Would you like to save this?

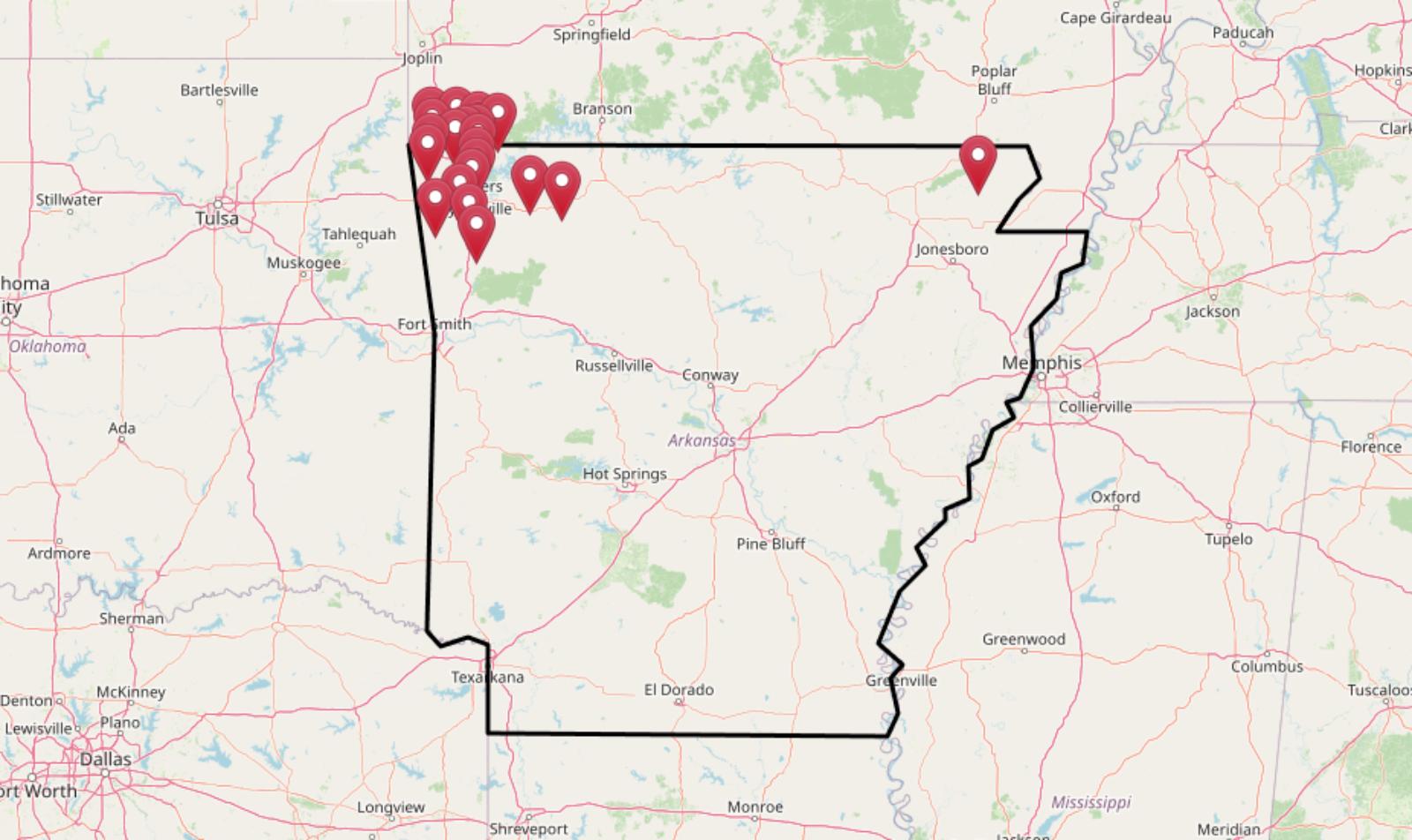

Some Arkansas towns took a hit—but came back swinging. According to the Zillow Home Value Index, 21 places across the state have pulled off remarkable home price recoveries, bouncing back from sharp drops to hit new highs by April 2025. In some cases, values fell more than 10% from earlier peaks, only to roar back with double-digit gains. Others had gentler dips but still surged to record territory. These rebounds aren’t random—they reveal where long-term demand, resilience, and fresh interest are rewriting the story on local real estate.

