Would you like to save this?

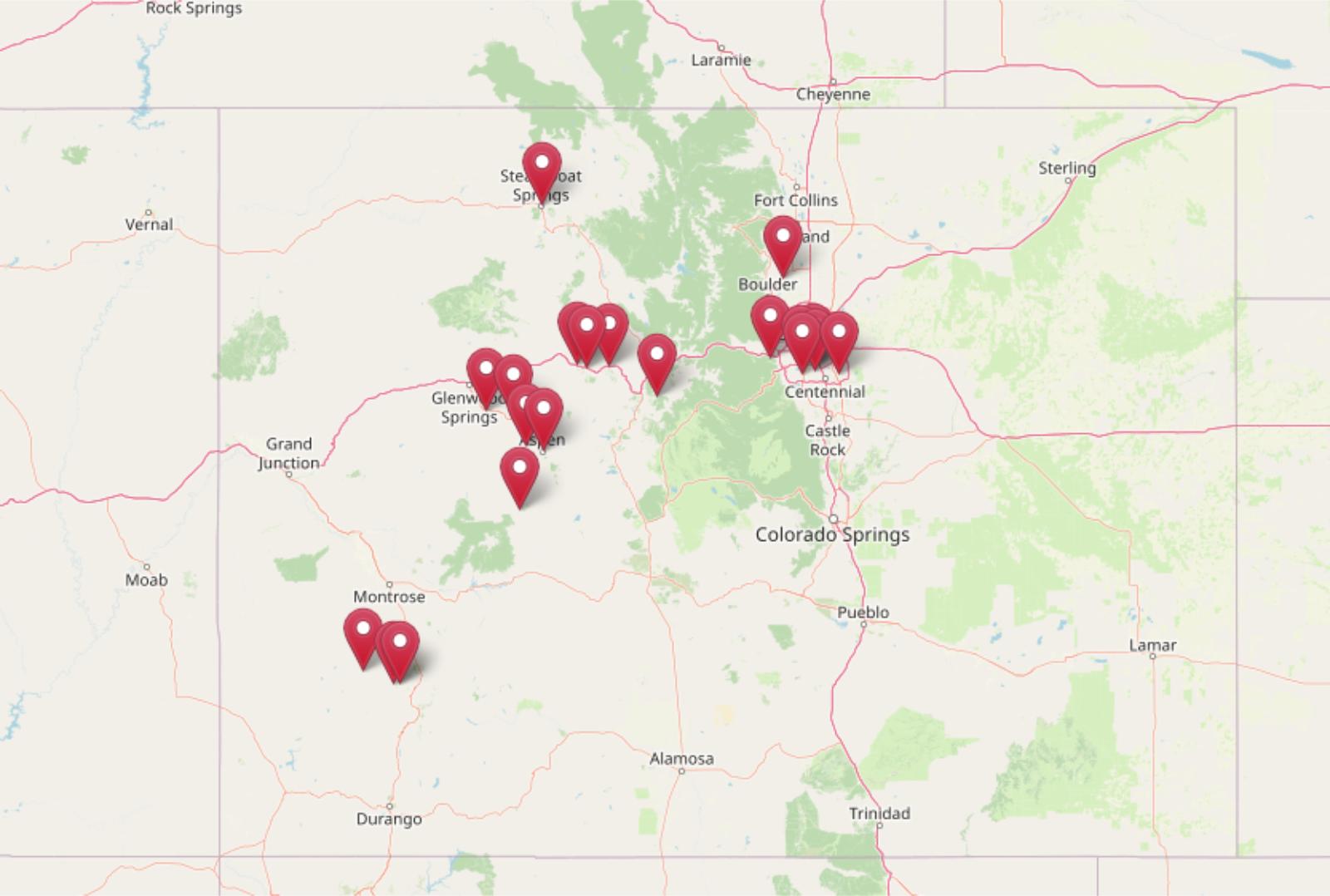

In Colorado’s top housing markets, home prices aren’t just high—they’re in thin-air territory. Zillow’s Home Value Index shows that in these 20 towns, values have soared over the last 15 years, turning once-sleepy suburbs and ski spots into some of the state’s most elite real estate. Sure, you’ll find the usual resort towns—but also fast-growing enclaves with killer schools, mountain views, and price tags to match. These places aren’t just popular—they’re expensive, exclusive, and not slowing down anytime soon.

20. Niwot – 136% Home Price Increase Since 2011

- 2010: $476,518

- 2011: $461,105 (-$15,413, -3.23% from previous year)

- 2012: $461,246 (+$141, +0.03% from previous year)

- 2013: $492,482 (+$31,236, +6.77% from previous year)

- 2014: $529,975 (+$37,493, +7.61% from previous year)

- 2015: $568,364 (+$38,389, +7.24% from previous year)

- 2016: $640,255 (+$71,891, +12.65% from previous year)

- 2017: $694,036 (+$53,781, +8.40% from previous year)

- 2018: $720,932 (+$26,896, +3.88% from previous year)

- 2019: $752,184 (+$31,252, +4.33% from previous year)

- 2020: $816,889 (+$64,705, +8.60% from previous year)

- 2021: $926,746 (+$109,858, +13.45% from previous year)

- 2022: $1,144,313 (+$217,567, +23.48% from previous year)

- 2023: $1,075,749 (-$68,564, -5.99% from previous year)

- 2024: $1,106,631 (+$30,882, +2.87% from previous year)

- 2025: $1,122,900 (+$16,268, +1.47% from previous year)

Niwot’s home values have more than doubled since 2011, climbing from $461,105 to $1,122,900 in May 2025—a 136% increase. The town saw consistent, healthy growth in the early 2010s before picking up pace sharply between 2020 and 2022, with an especially large jump in 2022 (+23.48%). While prices dipped slightly in 2023, they’ve resumed modest upward movement since then. The trend reflects both long-term value appreciation and temporary corrections that have affected high-end markets across Colorado. The rise of remote work and proximity to Boulder have helped boost demand in this area, even as price growth has slowed in the last year. For buyers, the market now offers stability more than explosive gains. Niwot’s price curve tells the story of a mature luxury market that still holds long-term potential.

Niwot – Boulder County Appeal With Easy Access to Tech Hubs

Niwot is an affluent enclave just northeast of Boulder, prized for its quiet neighborhoods, mountain views, and proximity to major employers in the Denver-Boulder tech corridor. The town’s high-ranking schools, strong sense of community, and easy access to trails and open space have made it a magnet for families and professionals. Home values here reflect both location and lifestyle: buyers are paying for space, scenery, and serenity without sacrificing convenience. Despite a dip in 2023, the market remains resilient and has recovered slightly in 2024 and 2025. Many homes in Niwot feature larger lots and custom designs, contributing to elevated price points. While affordability is a challenge, demand remains strong, especially among buyers seeking alternatives to Boulder’s dense core. Local amenities include charming historic downtown shops, gourmet dining, and access to top-tier public schools. Niwot’s strong price growth during the early pandemic years was fueled by the shift toward remote work and a preference for suburban luxury. Although more recent years have seen slowing appreciation, the town’s fundamentals remain solid. With prices holding above $1.1 million in 2025, Niwot continues to sit near the top of Colorado’s most expensive housing markets.

19. Foxfield – 154% Home Price Increase Since 2011

- 2010: $445,863

- 2011: $433,341 (-$12,522, -2.81% from previous year)

- 2012: $456,341 (+$22,999, +5.31% from previous year)

- 2013: $500,484 (+$44,143, +9.67% from previous year)

- 2014: $533,194 (+$32,710, +6.54% from previous year)

- 2015: $571,329 (+$38,136, +7.15% from previous year)

- 2016: $614,629 (+$43,300, +7.58% from previous year)

- 2017: $662,851 (+$48,221, +7.85% from previous year)

- 2018: $722,266 (+$59,415, +8.96% from previous year)

- 2019: $777,457 (+$55,192, +7.64% from previous year)

- 2020: $773,899 (-$3,558, -0.46% from previous year)

- 2021: $968,172 (+$194,273, +25.10% from previous year)

- 2022: $1,155,750 (+$187,578, +19.37% from previous year)

- 2023: $1,088,066 (-$67,683, -5.86% from previous year)

- 2024: $1,127,883 (+$39,817, +3.66% from previous year)

- 2025: $1,130,369 (+$2,485, +0.22% from previous year)

Home values in Foxfield have grown an impressive 154% since 2011, rising from $433,341 to $1,130,369. The town experienced especially strong gains between 2020 and 2022, with back-to-back increases of over 19%. While 2023 saw a noticeable dip, modest gains returned in 2024 and 2025, pointing to a stabilizing high-end market. Foxfield’s market is characterized by steady year-over-year increases, suggesting durable demand rather than speculative volatility. The area has proven attractive for buyers seeking large, upscale properties near Denver’s employment centers. The sharp rise in values since the pandemic underscores changing buyer preferences and sustained local appeal. Today, Foxfield remains one of Colorado’s most expensive and sought-after places to buy.

