Would you like to save this?

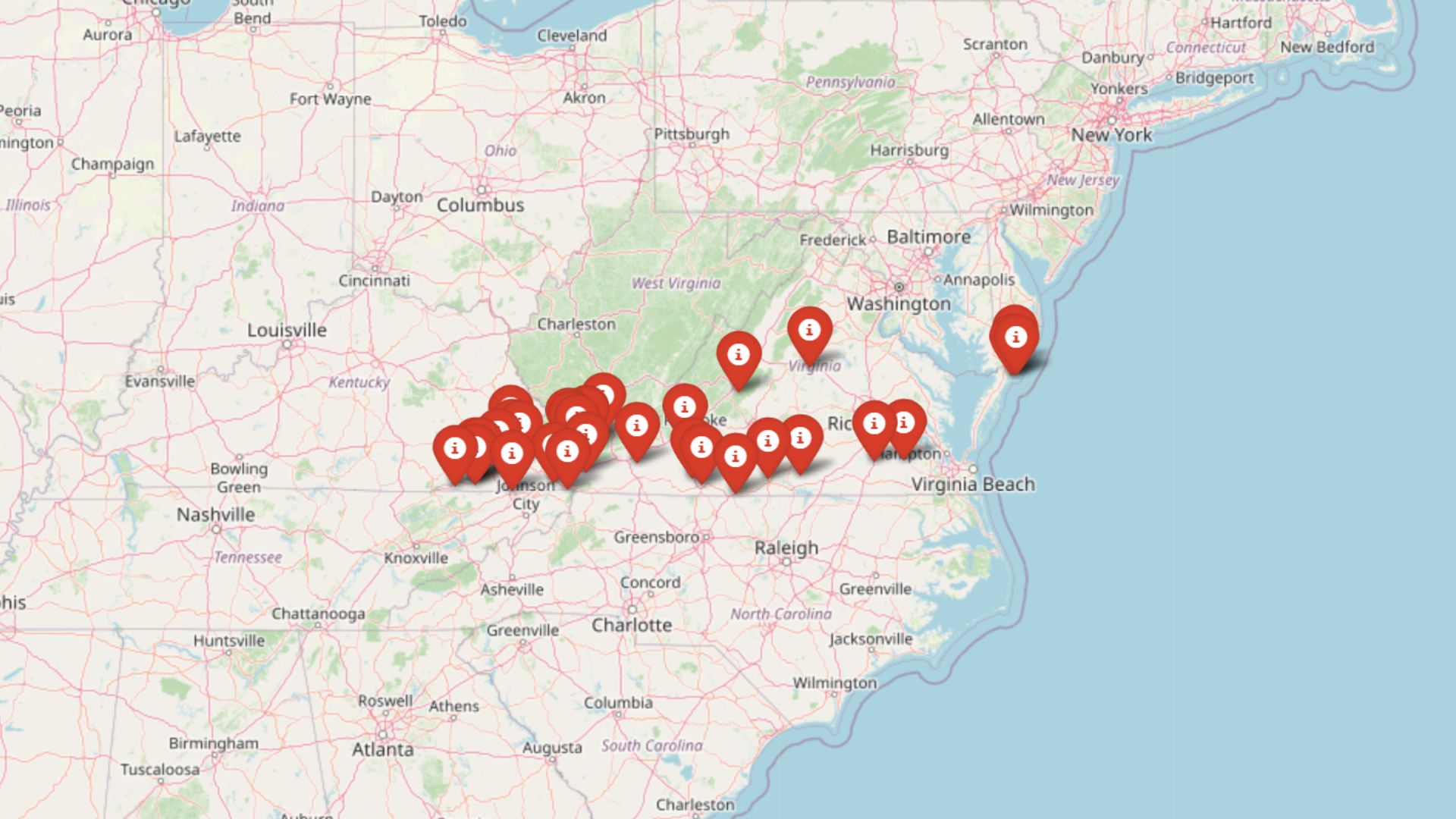

Some of Virginia’s most unassuming towns are becoming ground zero for a new kind of housing crunch. According to the Zillow Home Value Index, 33 communities across the state are experiencing investor-driven price spikes far beyond their historical norms. It’s part of a growing trend where outside capital floods small markets, sending home values soaring and pushing locals to the margins.

Places like Pennington Gap and Buena Vista have seen prices accelerate several times faster than what’s typical. That kind of leap often signals a speculative surge—what we call an “Investor Feeding Frenzy.” These towns now rank highest in the state for recent price growth compared to their long-term average. Whether you’re buying, selling, or watching from the sidelines, these trends offer a warning: the housing landscape in Virginia is shifting fast.

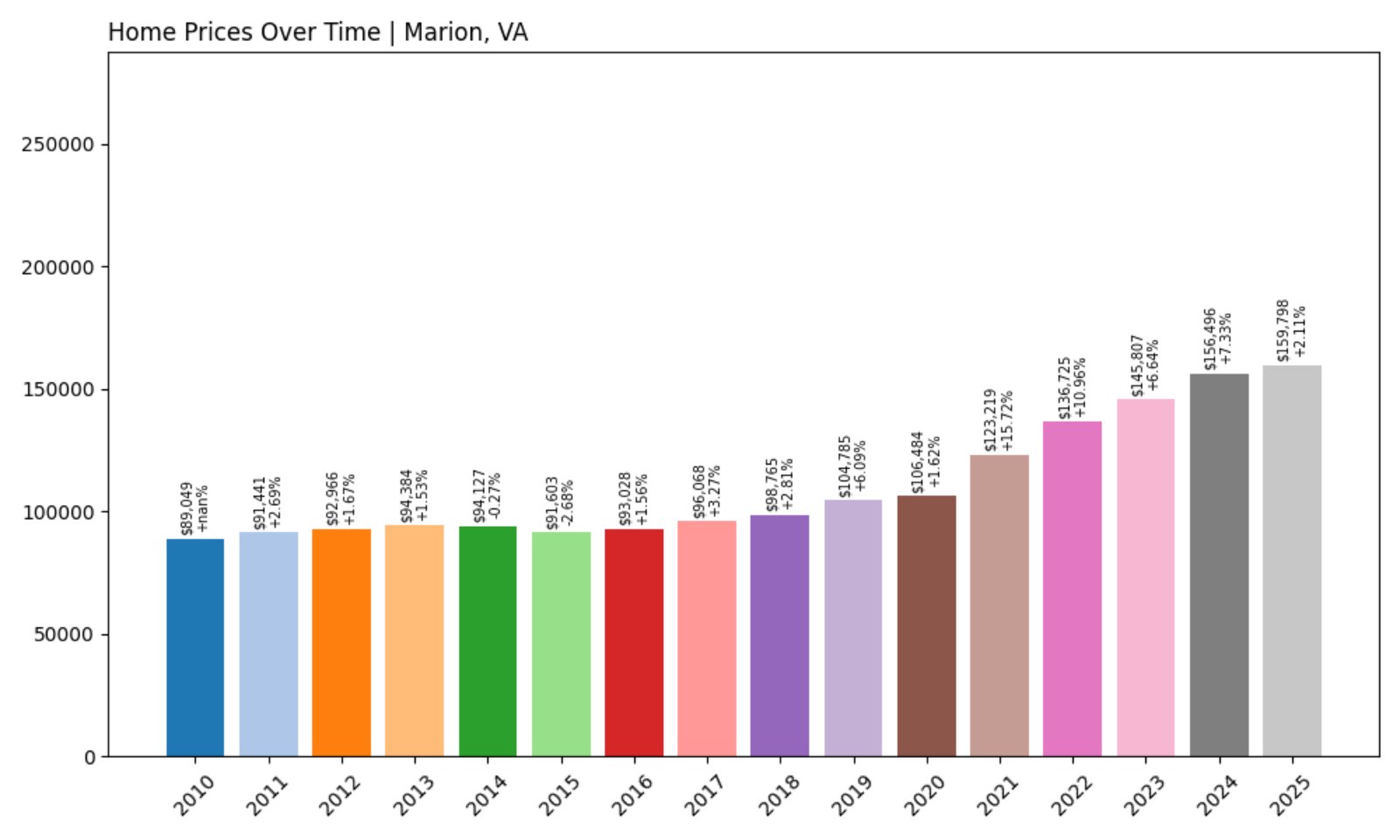

33. Marion – Investor Feeding Frenzy Factor 35.67% (July 2025)

- Historical annual growth rate (2012–2022): 3.93%

- Recent annual growth rate (2022–2025): 5.34%

- Investor Feeding Frenzy Factor: 35.67%

- Current 2025 price: $159,797.56

Marion’s price growth has ticked up from a historical 3.93% annually to 5.34% over the past three years, yielding a 35.67% Feeding Frenzy Factor. With a 2025 median home value just shy of $160,000, this town is seeing steady interest—especially from buyers seeking affordable alternatives to bigger regional hubs.

Marion – A Blue Ridge Town Drawing Investor Eyes

Located in Smyth County in Southwest Virginia, Marion is known for its scenic beauty and historic downtown district. The town sits along the I-81 corridor and offers easy access to both Bristol and Wytheville, making it appealing for commuters and telecommuters alike. Its relatively low housing prices—still well below the state median—are increasingly catching the attention of investors seeking rental properties or vacation homes near the Blue Ridge Highlands.

The modest but accelerating home value growth could be linked to Marion’s growing popularity with remote workers and second-home buyers. If this trend continues, local affordability may be strained in the years to come.

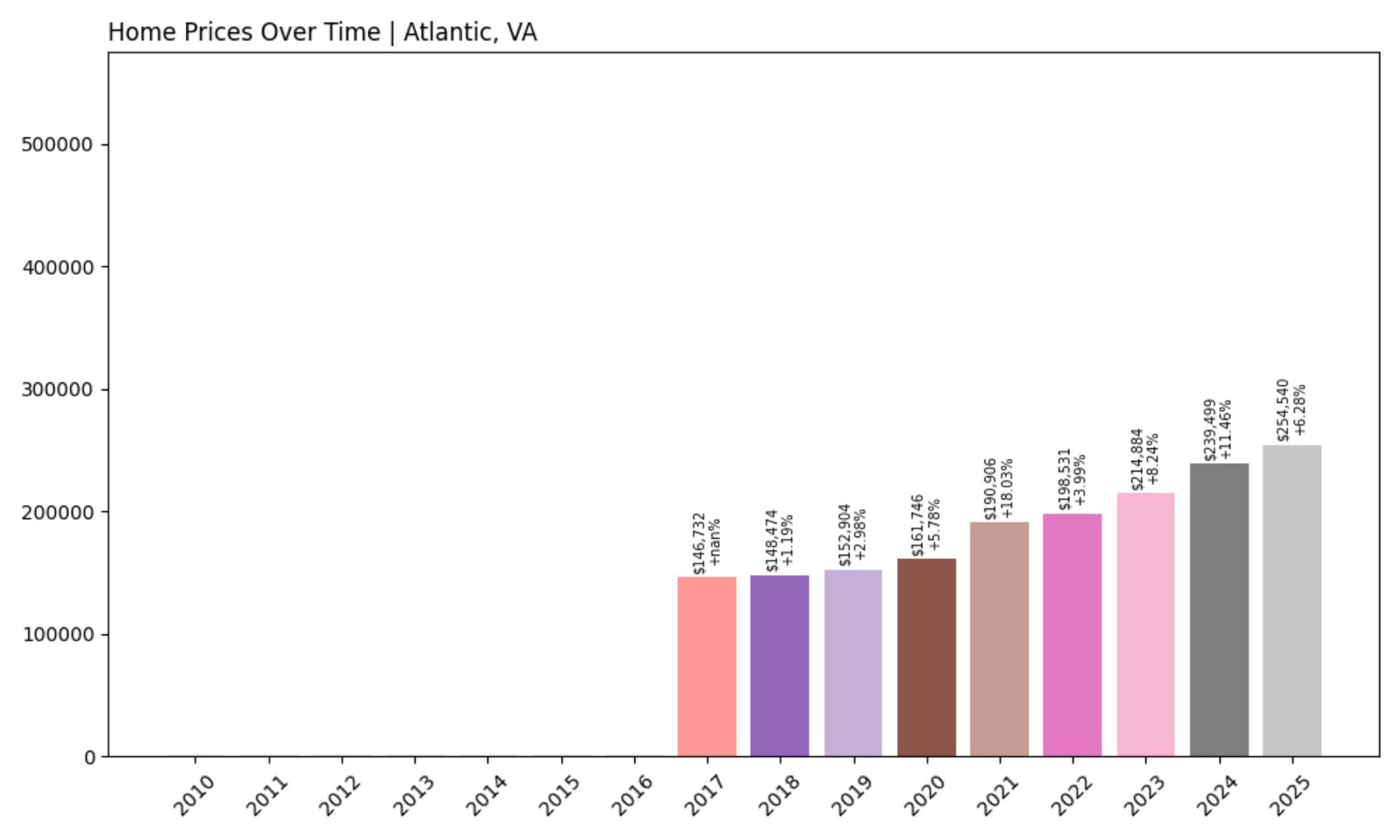

32. Atlantic – Investor Feeding Frenzy Factor 38.55% (July 2025)

- Historical annual growth rate (2012–2022): 6.23%

- Recent annual growth rate (2022–2025): 8.64%

- Investor Feeding Frenzy Factor: 38.55%

- Current 2025 price: $254,539.61

Atlantic, situated in Accomack County on Virginia’s Eastern Shore, has seen a recent growth rate of 8.64%—notably higher than its already-strong historical average of 6.23%. With a Feeding Frenzy Factor approaching 39%, it’s evident that investor pressure is mounting in this coastal town.

Atlantic – Eastern Shore Sees Escalating Interest

Atlantic’s location near Chincoteague Island and the Wallops Flight Facility makes it unique. The surrounding environment offers a mix of agricultural land, small beaches, and natural preserves—ideal for those seeking privacy and seclusion. Investors may be banking on this area’s potential for long-term vacation home demand or eco-tourism-related growth.

The town’s median price—now over $254,000—is not inexpensive for the region, suggesting that investor speculation may already be pricing out some local buyers. Whether driven by out-of-state vacation home buyers or rental property investment, the growth is accelerating faster than usual—and with it, affordability concerns.

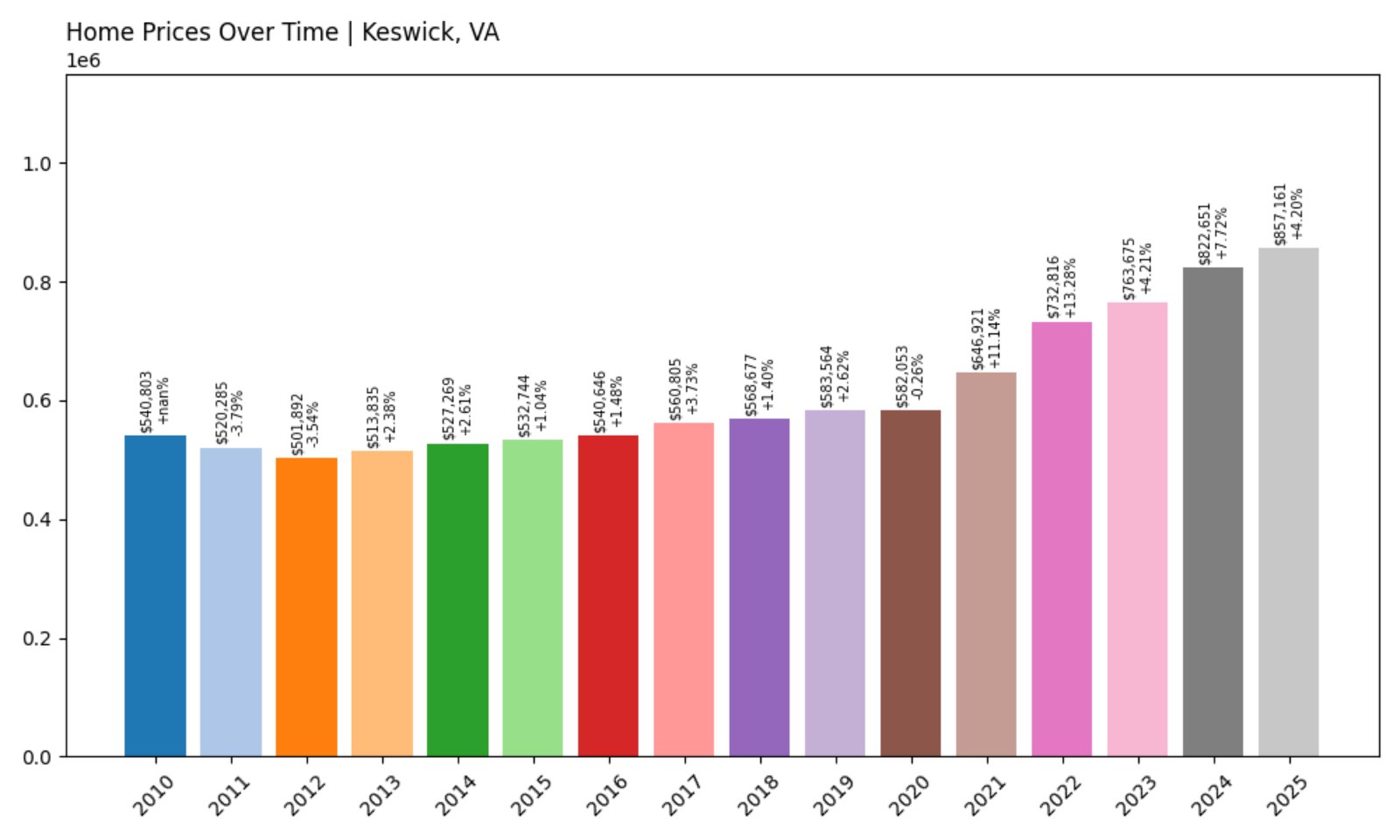

31. Keswick – Investor Feeding Frenzy Factor 39.03% (July 2025)

- Historical annual growth rate (2012–2022): 3.86%

- Recent annual growth rate (2022–2025): 5.36%

- Investor Feeding Frenzy Factor: 39.03%

- Current 2025 price: $857,160.84

Keswick is no stranger to high price tags, but its Feeding Frenzy Factor of 39.03% reflects an even faster rise in recent years. With home prices now averaging over $857,000, demand appears to be escalating in ways that could put long-term strain on affordability.

Keswick – Elite Enclave Heating Up Further

Would you like to save this?

Located just east of Charlottesville, Keswick is a prestigious community known for horse farms, vineyards, and large estates. Its proximity to the University of Virginia and the Blue Ridge Mountains gives it dual appeal to wealthy professionals and retirees. The area has long been a haven for luxury buyers, but recent price spikes suggest that speculative buyers may be driving values even higher.

As one of the most expensive towns in Virginia, Keswick’s price appreciation is significant in both absolute and relative terms. The high entry cost means few locals can afford to buy here, and continued price acceleration could entrench exclusivity further.

