Would you like to save this?

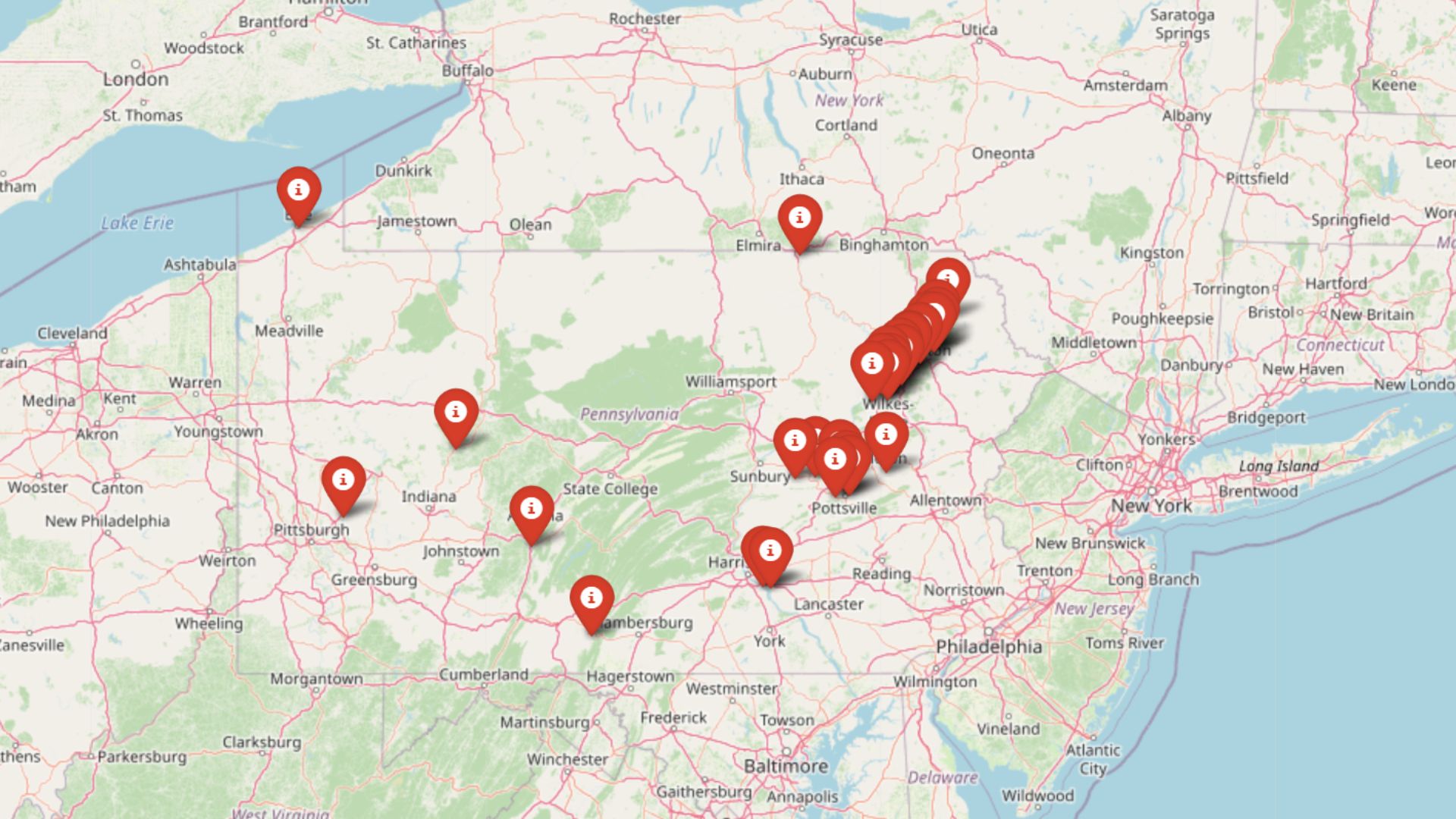

Home prices are climbing fast in dozens of Pennsylvania towns — but the reason behind the surge might surprise you. New data from the Zillow Home Value Index reveals that investor-driven speculation is reshaping local housing markets across the state. In many of these communities, price growth has far outpaced long-term trends, making it harder for everyday buyers to compete.

These aren’t flashy resort towns or luxury zip codes. In fact, many were once known for affordability and modest, steady growth. But when investor interest spikes, so do prices — often at rates thousands of percent above historical norms. By comparing recent price acceleration (2022–2025) to a decade of past performance, we’ve identified 30 towns where speculative activity is heating up fast — and the consequences are already showing.

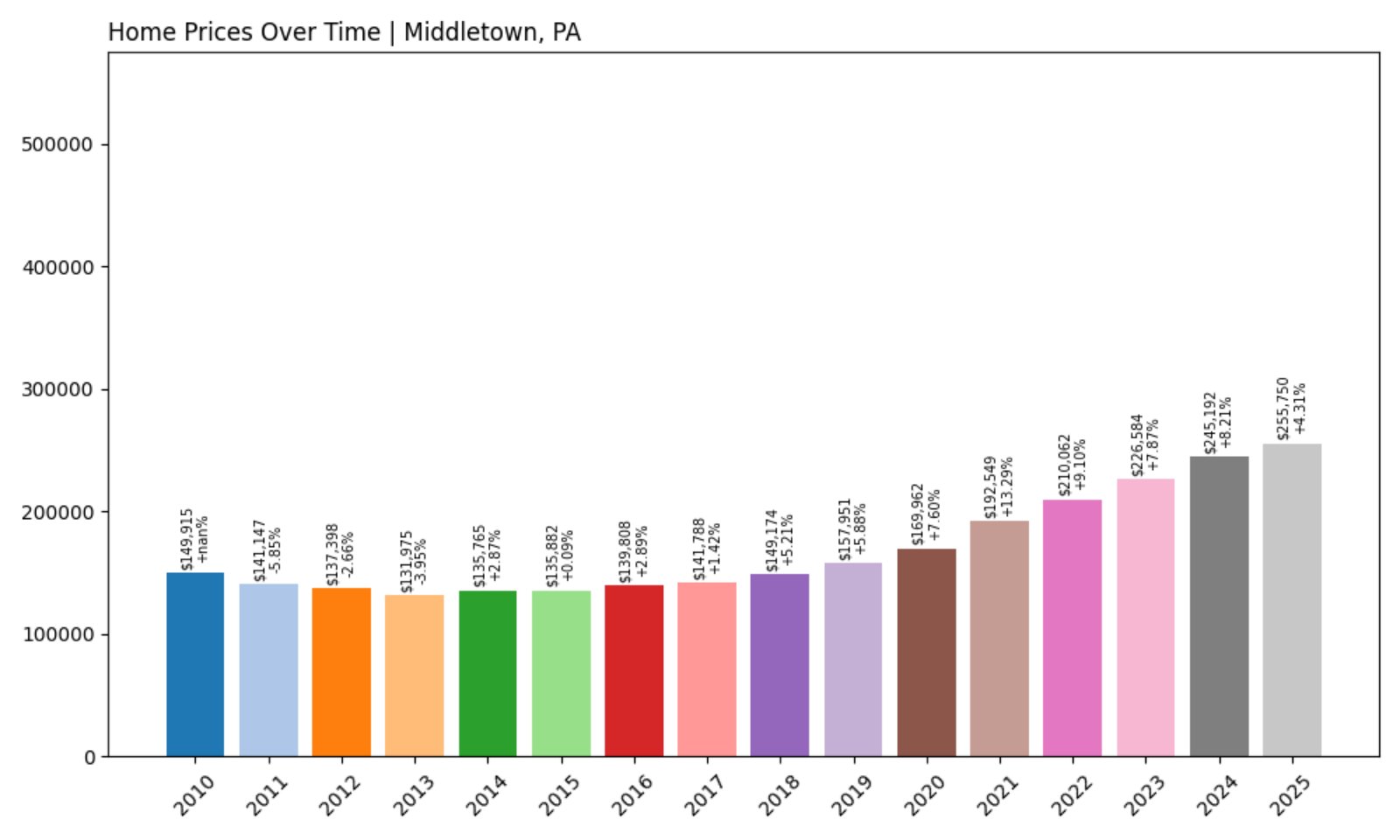

30. Middletown – Investor Feeding Frenzy Factor 56.34% (July 2025)

- Historical annual growth rate (2012–2022): 4.34%

- Recent annual growth rate (2022–2025): 6.78%

- Investor Feeding Frenzy Factor: 56.34%

- Current 2025 price: $255,750.44

Middletown’s home prices have seen a noticeable uptick in recent years. Historically, the market moved at a modest pace, but from 2022 to 2025, growth accelerated by more than 56% over its long-term trend. With a current price of over $255,000, the town is increasingly catching the eye of outside investors — potentially putting pressure on local buyers.

Middletown – Spiking Demand in a Commuter-Friendly Hub

Located in Dauphin County, Middletown offers proximity to Harrisburg International Airport and easy access to the state capital. That convenience has made it a favorite for investors hoping to capitalize on commuter demand. The recent surge in prices may reflect broader trends in Central Pennsylvania, where towns with rail and highway access are increasingly viewed as high-return investment zones. While still affordable by statewide standards, prices here have risen sharply in a short span.

The area offers a mix of historic charm and modern infrastructure, with walkable neighborhoods and decent school options. But if speculative buying continues at this pace, Middletown could quickly become unaffordable for the middle-income families who’ve long called it home.

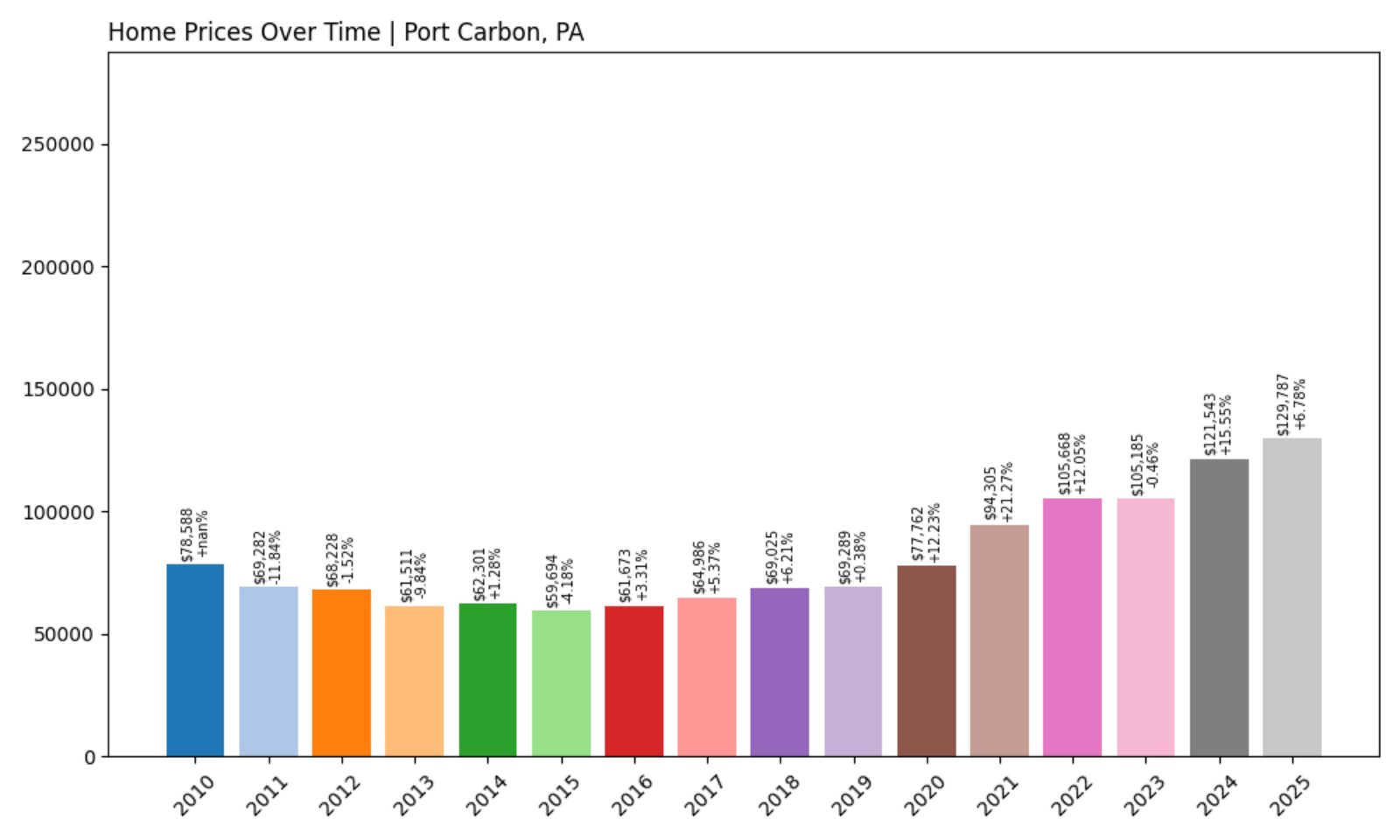

29. Port Carbon – Investor Feeding Frenzy Factor 58.63% (July 2025)

- Historical annual growth rate (2012–2022): 4.47%

- Recent annual growth rate (2022–2025): 7.09%

- Investor Feeding Frenzy Factor: 58.63%

- Current 2025 price: $129,786.80

Port Carbon’s housing market is heating up fast. Recent growth has surged well beyond its historical average, lifting the Feeding Frenzy Factor to nearly 59%. While the 2025 home value remains under $130,000, the pace of appreciation is creating new challenges for affordability in what was once a quiet borough in Schuylkill County.

Port Carbon – Affordable No Longer?

Situated near Pottsville in the heart of the coal region, Port Carbon traditionally attracted residents looking for small-town life at a budget-friendly price. But a shift is underway. As investors move in and housing inventory remains limited, prices have climbed quickly in just a few years. Even a moderate investor presence can disrupt pricing in markets this small.

Though still relatively low-cost, the town’s new trajectory could spell trouble for longtime residents hoping to buy or move up. If current trends hold, Port Carbon may soon be out of reach for the working families it once served.

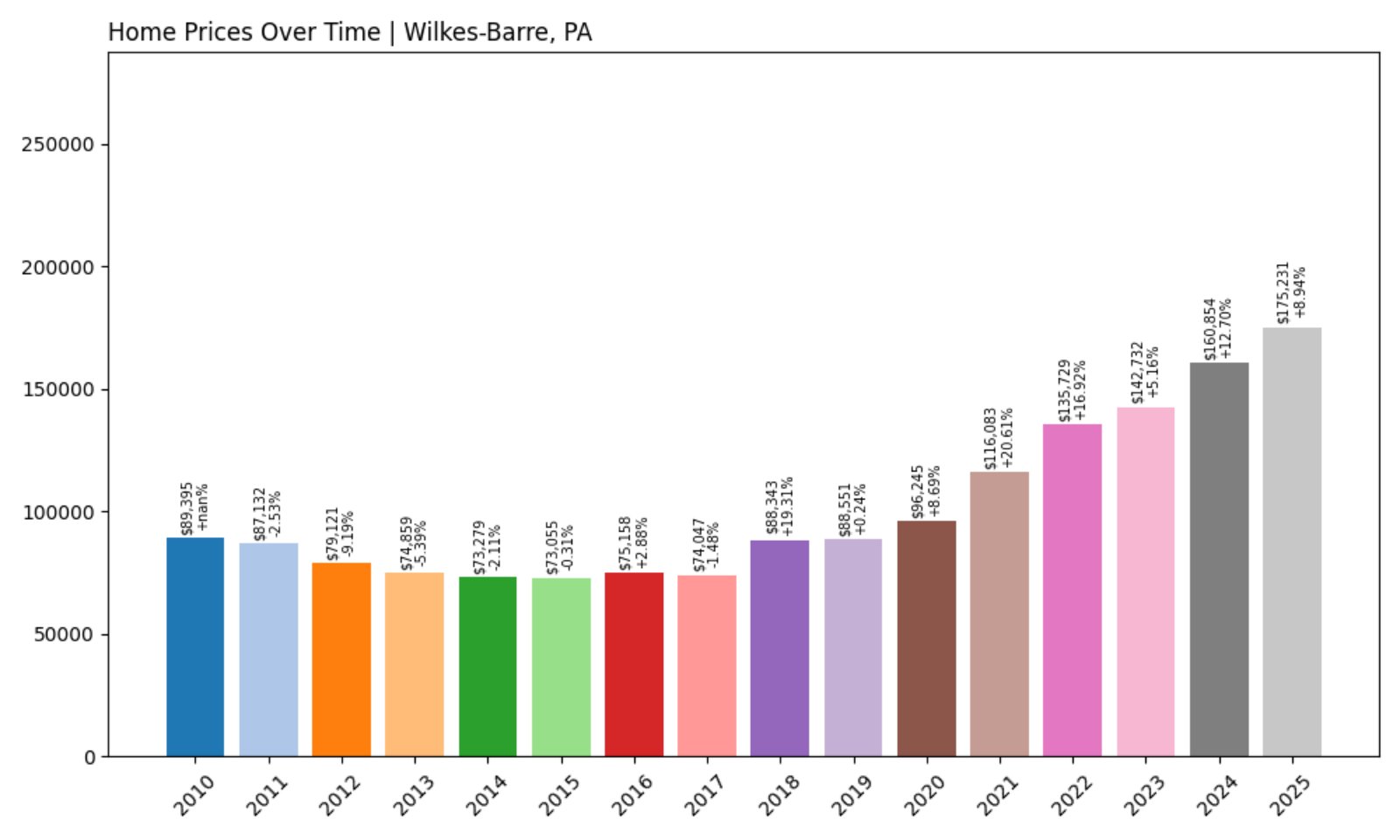

28. Wilkes-Barre – Investor Feeding Frenzy Factor 60.29% (July 2025)

- Historical annual growth rate (2012–2022): 5.55%

- Recent annual growth rate (2022–2025): 8.89%

- Investor Feeding Frenzy Factor: 60.29%

- Current 2025 price: $175,231.11

In Wilkes-Barre, home values have jumped nearly 9% annually since 2022 — a sharp deviation from the town’s long-term average. This has resulted in a Feeding Frenzy Factor of 60.29%, suggesting a noticeable ramp-up in speculative demand. With 2025 prices above $175,000, investor influence may be reshaping the market faster than expected.

