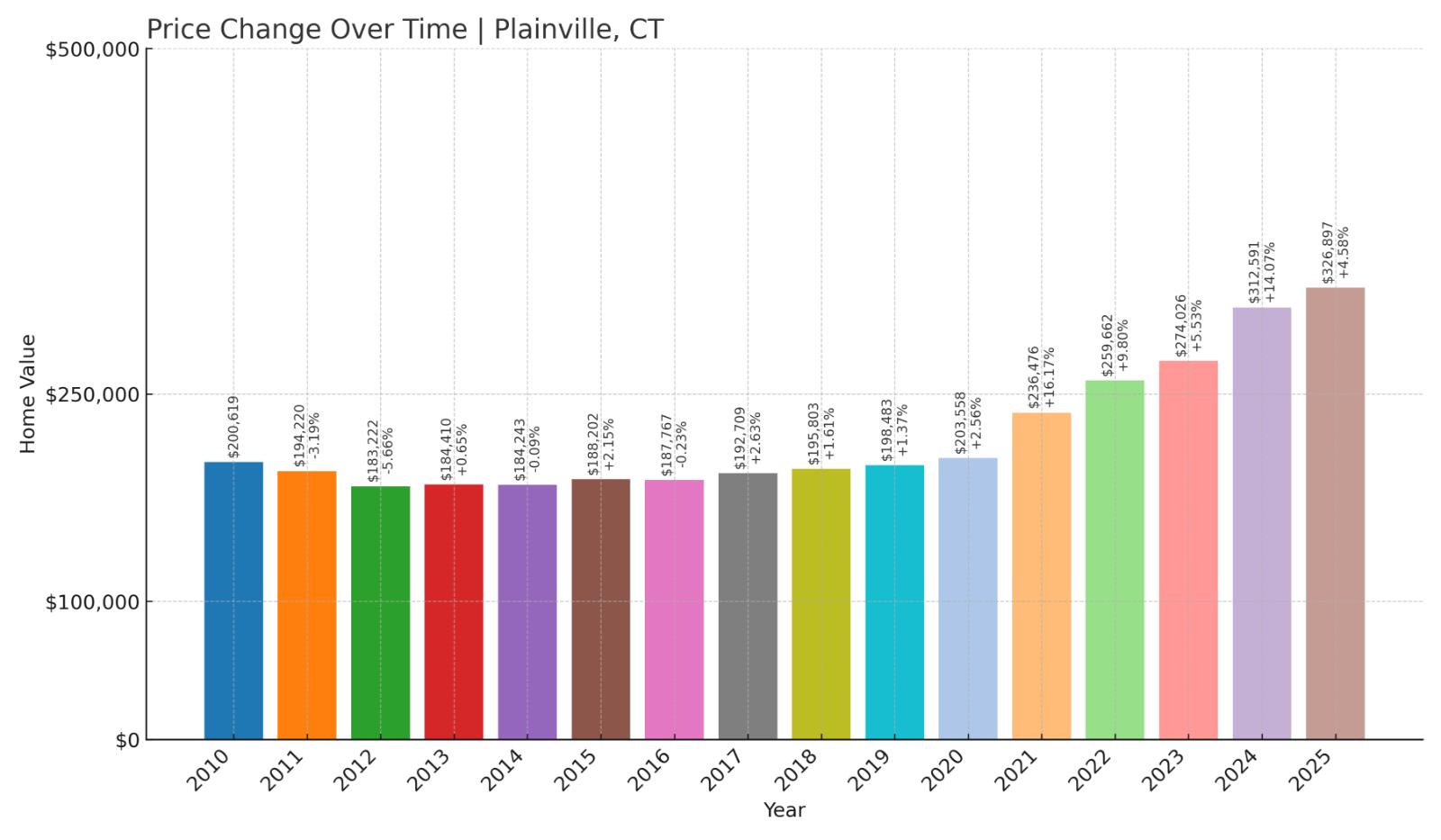

18. Plainville – Investor Feeding Frenzy Factor 124.83% (June 2025)

- Historical annual growth rate (2012–2022): 3.55%

- Recent annual growth rate (2022–2025): 7.98%

- Investor Feeding Frenzy Factor: 124.83%

- Current 2025 price: $326,897.05

Plainville has seen recent growth rates more than double its decade-long trend, with an investor frenzy factor of 124.83%. While its historical pace was a moderate 3.55% per year, the last three years brought a sharp increase to 7.98% annually. This surge has lifted the average home value to just under $327,000 in June 2025.

Plainville – Rising Demand in a Central Connecticut Hub

Centrally located between Hartford and Bristol, Plainville’s appeal lies in its accessibility, modest size, and relatively affordable home prices. That combination may have caught the eye of real estate investors looking to capitalize on growing interest in Connecticut’s middle-tier towns. With prices rising well beyond historical norms, the town is showing signs of heightened speculative pressure.

With a walkable downtown, schools in demand, and easy highway access via I-84, Plainville offers practical amenities in a manageable footprint. As more buyers are priced out of larger cities, investor attention has followed them to smaller towns like this one—rapidly changing the real estate equation for long-term residents.

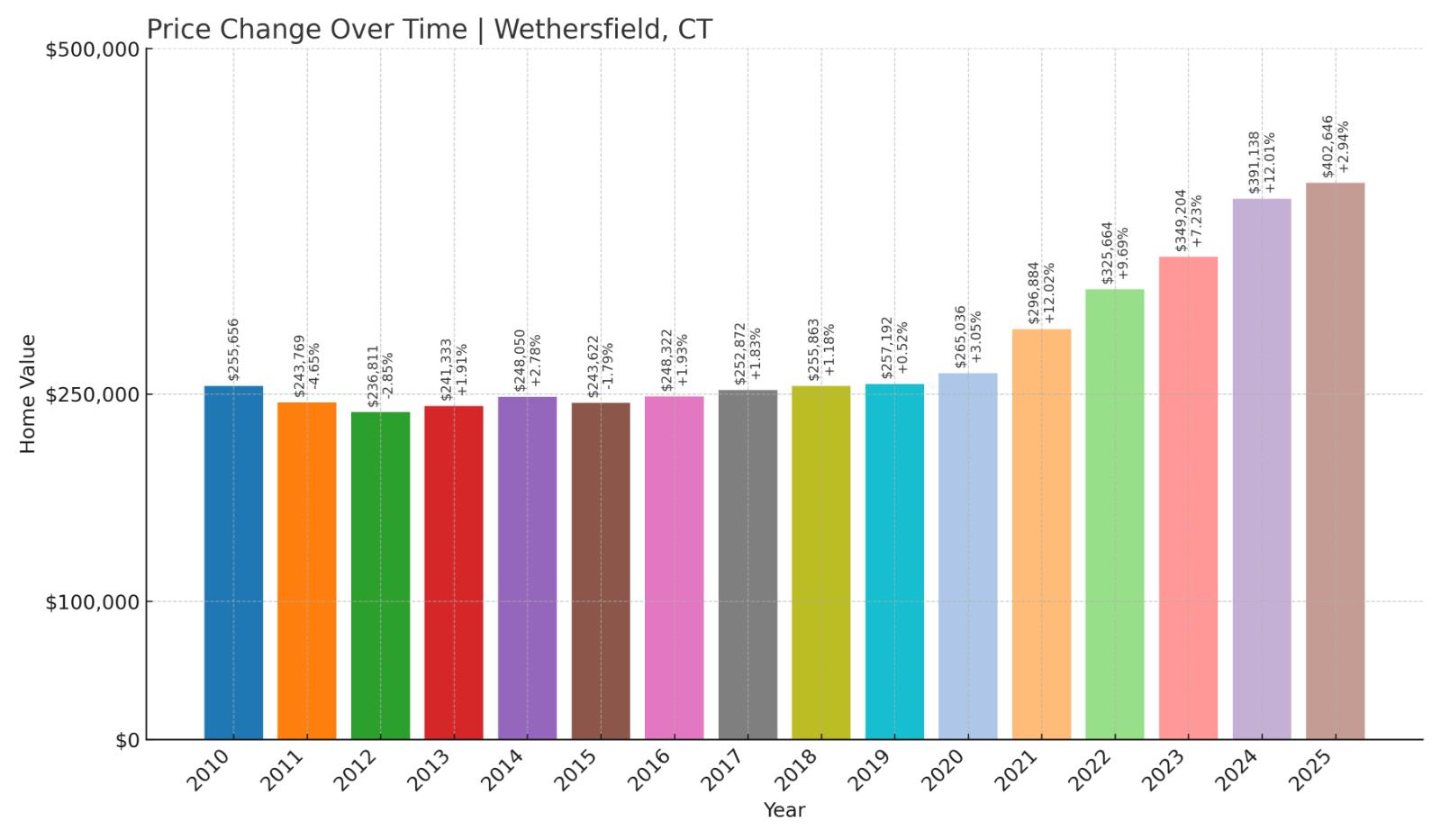

17. Wethersfield – Investor Feeding Frenzy Factor 126.39% (June 2025)

- Historical annual growth rate (2012–2022): 3.24%

- Recent annual growth rate (2022–2025): 7.33%

- Investor Feeding Frenzy Factor: 126.39%

- Current 2025 price: $402,646.08

Wethersfield’s price growth has jumped from a long-term 3.24% annual pace to 7.33% over the last three years—more than double the trend. With a frenzy factor of 126.39%, the town’s current average home value sits just over $402,000 as of June 2025.

Wethersfield – Historic Charm Meets Modern Pressure

As one of Connecticut’s oldest towns, Wethersfield is rich in history and colonial architecture. Its proximity to Hartford and scenic riverfront properties have always made it a desirable location—but lately, its real estate market has been heating up faster than usual. The accelerated price growth reflects both increased demand and possible investor speculation.

Wethersfield’s steady appeal to families and commuters now faces added competition from outside buyers. With limited housing stock and a growing interest in historic New England towns, its prices are rising at a rate that may be hard for traditional buyers to keep pace with.

