Would you like to save this?

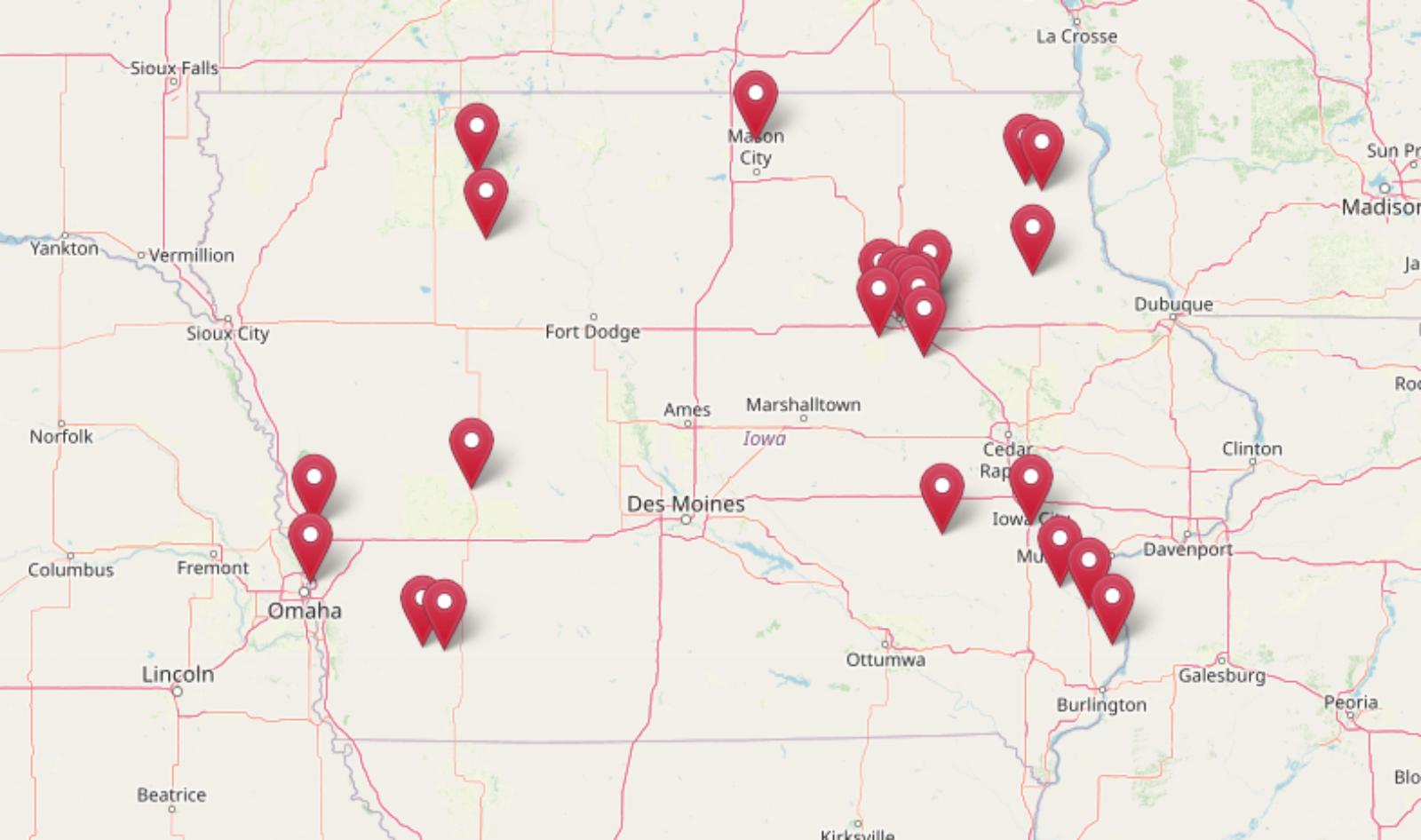

According to the Zillow Home Value Index, home prices in dozens of Iowa towns are rising at a pace that local incomes can’t match. In these 25 markets, recent growth rates far exceed the long-term norm—often a red flag that outside investors are driving the action. When property speculation heats up, it’s usually working families and first-time buyers who lose ground. These are the places where affordability is eroding fast, and where communities risk becoming investment portfolios instead of places to live.

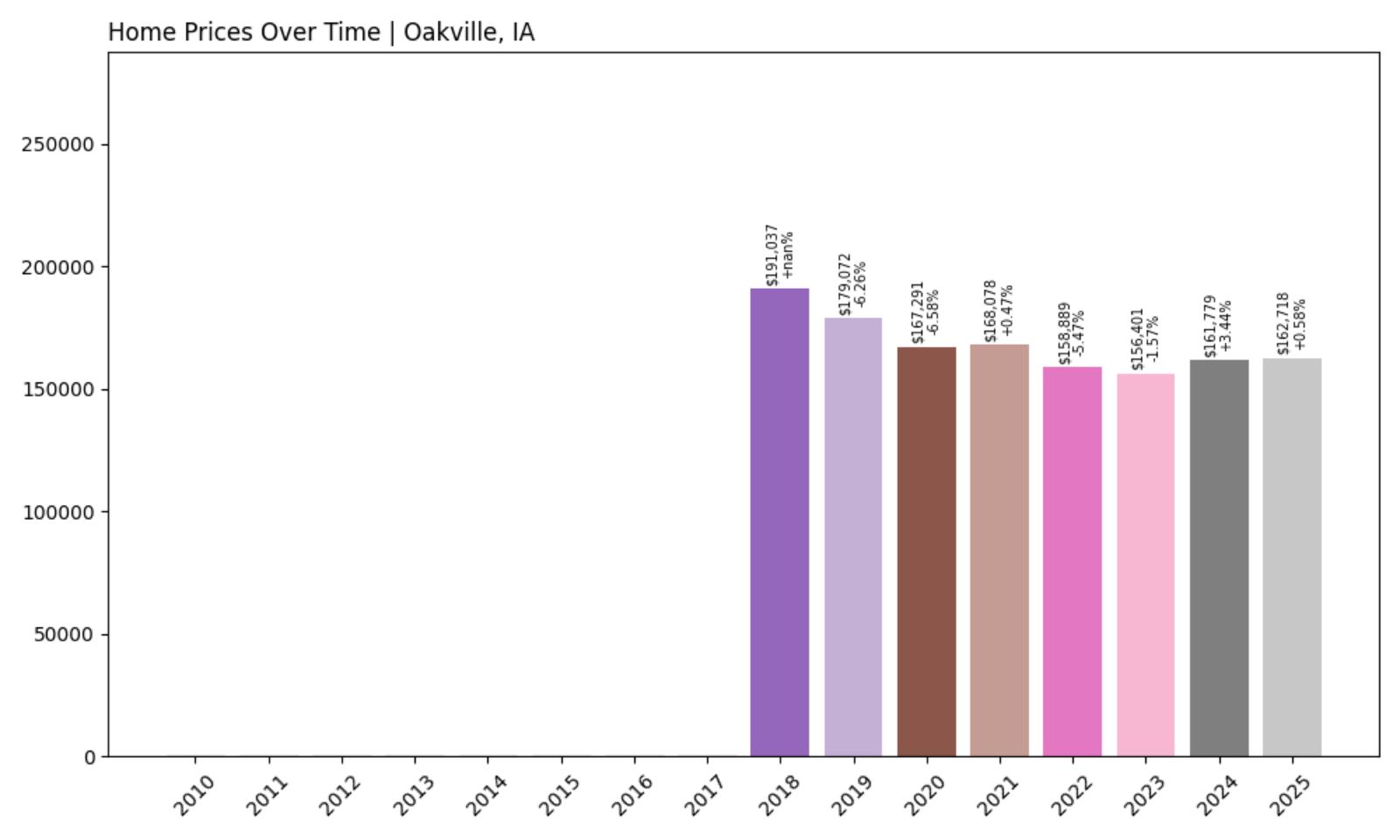

25. Oakville – Investor Feeding Frenzy Factor -117.70% (July 2025)

- Historical annual growth rate (2012–2022): -4.50%

- Recent annual growth rate (2022–2025): 0.80%

- Investor Feeding Frenzy Factor: -117.70%

- Current 2025 price: $162,717.86

Oakville represents a unique case where homes were actually losing value for a decade before recent stabilization brought modest gains. The town’s housing market had been declining at nearly 5% annually, making it one of Iowa’s most affordable options. This dramatic reversal from negative to positive growth suggests renewed interest in the community, though prices remain well below state averages.

Oakville – Recovery From Decade-Long Decline

Located in Louisa County along the Iowa River, Oakville is a small community of fewer than 500 residents that has struggled economically for years. The town’s housing market reflects broader challenges facing rural Iowa communities, where population loss and limited economic opportunities have kept property values suppressed. Manufacturing and agricultural jobs remain the primary employment sources, though many residents commute to larger nearby towns for work.

The recent price stabilization coincides with increased interest in rural properties and remote work opportunities that emerged during the pandemic. With median home values around $162,000, Oakville offers some of Iowa’s most affordable housing, attracting buyers priced out of larger markets. The town’s proximity to the Iowa River provides recreational opportunities, while its small-town character appeals to those seeking a quieter lifestyle.

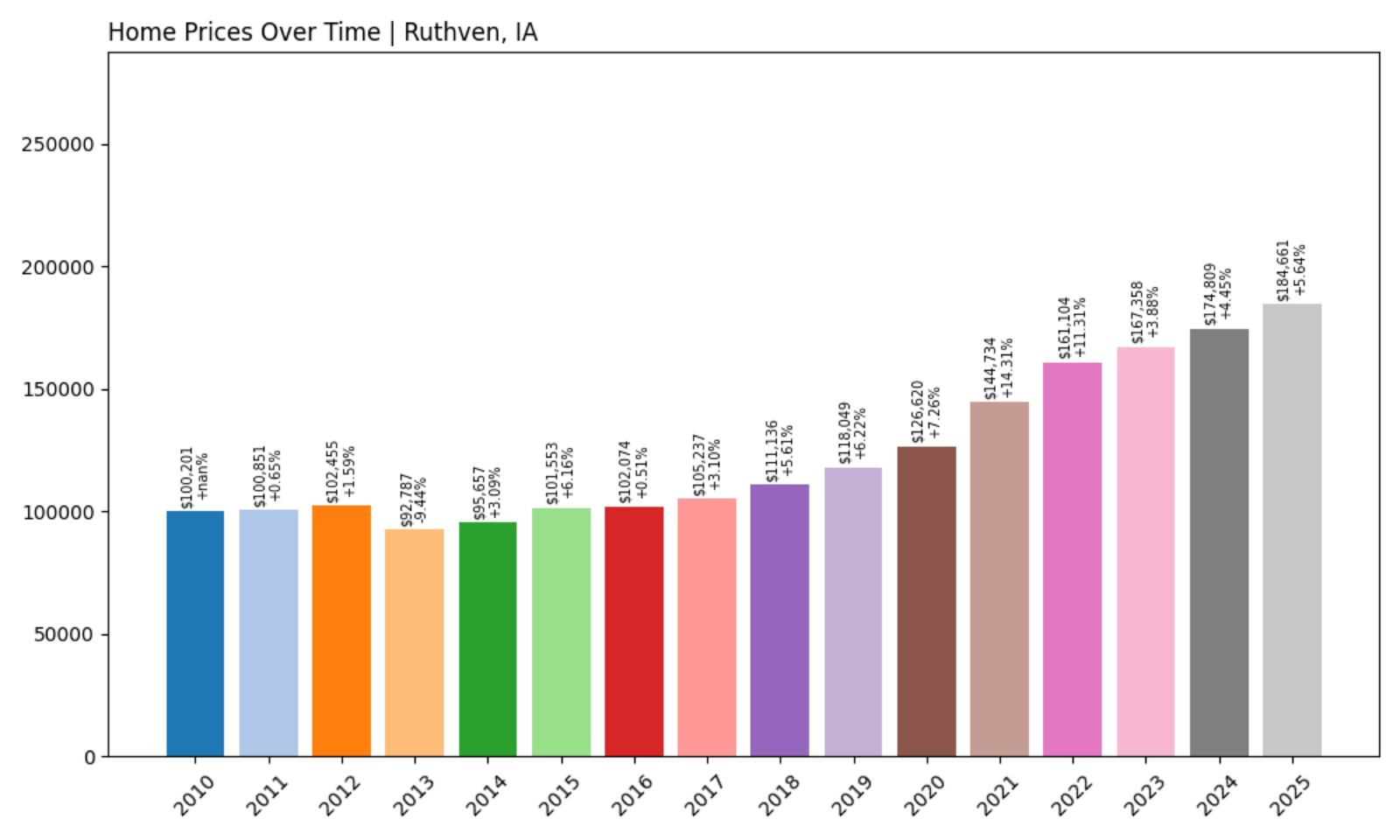

24. Ruthven – Investor Feeding Frenzy Factor 0.51% (July 2025)

- Historical annual growth rate (2012–2022): 4.63%

- Recent annual growth rate (2022–2025): 4.65%

- Investor Feeding Frenzy Factor: 0.51%

- Current 2025 price: $184,660.55

Ruthven demonstrates remarkable price stability, with recent growth rates nearly identical to its historical average. This consistency suggests a healthy housing market without speculative pressures. At $184,661, median home prices remain affordable while showing steady appreciation that benefits long-term homeowners without creating barriers for new buyers.

Ruthven – Steady Growth in Northwest Iowa

This Palo Alto County community of approximately 800 residents sits in Iowa’s northwest lake region, providing access to recreational opportunities at nearby lakes and parks. Ruthven’s economy centers on agriculture and related services, with several grain elevators and farming operations providing local employment. The town maintains essential services including a medical clinic, school system, and volunteer fire department.

Housing demand remains steady due to the area’s agricultural economy and recreational attractions. The town’s location provides easy access to Spirit Lake and other recreational destinations while maintaining small-town affordability. Local employers include agricultural businesses and service providers, creating stable demand for housing without the volatility seen in more urbanized areas.

