Would you like to save this?

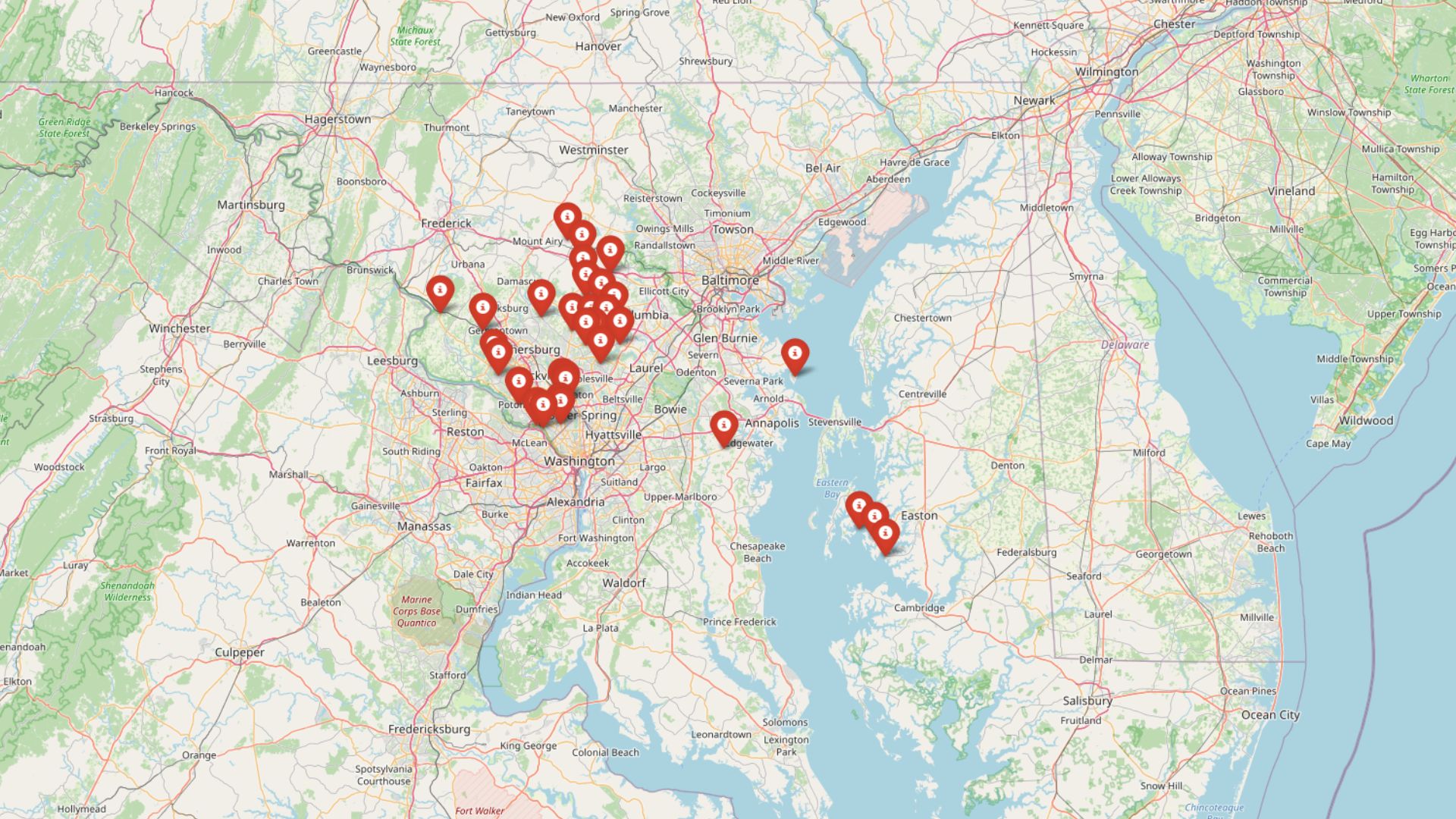

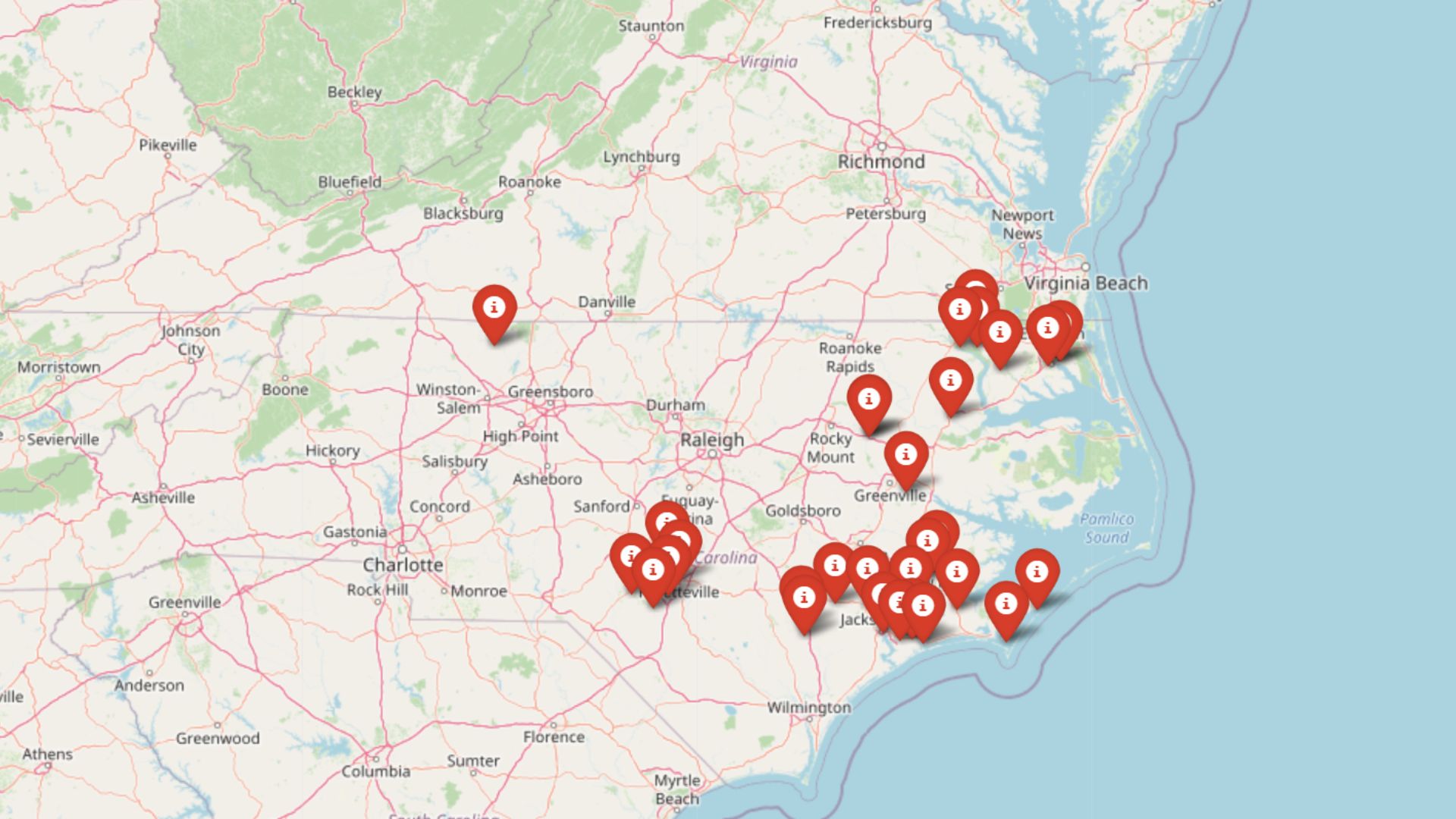

Home prices are climbing at breakneck speed in some of North Carolina’s most unassuming towns. According to the Zillow Home Value Index, investor activity has fueled sharp price acceleration in areas that once saw slow, steady growth. Over the past three years, price increases have outpaced historical trends, signaling speculative pressure that can make life tougher for local buyers.

From coastal communities to quiet inland suburbs, this surge isn’t just about numbers on a chart. It’s reshaping who can afford to live in these places, pushing first-time homebuyers to the sidelines and changing the character of long-established neighborhoods. The following towns are where the investor “feeding frenzy” is hitting hardest in July 2025.