Wilkes-Barre – Once Stable, Now Surging

A regional hub in northeastern Pennsylvania, Wilkes-Barre has long been viewed as a stable, blue-collar housing market. But recent price trends are rewriting that story. Revitalization efforts downtown and increased interest from out-of-area investors have fueled price spikes in neighborhoods that previously saw steady but moderate growth.

Despite a still-modest median price compared to urban markets, this rapid shift is sparking concern. Local buyers — especially first-timers — may find themselves squeezed out as investors compete for limited inventory and flip homes for profit.

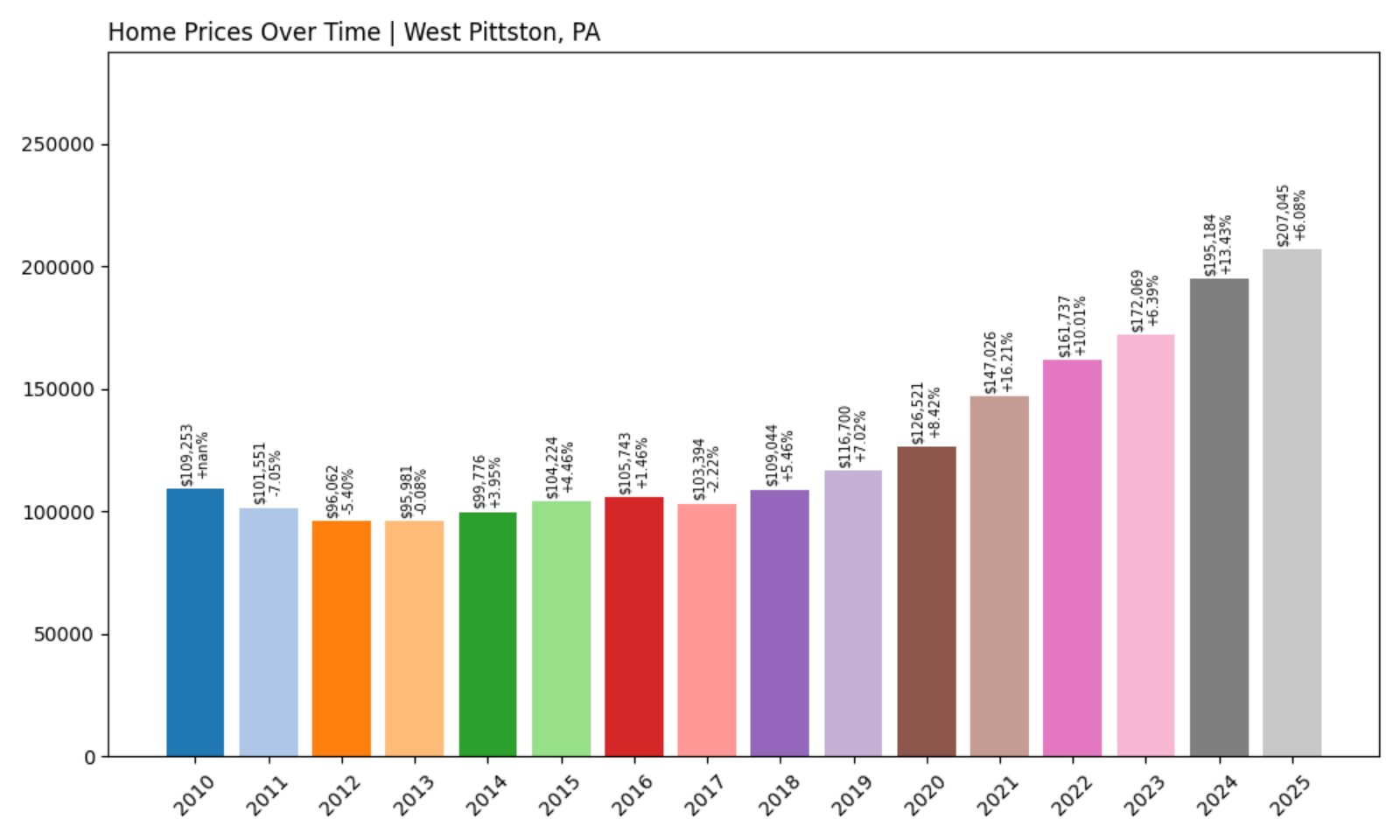

27. West Pittston – Investor Feeding Frenzy Factor 60.45% (July 2025)

- Historical annual growth rate (2012–2022): 5.35%

- Recent annual growth rate (2022–2025): 8.58%

- Investor Feeding Frenzy Factor: 60.45%

- Current 2025 price: $207,044.97

West Pittston’s price trajectory tells a familiar story: steady growth for a decade, then a sudden jolt. The recent uptick to 8.58% annually — nearly 60% above its historical average — suggests aggressive investor interest. Prices now hover above $207,000, a notable climb for a town this size.

West Pittston – A Small Town Seeing Big Changes

Nestled between Wilkes-Barre and Scranton, West Pittston has historically flown under the radar. Its riverside location and charming residential streets made it a low-key favorite for locals. But investors have started circling, particularly around fix-and-flip opportunities and short-term rentals.

With limited housing stock, even a small influx of speculative buyers can drive outsized change. The Feeding Frenzy Factor confirms that what’s happening here isn’t just organic growth — it’s a market rapidly shifting out of equilibrium.

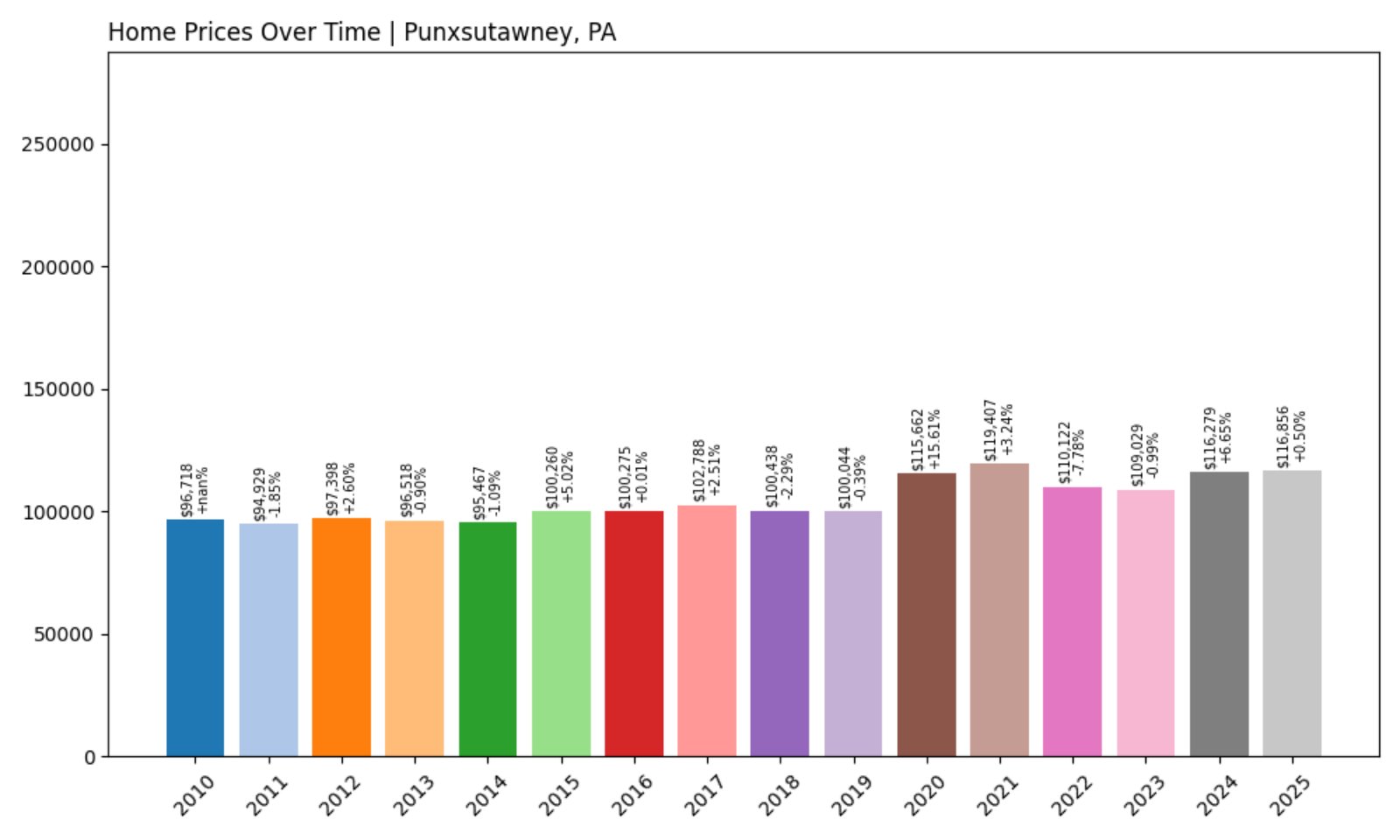

26. Punxsutawney – Investor Feeding Frenzy Factor 61.74% (July 2025)

- Historical annual growth rate (2012–2022): 1.24%

- Recent annual growth rate (2022–2025): 2.00%

- Investor Feeding Frenzy Factor: 61.74%

- Current 2025 price: $116,856.29

Famous for its Groundhog Day festivities, Punxsutawney’s housing market is now drawing attention for another reason — investor heat. The town’s Feeding Frenzy Factor of 61.74% stems from a nearly doubling of its long-term growth rate, albeit from a low base. Still, prices have surpassed $116,000 — a meaningful change for local affordability.

Punxsutawney – From Holiday Hype to Housing Surge

Jefferson County’s most famous town is no stranger to national media thanks to its groundhog, but its real estate scene is less well-known — until now. A low baseline of price growth made it fertile ground for speculative movement. Even modest investor action is enough to swing the needle in smaller communities like this.

With limited new development and rising prices, the dynamics are shifting. Whether this recent surge reflects genuine demand or speculative targeting remains to be seen, but for locals, the change is already being felt in rising costs.

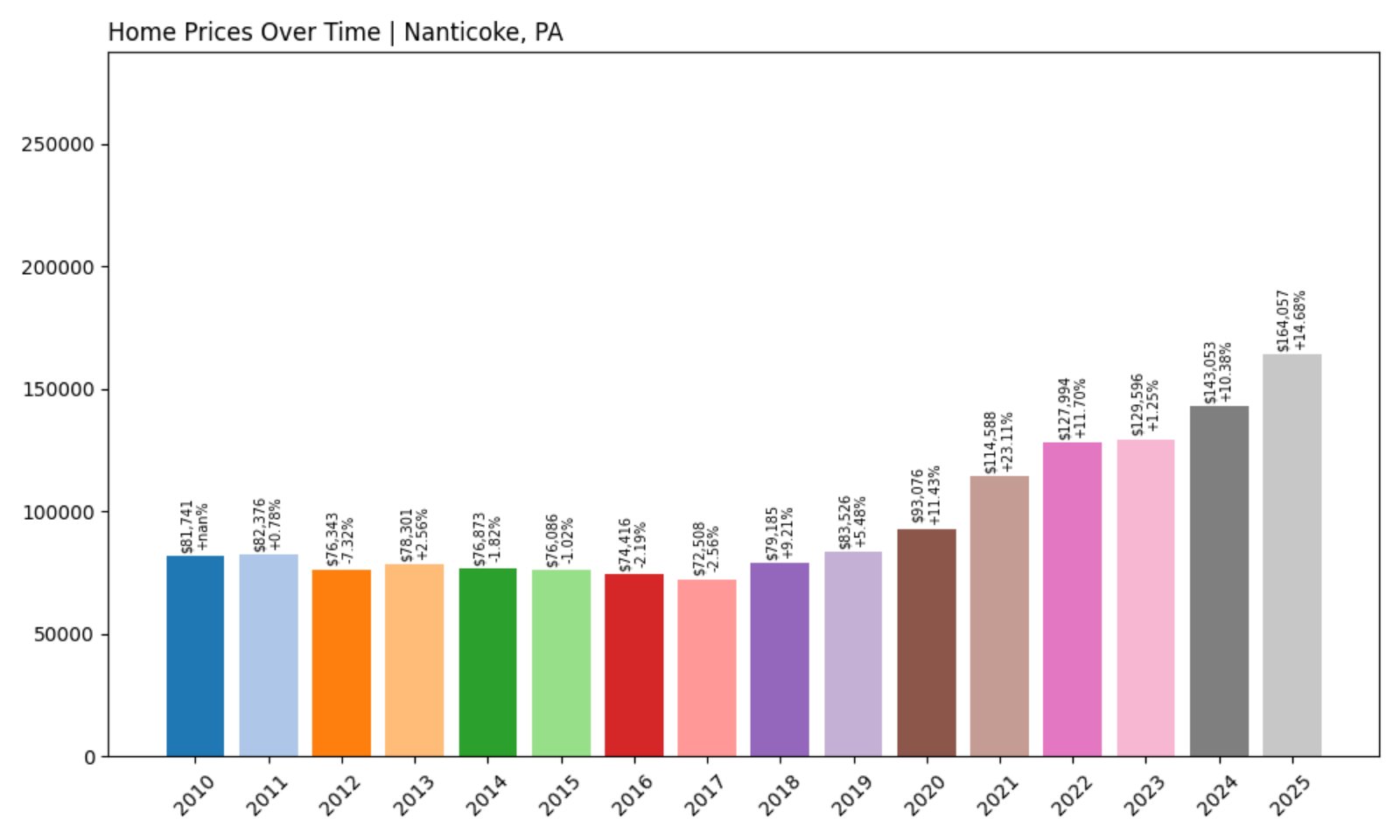

25. Nanticoke – Investor Feeding Frenzy Factor 62.66% (July 2025)

- Historical annual growth rate (2012–2022): 5.30%

- Recent annual growth rate (2022–2025): 8.63%

- Investor Feeding Frenzy Factor: 62.66%

- Current 2025 price: $164,057.12

Nanticoke has moved from steady to sizzling, with its recent growth rate rising more than 60% above its historical trend. The current median price of just over $164,000 still offers relative affordability, but the quickening pace suggests that demand—driven in part by outside investors—is beginning to reshape the market.

Nanticoke – A Former Coal Town Seeing a Revival

Located in Luzerne County, Nanticoke has deep industrial roots. Once shaped by the coal industry, it’s now seeing new waves of attention from both renters and buyers. Investors are capitalizing on its modest entry price and access to nearby Wilkes-Barre and Scranton.

Though the housing stock is older, that’s often exactly what attracts renovation-focused investors. As the Feeding Frenzy Factor shows, this once-stable market is rapidly accelerating, raising questions about how sustainable this growth really is—and who will benefit from it long-term.

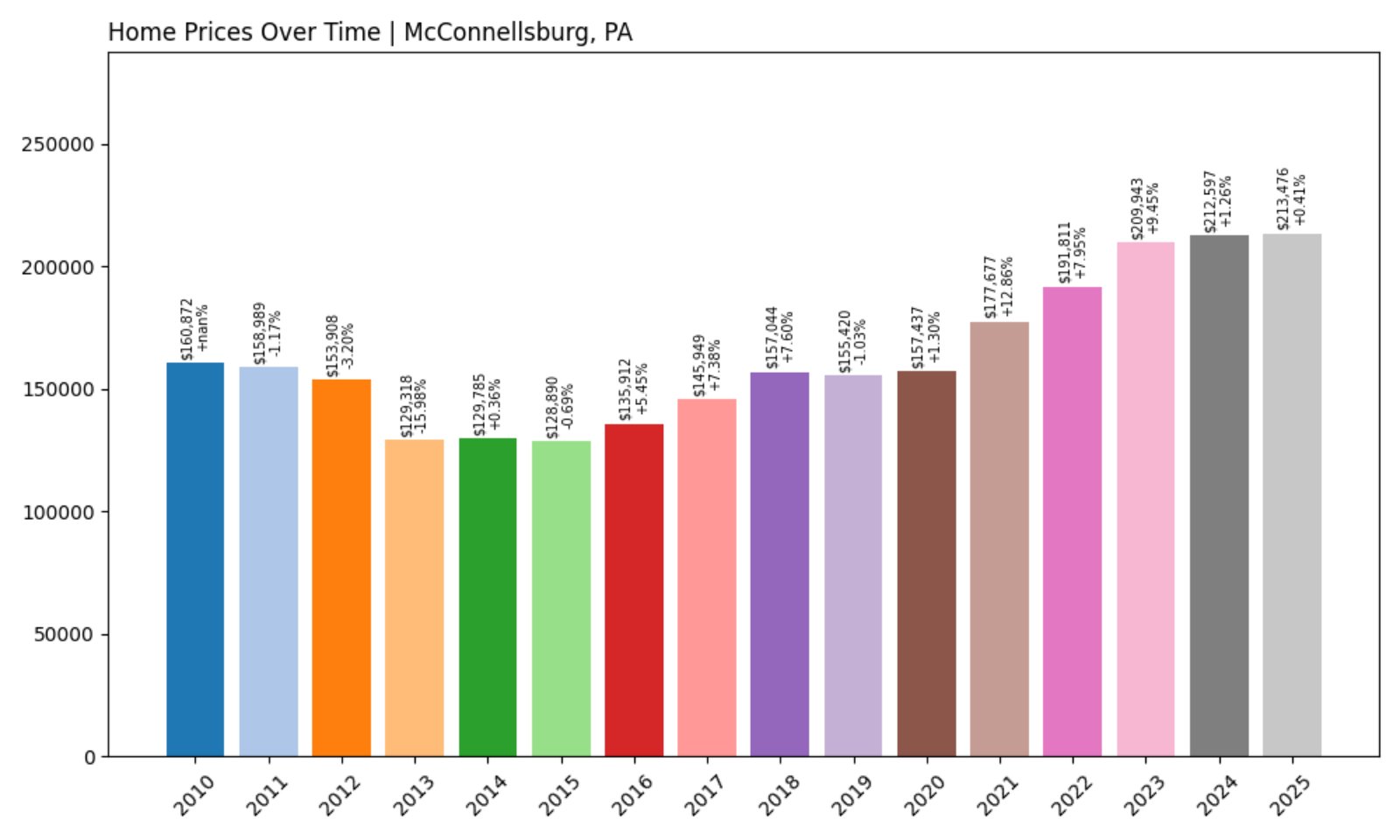

24. McConnellsburg – Investor Feeding Frenzy Factor 63.14% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 2.23%

- Recent annual growth rate (2022–2025): 3.63%

- Investor Feeding Frenzy Factor: 63.14%

- Current 2025 price: $213,475.67

McConnellsburg may be a small town, but it’s not immune to large-scale investment activity. The town’s growth rate has surged to 3.63%, a marked increase from its prior trend. This gives it a Feeding Frenzy Factor over 63%, reflecting that more buyers—possibly speculative ones—are entering the scene.