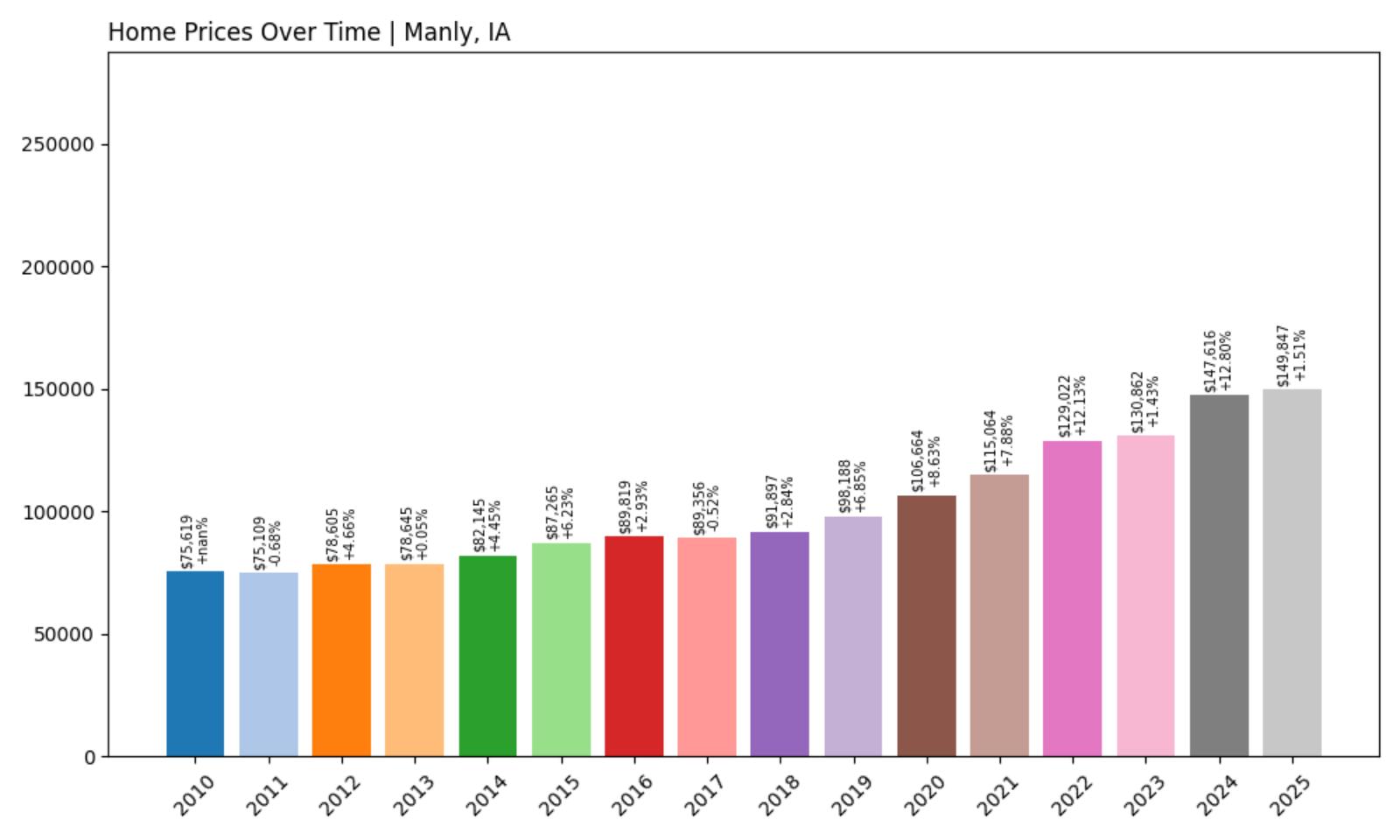

23. Manly – Investor Feeding Frenzy Factor 0.67% (July 2025)

- Historical annual growth rate (2012–2022): 5.08%

- Recent annual growth rate (2022–2025): 5.11%

- Investor Feeding Frenzy Factor: 0.67%

- Current 2025 price: $149,846.94

Manly maintains consistent growth patterns with minimal deviation from historical trends. The slight acceleration in recent years reflects steady demand in a stable market. With median prices under $150,000, the community offers exceptional affordability while demonstrating reliable appreciation for homeowners.

Manly – Agricultural Hub With Stable Housing

Located in Worth County near the Minnesota border, Manly serves as a center for the region’s agricultural economy. The community of roughly 1,300 residents benefits from its position along major transportation routes, making it attractive for agricultural businesses and related industries. The town hosts several manufacturing facilities and grain operations that provide local employment opportunities.

Housing costs remain among Iowa’s most affordable, with the $149,847 median price making homeownership accessible to working families. The community’s school system and recreational facilities support family life, while proximity to larger cities like Mason City provides additional employment and shopping opportunities. The stable housing market reflects steady local demand without significant investor pressure.

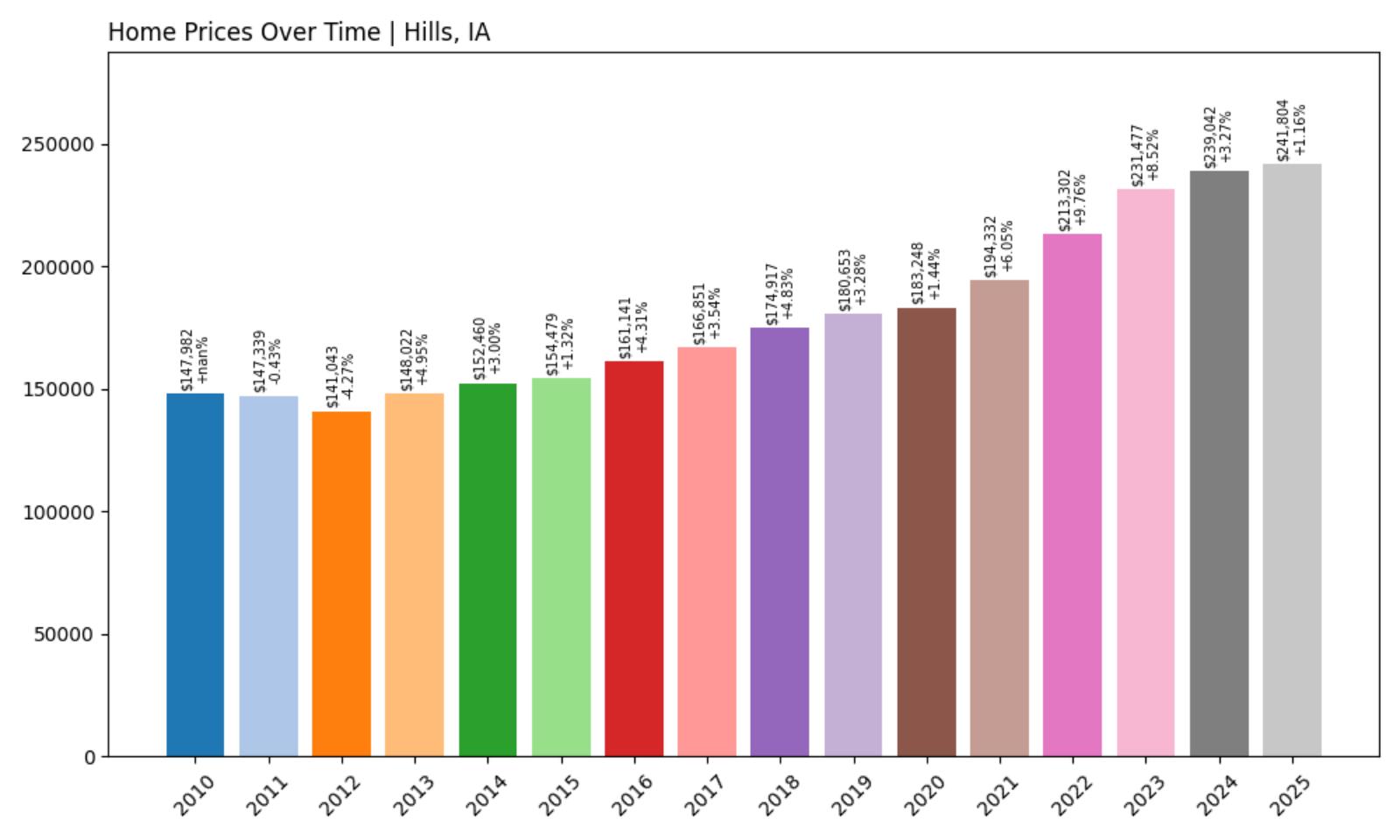

22. Hills – Investor Feeding Frenzy Factor 1.09% (July 2025)

- Historical annual growth rate (2012–2022): 4.22%

- Recent annual growth rate (2022–2025): 4.27%

- Investor Feeding Frenzy Factor: 1.09%

- Current 2025 price: $241,803.68

Hills shows minimal price acceleration beyond historical norms, indicating a balanced housing market. The higher median price of $241,804 reflects the community’s desirable location and quality of life amenities. Recent growth remains well within sustainable ranges that support both current residents and new buyers.

Hills – Growing Commuter Community

This Johnson County community has grown significantly as a desirable residential location for families working in nearby Iowa City and Cedar Rapids. With a population approaching 1,000 residents, Hills combines small-town character with access to larger metropolitan amenities. The community’s excellent school system and family-friendly environment attract young professionals and families seeking affordable alternatives to urban housing costs.

The higher median home price reflects Hills’ desirability and proximity to major employment centers. Recent development has added new housing options while maintaining the community’s rural character. Local amenities include parks, recreational facilities, and strong community organizations that enhance quality of life for residents.

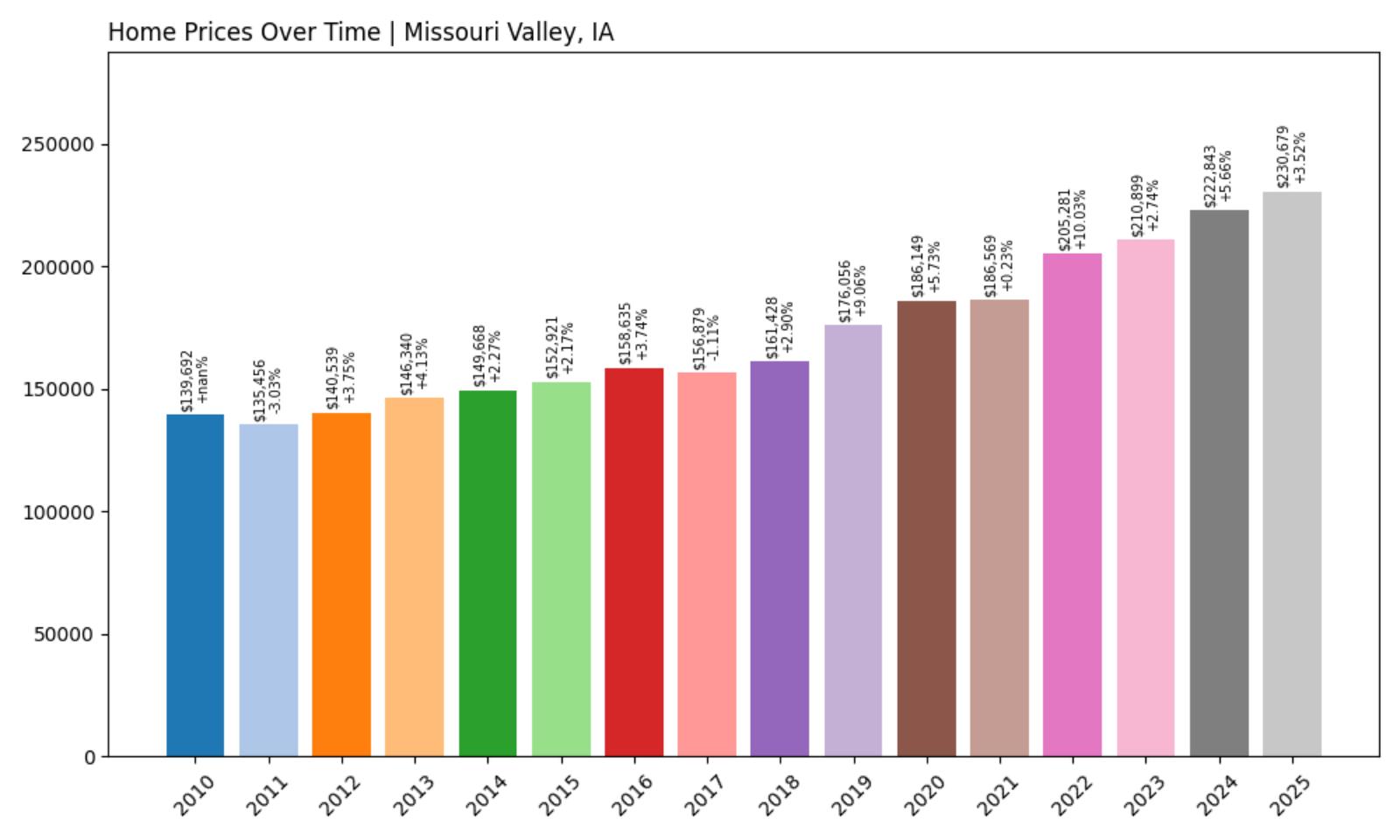

21. Missouri Valley – Investor Feeding Frenzy Factor 2.67% (July 2025)

- Historical annual growth rate (2012–2022): 3.86%

- Recent annual growth rate (2022–2025): 3.96%

- Investor Feeding Frenzy Factor: 2.67%

- Current 2025 price: $230,678.84

Missouri Valley displays modest acceleration in housing costs, with recent growth slightly outpacing historical averages. The $230,679 median price reflects the community’s strategic location and economic advantages. This measured increase suggests healthy market conditions without excessive speculation.

Missouri Valley – Strategic Location Drives Demand

Located in Harrison County along the Missouri River, this community of about 2,800 residents benefits from its position along major transportation corridors. The town serves as a regional center for agriculture and transportation, with rail and highway access supporting local businesses. Manufacturing and logistics companies have established operations in the area, providing diverse employment opportunities.

Housing demand reflects the community’s economic stability and strategic location between Omaha and other regional centers. The median price of $230,679 represents good value compared to larger metropolitan areas while offering access to employment and amenities. Local infrastructure investments and business development continue to support steady population and housing demand growth.

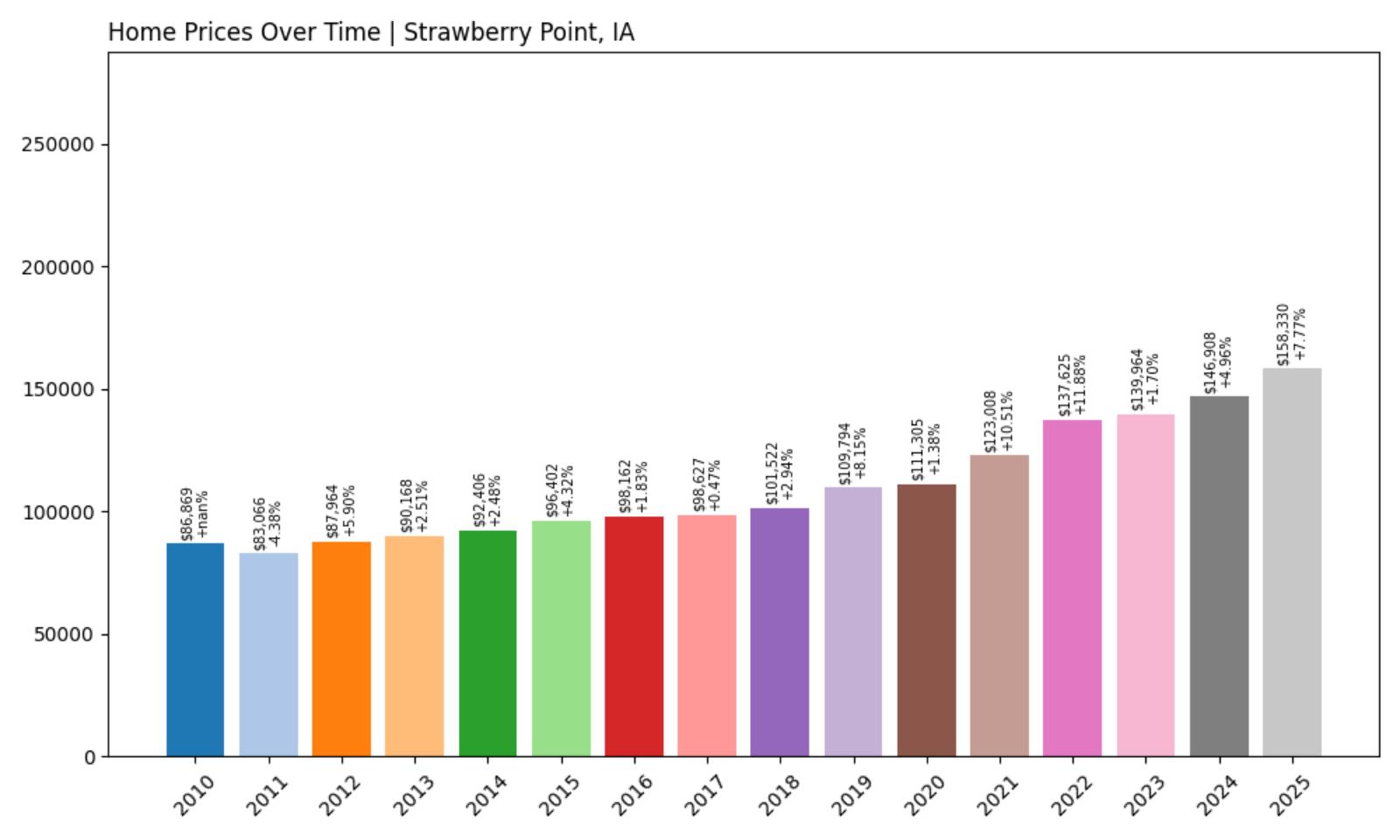

20. Strawberry Point – Investor Feeding Frenzy Factor 4.47% (July 2025)

- Historical annual growth rate (2012–2022): 4.58%

- Recent annual growth rate (2022–2025): 4.78%

- Investor Feeding Frenzy Factor: 4.47%

- Current 2025 price: $158,329.90

Strawberry Point shows slight acceleration above its historical growth pattern, though the increase remains modest. The community’s affordable median price of $158,330 continues to attract buyers, while steady appreciation provides value for existing homeowners. This level of growth suggests healthy demand without speculative pressures.

