🔥 Would you like to save this?

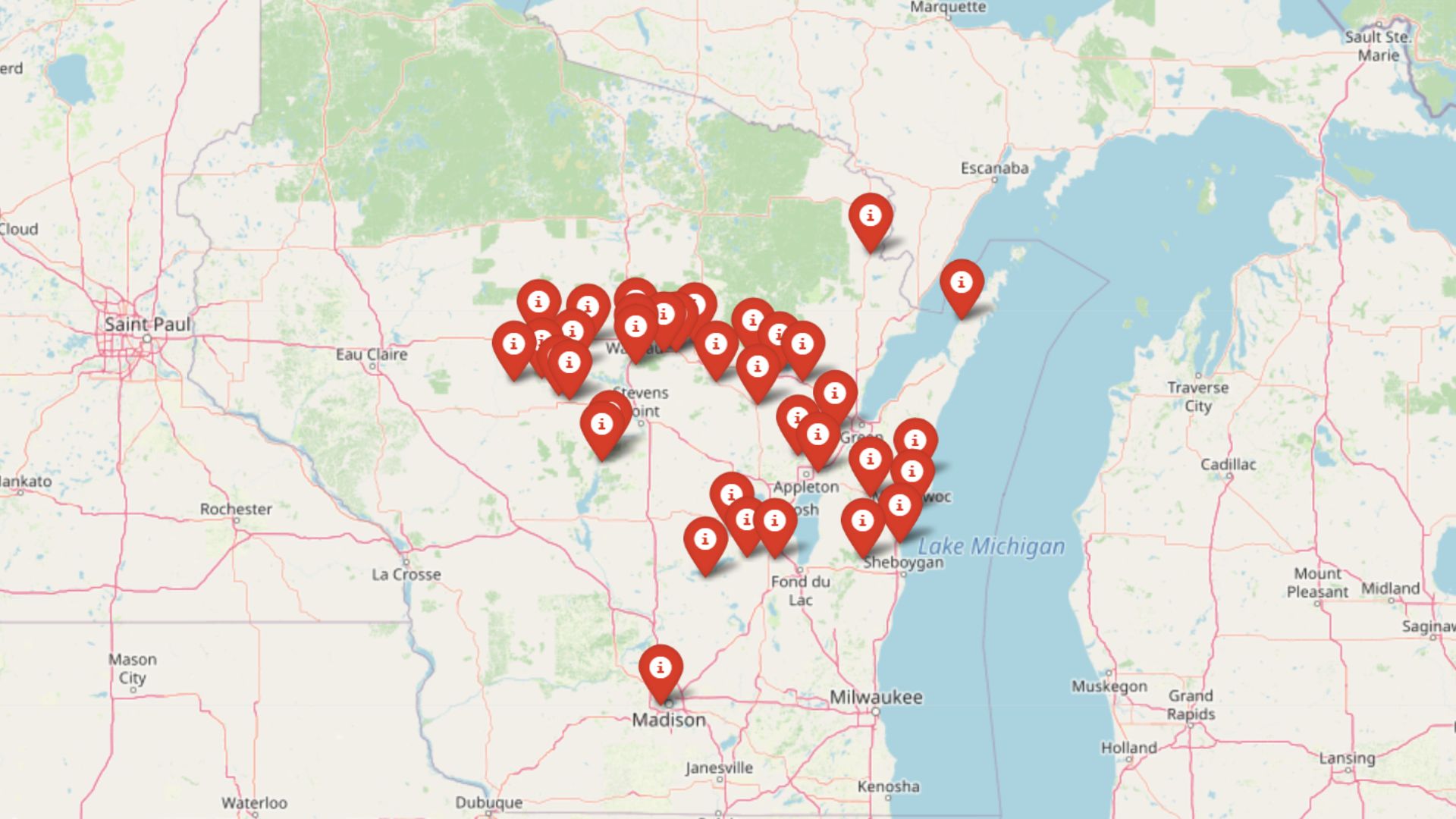

Home prices in Wisconsin are climbing faster than most families can keep up with — and the reasons go beyond simple demand. According to the Zillow Home Value Index, dozens of communities across the state are experiencing price acceleration that far exceeds their long-term trends, driven in part by investor speculation and rapid property turnover.

It’s not just a data anomaly. In many of these 35 towns, home prices have surged so quickly since 2022 that they’ve doubled their previous pace of growth. This kind of volatility signals more than a hot market — it’s a warning. When investors move in fast, affordability moves out just as quickly. These towns now rank highest in Wisconsin’s “Investor Feeding Frenzy Factor,” showing where pressure on local buyers is building the most.

In order to come up with the very specific design ideas, we create most designs with the assistance of state-of-the-art AI interior design software.

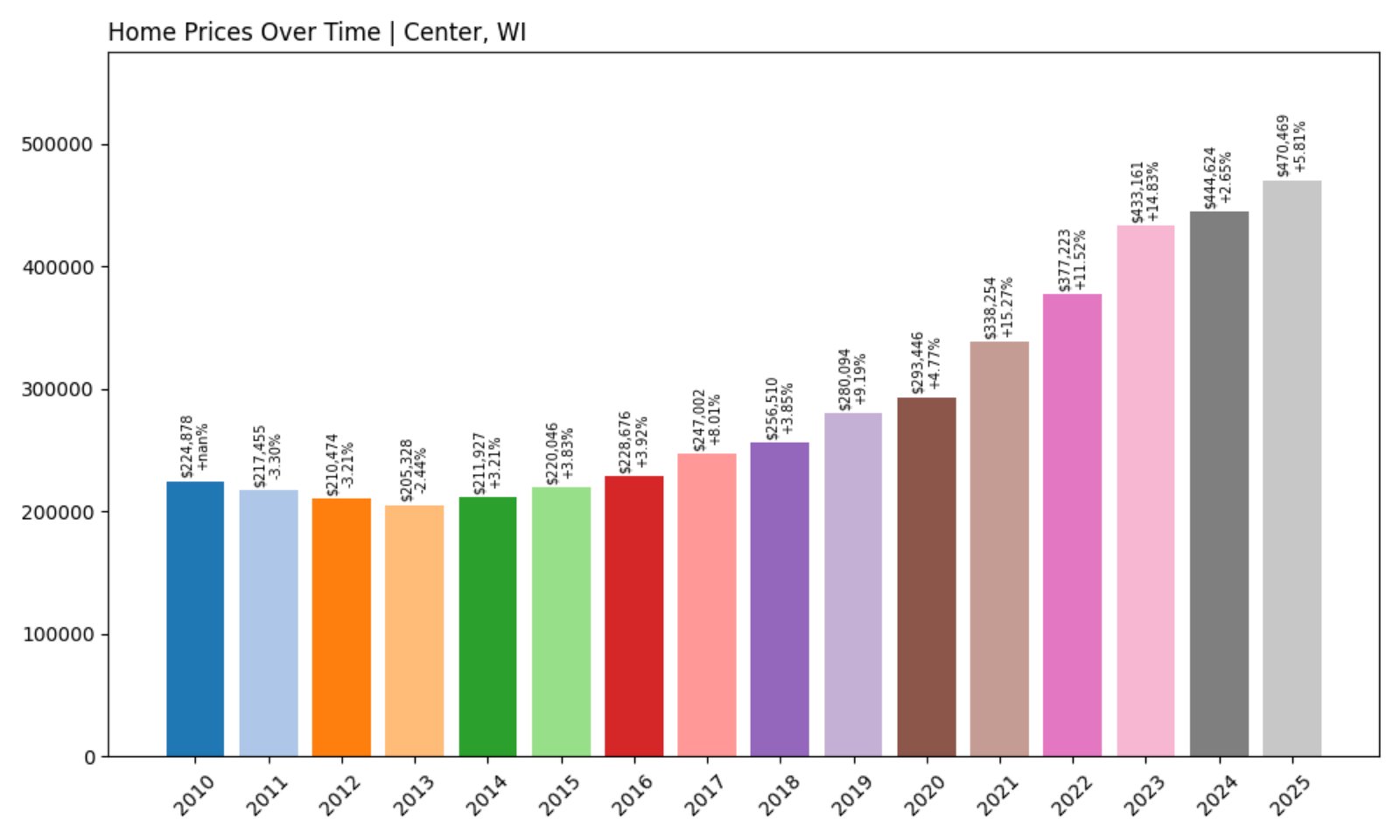

35. Center – Investor Feeding Frenzy Factor 27.17% (July 2025)

- Historical annual growth rate (2012–2022): 6.01%

- Recent annual growth rate (2022–2025): 7.64%

- Investor Feeding Frenzy Factor: 27.17%

- Current 2025 price: $470,468.76

Center’s recent surge in home values has pushed its growth nearly 30% above its long-term average. While not the highest on this list, it’s a sharp enough uptick to raise eyebrows — particularly given the town’s small size and relatively stable historical pricing patterns. The jump in prices from 2022 to 2025 is especially notable compared to its prior decade.

Center – Sudden Spike After Years of Stability

Nestled in Outagamie County just north of Appleton, Center is a quiet, rural town known for farmland and low-density residential areas. The area saw modest, consistent growth from 2012 through 2022, but the last three years have brought a rapid change. Its proximity to urban amenities while maintaining country charm may be driving recent investor interest, especially for those seeking short-term rentals or long-term appreciation.

With the current average home price now at $470K, affordability is quickly becoming a concern for long-time residents. Center’s large parcel zoning and low inventory might also be contributing to inflated demand. This is one of the fastest accelerations the town has seen in over a decade.

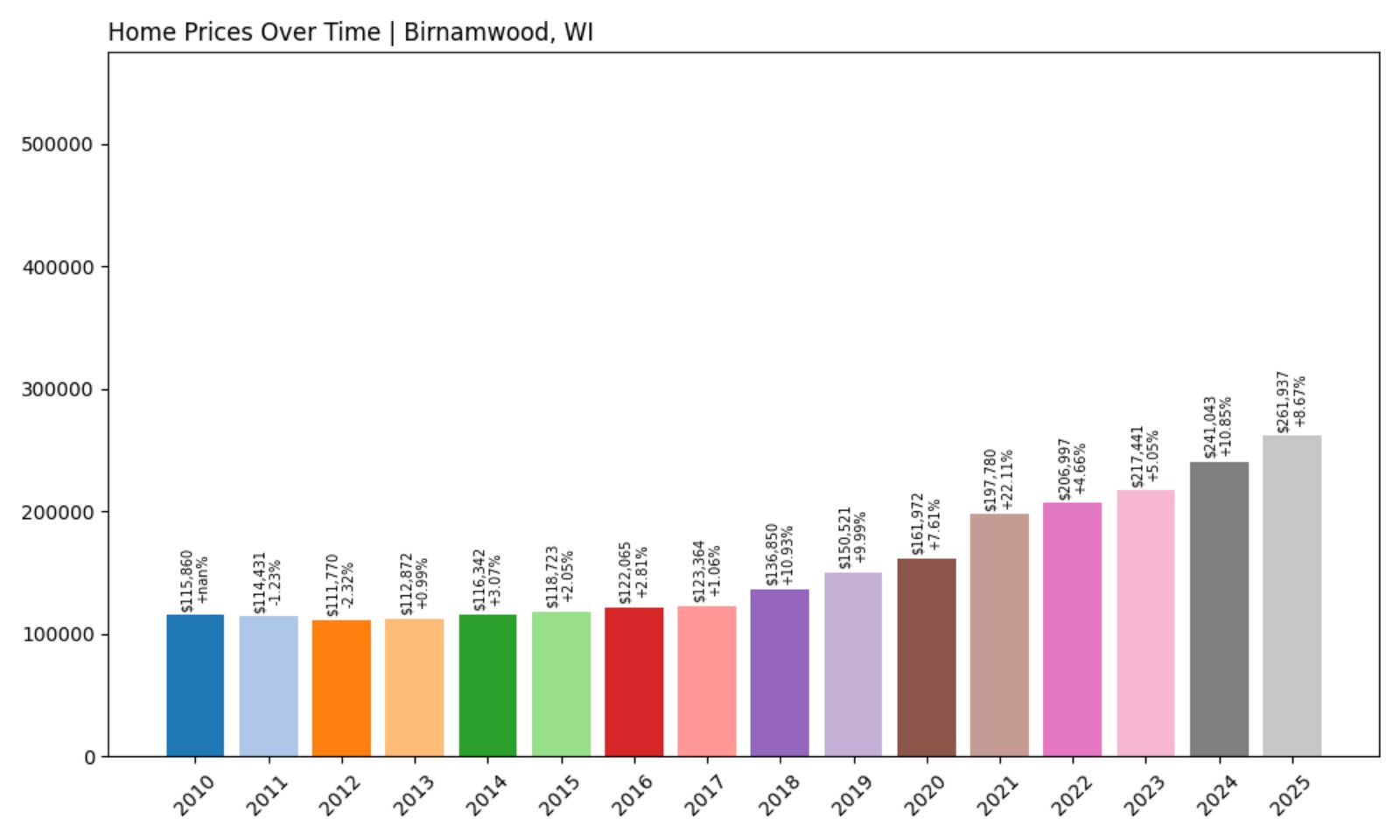

34. Birnamwood – Investor Feeding Frenzy Factor 28.42% (July 2025)

- Historical annual growth rate (2012–2022): 6.36%

- Recent annual growth rate (2022–2025): 8.16%

- Investor Feeding Frenzy Factor: 28.42%

- Current 2025 price: $261,936.53

Birnamwood’s Investor Feeding Frenzy Factor puts it near the bottom of this list, but the 8.16% growth rate in recent years still marks a meaningful acceleration. This jump, well above its 10-year average, indicates that the market here is heating up — and fast.

Birnamwood – A Rural Market Drawing Fresh Eyes

Birnamwood spans Shawano and Marathon counties and offers small-town living with easy access to north-central Wisconsin recreation. With a 2025 average price just over $261K, it still appears affordable — but that affordability is changing quickly. New buyers and out-of-area investors may be targeting this town for its value and growth potential.

The recent spike could reflect regional investment spillover from nearby towns, along with increased interest in rural second homes. If this pace keeps up, Birnamwood could see demand outstrip local capacity in the coming years.

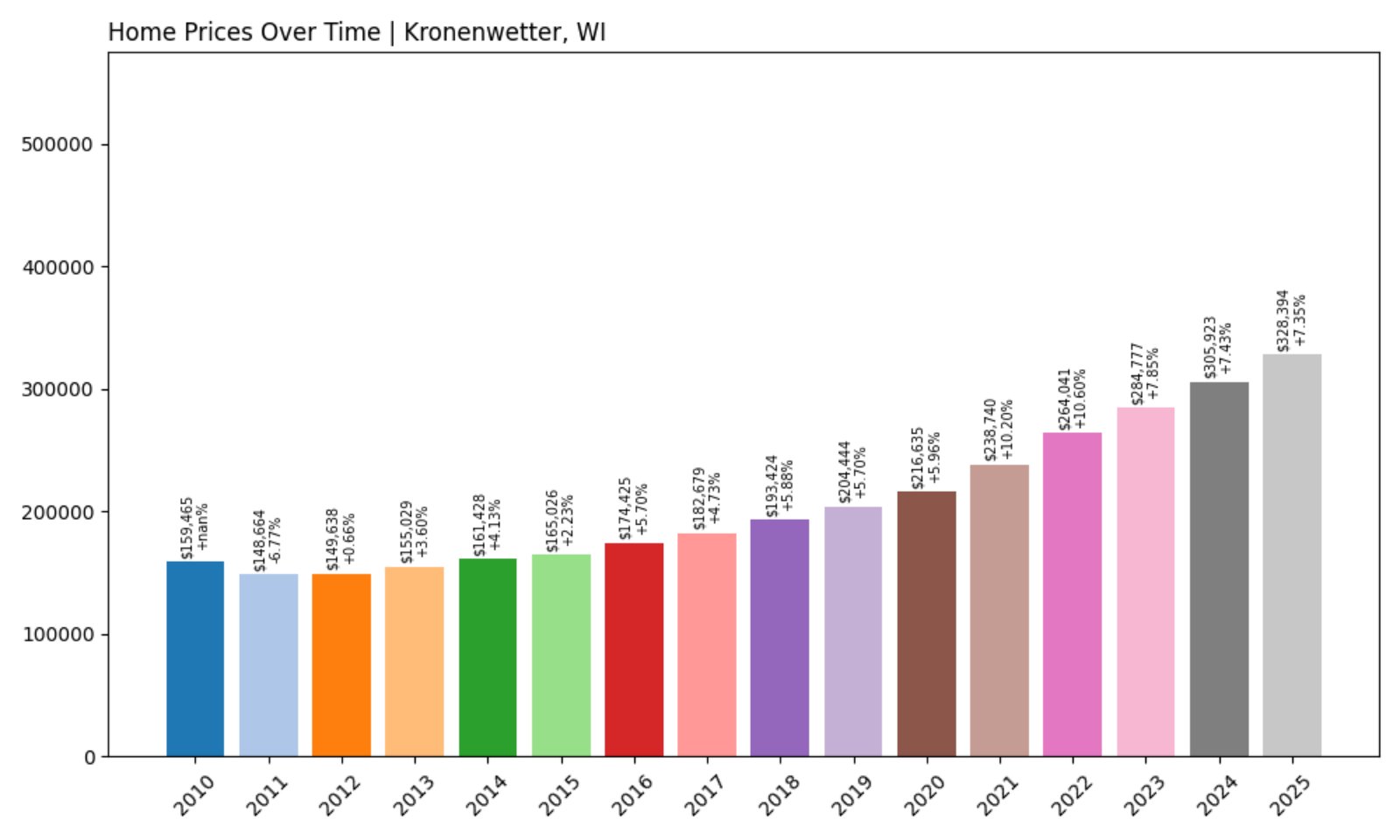

33. Kronenwetter – Investor Feeding Frenzy Factor 29.06% (July 2025)

- Historical annual growth rate (2012–2022): 5.84%

- Recent annual growth rate (2022–2025): 7.54%

- Investor Feeding Frenzy Factor: 29.06%

- Current 2025 price: $328,394.01

Kronenwetter’s growth rate has risen nearly 30% above its previous decade-long trend. This sudden acceleration, paired with a jump in average home value to $328K, points to intensifying competition in the market. The sharp rise is notable for a town that typically sees steady, moderate changes.

Kronenwetter – Moderate Growth Gives Way to Investor Interest

Located just southeast of Wausau, Kronenwetter is known for its suburban feel and strong school district. Its long-run growth pattern had been predictable and modest — until now. The rise in prices over the last three years suggests increasing demand from both families and outside investors.

Proximity to larger employment centers and access to recreation areas makes Kronenwetter appealing. However, the 29% spike over baseline growth suggests that speculation could be creeping into the market. If demand continues to accelerate, this once-stable town may become increasingly competitive.

