🔥 Would you like to save this?

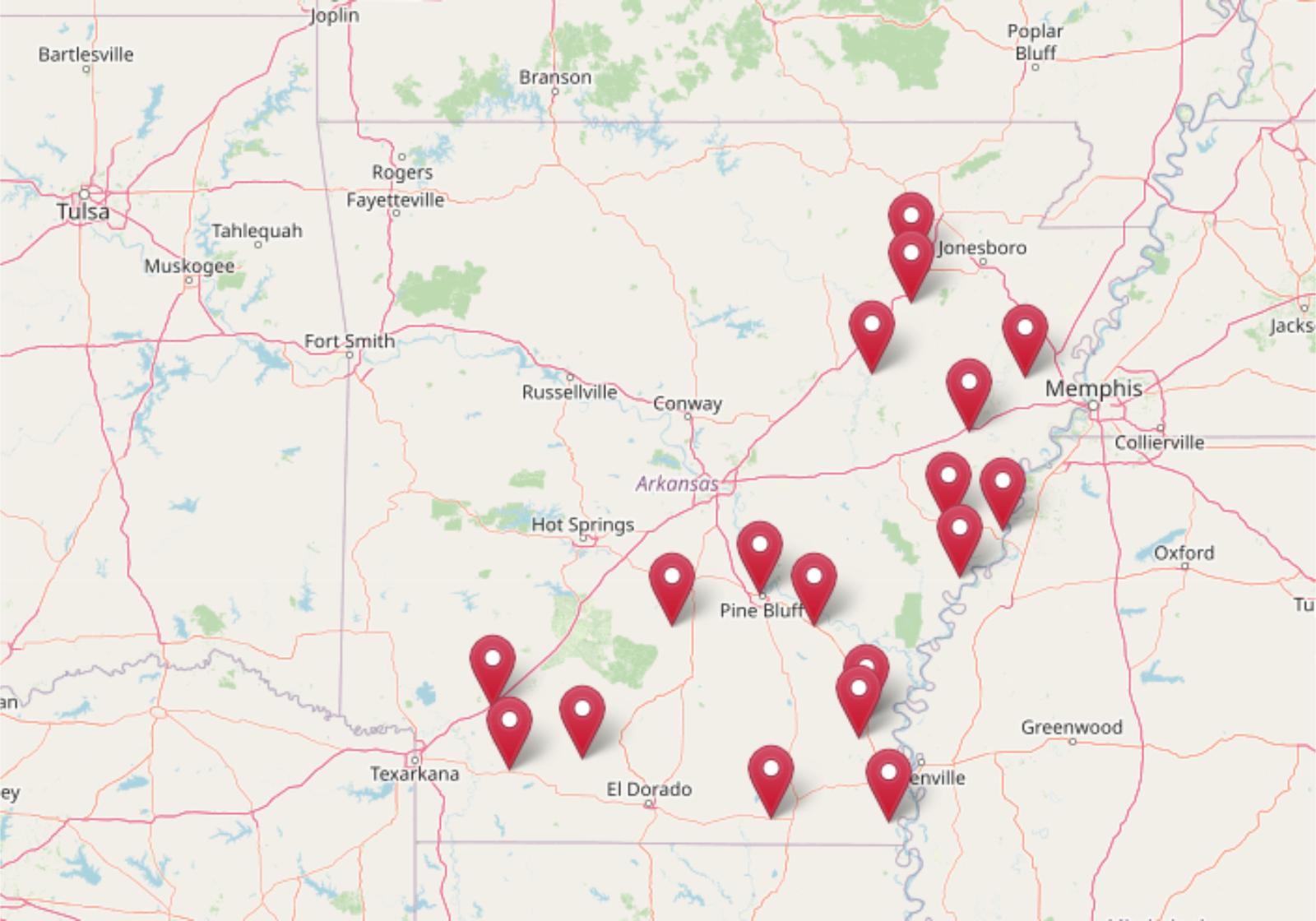

Even with housing costs rising across the country, Arkansas still offers some of the most affordable home prices in America, according to the Zillow Home Value Index. In a few of these towns, you can still snag a house for less than $60,000 — a number that feels almost impossible in 2025. While some places have held steady over the years, others saw wild swings in value, with prices peaking during the pandemic and plunging in the aftermath.

For buyers on a tight budget, this kind of volatility isn’t always bad news. It means re-entry points for folks who’ve been priced out elsewhere — whether you’re a first-time buyer, a retiree looking for low overhead, or just hunting for a rental property that won’t sink your savings. These 18 towns cover a wide stretch of Arkansas life, from rural Delta outposts to aging railroad hubs. What they share is a rare thing in today’s market: livable housing at a truly low cost.

In order to come up with the very specific design ideas, we create most designs with the assistance of state-of-the-art AI interior design software.

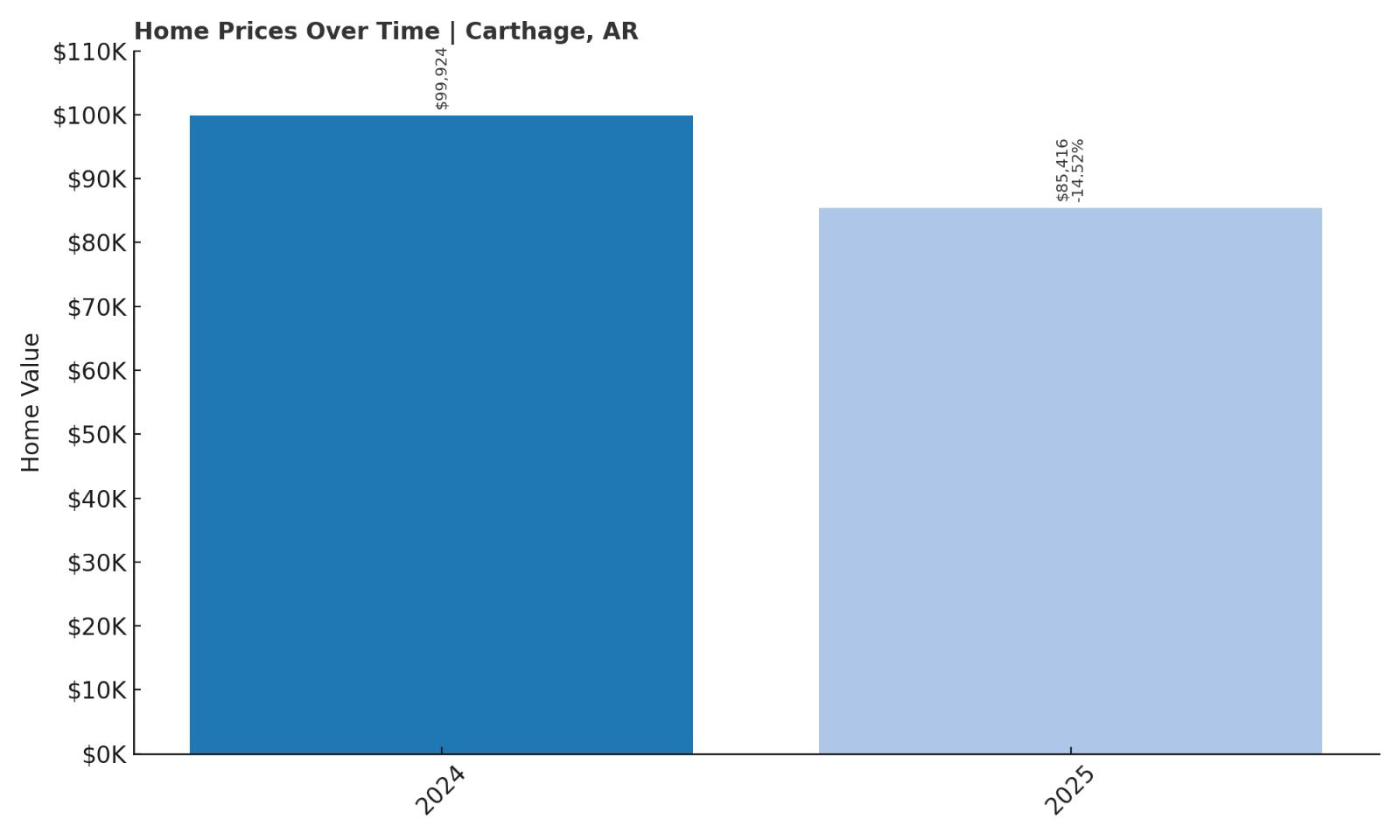

18. Carthage – 14.52% Price Drop Since May 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $99,924

- 2025: $85,416 ($-14,508, -14.52% from previous year)

With no historical data before 2024, Carthage enters the list at #18 due to a sharp 14.52% drop in home values over the past year. Prices fell from nearly $100,000 in 2024 to $85,416 in 2025, marking one of the steeper year-over-year declines among Arkansas’s most affordable markets. This shift may reflect a market correction after a brief surge or could be driven by local economic factors. Without a longer dataset, it’s unclear whether this is a trend or a one-off adjustment. Still, the sub-$90K price point positions Carthage as an attractive option for buyers seeking affordability. The decline could also hint at reduced competition, giving buyers more negotiating power. In a tightening market, these lower prices offer a potential advantage for those looking to enter at a discount. Carthage’s affordability now puts it back in line with many other rural Arkansas towns.

Carthage – Market Reset in a Rural Outpost

Carthage is a tiny community tucked into the woodlands of Dallas County in central Arkansas, with a population hovering around 300. Its isolation makes it less susceptible to rapid gentrification or development, and the town has long maintained a quiet, rural character. Carthage is accessible via Arkansas Highway 229 and sits about 40 miles from larger population centers like Pine Bluff or Camden. As a result, real estate activity here is limited — and when it happens, price swings can be exaggerated due to the low volume of transactions. The steep 14% drop in the past year may simply reflect one or two lower-priced sales pulling the average down, rather than a widespread market shift. Still, for prospective buyers looking to purchase a home under $90,000 in a low-pressure, low-density setting, Carthage delivers one of the lowest barriers to entry in the state.

The town’s housing stock consists mainly of modest single-family homes, often with large yards and proximity to nature. There’s limited access to shopping or medical services within town limits, but nearby Fordyce or Sheridan can fill those gaps. Internet and infrastructure improvements have reached even small towns like Carthage in recent years, meaning remote workers or retirees looking for peace and quiet might find this an appealing place to settle. While it lacks the tourist pull or commercial base of other towns on this list, Carthage compensates with cost, space, and a pace of life that hasn’t changed much in decades. For those who value privacy, simplicity, and a genuinely rural lifestyle, this market reset could present a rare buying opportunity in a town that rarely makes the headlines.

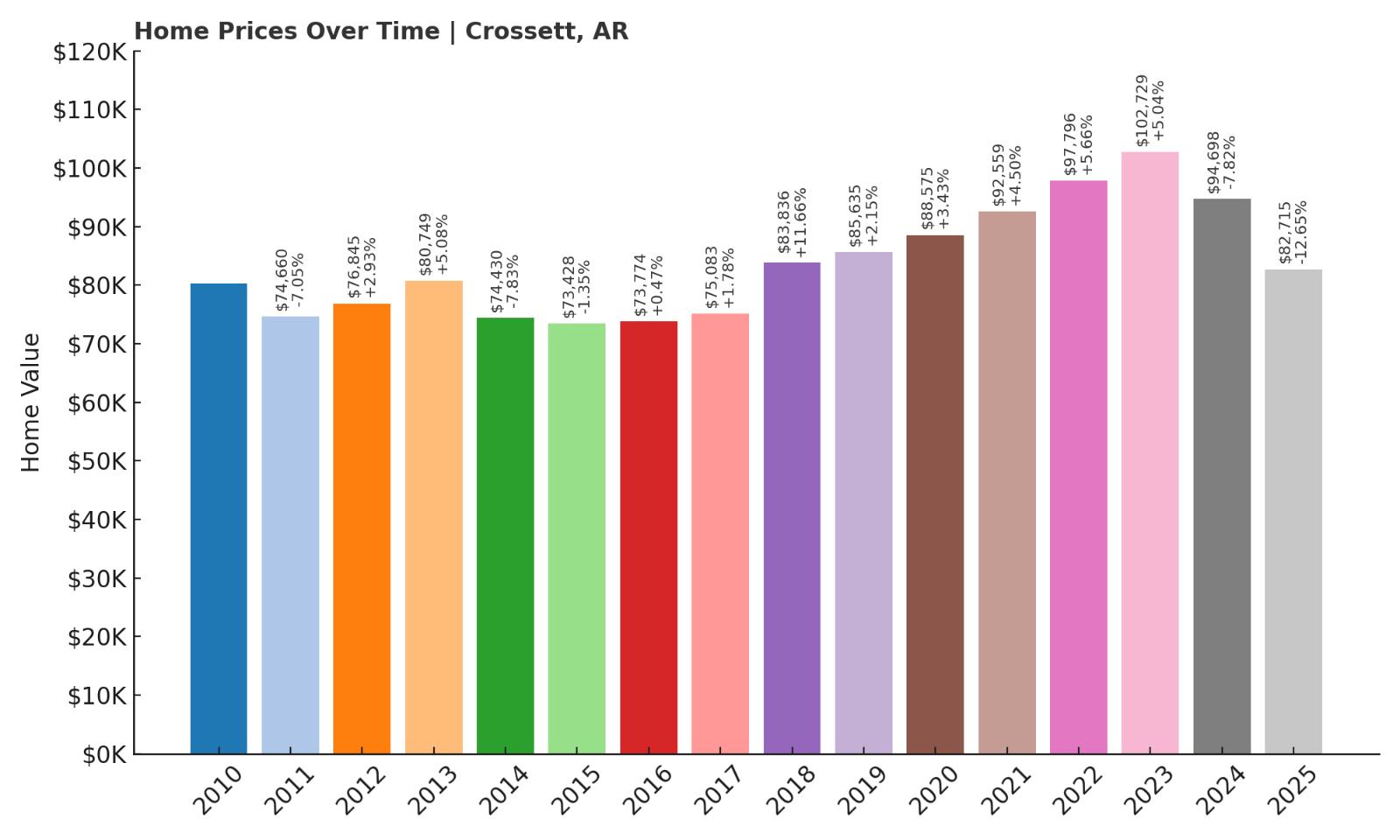

17. Crossett – 2.98% Price Increase Since May 2010

- 2010: $80,323

- 2011: $74,660 ($-5,663, -7.05% from previous year)

- 2012: $76,845 (+$2,186, +2.93% from previous year)

- 2013: $80,749 (+$3,904, +5.08% from previous year)

- 2014: $74,430 ($-6,320, -7.83% from previous year)

- 2015: $73,428 ($-1,001, -1.35% from previous year)

- 2016: $73,774 (+$345, +0.47% from previous year)

- 2017: $75,083 (+$1,310, +1.78% from previous year)

- 2018: $83,836 (+$8,752, +11.66% from previous year)

- 2019: $85,635 (+$1,799, +2.15% from previous year)

- 2020: $88,575 (+$2,940, +3.43% from previous year)

- 2021: $92,559 (+$3,984, +4.50% from previous year)

- 2022: $97,796 (+$5,237, +5.66% from previous year)

- 2023: $102,729 (+$4,933, +5.04% from previous year)

- 2024: $94,698 ($-8,031, -7.82% from previous year)

- 2025: $82,715 ($-11,983, -12.65% from previous year)

Crossett’s long-term housing trend shows a modest 2.98% gain since 2010, but that hides the more dramatic swings of recent years. After peaking above $102,000 in 2023, prices tumbled nearly 20% over the next two years, landing at $82,715 in 2025. This reversal could represent a market correction or the end of a short-term boom. Crossett had seen healthy appreciation from 2016 to 2022, suggesting a period of strong demand. But recent declines raise questions about sustainability, especially in smaller markets. Still, with average home values now back to early 2010s levels, this may be an ideal time for opportunistic buyers. The town offers a full-service community at small-town prices. If local conditions improve, these prices could rebound in the coming years.