Strawberry Point – Northeast Iowa’s Hidden Value

This Clayton County community of approximately 1,300 residents sits in Iowa’s scenic northeast region, known for its rolling hills and recreational opportunities. The town serves the surrounding agricultural area while maintaining its own manufacturing base, including food processing and fabrication companies. Strawberry Point’s location provides access to both rural recreation and regional employment centers.

The affordable housing market attracts families and retirees seeking small-town living with reasonable costs. Recent infrastructure improvements and downtown revitalization efforts have enhanced the community’s appeal. Local amenities include parks, a golf course, and proximity to state parks and recreational areas that add to the quality of life for residents.

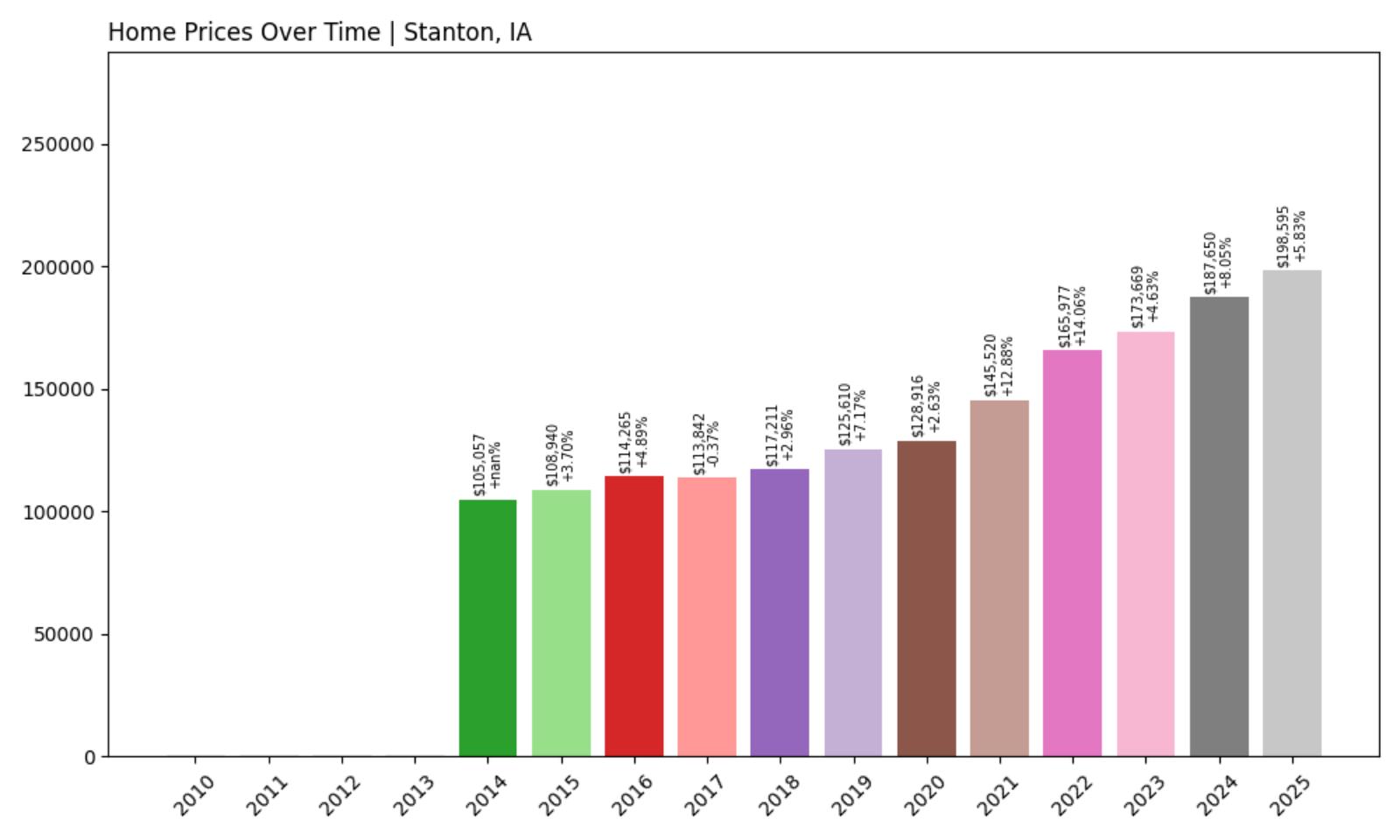

19. Stanton – Investor Feeding Frenzy Factor 4.75% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 5.88%

- Recent annual growth rate (2022–2025): 6.16%

- Investor Feeding Frenzy Factor: 4.75%

- Current 2025 price: $198,595.14

Stanton demonstrates consistent strong growth with only modest acceleration beyond historical patterns. The $198,595 median price reflects steady demand in a community that has maintained above-average appreciation rates. This performance suggests a healthy market with sustained interest from buyers.

Stanton – Consistent Growth in Southwest Iowa

Located in Montgomery County, this community of about 700 residents has maintained steady economic growth through agricultural diversification and small business development. Stanton’s rural location provides affordable living while maintaining access to regional employment centers. The town’s consistent housing appreciation reflects stable local demand and economic fundamentals.

The community offers small-town amenities including schools, recreational facilities, and local businesses that serve residents and the surrounding agricultural area. Housing costs remain reasonable at $198,595, providing good value for families seeking rural living with modern conveniences. The steady growth pattern indicates a balanced market without excessive speculation.

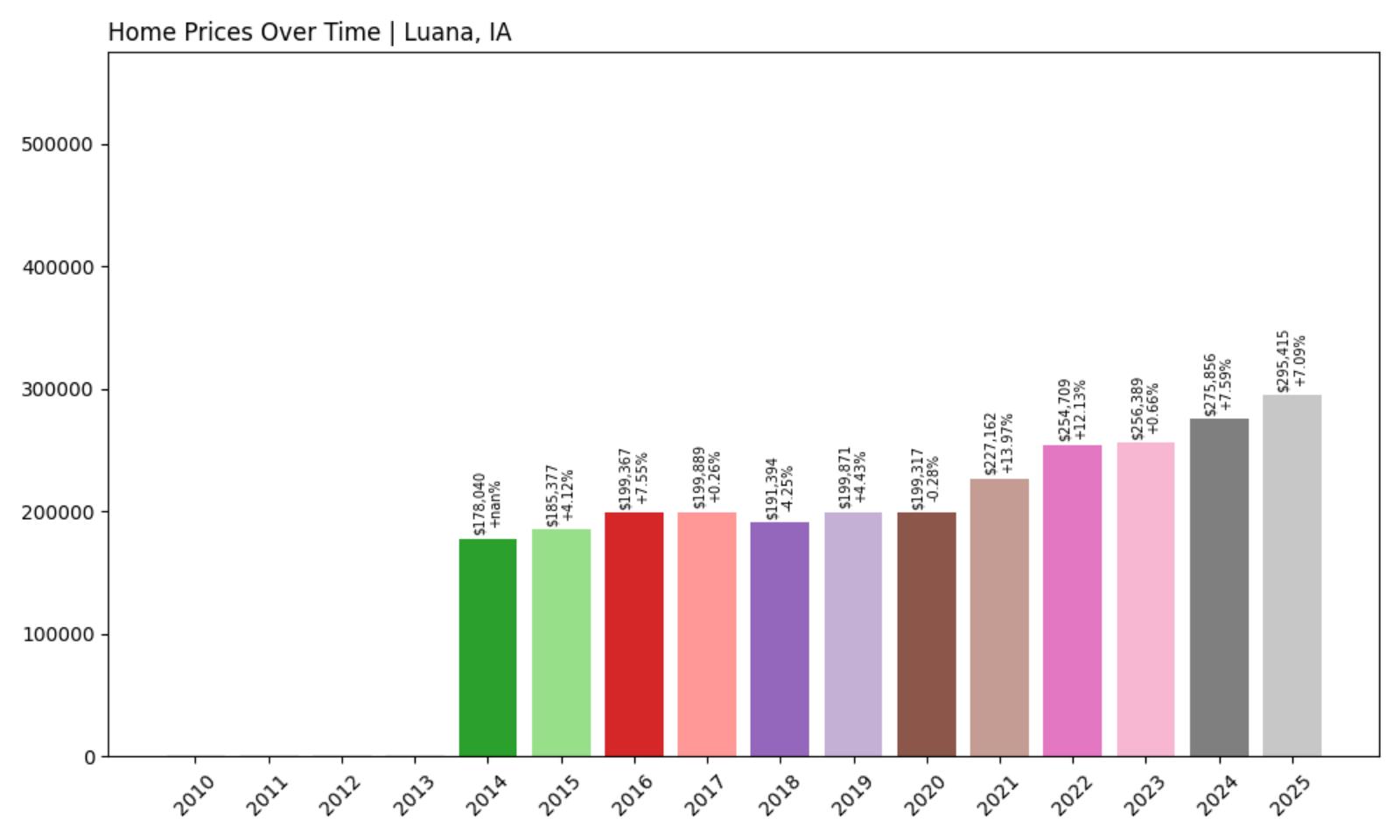

18. Luana – Investor Feeding Frenzy Factor 10.66% (July 2025)

- Historical annual growth rate (2012–2022): 4.58%

- Recent annual growth rate (2022–2025): 5.07%

- Investor Feeding Frenzy Factor: 10.66%

- Current 2025 price: $295,414.74

Luana shows noticeable acceleration in housing costs, with recent growth outpacing historical averages by over 10%. The high median price of $295,415 reflects strong demand in this scenic northeast Iowa community. While the increase is notable, it remains within manageable ranges that don’t suggest extreme speculation.

Luana – Scenic Beauty Drives Premium Pricing

This Clayton County community of fewer than 300 residents sits in Iowa’s most scenic region, characterized by bluffs, valleys, and proximity to the Mississippi River. Luana’s natural beauty and recreational opportunities make it attractive to buyers seeking rural retreat properties and seasonal homes. The town’s location near state parks and recreational areas adds significant value to local real estate.

The higher median price of $295,415 reflects both the area’s scenic appeal and limited housing inventory. Recent interest from buyers seeking rural properties and vacation homes has increased demand beyond traditional local needs. The community’s small size means that even modest increases in buyer activity can significantly impact pricing trends.

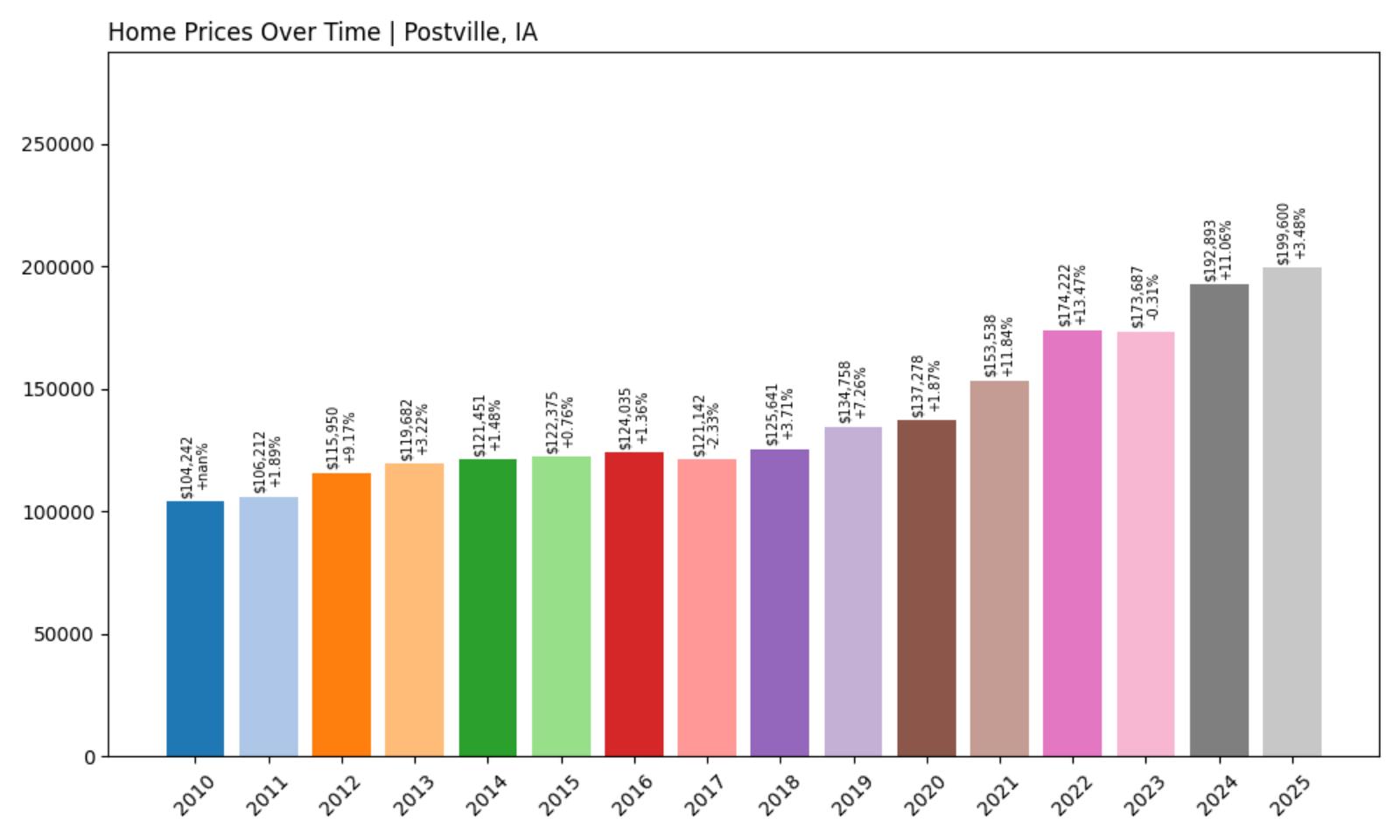

17. Postville – Investor Feeding Frenzy Factor 11.59% (July 2025)

- Historical annual growth rate (2012–2022): 4.16%

- Recent annual growth rate (2022–2025): 4.64%

- Investor Feeding Frenzy Factor: 11.59%

- Current 2025 price: $199,600.33

Postville displays accelerating growth with recent rates exceeding historical patterns by nearly 12%. The moderate median price of $199,600 remains accessible while showing increased demand. This acceleration suggests growing interest in the community, though pricing hasn’t reached levels that exclude working families.

