Would you like to save this?

According to the Zillow Home Value Index, home prices across Arkansas rose 5.8% in the past year—but in some small towns, that’s just the beginning. These 15 communities are seeing price growth rates that double or even triple historical trends, a signal that investors—not local demand—are driving the surge. As all-cash buyers and outside speculators compete for limited inventory, local families are being pushed to the sidelines. The math no longer works for working Arkansans—and the shift is happening fast.

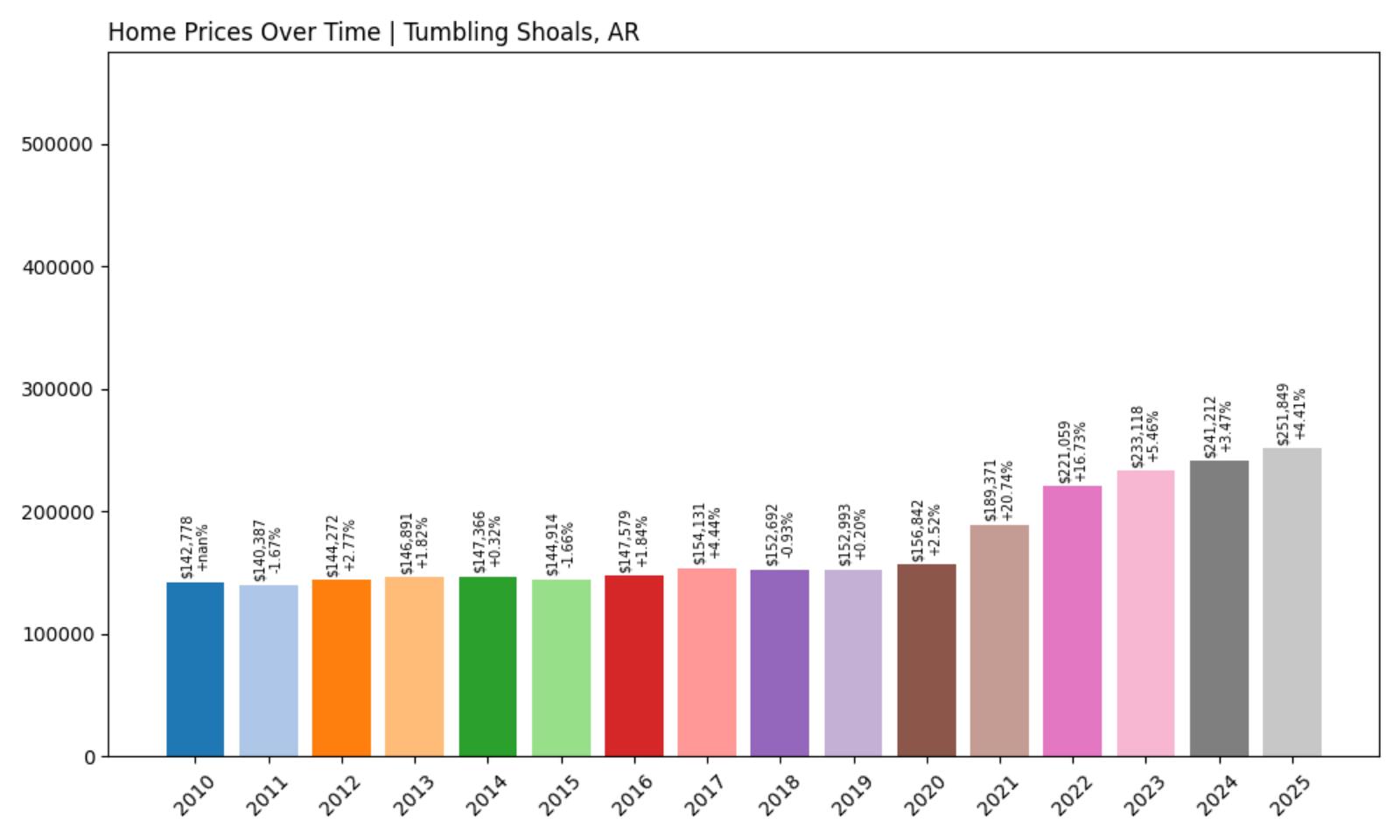

15. Tumbling Shoals – Investor Feeding Frenzy Factor 1.90% (July 2025)

- Historical annual growth rate (2012–2022): 4.36%

- Recent annual growth rate (2022–2025): 4.44%

- Investor Feeding Frenzy Factor: 1.90%

- Current 2025 price: $251,849.43

Tumbling Shoals ranks as the most stable market among these communities, with recent growth barely exceeding historical patterns. The 1.90% feeding frenzy factor indicates minimal speculation pressure, though the current median price of $251,849 puts it above the state average. This modest acceleration suggests organic growth rather than investor-driven inflation.

Tumbling Shoals – Rural Stability in Conway County

Tumbling Shoals sits in Conway County, roughly 60 miles northwest of Little Rock in the Arkansas River Valley region. This unincorporated community has maintained relatively steady housing appreciation compared to other areas experiencing dramatic price swings. The current median home price of $251,849 reflects gradual increases that align closely with the area’s economic fundamentals.

The community’s location provides access to outdoor recreation along the Arkansas River while maintaining the rural character that attracts families seeking affordable country living. Unlike towns seeing massive investor speculation, Tumbling Shoals’ 4.44% recent growth rate represents sustainable appreciation that doesn’t dramatically outpace local income growth.

This stability makes Tumbling Shoals an example of organic housing market growth where families can still compete with outside buyers. The minimal 1.90% feeding frenzy factor suggests that most transactions involve local residents rather than speculative investors, preserving the community’s character and affordability relative to more volatile markets.

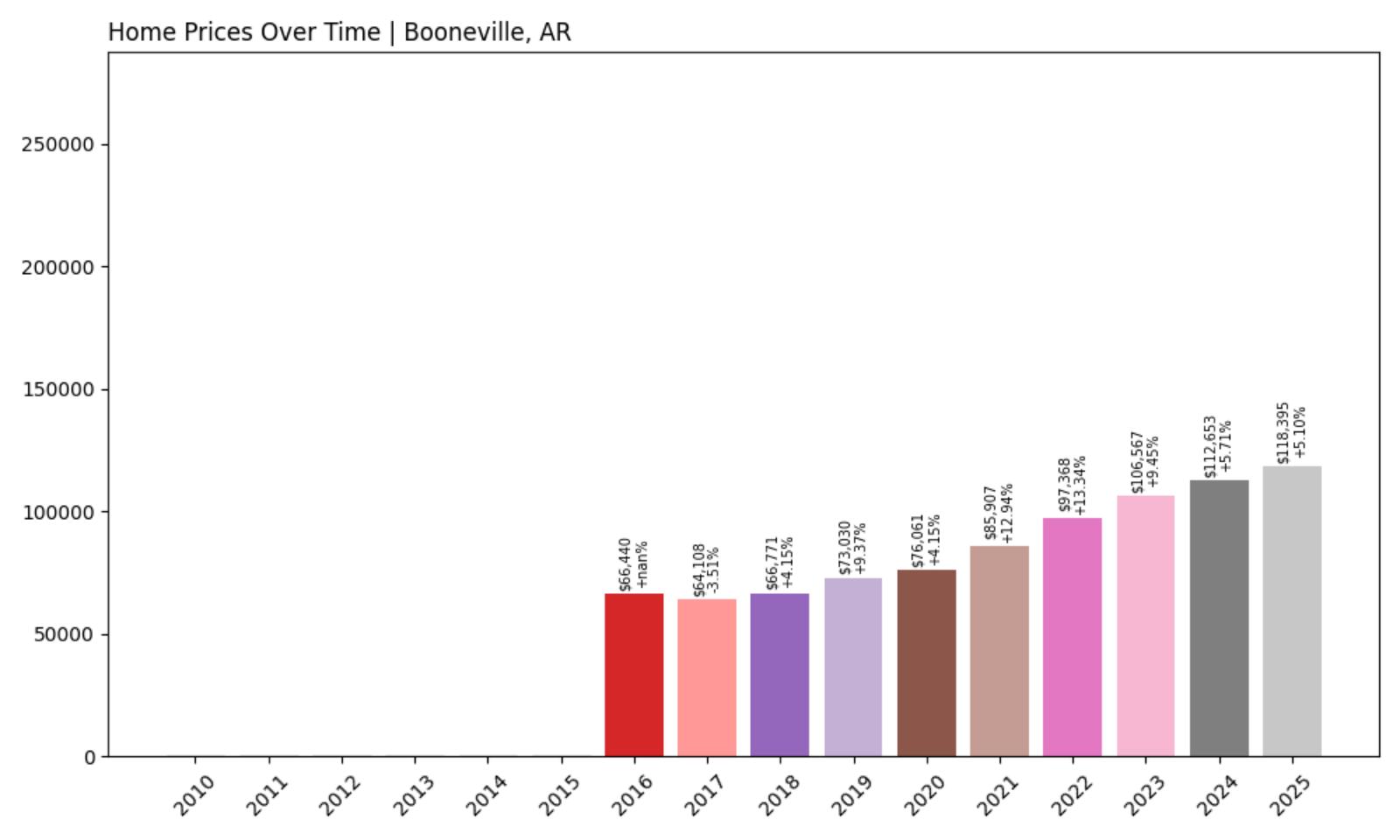

14. Booneville – Investor Feeding Frenzy Factor 2.40% (July 2025)

- Historical annual growth rate (2012–2022): 6.58%

- Recent annual growth rate (2022–2025): 6.73%

- Investor Feeding Frenzy Factor: 2.40%

- Current 2025 price: $118,395.17

Booneville shows minimal speculation despite strong historical growth rates around 6.5% annually. The low feeding frenzy factor of 2.40% combined with the most affordable median price on this list at $118,395 suggests this Logan County seat remains accessible to local buyers. Recent growth barely exceeds the already robust historical pattern.

