Would you like to save this?

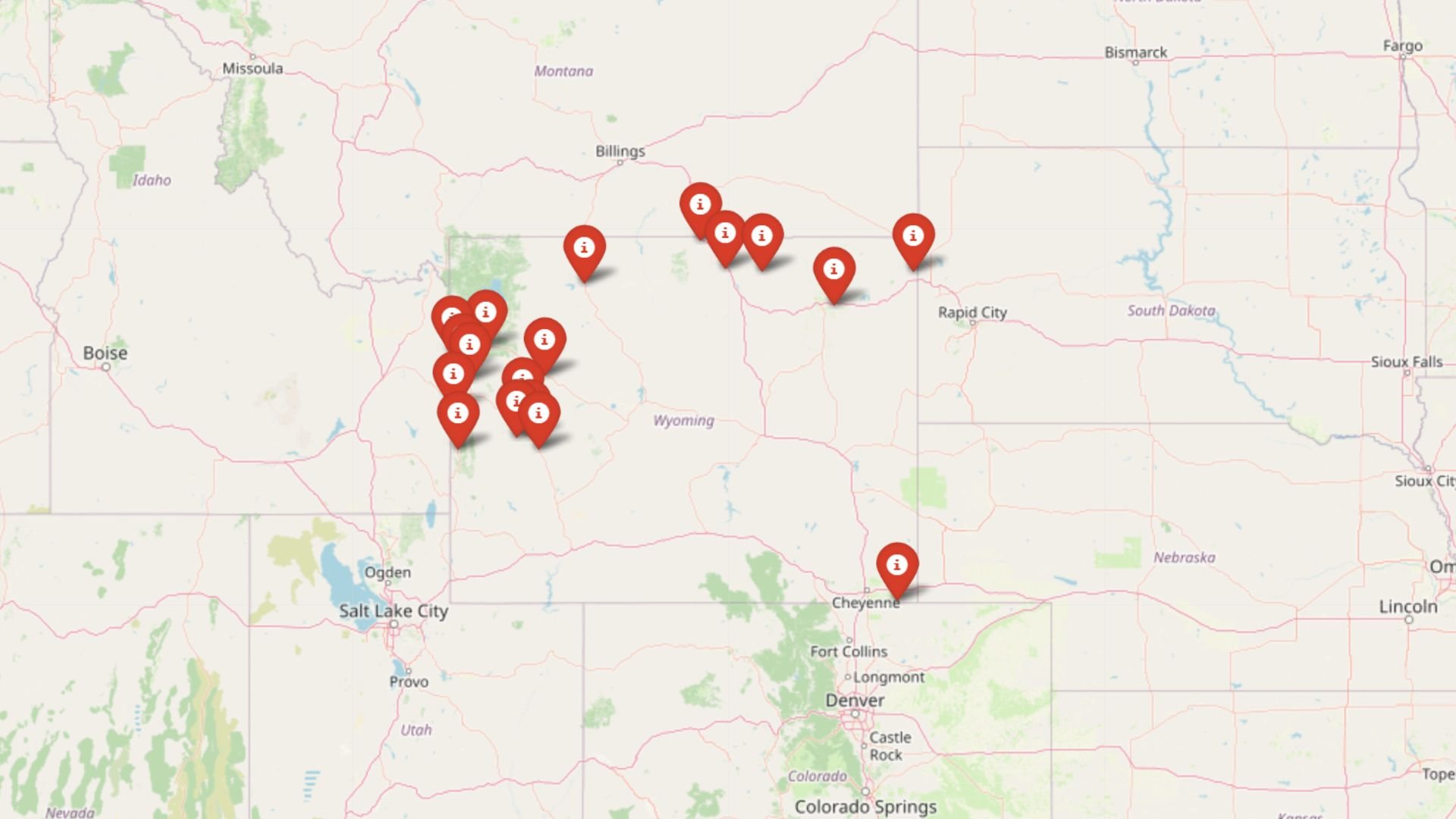

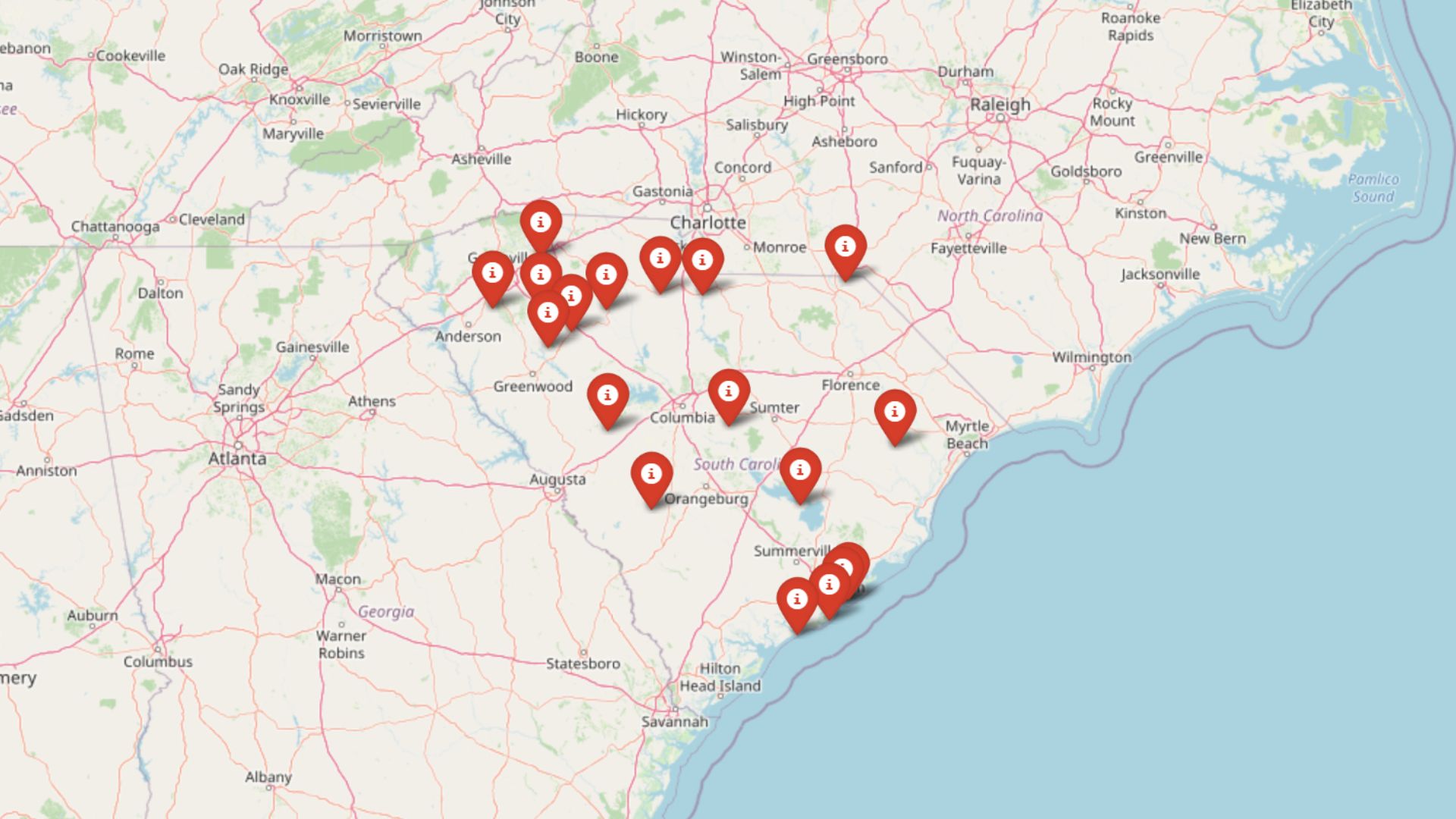

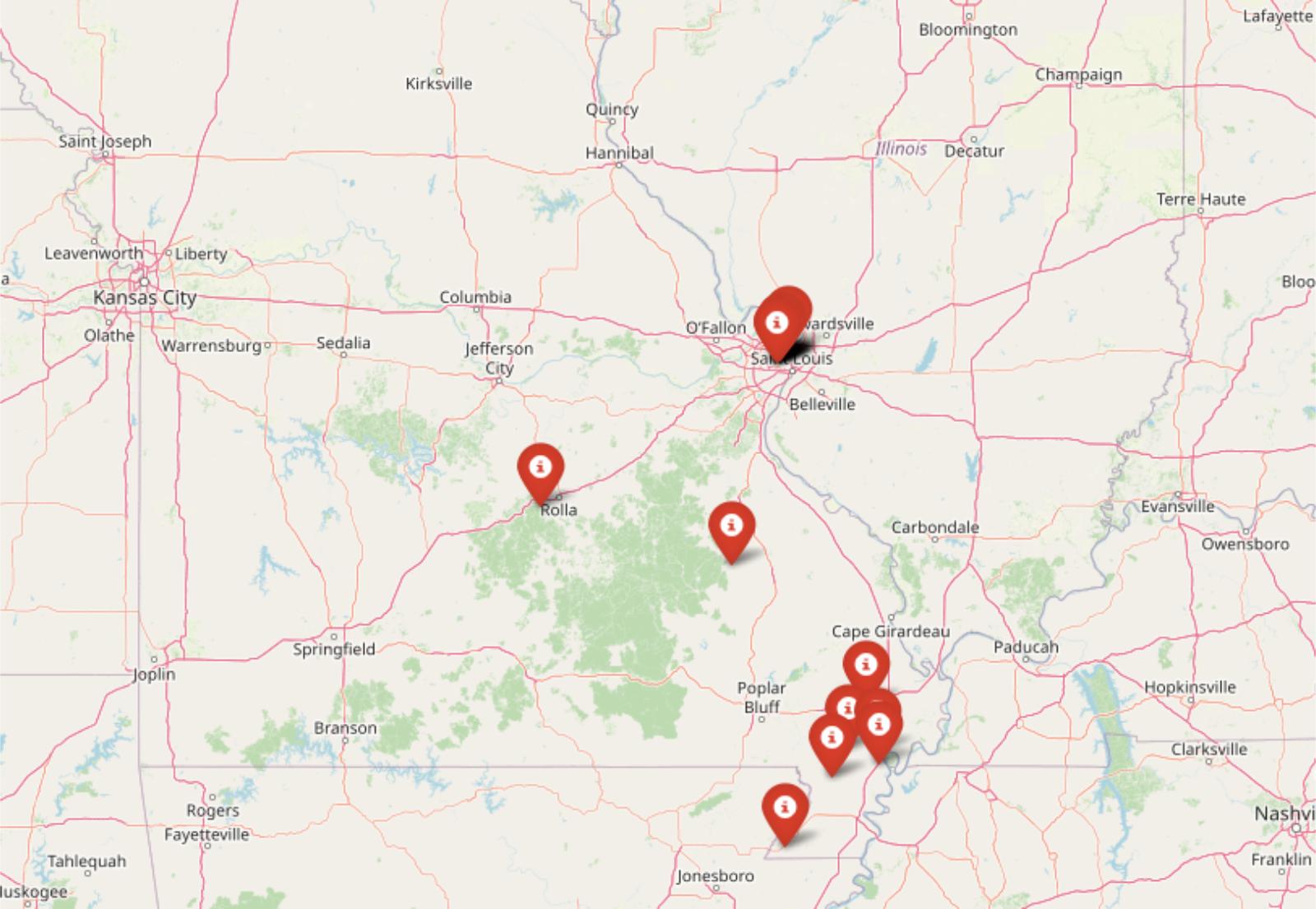

Zillow’s Home Value Index shows that while much of Missouri has seen prices climb, these 19 towns are holding the line on affordability. Home values here remain well below both state and national averages—offering rare breathing room in a tight housing market. From overlooked rural spots to edge-of-city neighborhoods, these towns offer more than just low prices; they reveal where buyers still have leverage in a market that’s mostly tilted the other way.