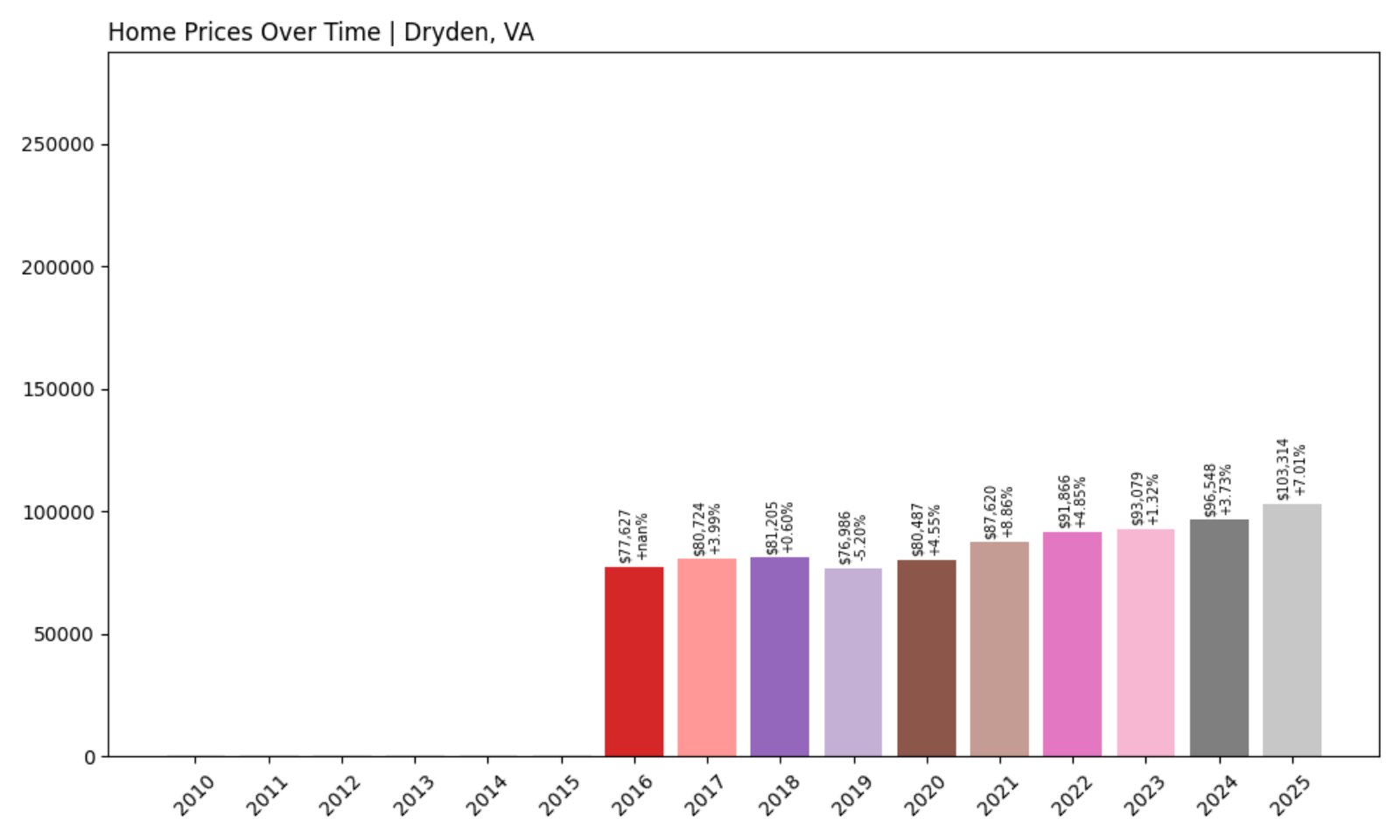

30. Dryden – Investor Feeding Frenzy Factor 40.25% (July 2025)

- Historical annual growth rate (2012–2022): 2.85%

- Recent annual growth rate (2022–2025): 3.99%

- Investor Feeding Frenzy Factor: 40.25%

- Current 2025 price: $103,314.43

Dryden, in Lee County, has experienced an upshift from a 2.85% growth rate to nearly 4% in recent years, pushing its Frenzy Factor to just over 40%. At just over $100K for the average home, Dryden remains affordable, but that may be changing fast.

Dryden – Once Overlooked, Now Under Pressure

Dryden is a quiet community nestled in far southwestern Virginia, not far from the Tennessee border. Historically considered remote and rural, the town has become more attractive to bargain-hunting investors looking to get in before larger waves of gentrification take hold.

With real estate still comparatively inexpensive, the recent uptick in prices is particularly meaningful. A growing share of interest appears to be coming from out-of-area buyers betting on long-term value growth in underserved rural markets like Dryden.

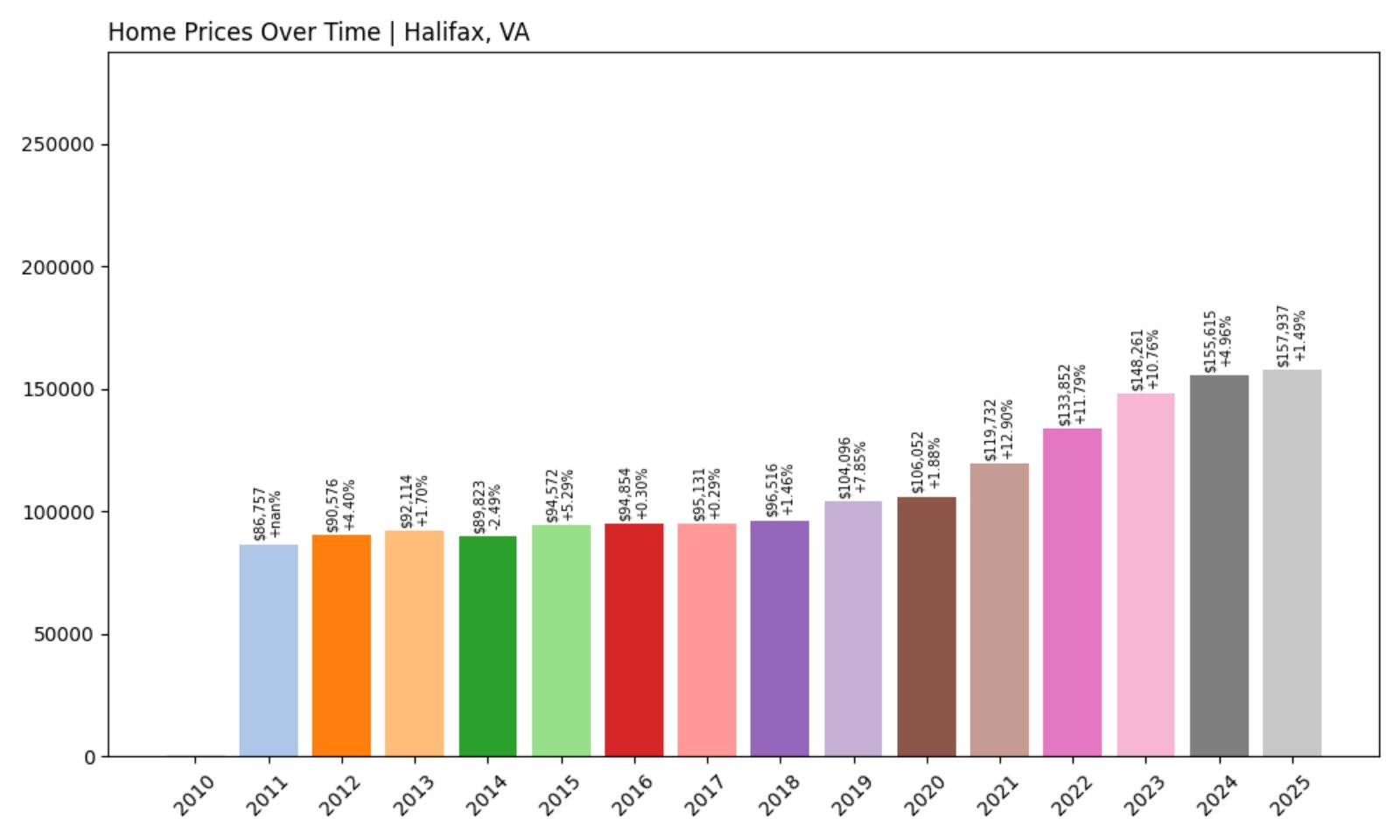

29. Halifax – Investor Feeding Frenzy Factor 42.37% (July 2025)

- Historical annual growth rate (2012–2022): 3.98%

- Recent annual growth rate (2022–2025): 5.67%

- Investor Feeding Frenzy Factor: 42.37%

- Current 2025 price: $157,937.34

Halifax’s growth has increased from just under 4% historically to 5.67% annually in the last three years. That’s a 42% jump in pace, putting this Southside Virginia town on the investor radar—especially with prices still well below the state average.

Halifax – Southside Community With Rising Appeal

Located along the Dan River and home to a quaint downtown area, Halifax offers affordability and small-town charm. Its close proximity to South Boston and moderate climate are appealing features for retirees and remote workers alike.

The area has seen growing investor interest, potentially spurred by the region’s untapped potential and improving broadband connectivity. If current trends hold, the window for affordable homeownership in Halifax may be narrowing fast.

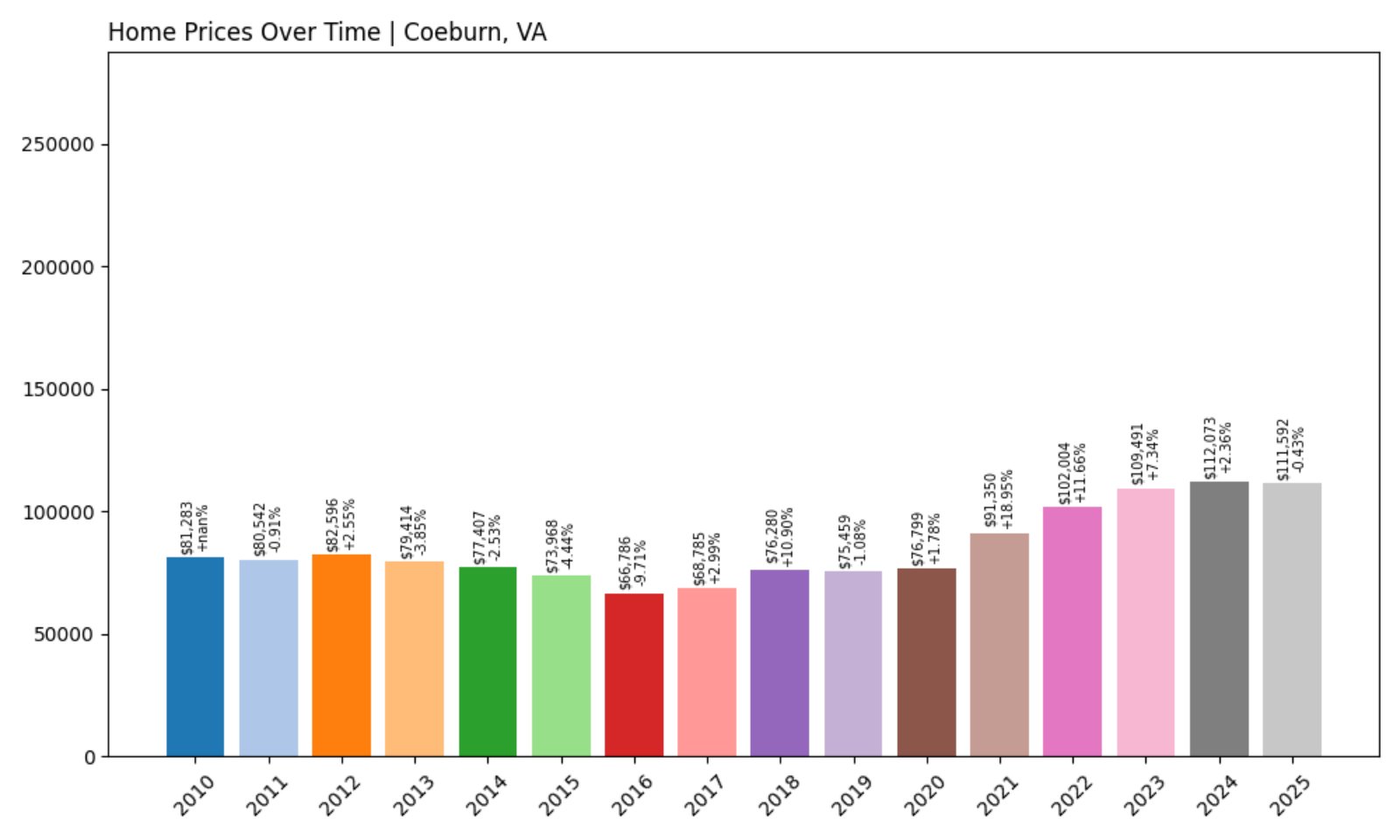

28. Coeburn – Investor Feeding Frenzy Factor 42.53% (July 2025)

- Historical annual growth rate (2012–2022): 2.13%

- Recent annual growth rate (2022–2025): 3.04%

- Investor Feeding Frenzy Factor: 42.53%

- Current 2025 price: $111,591.84

Home prices in Coeburn have jumped from a steady 2.13% annual growth to 3.04% in recent years, pushing its Feeding Frenzy Factor to 42.53%. With an average home still priced at around $111K, it remains one of Virginia’s more affordable towns, but investor-driven activity could change that.

Coeburn – Appalachian Affordability Draws Investors

Nestled in the Appalachian region of Wise County, Coeburn sits close to Jefferson National Forest and the Spearhead Trails system—both of which have bolstered tourism. In recent years, the town’s natural setting and low housing costs have made it attractive to vacation property buyers and rental investors alike.

Though small in size, Coeburn’s outdoor amenities and proximity to nature could be fueling the current price surge. With growth now exceeding long-term averages by over 40%, affordability could come under pressure if demand continues to rise unchecked.

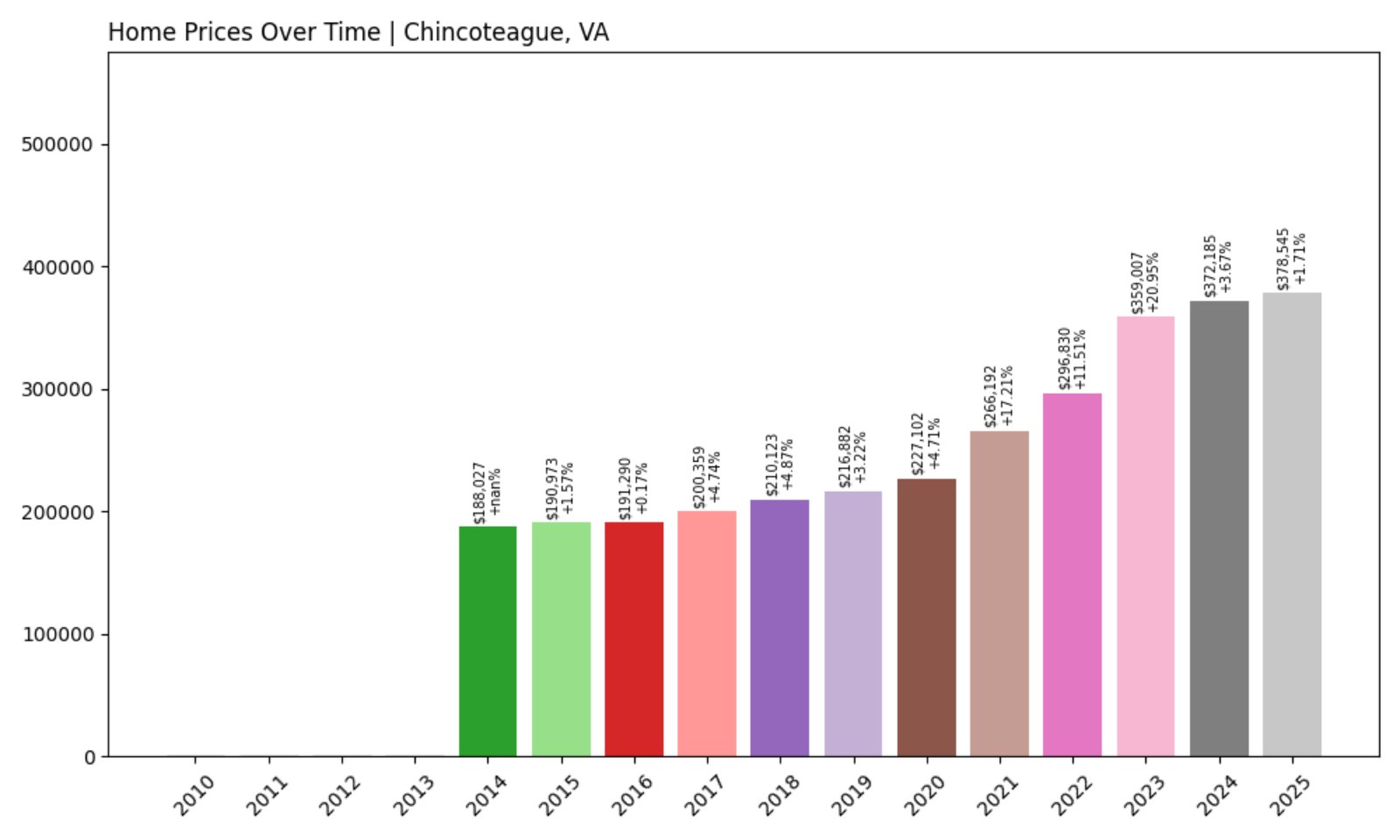

27. Chincoteague – Investor Feeding Frenzy Factor 43.76% (July 2025)

- Historical annual growth rate (2012–2022): 5.87%

- Recent annual growth rate (2022–2025): 8.44%

- Investor Feeding Frenzy Factor: 43.76%

- Current 2025 price: $378,545.39

Chincoteague’s recent growth rate of 8.44% represents a sharp increase over its already-strong historical average, producing a Feeding Frenzy Factor of nearly 44%. With home prices approaching $380,000, affordability concerns are mounting.

Chincoteague – Popular Seaside Town Feels the Pressure

Known for its wild ponies, beach access, and scenic marshlands, Chincoteague Island is one of the most beloved vacation spots in Virginia. As demand for coastal properties remains high, the local housing market has seen rapid appreciation, fueled in part by second-home buyers and short-term rental investors.

Though the area has long been pricey for the region, the pace of growth in recent years suggests intensifying speculative interest. The sharp rise in home values could make it increasingly difficult for local residents—many employed in hospitality and seasonal services—to remain in the area long-term.