Booneville – Affordable Mountain Town Remains Accessible

Booneville, the county seat of Logan County, sits nestled in the Arkansas River Valley between the Ozark and Ouachita Mountains. With a population around 3,800, this small city has maintained consistent housing appreciation rates near 6.5% annually over the past decade. The current median home price of $118,395 represents exceptional affordability compared to both state and national averages.

The town’s economy centers on agriculture, small manufacturing, and serving as the commercial hub for Logan County’s rural communities. Booneville’s location along Highway 10 provides access to outdoor recreation in both mountain ranges while maintaining small-town affordability. The University of Arkansas Rich Mountain campus also contributes to local economic stability.

Despite strong historical appreciation rates, the minimal 2.40% feeding frenzy factor indicates that recent price increases reflect genuine local demand rather than speculative investment. This makes Booneville one of Arkansas’s most affordable markets where working families can still achieve homeownership without competing against cash investors driving up prices beyond local wage capacity.

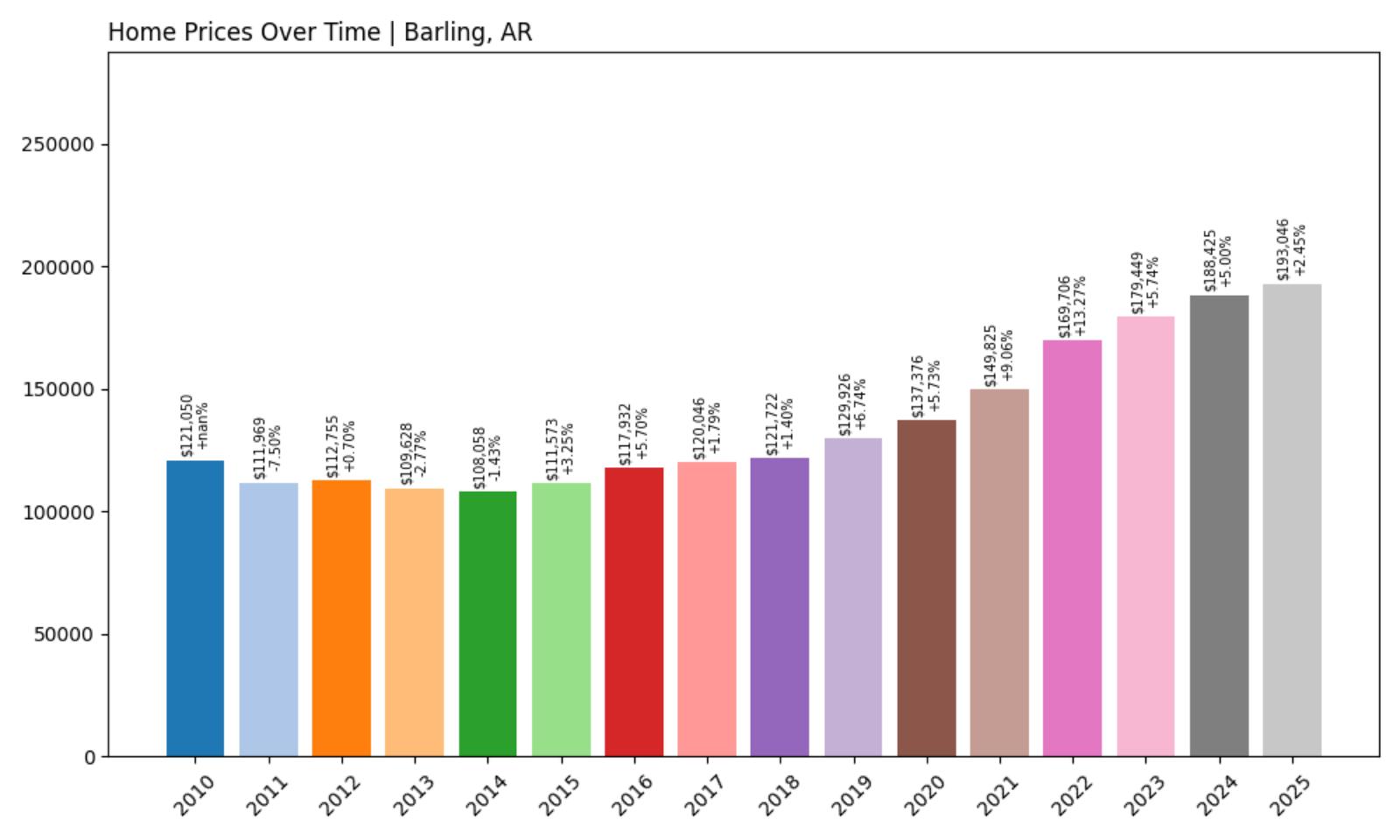

13. Barling – Investor Feeding Frenzy Factor 5.17% (July 2025)

- Historical annual growth rate (2012–2022): 4.17%

- Recent annual growth rate (2022–2025): 4.39%

- Investor Feeding Frenzy Factor: 5.17%

- Current 2025 price: $193,045.70

Barling demonstrates low investor pressure with a 5.17% feeding frenzy factor, indicating recent growth acceleration remains modest. The current median price of $193,045 reflects steady appreciation from the historically consistent 4.17% annual growth rate. This Sebastian County community shows sustainable price increases that don’t dramatically outpace local economic conditions.

Barling – Fort Smith Suburb Maintains Affordability

Would you like to save this?

Barling sits in Sebastian County, directly adjacent to Fort Smith along the Arkansas-Oklahoma border. This community of approximately 4,600 residents benefits from proximity to Fort Smith’s employment opportunities while maintaining lower housing costs. The current median home price of $193,045 positions Barling as an affordable alternative to larger nearby markets.

The town’s location provides easy access to Fort Smith’s jobs in manufacturing, healthcare, and logistics while offering a quieter suburban lifestyle. Barling’s housing market has shown steady but unremarkable growth, with recent rates of 4.39% barely exceeding the historical 4.17% pattern. This consistency suggests a healthy market driven by genuine housing demand from area workers.

The low 5.17% feeding frenzy factor indicates minimal speculative activity, allowing local families to compete effectively for homes. Barling represents the type of steady, sustainable growth that supports community stability rather than the dramatic price swings that displace long-term residents in favor of outside investors.

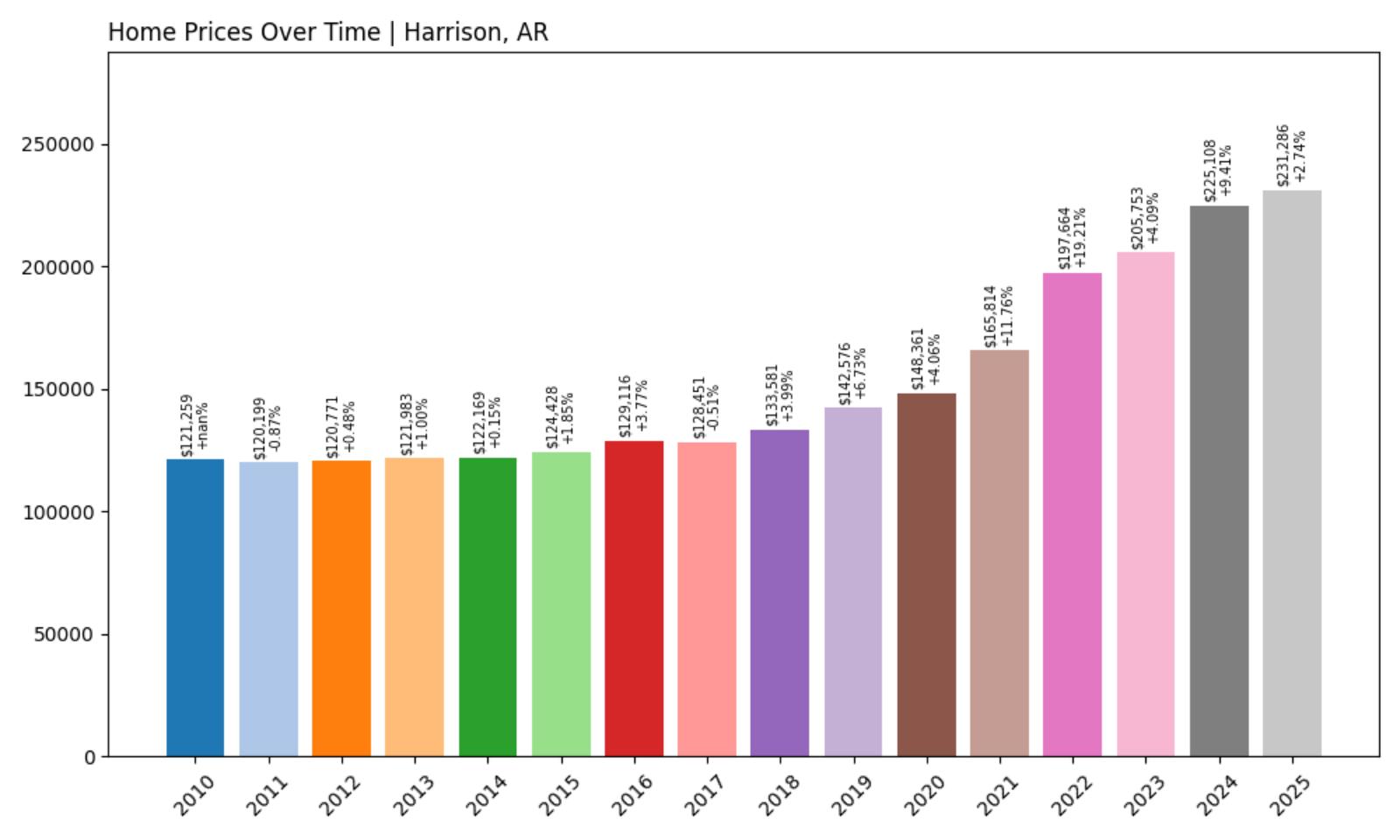

12. Harrison – Investor Feeding Frenzy Factor 6.45% (July 2025)

- Historical annual growth rate (2012–2022): 5.05%

- Recent annual growth rate (2022–2025): 5.38%

- Investor Feeding Frenzy Factor: 6.45%

- Current 2025 price: $231,285.76

Harrison shows early signs of market acceleration with a 6.45% feeding frenzy factor, though investor pressure remains relatively contained. The Boone County seat’s median price of $231,285 reflects modest increases above the solid historical growth rate of 5.05%. Recent appreciation of 5.38% annually indicates growing but manageable demand pressures.