McConnellsburg – Quiet Borough, Rising Numbers

Tucked in Fulton County, McConnellsburg has long flown under the radar with its rural charm and compact downtown. But proximity to I-70 and a stable housing market have made it increasingly attractive to investors looking for untapped opportunities.

The current home price sits above $213,000—remarkable for an area that was significantly cheaper just a few years ago. With limited inventory and few new builds, prices could continue climbing unless supply catches up. The town’s affordability advantage is quickly evaporating.

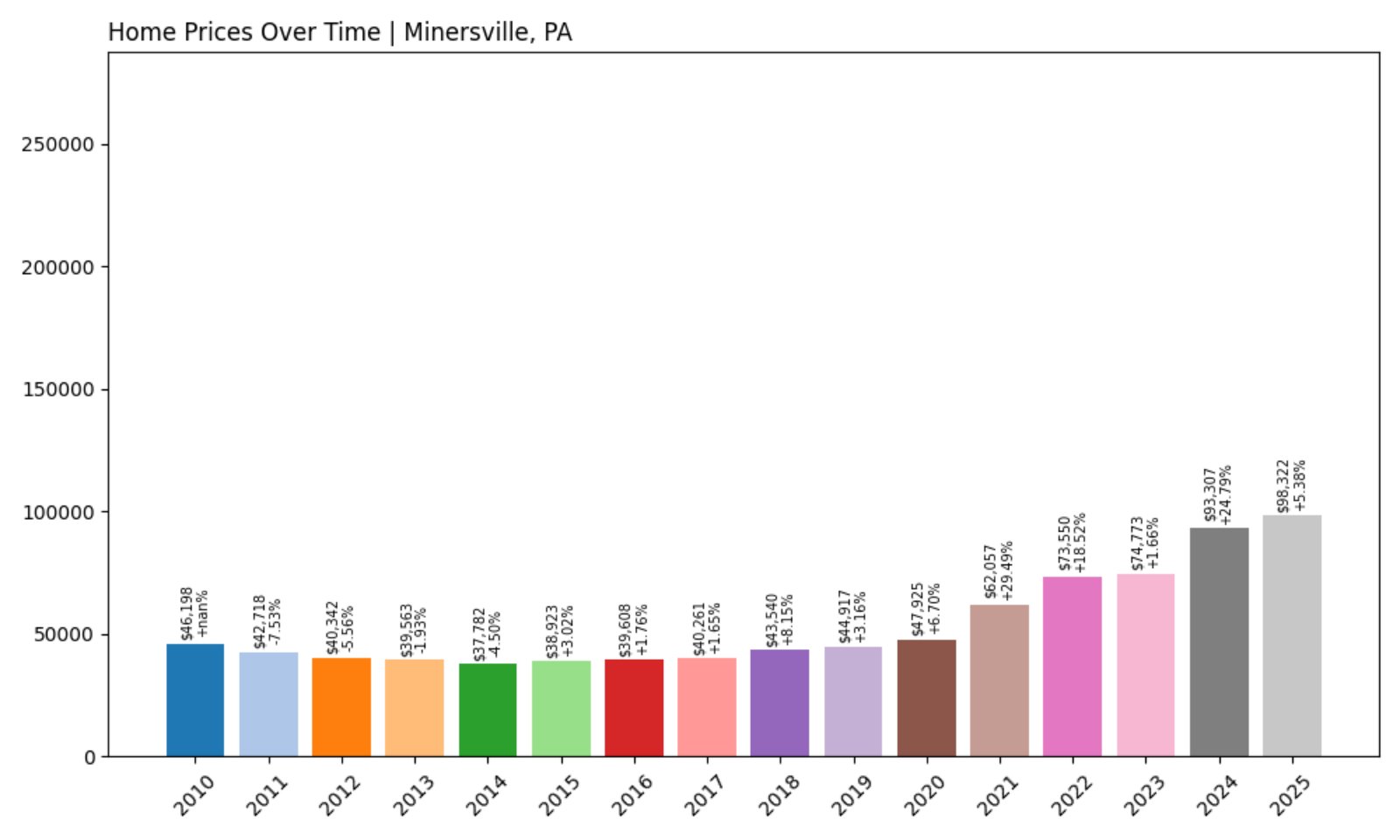

23. Minersville – Investor Feeding Frenzy Factor 64.14% (July 2025)

- Historical annual growth rate (2012–2022): 6.19%

- Recent annual growth rate (2022–2025): 10.16%

- Investor Feeding Frenzy Factor: 64.14%

- Current 2025 price: $98,322.02

With prices rising over 10% annually in the past few years, Minersville’s market is suddenly on the move. The Feeding Frenzy Factor of 64.14% flags a shift toward aggressive buying behavior in what was once an overlooked pocket of Schuylkill County. Prices remain under $100,000—for now.

Minersville – Bargain Prices Draw Outside Attention

Longtime residents of Minersville may be surprised to see their town on a hot list, but that’s what happens when prices double their historical pace. Investors are eyeing affordable boroughs like this for their low cost and profit potential.

The under-$100K price point is rare in Pennsylvania, and it’s likely part of what’s drawing attention. But with wages relatively flat and supply limited, there’s concern that this surge could hurt residents more than it helps, especially if local ownership falls behind investor purchasing.

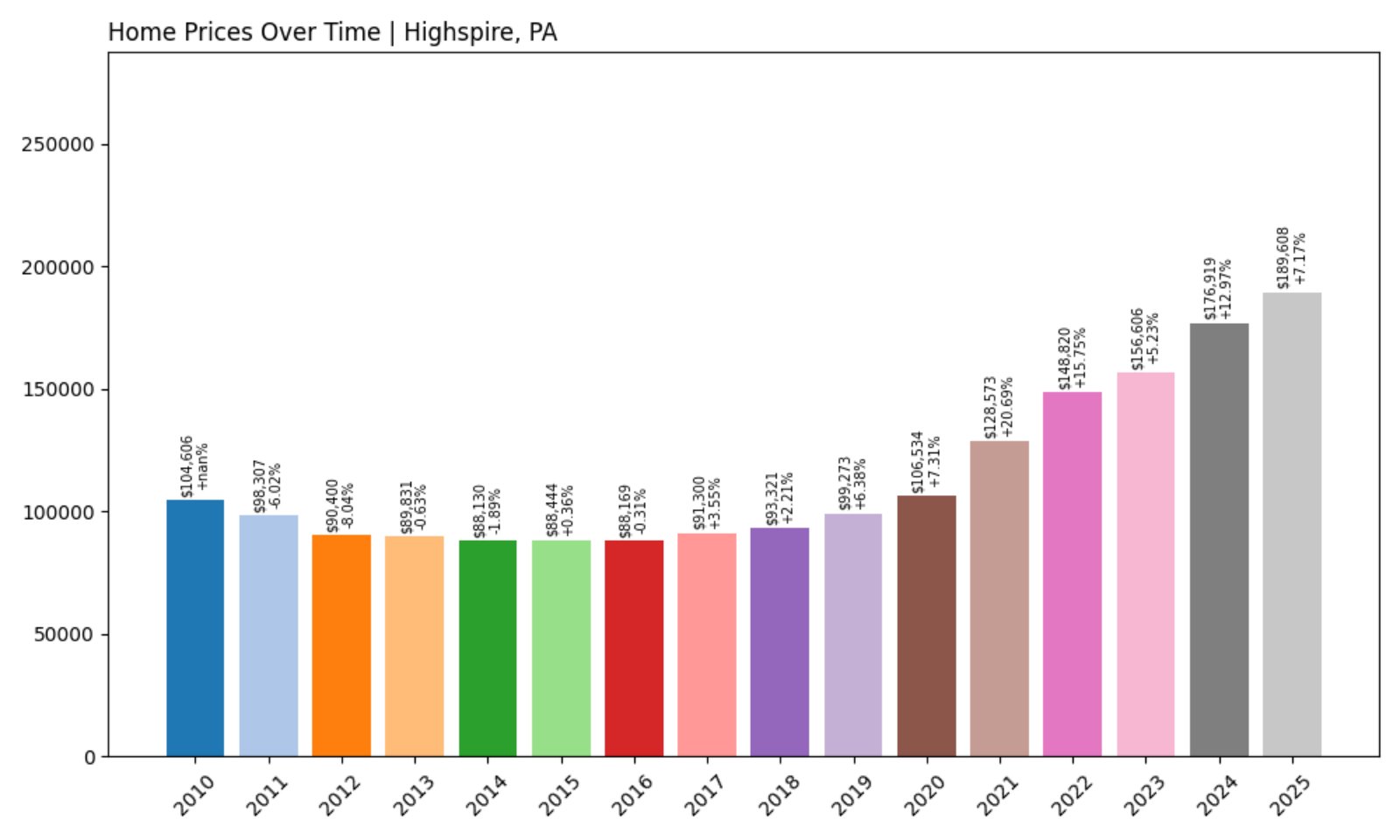

22. Highspire – Investor Feeding Frenzy Factor 64.52% (July 2025)

- Historical annual growth rate (2012–2022): 5.11%

- Recent annual growth rate (2022–2025): 8.41%

- Investor Feeding Frenzy Factor: 64.52%

- Current 2025 price: $189,608.24

Highspire has quietly become a standout in the Harrisburg metro area, with recent home price growth outpacing its past by over 64%. The current value sits just shy of $190,000, showing the shift from a quiet market into one that investors may see as high-opportunity.

Highspire – Urban Proximity Boosting Price Pressure

Located along the Susquehanna River, Highspire is minutes from Harrisburg and the airport. That convenience has helped transform this small borough into a hotspot for first-time investors and flippers. The Feeding Frenzy Factor reveals just how much that demand has accelerated since 2022.

For longtime residents, the changes may be both good and bad. Rising prices can mean more equity—but they also mean higher barriers to entry for new buyers. The rapid growth has put Highspire on the speculative map, and its future now depends on how much investor activity continues.

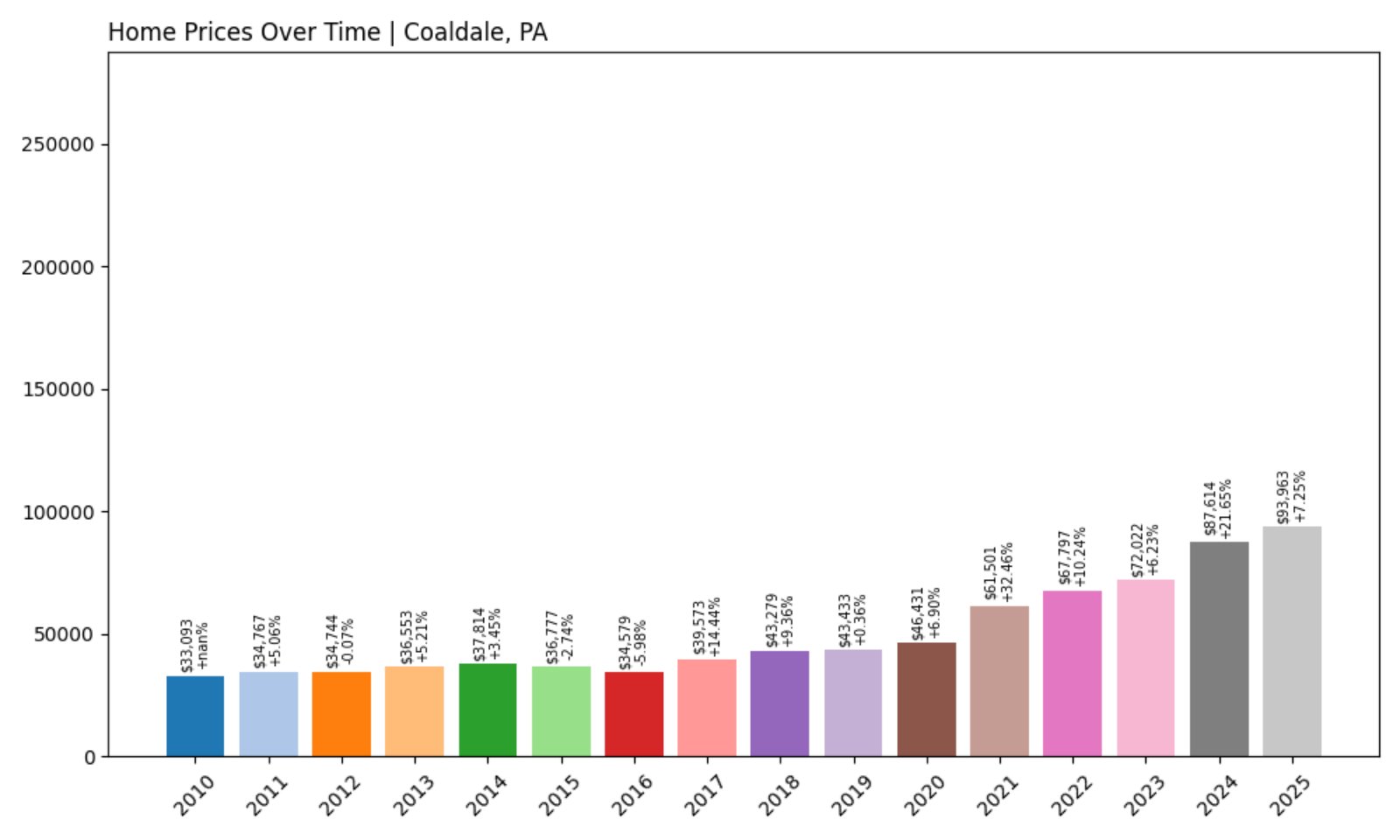

21. Coaldale – Investor Feeding Frenzy Factor 66.24% (July 2025)

- Historical annual growth rate (2012–2022): 6.91%

- Recent annual growth rate (2022–2025): 11.49%

- Investor Feeding Frenzy Factor: 66.24%

- Current 2025 price: $93,963.40

In Coaldale, home prices have jumped from already-solid growth into double-digit territory. A recent annual rate of 11.49%—up from 6.91% historically—puts its Feeding Frenzy Factor at over 66%. Yet the average home price remains under $94,000, raising eyebrows among affordability watchers.

Coaldale – A Small Town with Big Price Shifts

Coaldale lies on the edge of the Pocono region and has long offered affordable housing to buyers priced out of other markets. But with recent price acceleration, it’s clear the town is no longer flying under the radar. Some of the new interest is likely investor-driven, given the town’s extremely low base pricing.

That combination—rapid growth and low cost—creates prime conditions for speculation. Residents may soon face steeper property tax bills and tighter competition, especially if investor flips and rentals begin to dominate the local housing stock.

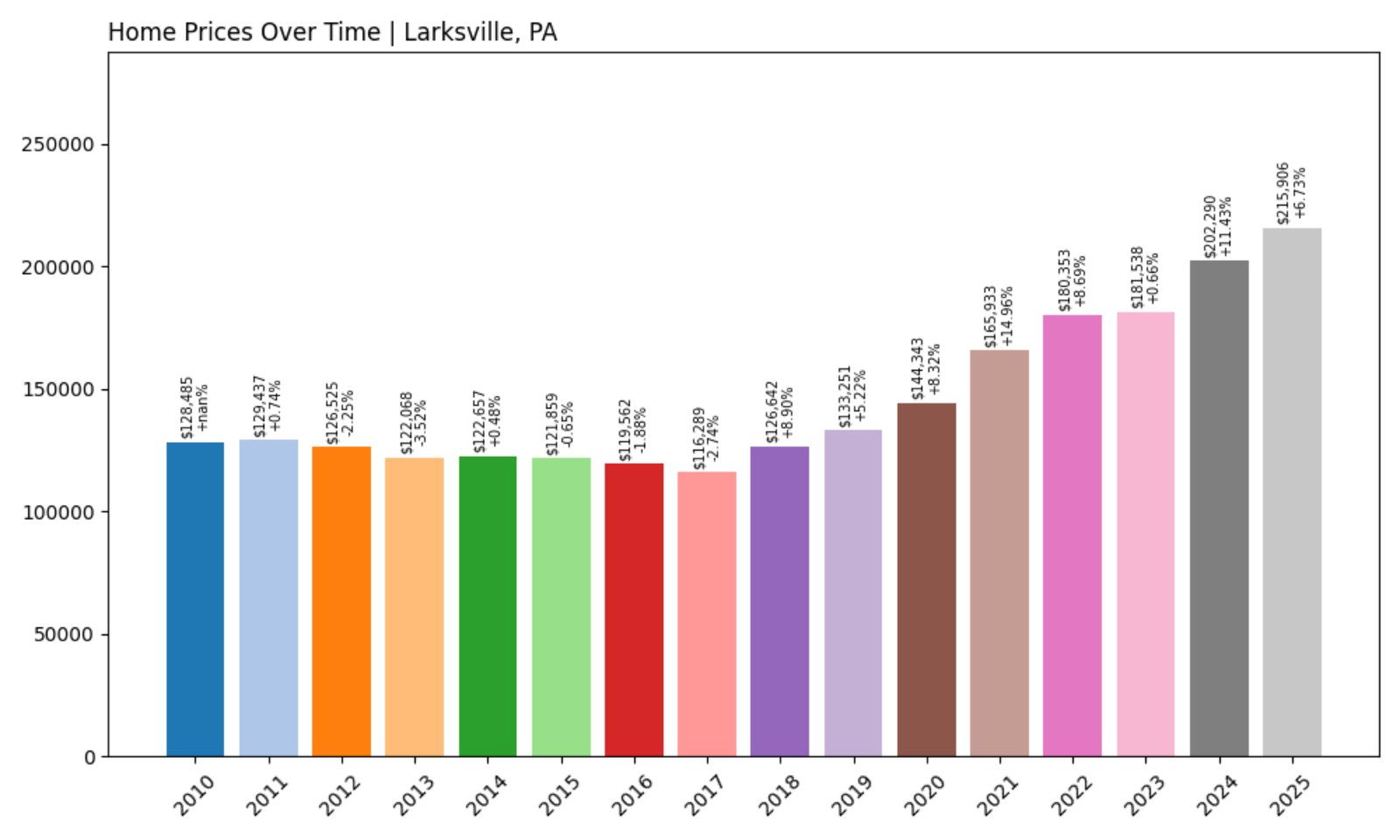

20. Larksville – Investor Feeding Frenzy Factor 71.30% (July 2025)

- Historical annual growth rate (2012–2022): 3.61%

- Recent annual growth rate (2022–2025): 6.18%

- Investor Feeding Frenzy Factor: 71.30%

- Current 2025 price: $215,906.22

In Larksville, recent home price growth has accelerated to 6.18% annually, far above its long-term trend of 3.61%. With a Feeding Frenzy Factor over 71%, the town is showing clear signs of speculative interest. Median prices now exceed $215,000, a sharp climb for a town of its size.