Foxfield – Upscale Acreage Living Just Outside Denver

Foxfield offers a rare blend of rural charm and city proximity, located in Arapahoe County on the southeast fringe of the Denver metro area. Known for its estate-sized lots and custom-built homes, this small town caters to buyers looking for elbow room without sacrificing access to urban jobs and services. The town’s scenic setting and semi-rural vibe give it a distinct identity in a region dominated by dense suburban development. Its zoning restrictions help preserve its low-density appeal, making properties here particularly valuable. Many homes feature horse facilities, wide setbacks, and mature landscaping, commanding premium prices as metro Denver continues to grow. Foxfield’s rapid price escalation in 2021 and 2022 coincided with high demand for space during the pandemic. While appreciation has slowed recently, prices remain elevated and relatively stable in 2025. Buyers here tend to be long-term residents who value privacy and property, which has helped protect the local market from more severe corrections. As growth continues to spread across the Front Range, Foxfield is likely to remain an exclusive outpost with enduring appeal.

18. Genesee – 135% Home Price Increase Since 2011

- 2010: $511,302

- 2011: $487,665 (-$23,637, -4.62% from previous year)

- 2012: $485,901 (-$1,764, -0.36% from previous year)

- 2013: $523,808 (+$37,907, +7.80% from previous year)

- 2014: $557,090 (+$33,282, +6.35% from previous year)

- 2015: $590,214 (+$33,124, +5.95% from previous year)

- 2016: $622,301 (+$32,087, +5.44% from previous year)

- 2017: $666,315 (+$44,014, +7.07% from previous year)

- 2018: $707,562 (+$41,247, +6.19% from previous year)

- 2019: $749,693 (+$42,131, +5.95% from previous year)

- 2020: $804,184 (+$54,491, +7.27% from previous year)

- 2021: $941,207 (+$137,023, +17.04% from previous year)

- 2022: $1,159,919 (+$218,712, +23.24% from previous year)

- 2023: $1,090,554 (-$69,365, -5.98% from previous year)

- 2024: $1,137,313 (+$46,759, +4.29% from previous year)

- 2025: $1,145,819 (+$8,506, +0.75% from previous year)

Genesee has seen a 135% jump in home values since 2011, when prices bottomed out at $487,665. That figure has more than doubled, reaching $1,145,819 in 2025. The market experienced particularly strong growth between 2020 and 2022, capped by a 23% increase in 2022 alone. Although values dipped slightly in 2023, they’ve resumed slow upward momentum in the past two years. This growth trend suggests a resilient high-end market driven by both lifestyle appeal and sustained demand. Year-over-year gains in the 5%–7% range were common throughout the 2010s, reflecting steady appreciation. Genesee’s data tells a story of consistent growth interrupted only briefly during the latest market correction. Today, the town sits firmly among Colorado’s elite housing markets.

Genesee – Scenic Mountain Living Just 25 Minutes From Denver

Would you like to save this?

Located in the foothills of the Rocky Mountains just west of Denver, Genesee offers luxury homes in a breathtaking setting. The town’s elevation and panoramic views attract high-end buyers who want a true mountain feel without a long commute. Genesee is part of Jefferson County and benefits from protected open space, winding roads, and forested neighborhoods. It’s a favorite for buyers looking to blend nature and convenience, and the housing stock reflects that balance—with many homes built to highlight outdoor living and views. Genesee’s home prices have surged in the past five years, largely due to demand from Denver professionals seeking more space and privacy. The 2021–2022 surge mirrors statewide trends during the pandemic housing boom. Although growth slowed in 2023, values have stabilized above $1.1 million and are climbing modestly again. The town’s proximity to I-70 provides direct access to both the city and Colorado’s top ski resorts, boosting its appeal as a base for both commuters and second-home owners. With its strong quality of life and unique location, Genesee remains one of the most desirable mountain communities in the state.

17. Breckenridge – 138% Home Price Increase Since 2012

- 2010: $524,664

- 2011: $502,585 (-$22,079, -4.21% from previous year)

- 2012: $497,370 (-$5,215, -1.04% from previous year)

- 2013: $521,378 (+$24,008, +4.83% from previous year)

- 2014: $547,823 (+$26,445, +5.07% from previous year)

- 2015: $577,572 (+$29,749, +5.43% from previous year)

- 2016: $635,542 (+$57,971, +10.04% from previous year)

- 2017: $720,309 (+$84,767, +13.34% from previous year)

- 2018: $792,336 (+$72,027, +10.00% from previous year)

- 2019: $862,753 (+$70,417, +8.89% from previous year)

- 2020: $892,530 (+$29,777, +3.45% from previous year)

- 2021: $1,049,458 (+$156,929, +17.58% from previous year)

- 2022: $1,369,498 (+$320,040, +30.50% from previous year)

- 2023: $1,231,224 (-$138,274, -10.10% from previous year)

- 2024: $1,211,180 (-$20,044, -1.63% from previous year)

- 2025: $1,197,104 (-$14,076, -1.16% from previous year)

Breckenridge home values have climbed 138% since 2012, going from $497,370 to $1,197,104. The ski town experienced some of the most dramatic growth in Colorado between 2020 and 2022, capped by a huge 30.5% increase in 2022 alone. However, the past three years have brought a gradual retreat in prices, though values remain far above their pre-pandemic levels. The market seems to have corrected slightly after peaking in 2022. This makes Breckenridge a clear example of a luxury destination town that surged during the pandemic housing frenzy but has since cooled. Still, current values remain over double their 2012 levels, highlighting strong long-term growth. Buyers are now entering a more stable phase of the market.

Breckenridge – One of Colorado’s Most Famous Mountain Destinations

Breckenridge is a world-renowned ski town nestled in Summit County, drawing visitors and buyers from around the globe. Its charming downtown, access to five mountain peaks, and year-round recreation make it one of the most desirable resort towns in the Rockies. While tourism fuels much of the local economy, it also drives up real estate values—especially for second homes and investment properties. Breckenridge has long attracted affluent buyers looking for vacation homes with rental income potential, which helped accelerate price gains during the 2021–2022 buying surge. Despite recent price declines, the market remains strong relative to pre-pandemic norms. Homes here often come with premium finishes, mountain views, and quick access to slopes and trails. The town has invested in walkability, sustainability, and infrastructure, further increasing its long-term value. Buyers seeking a mix of luxury and lifestyle continue to keep Breckenridge among Colorado’s most expensive towns. Even with modest corrections, demand for quality properties in this iconic ski town remains high in 2025.

16. Placerville – 80% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $696,557

- 2019: $718,872 (+$22,315, +3.20% from previous year)

- 2020: $768,555 (+$49,683, +6.91% from previous year)

- 2021: $945,561 (+$177,006, +23.03% from previous year)

- 2022: $1,292,469 (+$346,908, +36.69% from previous year)

- 2023: $1,175,136 (-$117,333, -9.08% from previous year)

- 2024: $1,220,640 (+$45,504, +3.87% from previous year)

- 2025: $1,258,458 (+$37,818, +3.10% from previous year)

Placerville home prices have increased by 80% since 2018, with values rising from $696,557 to $1,258,458. Much of this growth happened in a tight three-year window from 2020 to 2022, driven by a major 36.7% jump in 2022. After peaking, the town saw a modest decline in 2023, but has since recovered with steady growth in 2024 and 2025. Despite lacking earlier historical data, the available trend suggests a market shaped by sudden, pandemic-driven demand followed by modest correction and normalization. This price pattern is common in remote, desirable locations that experienced a rush of outside interest during COVID. Placerville’s current price levels remain strong, marking it as a high-value market.

Placerville – Small-Town Luxury Near Telluride

Placerville is a tiny, unincorporated community in San Miguel County, not far from Telluride. While it lacks the tourist bustle of its more famous neighbor, Placerville offers high-end homes in a quiet, remote setting with breathtaking views. Buyers are often drawn to its proximity to world-class skiing, hiking, and fly-fishing without the density or price extremes of resort towns. The market here surged during the pandemic as buyers sought mountain privacy and large lots. That demand cooled in 2023, but prices have begun to rebound as inventory remains tight and interest in mountain real estate continues. Properties in Placerville tend to be custom-built with premium finishes and expansive views, making them desirable for second-home buyers and outdoor enthusiasts. The area also appeals to retirees and telecommuters who value solitude and scenic beauty. With prices hovering above $1.25 million in 2025, Placerville is firmly in the luxury tier. Its smaller scale and limited inventory add exclusivity, helping it maintain high values even as broader markets shift. This niche appeal makes Placerville one of Colorado’s quieter but costlier places to live.

