Would you like to save this?

Home prices are surging across parts of New Jersey, and investors are leading the charge. According to the Zillow Home Value Index, 30 towns have seen their property values accelerate far beyond their historical trends between 2022 and 2025. Our Investor Feeding Frenzy Factor highlights where short-term price growth has more than doubled past decade norms, signaling intense speculative activity.

For local families and first-time buyers, the effects are tangible. Affordable homes are disappearing quickly, bidding wars are becoming routine, and once-stable communities are experiencing rapid change. These 30 towns mark the epicenter of New Jersey’s investor-driven housing boom in July 2025.

30. Closter – Investor Feeding Frenzy Factor 73.64% (July 2025)

- Historical annual growth rate (2012–2022): 4.04%

- Recent annual growth rate (2022–2025): 7.02%

- Investor Feeding Frenzy Factor: 73.64%

- Current 2025 price: $1,132,536.40

Closter’s price growth nearly doubled its historical pace from 2022 to 2025, signaling a clear uptick in speculative pressure. With a Feeding Frenzy Factor of 73.64%, the data points to a market heating up faster than expected — even by New Jersey’s high standards. Homebuyers entering in 2025 are now facing median prices exceeding $1.13 million, compared to much more modest increases in the prior decade.

Closter – Surge in Luxury-Level Demand and Investor Pressure

Located in Bergen County just a short drive from Manhattan, Closter offers a suburban lifestyle with an upscale edge. Its top-ranked public schools, access to shopping plazas like Closter Plaza, and well-maintained residential streets have made it attractive to both families and outside buyers looking for long-term investments. But what was once a relatively quiet suburban enclave has seen dramatic pricing shifts recently.

The recent growth rate of 7.02% annually from 2022–2025, compared to the 4.04% pace during the prior ten years, shows how investor interest has intensified. High-end redevelopment and proximity to affluent enclaves like Tenafly and Demarest may be adding pressure to the market. Closter’s current price level now exceeds $1.1 million, signaling a transition to luxury pricing that could challenge affordability for local buyers.

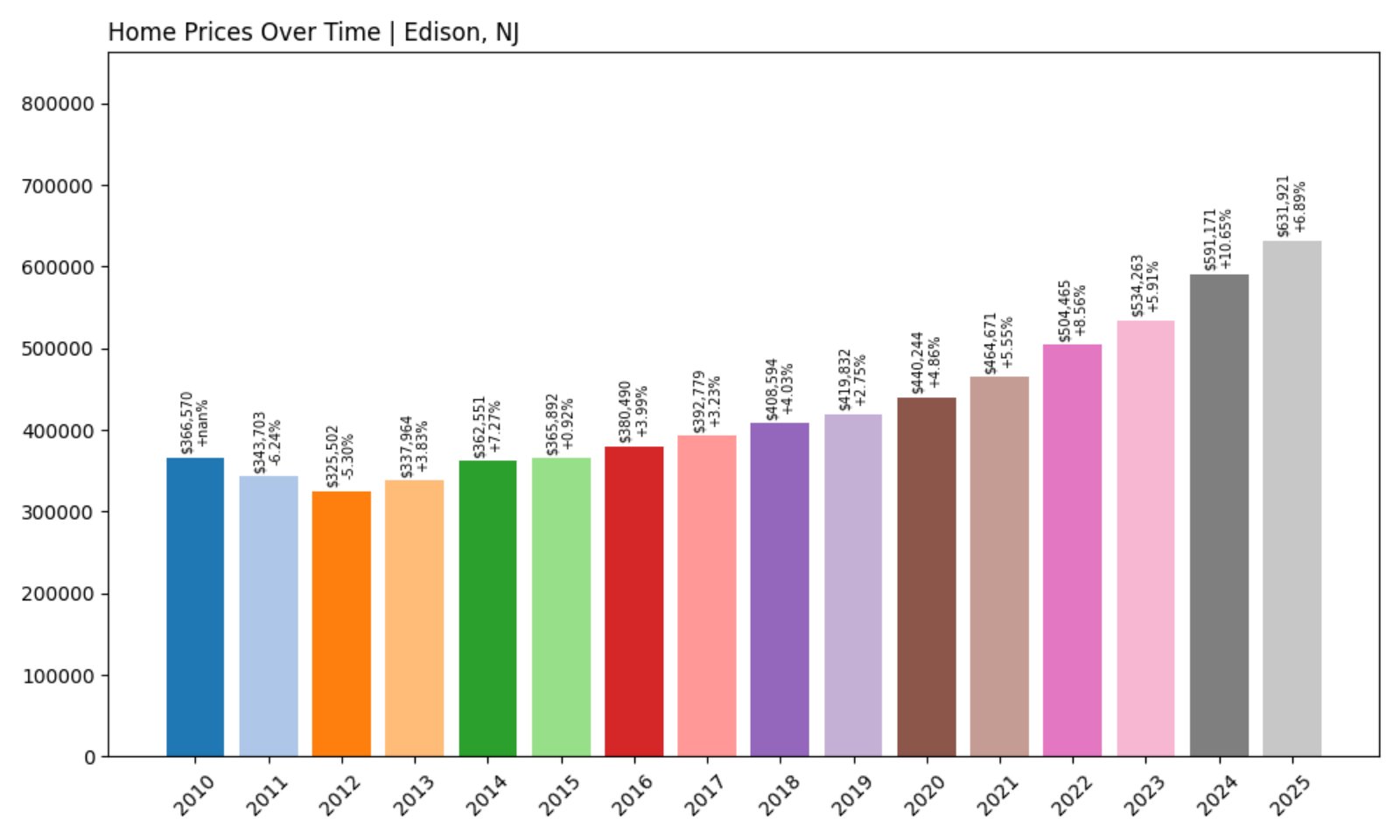

29. Edison – Investor Feeding Frenzy Factor 74.11% (July 2025)

- Historical annual growth rate (2012–2022): 4.48%

- Recent annual growth rate (2022–2025): 7.80%

- Investor Feeding Frenzy Factor: 74.11%

- Current 2025 price: $631,920.96

Edison’s recent price growth has surged well beyond its decade-long trend, with prices now climbing 7.8% annually compared to 4.48% in the ten years prior. The Feeding Frenzy Factor of 74.11% points to intensified investor interest in this centrally located Middlesex County township. Prices have now pushed past $630,000 in 2025 — a sharp increase for a community once considered relatively attainable.

Edison – Centrally Located, Rapidly Appreciating

Positioned along major transit corridors and home to a large and diverse population, Edison has always been a magnet for growth. It offers quick access to New York City via NJ Transit, strong public schools, and substantial shopping and dining hubs like Menlo Park Mall. These advantages have long made it a target for families — and increasingly, investors.

The 2022–2025 acceleration in prices reflects growing demand from remote workers and cash buyers seeking suburban stability. With median values now nearing $632,000, Edison is transitioning into a pricier tier, making it harder for first-time homebuyers and renters to gain a foothold. Local listings are frequently snapped up quickly, adding urgency to an already competitive market.

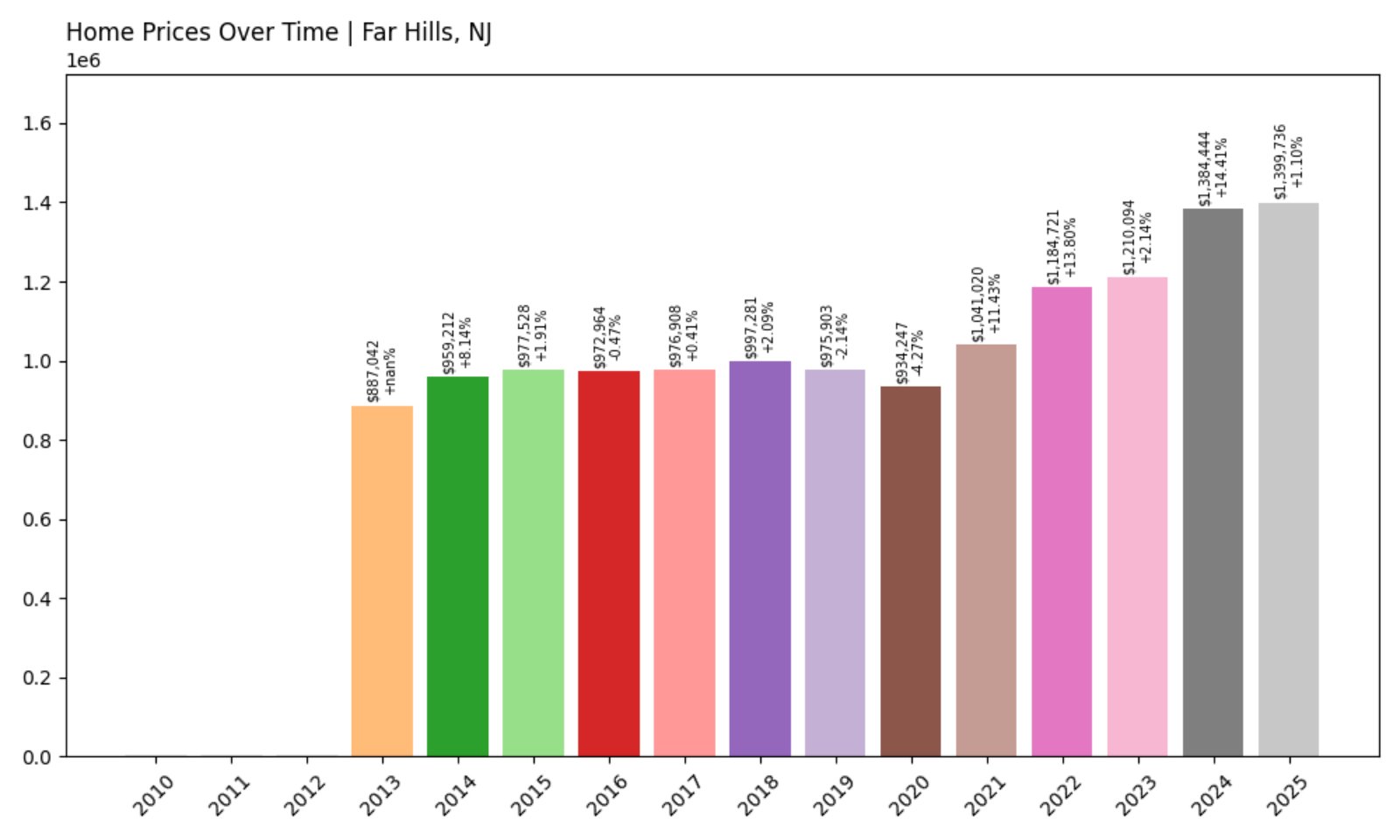

28. Far Hills – Investor Feeding Frenzy Factor 74.96% (July 2025)

- Historical annual growth rate (2012–2022): 3.27%

- Recent annual growth rate (2022–2025): 5.72%

- Investor Feeding Frenzy Factor: 74.96%

- Current 2025 price: $1,399,736.38

Far Hills has witnessed a significant shift in momentum, with recent growth outpacing its historical trend by more than 75%. Homes in this exclusive Somerset County borough now average nearly $1.4 million — reflecting both increased luxury interest and a shift toward investor-driven growth. The pace of appreciation has nearly doubled compared to the prior decade.