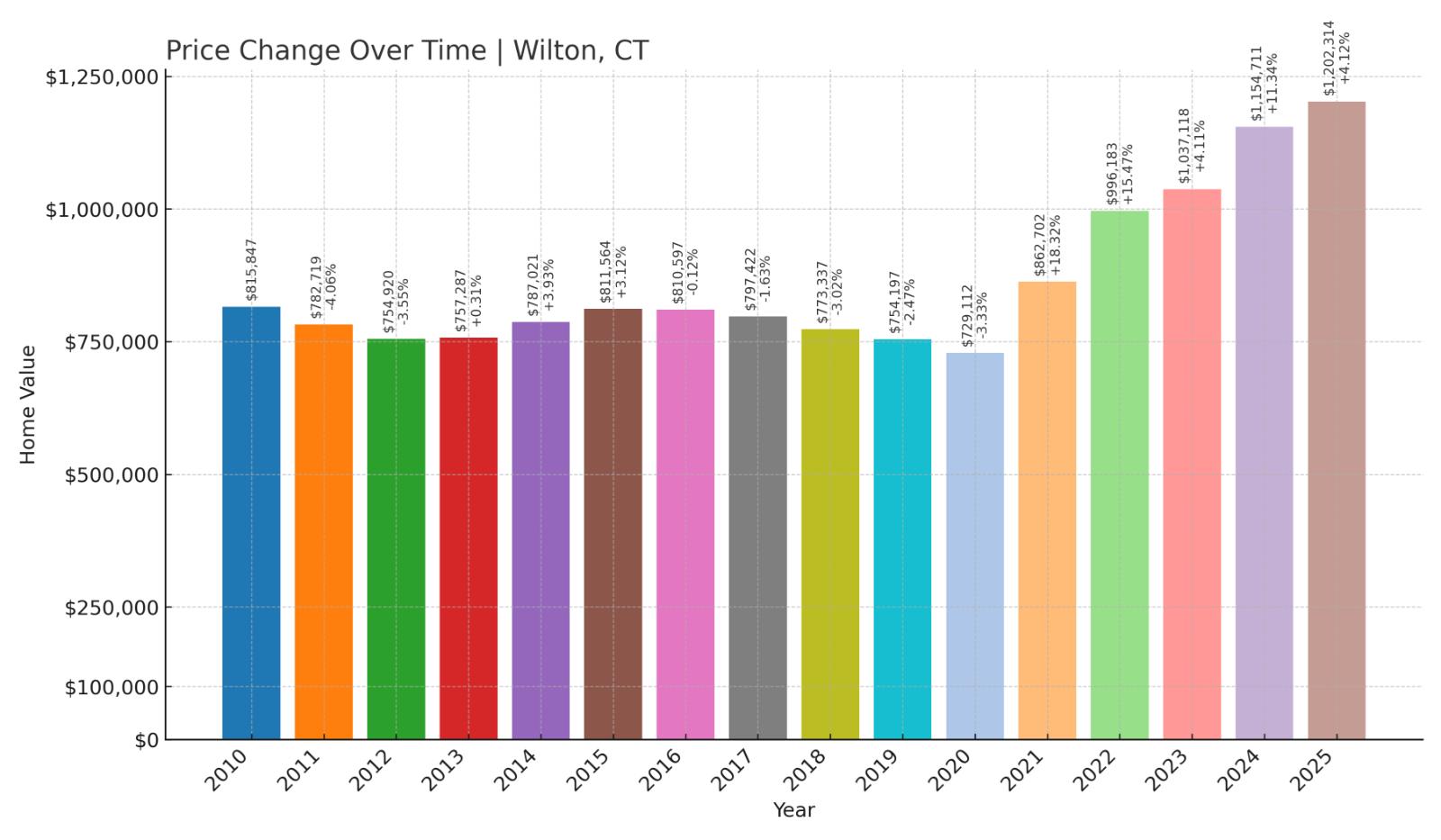

16. Wilton – Investor Feeding Frenzy Factor 130.08% (June 2025)

- Historical annual growth rate (2012–2022): 2.81%

- Recent annual growth rate (2022–2025): 6.47%

- Investor Feeding Frenzy Factor: 130.08%

- Current 2025 price: $1,202,313.91

Wilton’s home values have surged from a slow 2.81% annual rise over a decade to a recent 6.47% per year—generating a frenzy factor of 130.08%. That has pushed the average price well above $1.2 million as of June 2025, making it one of the priciest towns in the state.

Wilton – Luxury Market Accelerates Beyond Expectations

Located in Fairfield County and within commuting range of New York City, Wilton has always catered to a high-income demographic. But recent price increases are now outpacing even its traditionally slow-and-steady market. Investors seeking luxury properties in safe, suburban settings may be helping drive the spike.

Excellent schools, low-density zoning, and scenic wooded neighborhoods give Wilton its exclusive appeal. But with prices now rising faster than historical norms, some longtime buyers may be facing stiffer competition than ever—especially from deep-pocketed investors focused on long-term growth.

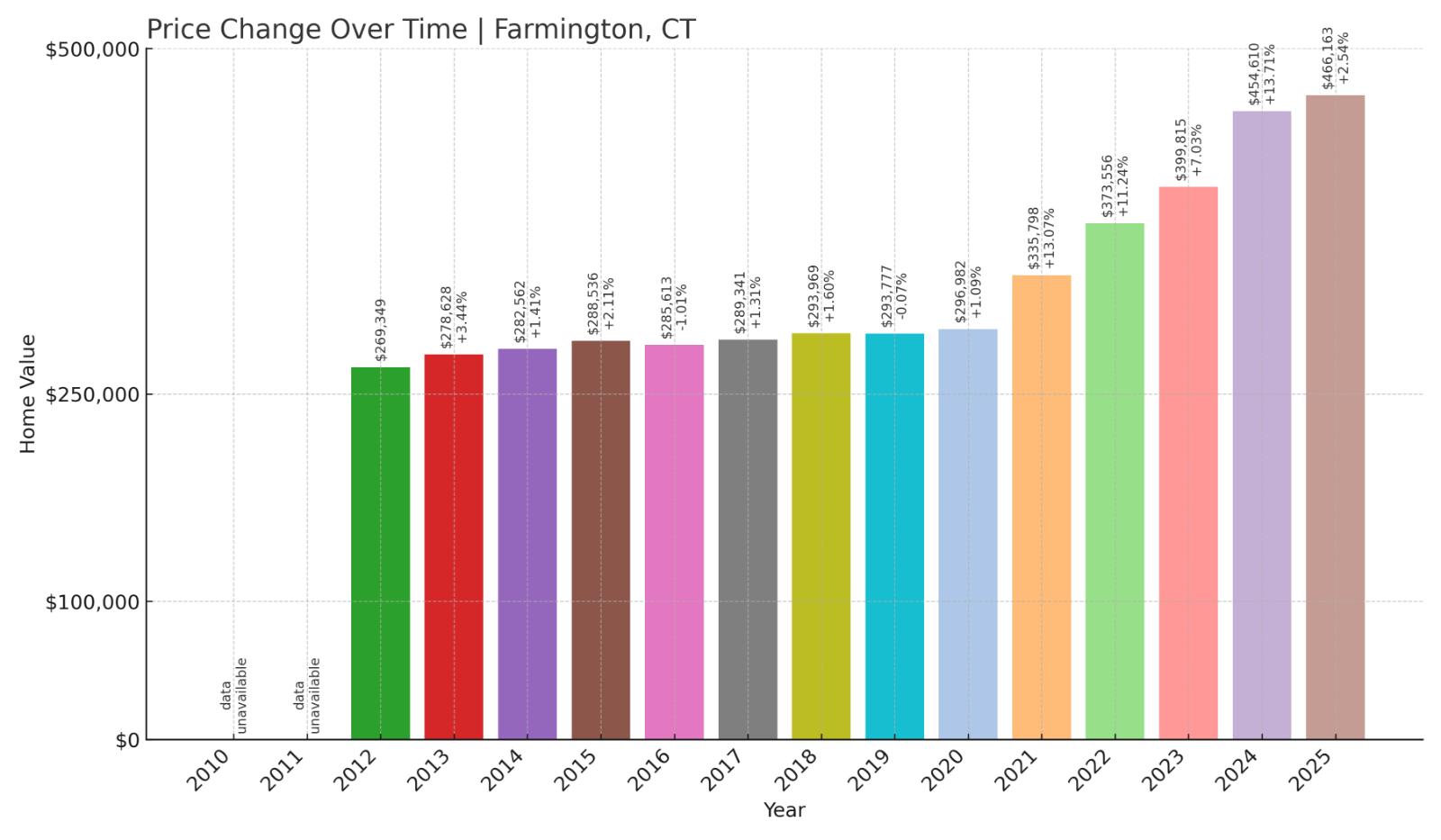

15. Farmington – Investor Feeding Frenzy Factor 130.45% (June 2025)

- Historical annual growth rate (2012–2022): 3.32%

- Recent annual growth rate (2022–2025): 7.66%

- Investor Feeding Frenzy Factor: 130.45%

- Current 2025 price: $466,163.23

Home prices in Farmington have jumped from a typical 3.32% annual growth to a more aggressive 7.66% since 2022. That acceleration results in a feeding frenzy factor of 130.45%, bringing the average home price to $466,163 by June 2025.

Farmington – High Demand in a Medical and Corporate Hub

Farmington is home to major institutions like UConn Health and several corporate offices, giving it a strong economic base. That, combined with its good schools and appealing suburban layout, makes it a consistent target for buyers—and now, increasingly, investors.

As more remote workers seek high-quality living environments outside major cities, Farmington has emerged as a favorite. The town’s accelerated price increases suggest that demand has become even more intense in recent years, putting added pressure on families trying to break into the market.