Harrison – Ozark Gateway Sees Growing Interest

Harrison serves as the county seat of Boone County in north-central Arkansas, positioned as a gateway to the Ozark Mountains and Buffalo National River region. With a population around 13,000, this regional center has experienced steady housing appreciation that recently accelerated beyond historical norms. The current median home price of $231,285 reflects growing recognition of the area’s recreational and retirement appeal.

The city’s economy blends government services, healthcare, education, and tourism related to the nearby Buffalo River and mountain recreation. Harrison’s location provides access to some of Arkansas’s most scenic areas while maintaining the amenities of a small regional center. The North Arkansas College campus also contributes to local economic stability.

The 6.45% feeding frenzy factor suggests early-stage speculation as outside buyers discover Harrison’s combination of affordability and natural amenities. While still manageable, this acceleration above the historical 5.05% growth rate indicates growing competition for housing that could eventually price out local buyers if investor interest continues increasing.

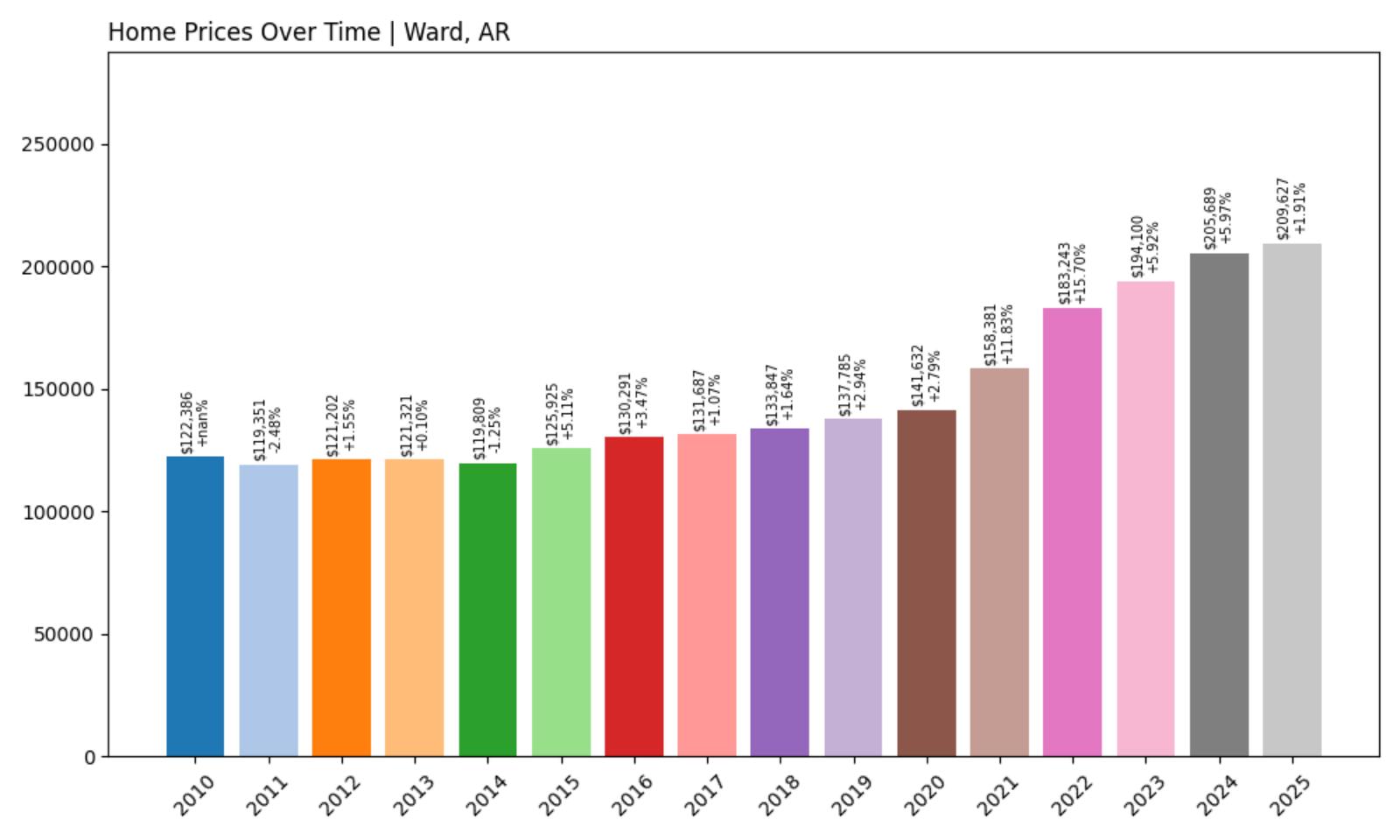

11. Ward – Investor Feeding Frenzy Factor 8.67% (July 2025)

- Historical annual growth rate (2012–2022): 4.22%

- Recent annual growth rate (2022–2025): 4.59%

- Investor Feeding Frenzy Factor: 8.67%

- Current 2025 price: $209,627.45

Ward enters the moderate speculation zone with an 8.67% feeding frenzy factor, showing recent growth acceleration beyond historical patterns. The Lonoke County community’s median price of $209,627 reflects increasing demand pressures that push appreciation from 4.22% historically to 4.59% recently. This represents emerging investor interest in the Little Rock metro periphery.

Ward – Little Rock Commuter Town Gains Attention

Ward sits in Lonoke County, approximately 20 miles northeast of Little Rock, making it an attractive option for commuters seeking affordable housing within reasonable driving distance of the capital city. This small community has traditionally experienced modest housing appreciation around 4.22% annually, but recent acceleration to 4.59% signals growing recognition among buyers seeking alternatives to higher-priced Little Rock suburbs.

The town’s rural character combined with metro accessibility has attracted families willing to trade longer commutes for larger lots and lower housing costs. Ward’s proximity to Interstate 40 provides convenient access to Little Rock while maintaining the small-town atmosphere that appeals to families seeking affordable homeownership.

The 8.67% feeding frenzy factor indicates emerging speculative interest as investors and out-of-area buyers discover Ward’s value proposition. While current median prices around $209,627 remain affordable, the acceleration pattern suggests this market could face increasing pressure if demand from Little Rock-area buyers continues growing faster than local supply.

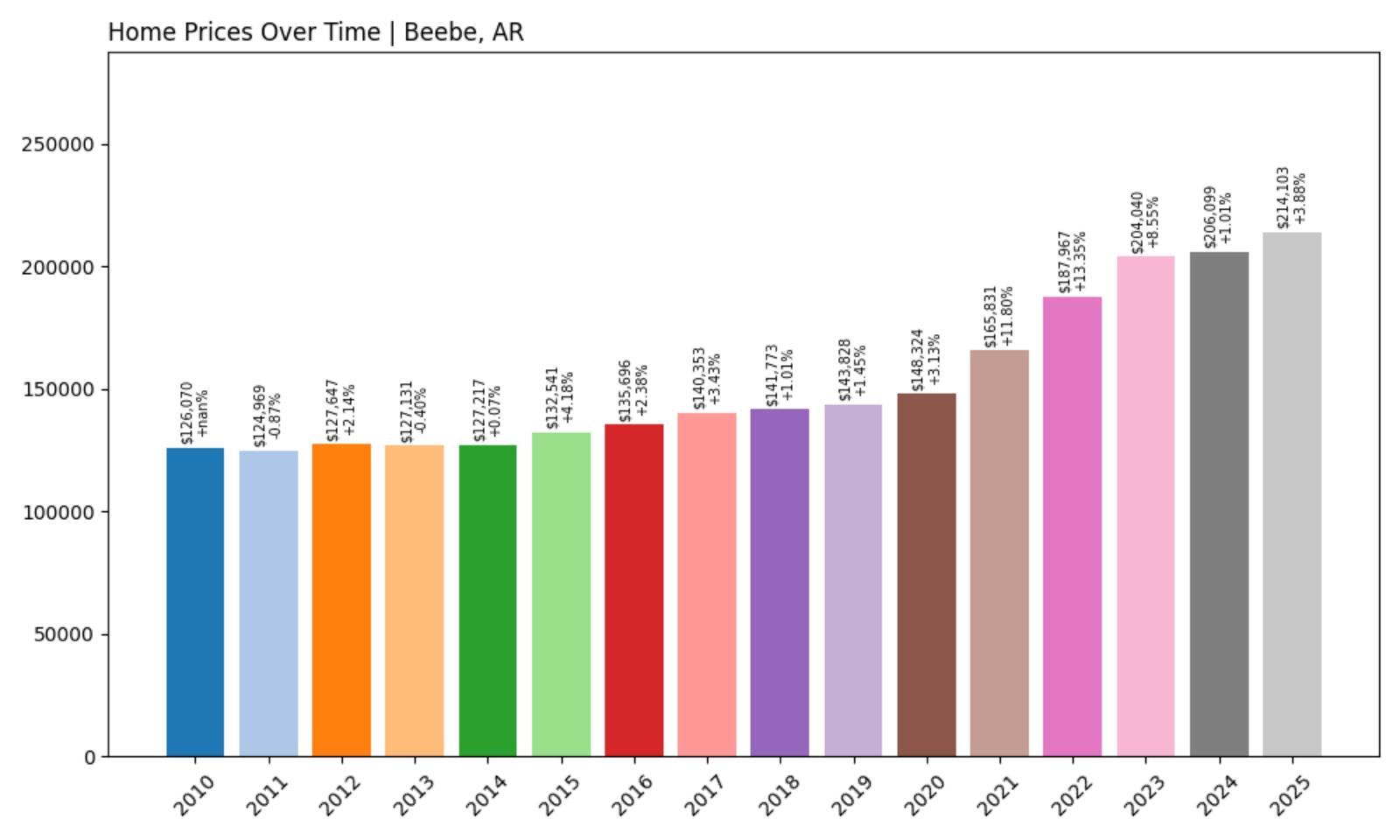

10. Beebe – Investor Feeding Frenzy Factor 12.40% (July 2025)

- Historical annual growth rate (2012–2022): 3.95%

- Recent annual growth rate (2022–2025): 4.44%

- Investor Feeding Frenzy Factor: 12.40%

- Current 2025 price: $214,103.01

Beebe crosses into concerning territory with a 12.40% feeding frenzy factor, indicating notable speculation pressure. The White County city has seen recent growth accelerate to 4.44% from a historically modest 3.95% baseline. The current median price of $214,103 reflects this growing demand from buyers seeking affordable alternatives near Little Rock and Searcy.