Crossett – Paper Industry Town Facing Price Corrections

Located in Ashley County, Crossett is one of southern Arkansas’s largest timber and paper-producing towns. For decades, it was anchored by the Georgia-Pacific paper mill, which shaped everything from jobs to housing demand. This industrial legacy is baked into the town’s layout, housing stock, and economic rhythm. As the paper industry has faced pressure from automation and market shifts, Crossett’s economy has had to adjust — and these adjustments often ripple through the housing market. While it experienced notable price growth between 2016 and 2022, that momentum has clearly reversed. A nearly 13% price decline in 2025 alone makes Crossett one of the state’s most affordable established markets, offering buyers space, infrastructure, and community at a reduced cost.

Crossett remains more built-up than many similarly priced towns. It has public schools, shopping centers, medical facilities, and recreational spaces like Crossett City Park and the nearby Felsenthal National Wildlife Refuge. These amenities have helped maintain quality of life even as economic conditions fluctuate. The housing stock includes both historic bungalows and mid-century suburban homes, many of which are affordable to first-time buyers and investors alike. For those willing to bet on the town’s long-term resilience, the current market presents strong value — particularly for buyers who can lock in low prices while demand remains soft. If Crossett’s economy finds new drivers beyond its industrial roots, home values could stabilize or even rise again in the coming years.

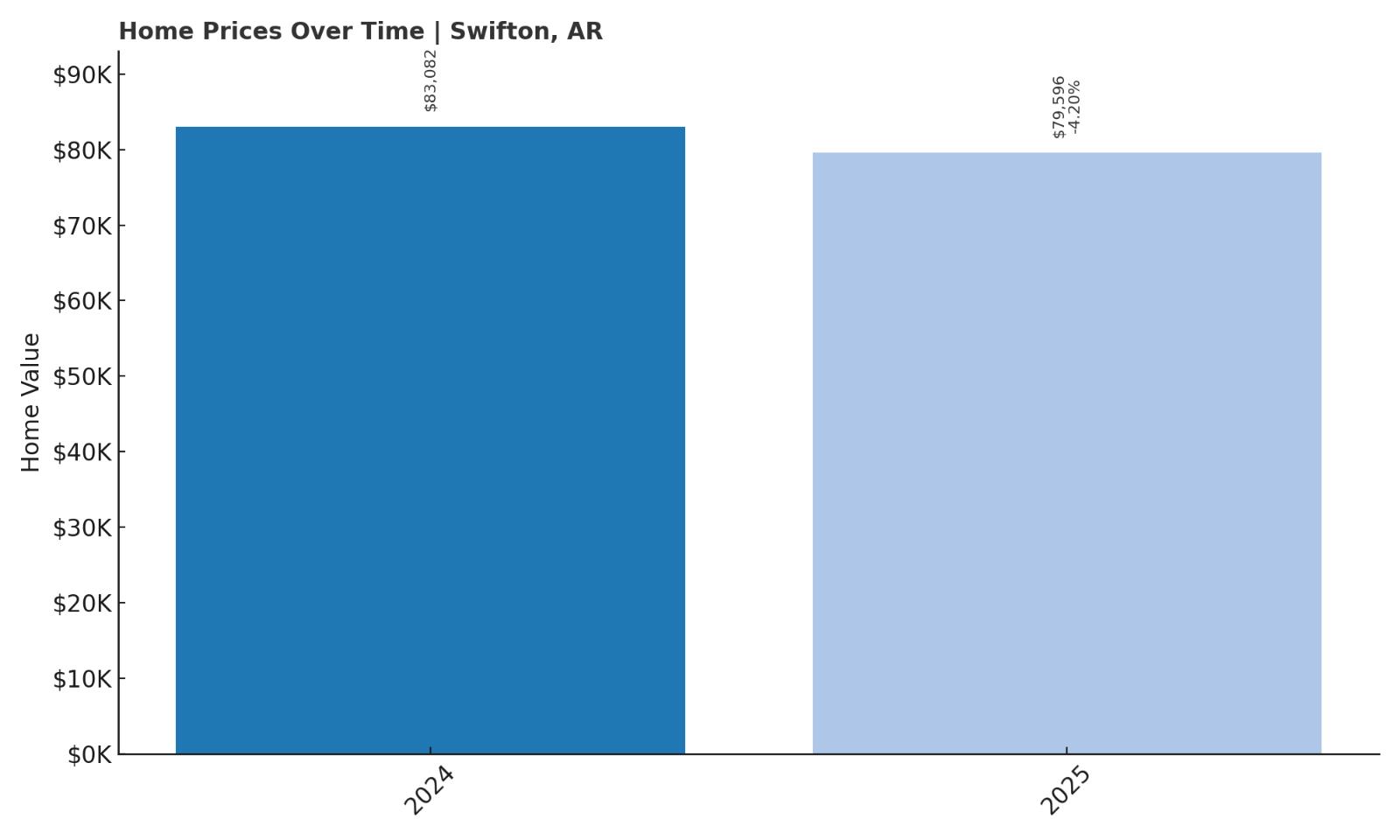

16. Swifton – 4.20% Price Drop Since May 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $83,082

- 2025: $79,596 ($-3,486, -4.20% from previous year)

Swifton experienced a 4.2% dip in average home values between 2024 and 2025, with prices falling from $83,082 to $79,596. Though limited data prevents a look at longer-term trends, this recent decline indicates a softening market. For buyers entering now, that drop could represent a strategic discount compared to last year’s peak. While the price shift isn’t dramatic, it may reflect broader economic stabilization or a simple return to baseline values after a one-year rise. With homes averaging under $80,000, Swifton remains among Arkansas’s more affordable towns. Even with minimal data, it’s clear that this market offers considerable value to budget-conscious buyers. The low entry point and the possibility of future appreciation make Swifton a town worth watching in 2025. Local factors and proximity to larger job markets could shape its path in the coming years.

Swifton – Quiet Affordability in Northeast Arkansas

Swifton is a quiet town in Jackson County, tucked away in northeast Arkansas, and home to just a few hundred residents. Its location along U.S. Route 67 provides access to nearby towns like Newport and Walnut Ridge, making it a rural bedroom community with basic connectivity. What it lacks in urban convenience, it makes up for with a calm lifestyle and remarkably low living costs. Like many Delta communities, Swifton has experienced population shifts over the decades, with fewer job opportunities leading to declining demand in some years. However, that very decline helps keep real estate prices low — which can be a huge advantage for buyers looking to own without a mortgage or build equity in a rental property.

While small in size, Swifton has a local school district, a post office, and several family-owned businesses that anchor the community. The surrounding landscape is defined by farmland and open sky, and residents tend to know one another by name. For retirees or remote workers seeking solitude and simplicity, Swifton offers a back-to-basics lifestyle with the benefits of ownership at a fraction of what you’d pay elsewhere. The recent drop in home prices may indicate a temporary correction or market readjustment, but overall, it continues to offer steady value. With proximity to rail lines and future infrastructure expansion possible, this quiet town could become more attractive to buyers priced out of more competitive markets in northeast Arkansas.

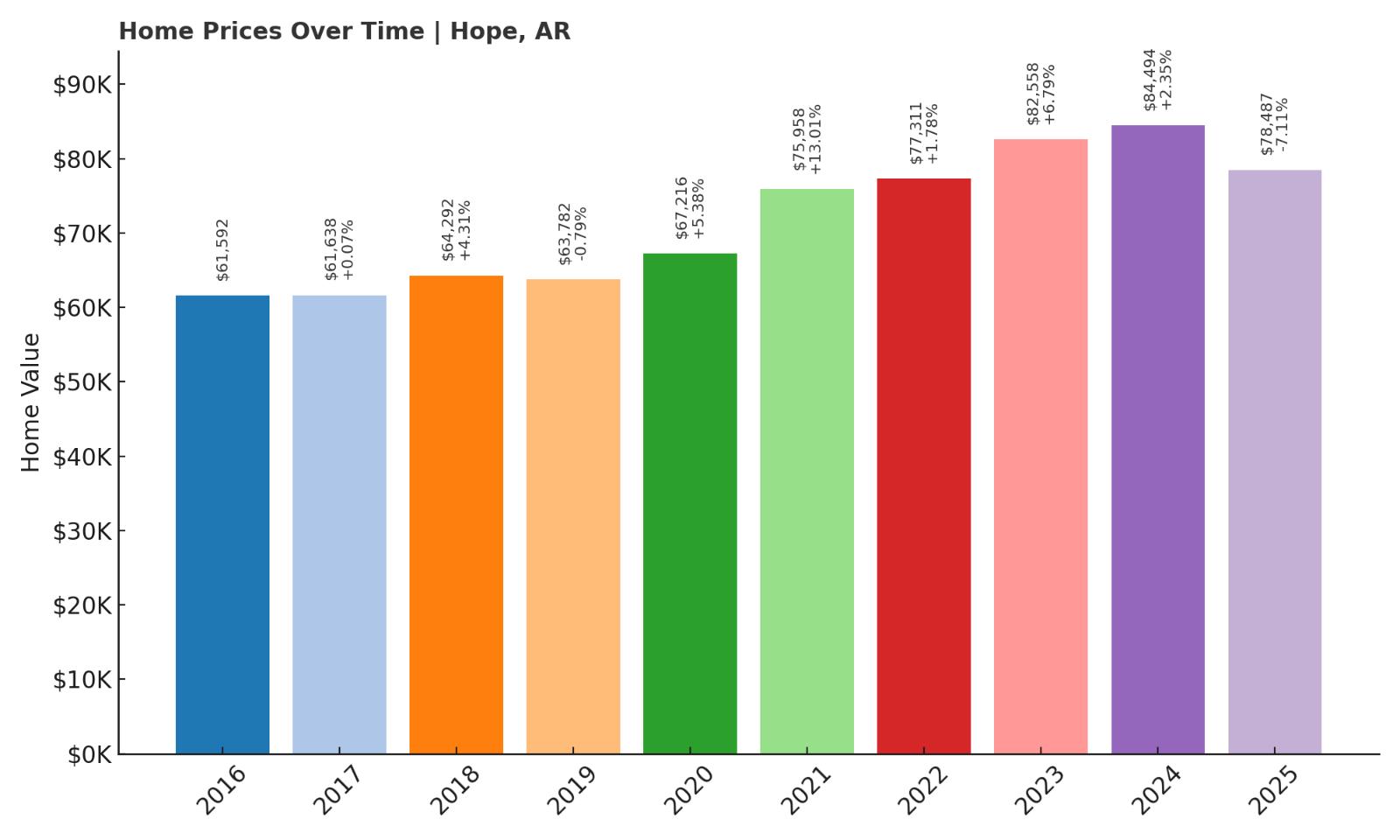

15. Hope – 27.42% Price Increase Since May 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $61,592

- 2017: $61,638 (+$46, +0.07% from previous year)

- 2018: $64,292 (+$2,654, +4.31% from previous year)

- 2019: $63,782 ($-510, -0.79% from previous year)

- 2020: $67,216 (+$3,434, +5.38% from previous year)

- 2021: $75,958 (+$8,743, +13.01% from previous year)

- 2022: $77,311 (+$1,352, +1.78% from previous year)

- 2023: $82,558 (+$5,247, +6.79% from previous year)

- 2024: $84,494 (+$1,936, +2.35% from previous year)

- 2025: $78,487 ($-6,008, -7.11% from previous year)

Hope has seen a 27.42% rise in home values since 2016, even after a 7% drop in the past year. After reaching $84,494 in 2024, prices dipped to $78,487 in 2025, possibly reflecting market fatigue or national economic shifts. Despite the dip, this town has experienced a relatively steady climb, especially from 2020 to 2023. Annual increases as high as 13% (in 2021) highlight periods of strong demand. That history suggests that Hope’s housing market still has room for growth. Its current price point under $80,000 keeps it accessible, even amid recent volatility. The broader upward trend gives buyers confidence in long-term value. Hope remains an affordable but historically stable option for those looking for dependable housing markets.

Hope – Historic Roots and a Gradual Comeback

Hope, located in Hempstead County, is best known as the birthplace of former U.S. President Bill Clinton, but its significance stretches beyond that claim to fame. The town has deep roots in agriculture, transportation, and industry, and it served for decades as a commercial hub for surrounding rural communities. With access to Interstate 30 and Amtrak service, Hope is more connected than many towns in this price bracket. Its economy has diversified in recent years with investments in education, local healthcare, and small business development. These slow but steady shifts have contributed to housing price appreciation — and even with the recent pullback in 2025, prices are still up significantly over the last decade. For buyers, that history of growth provides reassurance that dips like this year’s may be temporary.

The town also features historic downtown architecture, community festivals, and several museums and attractions that appeal to both locals and visitors. Hope’s local school district and healthcare facilities serve the wider region, making it a natural anchor for the southwestern part of the state. The housing stock ranges from older ranch-style homes to newer builds on large lots, many of which are still listed well under $90,000. Whether you’re a retiree seeking affordability with basic services, or a remote worker needing access to major roadways and infrastructure, Hope checks a lot of boxes. With its deep sense of place, slow-paced economic gains, and relatively low volatility over the years, Hope has quietly become one of Arkansas’s most appealing small towns for affordable long-term living.

