Would you like to save this?

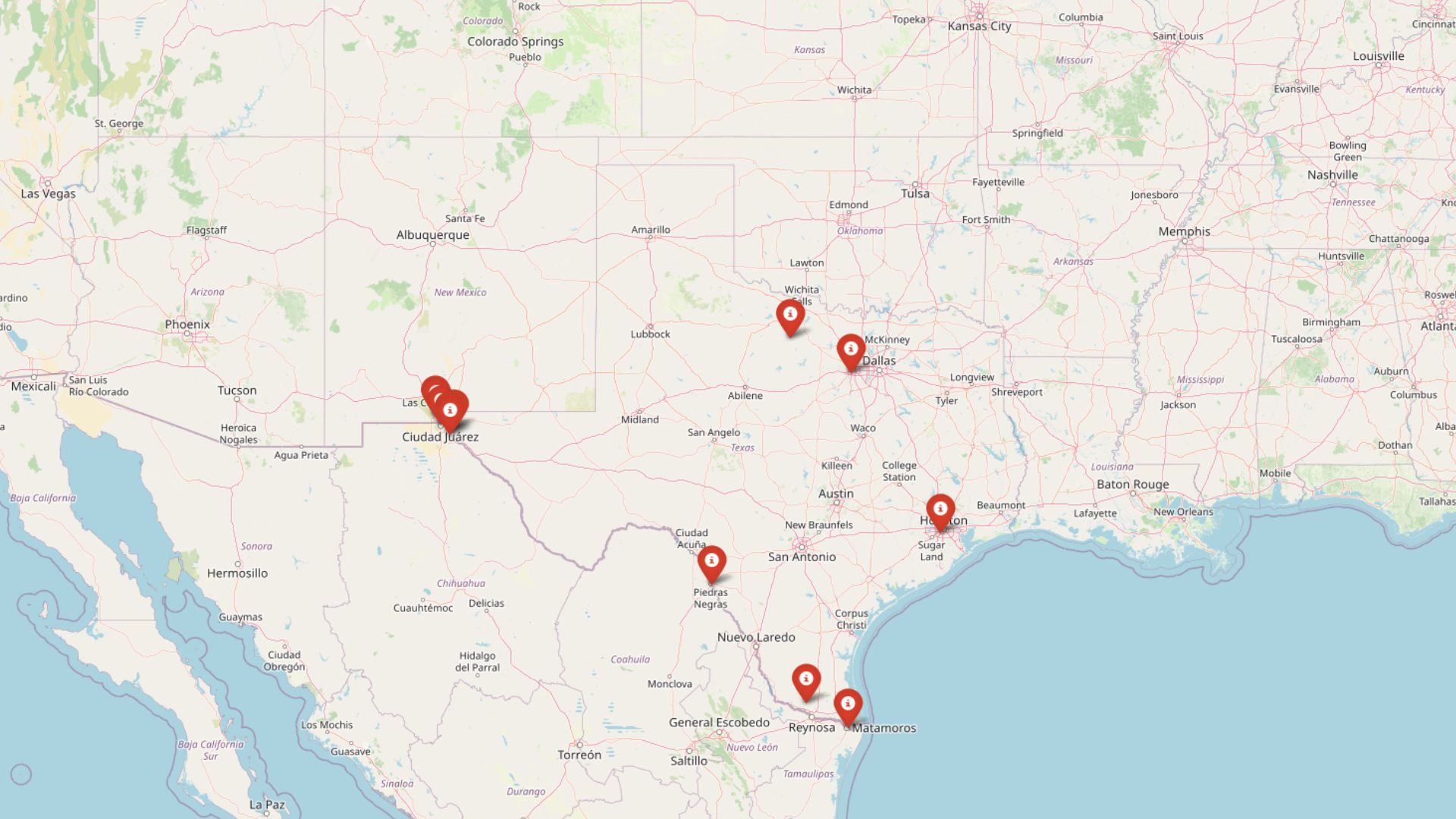

Investors are reshaping the Texas housing market — and not always for the better. According to the Zillow Home Value Index, twelve towns are experiencing sharp, investor-driven price spikes that far exceed historical norms. These fast-moving markets have all the hallmarks of speculative bubbles, leaving many longtime residents priced out while property values swing wildly on investor demand.