Beebe – Railroad Town Experiences Investment Pressure

Beebe, located in White County along the Union Pacific railroad line, has emerged as an affordable option for families seeking small-town living within commuting distance of both Little Rock and Searcy. The city of approximately 8,000 residents has experienced accelerating housing demand that pushes recent appreciation rates above historical norms, driving the current median home price to $214,103.

The community’s economy centers on agriculture, small manufacturing, and serving as a bedroom community for larger nearby cities. Beebe’s location along Highway 67/167 provides direct access to Little Rock, making it attractive to commuters seeking more affordable housing than closer-in suburbs. The town maintains rural character while offering basic amenities and services.

The 12.40% feeding frenzy factor signals emerging speculation risk as outside buyers recognize Beebe’s value relative to higher-priced markets. This acceleration from 3.95% historical growth to 4.44% recent rates suggests growing competition that could eventually challenge local families’ ability to purchase homes if investor interest continues intensifying without corresponding increases in housing supply.

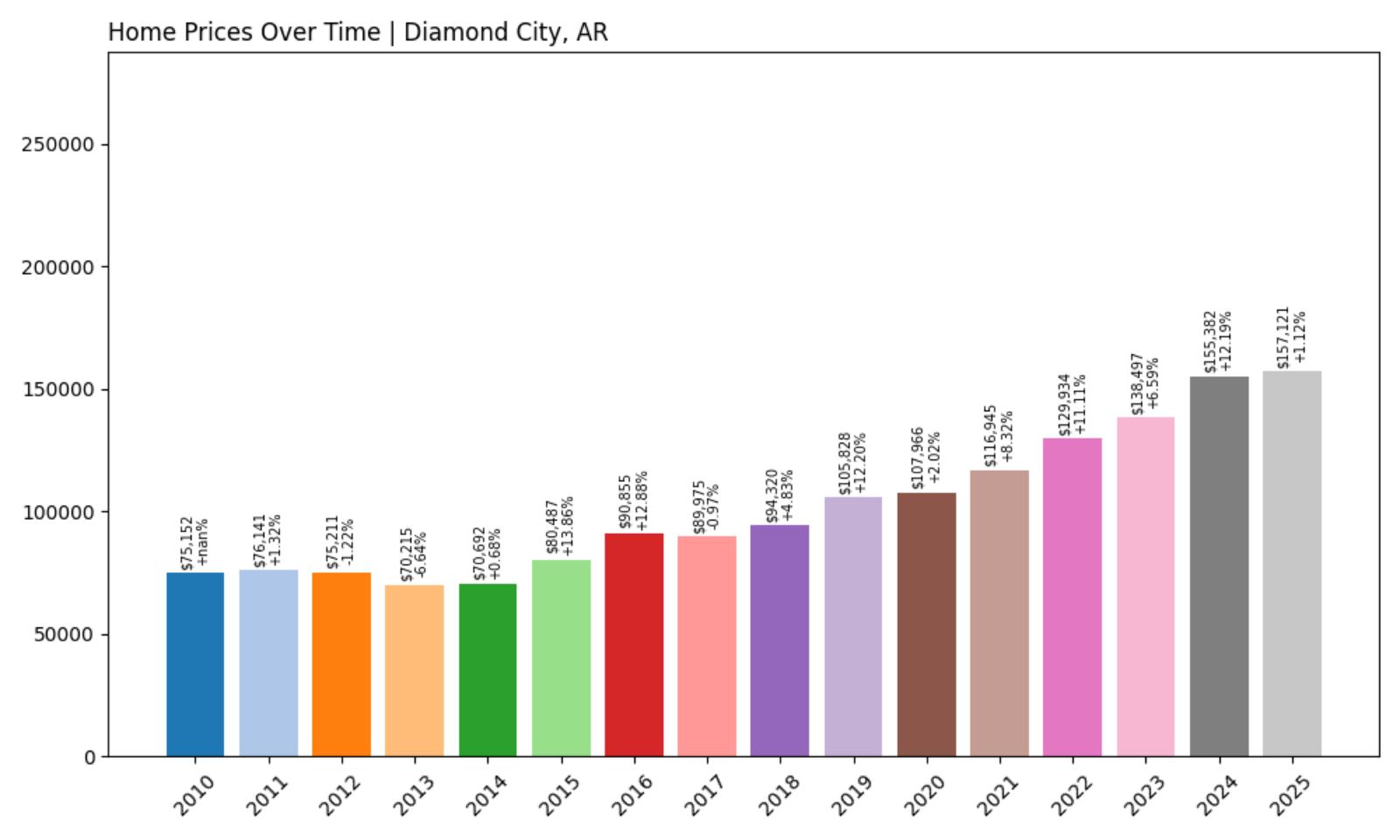

9. Diamond City – Investor Feeding Frenzy Factor 16.34% (July 2025)

- Historical annual growth rate (2012–2022): 5.62%

- Recent annual growth rate (2022–2025): 6.54%

- Investor Feeding Frenzy Factor: 16.34%

- Current 2025 price: $157,121.41

Diamond City enters significant speculation territory with a 16.34% feeding frenzy factor, showing concerning acceleration beyond already strong historical growth. The Boone County lakefront community has seen appreciation jump from 5.62% historically to 6.54% recently. Despite this pressure, the median price of $157,121 remains among the most affordable on this list, though rising rapidly.

Diamond City – Bull Shoals Lake Haven Under Pressure

Diamond City sits along the shores of Bull Shoals Lake in Boone County, offering some of Arkansas’s most desirable lakefront and water-access properties at historically affordable prices. This small community has attracted retirees, second-home buyers, and recreation enthusiasts, driving housing appreciation from an already robust 5.62% historical rate to 6.54% recently. The current median price of $157,121 still represents exceptional value for lakefront access.

The area’s economy revolves around tourism, recreation services, and retirees seeking affordable lakefront living. Bull Shoals Lake provides excellent fishing, boating, and water sports opportunities that have gained national recognition. Diamond City’s appeal extends beyond Arkansas as out-of-state buyers discover the combination of natural amenities and low housing costs.

The 16.34% feeding frenzy factor indicates substantial speculative pressure as investors and second-home buyers compete for limited lakefront inventory. While prices remain affordable compared to similar lakefront markets nationally, the acceleration pattern suggests local families may soon face difficulty competing with cash buyers from higher-income areas seeking vacation properties or investment opportunities.