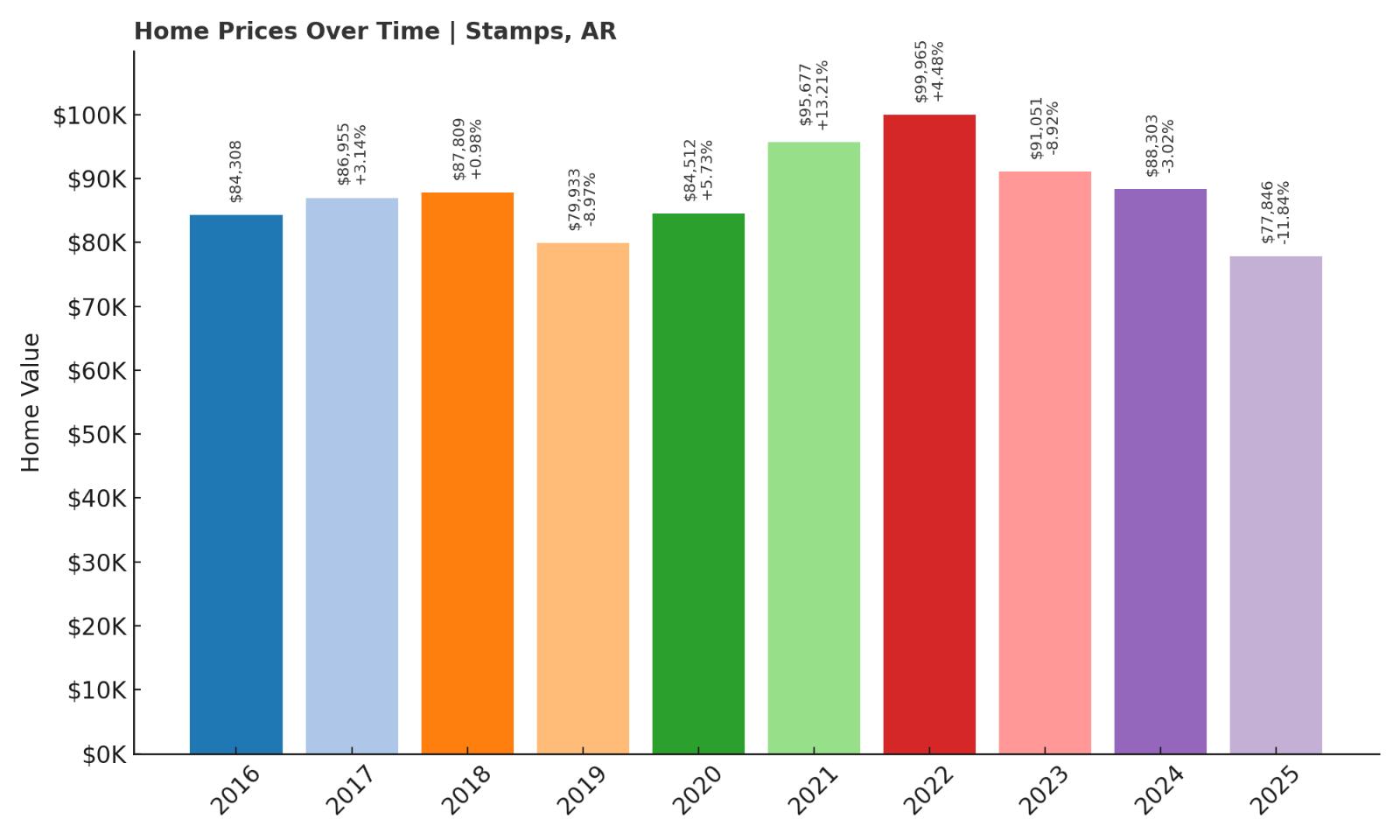

14. Stamps – 7.85% Price Drop Since May 2016

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: $84,308

- 2017: $86,955 (+$2,647, +3.14% from previous year)

- 2018: $87,809 (+$854, +0.98% from previous year)

- 2019: $79,933 ($-7,876, -8.97% from previous year)

- 2020: $84,512 (+$4,579, +5.73% from previous year)

- 2021: $95,677 (+$11,165, +13.21% from previous year)

- 2022: $99,965 (+$4,289, +4.48% from previous year)

- 2023: $91,051 ($-8,914, -8.92% from previous year)

- 2024: $88,303 ($-2,749, -3.02% from previous year)

- 2025: $77,846 ($-10,457, -11.84% from previous year)

Stamps has seen a net decrease of nearly 8% in home values since 2016, falling from $84,308 to $77,846. That overall figure, though, conceals dramatic movement. Prices surged to nearly $100,000 in 2022 before sliding sharply for three years straight. This means buyers today can purchase homes at prices last seen nearly a decade ago. The biggest recent dip came in 2025, with a loss of over $10,000 in average value — marking one of the steepest single-year declines on this list. Whether this is a local correction or part of a longer-term trend remains unclear. For now, it gives buyers significant negotiating power. The market’s unpredictability may be a risk, but the entry price remains one of the lowest in the state.

Stamps – Price Volatility in a Historically Rich Town

Stamps, located in Lafayette County near the Louisiana border, is a small town with a long industrial and agricultural past. The town once played a role in Arkansas’s timber and rail economy, and while its economic engine has slowed, its history is still visible in its buildings and street layout. The town is best known as the childhood home of Maya Angelou, who wrote about it in her memoirs. Despite its size, Stamps maintains its own school system, basic services, and community centers, giving it a more self-contained feel than some neighboring towns. The dramatic price growth between 2020 and 2022 reflected a brief period of local activity — possibly tied to out-of-state buyers or a short-lived uptick in demand for rural homes. Since then, the declines have been steep, creating the kind of volatility that’s rare in such a small market.

Yet this very volatility may present a buying opportunity. With values falling more than 20% in three years, Stamps has returned to an affordability level that makes ownership plausible even for lower-income buyers or retirees. Many homes here come with ample land, mature trees, and historic charm, often for less than the cost of a down payment elsewhere. If the recent downturn was driven more by individual transaction anomalies than economic decay, then the market could stabilize quickly — especially if remote work trends or rural revitalization efforts resume. Buyers considering Stamps should weigh the risks of price instability against the clear benefits of low cost and community cohesion. For some, that trade-off may be exactly what they’re looking for.

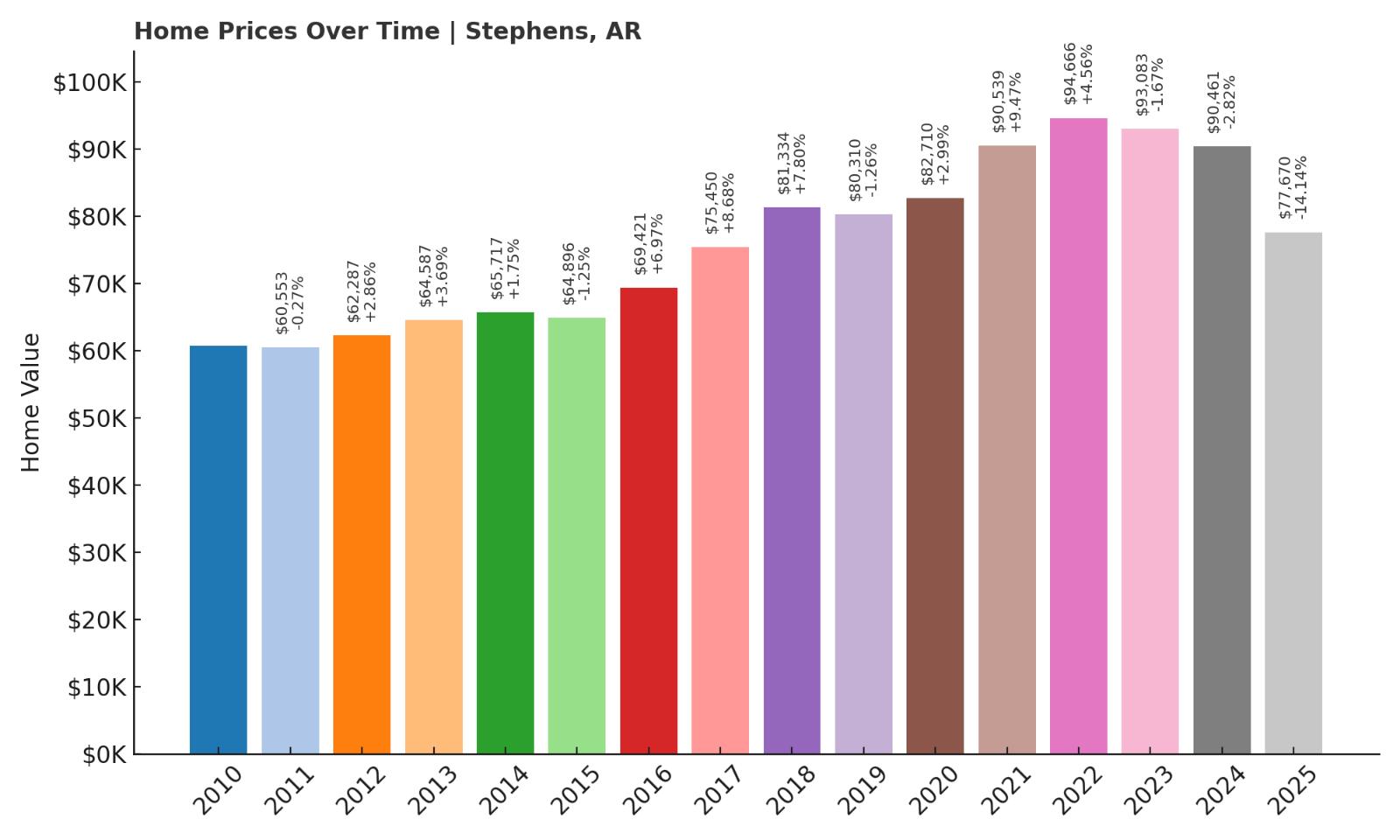

13. Stephens – 27.91% Price Increase Since May 2010

- 2010: $60,716

- 2011: $60,553 ($-163, -0.27% from previous year)

- 2012: $62,287 (+$1,734, +2.86% from previous year)

- 2013: $64,587 (+$2,300, +3.69% from previous year)

- 2014: $65,717 (+$1,130, +1.75% from previous year)

- 2015: $64,896 ($-821, -1.25% from previous year)

- 2016: $69,421 (+$4,525, +6.97% from previous year)

- 2017: $75,450 (+$6,029, +8.68% from previous year)

- 2018: $81,334 (+$5,884, +7.80% from previous year)

- 2019: $80,310 ($-1,024, -1.26% from previous year)

- 2020: $82,710 (+$2,400, +2.99% from previous year)

- 2021: $90,539 (+$7,829, +9.47% from previous year)

- 2022: $94,666 (+$4,128, +4.56% from previous year)

- 2023: $93,083 ($-1,583, -1.67% from previous year)

- 2024: $90,461 ($-2,623, -2.82% from previous year)

- 2025: $77,670 ($-12,790, -14.14% from previous year)

Stephens has posted a 27.91% rise in home values since 2010, climbing from $60,716 to $77,670 by 2025. But the recent trend tells a different story: after peaking near $95,000 in 2022, prices have fallen for three straight years, culminating in a sharp 14% drop just in 2025. This correction has brought prices back closer to their 2018 levels. Despite that, Stephens still holds long-term appreciation — and now sits at a lower entry point than in recent memory. It’s a case study in the cyclical nature of small-town housing markets. While volatility has returned, so has affordability. For prospective buyers, this reset may offer a prime chance to secure property in a town with prior growth momentum. Stephens remains among the more stable and historically resilient markets on this list.

Stephens – From Boom to Bargain in Southwest Arkansas

Stephens is located in Ouachita County, about 10 miles north of Camden, and has long been a quiet railroad and timber town. Like many small communities in Arkansas, its fortunes have followed the arc of industry — surging when jobs are plentiful and slipping when economic momentum slows. During the late 2010s and early 2020s, Stephens saw meaningful appreciation, with home values growing by over 50% in just six years. That kind of surge was rare among comparable towns, suggesting that Stephens may have benefited from proximity to Camden or even investor interest during the rural home-buying wave. Since 2022, however, prices have dropped sharply, reversing nearly $17,000 in gains. The most recent drop in 2025 is the steepest single-year decline the town has seen in over a decade, reflecting either market fatigue or a pause in demand.

Despite this volatility, Stephens retains many assets that support future recovery. The town is served by a small but established school district and offers access to healthcare and retail services in Camden. Its housing stock includes both early-20th-century craftsman homes and mid-century ranch-style houses, often located on large parcels of land. For buyers seeking space, quiet, and character — all at a price under $80,000 — Stephens checks many boxes. The sharp decline in 2025 may scare off short-term investors, but it could also make the town more appealing to long-term residents looking for affordability with upside potential. As broader housing markets stabilize, towns like Stephens may be first in line to rebound, thanks to their livable environments and low cost of entry.