19. Riverview – -1.44% Home Price Change Since 2010

- 2010: $75,664

- 2011: $56,487 (-$19,177, -25.34% from previous year)

- 2012: $50,022 (-$6,465, -11.45% from previous year)

- 2013: $44,571 (-$5,451, -10.90% from previous year)

- 2014: $35,046 (-$9,525, -21.37% from previous year)

- 2015: $34,112 (-$934, -2.66% from previous year)

- 2016: $38,386 (+$4,273, +12.53% from previous year)

- 2017: $38,117 (-$269, -0.70% from previous year)

- 2018: $46,343 (+$8,226, +21.58% from previous year)

- 2019: $51,784 (+$5,442, +11.74% from previous year)

- 2020: $N/A

- 2021: $61,489

- 2022: $75,108 (+$13,618, +22.15% from previous year)

- 2023: $71,301 (-$3,807, -5.07% from previous year)

- 2024: $68,089 (-$3,212, -4.50% from previous year)

- 2025: $74,572 (+$6,482, +9.52% from previous year)

Riverview has experienced a -1.44% change in home values since 2010, with prices reaching $74,572 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Riverview, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Riverview one of Missouri’s most affordable towns today.

Riverview – What Makes It Stand Out in 2025

Riverview is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Riverview as a standout for budget-conscious home seekers.

