Would you like to save this?

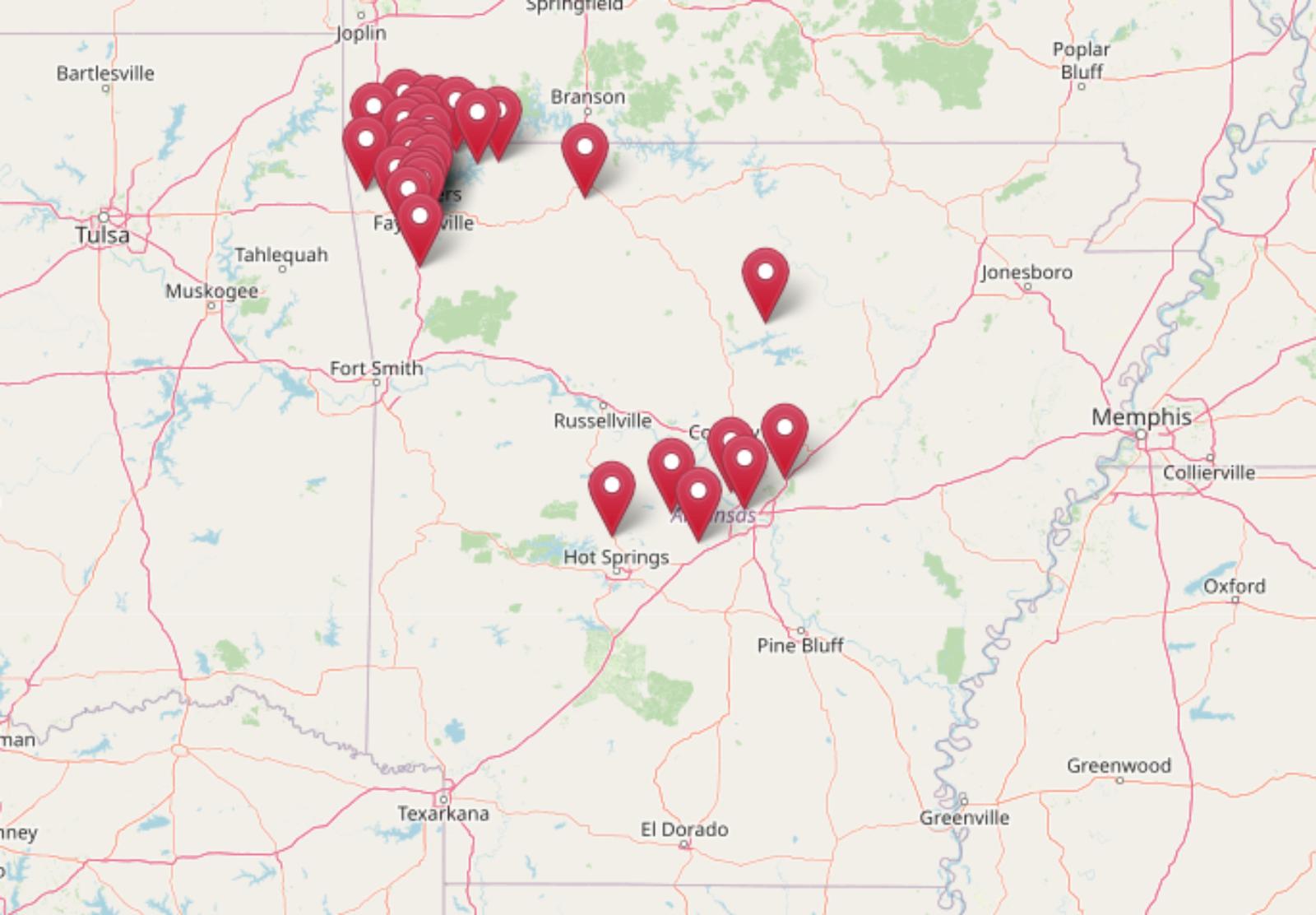

Home prices in Arkansas have quietly surged over the past 15 years, but in some towns, the increases have been anything but subtle. According to data from the Zillow Home Value Index, values in these 30 towns have more than doubled since 2010—far outpacing the statewide average. Many of the fastest-growing spots are clustered in the northwest corner, where scenic views meet job growth and relative affordability.

This ranking breaks down exactly where home prices have jumped the most and what’s driving the shift. Whether it’s out-of-state buyers moving in, limited housing supply, or ripple effects from hot markets like Bentonville and Fayetteville, each town tells a different story about Arkansas’s changing real estate map.

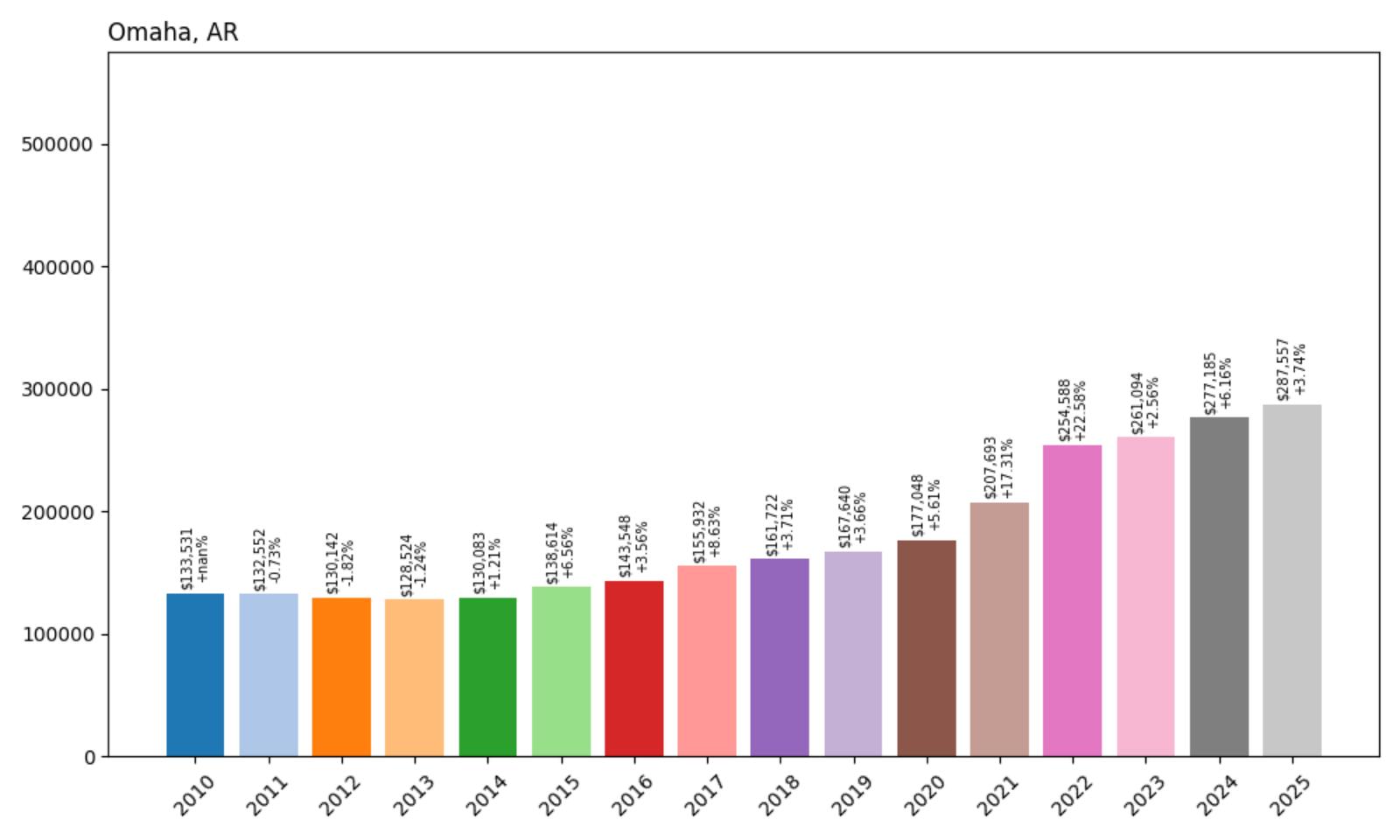

30. Omaha – 115% Home Price Increase Since 2010

- 2010: $133,531

- 2011: $132,552 (−$979, −0.73% from previous year)

- 2012: $130,142 (−$2,410, −1.82% from previous year)

- 2013: $128,524 (−$1,619, −1.24% from previous year)

- 2014: $130,083 (+$1,560, +1.21% from previous year)

- 2015: $138,614 (+$8,531, +6.56% from previous year)

- 2016: $143,548 (+$4,935, +3.56% from previous year)

- 2017: $155,932 (+$12,384, +8.63% from previous year)

- 2018: $161,722 (+$5,790, +3.71% from previous year)

- 2019: $167,640 (+$5,918, +3.66% from previous year)

- 2020: $177,048 (+$9,408, +5.61% from previous year)

- 2021: $207,693 (+$30,645, +17.31% from previous year)

- 2022: $254,588 (+$46,895, +22.58% from previous year)

- 2023: $261,094 (+$6,506, +2.56% from previous year)

- 2024: $277,185 (+$16,091, +6.16% from previous year)

- 2025: $287,557 (+$10,372, +3.74% from previous year)

Home values in Omaha have climbed from just over $133,000 in 2010 to more than $287,000 in 2025—a 115% increase. Much of that growth occurred after 2020, with double-digit annual jumps seen in 2021 and 2022. The town’s post-pandemic momentum has tapered slightly in recent years but remains firmly on an upward path.

Omaha – Steady Price Growth in a Quiet Ozark Town

Omaha is a small town tucked into northern Arkansas near the Missouri border, known for its access to the scenic Ozarks and proximity to Table Rock Lake. It’s not a bustling metro, but its peaceful charm and natural surroundings have made it increasingly attractive to retirees and remote workers. This quiet demand has helped push up prices steadily over the past decade.

Despite being rural, Omaha’s affordability has attracted buyers from surrounding states looking for second homes or investment properties. This growing interest likely contributed to the sharp home price rise between 2020 and 2022. The local market is relatively small, so even modest demand shifts can lead to noticeable impacts on home values.

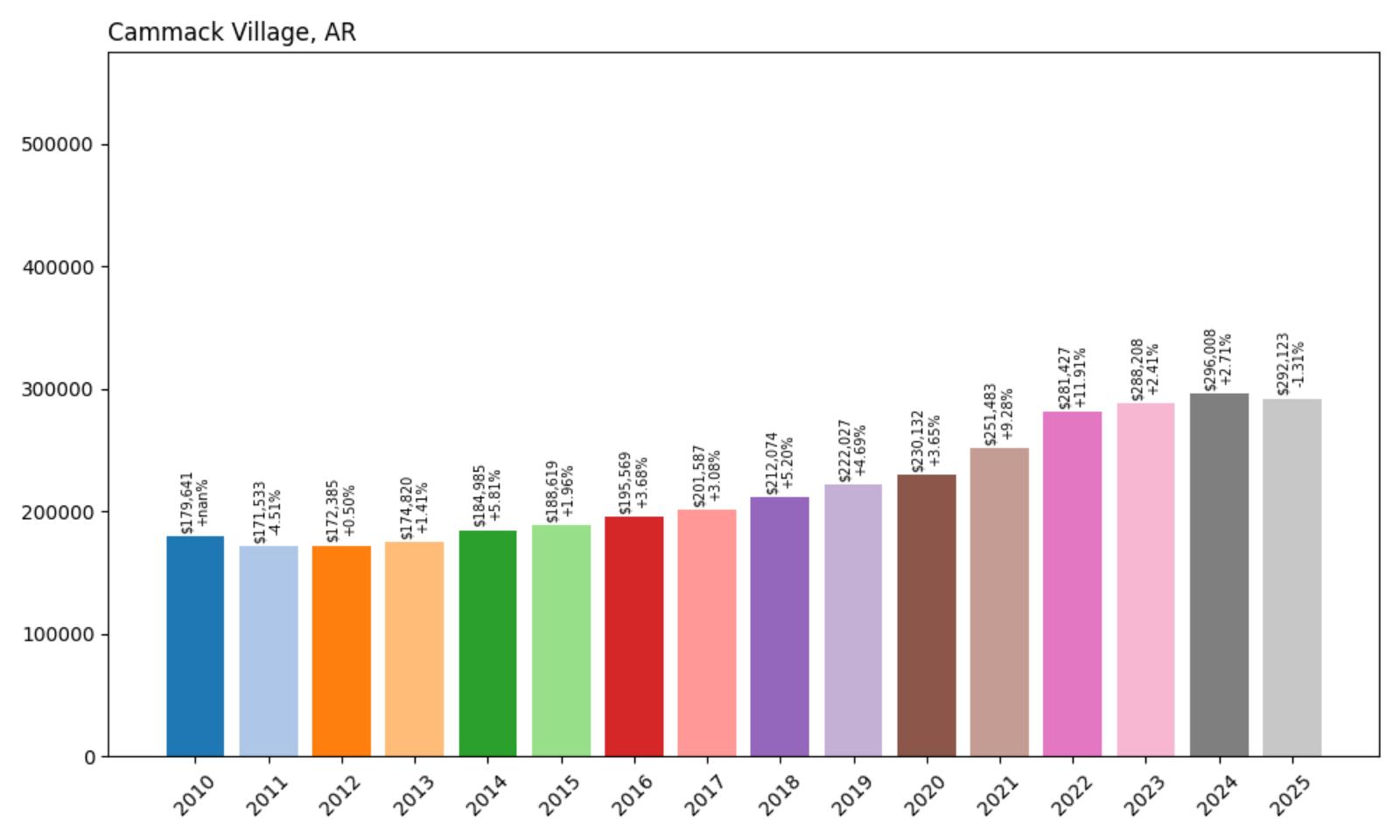

29. Cammack Village – 62.6% Home Price Increase Since 2010

- 2010: $179,641

- 2011: $171,533 (−$8,108, −4.51% from previous year)

- 2012: $172,385 (+$853, +0.50% from previous year)

- 2013: $174,820 (+$2,434, +1.41% from previous year)

- 2014: $184,985 (+$10,165, +5.81% from previous year)

- 2015: $188,619 (+$3,634, +1.96% from previous year)

- 2016: $195,569 (+$6,950, +3.68% from previous year)

- 2017: $201,587 (+$6,018, +3.08% from previous year)

- 2018: $212,074 (+$10,487, +5.20% from previous year)

- 2019: $222,027 (+$9,953, +4.69% from previous year)

- 2020: $230,132 (+$8,105, +3.65% from previous year)

- 2021: $251,483 (+$21,351, +9.28% from previous year)

- 2022: $281,427 (+$29,944, +11.91% from previous year)

- 2023: $288,208 (+$6,781, +2.41% from previous year)

- 2024: $296,008 (+$7,800, +2.71% from previous year)

- 2025: $292,123 (−$3,885, −1.31% from previous year)

Home values in Cammack Village have increased from roughly $179,000 in 2010 to over $292,000 in 2025. After a steady climb, prices dipped slightly in the most recent year, but the long-term growth trend remains strong. Much of the appreciation occurred between 2018 and 2022, driven by a sharp jump in demand.

Cammack Village – Prime Location Near Little Rock

Cammack Village is a small enclave surrounded entirely by Little Rock, giving residents suburban peace with easy access to the capital’s amenities. Its central location and quiet streets make it one of the most desirable places to live in Pulaski County. The housing stock is limited, which has helped drive up prices as demand continues.

Although the population is small, proximity to top-rated schools and downtown Little Rock has made the neighborhood attractive to professionals and families. The town has resisted overdevelopment, preserving its leafy character—a factor that keeps housing supply tight and values high.

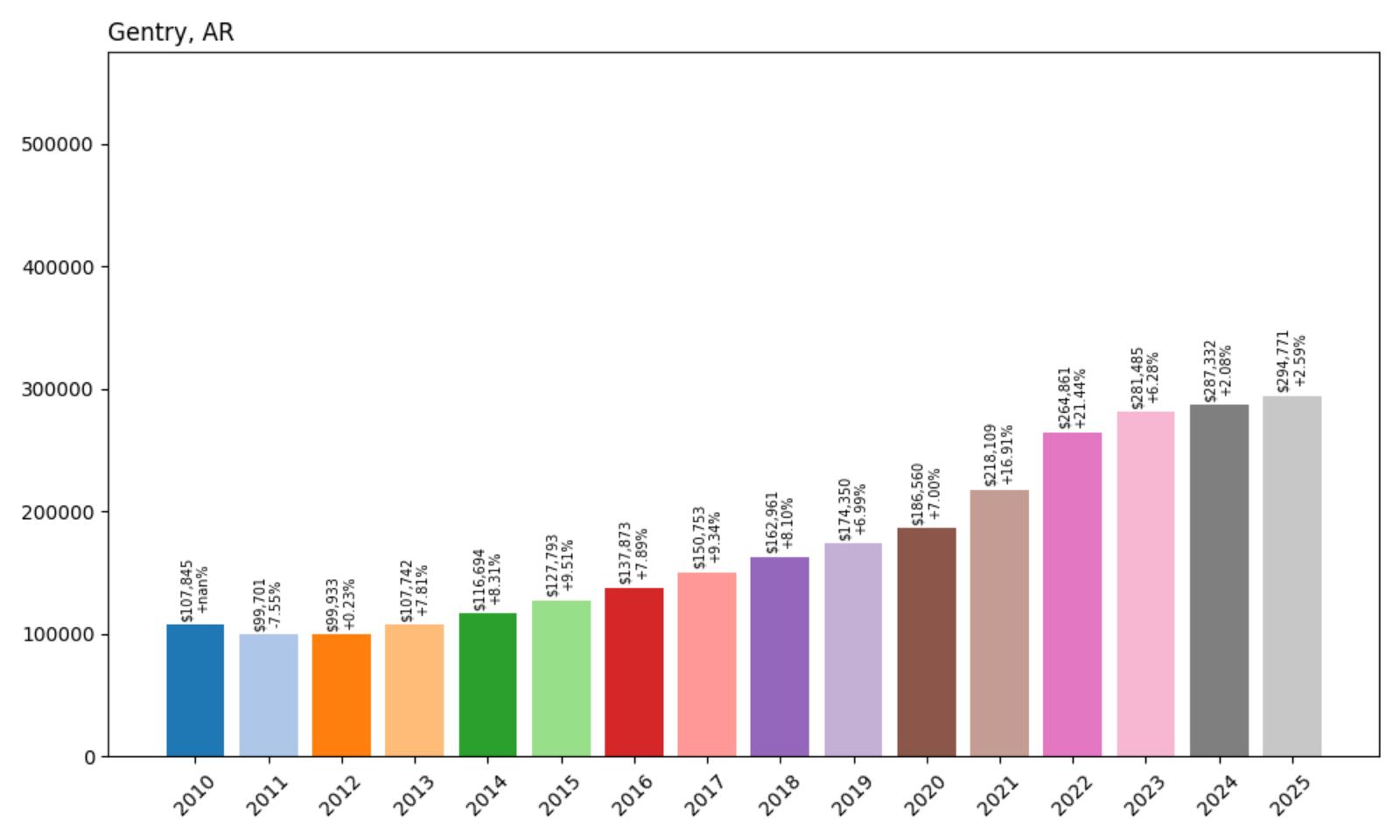

28. Gentry – 173% Home Price Increase Since 2010

- 2010: $107,845

- 2011: $99,701 (−$8,143, −7.55% from previous year)

- 2012: $99,933 (+$232, +0.23% from previous year)

- 2013: $107,742 (+$7,809, +7.81% from previous year)

- 2014: $116,694 (+$8,952, +8.31% from previous year)

- 2015: $127,793 (+$11,099, +9.51% from previous year)

- 2016: $137,873 (+$10,080, +7.89% from previous year)

- 2017: $150,753 (+$12,880, +9.34% from previous year)

- 2018: $162,961 (+$12,208, +8.10% from previous year)

- 2019: $174,350 (+$11,389, +6.99% from previous year)

- 2020: $186,560 (+$12,210, +7.00% from previous year)

- 2021: $218,109 (+$31,549, +16.91% from previous year)

- 2022: $264,861 (+$46,752, +21.44% from previous year)

- 2023: $281,485 (+$16,624, +6.28% from previous year)

- 2024: $287,332 (+$5,847, +2.08% from previous year)

- 2025: $294,771 (+$7,439, +2.59% from previous year)

Gentry has seen one of the steepest home price increases on this list—up 173% since 2010. The sharpest climbs came during the pandemic years, when migration into Northwest Arkansas surged. Since 2021, prices have continued to rise, though the pace has slowed.