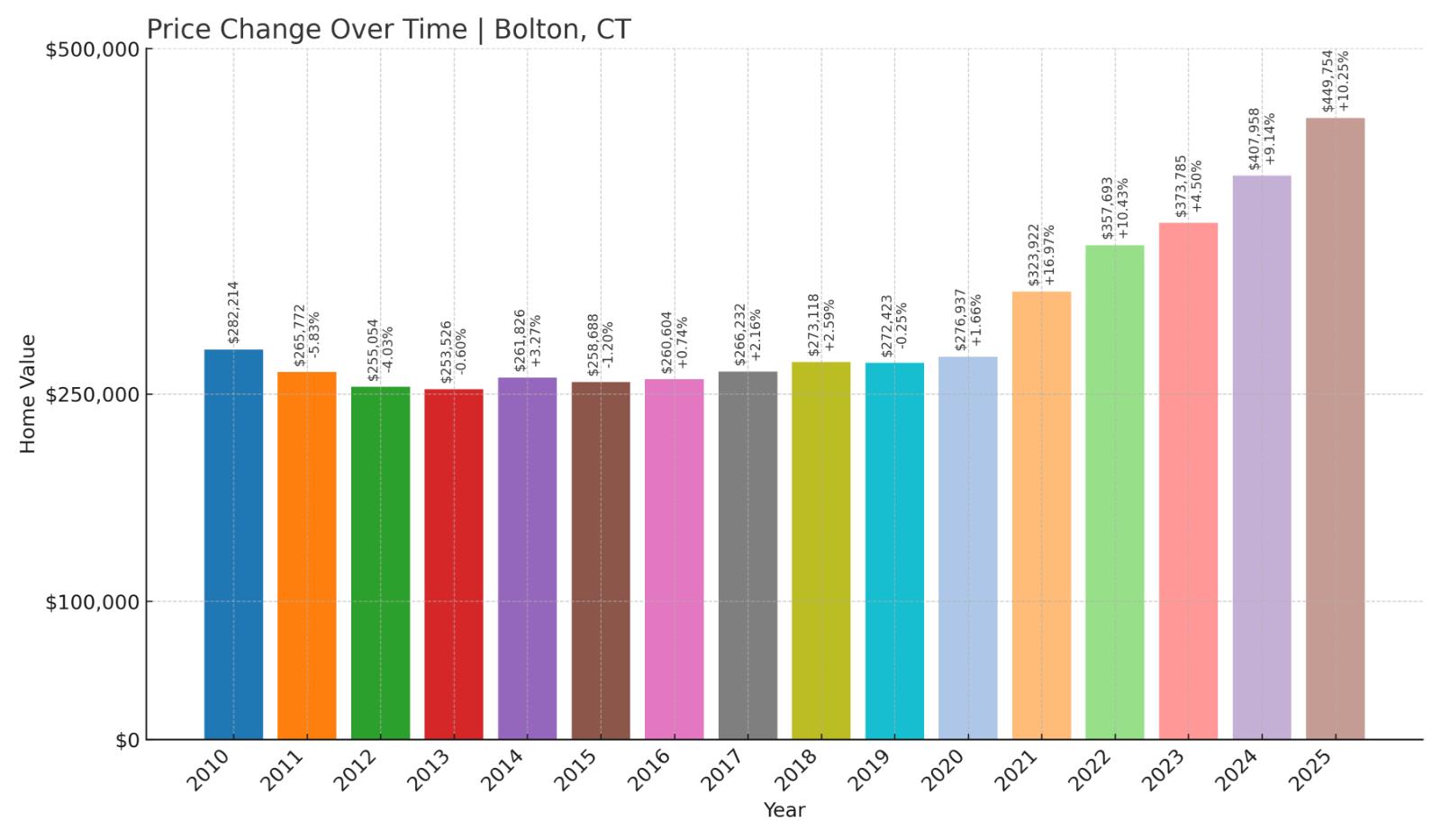

14. Bolton – Investor Feeding Frenzy Factor 130.63% (June 2025)

- Historical annual growth rate (2012–2022): 3.44%

- Recent annual growth rate (2022–2025): 7.93%

- Investor Feeding Frenzy Factor: 130.63%

- Current 2025 price: $449,753.78

Bolton’s recent price increases—nearly 8% annually since 2022—are more than double the town’s previous decade of growth. With an investor frenzy factor of 130.63%, the town’s average home price now stands just under $450,000.

Bolton – Rapid Growth in a Small-Town Market

With just over 5,000 residents, Bolton is a quiet community located east of Hartford. Known for its scenic woodlands, lakes, and rural feel, it has traditionally offered a lower-cost alternative to nearby towns. But the sharp increase in recent growth suggests it’s drawing new interest—potentially from outside investors.

As buyers look for value and lifestyle outside crowded suburbs, Bolton may be catching the wave. The town’s quick rise in prices shows how even smaller markets in Connecticut are being reshaped by broader shifts in housing demand and speculative pressure.

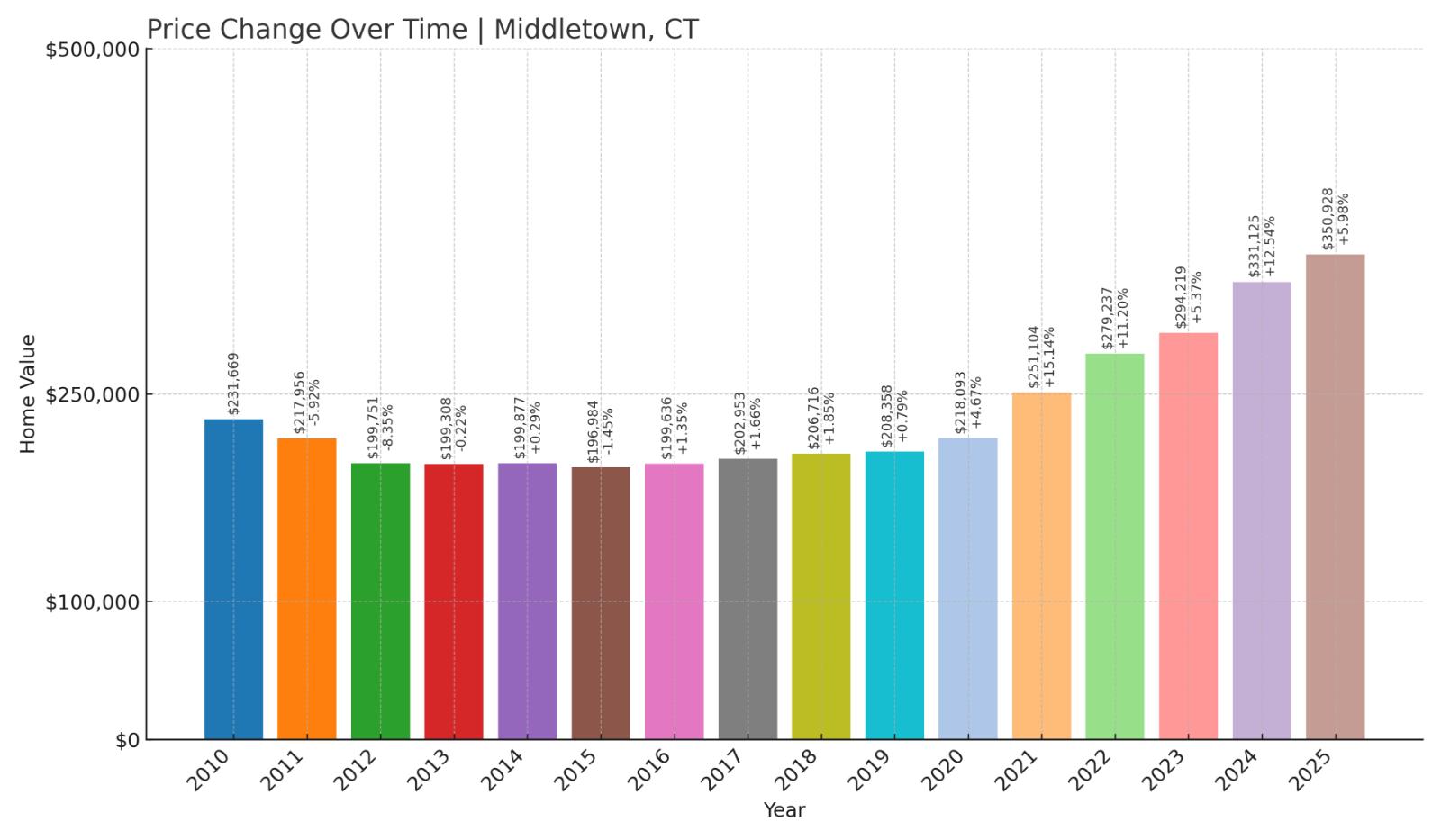

13. Middletown – Investor Feeding Frenzy Factor 132.34% (June 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 3.41%

- Recent annual growth rate (2022–2025): 7.91%

- Investor Feeding Frenzy Factor: 132.34%

- Current 2025 price: $350,927.78

Middletown’s growth rate has climbed from a stable 3.41% to a much higher 7.91% annually over the last three years. That spike gives it a feeding frenzy factor of 132.34%, with the current average home price sitting at $350,928 in June 2025.

Middletown – A River City Under Pressure

Situated along the Connecticut River, Middletown combines small-city amenities with a more suburban price point. It’s home to Wesleyan University and has long attracted a mix of students, professionals, and families. Now, investor interest may be accelerating, pushing prices up faster than its past trend would suggest.

With easy access to both Hartford and New Haven, the city’s central location has always been a selling point. But today’s double-digit price increases are a clear sign that more buyers—possibly including out-of-state investors—are targeting Middletown’s market for returns.

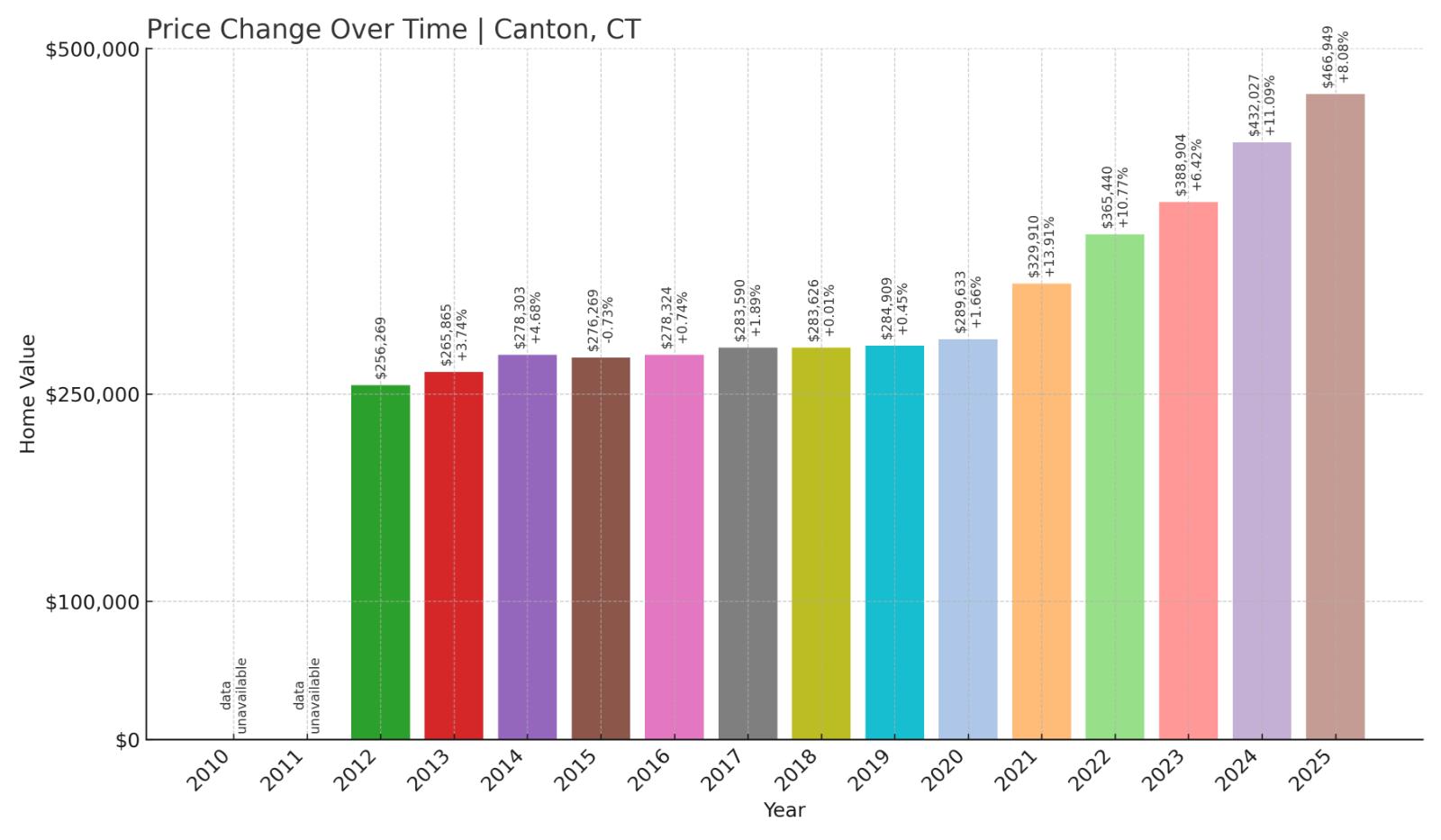

12. Canton – Investor Feeding Frenzy Factor 135.67% (June 2025)

- Historical annual growth rate (2012–2022): 3.61%

- Recent annual growth rate (2022–2025): 8.51%

- Investor Feeding Frenzy Factor: 135.67%

- Current 2025 price: $466,949.32

Canton’s recent price surge—up 8.51% annually since 2022—represents a 135.67% acceleration over its historical trend of 3.61%. Home values in the town have now reached $466,949 as of June 2025.