Far Hills – Luxury Living Fuels Frenzied Appreciation

Known for grand estates and horse country charm, Far Hills is an affluent enclave with a rural character. Its location near the Gladstone Branch train line and major highways connects it to New York City, but its spacious lots and wooded landscapes offer privacy that draws high-end buyers. In recent years, investor attention has added further fuel to an already exclusive market.

The rise from 3.27% historical to 5.72% recent annual growth — and a Feeding Frenzy Factor near 75% — points to heightened external demand. High-net-worth investors and second-home buyers may be driving the shift, as properties here increasingly appeal as safe havens for capital. This has placed additional upward pressure on home values, reshaping what was once a more sleepy high-income retreat.

27. Hillsdale – Investor Feeding Frenzy Factor 75.02% (July 2025)

- Historical annual growth rate (2012–2022): 3.37%

- Recent annual growth rate (2022–2025): 5.90%

- Investor Feeding Frenzy Factor: 75.02%

- Current 2025 price: $826,738.65

Hillsdale’s price growth has climbed to nearly 6% per year, a notable increase from the 3.37% average over the prior decade. That 75.02% Frenzy Factor places it firmly on the radar of anyone tracking investor influence. With current home prices averaging over $826,000, this Bergen County town has become significantly less affordable than in years past.

Hillsdale – Suburban Demand Meets Investment Momentum

Hillsdale offers the hallmarks of a classic New Jersey suburb: tree-lined streets, commuter rail access via the Pascack Valley Line, and proximity to strong public schools. These characteristics have made it a perennial favorite among families — but recent investor interest is changing the equation.

As price appreciation trends accelerate, Hillsdale has crossed into upper-tier pricing territory. Its modest historical growth was typical for the region, but the recent surge has raised alarms among affordability advocates. With its small-town feel and access to regional job markets, Hillsdale is now facing growing pressure from both long-term buyers and those looking for quick appreciation.

26. Chatham – Investor Feeding Frenzy Factor 75.54% (July 2025)

- Historical annual growth rate (2012–2022): 3.35%

- Recent annual growth rate (2022–2025): 5.88%

- Investor Feeding Frenzy Factor: 75.54%

- Current 2025 price: $1,295,661.15

With homes now averaging just under $1.3 million and growth pushing 5.88% per year, Chatham’s market is running significantly hotter than its historical trend. The Feeding Frenzy Factor of 75.54% underscores investor interest in this sought-after Morris County location, which has experienced sharp price acceleration since 2022.

Chatham – Elite Suburb Draws Intense Market Activity

Chatham has long been one of New Jersey’s most prestigious commuter towns. With direct train service to Manhattan, a top-tier school system, and charming downtown amenities, it’s consistently ranked as one of the state’s most desirable places to live. These traits have drawn not only families, but also investors seeking long-term value growth.

The recent increase in annual appreciation from 3.35% to 5.88% reveals a market under pressure from multiple fronts. Investor confidence in Chatham’s staying power as a premium location has led to aggressive bidding on available properties, contributing to upward pricing momentum that puts traditional buyers at a disadvantage.

25. Woodlynne – Investor Feeding Frenzy Factor 76.64% (July 2025)

- Historical annual growth rate (2012–2022): 7.88%

- Recent annual growth rate (2022–2025): 13.91%

- Investor Feeding Frenzy Factor: 76.64%

- Current 2025 price: $205,553.96

Woodlynne’s Feeding Frenzy Factor of 76.64% stems from already-strong historic growth that has nearly doubled in recent years. Its current appreciation rate of 13.91% annually is one of the steepest on this list, pushing average home prices to over $205,000 — a significant jump for a town that had long been among the more affordable in Camden County.

Woodlynne – Rapid Gains in a Small but Growing Market

Tiny and densely populated, Woodlynne is often overshadowed by larger neighbors like Camden and Collingswood, but its proximity to Philadelphia and major transit routes has made it increasingly attractive. With a population under 3,000, even modest shifts in demand can dramatically impact price dynamics.

Its 13.91% annual growth rate from 2022 to 2025 is reflective of a market undergoing major change. Investors are likely eyeing Woodlynne for its value and location potential, especially as surrounding areas experience their own pricing pressures. This fast-paced appreciation — from a strong baseline — could reshape the town’s housing mix in the years ahead.

24. Gloucester City – Investor Feeding Frenzy Factor 77.73% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 5.62%

- Recent annual growth rate (2022–2025): 9.99%

- Investor Feeding Frenzy Factor: 77.73%

- Current 2025 price: $245,971.41

Home values in Gloucester City have spiked nearly 10% annually since 2022 — far beyond its historical pace of 5.62%. That shift yields a Feeding Frenzy Factor of 77.73%, making it one of the most investor-influenced housing markets in South Jersey. The average price in 2025 now sits just under $246,000, a notable leap for this blue-collar community along the Delaware River.

Gloucester City – A Riverside Community in Transition

Situated along the Camden County waterfront, Gloucester City is known for its close-knit neighborhoods, walkable grid layout, and easy access to Philadelphia via the Walt Whitman Bridge. For decades, its working-class roots kept housing prices modest. But that affordability — combined with location — has recently attracted out-of-town buyers and real estate speculators.

The jump from 5.62% to 9.99% annual appreciation signals significant new demand. Investors appear to be betting on Gloucester City’s long-term potential, drawn by its historic homes, river views, and commuter convenience. The price shift is dramatic enough to potentially alter the town’s socioeconomic balance if the trend continues unchecked.

23. Linwood – Investor Feeding Frenzy Factor 77.81% (July 2025)

- Historical annual growth rate (2012–2022): 4.06%

- Recent annual growth rate (2022–2025): 7.22%

- Investor Feeding Frenzy Factor: 77.81%

- Current 2025 price: $486,771.34

Linwood has seen its annual growth rate rise from a historical 4.06% to 7.22% in the post-2022 period. With a Feeding Frenzy Factor approaching 78%, the town’s real estate market is shifting rapidly. Prices are now averaging nearly $487,000, reflecting both local demand and speculative outside interest in this Atlantic County suburb.

Linwood – Shore Suburb in High Demand

Just minutes from the beach towns of Margate and Ocean City, Linwood is a favorite for those seeking year-round living near the Jersey Shore without the crowds. With well-regarded schools, quiet neighborhoods, and recreational amenities like the Linwood Bike Path, the town has long appealed to families and retirees alike.

But Linwood’s affordability relative to nearby shore points has made it a target for investors. Its 77.81% Feeding Frenzy Factor underscores a shift in buying activity — not just from local move-up buyers, but from those seeking returns in South Jersey’s rising property markets. The median price, now near half a million, may be the new normal if demand continues to climb.

