Would you like to save this?

Zillow’s Home Value Index highlights 18 Iowa towns where home prices remain surprisingly low in 2025—well below both state and national averages. These aren’t just affordable—they’re often overlooked, under-the-radar places where buyers can still find space, stability, and serious value. From quiet farm towns to rural hubs with room to grow, these communities offer a rare chance to buy without overpaying. We’ve ranked them by current home values and included key trends, local context, and price shifts over time.

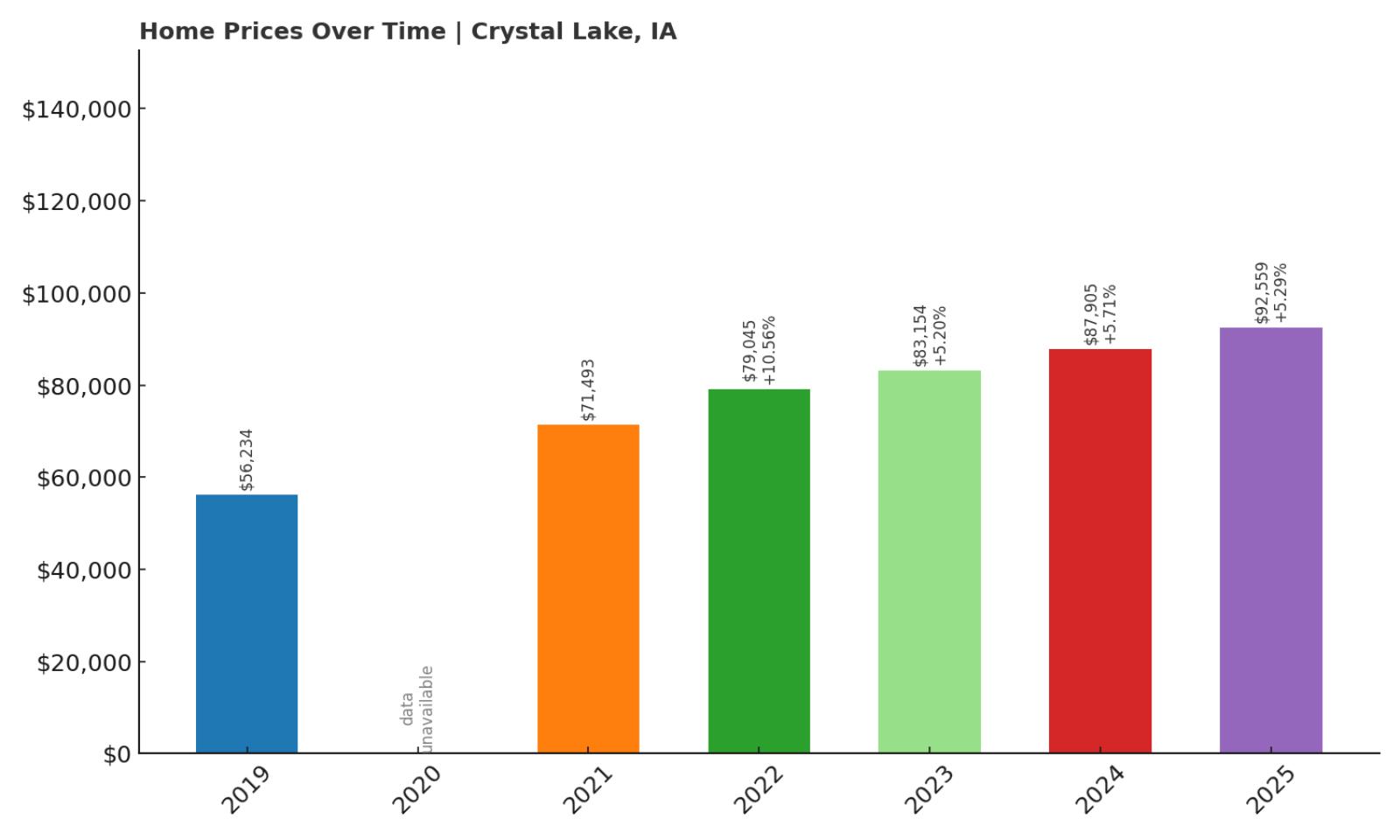

18. Crystal Lake – 65% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $56,234

- 2020: N/A

- 2021: $71,493

- 2022: $79,045 (+$7,551, +10.56% from previous year)

- 2023: $83,154 (+$4,110, +5.20% from previous year)

- 2024: $87,905 (+$4,750, +5.71% from previous year)

- 2025: $92,559 (+$4,654, +5.29% from previous year)

Crystal Lake has seen a steady rise in home prices since 2019, jumping more than 65% over six years. While the pace of growth has been moderate each year, the trend points clearly upward. It remains one of Iowa’s most affordable housing markets, with a 2025 median value under $93,000—far below statewide and national averages.

Crystal Lake – Quiet, Rural Living With Steady Value Growth

Nestled in Hancock County near Iowa’s northern border, Crystal Lake is a small rural town known for its peaceful setting and namesake lake. The town’s low home prices reflect its compact size and limited housing turnover. Despite this, prices have increased steadily since 2019, likely due to the town’s appeal to retirees and remote workers seeking calm, affordable places. Services are modest, but Mason City is only about 30 miles away for bigger needs. With housing costs still low, Crystal Lake offers an accessible entry point for those priced out of larger markets.

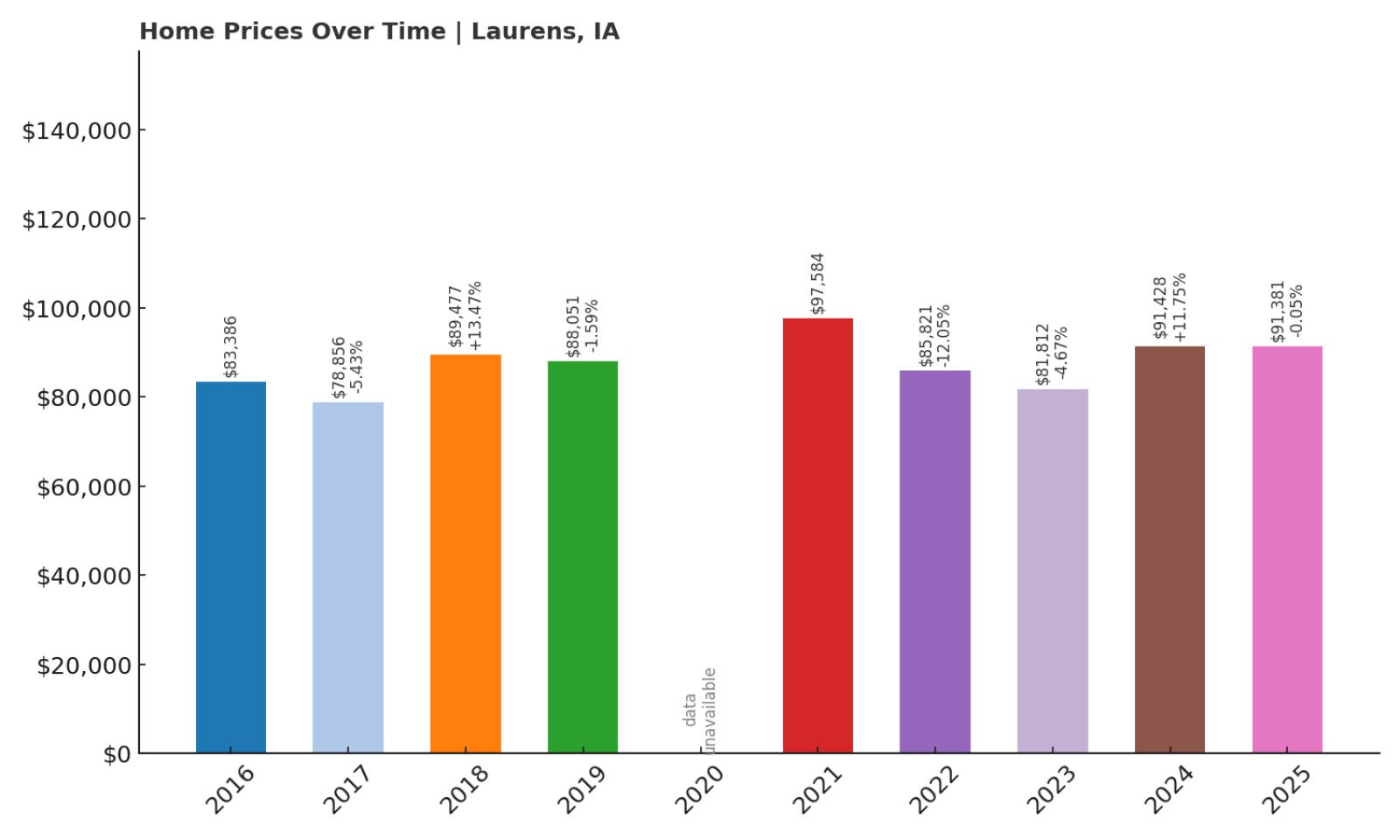

17. Laurens – 10% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $83,386

- 2017: $78,856 (-$4,530, -5.43% from previous year)

- 2018: $89,477 (+$10,621, +13.47% from previous year)

- 2019: $88,051 (-$1,427, -1.59% from previous year)

- 2020: N/A

- 2021: $97,584

- 2022: $85,821 (-$11,763, -12.05% from previous year)

- 2023: $81,812 (-$4,009, -4.67% from previous year)

- 2024: $91,428 (+$9,616, +11.75% from previous year)

- 2025: $91,381 (-$47, -0.05% from previous year)

Despite price dips in several years, Laurens shows an overall 10% increase in home values since 2016. With its current median home value around $91,000, it remains an affordable market in Iowa. The volatility in prices suggests fluctuating demand and possibly limited inventory.

Laurens – A Small Town With Bumps in the Road

Located in Pocahontas County, Laurens is a traditional Midwestern town with historic homes and a small-town atmosphere. The community is quiet, with a population under 1,000 and basic amenities that meet everyday needs. Price trends here show a somewhat erratic pattern, possibly due to occasional spikes in local interest or larger property sales that influence averages. Even with that volatility, home values have ultimately trended upward. Laurens could appeal to buyers looking for charm and affordability in a rural setting, especially with Iowa’s larger towns within commuting distance.