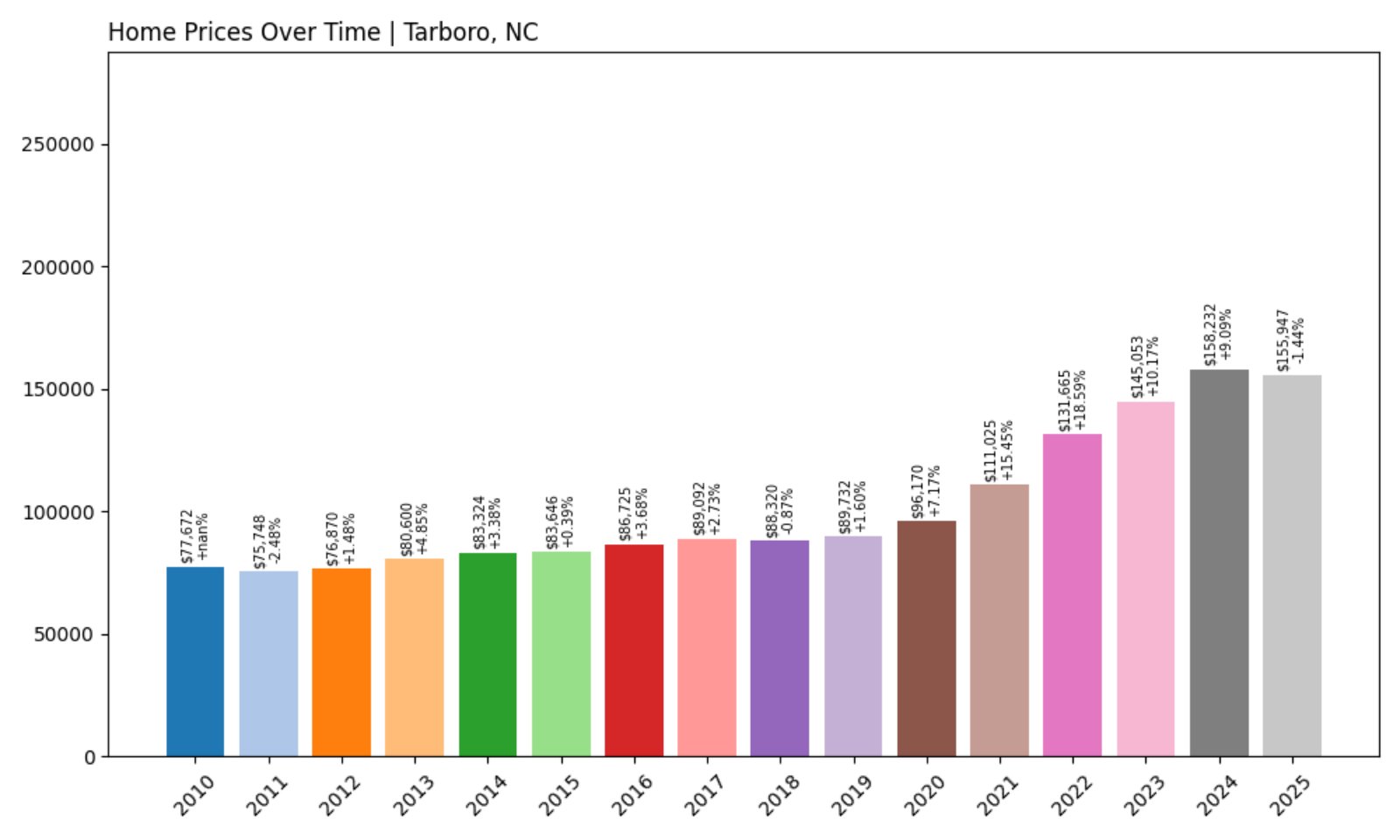

30. Tarboro – Investor Feeding Frenzy Factor 4.98% (July 2025)

- Historical annual growth rate (2012–2022): 5.53%

- Recent annual growth rate (2022–2025): 5.80%

- Investor Feeding Frenzy Factor: 4.98%

- Current 2025 price: $155,946.87

Tarboro’s home prices have grown slightly faster in recent years, with a feeding frenzy factor of just under 5%. The increase is modest compared to other towns in the state, suggesting that while investors may be active here, the pressure isn’t yet overwhelming. Still, the trend is worth watching, especially in a town where price growth was already above average over the last decade.

Tarboro – Quiet Growth, But Steady Investor Interest

Located in Edgecombe County along the Tar River, Tarboro offers historic charm and a relatively low cost of living. Its 2025 home price of $155,946.87 is still within reach for many buyers, but recent price gains suggest growing outside attention. With a rich history dating back to colonial times and a downtown listed on the National Register of Historic Places, Tarboro has long been appealing to preservationists and retirees. Now, a slow uptick in prices signals that it’s no longer flying entirely under the radar.

The town’s mild price acceleration could indicate early-stage interest from investors seeking affordable markets with upside. If trends continue, local residents might start to feel pricing pressure in the coming years.

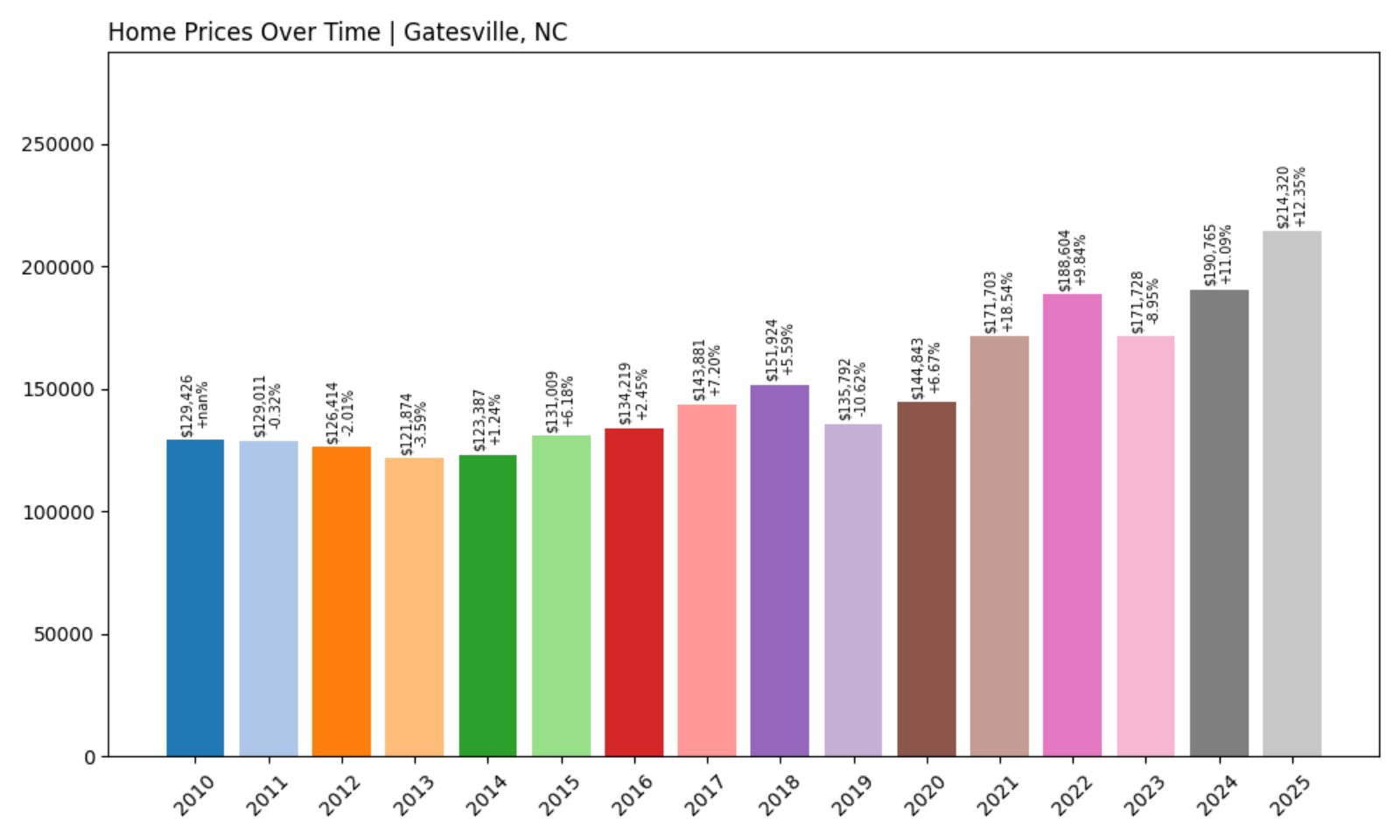

29. Gatesville – Investor Feeding Frenzy Factor 6.64% (July 2025)

- Historical annual growth rate (2012–2022): 4.08%

- Recent annual growth rate (2022–2025): 4.35%

- Investor Feeding Frenzy Factor: 6.64%

- Current 2025 price: $214,319.95

Gatesville has experienced a slight acceleration in home values, with recent growth about 6.6% above its historical rate. At just over $214K, the average home remains reasonably priced by state standards, but the subtle increase in pace could be a sign of shifting dynamics. The town’s position just below the radar may be exactly what makes it attractive to savvy buyers and investors.

Gatesville – Rural Appeal Meets Gentle Market Heat

Situated in the northeastern corner of North Carolina, Gatesville is a small, quiet town known for its rural surroundings and low-density housing. It serves as the county seat of Gates County, and its appeal lies in its peace, space, and access to outdoor recreation like Merchants Millpond State Park.

While prices haven’t surged dramatically, the town’s recent growth outpaces its long-term trend. Investors looking for underappreciated rural opportunities may be slowly discovering Gatesville. The data doesn’t yet indicate a feeding frenzy, but early signs of interest are clearly measurable.