Postville – Diverse Community With Growing Appeal

Located in Allamakee County, Postville has a unique character as one of Iowa’s most diverse small towns, with significant Latino and Orthodox Jewish populations. The community of about 2,200 residents has recovered from economic challenges in previous decades and now shows renewed growth. Local employers include food processing, manufacturing, and agricultural businesses.

Housing demand has increased as the community’s economic base has stabilized and diversified. The $199,600 median price provides reasonable value while recent acceleration reflects growing confidence in the local economy. Postville’s cultural diversity and economic recovery make it an increasingly attractive option for families seeking affordable small-town living.

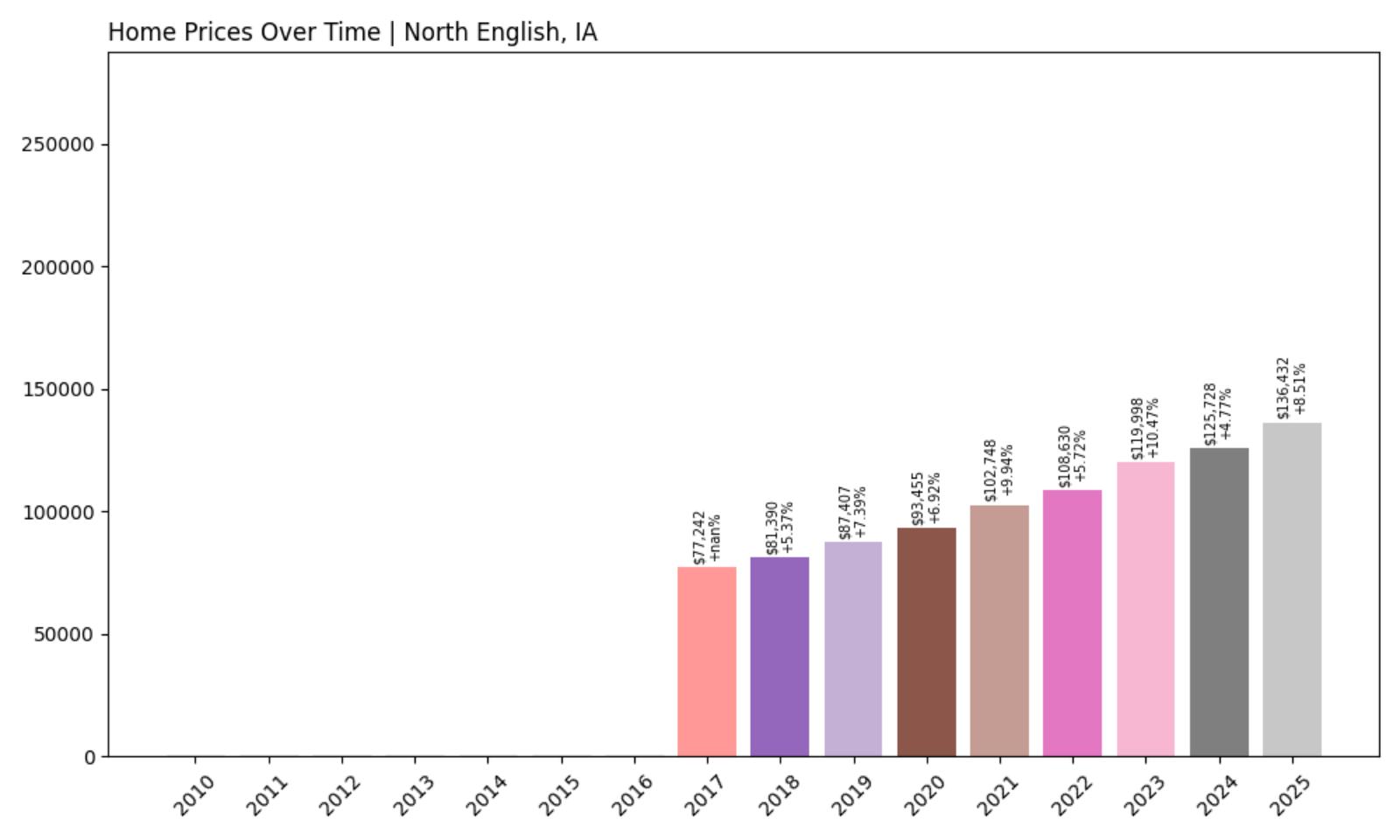

16. North English – Investor Feeding Frenzy Factor 11.81% (July 2025)

- Historical annual growth rate (2012–2022): 7.06%

- Recent annual growth rate (2022–2025): 7.89%

- Investor Feeding Frenzy Factor: 11.81%

- Current 2025 price: $136,431.60

North English shows concerning acceleration with already strong historical growth rates increasing further. Despite the rapid appreciation, the $136,432 median price remains among Iowa’s most affordable. The combination of strong growth and low prices suggests significant investor interest in an undervalued market.

North English – Rapid Growth From Low Base

This Iowa County community of approximately 1,000 residents has experienced remarkable housing appreciation while maintaining exceptional affordability. North English serves the surrounding agricultural area and has attracted attention from buyers seeking value in central Iowa. The town’s location provides access to larger cities while maintaining rural character and low costs.

The dramatic price acceleration from an already strong historical base indicates intense market activity. However, the $136,432 median remains extremely affordable, suggesting the market is correcting from previously undervalued levels. Local amenities include schools, recreational facilities, and businesses that support the surrounding agricultural community.

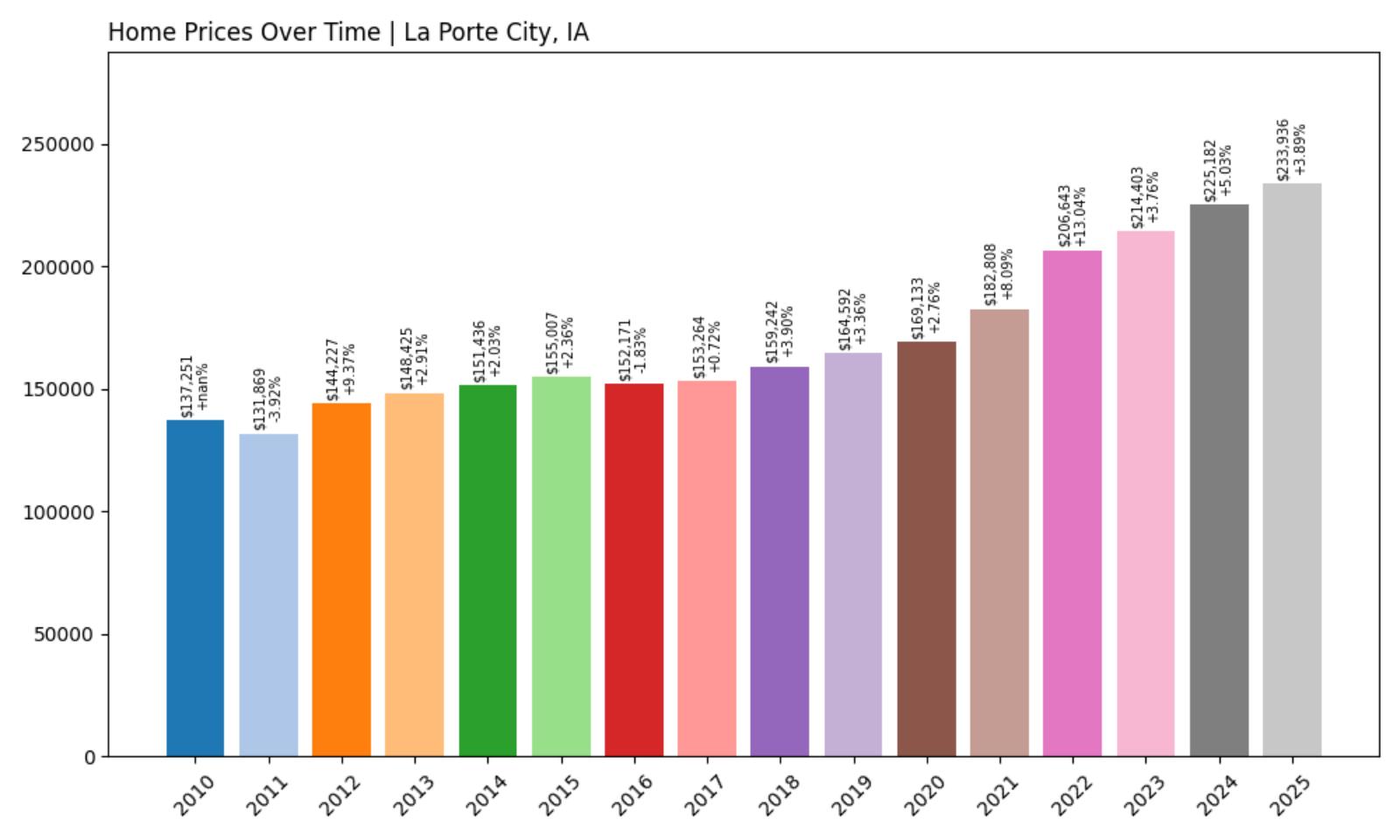

15. La Porte City – Investor Feeding Frenzy Factor 15.30% (July 2025)

- Historical annual growth rate (2012–2022): 3.66%

- Recent annual growth rate (2022–2025): 4.22%

- Investor Feeding Frenzy Factor: 15.30%

- Current 2025 price: $233,935.64

La Porte City demonstrates significant acceleration in housing costs, with recent growth outpacing historical averages by over 15%. The $233,936 median price reflects growing demand in this well-positioned community. This level of acceleration suggests increased investor and buyer interest beyond normal market conditions.

La Porte City – Strategic Location Fuels Demand

Located in Black Hawk County, this community of about 2,200 residents benefits from proximity to Waterloo-Cedar Falls while maintaining small-town character. La Porte City serves as a bedroom community for workers in the larger metropolitan area, offering affordable housing with access to urban amenities and employment. The town’s location along major transportation routes enhances its appeal to commuters.

Housing demand has accelerated as buyers seek alternatives to higher-priced urban markets. The $233,936 median price provides good value compared to nearby cities while offering quality schools and community amenities. Recent development has added housing options while maintaining the community’s residential character and appeal to families.

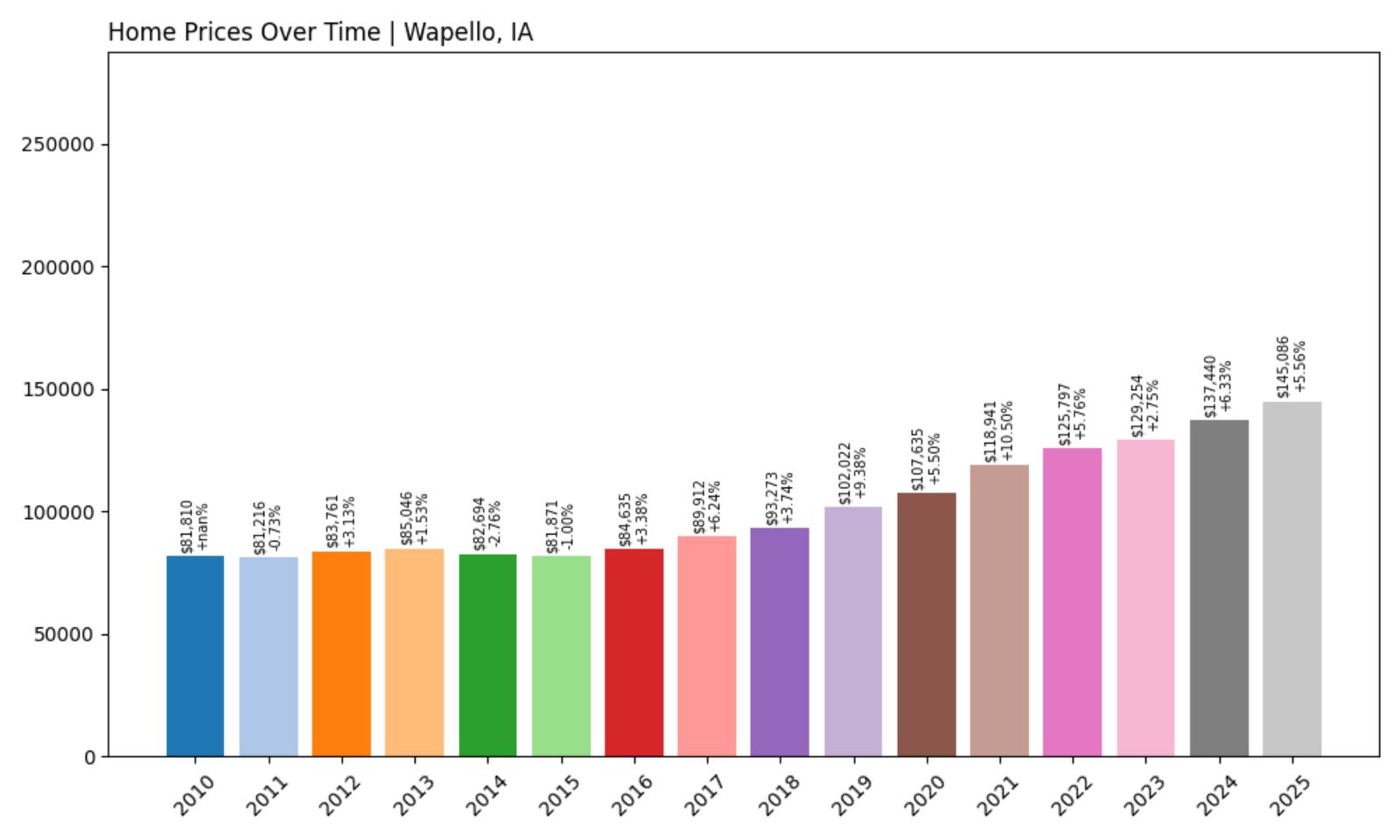

14. Wapello – Investor Feeding Frenzy Factor 17.33% (July 2025)

- Historical annual growth rate (2012–2022): 4.15%

- Recent annual growth rate (2022–2025): 4.87%

- Investor Feeding Frenzy Factor: 17.33%

- Current 2025 price: $145,086.07

Wapello shows notable acceleration with recent growth exceeding historical patterns by over 17%. The affordable median price of $145,086 makes this community attractive to value-seeking buyers. This significant acceleration suggests growing recognition of the area’s potential among investors and homebuyers.

Wapello – Riverside Community Gaining Recognition

This Louisa County community of about 2,000 residents sits along the Iowa River in southeast Iowa. Wapello has historically been an affordable market, but recent interest has driven increased activity and appreciation. The town serves as a center for the surrounding agricultural area while maintaining its own economic base including manufacturing and retail businesses.

The dramatic acceleration in housing costs indicates growing demand for affordable properties in the region. At $145,086, median prices remain well below state averages while showing strong appreciation. The community’s river location and rural character appeal to buyers seeking affordable living with natural amenities and small-town atmosphere.