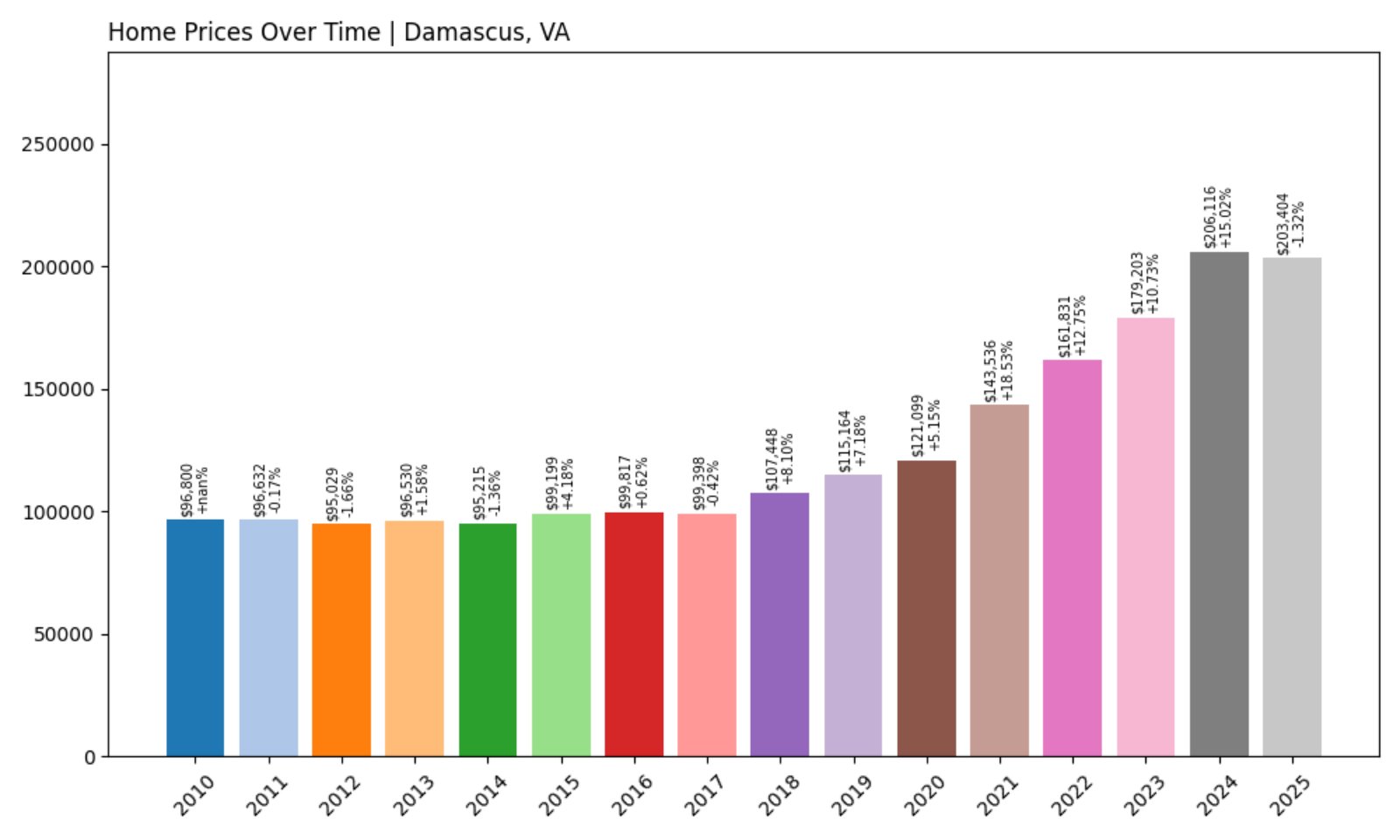

26. Damascus – Investor Feeding Frenzy Factor 44.83% (July 2025)

- Historical annual growth rate (2012–2022): 5.47%

- Recent annual growth rate (2022–2025): 7.92%

- Investor Feeding Frenzy Factor: 44.83%

- Current 2025 price: $203,404.13

Damascus is witnessing a price surge from its historical 5.47% growth to nearly 8% annually in recent years. That equates to a Feeding Frenzy Factor of nearly 45%, with average home prices now exceeding $203,000.

Damascus – Trail Town Turning Heads

Situated at the junction of several hiking and biking trails, including the Appalachian Trail and the Virginia Creeper Trail, Damascus is a magnet for outdoor enthusiasts. Its reputation as “Trail Town USA” has driven a steady trickle of eco-tourism and adventure-focused travelers.

Investors are increasingly eyeing Damascus as a base for short-term rentals and vacation properties. The town’s natural appeal, combined with still-moderate pricing, creates a tempting opportunity for buyers—but may gradually erode housing access for full-time residents.

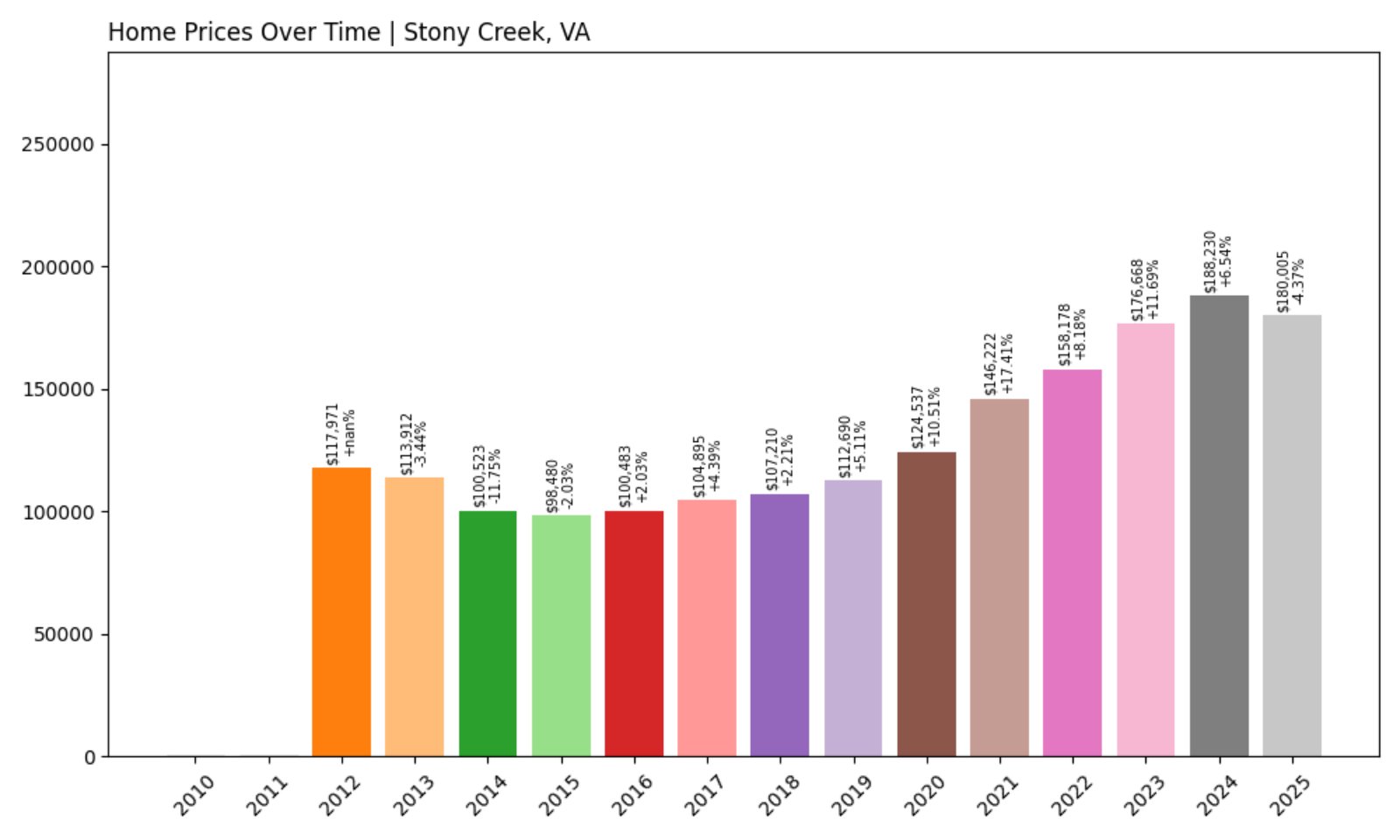

25. Stony Creek – Investor Feeding Frenzy Factor 47.94% (July 2025)

- Historical annual growth rate (2012–2022): 2.98%

- Recent annual growth rate (2022–2025): 4.40%

- Investor Feeding Frenzy Factor: 47.94%

- Current 2025 price: $180,005.27

In Stony Creek, the growth rate has climbed from 2.98% to 4.40% annually, a jump that generates a 47.94% Feeding Frenzy Factor. With average home prices now hovering around $180,000, this Sussex County town is starting to feel speculative pressures.

Stony Creek – Small-Town Growth Gains Steam

Located in southeastern Virginia, Stony Creek sits near major highways like I-95, giving it strong commuter potential while preserving a rural feel. The area has historically attracted low-key buyers looking for land or affordable homes—until recently.

Rising demand from outside investors could be linked to proximity to transportation routes and low property taxes. As growth accelerates, the town may face affordability challenges that disproportionately affect long-time residents and first-time buyers.

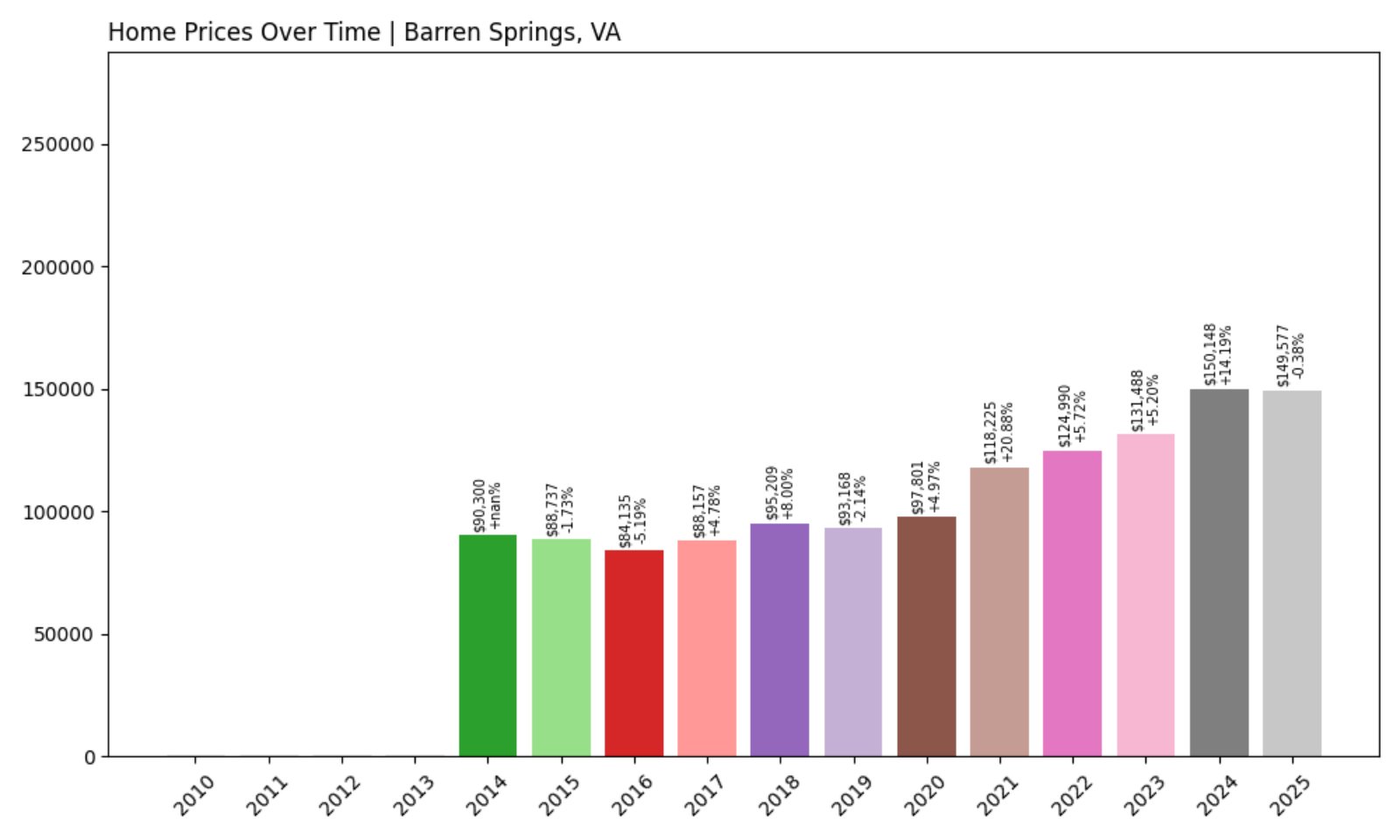

24. Barren Springs – Investor Feeding Frenzy Factor 48.73% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 4.15%

- Recent annual growth rate (2022–2025): 6.17%

- Investor Feeding Frenzy Factor: 48.73%

- Current 2025 price: $149,576.77

Barren Springs has jumped from a long-term average of 4.15% growth to 6.17% over the past three years, yielding a Feeding Frenzy Factor near 49%. At just under $150,000, the typical home here remains affordable—for now.

Barren Springs – Scenic Seclusion, Rising Demand

Set along the New River in Wythe County, Barren Springs is prized for its scenic, rural environment. Its appeal lies in affordability, privacy, and access to outdoor recreation like fishing and kayaking. Those same attributes are now drawing investor attention.

Growth is modest compared to urban centers, but the speed of the increase is what sets off red flags. If trends continue, Barren Springs may not remain a budget-friendly destination for much longer—especially for local buyers.

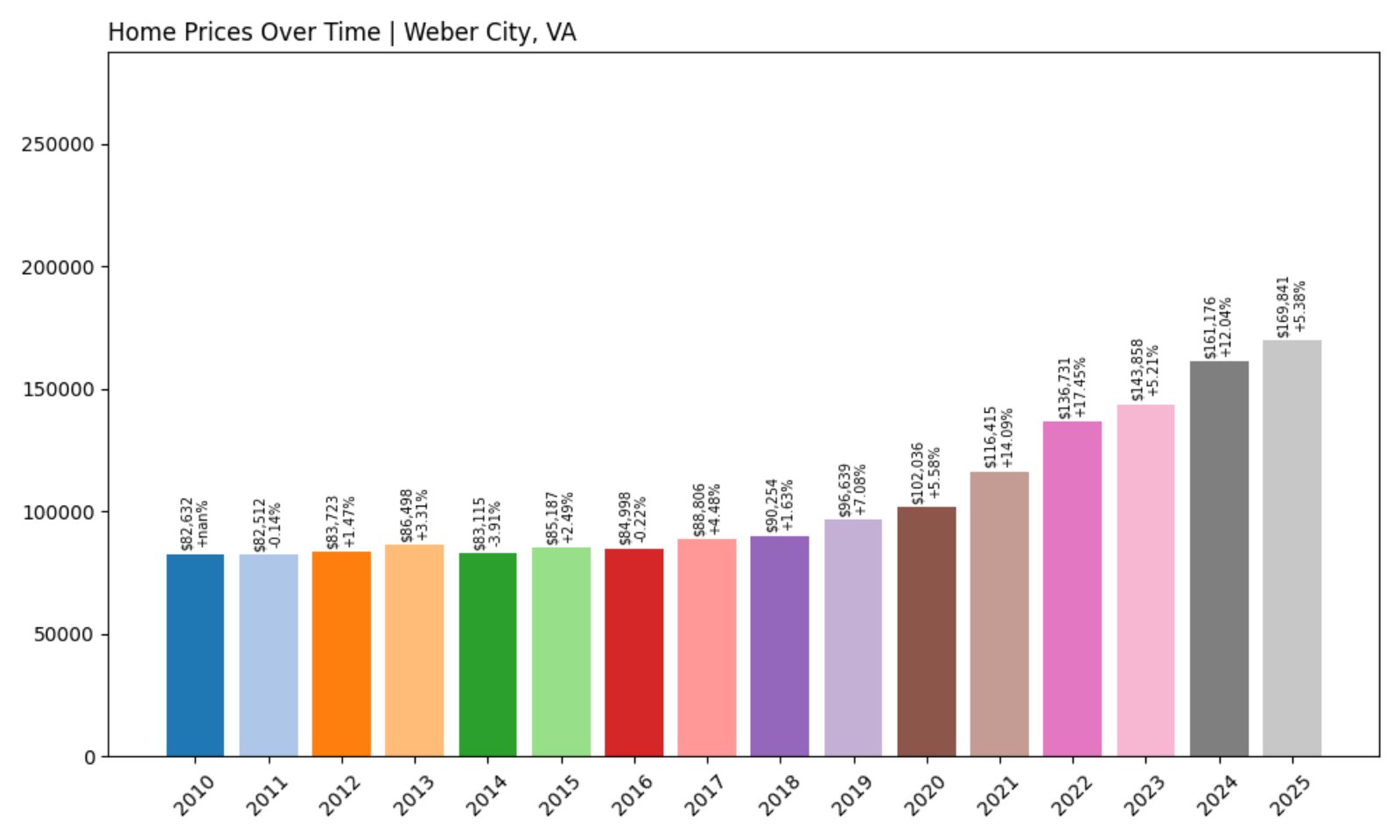

23. Weber City – Investor Feeding Frenzy Factor 49.11% (July 2025)

- Historical annual growth rate (2012–2022): 5.03%

- Recent annual growth rate (2022–2025): 7.50%

- Investor Feeding Frenzy Factor: 49.11%

- Current 2025 price: $169,841.00

Weber City’s home values have jumped from a healthy 5.03% annual increase to a striking 7.50% in recent years. That nearly 50% spike in the growth pace has raised concerns about speculative activity in this small southwestern town.

Weber City – Mountaintop Momentum Rising

Perched near the Tennessee border in Scott County, Weber City benefits from scenic views, proximity to Kingsport, and access to the Appalachian Mountains. It’s a quiet residential enclave with modest homes and a small-town pace of life.

Recent growth is likely driven by both affordability and location appeal—especially for remote workers or retirees seeking a lower cost of living near the Tri-Cities area. That said, the recent growth trajectory suggests some investor traction that could test the town’s long-standing affordability.

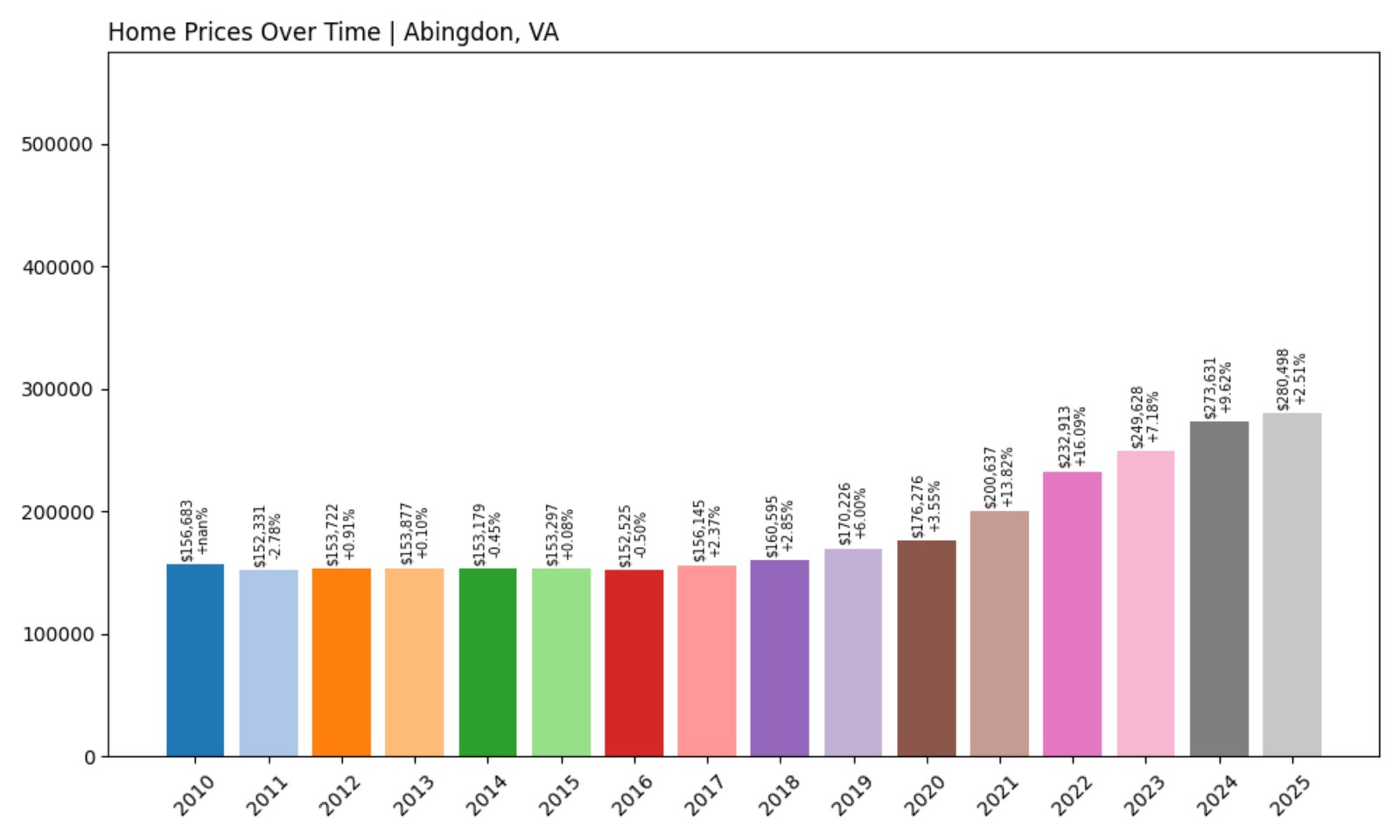

22. Abingdon – Investor Feeding Frenzy Factor 50.67% (July 2025)

- Historical annual growth rate (2012–2022): 4.24%

- Recent annual growth rate (2022–2025): 6.39%

- Investor Feeding Frenzy Factor: 50.67%

- Current 2025 price: $280,498.06

Abingdon’s recent growth rate of 6.39% is a sharp climb from its historical average of 4.24%, giving it a Feeding Frenzy Factor of 50.67%. With homes now averaging over $280,000, prices are escalating at a pace that could squeeze out long-time residents.