Community dynamics in Riverview may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Riverview, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Riverview remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Riverview may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

18. Newburg – 101.27% Home Price Change Since 2019

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $36,503

- 2020: $N/A

- 2021: $51,223

- 2022: $57,444 (+$6,221, +12.15% from previous year)

- 2023: $64,625 (+$7,180, +12.50% from previous year)

- 2024: $66,583 (+$1,959, +3.03% from previous year)

- 2025: $73,470 (+$6,887, +10.34% from previous year)

Newburg has experienced a 101.27% change in home values since 2019, with prices reaching $73,470 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Newburg, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Newburg one of Missouri’s most affordable towns today.

Newburg – What Makes It Stand Out in 2025

Newburg is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Newburg as a standout for budget-conscious home seekers.

Community dynamics in Newburg may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Newburg, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Newburg remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Newburg may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

17. Beverly Hills – 179.8% Home Price Change Since 2016

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $25,744

- 2017: $24,555 (-$1,189, -4.62% from previous year)

- 2018: $30,947 (+$6,392, +26.03% from previous year)

- 2019: $38,887 (+$7,940, +25.66% from previous year)

- 2020: $N/A

- 2021: $50,124

- 2022: $59,558 (+$9,434, +18.82% from previous year)

- 2023: $59,978 (+$420, +0.70% from previous year)

- 2024: $62,974 (+$2,996, +5.00% from previous year)

- 2025: $72,031 (+$9,057, +14.38% from previous year)

Beverly Hills has experienced a 179.8% change in home values since 2016, with prices reaching $72,031 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Beverly Hills, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Beverly Hills one of Missouri’s most affordable towns today.

Beverly Hills – What Makes It Stand Out in 2025

Would you like to save this?

Beverly Hills is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Beverly Hills as a standout for budget-conscious home seekers.

Community dynamics in Beverly Hills may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Beverly Hills, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Beverly Hills remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Beverly Hills may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

16. Jennings – 5.93% Home Price Change Since 2010

- 2010: $67,518

- 2011: $52,936 (-$14,583, -21.60% from previous year)

- 2012: $37,340 (-$15,596, -29.46% from previous year)

- 2013: $33,941 (-$3,398, -9.10% from previous year)

- 2014: $30,321 (-$3,621, -10.67% from previous year)

- 2015: $29,865 (-$455, -1.50% from previous year)

- 2016: $29,671 (-$194, -0.65% from previous year)

- 2017: $29,279 (-$392, -1.32% from previous year)

- 2018: $36,305 (+$7,026, +24.00% from previous year)

- 2019: $40,789 (+$4,484, +12.35% from previous year)

- 2020: $N/A

- 2021: $52,951

- 2022: $63,126 (+$10,175, +19.22% from previous year)

- 2023: $67,552 (+$4,427, +7.01% from previous year)

- 2024: $61,869 (-$5,683, -8.41% from previous year)

- 2025: $71,523 (+$9,654, +15.60% from previous year)

Jennings has experienced a 5.93% change in home values since 2010, with prices reaching $71,523 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Jennings, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Jennings one of Missouri’s most affordable towns today.

Jennings – What Makes It Stand Out in 2025

Jennings is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Jennings as a standout for budget-conscious home seekers.

Community dynamics in Jennings may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Jennings, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Jennings remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Jennings may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

15. Iron Mountain Lake – 39.13% Home Price Change Since 2017

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $50,422

- 2018: $49,818 (-$604, -1.20% from previous year)

- 2019: $46,025 (-$3,793, -7.61% from previous year)

- 2020: $N/A

- 2021: $62,520

- 2022: $69,160 (+$6,640, +10.62% from previous year)

- 2023: $65,187 (-$3,973, -5.74% from previous year)

- 2024: $72,896 (+$7,709, +11.83% from previous year)

- 2025: $70,152 (-$2,744, -3.76% from previous year)

Iron Mountain Lake has experienced a 39.13% change in home values since 2017, with prices reaching $70,152 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Iron Mountain Lake, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Iron Mountain Lake one of Missouri’s most affordable towns today.

Iron Mountain Lake – What Makes It Stand Out in 2025

Iron Mountain Lake is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Iron Mountain Lake as a standout for budget-conscious home seekers.