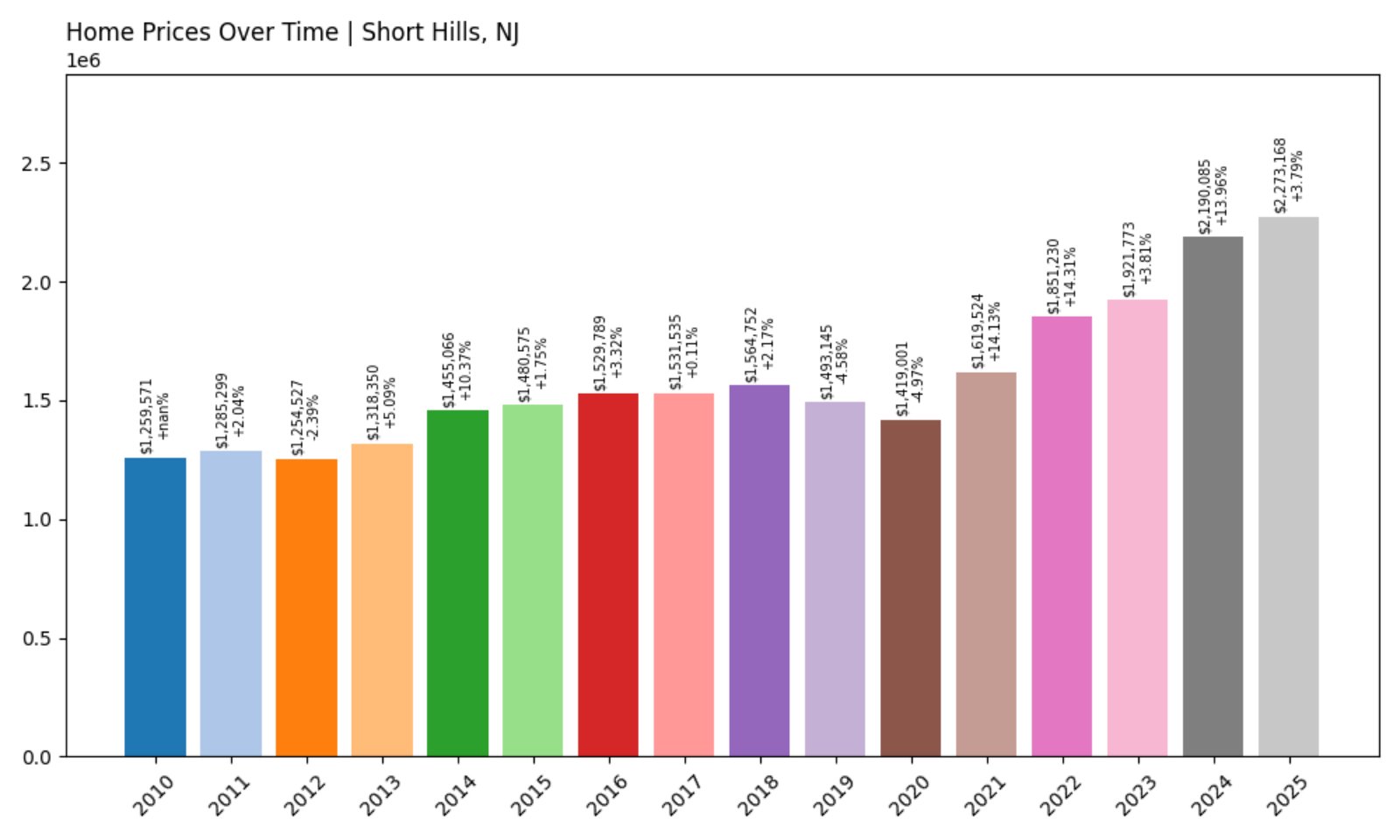

22. Short Hills – Investor Feeding Frenzy Factor 78.54% (July 2025)

- Historical annual growth rate (2012–2022): 3.97%

- Recent annual growth rate (2022–2025): 7.08%

- Investor Feeding Frenzy Factor: 78.54%

- Current 2025 price: $2,273,167.63

Short Hills has always been high-end, but the recent acceleration in growth — from 3.97% to 7.08% — reflects intensified market pressure. With home prices now exceeding $2.27 million on average, the Feeding Frenzy Factor of 78.54% confirms a luxury market seeing renewed speculative attention. This level of appreciation is dramatic even by Short Hills standards.

Short Hills – Premium Prices Meet Investment Acceleration

A section of Millburn Township in Essex County, Short Hills is one of the most affluent zip codes in New Jersey. With a direct Midtown Direct train line, boutique shopping at The Mall at Short Hills, and elite public schools, it’s a classic magnet for Wall Street buyers. Yet even in this rarefied market, the pace of change has been eye-opening.

The doubling of its growth rate in just three years speaks volumes. As remote work and lifestyle shifts continue to reshape where wealthy households choose to live, Short Hills has emerged as a major beneficiary — and investors are clearly taking notice. With limited inventory and deep-pocketed demand, prices are unlikely to slow any time soon.

21. Millville – Investor Feeding Frenzy Factor 78.76% (July 2025)

- Historical annual growth rate (2012–2022): 4.10%

- Recent annual growth rate (2022–2025): 7.33%

- Investor Feeding Frenzy Factor: 78.76%

- Current 2025 price: $251,918.45

Millville’s Feeding Frenzy Factor of 78.76% comes from a steady recent surge in appreciation, nearly doubling its prior 10-year average. Prices have now reached an average of $251,918, as the Cumberland County town sees renewed attention from investors and buyers priced out of nearby areas.

Millville – South Jersey Affordability Under Pressure

Known for its glass-making history and the scenic Maurice River, Millville has traditionally offered budget-friendly housing options in southern New Jersey. The town has invested in arts revitalization, with venues like the Levoy Theatre and Glasstown Arts District helping draw new interest over the last decade.

That increased appeal — along with strong investor momentum — has driven prices up sharply since 2022. Though still relatively affordable by statewide standards, Millville’s value surge highlights growing demand in historically undervalued areas. Whether that trend lifts the community or displaces it will depend on how the market evolves from here.

20. Watchung – Investor Feeding Frenzy Factor 79.02% (July 2025)

- Historical annual growth rate (2012–2022): 3.28%

- Recent annual growth rate (2022–2025): 5.87%

- Investor Feeding Frenzy Factor: 79.02%

- Current 2025 price: $1,077,565.84

Watchung’s home prices are up 5.87% annually over the past three years — a big jump from the 3.28% historical norm. That places the town’s Frenzy Factor just above 79%, with the 2025 average home now costing over $1.07 million. This pace of appreciation signals a market shift toward higher-stakes buying behavior.

Watchung – Hillside Views and High-Dollar Demand

Perched on the First Watchung Mountain in Somerset County, Watchung offers expansive views, custom homes, and a semi-rural feel — all within commuting distance of Manhattan. Its attractive setting, combined with quiet neighborhoods and upscale housing stock, has caught the eye of both traditional buyers and outside investors.

The town’s limited inventory and natural scenery make it a standout for those seeking privacy and value retention. But the Feeding Frenzy Factor shows the pace of change may now be outpacing local wage growth and family budgets. As Watchung’s average home pushes toward $1.1 million, questions of access and affordability will likely follow.

19. Montvale – Investor Feeding Frenzy Factor 80.20% (July 2025)

- Historical annual growth rate (2012–2022): 2.92%

- Recent annual growth rate (2022–2025): 5.26%

- Investor Feeding Frenzy Factor: 80.20%

- Current 2025 price: $918,777.52

Montvale’s home values have accelerated sharply in the last three years, with prices now growing 5.26% annually — a full 80.2% higher than the town’s prior 10-year average. With current prices near $919,000, Montvale has become a fast-rising market in northern New Jersey, boosted by investor confidence and its strategic location.

Montvale – Northern NJ’s Corporate Hub Sees Market Heat

Nestled in Bergen County along the New York border, Montvale is home to several corporate campuses, including those of Sharp, Benjamin Moore, and formerly Mercedes-Benz. It has long benefited from proximity to job centers and access to highways like the Garden State Parkway and Route 17.

Now, the market reflects a new urgency. The jump from 2.92% to 5.26% annual price growth suggests that demand is no longer just local — investors and outside buyers are playing a larger role. With luxury townhomes and newly built homes rising across the borough, Montvale is shifting into a higher tier of pricing faster than many anticipated.

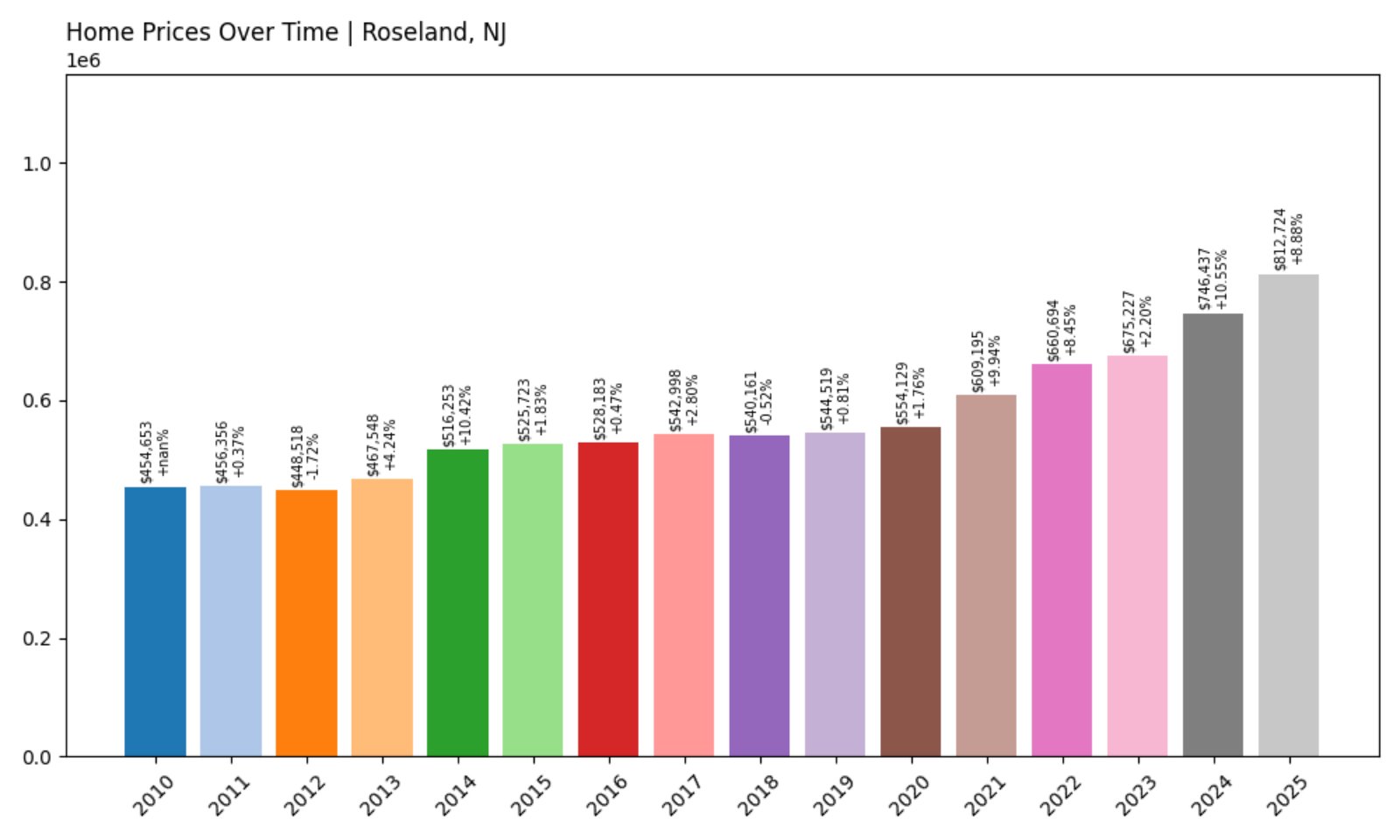

18. Roseland – Investor Feeding Frenzy Factor 80.97% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 3.95%

- Recent annual growth rate (2022–2025): 7.15%

- Investor Feeding Frenzy Factor: 80.97%

- Current 2025 price: $812,724.04

In Roseland, home values are climbing at 7.15% per year — a significant jump from the previous decade’s 3.95% rate. That change gives the town a Feeding Frenzy Factor of nearly 81%, and pushes the average home price over $812,000. For a borough with a traditionally stable real estate market, this marks a substantial shift.

