Would you like to save this?

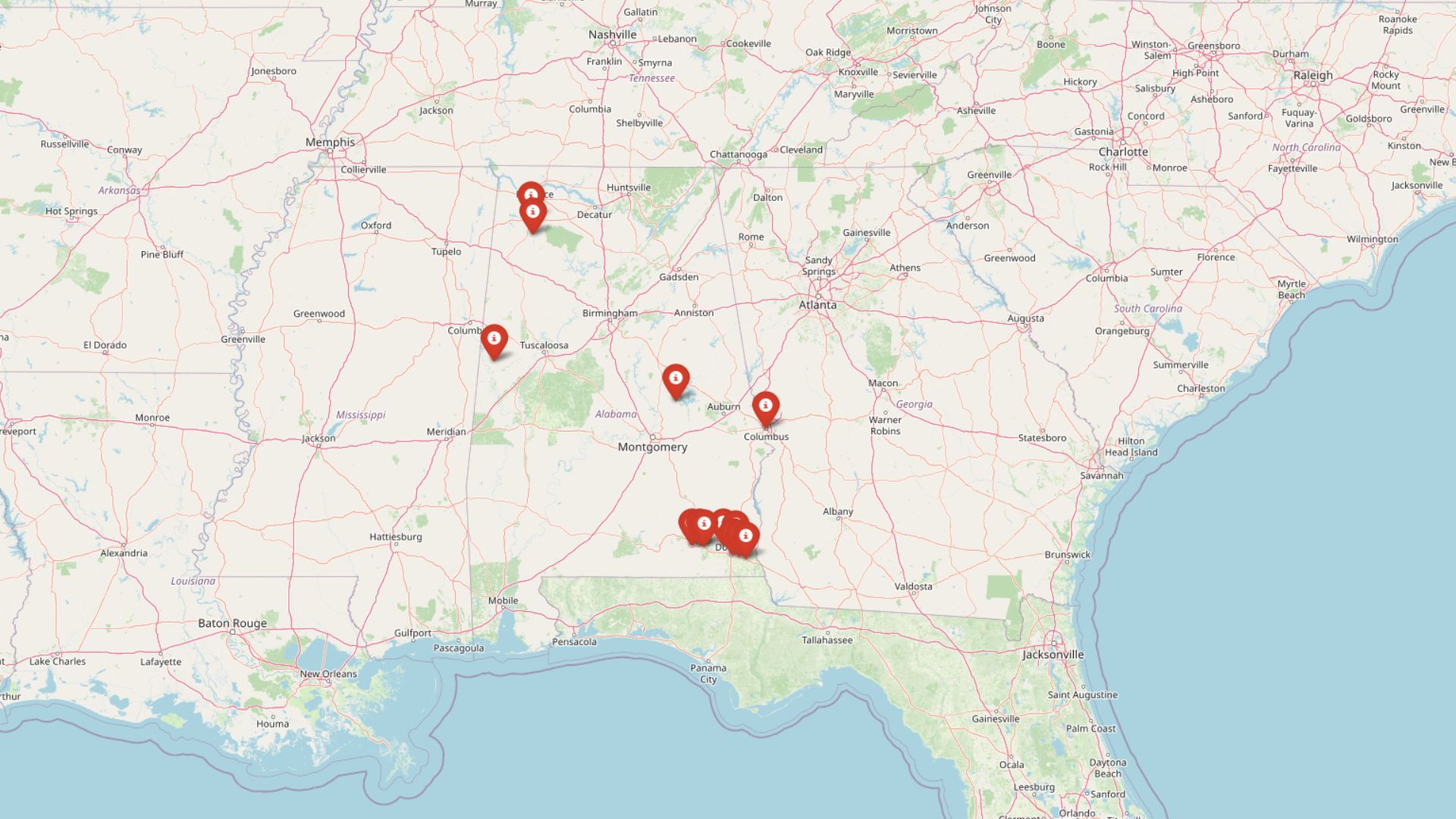

Investor activity is hitting Alabama’s small towns hard. According to the Zillow Home Value Index, home prices in 13 communities are rising far faster than local incomes or historical norms can support. These towns show the sharpest gaps between past trends and current growth, driven by a wave of investor buying that now accounts for nearly 11% of home sales statewide. While big cities are starting to stabilize, these small markets are still red-hot—and increasingly out of reach for local families.