Gentry – Northwest Arkansas on the Rise

Gentry is located in Benton County, near other high-growth cities like Siloam Springs and Springdale. Its appeal lies in the combination of small-town living and access to the broader Northwest Arkansas economy. With Walmart and Tyson Foods headquartered nearby, the region has drawn consistent job growth, which has driven housing demand.

Gentry has also invested in its schools and downtown infrastructure, making it more appealing to young families. As nearby areas become more expensive, buyers have looked to Gentry as an affordable but rising alternative, pushing up home values significantly.

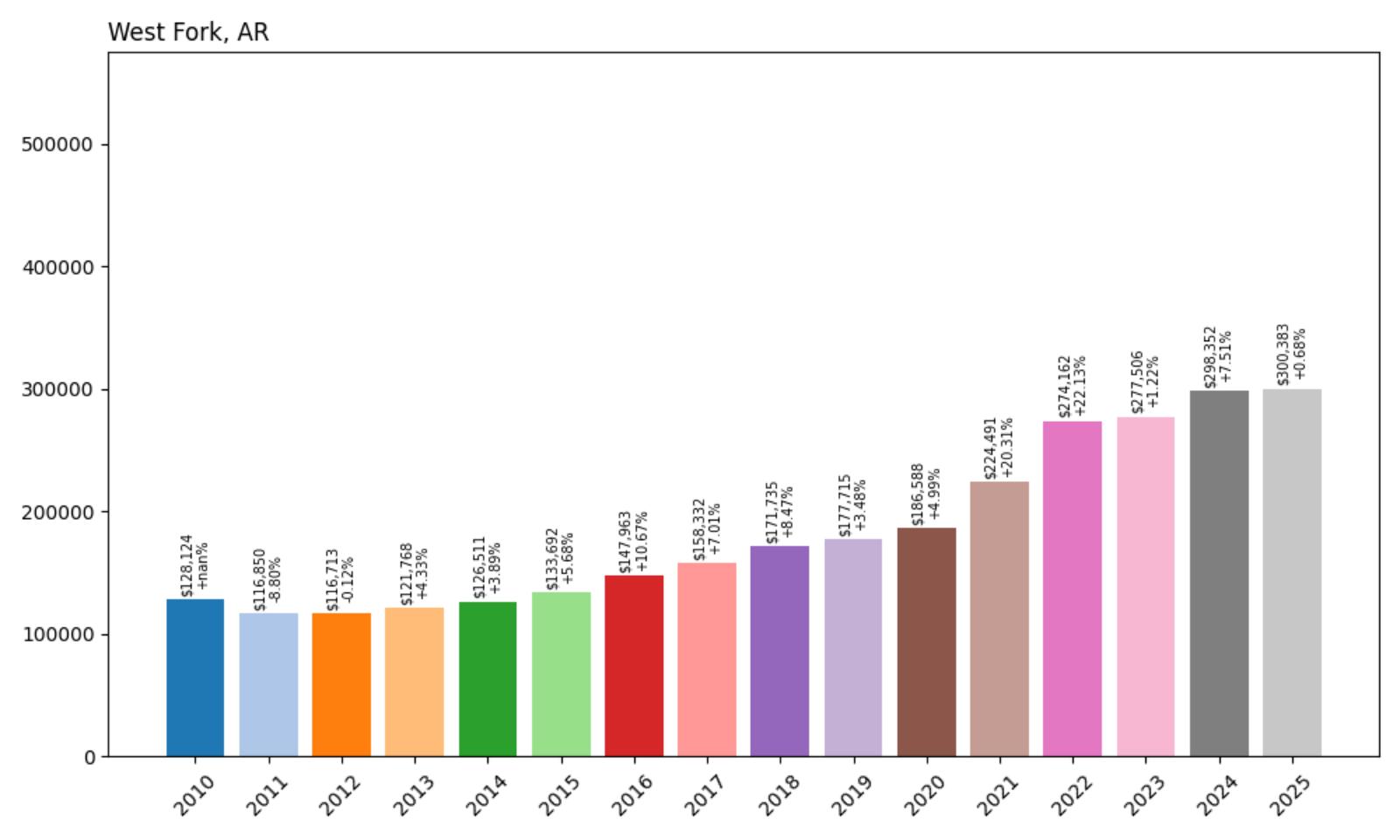

27. West Fork – 134% Home Price Increase Since 2010

- 2010: $128,124

- 2011: $116,850 (−$11,274, −8.80% from previous year)

- 2012: $116,713 (−$136, −0.12% from previous year)

- 2013: $121,768 (+$5,055, +4.33% from previous year)

- 2014: $126,511 (+$4,743, +3.89% from previous year)

- 2015: $133,692 (+$7,181, +5.68% from previous year)

- 2016: $147,963 (+$14,271, +10.67% from previous year)

- 2017: $158,332 (+$10,369, +7.01% from previous year)

- 2018: $171,735 (+$13,403, +8.47% from previous year)

- 2019: $177,715 (+$5,979, +3.48% from previous year)

- 2020: $186,588 (+$8,873, +4.99% from previous year)

- 2021: $224,491 (+$37,903, +20.31% from previous year)

- 2022: $274,162 (+$49,672, +22.13% from previous year)

- 2023: $277,506 (+$3,343, +1.22% from previous year)

- 2024: $298,352 (+$20,847, +7.51% from previous year)

- 2025: $300,383 (+$2,031, +0.68% from previous year)

West Fork’s home prices have risen from about $128,000 in 2010 to more than $300,000 in 2025. Much of the rise occurred post-2020, with back-to-back double-digit gains in 2021 and 2022. Although prices have leveled off recently, they remain well above pre-pandemic levels.

West Fork – A Gateway to Nature and Northwest Growth

Situated just south of Fayetteville, West Fork benefits from its location along I-49, providing easy access to the broader Northwest Arkansas metro. Its semi-rural appeal, access to outdoor recreation, and relatively low base prices a decade ago made it an attractive area for buyers priced out of bigger cities nearby.

The 2021–2022 boom pushed prices to new heights as more remote workers moved in and developers began building in response to demand. The town offers access to the Ozark National Forest and is known for its community-oriented feel, helping it maintain strong demand even as appreciation has slowed slightly in recent years.

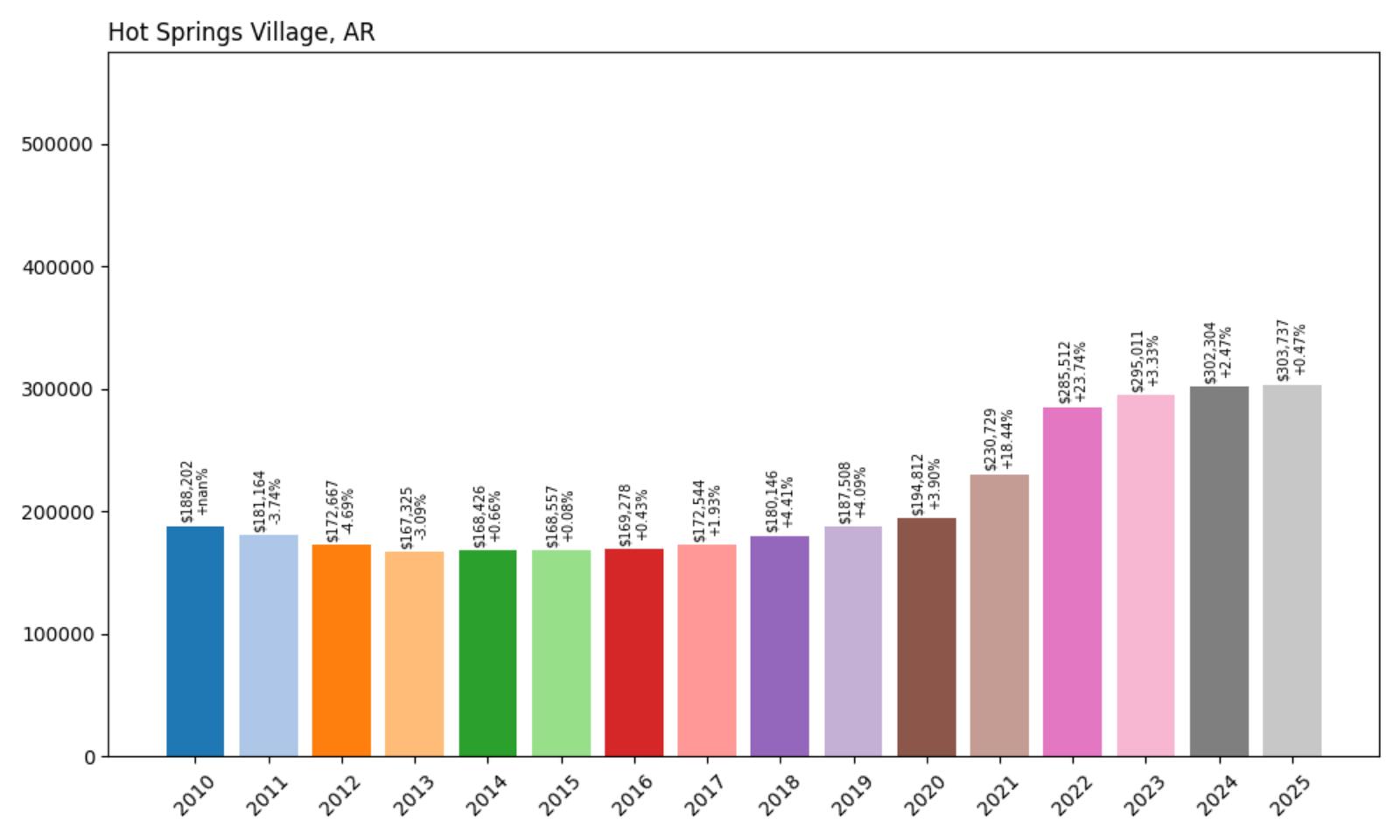

26. Hot Springs Village – 61% Home Price Increase Since 2010

- 2010: $188,202

- 2011: $181,164 (−$7,038, −3.74% from previous year)

- 2012: $172,667 (−$8,497, −4.69% from previous year)

- 2013: $167,325 (−$5,342, −3.09% from previous year)

- 2014: $168,426 (+$1,101, +0.66% from previous year)

- 2015: $168,557 (+$132, +0.08% from previous year)

- 2016: $169,278 (+$721, +0.43% from previous year)

- 2017: $172,544 (+$3,265, +1.93% from previous year)

- 2018: $180,146 (+$7,602, +4.41% from previous year)

- 2019: $187,508 (+$7,362, +4.09% from previous year)

- 2020: $194,812 (+$7,303, +3.90% from previous year)

- 2021: $230,729 (+$35,918, +18.44% from previous year)

- 2022: $285,512 (+$54,783, +23.74% from previous year)

- 2023: $295,011 (+$9,498, +3.33% from previous year)

- 2024: $302,304 (+$7,293, +2.47% from previous year)

- 2025: $303,737 (+$1,434, +0.47% from previous year)

Hot Springs Village has experienced a 61% rise in home values over the past 15 years. Most of that growth came in a concentrated period from 2020 to 2022. Though appreciation has slowed in recent years, the market has remained stable at higher price levels.

Hot Springs Village – A Retiree Favorite That’s Seen a Boom

Hot Springs Village is one of the country’s largest gated communities, known for its golf courses, lakes, and retirement-friendly amenities. Located in the Ouachita Mountains, it has long been a destination for retirees seeking a peaceful, amenity-rich lifestyle. That appeal grew significantly during the pandemic, drawing new residents from across the country.

Much of the price growth happened when remote work opened the doors to relocating. In 2021 and 2022 alone, prices jumped more than 40%. Although demand has since cooled, home values have held steady, suggesting this market has found a new baseline driven by out-of-state interest and stable retiree demand.

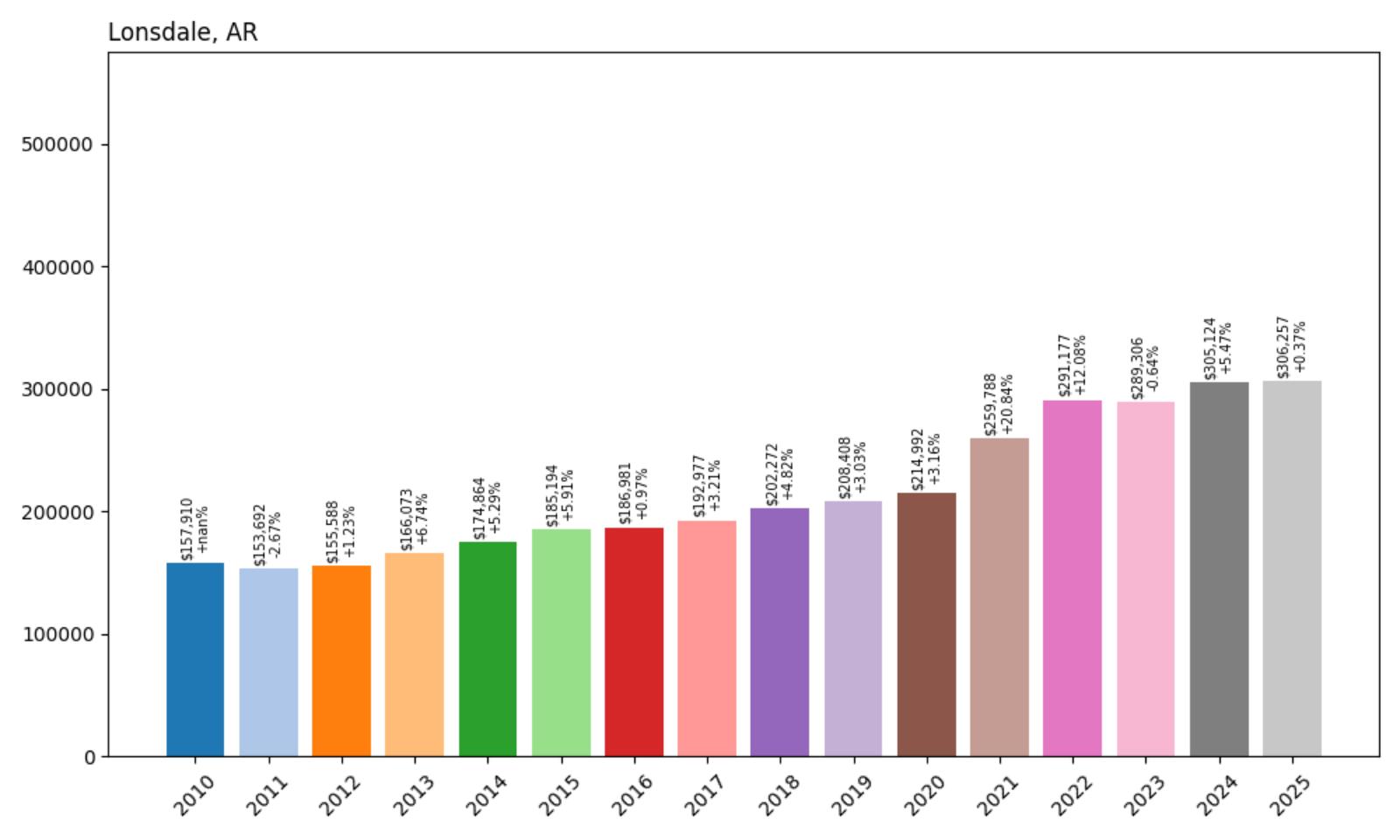

25. Lonsdale – 94% Home Price Increase Since 2010

- 2010: $157,910

- 2011: $153,692 (−$4,218, −2.67% from previous year)

- 2012: $155,588 (+$1,896, +1.23% from previous year)

- 2013: $166,073 (+$10,485, +6.74% from previous year)

- 2014: $174,864 (+$8,791, +5.29% from previous year)

- 2015: $185,194 (+$10,330, +5.91% from previous year)

- 2016: $186,981 (+$1,787, +0.97% from previous year)

- 2017: $192,977 (+$5,996, +3.21% from previous year)

- 2018: $202,272 (+$9,296, +4.82% from previous year)

- 2019: $208,408 (+$6,135, +3.03% from previous year)

- 2020: $214,992 (+$6,584, +3.16% from previous year)

- 2021: $259,788 (+$44,796, +20.84% from previous year)

- 2022: $291,177 (+$31,389, +12.08% from previous year)

- 2023: $289,306 (−$1,871, −0.64% from previous year)

- 2024: $305,124 (+$15,818, +5.47% from previous year)

- 2025: $306,257 (+$1,133, +0.37% from previous year)

Lonsdale’s home values have grown by 94% since 2010, increasing from $157,910 to $306,257 by 2025. The most dramatic rise came in 2021, with a single-year gain of nearly $45,000. Despite a brief dip in 2023, values resumed upward growth, reinforcing the area’s long-term market appeal.

Lonsdale – Central Arkansas Affordability in Transition

Lonsdale sits between Hot Springs and Benton, offering a low-density alternative for Arkansans looking to stay near larger towns without the higher housing costs. In the early 2010s, price gains were modest and reflected a fairly quiet housing market. But from 2020 onward, Lonsdale started seeing sharp interest as urban buyers sought less crowded options. 2021 was a tipping point, with values shooting up more than 20% in a single year. This likely reflected increased migration and remote work, allowing people to move farther from job centers without sacrificing employment opportunities. The housing stock is primarily single-family homes with some acreage, which adds to the town’s appeal. Following the spike, values have leveled out but continue rising—albeit slowly. The $306,000 price tag in 2025 positions Lonsdale as a moderately priced alternative in the broader Central Arkansas region.

Though it remains quiet, Lonsdale’s future may hinge on regional infrastructure improvements and spillover demand from nearby towns. New construction has been minimal, which helps explain the consistent pressure on home prices. With buyers increasingly priced out of Hot Springs Village and suburban Little Rock, places like Lonsdale are getting more attention. That visibility, combined with rising land costs and tighter inventory, could continue to drive appreciation. The town’s strategic location near Highway 5 makes it accessible, but it still maintains a relaxed, rural identity. While Lonsdale doesn’t have major industries of its own, its position as a residential haven with proximity to recreational lakes and mountain scenery makes it a quiet success story in Arkansas’s evolving real estate landscape.

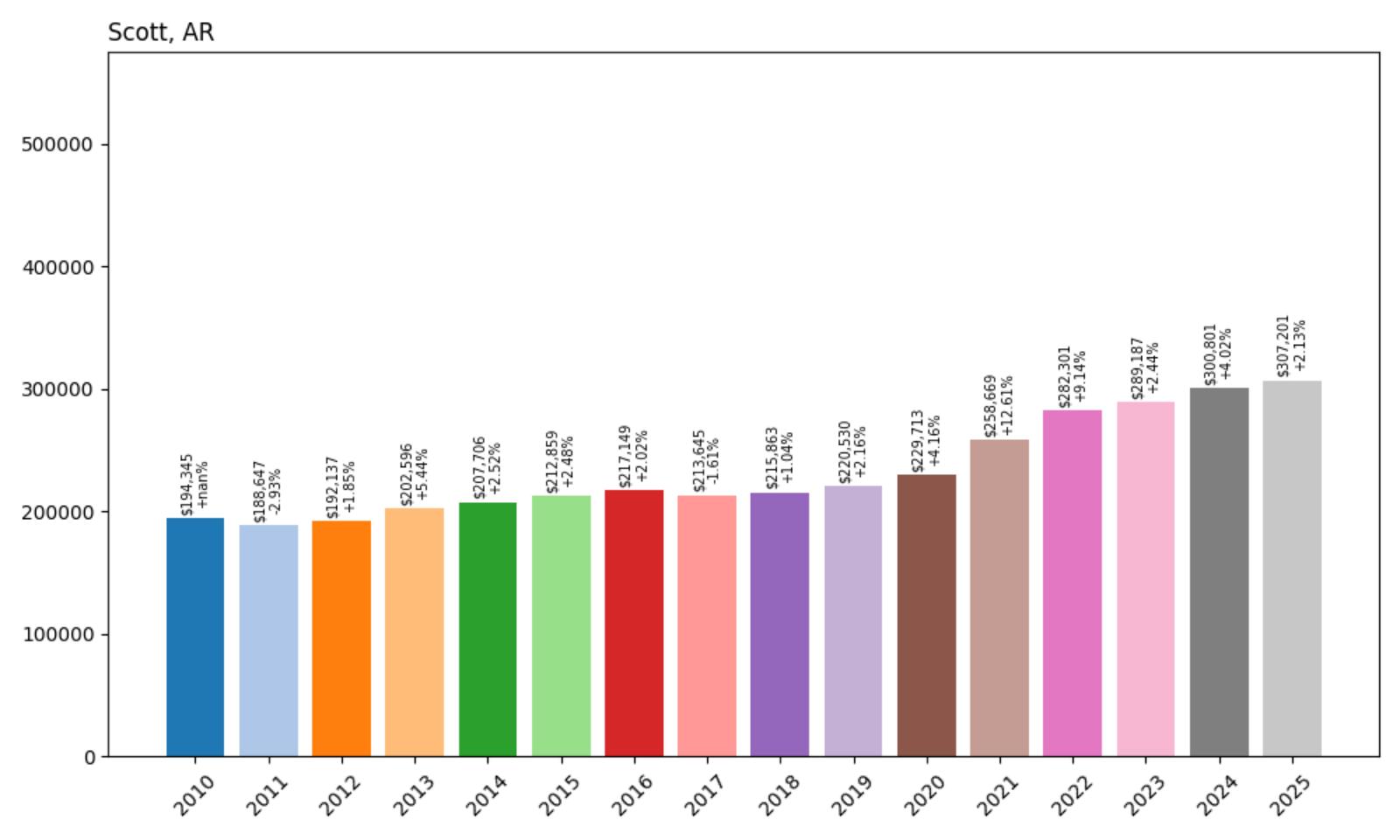

24. Scott – 58% Home Price Increase Since 2010

Would you like to save this?