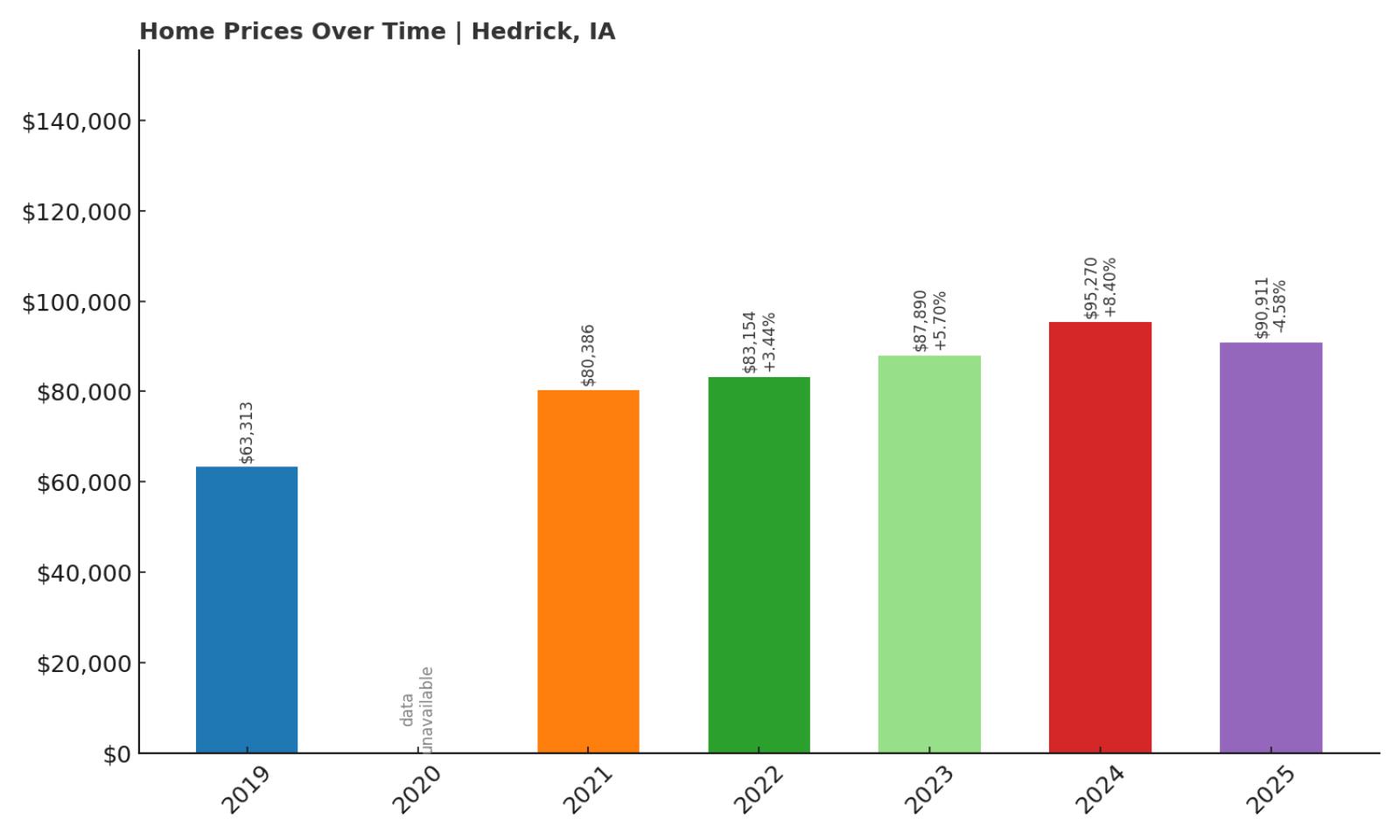

16. Hedrick – 44% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $63,313

- 2020: N/A

- 2021: $80,386

- 2022: $83,154 (+$2,769, +3.44% from previous year)

- 2023: $87,890 (+$4,736, +5.70% from previous year)

- 2024: $95,270 (+$7,379, +8.40% from previous year)

- 2025: $90,911 (-$4,359, -4.58% from previous year)

Hedrick’s prices have climbed nearly 44% since 2019, with only a small dip in 2025. Growth has been especially strong between 2021 and 2024. At under $91,000, homes here remain very affordable despite recent upward pressure.

Hedrick – Rising Values in Southeast Iowa

Hedrick sits in Keokuk County in southeastern Iowa, not far from Ottumwa. The area has a strong agricultural base and a tight-knit community feel. With home prices below $100K and increasing, Hedrick has become an increasingly interesting choice for value-conscious buyers. Its price uptick likely reflects wider regional demand and a relatively small housing stock. Nearby amenities in larger towns offer convenience while keeping Hedrick rural and peaceful. The market here could appeal to buyers seeking quiet country living with modest but positive price growth.

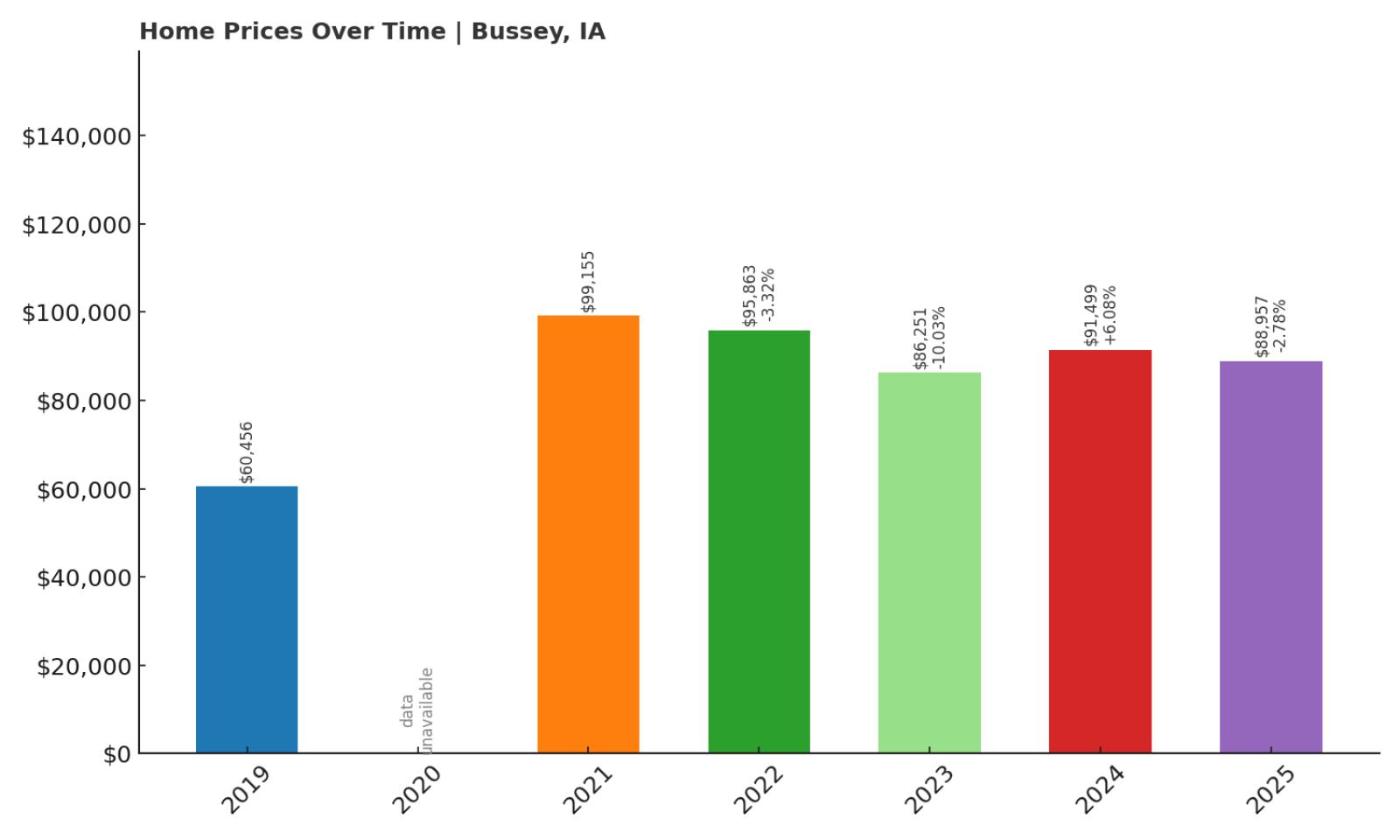

15. Bussey – 47% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $60,456

- 2020: N/A

- 2021: $99,155

- 2022: $95,863 (-$3,293, -3.32% from previous year)

- 2023: $86,251 (-$9,612, -10.03% from previous year)

- 2024: $91,499 (+$5,248, +6.08% from previous year)

- 2025: $88,957 (-$2,542, -2.78% from previous year)

Home prices in Bussey have risen by 47% since 2019, though they’ve cooled slightly in the last couple of years. The 2021 peak appears to have been a local high, with recent declines bringing values down to around $89,000.

Bussey – Affordable Living With Recent Fluctuations

Bussey is located in Marion County and offers access to both Knoxville and Pella, two larger towns in central Iowa. Despite a strong rise in home values up to 2021, the local market has softened a bit. Price dips in 2022 and 2023 could signal cooling demand or economic shifts. Still, the long-term trend is upward, and prices remain accessible by almost any standard. The town itself is small, with a welcoming community and easy access to outdoor recreation. It may appeal to buyers looking to settle quietly while staying within reach of larger services and jobs.

14. Dow City – 71% Home Price Increase Since 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $51,033

- 2020: N/A

- 2021: $61,272

- 2022: $66,024 (+$4,751, +7.75% from previous year)

- 2023: $72,869 (+$6,846, +10.37% from previous year)

- 2024: $79,965 (+$7,096, +9.74% from previous year)

- 2025: $87,375 (+$7,410, +9.27% from previous year)

Dow City’s home prices have surged over 70% since 2019. Growth has been strong and consistent, with annual increases between 7% and 10% since 2021. Median prices are still under $90,000, making it a budget-friendly option with upside.

Dow City – Strong Demand in Western Iowa

Found in Crawford County in western Iowa, Dow City is a small rural town with just a few hundred residents. Despite its size, the housing market here has performed impressively since 2019. A possible reason is the affordability paired with stable demand from locals or newcomers seeking quieter alternatives to larger cities. Its price trajectory is among the steepest on this list. That upward pressure could continue as urban overflow and remote work trends make places like Dow City more attractive. It’s one to watch for investors and first-time buyers alike.