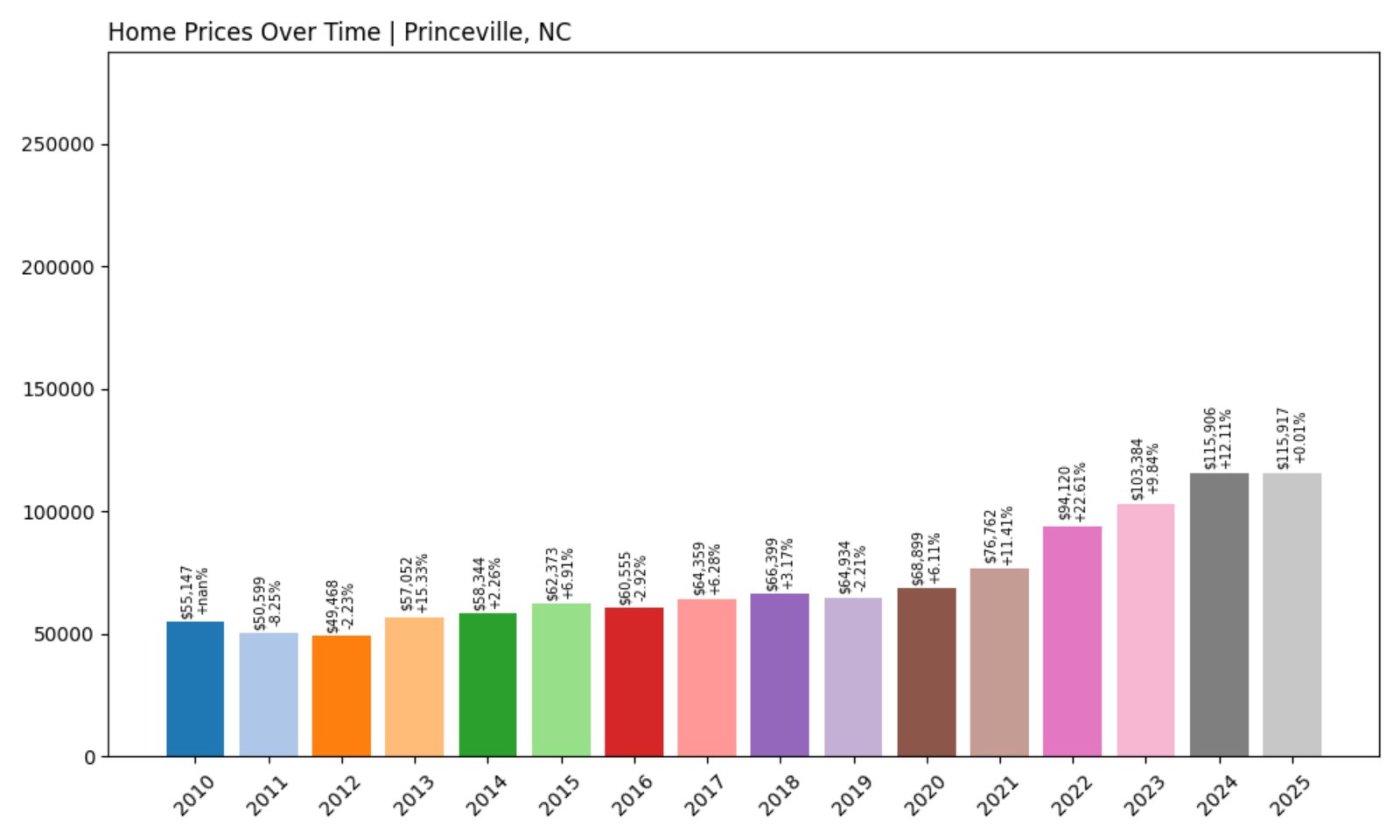

28. Princeville – Investor Feeding Frenzy Factor 8.23% (July 2025)

- Historical annual growth rate (2012–2022): 6.64%

- Recent annual growth rate (2022–2025): 7.19%

- Investor Feeding Frenzy Factor: 8.23%

- Current 2025 price: $115,917.37

Princeville’s price growth has been steady and slightly above its long-term average. While its feeding frenzy factor remains in the single digits, the relatively low average home price of under $120K makes it highly vulnerable to investor attention, especially from buyers priced out of more expensive markets.

Princeville – Historically Resilient, But Vulnerable to Speculation

Would you like to save this?

Princeville, one of the oldest towns incorporated by African Americans in the U.S., carries deep historical significance. Nestled near the Tar River, the community has faced repeated natural disasters, including major flooding. Yet its residents have shown resilience, rebuilding time and again.

At just over $115,000, the 2025 home price remains attractively low. That affordability, however, may catch the eye of investors looking for inexpensive homes with room for appreciation. With growth already trending above normal, the early warning signs of speculative pressure are present, though not yet overwhelming.

27. New Bern – Investor Feeding Frenzy Factor 8.34% (July 2025)

- Historical annual growth rate (2012–2022): 4.85%

- Recent annual growth rate (2022–2025): 5.26%

- Investor Feeding Frenzy Factor: 8.34%

- Current 2025 price: $277,545.13

New Bern has experienced modest price acceleration, with its recent growth rate topping its historical norm by just over 8%. This increase may not scream frenzy, but it suggests more interest from buyers and investors drawn to its coastal appeal and livability.

New Bern – Waterfront Lifestyle, Subtle Market Shift

Founded in 1710, New Bern blends coastal beauty, colonial history, and a thriving arts scene. It sits at the junction of the Neuse and Trent rivers and is well known for its marinas, historic districts, and vibrant tourism industry. The town also happens to be the birthplace of Pepsi.

With home prices hovering around $277,000 in 2025, New Bern still offers a mix of affordability and coastal living. That combination may be nudging investor interest higher. While not yet dramatic, the town’s pricing trends are starting to move more quickly than in years past, hinting at the early stages of a shift.

26. Lumber Bridge – Investor Feeding Frenzy Factor 10.06% (July 2025)

- Historical annual growth rate (2012–2022): 4.74%

- Recent annual growth rate (2022–2025): 5.22%

- Investor Feeding Frenzy Factor: 10.06%

- Current 2025 price: $221,223.52

With a 10% spike above its historical growth trend, Lumber Bridge is starting to draw more attention. Its modest price tag and double-digit frenzy factor suggest that early-stage speculation may be underway in this small town.

Lumber Bridge – Tiny Town, Growing Attention

Located in Robeson County, Lumber Bridge is a very small community with a population under 100. It offers rural living and quiet streets, but its location near Fayetteville provides access to larger economic centers. Historically, its housing market has been very stable.

The recent uptick in growth suggests a change in trajectory. Investors may be taking note of its proximity to major highways and low home prices. Though small in size, Lumber Bridge is showing big percentage changes that could signal future heat.

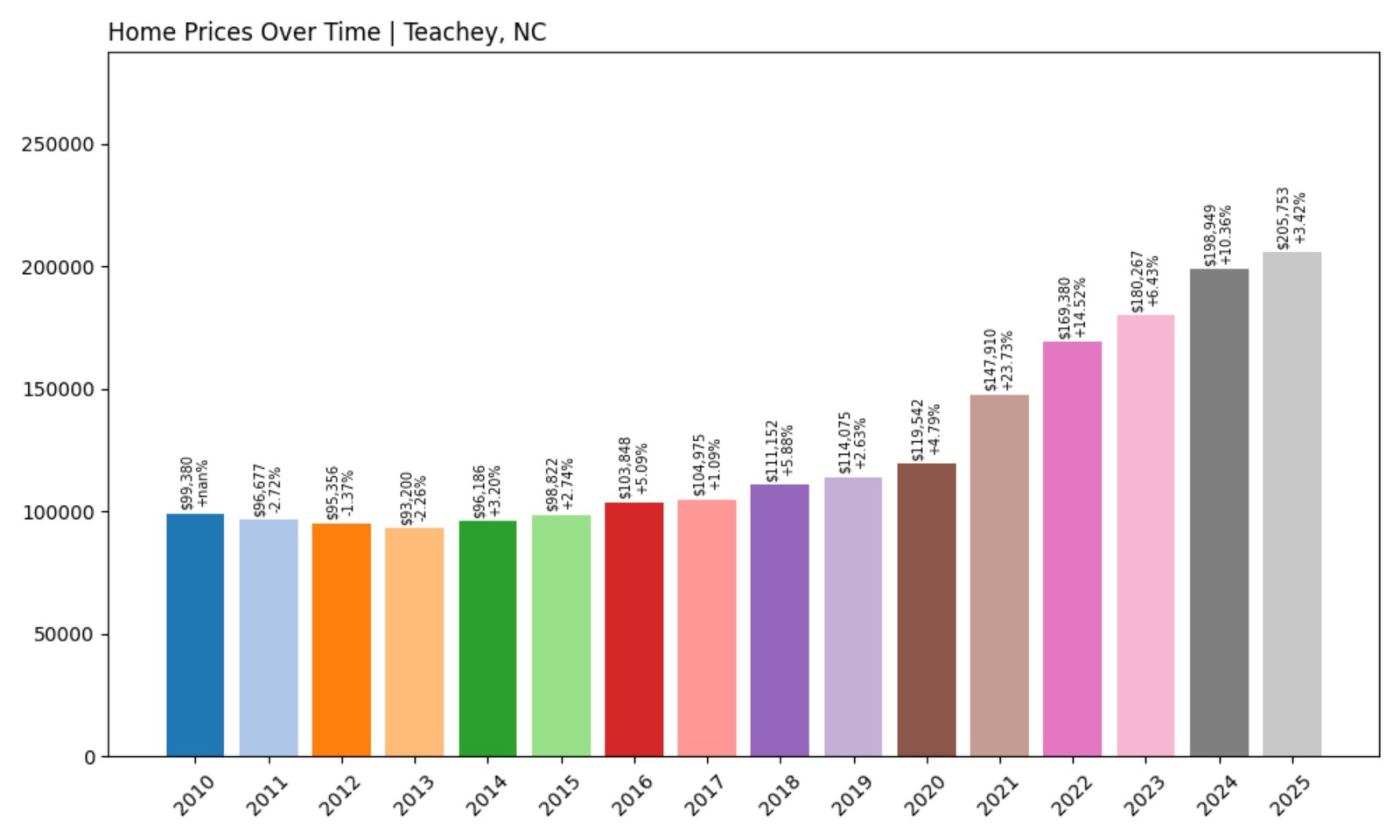

25. Teachey – Investor Feeding Frenzy Factor 13.29% (July 2025)

- Historical annual growth rate (2012–2022): 5.91%

- Recent annual growth rate (2022–2025): 6.70%

- Investor Feeding Frenzy Factor: 13.29%

- Current 2025 price: $205,753.41

Teachey has seen its growth edge up by more than 13% over past patterns. While still affordable at just over $200K, it’s starting to attract the kind of price action that draws investor speculation.

Teachey – Small-Town Stability Meets Emerging Demand

Situated in Duplin County, Teachey is a quiet, predominantly residential town surrounded by farmland and forests. It’s known for its sense of community and low-key lifestyle. Historically, home values here have grown at a strong but steady pace.

Now, with a 13% jump beyond typical trends, Teachey is showing signs of increased demand. Its affordability and rural charm make it an easy target for investors seeking long-term rental or resale potential. Locals may not feel the pressure just yet, but the data points toward growing attention.