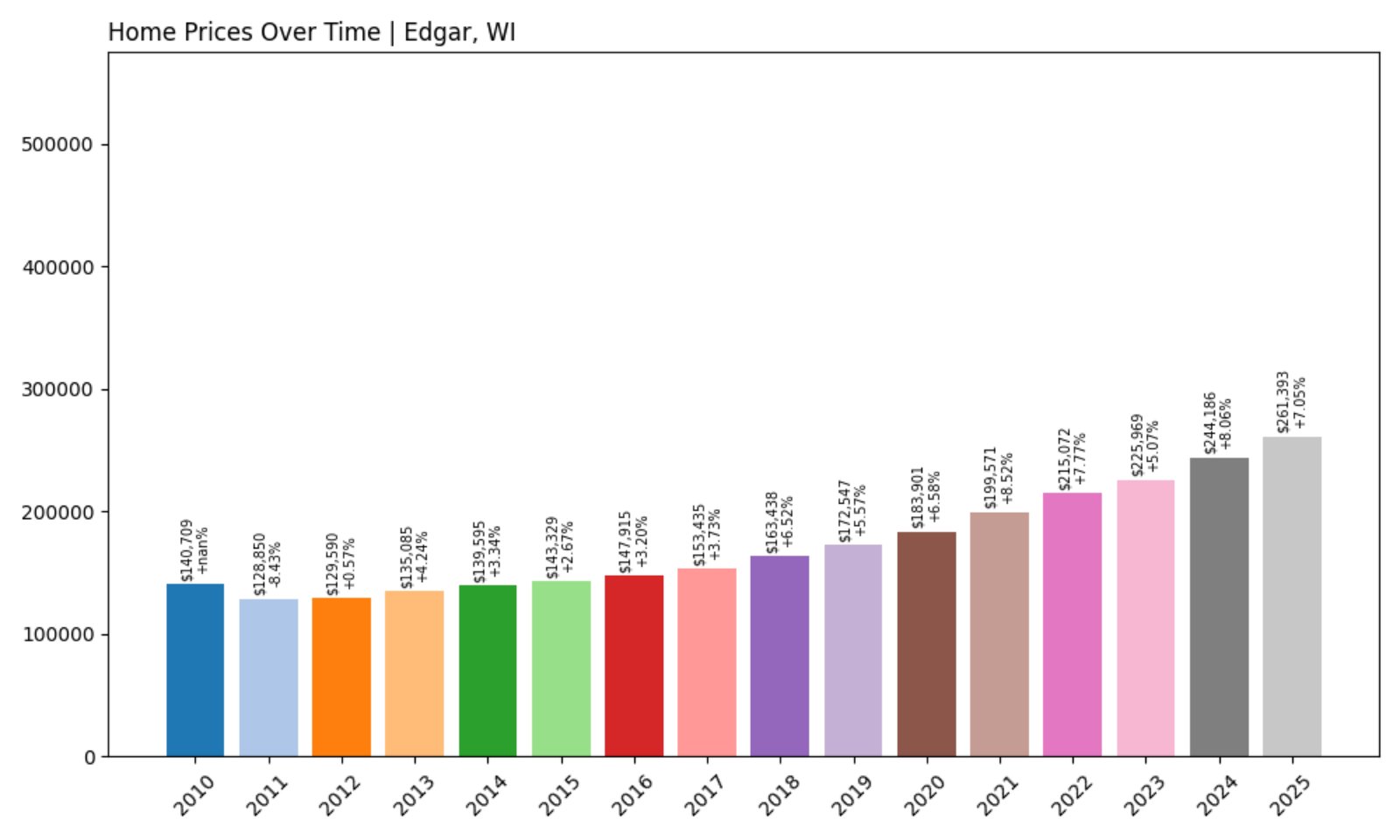

32. Edgar – Investor Feeding Frenzy Factor 29.28% (July 2025)

- Historical annual growth rate (2012–2022): 5.20%

- Recent annual growth rate (2022–2025): 6.72%

- Investor Feeding Frenzy Factor: 29.28%

- Current 2025 price: $261,393.35

Edgar has experienced a recent growth rate 29% above its historical average — a sharp shift for a town used to steadier pricing. The price increase has elevated the average 2025 home value to over $261K, pushing it into unfamiliar territory.

Edgar – An Underrated Market No Longer Flying Under the Radar

A village in Marathon County, Edgar sits west of Wausau and has long been prized for its small-town charm and affordability. Until recently, price increases here were minimal and manageable. Now, surging growth and investor interest are changing that narrative.

The town’s strong community feel and proximity to larger towns make it a convenient and attractive option. That may be exactly why prices are accelerating faster than locals expected, creating real pressure on entry-level buyers and young families.

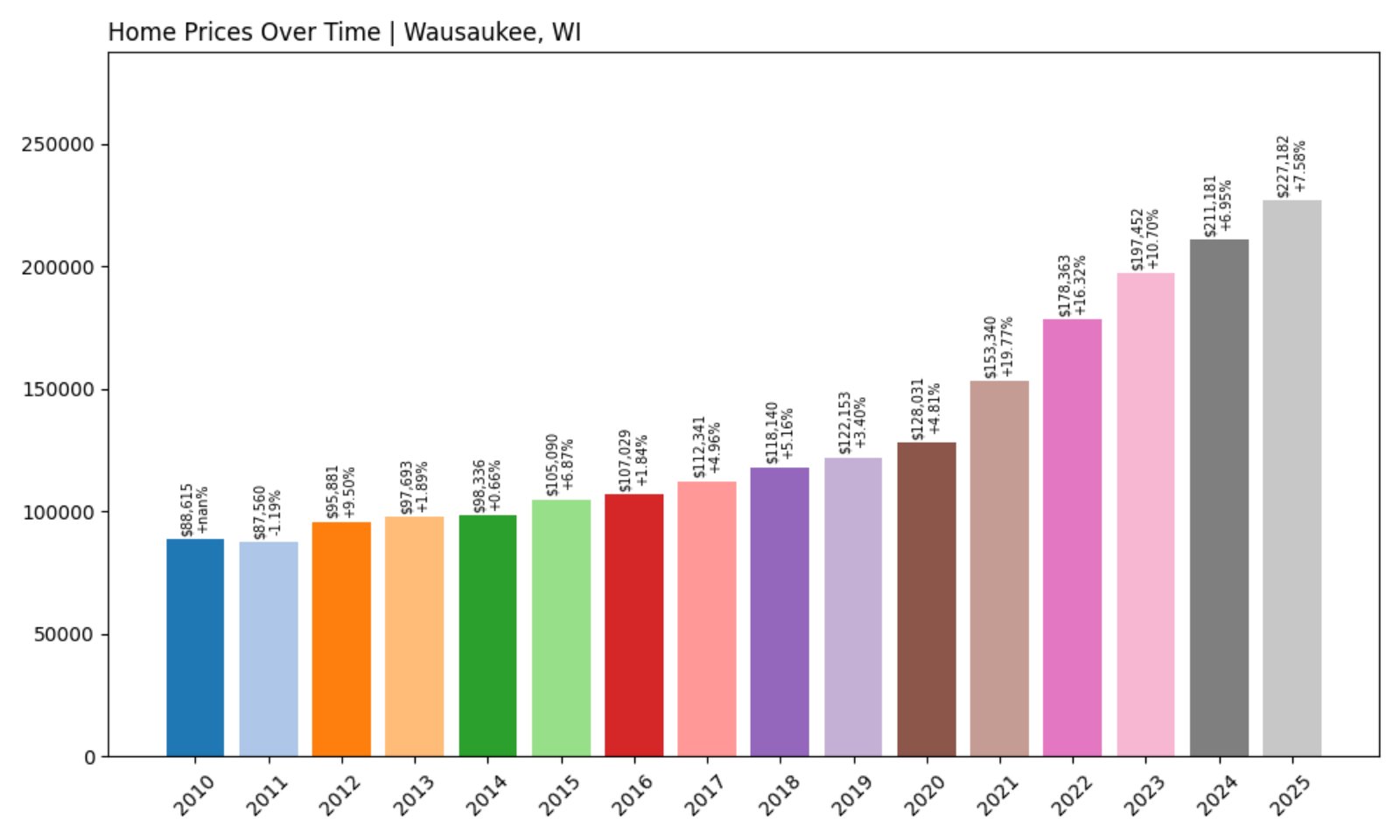

31. Wausaukee – Investor Feeding Frenzy Factor 31.15% (July 2025)

- Historical annual growth rate (2012–2022): 6.40%

- Recent annual growth rate (2022–2025): 8.40%

- Investor Feeding Frenzy Factor: 31.15%

- Current 2025 price: $227,181.71

Wausaukee’s home price growth has surged over 31% above its past norms. With a 2025 average home value now above $227K, this small village is seeing fast change, and locals are starting to feel it.

Wausaukee – Quiet Northwoods Village Feeling Investor Pressure

Tucked away in Marinette County, Wausaukee offers scenic drives, forested land, and a traditionally low cost of living. That’s changing. The recent uptick in price growth marks one of the most dramatic shifts in the area in over a decade.

As remote work expands and interest in outdoor living grows, Wausaukee’s profile has risen. But so have its prices — a combination that spells trouble for locals seeking to stay put or buy in. If the pace continues, this peaceful corner of the state may soon become unaffordable to the very residents who shaped it.

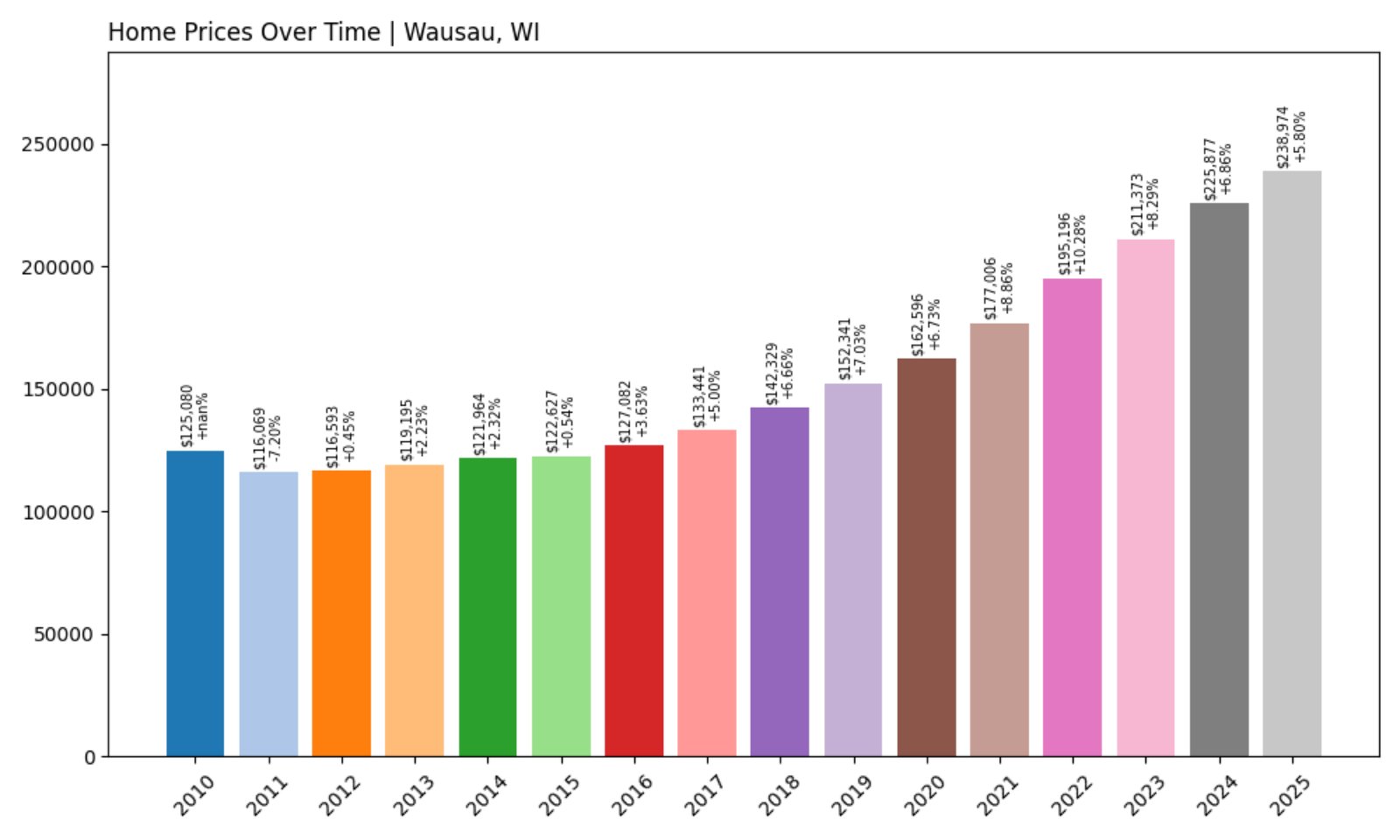

30. Wausau – Investor Feeding Frenzy Factor 31.94% (July 2025)

- Historical annual growth rate (2012–2022): 5.29%

- Recent annual growth rate (2022–2025): 6.98%

- Investor Feeding Frenzy Factor: 31.94%

- Current 2025 price: $238,973.89

Wausau’s housing market has accelerated by nearly 32% beyond its long-term average growth rate, signaling a shift from predictable price trends to growing market heat. The city’s current average home value just shy of $239K reflects how that shift is playing out.

Wausau – A Regional Hub Facing New Price Pressures

As one of central Wisconsin’s larger cities, Wausau has long offered a mix of affordability and economic stability. It sits on the Wisconsin River and hosts major employers, outdoor sports venues, and cultural attractions. That appeal is now drawing the attention of investors.

With demand growing and inventory tight, home values are rising at their fastest pace in years. While still more affordable than larger metros, Wausau’s market is heating up — and that change is being felt across neighborhoods that once saw minimal pricing competition.

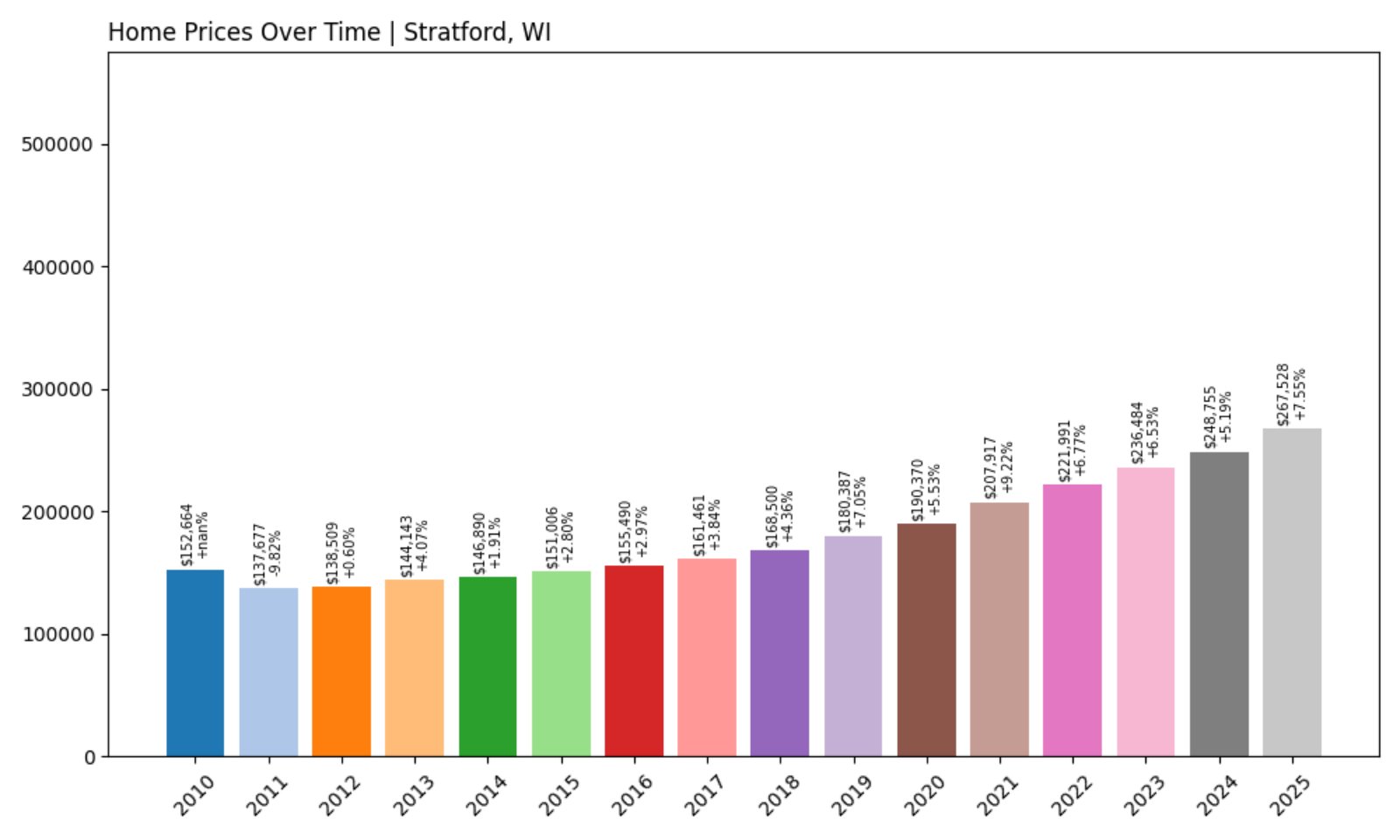

29. Stratford – Investor Feeding Frenzy Factor 32.86% (July 2025)

🔥 Would you like to save this?

- Historical annual growth rate (2012–2022): 4.83%

- Recent annual growth rate (2022–2025): 6.42%

- Investor Feeding Frenzy Factor: 32.86%

- Current 2025 price: $267,528.39

Stratford’s recent annual growth rate is over 32% higher than its past trend, marking a major inflection point. A town that once saw slow, steady growth is now watching prices climb faster than local incomes can keep pace.

Stratford – A Small Town Seeing Big-Time Growth

Located in Marathon County, Stratford is known for its close-knit community and school pride. Historically, it’s been a place where homeownership was within reach. Now, with prices nearing $268K, affordability is slipping.

Recent appreciation rates suggest new pressure from outside buyers, including those seeking to invest in modestly priced homes with room to grow. If this continues, first-time homebuyers and young families could find themselves priced out in what was once an accessible market.

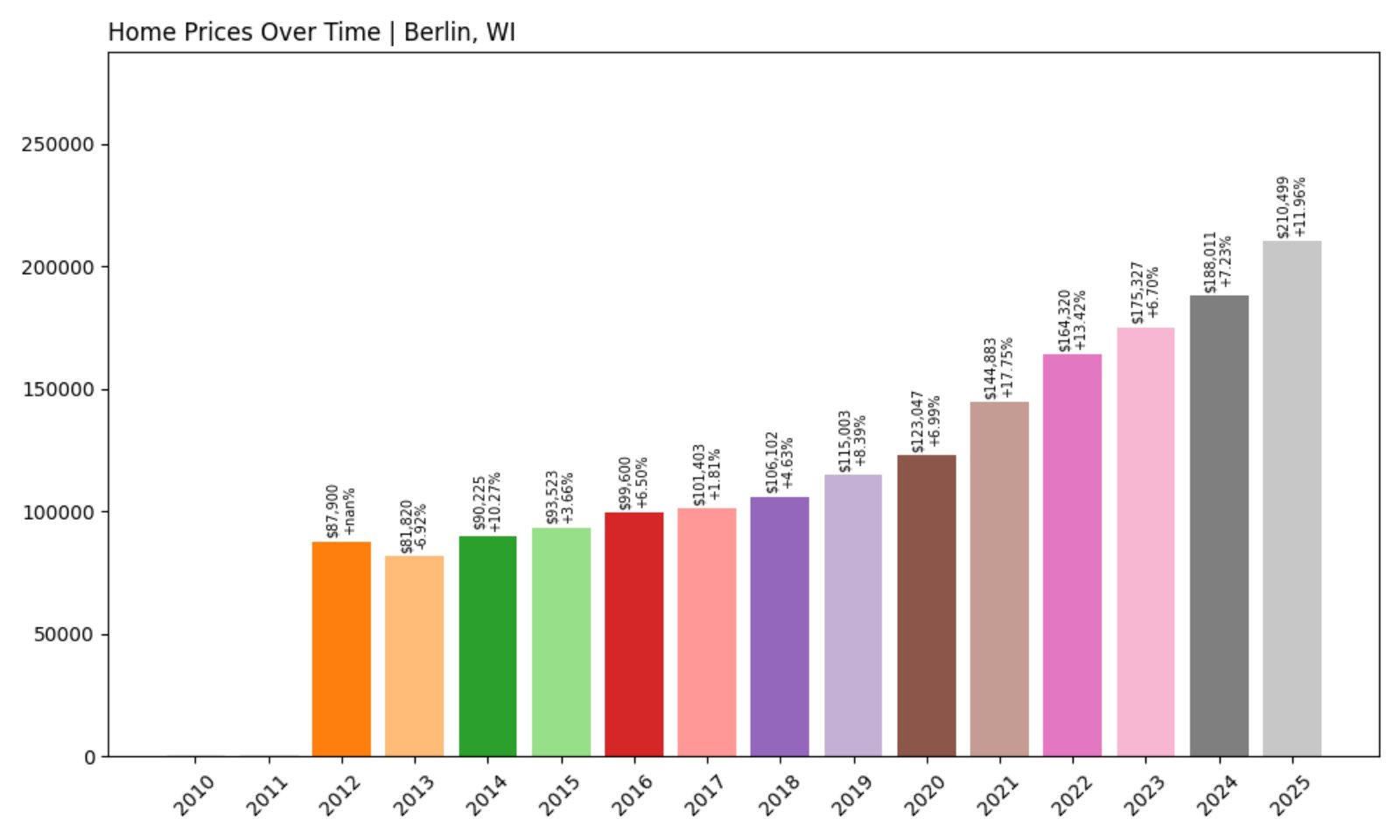

28. Berlin – Investor Feeding Frenzy Factor 33.30% (July 2025)

- Historical annual growth rate (2012–2022): 6.46%

- Recent annual growth rate (2022–2025): 8.61%

- Investor Feeding Frenzy Factor: 33.30%

- Current 2025 price: $210,499.32

Berlin has experienced an impressive 33% surge above its historical growth rate, moving from stable gains to a notable escalation. With prices now exceeding $210K, this uptick is being felt in one of Wisconsin’s most traditionally affordable communities.

