Would you like to save this?

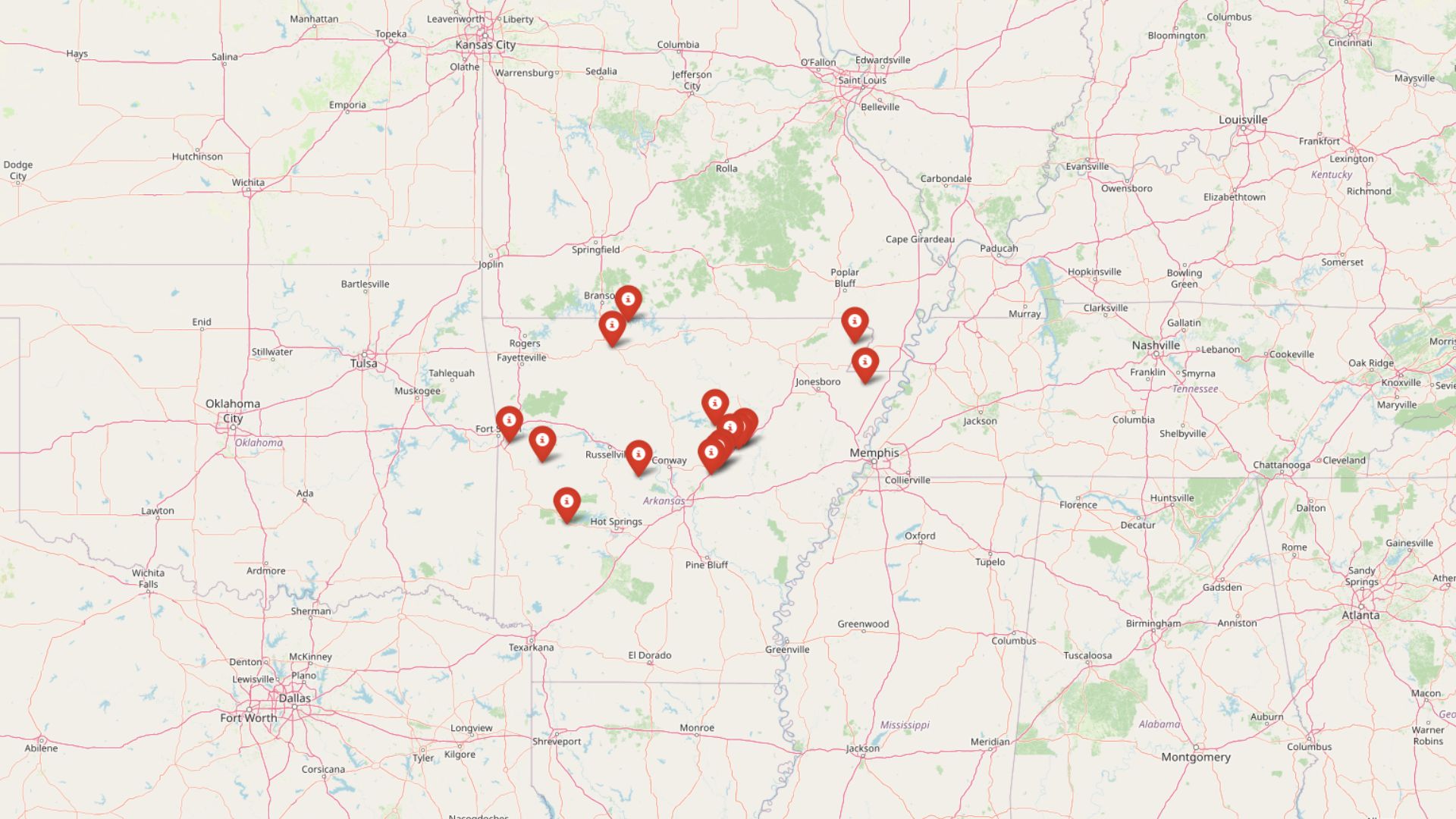

Recent data from the Zillow Home Value Index reveals that investor activity is reshaping the housing landscape across Arkansas. In these 15 towns, home prices have surged far beyond historical norms — not because of local demand, but because of outside investment pressure. The result is what experts call a full-blown investor feeding frenzy, where recent price spikes outpace long-term averages by 50% or more.

In some of these markets, the acceleration is so extreme it signals serious affordability strain, especially for local families. This ranking shows which Arkansas communities are seeing the biggest distortions, and just how fast speculative buying is transforming once-accessible towns into investor-driven hot zones.