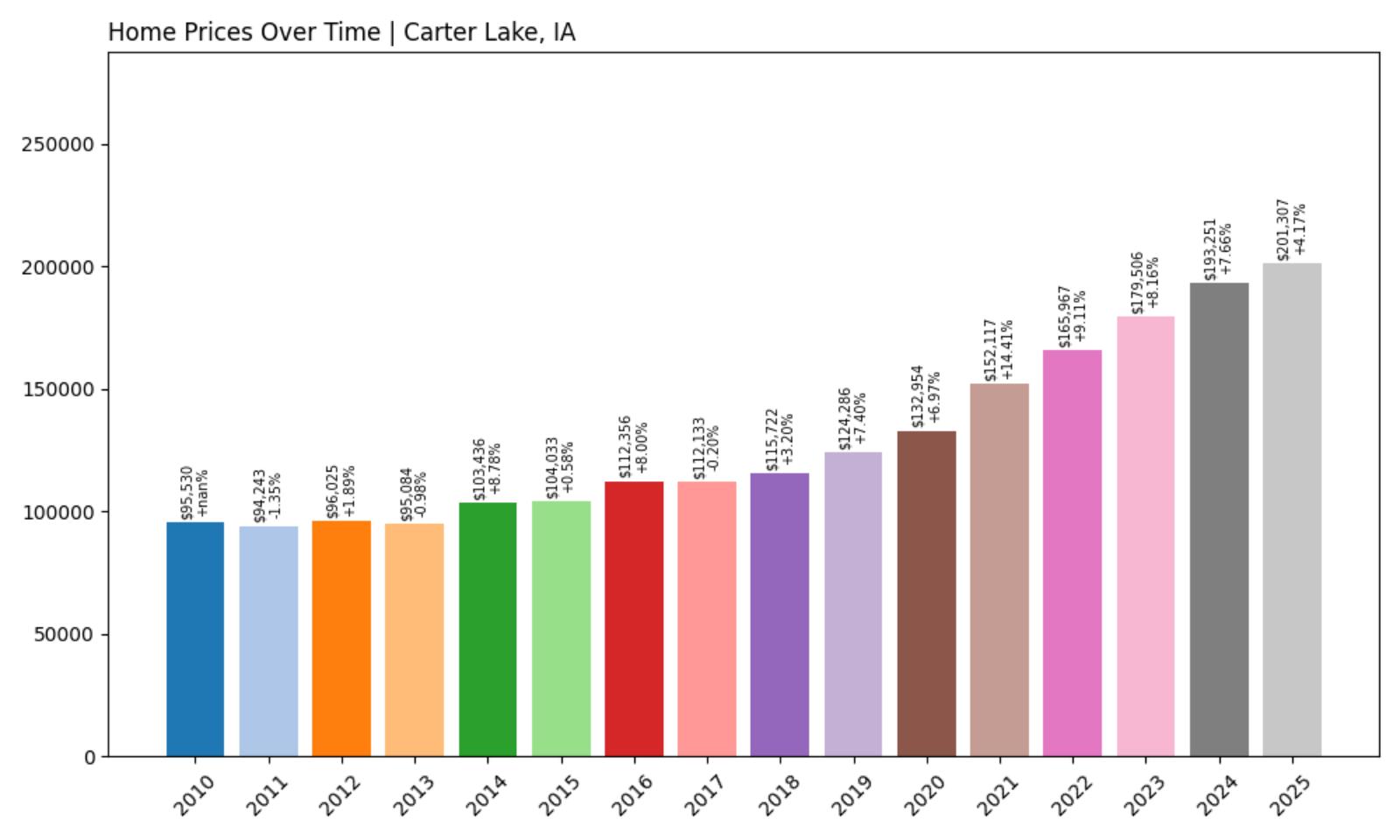

13. Carter Lake – Investor Feeding Frenzy Factor 18.17% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 5.62%

- Recent annual growth rate (2022–2025): 6.65%

- Investor Feeding Frenzy Factor: 18.17%

- Current 2025 price: $201,307.08

Carter Lake displays significant acceleration beyond already strong historical growth patterns. The $201,307 median price reflects the community’s unique position and growing appeal. This level of acceleration suggests intense market activity that may be pricing out some traditional buyers.

Carter Lake – Unique Geography Creates Premium Market

This unique community sits on the Nebraska side of the Missouri River but remains part of Iowa due to historical river changes. Carter Lake’s proximity to Omaha makes it highly desirable for commuters seeking affordable alternatives to Nebraska housing costs. The community of about 3,800 residents enjoys easy access to metropolitan amenities while maintaining lower taxes and costs.

The significant price acceleration reflects growing recognition of Carter Lake’s advantages among buyers and investors. The $201,307 median price provides substantial savings compared to nearby Omaha while offering the same metropolitan access. This unique position continues to drive demand beyond the community’s historical patterns.

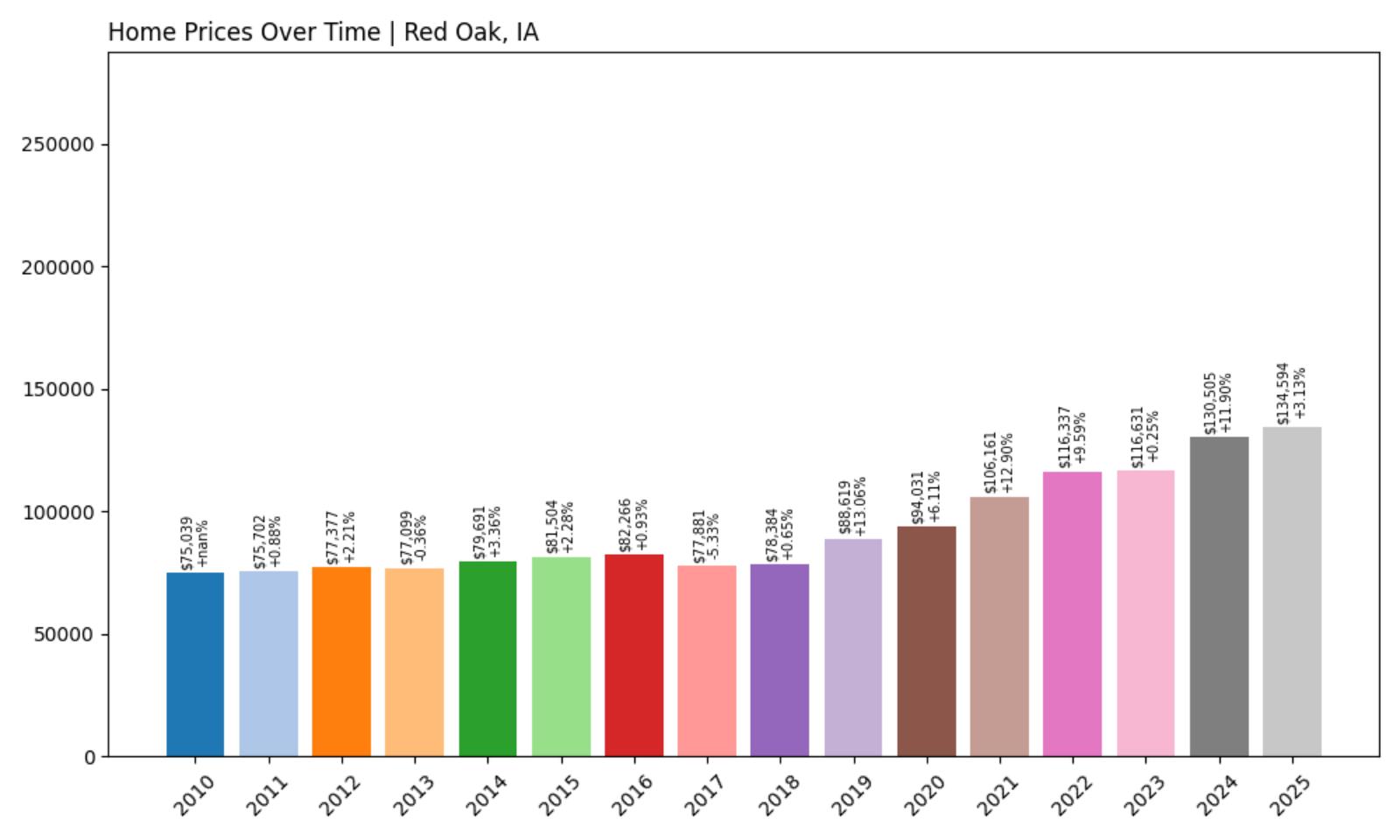

12. Red Oak – Investor Feeding Frenzy Factor 19.62% (July 2025)

- Historical annual growth rate (2012–2022): 4.16%

- Recent annual growth rate (2022–2025): 4.98%

- Investor Feeding Frenzy Factor: 19.62%

- Current 2025 price: $134,593.98

Red Oak shows concerning acceleration with recent growth nearly 20% above historical averages. Despite this rapid appreciation, the $134,594 median price remains among Iowa’s most affordable. The combination of strong growth and low absolute prices suggests significant investor recognition of undervalued opportunities.

Red Oak – Southwest Iowa Value Discovery

This Montgomery County community of about 5,400 residents serves as a regional center for southwest Iowa. Red Oak has maintained economic stability through diversified local businesses, manufacturing, and agricultural services. The town’s role as a county seat provides additional employment and stability, while its affordable housing market has attracted increased attention from value-seeking buyers.

The dramatic acceleration in housing costs indicates growing investor and buyer interest in previously undervalued markets. At $134,594, median prices remain exceptionally affordable while showing rapid appreciation. Local amenities include healthcare facilities, educational institutions, and recreational opportunities that support quality of life for residents.

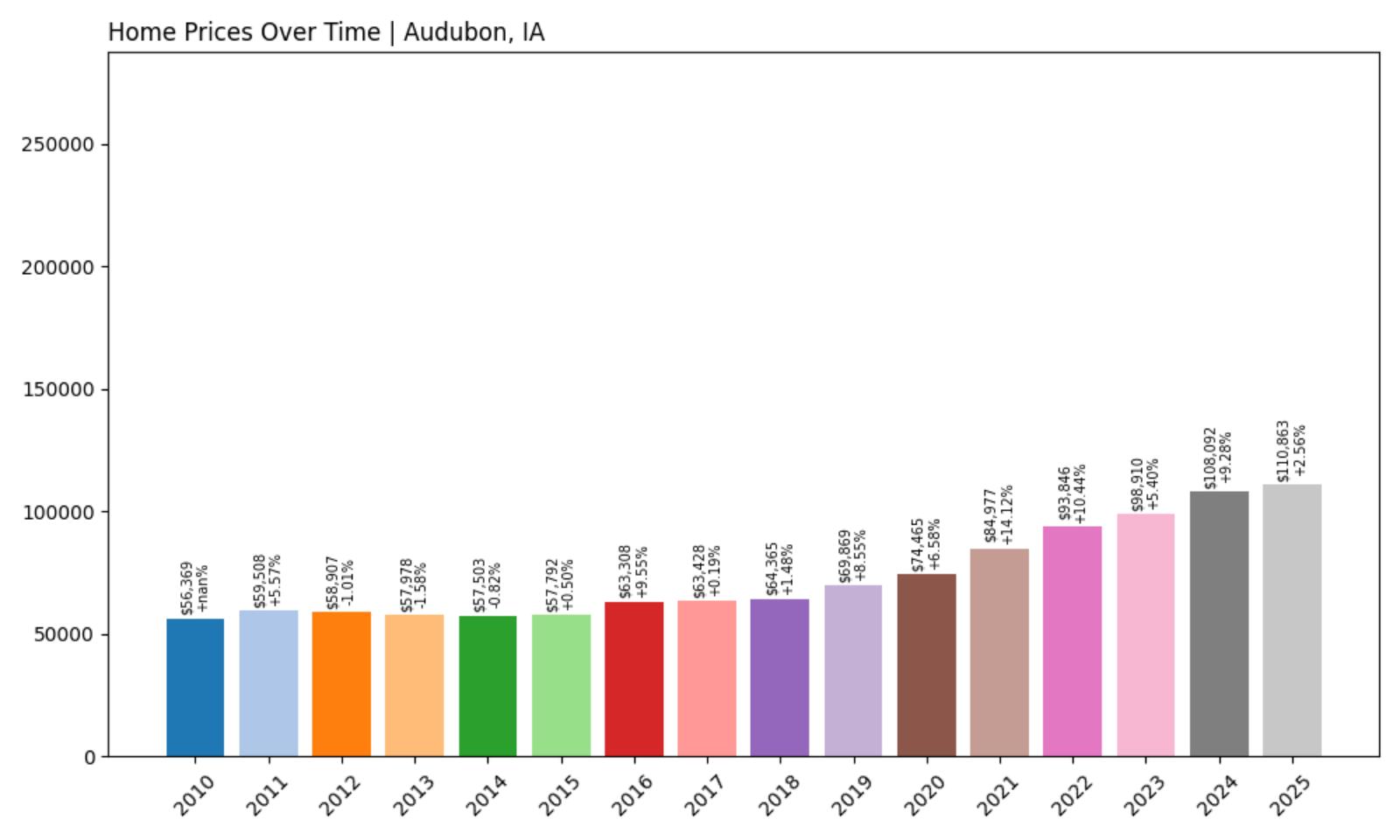

11. Audubon – Investor Feeding Frenzy Factor 19.81% (July 2025)

- Historical annual growth rate (2012–2022): 4.77%

- Recent annual growth rate (2022–2025): 5.71%

- Investor Feeding Frenzy Factor: 19.81%

- Current 2025 price: $110,862.84

Audubon demonstrates significant acceleration with nearly 20% growth beyond historical patterns. The extremely affordable median price of $110,863 makes this community highly attractive to value investors. This dramatic acceleration suggests major investor discovery of an undervalued rural market.

Audubon – Extreme Value Attracts Investment Interest

Located in Audubon County, this community of about 2,100 residents offers some of Iowa’s most affordable housing. The town serves the surrounding agricultural area and has maintained economic stability through diversified local businesses and agricultural services. Audubon’s extremely low housing costs have attracted attention from investors and buyers seeking maximum value.

The exceptional affordability at $110,863 combined with rapid acceleration indicates intense investor interest in previously overlooked markets. The community offers essential services and amenities while maintaining rural character and extremely low costs. This combination has driven unprecedented investor attention and price acceleration.

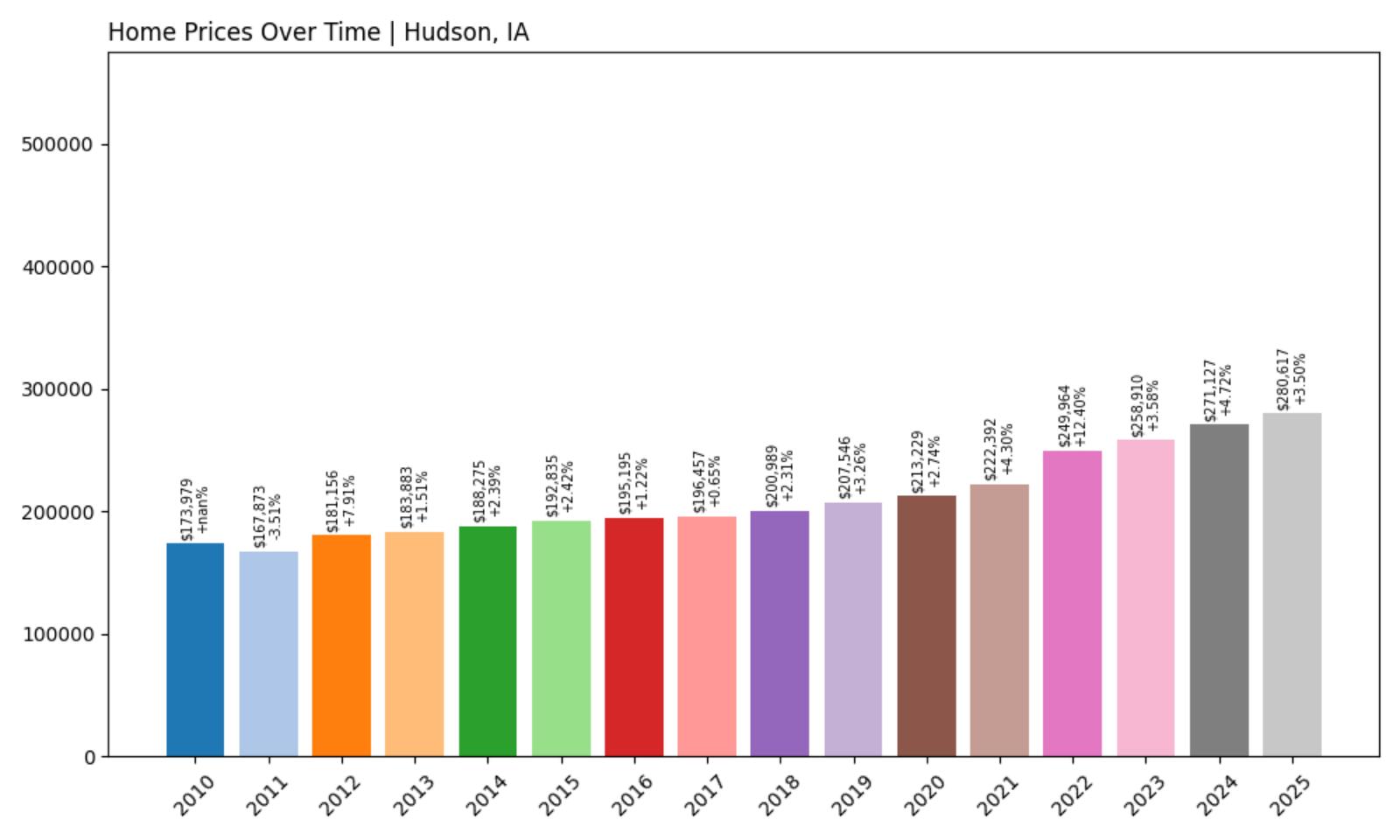

10. Hudson – Investor Feeding Frenzy Factor 20.15% (July 2025)

- Historical annual growth rate (2012–2022): 3.27%

- Recent annual growth rate (2022–2025): 3.93%

- Investor Feeding Frenzy Factor: 20.15%

- Current 2025 price: $280,617.22

Hudson shows dramatic acceleration with recent growth exceeding historical patterns by over 20%. The higher median price of $280,617 reflects the community’s desirable characteristics and prime location. This level of acceleration indicates intense market pressure that may challenge affordability for local buyers.