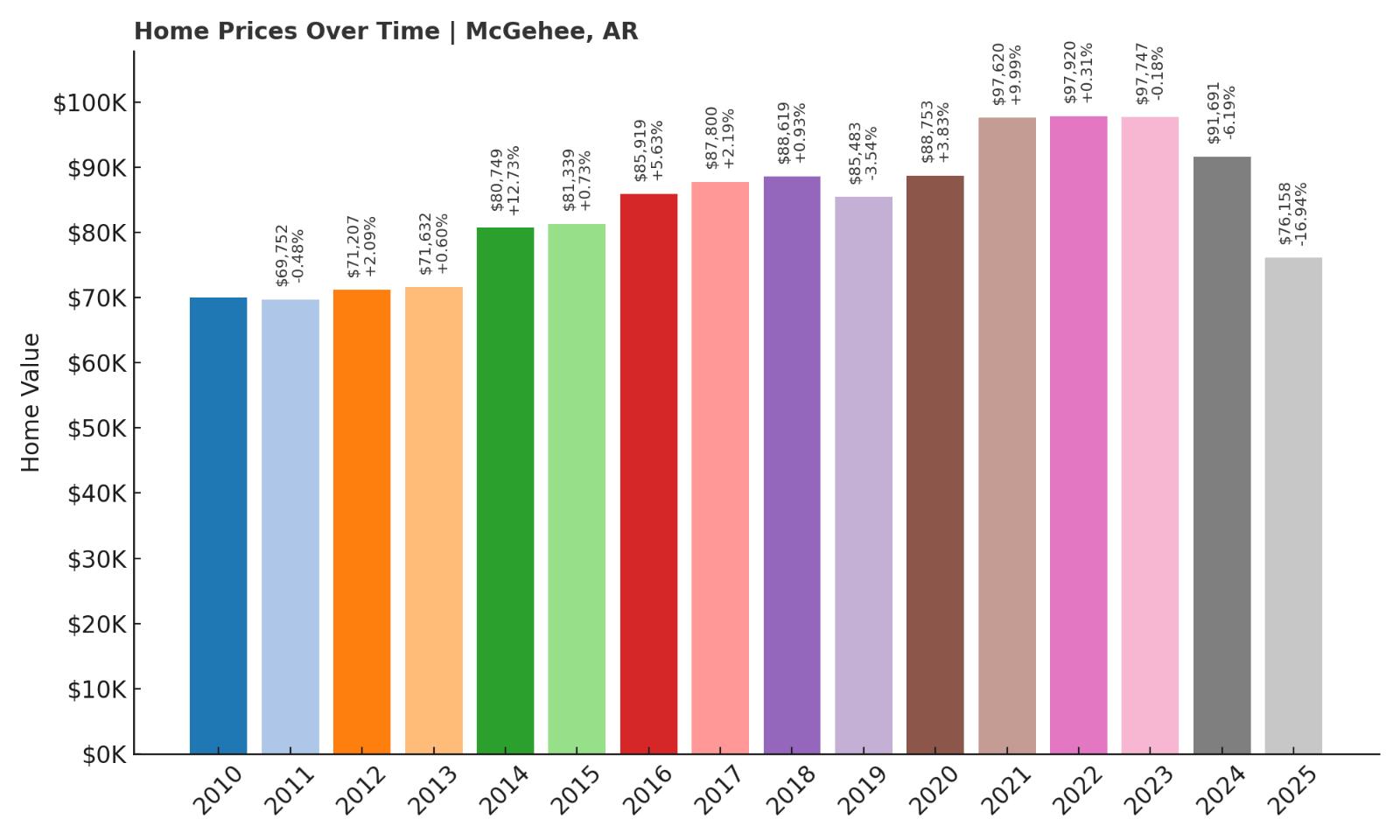

12. McGehee – 8.65% Price Increase Since May 2010

🔥 Would you like to save this?

- 2010: $70,088

- 2011: $69,752 ($-336, -0.48% from previous year)

- 2012: $71,207 (+$1,455, +2.09% from previous year)

- 2013: $71,632 (+$425, +0.60% from previous year)

- 2014: $80,749 (+$9,117, +12.73% from previous year)

- 2015: $81,339 (+$590, +0.73% from previous year)

- 2016: $85,919 (+$4,579, +5.63% from previous year)

- 2017: $87,800 (+$1,882, +2.19% from previous year)

- 2018: $88,619 (+$819, +0.93% from previous year)

- 2019: $85,483 ($-3,136, -3.54% from previous year)

- 2020: $88,753 (+$3,270, +3.83% from previous year)

- 2021: $97,620 (+$8,867, +9.99% from previous year)

- 2022: $97,920 (+$300, +0.31% from previous year)

- 2023: $97,747 ($-174, -0.18% from previous year)

- 2024: $91,691 ($-6,055, -6.19% from previous year)

- 2025: $76,158 ($-15,533, -16.94% from previous year)

McGehee’s home values have climbed 8.65% since 2010, rising from $70,088 to $76,158 over a 15-year period. That appreciation would have been much higher if not for recent pullbacks — especially the sharp 16.94% drop in 2025 alone. This decline follows a relatively stable stretch from 2016 to 2023, when home values hovered near or just below $90,000. That long period of stability has given way to uncertainty. But with prices now back near 2010 levels, affordability has returned to the forefront. McGehee offers a lot of house for the money and could represent a turnaround opportunity if local demand picks up again. The current low is a sharp contrast to just a few years ago — and for many buyers, that makes now a compelling time to look closely.

McGehee – Rail-Town Roots and River Delta Prices

McGehee is one of the larger towns in Desha County, located in the Arkansas Delta along U.S. Route 65. Historically, the town served as a regional railroad hub and agricultural shipping point, and it still benefits from those logistical connections today. The economy is grounded in agriculture and light industry, and the town has a small but active commercial core. With a population of around 3,500, McGehee maintains schools, medical services, and cultural institutions like the WWII Japanese American Internment Museum — a rare educational draw in this part of the state. Housing demand has been steady over time, with growth driven more by local need than speculative investment. But the nearly 17% drop in home values in 2025 is a significant reset, especially after several years of flat-to-positive gains.

Despite the price declines, McGehee remains one of the most functional towns in the region. Homes here often sit on wide, shaded lots and are typically well under 1,500 square feet — easy to maintain and relatively inexpensive to update. The return of affordability might invite more first-time buyers or young families seeking small-town stability with some economic diversity. The town’s low housing density, transportation links, and access to recreational areas like the Mississippi River or nearby wildlife refuges add lifestyle value beyond the listing price. While buyers should keep an eye on long-term trends, McGehee’s size and services set it apart from many other Delta towns — and the current price point could make it an attractive bet for future growth.

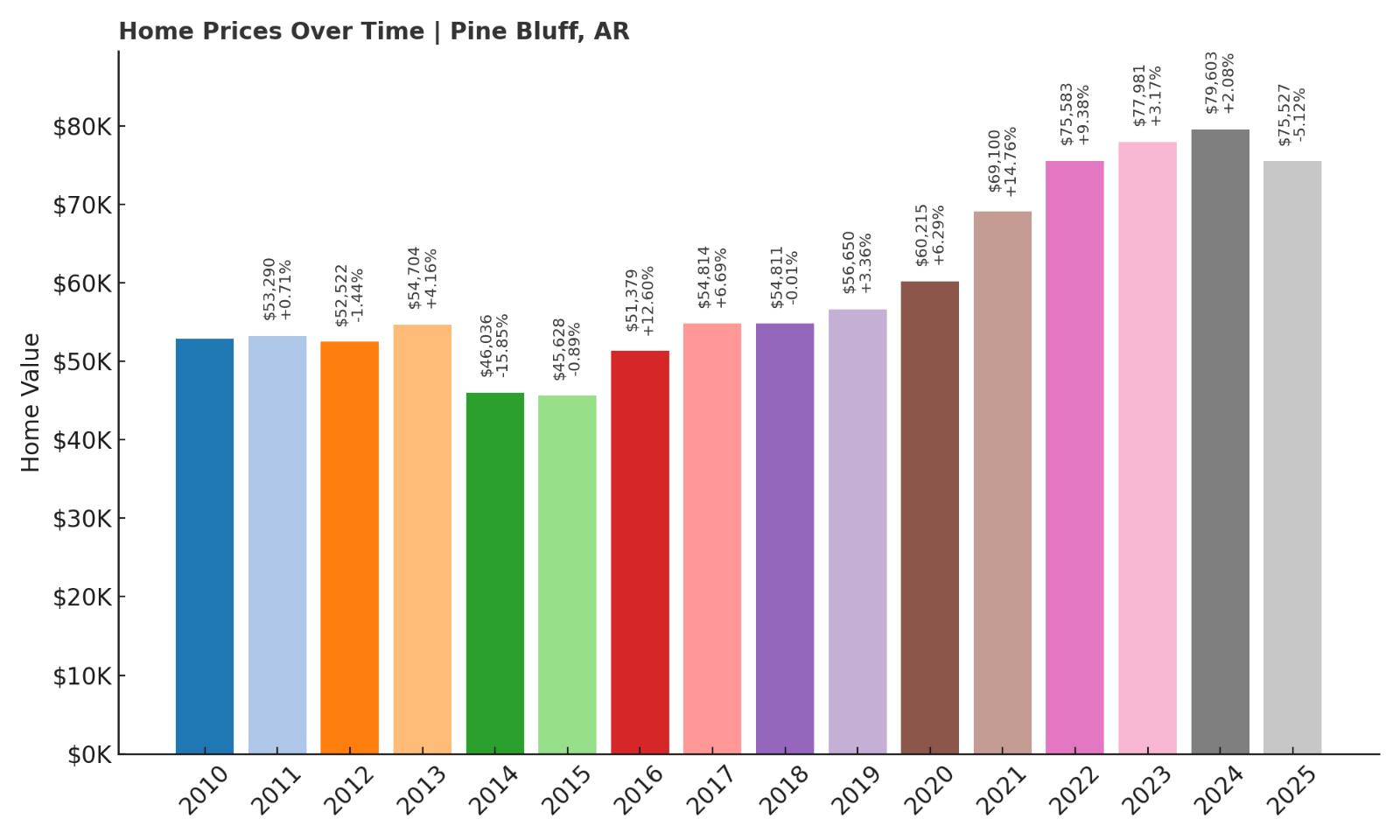

11. Pine Bluff – 42.74% Price Increase Since May 2010

- 2010: $52,915

- 2011: $53,290 (+$375, +0.71% from previous year)

- 2012: $52,522 ($-768, -1.44% from previous year)

- 2013: $54,704 (+$2,183, +4.16% from previous year)

- 2014: $46,036 ($-8,668, -15.85% from previous year)

- 2015: $45,628 ($-408, -0.89% from previous year)

- 2016: $51,379 (+$5,751, +12.60% from previous year)

- 2017: $54,814 (+$3,435, +6.69% from previous year)

- 2018: $54,811 ($-3, -0.01% from previous year)

- 2019: $56,650 (+$1,839, +3.36% from previous year)

- 2020: $60,215 (+$3,565, +6.29% from previous year)

- 2021: $69,100 (+$8,886, +14.76% from previous year)

- 2022: $75,583 (+$6,483, +9.38% from previous year)

- 2023: $77,981 (+$2,398, +3.17% from previous year)

- 2024: $79,603 (+$1,622, +2.08% from previous year)

- 2025: $75,527 ($-4,076, -5.12% from previous year)

Pine Bluff has seen a solid 42.74% rise in home prices since 2010, even with the 5.12% drop in 2025. This makes it one of the better long-term performers on the affordability list. From a low of $45,628 in 2015, prices rose steadily through 2022 and 2023, peaking near $80,000. The recent pullback may reflect larger market pressures, but values remain well above historical norms. The town’s size and amenities have helped maintain buyer interest. With a population exceeding 40,000, Pine Bluff is the largest and most urbanized place in this roundup. That makes its continued affordability even more notable. It offers the scale of a small city with the prices of a rural market — a combination that’s becoming increasingly rare.

Pine Bluff – Urban Infrastructure, Small-Town Prices

Pine Bluff is the seat of Jefferson County and one of Arkansas’s largest cities outside of the Little Rock metro. It sits about 45 minutes south of the capital and has historically served as a regional hub for industry, healthcare, and education. The city is home to the University of Arkansas at Pine Bluff, as well as major employers in the healthcare and corrections sectors. While its economy has faced challenges over the decades — including population loss and commercial decline — recent years have brought signs of stabilization. Public investment in downtown redevelopment, cultural institutions like the Arts & Science Center, and transportation infrastructure has helped attract new interest. Pine Bluff’s housing market followed suit, with consistent growth from 2016 to 2023 and only mild softening in the most recent year.

The city offers buyers far more than most towns in this price range. Public schools, hospitals, restaurants, and entertainment venues are all available — many of them located along Main Street or in the revitalized downtown corridor. For investors, Pine Bluff may represent one of the few remaining large markets in the state where prices are still under $80,000. That affordability, paired with infrastructure and population size, gives it long-term upside that smaller towns simply can’t match. While the recent price dip is worth watching, the town’s fundamentals remain solid. For buyers looking for low-cost entry into a city-scale community, Pine Bluff continues to deliver unmatched value.

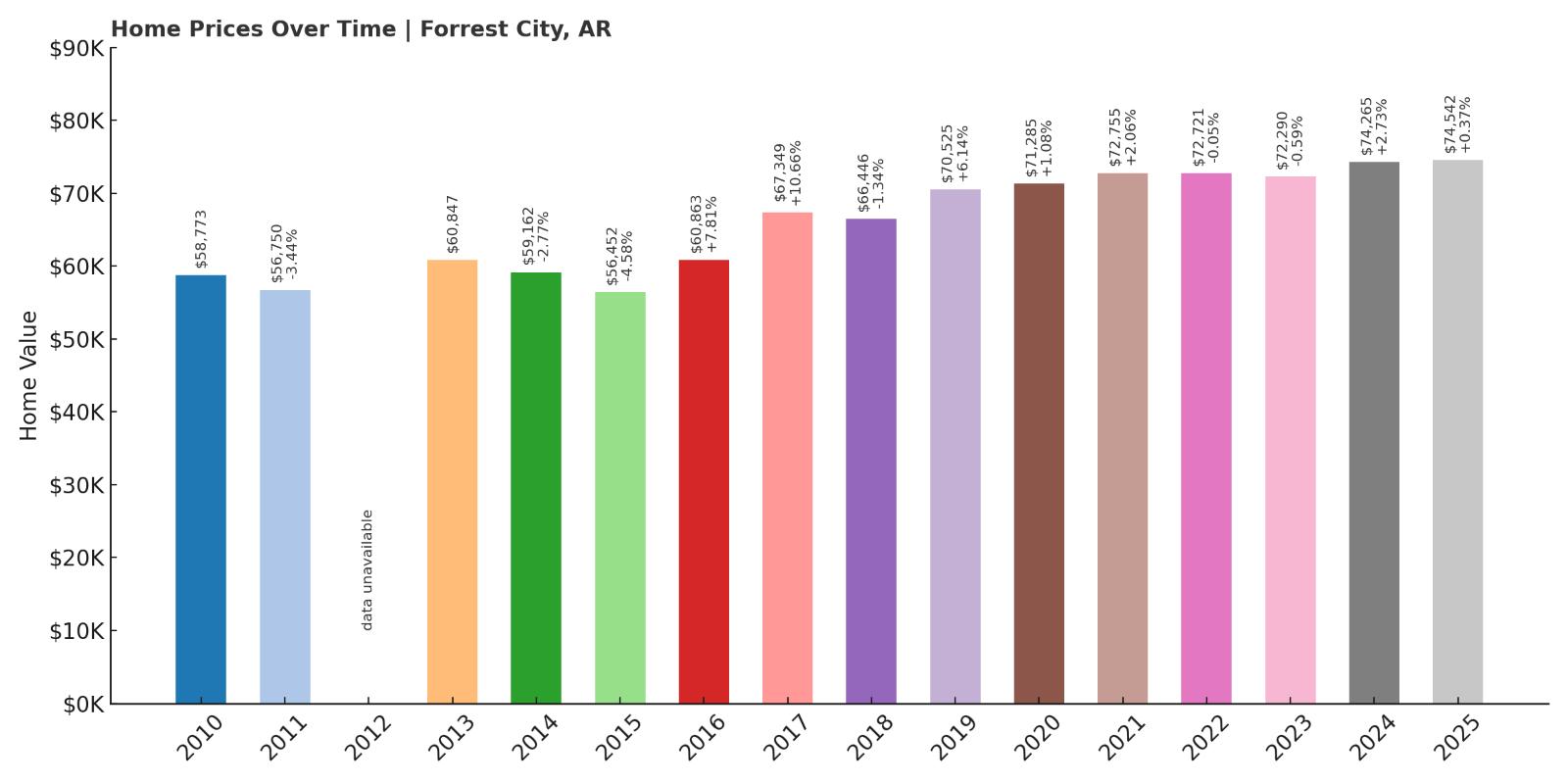

10. Forrest City – 26.79% Price Increase Since May 2010

- 2010: $58,773

- 2011: $56,750 ($-2,024, -3.44% from previous year)