15. Tumbling Shoals – Investor Feeding Frenzy Factor 1.90% (July 2025)

- Historical annual growth rate (2012–2022): 4.36%

- Recent annual growth rate (2022–2025): 4.44%

- Investor Feeding Frenzy Factor: 1.90%

- Current 2025 price: $251,849.43

Tumbling Shoals shows minimal investor feeding frenzy activity with only a slight acceleration in recent price growth. The town maintains relatively stable market conditions, with recent growth rates barely exceeding historical patterns. At $251,849, home prices reflect the area’s desirability without the dramatic speculation seen elsewhere in Arkansas.

Tumbling Shoals – Steady Growth Amid Statewide Speculation

Located in Cleburne County along the Little Red River, Tumbling Shoals represents one of Arkansas’s most stable housing markets despite commanding the highest median price on this list. The community’s proximity to Greers Ferry Lake and the Little Red River has long attracted retirees and second-home buyers, creating steady demand that supports consistent price appreciation without speculative bubbles. The town’s limited housing stock and scenic riverfront properties naturally maintain higher values, but the modest 1.90% feeding frenzy factor indicates prices remain tied to genuine local demand rather than investor manipulation.

The area’s reputation as a premier trout fishing destination and its established vacation rental market provide economic fundamentals that support the $251,849 median price point. Unlike communities experiencing rapid speculation, Tumbling Shoals benefits from long-term residents and regular visitors who understand local market conditions, preventing the price distortions that plague investor-heavy markets elsewhere in the state.

14. Booneville – Investor Feeding Frenzy Factor 2.40% (July 2025)

- Historical annual growth rate (2012–2022): 6.58%

- Recent annual growth rate (2022–2025): 6.73%

- Investor Feeding Frenzy Factor: 2.40%

- Current 2025 price: $118,395.17

Booneville demonstrates remarkably consistent growth patterns with minimal investor disruption. The town’s strong historical appreciation rate of 6.58% has continued steadily into recent years, suggesting a healthy local market driven by genuine demand rather than speculation. At $118,395, homes remain among the most affordable on this list while maintaining steady value growth.

Booneville – Mountain Town Stability in Logan County

This Logan County seat nestled in the Arkansas River Valley has maintained consistent housing demand through its role as a regional service center and its proximity to outdoor recreation opportunities in the Ouachita Mountains. Booneville’s economy benefits from its position along Interstate 40 and the presence of several manufacturing facilities, providing stable employment that supports local housing demand. The town’s historical growth rate of 6.58% reflects genuine economic fundamentals rather than speculative investment, with recent slight acceleration to 6.73% indicating healthy market conditions.

The community’s combination of affordable housing stock and access to mountain recreation creates sustained appeal for both residents and modest numbers of second-home buyers. Booneville’s median price of $118,395 represents exceptional value in today’s Arkansas market, supported by the town’s established infrastructure, schools, and proximity to both outdoor activities and employment centers without the dramatic price inflation affecting other regional markets.

13. Barling – Investor Feeding Frenzy Factor 5.17% (July 2025)

- Historical annual growth rate (2012–2022): 4.17%

- Recent annual growth rate (2022–2025): 4.39%

- Investor Feeding Frenzy Factor: 5.17%

- Current 2025 price: $193,045.70

Barling shows minimal signs of investor feeding frenzy with only slight acceleration beyond historical growth patterns. The town’s proximity to Fort Smith provides economic stability that supports steady housing demand without dramatic speculation. Current prices of $193,045 reflect the area’s appeal to both military families and civilian workers in the broader Fort Smith metropolitan area.

Barling – Fort Smith Suburb With Military Appeal

Would you like to save this?

Located just southeast of Fort Smith near the Arkansas-Oklahoma border, Barling benefits from its connection to Fort Chaffee and the broader military presence in the region. The community’s housing market reflects steady demand from military families and civilian employees working in Fort Smith, creating consistent appreciation that rarely experiences dramatic swings. The town’s 4.17% historical growth rate demonstrates the stability that comes from established employment centers and military housing allowances that provide predictable buyer demand.

Barling’s median home price of $193,045 positions it as an accessible option for military families and Fort Smith commuters seeking newer housing stock outside the urban core. The minimal 5.17% feeding frenzy factor indicates that recent slight price acceleration stems from increased regional employment rather than speculative investment, maintaining the area’s reputation as a stable housing market that serves local residents rather than outside investors.