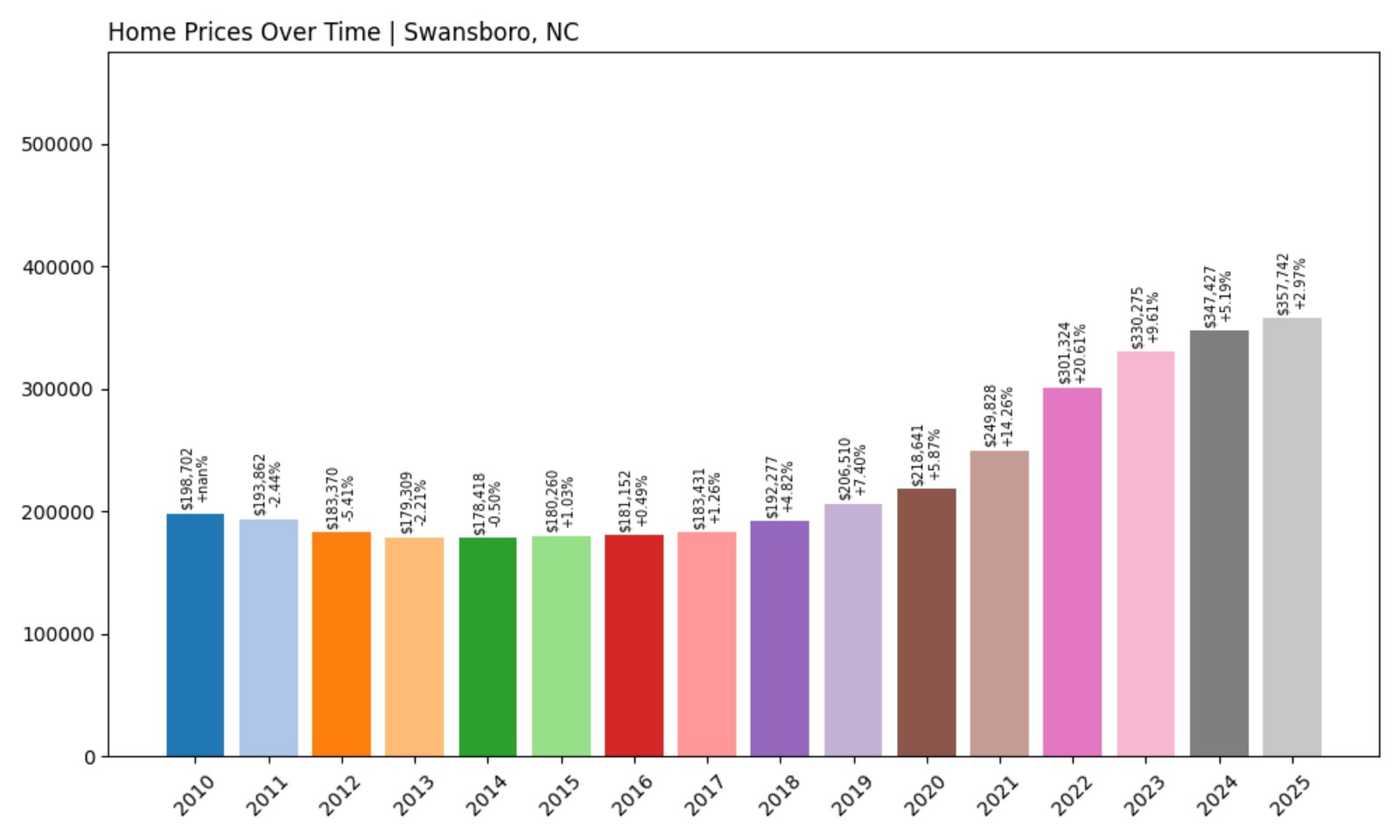

24. Swansboro – Investor Feeding Frenzy Factor 15.62% (July 2025)

- Historical annual growth rate (2012–2022): 5.09%

- Recent annual growth rate (2022–2025): 5.89%

- Investor Feeding Frenzy Factor: 15.62%

- Current 2025 price: $357,742.14

Swansboro’s housing market has picked up steam, with prices growing nearly 16% faster than in previous years. With current prices approaching $360K, this scenic coastal town is becoming less attainable for working families.

Swansboro – Coastal Appeal Fuels Demand Surge

Known as the “Friendly City by the Sea,” Swansboro is located on the Intracoastal Waterway and offers direct access to Bogue Sound and nearby beaches. It’s popular among boaters, tourists, and retirees alike.

As more people seek homes near the coast, Swansboro’s desirability is pushing up prices. That appeal, combined with limited supply, may be attracting investors hoping to cash in on rental income or future appreciation. With prices accelerating beyond trend, locals could soon find it harder to afford a piece of this charming waterfront town.

23. Camden – Investor Feeding Frenzy Factor 16.56% (July 2025)

- Historical annual growth rate (2012–2022): 4.91%

- Recent annual growth rate (2022–2025): 5.72%

- Investor Feeding Frenzy Factor: 16.56%

- Current 2025 price: $385,491.19

Camden has seen price growth rise more than 16% beyond its historical trend, and with prices nearing $400K, affordability is quickly becoming a concern. The signs suggest that outside demand is heating up.

Camden – High Prices, High Pressure

Located in northeastern North Carolina near the Virginia border, Camden is a largely residential area with picturesque waterways and easy access to both the Outer Banks and Hampton Roads. Its schools and peaceful lifestyle make it attractive to families and retirees.

The town’s desirability, however, comes with a price. With 2025 home values topping $385K and growing faster than in years past, Camden may be reaching a tipping point. Investor interest could be accelerating the shift, raising questions about long-term accessibility for locals.

22. Simpson – Investor Feeding Frenzy Factor 16.66% (July 2025)

- Historical annual growth rate (2012–2022): 5.63%

- Recent annual growth rate (2022–2025): 6.57%

- Investor Feeding Frenzy Factor: 16.66%

- Current 2025 price: $226,740.79

Simpson is experiencing growth nearly 17% above its historical pace, with prices still in the mid-$200Ks. The rapid acceleration places it among the towns most vulnerable to speculation.

Simpson – Fast Movers in Pitt County

Simpson is a small town just southeast of Greenville in Pitt County. Though it’s quiet and low in population, its proximity to a larger city gives it commuter appeal. Buyers seeking a blend of rural living and city access may be helping to drive prices up.

With home prices now nearing $227K and investor interest likely growing, Simpson’s real estate market may no longer be a secret. If the current trends continue, the town could see more pressure from both investors and new residents.

21. Spring Lake – Investor Feeding Frenzy Factor 19.21% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 4.42%

- Recent annual growth rate (2022–2025): 5.27%

- Investor Feeding Frenzy Factor: 19.21%

- Current 2025 price: $253,124.69

Spring Lake’s price acceleration has surpassed its historic growth rate by more than 19%, signaling a clear rise in demand. With a current home price in the $250K range, the town remains accessible — but maybe not for long.

Spring Lake – Military Proximity and Investor Pull

Located in Cumberland County, Spring Lake is adjacent to Fort Liberty (formerly Fort Bragg), one of the largest military installations in the world. That proximity has always brought population churn and steady demand for housing. Now, prices are rising faster than before, possibly due to increased investor interest in rental properties for military families.

The feeding frenzy score suggests the market is warming. If these trends hold, affordability in Spring Lake may soon be a thing of the past — especially for first-time buyers or military families on tight budgets.

20. Beulaville – Investor Feeding Frenzy Factor 20.79% (July 2025)

- Historical annual growth rate (2012–2022): 5.45%

- Recent annual growth rate (2022–2025): 6.59%

- Investor Feeding Frenzy Factor: 20.79%

- Current 2025 price: $215,358.47

Home prices in Beulaville have grown over 20% faster than historical trends in the last three years, pushing average values to around $215K. That level of acceleration suggests that investors are circling this small town, likely drawn by its affordability and potential for appreciation.

Beulaville – Rural Value, Rising Investor Buzz

Beulaville, in Duplin County, is a small town rooted in agriculture and surrounded by farmland. While it has traditionally been overlooked by large-scale buyers, its recent growth suggests that could be changing. Its location between Jacksonville and Goldsboro gives it strategic value for commuters and retirees looking for peace and low prices.

The town’s affordability may be exactly what’s catching investor eyes. A feeding frenzy score above 20% shows that something has shifted in Beulaville — a quiet market is starting to heat up fast, and locals could feel it soon.

19. Harkers Island – Investor Feeding Frenzy Factor 21.55% (July 2025)

- Historical annual growth rate (2012–2022): 4.23%

- Recent annual growth rate (2022–2025): 5.14%

- Investor Feeding Frenzy Factor: 21.55%

- Current 2025 price: $387,818.09

Harkers Island’s home values have surged by over 21% beyond their long-term pace. With the average 2025 price now pushing close to $390K, this waterfront community is becoming increasingly out of reach for middle-income families.

Harkers Island – Coastal Charm Under Investor Strain

Located in Carteret County, Harkers Island offers stunning views of Core Sound and Cape Lookout National Seashore. Long cherished by fishermen, boaters, and locals who value its isolation, the island is now seeing dramatic price increases as its reputation spreads.

With home values growing much faster than normal, the town’s unique location may be making it a prime target for second-home buyers and real estate investors. Residents who’ve lived here for generations may soon be priced out unless the pace cools.