Berlin – Rising Demand in a Formerly Undervalued Town

Sitting along the Fox River in Green Lake County, Berlin blends history with small-town living. Once overlooked by investors, it’s now seeing increased buyer activity. The town’s charm, combined with relatively low prices, has made it attractive for investors hoping to ride the next wave.

The recent jump in pricing puts pressure on longtime residents, especially those with limited housing options. If investor demand continues at this pace, the affordability Berlin is known for could be at risk of vanishing.

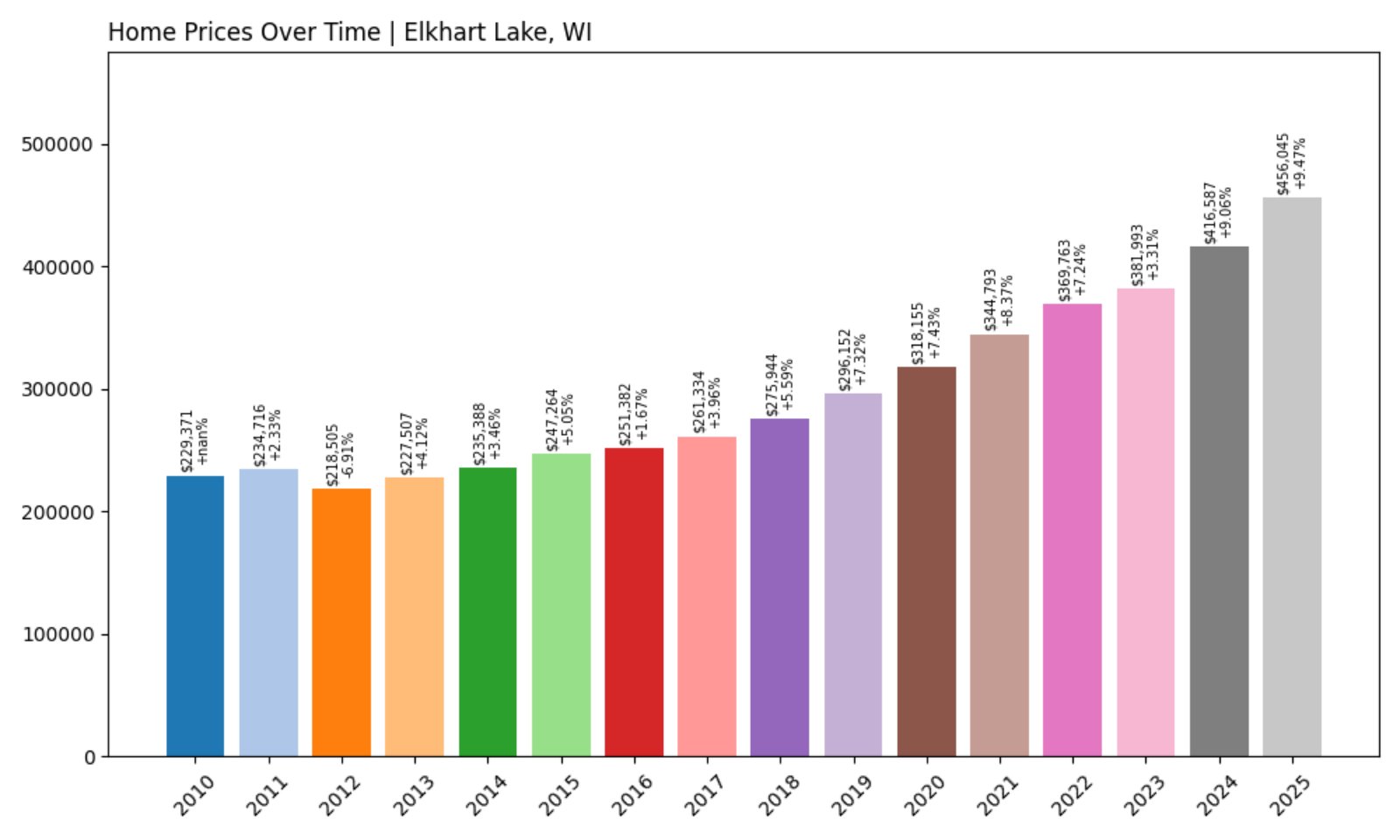

27. Elkhart Lake – Investor Feeding Frenzy Factor 34.06% (July 2025)

- Historical annual growth rate (2012–2022): 5.40%

- Recent annual growth rate (2022–2025): 7.24%

- Investor Feeding Frenzy Factor: 34.06%

- Current 2025 price: $456,044.57

Elkhart Lake’s already high home prices have grown 34% faster than historical trends. With the average home now topping $456K, this once-exclusive getaway spot is becoming even more unattainable.

Elkhart Lake – Resort Community Sees Renewed Buying Surge

Known for its raceway and lakeside charm, Elkhart Lake in Sheboygan County has long attracted second-home seekers and tourists. But recent years have seen a new wave of buyers — many of them investors looking for rental income or long-term appreciation.

With prices climbing and inventory tight, locals and service workers face growing affordability barriers. While the town’s beauty remains a draw, its housing market is tilting further away from year-round residents and more toward short-term gain.

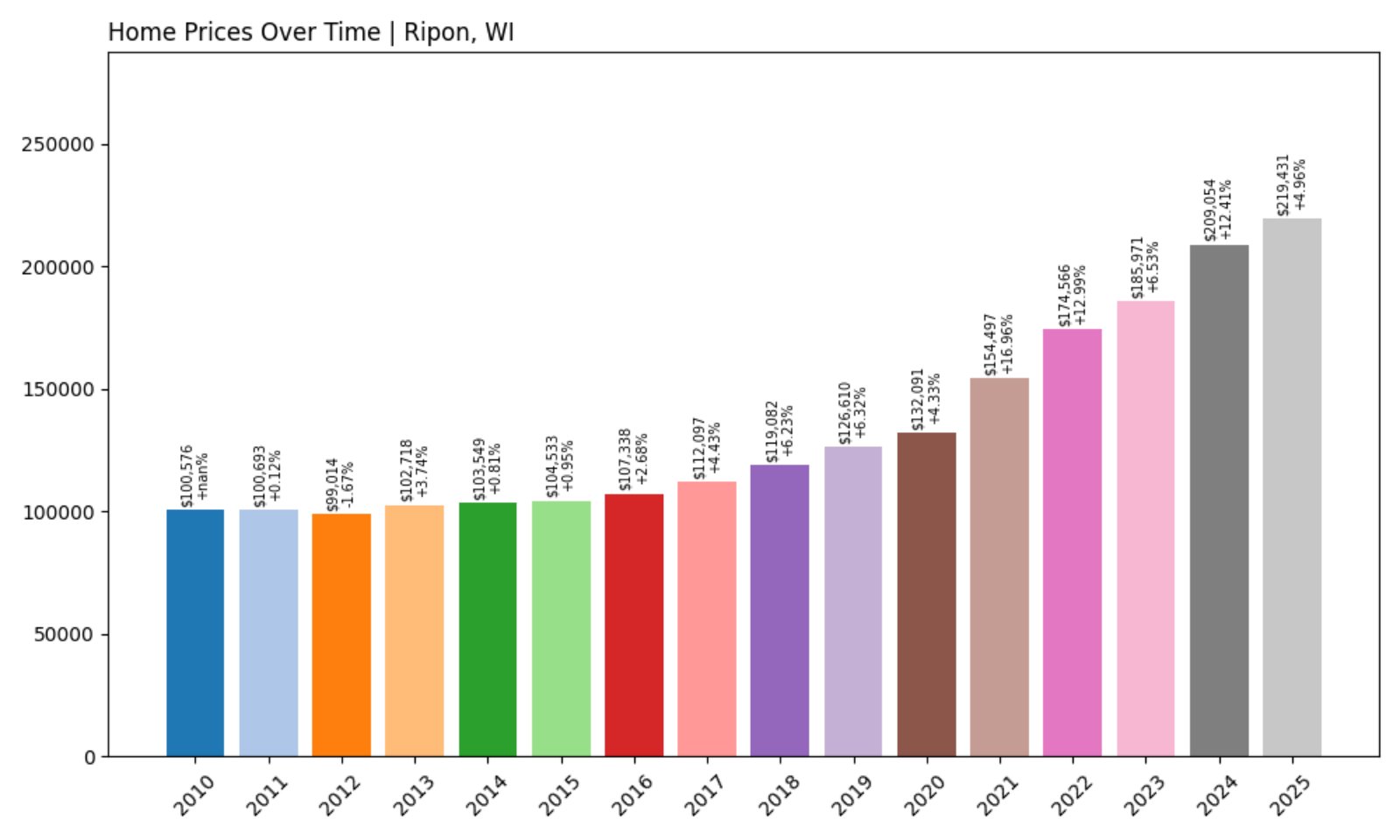

26. Ripon – Investor Feeding Frenzy Factor 35.80% (July 2025)

- Historical annual growth rate (2012–2022): 5.83%

- Recent annual growth rate (2022–2025): 7.92%

- Investor Feeding Frenzy Factor: 35.80%

- Current 2025 price: $219,431.45

Ripon’s current price growth has jumped over 35% beyond historical norms, lifting the average home value above $219K. That’s a big move for a town with deep roots and a history of slow, steady market performance.

Ripon – Historic Charm Meets Fast-Moving Market

Home to Ripon College and considered the birthplace of the Republican Party, this Fond du Lac County town blends historic charm with modern amenities. But the past few years have brought a new twist — rapidly rising home values driven by a new wave of investment.

The recent price increases are putting pressure on renters and lower-income households. As buyers compete for limited inventory, Ripon may soon find itself at the center of a conversation it’s not used to: affordability.

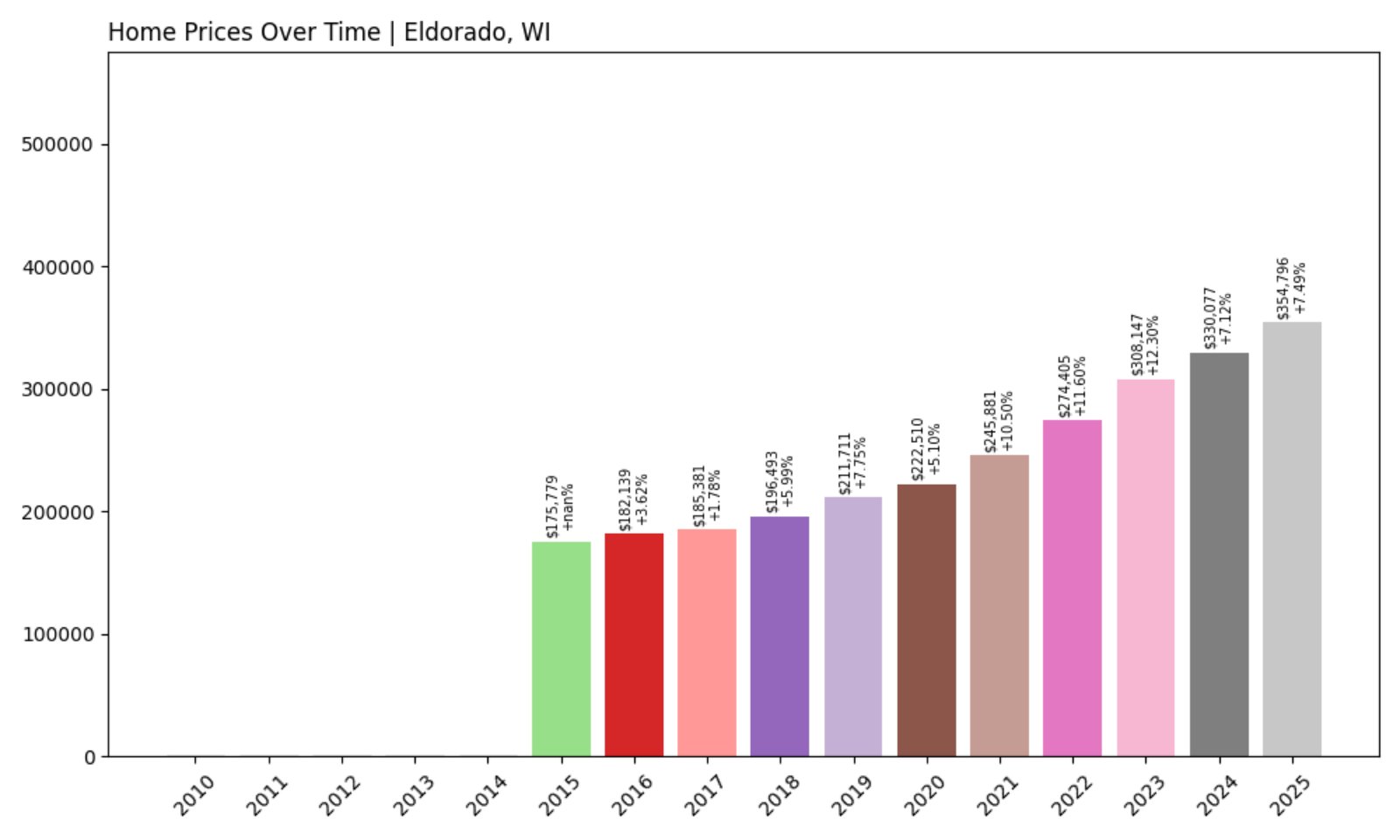

25. Eldorado – Investor Feeding Frenzy Factor 36.12% (July 2025)

- Historical annual growth rate (2012–2022): 6.57%

- Recent annual growth rate (2022–2025): 8.94%

- Investor Feeding Frenzy Factor: 36.12%

- Current 2025 price: $354,796.25

In Eldorado, recent growth has accelerated nearly 36% over the historical trend. With average home prices now sitting just below $355K, this uptick represents a sharp shift for a rural town that once prided itself on affordability.

Eldorado – From Quiet Farmland to Red-Hot Investment Zone

Situated in Fond du Lac County, Eldorado is a quiet, agricultural town surrounded by open fields and wildlife areas. Historically known for its low cost of living, the town is now seeing a steady inflow of outside buyers and real estate speculators.

The price surge is narrowing the window for first-time buyers and longtime renters. As Eldorado moves from overlooked to overvalued, the town faces increasing pressure to balance growth with livability.

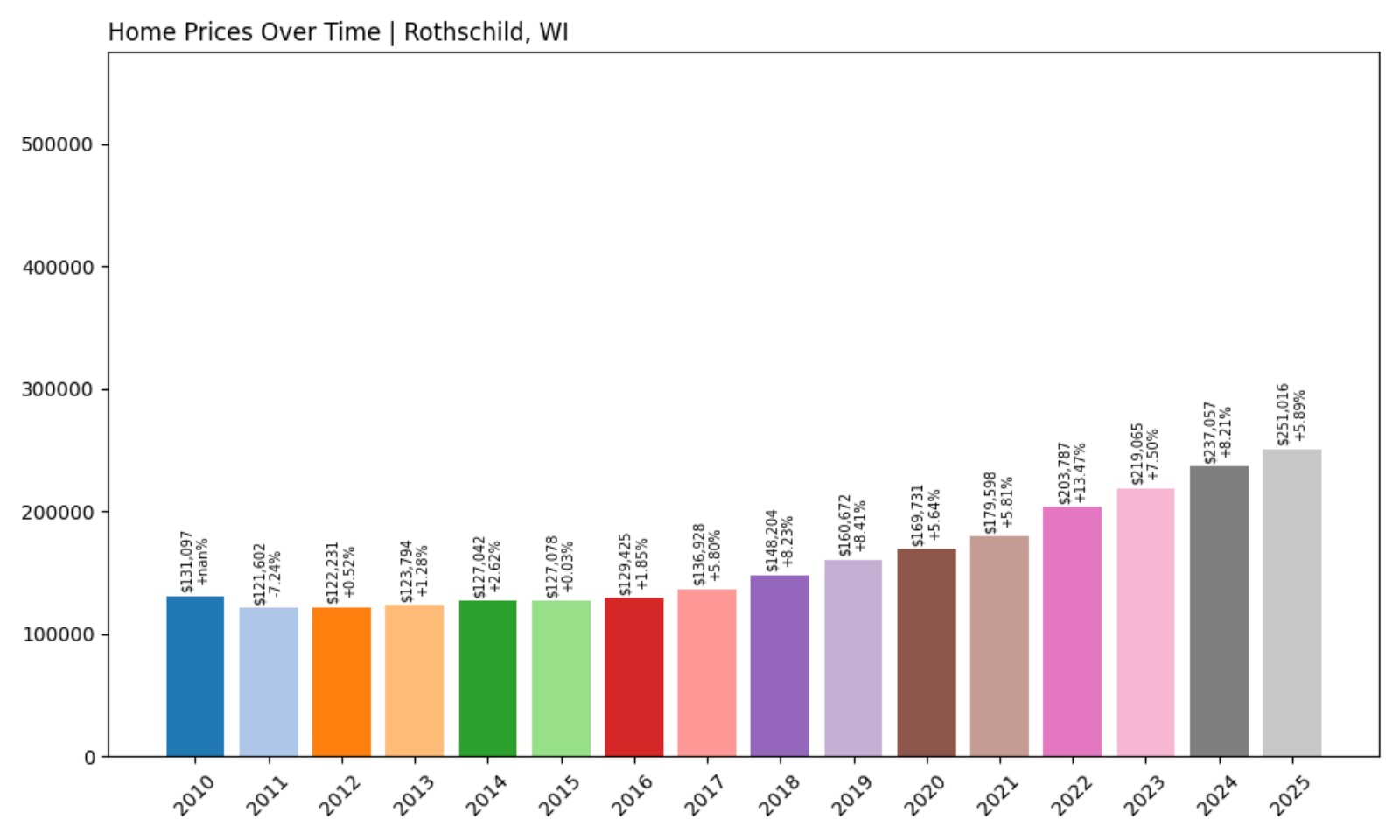

24. Rothschild – Investor Feeding Frenzy Factor 37.19% (July 2025)

- Historical annual growth rate (2012–2022): 5.24%

- Recent annual growth rate (2022–2025): 7.20%

- Investor Feeding Frenzy Factor: 37.19%

- Current 2025 price: $251,015.96

Rothschild has seen its home values spike at a pace more than 37% above its long-term average. With 2025 prices climbing past $251K, the local market is feeling pressure from rising investor interest and declining availability.

Rothschild – Steady Suburb Now Catching Heat

Just south of Wausau, Rothschild offers suburban convenience, outdoor recreation, and access to central Wisconsin employers. For years, its market was considered stable. Today, it’s becoming a magnet for investors chasing strong appreciation without major metro prices.

New construction hasn’t kept pace with demand, and that imbalance is driving prices sharply upward. For families looking to settle in this part of Marathon County, that’s creating new financial hurdles.