12. Harrison – Investor Feeding Frenzy Factor 6.45% (July 2025)

- Historical annual growth rate (2012–2022): 5.05%

- Recent annual growth rate (2022–2025): 5.38%

- Investor Feeding Frenzy Factor: 6.45%

- Current 2025 price: $231,285.76

Harrison maintains relatively stable market conditions with only modest acceleration in recent price growth. The Boone County seat’s strong historical appreciation of 5.05% reflects its role as a regional center, while the slight increase to 5.38% suggests growing recognition of the area’s appeal. At $231,285, home prices reflect the town’s established amenities and proximity to Buffalo National River.

Harrison – Ozark Gateway With Regional Influence

As the county seat of Boone County and gateway to the Buffalo National River, Harrison combines small-town charm with regional economic importance. The town serves as a hub for outdoor recreation enthusiasts drawn to the nearby Buffalo River and Ozark Mountains, while also functioning as a medical and retail center for north-central Arkansas. Harrison’s steady 5.05% historical growth rate reflects its established role as a destination for retirees and outdoor enthusiasts, with recent slight acceleration indicating increased recognition of the area’s recreational and lifestyle benefits.

The community’s median price of $231,285 represents premium positioning within Arkansas markets, supported by the town’s comprehensive healthcare facilities, established downtown district, and proximity to world-class fishing and floating opportunities. Harrison’s minimal 6.45% feeding frenzy factor suggests that recent price increases stem from genuine demand growth rather than speculative investment, maintaining the area’s character as a destination for residents seeking Ozark Mountain lifestyle rather than investor profits.

11. Ward – Investor Feeding Frenzy Factor 8.67% (July 2025)

- Historical annual growth rate (2012–2022): 4.22%

- Recent annual growth rate (2022–2025): 4.59%

- Investor Feeding Frenzy Factor: 8.67%

- Current 2025 price: $209,627.45

Ward exhibits minimal investor feeding frenzy activity with moderate acceleration in housing prices over recent years. The town’s location in Pulaski County provides access to Little Rock employment while maintaining small-town character. Recent growth to 4.59% from a historical 4.22% suggests increasing recognition of Ward’s appeal, though speculation remains limited.

Ward – Little Rock Suburb With Small Town Feel

Located in southwestern Pulaski County, Ward benefits from proximity to Little Rock while maintaining rural character that appeals to families seeking space and affordability. The community’s housing market reflects steady demand from Little Rock commuters who prefer the town’s larger lots and quieter pace, with the 4.22% historical growth rate indicating consistent appreciation driven by genuine residential demand. Recent acceleration to 4.59% suggests growing recognition of Ward’s value proposition as Little Rock housing costs continue rising.

Ward’s median home price of $209,627 offers accessible homeownership for families working in the broader Little Rock metropolitan area while providing the benefits of rural living. The modest 8.67% feeding frenzy factor indicates that recent price increases reflect increased commuter demand rather than speculative investment, positioning Ward as a stable choice for residents seeking affordability and space within reasonable commuting distance of Arkansas’s capital city.

10. Beebe – Investor Feeding Frenzy Factor 12.40% (July 2025)

- Historical annual growth rate (2012–2022): 3.95%

- Recent annual growth rate (2022–2025): 4.44%

- Investor Feeding Frenzy Factor: 12.40%

- Current 2025 price: $214,103.01

Beebe shows emerging signs of investor interest with modest acceleration in price growth over recent years. The White County community’s strategic location along Highway 67 between Little Rock and Jonesboro creates appeal for both residents and potential investors. At $214,103, housing remains relatively accessible while showing increased market activity.

Beebe – Highway 67 Corridor Growth

Positioned along the busy Highway 67 corridor in White County, Beebe has experienced steady growth as both a bedroom community for Little Rock workers and a stop for travelers between Arkansas’s capital and northeast regions. The town’s historical growth rate of 3.95% reflected its role as a quiet highway community, but recent acceleration to 4.44% indicates growing recognition of Beebe’s strategic location and development potential. The community benefits from easy highway access while maintaining affordable housing that attracts young families and retirees.

Beebe’s current median price of $214,103 represents solid value for buyers seeking small-town living with metropolitan access, though the 12.40% feeding frenzy factor suggests early-stage investor attention. The town’s growing retail sector and continued residential development indicate healthy local economic conditions, but the modest speculation increase warrants monitoring to ensure housing remains accessible to local families rather than becoming dominated by outside investment interests.