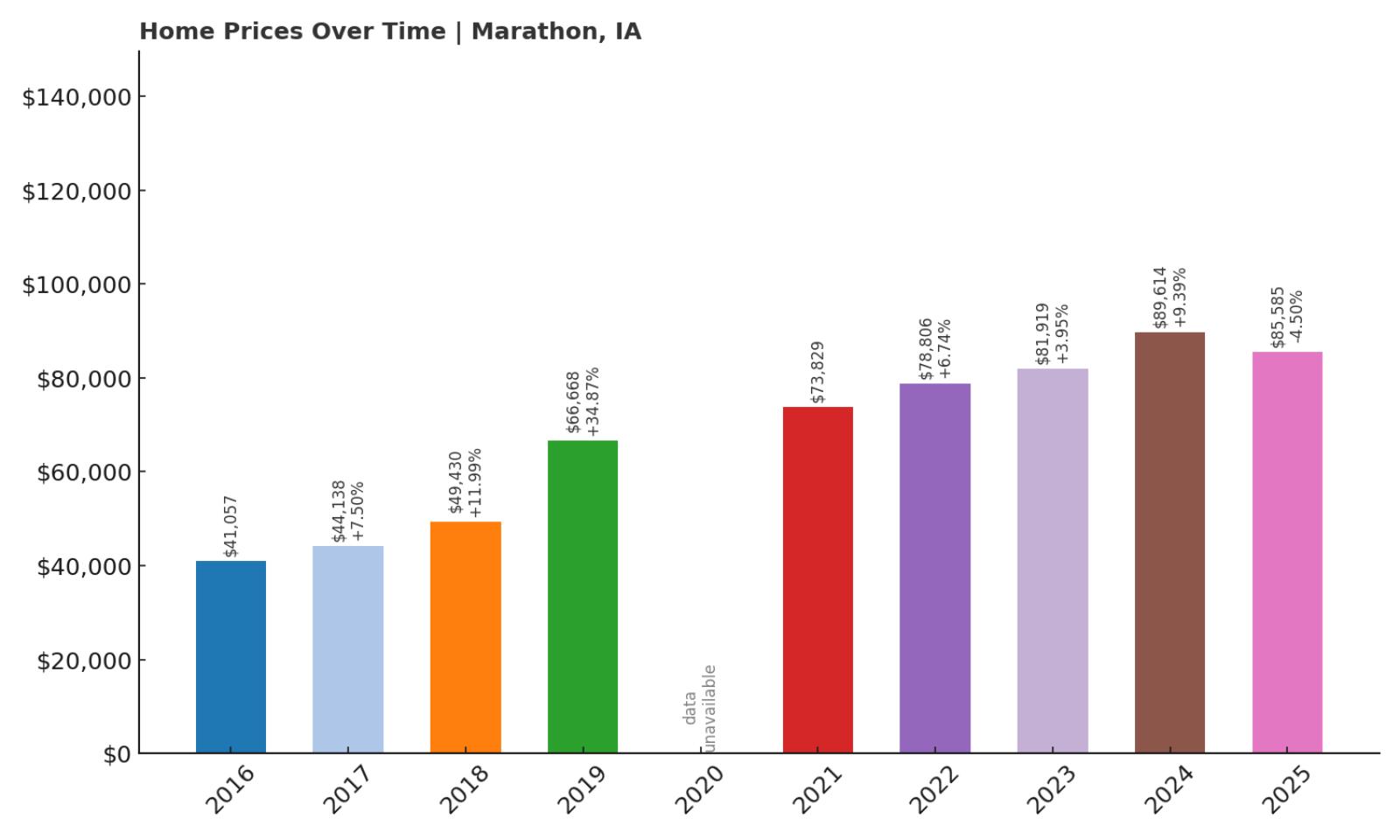

13. Marathon – 108% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $41,057

- 2017: $44,138 (+$3,081, +7.50% from previous year)

- 2018: $49,430 (+$5,292, +11.99% from previous year)

- 2019: $66,668 (+$17,237, +34.87% from previous year)

- 2020: N/A

- 2021: $73,829

- 2022: $78,806 (+$4,976, +6.74% from previous year)

- 2023: $81,919 (+$3,113, +3.95% from previous year)

- 2024: $89,614 (+$7,695, +9.39% from previous year)

- 2025: $85,585 (-$4,029, -4.50% from previous year)

Marathon has experienced one of the most dramatic increases on this list, with home values more than doubling since 2016. While 2025 saw a modest correction, prices remain far above earlier years, signaling long-term appreciation. From $41,000 in 2016 to over $85,000 in 2025, the growth is both significant and steady. In particular, the period between 2018 and 2024 saw a strong upward trend. A combination of limited inventory and rising interest may be fueling these gains. This town remains one of the most affordable markets in Iowa despite its steep climb. The recent dip could present an entry point for budget-conscious buyers. Overall, Marathon offers impressive long-term value growth for its price point.

Marathon – Big Growth in a Tiny Community

Located in Buena Vista County in northwest Iowa, Marathon is a town of fewer than 300 people. Its small size hasn’t prevented home values from rising steeply in recent years, likely due to a combination of low supply and periodic market attention. There are limited commercial amenities, but nearby Storm Lake offers schools, healthcare, and retail within a 20-minute drive. The town’s quiet charm and affordability may appeal to retirees or remote workers seeking seclusion. Marathon’s sharp price increases suggest rising interest, though it remains well below state averages. The recent price drop in 2025 could be a short-term fluctuation rather than a long-term trend reversal. Given its size, even a few home sales can noticeably shift averages. Still, the multi-year growth pattern points to solid underlying demand in this tiny town.

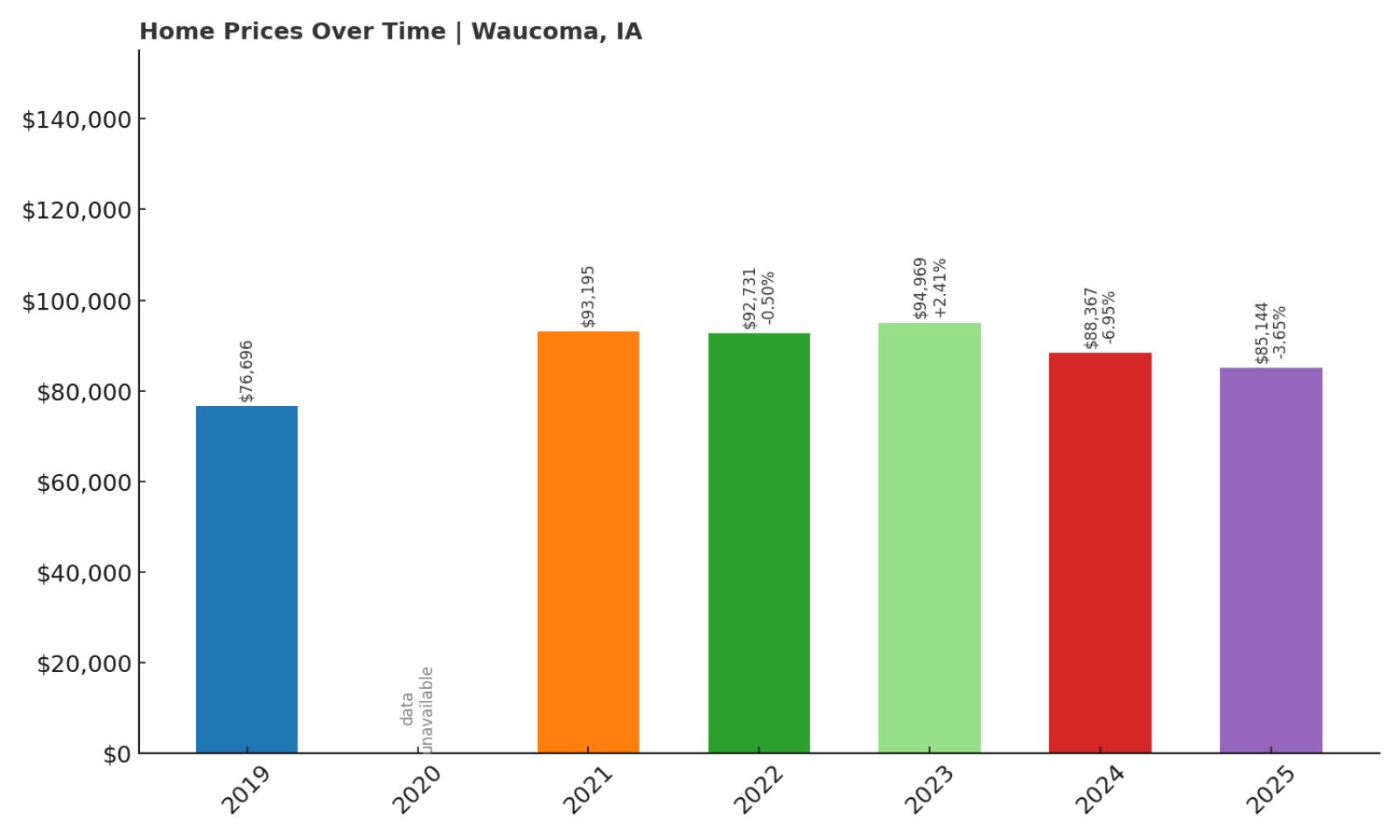

12. Waucoma – 11% Home Price Increase Since 2019

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $76,696

- 2020: N/A

- 2021: $93,195

- 2022: $92,731 (-$464, -0.50% from previous year)

- 2023: $94,969 (+$2,238, +2.41% from previous year)

- 2024: $88,367 (-$6,601, -6.95% from previous year)

- 2025: $85,144 (-$3,223, -3.65% from previous year)

Waucoma’s home values have moved up modestly since 2019, with a total increase of around 11% over the six-year period. However, the market has experienced recent declines, with values dipping in both 2024 and 2025. From a high of over $94,000, the 2025 median has fallen to about $85,000. That said, the overall price point remains attractive for budget-conscious buyers. The small swings suggest market fluctuations more than long-term decline. Home values remain higher than they were in the late 2010s. Buyers may find opportunity in these lower recent figures. With values still well under six figures, Waucoma holds potential as a low-cost investment.

Waucoma – Stable Prices and Small-Town Appeal

Waucoma lies in Fayette County in northeastern Iowa and is home to just a few hundred residents. The town is quiet, with a traditional rural setup and easy access to nearby West Union and Decorah. Prices here saw a strong bump in the early 2020s before softening slightly. That trajectory could be linked to broader state and national market trends, rather than local decline. Services are basic but cover essentials, and larger towns are within easy reach for commuting. The area is primarily residential and agricultural, contributing to its affordability. For buyers seeking low prices without a big city nearby, Waucoma fits the bill. The recent drop may be temporary and could present a good entry point into an otherwise stable market.

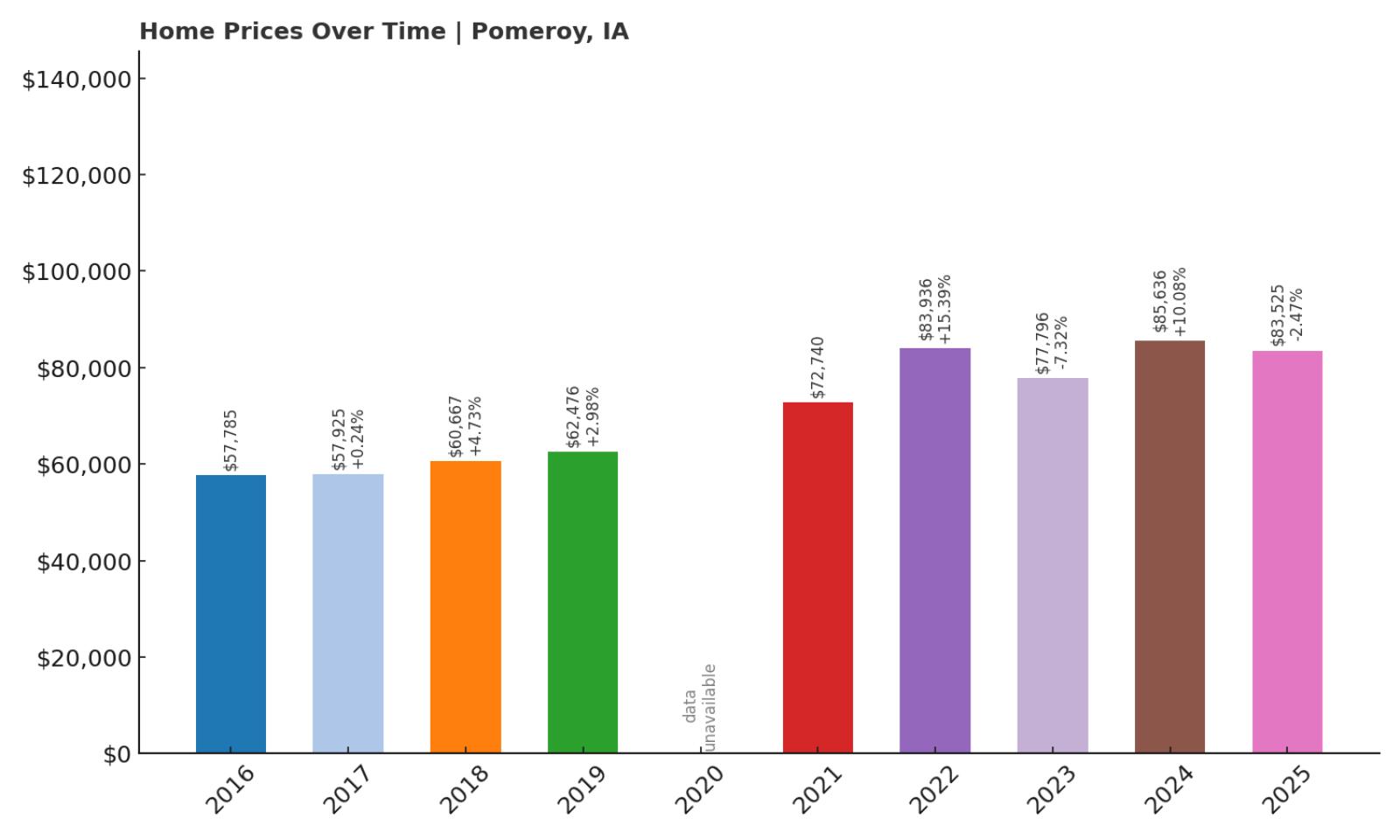

11. Pomeroy – 45% Home Price Increase Since 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $57,785

- 2017: $57,925 (+$141, +0.24% from previous year)