Abingdon – Arts, Trails, and Price Escalation

Abingdon is a historic town in Washington County known for its vibrant arts scene, colonial architecture, and proximity to the Virginia Creeper Trail. It has long been a favorite for retirees and weekenders, but its small-town charm is now attracting broader attention.

The area’s amenities, cultural offerings, and walkable downtown are major draws. With rising demand, the market is tightening—particularly for starter homes and smaller properties. The town’s growing popularity has helped fuel recent investor interest, and that could pressure affordability in the near future.

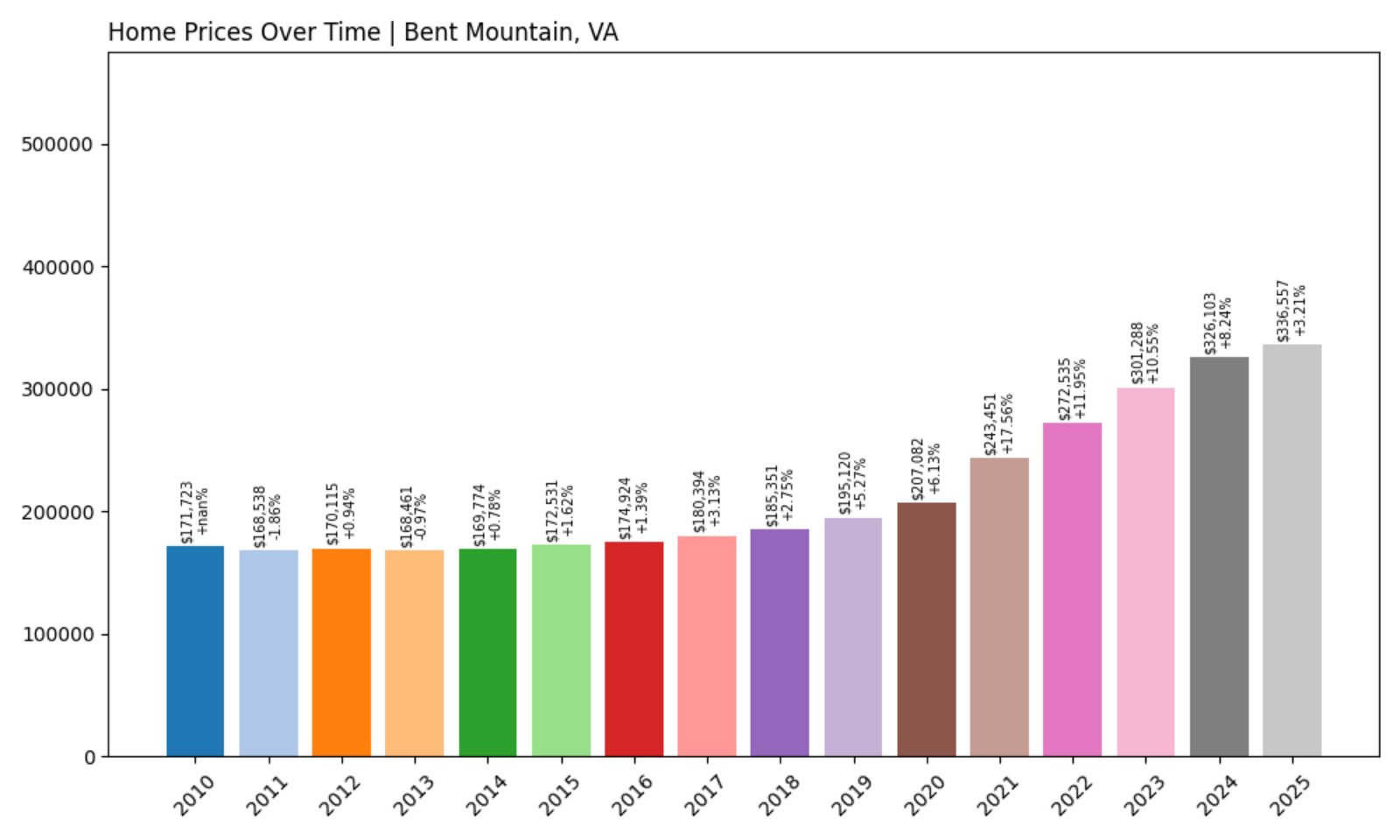

21. Bent Mountain – Investor Feeding Frenzy Factor 50.99% (July 2025)

- Historical annual growth rate (2012–2022): 4.83%

- Recent annual growth rate (2022–2025): 7.29%

- Investor Feeding Frenzy Factor: 50.99%

- Current 2025 price: $336,556.52

Bent Mountain has seen a leap from its already strong 4.83% annual growth to 7.29%, giving it a Feeding Frenzy Factor just shy of 51%. Homes are now priced over $336,000 on average—higher than many surrounding rural areas.

Bent Mountain – High Elevation, High Demand

Bent Mountain, located in Roanoke County, offers a combination of elevation, seclusion, and access to outdoor activities like hiking and biking along the Blue Ridge Parkway. Its peaceful atmosphere and large-lot homes make it a top pick for those wanting space without being far from Roanoke’s amenities.

That combination of privacy and proximity is likely behind the surge in interest, with remote workers and nature enthusiasts taking notice. But with prices rising more than 50% faster than historic norms, affordability could quickly erode in this once-sleepy mountain community.

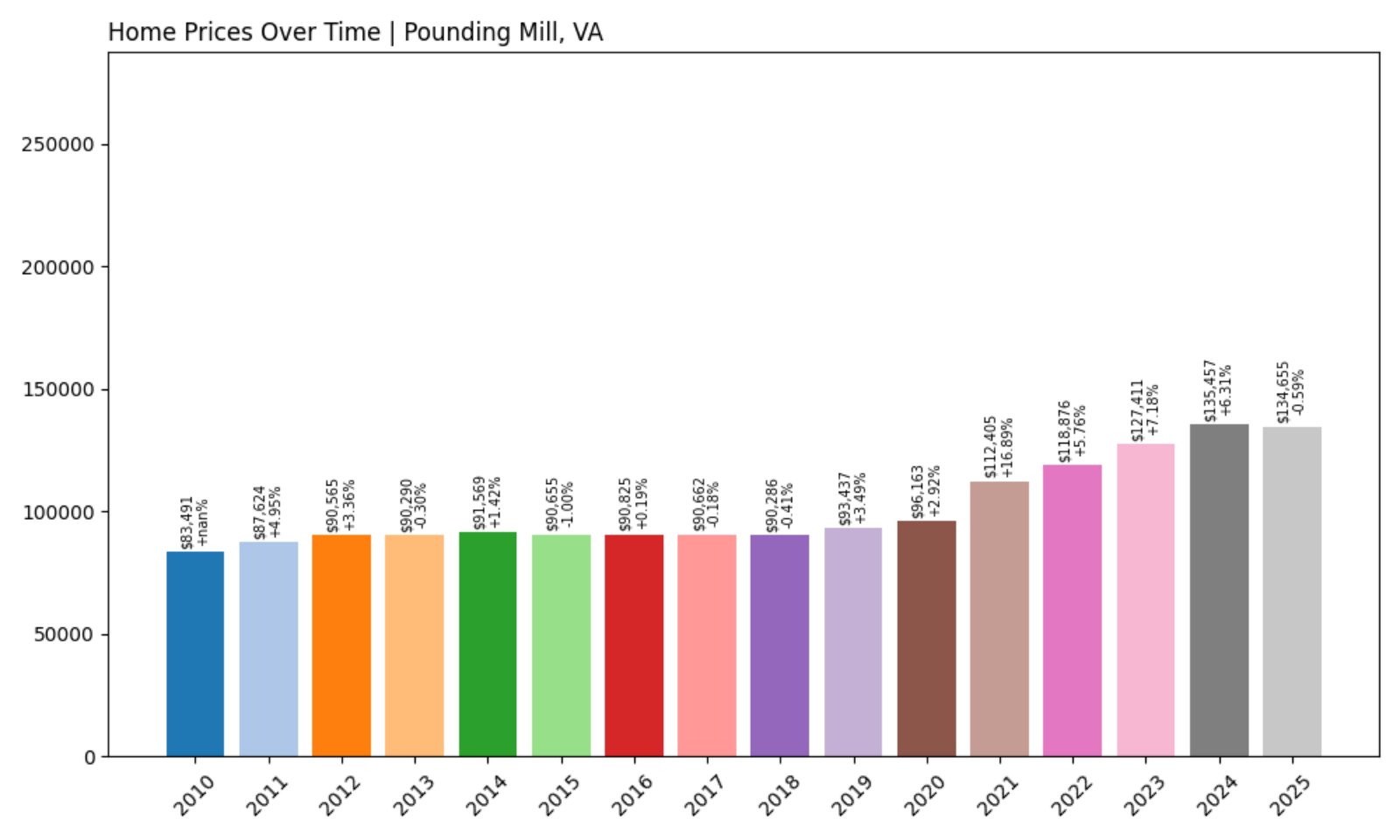

20. Pounding Mill – Investor Feeding Frenzy Factor 53.83% (July 2025)

- Historical annual growth rate (2012–2022): 2.76%

- Recent annual growth rate (2022–2025): 4.24%

- Investor Feeding Frenzy Factor: 53.83%

- Current 2025 price: $134,654.73

Pounding Mill’s growth rate has climbed from a modest 2.76% to 4.24%, giving it a Feeding Frenzy Factor of 53.83%. With a 2025 average price under $135,000, it remains affordable—though that’s starting to change.

Pounding Mill – Tucked-Away Town Gains Investor Buzz

Located in Tazewell County, Pounding Mill is a small Appalachian community surrounded by forested hills and close-knit neighborhoods. Historically a quiet and affordable market, it’s begun drawing attention from investors looking for under-the-radar opportunities.

With limited inventory and growing demand, even modest changes in interest can drive sharp price increases. The recent uptick likely reflects early speculation, as buyers seek low-cost rural properties for rentals or future resale.

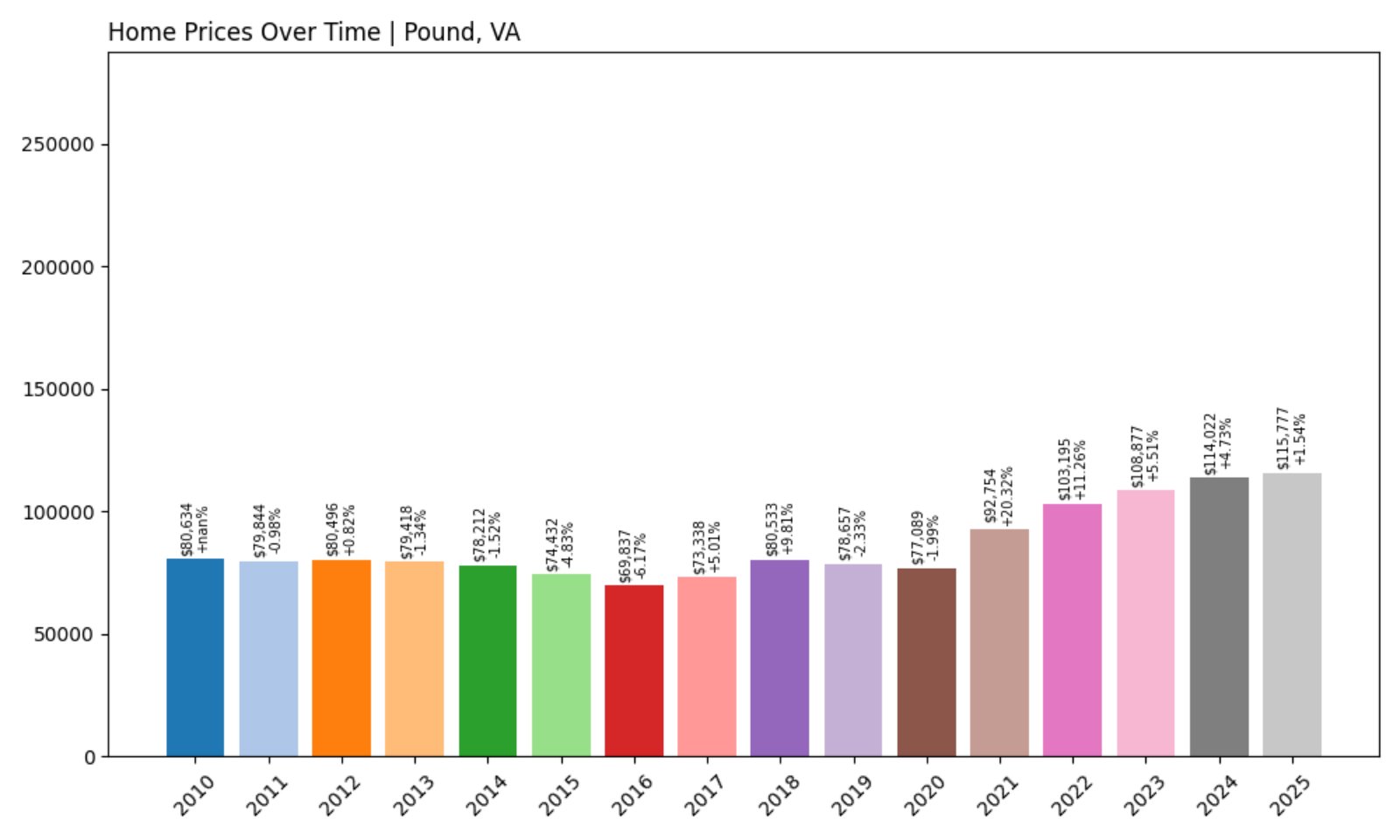

19. Pound – Investor Feeding Frenzy Factor 55.43% (July 2025)

- Historical annual growth rate (2012–2022): 2.52%

- Recent annual growth rate (2022–2025): 3.91%

- Investor Feeding Frenzy Factor: 55.43%

- Current 2025 price: $115,777.50

Pound’s home price trajectory has risen from 2.52% to 3.91% annually, yielding a Feeding Frenzy Factor of 55.43%. With homes averaging around $115,000, it’s still accessible—but rising demand could change that outlook.

Pound – A Small Town With Fast-Rising Prices

Found in Wise County, Pound lies along the Powell River and near Breaks Interstate Park, a region rich in outdoor recreation. While historically overlooked in the housing market, its scenic setting and affordability are making it increasingly attractive to out-of-town buyers and property investors.

Even small price increases can have big impacts in such modest markets. The recent acceleration hints at growing interest—perhaps from remote workers or second-home seekers—which may outpace the town’s ability to provide housing for locals.

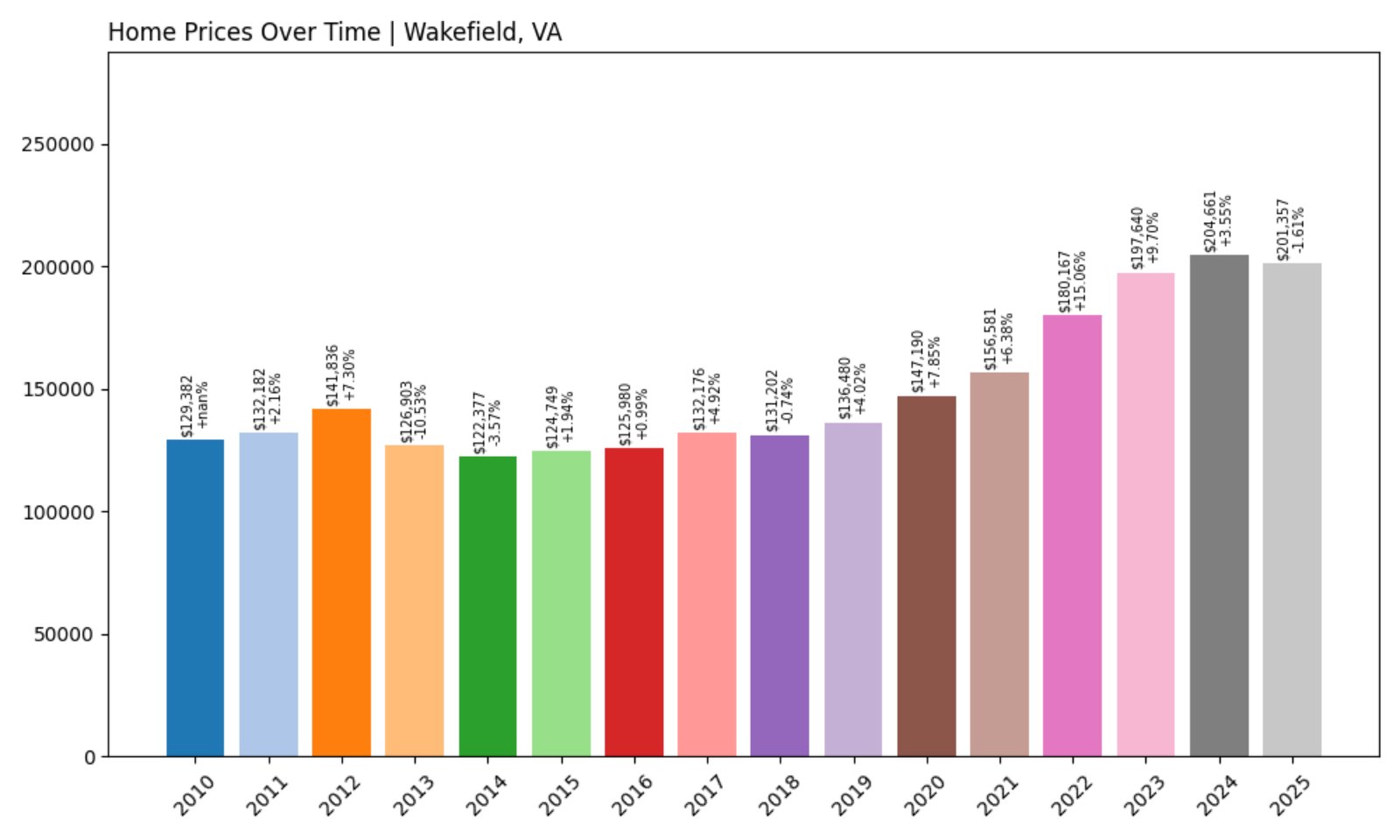

18. Wakefield – Investor Feeding Frenzy Factor 55.97% (July 2025)

- Historical annual growth rate (2012–2022): 2.42%

- Recent annual growth rate (2022–2025): 3.78%

- Investor Feeding Frenzy Factor: 55.97%

- Current 2025 price: $201,356.60

Wakefield’s growth rate has increased from 2.42% to 3.78%, a 56% surge that has pushed the Feeding Frenzy Factor to notable levels. With the average home now valued at just over $200,000, this town is quickly becoming less affordable.