- 2010: $194,345

- 2011: $188,647 (−$5,699, −2.93% from previous year)

- 2012: $192,137 (+$3,490, +1.85% from previous year)

- 2013: $202,596 (+$10,459, +5.44% from previous year)

- 2014: $207,706 (+$5,110, +2.52% from previous year)

- 2015: $212,859 (+$5,152, +2.48% from previous year)

- 2016: $217,149 (+$4,290, +2.02% from previous year)

- 2017: $213,645 (−$3,504, −1.61% from previous year)

- 2018: $215,863 (+$2,218, +1.04% from previous year)

- 2019: $220,530 (+$4,667, +2.16% from previous year)

- 2020: $229,713 (+$9,183, +4.16% from previous year)

- 2021: $258,669 (+$28,956, +12.61% from previous year)

- 2022: $282,301 (+$23,632, +9.14% from previous year)

- 2023: $289,187 (+$6,885, +2.44% from previous year)

- 2024: $300,801 (+$11,614, +4.02% from previous year)

- 2025: $307,201 (+$6,400, +2.13% from previous year)

Home prices in Scott climbed from $194,345 in 2010 to $307,201 by 2025—a total increase of 58%. Although growth was gradual at first, the market picked up momentum after 2020, with two consecutive years of double-digit gains in 2021 and 2022 pushing prices significantly higher.

Scott – Historic Farmland Town with Modern Appeal

Scott, located along the Pulaski-Lonoke county line, is a rural community with deep agricultural roots. The area is best known for its plantations, museums, and preserved farmland that stretches across the Arkansas Delta. What it lacks in urban amenities, it makes up for in space, heritage, and convenience to Little Rock. The relatively modest growth in home prices from 2010 to 2019 reflected Scott’s quiet and consistent housing market. But things changed quickly after 2020, as more buyers searched for rural living without giving up access to city services. By 2022, prices had jumped more than $50,000 in just two years. The area’s large parcels of land and scenic settings are especially attractive to retirees and families looking for homesteads or quiet primary residences. Unlike flashier markets, Scott’s growth feels organic, built on land value and long-term investment appeal rather than speculative flips.

Scott’s proximity to both Little Rock and North Little Rock gives it a distinct advantage over more remote towns. The Plantation Agriculture Museum, Toltec Mounds, and farming heritage lend unique cultural value to the area, while easy access to major roadways and jobs makes it viable for commuters. The town’s appeal isn’t about nightlife or trendy coffee shops—it’s about space, stability, and southern landscapes that offer both charm and function. This blend of tradition and accessibility helps explain the market’s resilience even in years when growth in other areas flattened. As of 2025, homes in Scott are priced just over $307,000, with little sign of overvaluation. If development remains limited and demand for rural-suburban hybrids continues, Scott is well-positioned to remain a top-tier housing market in central Arkansas.

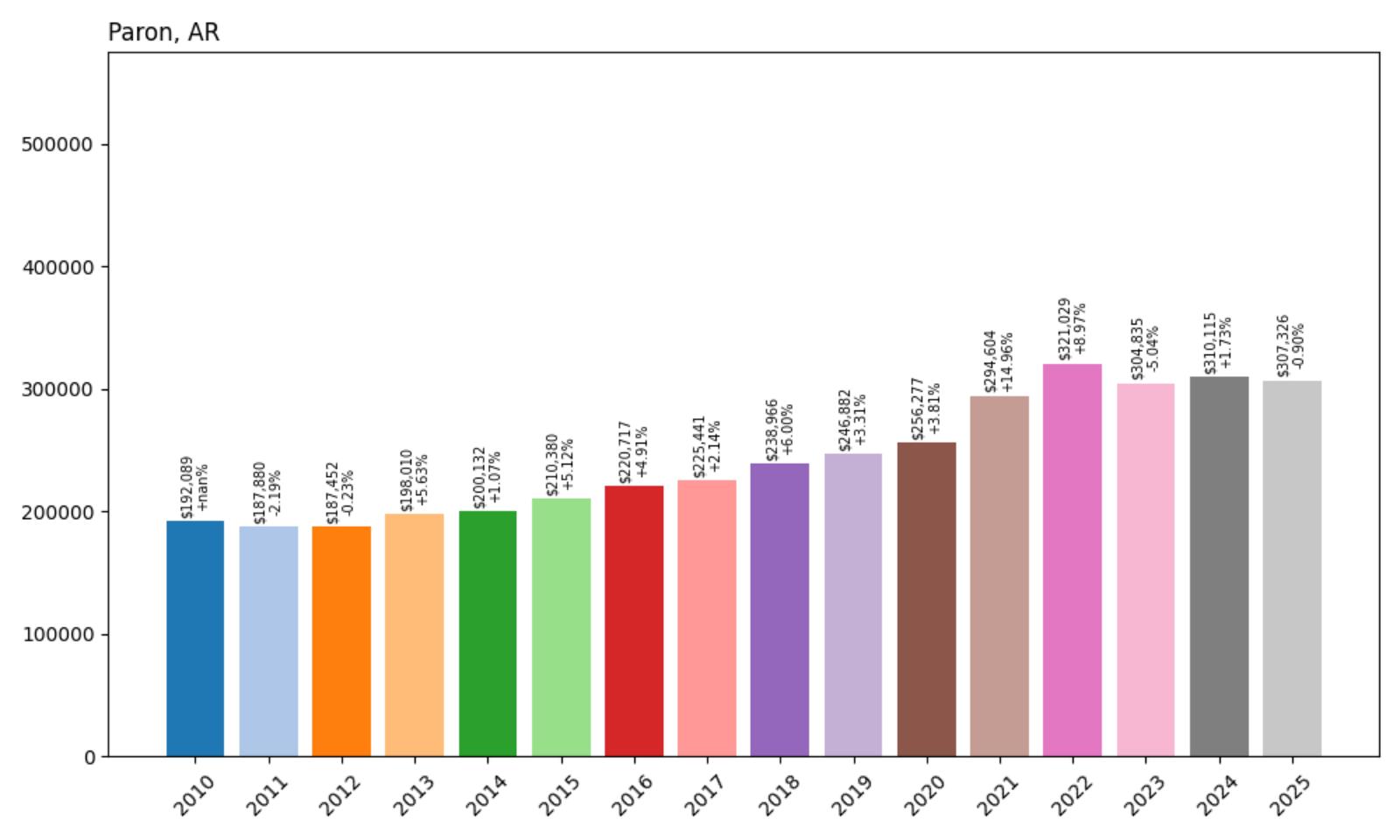

23. Paron – 60% Home Price Increase Since 2010

- 2010: $192,089

- 2011: $187,880 (−$4,209, −2.19% from previous year)

- 2012: $187,452 (−$428, −0.23% from previous year)

- 2013: $198,010 (+$10,558, +5.63% from previous year)

- 2014: $200,132 (+$2,122, +1.07% from previous year)

- 2015: $210,380 (+$10,248, +5.12% from previous year)

- 2016: $220,717 (+$10,337, +4.91% from previous year)

- 2017: $225,441 (+$4,724, +2.14% from previous year)

- 2018: $238,966 (+$13,526, +6.00% from previous year)

- 2019: $246,882 (+$7,915, +3.31% from previous year)

- 2020: $256,277 (+$9,395, +3.81% from previous year)

- 2021: $294,604 (+$38,327, +14.96% from previous year)

- 2022: $321,029 (+$26,426, +8.97% from previous year)

- 2023: $304,835 (−$16,195, −5.04% from previous year)

- 2024: $310,115 (+$5,281, +1.73% from previous year)

- 2025: $307,326 (−$2,789, −0.90% from previous year)

Paron’s home values have increased from around $192,000 in 2010 to just over $307,000 in 2025, a 60% rise. Most of that growth happened between 2020 and 2022, when annual gains approached 15%. Although values dipped slightly in two of the last three years, they remain far above their pre-pandemic levels.

Paron – Remote Living with Real Value

Paron is an unincorporated community tucked into Saline County’s wooded hills, with no formal town center or government. It draws people seeking quiet, off-the-grid living without giving up access to nearby towns like Benton and Hot Springs. Paron’s early years of modest price changes reflected its quiet, rural character. But starting in 2020, buyers started turning to areas like Paron in search of space and isolation—pushing home prices up significantly.

The town’s sharpest price jumps came in 2021 and 2022, when it gained more than $64,000 in just two years. While prices have slightly retreated since then, they remain elevated, a sign that demand for rural acreage is still strong. Few homes hit the market here, and when they do, they often feature large plots of land, outbuildings, and rustic cabins. This lack of inventory helps explain why even small shifts in demand can have such a big impact on home values.

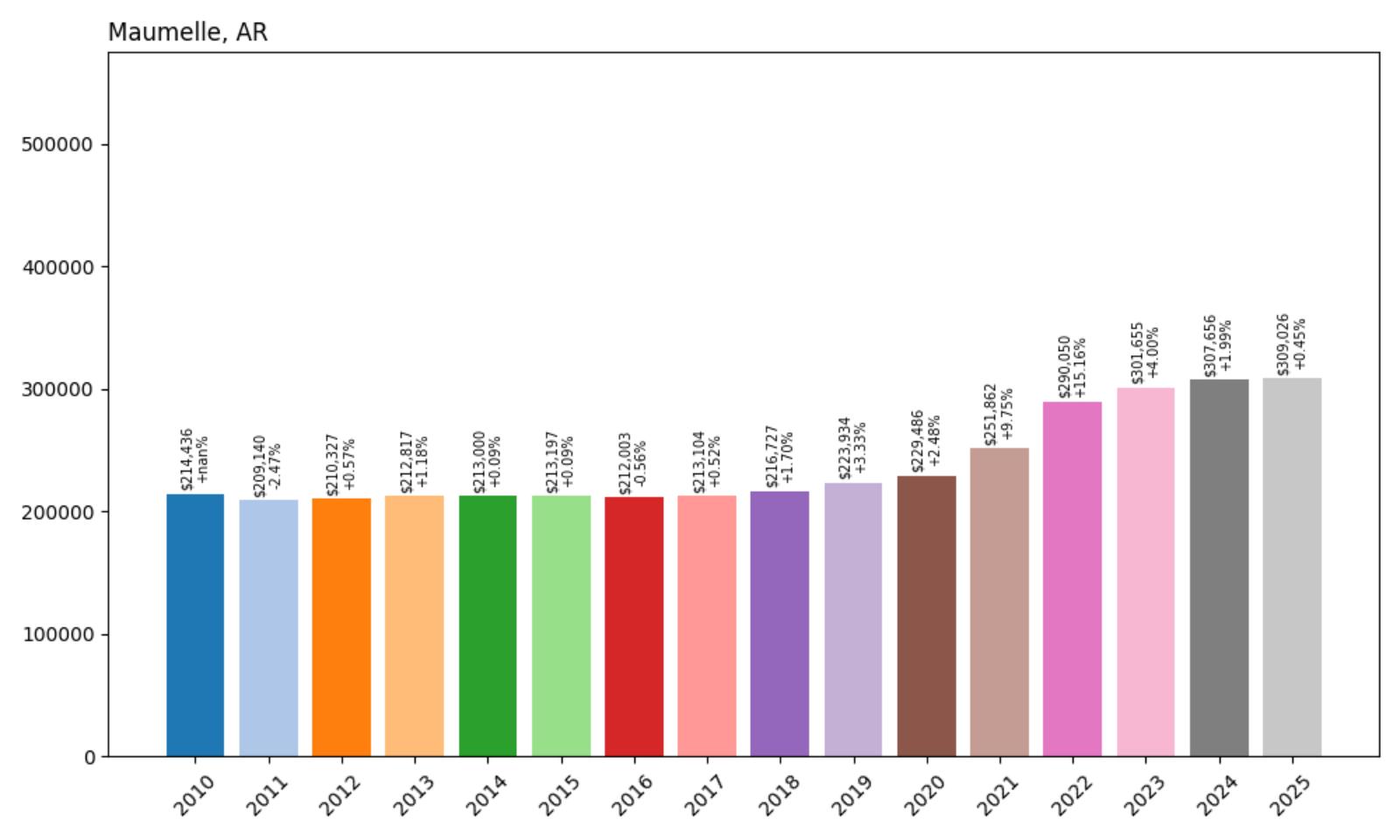

22. Maumelle – 44% Home Price Increase Since 2010

- 2010: $214,436

- 2011: $209,140 (−$5,296, −2.47% from previous year)

- 2012: $210,327 (+$1,187, +0.57% from previous year)

- 2013: $212,817 (+$2,489, +1.18% from previous year)

- 2014: $213,000 (+$183, +0.09% from previous year)

- 2015: $213,197 (+$197, +0.09% from previous year)

- 2016: $212,003 (−$1,194, −0.56% from previous year)

- 2017: $213,104 (+$1,101, +0.52% from previous year)

- 2018: $216,727 (+$3,623, +1.70% from previous year)

- 2019: $223,934 (+$7,207, +3.33% from previous year)

- 2020: $229,486 (+$5,551, +2.48% from previous year)

- 2021: $251,862 (+$22,376, +9.75% from previous year)

- 2022: $290,050 (+$38,188, +15.16% from previous year)

- 2023: $301,655 (+$11,605, +4.00% from previous year)

- 2024: $307,656 (+$6,001, +1.99% from previous year)

- 2025: $309,026 (+$1,371, +0.45% from previous year)

Maumelle’s home values have climbed from $214,436 in 2010 to $309,026 in 2025, reflecting a 44% increase. Price growth was relatively modest until 2020, but sharp gains in 2021 and 2022 pushed the city into a higher price tier. Growth has since cooled but remains steady.

Maumelle – Suburban Comfort Just Outside Little Rock

Located just northwest of Little Rock, Maumelle is a master-planned community that has long been a go-to suburb for families and professionals. The city was originally developed around two lakes and offers extensive parks, trails, and recreational areas, contributing to its quality-of-life appeal.

Maumelle’s attractiveness comes from more than just location—it’s a city designed with residents in mind. The street layout discourages through traffic, creating quiet neighborhoods, and there’s a strong emphasis on community engagement through sports leagues and festivals. Retail options have grown steadily, and the city’s close connection to I-40 makes it easy to access larger employers across central Arkansas. As demand increased statewide, Maumelle became one of the top picks for buyers who wanted predictable value without the volatility of remote towns. With no major swings in home prices since 2023, the city appears to be settling into a post-boom equilibrium. For buyers looking for consistency in both home quality and appreciation, Maumelle continues to be one of Arkansas’s most dependable housing markets.

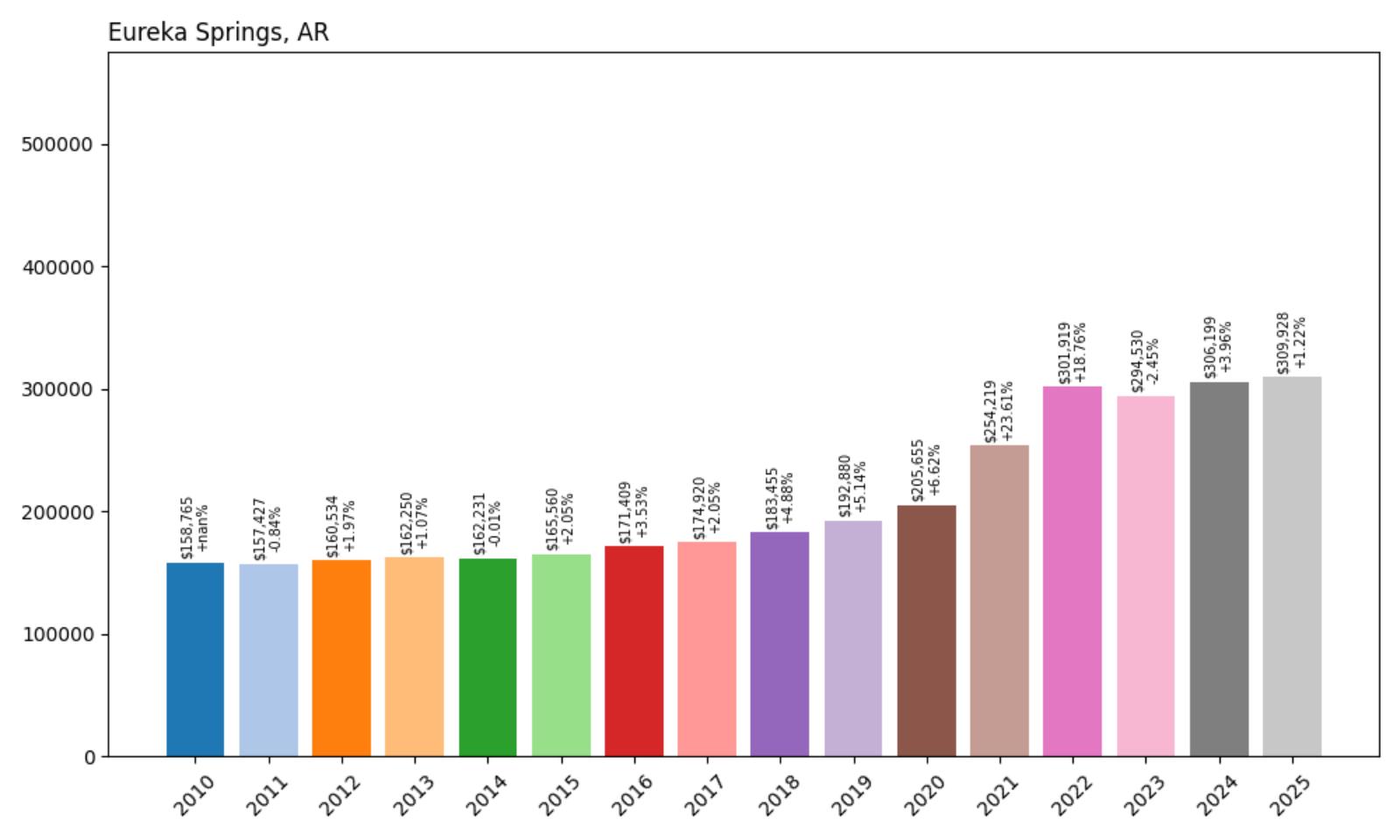

21. Eureka Springs – 95% Home Price Increase Since 2010

- 2010: $158,765

- 2011: $157,427 (−$1,338, −0.84% from previous year)

- 2012: $160,534 (+$3,107, +1.97% from previous year)

- 2013: $162,250 (+$1,716, +1.07% from previous year)

- 2014: $162,231 (−$19, −0.01% from previous year)

- 2015: $165,560 (+$3,329, +2.05% from previous year)

- 2016: $171,409 (+$5,848, +3.53% from previous year)

- 2017: $174,920 (+$3,511, +2.05% from previous year)

- 2018: $183,455 (+$8,535, +4.88% from previous year)

- 2019: $192,880 (+$9,426, +5.14% from previous year)

- 2020: $205,655 (+$12,775, +6.62% from previous year)

- 2021: $254,219 (+$48,564, +23.61% from previous year)

- 2022: $301,919 (+$47,700, +18.76% from previous year)

- 2023: $294,530 (−$7,389, −2.45% from previous year)

- 2024: $306,199 (+$11,670, +3.96% from previous year)

- 2025: $309,928 (+$3,729, +1.22% from previous year)

Eureka Springs saw home values grow from $158,765 in 2010 to $309,928 in 2025, a 95% increase. The most dramatic gains came in 2021 and 2022, when tourism and migration drove rapid housing demand. Values remain elevated even after a small dip in 2023.

Eureka Springs – A Tourist Town With Lasting Appeal

Known for its Victorian architecture, winding hills, and quirky charm, Eureka Springs is a major tourist destination in the Ozarks. The housing market here has long been tied to second-home buyers, retirees, and investors in vacation rentals. That dynamic fueled rapid appreciation during the pandemic when remote work and outdoor destinations became more appealing. Between 2020 and 2022, home values soared by nearly $100,000, making it one of the most dramatic price surges in the state. Even with a small decline in 2023, the city rebounded in 2024 and 2025, suggesting long-term demand remains.