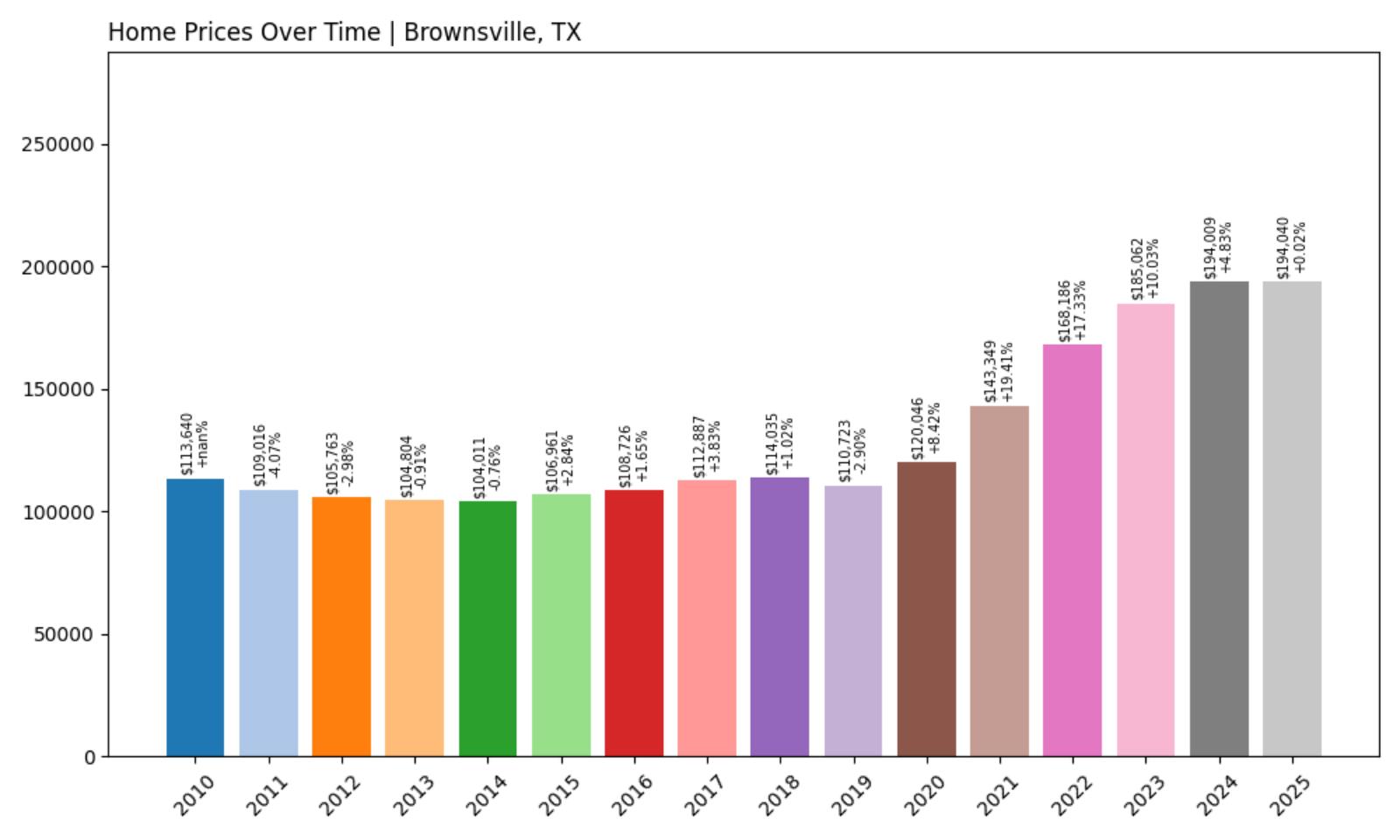

12. Brownsville – Investor Feeding Frenzy Factor 2.82% (July 2025)

- Historical annual growth rate (2012–2022): 4.75%

- Recent annual growth rate (2022–2025): 4.88%

- Investor Feeding Frenzy Factor: 2.82%

- Current 2025 price: $194,040.25

Brownsville shows the most modest investor pressure among our analyzed communities, with recent price acceleration remaining relatively controlled. The border city has seen steady but manageable growth, with current median prices still accessible to many local families earning typical South Texas wages.