13. Phil Campbell – Investor Feeding Frenzy Factor 1.18% (July 2025)

- Historical annual growth rate (2012–2022): 4.08%

- Recent annual growth rate (2022–2025): 4.13%

- Investor Feeding Frenzy Factor: 1.18%

- Current 2025 price: $174,181.33

Phil Campbell shows the most moderate investor activity on this list, with recent price growth barely exceeding its historical average. The town’s current median home price of $174,181 reflects steady but controlled appreciation, making it one of the few communities where local buyers still have a fighting chance against outside investment pressure.

Phil Campbell – Small-Town Stability in Northwest Alabama

Located in Franklin County in northwest Alabama, Phil Campbell maintains its character as a small rural community with a population of around 1,100 residents. The town sits along Highway 43, about 30 miles south of the Tennessee border, providing residents with access to larger employment centers while preserving a quiet, small-town atmosphere.

The relatively modest investor feeding frenzy factor of 1.18% suggests that Phil Campbell has largely avoided the speculative pressures affecting other Alabama communities. With homes averaging $174,181, the market remains accessible to local working families, particularly those employed in the area’s agricultural and manufacturing sectors. The town’s proximity to Muscle Shoals and the Tennessee Valley region provides residents with job opportunities while maintaining lower cost of living compared to more urbanized areas.

12. Cowarts – Investor Feeding Frenzy Factor 5.97% (July 2025)

- Historical annual growth rate (2012–2022): 5.55%

- Recent annual growth rate (2022–2025): 5.88%

- Investor Feeding Frenzy Factor: 5.97%

- Current 2025 price: $173,216.90

Cowarts demonstrates minimal acceleration in its housing market, with recent growth rates only slightly exceeding the already strong historical average of 5.55%. At $173,216, home prices remain relatively affordable compared to other communities experiencing investor pressure, though the consistent appreciation suggests growing outside interest.

Cowarts – Strategic Location Near Dothan Drives Steady Growth

Cowarts sits in Houston County, strategically positioned just north of Dothan, Alabama’s largest city in the southeastern region. This proximity to Dothan’s economic opportunities, including major employers like Michelin North America and various agricultural processing facilities, makes Cowarts an attractive option for families seeking lower housing costs while maintaining access to urban amenities and employment.

The town’s modest investor feeding frenzy factor of 5.97% indicates that while outside investment is present, it hasn’t reached the explosive levels seen in other Alabama communities. Home prices averaging $173,216 remain within reach for many local buyers, particularly those working in Dothan’s diverse economy. The area benefits from its position along major transportation corridors, including proximity to US Highway 84 and State Route 52, which facilitate both residential appeal and commercial development.

11. Enterprise – Investor Feeding Frenzy Factor 11.97% (July 2025)

- Historical annual growth rate (2012–2022): 3.64%

- Recent annual growth rate (2022–2025): 4.08%

- Investor Feeding Frenzy Factor: 11.97%

- Current 2025 price: $203,693.87

Enterprise shows moderate investor pressure with recent growth accelerating to 4.08% from a historical average of 3.64%. The current median home price of $203,693 represents a significant jump from historical norms, though the town’s strong economic fundamentals may justify some of this appreciation beyond pure speculation.

Enterprise – Military Presence Anchors Housing Demand

Would you like to save this?

Enterprise, located in Coffee County, benefits from its proximity to Fort Novosel (formerly Fort Rucker), the U.S. Army’s primary helicopter training base. This military connection provides economic stability and consistent housing demand, as military personnel and contractors seek housing in the area. The town’s population of approximately 28,000 makes it one of the larger communities on this list, with a diverse economy supporting the current median home price of $203,693.

The 11.97% investor feeding frenzy factor suggests that while military demand provides a foundation for the housing market, outside investors have recognized the area’s stability and growth potential. Enterprise’s location along Highway 84 and its proximity to both Montgomery and the Florida Panhandle make it attractive for both permanent residents and investment properties. The town’s strong school system and family-friendly amenities continue to draw new residents, supporting price appreciation that goes beyond speculative investment.

10. Aliceville – Investor Feeding Frenzy Factor 13.62% (July 2025)

- Historical annual growth rate (2012–2022): 2.92%

- Recent annual growth rate (2022–2025): 3.32%

- Investor Feeding Frenzy Factor: 13.62%

- Current 2025 price: $85,460.29

Aliceville presents a stark contrast with the lowest median home price on this list at $85,460, yet still shows concerning investor activity. The acceleration from 2.92% historical growth to 3.32% recent growth may seem modest, but represents a significant 13.62% increase in market velocity that could price out local buyers in this historically affordable community.