Larksville – Investor Momentum in the Wyoming Valley

Just west of Wilkes-Barre, Larksville has emerged as a growing favorite for investors targeting Luzerne County. The town offers access to nearby employment centers, suburban-style housing, and views of the Susquehanna River. With limited buildable land, demand is outpacing supply.

These conditions have created fertile ground for speculative growth. Families looking to buy here now face much stiffer competition, especially as the investor share of purchases increases. With inventory tight and prices rising quickly, the window for affordability could be closing fast.

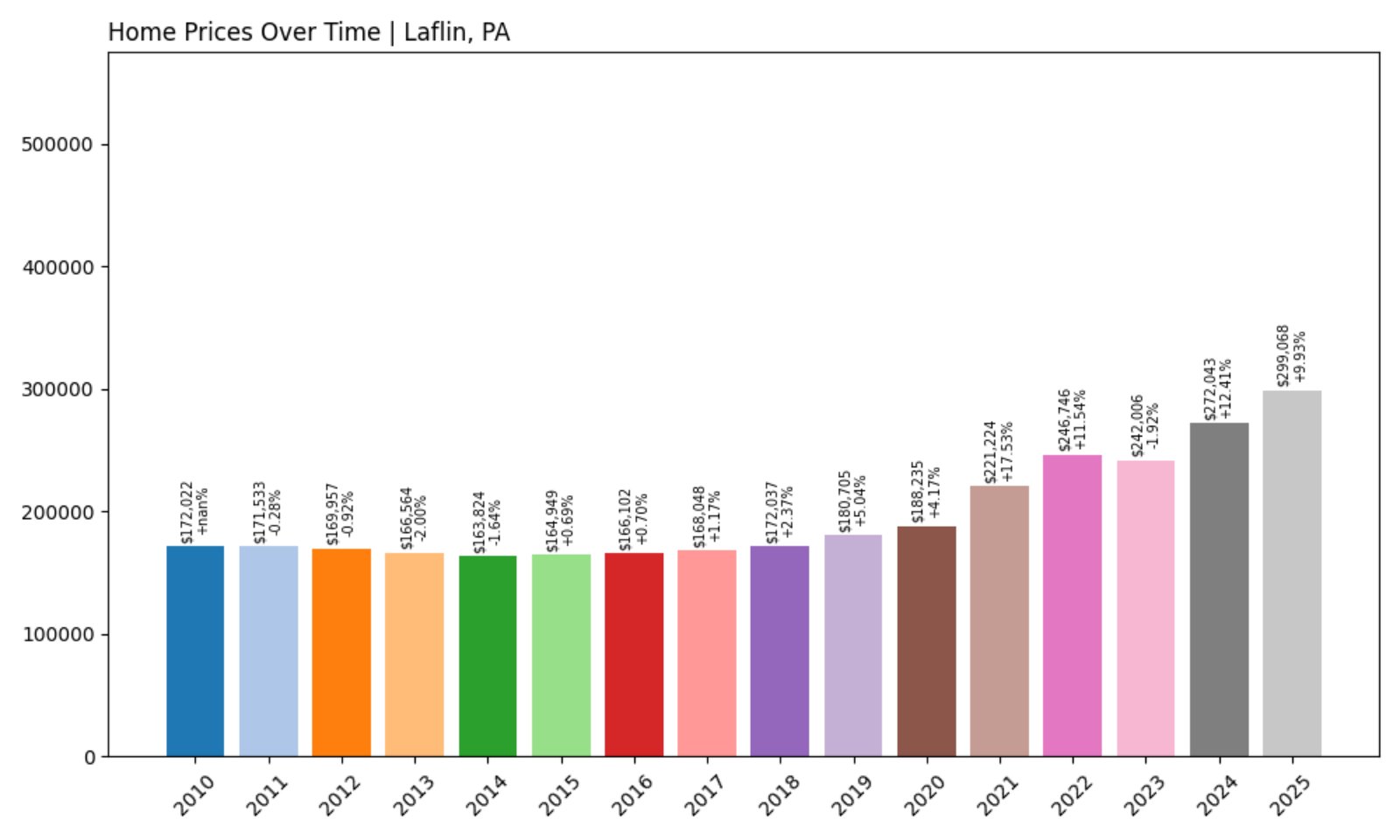

19. Laflin – Investor Feeding Frenzy Factor 74.29% (July 2025)

- Historical annual growth rate (2012–2022): 3.80%

- Recent annual growth rate (2022–2025): 6.62%

- Investor Feeding Frenzy Factor: 74.29%

- Current 2025 price: $299,067.94

Laflin’s recent growth has surged 74% above historical norms, pushing the average home price close to $300,000. The pace of growth between 2022 and 2025 has turned this small Luzerne County borough into an investor magnet, reflecting the broader trend of suburban acceleration.

Laflin – From Quiet Suburb to Price Hotspot

Located just a short drive from both Wilkes-Barre and Scranton, Laflin blends residential quiet with regional access. Its attractive housing stock and low crime rates have long made it a draw, but recent growth suggests more than just organic demand.

Investors are likely zeroing in on properties that promise rental income or long-term appreciation. As home prices rise faster than wages, residents may find themselves caught between shrinking inventory and increasing outside competition. Laflin’s transition from stable suburb to speculative zone has been swift.

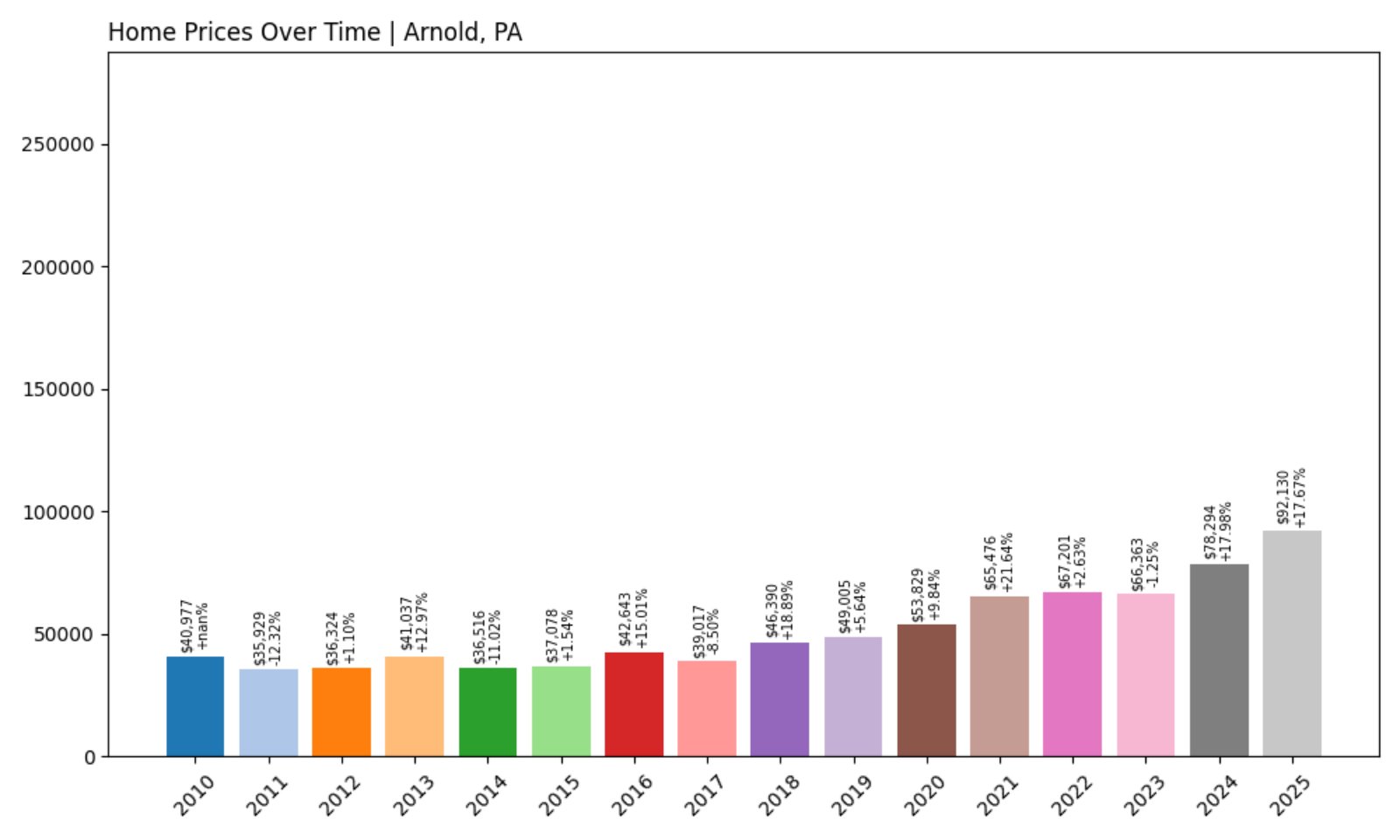

18. Arnold – Investor Feeding Frenzy Factor 74.78% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 6.35%

- Recent annual growth rate (2022–2025): 11.09%

- Investor Feeding Frenzy Factor: 74.78%

- Current 2025 price: $92,130.33

Arnold’s housing market has seen its recent growth almost double its already strong historical pace. That’s pushed its Feeding Frenzy Factor to nearly 75%, with home prices now averaging around $92,000. While still affordable, that price represents a major shift for this small western Pennsylvania town.

Arnold – Affordable Pricing Meets Aggressive Growth

Sitting along the Allegheny River northeast of Pittsburgh, Arnold has always offered low-cost living in a tight-knit community. But those same traits are now drawing interest from outside investors, particularly those looking to profit from the Pittsburgh metro’s overflow demand.

Arnold’s price acceleration shows how quickly the math can change when investor dollars flood a small market. As affordability declines and investor-driven transactions increase, the risk of displacement for long-term residents becomes very real.

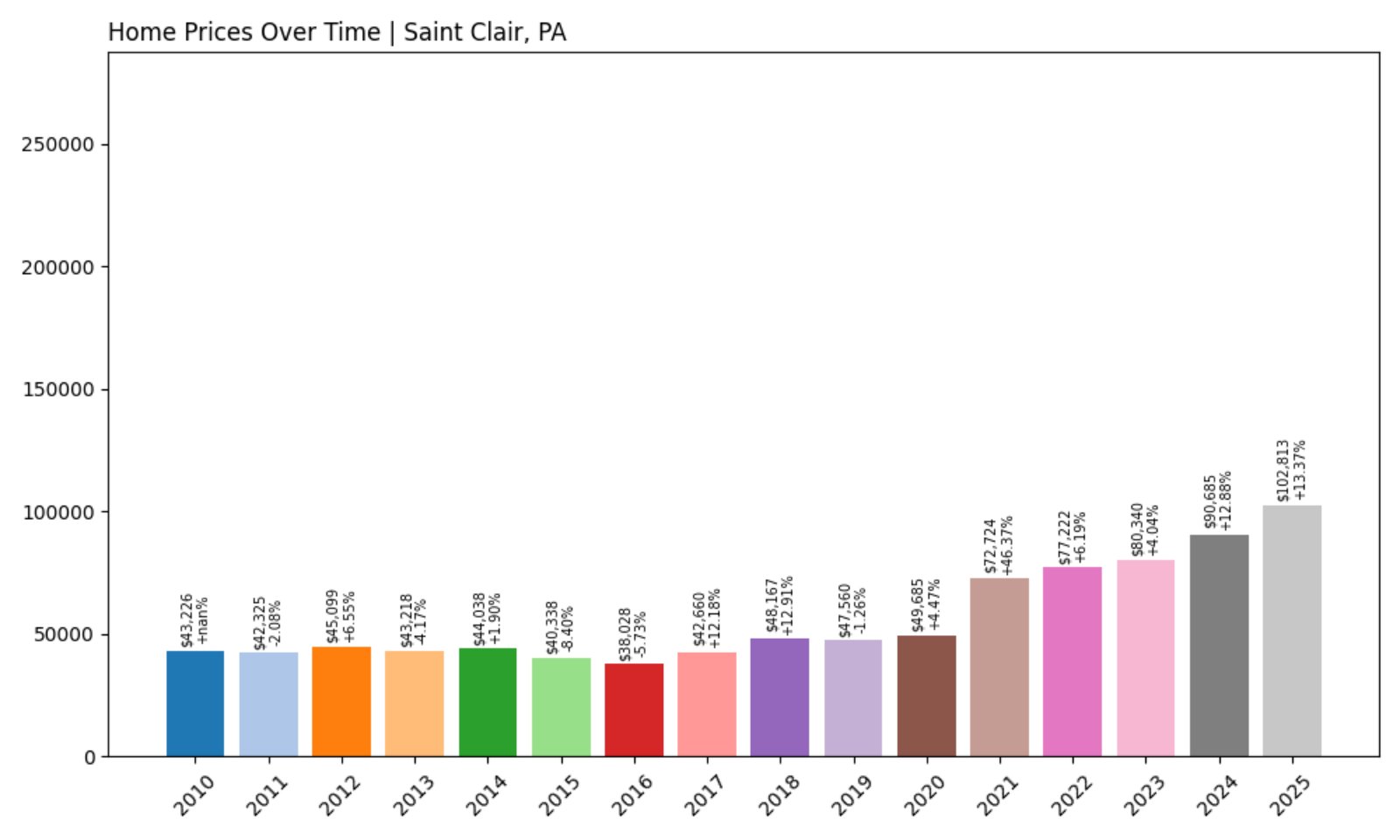

17. Saint Clair – Investor Feeding Frenzy Factor 81.17% (July 2025)

- Historical annual growth rate (2012–2022): 5.53%

- Recent annual growth rate (2022–2025): 10.01%

- Investor Feeding Frenzy Factor: 81.17%

- Current 2025 price: $102,813.36

Saint Clair’s price growth has accelerated to over 10% a year, up sharply from its previous rate. With a Feeding Frenzy Factor exceeding 81%, the town is showing strong signs of investor-driven price pressure. Yet the current average price remains relatively modest, at around $103,000.

Saint Clair – On the Radar for Value-Oriented Buyers

Adjacent to Pottsville in Schuylkill County, Saint Clair has traditionally offered affordable housing and a small-town feel. Recent trends suggest it’s no longer a hidden bargain. Investors appear to be betting on appreciation potential, especially given the low baseline pricing.

The sharp price gains in just a few years show how quickly sentiment can shift. With this level of appreciation, even small speculative surges can disrupt access for local homebuyers. Saint Clair may be cheap for now—but the clock is ticking.