Hudson – Premium Location Commands Higher Prices

This Black Hawk County community of about 2,300 residents has become highly desirable as a residential location for families working in the Cedar Falls-Waterloo metropolitan area. Hudson combines excellent schools, family-friendly amenities, and small-town character with easy access to urban employment and services. The community’s reputation for quality of life drives consistent demand for housing.

The significant price acceleration to $280,617 reflects intense competition among buyers for limited inventory in this desirable location. Hudson’s premium position in the regional housing market continues to attract families willing to pay higher prices for quality schools and community amenities. This demand pressure has driven prices well beyond historical growth patterns.

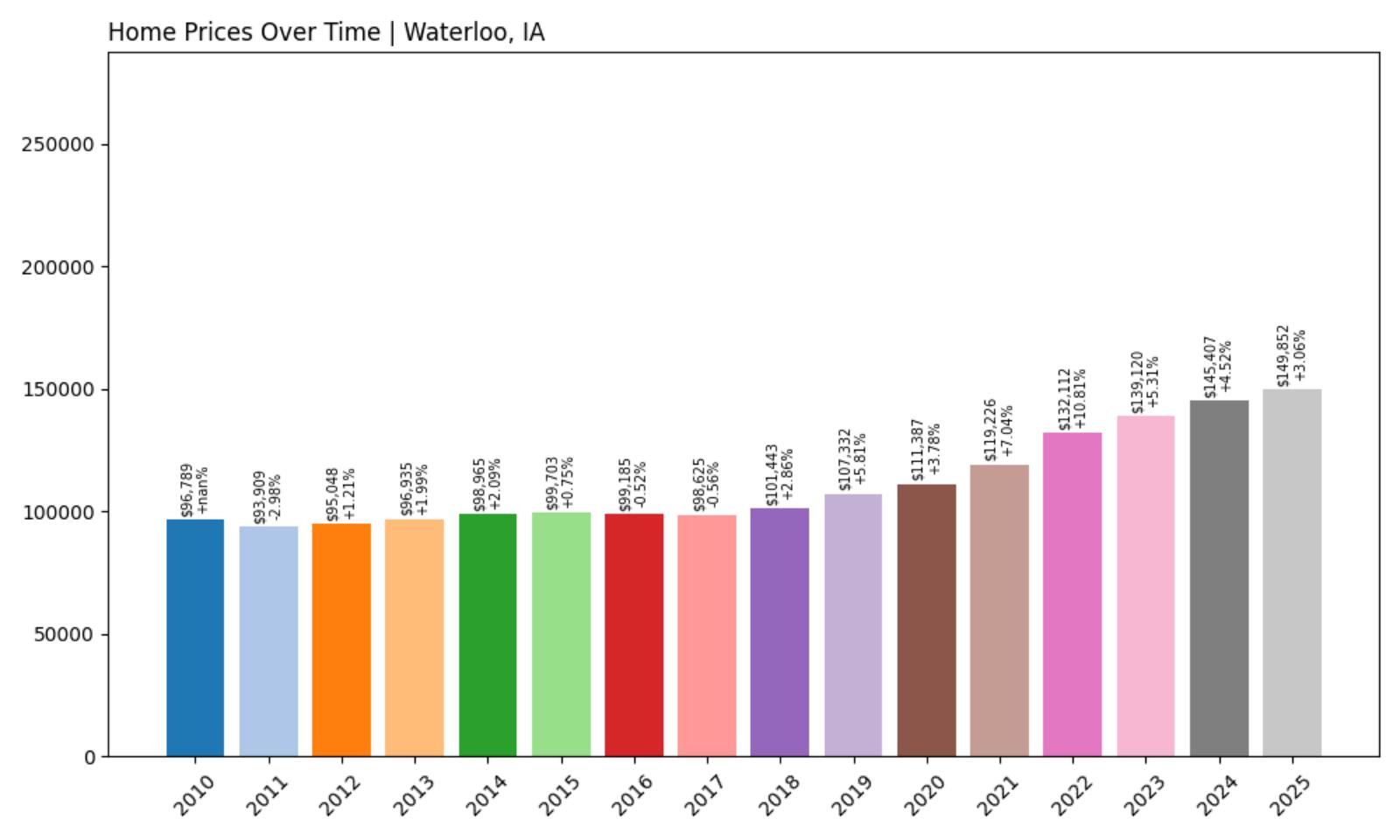

9. Waterloo – Investor Feeding Frenzy Factor 28.14% (July 2025)

- Historical annual growth rate (2012–2022): 3.35%

- Recent annual growth rate (2022–2025): 4.29%

- Investor Feeding Frenzy Factor: 28.14%

- Current 2025 price: $149,852.18

Waterloo displays alarming acceleration with recent growth exceeding historical patterns by over 28%. The moderate median price of $149,852 remains accessible, but this rapid acceleration suggests intense investor pressure. For Iowa’s fifth-largest city, this level of speculation could significantly impact housing affordability for working families.

Waterloo – Urban Market Shows Investor Pressure

Would you like to save this?

As Iowa’s fifth-largest city with about 67,000 residents, Waterloo anchors the Cedar Valley metropolitan area alongside Cedar Falls. The city has diversified its economy beyond traditional manufacturing to include healthcare, education, and technology sectors. Major employers include John Deere, Tyson Foods, and the University of Northern Iowa system, providing stable employment for the region.

The dramatic acceleration in housing costs indicates significant investor activity in previously affordable urban markets. At $149,852, median prices remain reasonable compared to larger cities, but the 28% acceleration beyond historical norms suggests speculative pressure. This trend threatens affordability for working families who depend on Waterloo’s diverse employment base and urban amenities.

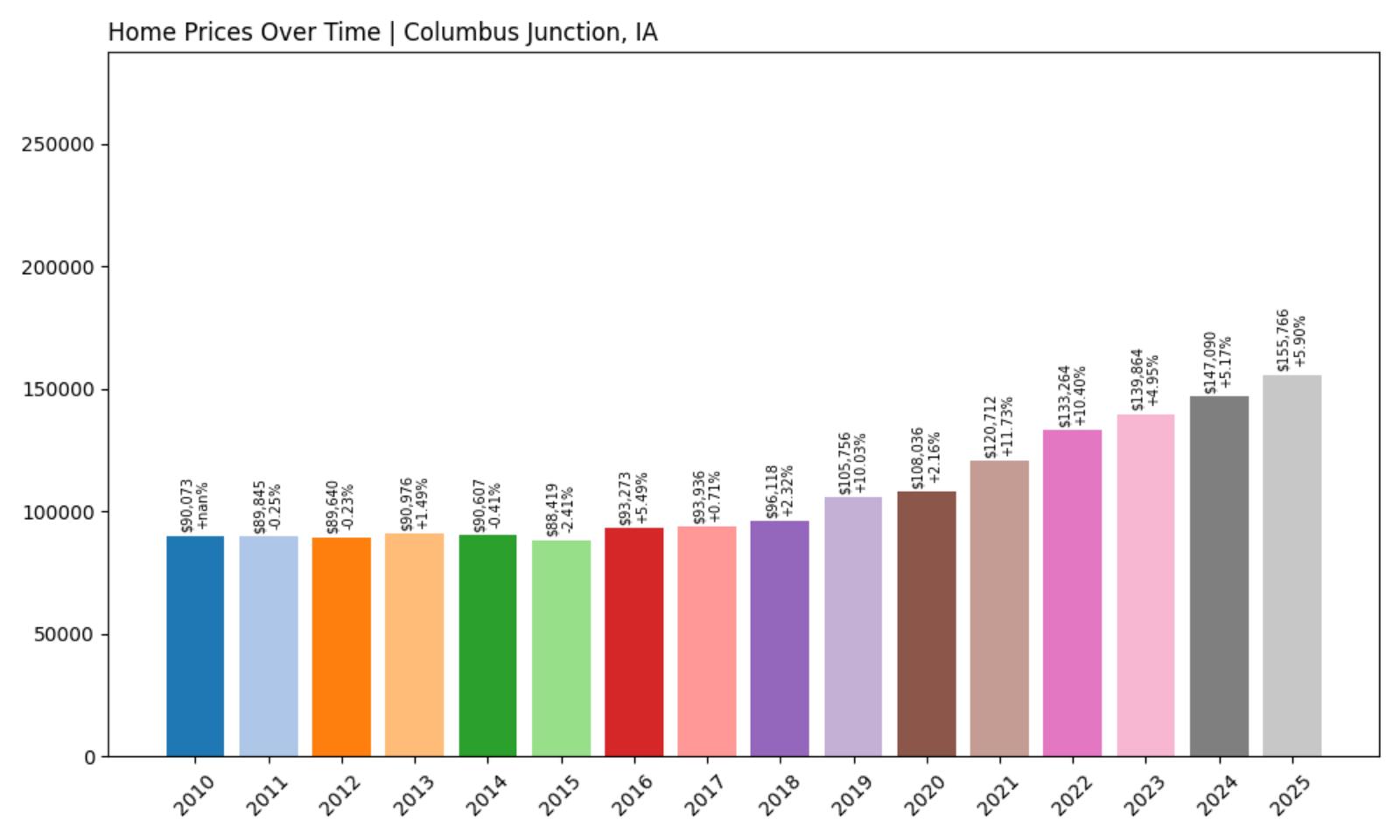

8. Columbus Junction – Investor Feeding Frenzy Factor 31.97% (July 2025)

- Historical annual growth rate (2012–2022): 4.05%

- Recent annual growth rate (2022–2025): 5.34%

- Investor Feeding Frenzy Factor: 31.97%

- Current 2025 price: $155,765.53

Columbus Junction shows severe acceleration with recent growth exceeding historical patterns by nearly 32%. While the $155,766 median price remains moderate, this dramatic acceleration indicates intense speculative pressure. The level of growth suggests investor activity that could displace local families from the housing market.

Columbus Junction – Small Town Under Investment Pressure

This Louisa County community of about 1,900 residents has experienced unprecedented investor attention despite its small size and rural location. Columbus Junction serves the surrounding agricultural area and has maintained a stable local economy through small businesses and agricultural services. The town’s affordable housing and rural character traditionally attracted working families and retirees.

The extreme acceleration to $155,766 indicates major investor discovery of previously overlooked rural markets. This 32% growth acceleration suggests speculative activity that threatens the community’s traditional affordability. Local residents may find themselves priced out as investors compete for limited housing inventory in this small market.

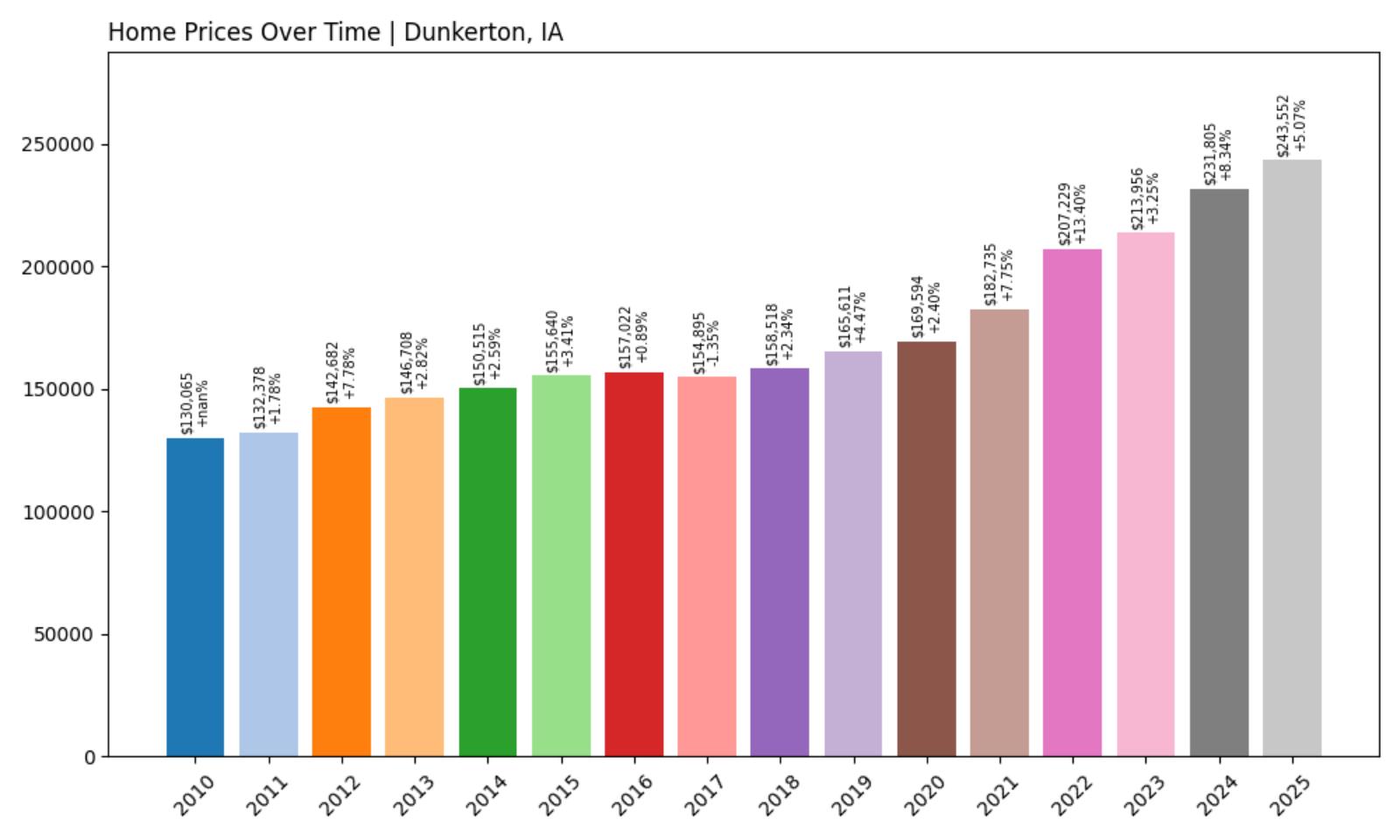

7. Dunkerton – Investor Feeding Frenzy Factor 45.46% (July 2025)

- Historical annual growth rate (2012–2022): 3.80%

- Recent annual growth rate (2022–2025): 5.53%

- Investor Feeding Frenzy Factor: 45.46%

- Current 2025 price: $243,552.23

Dunkerton displays extreme acceleration with recent growth exceeding historical patterns by over 45%. The elevated median price of $243,552 reflects intense demand pressure in this small community. This level of speculation creates serious affordability challenges for local families and traditional buyers.