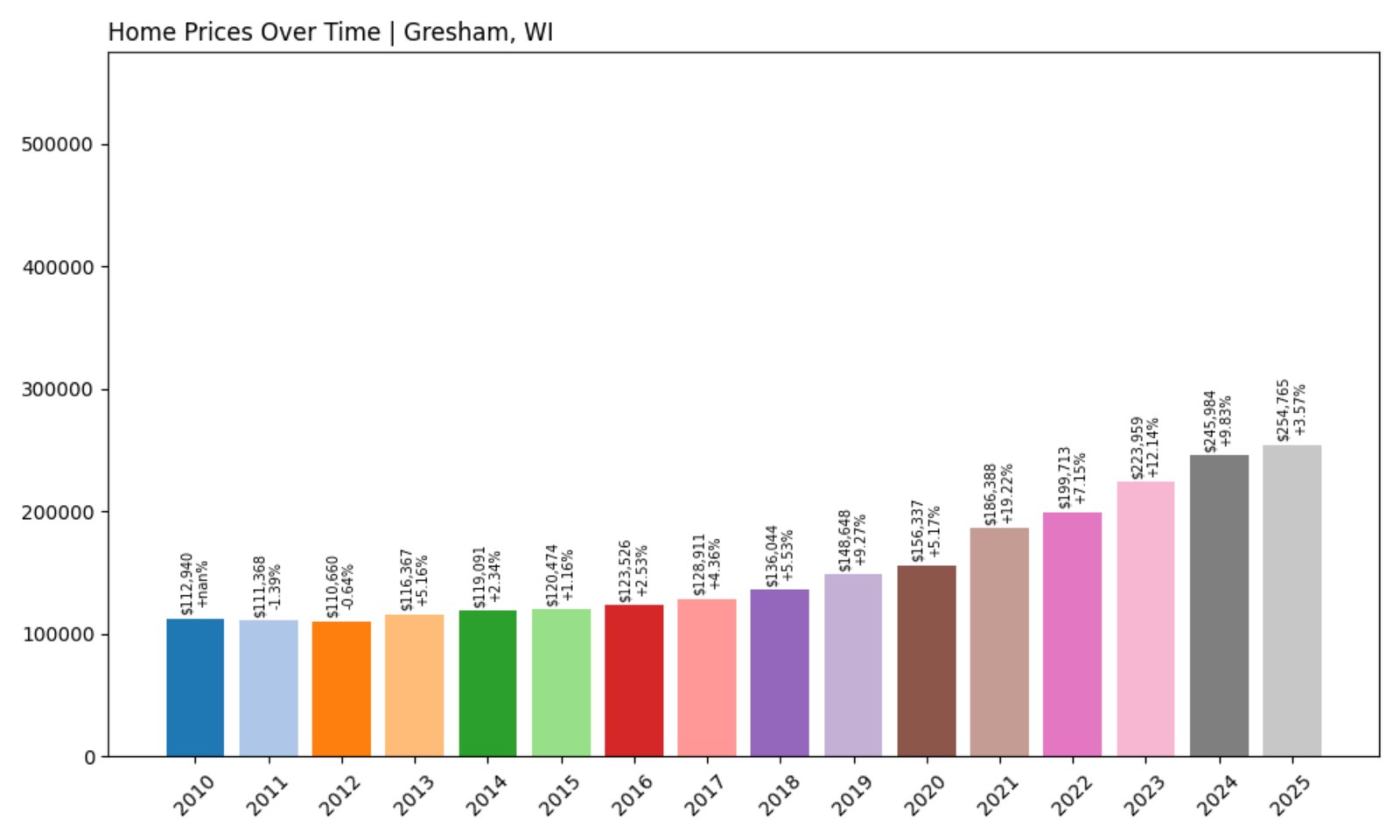

23. Gresham – Investor Feeding Frenzy Factor 38.99% (July 2025)

🔥 Would you like to save this?

- Historical annual growth rate (2012–2022): 6.08%

- Recent annual growth rate (2022–2025): 8.45%

- Investor Feeding Frenzy Factor: 38.99%

- Current 2025 price: $254,764.65

Gresham’s recent growth marks a nearly 39% surge beyond its previous decade trend — a significant swing for a town known more for natural beauty than real estate volatility. Home prices are now averaging just under $255K.

Gresham – From Scenic to Sizzling in Three Years

Located in Shawano County near lakes and forests, Gresham has historically appealed to outdoor enthusiasts and retirees. But the town’s tranquil setting is now attracting a different kind of attention — from investors looking for returns.

Short-term rental platforms and remote work have increased the town’s visibility. As prices rise, locals worry that Gresham’s charm may be overshadowed by its affordability crisis.

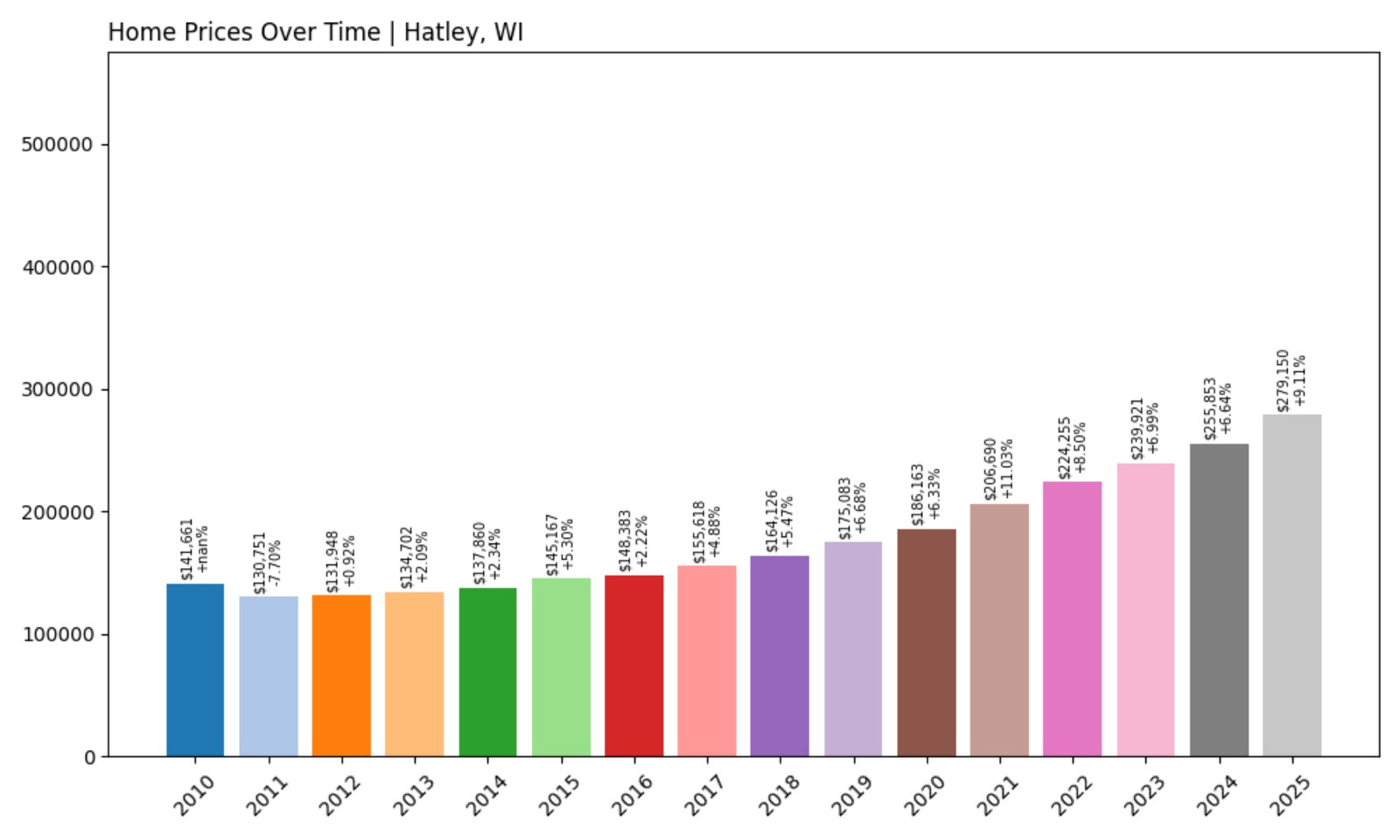

22. Hatley – Investor Feeding Frenzy Factor 39.01% (July 2025)

- Historical annual growth rate (2012–2022): 5.45%

- Recent annual growth rate (2022–2025): 7.57%

- Investor Feeding Frenzy Factor: 39.01%

- Current 2025 price: $279,150.23

Hatley’s recent price acceleration places it right at a 39% deviation from historical norms. With average prices approaching $280K, this small town is seeing home values rise faster than many of its neighbors.

Hatley – Big Growth in a Tiny Package

In eastern Marathon County, Hatley is a compact village with parks, a library, and community amenities. Its central location near major highways has made it increasingly attractive to commuters and investors alike.

Demand is outpacing supply, and the resulting price hikes are reshaping the local housing conversation. Residents who once enjoyed affordable living are now facing difficult decisions as investors enter the market.

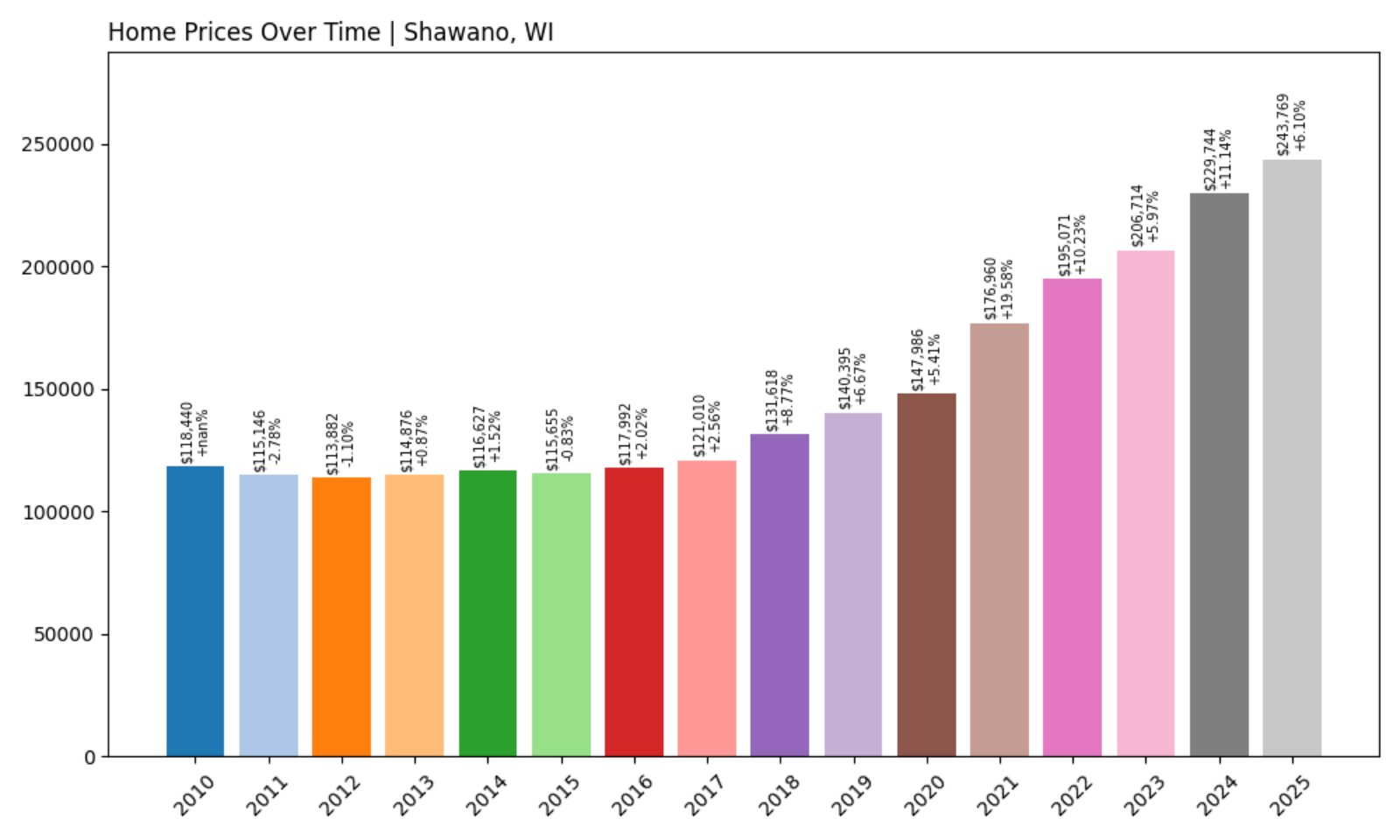

21. Shawano – Investor Feeding Frenzy Factor 39.46% (July 2025)

- Historical annual growth rate (2012–2022): 5.53%

- Recent annual growth rate (2022–2025): 7.71%

- Investor Feeding Frenzy Factor: 39.46%

- Current 2025 price: $243,769.01

Shawano’s market is heating up, with home prices growing 39% faster than their historic average. The 2025 median of nearly $244K reflects how that trend is reshaping affordability in this lakeside city.

Shawano – Lakeside Living Draws Investor Crowds

Located on Shawano Lake, this city has always drawn second-home seekers and anglers. But now, it’s not just retirees and weekenders showing up — investors are increasingly snapping up properties for short-term rentals and long-term gain.

That interest is driving up prices and reshaping who can afford to live here full-time. If trends hold, Shawano may find itself priced beyond the reach of many who’ve long called it home.

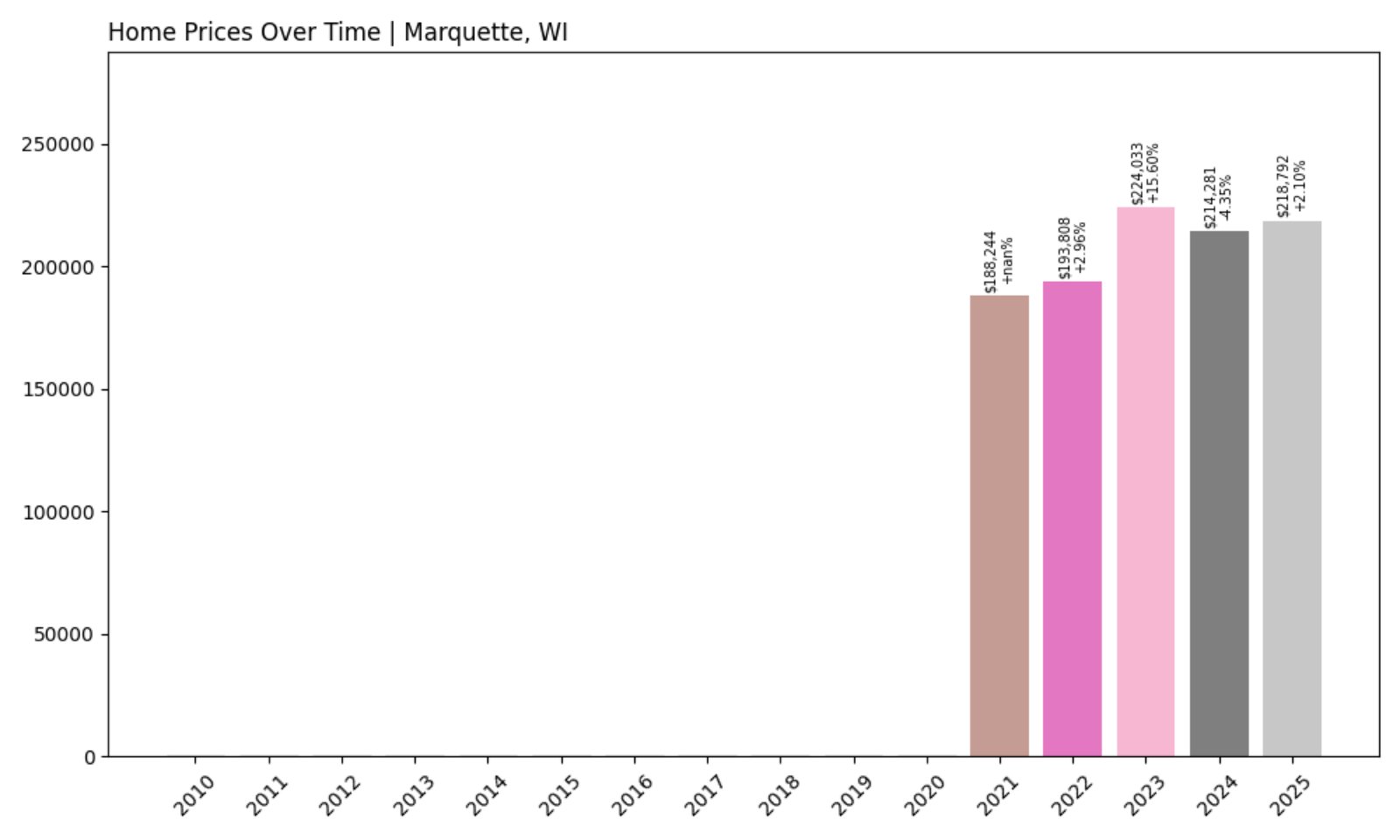

20. Marquette – Investor Feeding Frenzy Factor 39.54% (July 2025)

- Historical annual growth rate (2012–2022): 2.96%

- Recent annual growth rate (2022–2025): 4.12%

- Investor Feeding Frenzy Factor: 39.54%

- Current 2025 price: $218,791.82

Marquette’s recent growth rate of 4.12% may seem modest — but compared to its previous 2.96% pace, it’s a major jump, nearly 40% higher. This kind of acceleration in a town that’s historically seen slow growth suggests a new wave of speculation.

Marquette – Modest Growth Now Speeding Up

Sitting in Green Lake County, Marquette is a rural area known for nature preserves and quiet living. It’s been off most investors’ radars until recently. But the dramatic deviation from its usual pricing pace points to new demand bubbling under the surface.

With home prices averaging nearly $219K, the town is still relatively affordable — but the quickened pace means that may not last. A small market like Marquette is especially vulnerable to price shocks, and this surge could signal the beginning of deeper changes.

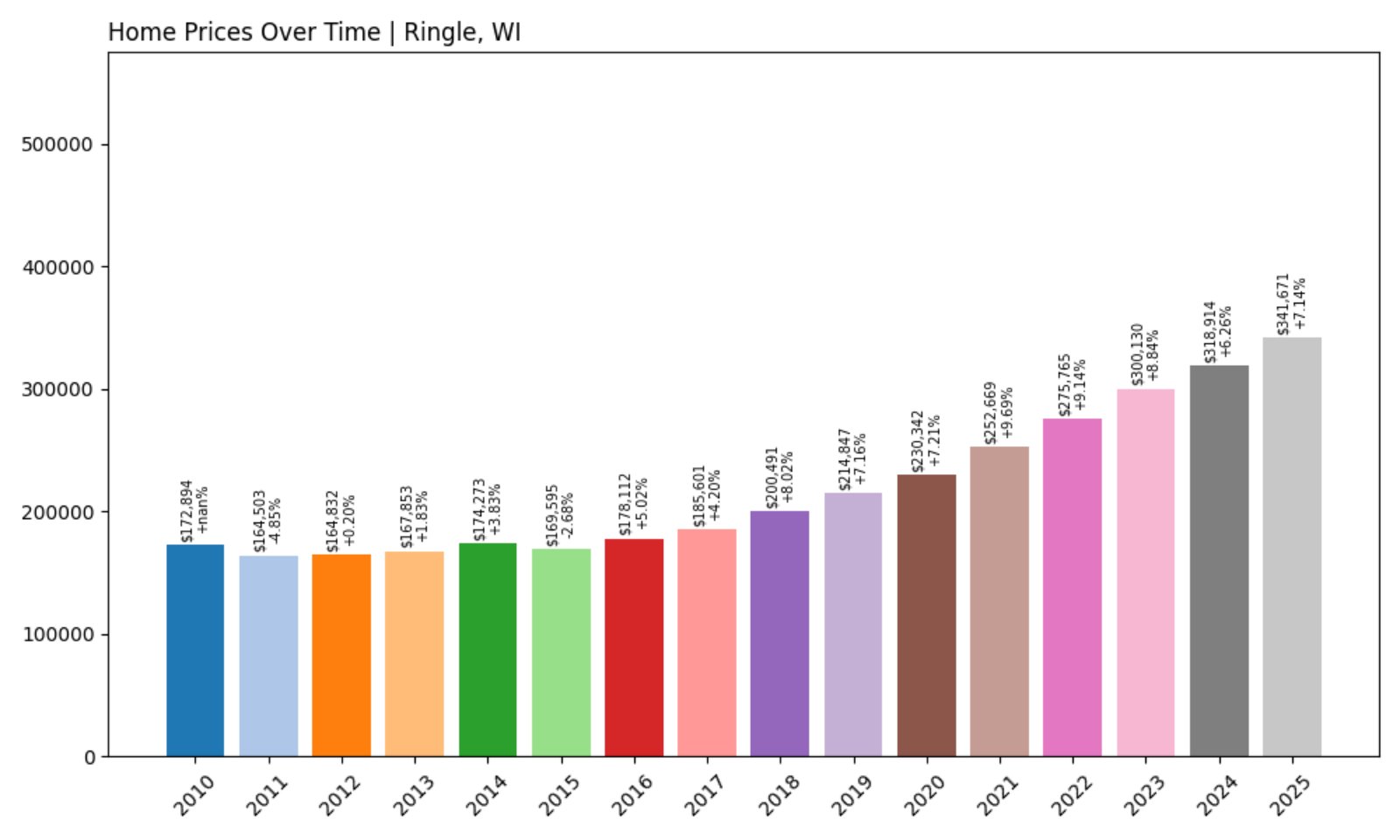

19. Ringle – Investor Feeding Frenzy Factor 40.21% (July 2025)

- Historical annual growth rate (2012–2022): 5.28%

- Recent annual growth rate (2022–2025): 7.40%

- Investor Feeding Frenzy Factor: 40.21%

- Current 2025 price: $341,670.77

Ringle’s price growth has surged more than 40% above historical levels, pushing its 2025 average price to over $341K. That’s a big leap for a semi-rural community with previously moderate growth patterns.