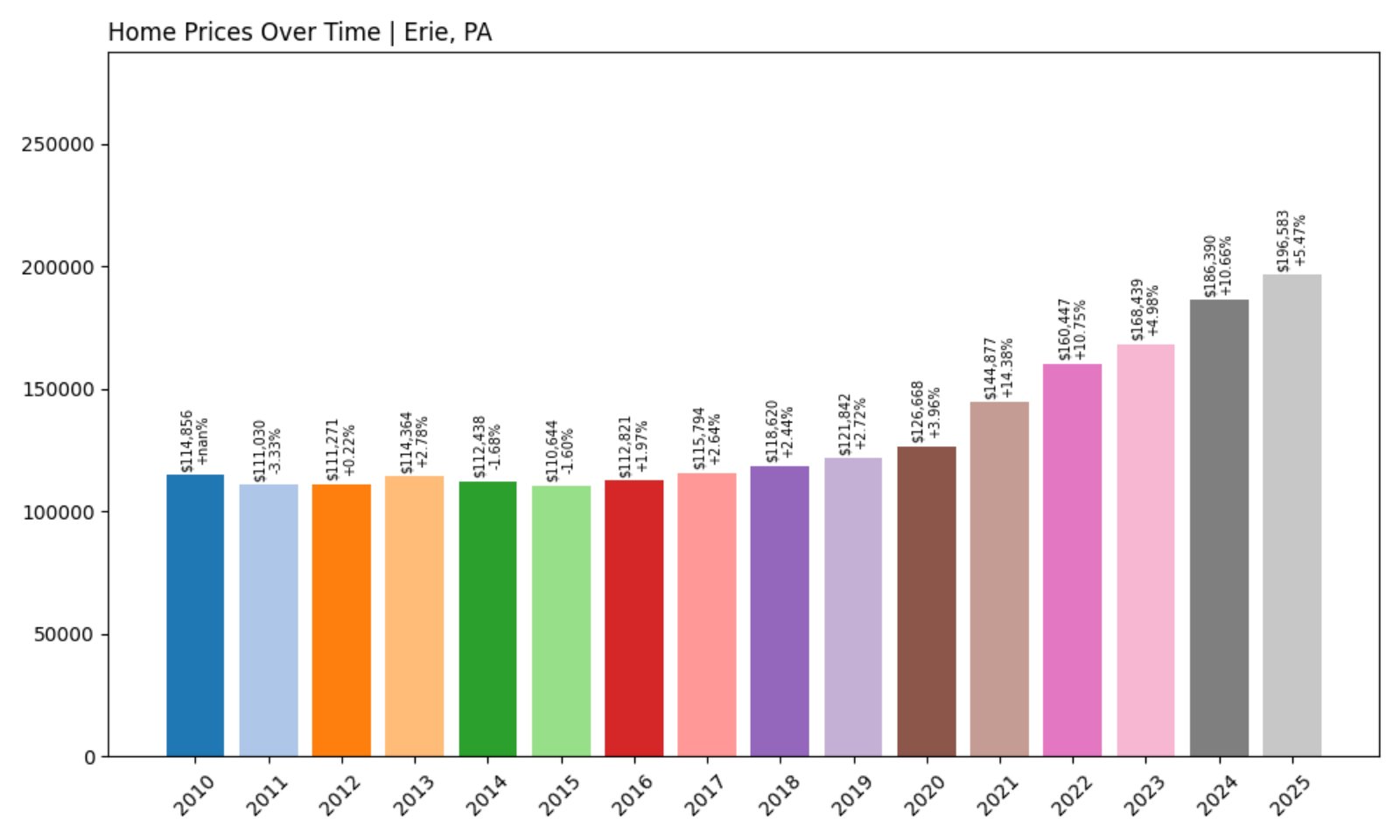

16. Erie – Investor Feeding Frenzy Factor 87.91% (July 2025)

- Historical annual growth rate (2012–2022): 3.73%

- Recent annual growth rate (2022–2025): 7.01%

- Investor Feeding Frenzy Factor: 87.91%

- Current 2025 price: $196,583.02

Erie’s housing market has heated up fast, with annual price growth surging to 7.01%—nearly double its historical rate. This results in a Feeding Frenzy Factor of almost 88%, highlighting how quickly market dynamics have shifted in one of Pennsylvania’s larger cities.

Erie – From Industrial Legacy to Real Estate Magnet

As a Great Lakes port city, Erie has seen decades of industrial transition. But its affordable homes, scenic waterfront, and recent economic diversification have caught investor attention. With prices nearing $200,000, it’s no longer the bargain it once was.

The city’s revitalization efforts and rising rental demand have created ripe conditions for outside investment. The data shows that growth is no longer gradual—it’s accelerating fast. If this pace continues, Erie could soon face the same housing strain seen in other mid-sized cities undergoing a speculative shift.

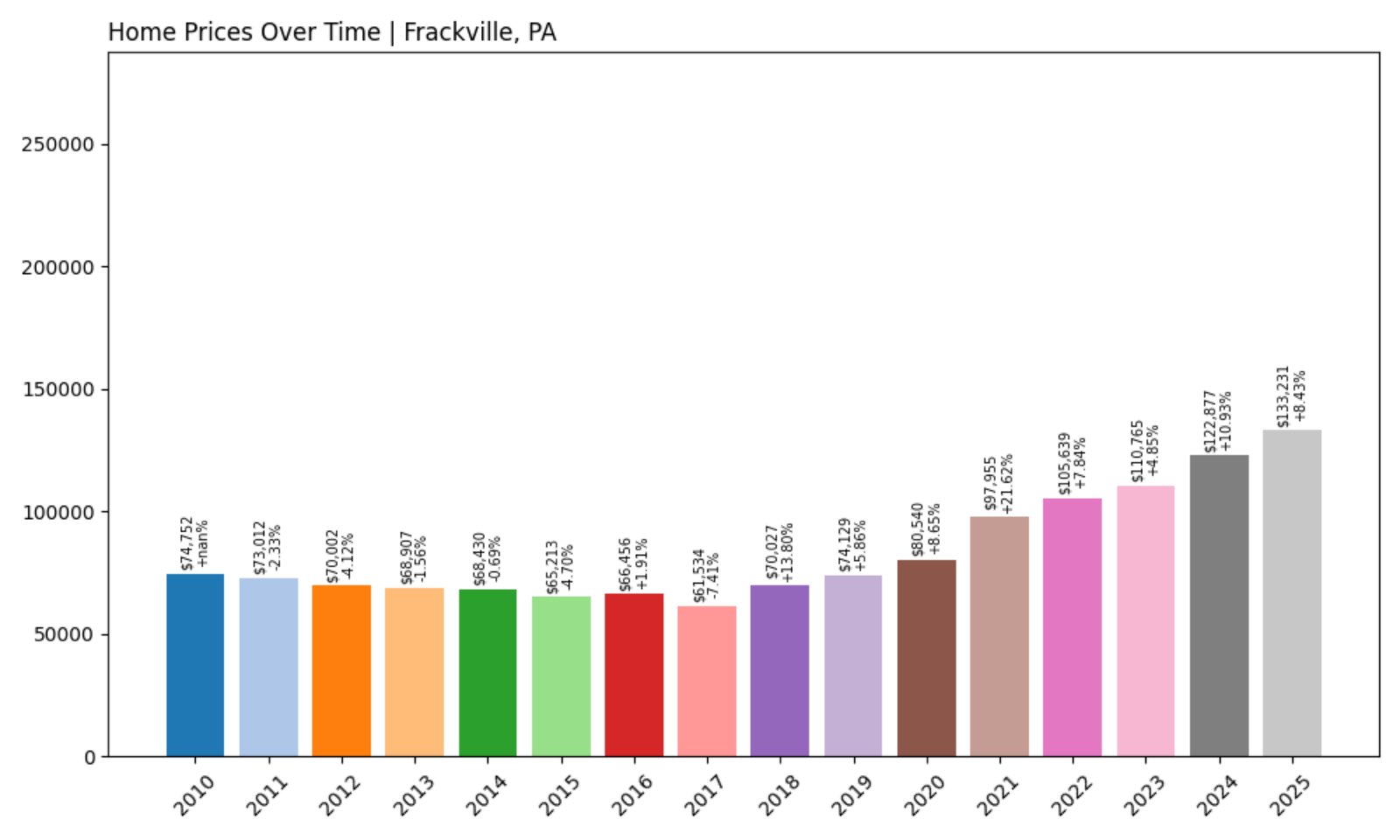

15. Frackville – Investor Feeding Frenzy Factor 91.44% (July 2025)

- Historical annual growth rate (2012–2022): 4.20%

- Recent annual growth rate (2022–2025): 8.04%

- Investor Feeding Frenzy Factor: 91.44%

- Current 2025 price: $133,230.67

Frackville’s housing market is nearly doubling its historical pace, with annual growth climbing to over 8%. Its Feeding Frenzy Factor of 91.44% points to significant investor activity in this Schuylkill County town, where average home prices are still under $135,000.

Frackville – Low Prices, High Investor Interest

Located near I-81, Frackville has always offered accessibility and affordability. But in the past few years, the price landscape has shifted. Homes that were once priced well below state averages are now climbing at a pace that far exceeds prior trends.

Investors appear drawn to the area’s value and potential for rental income or appreciation. The rapid increase in prices signals more than just organic demand—it’s an early warning sign that a quiet market is now under speculative pressure.

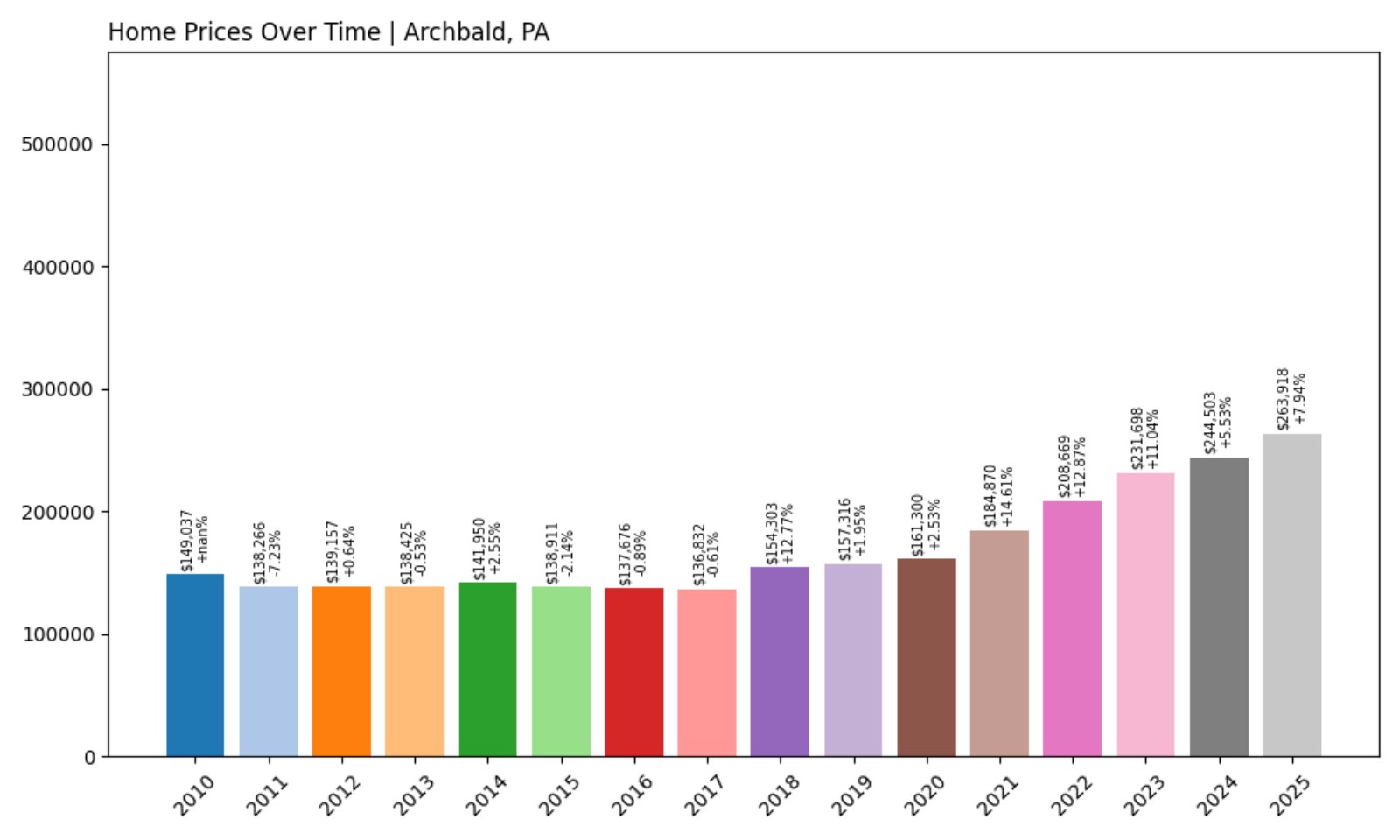

14. Archbald – Investor Feeding Frenzy Factor 96.97% (July 2025)

- Historical annual growth rate (2012–2022): 4.13%

- Recent annual growth rate (2022–2025): 8.14%

- Investor Feeding Frenzy Factor: 96.97%

- Current 2025 price: $263,917.58

Archbald’s growth has nearly doubled its historical pace, earning a Feeding Frenzy Factor of almost 97%. At over $263,000, home prices are now pushing past affordability thresholds for many local buyers, especially in a town that wasn’t on many radars just a few years ago.

Archbald – From Quiet Borough to High-Growth Hotspot

Would you like to save this?

Located in Lackawanna County, Archbald blends suburban appeal with a growing commuter base tied to the Scranton metro. It has seen rapid development interest in recent years, and rising prices now reflect that demand.

As the town becomes increasingly attractive to outside buyers, the impact on affordability and availability is being felt. What was once a stable market is now under intense upward pressure, signaling that investor influence is reshaping the local housing dynamic.

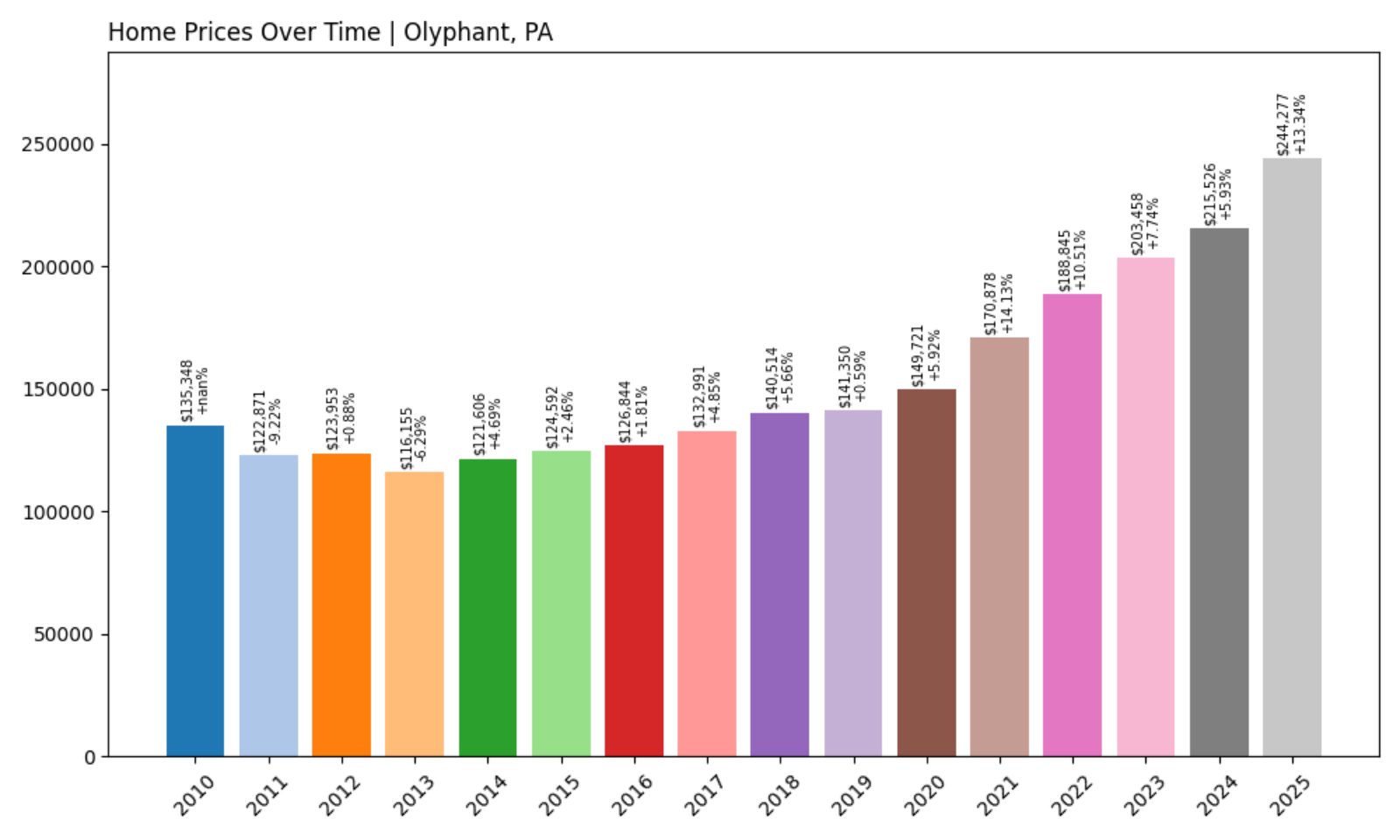

13. Olyphant – Investor Feeding Frenzy Factor 108.32% (July 2025)

- Historical annual growth rate (2012–2022): 4.30%

- Recent annual growth rate (2022–2025): 8.96%

- Investor Feeding Frenzy Factor: 108.32%

- Current 2025 price: $244,276.51

With its recent annual growth rate jumping to nearly 9%, Olyphant has a Feeding Frenzy Factor above 108%—one of the highest among Scranton-area towns. Its 2025 home price has climbed above $244,000, a major leap from where it stood just a few years ago.

Olyphant – Scranton Suburb Under Pressure

Olyphant is a northeastern Pennsylvania borough experiencing the ripple effects of Scranton’s regional surge. With good schools and easy access to employment, the town has become an investor target for both long-term rental properties and speculative resale.

Prices are growing at more than double the historical pace, raising red flags about sustainability. Residents who have lived here for decades may now find themselves priced out of a market they helped build.