15. Steamboat Springs – 187% Home Price Increase Since 2011

- 2010: $450,516

- 2011: $433,237 (-$17,279, -3.84% from previous year)

- 2012: $436,169 (+$2,932, +0.68% from previous year)

- 2013: $448,330 (+$12,161, +2.79% from previous year)

- 2014: $468,691 (+$20,361, +4.54% from previous year)

- 2015: $484,806 (+$16,116, +3.44% from previous year)

- 2016: $531,733 (+$46,926, +9.68% from previous year)

- 2017: $575,249 (+$43,517, +8.18% from previous year)

- 2018: $609,549 (+$34,299, +5.96% from previous year)

- 2019: $657,590 (+$48,041, +7.88% from previous year)

- 2020: $694,824 (+$37,234, +5.66% from previous year)

- 2021: $884,826 (+$190,002, +27.35% from previous year)

- 2022: $1,177,759 (+$292,932, +33.11% from previous year)

- 2023: $1,152,964 (-$24,794, -2.11% from previous year)

- 2024: $1,253,205 (+$100,241, +8.69% from previous year)

- 2025: $1,293,322 (+$40,117, +3.20% from previous year)

Steamboat Springs home prices have climbed 187% since 2011, jumping from $433,237 to $1,293,322 in 2025. Most of that growth occurred in the past five years, especially in 2021 and 2022 when values surged more than 60% combined. Despite a small decline in 2023, the market rebounded quickly with two years of renewed appreciation. The long-term data suggests this is a highly dynamic and desirable housing market with strong resilience. The early 2010s were marked by steady single-digit growth, but pandemic-era demand pushed prices sharply higher. In 2025, the market appears to be stabilizing at a new, elevated baseline. Buyers considering Steamboat Springs today are entering a mature, high-value market with deep demand.

Steamboat Springs – Year-Round Destination With Rising Prestige

Located in Routt County, Steamboat Springs is a major resort destination known for its “Champagne Powder” snow, Olympic heritage, and small-town charm. The town’s appeal stretches far beyond skiing. It’s also a summer haven with fly-fishing, hot springs, hiking, and a thriving arts scene. Real estate here caters to affluent buyers looking for both seasonal and full-time residences. Large homes with alpine views dominate the local market, and proximity to the resort lifts adds significant value. As demand has expanded, so too have prices, especially during the pandemic when remote workers and second-home buyers flooded in. Steamboat’s increasing popularity is reflected in significant infrastructure investments, including a base area redevelopment and a growing regional airport. As more buyers look for alternatives to Aspen or Vail, Steamboat’s relative value—though still high—has attracted interest. In 2025, with homes approaching $1.3 million, the town is no longer a hidden opportunity but a solidified luxury market. Its mix of access, amenities, and charm make it a top-tier destination for buyers seeking lifestyle and investment potential.

14. Avon – 200% Home Price Increase Since 2011

- 2010: $514,501

- 2011: $436,481 (-$78,020, -15.16% from previous year)

- 2012: $438,778 (+$2,297, +0.53% from previous year)

- 2013: $469,633 (+$30,855, +7.03% from previous year)

- 2014: $514,063 (+$44,430, +9.46% from previous year)

- 2015: $548,247 (+$34,184, +6.65% from previous year)

- 2016: $586,042 (+$37,795, +6.89% from previous year)

- 2017: $611,974 (+$25,932, +4.42% from previous year)

- 2018: $631,036 (+$19,062, +3.11% from previous year)

- 2019: $658,724 (+$27,688, +4.39% from previous year)

- 2020: $648,408 (-$10,316, -1.57% from previous year)

- 2021: $852,609 (+$204,202, +31.49% from previous year)

- 2022: $1,115,973 (+$263,364, +30.89% from previous year)

- 2023: $1,162,447 (+$46,473, +4.16% from previous year)

- 2024: $1,262,939 (+$100,492, +8.64% from previous year)

- 2025: $1,303,288 (+$40,349, +3.19% from previous year)

Avon home prices have surged 200% since hitting a low of $436,481 in 2011. The biggest jumps came in 2021 and 2022, when values skyrocketed more than 60% over two years. More recent growth has cooled but remains positive, with modest gains in 2024 and 2025. This suggests that the market, while no longer booming, remains healthy and in high demand. Avon’s position in the Vail Valley makes it a constant draw for resort-bound buyers, especially those priced out of Vail itself. The town’s long-term trajectory shows a solid pattern of growth, briefly interrupted by minor corrections. Buyers today are entering a high-value market that still offers upside.

Avon – Gateway to Vail With Strong Growth in the Last 5 Years

Avon is a vital hub in Eagle County and serves as the base for Beaver Creek Resort. Its proximity to both Beaver Creek and Vail has made it a popular option for full-time residents, second-home owners, and renters. The town has benefited from major infrastructure investments, improved public transit, and rising tourism over the past decade. Compared to nearby Vail, Avon offers slightly more affordable properties and a mix of condos, townhomes, and luxury single-family homes. This diversity has helped fuel growth and attract a broader buyer base. Avon’s price surge during the pandemic reflected buyers’ appetite for resort access combined with full-service living. While the market cooled slightly after 2022, prices are holding well above $1.3 million in 2025. The local economy, anchored in hospitality and tourism, has bounced back post-COVID, and new development continues. With its access to ski terrain, mountain trails, and year-round events, Avon remains one of the fastest-appreciating towns in Colorado’s high-end market.

13. Basalt – 198% Home Price Increase Since 2011

- 2010: $517,541

- 2011: $454,832 (-$62,709, -12.12% from previous year)

- 2012: $449,440 (-$5,392, -1.19% from previous year)

- 2013: $496,092 (+$46,653, +10.38% from previous year)

- 2014: $546,478 (+$50,386, +10.16% from previous year)

- 2015: $590,802 (+$44,324, +8.11% from previous year)

- 2016: $633,547 (+$42,745, +7.24% from previous year)

- 2017: $656,664 (+$23,117, +3.65% from previous year)

- 2018: $683,861 (+$27,197, +4.14% from previous year)

- 2019: $730,010 (+$46,149, +6.75% from previous year)

- 2020: $754,864 (+$24,854, +3.40% from previous year)

- 2021: $931,641 (+$176,777, +23.42% from previous year)

- 2022: $1,206,919 (+$275,279, +29.55% from previous year)

- 2023: $1,226,253 (+$19,334, +1.60% from previous year)

- 2024: $1,328,512 (+$102,258, +8.34% from previous year)

- 2025: $1,356,668 (+$28,156, +2.12% from previous year)

Since 2011, home values in Basalt have risen by nearly 200%, jumping from $454,832 to $1,356,668 in 2025. The town experienced steady growth throughout the 2010s and saw explosive gains during the pandemic years. In 2021 and 2022 alone, home values jumped by more than $450,000. Even as that rapid growth slowed in 2023, the market has continued to edge upward in subsequent years. Basalt’s consistency in year-over-year growth points to a durable and desirable housing market. It remains a solid bet for buyers seeking long-term appreciation in the Roaring Fork Valley.

Basalt – Upscale Riverfront Living Near Aspen

Basalt sits between Glenwood Springs and Aspen along the Roaring Fork River, offering a mix of small-town charm and upscale amenities. The town has grown in popularity due to its riverfront setting, excellent schools, and vibrant restaurant and shopping scene. It offers access to outdoor activities like fly fishing, biking, and skiing while maintaining a quieter pace than Aspen itself. This makes it a favorite for professionals, families, and retirees who want access to mountain luxury without Aspen’s premium prices. The pandemic surge brought a wave of buyers to the area, pushing prices rapidly upward. As inventory tightened, values spiked, and the market has remained elevated ever since. In 2025, Basalt’s home prices continue to climb, supported by limited supply and consistent demand. Buyers value the town’s balanced lifestyle and proximity to both wilderness and world-class amenities. With prices topping $1.35 million, Basalt holds its spot as one of the Roaring Fork Valley’s most desirable communities.