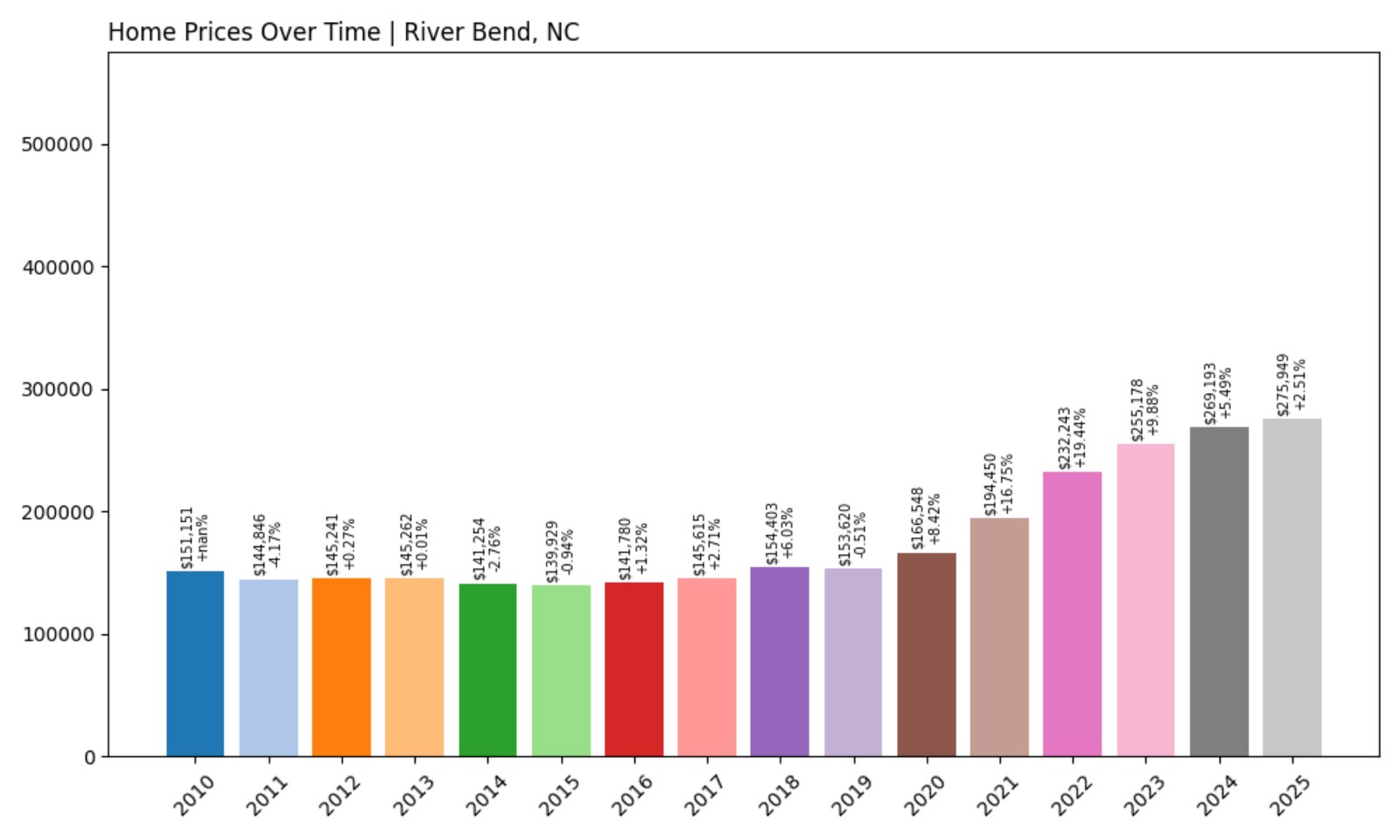

18. River Bend – Investor Feeding Frenzy Factor 23.10% (July 2025)

- Historical annual growth rate (2012–2022): 4.81%

- Recent annual growth rate (2022–2025): 5.92%

- Investor Feeding Frenzy Factor: 23.10%

- Current 2025 price: $275,948.86

River Bend’s home prices are rising at a rate 23% faster than their historic trend — a strong sign of increased speculative demand. The current price of just under $276K places it above average for eastern North Carolina.

River Bend – Small Town, Big Acceleration

River Bend is a residential town near New Bern that lives up to its name, bordered by tranquil waterways and known for its golf courses and boating access. It’s a popular choice for retirees and those looking for scenic suburban living near the coast.

But rapid price increases could soon change the equation. With strong infrastructure and proximity to larger hubs, River Bend’s desirability may be attracting investors and vacation buyers alike. The current trajectory suggests continued heat in this otherwise quiet town.

17. Hope Mills – Investor Feeding Frenzy Factor 27.02% (July 2025)

- Historical annual growth rate (2012–2022): 4.13%

- Recent annual growth rate (2022–2025): 5.24%

- Investor Feeding Frenzy Factor: 27.02%

- Current 2025 price: $254,994.13

Hope Mills is witnessing an investor feeding frenzy, with a growth factor above 27% and prices nearing $255K. The sharp acceleration signals demand from outside buyers eager to capitalize on this town’s appeal and affordability.

Hope Mills – Fayetteville Suburb Under Pressure

Located in Cumberland County, Hope Mills is a fast-growing suburb of Fayetteville with strong schools, community parks, and easy access to Fort Liberty. The town has long attracted military families and young professionals looking for more space than the city offers.

With its housing market heating up faster than the state average, Hope Mills is now a hotspot for investor interest. Prices have jumped far beyond their historical path, and while the area remains desirable, locals may need to act quickly before affordability erodes further.

16. Maysville – Investor Feeding Frenzy Factor 27.14% (July 2025)

- Historical annual growth rate (2012–2022): 4.57%

- Recent annual growth rate (2022–2025): 5.82%

- Investor Feeding Frenzy Factor: 27.14%

- Current 2025 price: $228,893.22

Maysville’s price gains outpaced its historical trend by over 27%, pushing average values close to $230K. The steep uptick points to increased investor focus on this quiet Jones County town.

Maysville – On the Radar for Price Shifts

Set between Jacksonville and New Bern, Maysville is a small town with direct access to Croatan National Forest and Highway 17. Its location offers a rural setting within reach of employment centers and the coast, making it increasingly attractive to buyers.

With a low baseline price and recent price growth pushing ahead, Maysville may be emerging as a place where investors see room for appreciation. The pace may soon put pressure on affordability and reshape who can buy in.

15. Wallace – Investor Feeding Frenzy Factor 27.66% (July 2025)

- Historical annual growth rate (2012–2022): 5.18%

- Recent annual growth rate (2022–2025): 6.62%

- Investor Feeding Frenzy Factor: 27.66%

- Current 2025 price: $209,491.92

Home values in Wallace have accelerated nearly 28% beyond their decade-long norm, bringing prices up to roughly $209K. This suggests mounting demand in a town once considered a slow-growth market.

Wallace – Agriculture Hub Sees Investor Heat

Wallace, in Duplin County, has a long tradition as a farming and market town. With a quaint downtown, golf courses, and nearby access to I-40, it has started to evolve beyond its rural roots into a more attractive prospect for homebuyers and investors alike.

The sharp increase in home prices could be linked to its affordability and strategic location. As surrounding towns grow more expensive, Wallace may become a popular alternative — but that could mean increased pressure on local families looking to stay put.

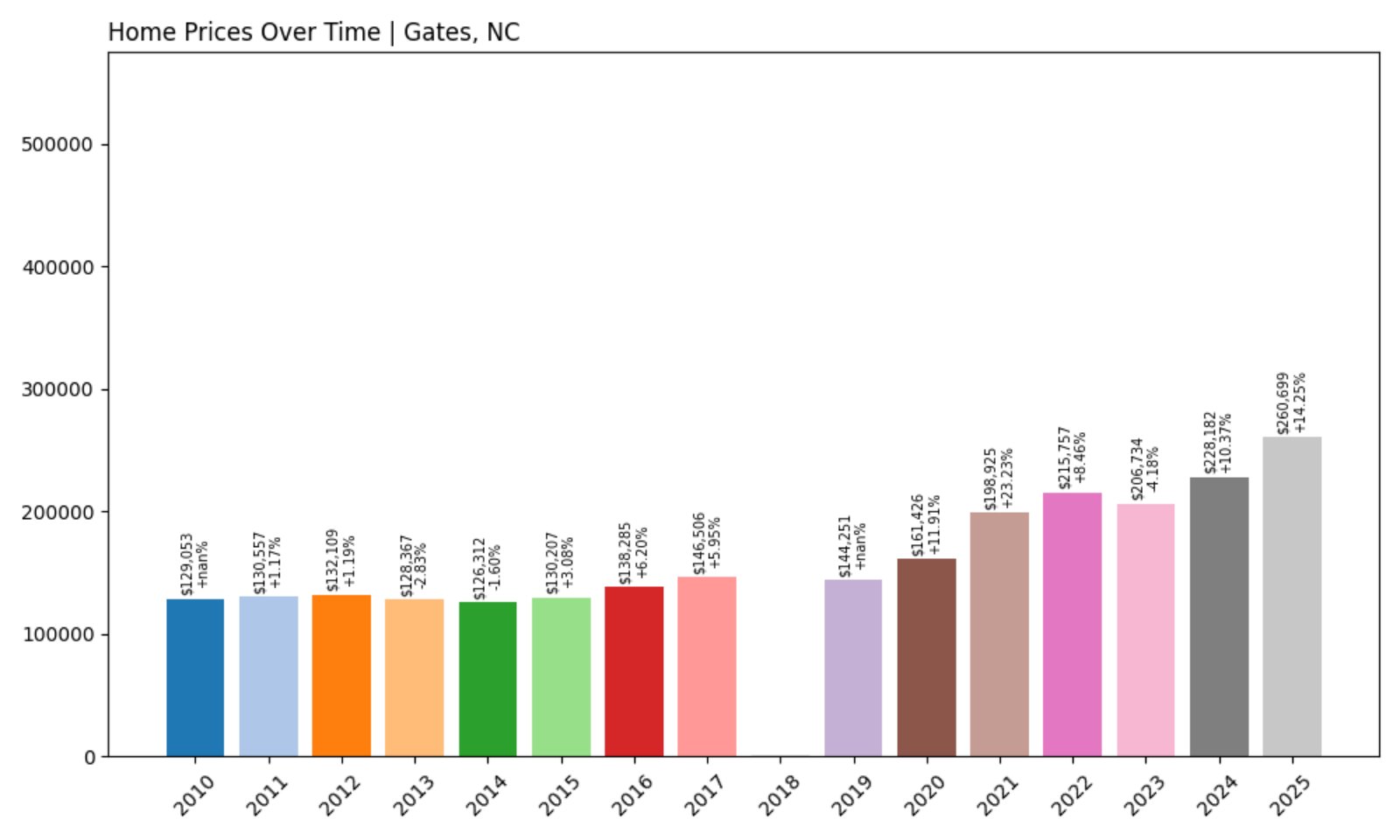

14. Gates – Investor Feeding Frenzy Factor 29.50% (July 2025)

- Historical annual growth rate (2012–2022): 5.03%

- Recent annual growth rate (2022–2025): 6.51%

- Investor Feeding Frenzy Factor: 29.50%

- Current 2025 price: $260,699.47

With a 29.5% frenzy factor, Gates is climbing the ranks of North Carolina’s most investor-influenced towns. Prices have spiked to over $260K — a significant rise for this historically stable rural area.

Gates – Quiet County, Loud Market Signals

Gates is a small, largely agricultural community in northeastern North Carolina, just across the border from Virginia. Known for its farmland and natural landscapes, the town has rarely been associated with rapid change.