Arkansas Bounce Back Champions Overview

Arkansas has seen a remarkable housing recovery in several smaller towns, especially those in the northwest corridor near the Fayetteville-Springdale-Rogers-Bentonville metro. At the top of the list is Sulphur Springs, where home prices have surged by over $195,000 since bottoming out in 2009—a gain of more than 2,500%. Other standout recoveries include Decatur, Garfield, and Gravette, each of which experienced dips of over 10% from their historical peaks, followed by a robust rebound into 2025. These towns didn’t just regain lost value—they more than doubled or tripled it, driven in part by proximity to economic hubs and regional population growth.

What’s especially notable is that even relatively modest markets like Lafe and Winslow, which saw early-2000s peaks and deep troughs, have staged major comebacks, reflecting broader statewide momentum in property values. Across the board, the common factor among these “bounce-back champions” is a strong long-term upward trend following clear market corrections. These patterns are valuable for investors and homebuyers alike—showing that even towns hit hard during prior downturns can deliver impressive returns over time when regional growth conditions align.

21. Bella Vista – 10.51% Dip to 1238.48% Recovery by May 2025

- Peak Value: $161,370.69 (2008)

- Trough Value: $144,408.97 (2013)

- Final (2025) Value: $354,476.13

- Recovery: +$210,067.16 (+1238.48%)

- Dip from Peak: -10.51%

Bella Vista saw a steady decline after its 2008 peak, with prices bottoming out in 2013. Since then, the town has seen a remarkable turnaround, with values climbing by over $210,000 to reach more than double their former high. This kind of recovery highlights a strong and sustained demand for homes in the area.

Bella Vista – A Retirement Haven With Long-Term Growth

Located in the Ozarks near the Missouri border, Bella Vista is well-known as a retirement-friendly community with a strong homeowners’ association and a focus on outdoor amenities like golf courses, lakes, and hiking trails. This popularity likely cushioned its downturn and fueled the massive rebound in home prices. Its affordable cost of living, proximity to Bentonville, and appealing lifestyle have made it a consistent draw for both retirees and remote workers.

With home values now well above their 2008 levels, Bella Vista’s recovery reflects broader demand in Northwest Arkansas and a shift toward smaller, amenity-rich towns. The town’s infrastructure and natural setting have helped it maintain its appeal, even as prices have surged.

20. Farmington – 10.29% Dip to 1240.19% Recovery by May 2025

- Peak Value: $150,780.61 (2010)

- Trough Value: $135,271.57 (2012)

- Final (2025) Value: $327,613.83

- Recovery: +$192,342.25 (+1240.19%)

- Dip from Peak: -10.29%

Farmington’s housing market took a dip shortly after its 2010 peak, falling by about 10%. However, by May 2025, home prices more than doubled, rebounding with a sharp 1240% increase from the trough. This level of growth indicates strong momentum in the local market.

Farmington – Rising Demand in a Growing Suburb

Farmington lies just west of Fayetteville, making it a popular choice for commuters and families seeking more space without giving up access to city amenities. That suburban appeal helped drive the demand that’s pushed home values sharply upward since the early 2010s.

With new residential developments, good schools, and a growing population, Farmington has evolved into one of the region’s fastest-growing small towns. The steady recovery in prices reflects both regional job growth and a shift in buyer preferences toward livable, lower-density areas with community charm.

19. Rogers – 10.20% Dip to 1262.62% Recovery by May 2025

- Peak Value: $171,939.56 (2006)

- Trough Value: $154,407.48 (2014)

- Final (2025) Value: $375,771.31

- Recovery: +$221,363.82 (+1262.62%)

- Dip from Peak: -10.20%

After peaking in 2006, Rogers experienced a modest but drawn-out dip in prices, bottoming out in 2014. Since then, the recovery has been significant, with values increasing by more than $221,000 and showing strong year-over-year growth into 2025.

Rogers – Retail Hub with Regional Pull

Home to a growing number of major retailers and business parks, Rogers has become a key economic center in Northwest Arkansas. The town’s infrastructure and proximity to both Bentonville and Springdale have made it a hotspot for buyers and investors alike.

The rebound in home prices likely reflects continued regional economic expansion, including job creation and infrastructure investments. Rogers also benefits from a strong school system and access to Beaver Lake, adding to its residential appeal.