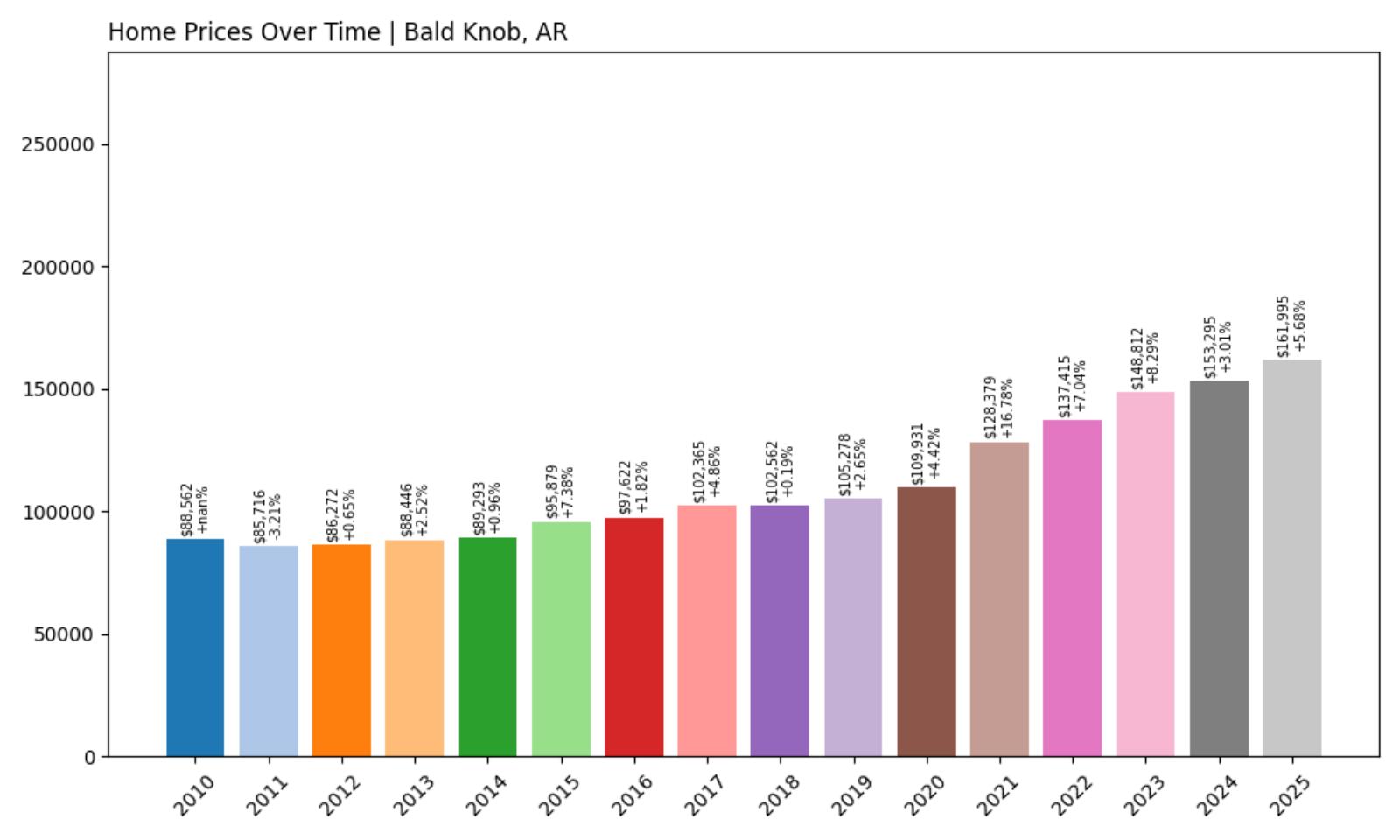

8. Bald Knob – Investor Feeding Frenzy Factor 18.33% (July 2025)

- Historical annual growth rate (2012–2022): 4.77%

- Recent annual growth rate (2022–2025): 5.64%

- Investor Feeding Frenzy Factor: 18.33%

- Current 2025 price: $161,995.35

Bald Knob shows escalating speculation with an 18.33% feeding frenzy factor, indicating substantial acceleration from its historical 4.77% growth to 5.64% recently. The White County community’s median price of $161,995 reflects growing demand pressures that threaten affordability for local families. This rice farming center faces increasing competition from outside buyers.

Bald Knob – Rice Capital Faces Outside Investment

Bald Knob, located in White County approximately 50 miles northeast of Little Rock, serves as a regional center for Arkansas’s rice-growing region. This community of about 2,800 residents has traditionally maintained affordable housing aligned with agricultural wages, but recent investor attention has accelerated appreciation beyond sustainable levels for local incomes. The current median price of $161,995 reflects this growing pressure.

The town’s economy centers on agriculture, particularly rice production, along with related processing and transportation services. Bald Knob’s location provides access to outdoor recreation areas while maintaining the agricultural character that has defined the community for generations. The annual Bald Knob Cross celebrates the area’s religious heritage and community spirit.

The 18.33% feeding frenzy factor signals serious speculation risk as outside investors discover this historically affordable market. The acceleration from 4.77% historical growth to 5.64% recent rates suggests growing competition that could displace agricultural workers and long-term residents who cannot compete with cash buyers seeking undervalued properties in stable rural communities.

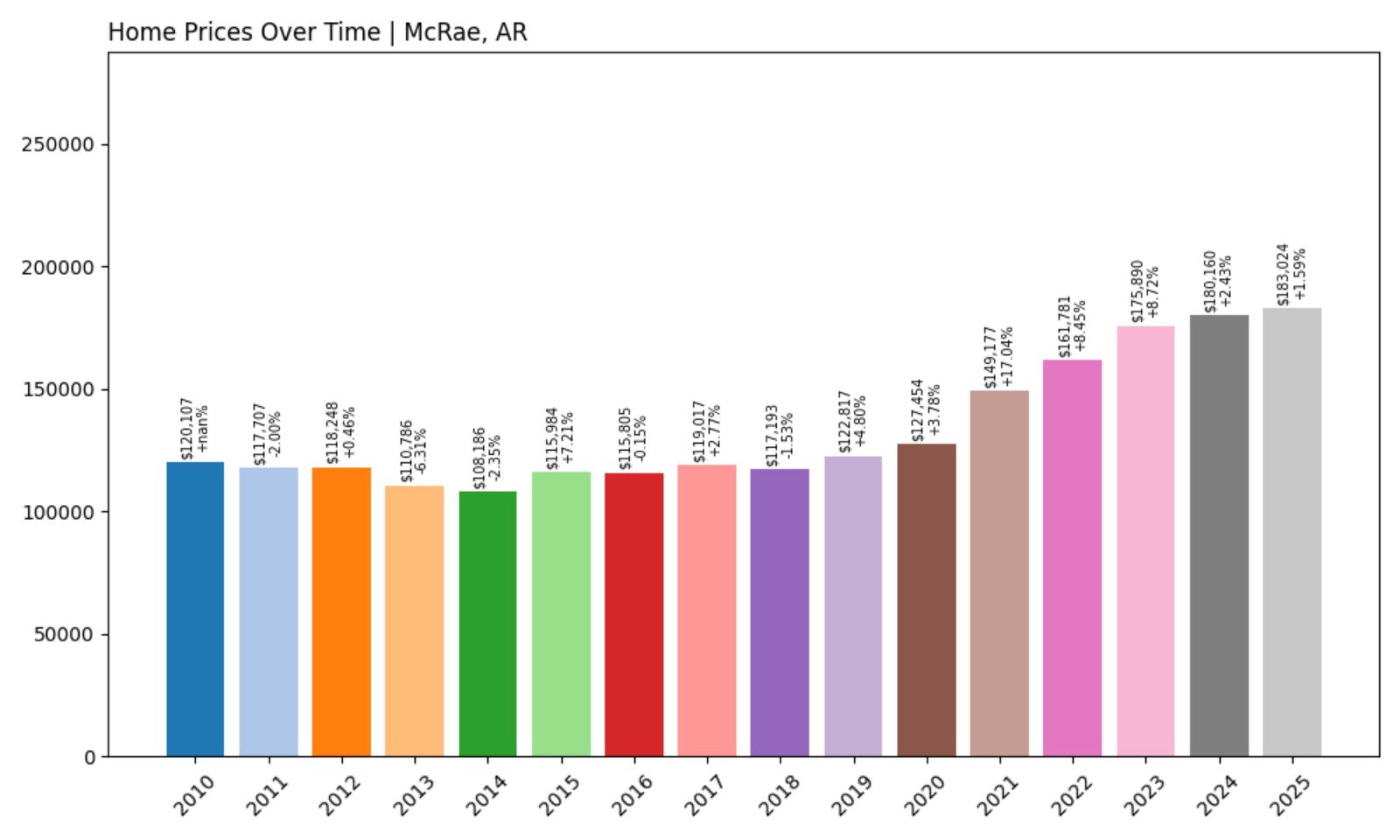

7. McRae – Investor Feeding Frenzy Factor 31.84% (July 2025)

- Historical annual growth rate (2012–2022): 3.18%

- Recent annual growth rate (2022–2025): 4.20%

- Investor Feeding Frenzy Factor: 31.84%

- Current 2025 price: $183,023.51

McRae enters dangerous speculation territory with a 31.84% feeding frenzy factor, showing dramatic acceleration from historically modest 3.18% growth to 4.20% recently. The White County town’s median price of $183,023 reflects significant pressure as investors target this previously stable market. This represents a concerning shift from organic to speculative growth patterns.

McRae – Small Town Under Siege from Speculation

McRae, a small White County community with fewer than 700 residents, exemplifies how investor speculation can transform previously stable rural housing markets. This tiny town historically experienced modest 3.18% annual appreciation aligned with its agricultural economy, but recent acceleration to 4.20% signals outside investment pressure that threatens community character. The current median home price of $183,023 reflects this unwelcome transformation.

The community’s economy traditionally centered on agriculture and small-scale farming operations that provided steady but modest incomes for local families. McRae’s rural setting offers affordable country living that has attracted families seeking to escape higher housing costs in larger cities. The town maintains the tight-knit character typical of small Arkansas communities.

The alarming 31.84% feeding frenzy factor indicates severe speculation risk as investors target undervalued rural properties. This dramatic acceleration beyond historical patterns suggests that local families increasingly face competition from cash buyers and investors seeking to capitalize on Arkansas’s relative affordability compared to other states, potentially displacing long-term residents.