Canton – Strong Growth in a Scenic Town

Located in the Farmington Valley and known for its picturesque landscapes, Canton has become a sought-after destination for buyers looking for charm and space. The town blends natural beauty with access to nearby employment centers like Avon and Hartford, which may be attracting speculative buyers as demand increases.

The town’s strong school system and outdoor recreation options—including Collinsville’s historic downtown and the Farmington River Trail—enhance its appeal. But as prices rise rapidly, affordability could become a concern for new buyers trying to enter what was once a more attainable market.

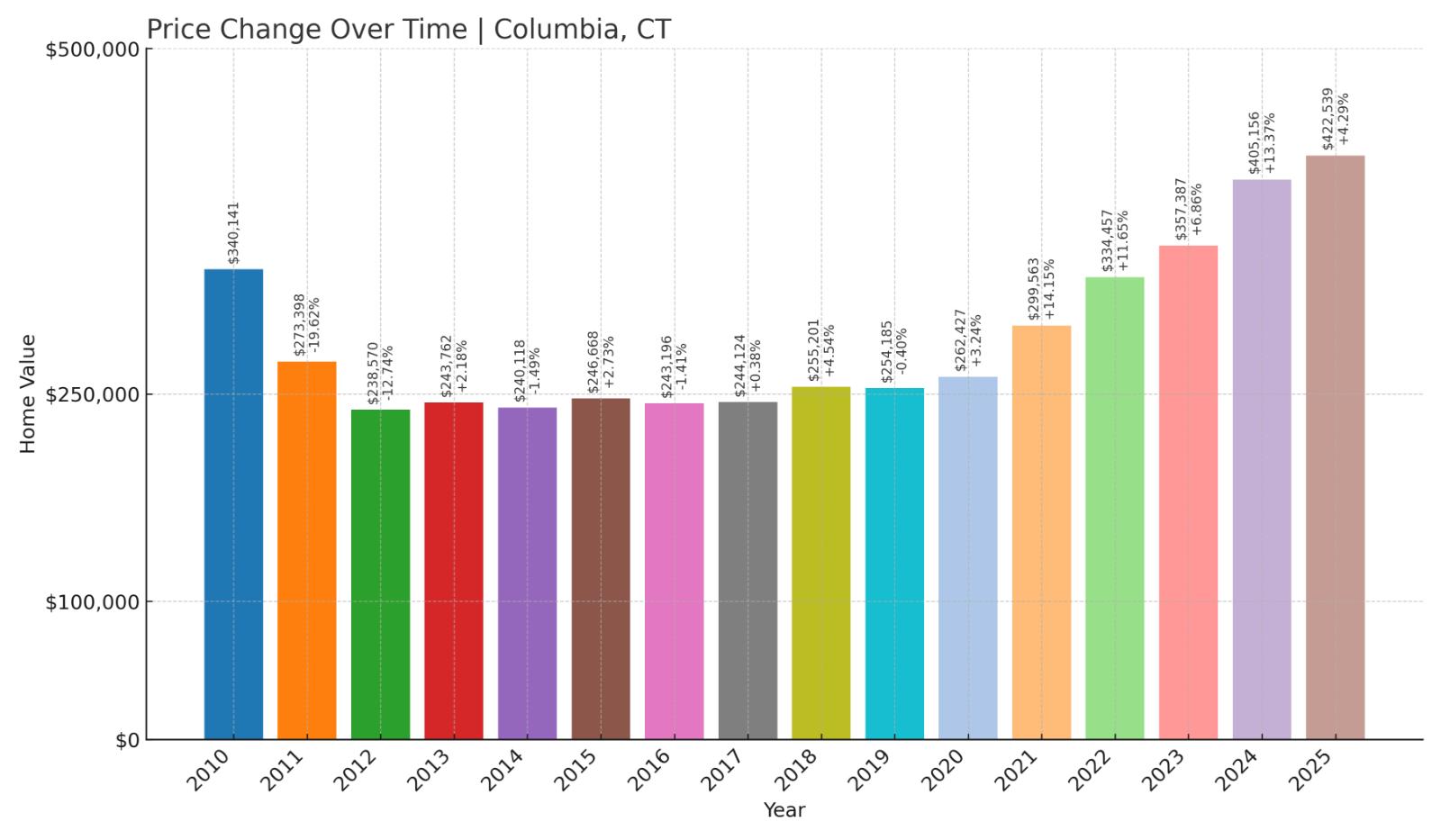

11. Columbia – Investor Feeding Frenzy Factor 135.85% (June 2025)

- Historical annual growth rate (2012–2022): 3.44%

- Recent annual growth rate (2022–2025): 8.10%

- Investor Feeding Frenzy Factor: 135.85%

- Current 2025 price: $422,539.33

Columbia’s home price growth has accelerated sharply from 3.44% annually over the last decade to 8.10% in just the past three years. That jump results in a feeding frenzy factor of 135.85%, with home values now averaging $422,539 in June 2025.

Columbia – Quiet and Scenic, but No Longer Overlooked

Columbia is a small rural town in eastern Connecticut with a population under 6,000. Known for Columbia Lake and peaceful surroundings, it has recently gained attention as buyers look beyond metro areas for lifestyle-driven purchases. That may include investors seeking properties that balance rental demand with long-term appreciation.

The town’s appeal lies in its balance of affordability, quality schools, and outdoor access. But the price shift since 2022 suggests new pressures may be transforming its market. For longtime residents, the recent uptick may come with a growing sense that their once-quiet town is now on investor radar.

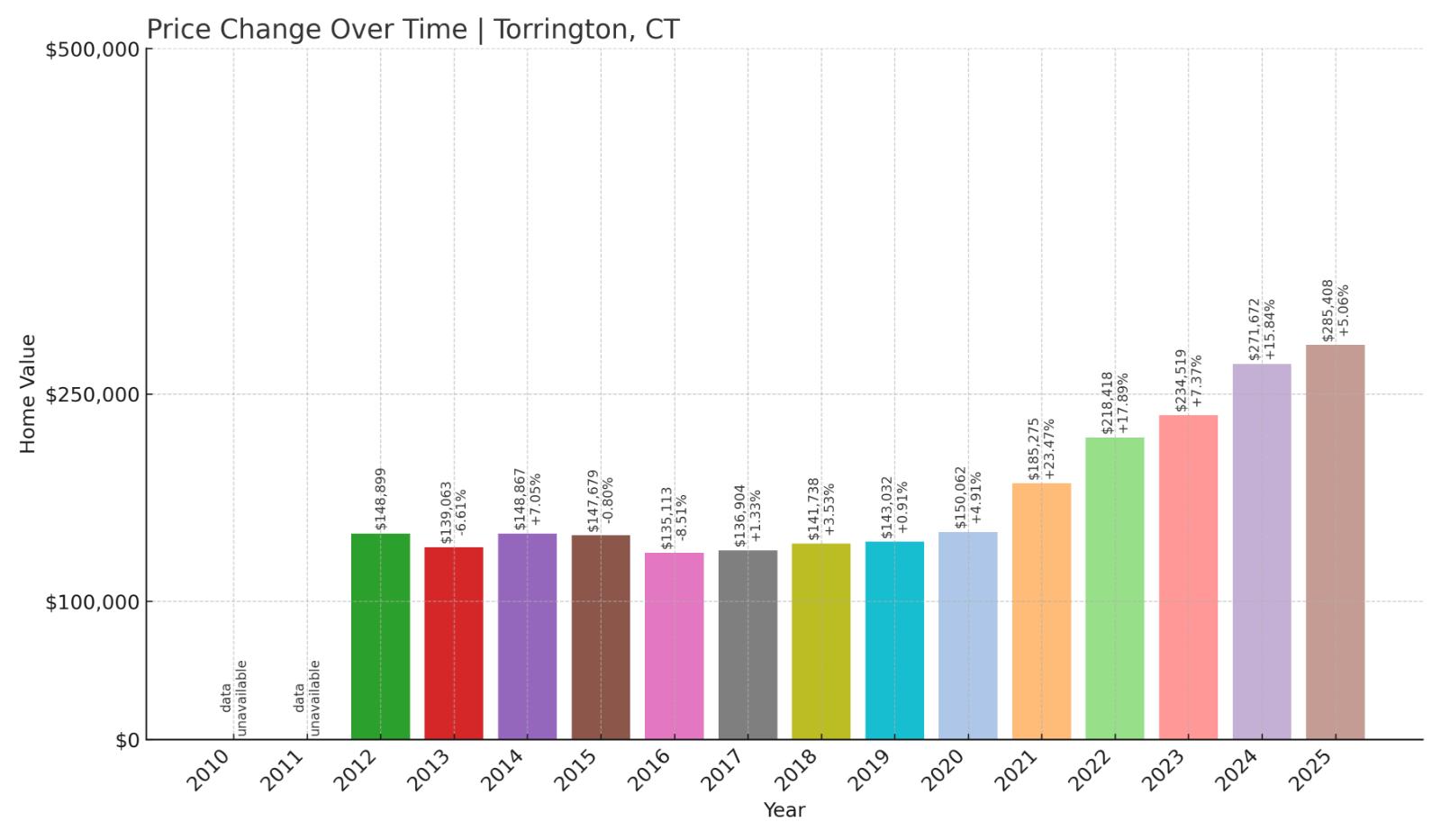

10. Torrington – Investor Feeding Frenzy Factor 138.79% (June 2025)

- Historical annual growth rate (2012–2022): 3.91%

- Recent annual growth rate (2022–2025): 9.33%

- Investor Feeding Frenzy Factor: 138.79%

- Current 2025 price: $285,407.90

Torrington’s already strong 3.91% growth over the past decade has accelerated to 9.33% annually in recent years. This produces a feeding frenzy factor of 138.79%—one of the highest in the state. Despite the surge, average prices remain relatively affordable at $285,408 in June 2025.

Torrington – Rapid Price Growth in an Affordable Market

As one of the largest towns in Litchfield County, Torrington offers an affordable option in western Connecticut with a mix of urban and rural features. Investors may be drawn to its lower entry price, increasing rents, and opportunity for value appreciation as more people look to move farther from high-cost metro areas.

With a lively arts scene, revitalizing downtown, and close proximity to nature, Torrington’s appeal continues to broaden. But with home prices rising at more than twice their historical pace, local buyers could find themselves competing with a growing pool of investor-funded offers.