- 2018: $60,667 (+$2,742, +4.73% from previous year)

- 2019: $62,476 (+$1,809, +2.98% from previous year)

- 2020: N/A

- 2021: $72,740

- 2022: $83,936 (+$11,196, +15.39% from previous year)

- 2023: $77,796 (-$6,141, -7.32% from previous year)

- 2024: $85,636 (+$7,840, +10.08% from previous year)

- 2025: $83,525 (-$2,111, -2.46% from previous year)

Over the long term, Pomeroy’s home values have risen 45% since 2016. That includes both strong gains and a couple of pullbacks in 2023 and 2025. The biggest year-over-year jump came in 2022, with a 15% increase. Even with minor declines, the overall upward movement is clear. The town’s current median sits in the low $80,000s, keeping it firmly in affordable territory. This price volatility may reflect the small size of the local housing market. Still, prices today are substantially higher than a decade ago. That pattern suggests long-term value with periodic dips.

Pomeroy – Long-Term Growth With Minor Fluctuations

Pomeroy is located in Calhoun County in north-central Iowa. It’s a quiet town surrounded by farmland, with easy access to Highway 4. The local economy is modest, but stable, centered around agriculture and small businesses. The home price data shows that even small towns can have significant long-term gains. While prices have bounced slightly in recent years, the overall trend is positive. This suggests that local demand, while limited, has been consistent enough to push values higher. Pomeroy is a place where budget-friendly housing still exists, even with double-digit gains over the past decade. For buyers willing to ride short-term price changes, it may offer strong long-term potential.

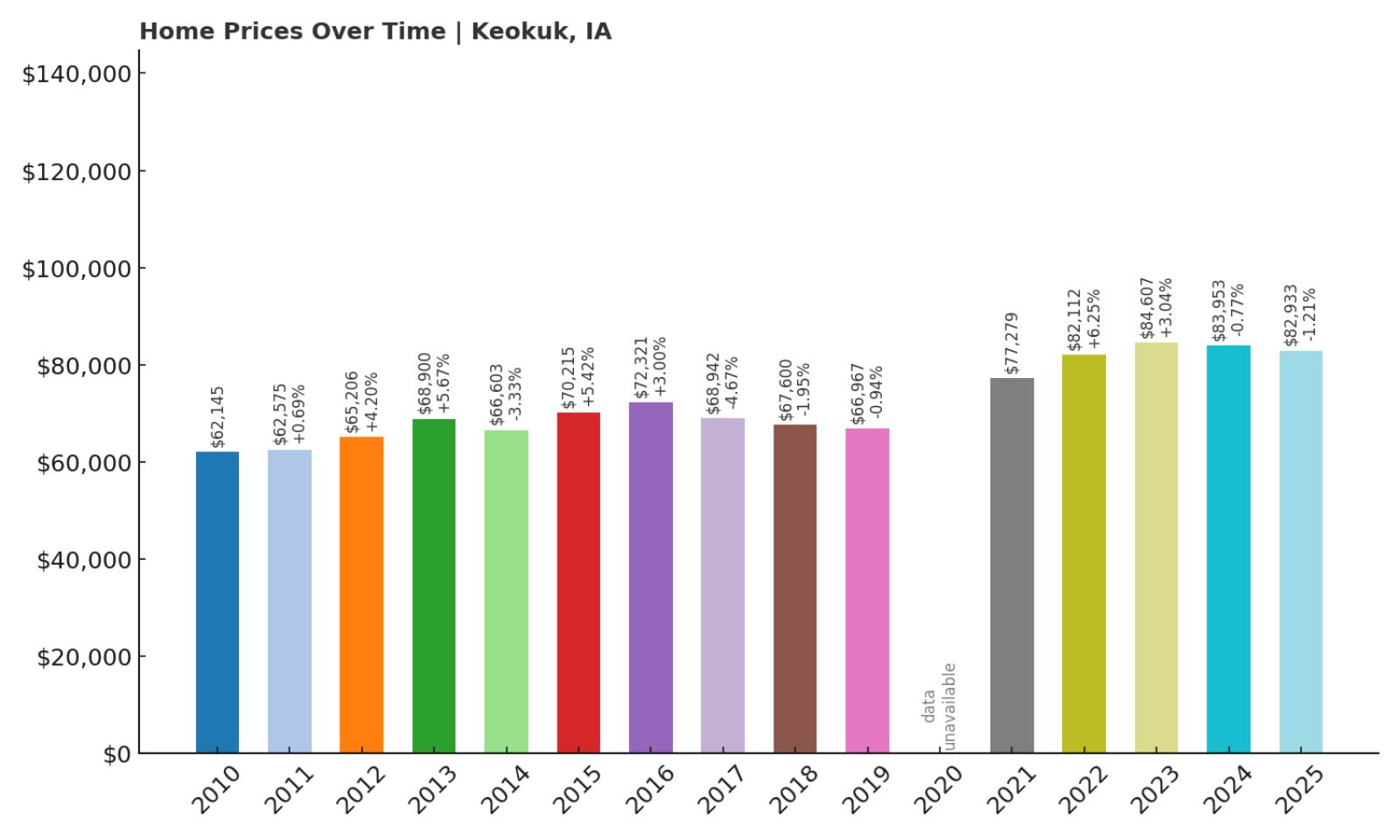

10. Keokuk – 33% Home Price Increase Since 2010

- 2010: $62,145

- 2011: $62,575 (+$431, +0.69% from previous year)

- 2012: $65,206 (+$2,631, +4.20% from previous year)

- 2013: $68,900 (+$3,694, +5.67% from previous year)

- 2014: $66,603 (-$2,297, -3.33% from previous year)

- 2015: $70,215 (+$3,612, +5.42% from previous year)

- 2016: $72,321 (+$2,106, +3.00% from previous year)

- 2017: $68,942 (-$3,379, -4.67% from previous year)

- 2018: $67,600 (-$1,342, -1.95% from previous year)

- 2019: $66,967 (-$633, -0.94% from previous year)

- 2020: N/A

- 2021: $77,279

- 2022: $82,112 (+$4,832, +6.25% from previous year)

- 2023: $84,607 (+$2,496, +3.04% from previous year)

- 2024: $83,953 (-$654, -0.77% from previous year)

- 2025: $82,933 (-$1,021, -1.22% from previous year)

Keokuk has seen a gradual but steady increase in home values since 2010, totaling a 33% rise over 15 years. Most of the growth occurred after 2020, with noticeable momentum in 2021 and 2022. That said, the last two years have brought minor decreases. Still, the 2025 median sits just under $83,000, far below the national average. The market shows signs of stability with mild fluctuations rather than sharp spikes or drops. That makes Keokuk a potentially dependable choice for long-term buyers. With consistent appreciation over the years, it has remained one of Iowa’s budget-friendly urban markets. The blend of affordability and steady growth gives it a strong position on this list.

Keokuk – Consistent Growth in a Historic Mississippi River Town

Keokuk is located at the southeastern tip of Iowa, right along the Mississippi River. It’s one of the larger towns in this roundup, offering more amenities, schools, and healthcare services than smaller rural communities. The town has a rich historical background, including Civil War-era sites and classic architecture. Its larger population helps create a more stable housing market with less volatility. The steady price increases since 2010 reflect a town that evolves slowly but consistently. Minor downturns haven’t undone years of growth. Keokuk offers a rare blend of affordability and city-like conveniences. That combination makes it a practical option for homebuyers who want value without giving up essential services.

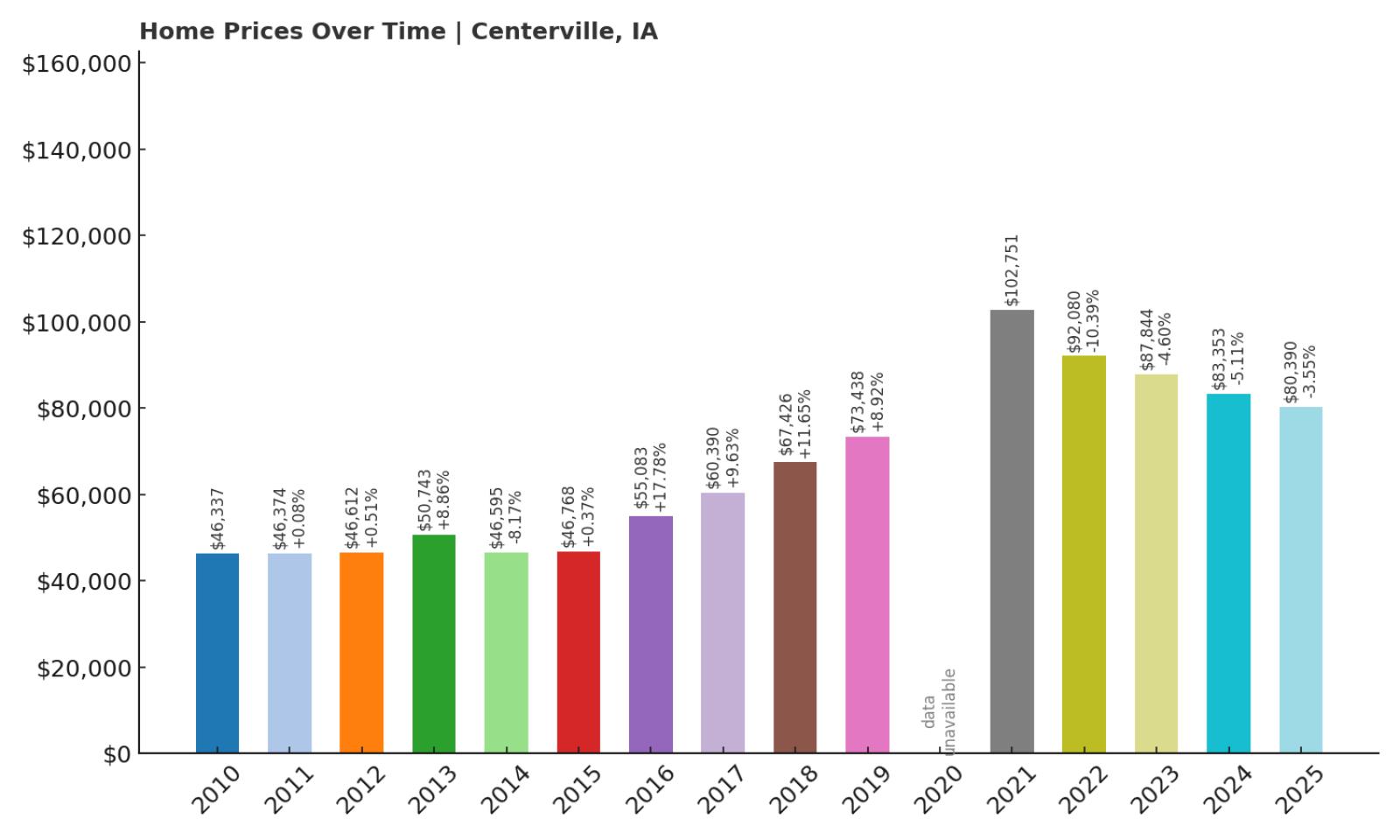

9. Centerville – 73% Home Price Increase Since 2010

- 2010: $46,337

- 2011: $46,374 (+$37, +0.08% from previous year)