18. Huntsville – 10.33% Dip to 1286.94% Recovery by May 2025

- Peak Value: $113,305.04 (2007)

- Trough Value: $101,598.17 (2011)

- Final (2025) Value: $252,258.29

- Recovery: +$150,660.12 (+1286.94%)

- Dip from Peak: -10.33%

Huntsville saw prices decline by over 10% during the 2007-2011 downturn, but the recovery since then has been dramatic. Prices have more than doubled from the trough, adding over $150,000 in value by May 2025.

Huntsville – Quiet Growth in the Ozarks

Located east of Fayetteville, Huntsville is a quieter alternative to the more commercial parts of Northwest Arkansas. It’s a town with a rich rural heritage, but recent growth has brought new housing developments and a more diverse local economy.

As buyers look beyond major suburbs, towns like Huntsville have gained favor for their affordability and proximity to outdoor recreation. The town’s recovery aligns with a trend of rediscovery in small Ozark towns that offer a balance of affordability, lifestyle, and accessibility.

17. Johnson – 10.20% Dip to 1297.26% Recovery by May 2025

- Peak Value: $153,809.65 (2005)

- Trough Value: $138,127.54 (2012)

- Final (2025) Value: $341,565.26

- Recovery: +$203,437.72 (+1297.26%)

- Dip from Peak: -10.20%

Johnson’s real estate market dipped just over 10% between 2005 and 2012, but the recovery since then has been consistent and strong. Home values have more than doubled, adding over $200,000 in gains through 2025.

Johnson – Growth Between Fayetteville and Springdale

Strategically nestled between Fayetteville and Springdale, Johnson benefits from its central location in the heart of Northwest Arkansas. With easy access to major employers, medical centers, and shopping, it’s become a desirable location for professionals and families alike.

This mid-sized town blends the convenience of urban proximity with a quieter, residential vibe. The price recovery mirrors the overall strength of the regional market and the growing preference for towns that offer both accessibility and a sense of community.

16. Centerton – 11.34% Dip to 1343.13% Recovery by May 2025

- Peak Value: $146,241.35 (2005)

- Trough Value: $129,651.49 (2011)

- Final (2025) Value: $352,474.40

- Recovery: +$222,822.91 (+1343.13%)

- Dip from Peak: -11.34%

Centerton experienced a dip of over 11% after peaking in 2005, with home prices hitting bottom in 2011. Since then, the town has shown consistent strength, gaining over $220,000 in value and hitting new highs by 2025.

Centerton – From Small Town to Suburban Powerhouse

Would you like to save this?

Once a sleepy farming community, Centerton has transformed rapidly in recent years thanks to its close proximity to Bentonville. As one of the fastest-growing areas in Northwest Arkansas, it offers modern housing developments and excellent access to regional job hubs.

This dramatic price recovery reflects both population growth and housing demand. With newer subdivisions, family-friendly amenities, and good schools, Centerton has become a magnet for homebuyers priced out of larger nearby cities. The steady appreciation in values confirms its place among Arkansas’s suburban success stories.

15. Lafe – 10.42% Dip to 1350.87% Recovery by May 2025

- Peak Value: $70,071.46 (2007)

- Trough Value: $62,767.01 (2012)

- Final (2025) Value: $161,440.32

- Recovery: +$98,673.30 (+1350.87%)

- Dip from Peak: -10.42%

Though prices in Lafe dropped slightly over 10% during the late 2000s, the long-term gain has been dramatic. By 2025, prices more than doubled, showing just how far this small town has come.

Lafe – Quiet Living With Surprising Gains

Lafe is a modest town in Greene County that rarely makes headlines—but its home values certainly have. With a rural character and a close-knit community, it offers a slower pace of life that has become more attractive in recent years.

The large percentage gain in prices likely reflects both a correction from undervaluation and an increasing interest in affordable, low-density living. While still a relatively small market, Lafe’s recovery proves that even the most unassuming towns can experience outsized real estate growth under the right conditions.

14. West Fork – 10.36% Dip to 1388.87% Recovery by May 2025

- Peak Value: $127,797.89 (2010)

- Trough Value: $114,560.51 (2012)

- Final (2025) Value: $298,410.73

- Recovery: +$183,850.22 (+1388.87%)

- Dip from Peak: -10.36%

After a mild downturn in the early 2010s, West Fork bounced back with impressive force. Prices soared nearly 1400% from the trough, reflecting both market strength and renewed interest in the area.