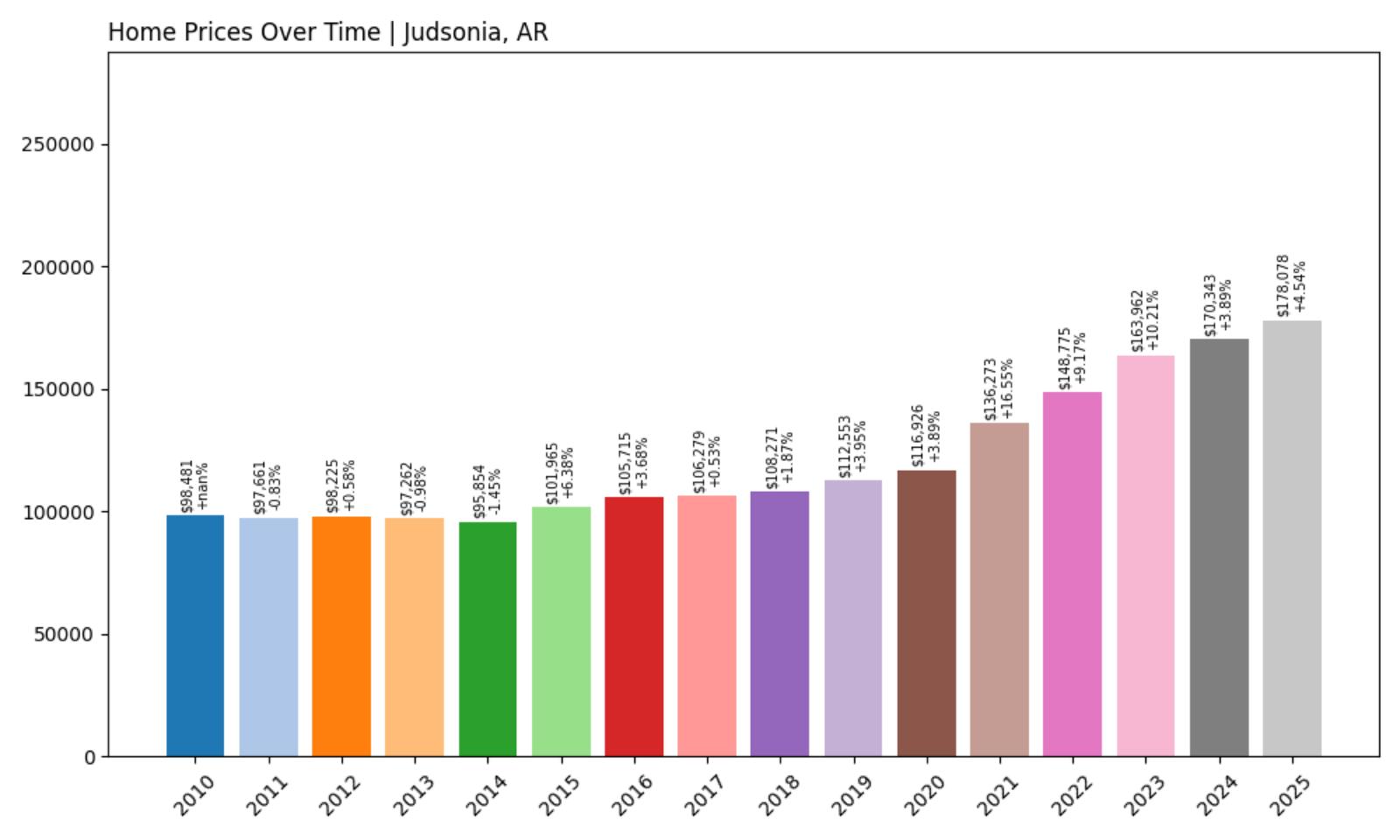

6. Judsonia – Investor Feeding Frenzy Factor 45.69% (July 2025)

Would you like to save this?

- Historical annual growth rate (2012–2022): 4.24%

- Recent annual growth rate (2022–2025): 6.18%

- Investor Feeding Frenzy Factor: 45.69%

- Current 2025 price: $178,078.30

Judsonia faces severe speculation pressure with a 45.69% feeding frenzy factor, showing dramatic acceleration from 4.24% historical growth to 6.18% recently. The White County city’s median price of $178,078 reflects intense competition as investors flood this previously affordable market. This represents a textbook example of speculation overwhelming local demand.

Judsonia – Railroad Heritage Town Overwhelmed by Investors

Judsonia, located in White County with a population around 2,000, has experienced a devastating transformation from stable small-town housing market to investor feeding frenzy. This historic railroad community traditionally maintained housing appreciation around 4.24% annually, but recent acceleration to 6.18% reflects massive outside investment pressure. The current median price of $178,078 represents this unwelcome shift.

The city’s heritage as a railroad town provided steady economic foundation through transportation and agricultural services. Judsonia’s location along major transportation corridors has attracted attention from investors seeking undervalued properties with good access to larger markets. The community previously offered affordable homeownership opportunities for working families.

The shocking 45.69% feeding frenzy factor indicates that investor speculation has overwhelmed genuine local housing demand. This near-doubling of appreciation rates signals a market where cash buyers and outside investors have gained dominant influence, making it increasingly difficult for local families to compete for homes in their own community.

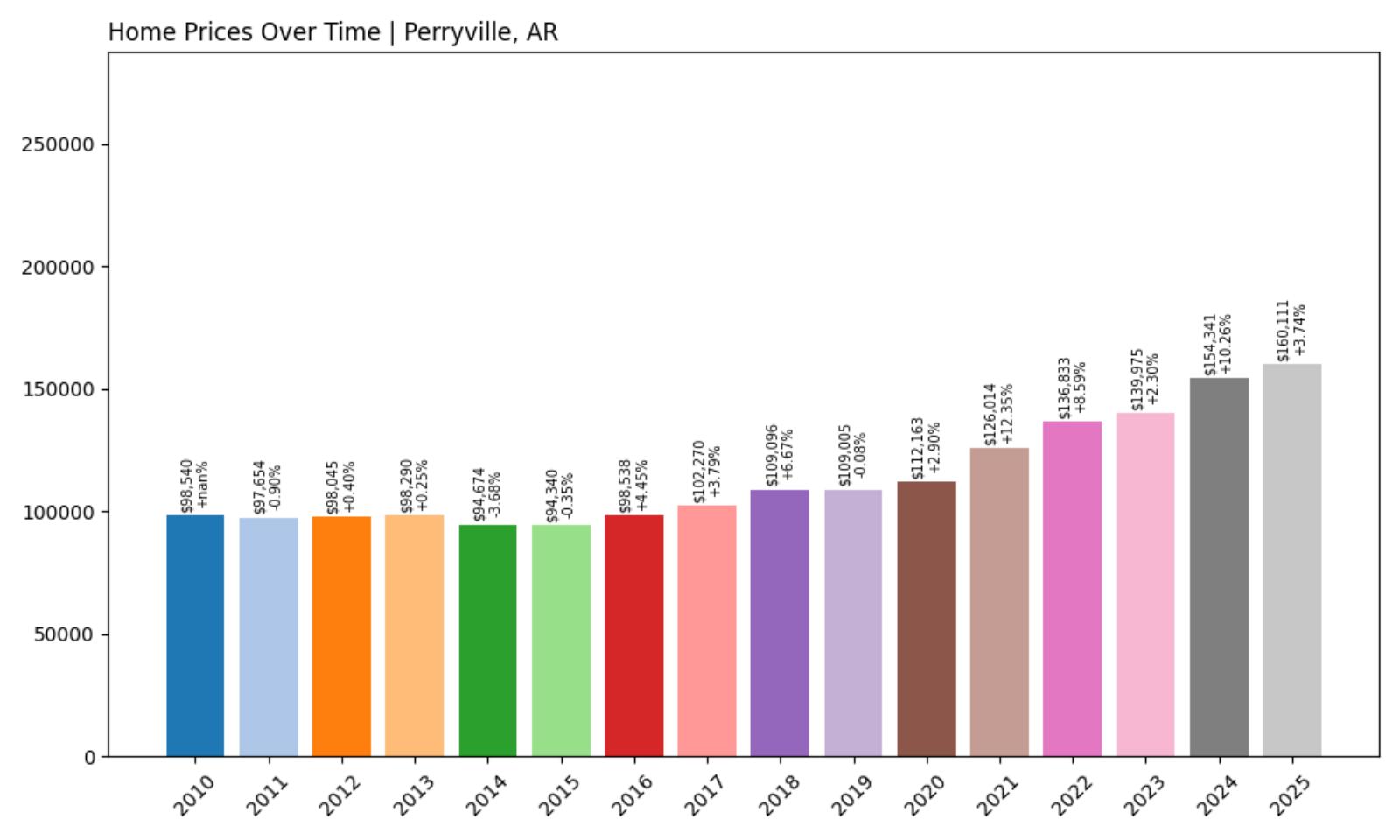

5. Perryville – Investor Feeding Frenzy Factor 58.62% (July 2025)

- Historical annual growth rate (2012–2022): 3.39%

- Recent annual growth rate (2022–2025): 5.38%

- Investor Feeding Frenzy Factor: 58.62%

- Current 2025 price: $160,111.05

Perryville enters extreme speculation territory with a 58.62% feeding frenzy factor, showing massive acceleration from 3.39% historical growth to 5.38% recently. The Perry County seat’s median price of $160,111 reflects devastating investor pressure that has nearly doubled appreciation rates. This transformation threatens to displace generations of local families.

Perryville – County Seat Under Investor Assault

Perryville, the county seat of Perry County with approximately 1,400 residents, exemplifies how investor speculation can devastate small Arkansas communities. This historic town previously maintained modest 3.39% annual housing appreciation aligned with local agricultural and government wages, but massive outside investment has accelerated growth to 5.38%. The current median price of $160,111 reflects this market transformation.

The community’s economy centers on county government services, agriculture, and small businesses serving the surrounding rural area. Perryville’s courthouse square and historic downtown reflect its role as a traditional county seat that has served local families for generations. The town’s small size and rural character previously provided affordable housing opportunities for working families.

The devastating 58.62% feeding frenzy factor indicates that investor speculation has completely overwhelmed local housing demand. This near-doubling of appreciation rates signals a market where outside cash buyers dominate transactions, making homeownership increasingly impossible for local families whose incomes cannot keep pace with speculative price increases.