Community dynamics in Iron Mountain Lake may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Iron Mountain Lake, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Iron Mountain Lake remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Iron Mountain Lake may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

14. Velda Village – 34.63% Home Price Change Since 2010

- 2010: $51,497

- 2011: $42,093 (-$9,404, -18.26% from previous year)

- 2012: $32,012 (-$10,081, -23.95% from previous year)

- 2013: $27,499 (-$4,513, -14.10% from previous year)

- 2014: $22,977 (-$4,522, -16.44% from previous year)

- 2015: $23,288 (+$311, +1.35% from previous year)

- 2016: $26,420 (+$3,131, +13.45% from previous year)

- 2017: $26,489 (+$69, +0.26% from previous year)

- 2018: $32,526 (+$6,037, +22.79% from previous year)

- 2019: $34,279 (+$1,752, +5.39% from previous year)

- 2020: $N/A

- 2021: $46,098

- 2022: $56,732 (+$10,634, +23.07% from previous year)

- 2023: $59,603 (+$2,871, +5.06% from previous year)

- 2024: $62,716 (+$3,113, +5.22% from previous year)

- 2025: $69,328 (+$6,612, +10.54% from previous year)

Velda Village has experienced a 34.63% change in home values since 2010, with prices reaching $69,328 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Velda Village, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Velda Village one of Missouri’s most affordable towns today.

Velda Village – What Makes It Stand Out in 2025

Velda Village is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Velda Village as a standout for budget-conscious home seekers.

Community dynamics in Velda Village may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Velda Village, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Velda Village remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Velda Village may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

13. Morehouse – 36.02% Home Price Change Since 2012

- 2010: $N/A

- 2011: $N/A

- 2012: $50,760

- 2013: $51,513 (+$753, +1.48% from previous year)

- 2014: $54,184 (+$2,671, +5.19% from previous year)

- 2015: $52,161 (-$2,023, -3.73% from previous year)

- 2016: $54,172 (+$2,011, +3.85% from previous year)

- 2017: $65,676 (+$11,504, +21.24% from previous year)

- 2018: $60,379 (-$5,296, -8.06% from previous year)

- 2019: $63,226 (+$2,847, +4.71% from previous year)

- 2020: $N/A

- 2021: $65,897

- 2022: $78,869 (+$12,973, +19.69% from previous year)

- 2023: $74,456 (-$4,413, -5.60% from previous year)

- 2024: $69,211 (-$5,246, -7.05% from previous year)

- 2025: $69,045 (-$166, -0.24% from previous year)

Morehouse has experienced a 36.02% change in home values since 2012, with prices reaching $69,045 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Morehouse, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Morehouse one of Missouri’s most affordable towns today.

Morehouse – What Makes It Stand Out in 2025

Morehouse is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Morehouse as a standout for budget-conscious home seekers.

Community dynamics in Morehouse may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Morehouse, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Morehouse remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Morehouse may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

12. Lilbourn – 126.2% Home Price Change Since 2010

- 2010: $30,418

- 2011: $29,276 (-$1,142, -3.76% from previous year)

- 2012: $30,337 (+$1,061, +3.63% from previous year)

- 2013: $28,246 (-$2,091, -6.89% from previous year)

- 2014: $29,461 (+$1,215, +4.30% from previous year)

- 2015: $30,921 (+$1,459, +4.95% from previous year)

- 2016: $34,594 (+$3,673, +11.88% from previous year)

- 2017: $36,967 (+$2,373, +6.86% from previous year)

- 2018: $39,485 (+$2,518, +6.81% from previous year)

- 2019: $45,451 (+$5,965, +15.11% from previous year)

- 2020: $N/A

- 2021: $48,545

- 2022: $61,844 (+$13,300, +27.40% from previous year)

- 2023: $64,215 (+$2,371, +3.83% from previous year)

- 2024: $68,274 (+$4,059, +6.32% from previous year)

- 2025: $68,804 (+$530, +0.78% from previous year)

Lilbourn has experienced a 126.2% change in home values since 2010, with prices reaching $68,804 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Lilbourn, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Lilbourn one of Missouri’s most affordable towns today.

Lilbourn – What Makes It Stand Out in 2025

Lilbourn is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Lilbourn as a standout for budget-conscious home seekers.