Ringle – Rapid Appreciation Hits a Rural Community

🔥 Would you like to save this?

Located in Marathon County just east of Wausau, Ringle offers acreage, quiet neighborhoods, and wooded lots. Those assets are suddenly becoming hot commodities for buyers fleeing higher-priced areas or betting on continued suburban sprawl.

This increase in attention has caused home values to spike well above expected trends. For locals, that means more competition and less time to act. For investors, it’s a sign the window of opportunity may be closing.

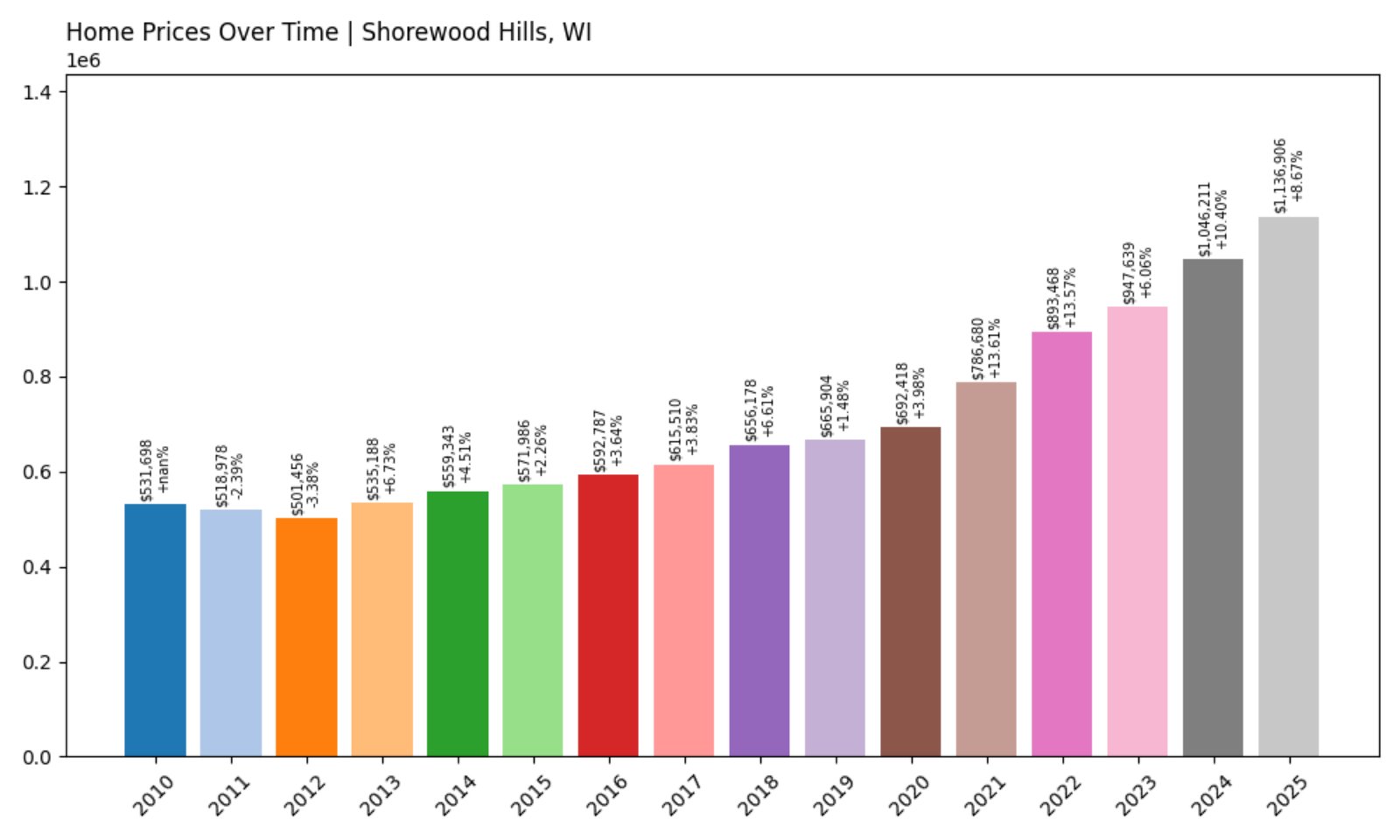

18. Shorewood Hills – Investor Feeding Frenzy Factor 40.65% (July 2025)

- Historical annual growth rate (2012–2022): 5.95%

- Recent annual growth rate (2022–2025): 8.36%

- Investor Feeding Frenzy Factor: 40.65%

- Current 2025 price: $1,136,906.44

Shorewood Hills is one of the priciest communities on this list, and recent price acceleration over 40% above its historic norm reinforces its elite status. With home values topping $1.13 million, the market is moving fast.

Shorewood Hills – Luxury Community Surging Even Higher

Located just west of downtown Madison, Shorewood Hills is known for its tree-lined streets, lakeside views, and some of the highest home values in the state. Its reputation for exclusivity has made it a magnet for high-income buyers and investors alike.

The current jump in prices shows even luxury markets aren’t immune to investor-driven surges. Whether driven by low inventory, increased cash purchases, or high-end renovations, this pace puts further strain on would-be buyers trying to enter the neighborhood.

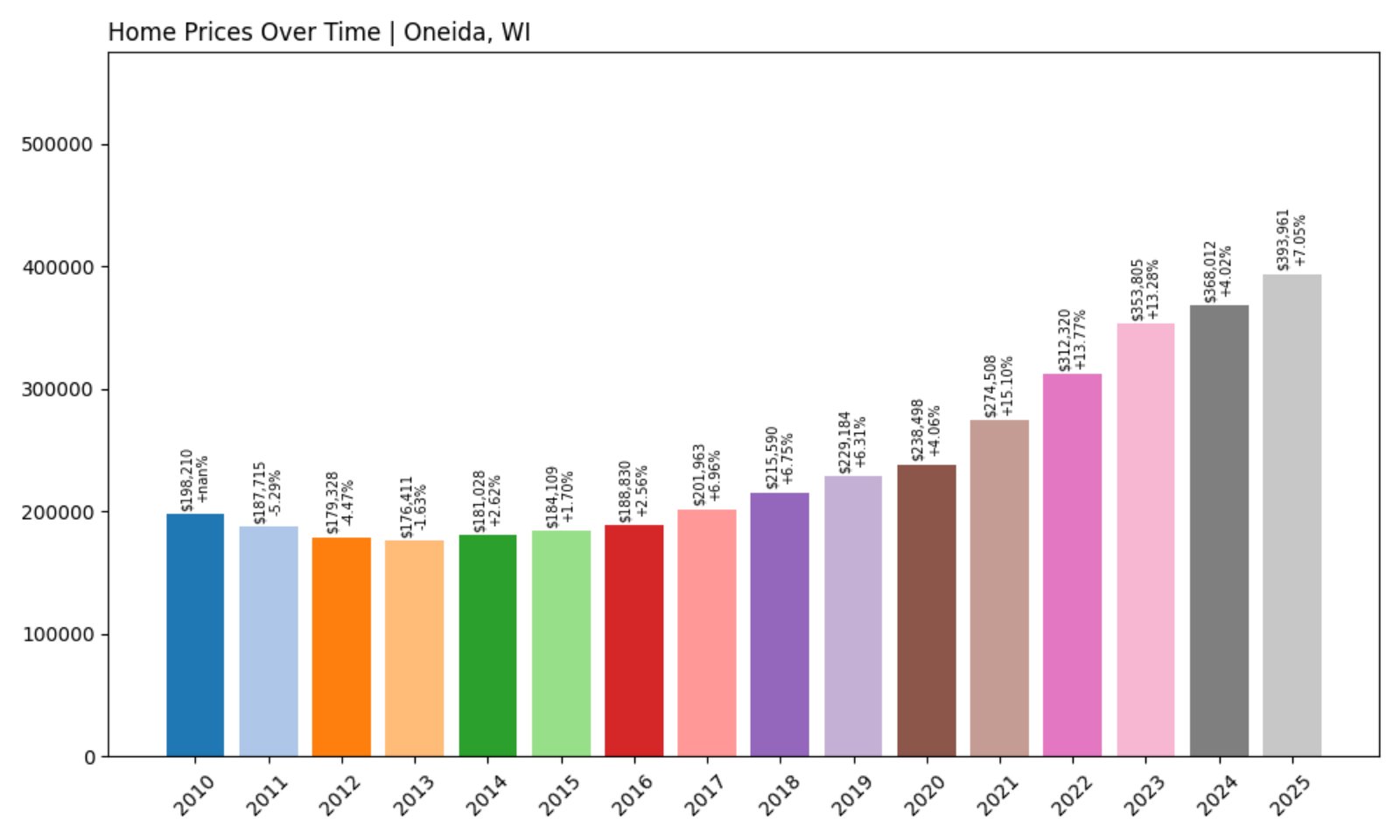

17. Oneida – Investor Feeding Frenzy Factor 41.08% (July 2025)

- Historical annual growth rate (2012–2022): 5.70%

- Recent annual growth rate (2022–2025): 8.05%

- Investor Feeding Frenzy Factor: 41.08%

- Current 2025 price: $393,961.11

Oneida’s home values have climbed more than 41% faster than expected, pushing average prices close to $394K. This rapid climb marks one of the steepest changes in growth rates across northeastern Wisconsin.

Oneida – Historic Region Grapples with Modern Pressures

Named for the Oneida Nation and located near Green Bay, this town blends history, cultural heritage, and rural land. It has become increasingly attractive to buyers looking for open space without leaving the region.

But as demand ramps up, so does competition. With investor interest growing in mid-size rural towns, Oneida is entering a new chapter — one where locals must contend with pricing pressures that were once rare in the region.

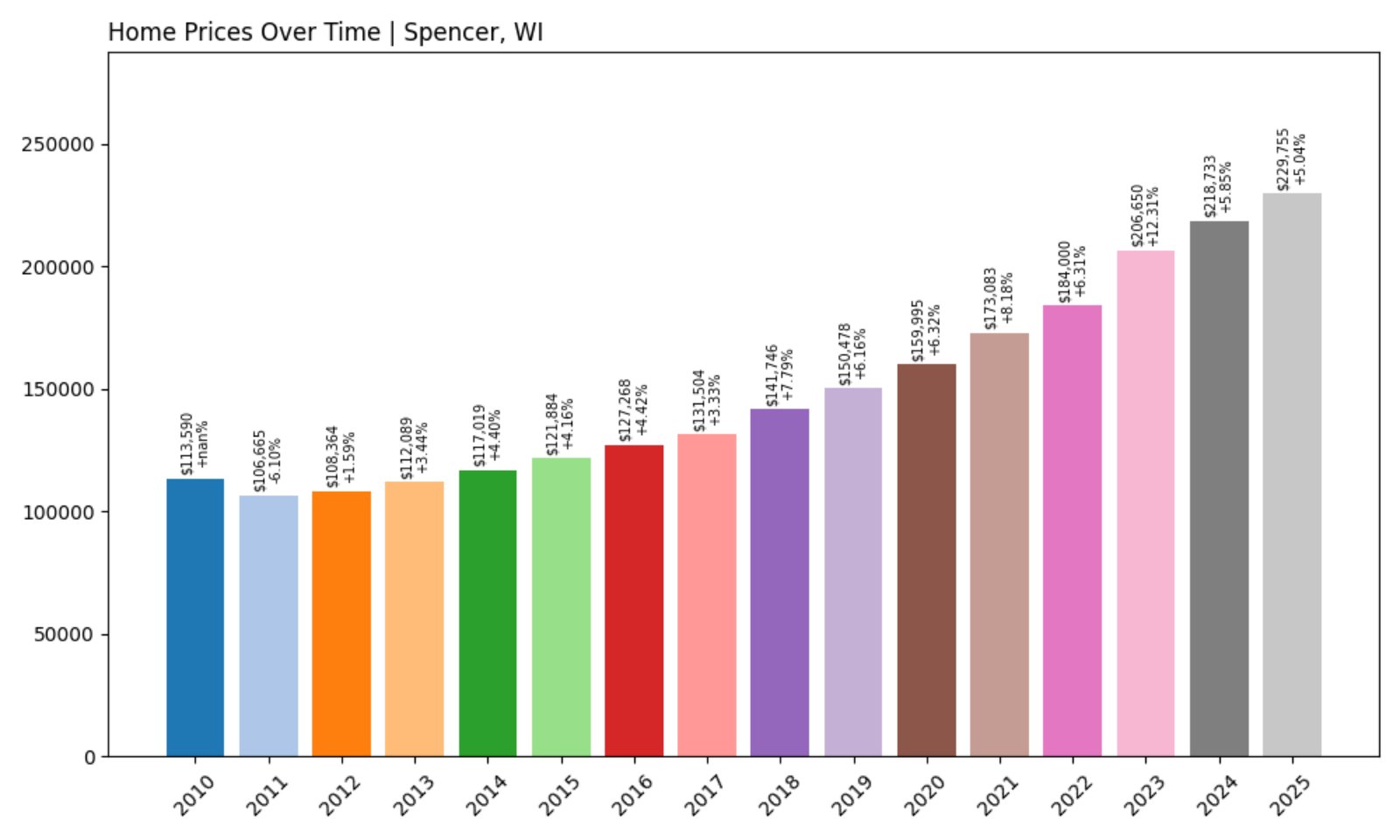

16. Spencer – Investor Feeding Frenzy Factor 41.31% (July 2025)

- Historical annual growth rate (2012–2022): 5.44%

- Recent annual growth rate (2022–2025): 7.68%

- Investor Feeding Frenzy Factor: 41.31%

- Current 2025 price: $229,754.73

Spencer’s growth rate has jumped more than 41% compared to the past decade, and the average 2025 home price has crept near $230K. For a small town, that’s a meaningful rise — one that reflects how demand is intensifying even outside major population centers.

Spencer – Fast Growth in a Traditionally Affordable Town

Located in Marathon County near Marshfield, Spencer has long offered affordable housing and a laid-back lifestyle. But what was once a slow-and-steady market has started heating up.

Spencer’s modest size and location make it attractive for investors seeking entry-level properties with growth upside. That dynamic has started shifting the landscape — and pricing out the buyers who once had the easiest path to ownership.

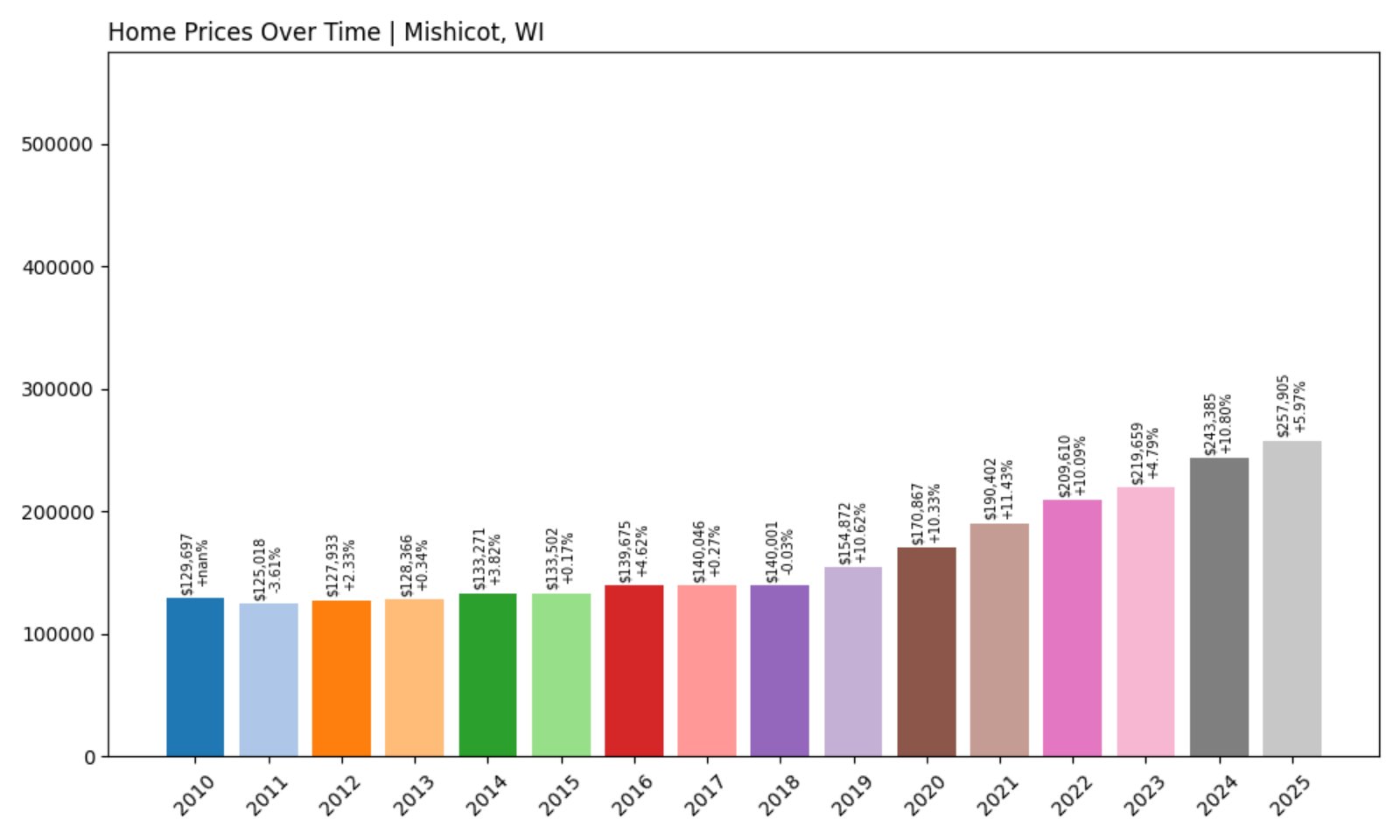

15. Mishicot – Investor Feeding Frenzy Factor 41.38% (July 2025)

- Historical annual growth rate (2012–2022): 5.06%

- Recent annual growth rate (2022–2025): 7.16%

- Investor Feeding Frenzy Factor: 41.38%

- Current 2025 price: $257,904.67

Mishicot has seen a significant shift in its housing market, with growth now more than 41% higher than its previous decade’s pace. Home prices averaging nearly $258K in 2025 reflect increased competition in what was once a lower-key market.

Mishicot – Quiet Village, Loud Price Increases

This small village in Manitowoc County is known for its peaceful setting, scenic river, and easy access to Lake Michigan. Historically, prices moved slowly here. But the last few years have seen a surge in demand, with rising prices to match.

Buyers are increasingly looking to towns like Mishicot as nearby cities grow expensive. The result is a fast-moving market that’s leaving less room for local homebuyers to keep pace.