12. Carbondale – 257% Home Price Increase Since 2011

- 2010: $401,852

- 2011: $389,482 (-$12,370, -3.08% from previous year)

- 2012: $396,883 (+$7,400, +1.90% from previous year)

- 2013: $435,055 (+$38,172, +9.62% from previous year)

- 2014: $502,491 (+$67,437, +15.50% from previous year)

- 2015: $573,789 (+$71,298, +14.19% from previous year)

- 2016: $631,682 (+$57,892, +10.09% from previous year)

- 2017: $662,354 (+$30,673, +4.86% from previous year)

- 2018: $695,321 (+$32,966, +4.98% from previous year)

- 2019: $726,304 (+$30,983, +4.46% from previous year)

- 2020: $755,893 (+$29,589, +4.07% from previous year)

- 2021: $939,211 (+$183,318, +24.25% from previous year)

- 2022: $1,216,407 (+$277,196, +29.51% from previous year)

- 2023: $1,205,849 (-$10,558, -0.87% from previous year)

- 2024: $1,336,739 (+$130,890, +10.85% from previous year)

- 2025: $1,391,322 (+$54,583, +4.08% from previous year)

Carbondale’s home values have increased by an extraordinary 257% since 2011, when the median price was $389,482. That figure has grown to $1,391,322 in 2025. The market saw strong gains through the 2010s, and even steeper increases during the pandemic-era housing boom—particularly from 2020 to 2022. Even with a brief pause in 2023, prices resumed upward movement, with a double-digit gain in 2024 and further growth in 2025. This pattern points to both strong demand and continued pressure on supply. Buyers here are paying for location, lifestyle, and consistent long-term value. Carbondale stands out not just for its raw price, but for the consistency of its price trajectory over more than a decade.

Carbondale – A Thriving Arts and Outdoor Hub in the Roaring Fork Valley

Nestled in the Roaring Fork Valley near the base of Mt. Sopris, Carbondale is a magnet for creatives, professionals, and families seeking a small-town lifestyle with big amenities. The town is known for its thriving arts scene, excellent schools, and access to year-round recreation—from skiing and hiking to mountain biking and river sports. This versatility has made it a prime destination for both full-time residents and second-home buyers. Carbondale’s location, about 30 miles from Aspen, allows for easy access to the high-end resort scene without the associated pricing extremes—though that gap has been closing quickly in recent years. The town has retained its character while experiencing significant investment and development. Local events like Mountain Fair and the First Fridays art walks help maintain a strong sense of community, even as new buyers arrive. With prices now above $1.3 million, Carbondale has firmly entered the luxury tier. Its ability to attract buyers year after year—regardless of national market trends—demonstrates its enduring appeal and long-term investment potential.

11. Crested Butte – 214% Home Price Increase Since 2011

Would you like to save this?

- 2010: $490,357

- 2011: $461,817 (-$28,539, -5.82% from previous year)

- 2012: $457,974 (-$3,844, -0.83% from previous year)

- 2013: $476,972 (+$18,998, +4.15% from previous year)

- 2014: $482,135 (+$5,163, +1.08% from previous year)

- 2015: $543,496 (+$61,361, +12.73% from previous year)

- 2016: $590,611 (+$47,116, +8.67% from previous year)

- 2017: $639,381 (+$48,770, +8.26% from previous year)

- 2018: $701,353 (+$61,972, +9.69% from previous year)

- 2019: $796,042 (+$94,689, +13.50% from previous year)

- 2020: $884,068 (+$88,025, +11.06% from previous year)

- 2021: $1,070,770 (+$186,703, +21.12% from previous year)

- 2022: $1,430,437 (+$359,666, +33.59% from previous year)

- 2023: $1,371,564 (-$58,873, -4.12% from previous year)

- 2024: $1,408,315 (+$36,751, +2.68% from previous year)

- 2025: $1,451,904 (+$43,589, +3.10% from previous year)

Crested Butte home prices have surged 214% since 2011, when the market bottomed out at $461,817. Prices now sit at $1,451,904 as of 2025. Growth was slow in the early 2010s, but gains accelerated sharply between 2015 and 2022. The town added more than $600,000 in value in just four years from 2018 to 2022. Though there was a modest pullback in 2023, the market rebounded again in 2024 and 2025. Buyers seeking luxury, charm, and unmatched access to recreation continue to pour into Crested Butte, keeping demand strong and prices high.

Crested Butte – High Elevation Charm With Enduring Demand

Crested Butte is often referred to as “Colorado’s Last Great Ski Town,” and for good reason. Tucked deep in Gunnison County, this alpine town blends historic charm with modern mountain luxury. Unlike many larger resorts, Crested Butte retains a laid-back, non-corporate feel that appeals to outdoor enthusiasts and second-home buyers alike. The town’s National Historic District preserves a colorful downtown filled with 19th-century storefronts, while its ski area and summer trails offer world-class recreation year-round. That blend of appeal has driven strong appreciation over the past decade. Crested Butte’s housing stock is relatively limited, which contributes to upward price pressure. The remote location didn’t deter buyers during the pandemic; if anything, it made the town more attractive. The sharp increases in 2021 and 2022 reflect the market’s breakout moment. While the fever has cooled slightly, prices remain well above $1.4 million in 2025. With its unique personality and strong seasonal draw, Crested Butte continues to hold a distinct place among Colorado’s most expensive real estate markets.

10. Greenwood Village – 150% Home Price Increase Since 2011

- 2010: $625,150

- 2011: $595,933 (-$29,217, -4.67% from previous year)

- 2012: $598,189 (+$2,256, +0.38% from previous year)

- 2013: $662,950 (+$64,761, +10.83% from previous year)

- 2014: $720,327 (+$57,377, +8.65% from previous year)

- 2015: $767,837 (+$47,510, +6.60% from previous year)

- 2016: $807,303 (+$39,466, +5.14% from previous year)

- 2017: $846,011 (+$38,708, +4.79% from previous year)

- 2018: $880,923 (+$34,911, +4.13% from previous year)

- 2019: $938,802 (+$57,879, +6.57% from previous year)

- 2020: $981,463 (+$42,661, +4.54% from previous year)

- 2021: $1,146,836 (+$165,373, +16.85% from previous year)

- 2022: $1,395,107 (+$248,271, +21.65% from previous year)

- 2023: $1,346,713 (-$48,394, -3.47% from previous year)

- 2024: $1,446,340 (+$99,626, +7.40% from previous year)

- 2025: $1,487,600 (+$41,261, +2.85% from previous year)

Greenwood Village has seen home values climb 150% since 2011, from $595,933 to $1,487,600 in 2025. After a slow but steady rise in the early 2010s, the market picked up significant speed between 2020 and 2022, with double-digit annual increases. Although prices dipped in 2023, that drop proved temporary. Growth resumed in the following years, bringing values to a new peak in 2025. Greenwood Village’s appeal as a top-tier Denver suburb continues to drive high demand, especially for buyers seeking luxury homes with convenience and privacy. The long-term growth trend reflects the area’s elite status in the metro real estate landscape.

Greenwood Village – Metro Denver’s Luxury Suburban Stronghold

Located in Arapahoe County, Greenwood Village is one of the Denver area’s most exclusive suburbs. With easy access to the Denver Tech Center and top-rated Cherry Creek schools, it offers a rare combination of upscale housing, green space, and connectivity. The area is known for its large custom homes, private estates, and quiet, tree-lined streets. Its strategic location makes it popular among executives and professionals looking for prestige without the congestion of city living. Parks, trails, and equestrian paths add to the town’s high-end appeal. Greenwood Village has consistently performed well over the past decade, but recent growth has elevated it further into the elite bracket. The post-pandemic period saw increased demand for spacious properties and home offices—features that are common in this area’s housing stock. In 2025, prices remain near record highs, reflecting the enduring demand for suburban luxury near Denver’s economic core. With limited inventory and continued buyer interest, Greenwood Village remains a safe harbor for long-term value.

9. Vail – 166% Home Price Increase Since 2011

- 2010: $717,350

- 2011: $621,868 (-$95,481, -13.31% from previous year)

- 2012: $617,288 (-$4,581, -0.74% from previous year)

- 2013: $664,775 (+$47,487, +7.69% from previous year)

- 2014: $728,450 (+$63,675, +9.58% from previous year)

- 2015: $765,091 (+$36,642, +5.03% from previous year)

- 2016: $829,458 (+$64,367, +8.41% from previous year)

- 2017: $863,718 (+$34,260, +4.13% from previous year)

- 2018: $905,012 (+$41,294, +4.78% from previous year)

- 2019: $936,917 (+$31,904, +3.53% from previous year)

- 2020: $962,188 (+$25,272, +2.70% from previous year)

- 2021: $1,185,116 (+$222,927, +23.17% from previous year)

- 2022: $1,493,557 (+$308,441, +26.03% from previous year)

- 2023: $1,520,916 (+$27,359, +1.83% from previous year)

- 2024: $1,635,091 (+$114,175, +7.51% from previous year)

- 2025: $1,654,928 (+$19,837, +1.21% from previous year)

Vail’s home prices have surged 166% since 2011, rebounding from a post-recession dip to reach $1,654,928 in 2025. While the early 2010s saw modest gains, appreciation accelerated rapidly starting in 2020. The town added over half a million dollars in value in just two years from 2020 to 2022. Growth has continued at a slower but positive pace since then. Vail’s performance highlights the continued strength of top-tier resort markets in Colorado. The area’s prestige, limited inventory, and year-round recreation keep prices at a premium even in fluctuating national markets.