9. Diamond City – Investor Feeding Frenzy Factor 16.34% (July 2025)

- Historical annual growth rate (2012–2022): 5.62%

- Recent annual growth rate (2022–2025): 6.54%

- Investor Feeding Frenzy Factor: 16.34%

- Current 2025 price: $157,121.41

Diamond City demonstrates moderate investor feeding frenzy activity with price acceleration that exceeds historical patterns. The town’s location on Bull Shoals Lake creates natural appeal for second-home buyers and vacation rental investors. Despite growing speculation, the $157,121 median price remains relatively affordable compared to other lake communities in Arkansas.

Diamond City – Bull Shoals Lake Investment Pressure

Situated on the shores of Bull Shoals Lake in Boone County, Diamond City has long attracted retirees and vacation home buyers drawn to the area’s fishing and boating opportunities. The community’s strong historical growth rate of 5.62% reflected steady demand from lake enthusiasts and retirees, but recent acceleration to 6.54% indicates increased investor interest in vacation rental properties and second homes. The town’s scenic location and recreational amenities make it a natural target for investors seeking to capitalize on Arkansas’s growing tourism industry.

Diamond City’s median price of $157,121 still offers relative affordability for a lakefront community, but the 16.34% feeding frenzy factor signals emerging concerns about investor displacement of local residents. The town’s economy depends heavily on tourism and retiree spending, making it vulnerable to speculation that could price out the service workers and young families essential to maintaining community character and seasonal business operations.

8. Bald Knob – Investor Feeding Frenzy Factor 18.33% (July 2025)

- Historical annual growth rate (2012–2022): 4.77%

- Recent annual growth rate (2022–2025): 5.64%

- Investor Feeding Frenzy Factor: 18.33%

- Current 2025 price: $161,995.35

Bald Knob shows noticeable investor feeding frenzy activity with price acceleration that suggests growing speculative interest. The White County community’s agricultural heritage and strategic location create appeal for both residential buyers and investors. Recent growth acceleration to 5.64% from 4.77% historically indicates increasing market pressure on local affordability.

Bald Knob – Agricultural Hub Under Investment Pressure

Located in White County’s agricultural heartland, Bald Knob has traditionally served as a farming community and regional service center, with housing prices reflecting the area’s rural character and agricultural economy. The town’s historical growth rate of 4.77% demonstrated steady appreciation based on local agricultural prosperity and its role as a county hub, but recent acceleration to 5.64% suggests outside investors are recognizing the area’s potential for development and speculation. The community’s location along major transportation routes and proximity to larger Arkansas cities makes it attractive for investors seeking affordable entry points.

Bald Knob’s median home price of $161,995 remains accessible compared to urban Arkansas markets, but the 18.33% feeding frenzy factor indicates concerning levels of speculative activity that could threaten housing affordability for agricultural workers and local families. The town’s economy depends on maintaining affordable housing for farm workers and service industry employees, making investor-driven price increases particularly problematic for sustaining the community’s agricultural character and economic base.

7. McRae – Investor Feeding Frenzy Factor 31.84% (July 2025)

- Historical annual growth rate (2012–2022): 3.18%

- Recent annual growth rate (2022–2025): 4.20%

- Investor Feeding Frenzy Factor: 31.84%

- Current 2025 price: $183,023.51

McRae exhibits significant investor feeding frenzy activity with substantial acceleration beyond historical growth patterns. The White County community has seen recent annual growth jump to 4.20% from a modest historical rate of 3.18%, indicating growing speculative pressure. At $183,023, housing costs reflect increasing investor interest in this previously stable market.

McRae – White County Town Facing Speculation Surge

This small White County community has traditionally maintained modest housing appreciation reflective of its rural character and agricultural economy, with the historical 3.18% growth rate indicating stable local demand without significant outside pressure. However, recent acceleration to 4.20% represents a dramatic 31.84% increase in speculation activity, suggesting investors are targeting McRae for its affordability and potential development opportunities. The town’s proximity to larger Arkansas cities and available land for development make it attractive to investors seeking undervalued markets.

McRae’s current median price of $183,023 still offers relative affordability, but the significant 31.84% feeding frenzy factor indicates substantial investor pressure that threatens local housing accessibility. The community’s economy and character depend on maintaining affordable housing for working families and retirees, making the surge in speculative activity particularly concerning for long-term residents who may find themselves priced out of their own community as outside investment distorts local market conditions.