West Fork – A Commuter Town With Growing Appeal

West Fork lies just south of Fayetteville along I-49, making it a convenient option for commuters and families. It retains a small-town atmosphere with access to nature, including Devil’s Den State Park nearby, which draws outdoor enthusiasts year-round.

The recovery in home prices likely owes a lot to location and timing. As Northwest Arkansas grew, buyers looking for a blend of affordability and access helped fuel demand in places like West Fork. That demand shows no signs of slowing, with home values continuing to rise well into 2025.

13. Little Flock – 10.29% Dip to 1389.96% Recovery by May 2025

- Peak Value: $208,305.87 (2007)

- Trough Value: $186,880.27 (2013)

- Final (2025) Value: $484,688.54

- Recovery: +$297,808.27 (+1389.96%)

- Dip from Peak: -10.29%

Little Flock’s housing market dipped slightly during the late 2000s but recovered dramatically by 2025. The town saw nearly $300,000 in price gains from the trough, showcasing powerful market momentum.

Little Flock – A Residential Stronghold Near Bentonville

Little Flock is perched just northeast of Bentonville and serves as a quiet, mostly residential area with excellent access to the region’s major employers. It’s often overlooked but offers larger lots and a less commercial feel compared to its neighbors.

The town’s price recovery mirrors demand for housing near Bentonville without the premium price tag. With limited new development and plenty of tree-lined neighborhoods, Little Flock continues to be a desirable choice for buyers seeking value and location in equal measure.

12. Lincoln – 10.50% Dip to 1402.33% Recovery by May 2025

- Peak Value: $106,079.77 (2009)

- Trough Value: $94,946.60 (2011)

- Final (2025) Value: $251,070.04

- Recovery: +$156,123.43 (+1402.33%)

- Dip from Peak: -10.50%

Lincoln’s home values dipped by over 10% between 2009 and 2011 but have since grown by more than $150,000. With over 1400% recovery from the trough, this small town has outpaced expectations.

Lincoln – Steady Growth in a Traditional Arkansas Town

Located southwest of Fayetteville, Lincoln offers a slower pace of life with historic roots and a strong sense of community. Its economy is based on agriculture and small businesses, with gradual development over the years.

The sharp recovery in prices shows that even smaller, more traditional towns are riding the wave of growth in Northwest Arkansas. For buyers seeking affordability, open space, and a connection to the land, Lincoln has quietly become a smart long-term choice.

11. Gentry – 11.69% Dip to 1465.21% Recovery by May 2025

- Peak Value: $111,196.02 (2009)

- Trough Value: $98,195.85 (2011)

- Final (2025) Value: $288,675.01

- Recovery: +$190,479.16 (+1465.21%)

- Dip from Peak: -11.69%

Gentry’s housing market experienced an 11.69% decline after its 2009 peak, but it bounced back strongly. By 2025, home values had climbed by nearly $190,500, making it one of the stronger turnarounds on this list.

Gentry – Historic Roots and a Bright Future

Gentry sits in western Benton County, not far from the Oklahoma border. Known for its historic downtown, scenic surroundings, and attractions like the Wild Wilderness Drive-Through Safari, it blends small-town charm with family appeal.

The town’s recovery has been driven by increased interest from buyers priced out of nearby urban markets. Gentry’s real estate market benefited from its proximity to Siloam Springs and the broader economic lift of Northwest Arkansas, helping it transform from a quiet town to one seeing steady investment and growth.

10. Springdale – 10.25% Dip to 1468.16% Recovery by May 2025

- Peak Value: $137,532.33 (2004)

- Trough Value: $123,430.72 (2011)

- Final (2025) Value: $330,464.91

- Recovery: +$207,034.19 (+1468.16%)

- Dip from Peak: -10.25%

Springdale saw home prices decline modestly in the early 2000s, bottoming out in 2011. Since then, the rebound has been steady and strong, with prices rising by over $200,000 by May 2025.

Springdale – A Major Player in the Regional Economy

Would you like to save this?

As one of the largest cities in Northwest Arkansas, Springdale plays a key role in the region’s economic engine. It’s home to Tyson Foods’ headquarters, a major regional airport, and a diverse workforce that drives housing demand.