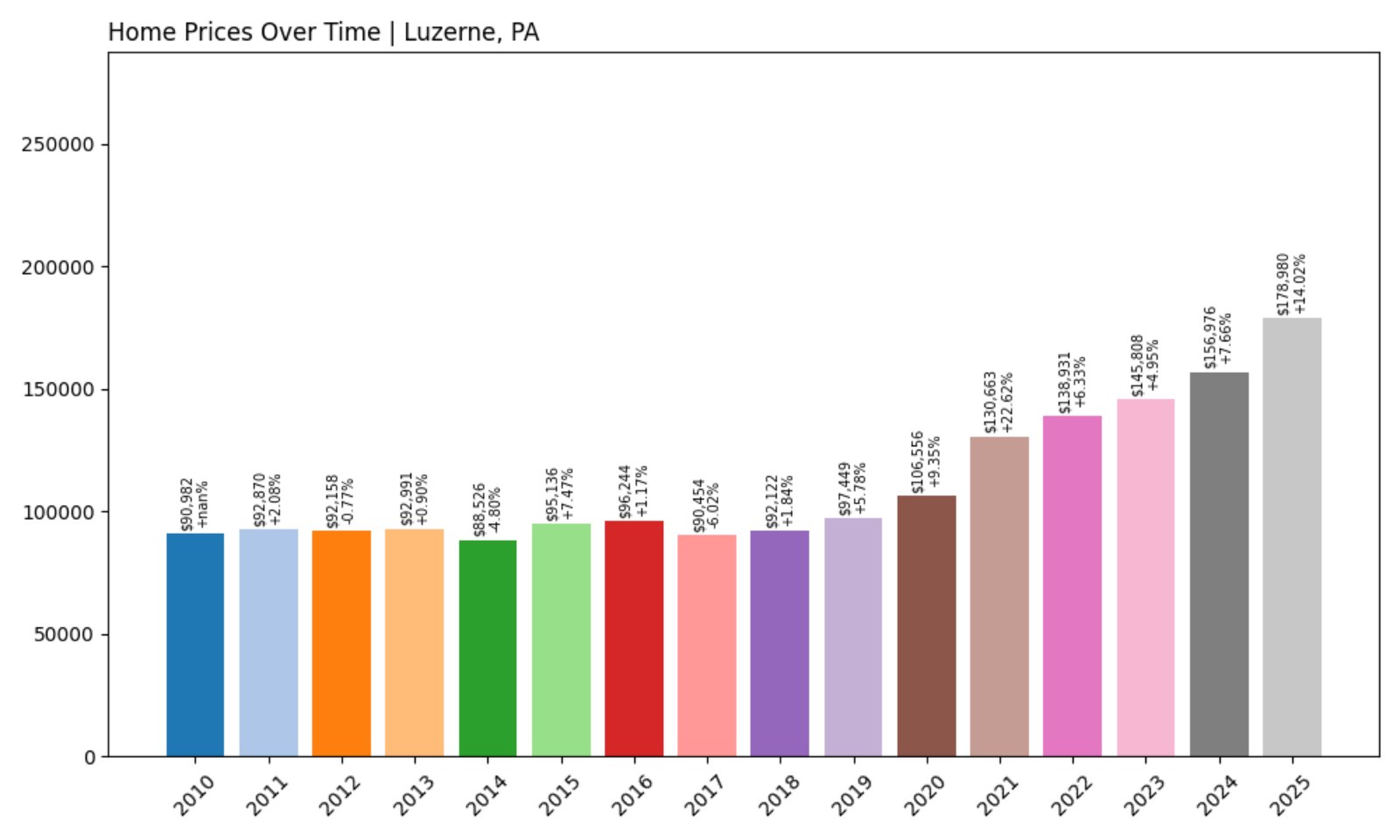

12. Luzerne – Investor Feeding Frenzy Factor 110.25% (July 2025)

- Historical annual growth rate (2012–2022): 4.19%

- Recent annual growth rate (2022–2025): 8.81%

- Investor Feeding Frenzy Factor: 110.25%

- Current 2025 price: $178,979.57

Luzerne has become one of the fastest-accelerating housing markets in the Wyoming Valley. Its recent growth has more than doubled from past trends, resulting in a Feeding Frenzy Factor of 110.25%. With prices nearing $179,000, buyers are feeling the shift.

Luzerne – Stable Roots, Now in Flux

As a historic borough near Wilkes-Barre, Luzerne has long offered affordability and close-knit charm. But recent market dynamics show a sharp break from the past. Prices have grown more in three years than in the previous ten.

Investors appear to be betting on continued regional growth and strong rental demand. That could mean fewer opportunities for first-time buyers unless new inventory is added quickly. Luzerne’s days as a slow-growth community may be over.

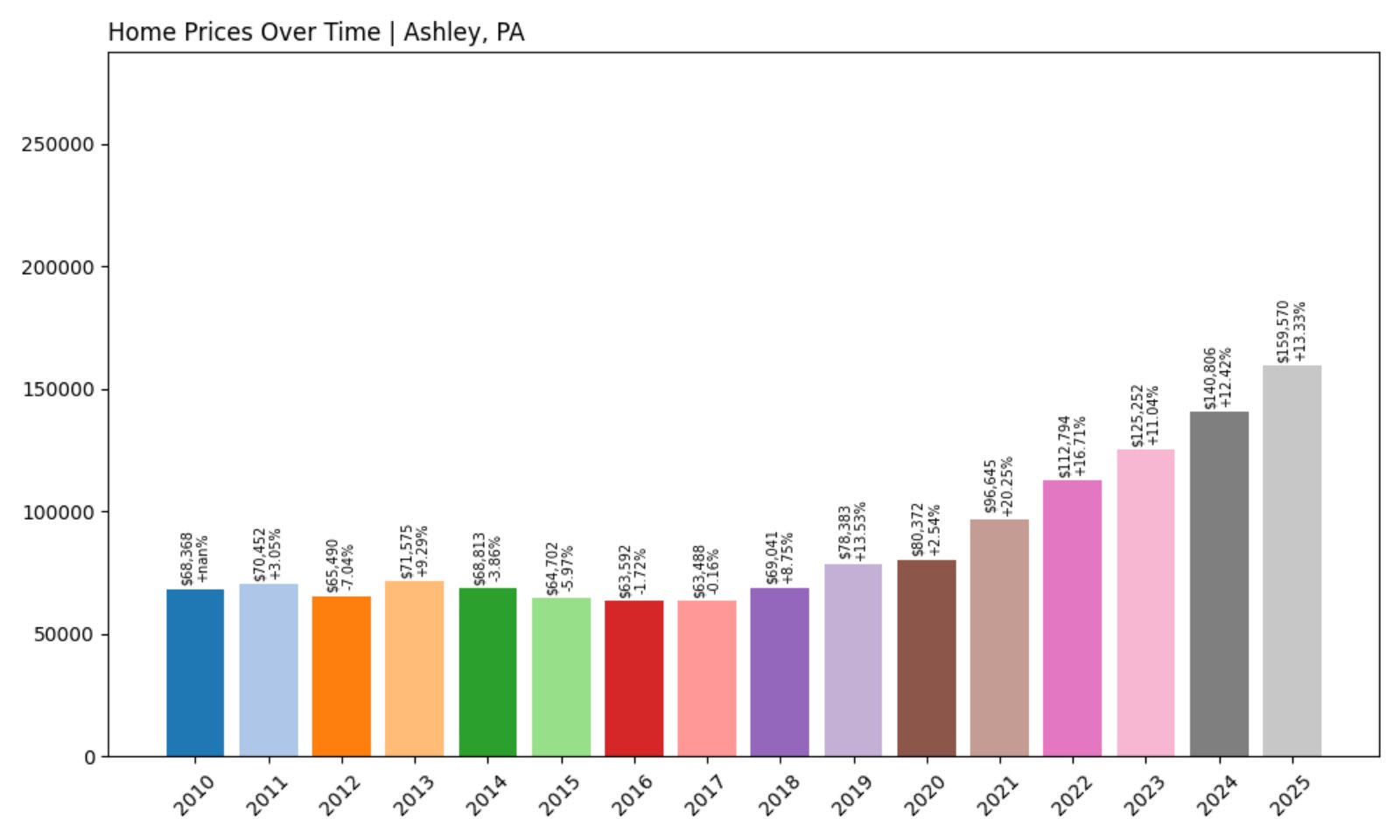

11. Ashley – Investor Feeding Frenzy Factor 119.41% (July 2025)

- Historical annual growth rate (2012–2022): 5.59%

- Recent annual growth rate (2022–2025): 12.26%

- Investor Feeding Frenzy Factor: 119.41%

- Current 2025 price: $159,570.17

Ashley has become one of the most rapidly appreciating towns in Luzerne County. With price growth jumping to over 12% annually—more than double its historical rate—the Feeding Frenzy Factor stands at 119.41%. Prices now sit just under $160,000 and are still climbing.

Ashley – A New Front in Luzerne County’s Boom

This small borough adjacent to Wilkes-Barre is quickly becoming a case study in speculative acceleration. Investors are drawn to its modest home prices and access to regional transportation. As demand surges, inventory struggles to keep up.

The town’s rapid price increase poses a risk for residents hoping to buy or upgrade locally. With affordability slipping away and investor competition rising, Ashley’s housing market could become much tougher to enter in the coming years.

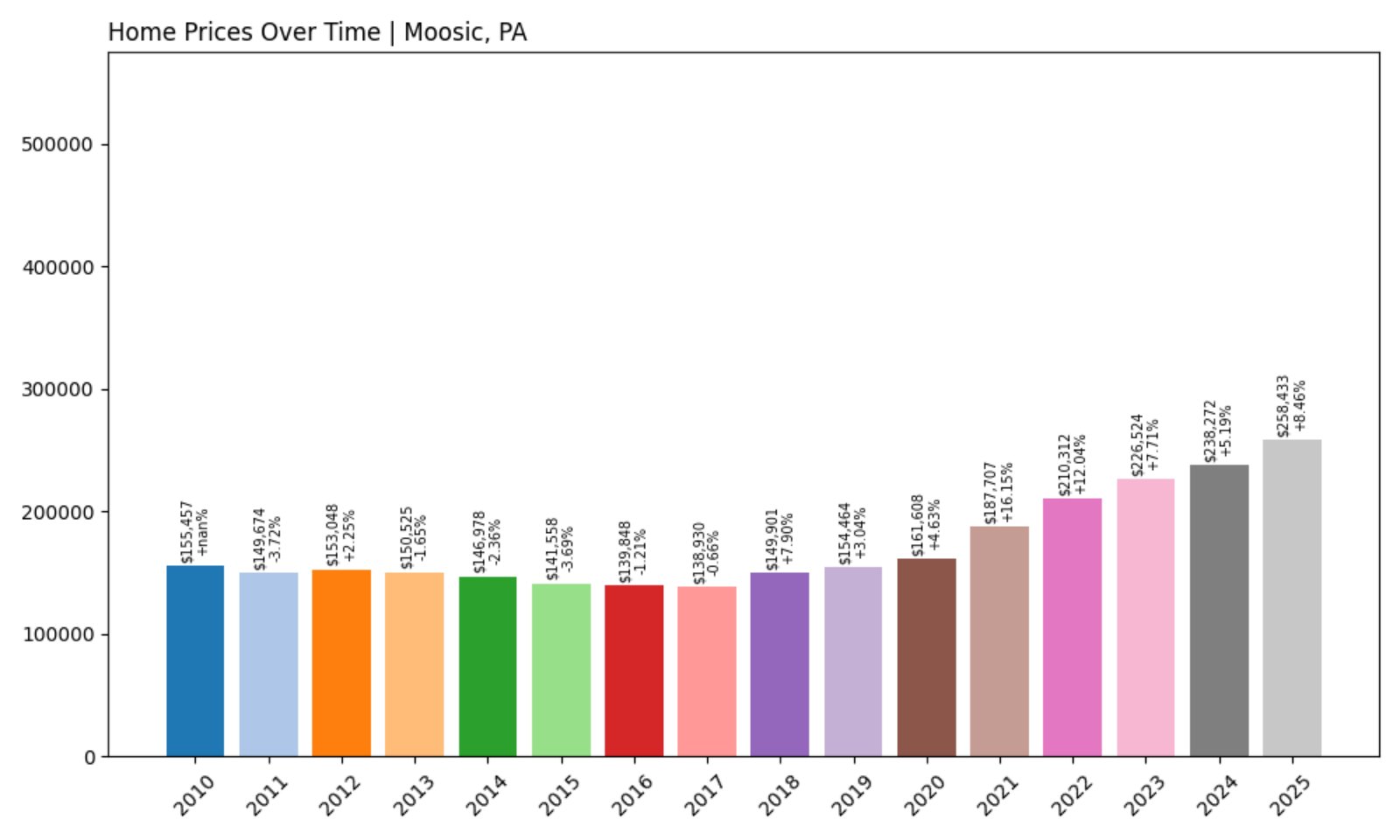

10. Moosic – Investor Feeding Frenzy Factor 120.14% (July 2025)

- Historical annual growth rate (2012–2022): 3.23%

- Recent annual growth rate (2022–2025): 7.11%

- Investor Feeding Frenzy Factor: 120.14%

- Current 2025 price: $258,433.44

Moosic’s recent home price growth has more than doubled its historical average, resulting in a Feeding Frenzy Factor of 120.14%. Prices now exceed $258,000, a significant leap for this Lackawanna County suburb that was once considered a steady-value market.

Moosic – Development Boom Driving Investor Appeal

Located between Scranton and Wilkes-Barre, Moosic has attracted attention for its strategic location and ongoing commercial development. The addition of retail hubs and proximity to Montage Mountain have made it increasingly attractive to both homebuyers and investors.

As amenities have grown, so has demand. The town’s new trajectory reflects a market being redefined by speculation, with home values rising rapidly and affordability taking a hit. Moosic is no longer just a suburb—it’s an investment target.

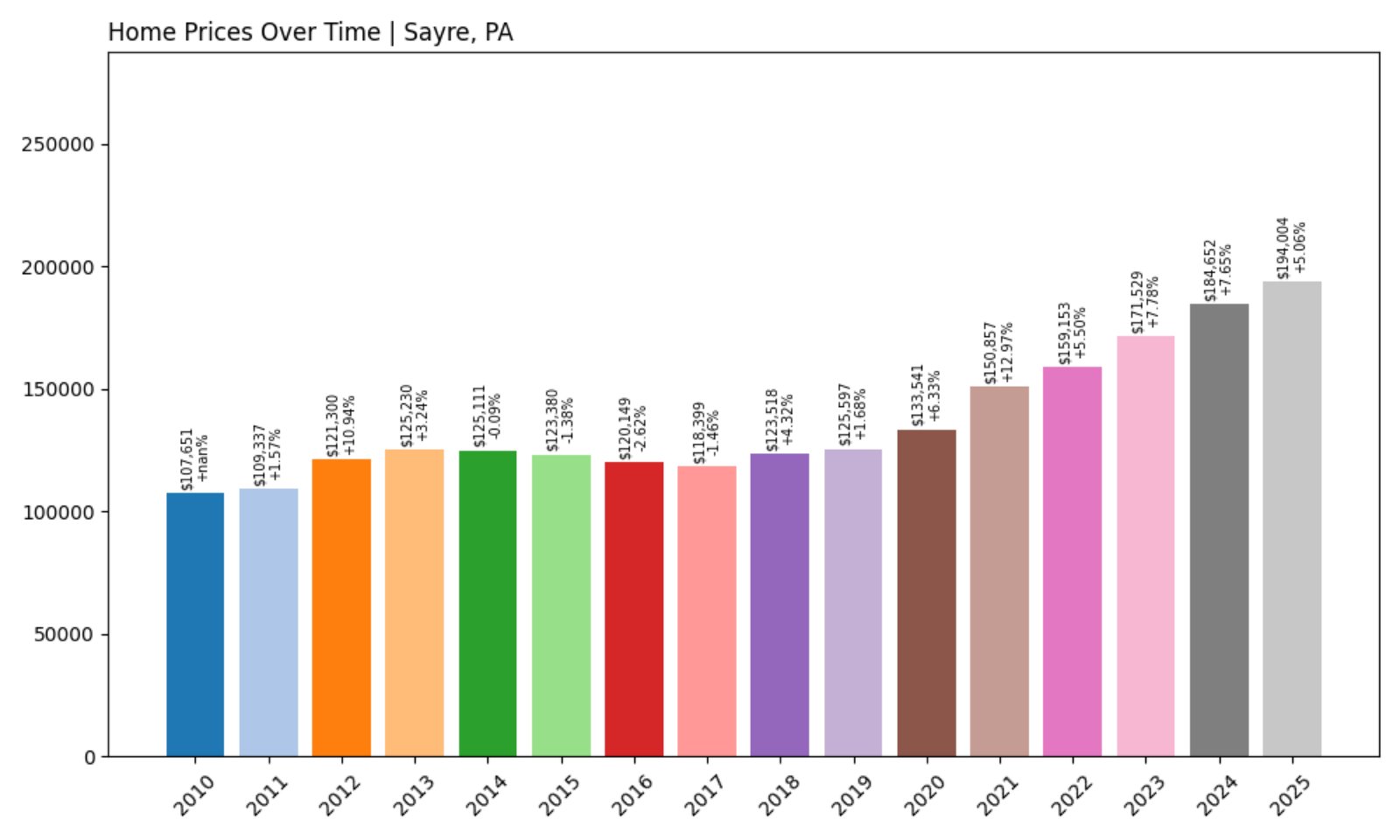

9. Sayre – Investor Feeding Frenzy Factor 147.82% (July 2025)

- Historical annual growth rate (2012–2022): 2.75%

- Recent annual growth rate (2022–2025): 6.82%

- Investor Feeding Frenzy Factor: 147.82%

- Current 2025 price: $194,004.03

Sayre’s home price growth has shot up by nearly 150% compared to historical patterns, with current values just shy of $200,000. The Feeding Frenzy Factor of 147.82% signals a market experiencing intense outside interest.

Sayre – Northern Tier Town Faces Sudden Price Shock

As Bradford County’s largest borough, Sayre traditionally offered small-town affordability. But recent years have brought new pressures. Its position near the New York border and regional hospitals has made it appealing to investors looking for cross-border rental returns.

The price surge may catch long-time residents off guard. While the town retains much of its traditional charm, buyers entering the market today face far steeper costs than just a few years ago. If investor demand continues, prices could climb even higher.