Wakefield – Steady Growth With Rising Demand

Located in Sussex County and nicknamed the “Peanut Capital of the World,” Wakefield has long been a quiet, agricultural community. Its small-town atmosphere, rural setting, and proximity to Route 460 make it a manageable commute to larger employment hubs like Petersburg or Suffolk.

As prices increase beyond their historic pace, Wakefield is likely attracting interest from buyers priced out of coastal and suburban markets. The jump in growth suggests that investor activity is heating up, gradually pushing prices higher than what many locals are used to.

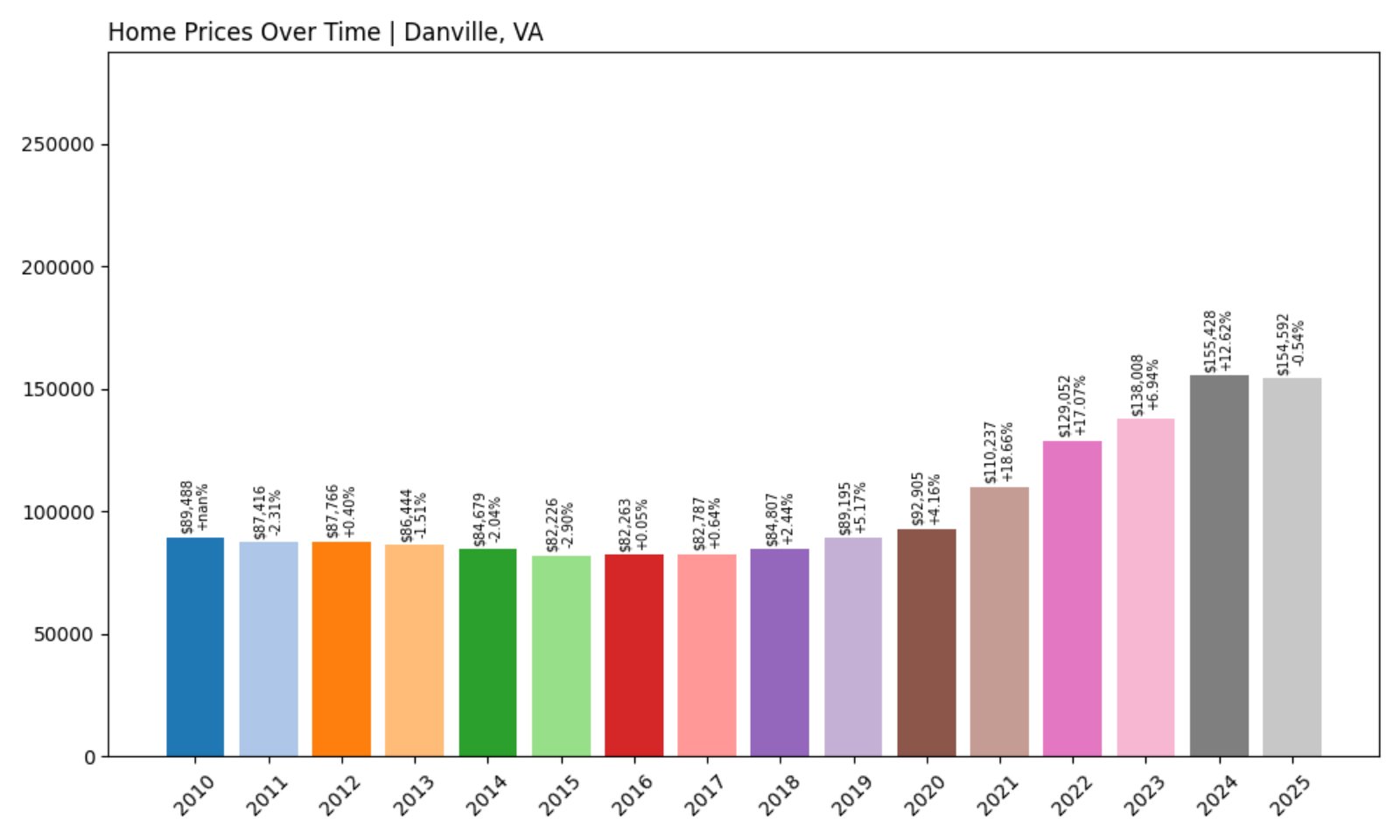

17. Danville – Investor Feeding Frenzy Factor 57.84% (July 2025)

- Historical annual growth rate (2012–2022): 3.93%

- Recent annual growth rate (2022–2025): 6.20%

- Investor Feeding Frenzy Factor: 57.84%

- Current 2025 price: $154,592.33

Danville’s growth has accelerated from 3.93% to 6.20%, creating a Feeding Frenzy Factor of nearly 58%. That’s a significant deviation from trend in a town where home prices still hover around $155,000.

Danville – From Post-Industrial to Investor Magnet

Once known for its textile and tobacco industries, Danville has seen a revival in recent years through redevelopment efforts, tech investment, and the emerging Caesars casino project. These changes are making Danville more attractive for buyers and investors alike.

With large-scale revitalization underway and prices still relatively affordable compared to the Virginia average, speculators appear to be moving in quickly. The sharp increase in price growth could reflect investor optimism—but also raise concerns about future displacement for lower-income residents.

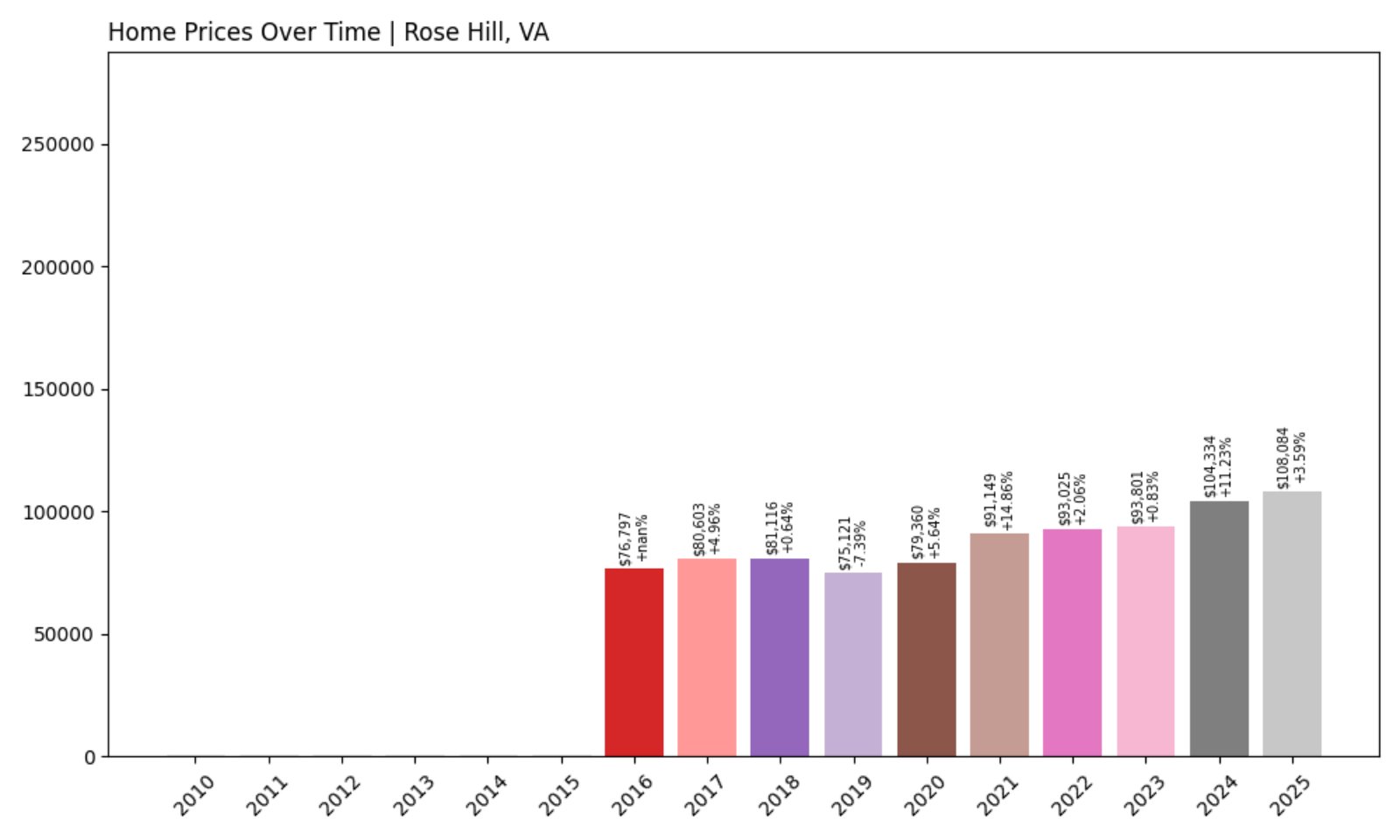

16. Rose Hill – Investor Feeding Frenzy Factor 57.96% (July 2025)

- Historical annual growth rate (2012–2022): 3.25%

- Recent annual growth rate (2022–2025): 5.13%

- Investor Feeding Frenzy Factor: 57.96%

- Current 2025 price: $108,083.69

Rose Hill has seen its annual price growth jump from 3.25% to over 5%, leading to a Feeding Frenzy Factor just under 58%. Despite this rise, the average home is still affordably priced at around $108,000—but how long that lasts is uncertain.

Rose Hill – Border Town With Surging Interest

Situated in Lee County near the Kentucky and Tennessee borders, Rose Hill is a rural community with Appalachian charm. Its proximity to Cumberland Gap National Historical Park and abundance of open land make it attractive to buyers seeking tranquility and lower cost of living.

These qualities may be fueling investor activity—especially from buyers outside Virginia—who view the area as undervalued. As price growth accelerates, Rose Hill may transition from a hidden rural outpost into a hotspot for long-term speculation.

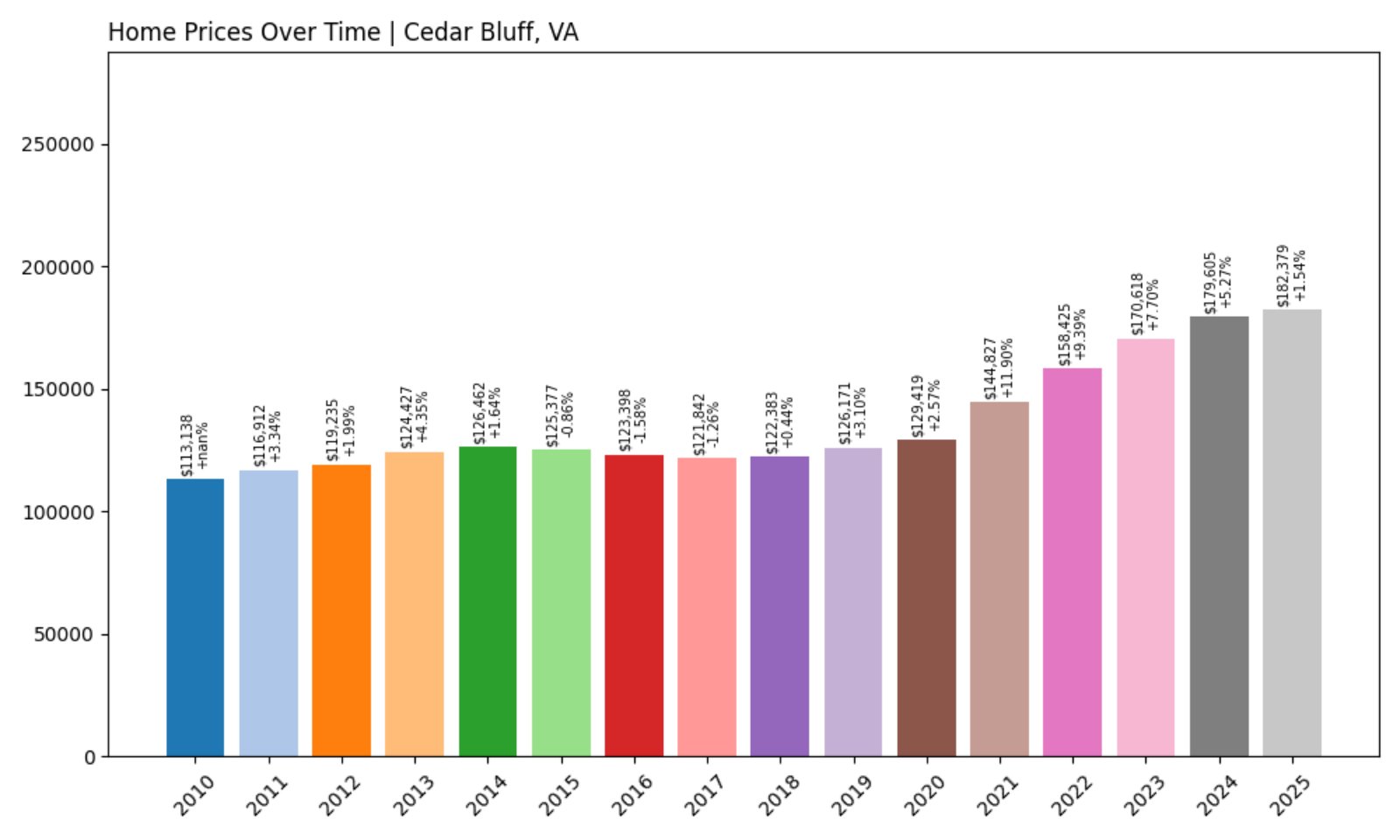

15. Cedar Bluff – Investor Feeding Frenzy Factor 66.71% (July 2025)

- Historical annual growth rate (2012–2022): 2.88%

- Recent annual growth rate (2022–2025): 4.81%

- Investor Feeding Frenzy Factor: 66.71%

- Current 2025 price: $182,378.90

In Cedar Bluff, home prices are growing at 4.81% annually—far above the historical rate of 2.88%—pushing its Feeding Frenzy Factor to nearly 67%. At just over $182,000, the average price is still accessible, though that window may be closing.

Cedar Bluff – Affordable Appalachian Town in High Demand

Located in Tazewell County, Cedar Bluff is a small town nestled along the Clinch River. It’s known for its riverfront setting, proximity to the Jefferson National Forest, and relatively low cost of living.

The increase in investor activity may be tied to the area’s scenic beauty, recreational potential, and investment value. If growth continues at this pace, Cedar Bluff could soon see the kind of affordability crunch that has hit other rural towns caught in investor crosshairs.

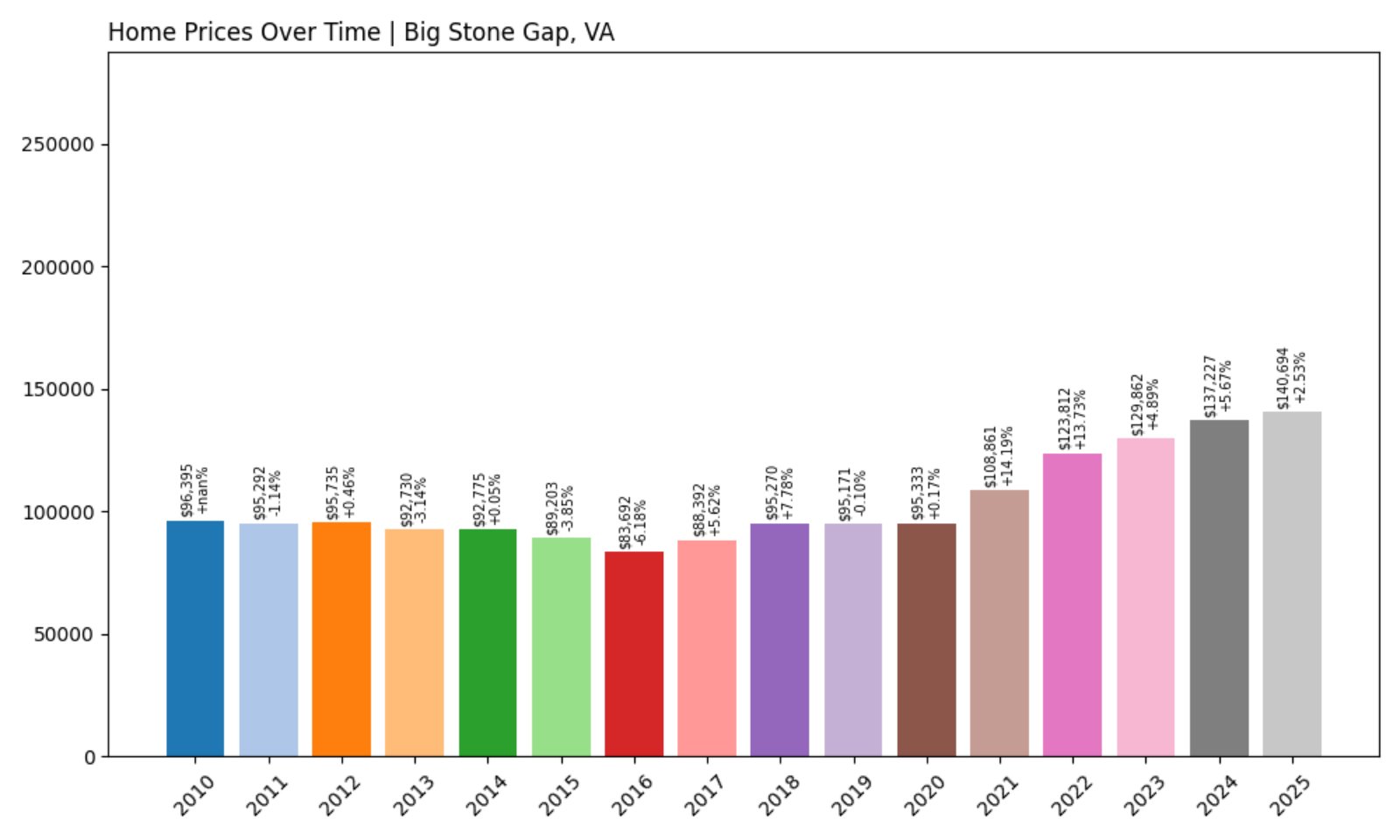

14. Big Stone Gap – Investor Feeding Frenzy Factor 67.08% (July 2025)

- Historical annual growth rate (2012–2022): 2.61%

- Recent annual growth rate (2022–2025): 4.35%

- Investor Feeding Frenzy Factor: 67.08%

- Current 2025 price: $140,694.32

Big Stone Gap’s Feeding Frenzy Factor has risen to just over 67%, with recent price growth rates significantly higher than long-term averages. Homes now average about $140,700—still modest by state standards.

Big Stone Gap – Rising Fast in the Southwest

This town in Wise County has historical roots in coal mining but is increasingly reinventing itself as a destination for heritage tourism, outdoor recreation, and remote work. The Museum of the Southwest and nearby Powell Valley offer both culture and natural beauty.

As the housing market heats up, more buyers—particularly those from out of the region—may be looking to secure properties in this still-affordable corner of Virginia. That influx could lead to long-term shifts in housing access for local families.