But that may be changing. The nearly 30% acceleration in home price growth suggests rising demand — likely from buyers seeking space and relative affordability compared to more urban markets nearby. For residents, this could mark the start of a new pricing reality.

13. Danbury – Investor Feeding Frenzy Factor 31.03% (July 2025)

- Historical annual growth rate (2012–2022): 4.26%

- Recent annual growth rate (2022–2025): 5.58%

- Investor Feeding Frenzy Factor: 31.03%

- Current 2025 price: $214,030.72

Danbury has seen its home prices grow 31% faster than usual, pushing average values above $214K. With a quiet location and scenic views, this town is fast becoming a target for speculative buying.

Danbury – Scenic and Surging

Danbury is the county seat of Stokes County and sits near Hanging Rock State Park, one of the region’s most visited outdoor destinations. While small, the town is known for its mountain views, trails, and peaceful lifestyle.

As more buyers seek homes with proximity to nature, Danbury’s appeal has grown. That interest appears to be translating into real estate pressure, with prices rising fast. If that pace continues, it may become difficult for longtime residents to keep up.

12. Elizabeth City – Investor Feeding Frenzy Factor 35.58% (July 2025)

- Historical annual growth rate (2012–2022): 4.07%

- Recent annual growth rate (2022–2025): 5.52%

- Investor Feeding Frenzy Factor: 35.58%

- Current 2025 price: $263,517.71

Elizabeth City’s home prices are now growing more than 35% faster than usual, with average values near $263K. That sharp climb points to a sudden surge in attention from investors and buyers alike.

Elizabeth City – Coastal Gateway With Surging Prices

Located on the Pasquotank River near the Albemarle Sound, Elizabeth City is known for its waterfront, history, and as a hub for boating and Coast Guard operations. Its mix of small-town charm and water access makes it increasingly attractive to those leaving more congested areas.

The town’s sharp price increase suggests that rising demand is already hitting the market. With limited inventory and rising investor interest, affordability could quickly become a challenge for locals looking to stay in the area.

11. Fayetteville – Investor Feeding Frenzy Factor 41.70% (July 2025)

- Historical annual growth rate (2012–2022): 4.16%

- Recent annual growth rate (2022–2025): 5.90%

- Investor Feeding Frenzy Factor: 41.70%

- Current 2025 price: $220,552.05

Fayetteville has surged past its historical price growth by nearly 42%, pushing the current average home price to over $220K. That acceleration suggests heightened investor activity in one of the state’s largest cities.

Fayetteville – Military Hub, Investor Magnet

Fayetteville is home to Fort Liberty and one of North Carolina’s most dynamic populations. With a steady stream of military personnel, families, and contractors, its housing market has long been busy — but now, prices are climbing faster than usual.

The feeding frenzy factor suggests more speculative demand is entering the picture. The city’s blend of affordability, job stability, and regional infrastructure may make it irresistible to investors. That trend could mean tighter competition and higher prices for locals in the near future.

10. Raeford – Investor Feeding Frenzy Factor 47.82% (July 2025)

- Historical annual growth rate (2012–2022): 4.14%

- Recent annual growth rate (2022–2025): 6.12%

- Investor Feeding Frenzy Factor: 47.82%

- Current 2025 price: $285,798.40

Raeford’s home prices are rising almost 48% faster than their long-term trend, with average values now approaching $286K. That’s a sharp shift for a town that once maintained a modest growth pace, and it strongly suggests growing speculative demand.

Raeford – Hoke County’s Rising Star

Located west of Fayetteville in Hoke County, Raeford offers a suburban feel with proximity to major military installations. The area has seen steady population growth thanks to spillover from nearby urban areas and increased demand for housing near Fort Liberty.

With home prices now far outpacing their historical average, Raeford is becoming a hotbed for investors seeking quick appreciation. That trend may make it more difficult for first-time homebuyers or longtime residents to compete in the current market.

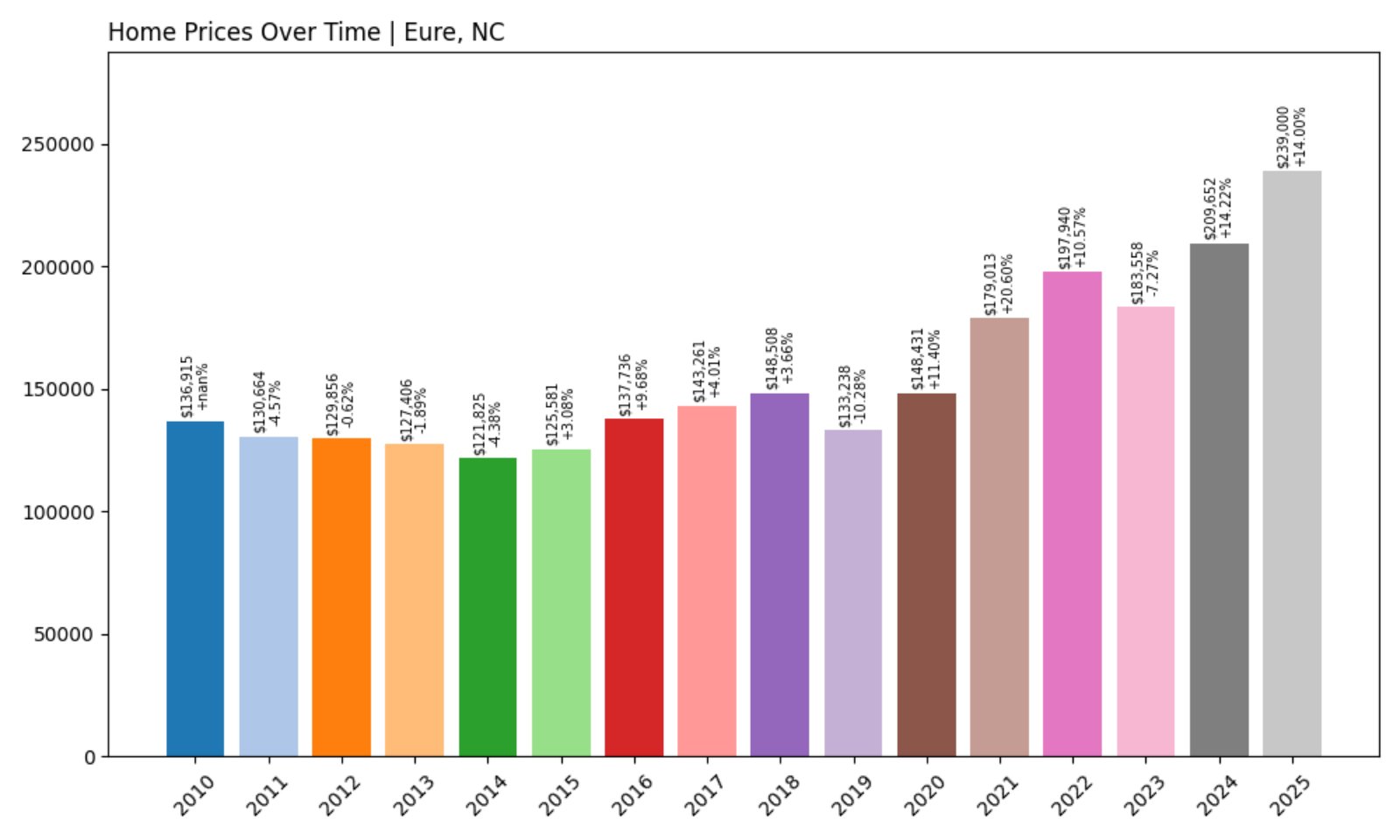

9. Eure – Investor Feeding Frenzy Factor 50.62% (July 2025)

- Historical annual growth rate (2012–2022): 4.31%

- Recent annual growth rate (2022–2025): 6.48%

- Investor Feeding Frenzy Factor: 50.62%

- Current 2025 price: $239,000.13

Eure’s housing market has gained serious momentum, growing over 50% faster than usual. With prices near $239K and rising quickly, this rural town is experiencing a transformation driven by outside demand.

Eure – Rural Retreat With Investor Intrigue

Located in Gates County near the Virginia state line, Eure is a small, unincorporated community known for its agricultural land and seclusion. It has historically seen little turnover in its housing market.

But that may be changing. The data shows a spike in appreciation that far exceeds the past decade’s trend, hinting at growing investor interest. If this continues, Eure’s identity as a rural holdout could shift toward a higher-priced enclave, leaving longtime locals squeezed by fast-moving market forces.

8. Atlantic – Investor Feeding Frenzy Factor 51.18% (July 2025)

- Historical annual growth rate (2012–2022): 3.94%

- Recent annual growth rate (2022–2025): 5.96%

- Investor Feeding Frenzy Factor: 51.18%

- Current 2025 price: $223,644.48

Atlantic has seen recent home price growth exceed historic levels by over 51%, signaling a spike in attention. Despite its remote location, the town’s appeal as a coastal hideaway may be drawing in investors and second-home seekers.

Atlantic – Quiet Coastline, Quick Price Gains

Set along the Core Sound in Carteret County, Atlantic is a fishing village with deep maritime roots. Its location near Cape Lookout National Seashore and low home prices once kept it off the investment radar — but not anymore.

The town’s feeding frenzy score now ranks in the top 10 statewide. That level of appreciation suggests investors are betting on future demand, possibly for rentals or vacation homes. Residents may begin to feel the pinch as prices rise faster than incomes.