Eureka Springs’ appeal isn’t just in its architecture—it’s in the culture. Annual events like the May Festival of the Arts, the Blues Weekend, and LGBTQ+ pride celebrations draw thousands of visitors. This cultural vibrancy supports a steady short-term rental economy, which has in turn boosted property values. The town’s location in Carroll County places it near popular hiking and biking trails, making it attractive to active retirees and outdoor enthusiasts. Despite limited room for expansion due to its geography, buyer interest hasn’t waned. As of 2025, with median home prices just under $310,000, Eureka Springs remains one of Arkansas’s most in-demand destinations for both tourists and long-term homeowners alike.

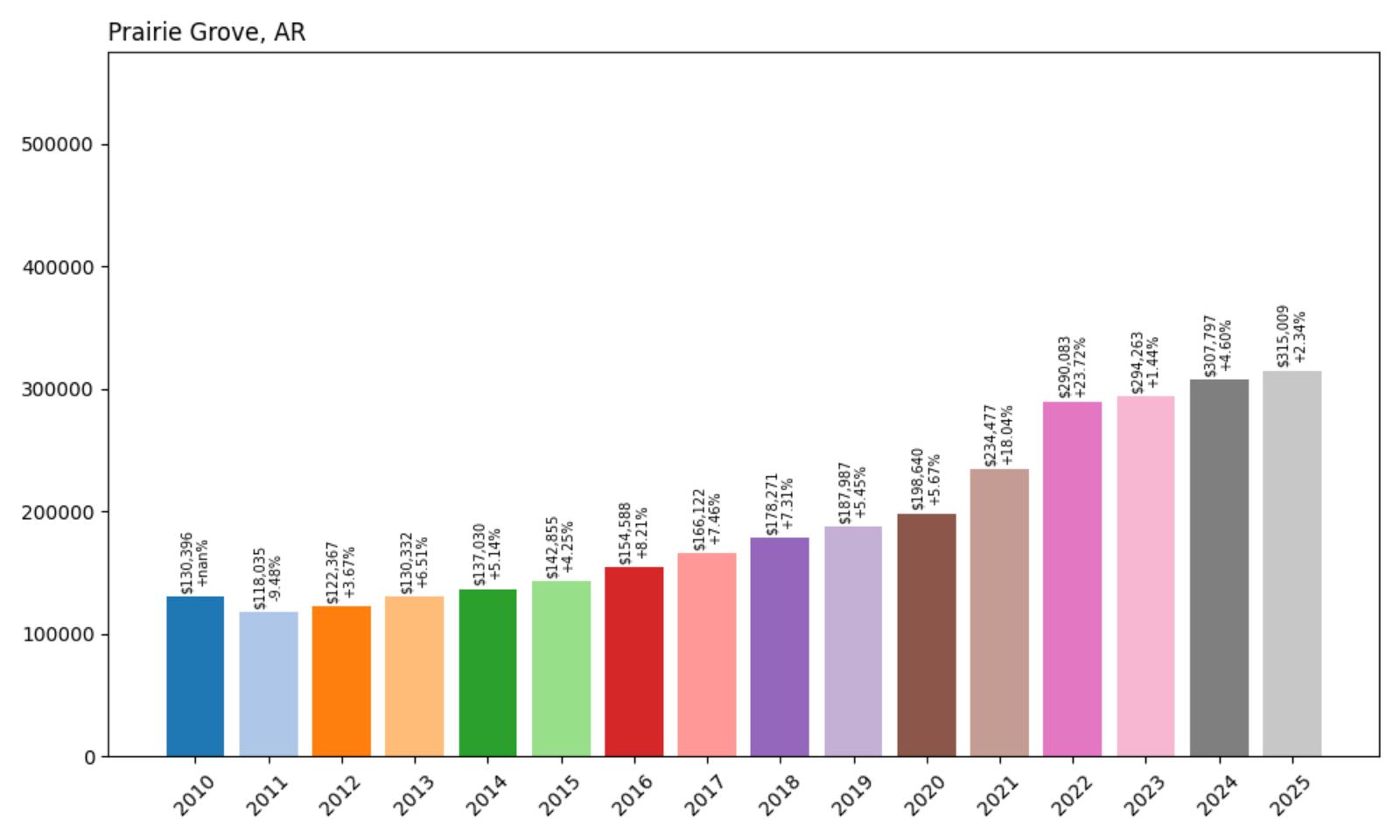

20. Prairie Grove – 142% Home Price Increase Since 2010

- 2010: $130,396

- 2011: $118,035

- 2012: $122,367

- 2013: $130,332

- 2014: $137,030

- 2015: $142,855

- 2016: $154,588

- 2017: $166,122

- 2018: $178,271

- 2019: $187,987

- 2020: $198,640

- 2021: $234,477

- 2022: $290,083

- 2023: $294,263

- 2024: $307,797

- 2025: $315,009

Home prices in Prairie Grove have climbed by over 140% since 2010, making it one of the fastest-appreciating markets in Arkansas. After slow, steady growth during the 2010s, the market exploded after 2020, with prices jumping from under $200,000 to over $315,000 in just five years. This surge highlights the town’s rising appeal among both local and out-of-state buyers.

Prairie Grove – Historic Core With Explosive Growth

Prairie Grove, located just west of Fayetteville, blends historical charm with modern suburban growth. Known for the Prairie Grove Battlefield State Park and its strong public school system, the town has become a magnet for families and professionals alike. Its proximity to the economic engine of northwest Arkansas gives it access to jobs while offering a more relaxed pace of life. As the region grows, buyers looking to escape the intensity of Fayetteville and Springdale have helped fuel demand here. With newer subdivisions emerging around its historic core, the town is now expanding in every direction. That growth has translated directly into soaring home values that outpace statewide averages.

Infrastructure improvements and new retail developments have made Prairie Grove even more self-sufficient, giving residents access to amenities without long commutes. The town’s strong community identity and manageable size make it especially attractive to those who want both space and connection. While real estate here was once seen as a value alternative, current prices suggest it has fully arrived as a serious investment market. Prairie Grove’s growth is not speculative—it’s rooted in population increases, school demand, and regional momentum. With ongoing development pressure in northwest Arkansas, its trajectory is likely to continue upward. The town stands as a clear example of how secondary markets are becoming major destinations in their own right.

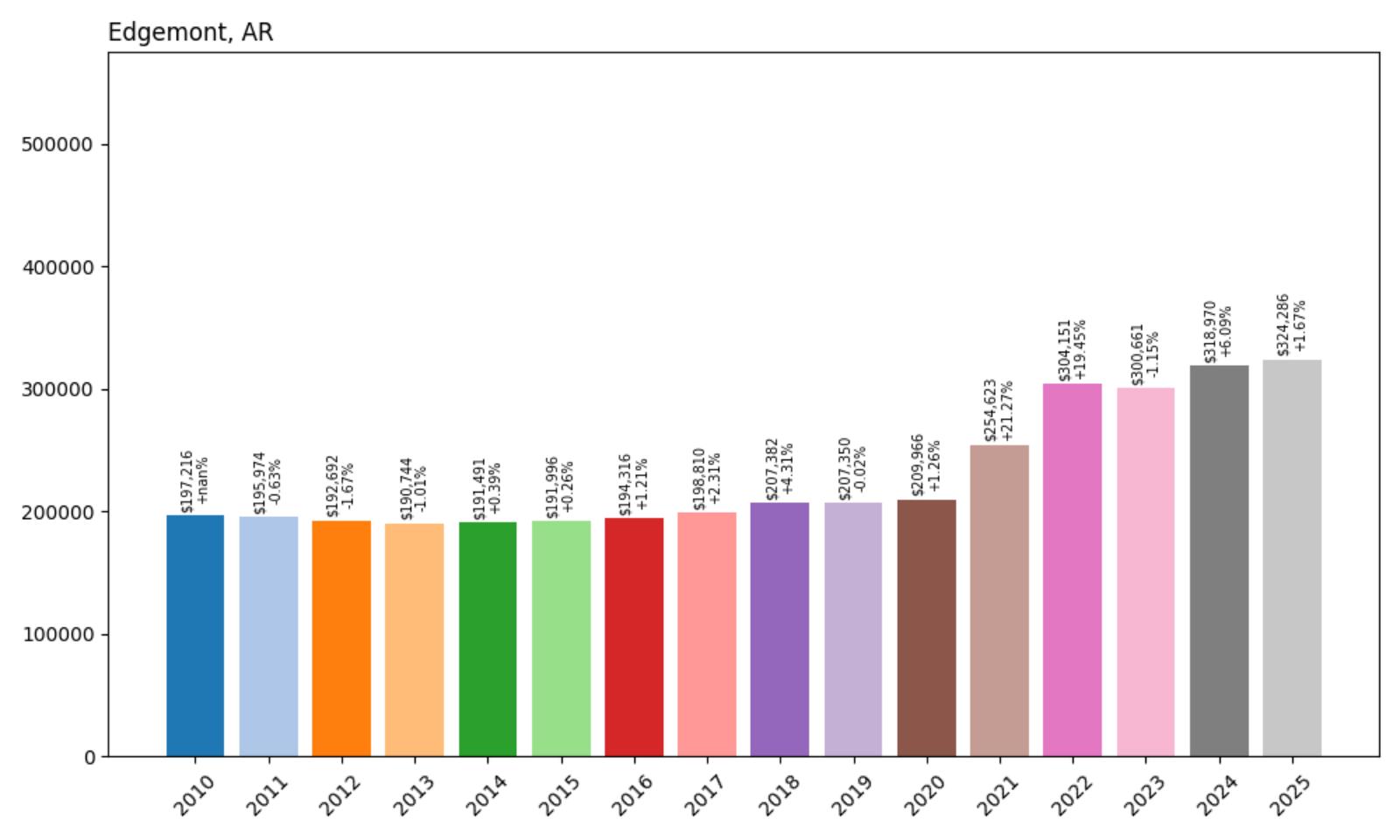

19. Edgemont – 64% Home Price Increase Since 2010

- 2010: $197,216

- 2011: $195,974

- 2012: $192,692

- 2013: $190,744

- 2014: $191,491

- 2015: $191,996

- 2016: $194,316

- 2017: $198,810

- 2018: $207,382

- 2019: $207,350

- 2020: $209,966

- 2021: $254,623

- 2022: $304,151

- 2023: $300,661

- 2024: $318,970

- 2025: $324,286

Edgemont has experienced a 64% increase in home prices since 2010, growing from under $200,000 to well above $320,000 in 2025. Nearly half of that increase came between 2020 and 2022, when prices jumped by nearly $100,000 in just two years. Despite a brief dip in 2023, values rebounded quickly, reflecting continued demand for lake-area properties.

Edgemont – Lakeside Appeal That Won’t Slow Down

Perched on the northern edge of Greers Ferry Lake, Edgemont offers panoramic views, secluded lots, and lakefront living that is increasingly rare in central Arkansas. The area has traditionally attracted vacation home buyers, but in recent years it’s become more than a seasonal escape. Improved internet access and remote work flexibility have allowed more people to settle here year-round, pushing up prices across the board.

The limited number of properties along the lakefront, combined with rising demand, has made the housing market highly competitive. While the town remains quiet and lightly developed, that scarcity is exactly what drives its value. Buyers are willing to pay a premium for privacy, lake access, and proximity to the Ozark foothills.

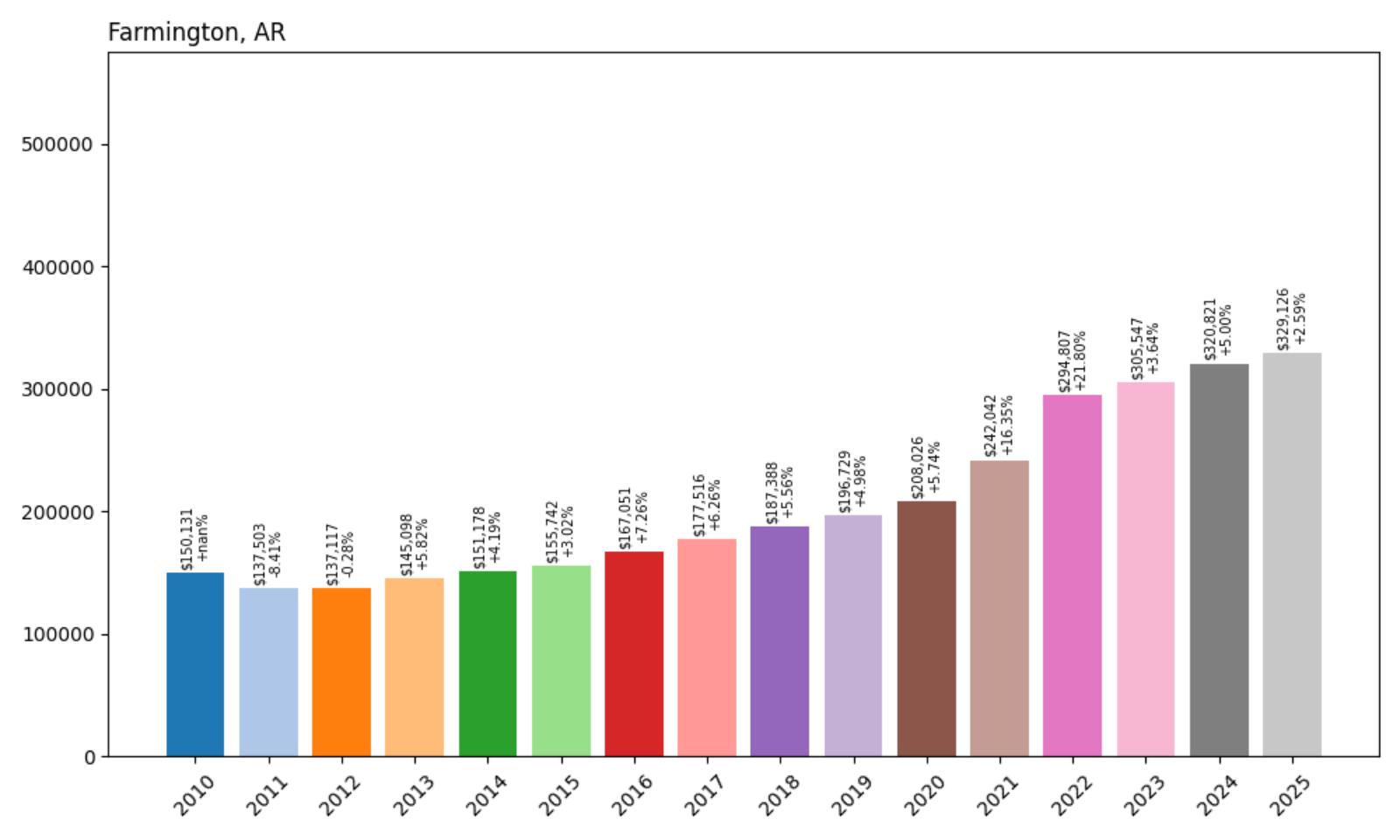

18. Farmington – 119% Home Price Increase Since 2010

Would you like to save this?

- 2010: $150,131

- 2011: $137,503

- 2012: $137,117

- 2013: $145,098

- 2014: $151,178

- 2015: $155,742

- 2016: $167,051

- 2017: $177,516

- 2018: $187,388

- 2019: $196,729

- 2020: $208,026

- 2021: $242,042

- 2022: $294,807

- 2023: $305,547

- 2024: $320,821

- 2025: $329,126

Home prices in Farmington have more than doubled since 2010, with a particularly aggressive climb since 2020. Values surged by over $120,000 in just five years, reflecting the town’s emergence as one of northwest Arkansas’s most in-demand residential areas. Even after a period of fast growth, prices continue to climb into 2025.

Farmington – New Subdivisions, Familiar Demand

Farmington is no longer a quiet outskirt of Fayetteville—it’s a high-growth suburb with modern subdivisions, strong schools, and direct access to regional employers. Once considered a bedroom community, it has rapidly gained its own identity as families flock to the area for affordability and convenience. The housing stock has expanded significantly since 2015, yet demand continues to outpace supply. Buyers are drawn to newer homes, well-planned neighborhoods, and the promise of appreciating values. That combination has made Farmington one of the hottest micro-markets in the region. It may not have a major downtown or employer hub, but its role as a residential anchor is clear.

City improvements and a new wave of residential development have redefined Farmington’s reputation in recent years. It’s increasingly common to see first-time buyers, young professionals, and even retirees eyeing the town. With major highways connecting it directly to Fayetteville and Prairie Grove, commuting is simple while quality of life remains high. That dynamic has created a feedback loop—more growth, more interest, and more value. As long as northwest Arkansas keeps booming, Farmington’s place in the housing market seems all but secure. For those who bought early, the returns have been strong—and for new buyers, confidence in the area remains high.

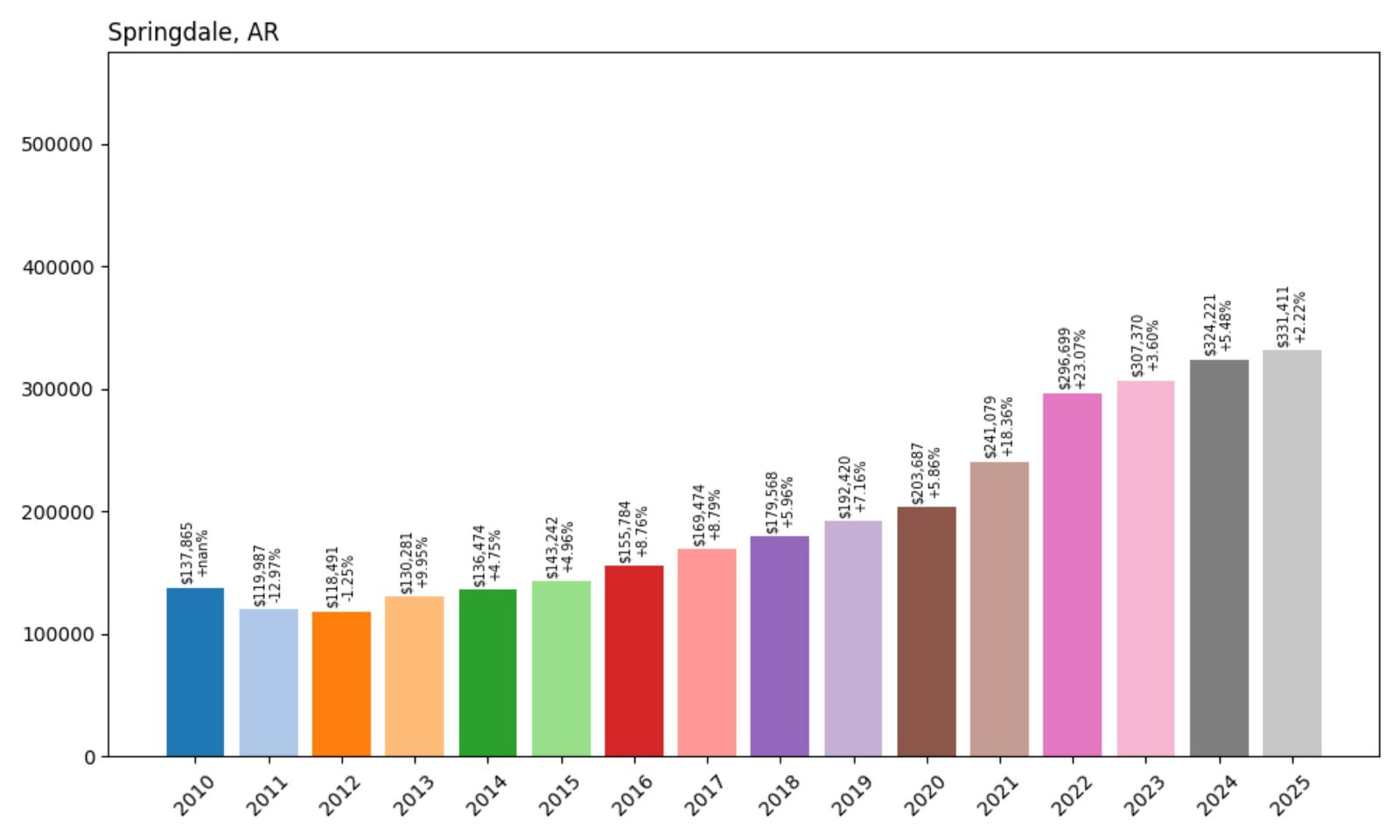

17. Springdale – 140% Home Price Increase Since 2010

- 2010: $137,865

- 2011: $119,987

- 2012: $118,491

- 2013: $130,281

- 2014: $136,474

- 2015: $143,242

- 2016: $155,784

- 2017: $169,474

- 2018: $179,568

- 2019: $192,420

- 2020: $203,687

- 2021: $241,079

- 2022: $296,699

- 2023: $307,370

- 2024: $324,221

- 2025: $331,411

Springdale home values have increased by over 140% since 2010, with prices rising from $137K to more than $330K. A strong economy and consistent population growth have fueled this rise, especially from 2020 onward. The town has become a magnet for buyers seeking both affordability and proximity to high-wage job centers.