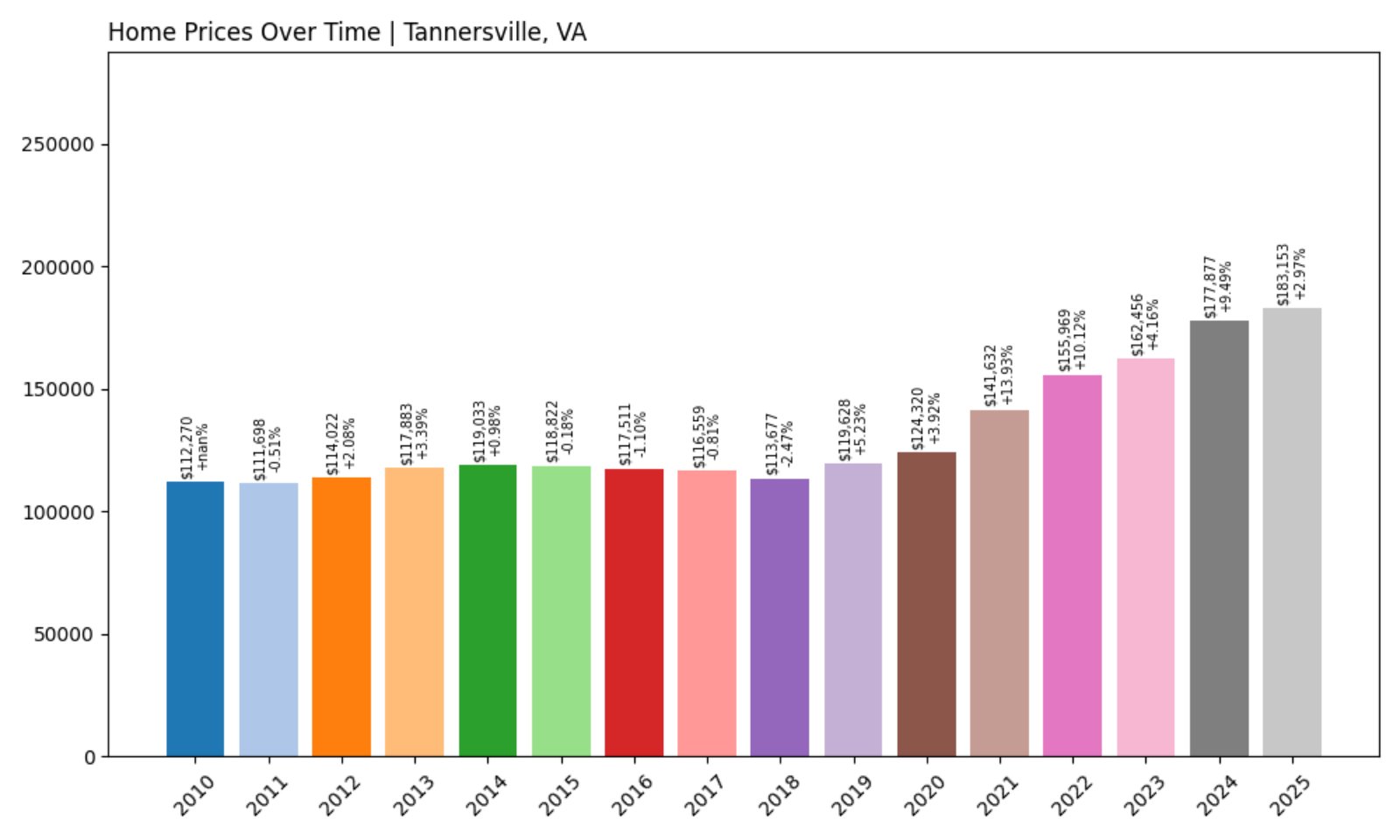

13. Tannersville – Investor Feeding Frenzy Factor 72.89% (July 2025)

- Historical annual growth rate (2012–2022): 3.18%

- Recent annual growth rate (2022–2025): 5.50%

- Investor Feeding Frenzy Factor: 72.89%

- Current 2025 price: $183,153.43

Tannersville has seen recent annual price growth surge to 5.50%—a significant jump from its historical rate of 3.18%. That’s resulted in a Feeding Frenzy Factor of nearly 73%, putting this rural town firmly in the investor spotlight.

Tannersville – Quiet and Remote, But Heating Up

Located in the highlands of Tazewell County, Tannersville offers privacy, mountain views, and rural living that appeals to remote workers and buyers seeking solitude. The area’s natural beauty and space to spread out have become more desirable in recent years.

With prices still moderate, this uptick signals increasing competition. Investors may be betting on long-term value, especially in lesser-known areas offering lower upfront costs and lifestyle perks. But those same dynamics could also start pricing out the local families that have lived here for generations.

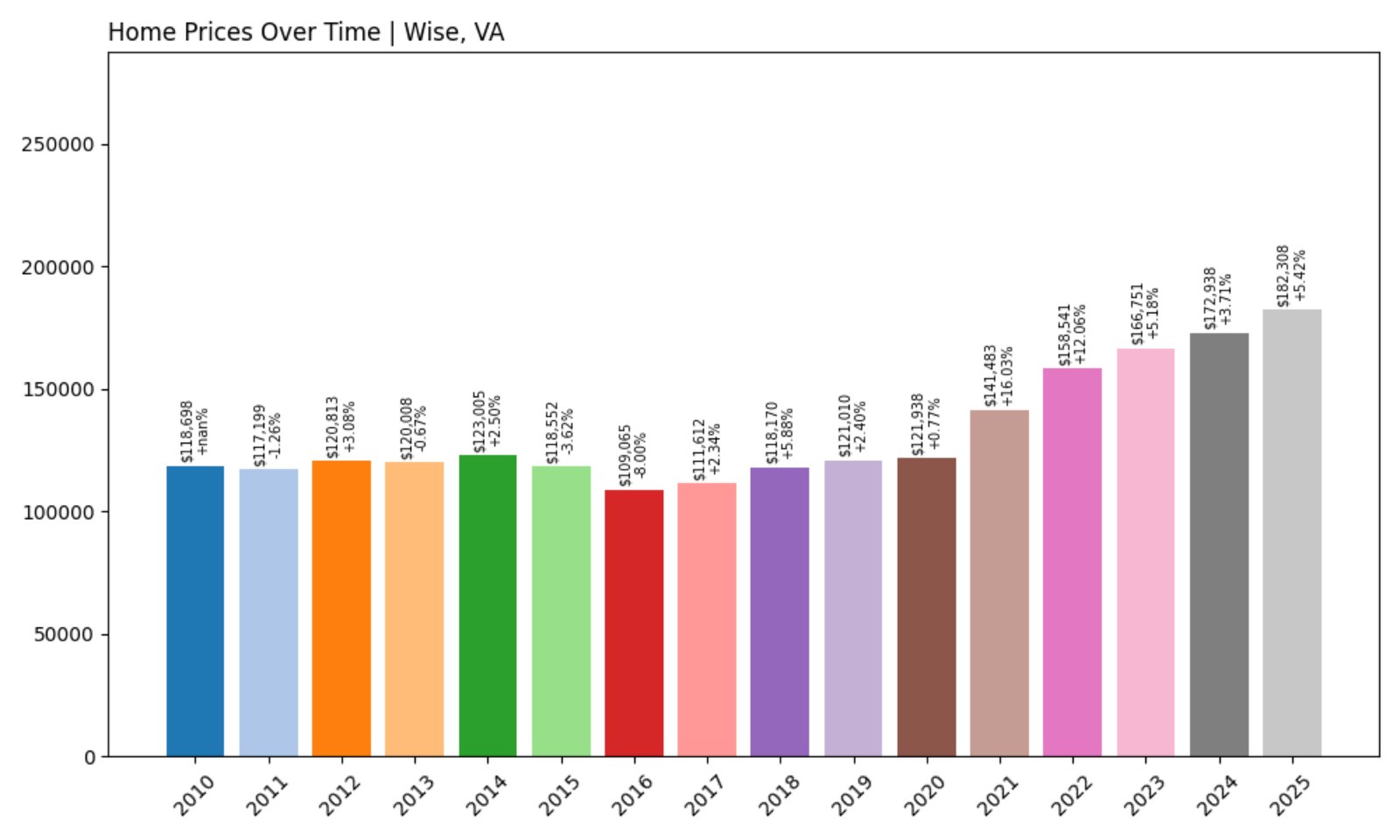

12. Wise – Investor Feeding Frenzy Factor 73.01% (July 2025)

- Historical annual growth rate (2012–2022): 2.75%

- Recent annual growth rate (2022–2025): 4.77%

- Investor Feeding Frenzy Factor: 73.01%

- Current 2025 price: $182,307.82

Wise is experiencing a steep growth acceleration, with price increases rising to 4.77% per year—well above the 2.75% historical norm. That gives it a Feeding Frenzy Factor of 73.01%, a sign that demand is growing fast in this Appalachian hub.

Wise – A College Town With Investor Momentum

Wise, the seat of Wise County, is home to the University of Virginia’s College at Wise. The presence of a public liberal arts college adds a layer of economic stability and drives steady housing demand. With nearby access to the Jefferson National Forest, it also attracts outdoor enthusiasts.

Growing investor activity may reflect confidence in the town’s dual identity as both an educational and recreational destination. While prices remain under $200K, continued growth at this pace could shift the housing balance away from long-term residents toward speculative owners.

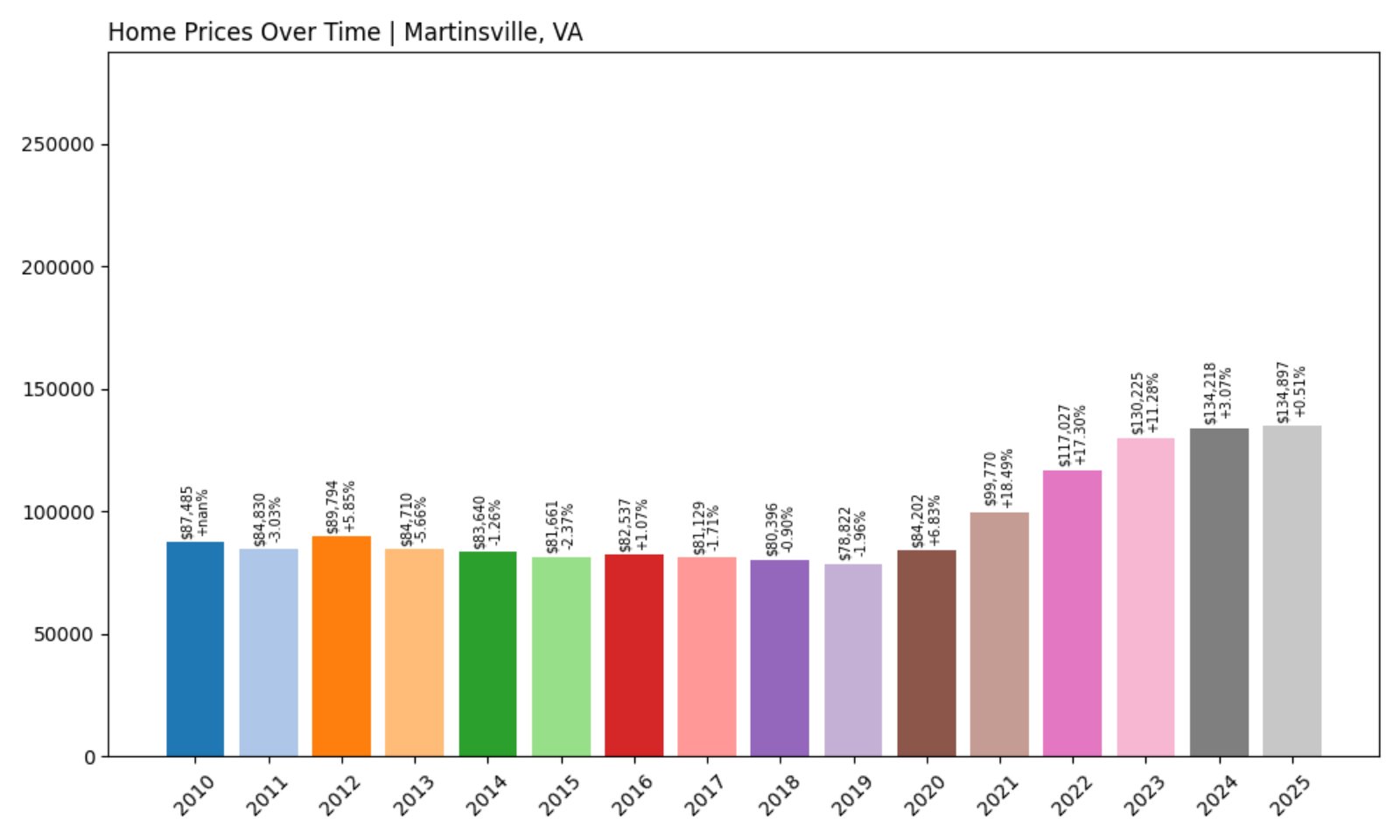

11. Martinsville – Investor Feeding Frenzy Factor 80.72% (July 2025)

- Historical annual growth rate (2012–2022): 2.68%

- Recent annual growth rate (2022–2025): 4.85%

- Investor Feeding Frenzy Factor: 80.72%

- Current 2025 price: $134,897.16

Martinsville’s annual growth has risen from 2.68% to 4.85%, triggering a Feeding Frenzy Factor of 80.72%. With average home prices around $135,000, this uptick is putting additional pressure on what was once an ultra-affordable market.

Martinsville – Industrial Legacy, Renewed Growth

Once a textile and furniture manufacturing powerhouse, Martinsville has weathered tough economic times but is now seeing signs of rebound. Downtown revitalization projects, historic architecture, and growing arts initiatives are bringing fresh attention to this Southern Virginia city.

For investors, the city’s low prices and stable rental demand make it attractive. The sharp increase in growth rates could point to flipping or rental property speculation, which may impact affordability for lower-income families already under strain from inflation and stagnant wages.

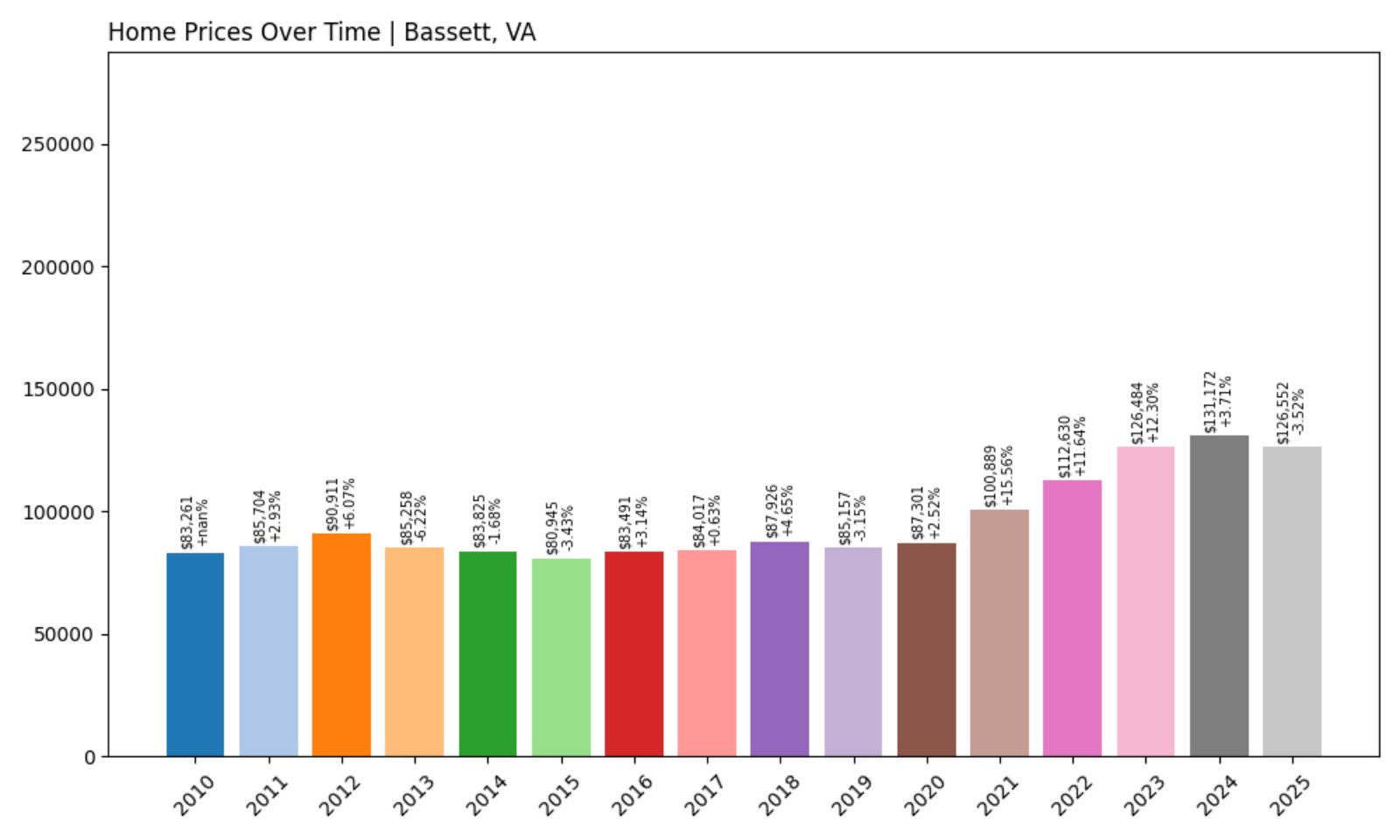

10. Bassett – Investor Feeding Frenzy Factor 82.92% (July 2025)

- Historical annual growth rate (2012–2022): 2.17%

- Recent annual growth rate (2022–2025): 3.96%

- Investor Feeding Frenzy Factor: 82.92%

- Current 2025 price: $126,551.66

Price growth in Bassett has nearly doubled—from 2.17% to 3.96%—in recent years, producing a Feeding Frenzy Factor of 82.92%. Even with average home values still under $130,000, the pace of change signals increasing pressure.

Bassett – Furniture Town on the Move

Bassett, also in Henry County, is best known for its connection to Bassett Furniture Industries. While its manufacturing heyday has passed, the community remains proud of its heritage and is finding new life through rural revitalization and tourism efforts.

The area’s mix of affordability, scenic riverfront areas, and nostalgic charm is beginning to attract remote workers and investors alike. If the trend continues, this once-stagnant market may experience a reshaping of its identity—and its affordability.