- 2012: $46,612 (+$238, +0.51% from previous year)

- 2013: $50,743 (+$4,131, +8.86% from previous year)

- 2014: $46,595 (-$4,148, -8.18% from previous year)

- 2015: $46,768 (+$173, +0.37% from previous year)

- 2016: $55,083 (+$8,315, +17.78% from previous year)

- 2017: $60,390 (+$5,307, +9.63% from previous year)

- 2018: $67,426 (+$7,036, +11.65% from previous year)

- 2019: $73,438 (+$6,013, +8.92% from previous year)

- 2020: N/A

- 2021: $102,751

- 2022: $92,080 (-$10,671, -10.38% from previous year)

- 2023: $87,844 (-$4,237, -4.60% from previous year)

- 2024: $83,353 (-$4,490, -5.11% from previous year)

- 2025: $80,390 (-$2,963, -3.55% from previous year)

Centerville has posted a strong 73% increase in home values since 2010, rising from just over $46,000 to more than $80,000 in 2025. The biggest gains occurred between 2016 and 2021, with the market peaking at over $100,000. Since then, prices have cooled off gradually, but the current median still reflects long-term appreciation. This downturn in recent years may offer an opportunity for buyers to enter the market at a more favorable price. Even with the recent pullback, Centerville’s pricing remains well below national averages. The overall trend shows that the town has experienced solid growth over the last decade. It stands out as one of the more dynamic markets among Iowa’s most affordable towns. Its current affordability and growth history make it a compelling option.

Centerville – Decade of Growth with a Recent Price Dip

Centerville is the county seat of Appanoose County in southern Iowa, not far from the Missouri border. It’s a historic town with a beautiful town square, a variety of restaurants, and several local festivals. The housing market benefited from strong gains throughout the 2010s and early 2020s, peaking in 2021. While prices have since dropped, the correction is relatively modest when compared to the town’s long-term growth. Its amenities make it more attractive than many other towns on this list, which may have helped fuel earlier price increases. Nearby Rathbun Lake also draws seasonal interest, which can influence the market. Centerville remains affordable and offers a more urban experience in a small-town setting. It’s a smart pick for buyers looking for livability with investment upside.

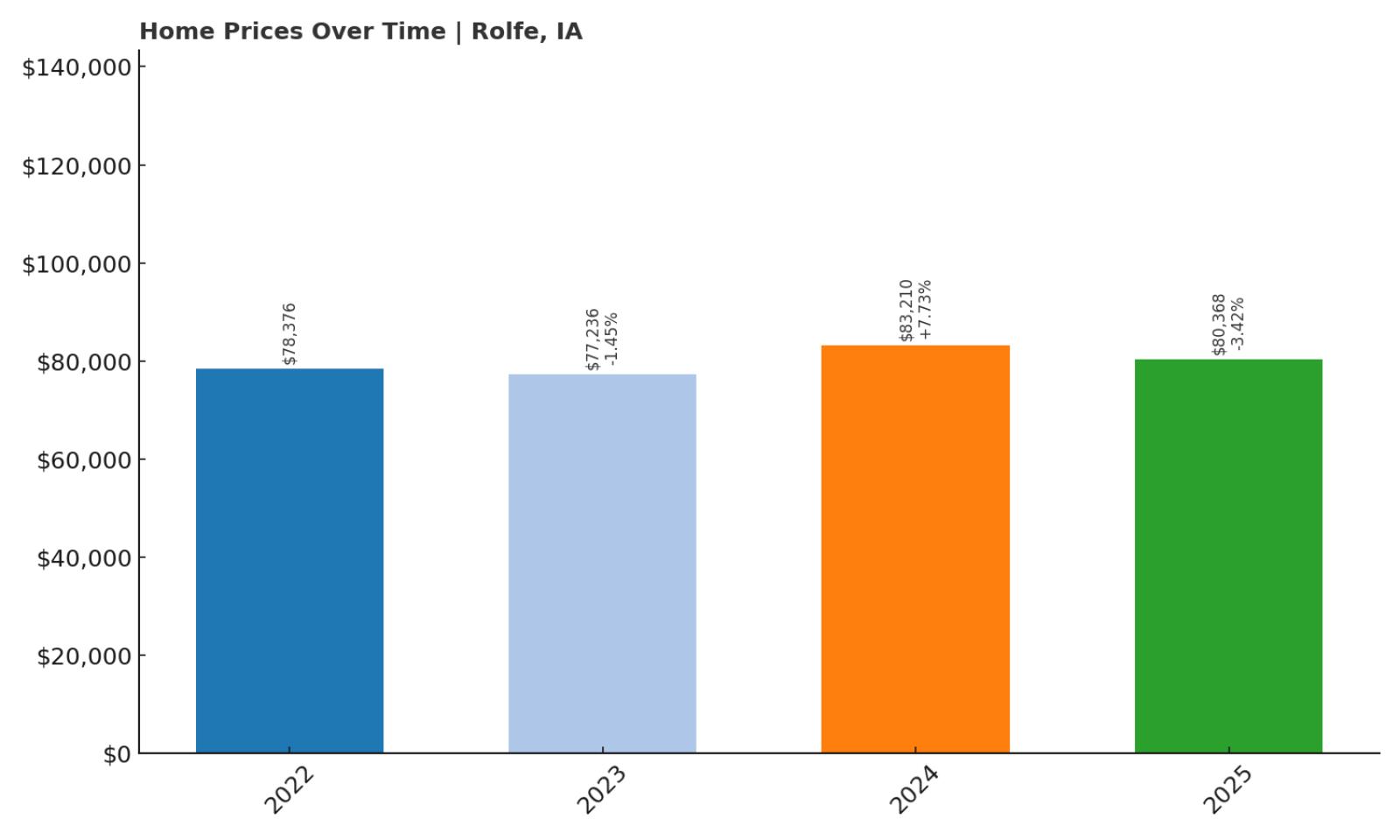

8. Rolfe – 3% Home Price Increase Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $78,376

- 2023: $77,236 (-$1,140, -1.45% from previous year)

- 2024: $83,210 (+$5,974, +7.74% from previous year)

- 2025: $80,368 (-$2,842, -3.42% from previous year)

Rolfe’s home prices have increased just 3% since 2022, with moderate fluctuations in the past three years. After a small decline in 2023, the market rebounded in 2024 before dipping again in 2025. These price changes are minor in the context of affordability, with values still holding near $80,000. The market here appears to be stabilizing after a short burst of growth. Despite limited historical data, the trend is upward overall. It’s one of the more affordable towns on this list with fairly recent market activity. The mild price swings could be tied to the small size and limited sales volume. Buyers who value affordability over sharp appreciation may find Rolfe a low-risk choice.

Rolfe – A Quiet Market with Modest Upside

Rolfe is located in Pocahontas County in northwest Iowa, surrounded by farmland and open skies. It’s a small community with a modest commercial presence, where life moves at a slower pace. The town’s housing market is minimal in size, so even a few transactions can shift averages. This explains the relatively mild year-over-year changes in value. Still, the current median price around $80,000 remains very competitive. For buyers looking to avoid volatile markets, Rolfe offers a calm environment with steady pricing. Its location allows for peaceful rural living while still being within reach of larger hubs like Fort Dodge. While not a major growth story, it stands out for consistent affordability and a grounded local economy.

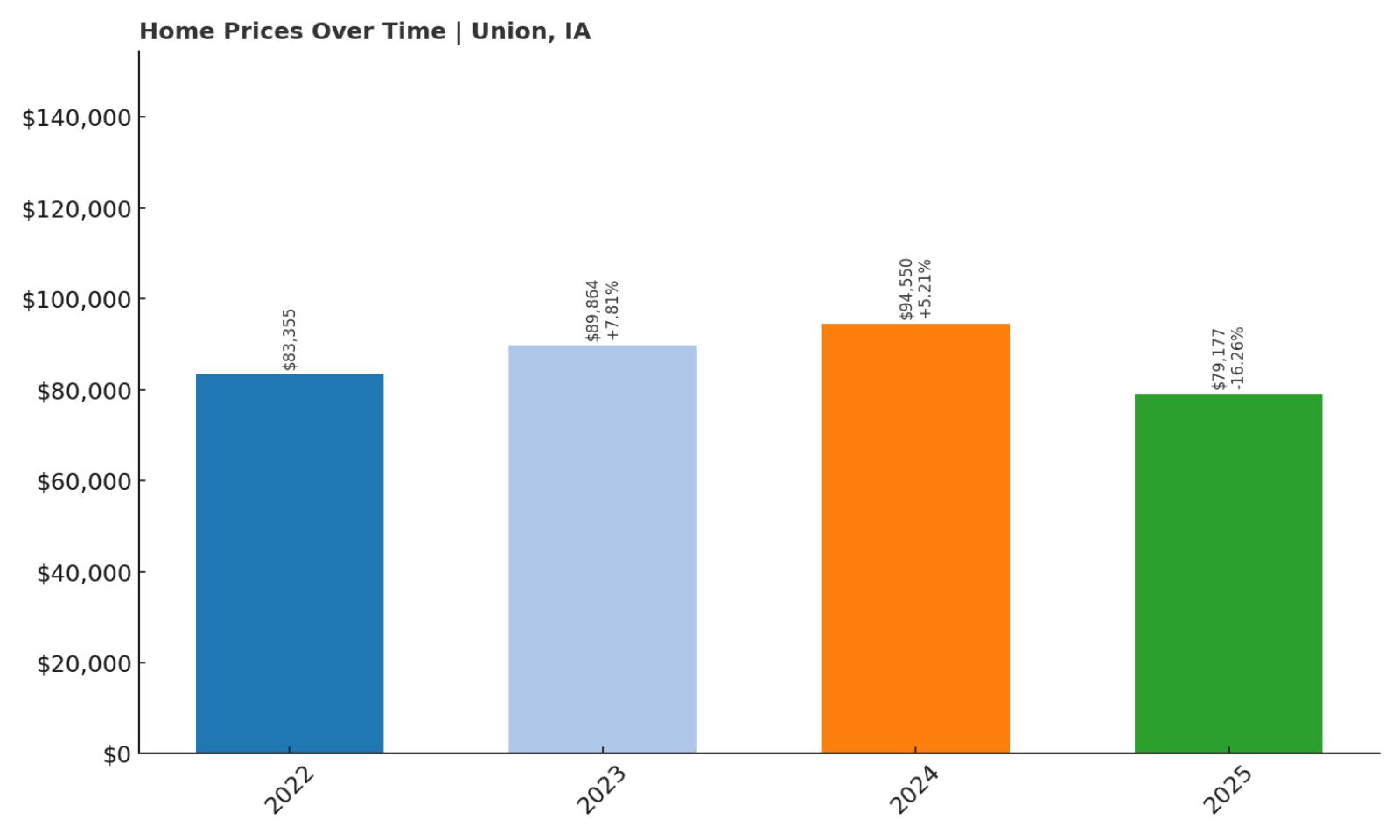

7. Union – 5% Home Price Decrease Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $83,355

- 2023: $89,864 (+$6,509, +7.81% from previous year)

- 2024: $94,550 (+$4,686, +5.21% from previous year)

- 2025: $79,177 (-$15,373, -16.26% from previous year)

Union saw strong growth from 2022 through 2024, but home prices fell sharply in 2025. Despite the recent drop, values remain close to where they started in 2022, meaning the overall decrease is modest at 5%. It’s a town that saw a sudden surge, followed by a course correction. The 2025 decline may present an opportunity for those looking for a bargain. The three-year pattern suggests that the town may have briefly overheated. Home prices now hover just under $80,000. Whether this recent dip continues or stabilizes remains to be seen. Union is still quite affordable relative to the broader state market.