Springdale – Big-City Growth Without Big-City Prices

Springdale has transformed over the past two decades, growing into a bustling city with a diverse economy and a major role in northwest Arkansas. It’s home to Tyson Foods’ global headquarters and benefits from strong ties to the broader Fayetteville-Rogers-Bentonville metro. That kind of economic engine has brought jobs, people, and rising demand for housing.

With investments in schools, downtown revitalization, and infrastructure, the city continues to attract both new residents and developers. Its central location in the region makes it ideal for those who need access to multiple cities while enjoying lower housing costs compared to Bentonville or Fayetteville.

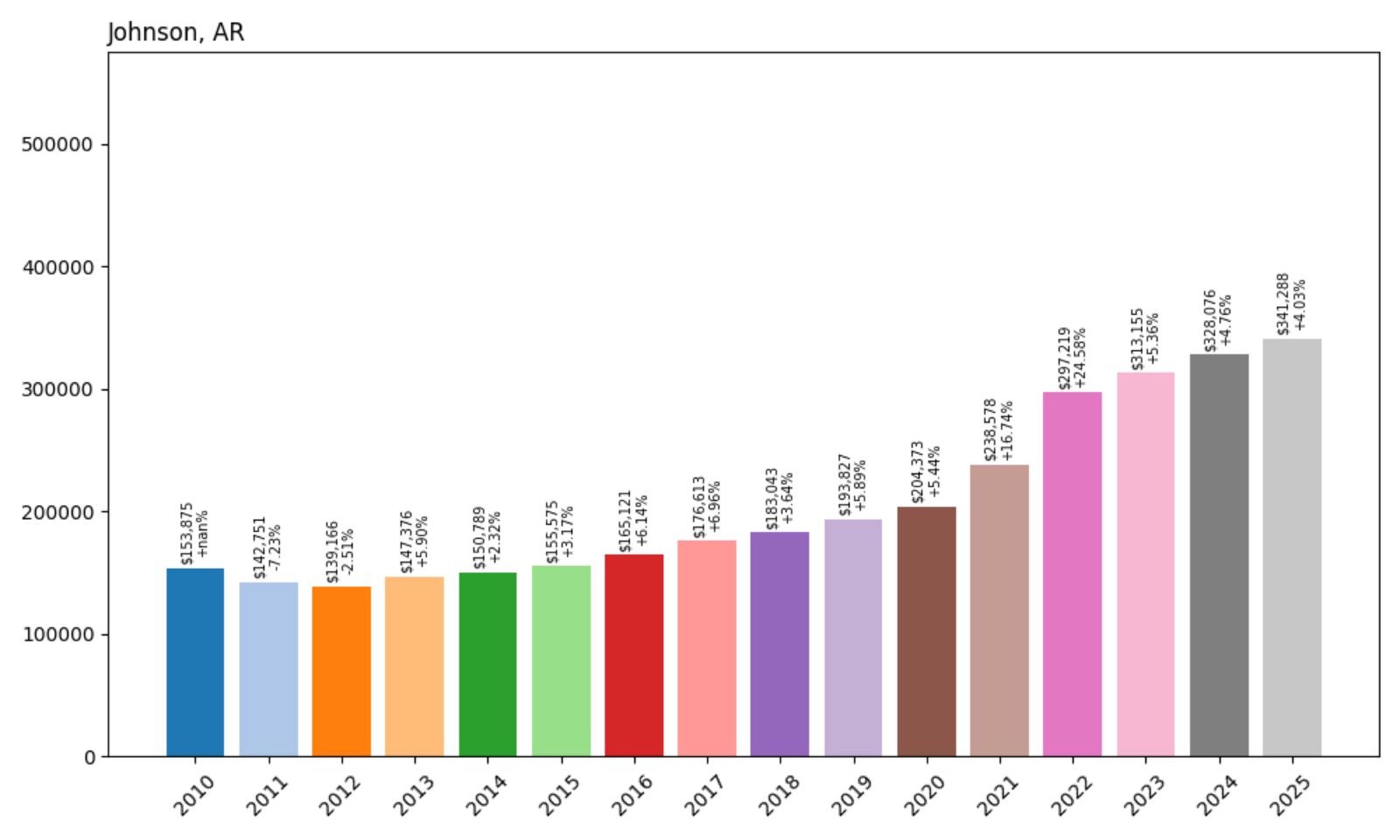

16. Johnson – 122% Home Price Increase Since 2010

- 2010: $153,875

- 2011: $142,751

- 2012: $139,166

- 2013: $147,376

- 2014: $150,789

- 2015: $155,575

- 2016: $165,121

- 2017: $176,613

- 2018: $183,043

- 2019: $193,827

- 2020: $204,373

- 2021: $238,578

- 2022: $297,219

- 2023: $313,155

- 2024: $328,076

- 2025: $341,288

Johnson has more than doubled its average home price over the past 15 years, jumping from $153K in 2010 to over $341K in 2025. The town’s strongest acceleration came between 2020 and 2022, reflecting both its central location and rapidly rising demand. Values have continued upward since, with no significant correction to date.

Johnson – Small But Central in Northwest Arkansas

Strategically nestled between Fayetteville and Springdale, Johnson is one of the most conveniently located towns in northwest Arkansas. It’s become a go-to destination for buyers who want access to both major cities without the congestion or price tag. Though the town is small in area and population, it has made the most of its location with steady development, improved roads, and commercial expansion.

New housing developments have sprung up in recent years, helping it capture part of the regional housing surge. The combination of quiet streets, proximity to jobs, and quality housing stock has made Johnson increasingly desirable.

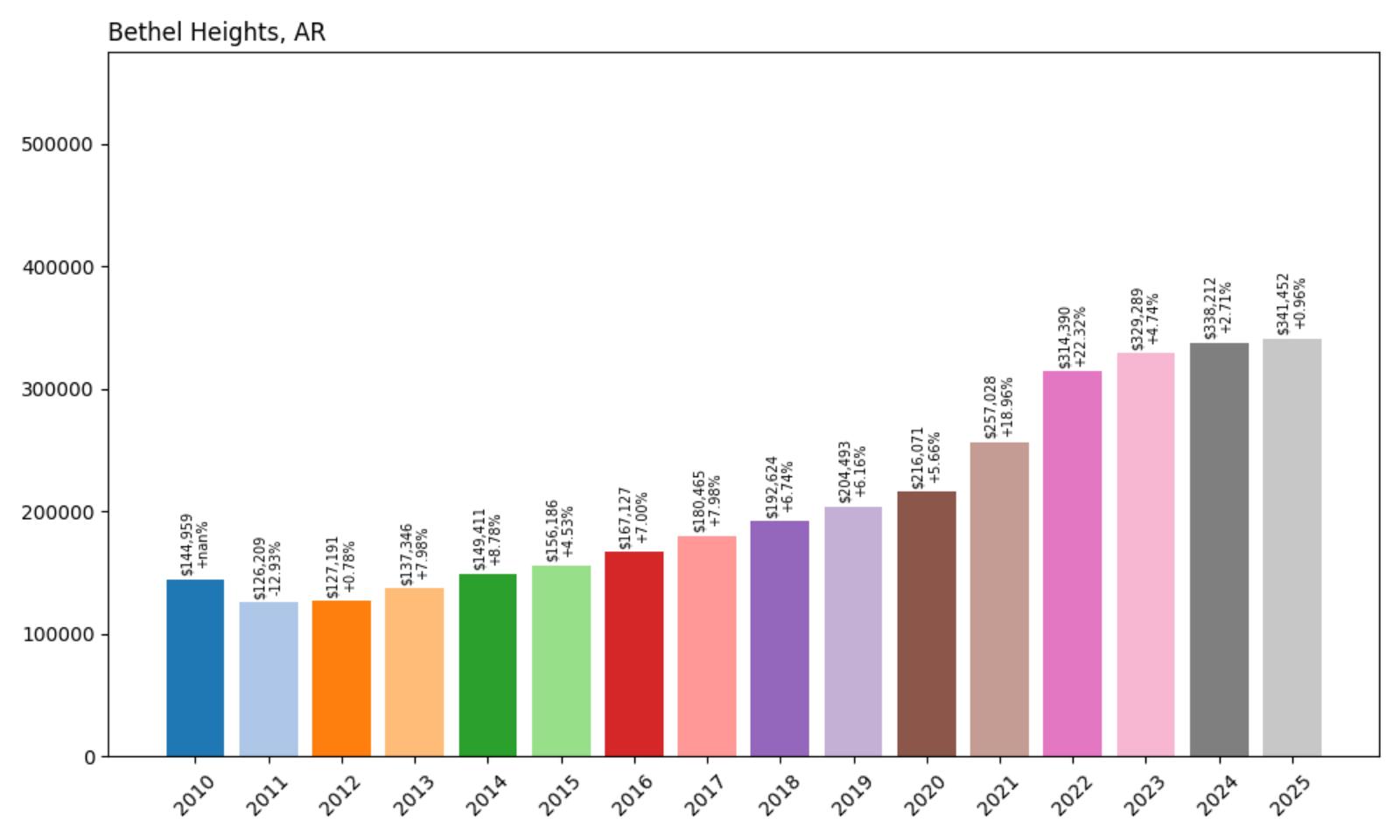

15. Bethel Heights – 135% Home Price Increase Since 2010

- 2010: $144,959

- 2011: $126,209

- 2012: $127,191

- 2013: $137,346

- 2014: $149,411

- 2015: $156,186

- 2016: $167,127

- 2017: $180,465

- 2018: $192,624

- 2019: $204,493

- 2020: $216,071

- 2021: $257,028

- 2022: $314,390

- 2023: $329,289

- 2024: $338,212

- 2025: $341,452

Bethel Heights has seen its average home value climb from $145K in 2010 to over $341K in 2025—an increase of 135%. The growth has been sharp and steady, especially post-2020, when prices jumped nearly $100K in two years. This upward trend reflects the town’s rapid suburbanization and strong regional spillover demand.

Bethel Heights – Skyrocketing Prices in a Fast-Growing Corridor

Located between Springdale and Lowell, Bethel Heights sits in the heart of one of the most rapidly developing regions in Arkansas. While historically a quiet town, its incorporation into the regional growth wave has been dramatic. As Springdale’s borders expanded, so did demand for nearby housing, making Bethel Heights a natural extension for new subdivisions.

Many of the town’s newer developments cater to middle-income families who value proximity to major employers, schools, and commercial areas. This pressure has pushed land and home values sharply upward, transforming it from a peripheral town into a legitimate residential hub. Its price growth shows how fast location and accessibility can change a town’s housing dynamic.

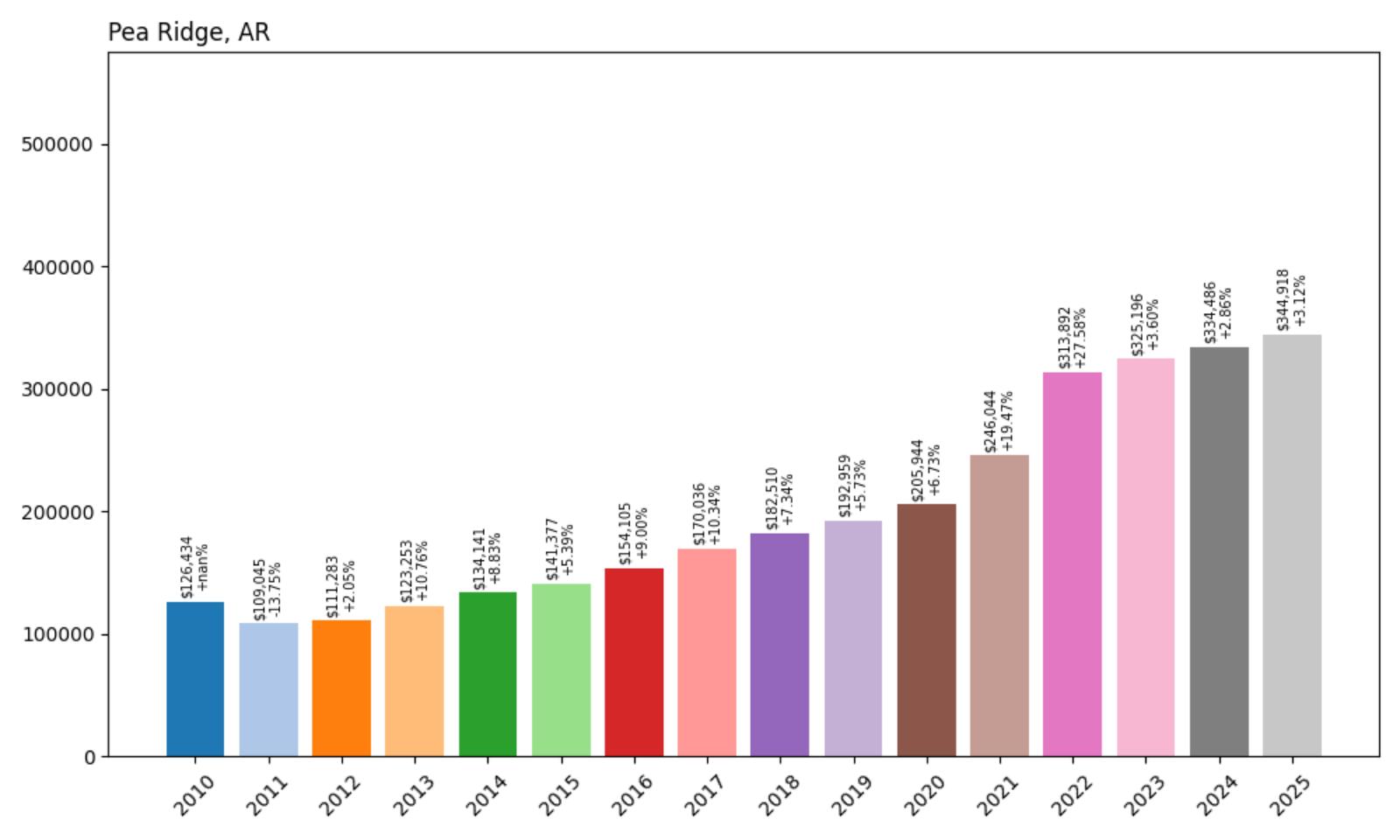

14. Pea Ridge – 173% Home Price Increase Since 2010

- 2010: $126,434

- 2011: $109,045

- 2012: $111,283

- 2013: $123,253

- 2014: $134,141

- 2015: $141,377

- 2016: $154,105

- 2017: $170,036

- 2018: $182,510

- 2019: $192,959

- 2020: $205,944

- 2021: $246,044

- 2022: $313,892

- 2023: $325,196

- 2024: $334,486

- 2025: $344,918

Home prices in Pea Ridge have nearly tripled since 2010, increasing from $126K to almost $345K. That’s a 173% increase over 15 years, with the steepest jump happening between 2020 and 2022. Demand has remained high even as the market began stabilizing statewide.

Pea Ridge – Rural Roots, Regional Momentum

Would you like to save this?

Pea Ridge has managed to retain its small-town charm while becoming one of the hottest real estate markets in northwest Arkansas. Known for its strong school system and proximity to the Pea Ridge National Military Park, the town offers a mix of community feel and access to nature. Yet the real game-changer has been its location. Just a short drive from Bentonville and Rogers, it has become a prime destination for buyers priced out of those cities. Subdivisions have cropped up rapidly, but demand still outpaces supply, driving prices higher. That balance of space, convenience, and affordability has put Pea Ridge squarely on buyers’ radar.

Local leaders have invested in infrastructure and zoning updates to support the housing influx, and that’s encouraged more developers to bet on the town. As Pea Ridge becomes more connected to the larger metro area, its homes are no longer seen as rural outliers—they’re considered smart, strategic purchases. While housing costs have risen quickly, many still see the town as offering relative value for the region. That perception, backed by growth in schools and services, ensures Pea Ridge will remain a key part of the northwest Arkansas housing story in years to come.

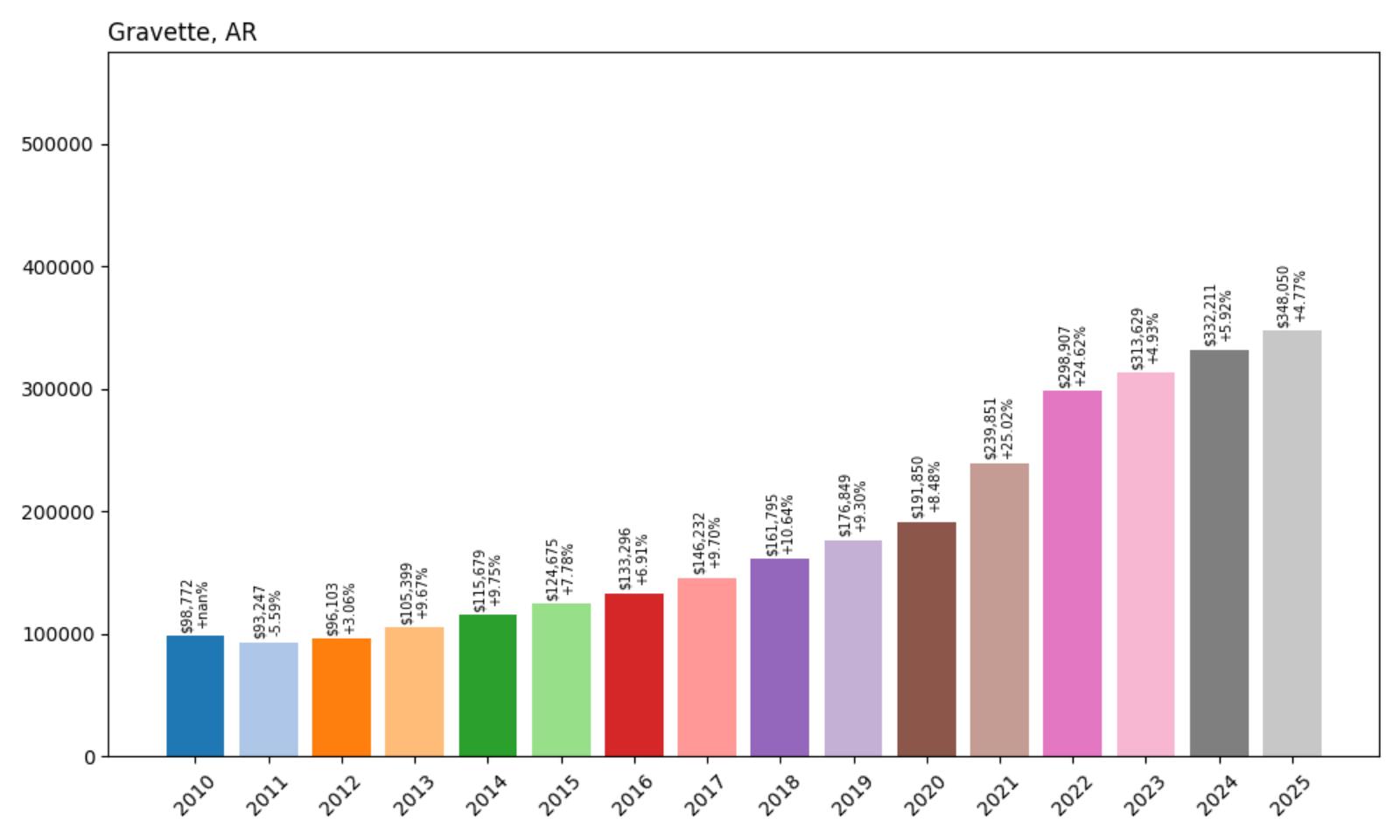

13. Gravette – 252% Home Price Increase Since 2010

- 2010: $98,772

- 2011: $93,247

- 2012: $96,103

- 2013: $105,399

- 2014: $115,679

- 2015: $124,675

- 2016: $133,296

- 2017: $146,232

- 2018: $161,795

- 2019: $176,849

- 2020: $191,850

- 2021: $239,851

- 2022: $298,907

- 2023: $313,629

- 2024: $332,211

- 2025: $348,050

Gravette’s home values have soared by over 250% since 2010, making it one of the biggest gainers on this entire list. The average home price has risen from just under $100K to nearly $350K in 2025. The steady year-over-year gains reflect growing regional demand and its proximity to Benton County growth centers.