Community dynamics in Lilbourn may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Lilbourn, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Lilbourn remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Lilbourn may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

11. Pagedale – 25.12% Home Price Change Since 2010

- 2010: $53,611

- 2011: $38,596 (-$15,014, -28.01% from previous year)

- 2012: $34,582 (-$4,014, -10.40% from previous year)

- 2013: $29,692 (-$4,890, -14.14% from previous year)

- 2014: $27,712 (-$1,980, -6.67% from previous year)

- 2015: $25,440 (-$2,272, -8.20% from previous year)

- 2016: $26,281 (+$841, +3.30% from previous year)

- 2017: $28,404 (+$2,123, +8.08% from previous year)

- 2018: $32,945 (+$4,541, +15.99% from previous year)

- 2019: $36,360 (+$3,415, +10.37% from previous year)

- 2020: $N/A

- 2021: $46,900

- 2022: $54,858 (+$7,957, +16.97% from previous year)

- 2023: $56,515 (+$1,658, +3.02% from previous year)

- 2024: $59,508 (+$2,993, +5.30% from previous year)

- 2025: $67,078 (+$7,570, +12.72% from previous year)

Pagedale has experienced a 25.12% change in home values since 2010, with prices reaching $67,078 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Pagedale, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Pagedale one of Missouri’s most affordable towns today.

Pagedale – What Makes It Stand Out in 2025

Pagedale is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Pagedale as a standout for budget-conscious home seekers.

Community dynamics in Pagedale may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Pagedale, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Pagedale remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Pagedale may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

10. Velda Village Hills – 195.36% Home Price Change Since 2016

Would you like to save this?

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $22,233

- 2017: $24,028 (+$1,795, +8.08% from previous year)

- 2018: $31,059 (+$7,031, +29.26% from previous year)

- 2019: $34,821 (+$3,762, +12.11% from previous year)

- 2020: $N/A

- 2021: $41,800

- 2022: $56,070 (+$14,270, +34.14% from previous year)

- 2023: $56,867 (+$797, +1.42% from previous year)

- 2024: $59,708 (+$2,841, +5.00% from previous year)

- 2025: $65,667 (+$5,959, +9.98% from previous year)

Velda Village Hills has experienced a 195.36% change in home values since 2016, with prices reaching $65,667 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Velda Village Hills, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Velda Village Hills one of Missouri’s most affordable towns today.

Velda Village Hills – What Makes It Stand Out in 2025

Velda Village Hills is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Velda Village Hills as a standout for budget-conscious home seekers.

Community dynamics in Velda Village Hills may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Velda Village Hills, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Velda Village Hills remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Velda Village Hills may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

9. Marston – 98.53% Home Price Change Since 2012

- 2010: $N/A

- 2011: $N/A

- 2012: $32,361

- 2013: $32,925 (+$564, +1.74% from previous year)

- 2014: $34,271 (+$1,346, +4.09% from previous year)

- 2015: $32,873 (-$1,398, -4.08% from previous year)

- 2016: $39,029 (+$6,156, +18.73% from previous year)

- 2017: $46,866 (+$7,837, +20.08% from previous year)

- 2018: $45,660 (-$1,206, -2.57% from previous year)

- 2019: $53,045 (+$7,385, +16.17% from previous year)

- 2020: $N/A

- 2021: $61,587

- 2022: $72,425 (+$10,838, +17.60% from previous year)

- 2023: $66,612 (-$5,813, -8.03% from previous year)

- 2024: $67,630 (+$1,018, +1.53% from previous year)

- 2025: $64,247 (-$3,382, -5.00% from previous year)

Marston has experienced a 98.53% change in home values since 2012, with prices reaching $64,247 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Marston, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Marston one of Missouri’s most affordable towns today.

Marston – What Makes It Stand Out in 2025

Marston is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Marston as a standout for budget-conscious home seekers.

Community dynamics in Marston may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Marston, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Marston remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Marston may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

8. Country Club Hills – 173.11% Home Price Change Since 2015

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $23,241

- 2016: $24,386 (+$1,146, +4.93% from previous year)

- 2017: $23,978 (-$408, -1.67% from previous year)

- 2018: $29,858 (+$5,880, +24.52% from previous year)

- 2019: $33,965 (+$4,107, +13.76% from previous year)

- 2020: $N/A

- 2021: $43,969

- 2022: $53,319 (+$9,350, +21.27% from previous year)

- 2023: $58,051 (+$4,731, +8.87% from previous year)

- 2024: $57,782 (-$268, -0.46% from previous year)

- 2025: $63,473 (+$5,690, +9.85% from previous year)

Country Club Hills has experienced a 173.11% change in home values since 2015, with prices reaching $63,473 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Country Club Hills, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Country Club Hills one of Missouri’s most affordable towns today.

Country Club Hills – What Makes It Stand Out in 2025

Country Club Hills is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Country Club Hills as a standout for budget-conscious home seekers.