Aliceville – Rural Affordability Under Pressure

Located in Pickens County along the Mississippi border, Aliceville represents one of the most affordable housing markets in Alabama, with median home prices of just $85,460. This small town of approximately 2,000 residents has historically served as an affordable option for working-class families, but the 13.62% investor feeding frenzy factor suggests that even these modest prices are attracting outside investment attention.

The town’s location along Highway 17 and its proximity to the Tombigbee River have traditionally supported a quiet, rural lifestyle centered around agriculture and small-scale manufacturing. However, the recent acceleration in price growth from a historical 2.92% to 3.32% annually indicates that investors may be targeting Aliceville as an undervalued market. For a community where the median household income is significantly lower than the state average, even modest price acceleration can have devastating effects on local homeownership opportunities.

9. Ashford – Investor Feeding Frenzy Factor 14.83% (July 2025)

- Historical annual growth rate (2012–2022): 4.92%

- Recent annual growth rate (2022–2025): 5.65%

- Investor Feeding Frenzy Factor: 14.83%

- Current 2025 price: $171,698.82

Ashford demonstrates moderate investor pressure with price growth accelerating from an already healthy 4.92% historical average to 5.65% recently. At $171,698, home prices remain relatively affordable, but the 14.83% acceleration in market activity suggests growing investment interest that could challenge local affordability.

Ashford – Agricultural Hub Experiencing Growing Investment Pressure

Ashford, located in Houston County near the Georgia border, serves as a regional agricultural center with a population of approximately 2,100 residents. The town’s economy traditionally revolves around farming, particularly peanut and cotton production, with several agricultural processing facilities providing local employment. The current median home price of $171,698 has historically been accessible to agricultural workers and their families.

The 14.83% investor feeding frenzy factor indicates that outside investors are recognizing Ashford’s potential, possibly due to its strategic location near the Georgia border and along major agricultural transportation routes. The acceleration from 4.92% to 5.65% annual growth suggests that what was once a stable, affordable market for local families is experiencing speculative pressure. This trend is particularly concerning for a community where many residents work in seasonal agricultural employment and depend on stable, affordable housing to maintain their livelihoods.

8. Dothan – Investor Feeding Frenzy Factor 14.98% (July 2025)

- Historical annual growth rate (2012–2022): 3.83%

- Recent annual growth rate (2022–2025): 4.41%

- Investor Feeding Frenzy Factor: 14.98%

- Current 2025 price: $200,935.74

Dothan, as the largest city in southeast Alabama, shows investor interest with growth accelerating from 3.83% to 4.41% annually. The current median price of $200,935 reflects the city’s role as a regional economic center, though the 14.98% feeding frenzy factor suggests that investment activity is beginning to outpace organic demand from local residents and job growth.

Dothan – Regional Economic Center Attracts Investment Capital

Dothan stands as the largest city in southeast Alabama with approximately 71,000 residents, serving as the economic hub for the Wiregrass region. The city’s diverse economy includes major employers like Michelin North America, Farley Nuclear Plant operations, and a significant agricultural processing sector. This economic diversity has traditionally supported a stable housing market with median prices around $200,935.

The 14.98% investor feeding frenzy factor reflects Dothan’s growing appeal to outside investment, driven partly by the city’s role as a regional medical and educational center. Southeast Alabama Medical Center and the University of Alabama’s Dothan campus contribute to steady population growth and housing demand. However, the acceleration from 3.83% to 4.41% annual price growth suggests that investor interest is beginning to outpace the city’s organic economic growth, potentially creating affordability challenges for local workers in the manufacturing and service sectors that form the backbone of Dothan’s economy.

7. Kinsey – Investor Feeding Frenzy Factor 19.80% (July 2025)

- Historical annual growth rate (2012–2022): 3.74%

- Recent annual growth rate (2022–2025): 4.48%

- Investor Feeding Frenzy Factor: 19.80%

- Current 2025 price: $143,538.85

Kinsey shows significant investor pressure with a 19.80% feeding frenzy factor, as growth has jumped from 3.74% historically to 4.48% recently. Despite the concerning investment activity, the median home price of $143,538 remains among the more affordable on this list, though this affordability may be exactly what’s attracting speculative interest.

Kinsey – Small Community Faces Disproportionate Investment Pressure

Kinsey, a small unincorporated community in Houston County, represents one of the more concerning cases of investor activity relative to its size and economic base. With a population of fewer than 1,000 residents, the community has historically offered some of the most affordable housing options in the region, with median prices of $143,538 that were accessible to working families in agriculture and nearby manufacturing.