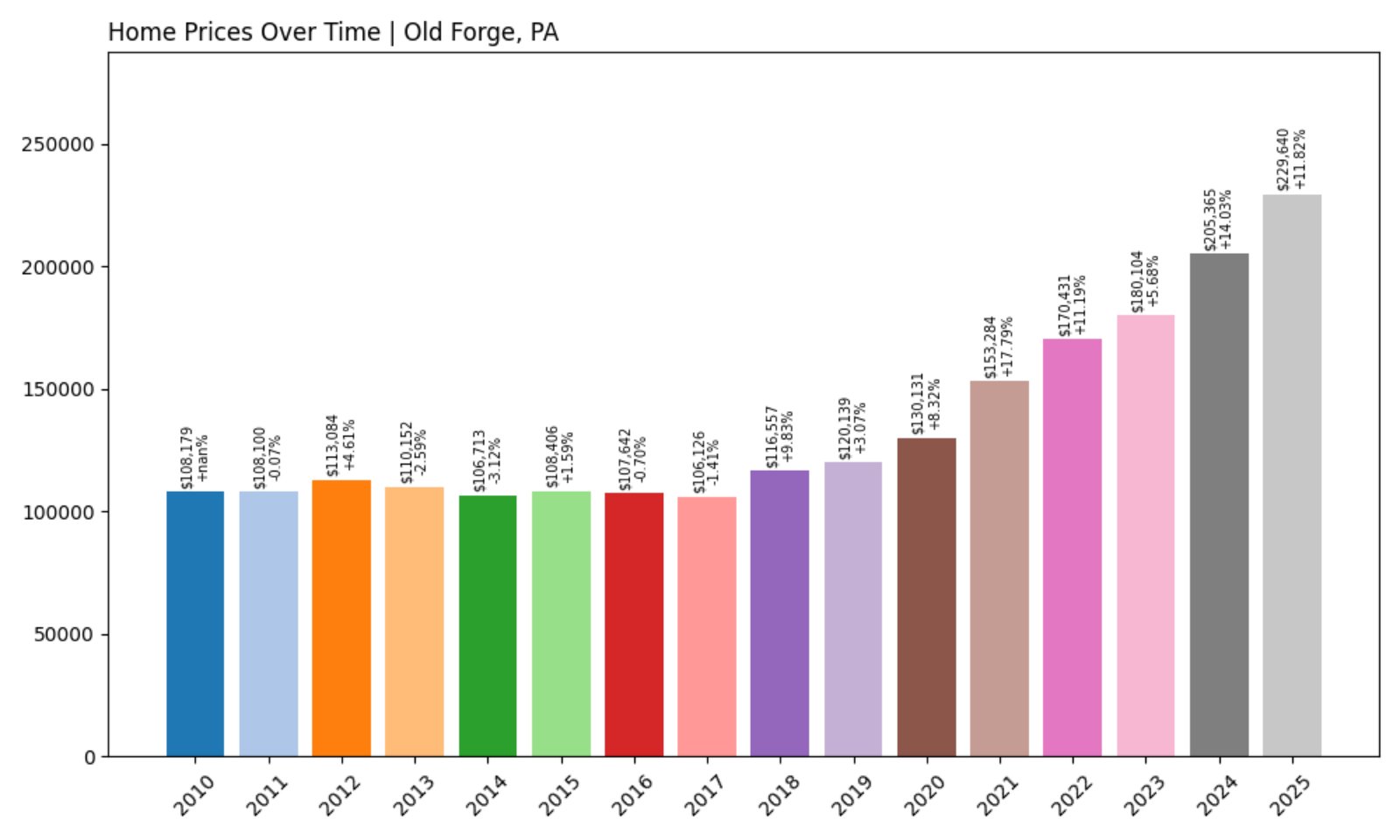

8. Old Forge – Investor Feeding Frenzy Factor 149.57% (July 2025)

- Historical annual growth rate (2012–2022): 4.19%

- Recent annual growth rate (2022–2025): 10.45%

- Investor Feeding Frenzy Factor: 149.57%

- Current 2025 price: $229,639.59

Old Forge is now growing at more than twice its historical rate, with home prices averaging just under $230,000. The town’s Feeding Frenzy Factor of nearly 150% indicates heavy investor activity over the past few years.

Old Forge – Pizza Capital Now a Price Surge Capital

Known for its legendary pizza, Old Forge is now drawing a different kind of crowd—real estate investors. Just outside of Scranton, the borough’s tight-knit community and convenient location have helped fuel rapid home appreciation.

While still accessible compared to larger cities, the town’s sharp price gains are changing its affordability profile. Residents hoping to stay may find themselves priced out, while speculative buying continues to reshape the local market.

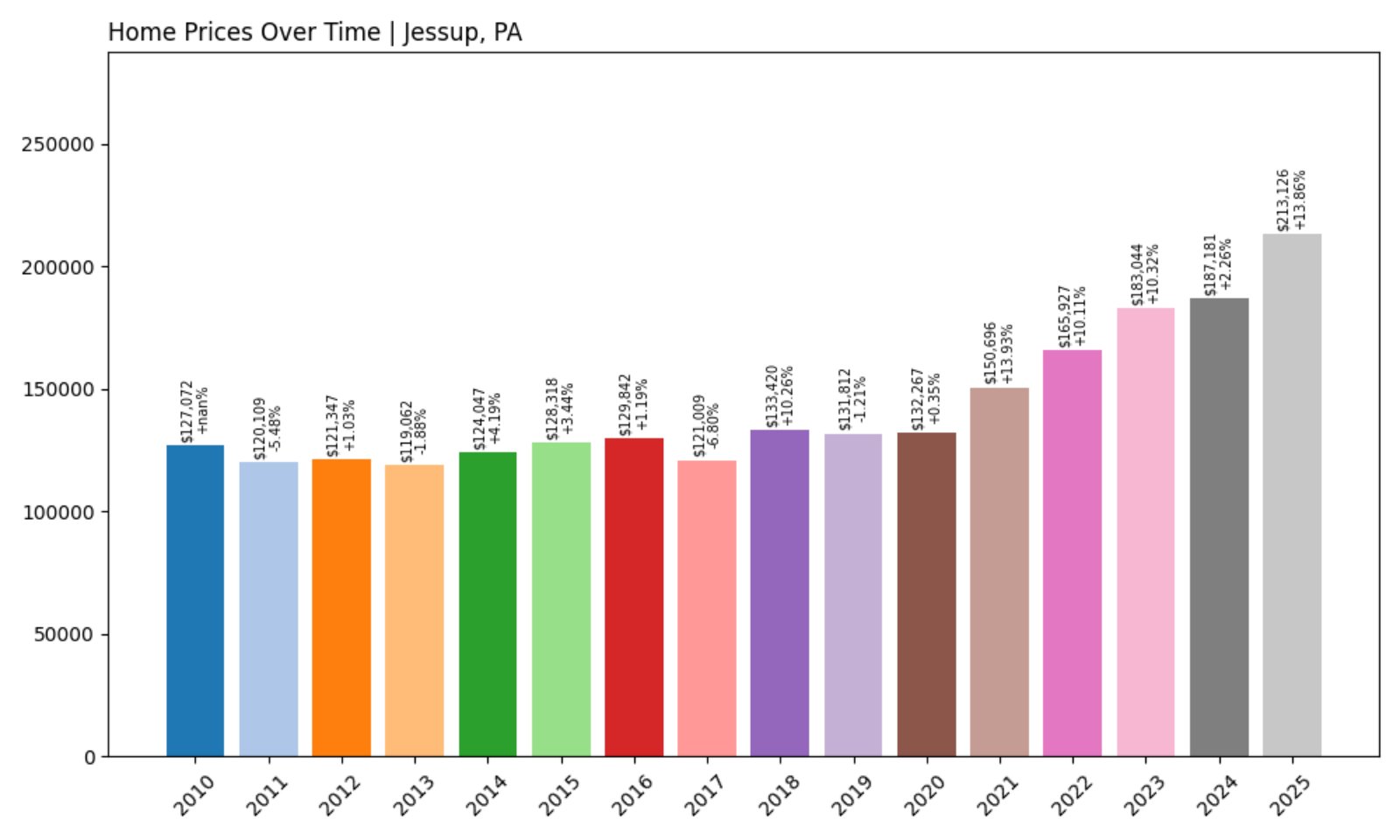

7. Jessup – Investor Feeding Frenzy Factor 173.81% (July 2025)

- Historical annual growth rate (2012–2022): 3.18%

- Recent annual growth rate (2022–2025): 8.70%

- Investor Feeding Frenzy Factor: 173.81%

- Current 2025 price: $213,126.34

Jessup has experienced an explosive increase in home value growth, with recent rates nearly triple its long-term average. With prices now above $213,000, the Feeding Frenzy Factor of 173.81% reflects intense investor focus on this small borough.

Jessup – A Scranton-Area Town Under Pressure

Jessup, located in Lackawanna County, has long served as a quiet residential community with access to Scranton-area jobs. That low profile is fading fast, as sharp price hikes attract investor interest in both rentals and fix-and-flips.

What was once a modest market is now flashing signs of overheating. As prices accelerate and investor activity ramps up, Jessup is quickly transforming into one of the most competitive towns in northeastern Pennsylvania.

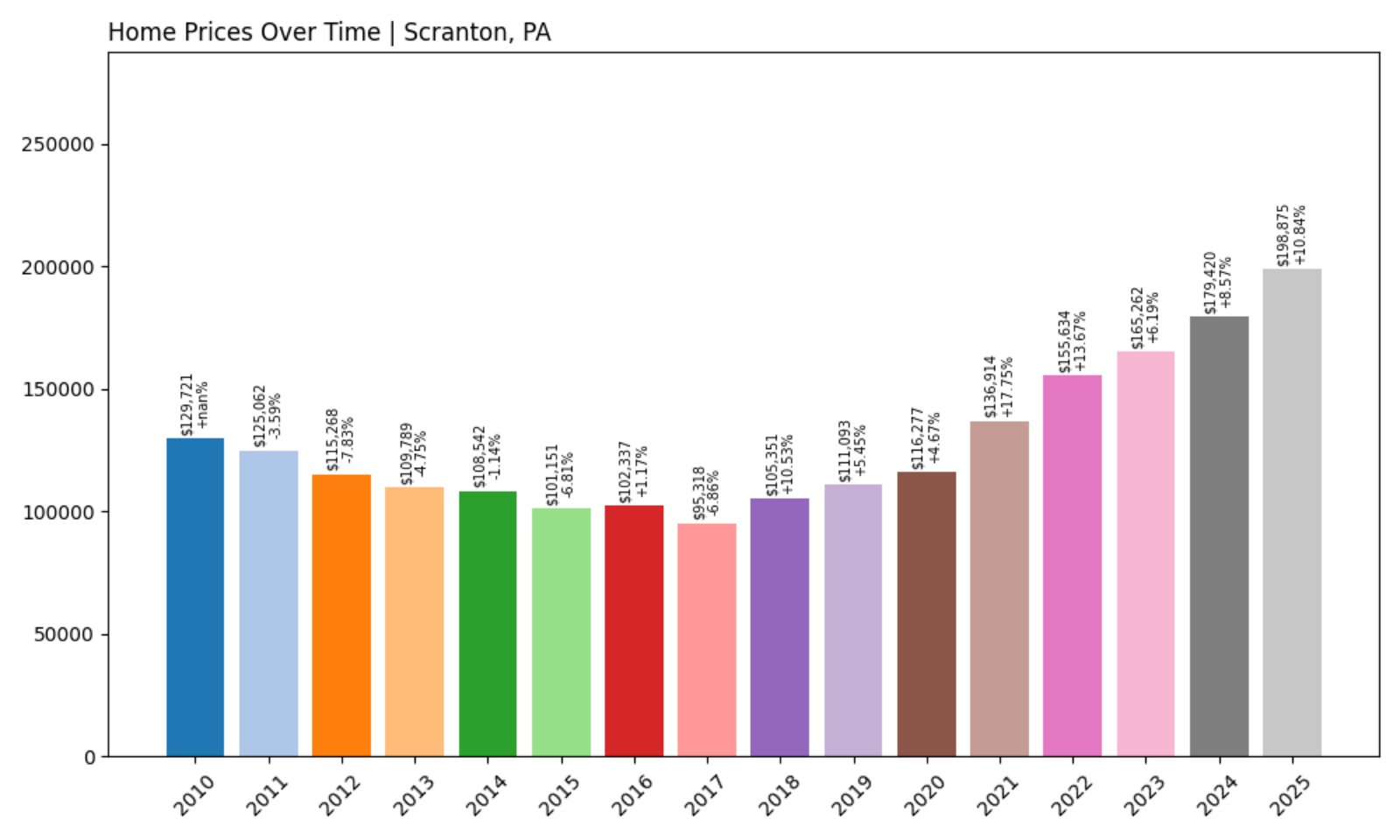

6. Scranton – Investor Feeding Frenzy Factor 179.38% (July 2025)

- Historical annual growth rate (2012–2022): 3.05%

- Recent annual growth rate (2022–2025): 8.52%

- Investor Feeding Frenzy Factor: 179.38%

- Current 2025 price: $198,875.16

Scranton’s housing market has shifted into high gear, with annual growth now at 8.52%—nearly triple its historical rate. The city’s Feeding Frenzy Factor of 179.38% suggests major speculative activity. Prices now approach $200,000 and are rising fast.

Scranton – Big City Value Fuels Investor Rush

Scranton, the largest city in northeastern Pennsylvania, has become a hotbed of investor interest. With a revitalized downtown, increasing rental demand, and a modest cost of entry, it’s drawing in both local and out-of-state buyers.

The city’s rapid appreciation is altering its real estate landscape. While Scranton once offered dependable affordability, the current trajectory is pushing prices higher than many residents expected. The Feeding Frenzy Factor confirms: Scranton is no longer a hidden value—it’s a fast-moving target.

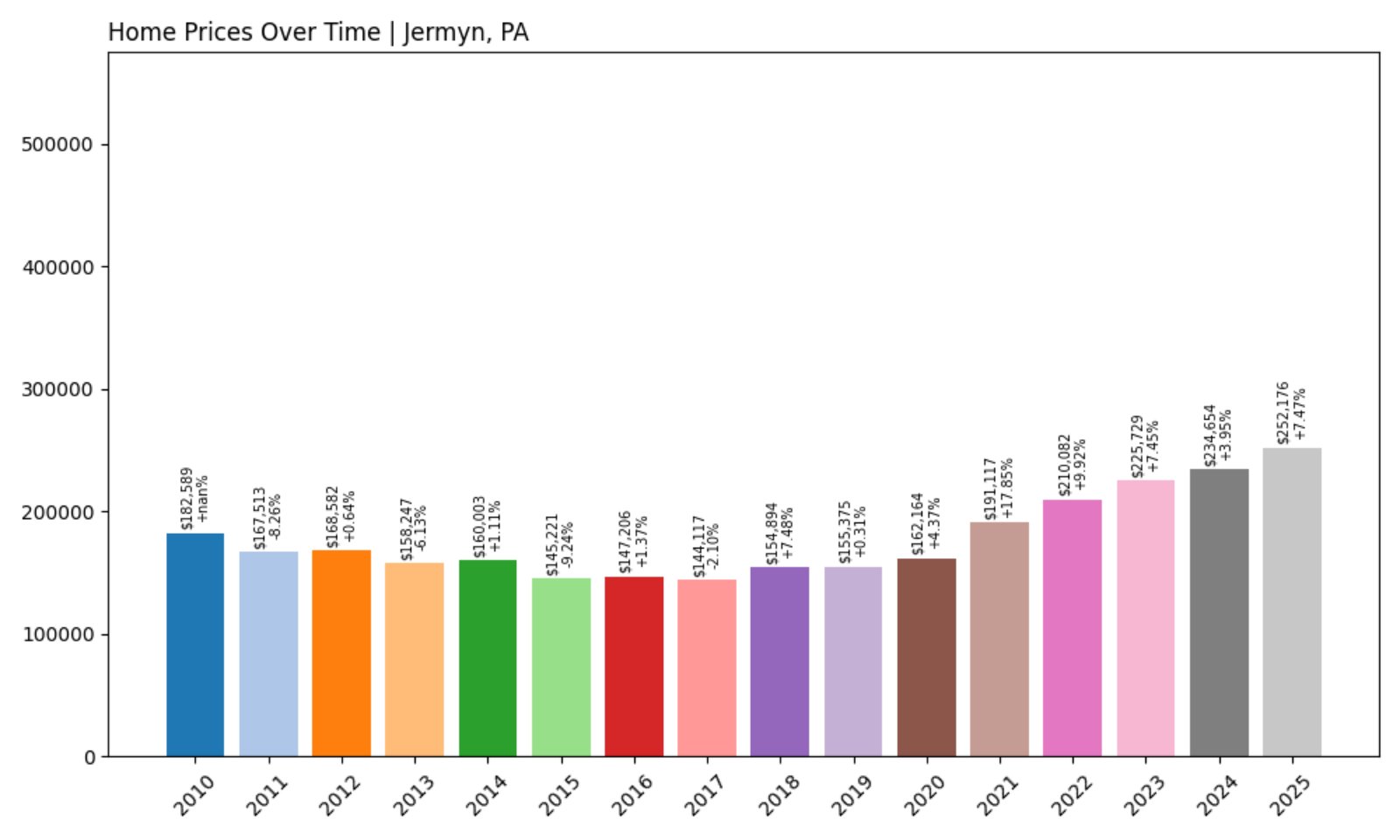

5. Jermyn – Investor Feeding Frenzy Factor 182.09% (July 2025)

- Historical annual growth rate (2012–2022): 2.23%

- Recent annual growth rate (2022–2025): 6.28%

- Investor Feeding Frenzy Factor: 182.09%

- Current 2025 price: $252,175.95

In Jermyn, prices are growing at nearly triple their historical pace, pushing the Feeding Frenzy Factor to over 182%. The current home price of over $252,000 marks a major leap for this small Lackawanna County borough, and a clear signal that speculative buying may be in play.

Jermyn – Rapid Growth in the Lackawanna Valley

Jermyn, also known as “The Birthplace of First Aid,” has seen dramatic shifts in recent years. Once a sleepy borough, it’s now among the fastest-growing housing markets in northeastern Pennsylvania. Its proximity to Scranton and scenic charm are attracting buyers from outside the region.

As prices soar, longtime residents could find themselves facing a rapidly changing community. With inventory limited and demand spiking, even modest homes are commanding premium prices. The Feeding Frenzy Factor tells us this is no accident—investors are driving much of the surge.