Brownsville – Border Economics Drive Steady Growth

Brownsville sits at the southernmost tip of Texas, directly across from Matamoros, Mexico, making it a crucial hub for international trade and commerce. The city’s economy relies heavily on cross-border business, the Port of Brownsville, and proximity to South Padre Island’s tourism industry. With a population of roughly 185,000, Brownsville offers relatively affordable housing compared to other Texas metros. The modest investor feeding frenzy factor suggests the market remains primarily driven by local demand rather than speculative investment.

Current median prices around $194,000 keep homeownership within reach for many residents, particularly those working in logistics, healthcare, and education sectors that form the backbone of the local economy. The steady 4.88% recent growth rate indicates healthy appreciation without the dramatic spikes seen in other Texas communities.

11. Canutillo – Investor Feeding Frenzy Factor 3.23% (July 2025)

- Historical annual growth rate (2012–2022): 3.74%

- Recent annual growth rate (2022–2025): 3.86%

- Investor Feeding Frenzy Factor: 3.23%

- Current 2025 price: $218,292.22

Canutillo demonstrates minimal investor feeding frenzy activity, with recent price growth barely exceeding historical patterns. This small El Paso County community has maintained relatively stable pricing, though current median values around $218,000 reflect the broader West Texas market dynamics.

Canutillo – Desert Community Maintains Affordability

Kitchen Style?

Located northwest of El Paso along the Rio Grande, Canutillo serves as a predominantly Hispanic community with deep agricultural roots in the Chihuahuan Desert region. The unincorporated area houses approximately 6,000 residents who benefit from proximity to El Paso’s job market while maintaining a more rural lifestyle. Local schools serve as community anchors, with Canutillo Independent School District providing educational services across the area.

The minimal 3.23% investor feeding frenzy factor indicates this market remains driven by local buyers rather than outside speculation. Current median prices around $218,000 reflect the area’s position within El Paso County’s housing ecosystem, where desert geography and border economics create unique market conditions. The stable growth pattern suggests families can still find affordable options without competing against waves of investor capital.

10. El Paso – Investor Feeding Frenzy Factor 3.37% (July 2025)

- Historical annual growth rate (2012–2022): 4.48%

- Recent annual growth rate (2022–2025): 4.63%

- Investor Feeding Frenzy Factor: 3.37%

- Current 2025 price: $231,159.20

El Paso shows surprisingly low investor feeding frenzy activity for a major Texas city, with recent price acceleration remaining modest. The Sun City’s market appears resistant to the speculative pressures affecting other Texas communities, maintaining steady growth patterns that align with local economic fundamentals.

El Paso – Sun City Resists Speculation Bubble

El Paso stands as Texas’s sixth-largest city with over 680,000 residents, positioned strategically where Texas, New Mexico, and Mexico converge along the Rio Grande. The city’s economy centers on military installations like Fort Bliss, international trade through multiple border crossings, and manufacturing operations that benefit from NAFTA agreements. Downtown revitalization efforts and the University of Texas at El Paso provide additional economic anchors. Despite its size and economic importance, El Paso has largely avoided the investor feeding frenzies plaguing other Texas markets.

The 3.37% feeding frenzy factor suggests local buyers still compete primarily against other locals rather than institutional investors. Current median prices around $231,000 remain reasonable for a major metropolitan area, particularly given El Paso’s relatively high wages in military, healthcare, and trade sectors.