- 2012: N/A

- 2013: $60,847

- 2014: $59,162 ($-1,685, -2.77% from previous year)

- 2015: $56,452 ($-2,709, -4.58% from previous year)

- 2016: $60,863 (+$4,411, +7.81% from previous year)

- 2017: $67,349 (+$6,486, +10.66% from previous year)

- 2018: $66,446 ($-903, -1.34% from previous year)

- 2019: $70,525 (+$4,080, +6.14% from previous year)

- 2020: $71,285 (+$760, +1.08% from previous year)

- 2021: $72,755 (+$1,470, +2.06% from previous year)

- 2022: $72,721 ($-35, -0.05% from previous year)

- 2023: $72,290 ($-430, -0.59% from previous year)

- 2024: $74,265 (+$1,975, +2.73% from previous year)

- 2025: $74,542 (+$277, +0.37% from previous year)

Forrest City’s home values have increased 26.79% since 2010, rising from $58,773 to $74,542 by 2025. Although the growth hasn’t been explosive, it has been fairly steady over the last decade. There were a few dips — notably in 2014–2015 and 2022–2023 — but these were followed by recoveries. The market’s current trajectory is flat, with only minor gains in 2025, suggesting stability rather than rapid movement. This consistency may appeal to risk-averse buyers who value predictability. With average home prices now just over $74,000, Forrest City sits squarely in the affordable range. Its history of modest appreciation indicates a solid long-term play, especially for owner-occupants. If growth resumes, current buyers could benefit from locking in now.

Forrest City – Steady Growth in the Delta Gateway

Located along Interstate 40 between Memphis and Little Rock, Forrest City serves as a gateway to the Arkansas Delta. Its strategic location has always made it an important stop for travelers and commerce, and the city remains one of the largest population centers in St. Francis County. Forrest City benefits from a regional healthcare presence, public schools, and a variety of retail and service businesses that give it a more developed feel than many nearby towns. Its proximity to major highways has helped it stay relevant even as smaller towns have shrunk. Housing here includes a mix of modest 1950s ranch homes and newer constructions, many still priced below $80,000. This accessibility, combined with infrastructure and location, keeps demand relatively steady year to year.

The town also has access to outdoor destinations such as Village Creek State Park, a large recreational area known for fishing, hiking, and horseback riding. Forrest City’s economy has diversified over time, with corrections, agriculture, manufacturing, and services all contributing to employment. Though it’s not immune to economic shifts — especially given its reliance on regional employment hubs — the local housing market has proven relatively resilient. The gradual climb in home prices over the last 15 years, even through national housing downturns, is a sign of a slow-but-steady market. For budget-conscious buyers looking to live between two metropolitan areas without breaking the bank, Forrest City continues to be a practical and affordable option.

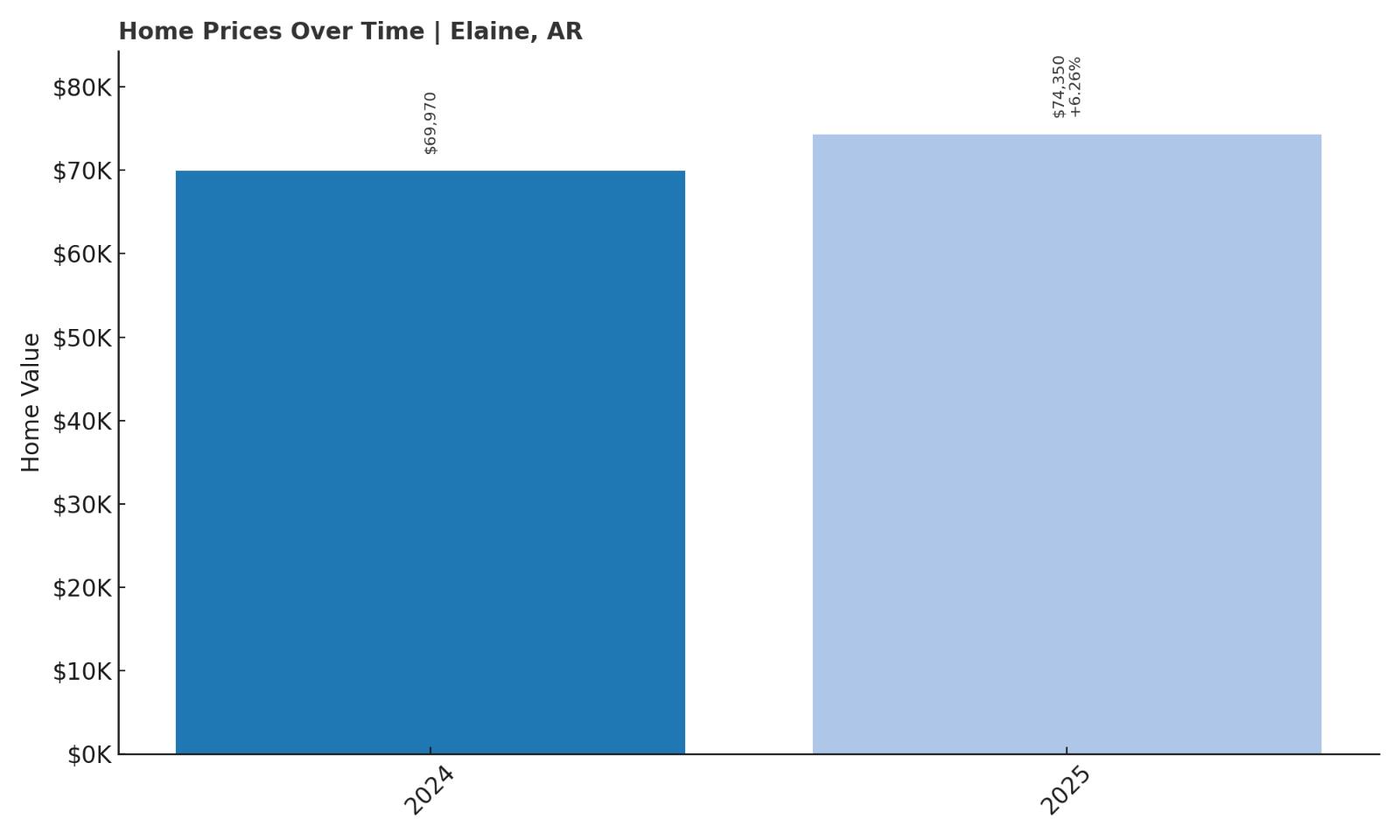

9. Elaine – 6.25% Price Increase Since May 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $69,970

- 2025: $74,350 (+$4,380, +6.26% from previous year)

Elaine is one of the few towns on this list to see a home price increase in 2025. With a 6.26% rise from $69,970 in 2024 to $74,350 this year, Elaine is showing signs of upward movement even as other markets cool. Without historical data prior to 2024, it’s hard to gauge long-term performance. However, this recent bump could reflect new demand or a market correction from undervalued prices. The current home value puts it among the more affordable towns in Arkansas, even after the gain. Buyers may want to monitor whether this uptick is a trend or an anomaly. But for now, Elaine represents a rising option for those looking to get in early. Price momentum this year may attract new attention from investors or long-term owners alike.

Elaine – Quiet Town, Rising Values

Elaine is a small town in Phillips County, located deep in the Arkansas Delta. With a population under 500, it’s one of the smallest communities in the state — and one of the most overlooked. Its remote location and agricultural surroundings have historically kept housing prices low, and for decades it has seen minimal residential development. However, that quiet isolation is now paired with signs of market movement. The 6.26% jump in home values this year is notable, especially at a time when many rural markets are retreating. That rise may reflect interest from remote buyers, land investors, or locals returning to settle in family-owned homes. While inventory remains tight, even small shifts in demand can move the needle in a market like Elaine’s.

While basic services in Elaine are limited, the town is within driving distance of Helena-West Helena and other Mississippi River towns, offering residents access to groceries, healthcare, and schools. Its affordable housing stock includes older single-story homes, often with large lots and mature trees. At current price levels, Elaine presents a low-risk entry point for buyers looking for rural property under $75,000. Whether the recent appreciation continues or flattens out, the town’s ultra-low base makes it appealing from a cost standpoint alone. For those comfortable with rural living and minimal amenities, Elaine offers a rare blend of affordability and early momentum — and could quietly become a high-upside market if this year’s gains continue in 2026.

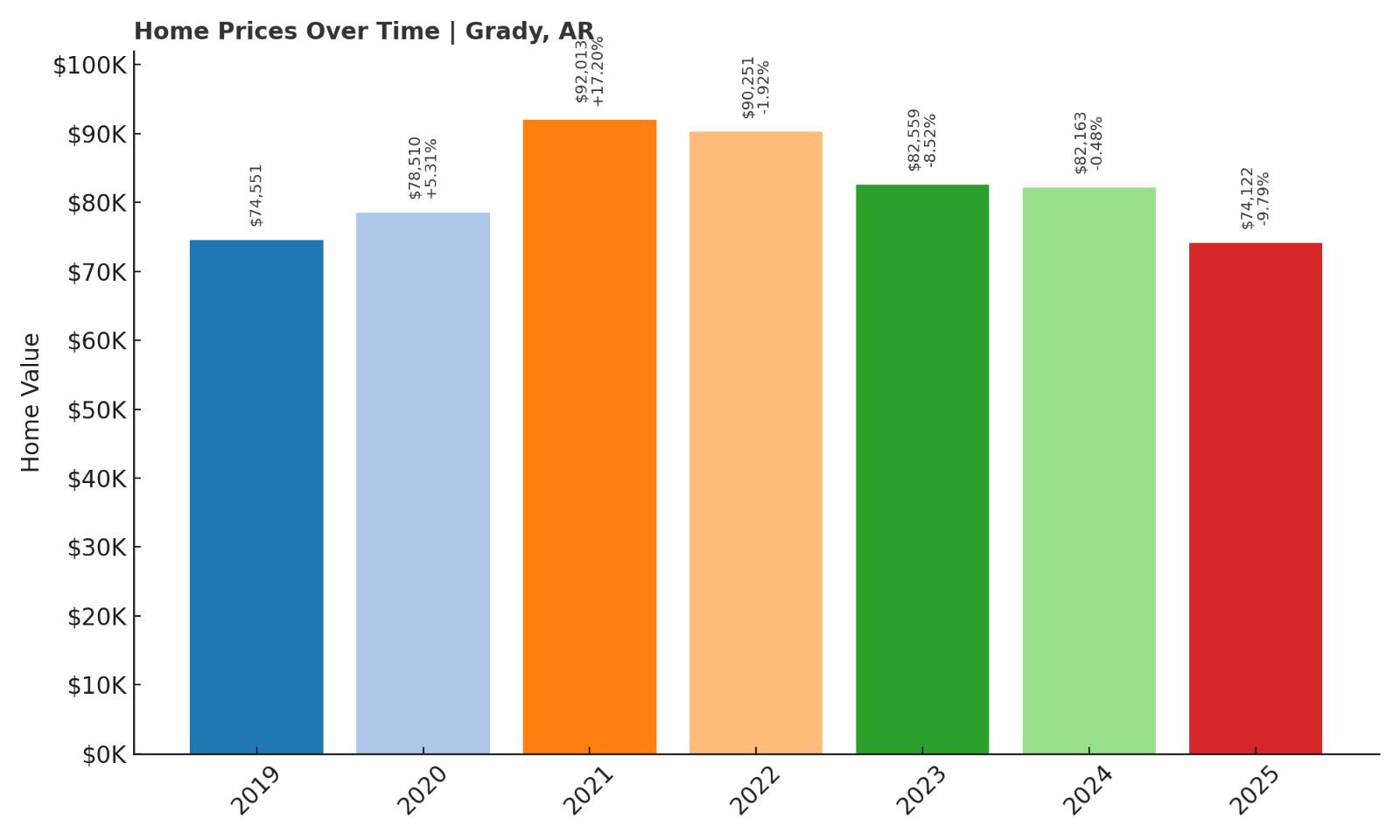

8. Grady – 0.91% Price Drop Since May 2019

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: $74,551

- 2020: $78,510 (+$3,959, +5.31% from previous year)

- 2021: $92,013 (+$13,503, +17.20% from previous year)

- 2022: $90,251 ($-1,762, -1.92% from previous year)

- 2023: $82,559 ($-7,692, -8.52% from previous year)

- 2024: $82,163 ($-396, -0.48% from previous year)

- 2025: $74,122 ($-8,041, -9.79% from previous year)

Grady’s home prices are now 0.91% lower than they were in 2019, dropping from $74,551 to $74,122 over six years. That statistic doesn’t capture the full story: the market boomed in 2021 with a massive 17% spike, reaching over $92,000. But prices have since declined each year, with a nearly 10% drop in 2025 alone. Grady is now back near 2019 levels, making it one of the most affordable towns in the state once again. This steep pullback suggests overextension during the pandemic-era surge. For buyers, the reset offers a return to value pricing in a town that had briefly grown more expensive. Current values may now represent a new floor, particularly if demand rebounds or stabilizes in the coming years.

Grady – From Pandemic Spike to Price Reset

Grady is a small city in Lincoln County, nestled in southeast Arkansas between Pine Bluff and Lake Village. With a population under 500, it maintains a peaceful rural character but still offers direct access to U.S. Route 65, a key corridor running north to Little Rock and south to the Louisiana border. Grady’s dramatic price spike in 2021 mirrored national trends in rural and remote markets, when buyers rushed to secure space and affordability outside metro zones. The 17% increase that year pushed values above $90,000 — a level that proved unsustainable in the years that followed. The 2025 figure reflects a significant correction, suggesting that speculative demand has cooled and prices have returned to more grounded levels. Still, Grady retains appeal for those seeking low-cost property in a region with strong transportation links and proximity to natural beauty.