Gravette – From Affordable Outpost to High-Demand Market

Once viewed as one of the more affordable corners of Benton County, Gravette has transformed rapidly. With major job centers only a short drive away, homebuyers have flocked here in search of lower prices and more space. As demand poured into the region, the gap between Gravette and its neighbors began to narrow. Developers responded with new construction, yet the influx has continued to push prices higher. Buyers who saw the opportunity early have seen significant appreciation in just a few years. It’s no longer a secret that Gravette is a high-potential growth market.

Community investment has also played a role. The town has expanded its school facilities, improved its parks, and built out infrastructure to support its rising population. These changes have only strengthened its appeal. What was once farmland and open space now hosts subdivisions and families settling in for the long term. Gravette’s success isn’t a fluke—it’s a case study in how affordability, geography, and timing can intersect to create a real estate boom.

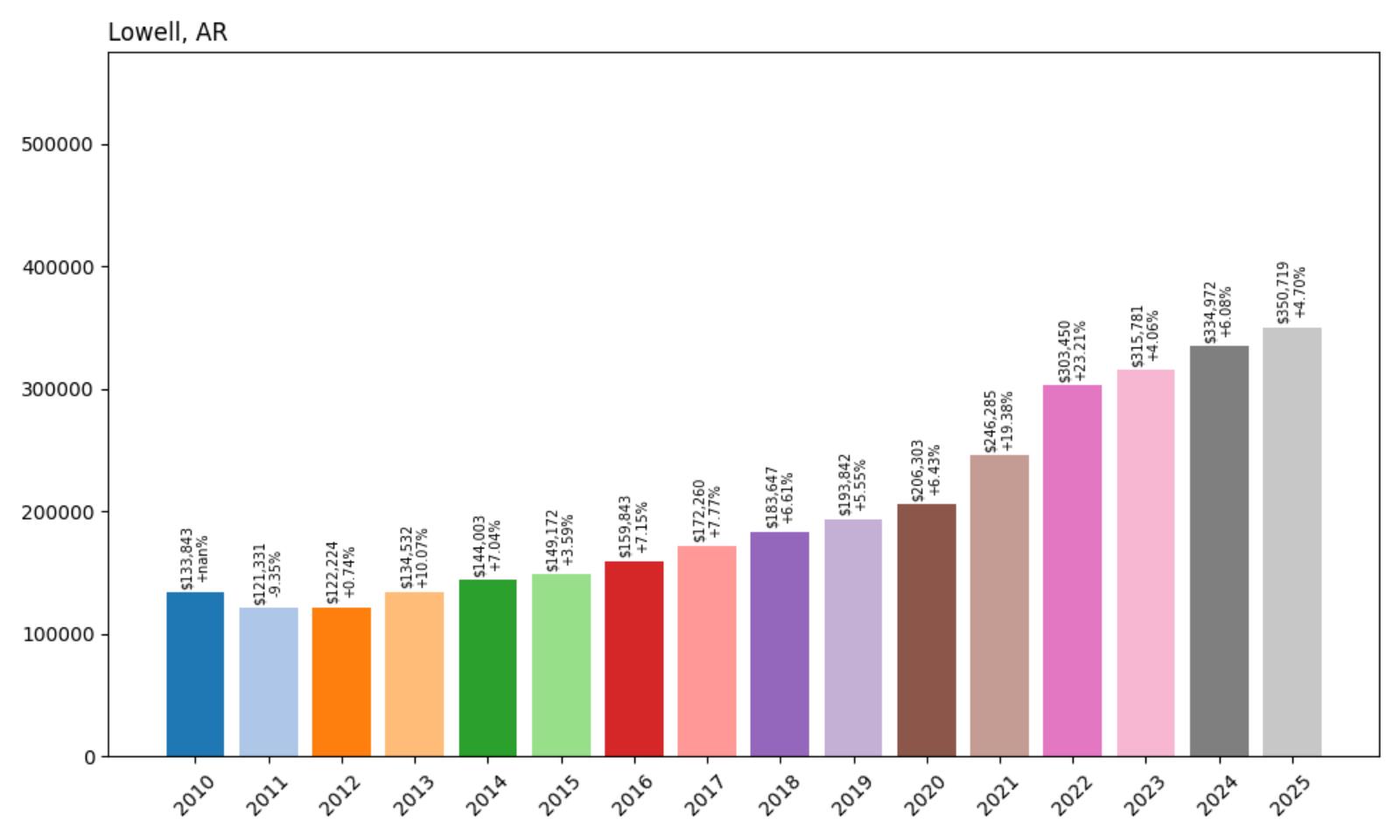

12. Lowell – 162% Home Price Increase Since 2010

- 2010: $133,843

- 2011: $121,331

- 2012: $122,224

- 2013: $134,532

- 2014: $144,003

- 2015: $149,172

- 2016: $159,843

- 2017: $172,260

- 2018: $183,647

- 2019: $193,842

- 2020: $206,303

- 2021: $246,285

- 2022: $303,450

- 2023: $315,781

- 2024: $334,972

- 2025: $350,719

Lowell’s average home price has surged more than 160% since 2010, rising from around $134K to over $350K in 2025. The sharpest acceleration occurred after 2020, when prices rose by more than $100,000 in just three years. That trajectory underscores the town’s evolving role within northwest Arkansas.

Lowell – Centered Between Giants, Fueled by Spillover

Positioned almost exactly between Fayetteville and Rogers, Lowell has become a strategic housing choice for commuters, families, and investors. It has historically flown under the radar, but rising prices in surrounding cities pushed buyers to reconsider Lowell’s potential. That shift has created a wave of interest that continues to reshape the local market. With access to I-49 and the region’s largest employers, residents can easily move in any direction. The town also offers newer housing stock, making it especially appealing to younger buyers looking for move-in-ready homes. What Lowell lacks in name recognition, it makes up for in livability and convenience.

The city has responded to this growth with new commercial development and public services, helping it shed its reputation as a pass-through town. As more buyers search for alternatives to Fayetteville and Bentonville, Lowell consistently ranks high on affordability and location. That combination has pushed prices steadily upward, with 2025 values now rivaling some larger cities in the region. With more planned development and continued buyer interest, Lowell’s growth is likely far from over.

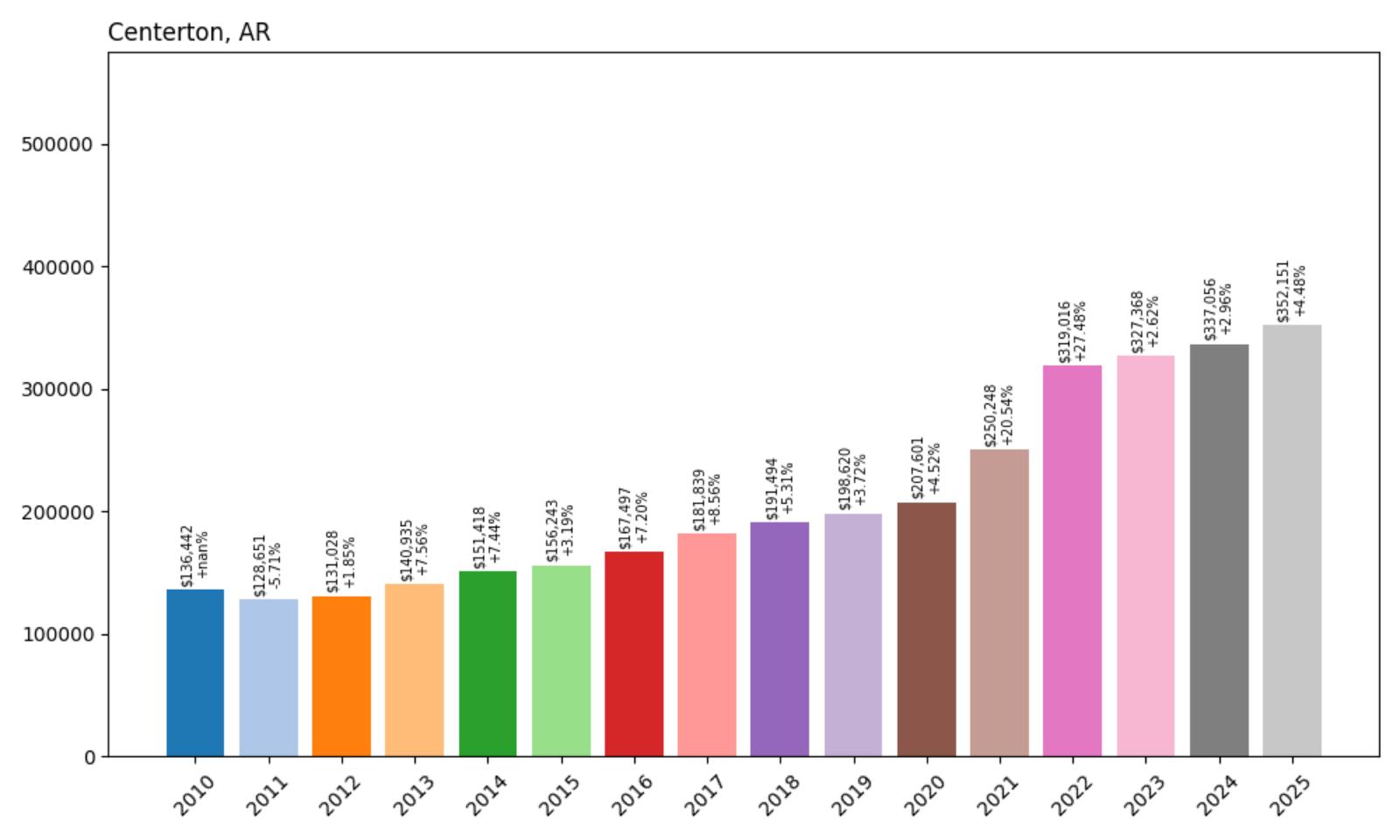

11. Centerton – 158% Home Price Increase Since 2010

- 2010: $136,442

- 2011: $128,651

- 2012: $131,028

- 2013: $140,935

- 2014: $151,418

- 2015: $156,243

- 2016: $167,497

- 2017: $181,839

- 2018: $191,494

- 2019: $198,620

- 2020: $207,601

- 2021: $250,248

- 2022: $319,016

- 2023: $327,368

- 2024: $337,056

- 2025: $352,151

Centerton’s home values have jumped from $136K to over $352K since 2010—a 158% increase. That growth has been especially strong since 2020, driven by demand spilling over from neighboring Bentonville. The housing market here shows no signs of losing momentum.

Centerton – Booming Bedroom Community Near Bentonville

Centerton has become a favorite for buyers priced out of Bentonville but still wanting access to its schools and employers. Just 15 minutes from Walmart’s corporate campus, the town has seen a wave of new development to accommodate rising demand. Builders have responded with large-scale subdivisions, giving buyers newer options at slightly more affordable prices. The schools, infrastructure, and proximity to amenities make it a smart choice for families. This surge in desirability has kept price growth high while maintaining a stable resale market. As Benton County booms, Centerton is one of the clearest beneficiaries of that momentum.

The town has embraced its role as a fast-growing suburb with a strong emphasis on quality of life. Parks, schools, and community planning have made Centerton feel less like an overflow market and more like a destination in itself. Its price trajectory reflects that shift. As long as northwest Arkansas remains one of the state’s economic powerhouses, Centerton’s appeal will remain strong—and so will its home values.

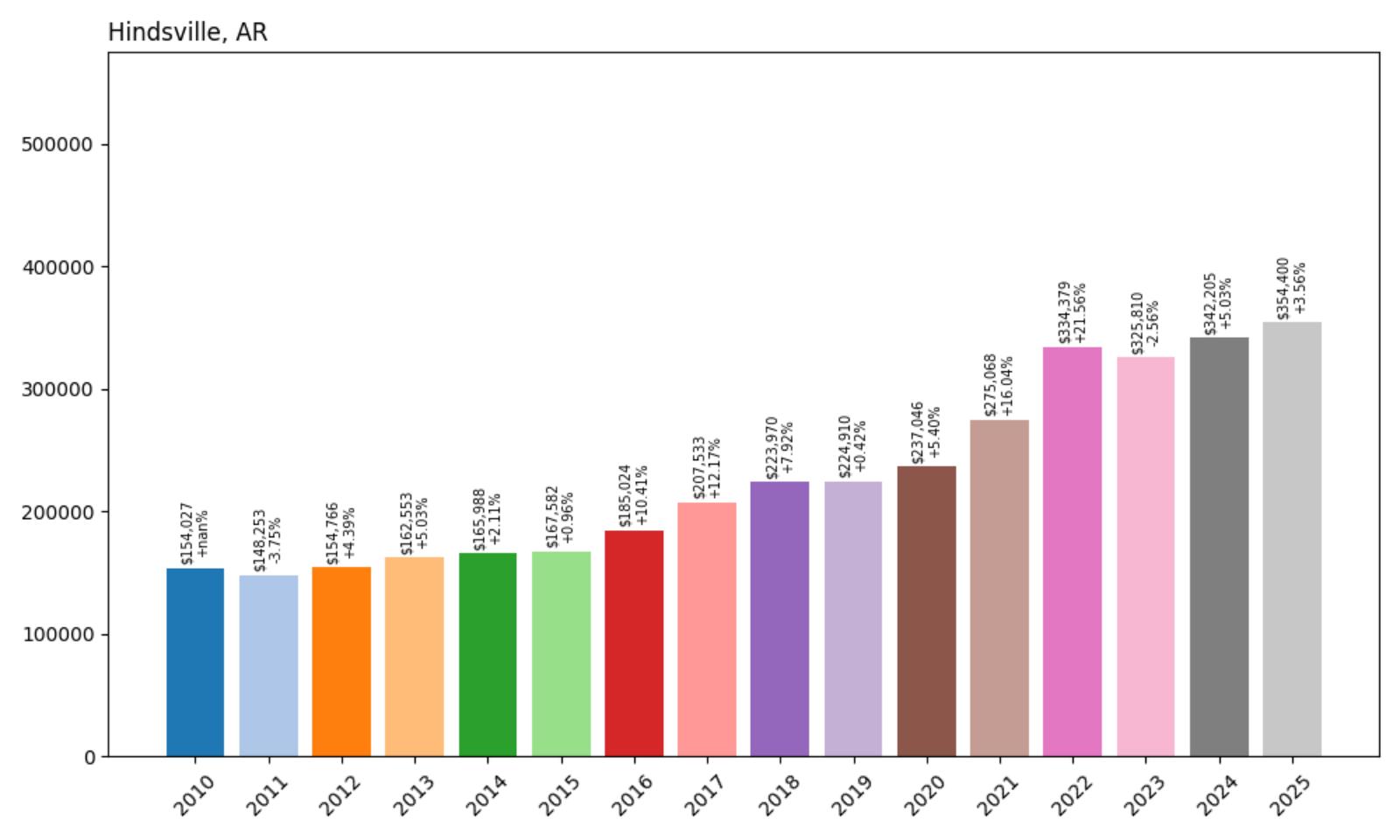

10. Hindsville – 130% Home Price Increase Since 2010

- 2010: $154,027

- 2011: $148,253

- 2012: $154,766

- 2013: $162,553

- 2014: $165,988

- 2015: $167,582

- 2016: $185,024

- 2017: $207,533

- 2018: $223,970

- 2019: $224,910

- 2020: $237,046

- 2021: $275,068

- 2022: $334,379

- 2023: $325,810

- 2024: $342,205

- 2025: $354,400

Since 2010, home values in Hindsville have surged from $154,027 to $354,400—a 130% increase. The town saw a steady climb through the 2010s, but prices truly took off after 2020. Even a small dip in 2023 didn’t stop the long-term trend upward, reflecting consistent demand in this quiet part of northwest Arkansas.

Hindsville – Strong Post-2020 Growth in a Rural Setting

Hindsville may be a small, rural community in Madison County, but recent price trends show it’s no longer off the radar. The post-pandemic housing boom reached all corners of the region, and Hindsville saw some of its largest single-year gains between 2020 and 2022—especially the 21.5% spike in 2022 alone. That kind of momentum in a town without major urban development suggests that buyers are being drawn in by affordability, open space, or proximity to larger cities like Fayetteville and Springdale. The town’s relative calm and small-town feel may be exactly what today’s remote workers or retirees are looking for.

While prices cooled slightly in 2023, Hindsville quickly rebounded in 2024 and 2025, proving that the demand wasn’t a short-lived trend. Its location, tucked between the Ozark National Forest and major job markets in northwest Arkansas, makes it attractive for buyers priced out of other towns. The solid gains across multiple years show this isn’t just a blip—it’s a shift. Hindsville’s value proposition is clear, and buyers appear to be taking notice.

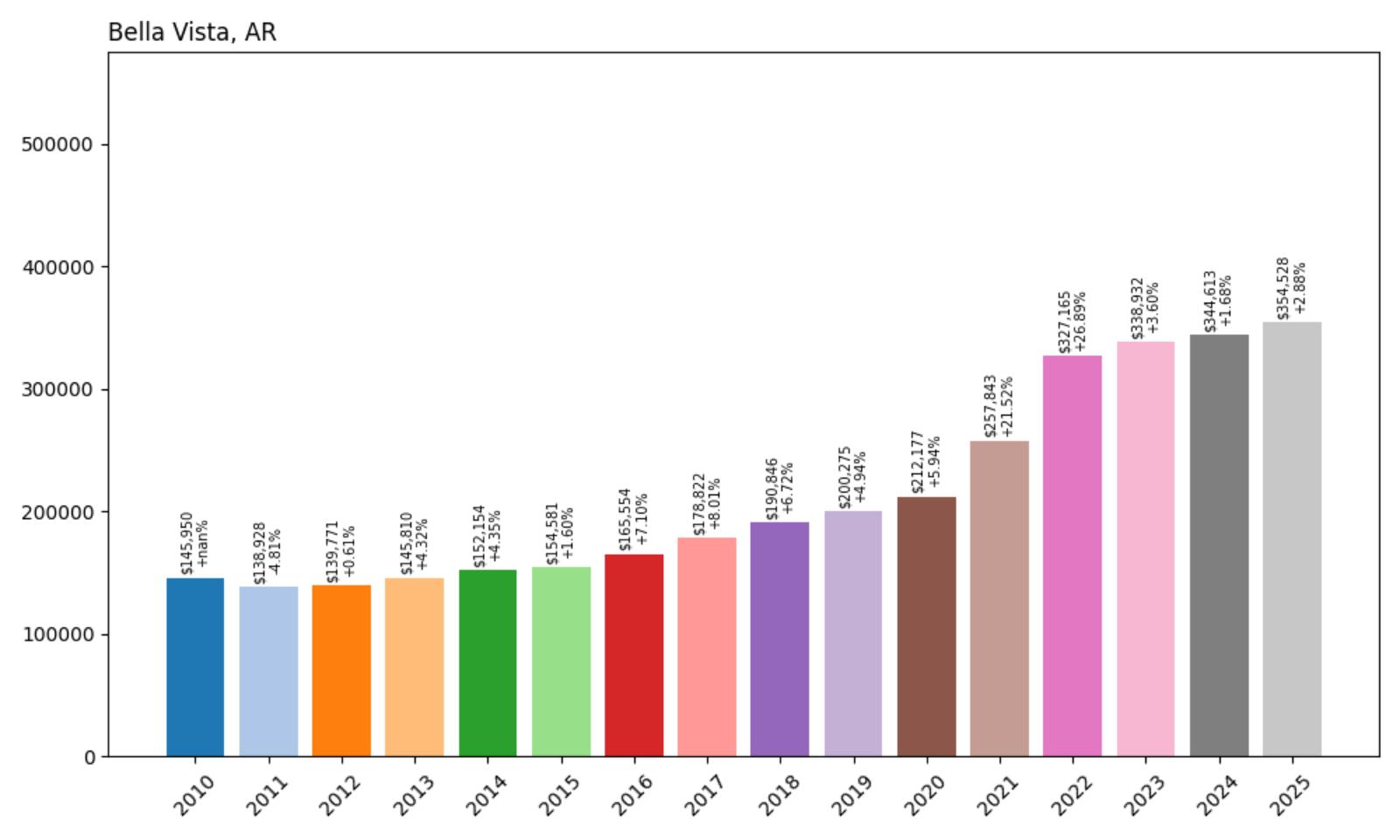

9. Bella Vista – 143% Home Price Increase Since 2010

- 2010: $145,950

- 2011: $138,928

- 2012: $139,771

- 2013: $145,810

- 2014: $152,154

- 2015: $154,581

- 2016: $165,554

- 2017: $178,822

- 2018: $190,846

- 2019: $200,275

- 2020: $212,177

- 2021: $257,843

- 2022: $327,165

- 2023: $338,932

- 2024: $344,613

- 2025: $354,528

Bella Vista home prices have climbed from $145,950 in 2010 to $354,528 in 2025, marking a 143% increase. Price appreciation accelerated sharply after 2020, with 2022 alone showing a massive 26.9% jump. Even with cooling since then, values have remained stable and strong.