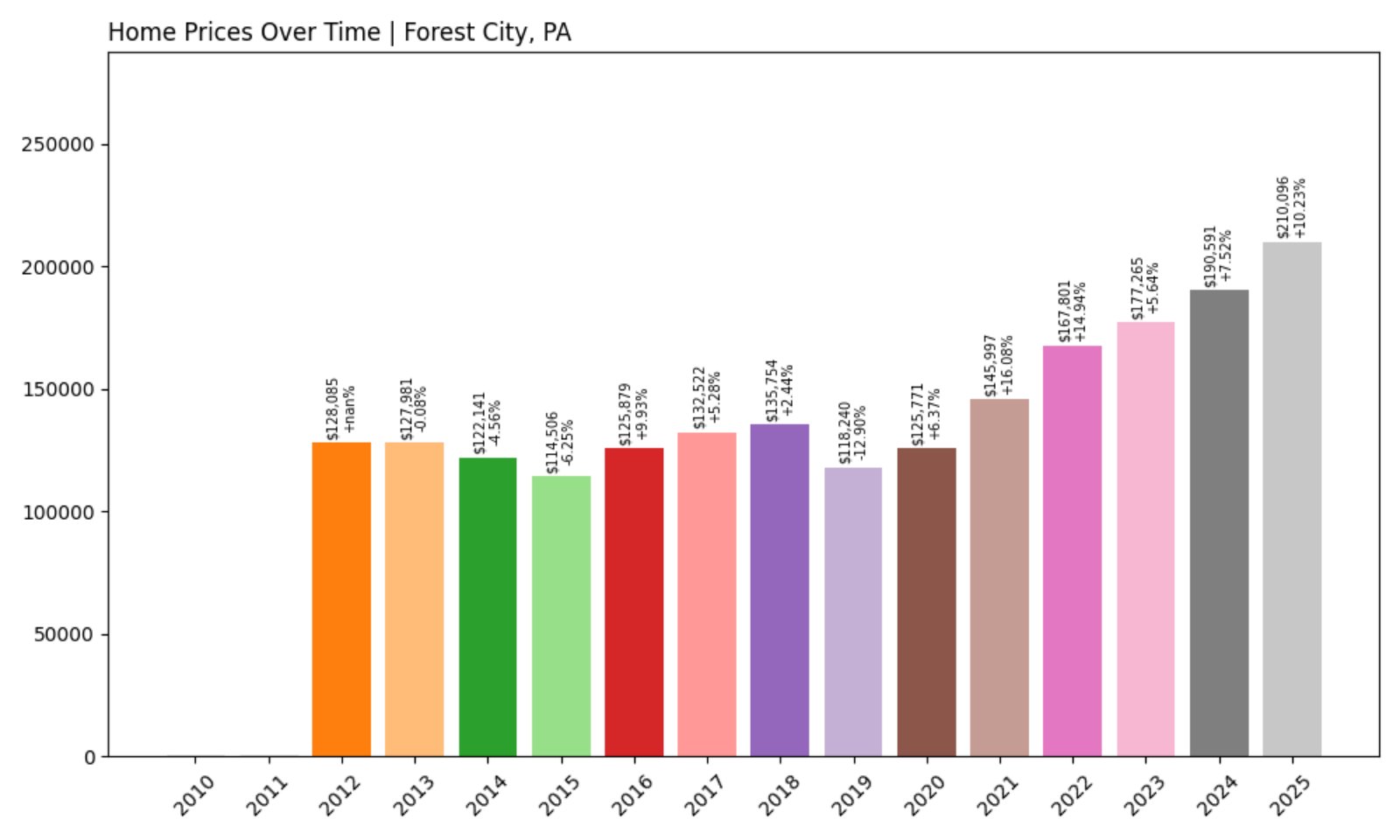

4. Forest City – Investor Feeding Frenzy Factor 184.21% (July 2025)

- Historical annual growth rate (2012–2022): 2.74%

- Recent annual growth rate (2022–2025): 7.78%

- Investor Feeding Frenzy Factor: 184.21%

- Current 2025 price: $210,095.65

Forest City’s recent growth rate of 7.78% is nearly triple its prior 10-year trend, leading to a Feeding Frenzy Factor of 184.21%. With prices now averaging just over $210,000, the town is seeing one of the steepest appreciation curves in Pennsylvania.

Forest City – Rural Appeal, Rapid Climb

Situated in Susquehanna County, Forest City combines mountain views with a walkable downtown and small-town atmosphere. But beneath that quiet surface, the real estate market is anything but calm. Investor activity has sent home values soaring in just a few short years.

The sudden shift reflects broader patterns seen across rural America, where affordability and quality of life are attracting buyers seeking value. Forest City may still look like a quiet place—but its housing data suggests a storm is building.

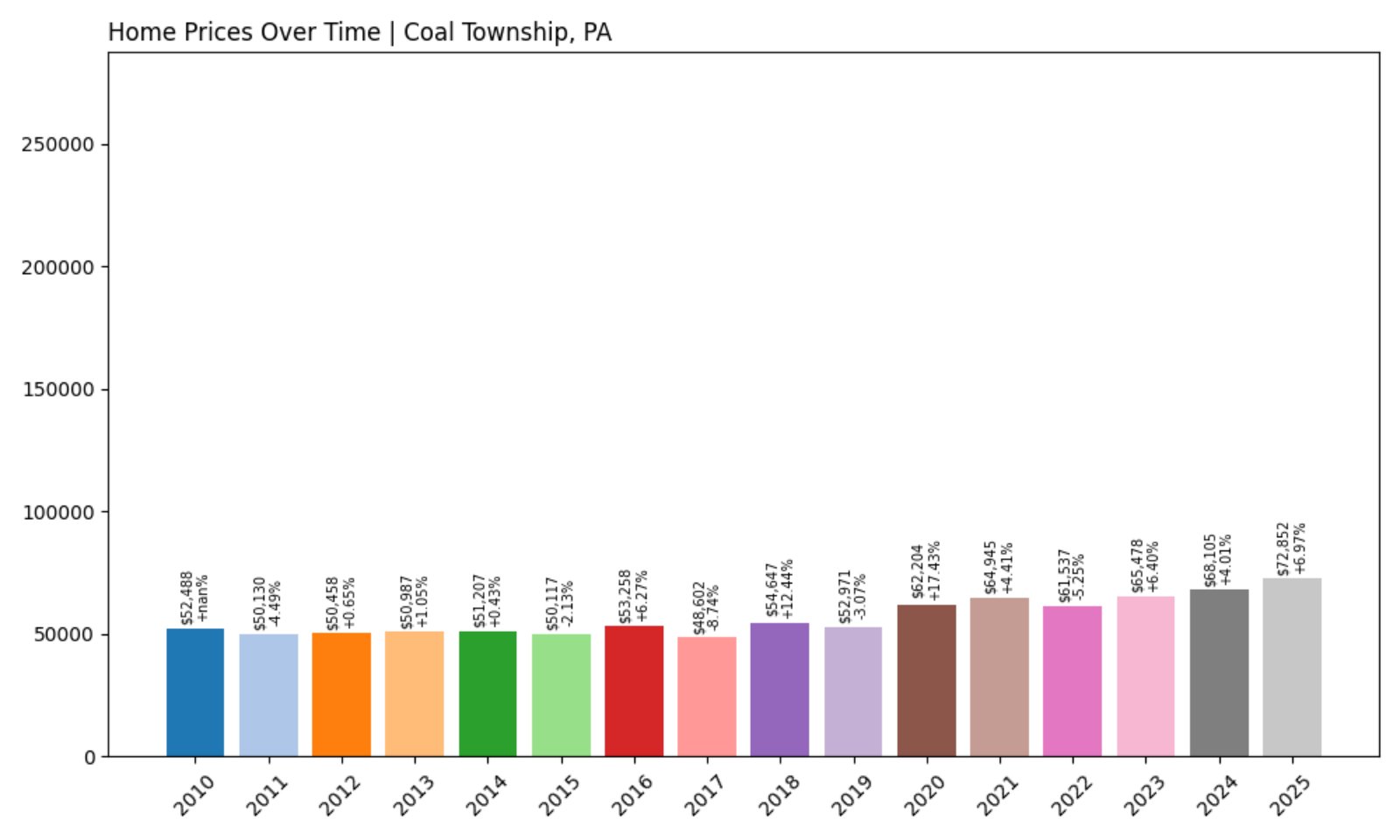

3. Coal Township – Investor Feeding Frenzy Factor 188.67% (July 2025)

- Historical annual growth rate (2012–2022): 2.00%

- Recent annual growth rate (2022–2025): 5.79%

- Investor Feeding Frenzy Factor: 188.67%

- Current 2025 price: $72,851.74

With home prices growing at nearly 6% annually—almost triple the historic rate—Coal Township shows a Feeding Frenzy Factor of 188.67%. Prices remain very low by statewide standards, at just under $73,000, but that affordability may not last.

Coal Township – Skyrocketing Growth on a Low Base

Coal Township, in Northumberland County, has long been one of Pennsylvania’s more affordable markets. But that low entry point is exactly what makes it so attractive to investors looking to maximize returns. With small capital outlays and big percentage growth, the area is ripe for flipping and rental investing.

The dramatic price rise relative to past trends shows that investor pressure can dramatically alter even low-demand markets. If local incomes don’t keep pace, this growth could quickly outpace affordability for existing residents.

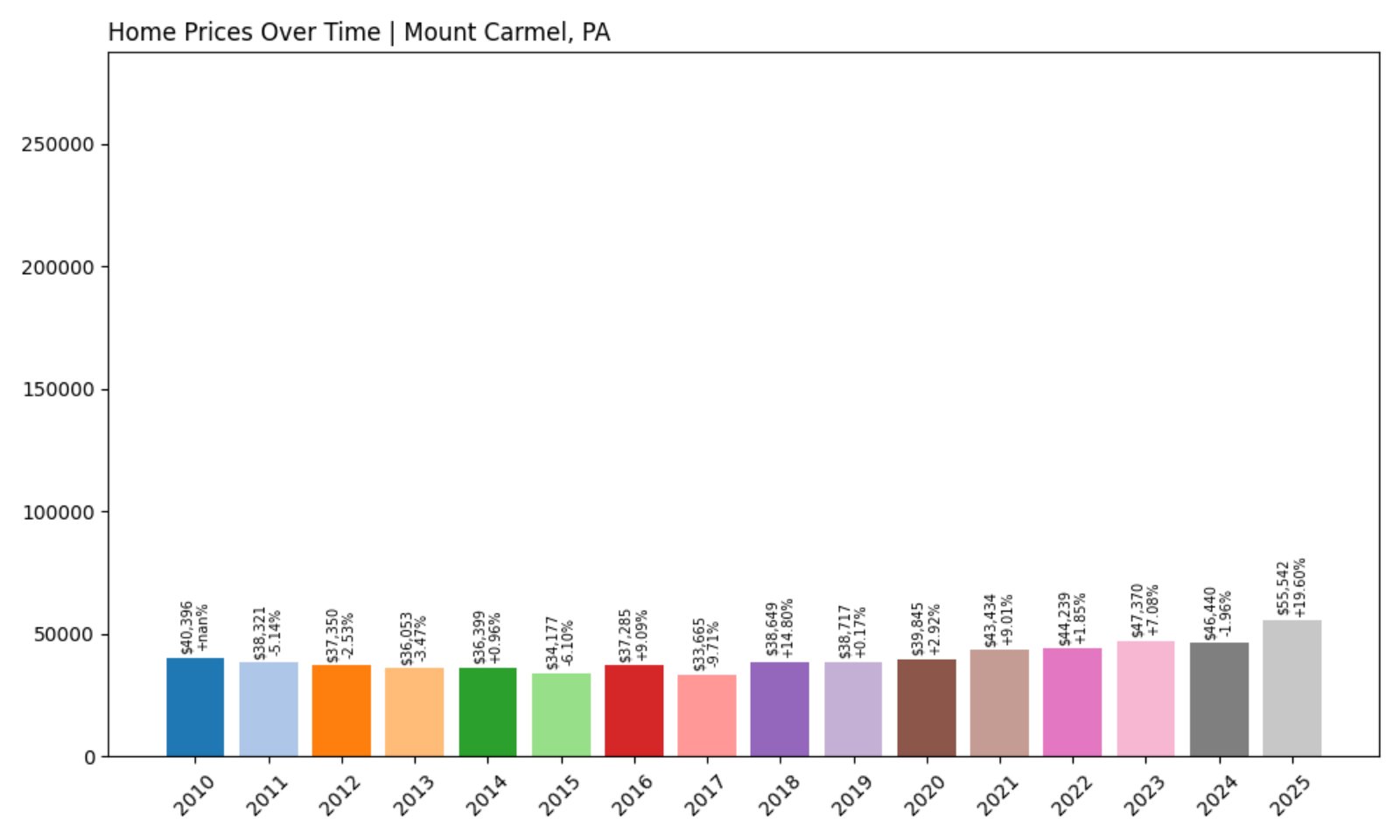

2. Mount Carmel – Investor Feeding Frenzy Factor 361.54% (July 2025)

- Historical annual growth rate (2012–2022): 1.71%

- Recent annual growth rate (2022–2025): 7.88%

- Investor Feeding Frenzy Factor: 361.54%

- Current 2025 price: $55,541.50

Mount Carmel’s Feeding Frenzy Factor of 361.54% is among the highest in the state. Home prices have surged at a rate more than four times their historic average—yet they remain surprisingly low, at just over $55,000. That gap is attracting investors by the dozens.

Mount Carmel – Budget Pricing, Surging Demand

Another Northumberland County borough, Mount Carmel offers some of the lowest home prices in Pennsylvania. That alone has made it a favorite among real estate investors seeking high returns on low-cost assets. As prices rise rapidly, local demand is being met—and sometimes eclipsed—by investor competition.

While the town remains affordable on paper, its trajectory could soon make it unaffordable for many local residents. With the fastest appreciation in its recent history, Mount Carmel is no longer just a bargain—it’s becoming a battleground for buyers.

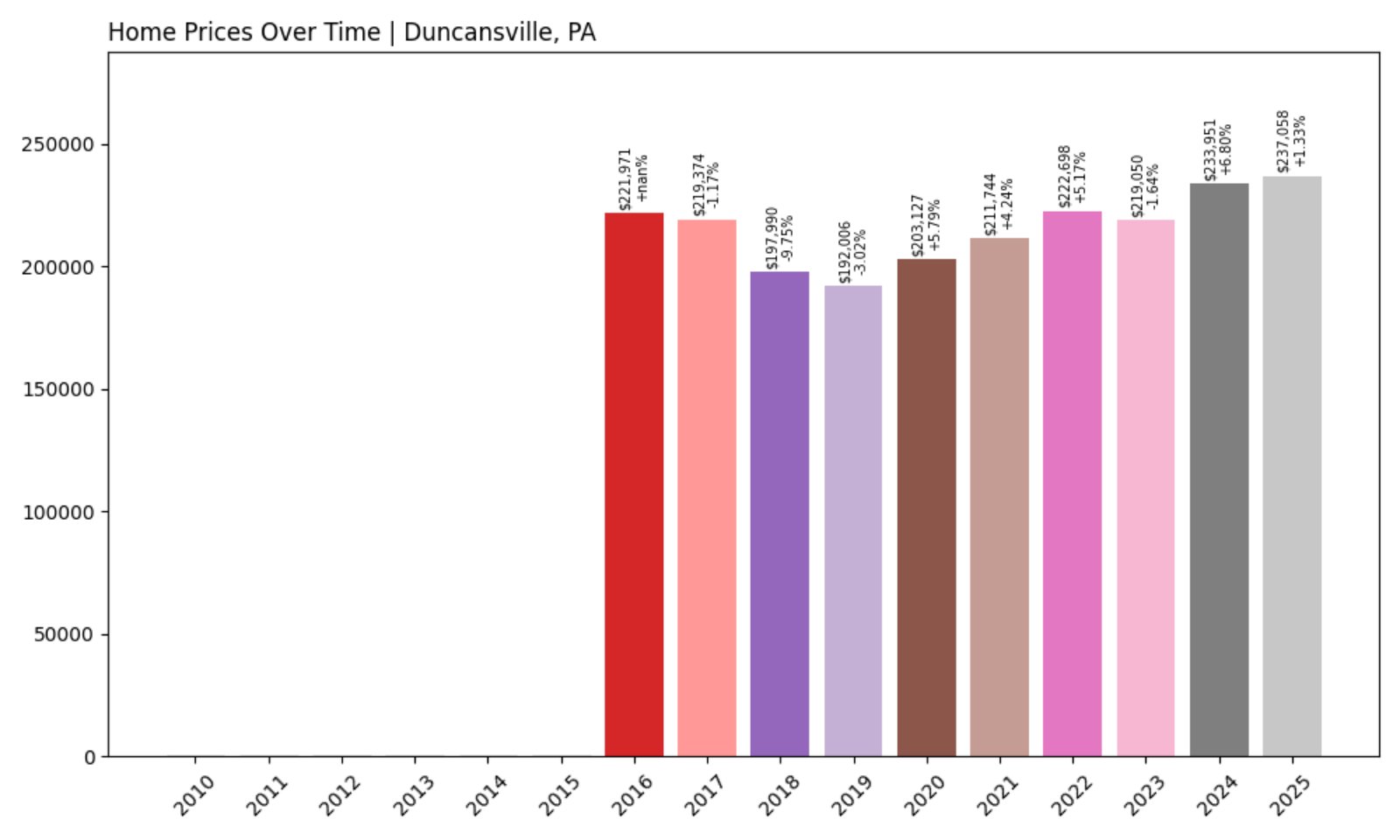

1. Duncansville – Investor Feeding Frenzy Factor 3763.24% (July 2025)

- Historical annual growth rate (2012–2022): 0.05%

- Recent annual growth rate (2022–2025): 2.10%

- Investor Feeding Frenzy Factor: 3763.24%

- Current 2025 price: $237,058.27

Duncansville tops the list with a jaw-dropping Feeding Frenzy Factor of 3763.24%. While the town’s growth may seem modest at 2.10% annually, that figure represents a more than 37-fold increase over its historical average. With home prices now over $237,000, this is a town undergoing massive transformation.

Duncansville – From Dormant to Dominant

Located in Blair County near Altoona, Duncansville has long flown under the radar with minimal price movement. That stability is now gone. Investors have moved in aggressively, exploiting the town’s prior stagnation and sparking a new era of rapid price growth.

The town’s extraordinary Feeding Frenzy Factor suggests a market shift unlike any other in Pennsylvania. For residents, the upside is rising equity—but the downside could be steep, especially for first-time buyers or renters facing limited options in a fast-moving market.