Roseland – Corporate Comfort and Rising Investment

Located in Essex County, Roseland offers a suburban lifestyle with strong corporate ties — it’s home to major employers like ADP and law firm Connell Foley. Its residential neighborhoods, excellent schools, and access to Route 280 have historically made it popular among professionals and families.

But the recent acceleration in home prices shows a shift in market behavior. As interest in move-in ready homes near business centers rises, Roseland is seeing a growing presence of buyers looking for long-term appreciation. With inventory tightening and pricing rising, affordability is becoming a bigger concern — especially for younger buyers trying to settle in the area.

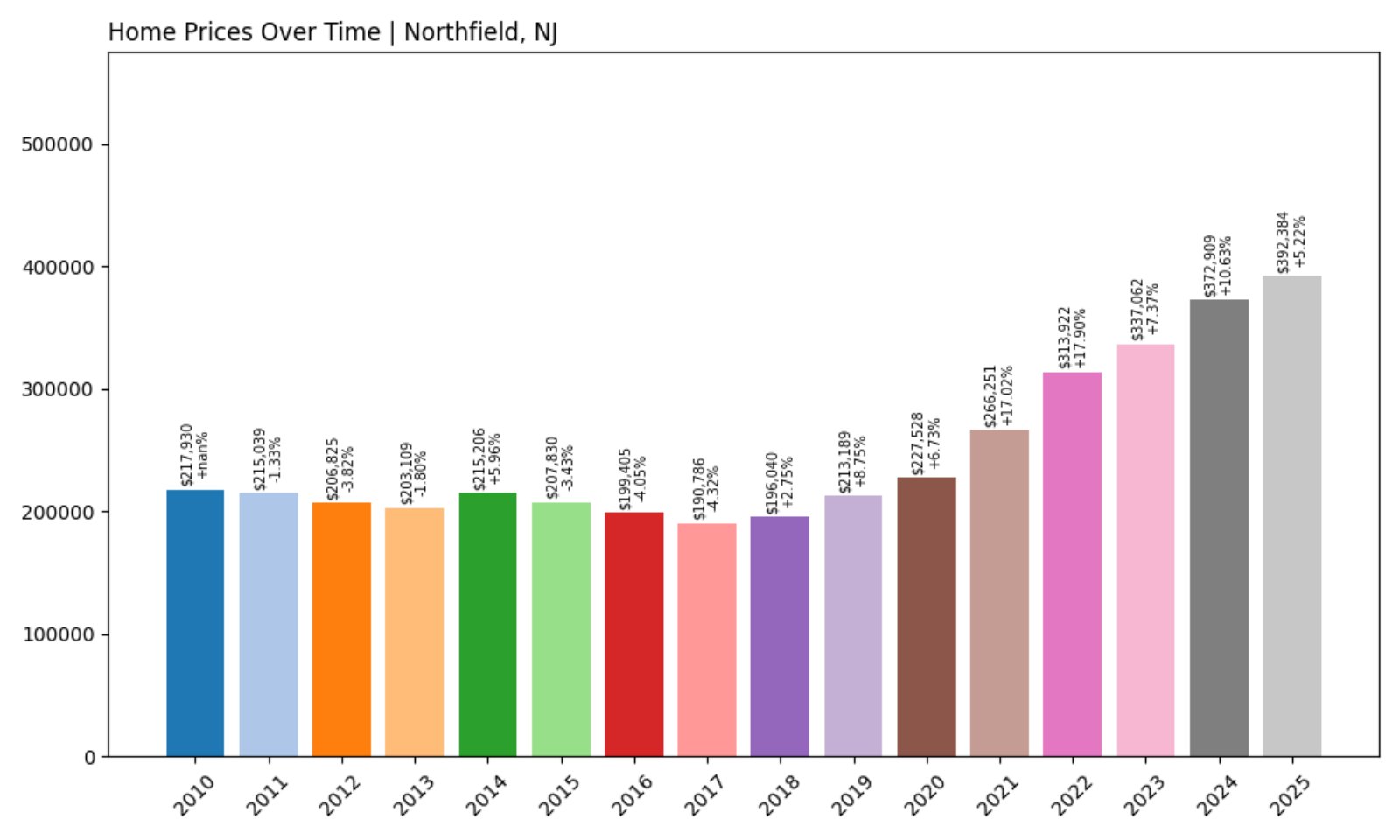

17. Northfield – Investor Feeding Frenzy Factor 81.18% (July 2025)

- Historical annual growth rate (2012–2022): 4.26%

- Recent annual growth rate (2022–2025): 7.72%

- Investor Feeding Frenzy Factor: 81.18%

- Current 2025 price: $392,384.02

Northfield’s price appreciation has leapt from a steady 4.26% to 7.72% annually in just three years, giving it an 81.18% Feeding Frenzy Factor. With median home prices now near $392,000, this suburban Atlantic County town has become increasingly attractive to buyers and investors alike.

Northfield – Atlantic County Growth Corridor

Often referred to as “The Gateway to the Shore,” Northfield borders Pleasantville and Linwood, offering both inland stability and access to the Jersey Shore. Its quiet neighborhoods, well-regarded schools, and access to Route 9 and the Garden State Parkway have made it an appealing place to settle down without paying beach-town prices.

But affordability is shifting quickly. With price growth nearing 8% annually, investors seem to be banking on Northfield as a high-upside alternative to pricier shore markets. Whether it’s rental investors or cash buyers looking for long-term holds, the numbers suggest rising interest is reshaping expectations for this once-steady market.

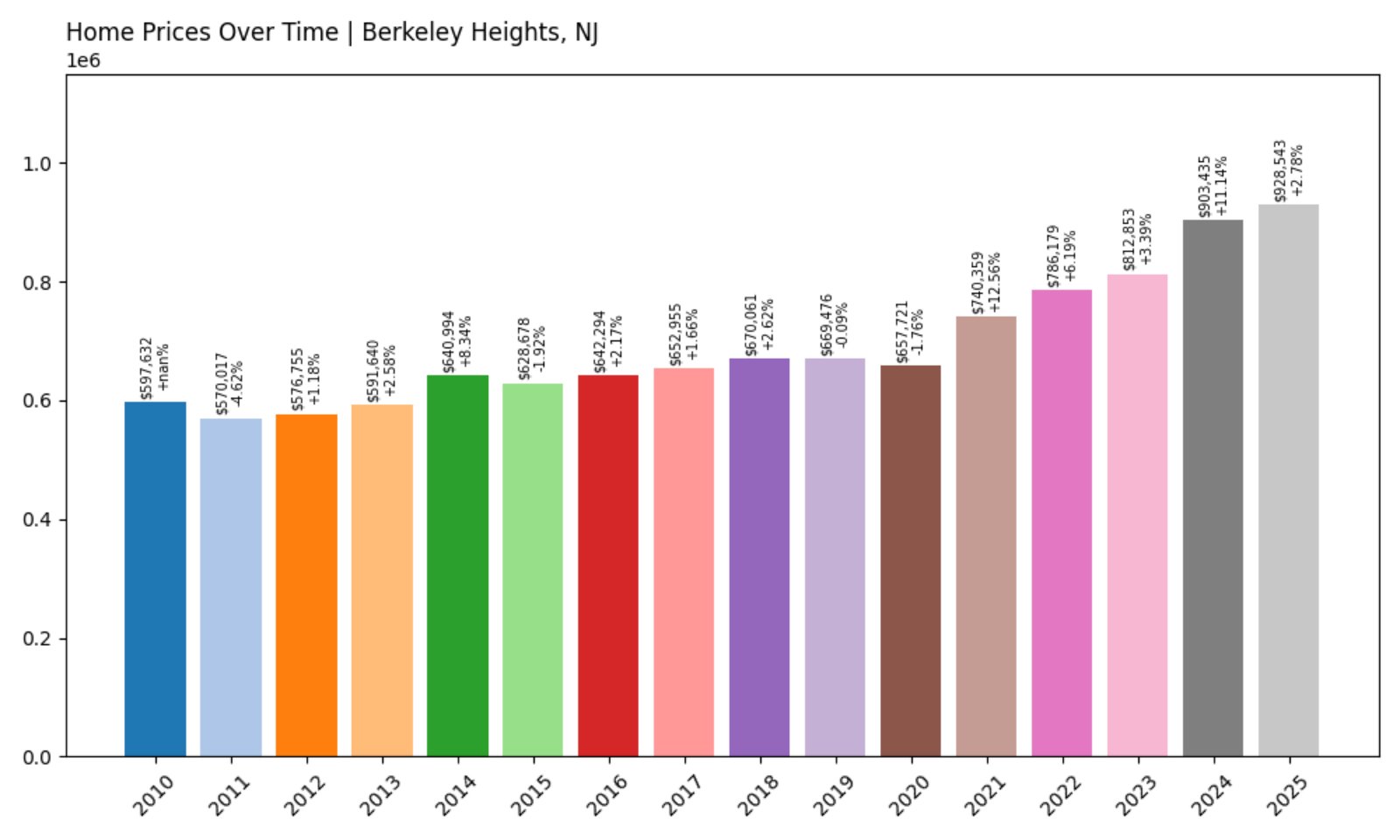

16. Berkeley Heights – Investor Feeding Frenzy Factor 81.32% (July 2025)

- Historical annual growth rate (2012–2022): 3.15%

- Recent annual growth rate (2022–2025): 5.70%

- Investor Feeding Frenzy Factor: 81.32%

- Current 2025 price: $928,543.11

In Berkeley Heights, annual home price growth has increased to 5.7%, well above its prior 10-year trend of 3.15%. That marks an 81.32% Feeding Frenzy Factor and helps push the average home price to over $928,000. The town’s combination of commuter access and suburban charm appears to be attracting new interest at a rapid pace.