6. Judsonia – Investor Feeding Frenzy Factor 45.69% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 4.24%

- Recent annual growth rate (2022–2025): 6.18%

- Investor Feeding Frenzy Factor: 45.69%

- Current 2025 price: $178,078.30

Judsonia demonstrates substantial investor feeding frenzy activity with dramatic price acceleration that signals significant speculative pressure. The White County seat has experienced recent growth jumping to 6.18% from a historical 4.24%, creating affordability concerns for local residents. Despite speculation, the $178,078 median price remains below many Arkansas markets.

Judsonia – County Seat Under Investment Siege

As the county seat of White County, Judsonia traditionally maintained steady housing demand based on its government employment and regional service role, with the historical 4.24% appreciation rate reflecting stable local economic conditions. However, recent acceleration to 6.18% represents a concerning 45.69% increase in speculative activity, indicating that investors are aggressively targeting this previously affordable community. The town’s courthouse square, established infrastructure, and central location make it attractive to speculators seeking undervalued properties with development potential.

Judsonia’s median price of $178,078 still provides relative affordability compared to larger Arkansas cities, but the significant 45.69% feeding frenzy factor signals serious displacement risk for working families and longtime residents. The community’s role as a county seat requires affordable housing for government workers, teachers, and service employees, making investor-driven speculation particularly problematic for maintaining the workforce necessary to support essential county services and local businesses.

5. Perryville – Investor Feeding Frenzy Factor 58.62% (July 2025)

- Historical annual growth rate (2012–2022): 3.39%

- Recent annual growth rate (2022–2025): 5.38%

- Investor Feeding Frenzy Factor: 58.62%

- Current 2025 price: $160,111.05

Perryville shows severe investor feeding frenzy activity with price acceleration that dramatically exceeds historical patterns. The Perry County seat has experienced recent growth surge to 5.38% from a modest historical 3.39%, indicating dangerous levels of speculation. At $160,111, the median price reflects significant investor pressure on this previously affordable community.

Perryville – Arkansas River Valley Speculation Hotspot

Located in the Arkansas River Valley, Perryville has historically served as a quiet county seat with modest housing appreciation that reflected its agricultural economy and small-town character. The town’s historical growth rate of 3.39% indicated stable local conditions without significant outside pressure, but recent acceleration to 5.38% represents a massive 58.62% increase in speculative activity that threatens the community’s affordability and character. Investors appear drawn to the area’s scenic river valley location and undervalued properties relative to other Arkansas markets.

Perryville’s current median price of $160,111 remains accessible compared to urban Arkansas markets, but the severe 58.62% feeding frenzy factor indicates dangerous levels of speculation that risk displacing local families and workers. The community’s economy depends on affordable housing for agricultural workers, government employees, and small business owners, making the dramatic surge in investor activity particularly concerning for maintaining the workforce and community character that define this Arkansas River Valley town.