Vail – Colorado’s Premier Ski Market With Enduring Global Demand

Vail is a household name in global skiing, and that brand power translates directly into real estate value. Located in Eagle County, this luxury alpine destination draws international visitors and property investors alike. Homes here are not just expensive—they’re iconic, offering ski-in/ski-out access, mountain views, and proximity to high-end shopping and fine dining. The town also benefits from sustained infrastructure investment and a highly active short-term rental economy. Vail’s housing market is shaped by scarcity, exclusivity, and consistent global demand. Even as other markets wavered, Vail held its value and continued to grow, proving its resilience and appeal. The massive price jumps in 2021 and 2022 reflect a surge in high-net-worth buyers looking for secure luxury investments. While the rate of appreciation has slowed in 2024 and 2025, the trajectory remains upward. With a 2025 median home price well above $1.6 million, Vail remains the gold standard for ski-town real estate in Colorado—and one of the most desirable addresses in the state.

8. Edwards – 213% Home Price Increase Since 2011

- 2010: $636,992

- 2011: $540,950 (-$96,042, -15.08% from previous year)

- 2012: $536,066 (-$4,884, -0.90% from previous year)

- 2013: $553,204 (+$17,138, +3.20% from previous year)

- 2014: $596,173 (+$42,969, +7.77% from previous year)

- 2015: $630,491 (+$34,319, +5.76% from previous year)

- 2016: $676,905 (+$46,414, +7.36% from previous year)

- 2017: $711,428 (+$34,522, +5.10% from previous year)

- 2018: $738,473 (+$27,046, +3.80% from previous year)

- 2019: $772,304 (+$33,831, +4.58% from previous year)

- 2020: $750,915 (-$21,390, -2.77% from previous year)

- 2021: $1,048,238 (+$297,323, +39.59% from previous year)

- 2022: $1,409,620 (+$361,382, +34.48% from previous year)

- 2023: $1,486,613 (+$76,993, +5.46% from previous year)

- 2024: $1,650,399 (+$163,786, +11.02% from previous year)

- 2025: $1,693,993 (+$43,594, +2.64% from previous year)

Edwards has seen home prices soar by 213% since 2011, going from $540,950 to $1,693,993 in 2025. The most dramatic increases happened in 2021 and 2022, when prices nearly doubled in just two years. The market has since remained strong, with consistent annual gains. Located just west of Vail, Edwards has emerged as a high-end market in its own right, attracting buyers priced out of resort towns or looking for a quieter year-round community. With prices now nearing $1.7 million, Edwards has become one of Colorado’s most expensive markets.

Edwards – Luxury Alternative to Vail With Growing Prestige

Edwards is a thriving community in the Vail Valley that blends mountain lifestyle with suburban comfort. Located along I-70, it provides easy access to Vail and Beaver Creek, while offering larger homes and a quieter, more residential feel. The town features excellent schools, shopping centers like Riverwalk, and a growing network of trails and parks. It appeals to both full-time residents and second-home owners who want access to the resort lifestyle without the bustle of Vail’s tourism scene. Edwards saw explosive price growth during the pandemic as buyers looked for more space and flexibility. That trend has held up, with double-digit growth continuing even into 2024. The town’s infrastructure and amenities have kept pace with demand, making it an increasingly competitive luxury market. In 2025, with home prices well over $1.6 million, Edwards now ranks among the most elite housing markets in Colorado. Its blend of value, location, and lifestyle continues to fuel strong demand.

7. Columbine Valley – 167% Home Price Increase Since 2011

- 2010: $687,049

- 2011: $646,293 (-$40,756, -5.93% from previous year)

- 2012: $651,873 (+$5,580, +0.86% from previous year)

- 2013: $717,316 (+$65,443, +10.04% from previous year)

- 2014: $770,045 (+$52,729, +7.35% from previous year)

- 2015: $826,919 (+$56,875, +7.39% from previous year)

- 2016: $885,020 (+$58,101, +7.03% from previous year)

- 2017: $931,599 (+$46,579, +5.26% from previous year)

- 2018: $970,277 (+$38,679, +4.15% from previous year)

- 2019: $1,031,711 (+$61,433, +6.33% from previous year)

- 2020: $1,095,809 (+$64,099, +6.21% from previous year)

- 2021: $1,272,360 (+$176,551, +16.11% from previous year)

- 2022: $1,653,797 (+$381,437, +29.98% from previous year)

- 2023: $1,593,019 (-$60,778, -3.68% from previous year)

- 2024: $1,670,387 (+$77,368, +4.86% from previous year)

- 2025: $1,694,639 (+$24,253, +1.45% from previous year)

Columbine Valley has experienced a 167% home price increase since 2011, growing from $646,293 to $1,694,639 by 2025. The town showed strong and steady growth throughout the 2010s, followed by a major surge between 2020 and 2022. After a small correction in 2023, home values bounced back with gains in both 2024 and 2025. The overall trajectory reflects consistent demand for high-end suburban living with a country club feel. Even with some minor volatility, Columbine Valley continues to attract affluent buyers looking for exclusivity near Denver.

Columbine Valley – Private Golf Community With Million-Dollar Homes

Columbine Valley is a small, exclusive town centered around the historic Columbine Country Club in Arapahoe County. With just a few hundred homes, the community is known for its spacious lots, lush landscaping, and quiet streets. Residents enjoy direct access to golf, tennis, and other private amenities, making it one of the most desirable places to live for Denver-area professionals and retirees. The town’s location, tucked near Littleton but removed from major commercial corridors, gives it a secluded and upscale atmosphere. Real estate here consists mainly of large, custom homes with high-end finishes, and buyers are typically looking for long-term residences rather than quick investments. The surge in prices during 2021–2022 aligned with increased demand for privacy, space, and premium home features. Even with a slight decline in 2023, prices have resumed growth and remain near historic highs in 2025. With limited new development and a strong community feel, Columbine Valley is likely to remain one of the Denver area’s most stable luxury markets.

6. Telluride – 293% Home Price Increase Since 2011

- 2010: $541,337

- 2011: $517,915 (-$23,422, -4.33% from previous year)

- 2012: $547,680 (+$29,765, +5.75% from previous year)

- 2013: $512,741 (-$34,939, -6.38% from previous year)

- 2014: $659,250 (+$146,509, +28.57% from previous year)

- 2015: $771,437 (+$112,187, +17.02% from previous year)

- 2016: $826,585 (+$55,148, +7.15% from previous year)

- 2017: $855,585 (+$29,000, +3.51% from previous year)

- 2018: $917,961 (+$62,376, +7.29% from previous year)

- 2019: $1,012,513 (+$94,552, +10.30% from previous year)

- 2020: $1,090,015 (+$77,502, +7.65% from previous year)

- 2021: $1,342,780 (+$252,765, +23.19% from previous year)

- 2022: $2,060,402 (+$717,623, +53.44% from previous year)

- 2023: $1,934,615 (-$125,787, -6.10% from previous year)

- 2024: $1,925,617 (-$8,998, -0.47% from previous year)

- 2025: $2,037,338 (+$111,721, +5.80% from previous year)

Telluride home values have exploded by 293% since 2011, rising from $517,915 to $2,037,338. The market’s most dramatic growth came during the post-2020 boom, when values more than doubled in just two years from 2020 to 2022. While there was a mild retreat in 2023 and 2024, prices bounced back again in 2025. The long-term trend is clear: Telluride is one of Colorado’s most expensive—and fastest-appreciating—housing markets. This is a destination where limited inventory and high global demand keep pressure on prices even when the broader market cools.

Telluride – Remote Luxury With Global Name Recognition

Telluride has long been known as one of Colorado’s most elite and scenic mountain towns. Tucked into a box canyon in San Miguel County, the town offers stunning alpine views, a world-class ski resort, and a historic downtown filled with boutiques and gourmet dining. Unlike some resort areas, Telluride maintains strict development limits, which adds scarcity to its already desirable market. Wealthy buyers from across the country—and increasingly, the world—are willing to pay a premium for homes here. The 2021–2022 surge was fueled by remote work and a rush for luxurious getaways far from major cities. Telluride’s appeal grew even stronger during that time, as buyers sought exclusivity and outdoor access. Even after minor corrections, prices remain above $2 million in 2025. The market here is not just about housing—it’s about owning a piece of one of the most prestigious mountain communities in North America. With limited inventory and enduring prestige, Telluride’s real estate remains among the most prized in the Rockies.