Berkeley Heights – Transit Access Meets Market Acceleration

Tucked in Union County, Berkeley Heights benefits from its NJ Transit train station and close proximity to Interstate 78. Known for its strong public schools, parks, and low crime, the town has historically appealed to professionals commuting to Manhattan and families looking for long-term community ties.

Its recent pricing momentum suggests outside investors are also circling. With prices now near $930,000 and growth rates rising, Berkeley Heights may be entering a new pricing tier — one that puts pressure on traditional buyers and long-time residents. Whether that changes the town’s character remains to be seen, but the trend is undeniable.

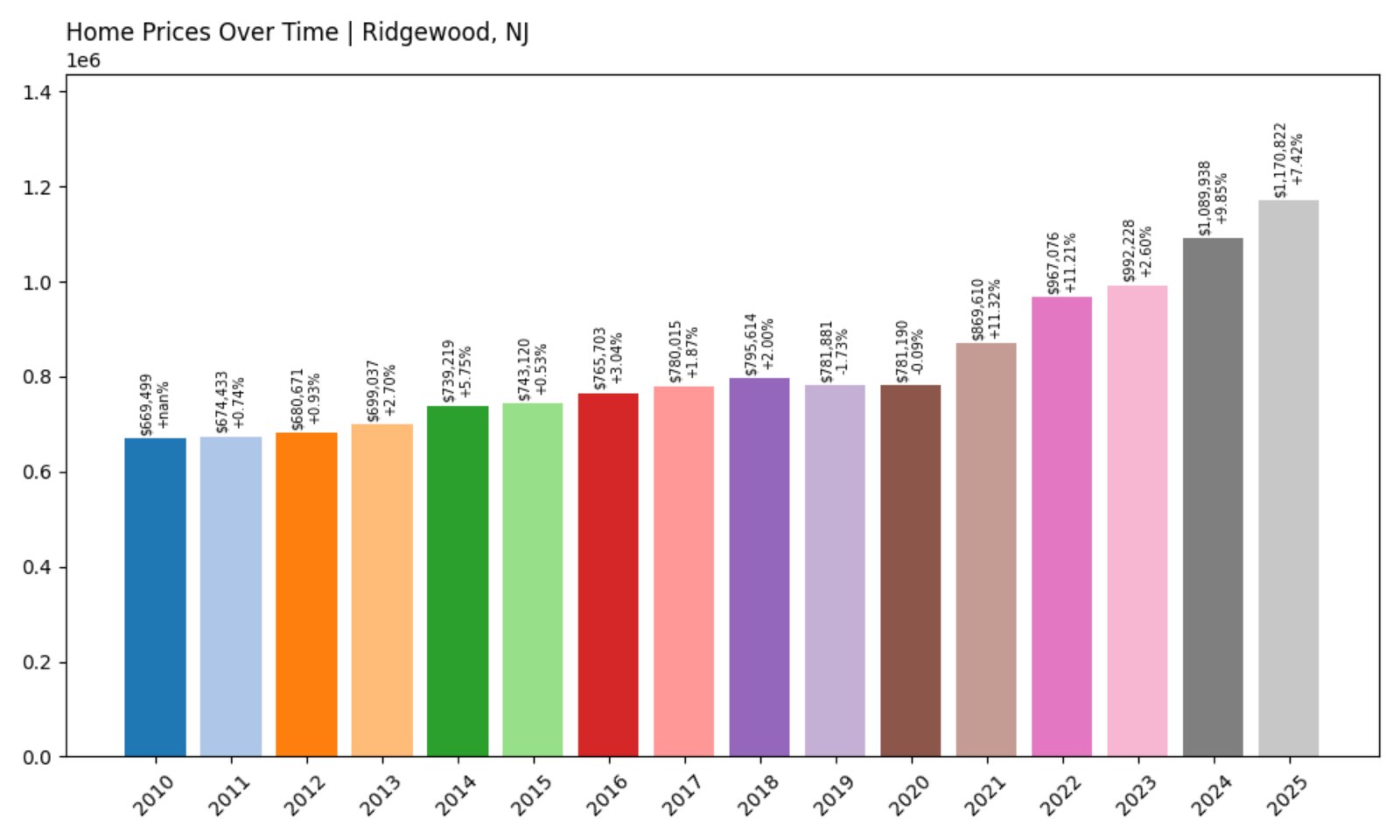

15. Ridgewood – Investor Feeding Frenzy Factor 84.10% (July 2025)

- Historical annual growth rate (2012–2022): 3.57%

- Recent annual growth rate (2022–2025): 6.58%

- Investor Feeding Frenzy Factor: 84.10%

- Current 2025 price: $1,170,821.90

Ridgewood’s market has heated up dramatically, with home values rising at 6.58% annually — up from 3.57% over the previous decade. The Feeding Frenzy Factor of 84.10% reflects growing competition for homes in one of Bergen County’s most well-regarded suburbs. As a result, average home prices have climbed to more than $1.17 million.

Ridgewood – Premier Schools and Premium Pricing

Ridgewood is often considered one of North Jersey’s most desirable towns. With a vibrant downtown, historic architecture, and a nationally ranked public school system, it has long commanded high prices and sustained demand. Its NJ Transit rail station offers direct service to Manhattan, further adding to its appeal.

Yet even in this affluent context, the recent pace of appreciation stands out. The nearly doubled growth rate suggests a shift in the buying base, with more investors or cash-rich buyers entering the fray. As inventory tightens and demand stays high, Ridgewood may continue its climb into the upper echelons of New Jersey real estate.

14. Demarest – Investor Feeding Frenzy Factor 85.05% (July 2025)

- Historical annual growth rate (2012–2022): 3.65%

- Recent annual growth rate (2022–2025): 6.75%

- Investor Feeding Frenzy Factor: 85.05%

- Current 2025 price: $1,315,595.48

Demarest has seen its annual growth rate climb from 3.65% to 6.75%, resulting in an 85.05% Feeding Frenzy Factor. With average home prices now topping $1.3 million, this exclusive Bergen County borough is attracting increased investor attention, further tightening an already competitive luxury market.

Demarest – Quiet Prestige Drives Price Acceleration

Would you like to save this?

Demarest is a small, quiet borough known for its tree-lined streets, historic homes, and prestigious private and public schools, including the highly ranked Northern Valley Regional High School. Its proximity to New York City, combined with its low density and affluent appeal, has kept it consistently desirable.

But recent price movement suggests more than just traditional demand. The steep rise in values — nearly doubling the prior growth rate — signals that outside money may be flowing into the market. With limited land and inventory, competition for properties is fierce, pushing home values sharply higher in just a few short years.

13. Mount Ephraim – Investor Feeding Frenzy Factor 86.68% (July 2025)

- Historical annual growth rate (2012–2022): 4.77%

- Recent annual growth rate (2022–2025): 8.91%

- Investor Feeding Frenzy Factor: 86.68%

- Current 2025 price: $313,409.79

Mount Ephraim has seen prices rise nearly 9% per year since 2022, compared to a 4.77% annual increase over the previous decade. That jump translates into an 86.68% Feeding Frenzy Factor, and average prices are now just over $313,000 — a sizable leap for this modestly sized Camden County borough.

Mount Ephraim – Modest Market, Fast Gains

Just outside Philadelphia and neighboring towns like Audubon and Haddon Heights, Mount Ephraim has long offered affordability and small-town charm. Its compact size and access to major highways like Route 42 and I-295 make it an ideal location for commuters seeking value close to urban centers.

Now, the town is experiencing outsized growth. A nearly 9% annual increase reflects significant new demand — likely from investors and buyers priced out of trendier Camden County spots. With prices still under $325,000, Mount Ephraim may continue to attract interest until its pricing catches up with nearby markets.