9. Sparks – Investor Feeding Frenzy Factor 4.21% (July 2025)

- Historical annual growth rate (2012–2022): 5.19%

- Recent annual growth rate (2022–2025): 5.40%

- Investor Feeding Frenzy Factor: 4.21%

- Current 2025 price: $175,653.20

Sparks exhibits minimal investor pressure with recent growth rates only slightly exceeding historical patterns. This small East Texas community maintains some of the most affordable median prices in our analysis, suggesting local market conditions continue to drive pricing rather than external speculation.

Sparks – East Texas Affordability Persists

Sparks operates as a small rural community in East Texas, where pine forests and agricultural land create a distinctly different economic environment from the state’s major metropolitan areas. The town’s economy traditionally relies on timber, farming, and small-scale manufacturing, with many residents commuting to larger nearby cities for employment opportunities. Local schools and community centers serve as gathering points for this tight-knit population.

The low 4.21% investor feeding frenzy factor indicates Sparks remains largely insulated from the speculative investment waves hitting other Texas communities. Current median prices around $175,000 represent exceptional affordability, even by Texas standards, making this area attractive to first-time buyers and families seeking rural lifestyles. The modest recent growth suggests healthy local demand without the artificial inflation created by investor competition.

8. Bellaire – Investor Feeding Frenzy Factor 8.32% (July 2025)

- Historical annual growth rate (2012–2022): 4.25%

- Recent annual growth rate (2022–2025): 4.60%

- Investor Feeding Frenzy Factor: 8.32%

- Current 2025 price: $1,129,758.43

Bellaire shows moderate investor feeding frenzy activity, with recent price acceleration creating upward pressure on an already expensive market. Current median prices exceeding $1.1 million place this Houston-area enclave among Texas’s most exclusive residential markets, where even modest investor activity creates significant affordability challenges.

Bellaire – Houston Enclave Commands Premium Prices

Bellaire functions as an affluent enclave completely surrounded by Houston, offering residents a small-town atmosphere within America’s fourth-largest city. This 2.2-square-mile community houses approximately 17,000 residents who benefit from top-rated schools, tree-lined streets, and proximity to Houston’s major employment centers. The city maintains its own police and fire departments while providing easy access to the Texas Medical Center, downtown Houston, and Energy Corridor.

Even moderate investor activity creates substantial impacts in Bellaire’s luxury market, where the 8.32% feeding frenzy factor represents significant speculation pressure. Current median prices around $1.13 million reflect the community’s desirability among Houston’s professional class, but also indicate how investor interest can push already expensive markets beyond reach of even high-earning families. The premium pricing reflects both genuine local demand and speculative investment in one of Houston’s most prestigious addresses.

7. Socorro – Investor Feeding Frenzy Factor 9.47% (July 2025)

- Historical annual growth rate (2012–2022): 4.86%

- Recent annual growth rate (2022–2025): 5.32%

- Investor Feeding Frenzy Factor: 9.47%

- Current 2025 price: $205,154.36

Socorro demonstrates emerging investor feeding frenzy conditions, with recent price acceleration beginning to outpace historical growth patterns. This El Paso County community has seen modest but concerning increases in speculative activity, pushing median prices toward levels that challenge local affordability.

Socorro – El Paso Suburb Feels Pressure

Socorro sits in El Paso County as an independent city serving approximately 35,000 residents along the Rio Grande southeast of El Paso proper. The community developed around agricultural activities and has evolved into a suburban area with strong Hispanic cultural roots and family-oriented neighborhoods. Local schools, parks, and community centers provide focal points for residents who often commute to El Paso or work in regional logistics and manufacturing.

The 9.47% investor feeding frenzy factor signals growing speculative interest in this previously stable market. Current median prices around $205,000 still offer relative affordability compared to other Texas markets, but the acceleration beyond historical patterns suggests outside investors are beginning to view Socorro as an opportunity. This early-stage feeding frenzy activity could rapidly transform affordability conditions if the trend continues unchecked.