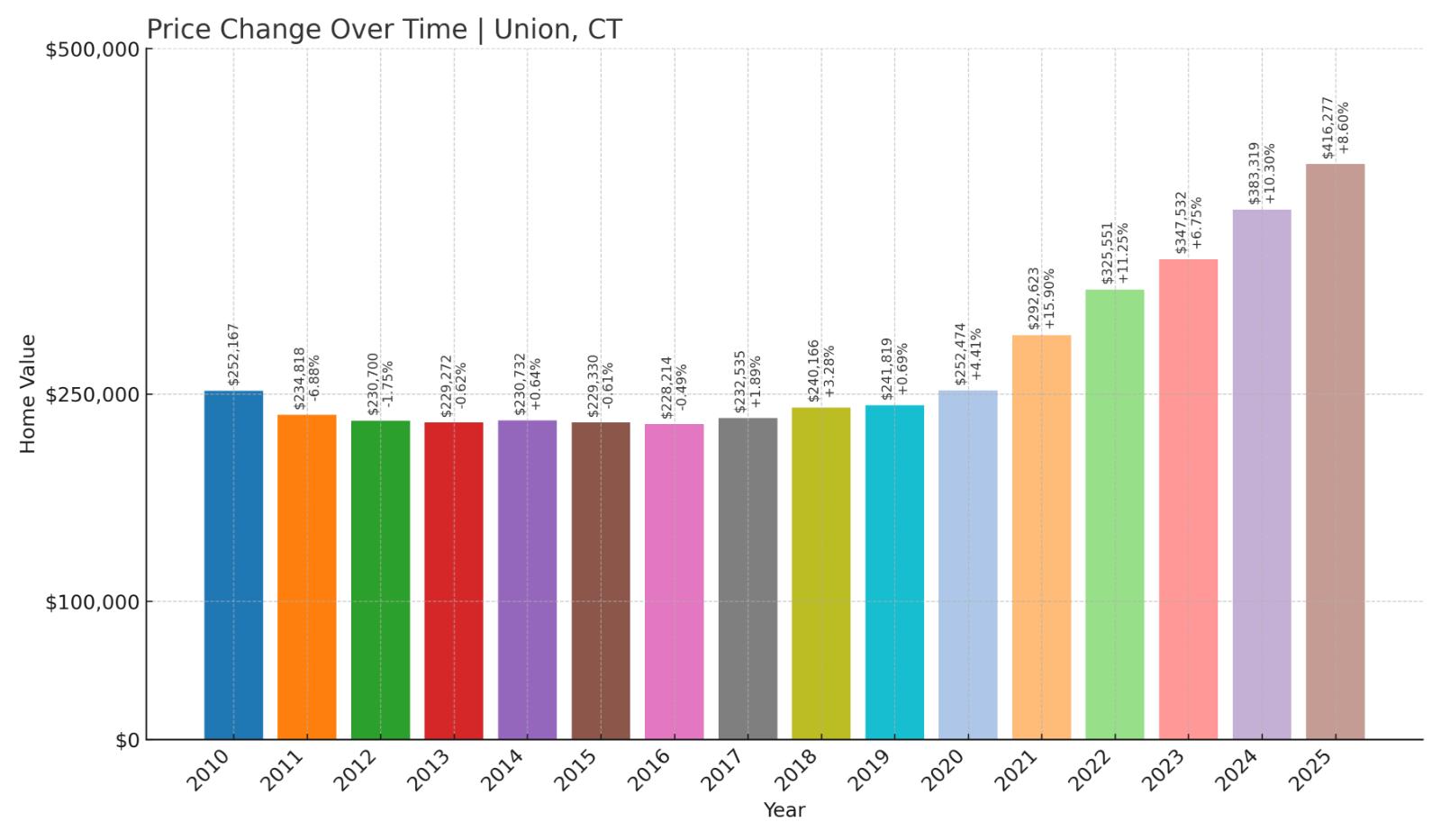

9. Union – Investor Feeding Frenzy Factor 143.71% (June 2025)

- Historical annual growth rate (2012–2022): 3.50%

- Recent annual growth rate (2022–2025): 8.54%

- Investor Feeding Frenzy Factor: 143.71%

- Current 2025 price: $416,277.07

Union’s home prices have increased dramatically, rising at 8.54% annually since 2022—far above its prior 3.5% trend. This gives it a feeding frenzy factor of 143.71%, with the current median home value now $416,277 in June 2025.

Union – A Tiny Town With Outsized Growth

As Connecticut’s least populated town, Union typically flies under the radar. Nestled in the northeast corner of the state and surrounded by forest, it has long been known for its remote feel and access to trails and state parks. But even this quiet area hasn’t escaped the reach of surging housing demand.

With few homes on the market and prices still relatively modest, Union’s inventory has become a target for buyers priced out elsewhere. That includes investors seeking rural properties with long-term upside. As demand tightens and prices jump, the change is palpable even in a town with fewer than 1,000 residents.

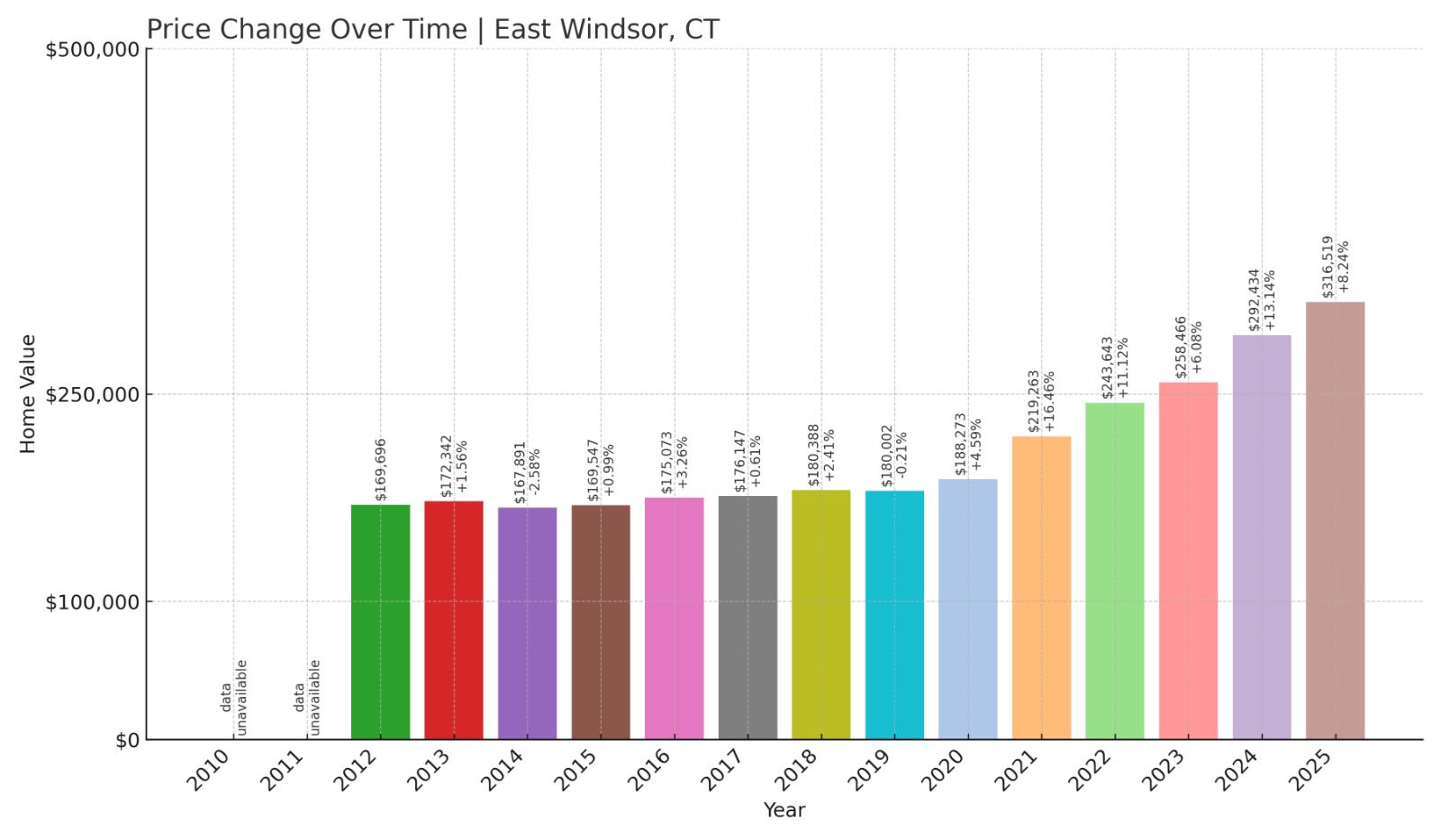

8. East Windsor – Investor Feeding Frenzy Factor 147.46% (June 2025)

- Historical annual growth rate (2012–2022): 3.68%

- Recent annual growth rate (2022–2025): 9.11%

- Investor Feeding Frenzy Factor: 147.46%

- Current 2025 price: $316,518.75

East Windsor’s home price trajectory has jumped sharply from a historical growth rate of 3.68% to 9.11% annually since 2022. That shift yields a feeding frenzy factor of 147.46%, with the median home price now at $316,519 in June 2025.

East Windsor – High Growth in a Transitioning Market

Located along the Connecticut River and close to I-91, East Windsor is strategically placed between Hartford and Springfield, MA. With decent commute options and competitive home prices, the town has become increasingly attractive to first-time buyers and investors alike.

Recent development and planned projects—like commercial revitalization and transportation upgrades—have likely fueled the jump in interest. For investors looking for value plays in Connecticut, East Windsor’s affordability and location may make it a strong candidate, even as that drives up prices for locals.