The 19.80% investor feeding frenzy factor is particularly alarming for such a small community, as the acceleration from 3.74% to 4.48% annual growth suggests that outside investors are targeting Kinsey precisely because of its affordability. This small community’s proximity to larger employment centers like Dothan makes it attractive for rental property investment, but the scale of investor interest relative to the local population could fundamentally alter the community’s character and displace longtime residents who can no longer compete with cash-buying investors.

6. Russellville – Investor Feeding Frenzy Factor 22.45% (July 2025)

- Historical annual growth rate (2012–2022): 5.87%

- Recent annual growth rate (2022–2025): 7.19%

- Investor Feeding Frenzy Factor: 22.45%

- Current 2025 price: $176,953.41

Russellville demonstrates substantial investor pressure with growth accelerating from an already strong 5.87% historical rate to 7.19% recently. The 22.45% feeding frenzy factor indicates significant speculative activity, while the median home price of $176,953 suggests the market is moving beyond the reach of many local families despite the city’s employment opportunities.

Russellville – Industrial Growth Attracts Speculative Investment

Russellville, located in Franklin County in northwest Alabama, serves as a regional industrial center with approximately 10,000 residents. The city benefits from its location along Highway 43 and proximity to the Tennessee Valley, with major employers including several manufacturing facilities and the nearby Browns Ferry Nuclear Plant providing high-paying jobs. This economic foundation has historically supported a robust housing market with median prices around $176,953.

The concerning 22.45% investor feeding frenzy factor reflects how outside investors are capitalizing on Russellville’s industrial growth and strategic location. The acceleration from 5.87% to 7.19% annual price growth suggests that speculative investment is outpacing the city’s actual economic fundamentals. While the nuclear plant and manufacturing jobs provide good wages, the rapid price appreciation driven by investor activity is beginning to price out local families, particularly younger workers just starting their careers in the area’s industrial sector.

5. Midland City – Investor Feeding Frenzy Factor 23.43% (July 2025)

- Historical annual growth rate (2012–2022): 4.12%

- Recent annual growth rate (2022–2025): 5.08%

- Investor Feeding Frenzy Factor: 23.43%

- Current 2025 price: $189,791.10

Midland City shows alarming investor activity with a 23.43% feeding frenzy factor, as annual growth has jumped from 4.12% to 5.08%. The current median price of $189,791 represents a significant escalation from historical norms, suggesting that speculative investment is rapidly transforming what was once an affordable market for local families.

Midland City – Proximity to Dothan Drives Investment Speculation

Midland City, located in Dale County just northeast of Dothan, benefits from its proximity to the region’s largest employment center while maintaining a smaller-town atmosphere. With approximately 2,400 residents, the community has traditionally attracted families seeking affordable housing within commuting distance of Dothan’s diverse job market. The median home price of $189,791 reflects this desirable balance of accessibility and affordability.

The alarming 23.43% investor feeding frenzy factor indicates that Midland City has become a target for speculative investment, likely due to its strategic location and historically affordable prices. The acceleration from 4.12% to 5.08% annual growth suggests that investors are recognizing the community’s potential for rental income from workers commuting to Dothan. This trend threatens to transform Midland City from an affordable homeownership community into a rental market dominated by outside investors, potentially displacing longtime residents and changing the fundamental character of this small Alabama town.

4. Daleville – Investor Feeding Frenzy Factor 23.56% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 4.58%

- Recent annual growth rate (2022–2025): 5.65%

- Investor Feeding Frenzy Factor: 23.56%

- Current 2025 price: $146,766.37

Daleville faces severe investor pressure with a 23.56% feeding frenzy factor, as growth has accelerated from 4.58% to 5.65% annually. Despite maintaining one of the lower median prices at $146,766, the rapid acceleration suggests that investors are targeting the community precisely because of its affordability relative to nearby military-influenced markets.

Daleville – Military Proximity Creates Investment Target

Daleville, located in Dale County near Fort Novosel, has traditionally served as an affordable housing option for military families and civilian contractors working at the Army aviation training base. With approximately 5,000 residents, the community has maintained median home prices around $146,766, making it accessible to enlisted military personnel and civilian employees at various income levels.

The severe 23.56% investor feeding frenzy factor reflects how outside investors are exploiting Daleville’s military-adjacent location and relative affordability. The acceleration from 4.58% to 5.65% annual growth indicates that speculative investment is rapidly transforming the local housing market. This trend is particularly concerning for military families, who often rely on affordable homeownership opportunities during their stationing periods. As investors target these properties for rental income, they’re effectively pricing out the very military personnel the community has traditionally served, creating a housing crisis that undermines the stability of military families and the broader Fort Novosel community.