Community dynamics in Country Club Hills may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Country Club Hills, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Country Club Hills remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Country Club Hills may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

7. Gideon – 94.32% Home Price Change Since 2010

- 2010: $31,393

- 2011: $31,497 (+$105, +0.33% from previous year)

- 2012: $31,381 (-$117, -0.37% from previous year)

- 2013: $30,605 (-$776, -2.47% from previous year)

- 2014: $35,995 (+$5,390, +17.61% from previous year)

- 2015: $34,670 (-$1,325, -3.68% from previous year)

- 2016: $36,053 (+$1,383, +3.99% from previous year)

- 2017: $45,172 (+$9,119, +25.29% from previous year)

- 2018: $45,691 (+$518, +1.15% from previous year)

- 2019: $48,008 (+$2,317, +5.07% from previous year)

- 2020: $N/A

- 2021: $50,965

- 2022: $56,092 (+$5,127, +10.06% from previous year)

- 2023: $52,132 (-$3,960, -7.06% from previous year)

- 2024: $55,997 (+$3,865, +7.41% from previous year)

- 2025: $61,003 (+$5,006, +8.94% from previous year)

Gideon has experienced a 94.32% change in home values since 2010, with prices reaching $61,003 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Gideon, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Gideon one of Missouri’s most affordable towns today.

Gideon – What Makes It Stand Out in 2025

Gideon is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Gideon as a standout for budget-conscious home seekers.

Community dynamics in Gideon may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Gideon, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Gideon remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Gideon may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

6. Flordell Hills – 196.64% Home Price Change Since 2016

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $20,133

- 2017: $22,725 (+$2,592, +12.87% from previous year)

- 2018: $27,109 (+$4,385, +19.30% from previous year)

- 2019: $29,308 (+$2,198, +8.11% from previous year)

- 2020: $N/A

- 2021: $37,714

- 2022: $48,450 (+$10,736, +28.47% from previous year)

- 2023: $53,865 (+$5,415, +11.18% from previous year)

- 2024: $51,138 (-$2,727, -5.06% from previous year)

- 2025: $59,723 (+$8,585, +16.79% from previous year)

Flordell Hills has experienced a 196.64% change in home values since 2016, with prices reaching $59,723 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Flordell Hills, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Flordell Hills one of Missouri’s most affordable towns today.

Flordell Hills – What Makes It Stand Out in 2025

Flordell Hills is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Flordell Hills as a standout for budget-conscious home seekers.

Community dynamics in Flordell Hills may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Flordell Hills, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Flordell Hills remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Flordell Hills may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

5. Parma – 106.34% Home Price Change Since 2016

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $28,490

- 2017: $34,658 (+$6,168, +21.65% from previous year)

- 2018: $37,490 (+$2,832, +8.17% from previous year)

- 2019: $44,468 (+$6,978, +18.61% from previous year)

- 2020: $N/A

- 2021: $44,197

- 2022: $50,984 (+$6,788, +15.36% from previous year)

- 2023: $56,708 (+$5,724, +11.23% from previous year)

- 2024: $61,107 (+$4,399, +7.76% from previous year)

- 2025: $58,787 (-$2,320, -3.80% from previous year)

Parma has experienced a 106.34% change in home values since 2016, with prices reaching $58,787 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Parma, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Parma one of Missouri’s most affordable towns today.

Parma – What Makes It Stand Out in 2025

Parma is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Parma as a standout for budget-conscious home seekers.

Community dynamics in Parma may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Parma, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Parma remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Parma may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

4. Arbyrd – -19.02% Home Price Change Since 2022

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $N/A

- 2017: $N/A

- 2018: $N/A

- 2019: $N/A

- 2020: $N/A

- 2021: $N/A

- 2022: $71,464

- 2023: $63,905 (-$7,559, -10.58% from previous year)

- 2024: $49,819 (-$14,086, -22.04% from previous year)

- 2025: $57,872 (+$8,053, +16.16% from previous year)

Arbyrd has experienced a -19.02% change in home values since 2022, with prices reaching $57,872 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Arbyrd, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Arbyrd one of Missouri’s most affordable towns today.

Arbyrd – What Makes It Stand Out in 2025

Arbyrd is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Arbyrd as a standout for budget-conscious home seekers.