Springdale’s sharp price recovery reflects both local job growth and infrastructure expansion. It’s also seen increased investment in schools, parks, and commercial areas, making it an attractive option for families, workers, and developers alike.

9. Kingston – 11.07% Dip to 1483.84% Recovery by May 2025

- Peak Value: $101,189.94 (2008)

- Trough Value: $89,989.84 (2012)

- Final (2025) Value: $256,181.90

- Recovery: +$166,192.06 (+1483.84%)

- Dip from Peak: -11.07%

After a downturn in the wake of the 2008 peak, Kingston’s housing prices hit a low in 2012. The climb since then has been notable, with a recovery nearing 1500% by 2025, adding more than $166,000 in value.

Kingston – Scenic Seclusion with Strong Price Growth

Kingston is a small community tucked into the hills of Madison County, east of Huntsville. Known for its scenic drives and rural charm, it’s a favorite among buyers looking for a break from urban life.

The housing rebound here reflects a growing trend of people investing in quiet, natural settings that still offer reasonable access to larger towns. Its affordable base prices and scenic setting likely contributed to the outsized percentage gain in values over time.

8. Bentonville – 10.49% Dip to 1504.60% Recovery by May 2025

- Peak Value: $194,175.72 (2005)

- Trough Value: $173,804.61 (2011)

- Final (2025) Value: $480,308.71

- Recovery: +$306,504.10 (+1504.60%)

- Dip from Peak: -10.49%

Bentonville experienced a modest housing dip following its 2005 peak, but it has since seen tremendous growth. With a price gain of more than $300,000 by 2025, it stands out as one of the state’s strongest markets.

Bentonville – Corporate Magnet Turned Cultural Hub

Home to Walmart’s global headquarters, Bentonville has undergone a transformation from a small Arkansas town to a global business and cultural destination. It now boasts world-class museums, bike trails, and one of the hottest real estate markets in the region.

The price surge reflects ongoing demand from corporate employees, entrepreneurs, and families relocating for job opportunities and lifestyle perks. Bentonville’s reputation for blending commerce with culture continues to drive its real estate values upward.

7. Pea Ridge – 10.08% Dip to 1656.66% Recovery by May 2025

- Peak Value: $134,418.74 (2009)

- Trough Value: $120,865.10 (2013)

- Final (2025) Value: $345,402.59

- Recovery: +$224,537.49 (+1656.66%)

- Dip from Peak: -10.08%

Pea Ridge saw a mild decline after 2009, but home prices have more than doubled since reaching their low in 2013. By May 2025, the town had recovered by over $224,000, marking a sharp and sustained comeback.

Pea Ridge – A Civil War Town With Modern Momentum

Best known for the Pea Ridge National Military Park, this town blends historical significance with modern appeal. Located near the Missouri border, it has attracted new development while preserving its small-town character.

The strong recovery in prices highlights its growing appeal to families and retirees alike. Easy access to Bentonville and new residential developments have helped fuel demand, making Pea Ridge a rising star in Northwest Arkansas’s housing market.

6. Lowell – 10.23% Dip to 1680.78% Recovery by May 2025

- Peak Value: $136,493.02 (2010)

- Trough Value: $122,535.76 (2012)

- Final (2025) Value: $357,127.10

- Recovery: +$234,591.34 (+1680.78%)

- Dip from Peak: -10.23%

Lowell’s home prices dropped just over 10% after 2010, but its recovery has been remarkable. Values soared by nearly $235,000, giving it one of the most impressive rebounds on the list.

Lowell – Central Location and Steady Growth

Situated between Rogers and Springdale, Lowell has become a central hub in Northwest Arkansas. It offers convenient access to major highways, making it ideal for commuters and logistics companies alike.

Lowell’s home values have benefitted from regional job growth and infrastructure investment, while remaining more affordable than its neighbors. The town’s rapid climb in value shows how central location and steady development can drive long-term market strength.

5. Winslow – 12.95% Dip to 1872.50% Recovery by May 2025

Would you like to save this?