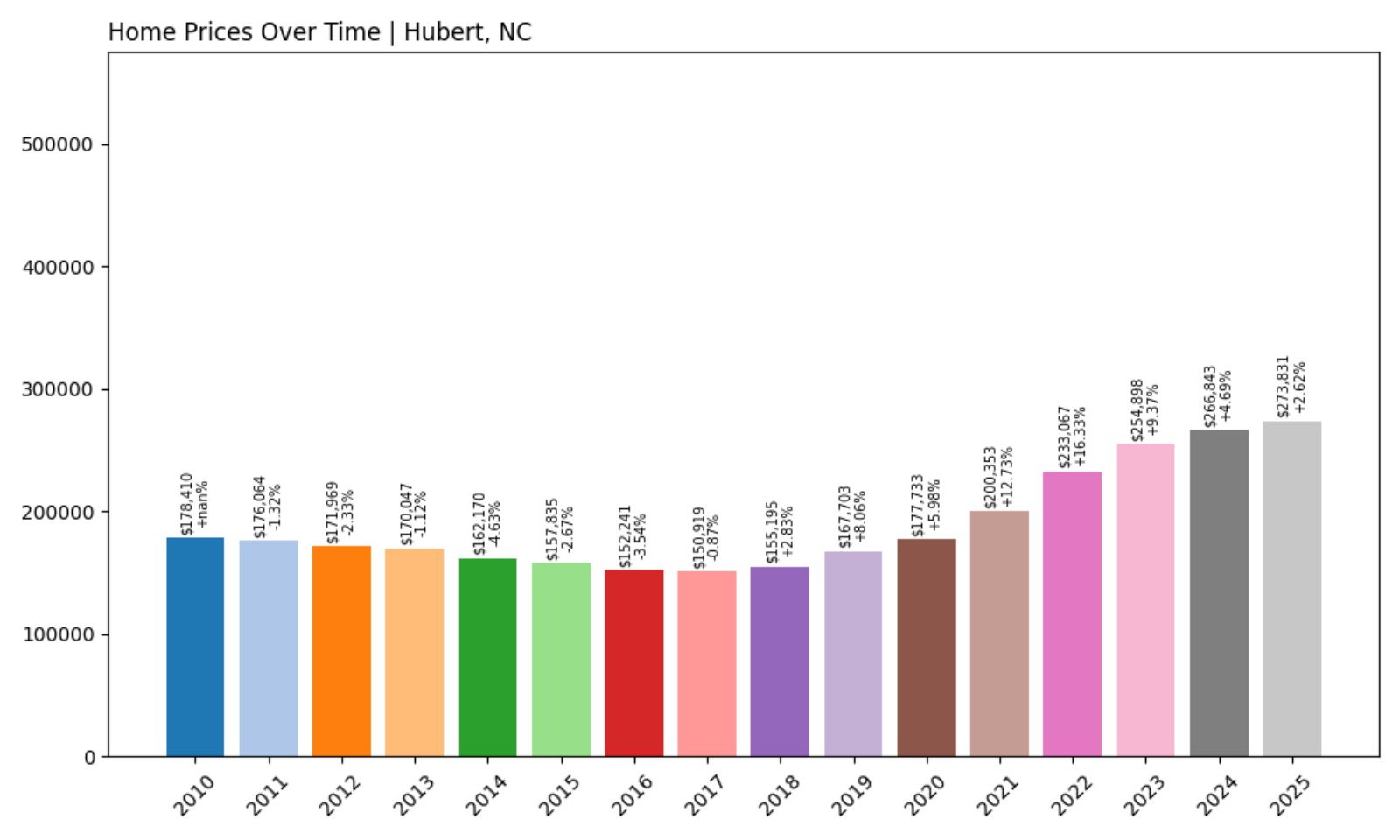

7. Hubert – Investor Feeding Frenzy Factor 78.82% (July 2025)

- Historical annual growth rate (2012–2022): 3.09%

- Recent annual growth rate (2022–2025): 5.52%

- Investor Feeding Frenzy Factor: 78.82%

- Current 2025 price: $273,831.44

Hubert’s market is heating up fast, with home prices growing nearly 79% faster than in previous years. The surge has lifted average values to nearly $274K, well above historical norms.

Hubert – Military Neighbor, Market on Fire

Hubert lies just outside the main gate of Camp Lejeune, one of the largest Marine Corps bases in the country. Its proximity to the base has long made it a popular housing choice for military families, but now investors seem to be piling in too.

The sharp acceleration in home price growth reflects increased competition, possibly driven by rental demand and relocations. With affordability shrinking and growth soaring, Hubert may become one of the state’s more contested markets in coming years.

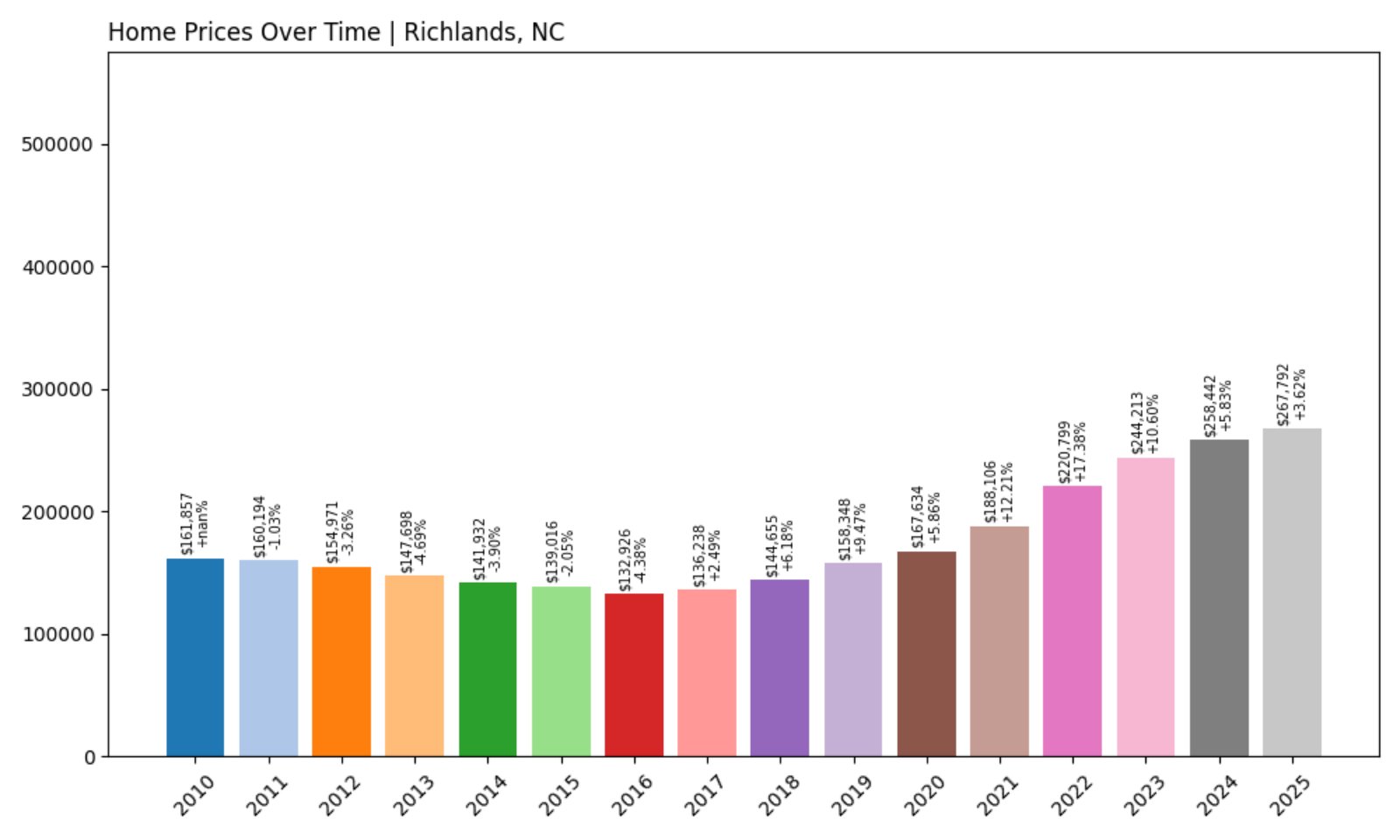

6. Richlands – Investor Feeding Frenzy Factor 84.36% (July 2025)

- Historical annual growth rate (2012–2022): 3.60%

- Recent annual growth rate (2022–2025): 6.64%

- Investor Feeding Frenzy Factor: 84.36%

- Current 2025 price: $267,792.31

Richlands has surged nearly 85% past its historical growth trend, placing it among the most rapidly appreciating towns in North Carolina. At just under $268K, homes here are becoming significantly less affordable for longtime residents.

Richlands – From Small Town to Investment Target

Located in Onslow County, Richlands has traditionally been a quiet, family-oriented town with modest price growth. Its proximity to Jacksonville and Camp Lejeune has always created steady housing demand, but the last few years have turned that into full-blown acceleration.

The town’s dramatic growth rate suggests increased investor interest — possibly driven by expectations for future rental returns or continued population inflow. As price hikes continue, local buyers may find themselves sidelined.

5. Belvidere – Investor Feeding Frenzy Factor 87.53% (July 2025)

- Historical annual growth rate (2012–2022): 1.19%

- Recent annual growth rate (2022–2025): 2.23%

- Investor Feeding Frenzy Factor: 87.53%

- Current 2025 price: $226,730.11

Belvidere’s home values have nearly doubled their normal growth pace, rising 87.5% faster than expected. While still relatively affordable at $227K, that kind of acceleration is a red flag for market overheating.

Belvidere – Accelerating From a Low Baseline

Belvidere is a tiny unincorporated community in Perquimans County, known for its farmland and rural tranquility. Historically, its home prices have barely budged — making the recent gains especially striking.

With such a low historical baseline, even modest demand can trigger sharp increases. Investors seeking low-cost entry points may be flocking here, but the town’s limited inventory and infrastructure could struggle to support rapid changes.