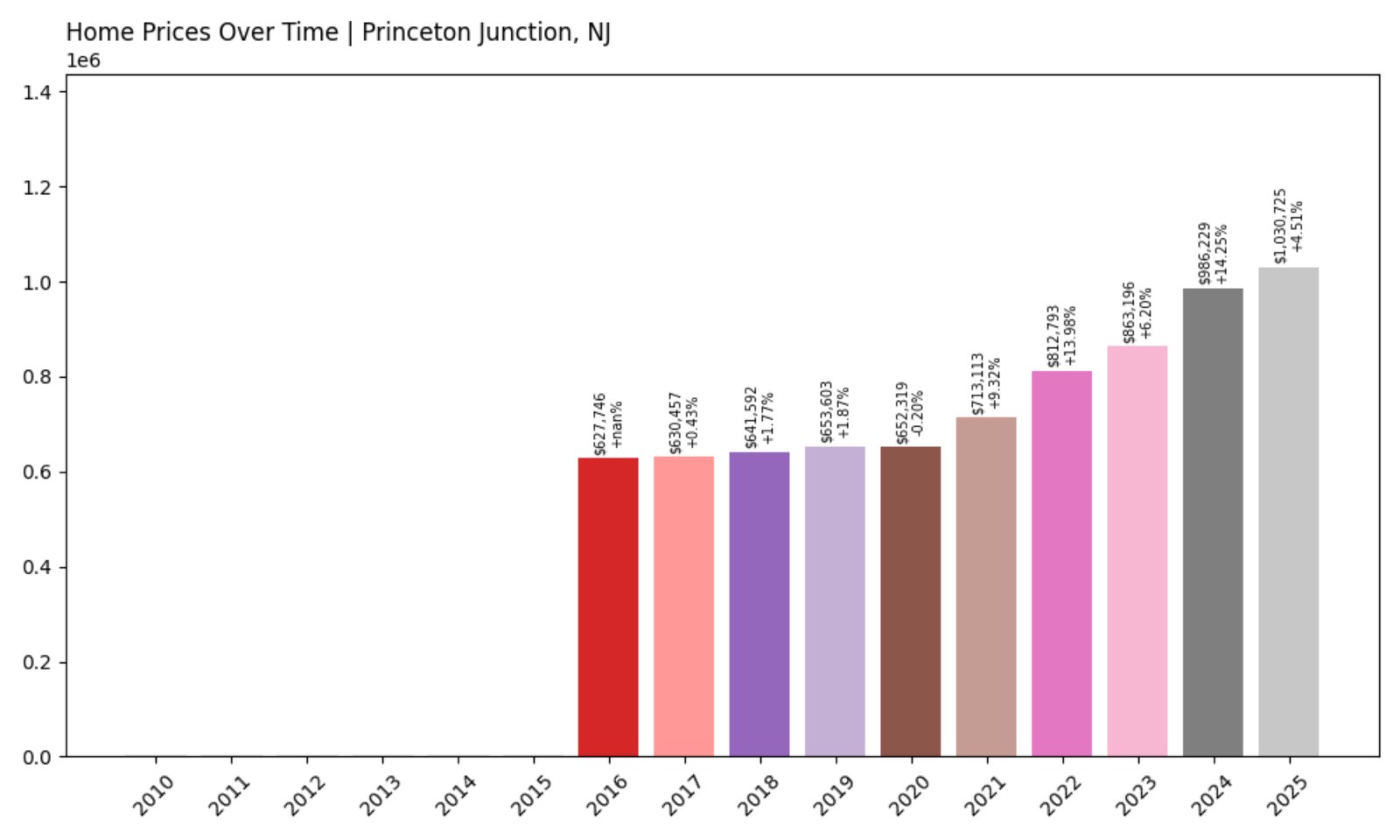

12. Princeton Junction – Investor Feeding Frenzy Factor 87.28% (July 2025)

- Historical annual growth rate (2012–2022): 4.40%

- Recent annual growth rate (2022–2025): 8.24%

- Investor Feeding Frenzy Factor: 87.28%

- Current 2025 price: $1,030,724.74

Princeton Junction has moved into the high-demand tier, with recent price growth of 8.24% outpacing its already strong historical rate of 4.40%. The Feeding Frenzy Factor of 87.28% reveals that demand has surged since 2022, pushing average prices above the $1 million mark.

Princeton Junction – Transit-Oriented Growth and Investor Focus

Part of West Windsor Township in Mercer County, Princeton Junction is anchored by one of New Jersey’s most important NJ Transit hubs — offering direct service to New York City and Philadelphia. Its location, strong schools, and suburban affluence have long made it attractive, but price growth has picked up sharply in recent years.

The area’s proximity to Princeton University and top employers adds another layer of desirability. As work-from-home dynamics shift and remote-capable households seek prestige and transit convenience, investor activity is accelerating. The seven-figure average home price is now the starting point, not the exception.

11. Brooklawn – Investor Feeding Frenzy Factor 88.93% (July 2025)

- Historical annual growth rate (2012–2022): 4.51%

- Recent annual growth rate (2022–2025): 8.53%

- Investor Feeding Frenzy Factor: 88.93%

- Current 2025 price: $252,565.64

Brooklawn’s housing market has exploded, with recent growth of 8.53% per year — nearly double its historical trend of 4.51%. This yields a Feeding Frenzy Factor of 88.93%, and an average home price of just over $252,000. Despite the increase, the town remains relatively affordable — for now.

Brooklawn – Small Size, Big Investment Appeal

This tiny borough in Camden County spans less than a half square mile, but its location near major highways and the Walt Whitman Bridge makes it highly accessible to both Philadelphia and South Jersey employment centers. For decades, Brooklawn’s modest homes and quiet streets made it a low-profile choice for budget-conscious buyers.

That profile is changing fast. With prices rising quickly and competition heating up, Brooklawn is starting to resemble neighboring communities that experienced early investor waves. Investors may see it as a final frontier for low-cost entry near urban centers, but that shift is already affecting local affordability and availability.

10. Salem – Investor Feeding Frenzy Factor 90.27% (July 2025)

- Historical annual growth rate (2012–2022): 4.06%

- Recent annual growth rate (2022–2025): 7.72%

- Investor Feeding Frenzy Factor: 90.27%

- Current 2025 price: $233,138.73

Salem’s recent price growth of 7.72% annually nearly doubles its previous 10-year trend, yielding a Feeding Frenzy Factor of 90.27%. With home prices now averaging $233,139, this small city along the Delaware River is seeing renewed — and rapid — interest from investors and buyers seeking affordable stock.

Salem – Waterfront History Meets Market Acceleration

Located in Salem County, this city is one of the oldest in New Jersey, with deep colonial roots and a walkable downtown full of historic architecture. While it has long faced economic challenges, its low price point and riverfront setting have increasingly drawn attention from value-seeking buyers.

The jump in annual growth reflects both local improvements and external speculation. As remote work enables broader geographic flexibility, towns like Salem are getting a second look. The relatively low average price may seem like a bargain — but with growth this steep, that window could close quickly.

9. Mountain Lakes – Investor Feeding Frenzy Factor 96.56% (July 2025)

- Historical annual growth rate (2012–2022): 2.80%

- Recent annual growth rate (2022–2025): 5.50%

- Investor Feeding Frenzy Factor: 96.56%

- Current 2025 price: $1,176,814.80

Mountain Lakes has nearly doubled its long-term growth trend, moving from a historical rate of 2.80% to a recent rate of 5.50%. That 96.56% Feeding Frenzy Factor reflects a dramatic surge in investor and high-income buyer activity, with home prices now averaging more than $1.17 million.

Mountain Lakes – Lakeside Luxury Sees Swift Climb

This planned community in Morris County was originally developed in the early 20th century as a commuter suburb for executives. It still lives up to that purpose today, with large homes, winding roads, and proximity to NYC-bound transit. Its namesake lakes add scenic appeal, making it a magnet for high-end buyers.

While always desirable, the recent spike in pricing is notable. Investor demand may be fueled by the town’s exclusivity, historical charm, and consistent school rankings. With limited inventory and landlocked boundaries, prices have surged — and show no sign of retreating in the near future.

8. Warren Township – Investor Feeding Frenzy Factor 97.15% (July 2025)

- Historical annual growth rate (2012–2022): 3.28%

- Recent annual growth rate (2022–2025): 6.46%

- Investor Feeding Frenzy Factor: 97.15%

- Current 2025 price: $1,123,989.12

Warren Township’s annual price growth has leapt from 3.28% to 6.46% in just three years, creating a Feeding Frenzy Factor of 97.15%. With home prices averaging over $1.12 million, the township is experiencing strong upward pressure from both local demand and external investor interest.

Warren Township – Spacious Homes and Soaring Prices

Located in Somerset County, Warren Township is known for its expansive lots, upscale homes, and high-performing schools. It offers suburban calm just 30 miles from Manhattan, drawing families seeking space and stability. These strengths have always made it a stronghold of high-end housing.

The sharp rise in appreciation indicates something more — investor speculation and high-income migration have picked up. Its Feeding Frenzy Factor shows that market dynamics have shifted quickly, and $1.1 million may now be the starting point for serious buyers looking to enter this competitive area.