Union – Big Drop After a Brief Price Spike

Union is a small community in Hardin County, central Iowa, known for its peaceful neighborhoods and family-friendly atmosphere. It’s within reach of Marshalltown and Waterloo, offering residents access to urban amenities while keeping costs low. The town saw a surprising rise in prices leading up to 2024, which could have been influenced by low inventory or increased demand from nearby commuters. However, 2025 saw a significant decline that reset values closer to their 2022 levels. This kind of rapid shift can happen in smaller housing markets where a few sales have an outsized impact. Still, Union remains well-priced and could appeal to buyers who value location and price stability. Its rural charm and easy access to services make it an appealing option despite the recent volatility. Over time, the market may stabilize at a sustainable price point, especially if regional growth continues.

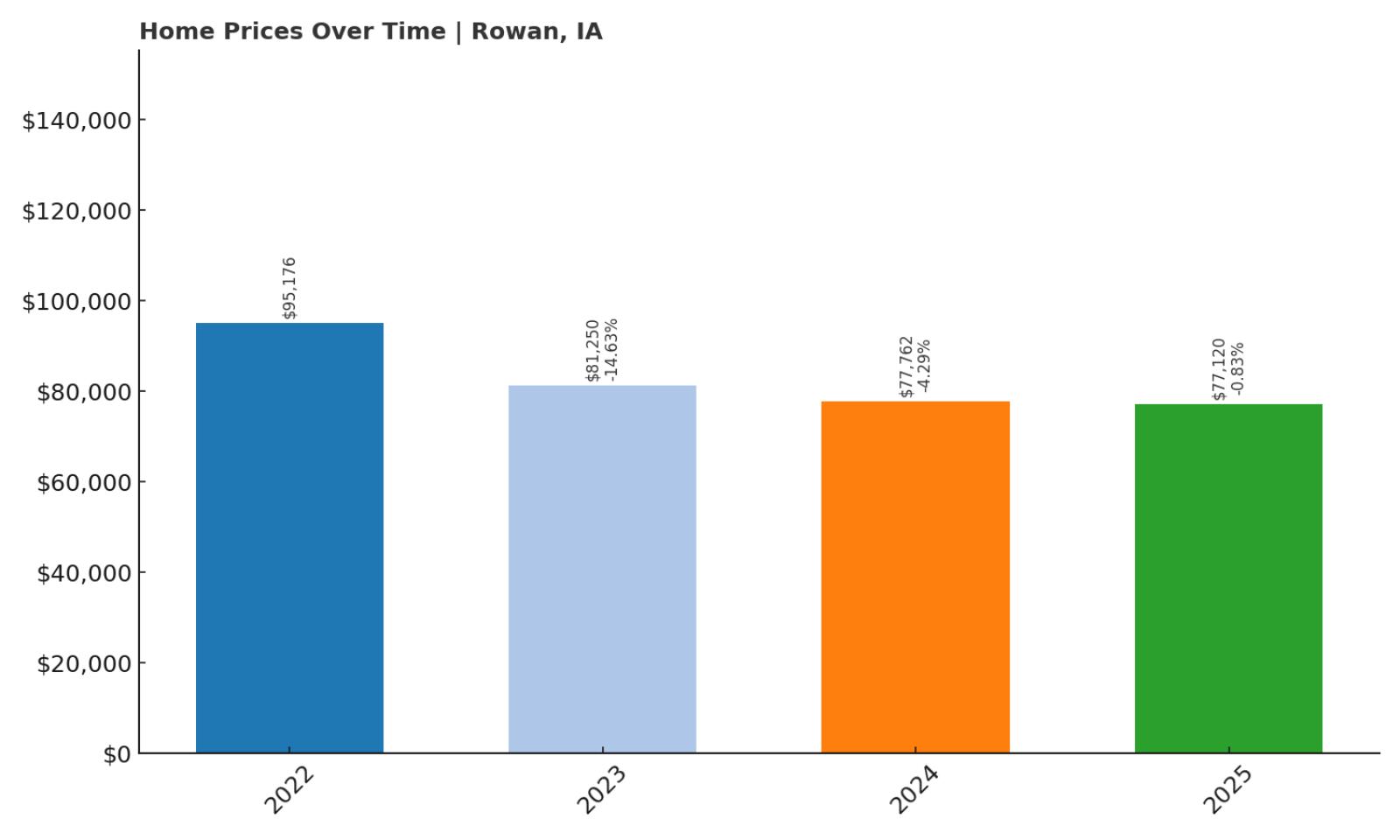

6. Rowan – 19% Home Price Decrease Since 2022

Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $95,176

- 2023: $81,250 (-$13,926, -14.63% from previous year)

- 2024: $77,762 (-$3,489, -4.29% from previous year)

- 2025: $77,120 (-$642, -0.83% from previous year)

Rowan has experienced a significant 19% drop in home prices since 2022, falling from a high of $95,000 to about $77,000 in 2025. The decline has been steady over three consecutive years, which may reflect cooling demand or a correction from an earlier spike. Despite this downturn, the market remains well within affordable territory. The average price is still accessible to many first-time buyers. The decline may offer an opportunity for buyers to purchase at a discount relative to recent highs. This kind of pattern is not uncommon in smaller, less active housing markets. Whether Rowan will bounce back or level off remains uncertain. But it continues to offer value to price-conscious buyers.

Rowan – Steady Slide After a Pandemic-Era Peak

Rowan is located in Wright County in north-central Iowa, just off Highway 3. It’s a quiet town with a small population, primarily serving as a residential community surrounded by farmland. During the post-pandemic housing surge, prices briefly soared—likely due to low supply and shifting preferences toward rural areas. That momentum appears to have cooled sharply, returning prices to pre-spike levels. Rowan’s appeal lies in its affordability and peaceful setting, with nearby access to Clarion and Eagle Grove for everyday needs. The town may appeal to buyers looking for quiet without venturing too far from services. The housing stock is limited, and small changes in demand can cause large price movements. With prices now back below $80,000, it may attract renewed interest from budget-focused buyers.

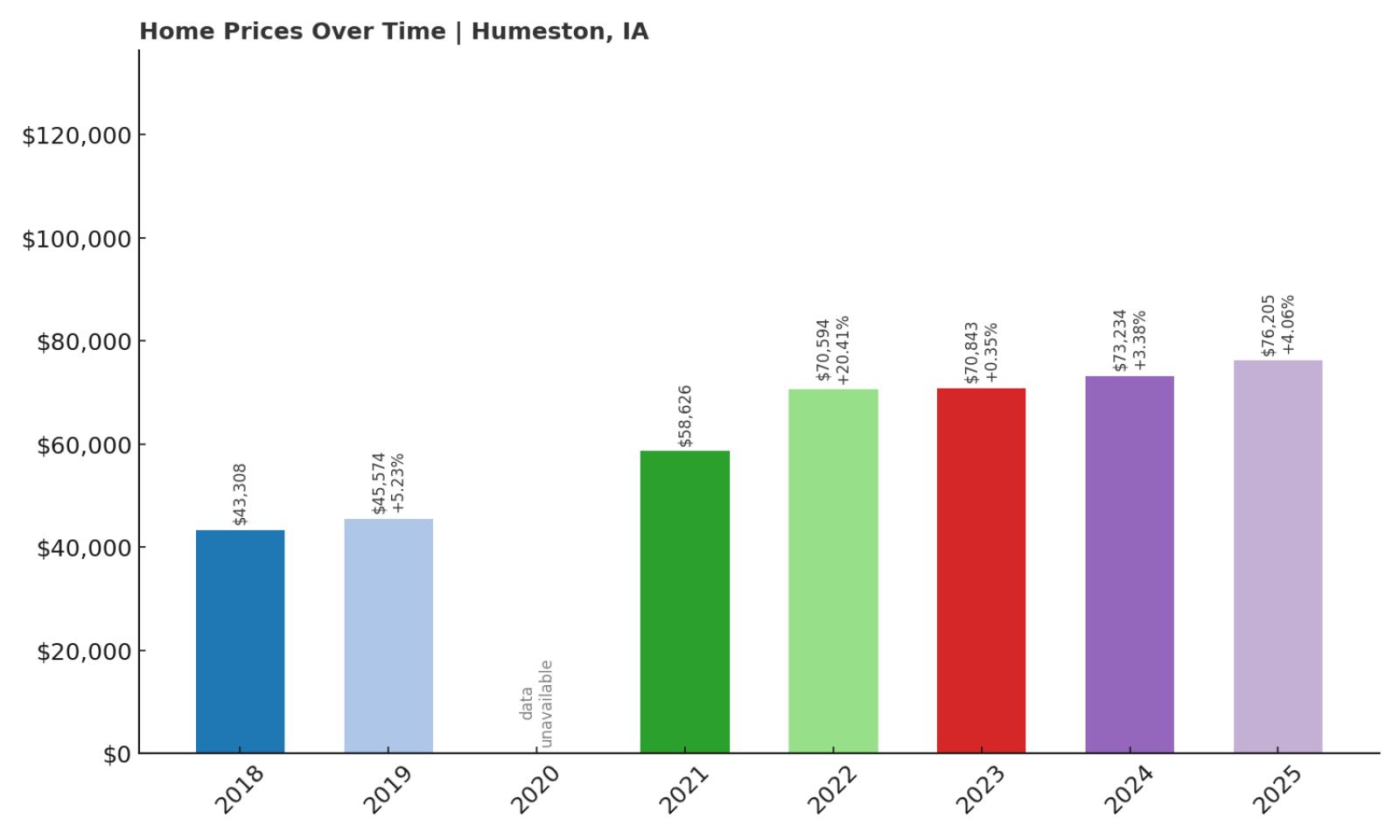

5. Humeston – 76% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $43,308

- 2019: $45,574 (+$2,266, +5.23% from previous year)

- 2020: N/A

- 2021: $58,626

- 2022: $70,594 (+$11,968, +20.41% from previous year)

- 2023: $70,843 (+$249, +0.35% from previous year)

- 2024: $73,234 (+$2,391, +3.38% from previous year)

- 2025: $76,205 (+$2,970, +4.06% from previous year)

Humeston has seen a 76% rise in home prices since 2018, with a smooth and consistent upward climb. The biggest jump came in 2022 with a remarkable 20% gain, followed by stable growth in the years that followed. There were no price declines during this stretch, which sets Humeston apart from many towns on the list. The market appears calm, with healthy, incremental growth over time. The 2025 value of just over $76,000 still ranks it among the most affordable places in Iowa. This price consistency adds to its appeal for buyers looking for reliability and upward momentum. The town’s performance suggests a stable housing market supported by quiet demand. Overall, it offers both affordability and long-term value growth.