The town is located near Bayou Bartholomew, the longest bayou in the world, and offers access to abundant fishing, birdwatching, and boating opportunities. It’s also just a short drive from larger towns like Star City and Dumas, where residents can find groceries, schools, and medical services. Housing in Grady typically consists of simple single-family homes and mobile homes, many on large lots with shade trees and privacy. The recent drop in prices makes this a particularly attractive option for buyers with cash or those seeking affordable rental investments. If housing demand creeps back into the Delta or remote work continues to drive migration into rural areas, Grady could again see modest gains. But even if it doesn’t, buyers are getting in near the bottom — and that alone is often enough to make a market worth considering.

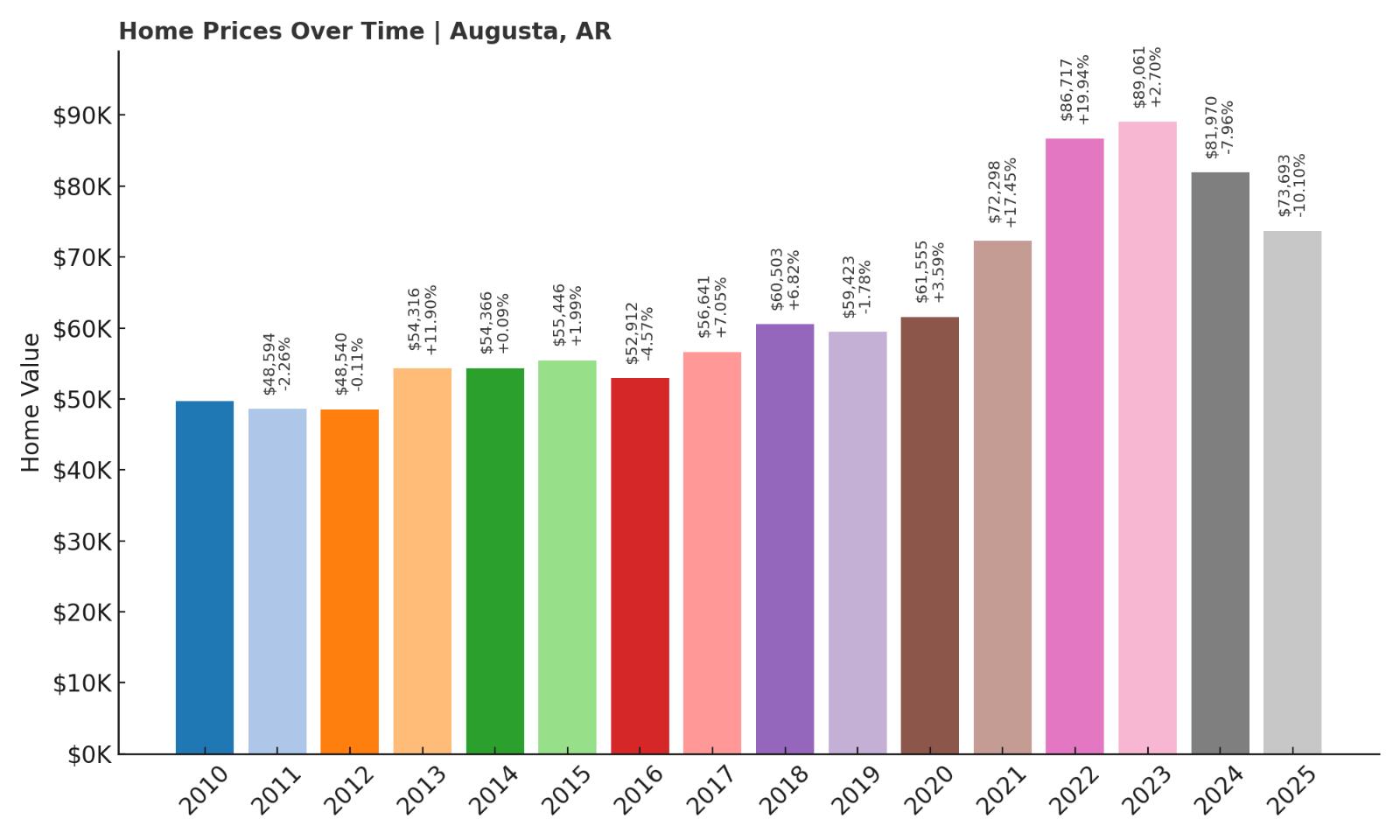

7. Augusta – 48.17% Price Increase Since May 2010

- 2010: $49,717

- 2011: $48,594 ($-1,123, -2.26% from previous year)

- 2012: $48,540 ($-54, -0.11% from previous year)

- 2013: $54,316 (+$5,777, +11.90% from previous year)

- 2014: $54,366 (+$50, +0.09% from previous year)

- 2015: $55,446 (+$1,080, +1.99% from previous year)

- 2016: $52,912 ($-2,534, -4.57% from previous year)

- 2017: $56,641 (+$3,729, +7.05% from previous year)

- 2018: $60,503 (+$3,862, +6.82% from previous year)

- 2019: $59,423 ($-1,079, -1.78% from previous year)

- 2020: $61,555 (+$2,131, +3.59% from previous year)

- 2021: $72,298 (+$10,743, +17.45% from previous year)

- 2022: $86,717 (+$14,420, +19.94% from previous year)

- 2023: $89,061 (+$2,344, +2.70% from previous year)

- 2024: $81,970 ($-7,091, -7.96% from previous year)

- 2025: $73,693 ($-8,277, -10.10% from previous year)

Augusta has seen a substantial 48.17% home value increase since 2010, rising from $49,717 to $73,693. However, it has given up nearly all of the impressive gains it made between 2020 and 2022. From a peak of nearly $90,000 in 2023, prices have declined sharply in each of the last two years. The double-digit drop in 2025 (-10.10%) marks a major correction after two years of rapid expansion. Still, even with that reset, Augusta’s long-term appreciation remains strong. Its location and solid infrastructure may help it recover once markets stabilize. For buyers, the current price point offers a chance to buy into a town with historical upward momentum — now at a steep discount from recent highs.

Augusta – Historic River Town with a Volatile Edge

Situated along the White River in Woodruff County, Augusta is a picturesque small town with deep historical roots and a strong sense of identity. Once a thriving riverport, Augusta still retains its 19th-century downtown charm and has become a regional center for fishing, hunting, and agricultural services. Its relatively diversified economy — combining farming, education, and local retail — has kept it more stable than many similarly priced towns in the Delta. That said, its housing market has shown some wild swings in recent years. A surge in values during the 2021–2022 rural housing wave pushed prices to historic highs, but that momentum proved short-lived. The subsequent drop has brought values down by over $15,000, making homes more affordable again while retaining long-term upside potential.

Augusta is one of the few towns on this list with amenities like a hospital, high school, and small but active cultural scene, including festivals and events centered around its riverside location. Homes here range from restored Victorian-era properties to modest 1960s ranch homes, many priced well below statewide averages. While price volatility may be concerning to some, others will see it as a window of opportunity. If Augusta can regain its footing and attract more full-time residents — especially remote workers or retirees — the housing market could rebound. For now, buyers are getting in at prices last seen five years ago, in a town with character, services, and room to grow. That combination is increasingly hard to find in Arkansas under $75,000.

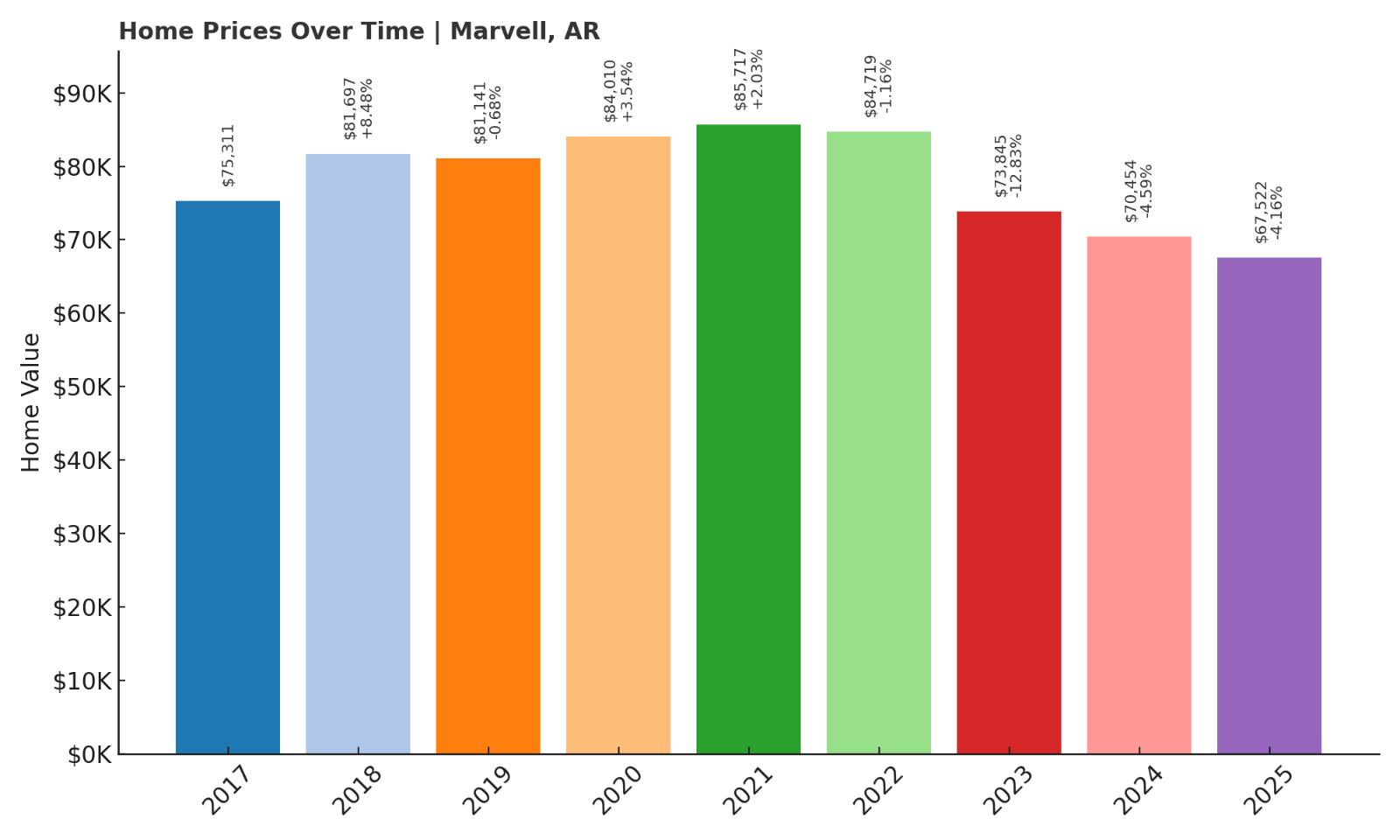

6. Marvell – 10.95% Price Drop Since May 2017

🔥 Would you like to save this?

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: $75,311

- 2018: $81,697 (+$6,386, +8.48% from previous year)

- 2019: $81,141 ($-556, -0.68% from previous year)

- 2020: $84,010 (+$2,870, +3.54% from previous year)

- 2021: $85,717 (+$1,706, +2.03% from previous year)

- 2022: $84,719 ($-998, -1.16% from previous year)

- 2023: $73,845 ($-10,874, -12.83% from previous year)

- 2024: $70,454 ($-3,391, -4.59% from previous year)

- 2025: $67,522 ($-2,931, -4.16% from previous year)

Marvell’s home values have dropped 10.95% since 2017, sliding from $75,311 to $67,522 over an 8-year span. The town saw moderate growth between 2017 and 2021, peaking near $86,000. But it’s been in steady decline since then, losing ground each of the past four years. The biggest drop came in 2023, when prices fell by nearly 13%. This trend suggests waning demand or economic stagnation, but it also opens the door to deeply discounted buying opportunities. With current prices well below the state average, Marvell is one of the least expensive markets in Arkansas. That makes it particularly attractive to buyers with limited budgets, as well as investors hunting for low-cost properties in communities with long-term potential.

Marvell – Deep Delta Affordability with Room to Rebound

Marvell is a small city in Phillips County, deep in the Arkansas Delta and surrounded by farmland, forests, and levees. It’s a place where life moves slowly, community ties run deep, and real estate remains one of the best bargains in the state. With a population under 1,000, Marvell offers peace, privacy, and rural simplicity — but also struggles with the kinds of economic challenges that affect many Delta towns. The recent slide in home prices reflects that reality, as demand has declined and housing turnover remains minimal. Still, the town’s location near Helena-West Helena gives it access to schools, healthcare, and shopping — making it more livable than some of its even more remote counterparts. The large, flat lots and traditional homes here are ideal for buyers looking to settle in or rent out without major renovation costs.

What makes Marvell compelling is how far a dollar can stretch. At under $70,000 on average, buyers can find two- and three-bedroom homes with yards, porches, and good bones — often needing only modest updates. For remote workers who don’t need to commute, or for retirees seeking a quiet home base, Marvell offers an unmatched cost-to-space ratio. While population trends suggest continued stagnation, the affordability factor may eventually lure new residents seeking relief from urban costs. And if broader interest in Delta revitalization efforts picks up again, Marvell stands to benefit. Until then, buyers have the opportunity to purchase well below replacement cost — in a market that, while challenged, remains accessible and full of untapped potential.