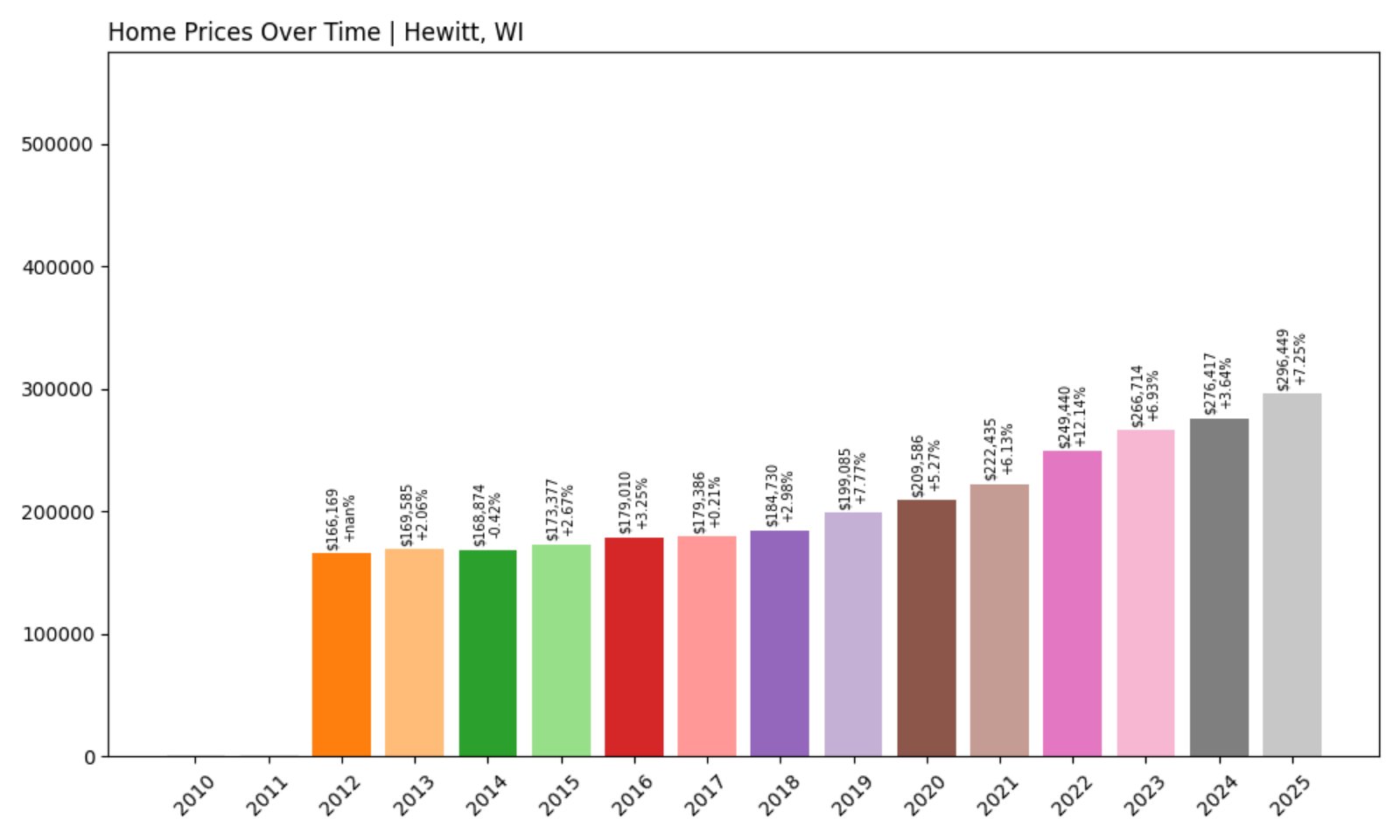

14. Hewitt – Investor Feeding Frenzy Factor 42.90% (July 2025)

- Historical annual growth rate (2012–2022): 4.15%

- Recent annual growth rate (2022–2025): 5.92%

- Investor Feeding Frenzy Factor: 42.90%

- Current 2025 price: $296,449.47

In Hewitt, home prices are growing nearly 43% faster than they had over the previous ten years. The new average price of just under $296.5K highlights the impact of that shift — particularly in a town known for stability.

Hewitt – Rising Prices in a Once-Steady Market

Just east of Marshfield in Wood County, Hewitt is a small, tight-knit community with a modest housing stock. Until recently, affordability was a given here. Now, even this quiet town is seeing prices rise more aggressively.

Limited availability and rising outside interest have played a role. Hewitt’s appeal as a peaceful but connected location may continue to fuel its price trend upward — and increase strain on first-time buyers.

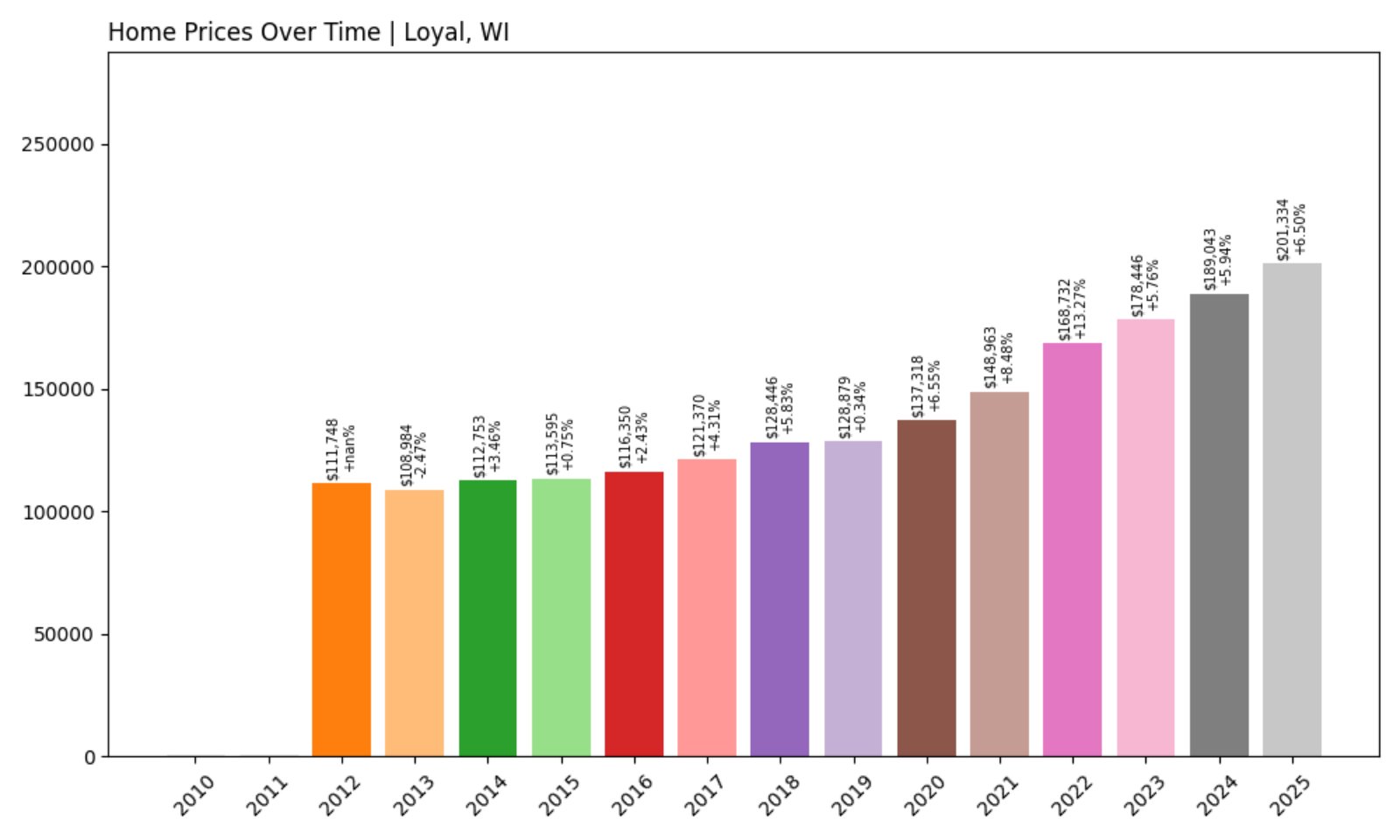

13. Loyal – Investor Feeding Frenzy Factor 44.18% (July 2025)

- Historical annual growth rate (2012–2022): 4.21%

- Recent annual growth rate (2022–2025): 6.07%

- Investor Feeding Frenzy Factor: 44.18%

- Current 2025 price: $201,333.86

Loyal’s growth rate now sits more than 44% higher than its previous decade average. With the current home value at about $201K, the pressure on the local housing market is evident and growing.

Loyal – Affordable No More?

Located in Clark County, Loyal is a quiet town surrounded by farmland and forestry. Historically, it was one of the most affordable markets in the region — a fact that helped anchor its community for decades.

But that’s changing. Accelerated price growth may be pulling the town into investor crosshairs, especially as more remote buyers search for properties with room to grow. The trend is reshaping who can afford to buy here.

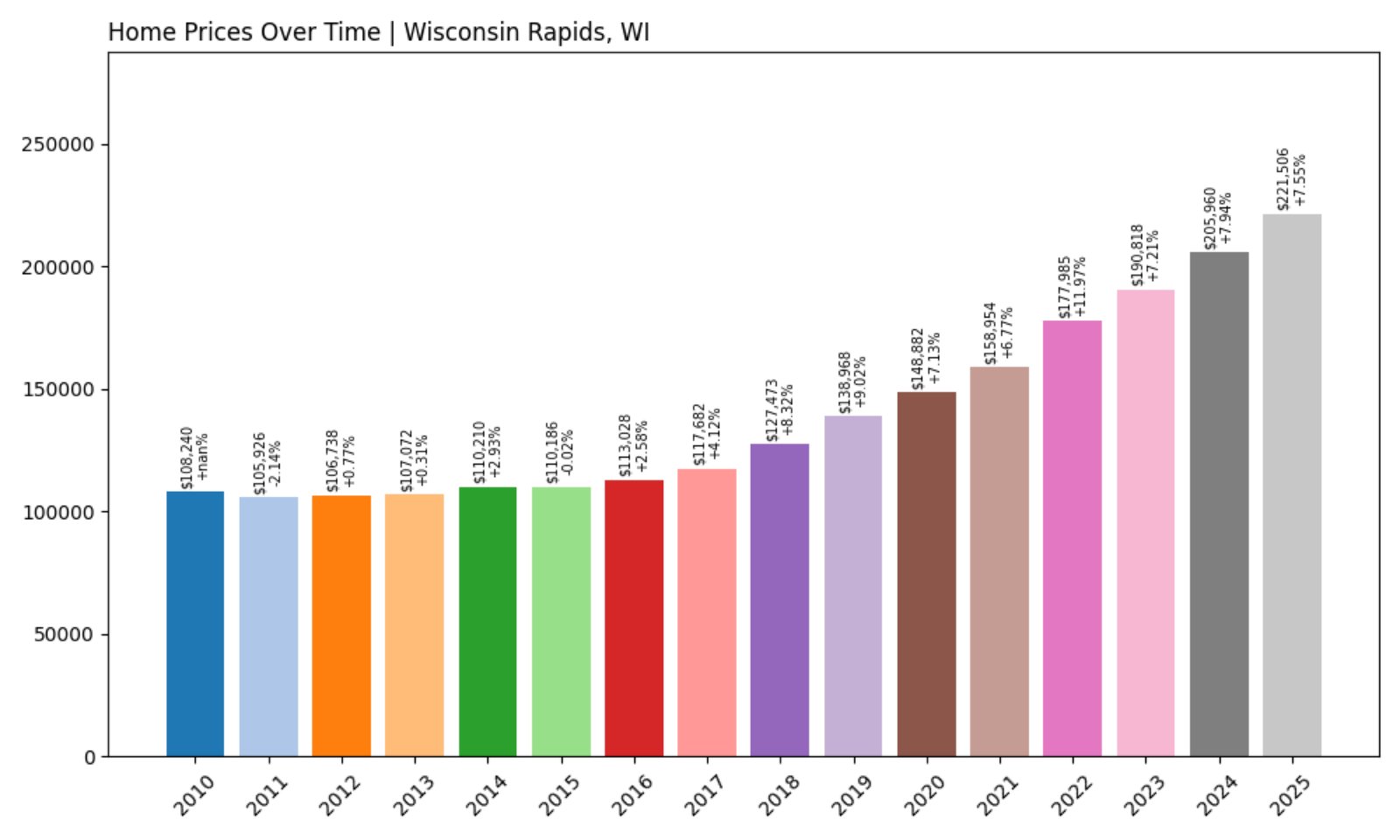

12. Wisconsin Rapids – Investor Feeding Frenzy Factor 44.18% (July 2025)

- Historical annual growth rate (2012–2022): 5.25%

- Recent annual growth rate (2022–2025): 7.56%

- Investor Feeding Frenzy Factor: 44.18%

- Current 2025 price: $221,506.31

Wisconsin Rapids is growing 44% faster than its historical norm — a major jump for a mid-sized city. Average home prices have now surpassed $221K, and the speed of change is only accelerating.

Wisconsin Rapids – Industrial Roots, Rising Values

Known for its history in the paper industry and scenic riverfront, Wisconsin Rapids is a regional center in Wood County. The city blends suburban affordability with infrastructure, making it attractive to buyers seeking value.

But as prices rise faster than expected, long-time residents are facing new barriers. Whether driven by investor interest or renewed local demand, this is one of the city’s sharpest surges in recent memory.

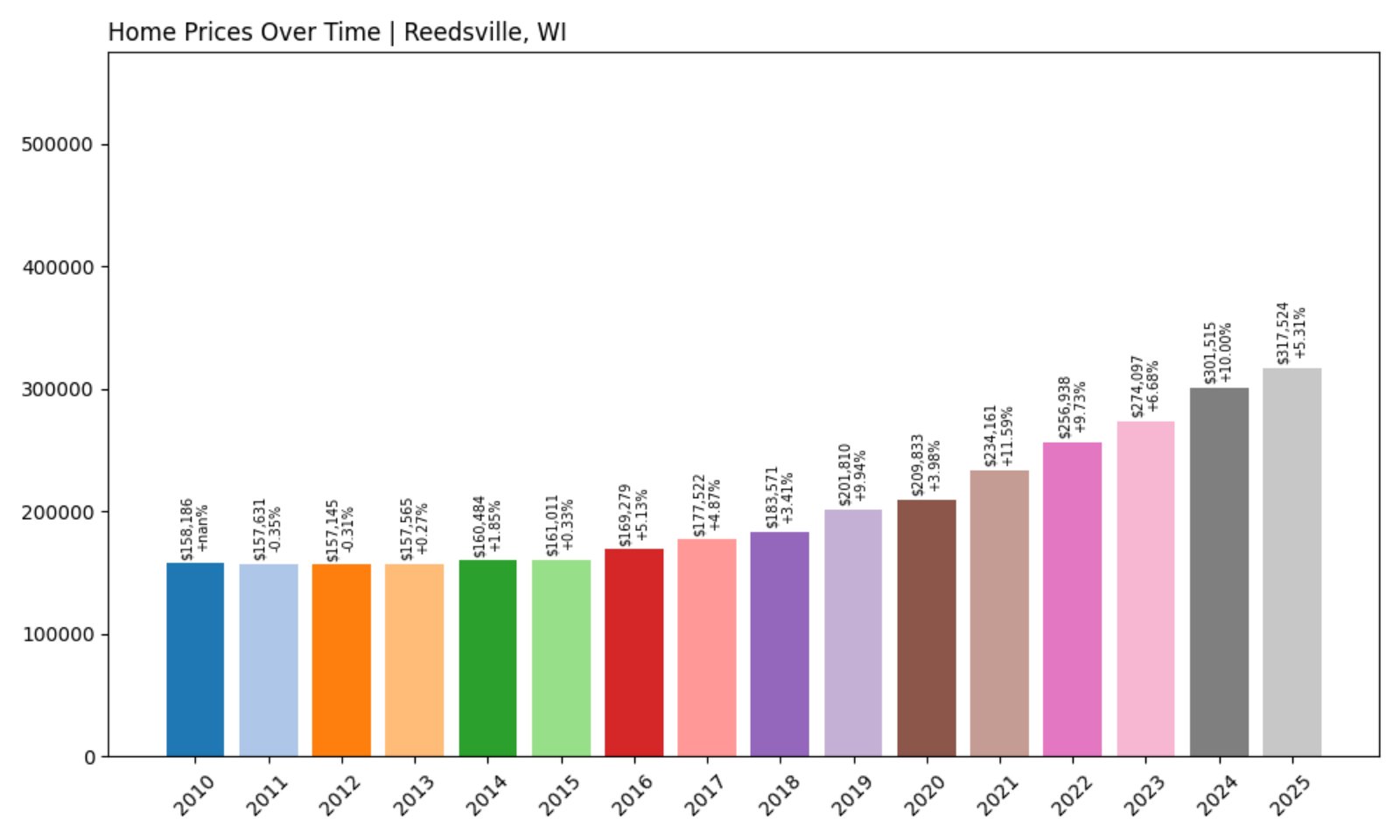

11. Reedsville – Investor Feeding Frenzy Factor 45.10% (July 2025)

- Historical annual growth rate (2012–2022): 5.04%

- Recent annual growth rate (2022–2025): 7.31%

- Investor Feeding Frenzy Factor: 45.10%

- Current 2025 price: $317,523.89

Reedsville has seen its price growth speed up by over 45% compared to the last decade’s pace. With the average home now valued at $317K, the community is quickly transitioning from affordable to highly competitive.

Reedsville – Big Change in a Small Town

This Manitowoc County village has traditionally been a place of modest means and manageable prices. But the market today tells a different story — one of price pressure, increased investor activity, and changing expectations.

With its proximity to both rural land and larger employment centers, Reedsville is suddenly on the radar. And that’s making things tougher for those who call it home.

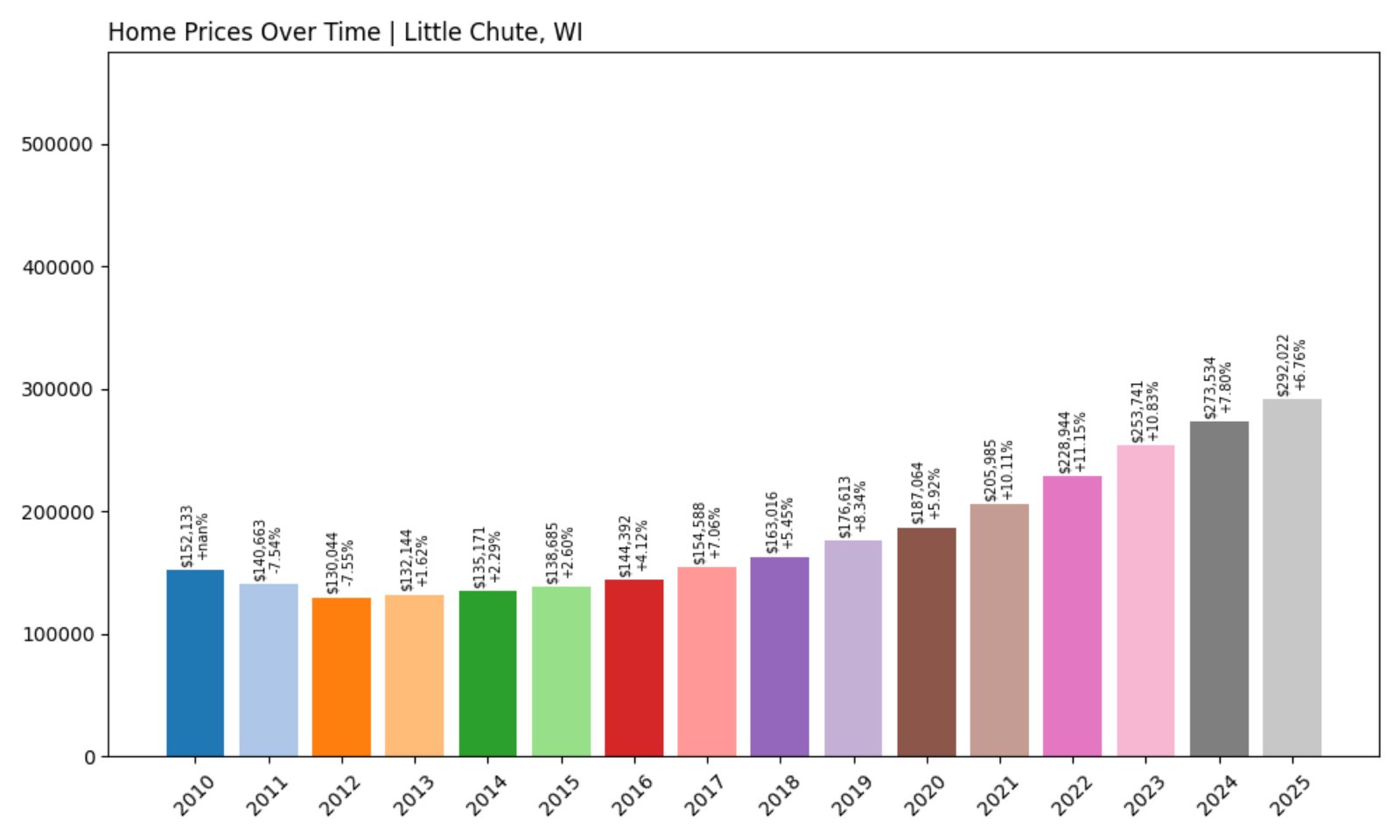

10. Little Chute – Investor Feeding Frenzy Factor 45.21% (July 2025)

- Historical annual growth rate (2012–2022): 5.82%

- Recent annual growth rate (2022–2025): 8.45%

- Investor Feeding Frenzy Factor: 45.21%

- Current 2025 price: $292,022.11

Little Chute’s price growth has accelerated more than 45% compared to historical norms. With home values now hovering just above $292K, the town is facing more demand than many anticipated.

Little Chute – Tight Supply Meets Rising Demand

Located in Outagamie County along the Fox River, Little Chute is a community known for its Dutch heritage and tight-knit neighborhoods. Its modest pricing once drew in young families and first-time buyers, but those days may be numbered.