6. Westover Hills – Investor Feeding Frenzy Factor 13.05% (July 2025)

- Historical annual growth rate (2012–2022): 5.49%

- Recent annual growth rate (2022–2025): 6.21%

- Investor Feeding Frenzy Factor: 13.05%

- Current 2025 price: $2,540,503.14

Westover Hills experiences significant investor feeding frenzy activity despite already commanding the highest median prices in our analysis. Recent acceleration beyond historical patterns has pushed this exclusive Fort Worth enclave into ultra-luxury territory, where investor speculation amplifies already extreme pricing pressures.

Westover Hills – Luxury Market Enters Speculation Territory

Westover Hills operates as one of Texas’s most exclusive municipalities, encompassing just 0.3 square miles within Fort Worth’s affluent western suburbs. This tiny city houses fewer than 1,000 residents in sprawling estates and luxury homes, many featuring panoramic views of the Trinity River valley. The community maintains strict zoning requirements that preserve large lot sizes and architectural standards befitting its ultra-premium market position.

The 13.05% investor feeding frenzy factor creates extraordinary speculation pressure in an already exclusive market where current median prices exceed $2.5 million. Even wealthy professionals struggle to compete against investor capital in this rarified market segment. The acceleration beyond historical patterns suggests speculation has become a significant factor alongside genuine buyer demand, potentially pushing this exclusive enclave beyond reach of even high-net-worth families seeking luxury Texas living.

5. Olney – Investor Feeding Frenzy Factor 23.92% (July 2025)

- Historical annual growth rate (2012–2022): 5.34%

- Recent annual growth rate (2022–2025): 6.62%

- Investor Feeding Frenzy Factor: 23.92%

- Current 2025 price: $120,650.96

Olney faces substantial investor feeding frenzy pressure, with recent price acceleration significantly exceeding historical patterns. Despite maintaining relatively affordable median prices, this North Central Texas community experiences concerning speculation activity that threatens long-term affordability for local families.

Olney – Small Town Battles Big Investment Pressure

Olney serves as the county seat of Young County in North Central Texas, supporting approximately 3,200 residents in a region known for agriculture, oil production, and small-town values. The community’s economy traditionally relied on farming, ranching, and energy sector activities, with local businesses serving surrounding rural areas. Historic downtown buildings and community events maintain the area’s small-town character despite growing outside pressures.

The 23.92% investor feeding frenzy factor represents alarming speculation activity for a small rural community where current median prices around $120,000 should remain accessible to local workers. This level of investor interest suggests outside capital views Olney as an undervalued opportunity, potentially transforming a stable local market into a speculation target. The dramatic acceleration beyond historical growth patterns threatens to price out teachers, municipal workers, and other essential community members who form the backbone of small-town Texas life.

4. Vinton – Investor Feeding Frenzy Factor 37.25% (July 2025)

- Historical annual growth rate (2012–2022): 3.90%

- Recent annual growth rate (2022–2025): 5.36%

- Investor Feeding Frenzy Factor: 37.25%

- Current 2025 price: $208,854.69

Vinton experiences severe investor feeding frenzy conditions, with recent price acceleration far exceeding historical growth patterns. This El Paso County community faces intense speculation pressure that has transformed a previously stable market into a battleground between local families and investment capital.

Vinton – Border Community Under Investment Siege

Vinton operates as a small city in far West El Paso County, positioned along the New Mexico border in an area where desert landscapes meet agricultural activities. The community of roughly 2,000 residents has traditionally served families seeking affordable homeownership while maintaining access to El Paso’s employment opportunities. Local schools, parks, and community facilities anchor this tight-knit border community. The severe 37.25% investor feeding frenzy factor indicates Vinton has become a primary target for speculative investment activity.

Current median prices around $208,000 might appear reasonable, but the dramatic acceleration beyond historical patterns suggests outside investors recognize an opportunity to profit from previously affordable housing stock. This level of speculation pressure threatens to displace long-term residents and transform a stable community into an investment vehicle rather than a place where working families can build generational wealth.