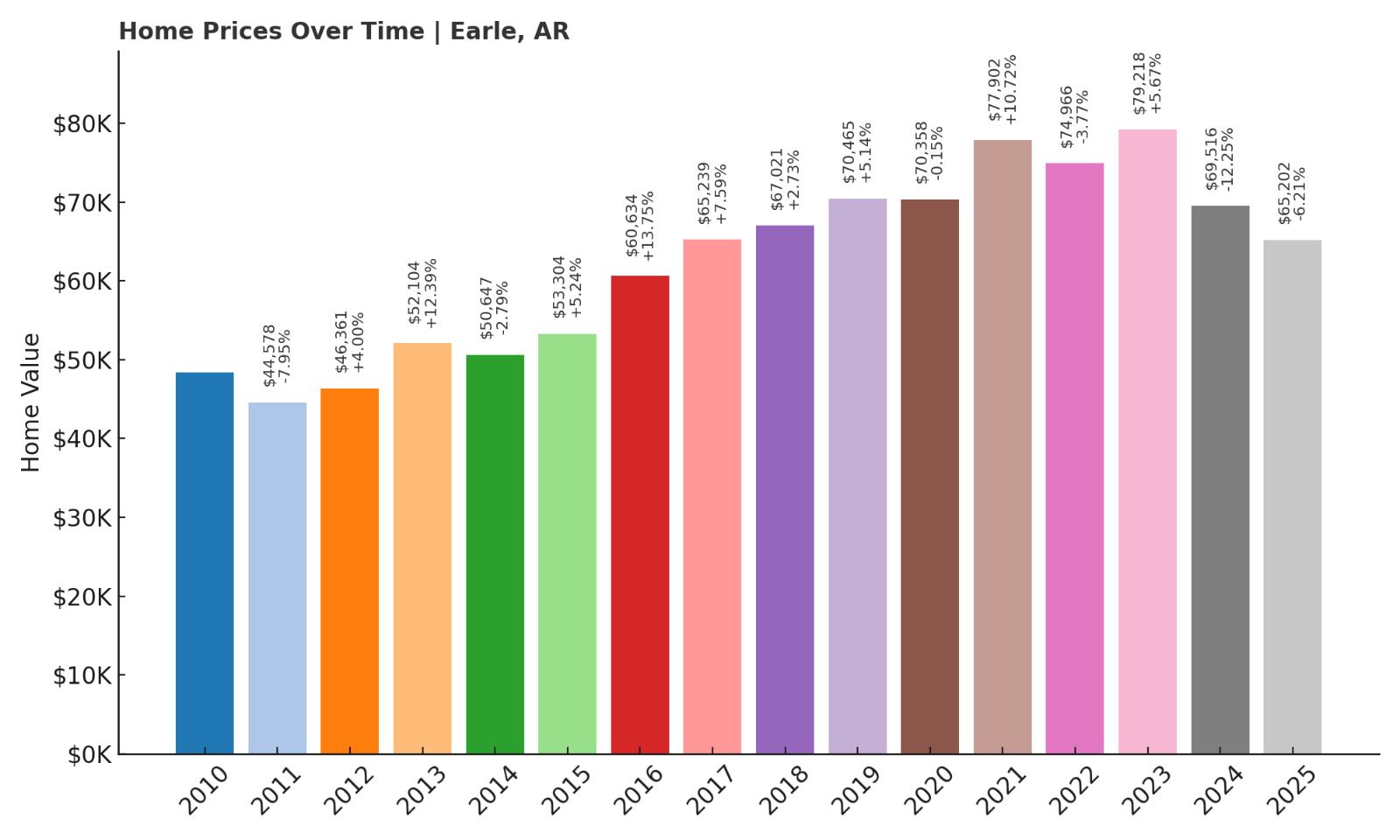

5. Earle – 34.58% Price Increase Since May 2010

- 2010: $48,430

- 2011: $44,578 ($-3,852, -7.95% from previous year)

- 2012: $46,361 (+$1,783, +4.00% from previous year)

- 2013: $52,104 (+$5,743, +12.39% from previous year)

- 2014: $50,647 ($-1,456, -2.79% from previous year)

- 2015: $53,304 (+$2,656, +5.24% from previous year)

- 2016: $60,634 (+$7,331, +13.75% from previous year)

- 2017: $65,239 (+$4,604, +7.59% from previous year)

- 2018: $67,021 (+$1,783, +2.73% from previous year)

- 2019: $70,465 (+$3,443, +5.14% from previous year)

- 2020: $70,358 ($-106, -0.15% from previous year)

- 2021: $77,902 (+$7,544, +10.72% from previous year)

- 2022: $74,966 ($-2,936, -3.77% from previous year)

- 2023: $79,218 (+$4,252, +5.67% from previous year)

- 2024: $69,516 ($-9,702, -12.25% from previous year)

- 2025: $65,202 ($-4,314, -6.21% from previous year)

Home prices in Earle have climbed 34.58% since 2010, rising from $48,430 to $65,202. But that headline increase masks recent turbulence. The market peaked in 2021 at just under $78,000 and has since declined for three of the last four years, including a 12.25% plunge in 2024. Values in 2025 continued to fall, though at a slower pace. This cooling-off period brings prices back to their mid-2010s levels — a reality check for a town that had once surged quickly. Still, the long-term growth remains positive. For buyers, current pricing offers a steep discount compared to the recent high. Earle’s trend suggests that the bottom may be nearing, making now a potentially strategic time to enter.

Earle – A Receding Market With Long-Term Gains

Located in Crittenden County in eastern Arkansas, Earle is about 30 miles west of Memphis, Tennessee — giving it better access to urban opportunity than most towns on this list. Once a vibrant agricultural hub, Earle has struggled with depopulation and disinvestment over the years, but its real estate market experienced a surprising burst of growth during the 2015–2021 period. Prices jumped nearly 60% in just six years, thanks to new investor interest and a rise in remote relocations. However, those gains proved difficult to sustain, and recent declines have brought the town back to its affordability roots. Homes here are typically modest single-family houses from the 1960s and ’70s, often on large, quiet lots. Many are structurally sound but in need of updates — which presents opportunity for budget-conscious buyers or flippers.

Earle’s proximity to West Memphis and the broader Memphis metro gives it logistical advantages that most Arkansas Delta towns don’t enjoy. Access to U.S. Route 64 and I-40 makes commuting feasible, and larger employers and services are within reach. While the local economy remains limited, the city does have a school system and basic infrastructure that make it livable. If regional growth resumes or investment returns to smaller towns outside of major metros, Earle could once again benefit. For now, buyers get the chance to purchase well below peak prices, with the long-term growth record suggesting eventual upside. At just over $65,000, Earle offers more home and more location value than most markets at this price point.

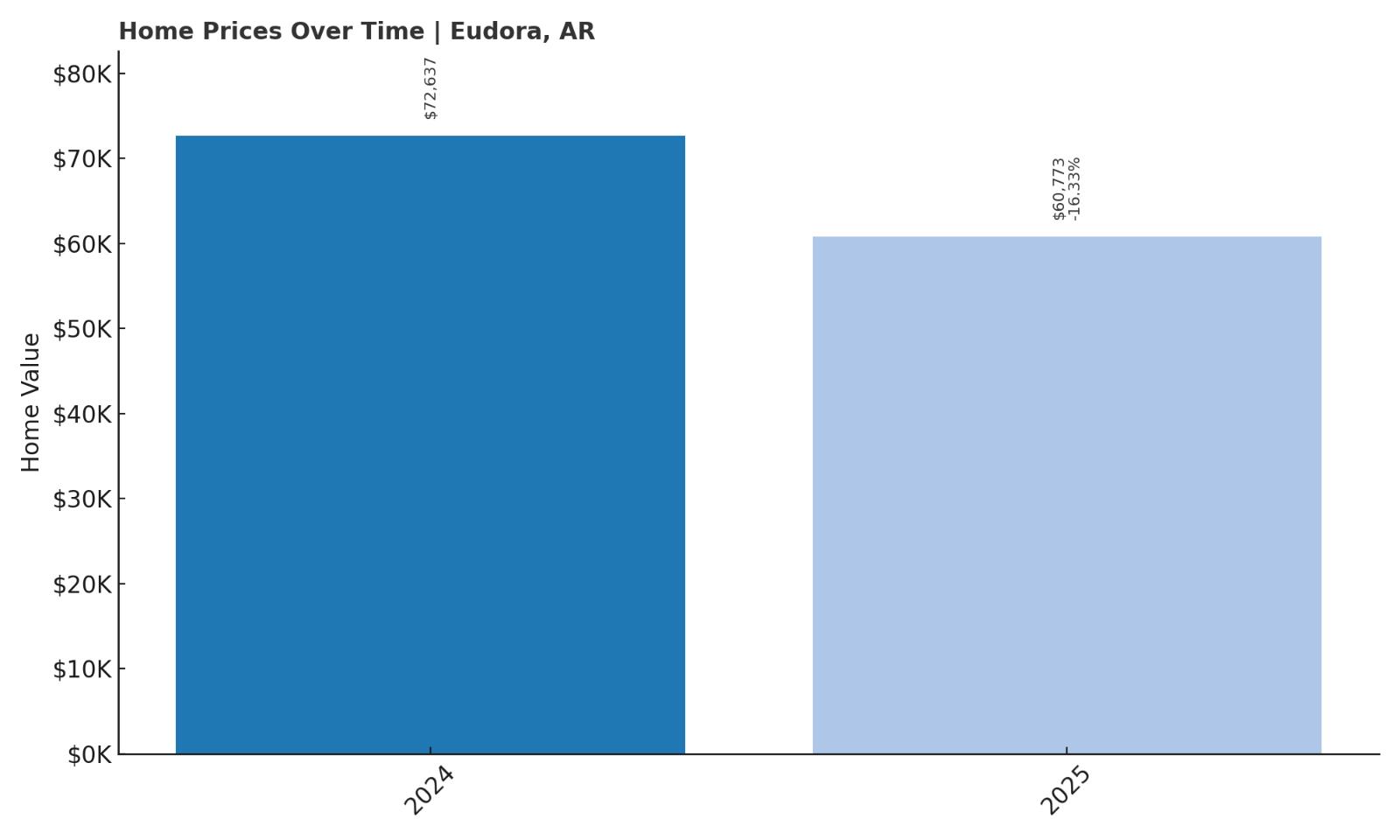

4. Eudora – 16.33% Price Drop Since May 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $72,637

- 2025: $60,773 ($-11,864, -16.33% from previous year)

In Eudora, home values dropped by 16.33% in just one year — the largest single-year decline on this entire list. Prices fell from $72,637 in 2024 to just $60,773 in 2025. With no previous data available, we can’t evaluate long-term trends, but this correction is significant. It could reflect overpricing in 2024 or external market pressures that pushed prices down. For buyers, this sudden decrease opens the door to low-cost opportunities. Eudora now ranks among the most affordable towns in the state. The drop may worry some investors, but for owner-occupants or buyers seeking a rural retreat, the new pricing could be ideal. The next few years will reveal whether this was a blip or a longer-term shift.

Eudora – Deep Delta Price Collapse and Opportunity

Located in Chicot County at the very southern tip of Arkansas, Eudora lies along the Mississippi River and just a few miles from the Louisiana border. With a population under 2,000, it serves as a local center for agriculture and rural services, but its isolation and distance from job hubs limit economic diversity. That said, Eudora is one of the few towns in southeast Arkansas with a grid-style downtown, civic institutions, and a recognizable community core. Its housing stock consists of compact homes, many built in the mid-20th century and still structurally intact. The massive 16% price drop in 2025 may be tied to decreased demand or economic uncertainty in the region, but it also resets the affordability baseline. For buyers who prioritize space and peace over connectivity, Eudora is now offering prices that are hard to match statewide.

The town has proximity to Lake Chicot — the largest natural oxbow lake in North America — and benefits from fertile farmland, access to outdoor recreation, and scenic views along the Great River Road. While amenities are basic, residents enjoy a close-knit community with schools, churches, and family-run businesses. Housing prices under $61,000 are nearly unheard of in most of the U.S., making Eudora a potential magnet for retirees, off-grid enthusiasts, or buyers with vision and patience. There is risk here — particularly in terms of resale and liquidity — but for those looking for long-term, debt-free ownership, it’s one of Arkansas’s most deeply discounted real estate markets right now.

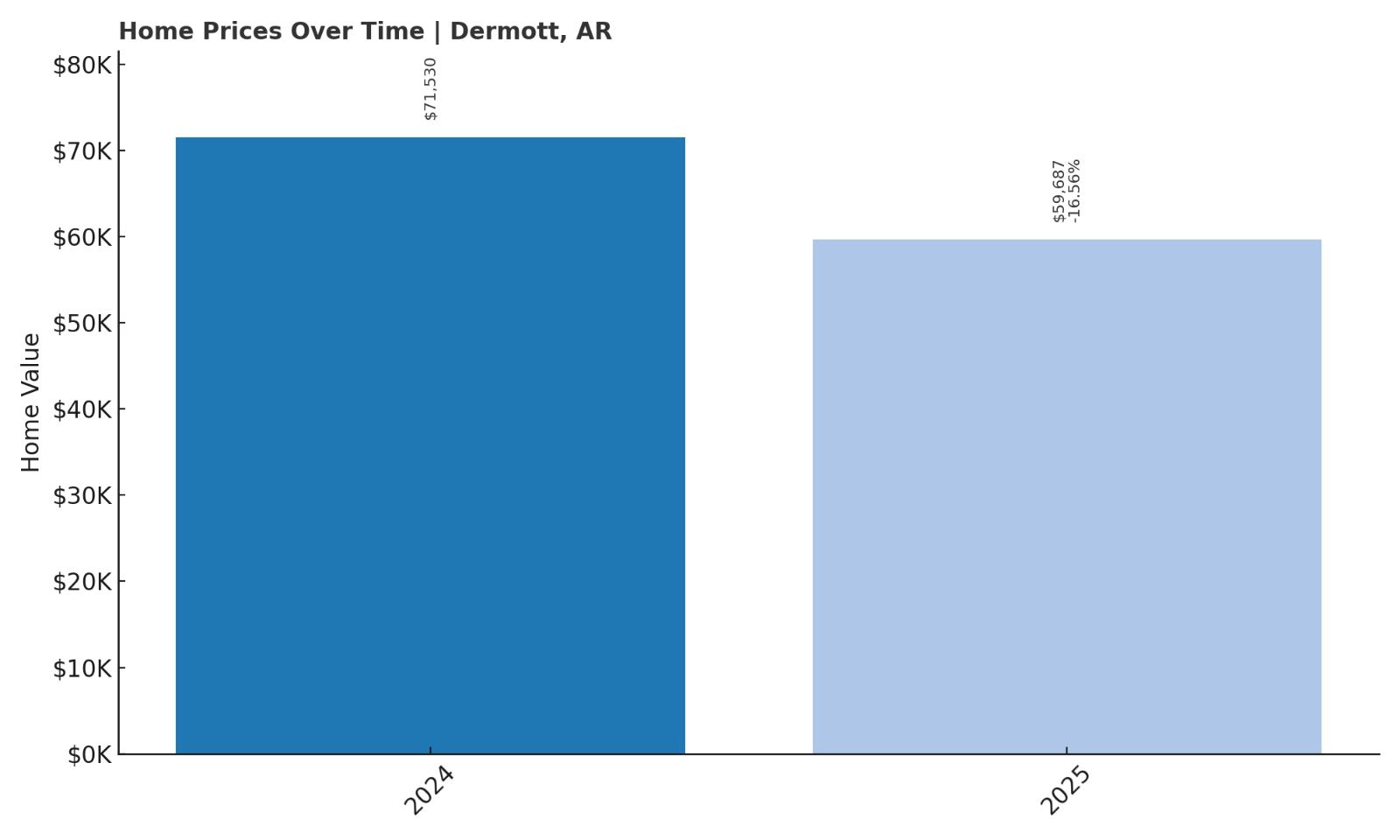

3. Dermott – 16.56% Price Drop Since May 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $71,530

- 2025: $59,687 ($-11,843, -16.56% from previous year)

Dermott’s home values declined 16.56% in 2025 — falling from $71,530 to $59,687 in just one year. Like several other towns in the Delta, Dermott appears to have experienced a short-lived price surge that quickly corrected. Without data prior to 2024, we can’t tell if this is a return to average or an abnormal dip. Regardless, it now ranks as one of Arkansas’s most affordable markets. With average home prices under $60,000, Dermott is accessible to nearly any buyer. The steep discount may signal a loss of momentum, but it also creates potential upside for long-term owners. Investors looking for low-risk entry points might find this price drop an unexpected advantage. For first-time buyers, the cost barrier is nearly gone.