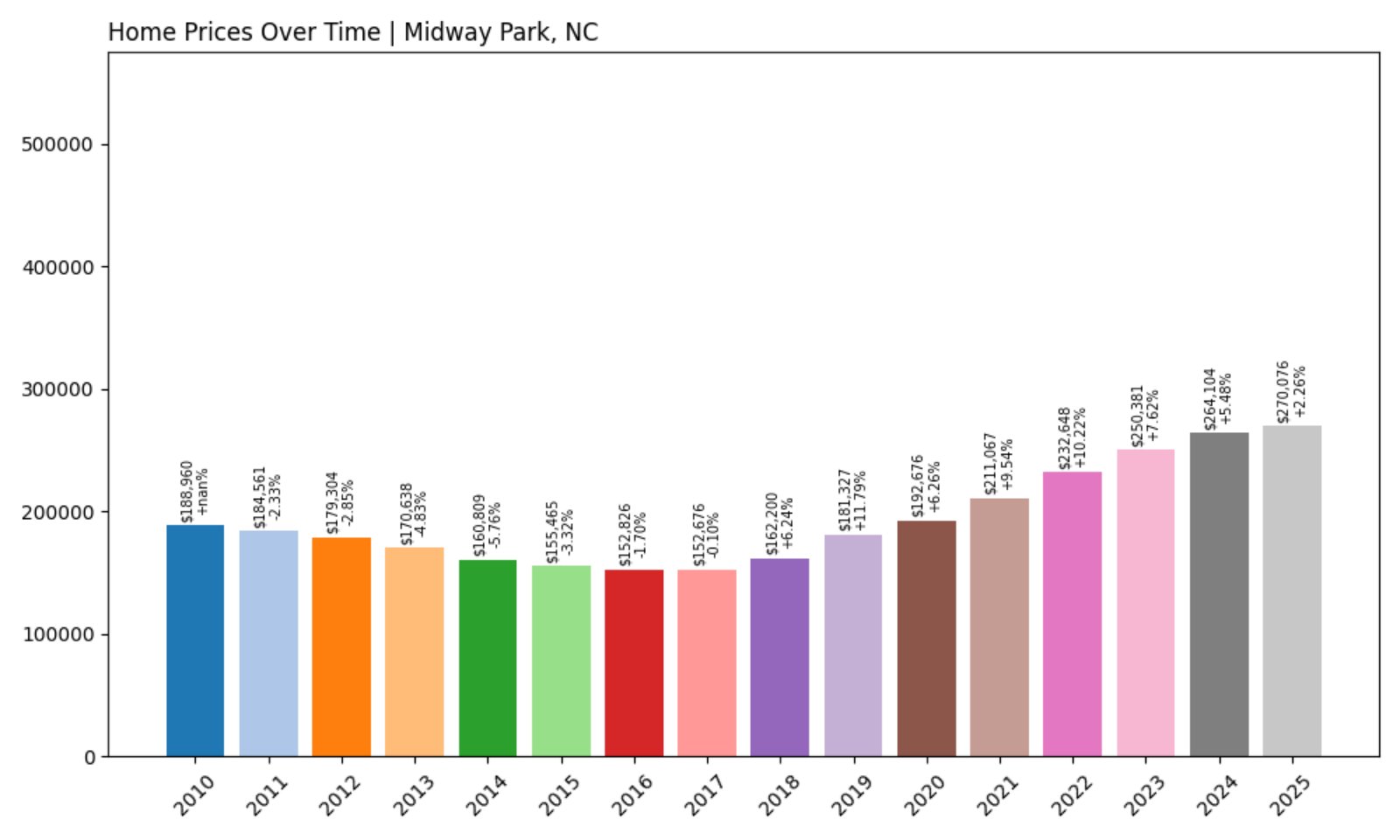

4. Midway Park – Investor Feeding Frenzy Factor 93.22% (July 2025)

- Historical annual growth rate (2012–2022): 2.64%

- Recent annual growth rate (2022–2025): 5.10%

- Investor Feeding Frenzy Factor: 93.22%

- Current 2025 price: $270,076.16

Midway Park has seen a dramatic rise in housing costs, with growth nearly doubling past trends. Its price point around $270K makes it accessible — for now — but the market shows clear signs of feeding frenzy dynamics.

Midway Park – Base-Adjacent and Booming

Midway Park sits just southeast of Jacksonville and Camp Lejeune, putting it in the direct path of military-driven housing demand. The area is primarily residential, with many homes built to serve military personnel and their families.

Now, the pace of appreciation suggests investors may be moving in more aggressively. Rentals, flips, and new builds could all be part of the shift, but for local families, the change may translate to higher prices and shrinking options.

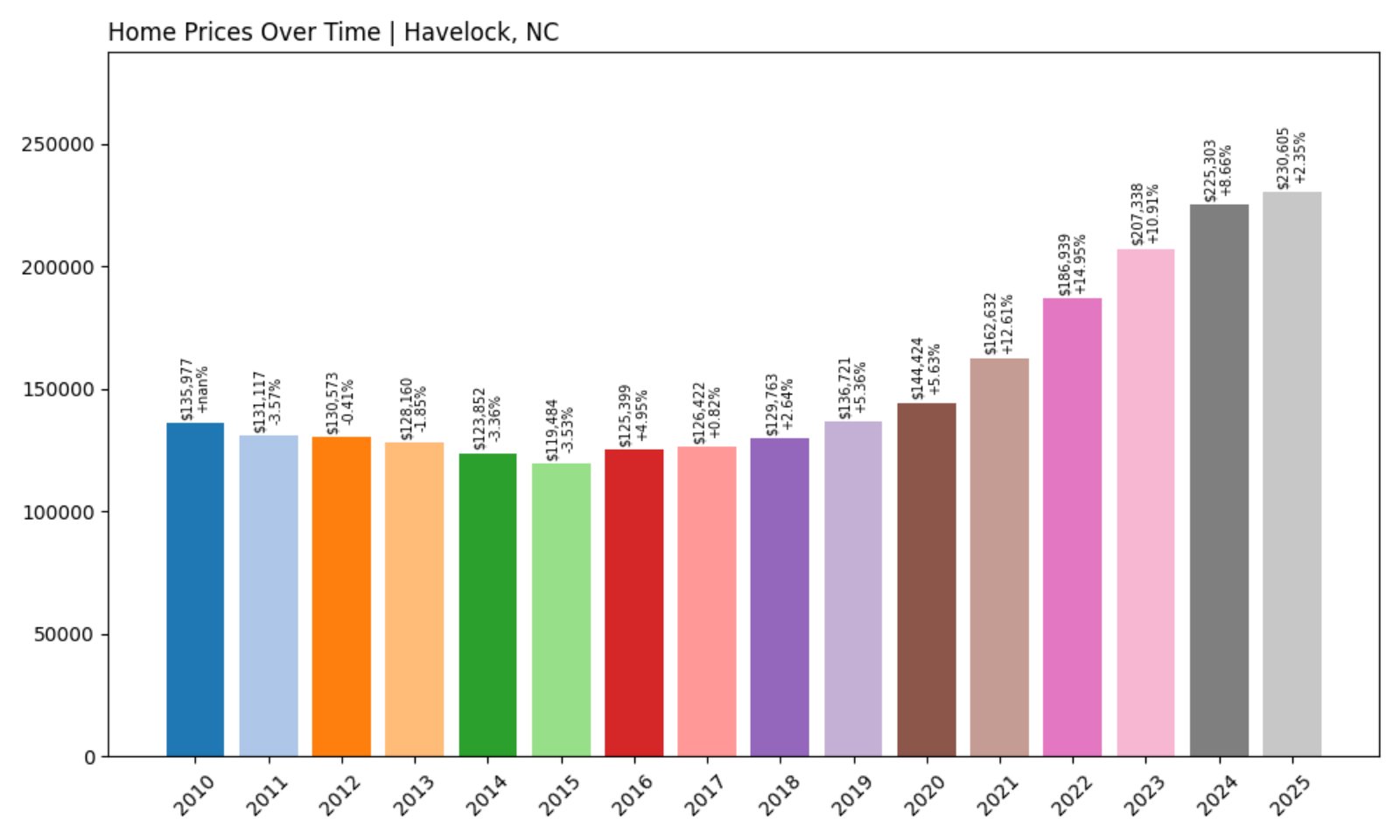

3. Havelock – Investor Feeding Frenzy Factor 98.38% (July 2025)

- Historical annual growth rate (2012–2022): 3.65%

- Recent annual growth rate (2022–2025): 7.25%

- Investor Feeding Frenzy Factor: 98.38%

- Current 2025 price: $230,604.65

Havelock’s home price growth has nearly doubled its historical pace, climbing almost 100% faster than average. The surge has pushed average home prices past $230K, marking it as one of the most investor-influenced markets in the state.

Havelock – Military Town With Mounting Market Pressure

Home to Marine Corps Air Station Cherry Point, Havelock has always been a military-centric town with steady housing demand. But the recent spike in growth signals a major shift, likely involving more external investment.

The town’s strategic location and affordability make it a prime target for buyers looking to capitalize on population turnover and rental potential. With prices moving this fast, long-term residents may be feeling the pressure already.

2. Jacksonville – Investor Feeding Frenzy Factor 103.39% (July 2025)

- Historical annual growth rate (2012–2022): 3.09%

- Recent annual growth rate (2022–2025): 6.29%

- Investor Feeding Frenzy Factor: 103.39%

- Current 2025 price: $252,244.09

Jacksonville has seen its growth rate double in recent years, with prices climbing to over $252K. Its feeding frenzy score of 103.39% places it squarely in the investor crosshairs.

Jacksonville – Explosive Growth Around Camp Lejeune

Jacksonville, the largest city in Onslow County, is dominated by Camp Lejeune and the constant flow of military families. While housing demand has always been strong, something new is happening — a major upswing in prices that outpaces even this dynamic market’s history.

Real estate investors are likely fueling the trend, banking on reliable rental demand and future appreciation. The rapid changes may be good news for sellers, but they could spell trouble for families looking to buy their first home in the city.

1. Windsor – Investor Feeding Frenzy Factor 219.11% (July 2025)

- Historical annual growth rate (2012–2022): 1.11%

- Recent annual growth rate (2022–2025): 3.53%

- Investor Feeding Frenzy Factor: 219.11%

- Current 2025 price: $73,262.49

Windsor tops the list with a staggering feeding frenzy factor of 219%, the highest in North Carolina. Though average home prices remain low at just over $73K, they’re growing at more than triple the historical rate — a clear sign of investor-driven upheaval.

Windsor – North Carolina’s Most Volatile Market in 2025

Located in Bertie County in the northeastern part of the state, Windsor is a quiet, rural town with a long history and a small population. Its housing market was long stagnant, but things have changed dramatically in the last few years.

Such extreme growth from a low base suggests aggressive investor action, likely focused on flipping or renting low-cost properties. Windsor may still seem affordable, but the velocity of change is the real story — and one that could have major consequences for locals.