Dunkerton – Small Community Faces Major Price Pressure

Located in Black Hawk County, this community of about 800 residents has become attractive to buyers seeking alternatives to higher-priced areas near Cedar Falls and Waterloo. Dunkerton’s small size and rural character traditionally provided affordable housing for working families, but recent investor interest has dramatically altered the local market dynamics.

The extreme 45% acceleration to $243,552 indicates intense speculative pressure that threatens the community’s traditional character and affordability. This small market can be easily disrupted by outside investment activity, creating pricing that disconnects from local wage levels and traditional buyer capacity. The dramatic increase suggests a feeding frenzy that could permanently alter the community’s accessibility to working families.

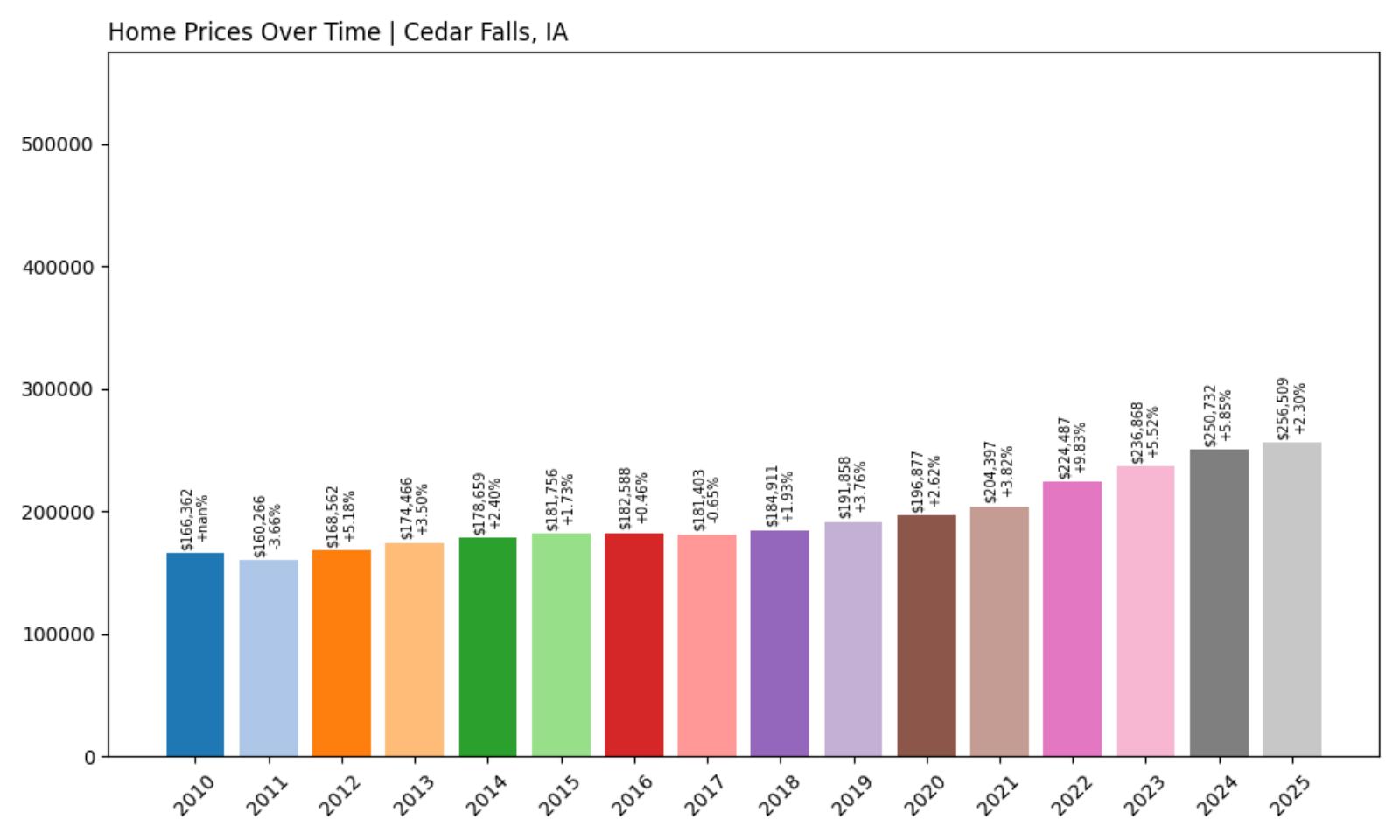

6. Cedar Falls – Investor Feeding Frenzy Factor 56.37% (July 2025)

- Historical annual growth rate (2012–2022): 2.91%

- Recent annual growth rate (2022–2025): 4.55%

- Investor Feeding Frenzy Factor: 56.37%

- Current 2025 price: $256,508.60

Cedar Falls shows severe speculation with recent growth exceeding historical patterns by over 56%. The high median price of $256,509 reflects intense investor pressure in this desirable university community. This extreme acceleration threatens affordability for local families, students, and traditional buyers.

Cedar Falls – University Town Under Investment Siege

Home to the University of Northern Iowa and about 40,000 residents, Cedar Falls represents one of Iowa’s most desirable communities for families and students. The city combines excellent educational opportunities, cultural amenities, and economic stability through its diverse employment base. Major employers include the university, healthcare systems, and technology companies that provide high-quality jobs and community stability.

The extreme 56% acceleration to $256,509 indicates severe investor pressure that threatens the community’s traditional affordability for students, faculty, and working families. Cedar Falls has historically provided reasonable housing costs for a university community, but intense speculation is rapidly changing market dynamics. This level of investor activity creates particular challenges for student housing and young professionals entering the market.

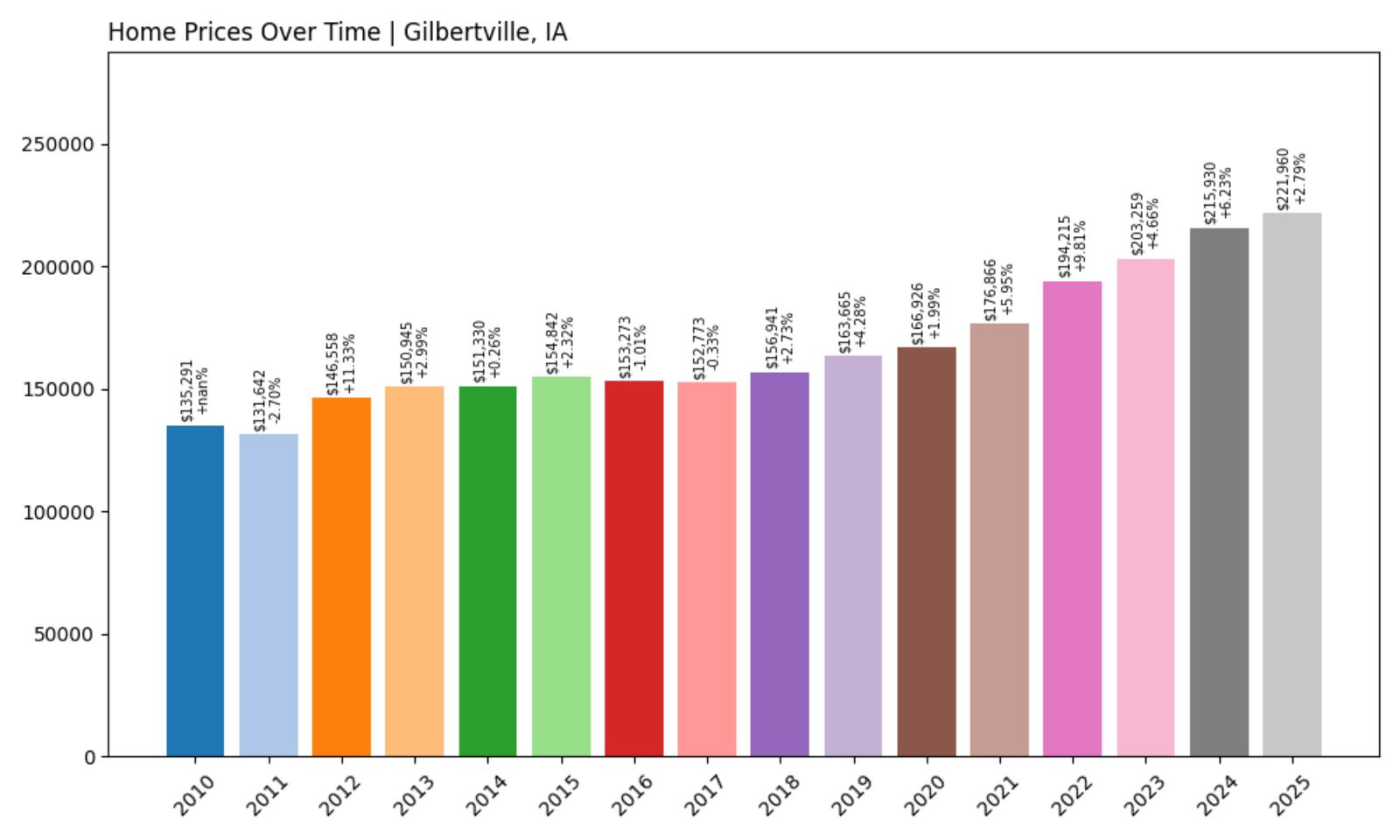

5. Gilbertville – Investor Feeding Frenzy Factor 59.40% (July 2025)

- Historical annual growth rate (2012–2022): 2.86%

- Recent annual growth rate (2022–2025): 4.55%

- Investor Feeding Frenzy Factor: 59.40%

- Current 2025 price: $221,960.47

Gilbertville demonstrates extreme acceleration with recent growth exceeding historical patterns by nearly 60%. The $221,960 median price reflects severe investor pressure in this small Black Hawk County community. This level of speculation threatens to permanently alter affordability for local residents and working families.

Gilbertville – Small Town Overwhelmed by Speculation

This community of fewer than 800 residents has traditionally served as an affordable option for families working in the Cedar Falls-Waterloo area. Gilbertville’s small size and rural character provided reasonably priced housing while maintaining access to metropolitan employment and services. The town’s quiet residential streets and family-friendly atmosphere attracted buyers seeking small-town living with urban convenience.

The devastating 59% acceleration to $221,960 indicates a complete transformation of the local housing market driven by outside investment pressure. This small community lacks the housing inventory to absorb significant investor activity without dramatic price increases. Local families face displacement as speculation drives costs beyond what local wages can support, fundamentally altering the community’s character and accessibility.

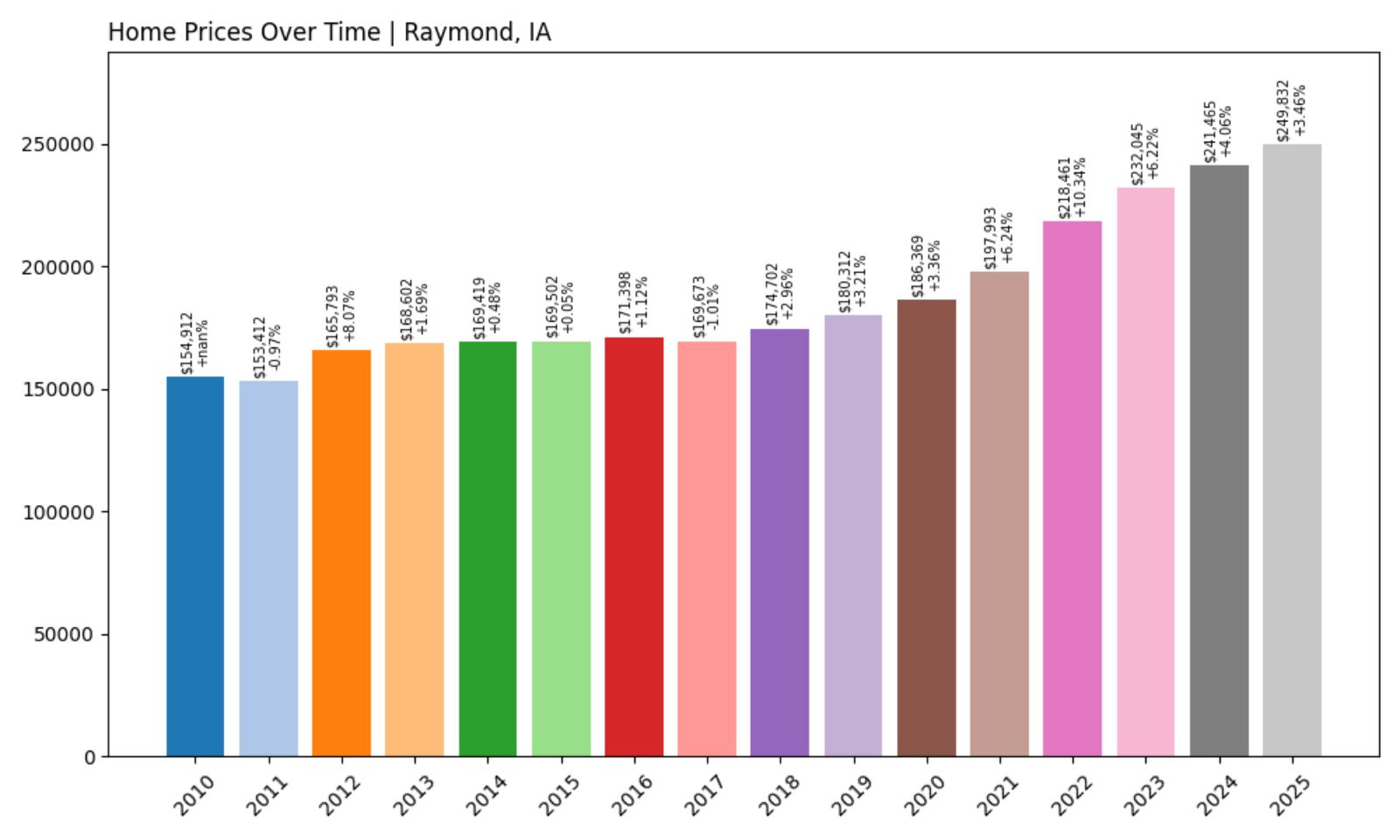

4. Raymond – Investor Feeding Frenzy Factor 63.54% (July 2025)

- Historical annual growth rate (2012–2022): 2.80%

- Recent annual growth rate (2022–2025): 4.57%

- Investor Feeding Frenzy Factor: 63.54%

- Current 2025 price: $249,831.61

Raymond shows catastrophic acceleration with recent growth exceeding historical patterns by over 63%. The elevated median price of $249,832 reflects intense speculative pressure that threatens to destroy affordability for local families. This level of investor frenzy creates a housing crisis in what was traditionally an affordable small community.

Raymond – Rural Community in Crisis

Located in Black Hawk County, this community of about 800 residents has experienced a complete transformation of its housing market due to investor speculation. Raymond traditionally provided affordable rural living for families working in nearby urban areas, offering small-town character with reasonable commuting access to Cedar Falls and Waterloo employment centers.