Investors and transplants from nearby urban hubs are adding pressure to the market, pushing prices up quickly. If this pattern holds, it could mark a significant shift in the affordability landscape of this historically balanced community.

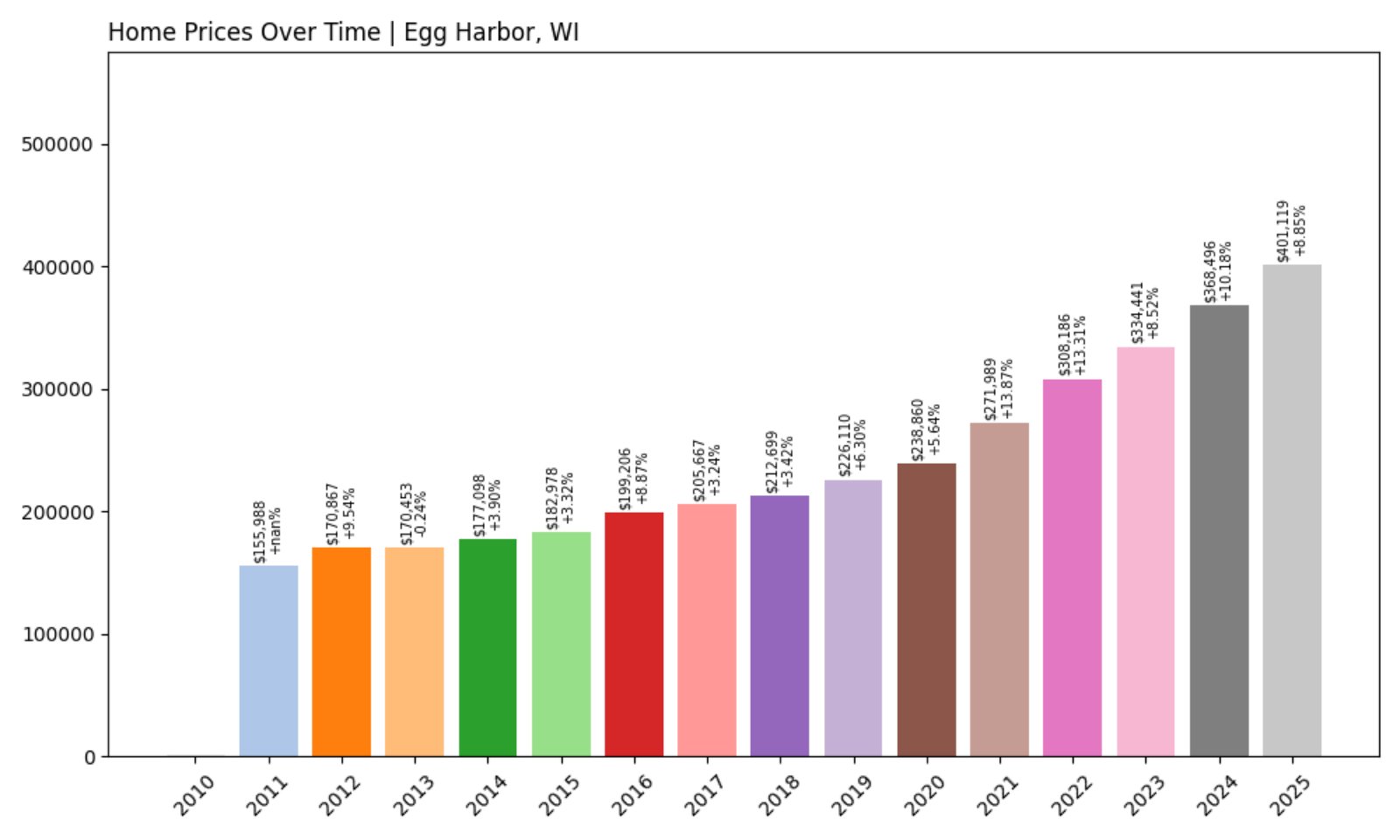

9. Egg Harbor – Investor Feeding Frenzy Factor 51.14% (July 2025)

- Historical annual growth rate (2012–2022): 6.08%

- Recent annual growth rate (2022–2025): 9.18%

- Investor Feeding Frenzy Factor: 51.14%

- Current 2025 price: $401,118.64

Egg Harbor’s already high prices have surged even further, with growth now exceeding historical trends by over 51%. The average home price has crossed $401K, reflecting intensified demand in this vacation-centric village.

Egg Harbor – High-End Market Heats Up

Nestled on the western shores of Door County, Egg Harbor is a popular destination for seasonal residents and tourists. With its waterfront views, boutiques, and restaurants, the town has long drawn affluent buyers.

That attraction is growing stronger, and prices are following suit. As demand rises for second homes and short-term rentals, locals are struggling to compete — especially those without the cash reserves to buy quickly.

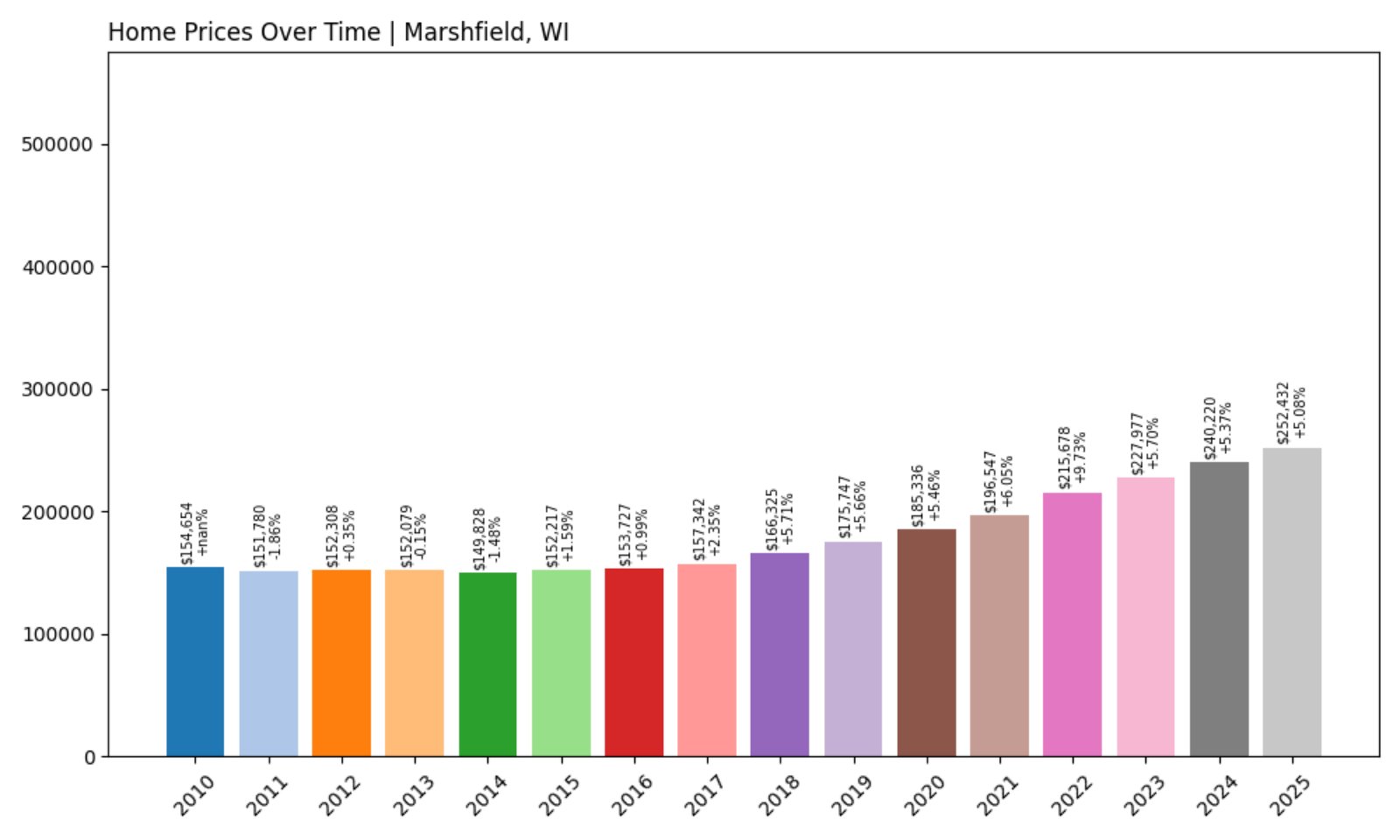

8. Marshfield – Investor Feeding Frenzy Factor 52.12% (July 2025)

- Historical annual growth rate (2012–2022): 3.54%

- Recent annual growth rate (2022–2025): 5.39%

- Investor Feeding Frenzy Factor: 52.12%

- Current 2025 price: $252,431.99

Marshfield’s growth has surged more than 52% above its historical average, with current prices sitting above $252K. That represents a strong upward shift for a city with a history of slow, predictable change.

Marshfield – Medical Hub Turned Investment Target

As the home of Marshfield Clinic, one of Wisconsin’s largest health systems, Marshfield has long offered job stability and community services. Until recently, its housing market mirrored that stability.

Now, however, real estate in Marshfield is appreciating at an unexpected pace. New demand — possibly from health workers, remote professionals, and investors — is putting pressure on inventory and reshaping price expectations.

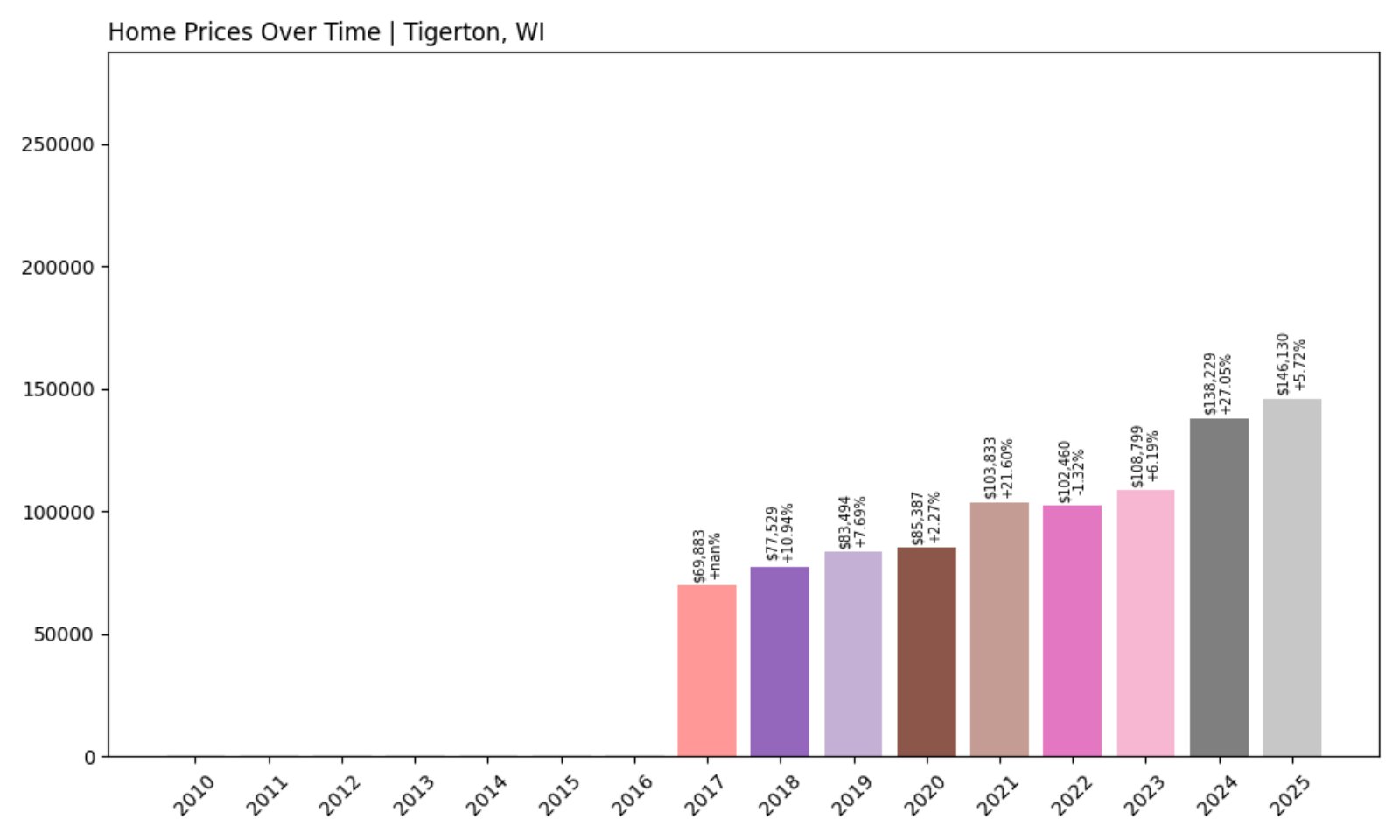

7. Tigerton – Investor Feeding Frenzy Factor 57.95% (July 2025)

- Historical annual growth rate (2012–2022): 7.95%

- Recent annual growth rate (2022–2025): 12.56%

- Investor Feeding Frenzy Factor: 57.95%

- Current 2025 price: $146,130.15

In Tigerton, price growth is approaching 58% above historical patterns. Though the average home value remains low at $146K, the rate of acceleration is among the fastest in the state.

Tigerton – Rapid Change in a Low-Cost Market

A tiny village in Shawano County, Tigerton is traditionally a low-cost housing market. That’s exactly what’s drawing investors now. Buyers are betting on outsized returns in smaller, undervalued markets.

While prices remain modest, the sharp spike in appreciation is concerning. Local buyers face tougher competition, and the market could become increasingly unstable if the frenzy continues unchecked.

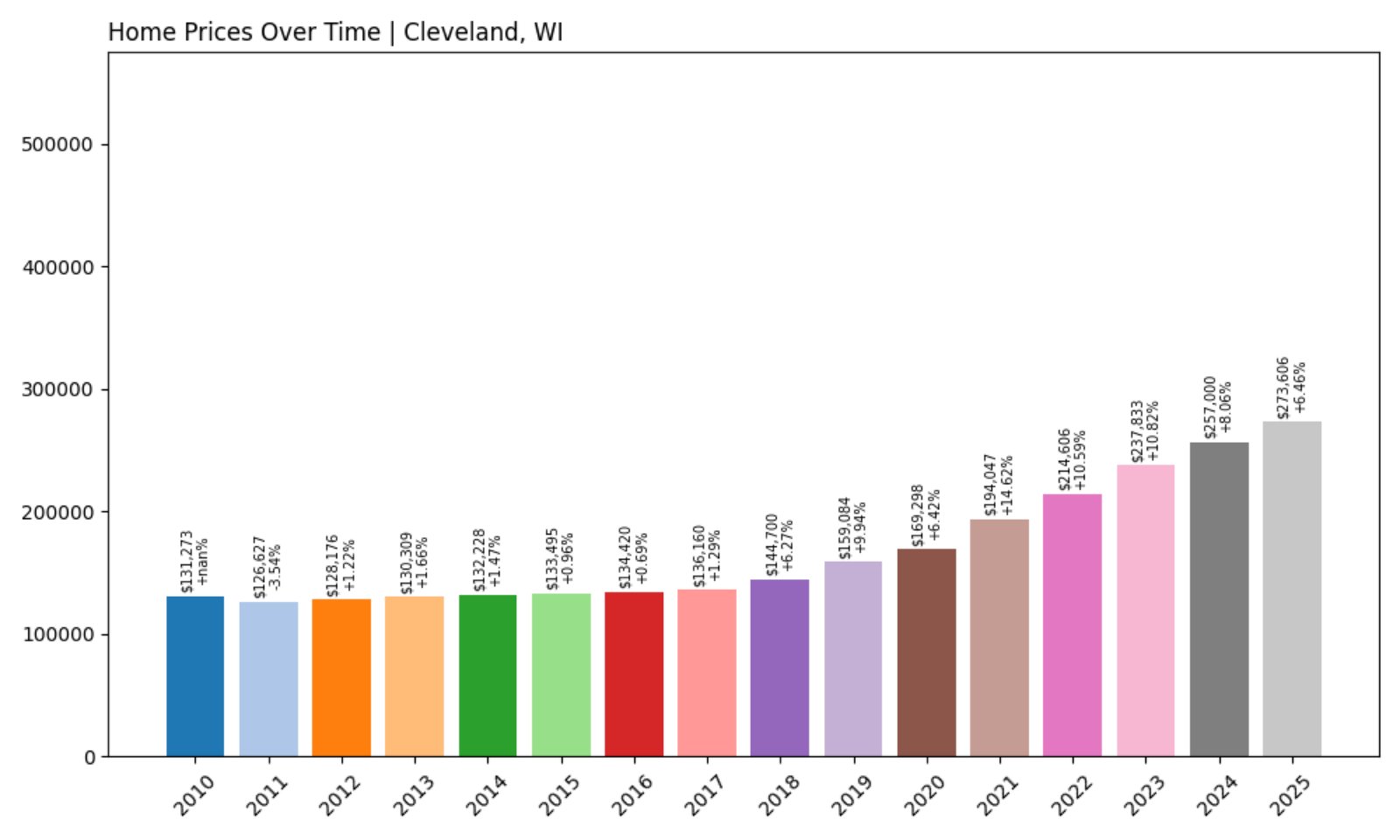

6. Cleveland – Investor Feeding Frenzy Factor 59.44% (July 2025)

- Historical annual growth rate (2012–2022): 5.29%

- Recent annual growth rate (2022–2025): 8.43%

- Investor Feeding Frenzy Factor: 59.44%

- Current 2025 price: $273,606.50

Cleveland has seen its housing market surge nearly 60% past its historical average growth. With 2025 prices just over $273K, this lakeside town is seeing increased buyer interest — and a noticeable strain on affordability.

Cleveland – Lakeshore Appeal Fueling Rapid Gains

Sitting on Lake Michigan in Manitowoc County, Cleveland is a quiet residential community known for its coastal views and access to water recreation. Those assets are now fueling a new wave of speculative buying.

This sudden uptick puts pressure on local households, especially those who could once rely on predictable pricing. With limited housing stock and rising interest, Cleveland may be entering a period of long-term price escalation.

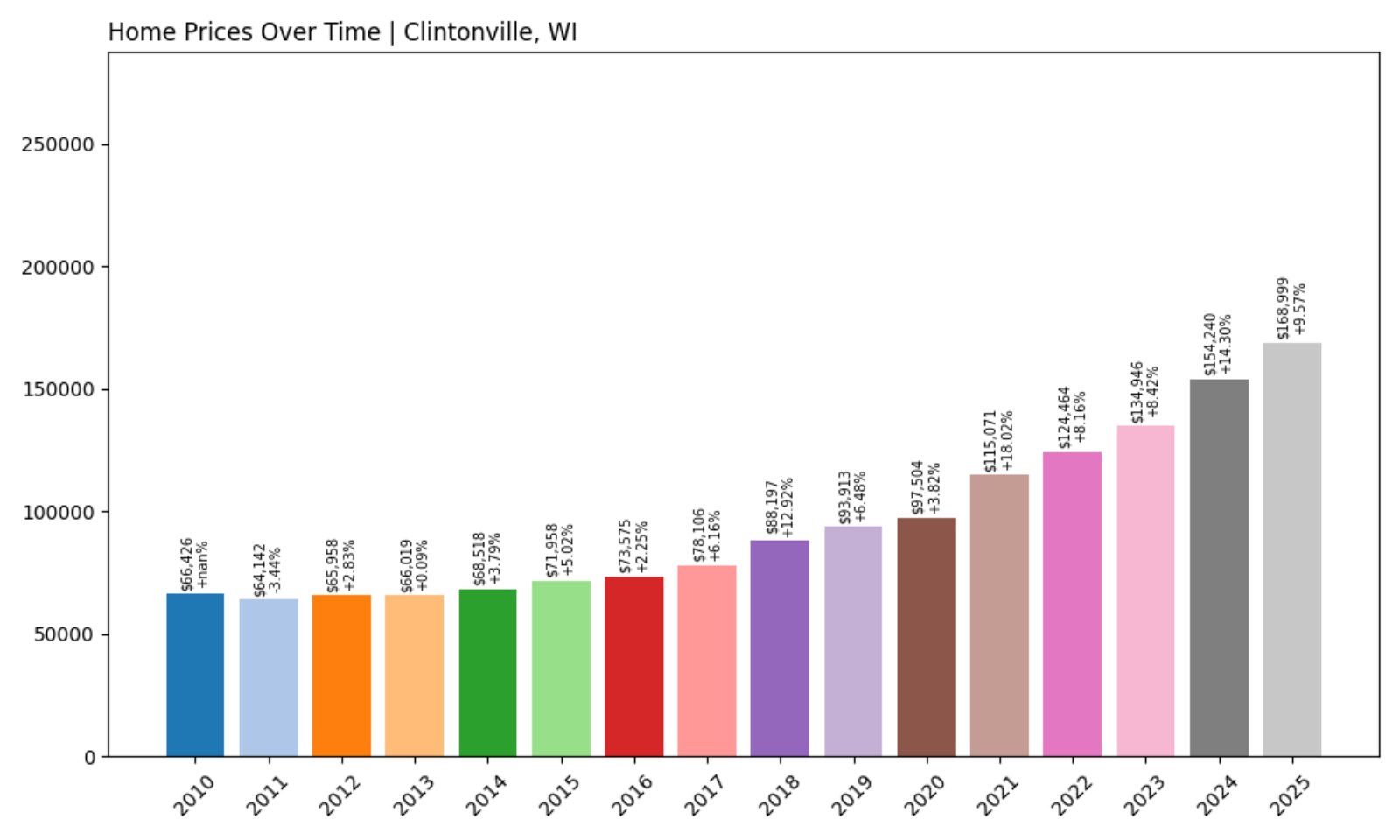

5. Clintonville – Investor Feeding Frenzy Factor 63.73% (July 2025)

- Historical annual growth rate (2012–2022): 6.56%

- Recent annual growth rate (2022–2025): 10.73%

- Investor Feeding Frenzy Factor: 63.73%

- Current 2025 price: $168,998.78

Clintonville’s recent growth rate is more than 63% higher than its historical pace, making it one of the state’s fastest-rising markets. While the average home price remains below $170K, the speed of appreciation signals rapidly growing investor attention.