Humeston – Quiet Strength in Southern Iowa

Located in Wayne County in southern Iowa, Humeston is a small agricultural town with a rich railroad history. It’s the kind of place where neighbors know one another, and daily life is relaxed. While small, the community has held onto essential services, including a grocery store, a post office, and a few local businesses. Its steady housing growth may reflect low turnover and consistent local demand. Humeston also benefits from being near Highway 65, which offers straightforward access to larger towns like Chariton and Osceola. With minimal volatility in prices, it has become one of the more predictable housing markets in rural Iowa. The affordability is especially appealing for first-time buyers, retirees, or those seeking to downsize. For anyone looking to settle into a peaceful lifestyle with rising property values, Humeston offers real promise.

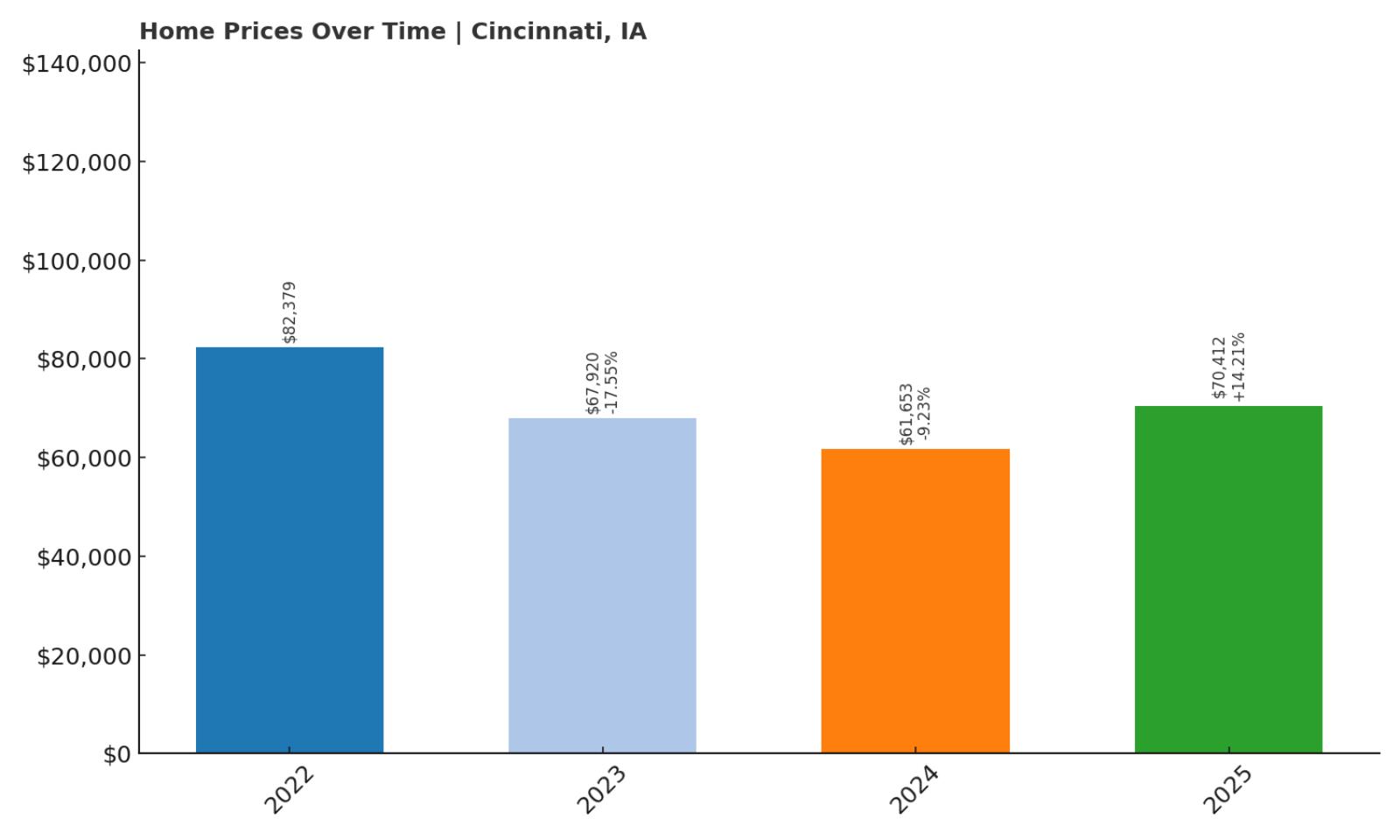

4. Cincinnati – 15% Home Price Decrease Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $82,379

- 2023: $67,920 (-$14,459, -17.55% from previous year)

- 2024: $61,653 (-$6,267, -9.23% from previous year)

- 2025: $70,412 (+$8,759, +14.21% from previous year)

Cincinnati experienced a sharp decline in home values between 2022 and 2024, dropping 25% before partially rebounding in 2025. Compared to its 2022 value, prices are still down about 15%, but the recent jump suggests the market could be recovering. This three-year cycle might have been influenced by local economic shifts or external market pressure. The price swing highlights the risk and reward potential in small, rural housing markets. At just over $70,000, homes remain highly affordable. The dip followed by a gain could make Cincinnati appealing for buyers hoping to buy low and benefit from future appreciation. Its volatility stands out, but so does its value. It’s a town to watch if current momentum holds.

Cincinnati – Volatile But Bouncing Back

Cincinnati is in Appanoose County, near Iowa’s southern edge, not far from Centerville. It’s a quiet place with limited commercial infrastructure and a very small population. The recent price rollercoaster may reflect the impact of just a few transactions, which can heavily influence averages in such small communities. The 2025 rebound may be due to renewed interest, perhaps from buyers priced out of nearby towns. Its location near the Missouri border gives it cross-state appeal and convenient access to larger retail hubs. While there isn’t much in town, Cincinnati’s low prices make it viable for investors or budget-focused homeowners. The sharp 2023–2024 drop was unusual, but its latest price gain shows that markets here can shift quickly. With that in mind, the town presents a potentially strategic entry point.

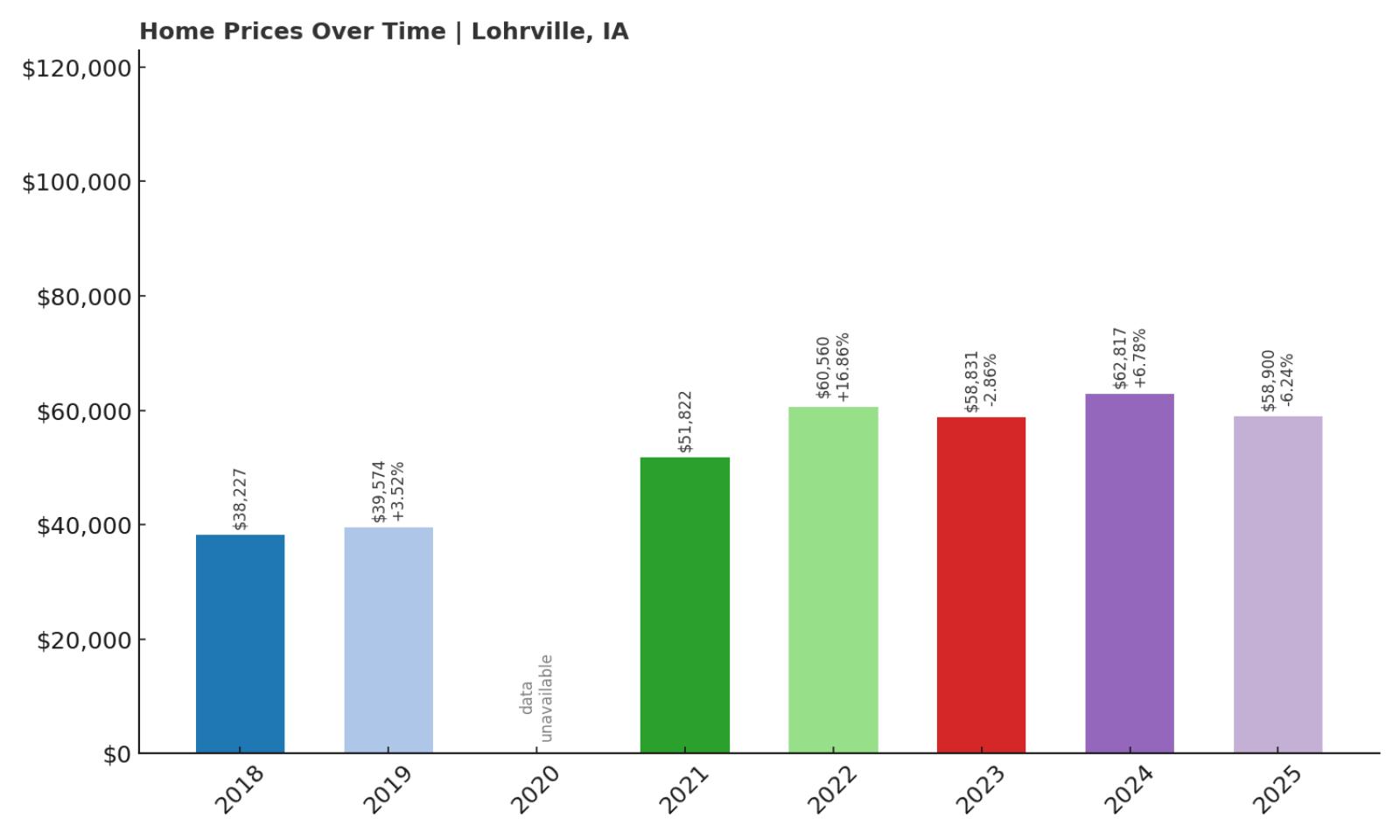

3. Lohrville – 54% Home Price Increase Since 2018

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: $38,227

- 2019: $39,574 (+$1,347, +3.52% from previous year)

- 2020: N/A

- 2021: $51,822

- 2022: $60,560 (+$8,738, +16.86% from previous year)

- 2023: $58,831 (-$1,730, -2.86% from previous year)

- 2024: $62,817 (+$3,986, +6.78% from previous year)

- 2025: $58,900 (-$3,917, -6.24% from previous year)

Lohrville’s home values have increased 54% since 2018, rising from under $40,000 to nearly $59,000 in 2025. The price surge between 2021 and 2022 was especially notable. However, there have been small setbacks since then, with minor declines in both 2023 and 2025. Overall, the market has held onto much of its early-2020s gains. Its affordability remains a strong point, with 2025 prices well under $60,000. That low entry cost continues to make Lohrville a viable option for first-time buyers. Even with minor dips, the broader trend over the last seven years is clearly upward. The town offers an affordable market with a proven growth track record.