Dermott – Affordable Homes in a Shrinking Market

Dermott is a small city in Chicot County with a long history tied to cotton farming and Delta culture. Like many towns in the region, it has seen a steady population decline over the past few decades, as job opportunities dried up and younger residents moved elsewhere. Today, it remains a quiet, mostly residential town surrounded by flat farmland and intersected by historic highways. Housing inventory is limited, but so is demand — which helps explain the recent price drop. Still, many of the homes are single-family structures on generously sized lots, built in the 1940s through 1970s. They may need updating, but they offer a stable starting point for those seeking shelter on a very modest budget.

Dermott has basic amenities — schools, a small library, and a few local businesses — but residents typically drive to Lake Village or McGehee for larger services. What it lacks in economic dynamism, it makes up for in affordability and space. Buyers interested in homesteading, retiring, or simply owning property outright will find very few towns where average prices are this low. The 2025 price drop brings Dermott close to what it may have been worth a decade ago — essentially reversing recent growth. While this might concern sellers, it creates a rare opportunity for buyers to enter a market at what could be its absolute floor. If the region sees any revival in infrastructure or migration trends, Dermott may one day see prices tick back upward.

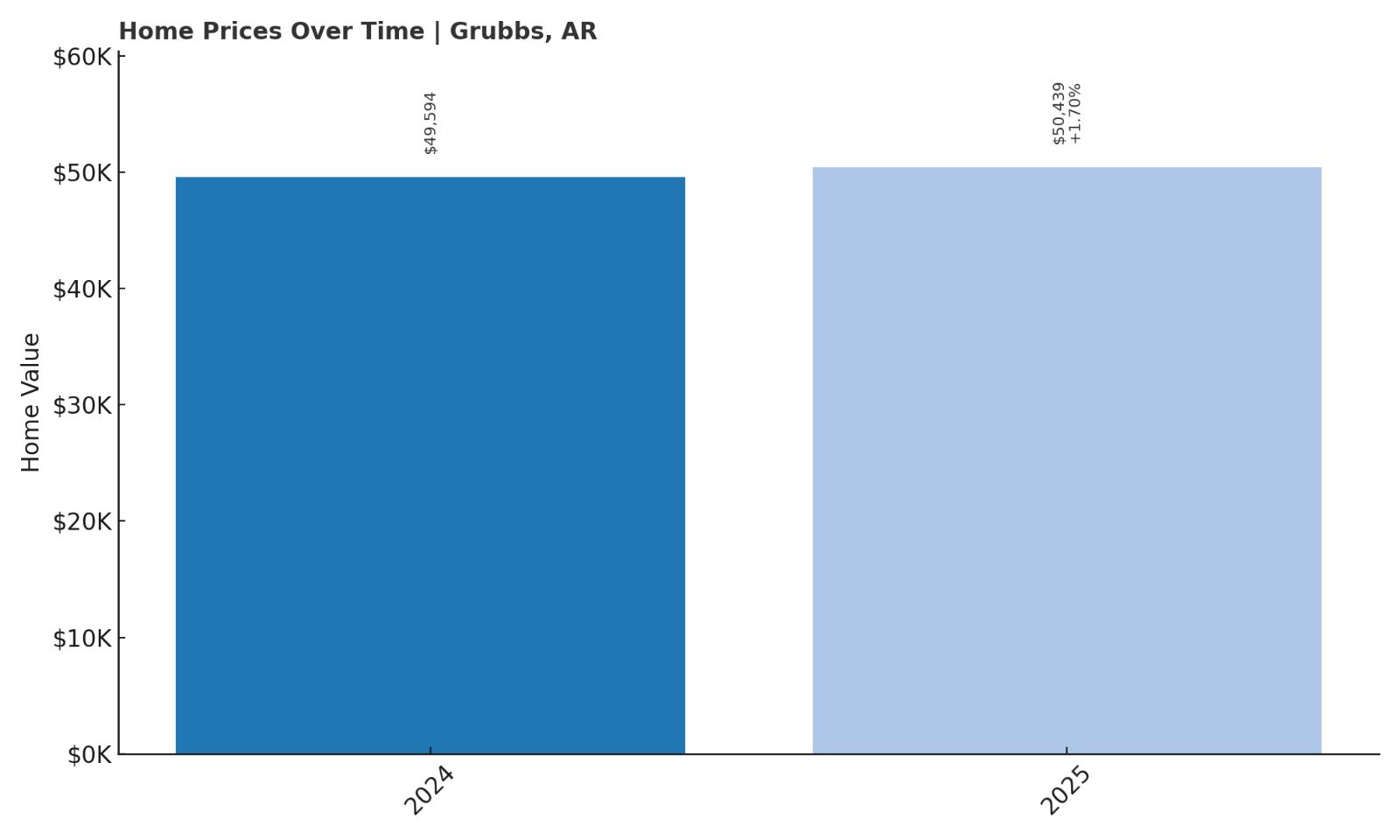

2. Grubbs – 1.70% Price Increase Since May 2024

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: N/A

- 2014: N/A

- 2015: N/A

- 2016: N/A

- 2017: N/A

- 2018: N/A

- 2019: N/A

- 2020: N/A

- 2021: N/A

- 2022: N/A

- 2023: N/A

- 2024: $49,594

- 2025: $50,439 (+$845, +1.70% from previous year)

Grubbs is one of only a few towns in Arkansas where prices rose in 2025. The increase was modest — just 1.70% — but it sets Grubbs apart from the widespread declines seen elsewhere. With values climbing from $49,594 to $50,439, the town remains extraordinarily affordable. Prices under $51,000 are almost unheard of nationally, making this one of the state’s best value propositions. The uptick may suggest stabilization or renewed interest in rural homeownership. Without historical data, it’s hard to predict the trend’s sustainability, but for now, Grubbs is holding steady — and that alone is notable in 2025. Buyers looking to purchase below $55K would be hard-pressed to find better options.

Grubbs – Holding Steady Below $51K

🔥 Would you like to save this?

Grubbs is a small community in Jackson County in northeastern Arkansas. With a population of fewer than 400 residents, it’s a deeply rural town with strong ties to agriculture and outdoor living. While not economically bustling, Grubbs offers a calm, close-knit environment with very low housing costs. It’s the kind of place where property remains in families for generations, and real estate rarely changes hands. The recent price bump — however slight — may suggest that demand is beginning to return, perhaps driven by affordability or lifestyle shifts. For prospective buyers, especially those paying in cash, Grubbs offers full ownership at a price point far below most other U.S. markets.

The homes in Grubbs are typically single-story, functional, and unpretentious. Most are built on sizable plots, with ample room for gardening, parking, or expansion. The town lacks a commercial core, but nearby Newport provides access to everything from groceries to medical care. For buyers seeking a peaceful retreat or a low-cost investment with minimal upkeep, Grubbs is a standout. It’s also a compelling candidate for long-term rental or second-home ownership, especially for those interested in escaping city prices. Whether prices rise or remain flat, the low entry cost and simple ownership structure make Grubbs a rare find in today’s real estate landscape.

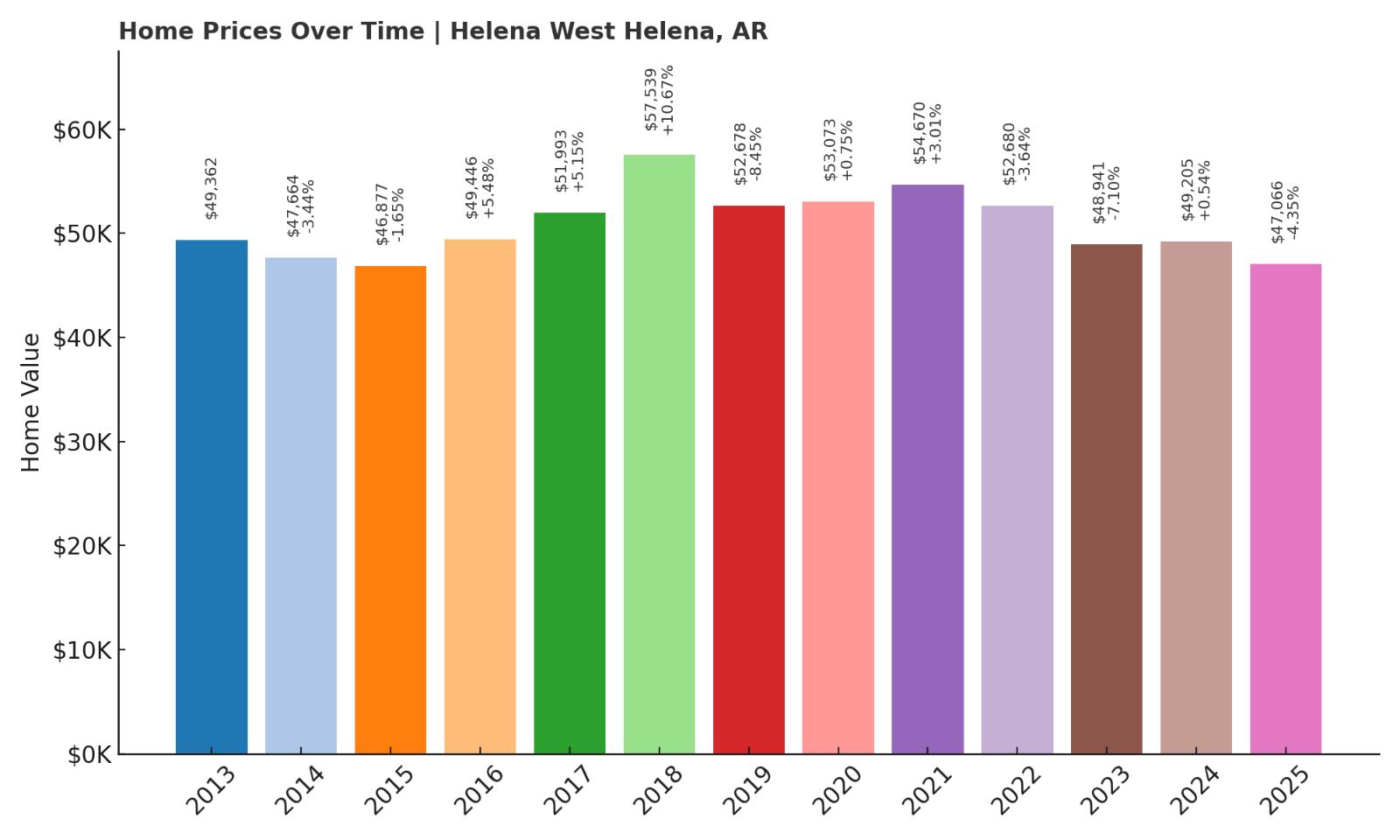

1. Helena-West Helena – 2.38% Price Drop Since May 2010

- 2010: N/A

- 2011: N/A

- 2012: N/A

- 2013: $49,362

- 2014: $47,664 ($-1,698, -3.44% from previous year)

- 2015: $46,877 ($-787, -1.65% from previous year)

- 2016: $49,446 (+$2,569, +5.48% from previous year)

- 2017: $51,993 (+$2,548, +5.15% from previous year)

- 2018: $57,539 (+$5,546, +10.67% from previous year)

- 2019: $52,678 ($-4,861, -8.45% from previous year)

- 2020: $53,073 (+$395, +0.75% from previous year)

- 2021: $54,670 (+$1,597, +3.01% from previous year)

- 2022: $52,680 ($-1,990, -3.64% from previous year)

- 2023: $48,941 ($-3,739, -7.10% from previous year)

- 2024: $49,205 (+$264, +0.54% from previous year)

- 2025: $47,066 ($-2,139, -4.35% from previous year)

Home prices in Helena-West Helena have dropped slightly since 2013 — down 2.38% overall. This minimal decline, however, masks what’s really happened: repeated swings between growth and correction. The market peaked in 2018 at $57,539, followed by a roller-coaster of gains and losses. The 2025 price of $47,066 puts the town back near its 2013 level. That stability — despite all the movement — means prices are still accessible. For buyers seeking low-cost housing in a town with some urban infrastructure, Helena-West Helena stands out. It remains one of Arkansas’s most affordable small cities, even after a full decade of market change.

Helena-West Helena – Delta History and Urban Affordability

Located on the banks of the Mississippi River, Helena-West Helena is one of the most historically significant cities in Arkansas. Once a bustling riverport and later a center for Delta blues music, the city still hosts the King Biscuit Blues Festival — one of the largest blues events in the world. The combined city has maintained civic infrastructure including schools, hospitals, and cultural institutions, even as the population has declined. While many smaller towns have withered completely, Helena-West Helena remains a functioning city with urban amenities and walkable neighborhoods. Despite economic challenges, the housing market here continues to offer value, with average prices still hovering near $47,000 in 2025.

The city’s housing stock includes a mix of historic homes, bungalows, and postwar structures — many of which can be restored affordably. Investors looking to rehabilitate properties, or homebuyers seeking character and community, will find options at deeply discounted prices. While resale potential is uncertain, ownership here can be rewarding for those planning to stay long-term. The city’s access to the river, museums, and active arts scene add richness to life in a way few towns this affordable can match. Helena-West Helena isn’t just one of the cheapest markets in the state — it’s also one of the most culturally interesting, making it a top pick for buyers who want both savings and substance.