3. Level Plains – Investor Feeding Frenzy Factor 33.15% (July 2025)

- Historical annual growth rate (2012–2022): 3.62%

- Recent annual growth rate (2022–2025): 4.82%

- Investor Feeding Frenzy Factor: 33.15%

- Current 2025 price: $207,300.07

Level Plains faces extreme investor pressure with a 33.15% feeding frenzy factor, representing one of the most dramatic examples of speculation-driven price acceleration. Growth has jumped from 3.62% historically to 4.82% recently, while the median price of $207,300 has moved well beyond typical affordability ranges for local working families.

Level Plains – Critical Investment Pressure Threatens Local Homeownership

Level Plains, a small community in Dale County, has experienced one of the most dramatic transformations on this list, with a devastating 33.15% investor feeding frenzy factor that signals severe speculative pressure. The town’s proximity to both Fort Novosel and Enterprise has traditionally made it an attractive option for military families and civilians seeking affordable homeownership, but median prices have now reached $207,300.

The extreme acceleration from 3.62% to 4.82% annual growth represents the kind of speculative bubble that completely transforms local housing markets. For a small community that has historically served working families with modest incomes, this level of investor activity effectively eliminates homeownership opportunities for local residents. The 33.15% feeding frenzy factor indicates that speculative investment has become the primary driver of the housing market, creating conditions where cash-buying investors consistently outbid local families, fundamentally altering the community’s economic and social fabric.

2. Phenix City – Investor Feeding Frenzy Factor 34.84% (July 2025)

- Historical annual growth rate (2012–2022): 3.58%

- Recent annual growth rate (2022–2025): 4.82%

- Investor Feeding Frenzy Factor: 34.84%

- Current 2025 price: $202,394.92

Phenix City exhibits catastrophic investor pressure with a 34.84% feeding frenzy factor, making it the second-most impacted community in Alabama. The acceleration from 3.58% to 4.82% annual growth has driven median prices to $202,394, creating a housing crisis that threatens to displace working families from this historically affordable border community.

Phenix City – Border Location Fuels Devastating Investment Speculation

Phenix City, located directly across the Chattahoochee River from Columbus, Georgia, has become ground zero for investor speculation due to its strategic location and historically affordable housing. With approximately 38,000 residents, this Russell County city has traditionally offered working families an affordable alternative to higher-priced Georgia markets while maintaining access to Columbus’s employment opportunities and amenities.

The catastrophic 34.84% investor feeding frenzy factor represents one of the most severe cases of speculation-driven displacement in Alabama. The acceleration from 3.58% to 4.82% annual growth has driven median home prices to $202,394, effectively pricing out local families who work in retail, manufacturing, and service industries. Investors are targeting Phenix City both for its affordability relative to Columbus and for its rental income potential from Georgia workers seeking lower housing costs. This speculation has created a housing crisis where longtime residents find themselves competing against cash-buying investors, often losing bidding wars and being forced to rent properties they once could have afforded to purchase.

1. Equality – Investor Feeding Frenzy Factor 40.06% (July 2025)

- Historical annual growth rate (2012–2022): 5.74%

- Recent annual growth rate (2022–2025): 8.04%

- Investor Feeding Frenzy Factor: 40.06%

- Current 2025 price: $643,792.46

Equality faces the most extreme investor feeding frenzy in Alabama, with a devastating 40.06% factor that has transformed this small community into an unaffordable market for local residents. Growth has exploded from 5.74% historically to 8.04% recently, driving the median home price to an astronomical $643,792 that bears no relationship to local wages or economic fundamentals.

Equality – Speculative Bubble Destroys Rural Affordability

Equality, a tiny census-designated place in Coosa County with fewer than 150 residents, represents the most extreme case of investor-driven price speculation in Alabama. The community’s median home price has skyrocketed to an unbelievable $643,792 — nearly three times the state average — driven by a 40.06% investor feeding frenzy factor that has completely disconnected housing costs from local economic reality.

The devastating acceleration from 5.74% to 8.04% annual growth has transformed Equality from a quiet rural community into an unaffordable enclave that excludes virtually all local working families. With median household incomes around $90,434 and high poverty rates, the current housing prices represent an impossible burden for residents who have historically called this area home. This extreme speculation appears to be driven by investors targeting rural properties for vacation homes or speculative investment, completely ignoring the devastating impact on the small community that has existed here for generations. Equality’s transformation represents the worst-case scenario of unchecked investor activity — a complete destruction of local affordability that threatens to erase entire communities from Alabama’s rural landscape.