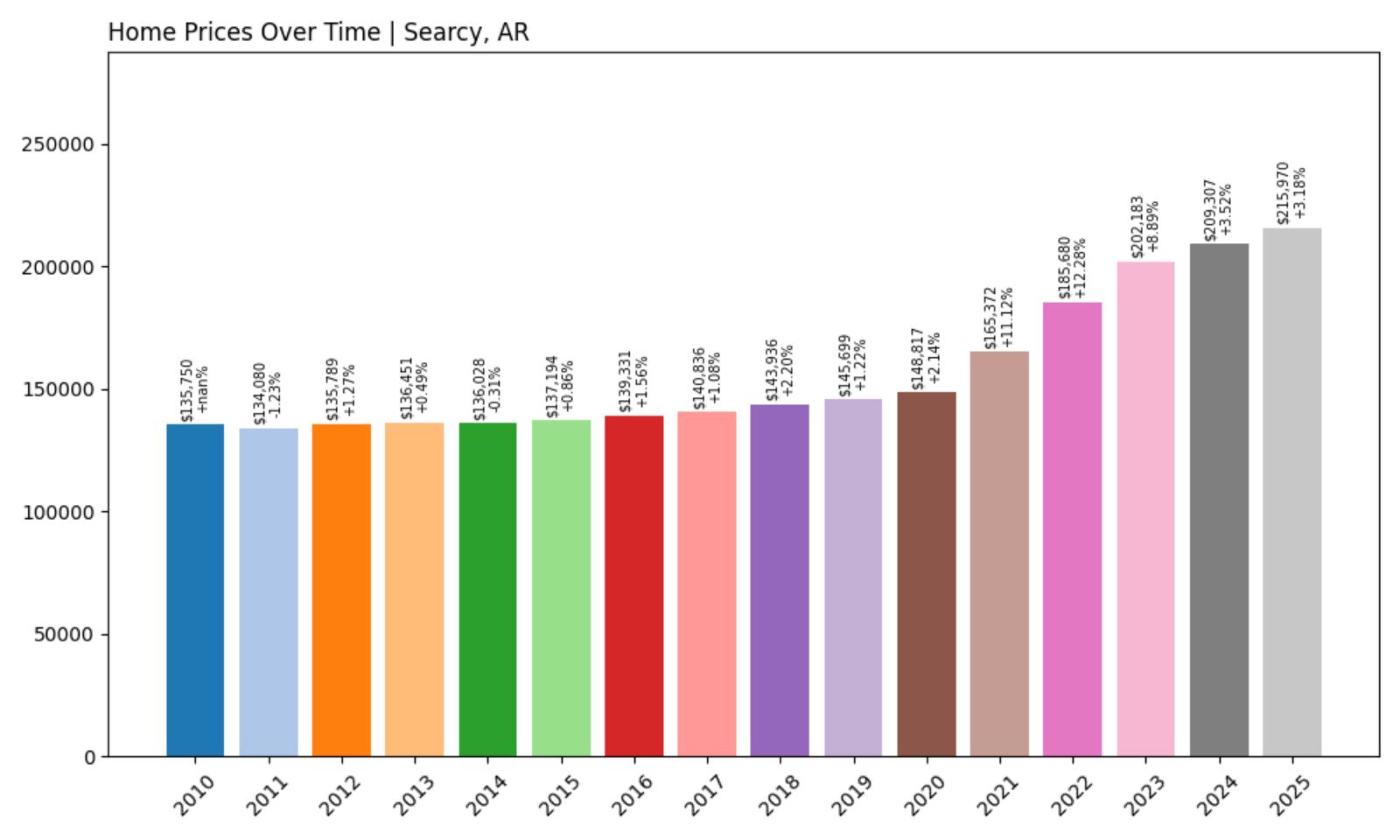

4. Searcy – Investor Feeding Frenzy Factor 62.53% (July 2025)

- Historical annual growth rate (2012–2022): 3.18%

- Recent annual growth rate (2022–2025): 5.17%

- Investor Feeding Frenzy Factor: 62.53%

- Current 2025 price: $215,969.83

Searcy faces catastrophic speculation with a 62.53% feeding frenzy factor, showing extreme acceleration from 3.18% historical growth to 5.17% recently. The White County seat and college town’s median price of $215,969 reflects massive investor pressure that has overwhelmed this regional center. University town amenities have attracted overwhelming outside investment.

Searcy – College Town Crushed by Speculation

Searcy, the largest city in White County with about 23,000 residents and home to Harding University, represents one of Arkansas’s most devastating examples of investor speculation overwhelming a regional center. This college town historically maintained modest 3.18% annual appreciation suitable for faculty, staff, and local families, but massive outside investment has accelerated growth to 5.17%. The current median price of $215,969 reflects this transformation.

The city’s economy centers on Harding University, healthcare, and regional services that previously provided stable employment for local residents. Searcy’s combination of educational amenities, healthcare facilities, and small-city conveniences made it an affordable regional center for families throughout White County. The university presence traditionally provided cultural and economic stability.

The catastrophic 62.53% feeding frenzy factor indicates that investor speculation has completely destabilized this once-affordable college town. This more-than-doubling of appreciation rates signals a market where outside investors have recognized Searcy’s undervalued amenities and infrastructure, making it increasingly impossible for university employees and local families to afford homes in their own community.

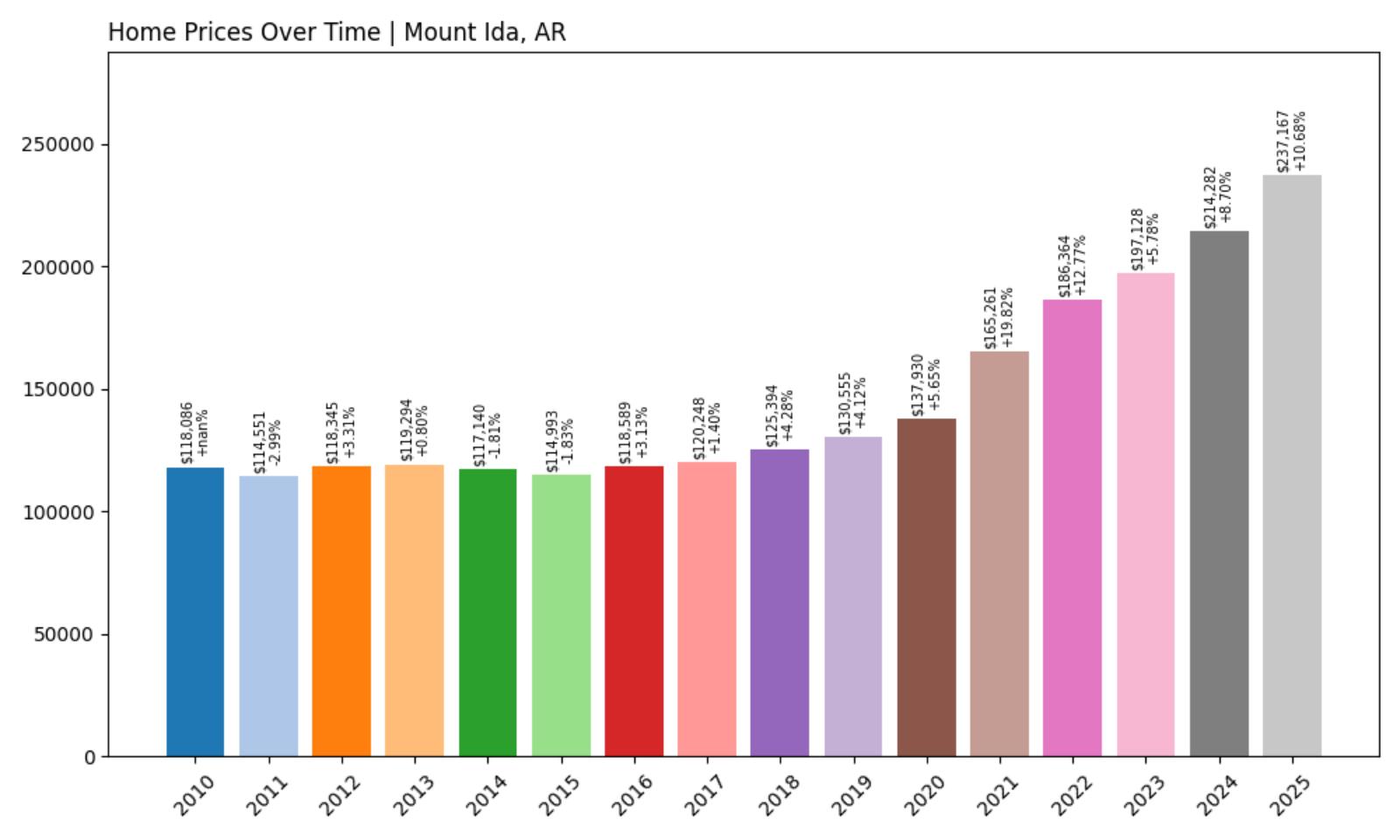

3. Mount Ida – Investor Feeding Frenzy Factor 80.10% (July 2025)

- Historical annual growth rate (2012–2022): 4.65%

- Recent annual growth rate (2022–2025): 8.37%

- Investor Feeding Frenzy Factor: 80.10%

- Current 2025 price: $237,166.64

Mount Ida suffers extreme speculation with an 80.10% feeding frenzy factor, showing massive acceleration from 4.65% historical growth to 8.37% recently. The Montgomery County seat’s median price of $237,166 reflects devastating investor pressure in this quartz crystal and lake recreation area. Outside buyers have discovered this previously affordable mountain community.

Mount Ida – Crystal Capital Shattered by Investors

Mount Ida, the county seat of Montgomery County known as the “Quartz Crystal Capital of the World,” has experienced devastating investor speculation that threatens its character as an affordable mountain community. This town of approximately 1,000 residents traditionally maintained steady 4.65% annual appreciation, but massive outside investment has accelerated growth to 8.37%. The current median price of $237,166 reflects this unwelcome transformation.

The community’s economy centers on tourism related to quartz crystal mining, Lake Ouachita recreation, and outdoor activities in the Ouachita Mountains. Mount Ida’s combination of natural amenities, crystal mining heritage, and proximity to one of Arkansas’s clearest lakes made it a hidden gem for affordable mountain living. The area attracts rockhounds, outdoor enthusiasts, and retirees seeking scenic, affordable communities.

The shocking 80.10% feeding frenzy factor indicates that investor speculation has nearly doubled the town’s appreciation rate, making it one of Arkansas’s most extreme examples of speculation overwhelming local housing demand. This transformation threatens to price out the working families, retirees, and small business owners who have defined Mount Ida’s character for generations.