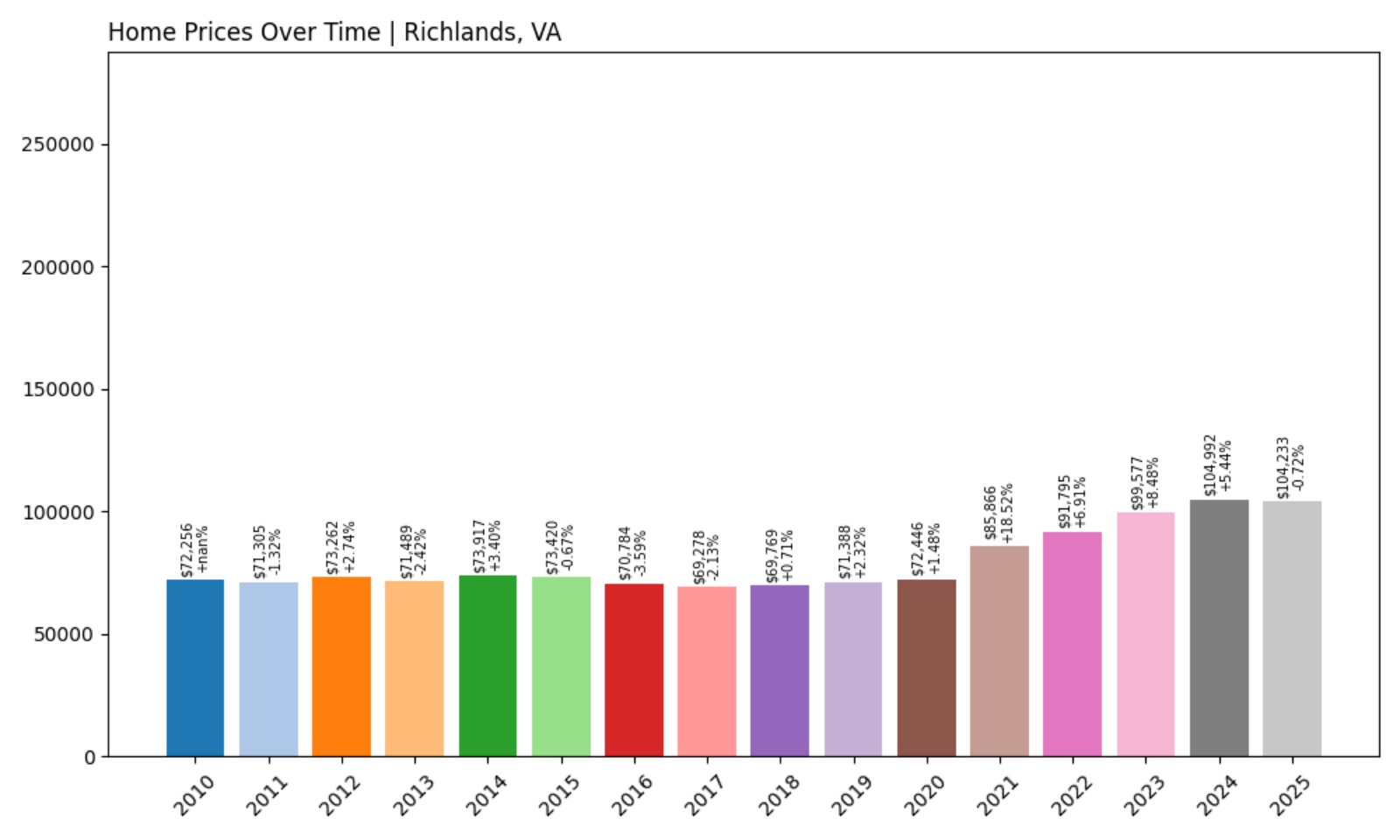

9. Richlands – Investor Feeding Frenzy Factor 89.71% (July 2025)

- Historical annual growth rate (2012–2022): 2.28%

- Recent annual growth rate (2022–2025): 4.33%

- Investor Feeding Frenzy Factor: 89.71%

- Current 2025 price: $104,233.43

Richlands has seen its growth rate jump from 2.28% to 4.33%, generating a Feeding Frenzy Factor of 89.71%. The average home price remains just above $104,000—but that may not last long.

Richlands – Coal Country Rebounds

Located in Tazewell County, Richlands has deep roots in the coal industry. In recent years, however, the town has begun carving out a new identity centered on education, healthcare, and small business development. Southwest Virginia Community College is a major presence here.

The sharp price growth is likely driven by renewed interest in undervalued towns with access to infrastructure and potential for appreciation. Investors entering at today’s low prices may be gambling on further regional recovery, but that surge could leave local buyers behind if wages don’t keep pace.

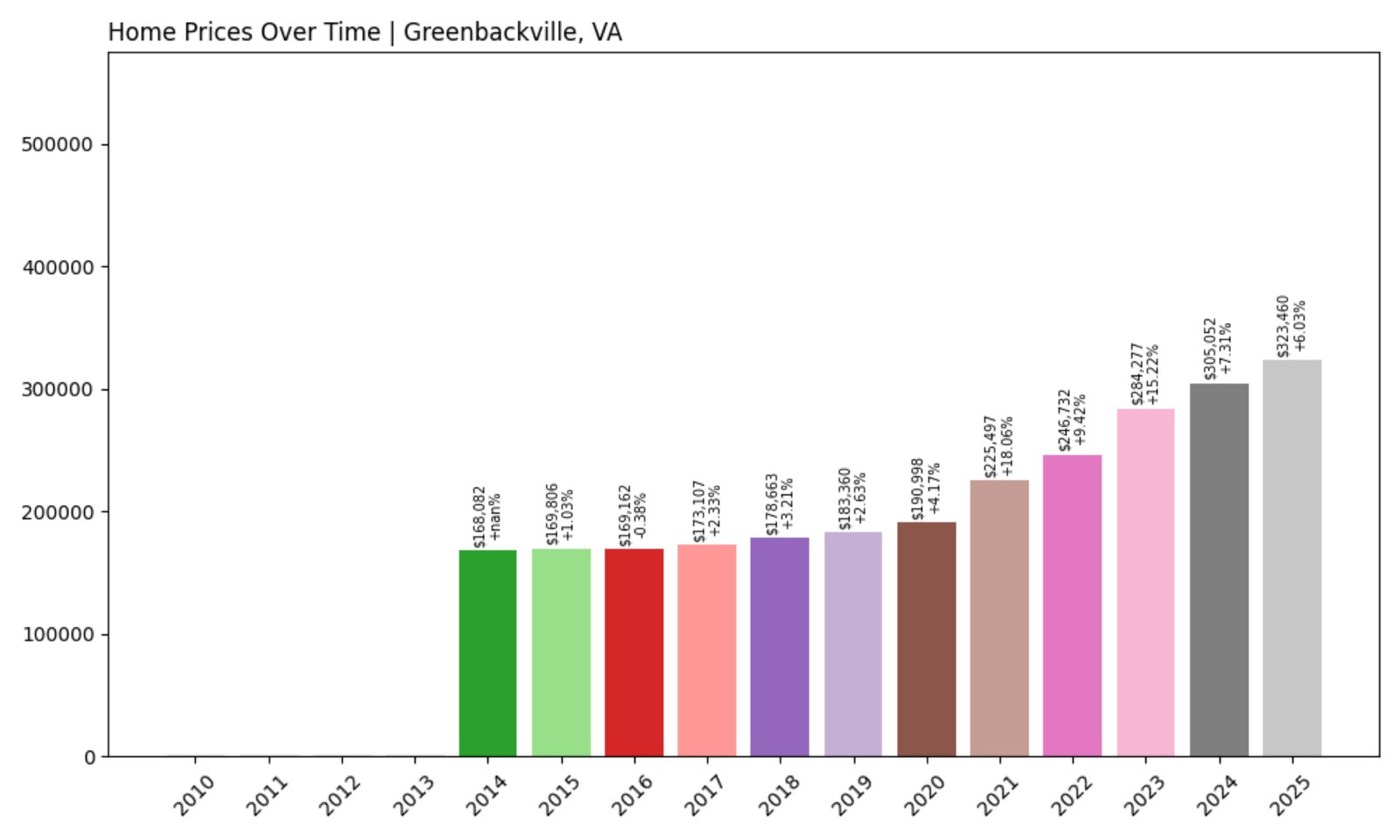

8. Greenbackville – Investor Feeding Frenzy Factor 92.17% (July 2025)

- Historical annual growth rate (2012–2022): 4.92%

- Recent annual growth rate (2022–2025): 9.45%

- Investor Feeding Frenzy Factor: 92.17%

- Current 2025 price: $323,460.16

Greenbackville’s home price growth rate nearly doubled in the past three years, rising from 4.92% to a staggering 9.45%. That change yields a Feeding Frenzy Factor of 92.17%, one of the highest in Virginia.

Greenbackville – Coastal Community Attracting Aggressive Investment

Located in Accomack County near the Maryland border, Greenbackville is part of the Chincoteague Bay shoreline and offers stunning waterfront access. It has historically been a seasonal or retirement market, but that appears to be shifting.

High demand for vacation properties, coupled with a surge in out-of-state buyers, has likely driven this market into investor territory. With home prices now exceeding $323,000 on average, what was once a sleepy coastal village is transforming into a high-stakes real estate hot spot.

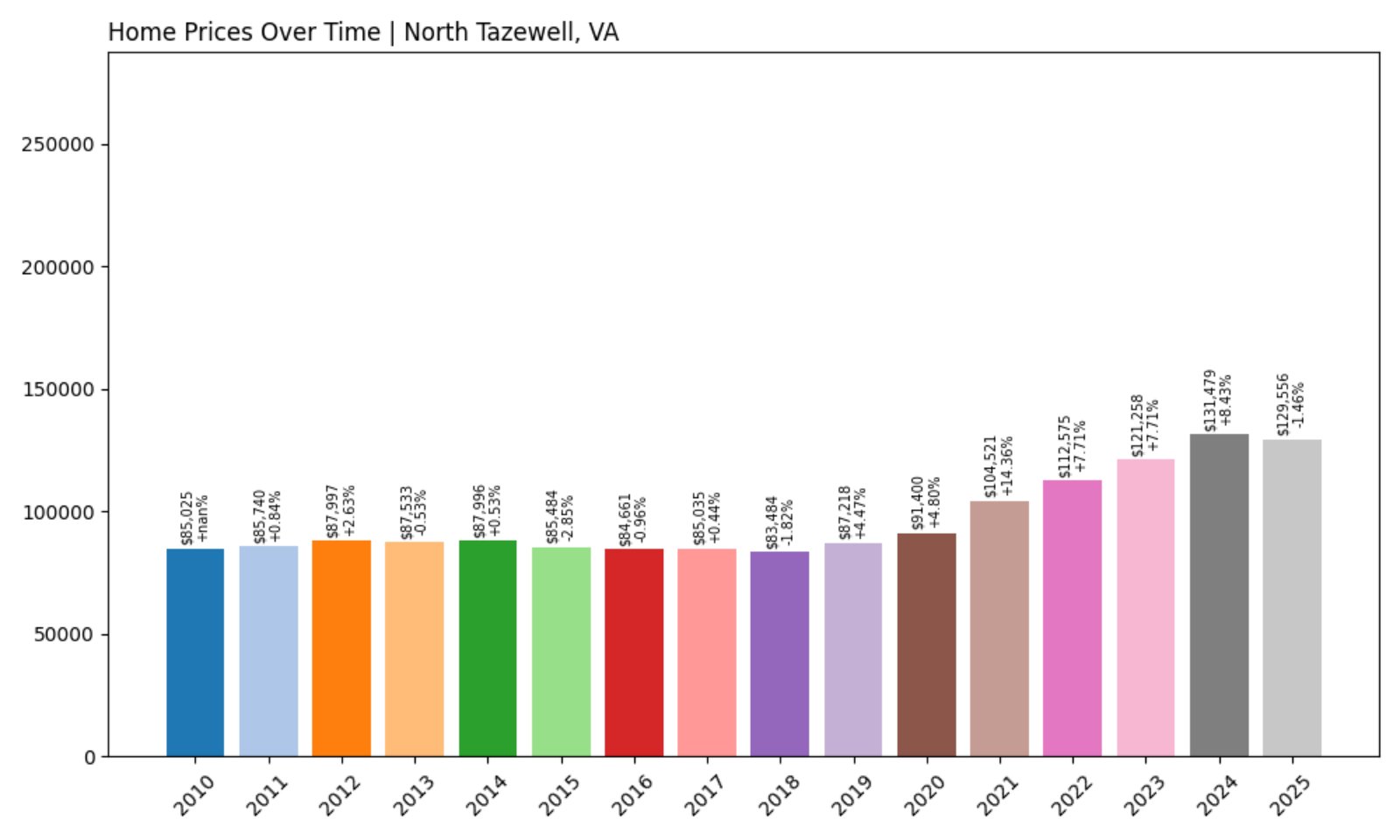

7. North Tazewell – Investor Feeding Frenzy Factor 92.26% (July 2025)

- Historical annual growth rate (2012–2022): 2.49%

- Recent annual growth rate (2022–2025): 4.79%

- Investor Feeding Frenzy Factor: 92.26%

- Current 2025 price: $129,556.31

North Tazewell has seen its annual growth rate surge from 2.49% to 4.79%, resulting in a Feeding Frenzy Factor of 92.26%. Home prices remain modest at around $130K, but the growth pace is raising red flags.

North Tazewell – Small Market With Big Acceleration

This unincorporated community in Tazewell County offers quiet mountain living and access to the Clinch River and national forest land. With its low cost of living, it’s long appealed to retirees and longtime residents.

The spike in appreciation suggests that investors are beginning to target it for its upside potential. If the pattern continues, homebuyers may soon find themselves competing with deep-pocketed outside buyers in what was once a reliably affordable town.

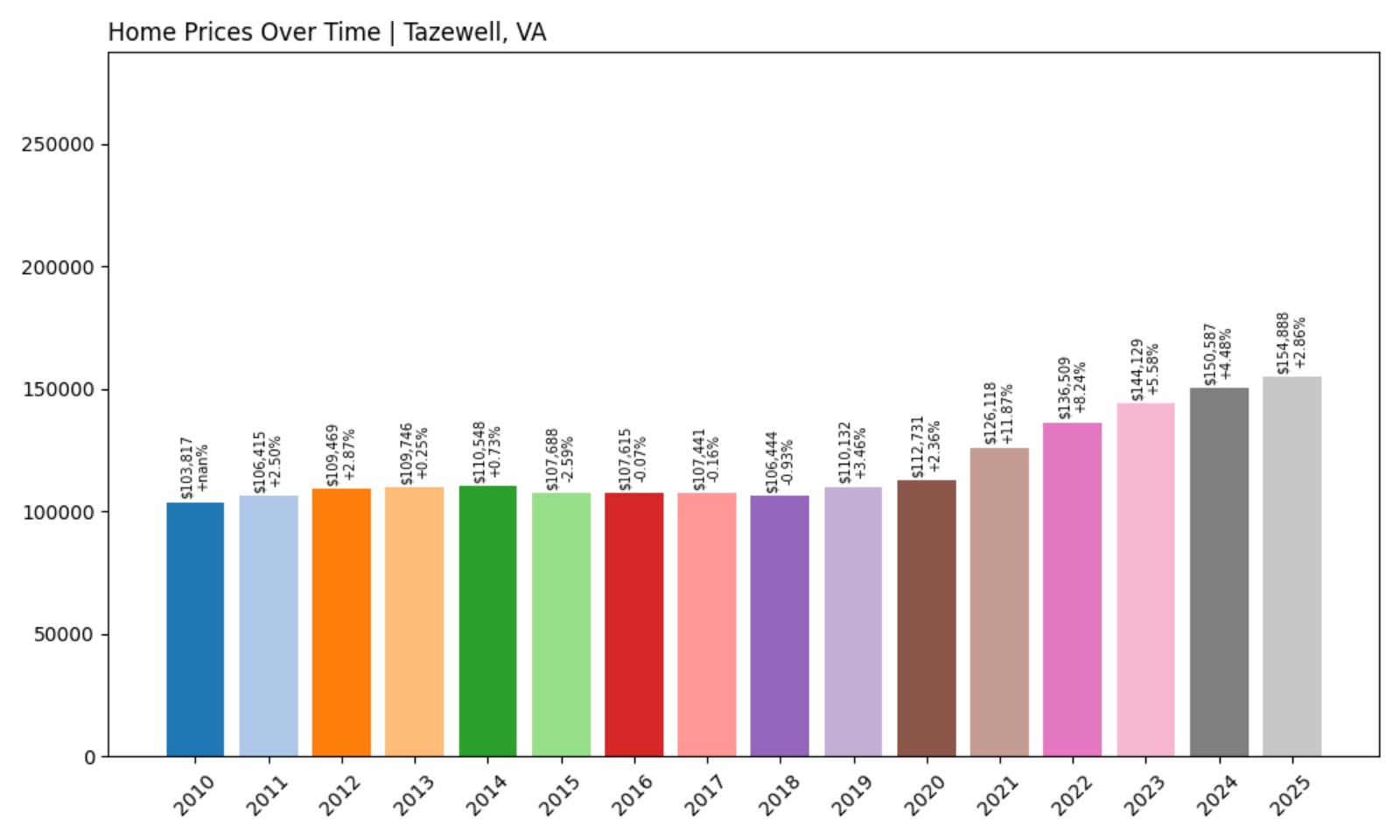

6. Tazewell – Investor Feeding Frenzy Factor 92.66% (July 2025)

- Historical annual growth rate (2012–2022): 2.23%

- Recent annual growth rate (2022–2025): 4.30%

- Investor Feeding Frenzy Factor: 92.66%

- Current 2025 price: $154,887.68

Tazewell’s price growth has nearly doubled in pace—from 2.23% historically to 4.30% in recent years. That equates to a Feeding Frenzy Factor of 92.66% and places the town firmly in the speculative crosshairs.

Tazewell – Anchored in History, Pushed by Price

The town of Tazewell, the county seat, is nestled in Virginia’s Appalachian Plateau. Its historic district, mountain scenery, and long-standing community roots make it an attractive place to live—but increasingly difficult to buy into for locals.

New interest from outside buyers is placing upward pressure on home values. At current price levels—around $155,000—Tazewell still appears affordable, but that affordability may be eroding faster than many residents realize.

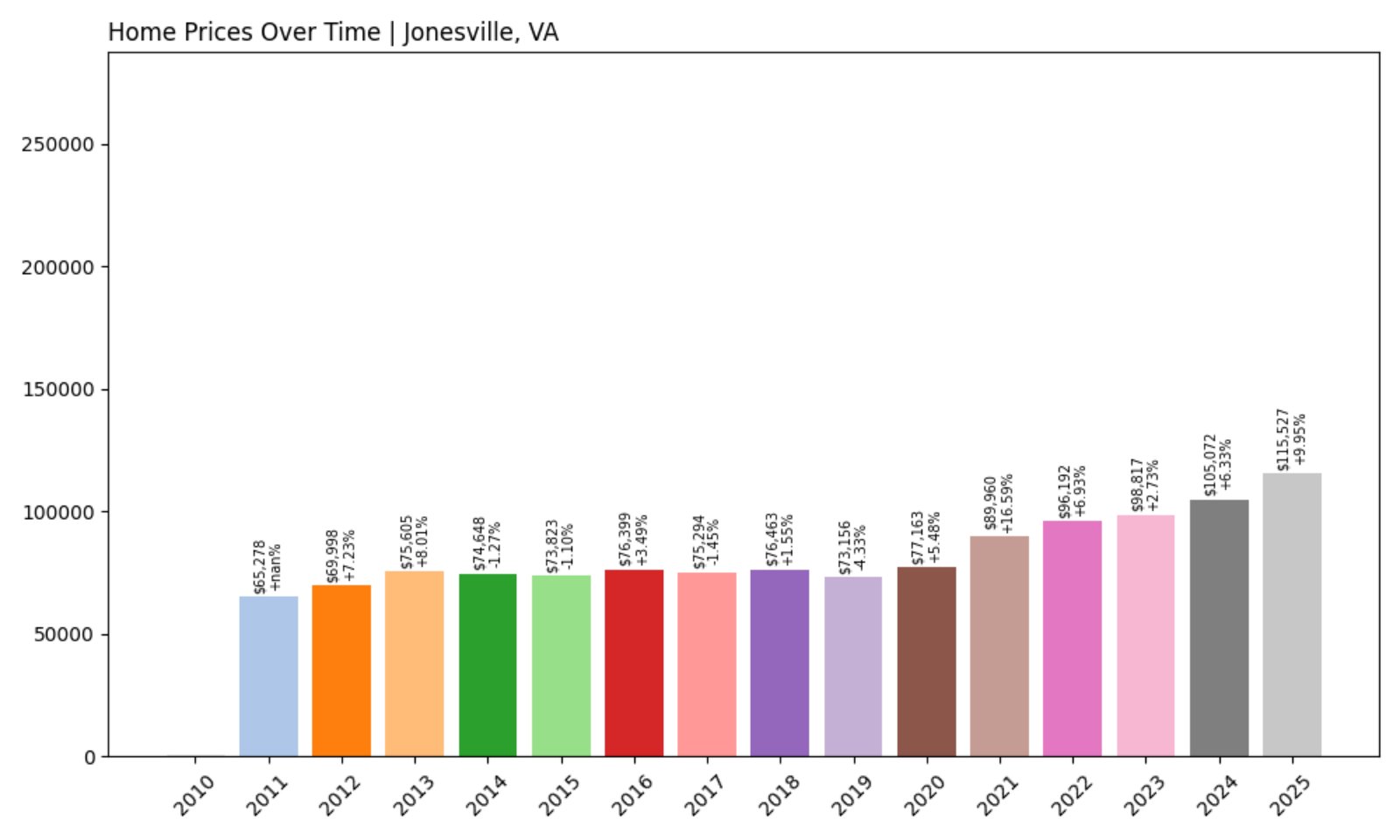

5. Jonesville – Investor Feeding Frenzy Factor 94.93% (July 2025)

- Historical annual growth rate (2012–2022): 3.23%

- Recent annual growth rate (2022–2025): 6.30%

- Investor Feeding Frenzy Factor: 94.93%

- Current 2025 price: $115,527.07

Jonesville has seen a dramatic leap in annual growth—from 3.23% to 6.30%—giving it a Feeding Frenzy Factor just shy of 95%. That’s one of the most aggressive shifts statewide, especially for a town with sub-$120K housing prices.