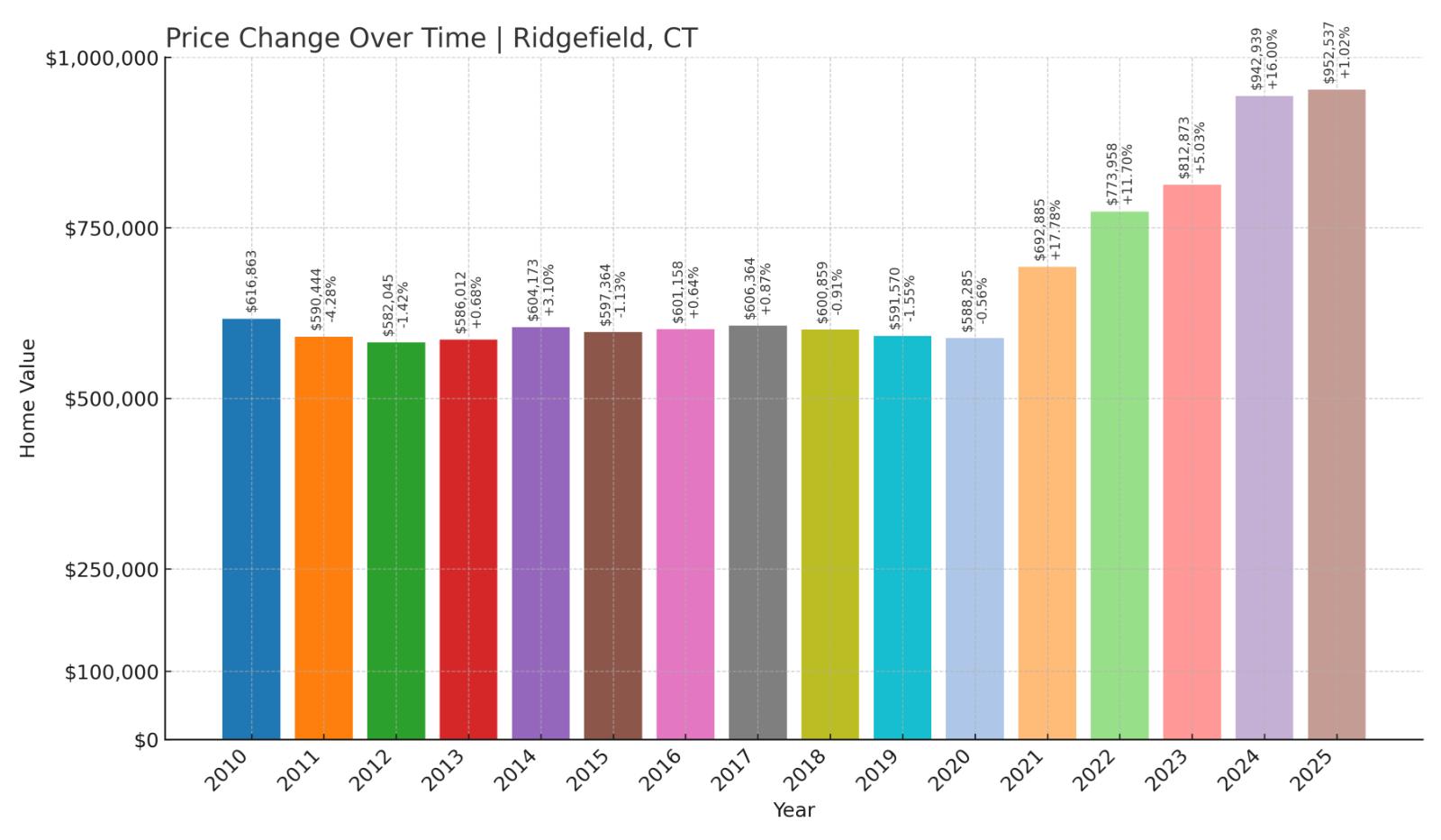

7. Ridgefield – Investor Feeding Frenzy Factor 147.88% (June 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 2.89%

- Recent annual growth rate (2022–2025): 7.17%

- Investor Feeding Frenzy Factor: 147.88%

- Current 2025 price: $952,537.03

Ridgefield’s average price growth has accelerated from a historically modest 2.89% annually to 7.17% in recent years. That’s a 147.88% increase over its past trend, driving home values to a steep $952,537 as of June 2025.

Ridgefield – Luxury Demand Fuels Fastest Growth in Years

As one of the most picturesque towns in Fairfield County, Ridgefield has long appealed to wealthy buyers. Its excellent schools, cultural attractions, and historic downtown make it an enduring favorite—but now it’s also seeing some of the sharpest price increases in Connecticut.

Investor interest in high-end suburban markets, especially within reach of New York City, could be accelerating the shift. As Ridgefield’s prices rise more rapidly than in years past, affordability is narrowing even for affluent families—suggesting investor demand may be altering the pace in traditionally stable markets.

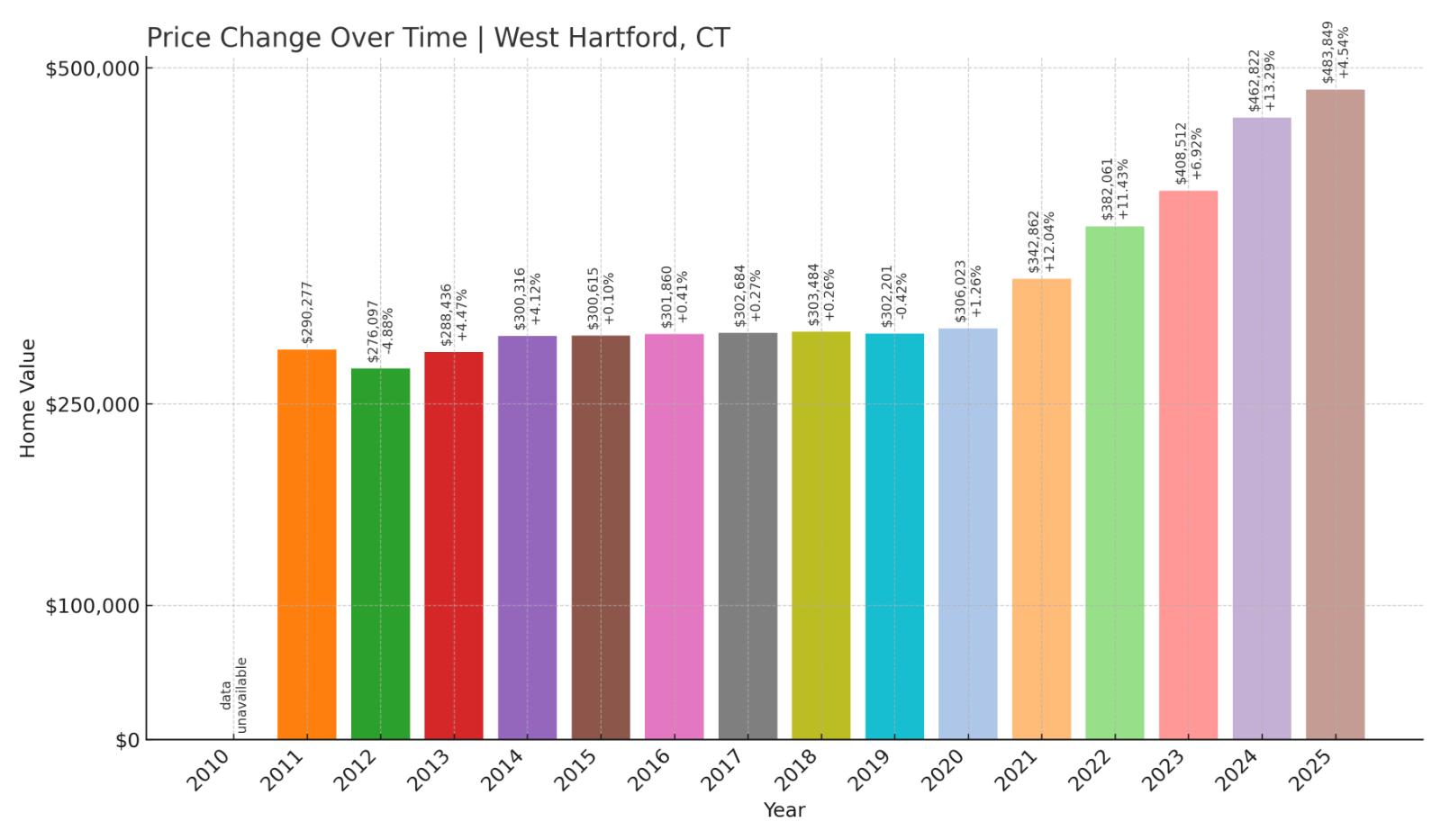

6. West Hartford – Investor Feeding Frenzy Factor 148.10% (June 2025)

- Historical annual growth rate (2012–2022): 3.30%

- Recent annual growth rate (2022–2025): 8.19%

- Investor Feeding Frenzy Factor: 148.10%

- Current 2025 price: $483,849.05

West Hartford’s annual home price growth jumped from a long-term average of 3.3% to 8.19% since 2022. That yields a feeding frenzy factor of 148.10%, with home values now sitting at $483,849 as of June 2025.

West Hartford – Investor Pressure in a High-Demand Town

West Hartford is a perennial favorite in central Connecticut, thanks to its vibrant downtown, strong public schools, and walkable neighborhoods. But even for a town used to strong demand, the recent acceleration in price growth is notable—driven in part by what looks like increased investor competition.

With proximity to both Hartford employers and higher-end suburban living, West Hartford checks many boxes. That may explain why home prices have broken away from their historical pattern. Residents looking to stay may now find themselves squeezed by competition from cash-heavy outside buyers seeking fast growth and reliable returns.