Community dynamics in Arbyrd may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Arbyrd, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Arbyrd remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Arbyrd may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

3. Pine Lawn – 149.76% Home Price Change Since 2016

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $23,145

- 2017: $24,167 (+$1,022, +4.42% from previous year)

- 2018: $26,803 (+$2,636, +10.91% from previous year)

- 2019: $31,014 (+$4,211, +15.71% from previous year)

- 2020: $N/A

- 2021: $41,203

- 2022: $48,188 (+$6,985, +16.95% from previous year)

- 2023: $49,443 (+$1,254, +2.60% from previous year)

- 2024: $48,796 (-$647, -1.31% from previous year)

- 2025: $57,806 (+$9,010, +18.46% from previous year)

Pine Lawn has experienced a 149.76% change in home values since 2016, with prices reaching $57,806 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Pine Lawn, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Pine Lawn one of Missouri’s most affordable towns today.

Pine Lawn – What Makes It Stand Out in 2025

Pine Lawn is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Pine Lawn as a standout for budget-conscious home seekers.

Community dynamics in Pine Lawn may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Pine Lawn, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Pine Lawn remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Pine Lawn may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

2. Wellston – 113.79% Home Price Change Since 2016

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $27,018

- 2017: $28,102 (+$1,084, +4.01% from previous year)

- 2018: $31,444 (+$3,342, +11.89% from previous year)

- 2019: $31,607 (+$164, +0.52% from previous year)

- 2020: $N/A

- 2021: $42,872

- 2022: $48,350 (+$5,478, +12.78% from previous year)

- 2023: $52,076 (+$3,726, +7.71% from previous year)

- 2024: $51,466 (-$610, -1.17% from previous year)

- 2025: $57,763 (+$6,297, +12.24% from previous year)

Wellston has experienced a 113.79% change in home values since 2016, with prices reaching $57,763 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Wellston, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Wellston one of Missouri’s most affordable towns today.

Wellston – What Makes It Stand Out in 2025

Wellston is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Wellston as a standout for budget-conscious home seekers.

Community dynamics in Wellston may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Wellston, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Wellston remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Wellston may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.

1. Hillsdale – 125.69% Home Price Change Since 2016

- 2010: $N/A

- 2011: $N/A

- 2012: $N/A

- 2013: $N/A

- 2014: $N/A

- 2015: $N/A

- 2016: $22,624

- 2017: $23,186 (+$562, +2.49% from previous year)

- 2018: $26,963 (+$3,777, +16.29% from previous year)

- 2019: $27,766 (+$803, +2.98% from previous year)

- 2020: $N/A

- 2021: $35,285

- 2022: $41,668 (+$6,382, +18.09% from previous year)

- 2023: $43,914 (+$2,247, +5.39% from previous year)

- 2024: $47,210 (+$3,295, +7.50% from previous year)

- 2025: $51,060 (+$3,850, +8.16% from previous year)

Hillsdale has experienced a 125.69% change in home values since 2016, with prices reaching $51,060 in 2025. This change reflects both market conditions and local dynamics that have shaped buyer demand over time. Prices have gone through ups and downs, but the latest data suggests a market that has either recovered or gained new traction. For many, this price point remains far more accessible than state averages. While some towns on this list have grown steadily, others, like Hillsdale, have had more volatile swings that tell a deeper story. Regardless of the journey, current prices make Hillsdale one of Missouri’s most affordable towns today.

Hillsdale – What Makes It Stand Out in 2025

Hillsdale is located in Missouri’s more budget-friendly zone, often appealing to residents who want space, simplicity, and an escape from urban pressures. The town features a blend of residential neighborhoods, local businesses, and modest infrastructure. Many homes in the area are older but offer solid value for first-time buyers or those on limited budgets. Accessibility to nearby cities or highways can vary, but this location often provides basic essentials. In some cases, recent infrastructure or zoning improvements may be helping to gradually increase local interest. For investors or long-term residents, the current pricing could represent either a solid entry point or an ongoing value trend. The affordability here positions Hillsdale as a standout for budget-conscious home seekers.

Community dynamics in Hillsdale may be shifting slightly as housing prices rise and more people look to rural or fringe areas for economic reasons. Schools, services, and employment access may vary, depending on the specific region or county within Missouri. That said, many towns on this list, including Hillsdale, are increasingly seen as practical alternatives to pricier suburbs or city centers. With average home values still well below national and state averages, Hillsdale remains viable for a wide range of buyers — from retirees to remote workers. Though prices have changed, they still reflect strong affordability and decent opportunity. Looking ahead, Hillsdale may benefit from continued interest as more people search for lower-cost living in accessible parts of the state.