Bella Vista – Golf, Lakes, and High Buyer Interest

Bella Vista has been one of northwest Arkansas’s most desirable communities for years, thanks to its abundance of lakes, golf courses, and scenic trails. But the housing data shows it wasn’t just quality of life—it was affordability, too.

The big leap in prices post-2020, especially in 2021 and 2022, signals rising demand not just from retirees but also from younger families and remote workers seeking access to nature and amenities. When a town with such a solid reputation still offers homes under $400K, buyers take notice.

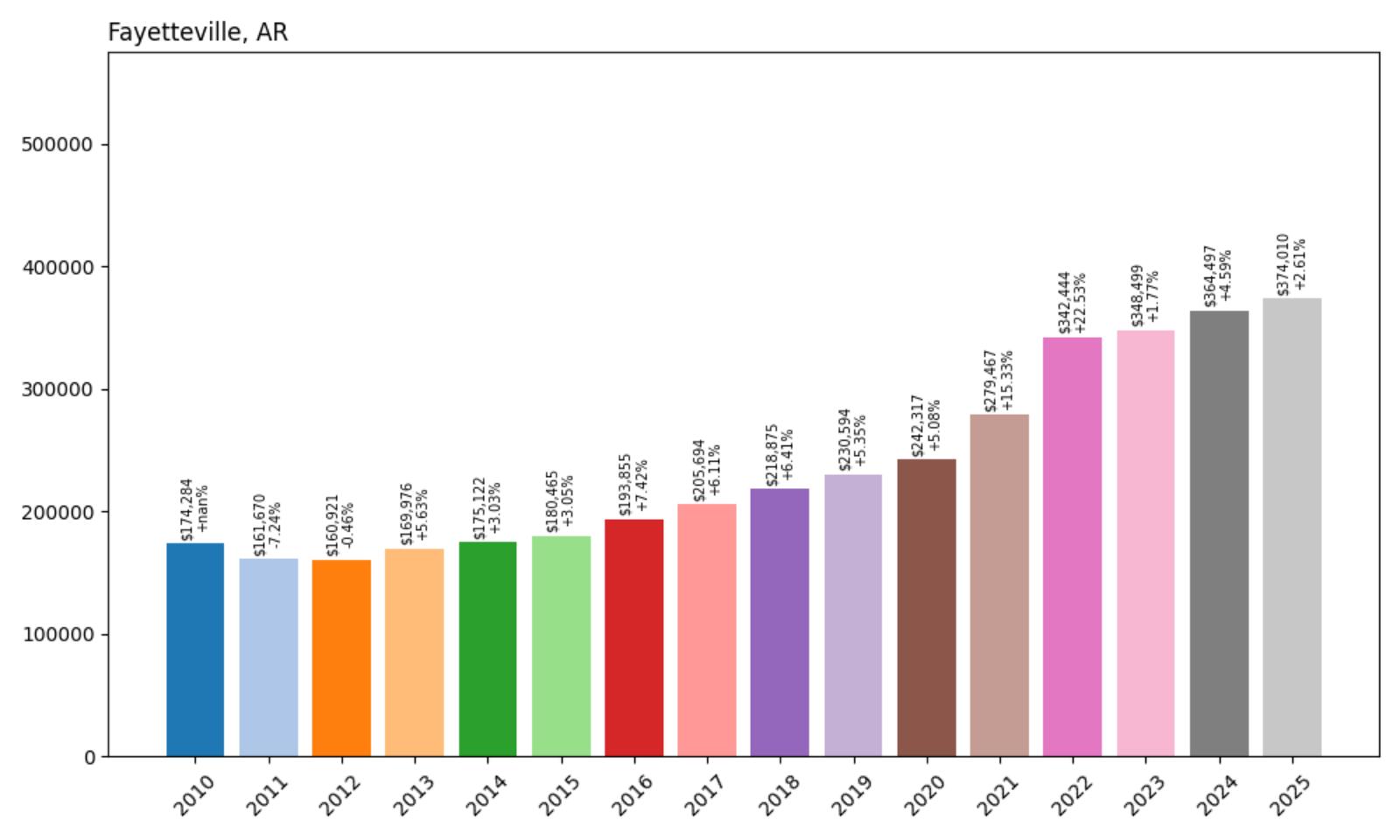

8. Fayetteville – 114% Home Price Increase Since 2010

- 2010: $174,284

- 2011: $161,670

- 2012: $160,921

- 2013: $169,976

- 2014: $175,122

- 2015: $180,465

- 2016: $193,855

- 2017: $205,694

- 2018: $218,875

- 2019: $230,594

- 2020: $242,317

- 2021: $279,467

- 2022: $342,444

- 2023: $348,499

- 2024: $364,497

- 2025: $374,010

Home values in Fayetteville more than doubled over the past 15 years, growing from $174,284 in 2010 to $374,010 in 2025. The most significant price gains came between 2020 and 2022, when buyers flooded the market and pushed values up by over $100,000 in just two years. Since then, price growth has moderated but continued to trend upward.

Fayetteville – Consistent Demand in a College Town

Fayetteville is home to the University of Arkansas, which has always helped stabilize its housing market. But the data shows the real surge began around 2020, when remote work made it easier for people to live in smaller cities with better quality of life. The sharp increase between 2020 and 2022 reflects new interest from both out-of-state buyers and regional movers. Fayetteville’s mix of cultural amenities, walkability, and access to the Ozarks gives it an edge in a crowded market.

Even though growth slowed after 2022, the gains have continued steadily, suggesting the town’s housing market remains strong and sustainable. The 2025 average home price of $374,010 still puts it within reach for many buyers compared to larger metros. As long as the university remains a local anchor and demand for northwest Arkansas continues, Fayetteville’s real estate will likely remain a solid bet.

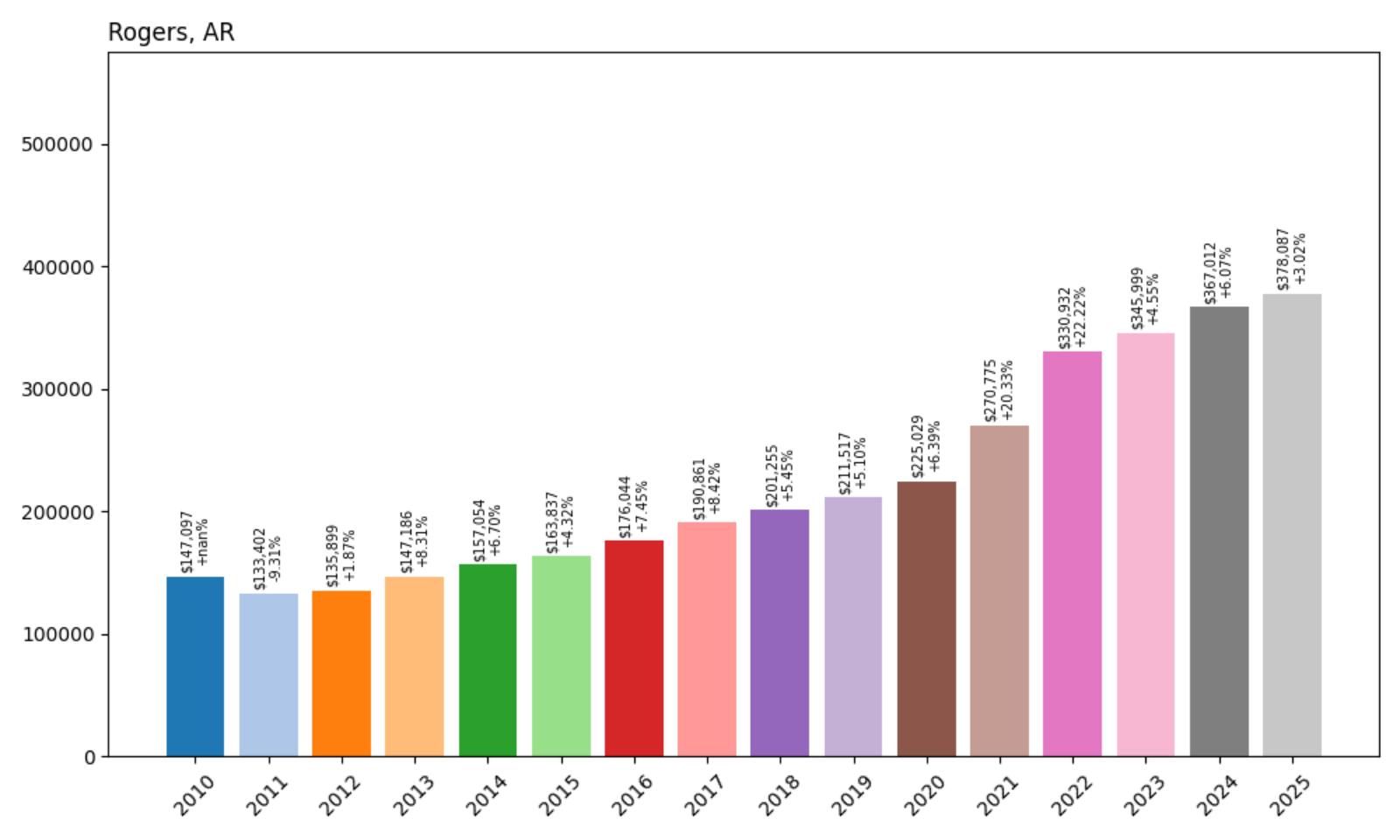

7. Rogers – 157% Home Price Increase Since 2010

- 2010: $147,097

- 2011: $133,402

- 2012: $135,899

- 2013: $147,186

- 2014: $157,054

- 2015: $163,837

- 2016: $176,044

- 2017: $190,861

- 2018: $201,255

- 2019: $211,517

- 2020: $225,029

- 2021: $270,775

- 2022: $330,932

- 2023: $345,999

- 2024: $367,012

- 2025: $378,087

Rogers home prices rose from $147,097 in 2010 to $378,087 in 2025—a 157% increase. The market saw consistent growth through the 2010s before accelerating sharply after 2020. Each year has delivered solid gains, particularly during the pandemic-era buying wave of 2020–2022.

Rogers – Fast-Growing Retail and Commercial Hub

Rogers has grown into one of northwest Arkansas’s top commercial and residential hubs. With major employers, shopping centers, and recreational spots like Lake Atalanta, it’s no surprise the housing market has boomed. After modest year-over-year growth through the mid-2010s, Rogers took off in 2020 with a $45,000 jump and never looked back. The largest single-year leap came in 2022 with a $60,000 increase—clear evidence of intensified demand and migration into the region.

Unlike some towns that saw price drops, Rogers has continued its upward trend through 2025. The consistent growth and lack of any decline suggest a resilient market backed by jobs, infrastructure, and steady population growth. Its central location between Bentonville and Fayetteville adds to the appeal, drawing buyers who want proximity to amenities without the higher prices of neighboring hotspots.

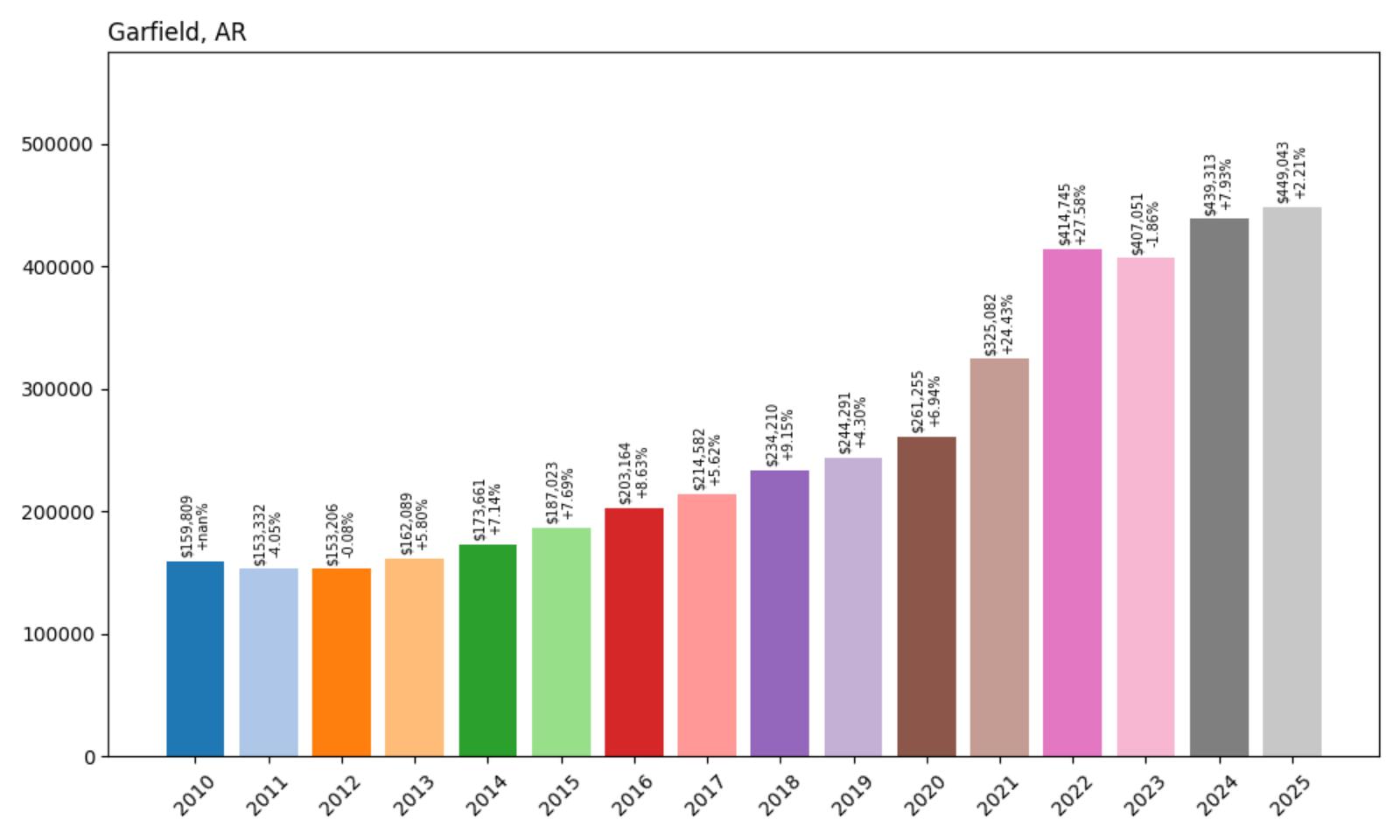

6. Garfield – 181% Home Price Increase Since 2010

- 2010: $159,809

- 2011: $153,332

- 2012: $153,206

- 2013: $162,089

- 2014: $173,661

- 2015: $187,023

- 2016: $203,164

- 2017: $214,582

- 2018: $234,210

- 2019: $244,291

- 2020: $261,255

- 2021: $325,082

- 2022: $414,745

- 2023: $407,051

- 2024: $439,313

- 2025: $449,043

Garfield home prices jumped from $159,809 in 2010 to $449,043 in 2025—a gain of 181%. While the rise was steady through the early years, the biggest jump came in 2021 and 2022, when the town added over $150,000 in value in just two years. Even after a brief dip in 2023, the market bounced back with strong gains.

Garfield – Remote Living with Soaring Appeal

Garfield is located in the northeastern corner of Benton County, close to the Missouri border and surrounded by nature. It’s long been a quiet, sparsely populated area—but that seems to be changing. Between 2020 and 2022, the town experienced back-to-back double-digit increases, reflecting new attention from buyers wanting rural living within range of city conveniences. Its appeal is in its balance: solitude without total isolation.

The dip in 2023 might have been cause for concern in another market, but Garfield shrugged it off and came roaring back with nearly $42,000 in gains across 2024 and 2025. As more buyers are priced out of places like Bentonville, they’re looking to nearby options like Garfield. With stunning views, access to Beaver Lake, and fewer zoning restrictions, it’s a town that feels both remote and increasingly relevant.

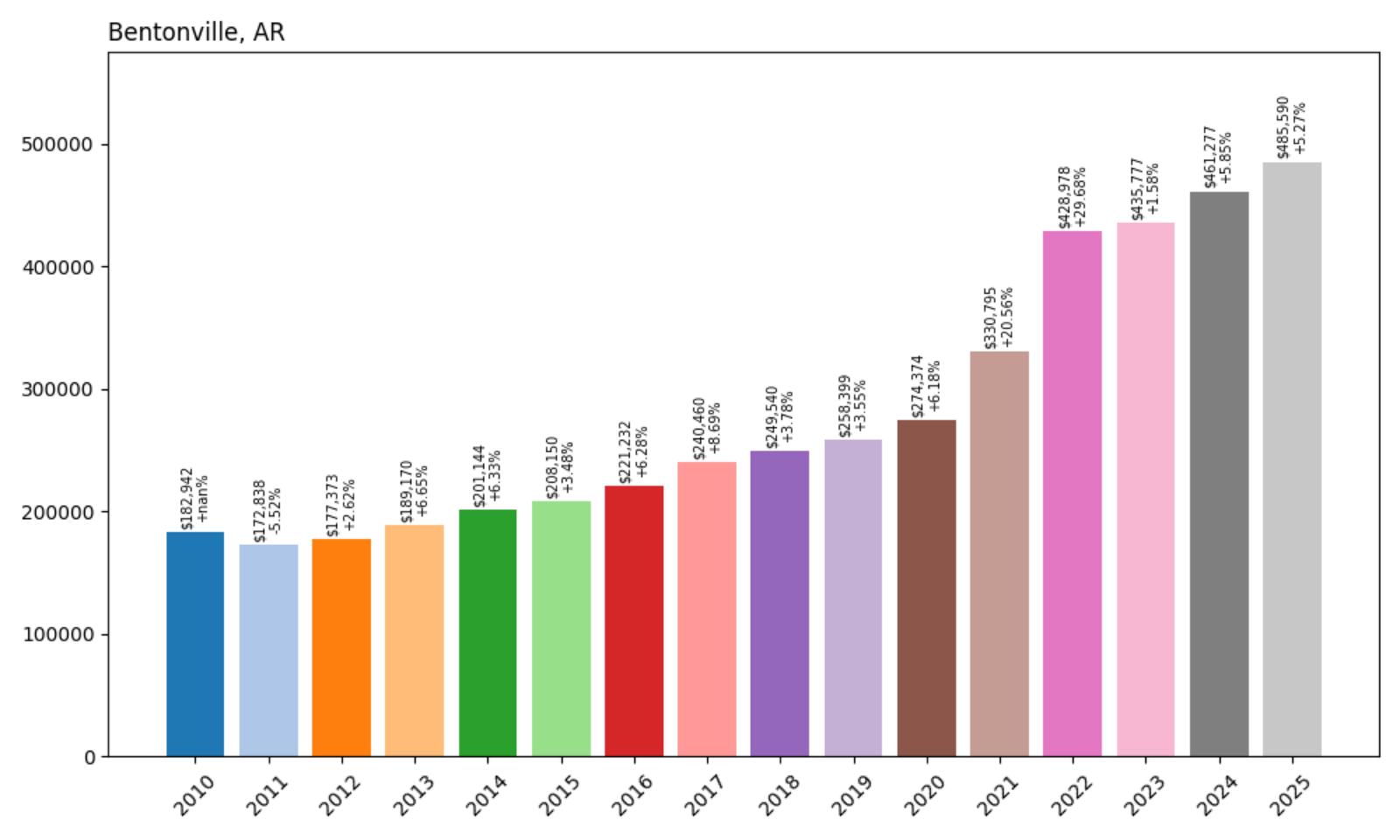

5. Bentonville – 165% Home Price Increase Since 2010

- 2010: $182,942

- 2011: $172,838

- 2012: $177,373

- 2013: $189,170

- 2014: $201,144

- 2015: $208,150

- 2016: $221,232

- 2017: $240,460

- 2018: $249,540

- 2019: $258,399

- 2020: $274,374

- 2021: $330,795

- 2022: $428,978

- 2023: $435,777

- 2024: $461,277

- 2025: $485,590

Home values in Bentonville rose from $182,942 in 2010 to $485,590 in 2025—a 165% increase. Prices grew steadily across the decade, with a dramatic spike between 2020 and 2022 that added over $150,000 to the average home price. Even as the market cooled slightly, growth continued through 2025.

Bentonville – Home of Walmart and Relocation Boom

Bentonville is known nationwide as the headquarters of Walmart, and that corporate presence continues to fuel its real estate market. Major investments, high-paying jobs, and robust infrastructure have turned this small city into an economic engine of northwest Arkansas. The sharp increase in prices after 2020 reflects an influx of new residents, often relocating professionals from other states seeking affordability and opportunity. Housing demand surged as corporate growth outpaced local housing development.