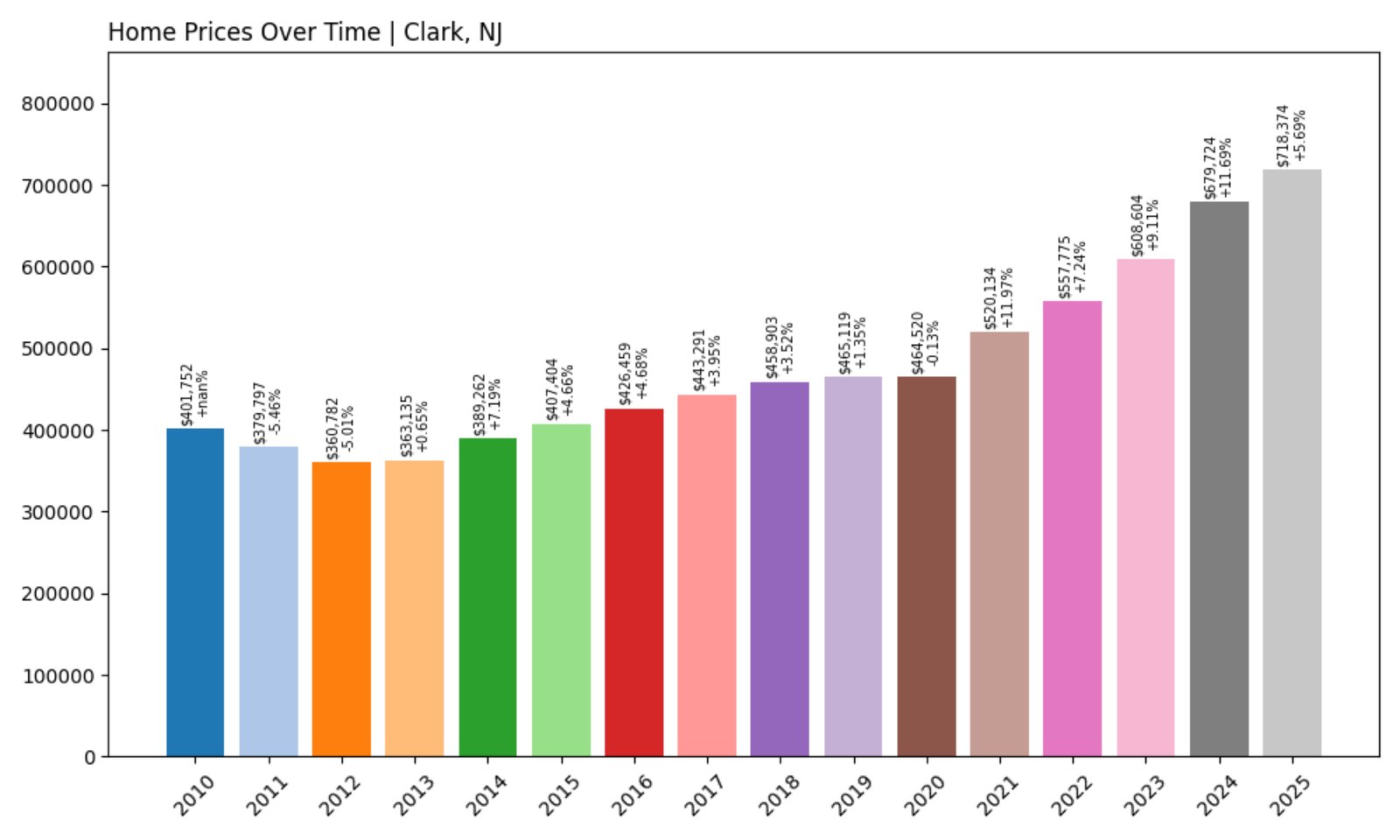

7. Clark – Investor Feeding Frenzy Factor 97.62% (July 2025)

- Historical annual growth rate (2012–2022): 4.45%

- Recent annual growth rate (2022–2025): 8.80%

- Investor Feeding Frenzy Factor: 97.62%

- Current 2025 price: $718,374.20

Clark’s home prices have almost doubled their previous rate of appreciation, jumping from 4.45% to 8.80% annually. With a Feeding Frenzy Factor of 97.62% and average home prices over $718,000, the township has become a standout for mid-tier price escalation.

Clark – Convenient Living Draws Competitive Heat

In Union County, Clark has long offered convenience and stability. Its location near the Garden State Parkway and key retail hubs like Clark Commons has made it popular among commuters and long-time residents alike. Strong schools and tidy neighborhoods add to its appeal.

But recent growth has intensified far beyond historical norms. Investors appear to be eyeing Clark’s accessibility and value as other North Jersey markets become saturated. With nearly 9% annual growth and rising price floors, the town’s era of affordability may be fading fast.

6. Springfield – Investor Feeding Frenzy Factor 100.97% (July 2025)

- Historical annual growth rate (2012–2022): 4.27%

- Recent annual growth rate (2022–2025): 8.58%

- Investor Feeding Frenzy Factor: 100.97%

- Current 2025 price: $721,155.93

Springfield’s recent annual growth rate of 8.58% is more than double its historical pace of 4.27%, producing a Feeding Frenzy Factor of 100.97%. With home values now averaging $721,000, the market is clearly responding to heightened investor interest and tightening inventory.

Springfield – Location, Schools, and Accelerating Value

Situated in Union County, Springfield balances access to New York City with suburban amenities and a strong school district. The town’s proximity to major highways, including I-78 and Route 22, makes it a prime choice for commuters. Parks, golf courses, and neighborhood stability have bolstered its appeal.

The recent surge in pricing shows Springfield is no longer flying under the radar. With appreciation now above 8.5% annually, buyers are acting quickly — and investors are following. As surrounding towns become unaffordable, Springfield’s central location and relatively lower baseline prices are pushing it into the spotlight.

5. Pemberton Township – Investor Feeding Frenzy Factor 101.28% (July 2025)

- Historical annual growth rate (2012–2022): 3.99%

- Recent annual growth rate (2022–2025): 8.04%

- Investor Feeding Frenzy Factor: 101.28%

- Current 2025 price: $337,282.53

Pemberton Township has more than doubled its prior growth trend, jumping from 3.99% to 8.04% annual appreciation. That surge results in a Feeding Frenzy Factor of 101.28%, with home prices now averaging $337,283. As one of the more affordable towns on this list, Pemberton’s rise is especially sharp.

Pemberton Township – South Jersey Growth with Room to Run

Located in Burlington County, Pemberton offers access to the Pinelands, Fort Dix/McGuire-Dix-Lakehurst military base, and other regional employment hubs. The town has a large footprint with a mix of rural and suburban housing, making it attractive to budget-conscious buyers and investors alike.

The data shows investor attention has intensified — fast. At just over $337K, the average home is still relatively affordable compared to statewide prices, but with appreciation above 8%, that advantage may not last long. Pemberton is clearly entering a period of rapid transformation driven by external buying pressure.

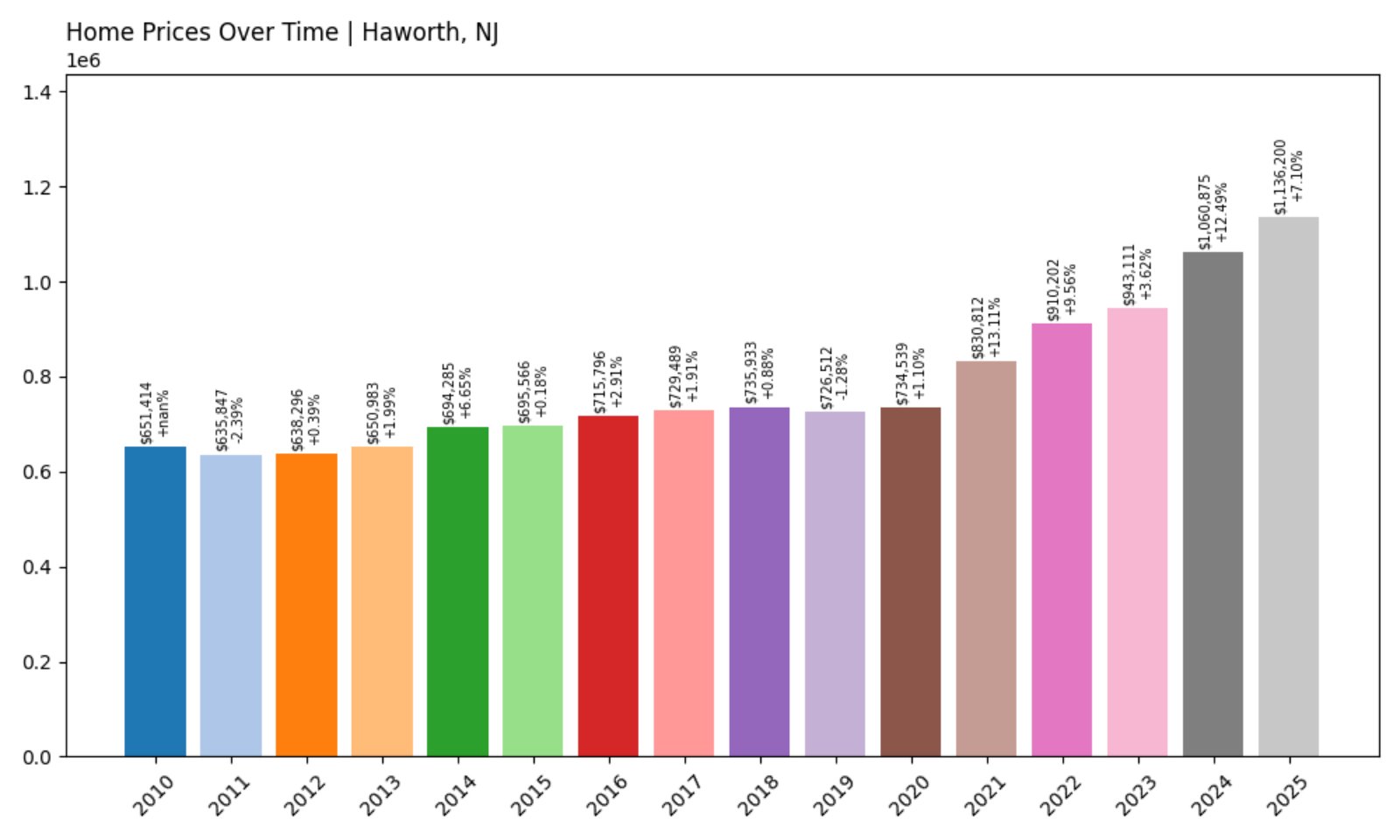

4. Haworth – Investor Feeding Frenzy Factor 112.40% (July 2025)

- Historical annual growth rate (2012–2022): 3.61%

- Recent annual growth rate (2022–2025): 7.67%

- Investor Feeding Frenzy Factor: 112.40%

- Current 2025 price: $1,136,199.90

Haworth’s housing market has taken off, with appreciation jumping from a historical 3.61% to 7.67% annually — a 112.4% increase. This Bergen County borough now commands an average home price of over $1.13 million, reflecting rapid value growth and heightened investor competition.

Haworth – Scenic and Serene, But No Longer Slow-Growing

Haworth, nestled in Bergen County, offers picturesque charm and affluent appeal. It’s known for its quiet, residential feel, top-rated schools, and proximity to outdoor spaces like the Oradell Reservoir. Historically stable, it has now become a target for wealthier buyers and strategic investors.

With price appreciation more than doubling since 2022, Haworth’s market is moving fast. Investors are likely drawn to its exclusivity and consistent demand from New York-bound professionals. That demand, coupled with a limited housing stock, is driving prices to new highs — and affordability out of reach for many.