5. Mountain Village – 219% Home Price Increase Since 2012

- 2010: $841,281

- 2011: N/A

- 2012: $677,682

- 2013: $646,400 (-$31,282, -4.62% from previous year)

- 2014: $770,722 (+$124,321, +19.23% from previous year)

- 2015: $844,614 (+$73,892, +9.59% from previous year)

- 2016: $900,534 (+$55,920, +6.62% from previous year)

- 2017: $914,954 (+$14,420, +1.60% from previous year)

- 2018: $953,730 (+$38,776, +4.24% from previous year)

- 2019: $1,070,616 (+$116,886, +12.26% from previous year)

- 2020: $1,156,101 (+$85,485, +7.98% from previous year)

- 2021: $1,417,903 (+$261,802, +22.65% from previous year)

- 2022: $2,016,074 (+$598,172, +42.19% from previous year)

- 2023: $1,983,644 (-$32,431, -1.61% from previous year)

- 2024: $2,112,430 (+$128,786, +6.49% from previous year)

- 2025: $2,163,362 (+$50,932, +2.41% from previous year)

Mountain Village has witnessed an incredible 219% increase in home prices since 2012, when values were at $677,682. The town’s housing market took off in earnest in the mid-2010s and gained serious momentum during the pandemic. The most explosive gains came in 2021 and 2022, when prices leapt from $1.4 million to over $2 million in just two years. Although 2023 brought a slight dip, prices rebounded quickly and have been rising again through 2024 and 2025. As of May 2025, the typical home value in Mountain Village stands at $2,163,362, putting it firmly in Colorado’s ultra-luxury tier. The consistent growth pattern reflects not just market volatility but the town’s long-term draw for high-income buyers seeking both exclusivity and lifestyle. Unlike flash-in-the-pan markets, Mountain Village has shown year-after-year appreciation backed by scarcity, demand, and investment in the local experience. With tight inventory and international buyer interest, the price trend remains upward. This market is now one of the most expensive outside of Aspen and Telluride—and buyers are still lining up.

Mountain Village – Ultra-Luxury Ski Real Estate in the San Juans

Mountain Village is a planned luxury resort community located just above Telluride in the heart of the San Juan Mountains. Developed in the 1990s as a complement to Telluride’s historic downtown, it offers ski-in/ski-out access, elegant modern homes, and a high-alpine European vibe. The area is known for its soaring gondolas, upscale lodges, and carefully designed pedestrian plazas that connect homes to ski terrain, shopping, and fine dining. What sets Mountain Village apart is its master-planned nature—it was built from the start to cater to wealthy seasonal and full-time residents looking for refined experiences and privacy. Many homes here feature expansive floor plans, dramatic mountain views, and premium finishes. Its proximity to Telluride, combined with larger lots and newer construction, has made it a favorite for buyers priced out of historic townhomes or looking for a second home with fewer constraints. The rise of remote work, especially among high-net-worth individuals, added fuel to the fire during 2020–2022, and the town saw one of the sharpest appreciation curves in the state. With infrastructure in place and access to all of Telluride’s amenities via a free gondola, it has become a standalone destination for luxury seekers. In 2025, as demand remains steady and land remains limited, Mountain Village is expected to hold its place among the most exclusive and expensive markets in the Rockies.

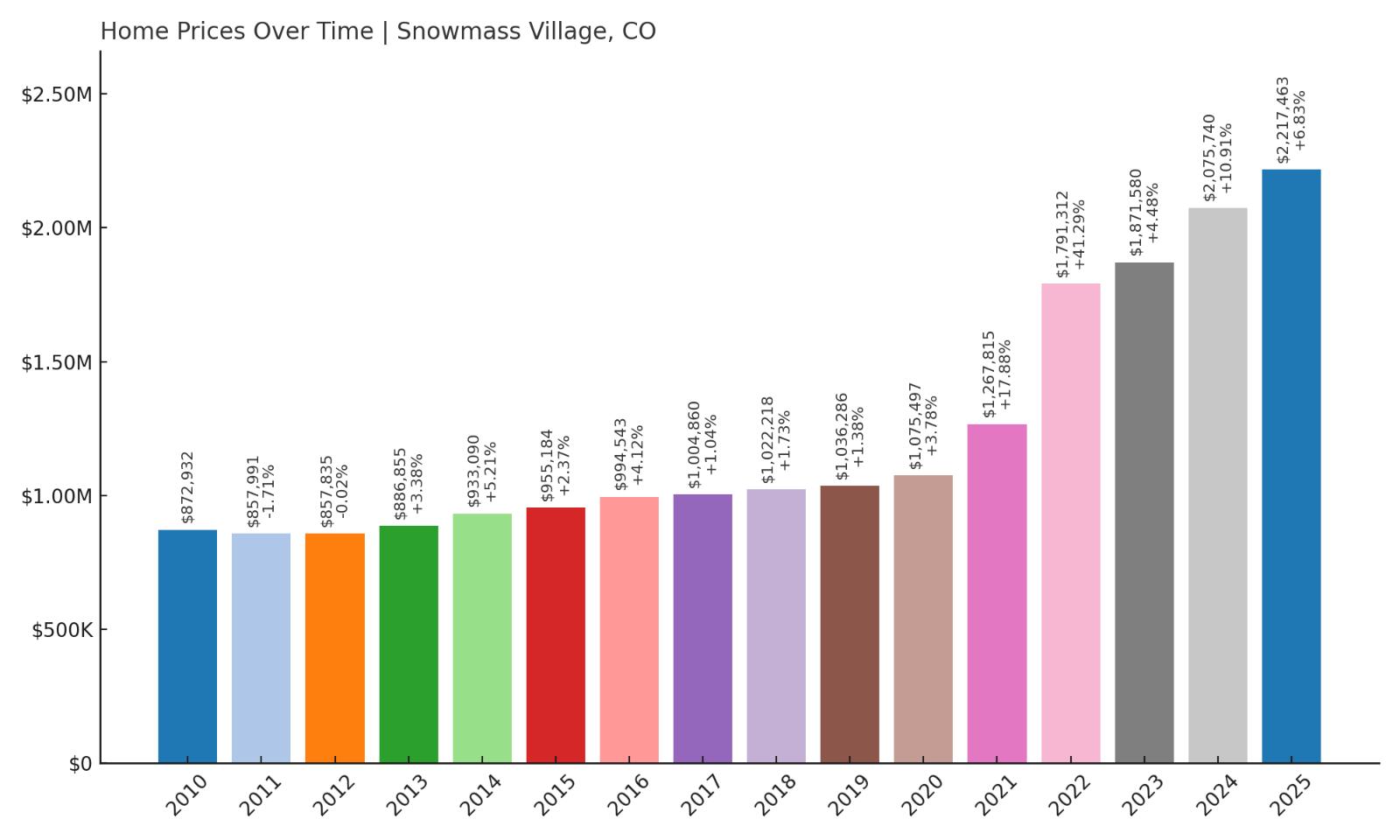

4. Snowmass Village – 159% Home Price Increase Since 2011

- 2010: $872,932

- 2011: $857,991 (-$14,941, -1.71% from previous year)

- 2012: $857,835 (-$156, -0.02% from previous year)

- 2013: $886,855 (+$29,019, +3.38% from previous year)

- 2014: $933,090 (+$46,235, +5.21% from previous year)

- 2015: $955,184 (+$22,094, +2.37% from previous year)

- 2016: $994,543 (+$39,359, +4.12% from previous year)

- 2017: $1,004,860 (+$10,317, +1.04% from previous year)

- 2018: $1,022,218 (+$17,357, +1.73% from previous year)

- 2019: $1,036,286 (+$14,068, +1.38% from previous year)

- 2020: $1,075,497 (+$39,212, +3.78% from previous year)

- 2021: $1,267,815 (+$192,318, +17.88% from previous year)

- 2022: $1,791,312 (+$523,497, +41.29% from previous year)

- 2023: $1,871,580 (+$80,268, +4.48% from previous year)

- 2024: $2,075,740 (+$204,160, +10.91% from previous year)

- 2025: $2,217,463 (+$141,723, +6.83% from previous year)

Since 2011, home values in Snowmass Village have increased by 159%, rising from $857,991 to a record $2,217,463 in 2025. For much of the 2010s, the town experienced modest single-digit growth year over year, building steadily on a strong base. But it wasn’t until the 2020s that appreciation turned aggressive, with 2021 and 2022 marking back-to-back breakout years. The $523,000 increase in 2022 alone pushed Snowmass firmly into Colorado’s luxury stratosphere. While many towns cooled off post-2022, Snowmass kept climbing, with gains in every year since. The steady rise through 2023, 2024, and 2025 signals more than just pandemic-era momentum—it points to a market driven by long-term desirability and constrained supply. Buyers continue to pursue Snowmass for its combination of slope-side access, resort amenities, and relative privacy. The town’s growth rate, while steep, has been remarkably stable, reinforcing its place among the state’s most expensive zip codes. For high-end buyers looking for appreciation and recreation, Snowmass delivers both in spades.