Clintonville – Fast Growth at a Low Price Point

Situated in Waupaca County, Clintonville blends small-town life with access to nearby employment hubs. The area’s relatively low prices are a magnet for budget-conscious buyers — and increasingly, for investors looking to buy in before the next big leap.

As prices rise quickly from a low base, Clintonville’s longtime residents are seeing competition from outside buyers. If trends continue, this once-predictable market may face affordability challenges in the near future.

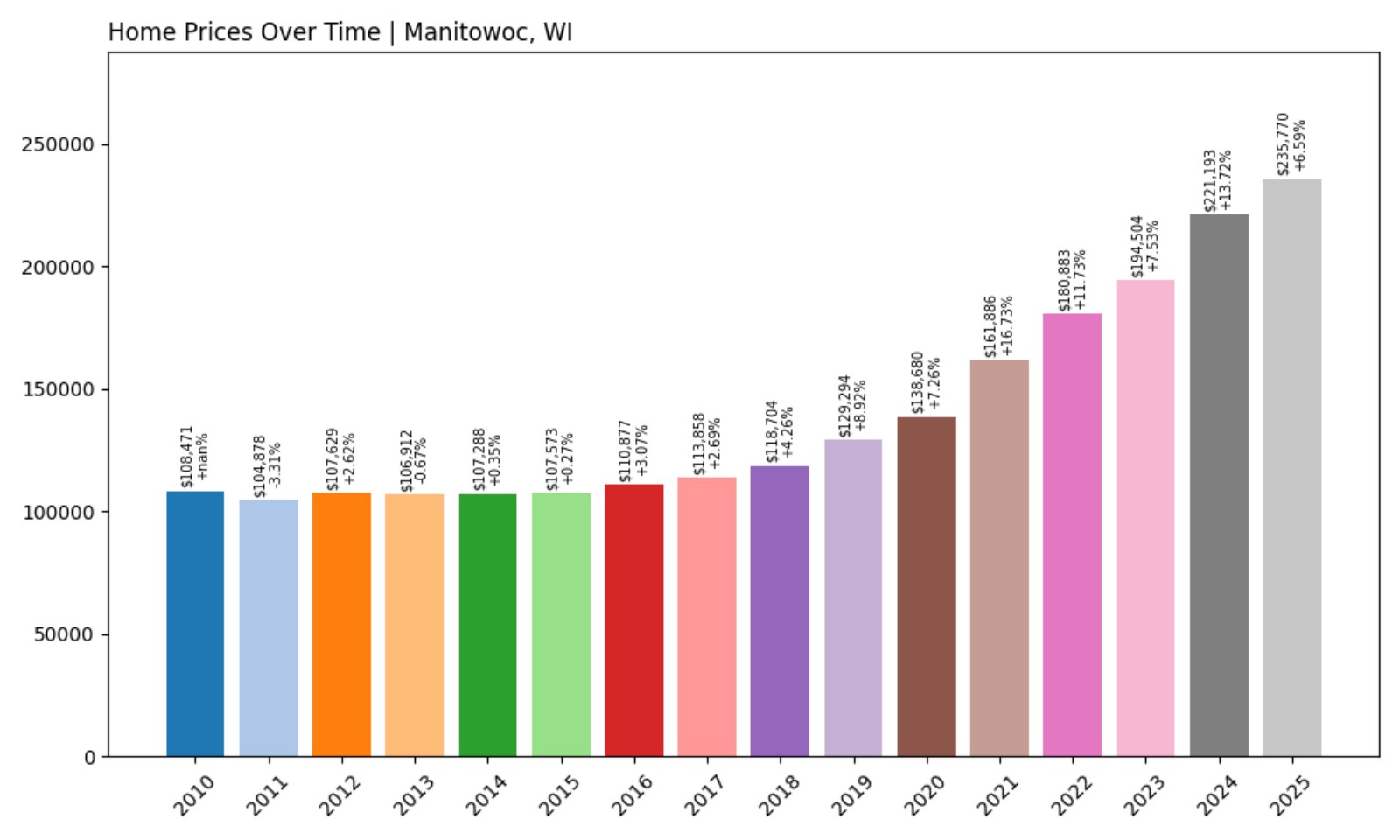

4. Manitowoc – Investor Feeding Frenzy Factor 73.31% (July 2025)

- Historical annual growth rate (2012–2022): 5.33%

- Recent annual growth rate (2022–2025): 9.24%

- Investor Feeding Frenzy Factor: 73.31%

- Current 2025 price: $235,770.04

Home prices in Manitowoc have surged over 73% above historical growth rates. With 2025 values now around $236K, the market has clearly shifted into high gear, raising concerns about long-term affordability.

Manitowoc – A Waterfront City with Accelerating Demand

Located on the shores of Lake Michigan, Manitowoc has long offered industrial heritage, lake access, and affordable homes. But today, its waterfront setting and relative value are drawing the eyes of investors and out-of-town buyers alike.

As appreciation rates accelerate, local buyers may find themselves squeezed out by cash-heavy investors or speculators. What was once a slow-growing market now finds itself squarely in the crosshairs of a housing frenzy.

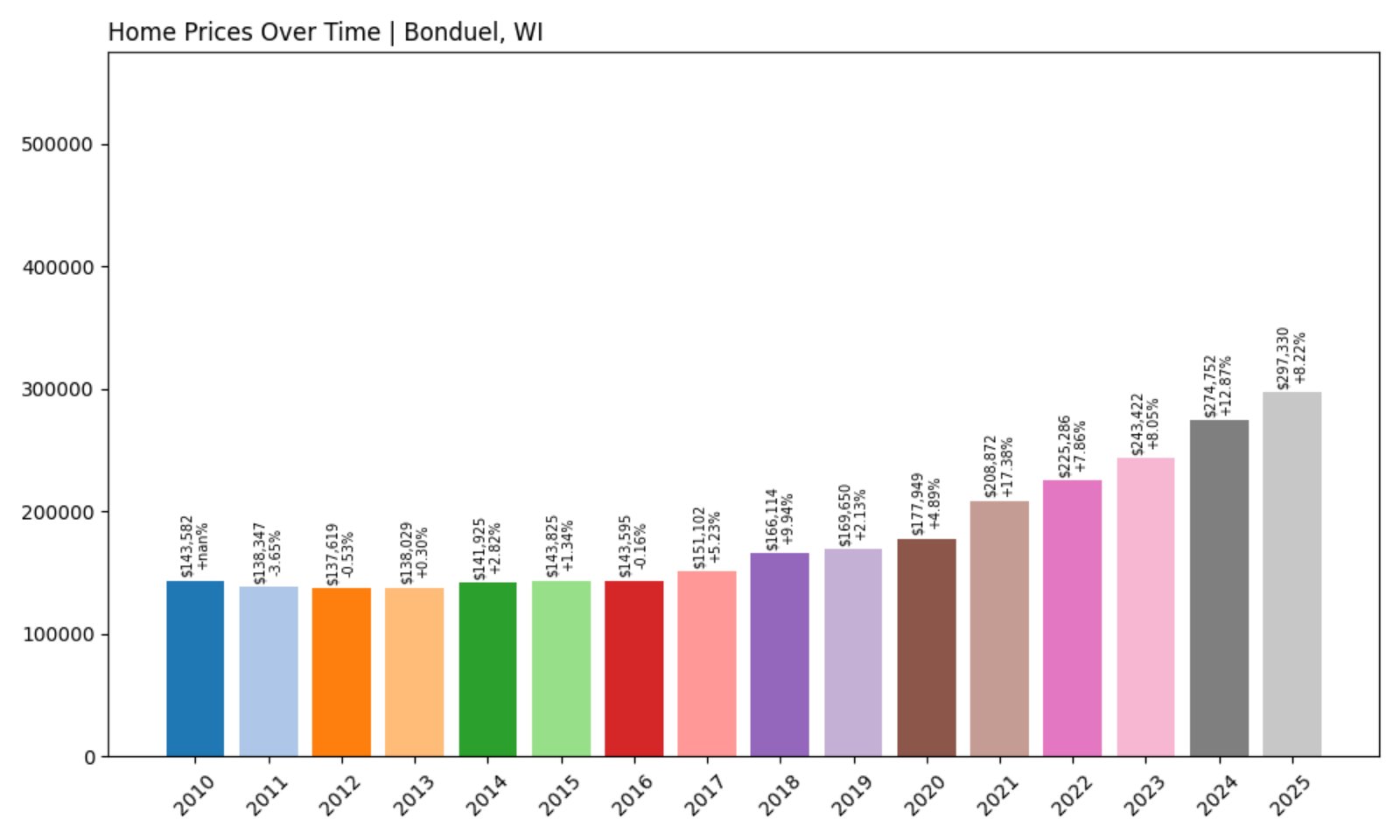

3. Bonduel – Investor Feeding Frenzy Factor 91.80% (July 2025)

- Historical annual growth rate (2012–2022): 5.05%

- Recent annual growth rate (2022–2025): 9.69%

- Investor Feeding Frenzy Factor: 91.80%

- Current 2025 price: $297,329.94

Bonduel’s housing market has exploded, growing nearly 92% faster than its long-term average. With home prices nearing $297K, this town has jumped from modest growth to full-blown boom territory in under three years.

Bonduel – From Steady to Surging

Tucked into Shawano County, Bonduel has typically offered a balance between rural calm and suburban convenience. Its housing market, until recently, moved at a steady clip. That changed quickly as the town became a target for investors hunting fast returns.

With prices climbing and inventory tightening, the risk of overvaluation grows. For now, Bonduel remains in high demand — but the speed of growth suggests it may be approaching unsustainable territory.

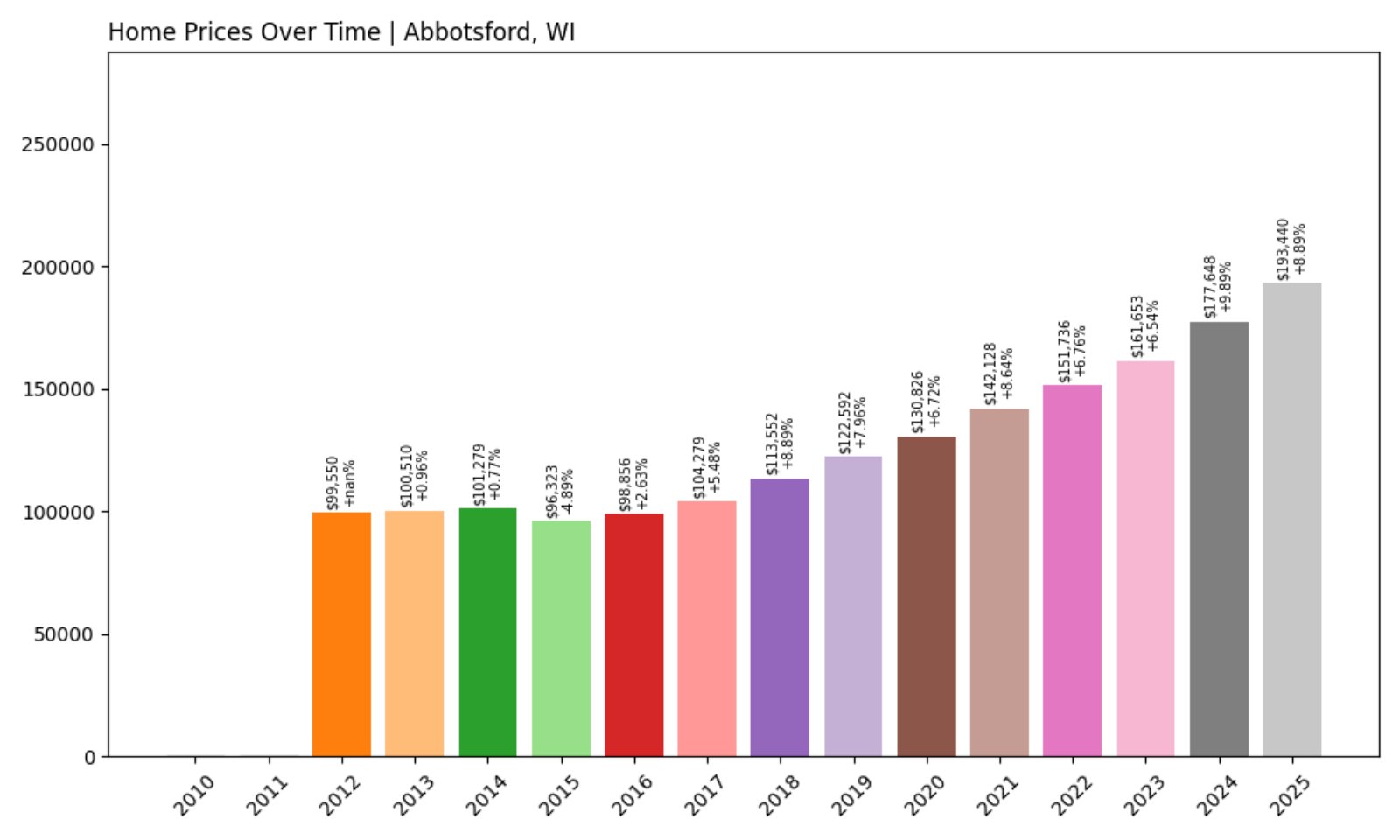

2. Abbotsford – Investor Feeding Frenzy Factor 95.85% (July 2025)

- Historical annual growth rate (2012–2022): 4.30%

- Recent annual growth rate (2022–2025): 8.43%

- Investor Feeding Frenzy Factor: 95.85%

- Current 2025 price: $193,440.11

Abbotsford’s market is running nearly double its historic pace, with an Investor Feeding Frenzy Factor of 95.85%. Home prices are still under $200K — but they’re moving fast, and the trend shows no signs of slowing.

Abbotsford – Low Prices, High Acceleration

Straddling Clark and Marathon counties, Abbotsford is a working-class town with industrial ties and bilingual culture. The price point has remained relatively low, but the recent spike in growth suggests buyers are moving in quickly.

The gap between historical and current growth rates indicates investor interest may be peaking. If left unchecked, affordability could evaporate in a matter of years — turning this once-overlooked town into a cautionary tale.

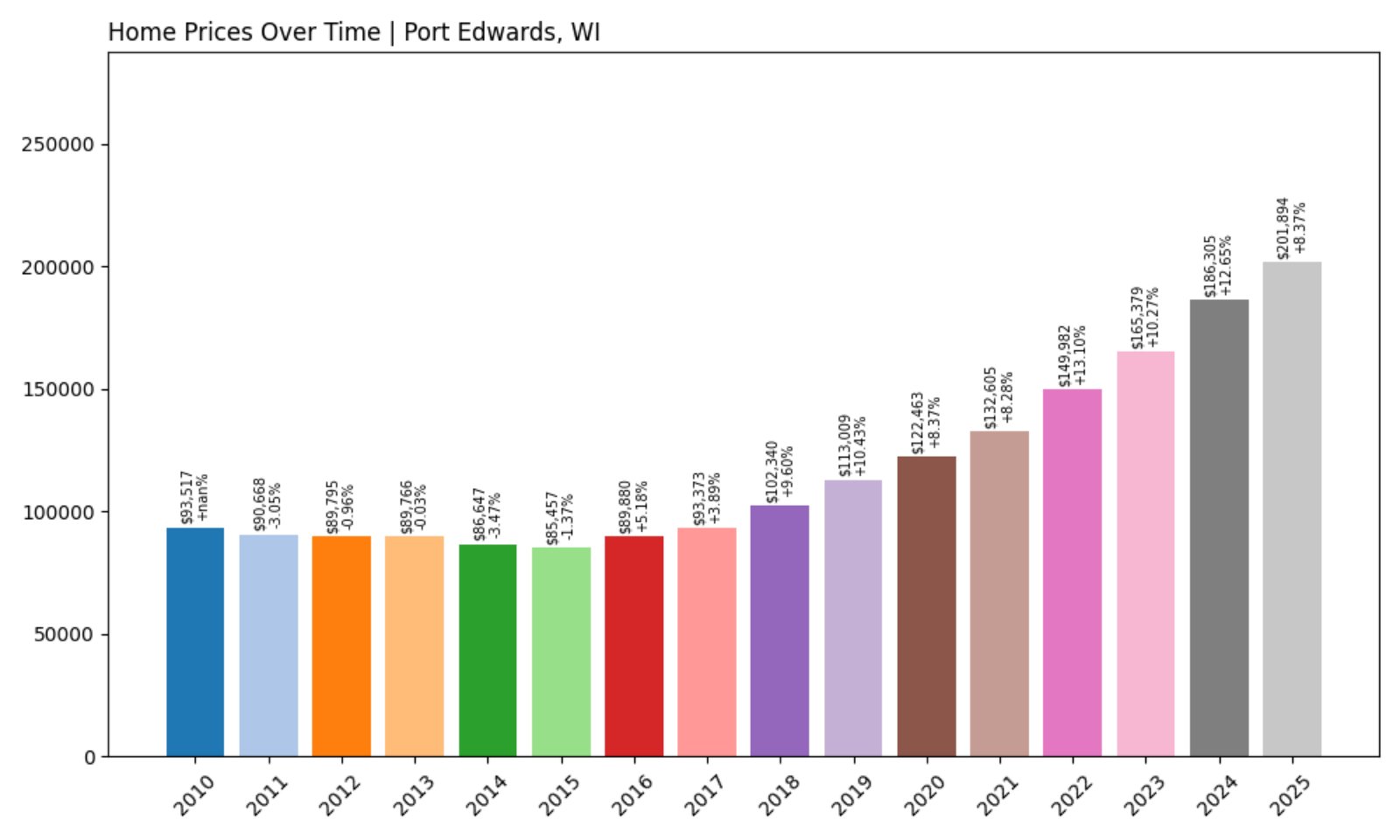

1. Port Edwards – Investor Feeding Frenzy Factor 97.86% (July 2025)

- Historical annual growth rate (2012–2022): 5.26%

- Recent annual growth rate (2022–2025): 10.41%

- Investor Feeding Frenzy Factor: 97.86%

- Current 2025 price: $201,894.26

Port Edwards tops the list with an astonishing 97.86% increase over its historical growth trend. Prices now average just over $201K — a massive climb from a town once considered extremely affordable.

Port Edwards – Leading the State in Market Acceleration

A former paper mill town in Wood County, Port Edwards has undergone a quiet transformation. With its small-town character and riverside setting, it’s now on investors’ radar — and home values are reflecting that surge in attention.

With nearly double the expected growth rate, the town’s affordability and accessibility are vanishing quickly. If current trends continue, Port Edwards may become a case study in how investor momentum reshapes a local housing market almost overnight.