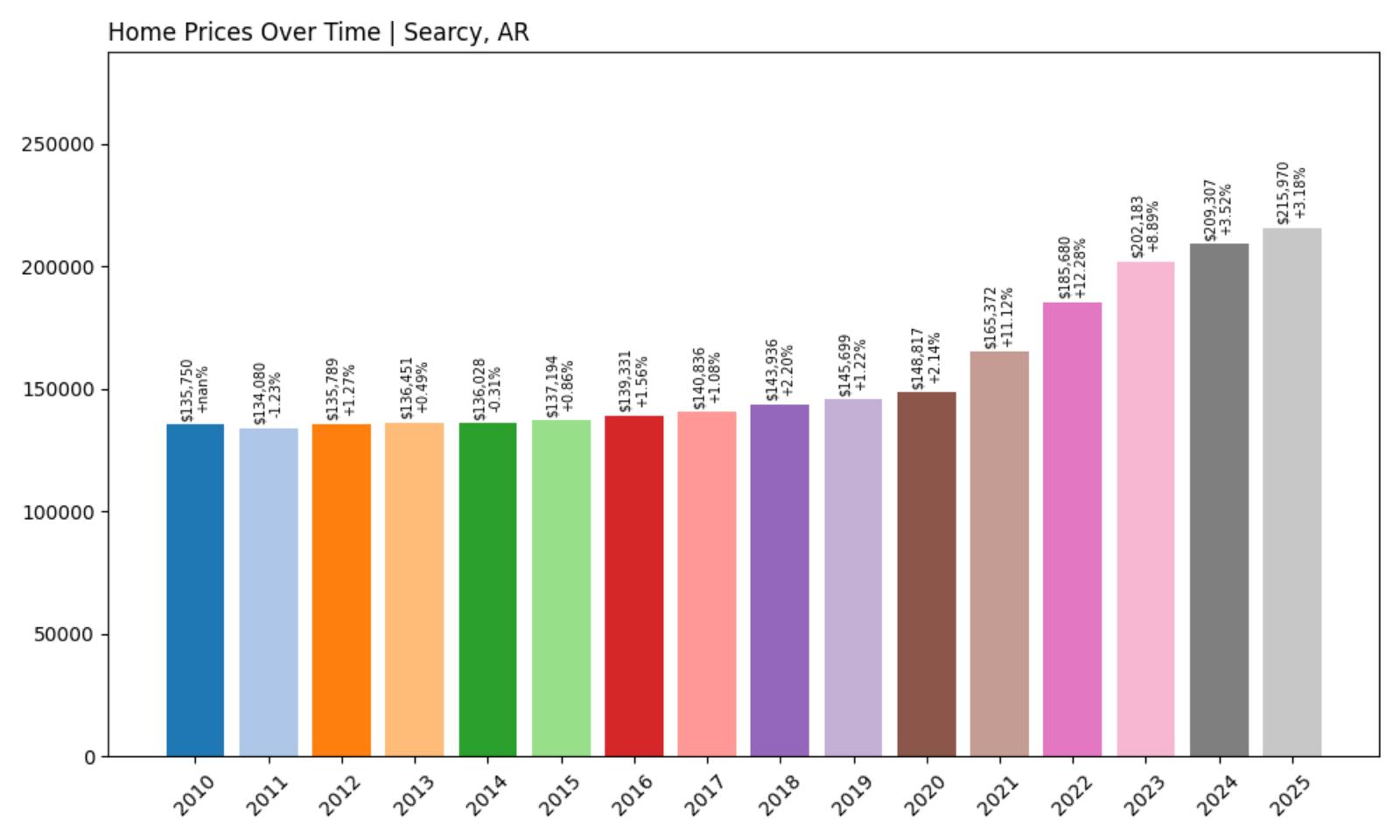

4. Searcy – Investor Feeding Frenzy Factor 62.53% (July 2025)

- Historical annual growth rate (2012–2022): 3.18%

- Recent annual growth rate (2022–2025): 5.17%

- Investor Feeding Frenzy Factor: 62.53%

- Current 2025 price: $215,969.83

Searcy demonstrates dangerous investor feeding frenzy levels with recent price acceleration far exceeding historical patterns. The White County community and home to Harding University has seen growth surge from 3.18% historically to 5.17% recently, creating significant affordability challenges. The $215,969 median price reflects substantial speculative pressure on this college town.

Searcy – College Town Investment Target

As home to Harding University and the largest city in White County, Searcy has traditionally maintained modest housing appreciation that balanced student housing demand with local economic conditions. The town’s historical 3.18% growth rate reflected stable demand from university employees, students, and regional workers, but recent acceleration to 5.17% represents a dramatic 62.53% increase in speculative activity that threatens both student housing affordability and local family homeownership. Investors appear drawn to the guaranteed rental demand from university students and the town’s regional economic importance.

Searcy’s median price of $215,969 reflects the impact of sustained investor pressure on what was once an affordable college community, with the severe 62.53% feeding frenzy factor indicating dangerous displacement risks for university employees, local families, and the service workers who support the college economy. The speculation threatens the community’s character as an accessible college town and creates challenges for Harding University in maintaining affordable housing options for students and faculty essential to the institution’s continued success.

3. Mount Ida – Investor Feeding Frenzy Factor 80.10% (July 2025)

- Historical annual growth rate (2012–2022): 4.65%

- Recent annual growth rate (2022–2025): 8.37%

- Investor Feeding Frenzy Factor: 80.10%

- Current 2025 price: $237,166.64

Mount Ida exhibits extreme investor feeding frenzy activity with price acceleration that represents severe market distortion. The Montgomery County seat has experienced dramatic growth acceleration to 8.37% from a historical 4.65%, indicating dangerous speculation levels. At $237,166, housing costs reflect substantial investor pressure that threatens local affordability.