Snowmass Village – Ski-In, Ski-Out Living Just Minutes From Aspen

Snowmass Village, part of Pitkin County, is one of the most prestigious alpine communities in the country. While often overshadowed by Aspen’s global brand, Snowmass has quietly built its own luxury legacy, supported by the largest ski mountain in the Aspen-Snowmass complex. The town’s real estate is characterized by slope-side estates, luxury condominiums, and private residences tucked into aspen groves and pine forests. Residents enjoy unrivaled ski access, beautiful views of Mt. Daly, and a pace of life that’s slightly more relaxed than its neighboring town. Over the past decade, the village has invested heavily in infrastructure and public amenities, including a major redevelopment of its base area, upgraded lifts, and a vibrant events schedule. These improvements helped turn Snowmass into a year-round destination, drawing buyers who once considered it primarily seasonal. The surge in prices since 2020 reflects this evolution, with new luxury construction attracting a fresh wave of affluent buyers. As remote work solidified and high-income buyers looked for “live where you play” destinations, Snowmass became a top pick for those balancing lifestyle with long-term value. In 2025, home prices above $2.2 million are the new normal—and the town shows no signs of slowing.

3. Bow Mar – 174% Home Price Increase Since 2011

- 2010: $851,174

- 2011: $814,267 (-$36,906, -4.34% from previous year)

- 2012: $828,608 (+$14,341, +1.76% from previous year)

- 2013: $898,348 (+$69,740, +8.42% from previous year)

- 2014: $981,721 (+$83,373, +9.28% from previous year)

- 2015: $1,064,654 (+$82,933, +8.45% from previous year)

- 2016: $1,141,020 (+$76,366, +7.17% from previous year)

- 2017: $1,168,878 (+$27,858, +2.44% from previous year)

- 2018: $1,253,073 (+$84,195, +7.20% from previous year)

- 2019: $1,317,640 (+$64,567, +5.15% from previous year)

- 2020: $1,382,457 (+$64,817, +4.92% from previous year)

- 2021: $1,723,497 (+$341,041, +24.67% from previous year)

- 2022: $2,212,522 (+$489,025, +28.37% from previous year)

- 2023: $2,106,879 (-$105,643, -4.77% from previous year)

- 2024: $2,213,241 (+$106,362, +5.05% from previous year)

- 2025: $2,229,983 (+$16,742, +0.76% from previous year)

Bow Mar has posted an impressive 174% increase in home values since 2011, when prices stood at $814,267. The town’s growth has been remarkably consistent, marked by steady gains throughout the 2010s followed by explosive increases in 2021 and 2022. Those two years alone added more than $800,000 in home value. Although 2023 brought a modest dip, the market quickly corrected, with prices rising again in 2024 and 2025. As of May 2025, homes in Bow Mar are priced just above $2.2 million. The trajectory reflects long-term desirability, limited supply, and a strong reputation for exclusive, lakefront living. Bow Mar’s stability through market fluctuations is a testament to its consistent appeal among Denver’s wealthiest buyers. The past decade of appreciation has transformed it from a quiet luxury enclave into one of Colorado’s most valuable neighborhoods. Its price resilience continues to draw buyers seeking a low-turnover, high-prestige community.

Bow Mar – Lakefront Luxury Minutes From Downtown Denver

Bow Mar is one of the Denver metro area’s best-kept secrets, offering lakefront properties, sweeping mountain views, and an unparalleled sense of privacy. Located at the southwest edge of the city, this small, incorporated town blends rural character with high-end amenities. Homes in Bow Mar often sit on half-acre to one-acre lots, many backing directly onto Bow Mar Lake—one of the few private lakes in the region. This rare access to water recreation, combined with proximity to Denver and Littleton, has made the town increasingly attractive to high-net-worth families. The neighborhood is also part of the highly rated Littleton Public School district, adding another layer of appeal for long-term residents. Bow Mar’s architectural landscape is diverse, ranging from mid-century modern to newly built estates, giving it a distinct, eclectic charm. With strict zoning and minimal commercial development, the town maintains a quiet and secluded feel that appeals to those seeking a retreat from urban life. The sharp gains in home prices since 2020 underscore the area’s growing reputation as a peaceful, prestige-driven alternative to more bustling suburbs. In 2025, Bow Mar is no longer a hidden gem—it’s a full-fledged luxury market commanding seven-figure prices and steady demand.

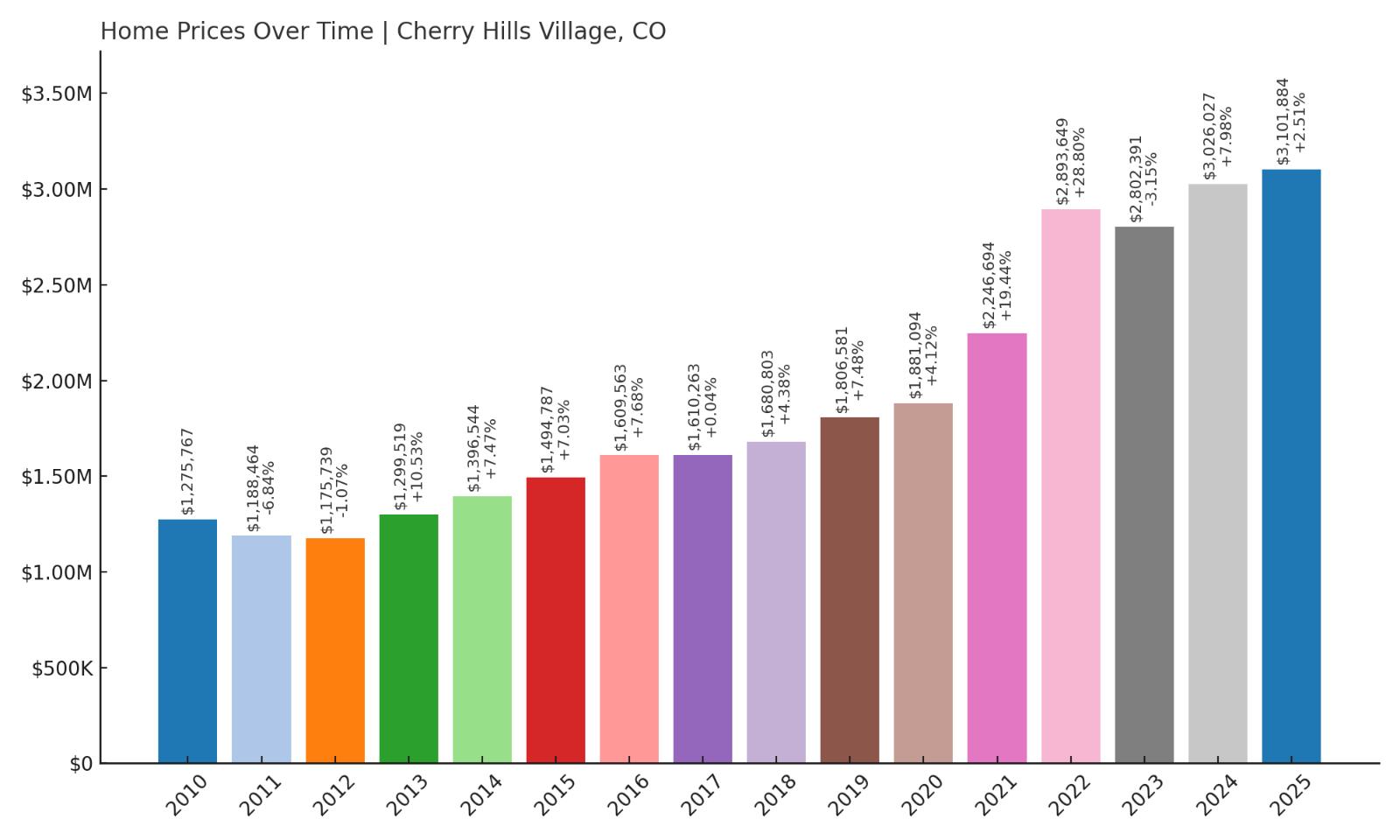

2. Cherry Hills Village – 161% Home Price Increase Since 2011

- 2010: $1,275,767

- 2011: $1,188,464 (-$87,303, -6.84% from previous year)

- 2012: $1,175,739 (-$12,725, -1.07% from previous year)

- 2013: $1,299,519 (+$123,780, +10.53% from previous year)

- 2014: $1,396,544 (+$97,025, +7.47% from previous year)

- 2015: $1,494,787 (+$98,243, +7.03% from previous year)

- 2016: $1,609,563 (+$114,775, +7.68% from previous year)

- 2017: $1,610,263 (+$701, +0.04% from previous year)

- 2018: $1,680,803 (+$70,540, +4.38% from previous year)

- 2019: $1,806,581 (+$125,777, +7.48% from previous year)

- 2020: $1,881,094 (+$74,514, +4.12% from previous year)

- 2021: $2,246,694 (+$365,600, +19.44% from previous year)

- 2022: $2,893,649 (+$646,955, +28.80% from previous year)

- 2023: $2,802,391 (-$91,258, -3.15% from previous year)

- 2024: $3,026,027 (+$223,636, +7.98% from previous year)

- 2025: $3,101,884 (+$75,857, +2.51% from previous year)

Cherry Hills Village has seen a 161% increase in home values since 2011, when prices dipped to $1,188,464. Over the past 14 years, values have more than doubled, with massive gains during the 2020–2022 boom period. In 2022 alone, prices jumped by nearly $650,000—a reflection of the market’s unique appeal to Colorado’s wealthiest homebuyers. Even after a small correction in 2023, the town bounced back with two years of steady appreciation, bringing the median home value to $3,101,884 in 2025. The long arc of growth in Cherry Hills Village is tied to its reputation for exclusivity, estate-style living, and proximity to Denver’s top private schools and country clubs. Despite economic headwinds and regional price volatility, the town’s trajectory remains solidly upward. Few other places in the state command the same prestige—or the same price points. This is a long-established luxury market where demand rarely falters and turnover is low.