- Peak Value: $84,160.34 (2000)

- Trough Value: $73,258.00 (2003)

- Final (2025) Value: $277,404.26

- Recovery: +$204,146.26 (+1872.50%)

- Dip from Peak: -12.95%

Winslow saw one of the largest early drops in home prices—nearly 13%—but the long-term recovery is just as dramatic. By 2025, values had risen by over $204,000, pushing the total gain to almost 1900% from the trough.

Winslow – Scenic Highlands With a View

Located high in the Boston Mountains, Winslow is one of the most scenic towns in Northwest Arkansas. It offers sweeping views, cooler temperatures, and a rugged landscape that appeals to outdoor enthusiasts.

While remote, Winslow has attracted a steady stream of residents seeking peace and natural beauty. Its steep rise in home values reflects growing interest in secluded living, especially among retirees and remote workers seeking quiet mountain towns.

4. Gravette – 10.85% Dip to 2097.52% Recovery by May 2025

- Peak Value: $109,403.99 (2008)

- Trough Value: $97,536.33 (2010)

- Final (2025) Value: $346,463.28

- Recovery: +$248,926.95 (+2097.52%)

- Dip from Peak: -10.85%

Gravette’s home prices dipped just under 11% after the 2008 peak but have soared since. The town added nearly $250,000 in value by 2025, giving it one of the strongest percentage recoveries in the state.

Gravette – Growth Along the State Line

Gravette sits in the far northwest corner of Arkansas, right near the Oklahoma border. It has seen consistent growth thanks to its location, highway access, and investment in schools and parks.

Its lower starting prices made it attractive for first-time buyers, while its recovery shows how demand has grown as more people move to the area. Gravette has quietly become one of the most resilient housing markets in Benton County.

3. Garfield – 10.73% Dip to 2175.26% Recovery by May 2025

- Peak Value: $136,703.58 (2002)

- Trough Value: $122,037.04 (2003)

- Final (2025) Value: $441,072.91

- Recovery: +$319,035.86 (+2175.26%)

- Dip from Peak: -10.73%

Garfield’s home prices dipped slightly after their 2002 peak but quickly began recovering. Over the next two decades, prices climbed by over $319,000, reflecting sustained growth and strong housing demand.

Garfield – Lakeside Living With Room to Grow

Garfield is located near the northern shores of Beaver Lake, a popular spot for boating, fishing, and vacation homes. Its scenic setting and access to outdoor recreation make it a draw for both permanent residents and seasonal buyers.

Over time, this demand has pushed prices upward, especially as more people seek homes near water. Garfield’s sharp recovery shows the appeal of lake-adjacent living in a region where outdoor lifestyle and affordability still go hand in hand.

2. Decatur – 10.65% Dip to 2202.12% Recovery by May 2025

- Peak Value: $80,609.26 (2005)

- Trough Value: $72,027.00 (2011)

- Final (2025) Value: $261,018.97

- Recovery: +$188,991.98 (+2202.12%)

- Dip from Peak: -10.65%

Decatur’s housing market saw a modest dip in the mid-2000s, but the recovery that followed was anything but modest. By 2025, prices had surged by over 2200% from their lowest point, driven by over $188,000 in gains.

Decatur – Small Town, Massive Growth

Decatur may be one of the smallest towns in Benton County, but its location along major transport routes has helped it gain traction in recent years. The town offers affordable housing, open space, and an easy commute to larger employment centers.

This explosive growth in home values reflects the spillover effect from nearby cities and an increased appreciation for quiet towns with development potential. Decatur’s rise has been steady—and fast.

1. Sulphur Springs – 10.19% Dip to 2577.15% Recovery by May 2025

- Peak Value: $74,526.57 (2007)

- Trough Value: $66,932.44 (2009)

- Final (2025) Value: $262,644.51

- Recovery: +$195,712.06 (+2577.15%)

- Dip from Peak: -10.19%

Sulphur Springs tops the list with the most extreme recovery, rising over 2500% from its 2009 low. The town added more than $195,000 in value by May 2025, securing its place as Arkansas’s ultimate comeback story.

Sulphur Springs – A Quiet Town With a Big Upside

Located near the Missouri border, Sulphur Springs is a small community with deep history and a strong sense of place. While it’s never been a major population center, it has seen a slow resurgence in interest over the last decade.

Its low base price in the early 2000s gave it room for explosive growth. With a mix of heritage buildings, open land, and regional access, Sulphur Springs has become an unexpected winner in Arkansas’s housing recovery story.