Lohrville – Affordable Growth With a Few Speed Bumps

Lohrville is a small town in Calhoun County in west-central Iowa. It has a quiet, rural setting and a population under 400. Like many towns on this list, it lacks major amenities but benefits from its proximity to larger communities like Carroll and Jefferson. The recent price movements suggest a market that’s maturing slowly and responding to broader economic factors. Lohrville’s price stability between 2022 and 2025 hints at quiet demand, possibly from retirees or remote workers. Housing inventory is limited, and even a few sales can push values noticeably. Despite the ups and downs, its overall affordability remains a major draw. Buyers looking for long-term appreciation without spending much up front may find Lohrville appealing.

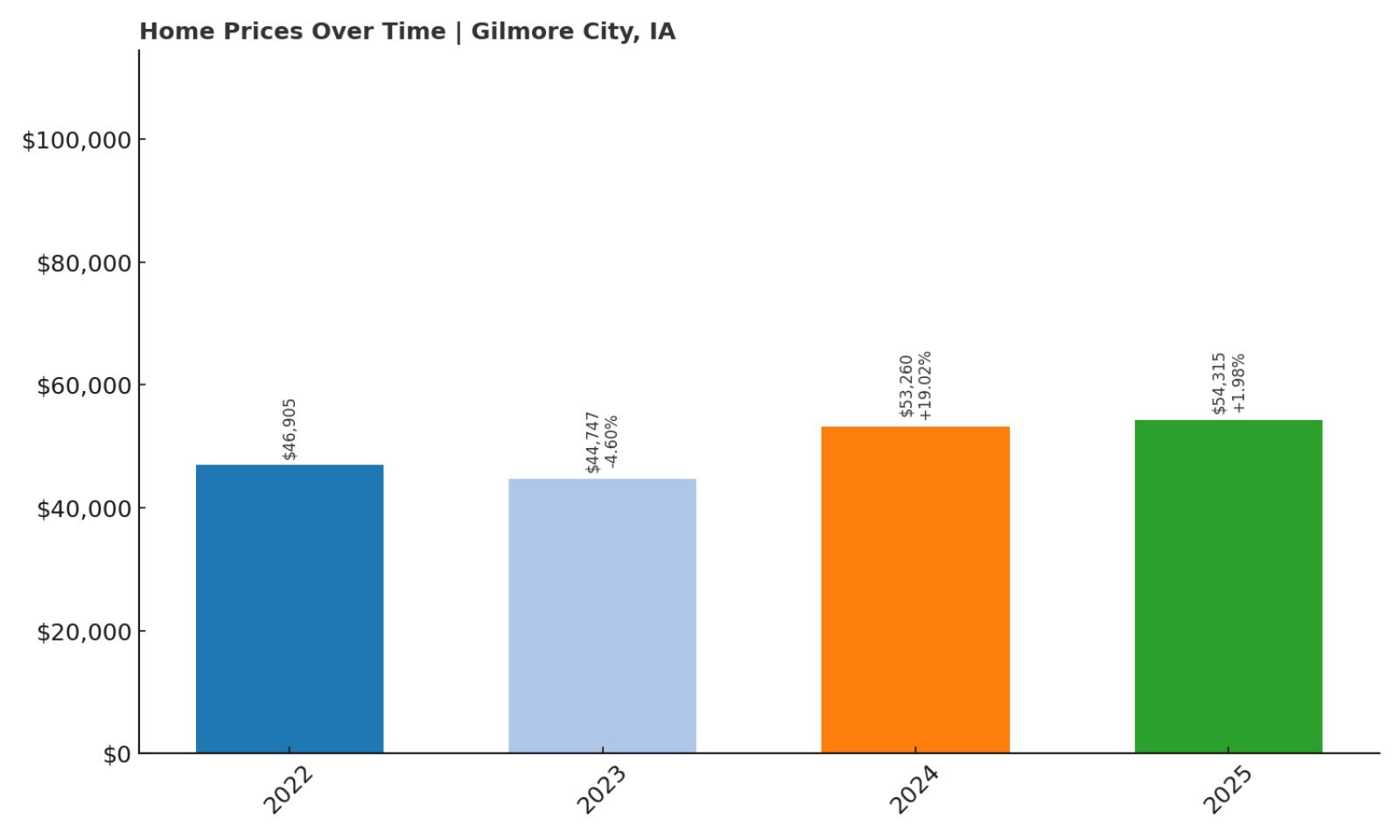

2. Gilmore City – 16% Home Price Increase Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $46,905

- 2023: $44,747 (-$2,159, -4.60% from previous year)

- 2024: $53,260 (+$8,513, +19.03% from previous year)

- 2025: $54,315 (+$1,055, +1.98% from previous year)

Gilmore City has posted a 16% increase in home values since 2022, driven mainly by a strong surge in 2024. The 2023 dip appears to have been temporary, with the market bouncing back quickly the following year. Current values remain among the lowest in the state, at just over $54,000. This extreme affordability is rare in today’s market. Gilmore City is one of the few towns where homeownership remains well within reach even for modest-income buyers. With limited volatility and upward progress overall, it’s a stable and low-cost option. The most recent gains indicate growing interest or demand. For those seeking bottom-dollar homes with real potential, this is a strong candidate.

Gilmore City – Among the Lowest Prices in Iowa

Would you like to save this?

Located in Humboldt and Pocahontas counties, Gilmore City is a tiny town with fewer than 500 residents. Its housing stock is aging but remains extremely affordable. The market here is quiet, with very little turnover, which keeps prices grounded. Still, the gains in 2024 suggest that demand may be picking up. Proximity to Fort Dodge and Humboldt offers access to jobs, schools, and retail for those willing to commute. The local economy is agriculture-based, but remote workers may find it an attractive base thanks to low costs. With prices this low, Gilmore City can be appealing for investors, flippers, or homebuyers looking to stretch their budgets. It’s a town where ownership is still possible without breaking the bank.

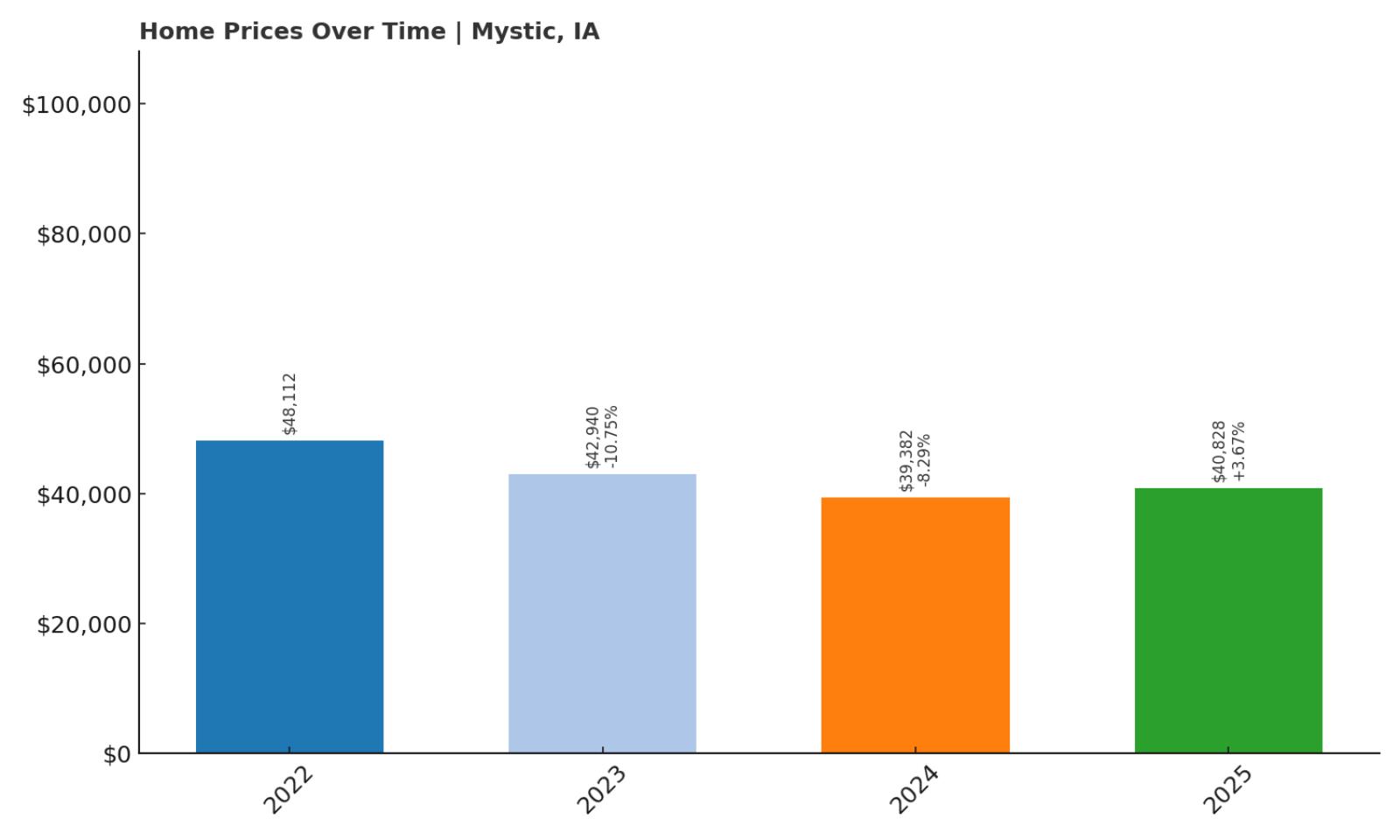

1. Mystic – 15% Home Price Decrease Since 2022

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: $48,112

- 2023: $42,940 (-$5,172, -10.75% from previous year)

- 2024: $39,382 (-$3,558, -8.29% from previous year)

- 2025: $40,828 (+$1,446, +3.67% from previous year)

Mystic has seen a 15% drop in home prices since 2022, falling to just above $40,000 by 2025. The largest losses occurred in 2023 and 2024, with a slight recovery in the most recent year. Despite this volatility, Mystic still ranks as the most affordable town on the list. That rock-bottom price makes it a potential entry point for buyers with limited funds. The 2025 bump could signal the beginning of a rebound, especially if investors take note. Its low price also gives it investment appeal for renovation or rental. The town’s small size and market activity mean even minor changes can shift averages. Overall, Mystic is a risk-tolerant buyer’s dream with ultra-low prices and possible upside.

Mystic – Iowa’s Most Affordable Housing Market

Mystic is in Appanoose County in southern Iowa and was once a bustling coal mining town. Today, it’s a quiet place with few businesses and a shrinking population. The housing market is extremely small, and home values have dropped in recent years, possibly due to limited demand and economic stagnation. Still, its location near Centerville adds convenience that other tiny towns might lack. The area’s rich history and wide-open spaces may appeal to buyers seeking peace and privacy. With the median home value now around $40,000, Mystic stands as Iowa’s cheapest town in 2025. Whether prices bounce back or stay flat, the entry cost is hard to beat. It’s ideal for buyers willing to trade amenities for price.