Jonesville – Low Prices, High Interest

As the county seat of Lee County, Jonesville offers a rural lifestyle with access to local government, schools, and services. Its location near the Tennessee border and along U.S. Route 58 provides reasonable accessibility despite its remote feel.

The steep rise in prices is especially notable given its still-affordable entry point. Such growth can spark speculation, and if trends persist, long-time residents may find themselves increasingly priced out of their own community.

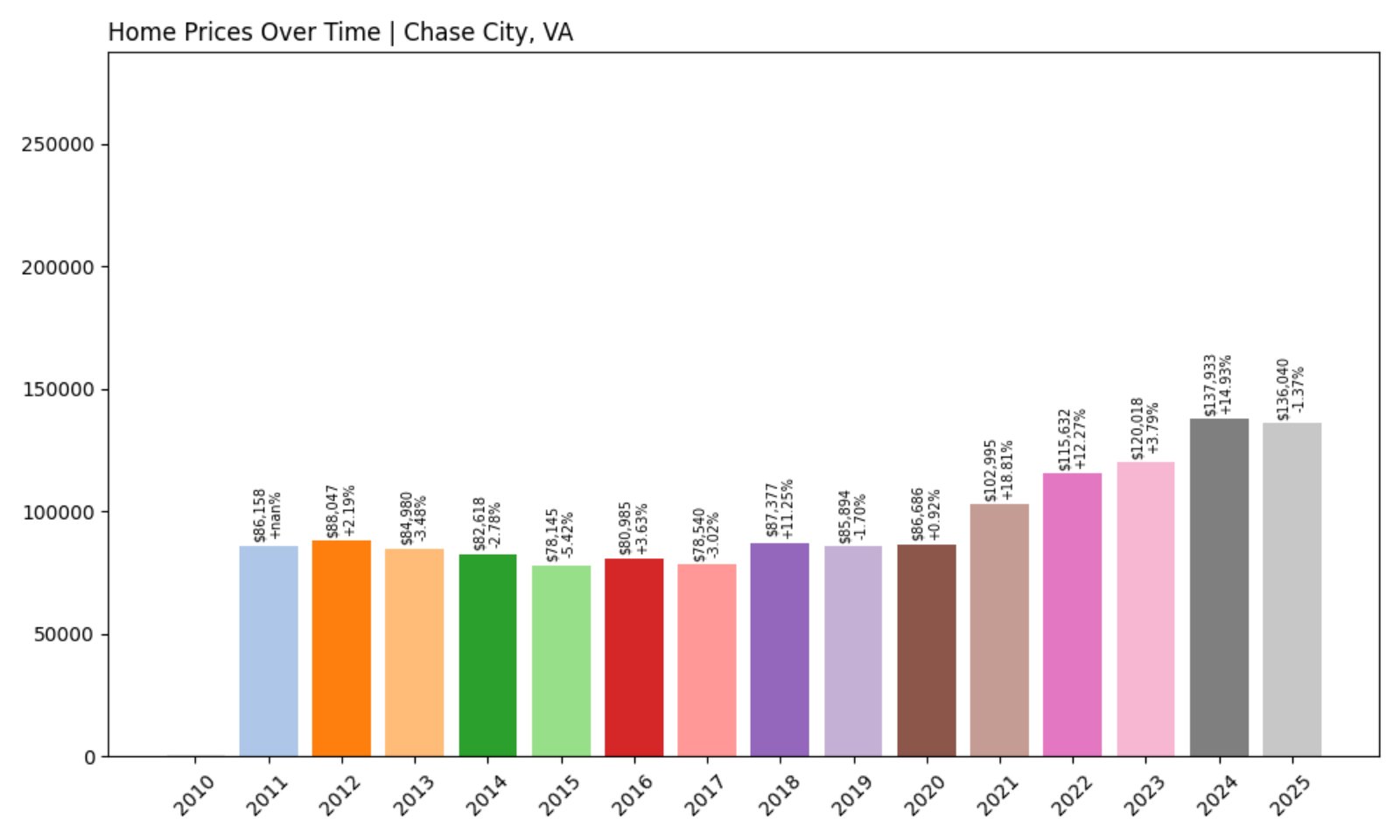

4. Chase City – Investor Feeding Frenzy Factor 101.51% (July 2025)

- Historical annual growth rate (2012–2022): 2.76%

- Recent annual growth rate (2022–2025): 5.57%

- Investor Feeding Frenzy Factor: 101.51%

- Current 2025 price: $136,039.88

Chase City’s price appreciation rate has more than doubled, rising from 2.76% to 5.57% annually and delivering a Feeding Frenzy Factor of 101.51%. That pace of change is one of the most extreme in Southern Virginia.

Chase City – Quiet Growth in Mecklenburg County

Located in Mecklenburg County near Buggs Island Lake and the North Carolina border, Chase City is a town with rural charm and plenty of space to grow. It has traditionally flown under the radar—but that’s changing fast.

Its location near recreation and retirement destinations may be contributing to its newfound popularity. But the speed of growth raises serious questions about long-term affordability for current residents and first-time homebuyers.

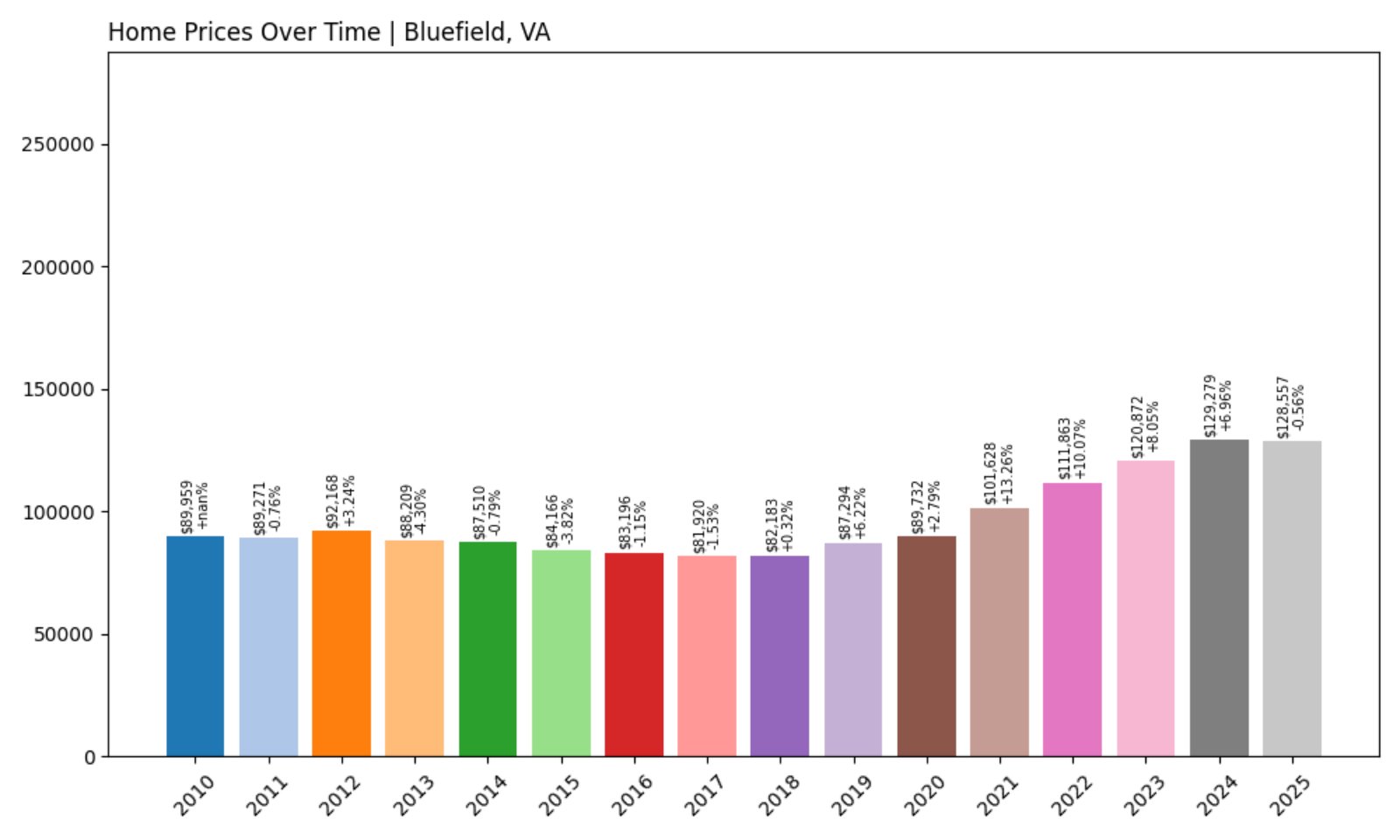

3. Bluefield – Investor Feeding Frenzy Factor 142.68% (July 2025)

- Historical annual growth rate (2012–2022): 1.96%

- Recent annual growth rate (2022–2025): 4.75%

- Investor Feeding Frenzy Factor: 142.68%

- Current 2025 price: $128,557.40

Bluefield’s annual growth rate more than doubled, jumping from 1.96% to 4.75%—creating a Feeding Frenzy Factor of 142.68%. That’s a significant surge for a town where homes still cost under $130,000 on average.

Bluefield – Twin Town on a Tear

Situated along the Virginia–West Virginia border, Bluefield offers a unique cross-state appeal. Its sister city in West Virginia shares the same name, and the region benefits from a shared economy, cultural ties, and access to rail and highway infrastructure.

The town has seen increased investor attention thanks to its low entry price and recent infrastructure improvements. With home values accelerating this quickly, the affordability advantage that once defined Bluefield may be slipping away.

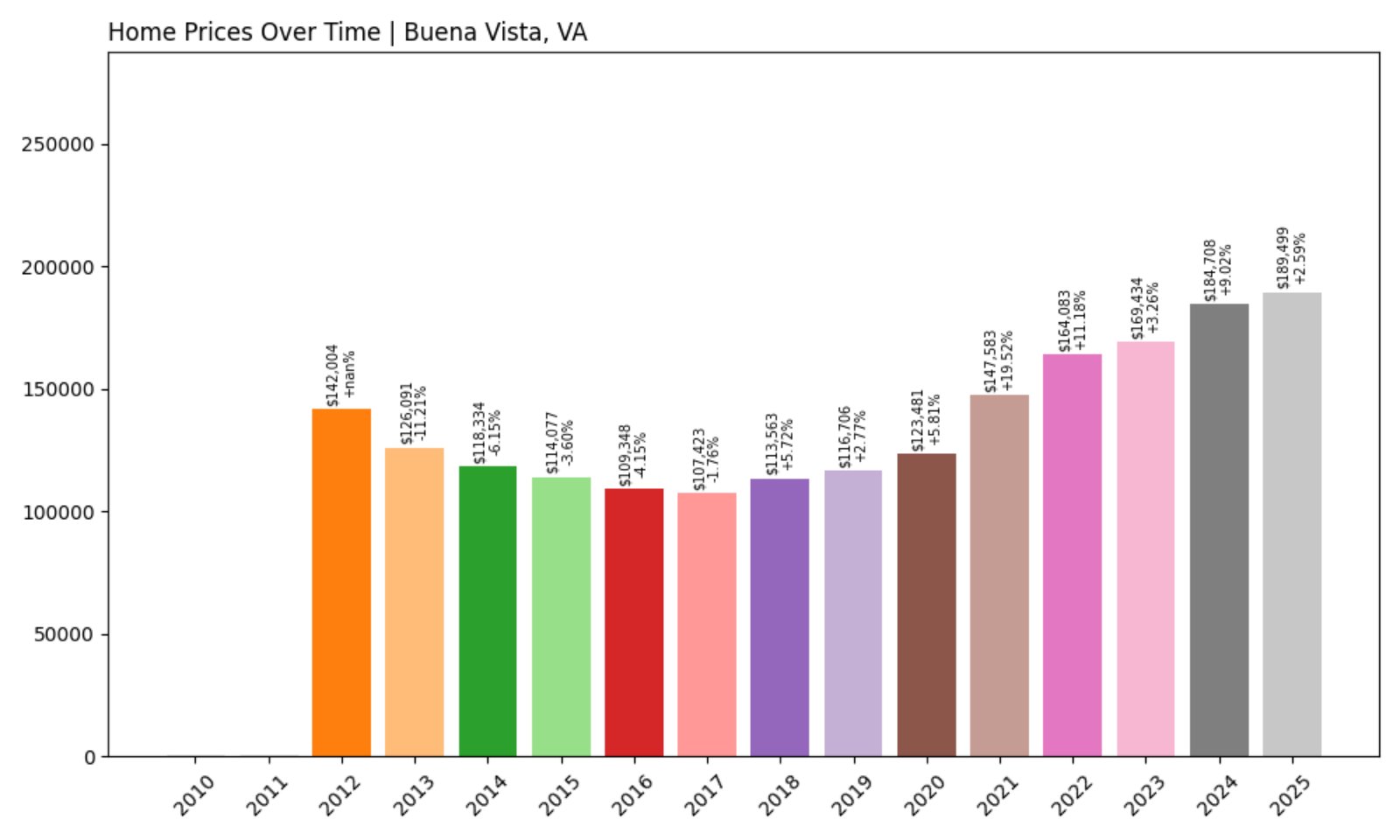

2. Buena Vista – Investor Feeding Frenzy Factor 237.83% (July 2025)

- Historical annual growth rate (2012–2022): 1.46%

- Recent annual growth rate (2022–2025): 4.92%

- Investor Feeding Frenzy Factor: 237.83%

- Current 2025 price: $189,499.29

Buena Vista’s price acceleration is among the most extreme in the state, rising from 1.46% to 4.92% annually. That yields a Feeding Frenzy Factor of nearly 238%, signaling a major shift in market behavior.

Buena Vista – University Town Facing Investor Influx

Home to Southern Virginia University, Buena Vista sits in the Shenandoah Valley near Lexington. Its blend of collegiate activity, natural beauty, and small-town infrastructure makes it appealing to a wide range of buyers—especially in a state with otherwise high real estate costs.

The dramatic rise in prices likely reflects increased demand from remote workers, student housing investors, and flippers alike. With values now just under $190,000, the town is no longer as affordable as it once was—raising the stakes for local buyers.

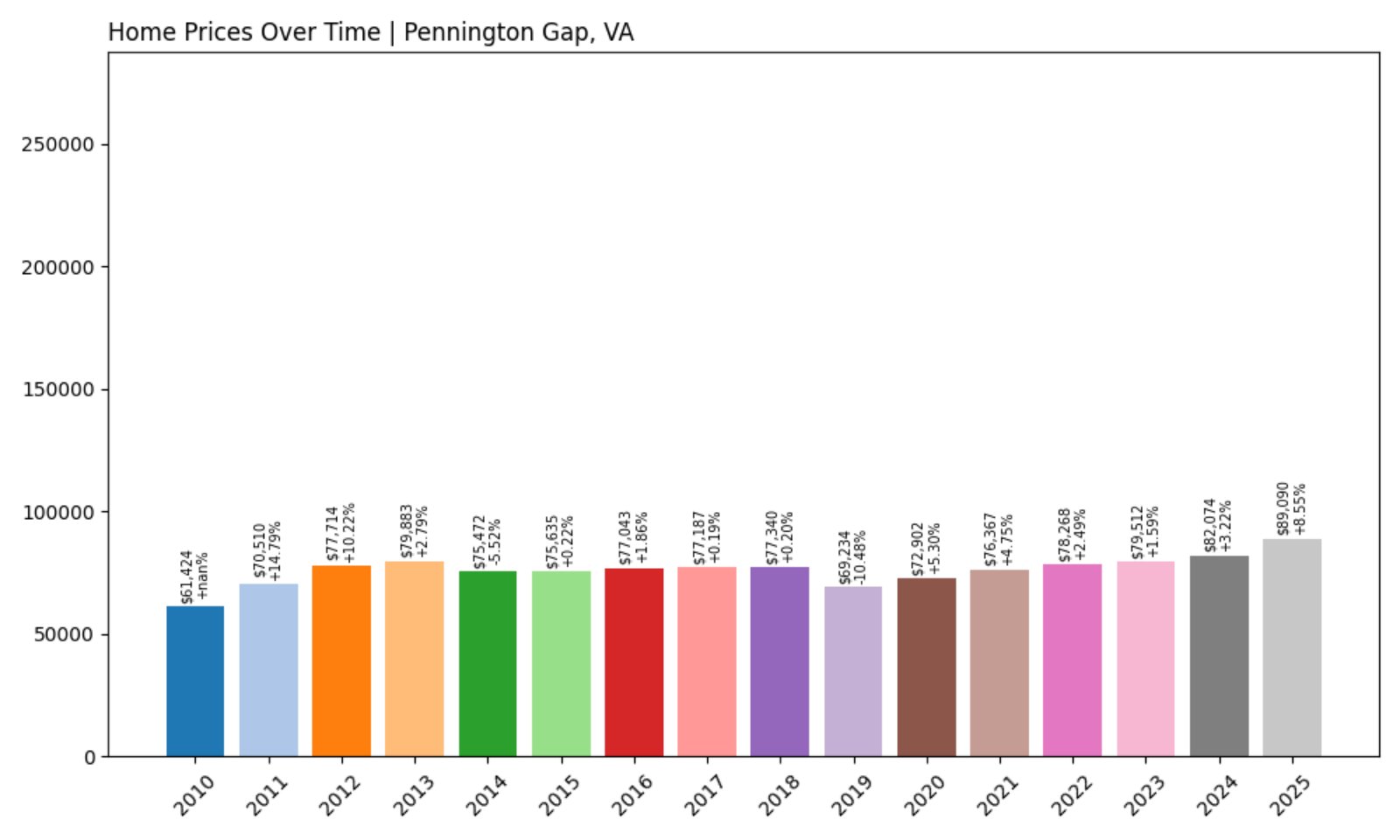

1. Pennington Gap – Investor Feeding Frenzy Factor 6104.98% (July 2025)

- Historical annual growth rate (2012–2022): 0.07%

- Recent annual growth rate (2022–2025): 4.41%

- Investor Feeding Frenzy Factor: 6104.98%

- Current 2025 price: $89,089.60

Pennington Gap tops the list with a jaw-dropping Feeding Frenzy Factor of 6104.98%. That’s due to a historic growth rate of just 0.07% suddenly spiking to 4.41%—a more than 60-fold increase. Home prices remain low for now at under $90K, but that may not last.

Pennington Gap – From Dormant to Desired

Located in far southwestern Virginia, Pennington Gap has long been a quiet town with deep Appalachian roots. It’s a gateway to Cumberland Gap National Historical Park and has historically seen very little housing market movement.

That appears to be changing fast. Whether driven by speculative buying, spillover from regional redevelopment, or investors hunting for ultra-low-cost homes, the price surge here is extraordinary. Such extreme growth relative to history is a textbook example of an investor feeding frenzy—and a flashing warning sign for future affordability.