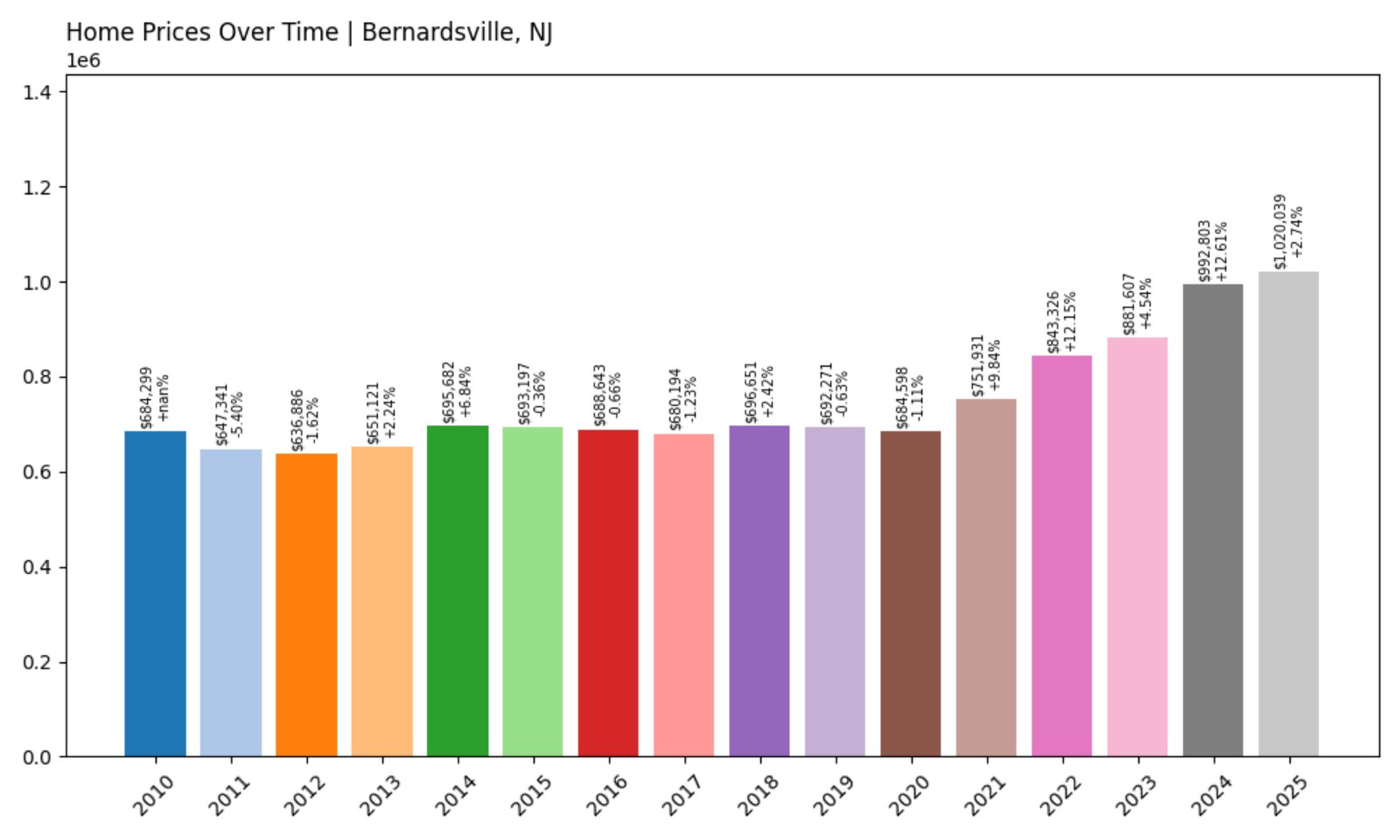

3. Bernardsville – Investor Feeding Frenzy Factor 129.92% (July 2025)

- Historical annual growth rate (2012–2022): 2.85%

- Recent annual growth rate (2022–2025): 6.55%

- Investor Feeding Frenzy Factor: 129.92%

- Current 2025 price: $1,020,038.88

Home prices in Bernardsville have surged from a modest 2.85% annual growth to 6.55%, resulting in a Feeding Frenzy Factor of 129.92%. With current prices breaking past the $1 million mark, this Somerset County borough has experienced a steep and rapid transformation.

Bernardsville – Historic Prestige Meets Investment Heat

Bernardsville is steeped in history and wealth — once a summer retreat for New York’s Gilded Age elite. Today, its blend of old estates, rolling hills, and quiet neighborhoods still attracts high-income buyers seeking privacy and class. But the recent spike in prices shows it’s no longer just families making the move.

Investors are now adding fuel to the fire. With appreciation jumping over 129% above the historical trend, Bernardsville has become a hotbed for long-horizon bets. Its limited housing stock and elevated desirability could mean that this market remains aggressive — even as other areas cool.

2. Skillman – Investor Feeding Frenzy Factor 134.60% (July 2025)

- Historical annual growth rate (2012–2022): 2.90%

- Recent annual growth rate (2022–2025): 6.80%

- Investor Feeding Frenzy Factor: 134.60%

- Current 2025 price: $1,029,100.13

Skillman has jumped from 2.90% to 6.80% annual growth in just three years, leading to a Feeding Frenzy Factor of 134.60%. That growth has pushed the average home price over $1 million, showing just how aggressively the market has shifted in this Mercer County community.

Skillman – Small Town, Massive Price Shift

A section of Montgomery Township, Skillman is known for its scenic landscapes, strong schools, and low population density. It has quietly offered one of the most stable lifestyles in central New Jersey, attracting buyers who prize privacy and education quality.

But Skillman is no longer quiet on the price front. The 134.60% Feeding Frenzy Factor signals major investor and high-net-worth attention. Its limited commercial development, combined with soaring buyer interest, is reshaping the local market into one of the state’s most rapidly appreciating — and elite — places to buy.

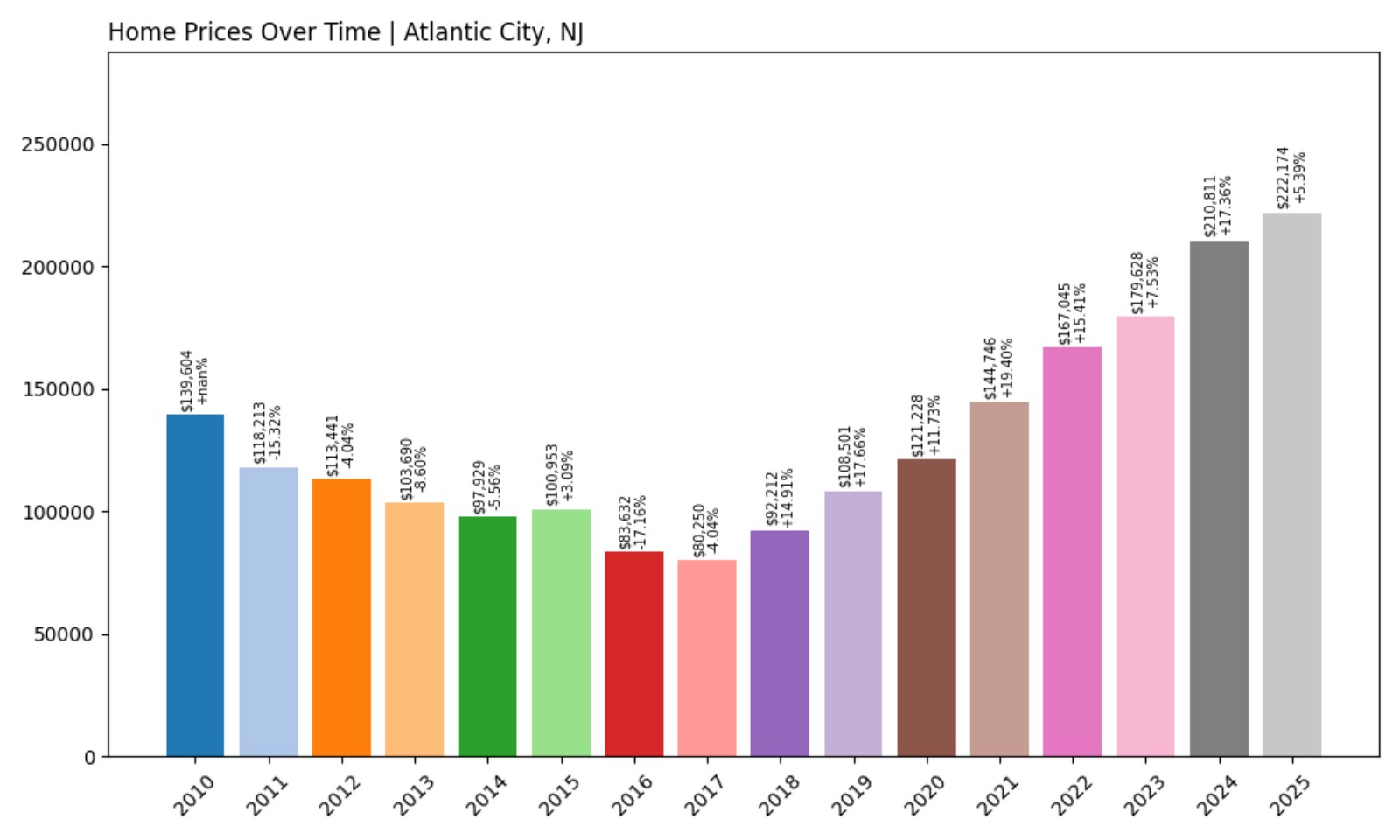

1. Atlantic City – Investor Feeding Frenzy Factor 152.76% (July 2025)

- Historical annual growth rate (2012–2022): 3.95%

- Recent annual growth rate (2022–2025): 9.97%

- Investor Feeding Frenzy Factor: 152.76%

- Current 2025 price: $222,173.77

Atlantic City tops the list with a Feeding Frenzy Factor of 152.76%, thanks to a staggering price growth jump from 3.95% to 9.97%. Despite the rapid appreciation, it remains one of the most affordable markets on the list, with average home prices still just over $222,000.

Atlantic City – High-Risk, High-Reward Market Turns Heads

Once synonymous with casinos and economic decline, Atlantic City is in the midst of a reinvention. Its beachfront location, walkable streets, and improving infrastructure have started to attract a new generation of buyers — including investors betting on long-term turnaround potential.

The sharp rise in home values suggests speculation is at an all-time high. With low entry prices and enormous upside potential, Atlantic City is drawing flippers, landlords, and those hoping to ride the wave of revitalization. But that momentum could carry serious implications for long-time residents facing displacement.