Even after the largest jumps in 2021 and 2022, the momentum never stalled. Prices climbed again in 2024 and 2025, showing that demand has remained strong. The town offers excellent public amenities, a growing arts scene, and proximity to scenic trails and lakes. All of this makes Bentonville not only a business center but also an attractive place to settle down, keeping its real estate market hot year after year.

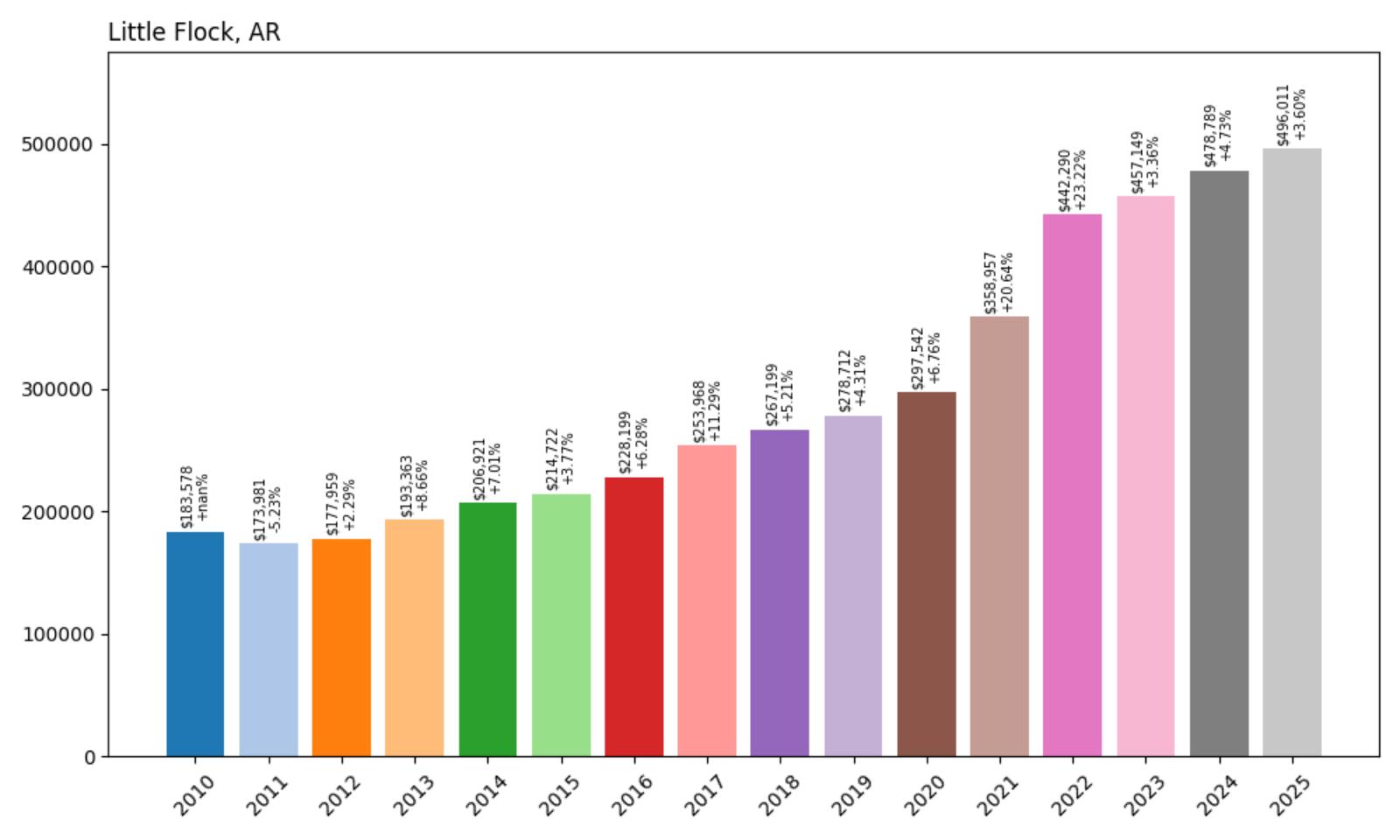

4. Little Flock – 170% Home Price Increase Since 2010

- 2010: $183,578

- 2011: $173,981

- 2012: $177,959

- 2013: $193,363

- 2014: $206,921

- 2015: $214,722

- 2016: $228,199

- 2017: $253,968

- 2018: $267,199

- 2019: $278,712

- 2020: $297,542

- 2021: $358,957

- 2022: $442,290

- 2023: $457,149

- 2024: $478,789

- 2025: $496,011

Little Flock home prices rose from $183,578 in 2010 to $496,011 in 2025, representing a 170% increase. Most of the growth came after 2020, with values rising more than $140,000 in just two years. Prices have continued to climb at a slower but steady pace since then.

Little Flock – Quiet Suburb with Soaring Demand

Once a quiet and relatively low-profile suburb of Rogers, Little Flock has seen its housing market explode in recent years. The town’s location near major highways and proximity to Bentonville and Rogers make it a prime spot for commuters. As homebuyers sought alternatives to pricier markets nearby, Little Flock became an appealing middle ground—accessible, affordable (at least initially), and increasingly in demand. The surge in 2021 and 2022 was especially steep, showing how quickly investor and buyer attention shifted here.

Unlike some markets that saw corrections, Little Flock kept climbing. From 2023 to 2025, the average price jumped nearly $39,000, indicating sustained interest and low inventory. With scenic rolling hills, modest tax rates, and access to top employment centers, it’s a location with staying power. For those priced out of core cities, Little Flock represents a solid blend of convenience and growth potential.

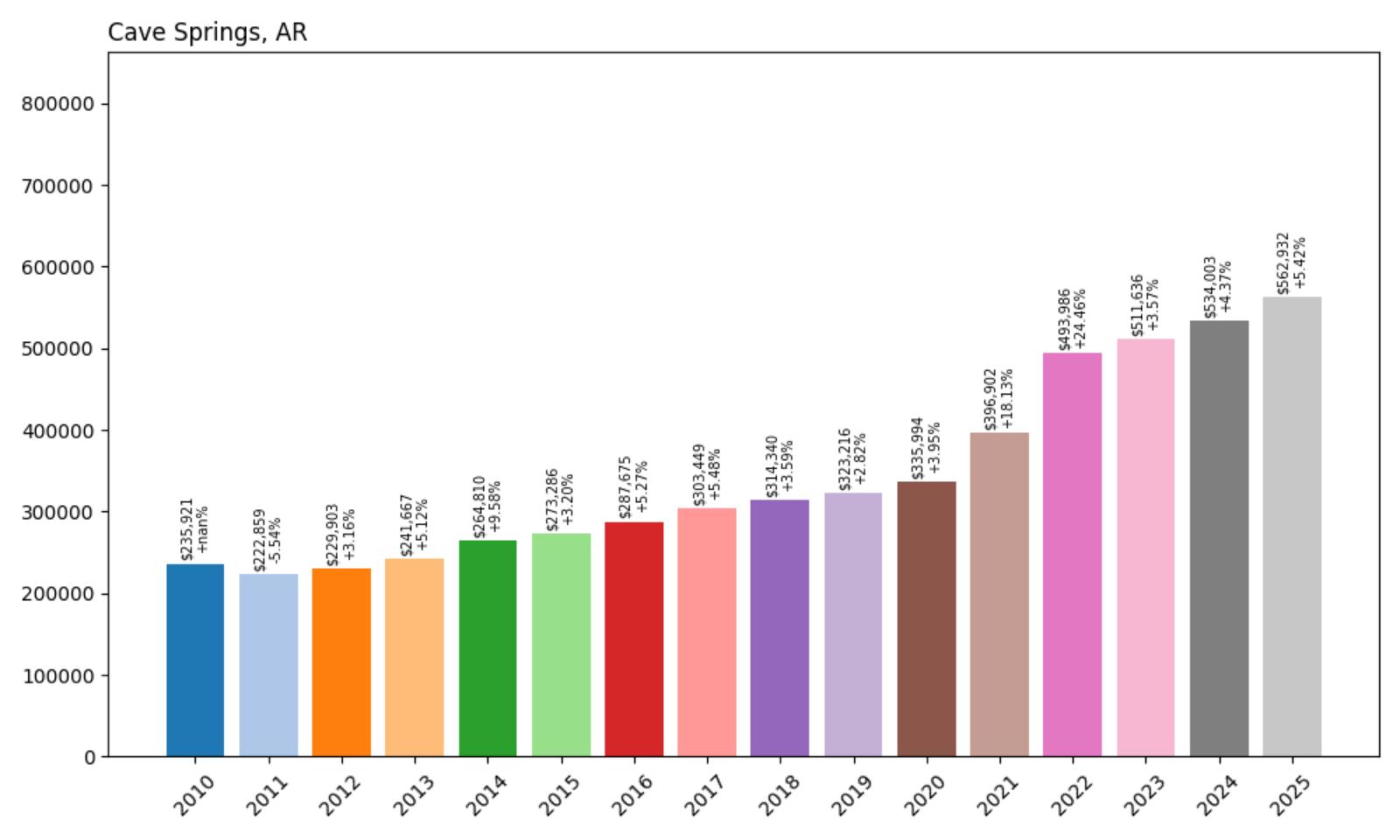

3. Cave Springs – 138% Home Price Increase Since 2010

- 2010: $235,921

- 2011: $222,859

- 2012: $229,903

- 2013: $241,667

- 2014: $264,810

- 2015: $273,286

- 2016: $287,675

- 2017: $303,449

- 2018: $314,340

- 2019: $323,216

- 2020: $335,994

- 2021: $396,902

- 2022: $493,986

- 2023: $511,636

- 2024: $534,003

- 2025: $562,932

Cave Springs home prices grew from $235,921 in 2010 to $562,932 in 2025—a 138% increase. The biggest jump occurred between 2020 and 2022, when the town added nearly $158,000 in value. Price growth has continued since, though at a more moderate pace.

Cave Springs – Upscale Growth with Small-Town Appeal

One of the most desirable residential areas in northwest Arkansas, Cave Springs has built a reputation for upscale developments and scenic living. Located just minutes from Bentonville and Rogers, the town draws families and professionals looking for new construction and excellent schools. The numbers clearly show a market that heated up fast—especially in 2021 and 2022, when new subdivisions and rising land values pushed the average home price up sharply.

Despite rapid growth, the town has maintained its quiet charm, with community events, open spaces, and easy access to natural areas like the Osage Creek. From 2023 through 2025, home prices continued climbing—adding over $51,000 in just three years. With limited land, strong demand, and high build quality, Cave Springs looks poised to remain one of Arkansas’s priciest housing markets.

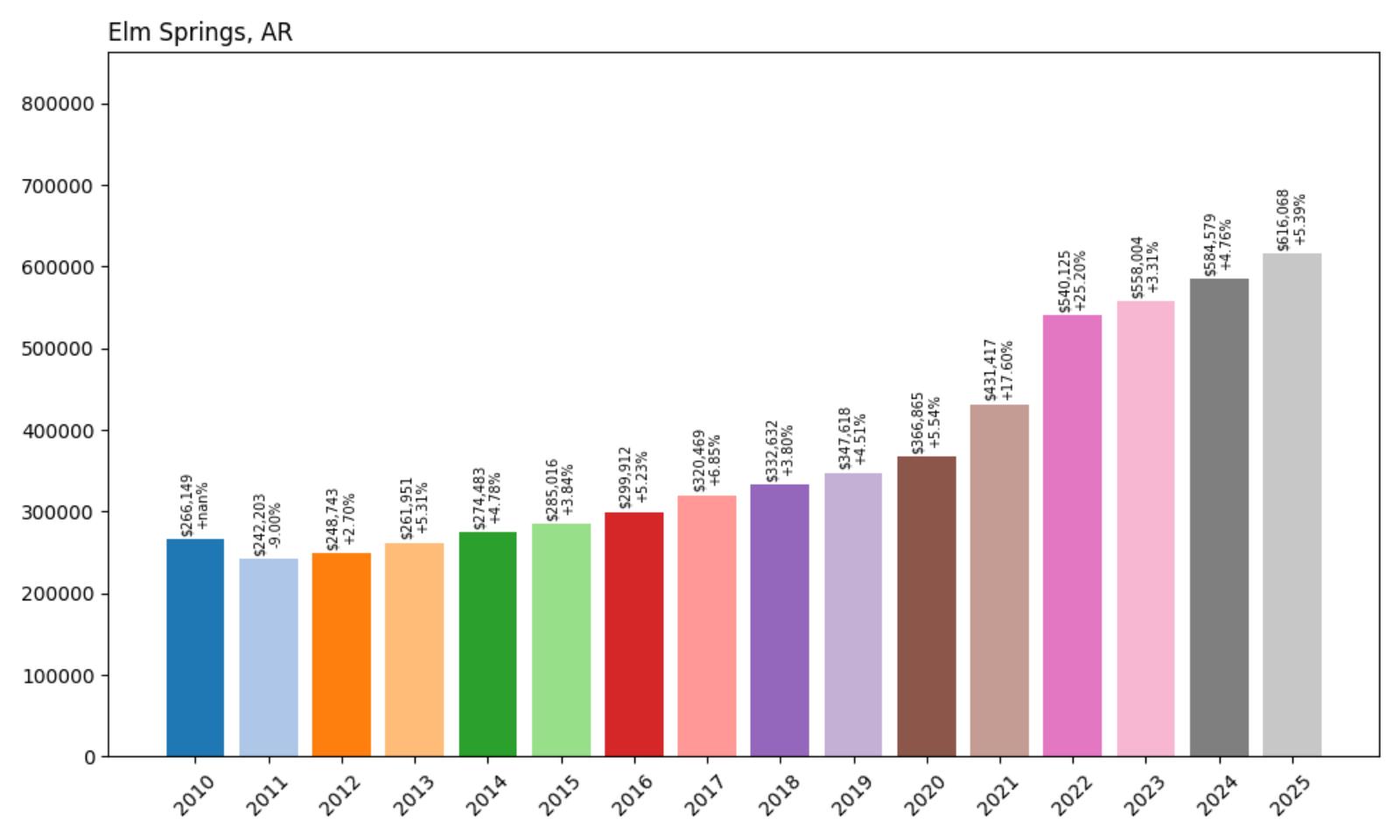

2. Elm Springs – 131% Home Price Increase Since 2010

- 2010: $266,149

- 2011: $242,203

- 2012: $248,743

- 2013: $261,951

- 2014: $274,483

- 2015: $285,016

- 2016: $299,912

- 2017: $320,469

- 2018: $332,632

- 2019: $347,618

- 2020: $366,865

- 2021: $431,417

- 2022: $540,125

- 2023: $558,004

- 2024: $584,579

- 2025: $616,068

Home prices in Elm Springs increased from $266,149 in 2010 to $616,068 in 2025—a 131% rise. The largest gains came between 2020 and 2022, when prices skyrocketed by over $170,000. Even after the peak surge, prices have continued to trend upward each year.

Elm Springs – Rural Setting, Luxury Growth

Elm Springs blends a rural setting with suburban access, and in recent years it’s become a magnet for upscale development. As buyers searched for larger lots and quieter surroundings while staying within reach of Springdale and Fayetteville, demand surged. The price jump from 2020 to 2022 was striking—evidence of aggressive buying and limited supply. With a population under 3,000, the town’s housing stock is tight, helping sustain high price levels.

Growth hasn’t slowed much since. The town added over $75,000 to its average home value from 2023 to 2025, signaling continued high interest. Elm Springs offers new builds, semi-rural tranquility, and high-end amenities without the congestion of bigger towns. That rare combination has helped it climb to one of the top spots in Arkansas’s housing market.

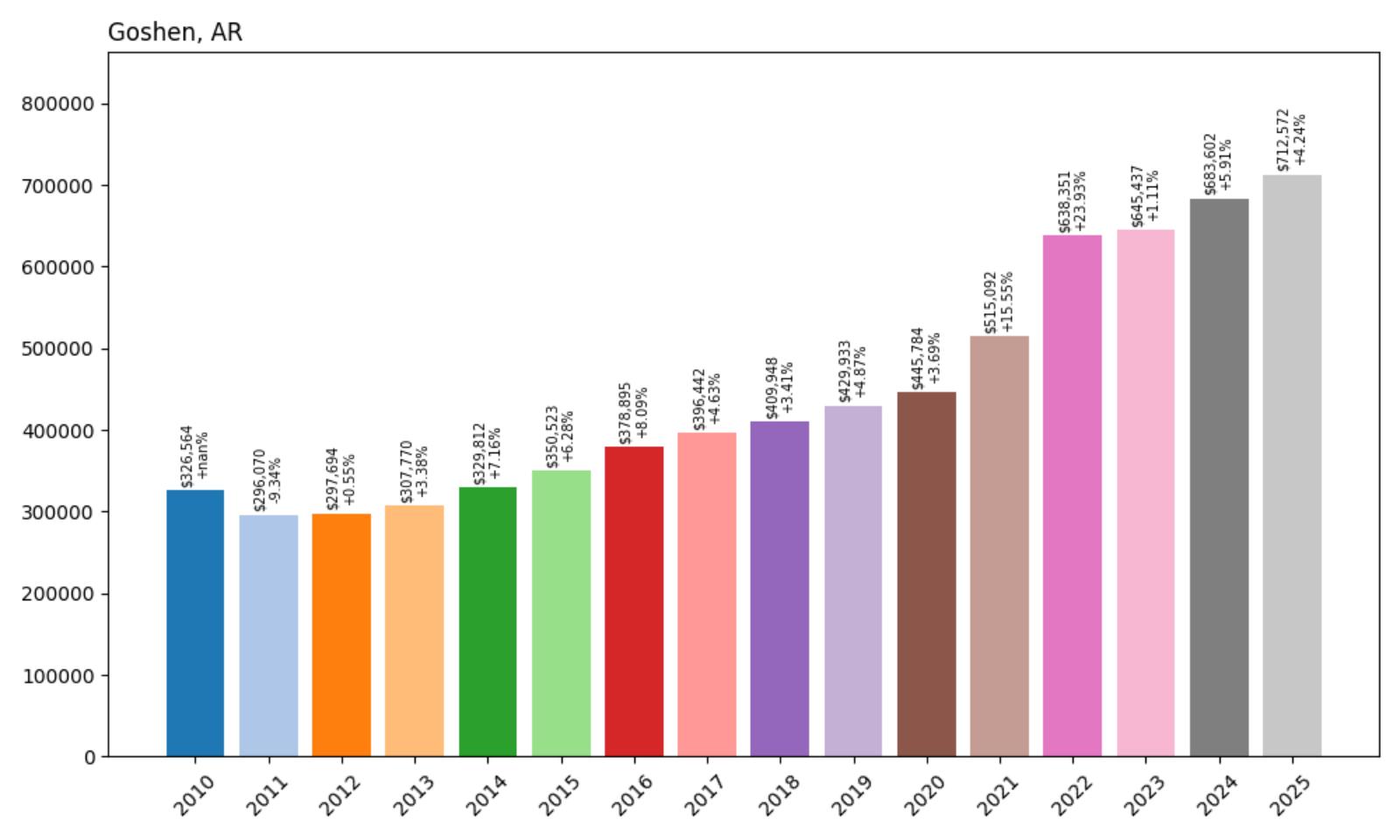

1. Goshen – 118% Home Price Increase Since 2010

- 2010: $326,564

- 2011: $296,070

- 2012: $297,694

- 2013: $307,770

- 2014: $329,812

- 2015: $350,523

- 2016: $378,895

- 2017: $396,442

- 2018: $409,948

- 2019: $429,933

- 2020: $445,784

- 2021: $515,092

- 2022: $638,351

- 2023: $645,437

- 2024: $683,602

- 2025: $712,572

Goshen tops the list with an average home price of $712,572 in 2025—up 118% from $326,564 in 2010. While the early years saw slow gains, values jumped dramatically in 2021 and 2022, with over $190,000 added in just two years. Growth has continued steadily through 2025.

Goshen – Exclusive Market on the Rise

Goshen has quietly transformed into one of Arkansas’s most exclusive and expensive housing markets. Located just east of Fayetteville, it combines rural appeal with proximity to city jobs and services. Large lots, luxury homes, and scenic surroundings have drawn buyers willing to pay a premium. The leap from $515K in 2021 to over $712K in 2025 shows a deep pool of high-end demand. This isn’t a speculative market—it’s a desirable one with limited inventory and steady interest.

With new construction constrained and more families seeking privacy, Goshen offers a rare mix of prestige and serenity. Even modest price gains from 2023 to 2025 added nearly $70,000 to average home values, solidifying its place at the top. For buyers chasing both space and sophistication in northwest Arkansas, Goshen remains unmatched.