Cherry Hills Village – Colorado’s Ultimate Prestige Zip Code

Cherry Hills Village is synonymous with old-money elegance, grand estates, and one of the highest concentrations of wealth in the Rocky Mountain region. Situated just south of Denver, this quiet, residential enclave is home to business executives, professional athletes, and politicians who value space, privacy, and stature. The town’s zoning regulations and large minimum lot sizes preserve a park-like atmosphere, with many properties spanning multiple acres. Gated drives, horse stables, and tennis courts are common features. It’s also home to the Cherry Hills Country Club, one of the most prestigious golf courses west of the Mississippi. The town lacks commercial development, which enhances its sense of seclusion while placing shopping, dining, and schools just a short drive away in nearby Greenwood Village or Denver. Cherry Hills is particularly attractive to families due to its access to both elite private institutions and top-performing public schools. The pandemic-era price surge reinforced its status as a safe haven for wealth, with buyers eager to trade downtown condos for expansive homes on tree-lined streets. In 2025, with home values above $3.1 million, Cherry Hills Village continues to be the gold standard for residential luxury in Colorado.

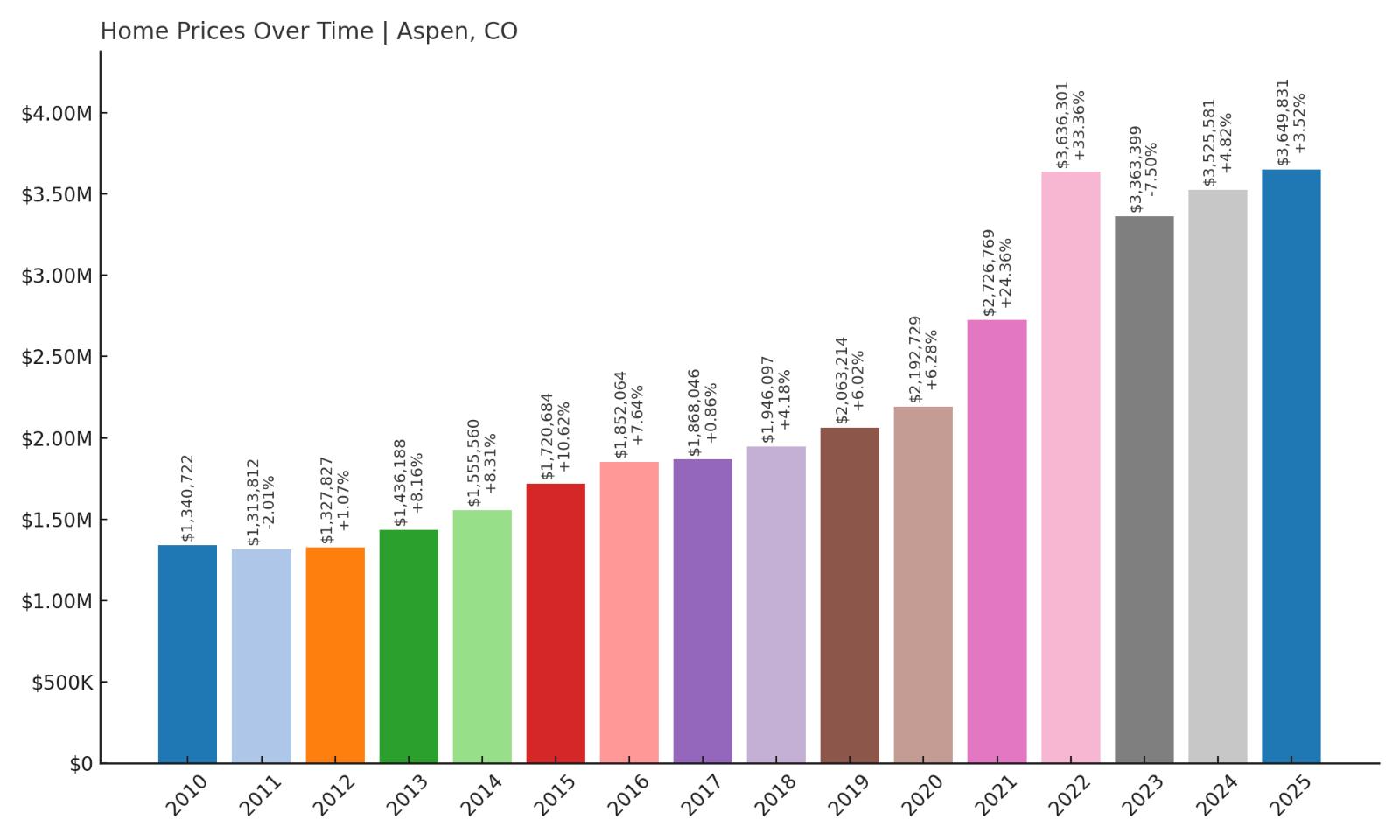

1. Aspen – 177% Home Price Increase Since 2011

- 2010: $1,340,722

- 2011: $1,313,812 (-$26,910, -2.01% from previous year)

- 2012: $1,327,827 (+$14,016, +1.07% from previous year)

- 2013: $1,436,188 (+$108,361, +8.16% from previous year)

- 2014: $1,555,560 (+$119,372, +8.31% from previous year)

- 2015: $1,720,684 (+$165,125, +10.62% from previous year)

- 2016: $1,852,064 (+$131,380, +7.64% from previous year)

- 2017: $1,868,046 (+$15,982, +0.86% from previous year)

- 2018: $1,946,097 (+$78,050, +4.18% from previous year)

- 2019: $2,063,214 (+$117,117, +6.02% from previous year)

- 2020: $2,192,729 (+$129,515, +6.28% from previous year)

- 2021: $2,726,769 (+$534,040, +24.36% from previous year)

- 2022: $3,636,301 (+$909,533, +33.36% from previous year)

- 2023: $3,363,399 (-$272,902, -7.50% from previous year)

- 2024: $3,525,581 (+$162,182, +4.82% from previous year)

- 2025: $3,649,831 (+$124,250, +3.52% from previous year)

Aspen tops the list with a 177% increase in home prices since 2011. After a decade of steady, multi-hundred-thousand-dollar annual increases, values skyrocketed in 2021 and 2022—climbing from $2.1 million to over $3.6 million. Even with a brief drop in 2023, the town’s prestige and ultra-luxury draw quickly pulled prices back upward. As of May 2025, Aspen’s median home value stands at $3,649,831, far surpassing every other town in the state. No other market in Colorado combines Aspen’s global cachet, limited buildable land, and nonstop demand from ultra-wealthy buyers. Over the past decade, Aspen has transformed from an elite ski town to a global destination for billionaires and celebrities. The town’s market is no longer just top-tier—it’s in a category of its own.

Aspen – Global Luxury Capital of the Rockies

Aspen has evolved from a mining town into one of the most luxurious and exclusive real estate markets in the world. Located in Pitkin County, it offers unmatched skiing, world-renowned cultural events, and breathtaking alpine beauty. But it’s not just about winter—Aspen thrives year-round, with summer festivals, outdoor concerts, and luxury shopping rivaling that of Beverly Hills or Manhattan. Real estate here is driven by scarcity and prestige. With strict zoning rules, limited space to build, and an international buyer pool, prices continue to climb. Homes often feature bespoke architecture, designer interiors, and panoramic views of the Elk Mountains. In Aspen, amenities like heated driveways, wine cellars, and private gyms are standard, not exceptional. Buyers range from tech billionaires and hedge fund managers to royalty and A-list celebrities. In 2025, Aspen represents more than just luxury—it’s a symbol of status, investment confidence, and timeless appeal. It is, without question, the crown jewel of Colorado’s high-end real estate market.