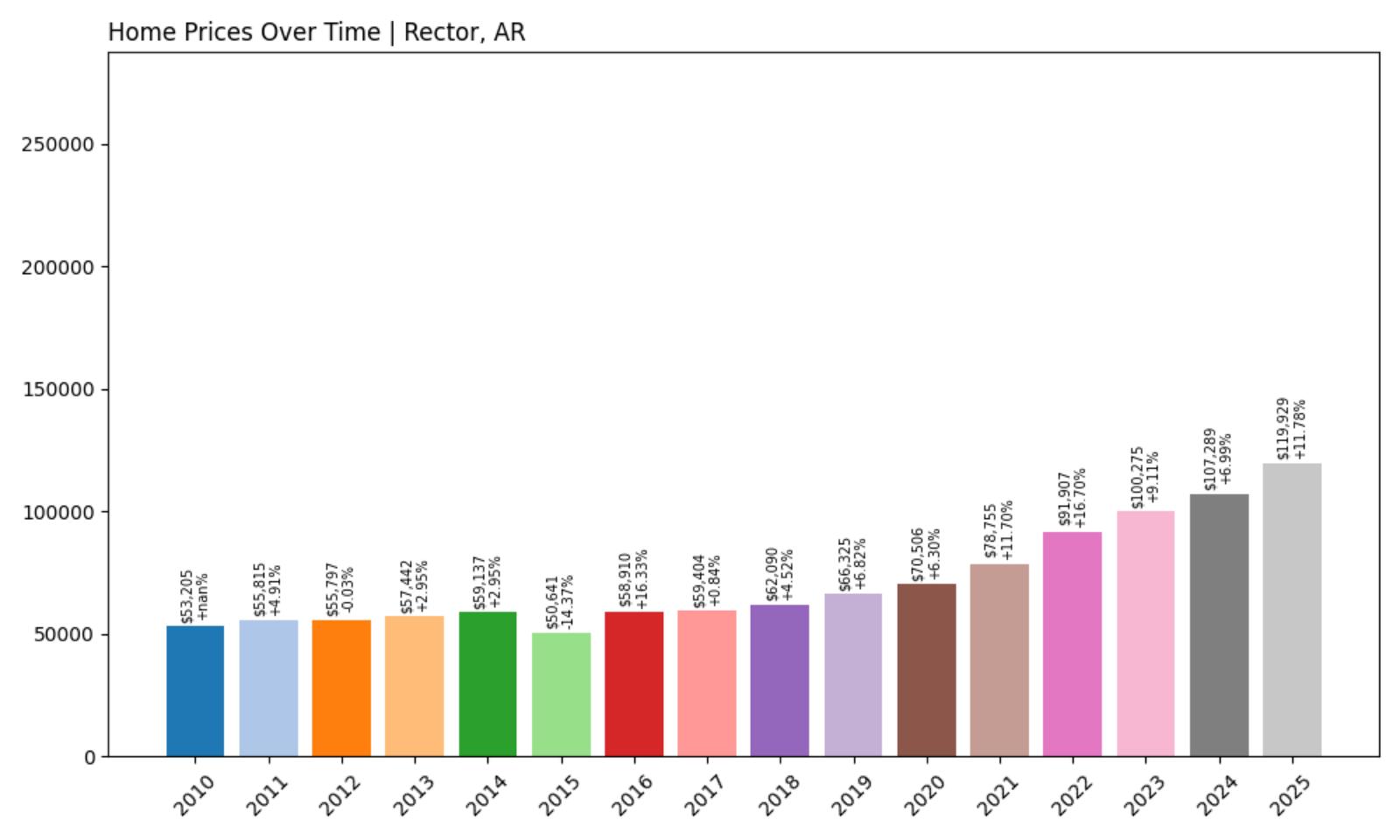

2. Rector – Investor Feeding Frenzy Factor 81.28% (July 2025)

- Historical annual growth rate (2012–2022): 5.12%

- Recent annual growth rate (2022–2025): 9.28%

- Investor Feeding Frenzy Factor: 81.28%

- Current 2025 price: $119,929.04

Rector experiences devastating speculation with an 81.28% feeding frenzy factor, showing extreme acceleration from 5.12% historical growth to 9.28% recently. The Clay County town’s median price of $119,929 remains low despite massive investor pressure, making it attractive to outside buyers seeking undervalued properties. This agricultural community faces complete market transformation.

Rector – Agricultural Town Devastated by Outside Money

Rector, a small Clay County community of fewer than 2,000 residents, represents one of Arkansas’s most extreme cases of investor speculation devastating a rural agricultural town. This farming community historically maintained solid 5.12% annual appreciation aligned with agricultural economics, but massive outside investment has accelerated growth to 9.28%. Despite this pressure, the current median price of $119,929 remains among the lowest on this list, making it irresistible to investors.

The town’s economy centers on agriculture, particularly rice and soybean production, along with related processing and transportation services. Rector’s location in the fertile Mississippi River Delta has provided steady agricultural employment for generations of families. The community’s small size and rural character previously offered affordable homeownership for farm workers and local families.

The devastating 81.28% feeding frenzy factor indicates that investor speculation has nearly doubled appreciation rates, creating a market where outside cash buyers dominate despite the community’s agricultural wages. This transformation threatens to displace the farming families who have defined Rector’s character, as speculation overwhelms a market where local incomes cannot compete with outside investment capital.

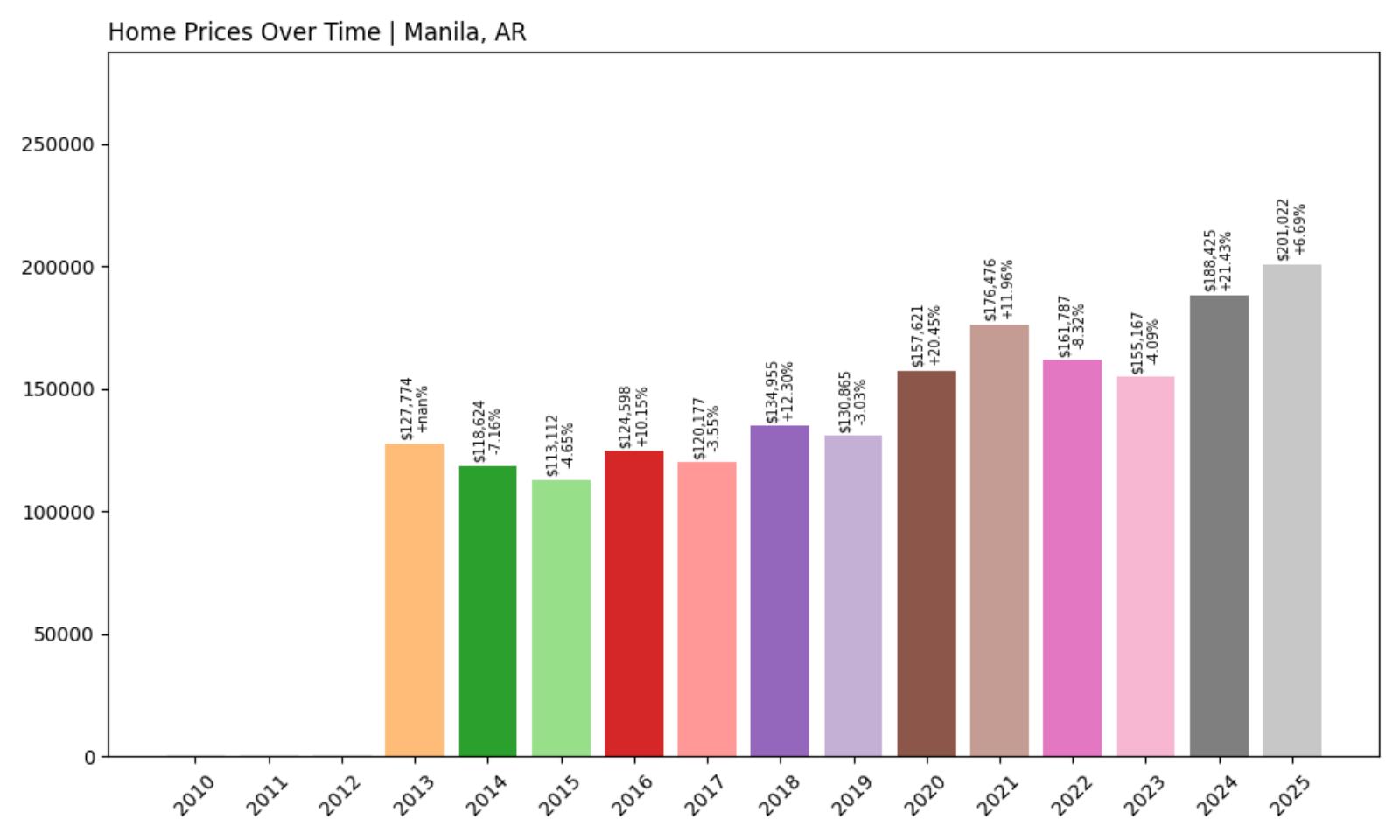

1. Manila – Investor Feeding Frenzy Factor 182.50% (July 2025)

- Historical annual growth rate (2012–2022): 2.66%

- Recent annual growth rate (2022–2025): 7.51%

- Investor Feeding Frenzy Factor: 182.50%

- Current 2025 price: $201,022.45

Manila suffers the most extreme speculation in Arkansas with a catastrophic 182.50% feeding frenzy factor, showing devastating acceleration from 2.66% historical growth to 7.51% recently. The Mississippi County town’s median price of $201,022 reflects complete market transformation as investor speculation has nearly tripled appreciation rates. This Delta community exemplifies how outside money can destroy local housing accessibility.

Manila – Delta Town Destroyed by Speculation

Manila, a small Mississippi County community of approximately 3,400 residents in the Arkansas Delta, represents the most extreme example of investor speculation devastating a rural Arkansas town. This agricultural community historically maintained modest 2.66% annual appreciation aligned with Delta farming wages, but massive outside investment has accelerated growth to 7.51%. The current median price of $201,022 reflects this complete market transformation.

The town’s economy centers on agriculture, particularly cotton and soybean production, along with related processing and transportation services. Manila’s location in the fertile Mississippi River Delta has provided agricultural employment for generations, but recent speculation has made homeownership increasingly impossible for farm workers and local families. The community’s small-town character and agricultural heritage face extinction under investor pressure.

The catastrophic 182.50% feeding frenzy factor indicates that investor speculation has nearly tripled the town’s appreciation rate, creating the most extreme example of speculation overwhelming local housing demand in Arkansas. This transformation represents a complete market failure where outside investment capital has destroyed housing accessibility for the working families who have defined Manila’s character for generations, making it a cautionary tale for other small Arkansas communities.