Mount Ida – Ouachita Mountains Speculation Crisis

Located in the heart of the Ouachita Mountains, Mount Ida has long attracted visitors for its crystal mining, Lake Ouachita recreation, and mountain scenery, with historical housing appreciation of 4.65% reflecting steady demand from retirees and second-home buyers. However, recent acceleration to 8.37% represents a catastrophic 80.10% increase in speculative activity, indicating that investors are aggressively targeting this mountain community for vacation rentals and speculative purchases. The town’s proximity to Lake Ouachita and Hot Springs makes it particularly attractive to investors seeking to capitalize on Arkansas’s growing tourism industry.

Mount Ida’s median price of $237,166 reflects the severe impact of speculation on what was once an affordable mountain community, with the extreme 80.10% feeding frenzy factor signaling a crisis-level threat to local housing accessibility. The community’s economy depends on tourism service workers, retirees on fixed incomes, and local business owners who cannot compete with investor cash offers and inflated pricing, creating a dangerous scenario where the very people who make the town function are being priced out by speculation targeting the area’s natural beauty and recreational amenities.

2. Rector – Investor Feeding Frenzy Factor 81.28% (July 2025)

- Historical annual growth rate (2012–2022): 5.12%

- Recent annual growth rate (2022–2025): 9.28%

- Investor Feeding Frenzy Factor: 81.28%

- Current 2025 price: $119,929.04

Rector shows extreme investor feeding frenzy activity with recent price acceleration representing severe market disruption. The Clay County community has experienced dramatic growth surge to 9.28% from a solid historical 5.12%, indicating crisis-level speculation. Despite the feeding frenzy, the $119,929 median price remains among the most affordable on this list, likely driving continued investor interest.

Rector – Northeast Arkansas Under Siege

This small Clay County community in northeast Arkansas has traditionally maintained steady housing demand based on its agricultural economy and regional location, with the historical 5.12% appreciation rate reflecting healthy local conditions without excessive speculation. However, recent acceleration to 9.28% represents a devastating 81.28% increase in speculative activity, indicating that investors are aggressively targeting Rector for its combination of affordability and potential returns. The town’s proximity to larger regional markets and agricultural land development opportunities make it attractive to speculators seeking maximum profit potential.

Rector’s current median price of $119,929 represents exceptional affordability in today’s Arkansas market, but the extreme 81.28% feeding frenzy factor indicates that this affordability is under severe threat from investor speculation. The community’s agricultural economy depends on affordable housing for farm workers and rural families, making the dramatic surge in speculative activity particularly dangerous for maintaining the workforce and community character essential to northeast Arkansas’s agricultural heritage and rural way of life.

1. Manila – Investor Feeding Frenzy Factor 182.50% (July 2025)

- Historical annual growth rate (2012–2022): 2.66%

- Recent annual growth rate (2022–2025): 7.51%

- Investor Feeding Frenzy Factor: 182.50%

- Current 2025 price: $201,022.45

Manila demonstrates catastrophic investor feeding frenzy activity with the most extreme price acceleration in Arkansas. This Mississippi County community has experienced explosive growth from a modest historical 2.66% to a staggering 7.51% recently, representing unprecedented speculation levels. The $201,022 median price reflects the devastating impact of investor pressure on this previously affordable Delta community.

Manila – Arkansas Delta Speculation Disaster

Located in Mississippi County in the Arkansas Delta, Manila traditionally maintained minimal housing appreciation that reflected the region’s agricultural economy and modest population growth, with the historical 2.66% rate indicating stable local conditions without significant outside pressure. However, recent acceleration to 7.51% represents a catastrophic 182.50% increase in speculative activity, the highest feeding frenzy factor in Arkansas, indicating that investors have completely distorted this rural market. The town’s proximity to major agricultural operations and potential for development speculation has attracted aggressive investor interest that threatens to destroy the community’s rural character.

Manila’s median price of $201,022 reflects the devastating impact of unprecedented speculation on what was once among Arkansas’s most affordable communities, with the catastrophic 182.50% feeding frenzy factor representing a complete market failure that prioritizes investor profits over local housing needs. The community’s agricultural economy depends entirely on affordable housing for farm workers, processing plant employees, and rural families who cannot compete with investor cash offers and speculative pricing, creating a crisis that threatens the very existence of this Delta community as a place where working families can afford to live.