3. Eagle Pass – Investor Feeding Frenzy Factor 42.39% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 3.59%

- Recent annual growth rate (2022–2025): 5.12%

- Investor Feeding Frenzy Factor: 42.39%

- Current 2025 price: $233,535.28

Eagle Pass confronts extreme investor feeding frenzy activity, with recent price acceleration creating unprecedented speculation pressure. This border city experiences some of the most severe investor competition in our analysis, fundamentally altering market dynamics for local homebuyers.

Eagle Pass – International Border City Becomes Investment Target

Eagle Pass serves as a crucial port of entry along the Texas-Mexico border, supporting approximately 29,000 residents in a community where international trade and border security create unique economic conditions. The city’s position directly across from Piedras Negras, Mexico, makes it vital for commercial traffic and cultural exchange. Local employment centers on customs operations, logistics companies, and businesses serving cross-border commerce.

The extreme 42.39% investor feeding frenzy factor represents devastating speculation pressure for a border community where current median prices around $233,000 should remain within reach of local workers. This level of investor activity suggests outside capital recognizes Eagle Pass as an undervalued opportunity, potentially due to its strategic border location and economic importance. The dramatic acceleration beyond historical patterns threatens to price out customs agents, teachers, and other essential workers who keep this international gateway functioning effectively.

2. Citrus City – Investor Feeding Frenzy Factor 42.85% (July 2025)

- Historical annual growth rate (2012–2022): 8.23%

- Recent annual growth rate (2022–2025): 11.76%

- Investor Feeding Frenzy Factor: 42.85%

- Current 2025 price: $148,799.72

Citrus City faces extreme investor feeding frenzy conditions, with recent price acceleration creating severe speculation pressure on what should be an affordable market. Despite relatively modest median prices, this South Texas community experiences devastating investor competition that threatens local homeownership opportunities.

Citrus City – Rio Grande Valley Under Investment Assault

Citrus City operates as a small community in Hidalgo County within the Rio Grande Valley, an area traditionally known for agriculture, particularly citrus farming that gives the town its name. The region’s economy relies heavily on farming, food processing, and cross-border trade with Mexico. Local families have historically found affordable homeownership opportunities in this area where median household incomes align with modest housing costs.

The extreme 42.85% investor feeding frenzy factor creates catastrophic speculation pressure for a community where current median prices around $148,000 should remain accessible to agricultural workers, teachers, and service employees. This level of investor activity represents a feeding frenzy that threatens to destroy the affordability that has made the Rio Grande Valley attractive to working families. The acceleration from an already robust 8.23% historical growth rate to 11.76% recent growth suggests speculation has become the dominant market force rather than genuine local demand.

1. San Elizario – Investor Feeding Frenzy Factor 56.74% (July 2025)

- Historical annual growth rate (2012–2022): 4.17%

- Recent annual growth rate (2022–2025): 6.54%

- Investor Feeding Frenzy Factor: 56.74%

- Current 2025 price: $173,607.69

San Elizario experiences the most severe investor feeding frenzy conditions in our analysis, with speculation pressure reaching catastrophic levels. This historic El Paso County community faces unprecedented investor competition that has fundamentally transformed local housing market dynamics and threatens to displace generations of resident families.

San Elizario – Historic Community Faces Investment Devastation

San Elizario stands as one of Texas’s oldest communities, established in the 1700s along the Rio Grande southeast of El Paso. This unincorporated area houses approximately 13,000 residents in a community rich with Hispanic cultural heritage and historical significance. The area features adobe buildings, historic churches, and cultural sites that reflect centuries of continuous habitation. Local economy traditionally centered on agriculture, small businesses, and residents commuting to El Paso for employment.

The catastrophic 56.74% investor feeding frenzy factor represents the most severe speculation pressure documented in our analysis. Current median prices around $173,000 should remain accessible to local families, but the extreme acceleration beyond historical patterns indicates outside investors have essentially taken control of the housing market. This level of feeding frenzy activity threatens to erase generations of community continuity, forcing out families whose roots in San Elizario extend back centuries and replacing them with rental properties managed by distant investment firms.

Haven't Seen Yet

Curated from our most popular plans. Click any to explore.