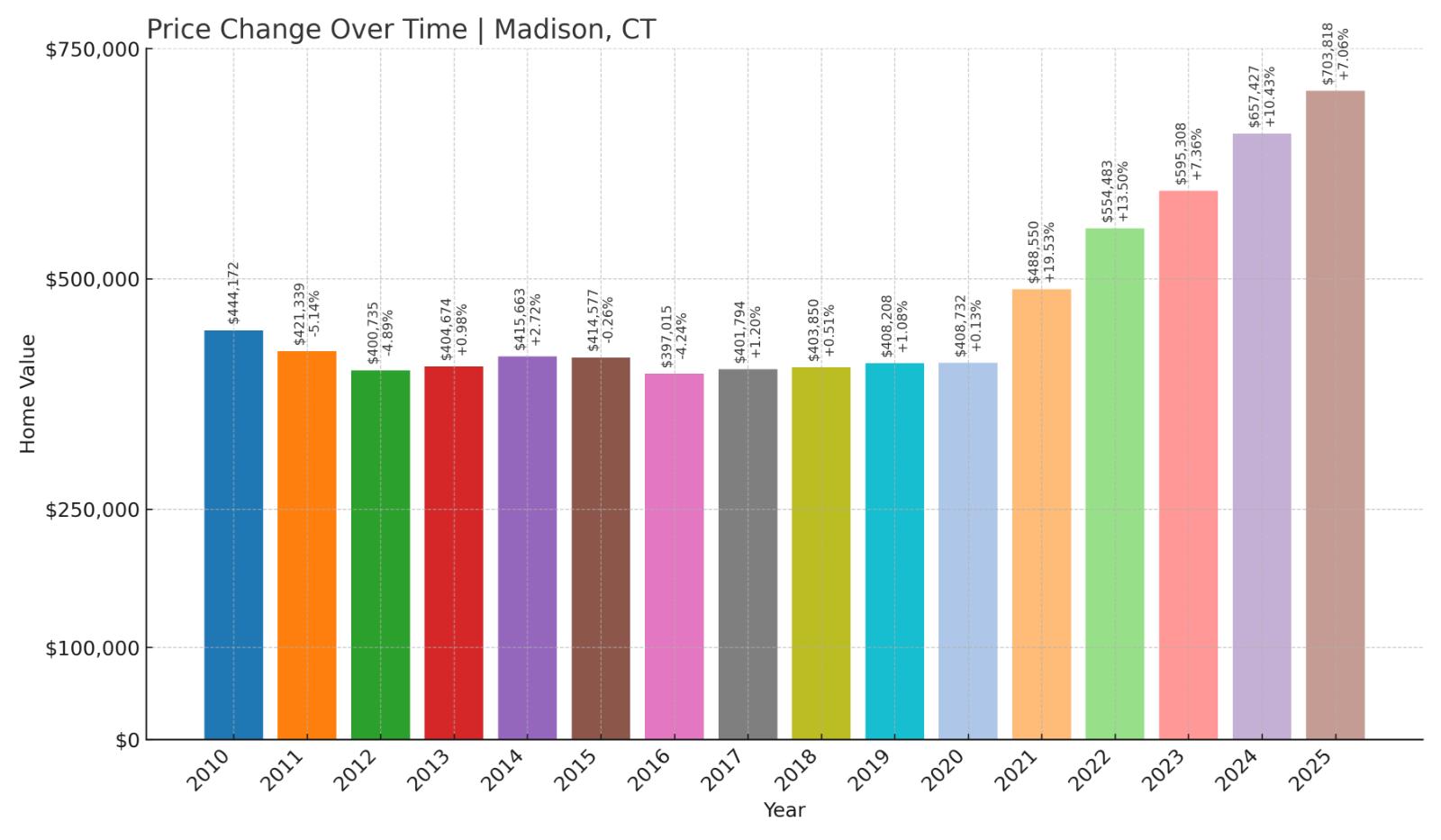

5. Madison – Investor Feeding Frenzy Factor 150.68% (June 2025)

- Historical annual growth rate (2012–2022): 3.30%

- Recent annual growth rate (2022–2025): 8.27%

- Investor Feeding Frenzy Factor: 150.68%

- Current 2025 price: $703,818.32

Madison’s recent price increases—up 8.27% annually since 2022—have far outpaced its long-term trend of 3.3%. That sharp deviation earns it a feeding frenzy factor of 150.68%, with the average home now valued at $703,818 in June 2025.

Madison – Shoreline Appeal Meets Surging Prices

Located along Long Island Sound, Madison has always drawn attention for its beaches, historic town center, and upscale coastal homes. But the town’s relatively stable price growth over the last decade has given way to a new level of acceleration. Madison is no longer just quietly expensive—it’s actively heating up.

With limited waterfront inventory and high demand from second-home buyers and investors, prices have broken away from their historical pattern. For longtime residents, especially younger families and retirees, the sharp rise may be closing the door on affordability in one of Connecticut’s most desirable coastal communities.

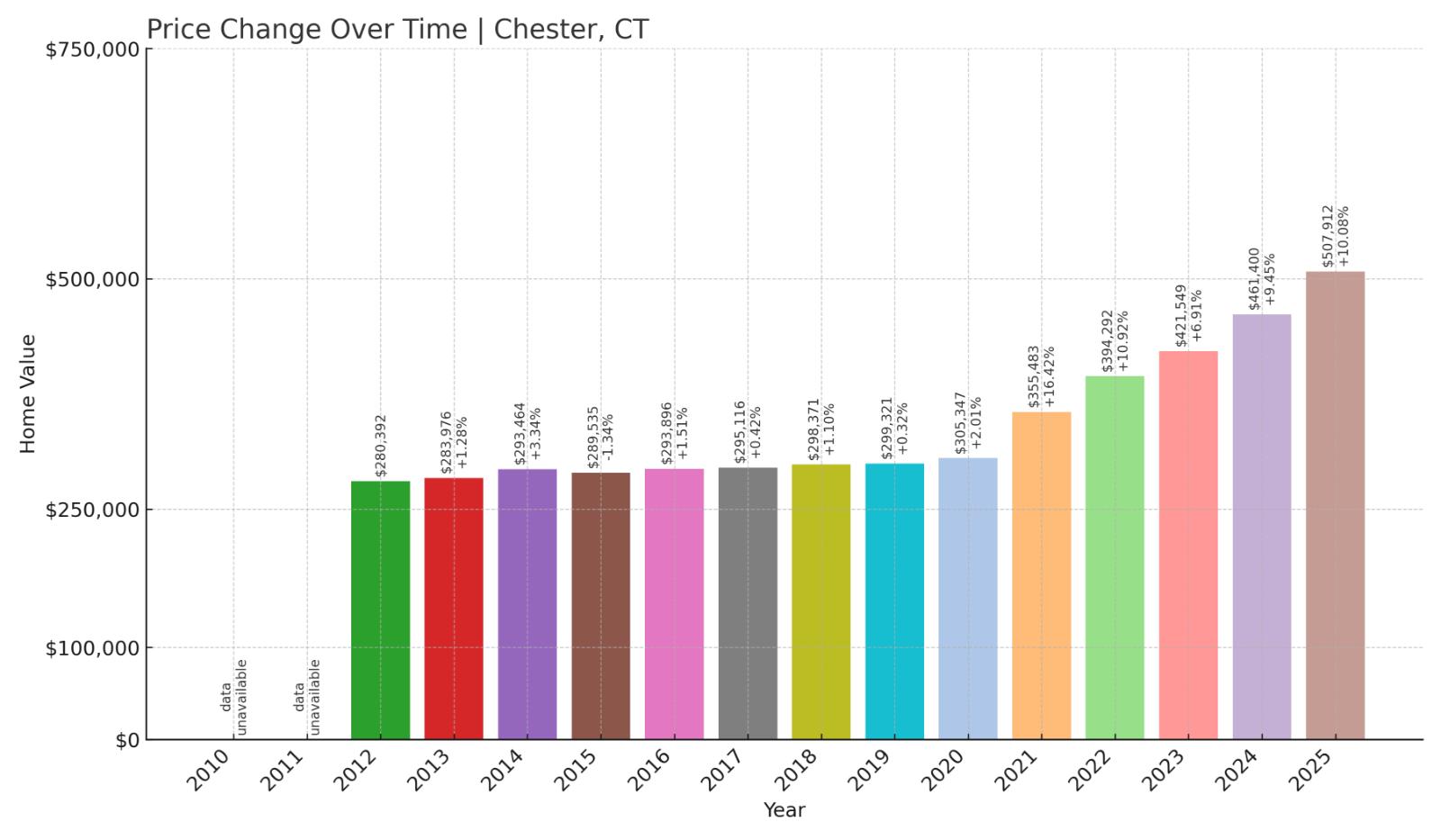

4. Chester – Investor Feeding Frenzy Factor 153.96% (June 2025)

- Historical annual growth rate (2012–2022): 3.47%

- Recent annual growth rate (2022–2025): 8.81%

- Investor Feeding Frenzy Factor: 153.96%

- Current 2025 price: $507,911.78

Chester’s recent annual growth rate of 8.81% is a steep increase over its historical 3.47% pace. That results in a feeding frenzy factor of 153.96%, with the average home price now surpassing $507,000 in June 2025.

Chester – Rapid Appreciation in an Artsy River Town

Chester is known for its creative energy, galleries, restaurants, and small-town charm nestled along the Connecticut River. Historically a haven for artists and weekenders, it’s now becoming a hotspot for more aggressive real estate activity. Investors appear to be moving in on what was once a quiet, culture-rich corner of the state.

The dramatic price jump may reflect limited housing supply, proximity to the water, and high desirability among remote workers and retirees. As demand surges, Chester is experiencing a rapid transformation—one that may shift its affordability and character more than residents expected.

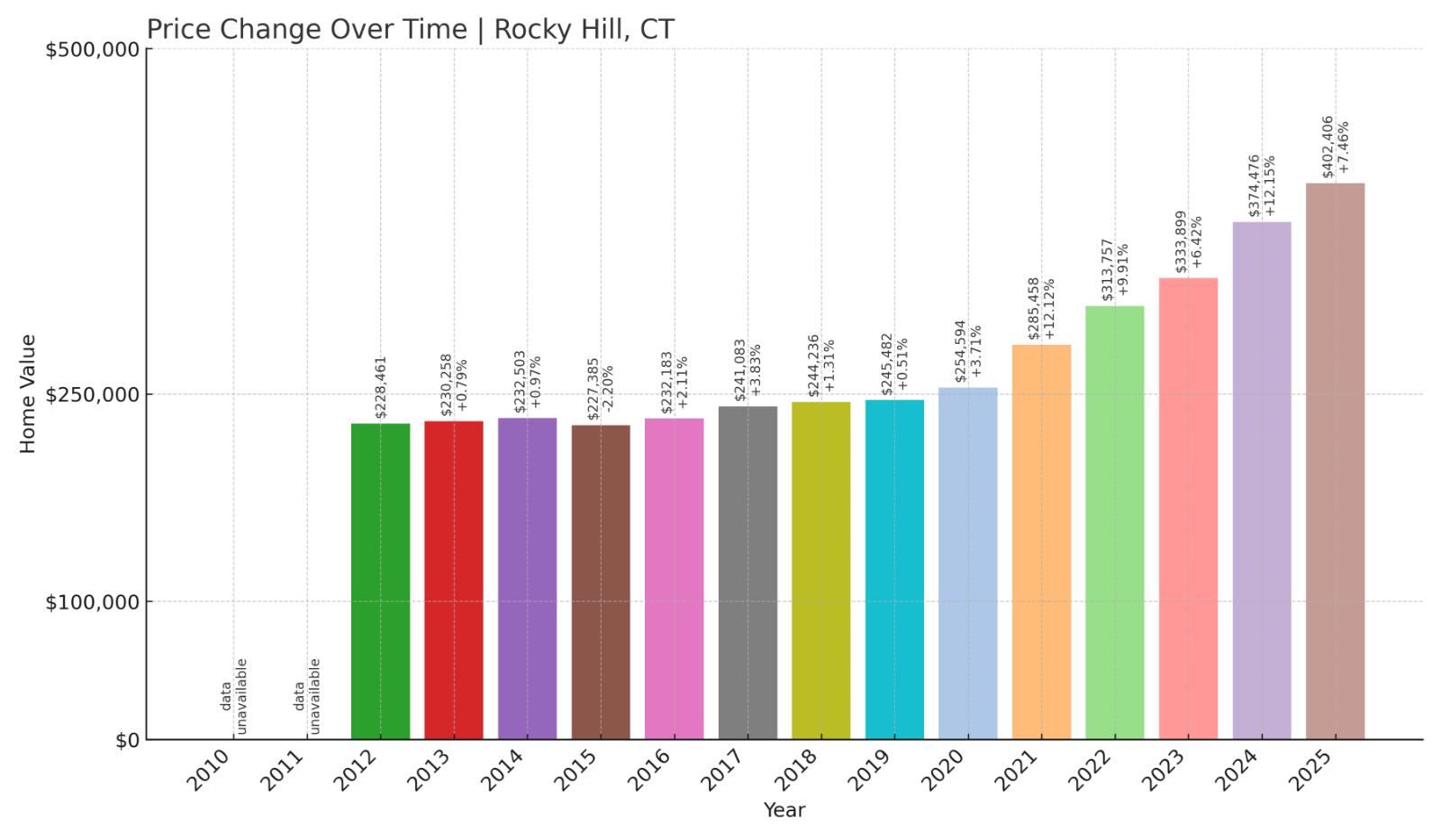

3. Rocky Hill – Investor Feeding Frenzy Factor 168.30% (June 2025)

- Historical annual growth rate (2012–2022): 3.22%

- Recent annual growth rate (2022–2025): 8.65%

- Investor Feeding Frenzy Factor: 168.30%

- Current 2025 price: $402,406.41

Rocky Hill has seen price growth explode from a modest 3.22% annually to 8.65% over the last three years. That’s a 168.30% deviation from its historic norm, with the average home now costing $402,406 as of June 2025.