The catastrophic 63% acceleration to $249,832 represents a housing affordability crisis driven by speculative investment activity. This small rural community cannot absorb significant outside investment without experiencing dramatic price inflation that displaces local residents. Working families who built their lives in Raymond now face housing costs that have disconnected entirely from local economic conditions and wage levels.

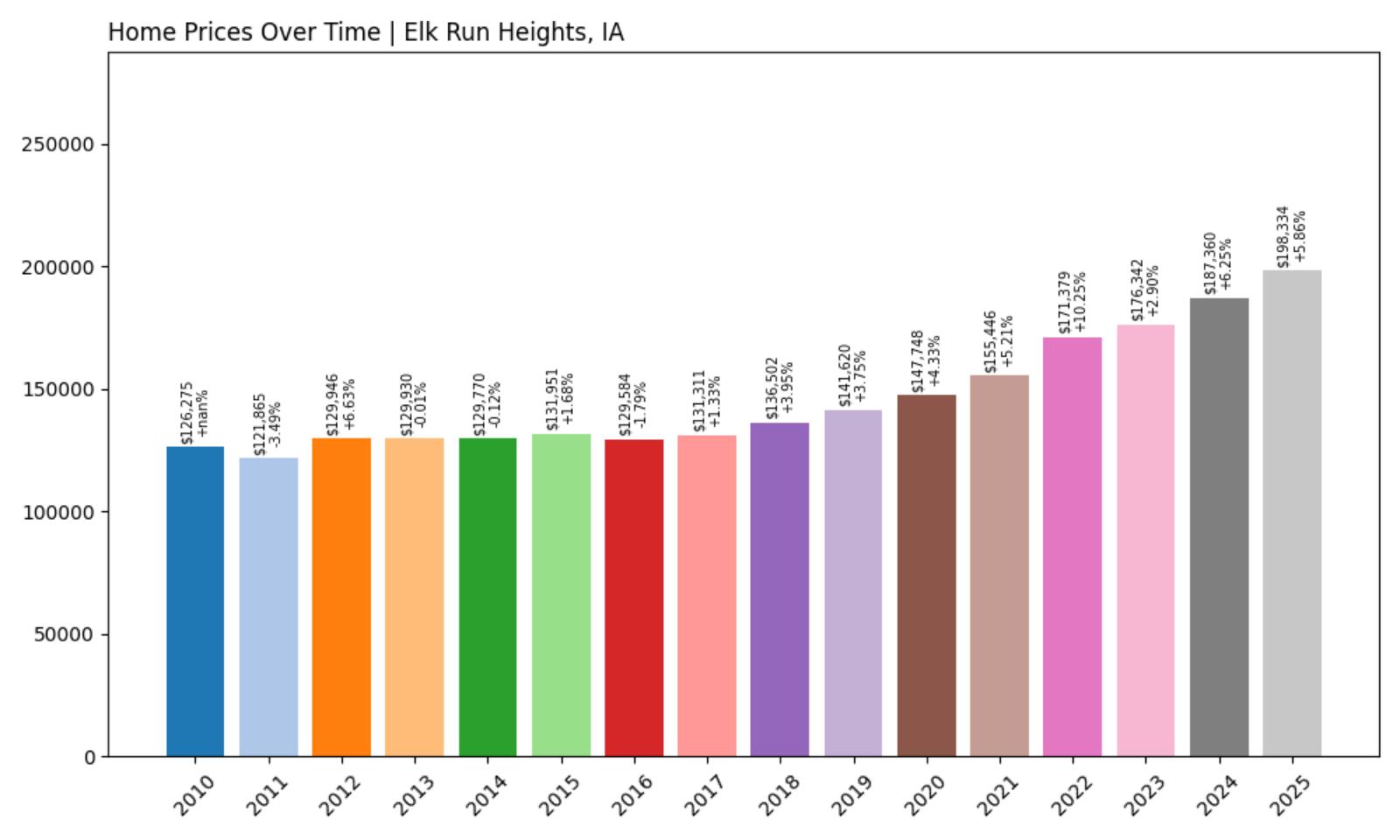

3. Elk Run Heights – Investor Feeding Frenzy Factor 77.81% (July 2025)

- Historical annual growth rate (2012–2022): 2.81%

- Recent annual growth rate (2022–2025): 4.99%

- Investor Feeding Frenzy Factor: 77.81%

- Current 2025 price: $198,333.93

Elk Run Heights displays devastating acceleration with recent growth exceeding historical patterns by nearly 78%. While the $198,334 median price remains below some nearby communities, this extreme acceleration indicates a feeding frenzy that threatens to displace long-term residents and destroy traditional affordability.

Elk Run Heights – Feeding Frenzy Destroys Affordability

This small Black Hawk County community of about 1,100 residents has become ground zero for investor speculation that threatens its traditional character as an affordable family community. Elk Run Heights historically provided reasonably priced housing for working families, retirees, and young professionals seeking alternatives to higher-priced nearby areas.

The devastating 78% acceleration indicates a complete market takeover by speculative forces that have disconnected pricing from local economic fundamentals. At $198,334, prices may appear reasonable compared to some markets, but the extreme rate of acceleration threatens long-term residents with displacement and prevents new local families from entering the housing market. This represents a textbook case of how investor feeding frenzies can destroy community affordability and stability.

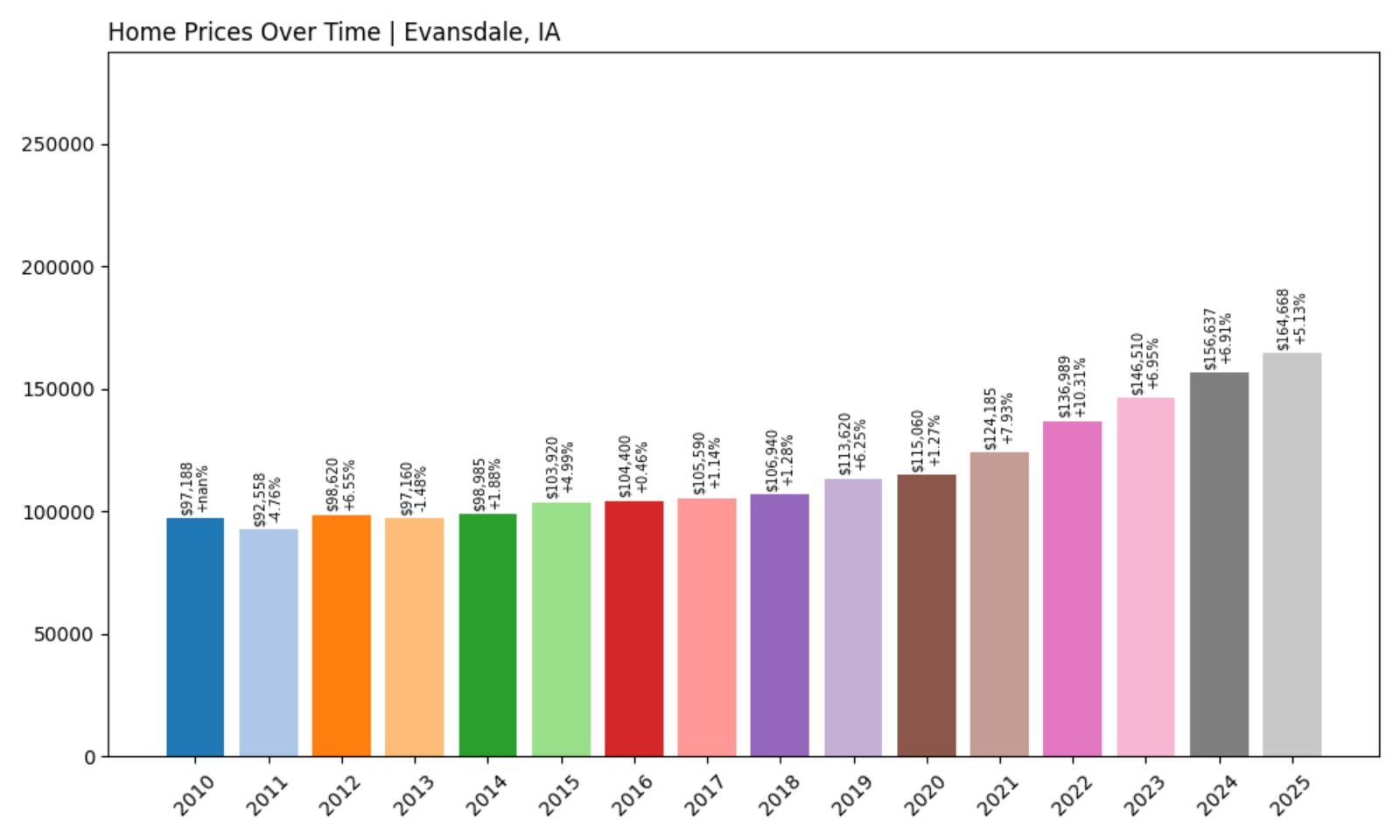

2. Evansdale – Investor Feeding Frenzy Factor 89.37% (July 2025)

- Historical annual growth rate (2012–2022): 3.34%

- Recent annual growth rate (2022–2025): 6.33%

- Investor Feeding Frenzy Factor: 89.37%

- Current 2025 price: $164,668.39

Evansdale shows catastrophic acceleration with recent growth exceeding historical patterns by nearly 90%. Despite the relatively moderate median price of $164,668, this extreme acceleration indicates a severe feeding frenzy that threatens to permanently destroy affordability for working families and local residents.

Evansdale – Community Under Siege From Speculation

This Black Hawk County community of about 4,800 residents has experienced one of Iowa’s most severe investor feeding frenzies, with price acceleration that threatens the community’s fundamental character as an affordable place for working families. Evansdale traditionally served as a budget-friendly option for families working in the broader Cedar Valley area while maintaining its own local businesses and community identity.

The catastrophic 89% acceleration represents a housing affordability crisis of the highest magnitude. Even with the current median price of $164,668, the extreme rate of increase indicates speculative pressure that will continue driving costs beyond local capacity to pay. This level of investor activity essentially represents a hostile takeover of the local housing market, displacing long-term residents and preventing new local families from accessing homeownership.

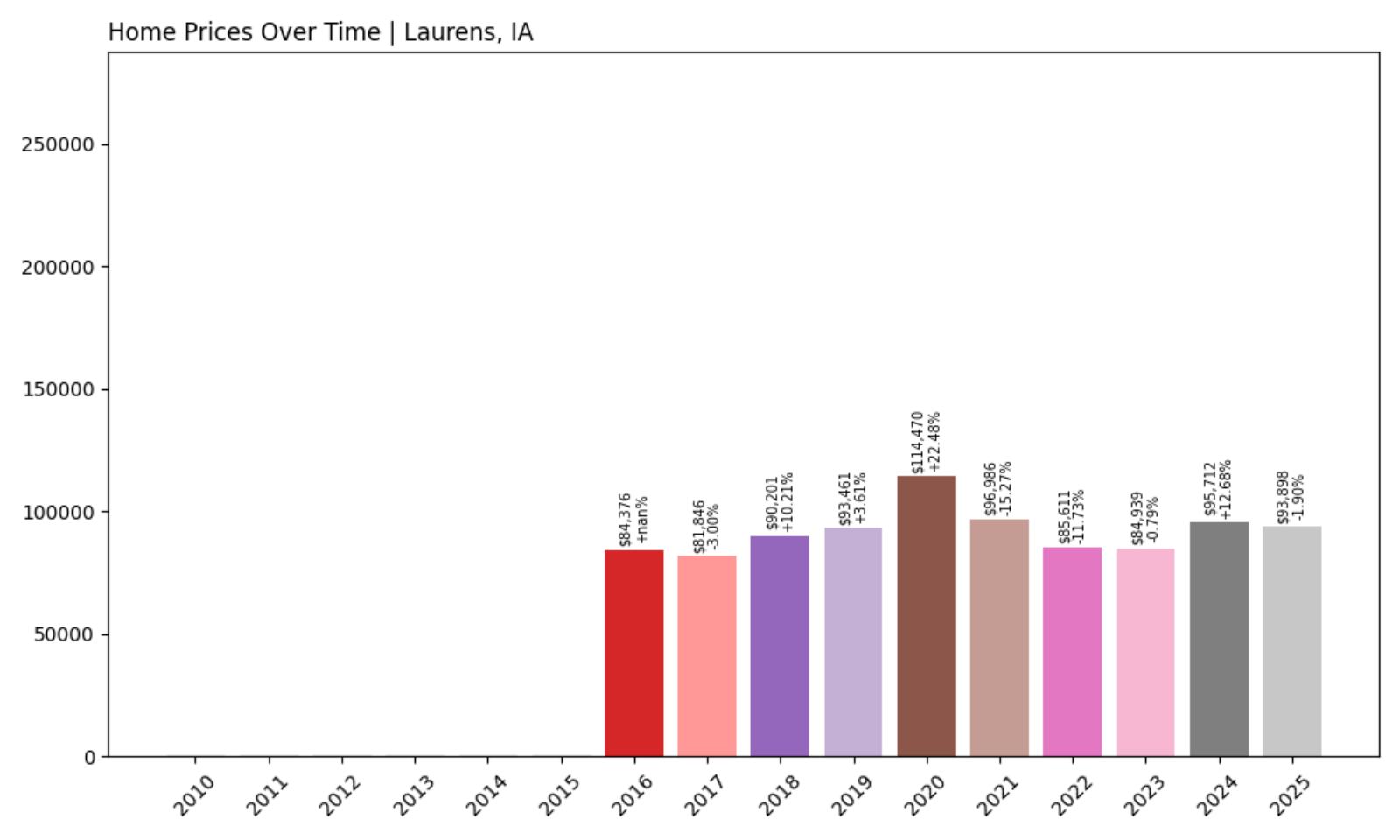

1. Laurens – Investor Feeding Frenzy Factor 1189.77% (July 2025)

- Historical annual growth rate (2012–2022): 0.24%

- Recent annual growth rate (2022–2025): 3.13%

- Investor Feeding Frenzy Factor: 1189.77%

- Current 2025 price: $93,897.72

Laurens represents the most extreme case of investor feeding frenzy in Iowa, with recent growth exceeding historical patterns by an astronomical 1,190%. While the $93,898 median price remains the state’s most affordable, this unprecedented acceleration indicates massive speculative pressure that has completely transformed the local market from stagnant to hyperactive.

Laurens – Ground Zero for Iowa’s Investment Speculation Crisis

Located in Pocahontas County, this small community of about 1,240 residents has experienced the most dramatic investor-driven transformation in Iowa’s housing market. Laurens was platted in 1881 and named in honor of Henry and John Laurens, father and son, two French Huguenots who became residents of Charleston, South Carolina. For decades, the town’s housing market remained virtually stagnant with minimal appreciation, making it one of Iowa’s most affordable places to live.

The astronomical 1,190% acceleration represents a complete market transformation driven by massive investor speculation targeting previously overlooked rural communities. Laurens has a 2025 population of 1,240 and is currently declining at a rate of -0.32% annually, yet housing costs have exploded as investors discover extreme value opportunities. The median household income of Laurens households was $53,594, making the rapid price acceleration particularly concerning for local residents on fixed incomes.

Despite the extreme acceleration, the $93,898 median price still represents exceptional value, which continues to attract speculative investment. The economy of Laurens employs 621 people, with the largest industries being Manufacturing (207 people), Health Care & Social Assistance (112 people), and Accommodation & Food Services (58 people). This level of investor frenzy in such a small market creates a cautionary tale about how speculation can completely overwhelm local housing markets, even in communities where prices remain nominally affordable. The unprecedented acceleration suggests that even Iowa’s most remote and affordable communities are not immune to the investor feeding frenzies reshaping housing markets across the state.