Rocky Hill – Extreme Growth in a Centrally Located Market

Would you like to save this?

Situated just south of Hartford with easy access to I-91, Rocky Hill has long been a solid choice for professionals and commuters. Its riverfront location, mix of suburban and urban amenities, and relatively reasonable prices make it attractive to a wide range of buyers.

That same appeal is now catching the attention of investors. Rocky Hill’s dramatic rise in home values suggests speculative demand has moved in forcefully—transforming a once predictable market into one of Connecticut’s fastest risers. Locals hoping to buy may find themselves edged out by higher offers coming from beyond the town line.

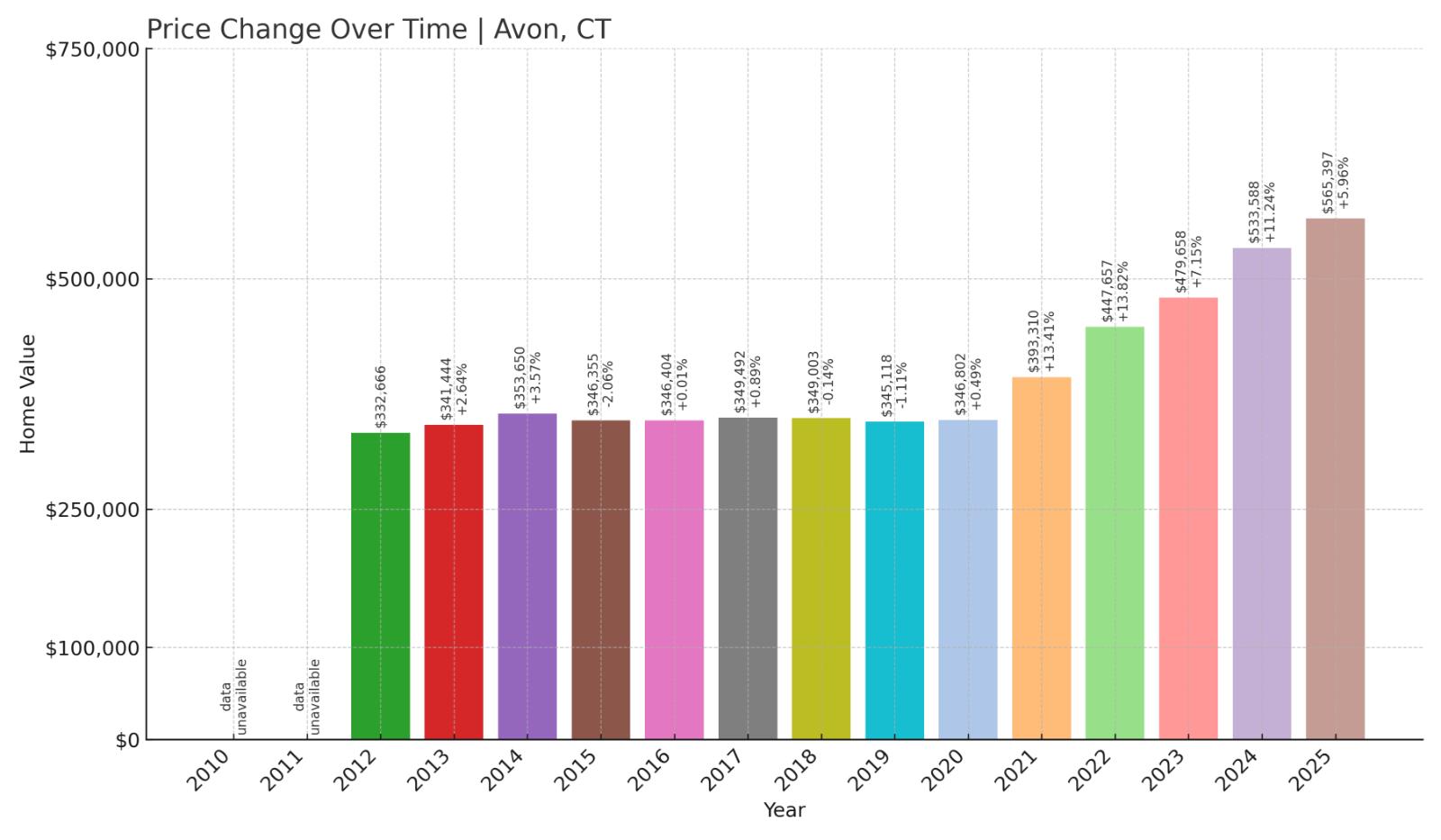

2. Avon – Investor Feeding Frenzy Factor 168.61% (June 2025)

- Historical annual growth rate (2012–2022): 3.01%

- Recent annual growth rate (2022–2025): 8.09%

- Investor Feeding Frenzy Factor: 168.61%

- Current 2025 price: $565,396.82

Avon’s price growth has shot up from a stable 3.01% to 8.09% annually in just three years. That’s a 168.61% increase over its prior trend—placing it among the top two towns in Connecticut’s investor frenzy rankings. As of June 2025, the average home price stands at $565,397.

Avon – One of Connecticut’s Most Rapidly Changing Suburbs

Located in the Farmington Valley, Avon has long attracted families with its top-rated schools, recreational options, and high quality of life. But recent data shows a pace of price growth far beyond anything seen in the past decade—suggesting something more than just organic demand is at play.

As more investors look for stable, high-demand suburbs to park capital, Avon fits the bill. The town’s rising prices may reflect an influx of investor interest seeking rental potential or future resale value. For residents, this means a fast-changing market that could put homeownership further out of reach for those just entering.

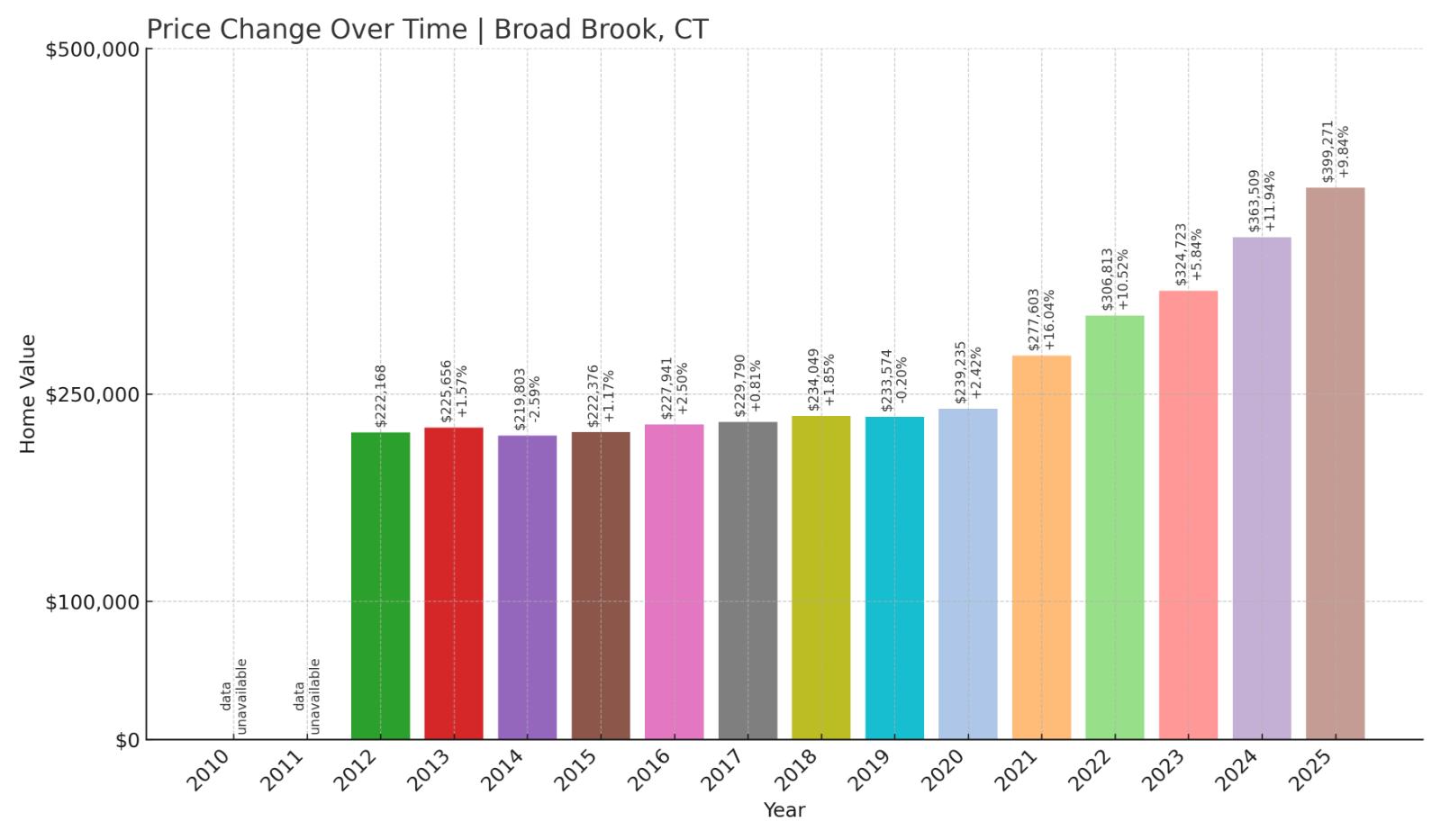

1. Broad Brook – Investor Feeding Frenzy Factor 179.73% (June 2025)

- Historical annual growth rate (2012–2022): 3.28%

- Recent annual growth rate (2022–2025): 9.18%

- Investor Feeding Frenzy Factor: 179.73%

- Current 2025 price: $399,271.27

With a recent annual growth rate of 9.18%—nearly triple its previous 3.28% pace—Broad Brook earns the highest feeding frenzy score in the state: 179.73%. The average home now sells for $399,271 as of June 2025, after years of aggressive appreciation.

Broad Brook – Connecticut’s Most Accelerated Housing Market

A section of East Windsor, Broad Brook blends small-town living with solid commuter access and a historically affordable market. But the last three years have seen it turn into a pricing hotspot, driven by rapid growth that outpaces every other town in Connecticut.

Investors may be attracted by the town’s combination of lower starting prices and growing demand from first-time buyers. But that growing interest is clearly driving up costs quickly—and reshaping the town’s affordability faster than many residents might have anticipated. Broad Brook is now ground zero for Connecticut’s sharpest housing price shift.